- KNL Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

-

ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

Knoll (KNL) DEF 14ADefinitive proxy

Filed: 1 Apr 21, 3:02pm

Use these links to rapidly review the document

TABLE OF CONTENTS

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

| Filed by the Registrant ý | ||

Filed by a Party other than the Registrant o | ||

Check the appropriate box: | ||

o | Preliminary Proxy Statement | |

o | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

ý | Definitive Proxy Statement | |

o | Definitive Additional Materials | |

o | Soliciting Material Pursuant to §240.14a-12 | |

| Knoll, Inc. | ||||

(Name of Registrant as Specified In Its Charter) | ||||

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) | ||||

Payment of Filing Fee (Check the appropriate box): | ||||

ý | No fee required. | |||

o | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||

(1) | Title of each class of securities to which transaction applies: | |||

| (2) | Aggregate number of securities to which transaction applies: | |||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |||

| (4) | Proposed maximum aggregate value of transaction: | |||

| (5) | Total fee paid: | |||

o | Fee paid previously with preliminary materials. | |||

o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

(1) | Amount Previously Paid: | |||

| (2) | Form, Schedule or Registration Statement No.: | |||

| (3) | Filing Party: | |||

| (4) | Date Filed: | |||

Notice of Annual Meeting of Stockholders

May 13, 2021

8:30 a.m. Eastern Time

Due to public health restrictions related to the COVID-19 pandemic,

and for the safety of our stockholders, the Annual Meeting will be

conducted virtually over the internet through an audio only webcast available at

www.meetingcenter.io/256453939 with the password KNL2021.

Stockholders of record as of the close of business on March 15, 2021, are entitled to notice of, and to vote at, the Annual Meeting. A list of stockholders of record will be available at the meeting and during regular business hours for the 10 days prior to the meeting at our offices at 1235 Water Street, East Greenville, PA 18041. A stockholder may examine the list for any legally valid purpose related to the meeting.

By Order of the Board of Directors,

Michael A. Pollner

Senior Vice President, Chief Administrative Officer, General Counsel & Corporate Secretary

April 1, 2021

Important Notice Regarding the Availability of Proxy Materials for

the Stockholders Meeting to Be Held on May 13, 2021:

The proxy statement and annual report to stockholders are available at www.edocumentview.com/KNL

Proxy Statement Summary

The Board of Directors ("Board") of Knoll, Inc. (the "Company," "we," "us," "our" or "Knoll") is furnishing this proxy statement and soliciting proxies in connection with the proposals to be voted on at the Knoll, Inc. 2021 Annual Meeting of Stockholders ("Annual Meeting") and any postponements or adjournments thereof. This summary highlights certain information contained in this proxy statement, but does not contain all of the information you should consider when voting your shares. Please read the entire proxy statement carefully before voting.

| | | | | | | |

| | 2021 Annual Meeting Information | | | |||

| | | | | | | |

| Date | May 13, 2021 | |||||

| | | | | | | |

| Time | 8:30 a.m. (Eastern Time) | |||||

| | | | | | | |

| Location | Webcast Meeting at www.meetingcenter.io/256453939 with the password KNL2021 | |||||

| | | | | | | |

| Record Date | March 15, 2021 | |||||

| | | | | | | |

| Stock Symbol | KNL | |||||

| | | | | | | |

| Stock Exchange | New York Stock Exchange ("NYSE") | |||||

| | | | | | | |

| Corporate Website | www.knoll.com | |||||

| | | | | | | |

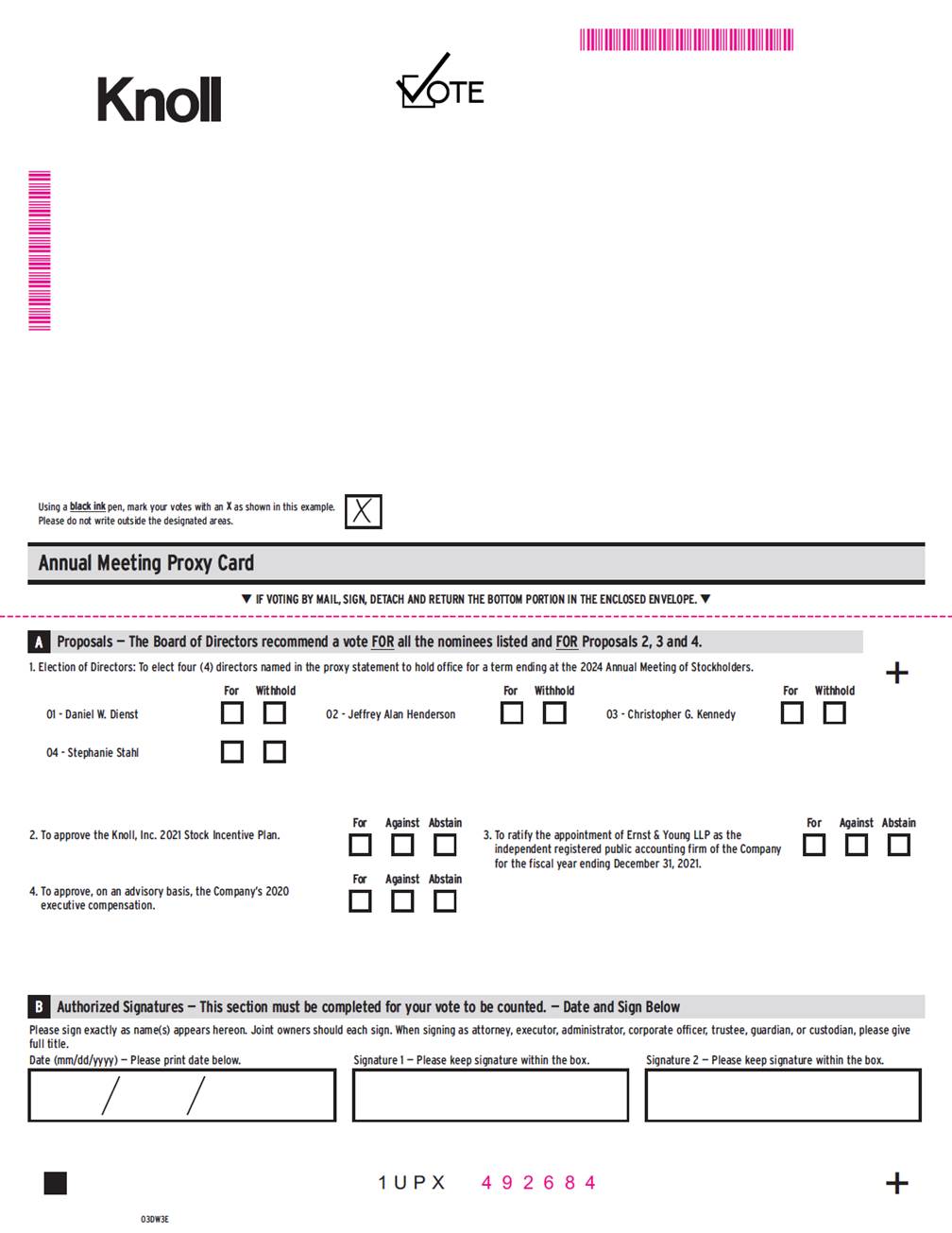

Voting Matters And Vote Recommendation

| | PROPOSAL | BOARD RECOMMENDATION | REASONS FOR RECOMMENDATION | MORE INFORMATION | ||||

|---|---|---|---|---|---|---|---|---|

| | | | | | | | | |

| 1. | Election of 4 director nominees named in our proxy statement to our Board of Directors for three-year terms | FOR | The Board and the Nominating and Corporate Governance Committee believe our nominees possess the skills, experience and qualifications to effectively monitor performance, provide oversight and support management's execution of the Company's long-term strategy. | Page 10 | ||||

| | ||||||||

| 2. | Approval of the Knoll, Inc. 2021 Stock Incentive Plan | FOR | We believe equity incentives are critical in attracting and retaining talented associates. | Page 25 | ||||

| | ||||||||

| 3. | Ratification of the appointment of Ernst & Young LLP as our independent registered public accounting firm for fiscal year 2021 | FOR | Based on its assessment, the Audit Committee believes that the re-appointment of Ernst & Young LLP is in the best interests of Knoll and our stockholders. | Page 36 | ||||

| | ||||||||

| 4. | "Say on Pay" advisory vote on 2020 executive compensation | FOR | Our executive compensation program incorporates several compensation governance best practices and reflects our commitment to paying for performance. | Page 37 | ||||

| | ||||||||

1

| | | | | |||||

| | | | | | | | | |

| | PROPOSAL1 | | ELECTION OF DIRECTORS | |||||

| | | | | | | | | |

| | | | |

Our board of directors currently consists of eleven members, classified into three classes. In Proposal 1, stockholders are asked to vote "FOR" the following Class II directors, who have terms that expire at the 2021 Annual Meeting.

| | | | | | | Board Committee Assignments | ||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Name | | Director Since | | Independent | | Audit | | Compensation | | Nominating and Corporate Governance | ||||||||||

| | | | | | | | | | | | | | | | | | | | | |

Daniel W. Dienst | 2017 | Yes | ✓ | |||||||||||||||||

| | | | | | | | | | | | | | | | | | | | | |

Jeffrey Alan Henderson | 2020 | Yes | ||||||||||||||||||

| | | | | | | | | | | | | | | | | | | | | |

Christopher G. Kennedy | 2014 | Yes | Chair | |||||||||||||||||

| | | | | | | | | | | | | | | | | | | | | |

Stephanie Stahl | 2013 | Yes | ✓ | Chair | ||||||||||||||||

| | | | | | | | | | | | | | | | | | | | | |

Committee membership is as of the date of this proxy statement. Current committee assignments are indicated by a (✓), and committee chairs are indicated by "Chair." Please see pages 11 through 16 for more information regarding our director nominees.

| Name | Age | Director Since | Independent | Term Expires | Audit | Compensation | Nominating | |||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| | | | | | | | | | | | | | | |

Roberto Ardagna | 40 | 2020 | Yes | 2023 | ||||||||||

Andrew B. Cogan (Chairman and CEO) | 58 | 1996 | No | 2023 | ||||||||||

Daniel W. Dienst | 55 | 2017 | Yes | 2021 | ||||||||||

Stephen F. Fisher | 68 | 2005 | Yes | 2023 | ||||||||||

Jeffrey A. Harris (Lead Director) | 65 | 1996 | Yes | 2022 | ||||||||||

Jeffrey Alan Henderson | 47 | 2020 | Yes | 2021 | ||||||||||

Ronald R. Kass | 64 | 2018 | Yes | 2022 | ||||||||||

Christopher G. Kennedy | 57 | 2014 | Yes | 2021 | Chair | |||||||||

John F. Maypole | 81 | 2004 | Yes | 2022 | Chair | |||||||||

Sarah E. Nash | 67 | 2006 | Yes | 2023 | ||||||||||

Stephanie Stahl | 54 | 2013 | Yes | 2021 | Chair |

Diversity is one of the factors considered by our nominating and corporate governance committee in the director nomination process. Among the factors considered when we evaluate the skills, experiences and perspectives of our directors are the following: (i) financial and accounting acumen; (ii) educational background; (iii) knowledge of our industry and related industries; (iv) personal and professional integrity; (v) business or management experience; (vi) crisis management experience; (vii) leadership and strategic planning experience; and (viii) brand development and consumer and digital marketing experience. We also consider diversity with respect to race and gender in evaluating whether the board as a whole has the right mix of perspectives to properly serve the company and its stockholders.

2

| | | | | |

Size of the Board of Directors | 11 | |||

Number of Independent Directors | 10 | |||

Audit, Compensation and Governance Committees Consist Entirely of Independent Directors | Yes | |||

Lead Independent Director of the Board | Yes | |||

Majority Voting Resignation Policy in Uncontested Director Elections | Yes | |||

Annual Advisory Approval of Named Executive Officer Compensation | Yes | |||

All Directors Attended at Least 75% of Meetings Held | Yes | |||

Annual Board and Committee Self-Evaluations | Yes | |||

Code of Ethics | Yes | |||

Stock Ownership Guidelines for Executive Officers and Directors | Yes | |||

Clawback Policy | Yes | |||

Stockholder Rights Plan (Poison Pill) | No | |||

| | | | | |

Community Impact and Corporate Social Responsibility

Since our founding, Knoll has not only focused on "good design," but also on what Florence Knoll called "good business." Today, good business means more than producing products and services that enable growth and innovation. As a design leader in our industry, we believe that working to promote sustainability — both for our company and for our stakeholders — is good business. This belief is reflected in our sustainability program. We believe sustainable design is timeless, it is "of today", while simultaneously drawing from yesterday and looking towards tomorrow. This is the essence of sustainability.

For Knoll, the concept encompasses a renewed emphasis on defining corporate purpose to consider the interests of all stakeholders — shareholders, associates, clients, suppliers and communities — when making decisions. We are committed to integrating sustainability into our daily actions to minimize risk, capture opportunity and create value for our shareholders and our stakeholders in the communities where we live and work. We pursue our purpose along three ESG dimensions through innovative design, inspired engagement, and intentional partnerships.

Environment

Our key environmental initiatives which encompass the environmental aspects and impacts of our business focus on addressing climate change risks and opportunities. We address this focus on three fronts: in our own operations, in the products we provide to our customers, and in partnerships with our customers, suppliers and communities.

In our operations, our priorities include increasing the use of clean technology that mitigates greenhouse gas (GHG) emissions; using natural resources responsibly to conserve resources and extend their useful life; and relying more on sustainable materials and other inputs. Our carbon reduction strategy includes setting and tracking progress towards annual targets to reduce our energy and water use and minimize our generation of waste. Knoll targets green building and interiors certifications, such as LEED® and WELL, throughout our manufacturing facilities, showrooms and offices in North America to minimize our carbon footprint.

Governed by Knoll's DfE (Design for the Environment) policies, we design and manufacture every product so that both the material content and our production process meet ambitious environmental standards. We partner with outside experts to research new materials and technologies that eliminate toxic emissions, reduce energy use, are derived from renewable sources, contain and apply recycled content, and are recyclable. We engage our suppliers to identify sustainable materials for our products. We support the carbon commitments, building certifications, and sustainability objectives of our customers by pursuing single and multi-attribute third party product certifications. We enable our customers to direct surplus

3

furniture, fixtures and equipment to resale, repurposing, recycling or energy recovery to minimize lifecycle impacts through the Knoll Full Circle program.

Knoll engages in environmental initiatives in our communities through financial support and employee volunteer activities such as stream clean-up events.

Social

Our social initiatives include our people practices, our safety and security standards, and our corporate social responsibility program. The nominating and corporate governance committee of our board of directors, under its charter, is responsible for overseeing these initiatives.

For our Associates, we are committed to diversity, equity and inclusion; to creating opportunities for people with disabilities and those who come from diverse cultural and ethnic backgrounds; and to building on our leadership in LBGTQ+ equality. We endeavor to provide employees with a work experience that enriches both their professional and personal lives. We offer wellness programs which engage our employees and their family members and provide parental leave designed to foster a supportive family environment. We offer a comprehensive Employee Assistance Program. We conduct extensive Associate training and offer a variety of programs to upgrade and improve marketable skills and ensure continued employability.

Knoll is committed to providing a safe and healthy work environment for our employees. We define roles and responsibilities; identify safety aspects, risks and hazards; and implement policies, practices procedures and controls to assess and manage safety risks. We are committed to preventing injuries and ill health through near miss reporting and a behavioral safety program designed to encourage and foster more thorough safety conversations. We report our results transparently.

The Knoll corporate social responsibility program identifies a positive vision of community engagement based on the power of design to build a better world. We target initiatives with multicultural reach that advance positive life-changing generational outcomes. We seek to partner with recognized and respected organizations who share our values; provide opportunities for our Associates and customers to join us in our efforts; and track our progress to impact lives. In 2020, we extended our commitment to building a better world at the intersection of:

We also continued our commitment to Good Design + Preservation through our support of the World Monuments Fund. Knoll is founding sponsor of the Modernism at Risk Program dedicated to preservation, sustainable design and public advocacy and is funder of the Knoll Modernism Prize which enhances the public's awareness of the seminal role that Modernism plays in the built environment.

4

| | | | | |||||

| | | | | | | | | |

| | PROPOSAL 2 | | APPROVAL OF THE KNOLL, INC. 2021 STOCK INCENTIVE PLAN | |||||

| | | | | | | | | |

| | | | |

On March 29, 2021, our board of directors approved for submission to a vote of the stockholders the Knoll, Inc. 2021 Stock Incentive Plan (the "2021 Plan") and submits the 2021 Plan to our stockholders for approval. We believe that equity incentives are critical in attracting and retaining talented employees in our industry, and aligning our employees with the interests of our stockholders. The approval of the Knoll, Inc. 2021 Stock Incentive Plan will allow us to continue to provide such incentives.

The 2021 Plan includes the following key features:

See page 25 for more details regarding the 2021 Plan, a copy of which is set forth in Exhibit B to this proxy statement and is incorporated herein by reference.

| | | | | |||||

| | | | | | | | | |

| | PROPOSAL 3 | | RATIFICATION OF APPOINTMENT OF AUDITORS | |||||

| | | | | | | | | |

| | | | |

Ernst & Young LLP, independent registered public accounting firm, served as our auditors for fiscal 2020. Our Audit Committee has selected Ernst & Young LLP to audit our financial statements for fiscal 2021. Although it is not required to do so, the board is submitting the Audit Committee's selection of our independent registered public accounting firm for ratification by the stockholders at the annual meeting in order to ascertain the view of our stockholders regarding such selection. Below is summary information about Ernst & Young LLP's fees for services during fiscal years 2020 and 2019:

| | 2020 | 2019 | |||||

|---|---|---|---|---|---|---|---|

| | | | | | | | |

Audit Fees: | $ | 2,174,589 | $ | 2,164,804 | |||

Audit-Related Fees: | | 0 | | 0 | |||

Tax Fees: | | 0 | | 0 | |||

All Other Fees: | | 3,725 | | 9,360 | |||

| | | | | | | | |

Total | $ | 2,178,314 | $ | 2,174,164 | |||

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

5

| | | | | |||||

| | | | | | | | | |

| | PROPOSAL 4 | | ADVISORY VOTE TO APPROVE EXECUTIVE COMPENSATION | |||||

| | | | | | | | | |

| | | | |

Our Executive Compensation Program

We provide our stockholders with the opportunity to vote to approve, on a nonbinding, advisory basis, the compensation of our named executive officers as disclosed in this proxy statement in accordance with the rules of the Securities and Exchange Commission ("SEC"). The vote on this resolution is not intended to address any specific element of compensation; rather, the advisory vote relates to the overall compensation of our named executive officers, as well as the philosophy, policies and practices, all as described in this proxy statement in accordance with the SEC's rules. The vote is advisory, and therefore it is not binding on the company, the compensation committee or our board of directors. We recommend that our stockholders vote "FOR" approval of our executive compensation as described in this proxy statement.

Our executive compensation programs are generally designed to:

6

We believe that motivating and rewarding exceptional performance is the overriding principle of our executive compensation programs.

| WE DO: | WE DO NOT: | |||||

| ✓ | Provide a significant portion of our named executive officers' total compensation in the form of awards tied to our long-term strategy and our performance. | ✘ | Have employment agreements with our named executive officers other than our Chairman and CEO. | |||

| | | | | | | |

| ✓ | Require compliance with our Stock Ownership Guidelines, which require that our executive officers own a specified value of shares of the Company's common stock. | ✘ | Provide tax gross-ups for our named executive officers. | |||

| | | | | | | |

| ✓ | Have a Compensation Committee comprised entirely of independent directors who use an independent consultant retained by the Compensation Committee. | ✘ | Time the grants of equity awards to coordinate with the release of material non-public information, or time the release of material non-public information for the purpose of affecting the value of any named executive officer compensation. | |||

| | | | | | | |

| ✓ | Have ongoing consideration and oversight by the Compensation Committee with respect to any potential risks associated with our incentive compensation programs. | ✘ | Provide material executive perquisites such as corporate aircraft, executive life insurance, tax or estate planning services. | |||

| | | | | | | |

| ✓ | Operate a Clawback Policy for Section 16 Officers which permits the Company to recover excess incentive compensation in the event of a restatement. | ✘ | Provide supplemental retirement benefits to our executive officers. | |||

| | | | | | | |

| ✓ | Prohibit our associates through our Insider Trading Policy from engaging in hedging transactions in our stock | ✘ | Operate deferred compensation plans for our executive officers. | |||

| | | | | | | |

| ✓ | Utilize "double trigger" change-in-control provisions in our equity award agreements | ✘ | Operate a stockholder rights plan (Poison Pill). | |||

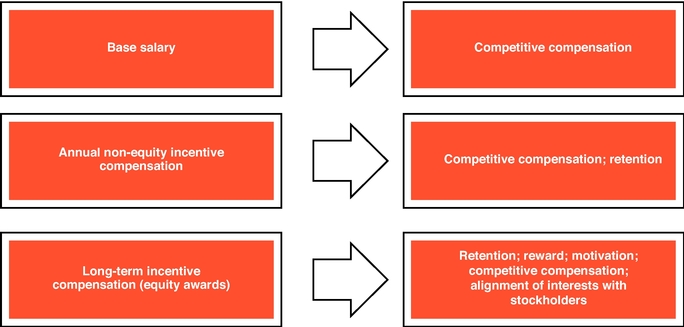

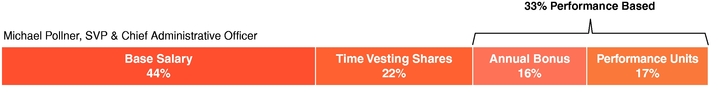

The following sets forth the primary objectives addressed by each component of our executive compensation programs:

For more information regarding our compensation, please see our Compensation Discussion and Analysis on page 42.

7

In response to our dialogue with stockholders during the past several years, we have incorporated a number of practices into our compensation programs:

See page 42 for more details regarding our executive compensation.

8

PROPOSAL 1: ELECTION OF DIRECTORS | 10 | |

Director Independence | 17 | |

CORPORATE GOVERNANCE GUIDELINES | 17 | |

Director Resignation Policy | 18 | |

Code of Ethics | 18 | |

Board Leadership Structure | 18 | |

Oversight of Risk Management by our Board of Directors | 19 | |

Board Diversity | 19 | |

Board Meetings and Committees | 19 | |

Compensation Committee Interlocks and Insider Participation | 21 | |

Communications with Directors | 21 | |

Compensation of Directors | 22 | |

Director Compensation Table — 2020 | 22 | |

REPORT OF AUDIT COMMITTEE | 24 | |

PROPOSAL 2 — APPROVAL OF THE KNOLL, INC. 2021 STOCK INCENTIVE PLAN | 25 | |

PROPOSAL 3 — INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM | 36 | |

PROPOSAL 4 — ADVISORY VOTE ON EXECUTIVE COMPENSATION | 37 | |

EXECUTIVE OFFICERS | 38 | |

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT | 39 | |

EXECUTIVE COMPENSATION | 42 | |

COMPENSATION DISCUSSION AND ANALYSIS ("CD&A") | 42 | |

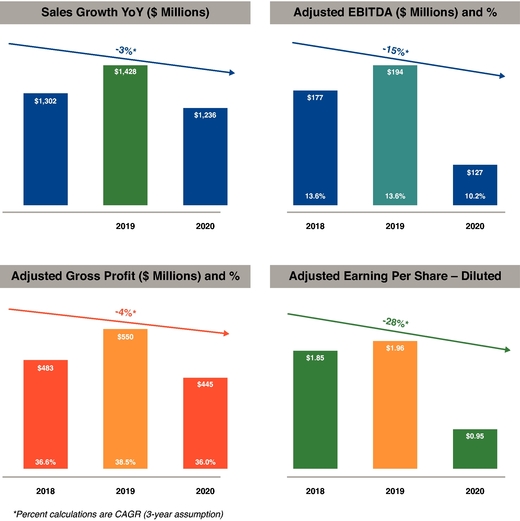

How Did We Perform? | 43 | |

What Are Our Compensation Practices? | 45 | |

How Are Compensation Decisions Made? | 47 | |

How Do We Compensate Our CEO and other NEOs? | 49 | |

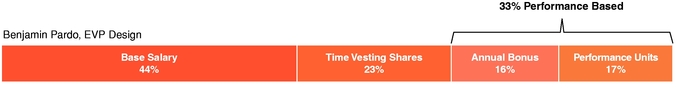

2020 Compensation — Analysis | 52 | |

How Do We Manage Risks Related to Our Compensation Program? | 56 | |

Risk Assessment — Incentive Compensation Programs | 56 | |

Executive Stock Ownership Policy | 56 | |

Compensation Committee Report | 57 | |

SUMMARY COMPENSATION TABLE | 58 | |

Grants of Plan-Based Awards | 60 | |

Narrative Disclosure For Summary Compensation Table and Grants of Plan-Based Awards Table | 61 | |

Outstanding Equity Awards at Fiscal Year-End | 63 | |

Option Exercises and Stock Vested | 64 | |

Pension Benefits | 64 | |

2020 Pension Benefits | 65 | |

Potential Payments Upon Termination or Change in Control | 65 | |

Severance Under Employment Agreement | 65 | |

Change-in-Control Provisions | 66 | |

Potential Post-Retirement Payments to Named Executive Officers As of December 31, 2020 | 66 | |

Pay Ratio Disclosure | 69 | |

TRANSACTIONS WITH RELATED PERSONS | 70 | |

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE | 70 | |

Stockholder Proposals and Nominations for Directors | 75 | |

MATTERS FOR THE ANNUAL MEETING | 76 | |

EXHIBIT A — RECONCILIATION OF NON-GAAP FINANCIAL MEASURES | 77 | |

EXHIBIT B — KNOLL, INC. 2021 STOCK INCENTIVE PLAN | 79 |

9

PROPOSAL 1: ELECTION OF DIRECTORS

Our board of directors currently consists of eleven members, classified into three classes as follows: Roberto Ardagna, Andrew B. Cogan, Stephen F. Fisher and Sarah E. Nash constitute a class with a term that expires at the 2023 Annual Meeting (the "Class I directors"); Daniel W. Dienst, Jeffrey Alan Henderson, Christopher G. Kennedy and Stephanie Stahl constitute a class with a term that expires at the 2021 Annual Meeting (the "Class II directors"); and Jeffrey A. Harris, Ronald R. Kass and John F. Maypole constitute a class with a term that expires at the 2022 Annual Meeting (the "Class III directors"). However, as has been previously disclosed, Mr. Maypole has elected to retire from our board of directors effective upon the conclusion of the 2021 Annual Meeting. At each Annual Meeting of Stockholders, directors are elected for a term ending at the third Annual Meeting of Stockholders after such election or until their respective successors are elected and qualified.

On February 28, 2021, our nominating and corporate governance committee recommended Daniel W. Dienst, Jeffrey Alan Henderson, Christopher G. Kennedy and Stephanie Stahl for re-election after due consideration of their qualifications and past experience on our board of directors. On February 28, 2021, based, in part, on the recommendation of our nominating and corporate governance committee, our board of directors voted to nominate Daniel W. Dienst, Jeffrey Alan Henderson, Christopher G. Kennedy and Stephanie Stahl for reelection at the 2021 Annual Meeting of Stockholders to serve for a term ending at the 2024 Annual Meeting of Stockholders or until their respective successors are elected and qualified.

Unless authority to vote for any of these nominees is withheld, the shares represented by the enclosed proxy will be voted FOR the election of the director nominees. In the event that a nominee becomes unable or unwilling to serve, the shares represented by the enclosed proxy will be voted for the election of such other person as the board of directors may recommend in his or her place. We have no reason to believe that any nominee will be unable or unwilling to serve as a director. However, if you hold your shares through a broker and do not instruct your broker how to vote in the election of directors, no vote will be cast on your behalf with respect to Proposal 1.

The election of directors will be determined by a majority of the votes cast, meaning the number of votes cast "for" a director's election exceeds the number of votes cast "against" that director's election (with "abstentions" and "broker non-votes" not counted as cast either "for" or "against" that director's election).

THE BOARD OF DIRECTORS RECOMMENDS THE ELECTION OF DANIEL W. DIENST, JEFFREY ALAN HENDERSON, CHRISTOPHER G. KENNEDY AND STEPHANIE STAHL AS DIRECTORS, AND PROXIES SOLICITED BY THE BOARD OF DIRECTORS WILL BE VOTED IN FAVOR THEREOF UNLESS A STOCKHOLDER HAS INDICATED OTHERWISE ON THE PROXY.

| YOUR BOARD OF DIRECTORS RECOMMENDS A VOTE "FOR" ALL NOMINEES |

10

Our Board of Directors

Set forth below are the names of the persons nominated as directors and directors whose terms do not expire this year, their ages as of February 28, 2021, their offices within the company, if any, their principal occupations or employment for the past five years, the length of their tenure as directors, the names of other public companies in which such persons hold directorships or held directorships within the past five years, and the particular experience, qualifications, attributes or skills that led the Board to determine that the individual should serve as a director.

| NAME | AGE | POSITION | TERM EXPIRATION | |||

|---|---|---|---|---|---|---|

| | | | | | | |

| Roberto Ardagna | 40 | Director | 2023 Annual Meeting | |||

Andrew B. Cogan | 58 |

| 2023 Annual Meeting | |||

Daniel W. Dienst | 55 |

| 2021 Annual Meeting | |||

Stephen F. Fisher | 68 |

| 2023 Annual Meeting | |||

Jeffrey A. Harris | 65 |

| 2022 Annual Meeting | |||

Jeffrey Alan Henderson | 47 |

| 2021 Annual Meeting | |||

Ronald R. Kass | 64 |

| 2022 Annual Meeting | |||

Christopher G. Kennedy | 57 |

| 2021 Annual Meeting | |||

John F. Maypole | 81 |

| 2022 Annual Meeting | |||

Sarah E. Nash | 67 |

| 2023 Annual Meeting | |||

Stephanie Stahl | 54 |

| 2021 Annual Meeting |

Director Since: 2020 | | ROBERTO ARDAGNA Independent Director Biography Mr. Ardagna has served as a director since July 21, 2020. Mr. Ardagna is a Senior Principal with Investindustrial Services Limited, an investment advisory firm, and has been selected to serve on our board by our Series A preferred stockholder, Global Furniture Holdings S.à.r.l. Mr. Ardagna is also a director and executive officer of Investindustrial Acquisition Corp. and several private companies. Previously, Mr. Ardagna was a director of Strategic Capital Advisors Limited. | ||||||

| | | | | | | | | |

| Committee Memberships: None | | Skills and Qualifications Mr. Ardagna has substantial experience in the investment banking, real estate and private equity fields, as well as experience as a board member for many portfolio companies. These skills are a valuable resource for our board. |

11

Director Since: 1996 | | ANDREW B. COGAN Chairman and Chief Executive Officer Biography Andrew Cogan has served as a director of Knoll, Inc. since February 1996. Mr. Cogan became Chief Executive Officer of Knoll, Inc. in April 2001 after serving as Chief Operating Officer since December 1999. Mr. Cogan has held several positions in the design and marketing group worldwide since joining us in 1989, including Executive Vice President—Marketing and Product Development and Senior Vice President. | ||||||

| | | | | | | | | |

Committee Memberships: None | | Skills and Qualifications Mr. Cogan has substantial industry and management experience, having served in management functions at Knoll for more than 20 years and as our Chief Executive Officer since 2001. Mr. Cogan is uniquely qualified to bring strategic insight, design and marketing expertise and in-depth knowledge of Knoll's worldwide business to the board, having served in numerous key positions within our design and marketing group, and as Chief Operating Officer prior to becoming Chief Executive Officer. Mr. Cogan is also a director of American Woodmark Corporation in Winchester, Virginia. |

Director Since: 2017 Committee Memberships: Audit | | DANIEL W. DIENST Independent Director Biography Daniel W. Dienst joined us as a director in August 2017. Mr. Dienst currently is the Executive Vice Chairman and Chief Strategy Officer of Authentic Brands Group, a role he has held since August 2018. Mr. Dienst also has been a Principal of D2Quared, LLC, a consulting firm, since 2013. He previously served as a Director and Chief Executive Officer of Martha Stewart Living Omnimedia, Inc. until its December 2015 sale to Sequential Brands, Inc. Prior to that, Mr. Dienst served as the Group Chief Executive of Sims Metal Management, Ltd., the world's largest publicly-listed metal and electronics recycler from 2008 to 2013. Prior to that, Mr. Dienst held various positions with CIBC World Markets Corp., a diversified global financial services firm. | ||||||

| | | | | | | | | |

| | | | Skills and Qualifications Mr. Dienst has substantial financial and executive experience and brings his strategic insight and financial acumen to the board's deliberations given his prior experience as a chief executive officer of a public company. |

12

| | STEPHEN F. FISHER Independent Director Biography Stephen F. Fisher has served as a director since December 2005. Mr. Fisher served as the Executive Vice President and Chief Financial Officer of Entercom Communications Corp., a radio broadcasting company, from November 1998 until April 28, 2017. | ||||||

| | | | | | | | | |

| | Director Since: 2005 Committee Memberships: Audit; Nominating and Corporate Governance | | Skills and Qualifications Mr. Fisher has held numerous financial management and operational positions. He served as Executive Vice President and Chief Financial Officer for a public company for over 17 years. Mr. Fisher also worked in the private equity field, making investments in companies and managing those portfolio companies as well as serving on the board of directors of both public and private companies. He brings significant financial and operational management, as well as financial reporting, experience to the board. |

Director Since: 1996 Committee Memberships: | | JEFFREY A. HARRIS Independent Director Biography Jeffrey A. Harris has been a director of Knoll, Inc. since February 1996. Mr. Harris is the founder and managing member of Global Reserve Group LLC, a financial advisory and investment firm focused primarily on the energy industry. Previously, he was a Managing Director of Warburg Pincus LLC, a private equity firm, where he was employed from 1983 until 2011 and where his responsibilities included involvement in investments in energy, technology and other industries. Mr. Harris is a director of InterPrivate II Acquisition Corp. and several private companies. In addition, he is a member of the Board of Trustees of the Cranbrook Educational Community, New York-Presbyterian Hospital and Friends of the High Line. Mr. Harris previously served as a director of Serica Energy PLC. | ||||||

| | | | | | | | | |

| | Nominating and Corporate Governance | | Skills and Qualifications Mr. Harris brings a strong business background to Knoll, having worked in the private equity field with Warburg Pincus for over 25 years. Mr. Harris has gained substantial experience in overseeing the management of diverse organizations, having served as a board member on many public and private boards, including a number of charitable and non-profit organizations. As a result of this service, Mr. Harris has a broad understanding of the operational, financial and strategic issues facing public and private companies. He has served on our board of directors since 1996 and through that service has developed extensive knowledge of our business. |

13

Director Since: 2020 | | JEFFREY ALAN HENDERSON Independent Director Biography Jeffrey Alan Henderson has served as a director since October 2020. Mr. Henderson is the founder and creative director of AndThem, a New York-based global creative agency focused on product design, engineering, content creation and strategy. Previously, Mr. Henderson held a range of creative and managerial roles in the footwear industry, including Footwear Design Director for Nike Sportswear and Innovation Director for Cole Haan. Mr. Henderson holds a graduate degree from the Georgia Institute of Technology. | ||||||

| | | | | | | | | |

| | Committee Memberships: None | | Skills and Qualifications Mr. Henderson has substantial design, engineering and product development experience and extensive business experience in brand-conscious retail industries and in consumer and digital marketing. |

Director Since: 2018 | | RONALD R. KASS Independent Director Biography Ronald R. Kass joined us as a director on July 30, 2018. Mr. Kass is currently the President and CEO of Hunter Douglas, Inc., the North American operations of Hunter Douglas N.V., the world market leader in window coverings and a major manufacturer of architectural products, a position he has held since July 2015. Prior to July 2015, Mr. Kass served as the Chief Operating of Officer of Hunter Douglas from July 2014 to July 2015 and served as President of the Design Products Group from January 2005 to July 2014. Mr. Kass also has served as President and CEO of The Robert Allen Group, an international designer, marketer and manufacturer of home furnishings from 1994 to 2002. | ||||||

| | | | | | | | | |

| | Committee Memberships: Compensation | | Skills and Qualifications Mr. Kass has substantial executive and management experience, both within the furniture industry and in other related design industries. The Knoll board benefits from his strategic, management and operational expertise. |

14

Director Since: 2014 | | CHRISTOPHER G. KENNEDY Independent Director Biography Christopher G. Kennedy joined us as a director in November 2014. Mr. Kennedy serves as Chairman of Joseph P. Kennedy Enterprises, Inc., which is the investment firm of the Kennedy Family. Mr. Kennedy also serves on the Board of Directors of Interface, Inc., a floor covering company, and is the Founder and Chairman of Top Box Foods, a Chicago-based non-profit hunger-relief organization. He formerly served as President of Merchandise Mart Properties, Inc., a subsidiary of Vornado Realty Trust, from 2000 to 2011. Since 1994, he has served on the Board of Trustees of Ariel Mutual Funds. Mr. Kennedy is also active in several educational and civic organizations. | ||||||

| | | | | | | | | |

| | Committee Memberships: Compensation | | Skills and Qualifications Mr. Kennedy has significant experience in the residential and commercial furniture markets, due to his experience as former President of Merchandise Mart Properties. Mr. Kennedy also brings substantial executive level experience that is particularly beneficial to our strategies and sales and marketing efforts in the corporate office and retail market segments. His insight into governmental and economic affairs and his civic involvement also are of great value to the Knoll board. |

Director Since: 2004 | | JOHN F. MAYPOLE Independent Director Biography John F. Maypole has served as a director of Knoll, Inc. since December 2004. Mr. Maypole has, for over 40 years, served as an independent director of, or consultant to, various corporations and providers of financial services. Mr. Maypole previously served as a director of Church and Dwight Co., Inc., the National Captioning Institute, Inc., Verizon Communications and the MassMutual Financial Group, among others. | ||||||

| | | | | | | | | |

| | Committee Memberships: Audit | | Skills and Qualifications Mr. Maypole brings substantial accounting, finance, and management experience to the board. Mr. Maypole previously served as a chief financial officer, chief operating officer, chief executive officer, chairman of the board and independent consultant to numerous industrial and financial services companies and has significant experience with operational and financial matters, including financial reporting. Mr. Maypole has served on a number of private and public boards and his experiences have resulted in a broad understanding of the operational, financial and strategic issues facing public and private companies. Mr. Maypole's perspectives on executive management, leadership and financial management are important to the board's deliberations. |

15

Director Since: 2006 Committee Memberships: | | SARAH E. NASH Independent Director Biography Sarah E. Nash has served as a director of Knoll, Inc. since September 2006. Ms. Nash was named Chairman and Chief Executive Officer of Novagard, Inc. in 2018. In March 2020, Ms. Nash was named the Chair of the Board of Directors of L Brands, Inc. In August 2005, Ms. Nash retired as a Vice Chairman of J.P. Morgan Chase & Co.'s Investment Bank where she was responsible for the firm's client relationships. Prior to these responsibilities, she was the Regional Executive and Co-Head of Investment Banking for North America at J.P. Morgan Co. Ms. Nash also serves on the Board of Directors of Irving Oil Company, Blackbaud Inc. and HBD Industries. She is a Trustee for New York-Presbyterian Hospital and is a member of the National Board of the Smithsonian Institution. | ||||||

| | | | | | | | | |

| | Compensation | | Skills and Qualifications Ms. Nash has significant finance and investment banking experience, and brings that experience and her perspectives on management and finance to the Knoll board. She had a long, successful career in investment banking, retiring as Vice Chairman of J.P. Morgan Chase & Co.'s Investment Bank. Ms. Nash has served on a number of private and public boards, which has resulted in a broad understanding of the operational, financial and strategic issues facing public and private companies. She brings these experiences and understandings to the Knoll board. |

Director Since: 2013 Committee Memberships: Audit; Nominating and | | STEPHANIE STAHL Independent Director Biography Stephanie Stahl joined us as a director in August 2013. Ms. Stahl is the founder of Studio Pegasus LLC, an early-stage investor in consumer ventures that she created in April 2015. Ms. Stahl previously served as Executive Vice President, Marketing and Strategy for Coach, Inc., a position she held from July 30, 2013 until February 14, 2015. Prior to that, Ms. Stahl served as the Senior Vice President, Strategy and Consumer for Coach from October 2012 until June 2013. Prior to joining Coach, Ms. Stahl was the Chief Executive Officer of the fitness company Tracy Anderson Mind and Body from July 2011 until July 2012. Prior to that, Ms. Stahl served as Executive Vice President and Chief Marketing Officer of Revlon and as a Partner and Managing Director of the Boston Consulting Group in the consumer goods, retail and media industries for over ten years. Ms. Stahl also serves on the Board of Directors of Dollar Tree Stores and Chopt Creative Salad Company. | ||||||

| | | | | | | | | |

| | Corporate Governance | | Skills and Qualifications Ms. Stahl has significant experience in high-design businesses and in creating and driving global brand building consumer and customer strategies, particularly in the consumer goods and retail segments. Ms. Stahl brings this experience to the board as Knoll positions itself as the premier high-design company in the interior space through expanded luxury offerings and new distribution channels. |

16

In accordance with our Corporate Governance Guidelines, our board of directors has reviewed the qualifications of each of its members and, on March 1, 2021, affirmatively determined that a majority of the members of our board of directors are independent under the New York Stock Exchange ("NYSE") Corporate Governance Standards. The independence standards of the NYSE are composed of objective standards and subjective standards. Under the objective standards, a director will generally not be deemed independent if he or she receives compensation (other than as a director) in excess of certain thresholds or if certain described relationships exist. Under the subjective standards, a director will not be independent if the board of directors determines that the director has a material relationship with us. In addition to our board of directors determining these directors meet the objective standards under the listing standards of the NYSE, our board of directors has determined that none of these individuals has a material relationship with the company (directly or as a partner, shareholder, or officer of an organization that has a relationship with the company) other than as a director. In making this determination, the board of directors considered that some of the directors serve on boards of companies, or are (or recently were) associated with companies or entities, to which we sold products, or from which we purchased products or services during the year. Given the size and nature of these transactions, we concluded that they would not interfere with the exercise of independent judgment by these board members. The board of directors relied on both information provided by the directors and information developed internally by the company in evaluating these facts.

The Board has determined that each of the following directors and director nominees listed below is independent under the independence standards of the New York Stock Exchange and would constitute a majority of the board of directors:

In addition, the board determined that each member of the Audit Committee also meets the additional independence standards for audit committee members established by the Securities and Exchange Commission ("SEC") and the NYSE, and each member of the Compensation Committee meets the additional independence standards for compensation committee members established by the SEC and the NYSE, and also qualifies as a "Non-Employee Director" as defined in Rule 16b-3 of the Exchange Act.

Our Corporate Governance Policies and Practices

Corporate Governance Guidelines

Our board of directors has adopted Corporate Governance Guidelines that provide the framework for the governance of the company. Our Corporate Governance Guidelines are available on our website at www.knoll.com and will also be made available to stockholders without charge upon request in writing to

17

our Corporate Secretary at Knoll, Inc., 1235 Water Street, East Greenville, Pennsylvania 18041. The information contained on our website is not included as part of, or incorporated by reference into, this proxy statement.

Our Corporate Governance Guidelines include a Director Resignation Policy. Under this policy, any nominee for director in an uncontested election (i.e., an election where the only nominees are those proposed by the board) who receives a greater number of votes "withheld" from his or her election than votes "for" such election shall promptly tender an offer of resignation for consideration by the board. The nominating and corporate governance committee shall evaluate the director's offer of resignation, taking into account the best interests of the Company and its stockholders, and shall recommend to the board whether to accept or reject such offer of resignation. In making this recommendation, the nominating and corporate governance committee may consider all factors deemed relevant by its members, including, without limitation, the underlying reasons why stockholders voted against the director (if ascertainable), the length of service and qualifications of the director, the director's past (and expected future) contributions to the Company, and whether by accepting such resignation the Company will no longer be in compliance with any applicable law, rule, regulation or governing document. The board shall act to accept or reject such offer of resignation within 120 days following certification of the stockholder vote at the stockholder meeting at which the election of directors was held. In making its decision, the board may consider the factors considered by the committee and such additional information and factors the board believes to be relevant.

Our board of directors has adopted a code of ethics that applies to all of our directors, officers and employees, including our chief executive officer and chief financial and accounting officers. The code of ethics is publicly available on our website at www.knoll.com and will also be made available without charge to any person upon request in writing to our Corporate Secretary at Knoll, Inc., 1235 Water Street, East Greenville, Pennsylvania 18041. We intend to disclose amendments to, or waivers from, provisions of the code of ethics that apply to any director or principal executive, financial or accounting officers on our website at www.knoll.com, in lieu of disclosing such matters in Current Reports on Form 8-K.

We currently have a chairman of the board and lead independent director. Andrew B. Cogan has served as Chairman of the Board since May 8, 2018. Mr. Cogan has served as our CEO since 2001, and originally joined us in 1989. Given the current composition of the board, we believe that it is appropriate for Mr. Cogan to hold both positions of chairman of the board and chief executive officer in light of the depth of his experience with the company and in our industry generally.

Additionally, we believe that when the chairman of the board is an employee of the company or otherwise not independent, it is important to have a separate lead independent director in order to facilitate the board's oversight of management and perform many of the same functions that an independent chairman would perform. Jeffrey A. Harris serves as our lead independent director. In that role, he presides over the board's executive sessions and serves as the principal liaison between management and the independent directors of our board. Mr. Harris has served as a Knoll director since 1996. We believe that the division of duties and avenues of communication between the board and our management associated with having Mr. Cogan serve as chairman and Mr. Harris as lead director provides the basis for the proper functioning of our board and its oversight of management.

18

Oversight of Risk Management by our Board of Directors

Our board of directors has overall responsibility for risk oversight. This role is primarily fulfilled by our audit committee. Our audit committee periodically discusses and evaluates company risk with our management, including our chief executive officer, chief financial officer and our chief legal officer. Our audit committee also periodically discusses and evaluates risk with our independent auditors and members of our internal audit group. The audit committee reports back to our full board with respect to those activities. In addition, as described in the section entitled "Risk Assessment — Incentive Compensation Programs" on page 56 below, our compensation committee specifically evaluates risks associated with our compensation programs. The board's role in risk oversight has not had any effect on the board's leadership structure.

Diversity is one of the factors considered by our nominating and corporate governance committee in the director nomination process. The overriding principle guiding our director nomination process is a desire to ensure that our board collectively serves the interests of our stockholders. We believe that having diverse skills, experiences and perspectives represented on the board provides the most value to the company and its stockholders. We also believe that an appropriate level of collegiality and chemistry among board members is extremely important to a well-functioning board.

Among the factors considered when we evaluate the skills, experiences and perspectives are the following:

We also consider diversity with respect to race and gender in evaluating whether the board has the right mix of perspectives to properly serve the company and its stockholders.

All the factors set forth above are considered by the nominating and corporate governance committee as it evaluates the directors that are nominated to serve on our board. It is not our desire to make sure every skill, type of experience and perspective is represented on the board, but we instead focus on making sure there is an appropriate mix of skills, experiences and perspectives, which we believe leads to more thoughtful and open board discussions and deliberations. Our nominating and corporate governance committee monitors its consideration of diversity as part of the annual self-evaluation process.

During the year ended December 31, 2020, there were seventeen meetings of our board of directors. Given the unique challenges presented by the pandemic, 2020 was an extremely busy year for our board. During 2020, no director attended fewer than 75% of the total number of meetings or fewer than 75% of meetings of a committee of the board on which he or she served. Currently, we do not have a formal policy regarding director attendance at our Annual Meetings of Stockholders. However, it is expected that, absent compelling circumstances, our directors will be in attendance at our 2021 Annual Meeting of Stockholders.

19

Due to public health restrictions related to the COVID-19 pandemic, and for the safety of our stockholders, the 2021 Annual Meeting of Stockholders will be conducted virtually. All of our directors attended our 2020 Annual Meeting of Stockholders, which was held via teleconference due to the COVID-19 pandemic.

In accordance with our Corporate Governance Guidelines, our non-management directors meet periodically without any management directors or employees present. As required by the New York Stock Exchange Listing requirements and in accordance with our Corporate Governance Guidelines, our independent directors also typically meet exclusively in an executive session in connection with most board meetings. Mr. Harris presides over meetings of the non-management directors and independent directors.

Our board of directors maintains an audit committee, a compensation committee, and a nominating and corporate governance committee. Each of these committees operates pursuant to a written charter, which are reviewed annually and publicly available on our website at www.knoll.com and will also be made available to stockholders without charge, upon request in writing to our Corporate Secretary at Knoll, Inc., 1235 Water Street, East Greenville, Pennsylvania 18041.

Audit Committee. Our audit committee met nine times during 2020. This committee currently has four members, Messrs. Dienst, Fisher and Maypole and Ms. Stahl. Our board of directors has determined that Mr. Maypole, the Chairman of the audit committee, is an "audit committee financial expert," as the SEC has defined that term in Item 407 of Regulation S-K. As has been previously disclosed, Mr. Maypole has elected to retire from our board of directors effective upon the conclusion of the 2021 Annual Meeting of Stockholders. Our board has appointed Mr. Fisher as Chairman of the audit committee, effective upon Mr. Maypole's retirement. The composition of our audit committee meets the currently applicable independence requirements of the New York Stock Exchange and SEC rules and regulations. Our audit committee (i) assists our board in monitoring the integrity of our financial statements, our compliance with legal and regulatory requirements, our independent registered public accounting firm's qualifications and independence, and the performance of our internal audit function and independent registered public accounting firm; (ii) assumes direct responsibility for the appointment, compensation, retention and oversight of the work of any independent registered public accounting firm engaged for the purpose of performing any audit, review or attest services and for dealing directly with any such accounting firm; (iii) provides a medium for consideration of matters relating to any audit issues; and (iv) prepares the audit committee report that the SEC rules require be included in our annual proxy statement or annual report on Form 10-K. The audit committee reviews and evaluates, at least annually, its performance and the performance of its members, including compliance with its charter. Please see the report of the audit committee set forth elsewhere in this proxy statement.

Compensation Committee. Our compensation committee met seven times during 2020. This committee currently has three members, Messrs. Kass and Kennedy and Ms. Nash. Mr. Kennedy serves as Chairman of the committee. Our compensation committee reviews and recommends policy relating to compensation and benefits of our officers and employees, including reviewing and approving corporate goals and objectives relevant to compensation of the chief executive officer and other senior officers, evaluating the performance of these officers in light of those goals and objectives and setting compensation of these officers based on such evaluations. Our board of directors has designated our compensation committee to serve as the administrative committee under our stock incentive plans. In that role, our compensation committee determines which individuals receive awards under our stock incentive plans, the types of such awards, the terms and conditions of such awards and, subject to our stock option grant policy, the time at which such awards are granted. The compensation committee reviews and evaluates, at least annually, the performance of the compensation committee and its members, including compliance of the compensation committee with its charter. A description of the compensation committee's processes and procedures for the consideration and determination of executive compensation is set forth in more detail below in this Proxy Statement under the heading "Compensation Discussion and Analysis."

20

Nominating and Corporate Governance Committee. Our nominating and corporate governance committee met two times during 2020. This committee currently has three members, Messrs. Fisher and Harris and Ms. Stahl. Ms. Stahl currently serves as Chair of our nominating and corporate governance committee. The nominating and corporate governance committee oversees and assists our board of directors in identifying, reviewing and recommending nominees for election as directors; evaluates our board of directors and corporate social responsibility initiatives; develops, reviews and recommends corporate governance guidelines and a corporate code of business conduct and ethics; and generally advises our board of directors on corporate governance and related matters. The nominating and corporate governance committee reviews and evaluates, at least annually, its performance and the performance of its members, including compliance with its charter. The nominating and corporate governance committee also facilitates the board's overall self-assessment.

The nominating and corporate governance committee may consider director candidates recommended by stockholders as well as from other sources such as other directors or officers, third party search firms or other appropriate sources. For all potential candidates, the committee may consider all factors it deems relevant, such as a candidate's personal integrity and judgment, business and professional skills and experience, independence, knowledge of the industry in which we operate, past service on the board of directors, possible conflicts of interest, diversity, the extent to which the candidate would fill a present need on the board of directors and concern for the long-term interests of the stockholders.

In general, persons recommended by stockholders will be considered on the same basis as candidates from other sources. If a stockholder wishes to nominate a candidate to be considered for election as a director at the 2022 Annual Meeting of Stockholders, it must follow the procedures described in "Stockholder Proposals and Nominations for Director" set forth elsewhere in this proxy statement. If a stockholder wishes simply to propose a candidate for consideration as a nominee by the nominating and corporate governance committee, it should submit any pertinent information regarding the candidate to the nominating and corporate governance committee by mail to Knoll, Inc., c/o Corporate Secretary, 1235 Water Street, East Greenville, Pennsylvania 18041.

Compensation Committee Interlocks and Insider Participation

No person who served as a member of our compensation committee during fiscal year 2020 was a current or former officer or employee of ours or engaged in transactions with us required to be disclosed by SEC regulations during fiscal year 2020. None of our executive officers serve as a member of the board of directors or compensation committee of any entity that has one or more executive officers who serve on our board of directors or compensation committee.

In accordance with our Corporate Governance Guidelines, interested persons may send communications to the board, to any committee of the board or to any individual members of the board (including non-management directors) by sending a letter to the following address: Knoll, Inc., c/o Corporate Secretary, 1235 Water Street, East Greenville, Pennsylvania 18041. In addition, our board of directors has adopted "Whistleblower Procedures" setting forth procedures to enable the receipt and investigation of accounting, legal or retaliatory claims. The Whistleblower Procedures are publicly available in the Corporate Governance portion of our website at www.knoll.com.

21

Our Corporate Governance Guidelines provide that the form and amount of compensation provided to our directors shall be determined by the board of directors with the assistance of the compensation committee. The board of directors and compensation committee periodically review our director compensation programs to ensure that they remain competitive. In making this review, the board of directors and compensation committee considers our size, industry characteristics, location, the practices at comparable companies in the same region, and such other factors as the board of directors or compensation committee deems relevant. Effective October 1, 2007, our board of directors adopted the Knoll, Inc. Non-Employee Director Compensation Plan, which was most recently amended effective January 1, 2018. Under this Plan, our compensation package for non-employee directors consists of:

All or a portion of annual fees may, at the election of the non-employee director, be paid in the form of shares of our common stock. The number of shares issuable pursuant to such an election is equal to the value of the fee forgone divided by the fair market value of the common stock on the payment date. Commencing June 30, 2020, all of our directors elected to receive their annual fees in the form of stock.

The table below sets forth information concerning the compensation we paid to our non-employee directors during 2020 for service on our board of directors. All of the directors listed below served for the entire year.

Director Compensation Table — 2020

| Name | Fees Earned or Paid in Cash ($) | Stock Awards $1 | Total ($) | |||||||

|---|---|---|---|---|---|---|---|---|---|---|

| | | | | | | | | | | |

Roberto Ardagna | | — | | — | | — | ||||

Daniel W. Dienst | | 50,000 | 2 | | 90,000 | 3 | | 140,000 | ||

Stephen F. Fisher | | 50,000 | 2 | | 90,000 | 3 | | 140,000 | ||

Jeffrey A. Harris | | 65,000 | 4 | | 90,000 | 3 | | 155,000 | ||

Jeffrey Alan Henderson | | 10,462 | 5 | | 45,000 | 5 | | 55,462 | ||

Ronald R. Kass | | 50,000 | 2 | | 90,000 | 3 | | 140,000 | ||

Christopher G. Kennedy | | 50,000 | 2 | | 90,000 | 3 | | 140,000 | ||

John F. Maypole | | 65,000 | 6 | | 90,000 | 3 | | 155,000 | ||

Sarah E. Nash | | 50,000 | 2 | | 90,000 | 3 | | 140,000 | ||

Stephanie Stahl | | 50,000 | 2 | | 90,000 | 3 | | 140,000 | ||

22

December 31, 2020, filed with the SEC on March 1, 2021. The restricted stock awards to which the amounts in this column relate are described in the footnotes below.

The following table sets forth the aggregate number of unvested restricted stock awards and the aggregate number of stock option awards outstanding as of December 31, 2020:

| Name | Aggregate Number of Outstanding Restricted Stock Awards | Aggregate Number of Outstanding Option Awards | |||||

|---|---|---|---|---|---|---|---|

| | | | | | | | |

Roberto Ardagna | | — | | — | |||

Daniel W. Dienst | | 10,093 | | — | |||

Stephen F. Fisher | | 10,093 | | — | |||

Jeffrey A. Harris | | 10,093 | | — | |||

Jeffrey Alan Henderson | | 3,903 | | — | |||

Ronald R. Kass | | 10,093 | | — | |||

Christopher G. Kennedy | | 10,093 | | — | |||

John F. Maypole | | 10,093 | | — | |||

Sarah E. Nash | | 10,093 | | — | |||

Stephanie Stahl | | 10,093 | | — | |||

23

The audit committee of the board of directors has furnished the following report:

The audit committee assists the board of directors in overseeing and monitoring the integrity of our financial reporting process, compliance with legal and regulatory requirements and the quality of internal and external audit processes. This committee's role and responsibilities are set forth in a charter adopted by the board of directors, which is available on our website at www.knoll.com. This committee reviews and reassesses our charter annually and recommends any changes to the board of directors for approval. The audit committee is responsible for overseeing our overall financial reporting process, and for the appointment, compensation, retention, and oversight of the work of our independent registered public accounting firm. In fulfilling its responsibilities for the financial statements for fiscal year 2020, the audit committee took the following actions:

Based on the audit committee's review of the audited financial statements and discussions with management and Ernst & Young LLP, including meetings held without management present, the audit committee recommended to the board of directors that the audited financial statements be included in our Annual Report on Form 10-K for the fiscal year ended December 31, 2020 for filing with the SEC.

Members of our audit committee

John F. Maypole (Chairman)

Stephen F. Fisher

Stephanie Stahl

Daniel W. Dienst

24

PROPOSAL 2 — APPROVAL OF KNOLL, INC. 2021 STOCK INCENTIVE PLAN

We are asking for our stockholders to approve the Knoll, Inc. 2021 Stock Incentive Plan (the "2021 Plan"). The Board approved the 2021 Plan on March 29, 2021, subject to approval by our stockholders. The 2021 Plan is set forth in Exhibit B to this proxy statement and incorporated by reference herein.

The board recommends that stockholders approve the 2021 Plan in order to attract, retain and compensate our employees, consultants and directors and align the interests of our stockholders with management. Our Board and Compensation Committee considered whether to adopt a new equity plan or to amend our 2018 Stock Incentive Plan (the "2018 Plan"). As of February 28, 2021, the 2018 Plan had approximately 332,640 shares available for issuance. After discussion, the Board and Compensation Committee believe that adopting a new plan, rather than amending the 2018 Plan would provide for a new framework that is aligned with the current status and outlook of the Company's management and Board. While the Board and the Compensation Committee have adopted the 2021 Plan and we are asking our stockholders to approve the 2021 Plan, the Board and Compensation Committee also determined to keep the 2018 Plan in operation and continue to grant awards under the 2018 Plan as prescribed by its terms.

If our stockholders approve this Proposal 2, the 2021 Plan will become effective immediately. If the 2021 Plan is not approved by our stockholders, the 2018 Plan will remain in place and we could continue to grant awards under the 2018 Plan. However, if the 2021 Plan is not approved by our stockholders, we would have fewer number of shares available for grant to our employees, directors and consultants. Accordingly, our Board recommends the approval of the 2021 Plan.

The 2021 Plan Includes Features Designed to Protect Stockholder Interests

The 2021 Plan includes a number of provisions that we believe promote best compensation and governance practices. These provisions include, but are not limited to, the following:

There are typical exceptions to the general rule, including that cash-settled only awards and, subject to exchange requirements, shares underlying substitute awards granted to employees of acquired companies or merger partners, in each case, will not count against the share reserve.

25

Determination of the Number of Shares Reserved for Issuance under the 2021 Plan

A total of 1,750,000 shares of common stock would be reserved for issuance under the 2021 Plan. In assessing the number of shares to be authorized for issuance under the 2021 Plan, the Compensation Committee considered, among other things, our compensation philosophy and practices, our anticipated compensation needs, our historic burn rate, overhang and dilution and the publicly-available positions of certain stockholder advisory firms and institutional investors.

Although our future share usage and needs cannot predict with certainty, the Board anticipates that the proposed 1,750,000 share reserve will provide us with sufficient shares for our equity compensation program for the next 2 to 4 years. Upon stockholder approval of the 2021 Plan, our dilution would be approximately 8.8% based on 54,138,184 fully diluted shares outstanding as of February 28, 2021, taking into account 49,378,912 shares of common stock outstanding as of February 28, 2021, 1,427,239 shares of restricted stock that are not entitled to vote, 428,754 remaining shares available under our existing plans and 1,153,279 outstanding restricted stock unit and option awards as of that date. As of February 28, 2021, the weighted-average remaining term of our 110,000 outstanding options is 6.95 years and the weighted-average exercise price of the options is $20.83.

Our three-year burn rate has varied between approximately 1.35% to 5.83% and the three-year average historical burn rate has been approximately 3.16%. The closing price of our common stock on March 15, 2021, was $18.07 per share.

Despite the potential dilution effect of the 2021 Plan, the Board believes that the share authorization request under the 2021 Plan is reasonable and customary within our industry, especially in light of the importance of equity compensation in attracting and retaining talent in our industry.

Summary of Material Terms of the 2021 Plan

The following discussion summarizes the material terms of the 2021 Plan. This discussion does not purport to be complete and is qualified in its entirety by reference to the 2021 Plan, a copy of which is attached hereto as Exhibit B.

26

The purpose of the 2021 Plan is to promote the success and enhance the value of the Company by linking the personal interests of employees, officers and directors of the Company to those of Company stockholders, and by providing such persons with an incentive for outstanding performance. The 2021 Plan is further intended to provide flexibility to the Company in its ability to motivate, attract, and retain the services of employees, officers, directors and consultants upon whose judgment, interest, and special effort the successful conduct of the Company's operation is largely dependent.

The 2021 Plan would be administered by our Compensation Committee. Subject to the provisions of the 2021 Plan, in its capacity as the 2021 Plan's administrator, the Compensation Committee would be authorized to adopt rules, regulations, guidelines and procedures for carrying out the provisions and purposes of the 2021 Plan and make such other determinations, not inconsistent with the 2021 Plan, as the Compensation Committee may deem appropriate. All decisions, determinations and interpretations by the Compensation Committee regarding the 2021 Plan and awards granted under the 2021 Plan would be final and binding on all participants and other persons holding or claiming rights under the 2021 Plan or an award under the 2021 Plan. The Compensation Committee may authorize a special committee, consisting of one or more independent directors, to make grants under the 2021 Plan to officers or employees of the Company or any of its subsidiaries other than the insiders subject to the short-swing profit rules of Section 16(a) of the Securities Exchange Act of 1934.

Any person who is an employee, consultant or non-employee director of our Company or subsidiary of the Company would be eligible to receive an award under the 2021 Plan.

For purposes of the 2021 Plan, the term "subsidiary" includes any corporation, limited liability company, partnership or other entity, of which 50% or more of the outstanding voting stock or voting power is beneficially owned directly or indirectly by the Company.

As of December 31, 2020, there were approximately three thousand employees and ten non-employee directors of the Company and our subsidiaries who would be potentially eligible to participate in the 2021 Plan.

Shares Subject to the 2021 Plan

Subject to changes in our capitalization, the aggregate number of shares of our common stock available for issuance for all awards under the 2021 Plan would not exceed 1,750,000 shares. The share reserve would be depleted by one share for each share underlying an award granted under the 2021 Plan. The shares available for issuance under the 2021 Plan may be shares that are authorized but unissued shares or issued shares that were reacquired by us, including shares purchased in the open market.

Any unissued or forfeited shares subject to an award that is canceled, terminated, expired, forfeited or lapses will be available to be granted again under the 2021 Plan. The full number of shares subject to an award will count against the share reserve, even if the exercise price of an option is satisfied through net-settlement or by delivering shares to the Company, and if a SAR is exercised and shares are issued, the full number of shares underlying the SAR would count against the share reserve, not just the net number of shares issued upon exercise. In addition, shares withheld from an award to satisfy withholding tax, shares delivered by a participant to satisfy withholding tax and any shares purchased in the open market with proceeds from the exercise of stock options and SARs will not be available for subsequent awards.

27

There are typical exceptions to the general rule, including that shares subject to any cash-settled only awards and substitute awards granted to employees of acquired companies or merger partners, in each case, will not count against the share reserve.

The 2021 Plan requires that the minimum vesting period for all awards to be no less than one year from the date the award is granted, provided that this restriction would not apply (A) as determined by the plan committee, in the case of the participant's death, disability or retirement or a change in control, (B) to an award that is granted in lieu of cash compensation foregone at the election of a participant, (C) to awards for an aggregate number of shares not to exceed 5% of the total number of shares available for issuance under this plan, and (D) to substitute awards awarded in connection with transactions. Awards to non-employee directors granted on or around the annual stockholders' meeting may vest at the next annual stockholders' meeting so long as the vesting period is no less than 50 weeks after grant.

Non-Employee Director Compensation Limits

The 2021 Plan contains limits on the amount of compensation awarded to non-employee directors. Under the 2021 Plan, a non-employee director may receive no more than $400,000 in total value any fiscal year. For purposes of the $400,000 cap, non-employee director fees paid in cash and the fair value, as of grant date, of stock awards awarded to the director are counted against the limit. Such cap does not include the value of dividend equivalents paid to a non-employee director pursuant to an award granted in a previous year. The Board may award additional compensation to a non-employee director in the event that the circumstances warrant, provided that the non-employee director whose compensation would exceed the limit must recuse himself or herself from such approval.

Restricted Stock and Stock Units

Restricted stock awards are grants of a specified number of shares of common stock that are subject to certain restrictions that limit the participant's ability to transfer the stock until the specific conditions are met. Under the 2021 Plan, restricted stock awards could be subject to conditions (including continued employment or performance conditions) that the Compensation Committee deems appropriate. RSU awards under the 2021 Plan may be settled in either cash or stock, in the Compensation Committee's discretion.

Except as otherwise set forth, and with respect to RSUs, until shares are released to the participant and he or she becomes the holder of record, the participant has none of the rights of a shareholder.

Participants are not entitled to receive dividends or dividend equivalents with respect to shares underlying RSUs unless otherwise provided by the Compensation Committee. All dividends or dividend equivalents with respect to shares of restricted stock or RSUs will be accumulated and subject to the same terms and conditions as are applicable to the restricted stock or RSUs to which the dividends or dividend equivalents relate.

In the Compensation Committee's discretion, an award of restricted stock or RSUs may provide for the vesting and settlement of the award after a participant's death, disability, retirement or other termination of employment.

Option Awards and Stock Appreciation Rights

Under the 2021 Plan, the Compensation Committee is authorized to grant stock options and SARs. Stock option entitles the participant to purchase shares of stock in the future at a specified price. A SAR gives the participant the right to share in the appreciation in value of one share of common stock. Options can be granted as incentive stock options or nonqualified stock options, but incentive stock options can only be

28

granted to participants who are employees. The Compensation Committee will determine the terms and conditions of the exercise of options and SARs, but no option or SAR can be exercised more than 10 years after the award date. In addition, no dividends or dividend equivalents can be granted to options or SARs. The aggregate market value of the stock with respect to incentive stock options that become exercisable for the first time by a participant during any calendar year may not exceed $100,000 or such other amount as may be permitted under the Internal Revenue Code of 1986, as amended (the "Code").

Performance Awards, Performance Goals, and Qualified Performance-Based Awards

Under the 2021 Plan, the Compensation Committee may establish performance goals and criteria in respect of the vesting of any award (making it a "performance award"). Section 162(m) of Code places a limit of $1,000,000 on the amount that can be deducted in any one-year for compensation paid to certain covered employees (as that term is used in Section 162(m) of the Code). The Tax Cuts and Jobs Act of 2017 eliminated the performance-based compensation exception under Section 162(m) of the Code, except with respect to certain grandfathered awards. As a result of this change in tax laws, we would not be able to grant awards under the 2021 Plan that qualify for the performance-based compensation exception under Section 162(m).