UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934: |

For the fiscal year ended December 31, 2010

Commission file number 1-14368

Titanium Metals Corporation

(Exact name of registrant as specified in its charter)

| | |

| Delaware | | 13-5630895 |

(State or other jurisdiction of incorporation or organization) | | (IRS employer identification no.) |

5430 LBJ Freeway, Suite 1700, Dallas, Texas 75240

(Address of principal executive offices, including zip code)

Registrant’s telephone number, including area code: (972) 233-1700

Securities registered pursuant to Section 12(b) of the Act:

| | |

| Common Stock ($.01 par value) | | New York Stock Exchange |

| (Title of each class) | | (Name of each exchange on which registered) |

Securities registered pursuant to Section 12(g) of the Act:

|

| 6 3/4% Series A Convertible Preferred Stock ($.01 par Value) |

| (Title of class) |

Indicate by check mark if the Registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes x No ¨

Indicate by check mark if the Registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of Registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company (as defined in Rule 12b-2 of the Act).

| | | | | | |

Large accelerated filer x | | Accelerated filer ¨ | | Non-accelerated filer ¨ | | Smaller reporting company ¨ |

Indicate by check mark whether the Registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ¨ No x

The aggregate market value of the 86.7 million shares of voting stock held by nonaffiliates of Titanium Metals Corporation as of June 30, 2010 approximated $1.5 billion. There are no shares of non-voting common stock outstanding. As of February 18, 2011, 180,174,253 shares of common stock were outstanding.

Documents incorporated by reference: The information required by Part III is incorporated by reference from the Registrant’s definitive proxy statement to be filed with the Commission pursuant to Regulation 14A not later than 120 days after the end of the fiscal year covered by this report.

Forward-Looking Information

The statements contained in this Annual Report on Form 10-K (“Annual Report”) that are not historical facts, including, but not limited to, statements found in the Notes to Consolidated Financial Statements and in Item 1- Business, Item 1A – Risk Factors, Item 2 – Properties, Item 3 - Legal Proceedings and Item 7 - Management’s Discussion and Analysis of Financial Condition and Results of Operations (“MD&A”), are forward-looking statements that represent our beliefs and assumptions based on currently available information. Forward-looking statements can generally be identified by the use of words such as “believes,” “intends,” “may,” “will,” “looks,” “should,” “could,” “anticipates,” “expects” or comparable terminology or by discussions of strategies or trends. Although we believe that the expectations reflected in such forward-looking statements are reasonable, we do not know if these expectations will prove to be correct. Such statements by their nature involve substantial risks and uncertainties that could significantly affect expected results. Actual future results could differ materially from those described in such forward-looking statements, and we disclaim any intention or obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. Among the factors that could cause actual results to differ materially are the risks and uncertainties discussed in this Annual Report, including risks and uncertainties in those portions referenced above and those described from time to time in our other filings with the Securities and Exchange Commission (“SEC”) which include, but are not limited to:

| | • | | the cyclicality of the commercial aerospace industry; |

| | • | | the performance of our customers and us under our long-term agreements; |

| | • | | the existence, amendment or renewal of certain long-term agreements; |

| | • | | the difficulty in forecasting demand for titanium products; |

| | • | | global economic, financial and political conditions; |

| | • | | global productive capacity for titanium; |

| | • | | changes in product pricing and costs; |

| | • | | the impact of long-term contracts with vendors on our ability to reduce or increase supply; |

| | • | | the possibility of labor disruptions; |

| | • | | fluctuations in currency exchange rates; |

| | • | | fluctuations in the market price of marketable securities; |

| | • | | uncertainties associated with new product or new market development; |

| | • | | the availability of raw materials and services; |

| | • | | changes in raw material prices and other operating costs (including energy costs); |

| | • | | possible disruption of business or increases in the cost of doing business resulting from terrorist activities or global conflicts; |

| | • | | competitive products and strategies; and |

| | • | | other risks and uncertainties. |

Should one or more of these risks materialize (or the consequences of such a development worsen), or should the underlying assumptions prove incorrect, actual results could differ materially from those forecasted or expected.

1

PART I

General. Titanium Metals Corporation is one of the world’s leading producers of titanium melted and mill products. We are the only producer with major titanium production facilities in both the United States and Europe, the world’s principal markets for titanium consumption. We are currently the largest U.S. producer of titanium sponge, a key raw material, and a major recycler of titanium scrap. Titanium Metals Corporation was formed in 1950 and was incorporated in Delaware in 1955. Unless otherwise indicated, references in this report to “we”, “us” or “our” refer to TIMET and its subsidiaries, taken as a whole.

Titanium was first manufactured for commercial use in the 1950s. Titanium’s unique combination of corrosion resistance, elevated-temperature performance and high strength-to-weight ratio makes it particularly desirable for use in commercial and military aerospace applications where these qualities satisfy essential design requirements for certain critical parts such as wing supports and jet engine components. While aerospace applications have historically accounted for a substantial portion of the worldwide demand for titanium, other end-use applications for titanium in military and industrial markets have continued to develop, including the use of titanium-based alloys in armor plating, structural components, chemical plants, power plants, desalination plants and pollution control equipment. Additionally, demand for titanium in emerging markets is supported by diverse uses including oil and gas production installations, automotive, geothermal facilities and architectural applications.

Our products include titanium sponge, melted products, mill products and industrial fabrications. The titanium industry is comprised of several manufacturers that, like us, produce a relatively complete range of titanium products and a significant number of producers worldwide that manufacture a limited range of titanium mill products.

Our long-term strategy is to maximize the value of our core aerospace business while expanding our presence in non-aerospace markets and developing new applications and products. Our existing productive capacity and the availability of our secure third-party conversion capabilities allow us to efficiently respond to the industry’s demand volatility. We will continue to evaluate opportunities to strategically expand our existing production and conversion capacities through internal expansion and long-term third-party arrangements, as well as potential joint ventures and acquisitions.

2

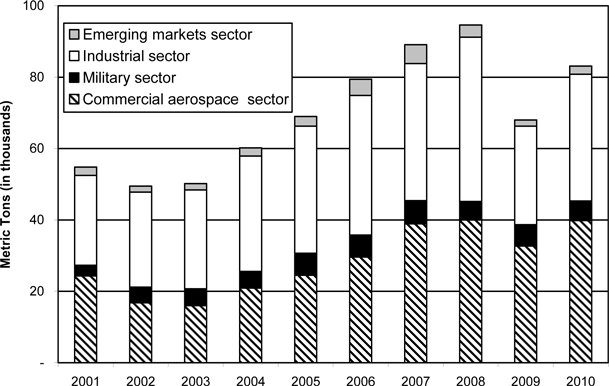

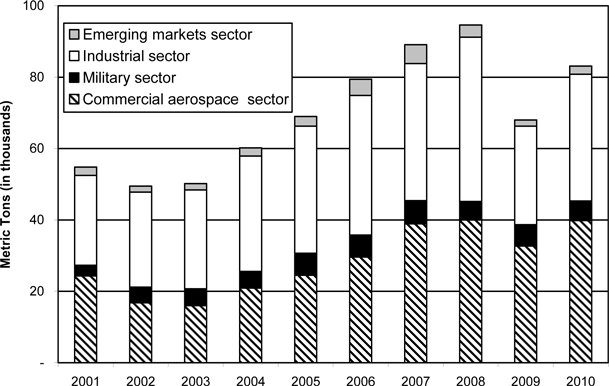

Titanium industry.We develop certain industry estimates based on our extensive experience within the titanium industry as well as information obtained from publicly available external resources (e.g., United States Geological Survey, International Titanium Association and Japan Titanium Society). We estimate we accounted for approximately 17% of 2009 and 15% of 2010 worldwide industry shipments of titanium mill products and approximately 7% of worldwide titanium sponge production in 2009 and 5% in 2010. The following chart illustrates our estimates of aggregate industry mill product shipments over the past ten years:

Industry Mill Product Shipments by Sector

(Volumes Exclude Shipments within China and Russia)

The cyclical nature of the commercial aerospace sector has been the principal driver of the historical fluctuations in titanium mill product shipment volume. Over the past 30 years, the titanium industry has had various cyclical peaks and troughs in mill product shipments. With the exception of decreased demand in 2009 resulting from the global economic downturn, over the last ten years, titanium mill product demand in the military, industrial and emerging market sectors has increased, primarily due to the continued development of innovative uses for titanium products in these industries. We estimate that industry shipments approximated 68,000 metric tons in 2009 and 83,100 metric tons in 2010. The estimated 22% increase in 2010 was driven by strong recoveries from the global economic downturn in 2009 in the commercial aerospace and industrial sectors. We currently expect 2011 total industry mill product shipments to grow 15% to 25%, driven by continued growth in the commercial aerospace and industrial sectors.

Commercial aerospace sector - Demand for titanium products within the commercial aerospace sector is derived from both jet engine components (e.g., blades, discs, rings and engine cases) and airframe components (e.g., bulkheads, tail sections, landing gear, wing supports and fasteners). The commercial aerospace sector has a significant influence on titanium companies, particularly mill product producers. Industry shipments increased approximately 22% in 2010 as aircraft build rates and supply chain inventory levels increased. Deliveries of titanium generally precede aircraft deliveries by about one year, and our business cycle generally correlates to this timeline, although the actual timeline can vary considerably depending on the titanium product.

3

Our business is more dependent on commercial aerospace demand than is the overall titanium industry. We shipped approximately 66% of our mill products to the commercial aerospace sector in 2010, whereas we estimate approximately 48% of the overall titanium industry’s mill products were shipped to the commercial aerospace sector in 2010.

The Airline Monitor, a leading aerospace publication, traditionally issues worldwide forecasts each January and July for commercial aircraft deliveries, approximately one-third of which are expected to be required by the U.S. over the next 20 years.The Airline Monitor’s most recently issued forecast (January 2011) estimates deliveries of large commercial aircraft (aircraft with over 100 seats) totaled 1,037 (including 195 twin aisle aircraft which require more titanium) in 2010, and the following table summarizes the forecasted deliveries of large commercial aircraft over the next five years:

| | | | | | | | | | | | | | | | |

| | | Forecasted deliveries | | | % increase

over previous year | |

Year | | Total | | | Twin aisle | | | Total | | | Twin aisle | |

2011 | | | 1,128 | | | | 243 | | | | 9 | % | | | 25 | % |

2012 | | | 1,266 | | | | 346 | | | | 12 | % | | | 42 | % |

2013 | | | 1,315 | | | | 370 | | | | 4 | % | | | 7 | % |

2014 | | | 1,375 | | | | 410 | | | | 5 | % | | | 11 | % |

2015 | | | 1,380 | | | | 440 | | | | — | | | | 7 | % |

The latest forecast from The Airline Monitor reflects a moderate 6% increase in forecasted deliveries over the next five years compared to the July 2010 forecast, mainly due to its expectation that airlines will continue to replace their fleets with more fuel efficient aircraft. Boeing and Airbus booked a total of 1,269 orders in 2010, andThe Airline Monitor forecasts that aggregate new orders in 2011 will be lower than 2010.

Changes in the economic environment and the financial condition of airlines can result in rescheduling or cancellation of orders. Accordingly, aircraft manufacturer backlogs are not necessarily a reliable indicator of near-term business activity but may be indicative of potential business levels over a longer-term horizon. The latest forecast fromThe Airline Monitor estimates decreases for firm order backlog for both Airbus and Boeing as deliveries are expected to be higher than orders for the next three years. Through December 31, 2010, Airbus’ firm order backlog is estimated at 1,134 twin aisle planes and 2,418 single aisle planes, and Boeing’s firm order backlog is estimated at 1,257 twin aisle planes and 2,168 single aisle planes. Boeing has previously announced that its does not plan to increase its build rates on the 787 aircraft to make up for delayed deliveries.

At year-end 2010, a total of 847 firm orders have been placed for the Boeing 787, a total of 234 firm orders have been placed for the Airbus A380 and a total of 583 firm orders had been placed for the Airbus A350 XWB. The 787 contains more composite materials than other Boeing aircraft, and increased utilization of composite materials in an aircraft’s structural components requires additional titanium on a per unit basis. The A350 XWBs will also use composite materials and new engines similar to those used on the Boeing 787 and are expected to require significantly more titanium as compared with earlier Airbus models. In early years of the manufacturing cycle for the 787 and A350 XWB, or with any aircraft model, additional titanium is required to produce each aircraft, and as the program reaches maturity, less titanium is required for each aircraft manufactured. First deliveries for the 787 are currently scheduled in late 2011, and first deliveries for the A350 XWB are currently scheduled for 2013.

Twin aisle planes (e.g., Boeing 747, 767, 777 and 787 and Airbus A330, A340, A350 and A380) tend to use a higher percentage of titanium in their airframes, engines and parts than single aisle planes (e.g., Boeing 737 and 757 and Airbus A318, A319 and A320), and new generation models require a significantly higher percentage of titanium. Additionally, Boeing generally uses a higher percentage of titanium in its airframes than Airbus. Based on information we receive from airframe and engine manufacturers and other industry sources, we estimate the following titanium product purchase weights will be used for the manufacture of each of the selected aircraft in the following table. All estimated titanium purchase weights include both the airframes and engines, and purchase weights are subject to change as manufacturers and other industry sources revise their estimates.

4

| | | | |

| | | Titanium purchased per aircraft | |

| | | (approximate metric tons) | |

| |

Boeing aircraft: | | | | |

737 | | | 18 | |

777 | | | 59 | |

747 | | | 76 | |

787 | | | 116 | |

| |

Airbus aircraft: | | | | |

A320 | | | 12 | |

A330 | | | 18 | |

A340 | | | 32 | |

A350 XWB | | | 127 | |

A380 | | | 146 | |

Military sector - Titanium shipments into the military sector are largely driven by government defense spending in North America and Europe. Military aerospace programs were the first to utilize titanium’s unique properties on a large scale, beginning in the 1950s. Titanium shipments to military aerospace markets reached a peak in the 1980s before falling to historical lows in the early 1990s after the end of the Cold War. Based on its physical and performance properties, titanium has also become widely accepted for use in applications for ground combat vehicles as well as in naval vessels. Current and anticipated future military strategy leading to light armament and mobility favor the use of titanium due to light weight and improved ballistic performance.

As the strategic military environment demands greater global lift and mobility, the U.S. military needs more airlift capacity and capability. Airframe programs are expected to drive the military market demand for titanium through 2015. Several of today’s active U.S. military programs, including the C-17, F-15, F/A-18 and F-16, are currently expected to continue in production into the middle of this decade. European military programs also have active aerospace programs offering the possibility for increased titanium consumption. Production levels for the Saab Gripen, Eurofighter Typhoon, Dassault Rafale and Dassault Mirage 2000 are all forecasted to remain steady through the middle or end of this decade.

In addition to the established programs, newer U.S. programs offer growth opportunities for increased titanium consumption. The F-35 Joint Strike Fighter, now known as the Lightning II, has begun low-rate initial production and assembly. Although no specific delivery schedules have been announced, according toThe Teal Group, a leading aerospace publication, procurement of the F-35 is expected to extend over the next 30 to 40 years and may include production of as many as 4,000 planes, including sales to foreign nations.

Utilization of titanium on military ground combat vehicles for armor appliqué and integrated armor or structural components continues to gain acceptance within the global military market segment. Titanium armor components provide the necessary ballistic performance while achieving a mission critical vehicle performance objective of reduced weight in new generation and legacy vehicles. In order to counteract increased global threat levels, titanium is being utilized on vehicle upgrade programs as well as in new programs. Based on active programs, as well as programs currently under evaluation, we believe titanium will continue to be used on ground combat vehicles in the military market sector. In armor and armament, we sell complete vehicle armor kits as well as plate and sheet products for fabrication into appliqué plate and reactive armor for protection of the entire ground combat vehicle as well as the vehicle’s primary structure.

Industrial and emerging markets sectors- With its unique and desirable physical properties, titanium can be used in a number of other end-use markets. Established industrial uses for titanium include chemical plants, power plants, desalination plants and pollution control equipment. Rapid growth of the Chinese and other Southeast Asian economies has brought unprecedented demand for titanium-intensive industrial equipment. In order to participate in this rise in demand, we have an ownership interest in a joint venture, XI’AN BAOTIMET VALINOX TUBES CO. LTD. (“BAOTIMET”), which produces welded titanium tubing in Xi’an, China.

5

Titanium is accepted for many emerging market applications, including transportation, energy (including oil and gas) and architecture. Although titanium is often more expensive than other competing metals, over the entire life cycle of the application, we believe titanium is a better value alternative due to its durability, longevity and overall environmental impact. In many cases customers also find the physical properties of titanium to be attractive from the standpoint of weight, performance, design alternatives and other factors. The oil and gas market, a relatively new, potentially large growth area, utilizes titanium in certain down-hole casing, critical riser components, tapered stress joints, fire suppression water pump systems and saltwater-cooling systems. Additionally, as offshore development of new oil and gas fields moves into the ultra deep-water depths and as geothermal energy production expands, market demand for titanium’s light-weight, high-strength and corrosion-resistance properties is creating potential new growth opportunities. We have resources dedicated to the research and development of alloys and production processes to promote the expansion of titanium use in this market and in other non-aerospace applications.

Although we estimate emerging market demand presently represents less than 5% of the total industry demand for titanium mill products, we believe the emerging market sector offers many opportunities, and we have ongoing initiatives to actively pursue and expand our presence in these markets.

Products and operations. We are a vertically integrated titanium manufacturer whose products include:

| | (i) | titanium sponge, the basic form of titanium metal used in titanium products; |

| | (ii) | melted products (ingot, electrode and slab), the result of melting titanium sponge and titanium scrap, either alone or with various alloys; |

| | (iii) | mill products that are forged and rolled from ingot or slab, including long products (billet and bar), flat products (plate, sheet and strip) and pipe; and |

| | (iv) | fabrications (spools, pipe fittings, manifolds, vessels, etc.) that are cut, formed, welded and assembled from titanium mill products. |

All of our net sales were generated by our integrated titanium operations (our “Titanium melted and mill products” segment), which is our only business segment. Business and geographic financial information is included in Note 18 to the Consolidated Financial Statements.

Titanium sponge is the commercially pure, elemental form of titanium metal with a porous and sponge-like appearance. The first step in our sponge production involves combining titanium-containing rutile ore (derived from beach sand) with chlorine and petroleum coke to produce titanium tetrachloride. Titanium tetrachloride is purified and then reacted with magnesium in a closed system, producing titanium sponge and residual magnesium chloride as a by-product. Our titanium sponge production facility in Henderson, Nevada uses vacuum distillation process (“VDP”) technology, which removes the magnesium and magnesium chloride residues by applying heat to the sponge mass while maintaining a vacuum in a chamber. The combination of heat and vacuum boils the residues from the sponge mass, and then the sponge mass is mechanically pushed out of the distillation vessel, sheared and crushed to prepare the sponge for incorporation into one of our melted products. We electrolytically separate and recycle the residual magnesium chloride to improve cost efficiency and reduce environmental impact. We use all of our internally produced titanium sponge in the production of our melted and mill products.

6

Melted products (ingot, electrode and slab) are produced by melting sponge and titanium scrap, either alone or with alloys, to produce various grades of titanium products suited to the ultimate application of the product. By introducing other alloys such as vanadium, aluminum, molybdenum, tin and zirconium, the melted titanium product is engineered to produce quality grades with varying combinations of certain physical attributes such as strength-to-weight ratio, corrosion-resistance and milling compatibility. Titanium ingot is a cylindrical solid shape that, in our case, weighs up to 8 metric tons. Titanium slab is a rectangular solid shape that, in our case, weighs up to 16 metric tons. The melting process for ingot and slab is closely controlled and monitored utilizing computer control systems to maintain product quality and consistency and to meet customer specifications. In most cases, we use our ingot and slab as the intermediate material for further processing into mill products. However, we also sell melted products to our customers.

Mill products are forged or rolled from our melted products (ingot or slab). Mill products include long products (billet and bar), flat products (plate, sheet and strip) and pipe. Our mill products can be further machined to meet customer specifications with respect to size and finish.

We send certain products to various outside vendors for further processing (e.g., certain rolling, forging, finishing and other processing steps in the U.S., and certain melting and forging steps in France) before being shipped to customers. We currently utilize one U.S. supplier under a 20-year conversion services agreement, whereby they provide an annual output capacity of 4,500 metric tons of titanium mill rolling services until 2026, with our option to increase the annual output capacity to 9,000 metric tons. Additionally, another U.S. supplier provides dedicated annual forging capacity of 8,900 metric tons through at least 2019. In France, our primary processor is also a partner in our 70%-owned subsidiary, TIMET Savoie, S.A., and our agreement with them provides us with annual melt capacity of up to 3,200 metric tons and annual mill capacity up to 2,600 metric tons through 2015. These agreements and partnerships provide us with long-term secure sources for processing round and flat products, resulting in a significant increase in our existing mill product conversion capabilities, which allows us to assure our customers of our long-term ability to meet their needs.

During the production process and following the completion of manufacturing, we perform extensive testing on our products. Sonic inspection as well as chemical and mechanical testing procedures are critical to ensuring that our products meet our customers’ high quality requirements, particularly in aerospace component production. We certify that our products meet customer specification at the time of shipment for substantially all customer orders.

Titanium scrap is a by-product of the forging, rolling and machining operations, and significant quantities of scrap are generated in the production process for finished titanium products and components. Scrap by-products from our mill production processes, as well as the scrap purchased from our customers or on the open metals market, is typically recycled and introduced into the melting process once the scrap is sorted and cleaned. We have the capacity to recycle 14,000 to 16,000 metric tons of titanium scrap annually at our facility in Morgantown, Pennsylvania depending on the form of the scrap and end-use product mix. We believe our capability and expertise in recycling titanium scrap provides us with a competitive advantage in the titanium industry.

Distribution. We sell our products through our own sales force based in the U.S. and Europe and through independent agents and distributors worldwide. We also operate eight service centers (five in the U.S. and three in Europe), which we use to sell our products on a just-in-time basis. The service centers primarily sell value-added and customized mill products, including bar, sheet, plate, tubing and strip. We believe our service centers provide us with a competitive advantage because of our ability to foster customer relationships, customize products to suit specific customer requirements and respond quickly to customer needs.

7

Raw materials. The principal raw materials used in the production of titanium melted and mill products are titanium sponge, titanium scrap and alloys. The proportions and grades of sponge and scrap are sometimes dictated by the product mix or customer requirements for the end-use product; however, we generally have the operating flexibility to vary the raw material components to optimize our manufacturing efficiency and maximize our profitability. The following table summarizes our raw material usage requirements in the production of our melted and mill products:

| | | | | | | | | | | | |

| | | 2008 | | | 2009 | | | 2010 | |

Internally produced sponge | | | 24 | % | | | 27 | % | | | 30 | % |

Purchased sponge | | | 31 | % | | | 16 | % | | | 22 | % |

Titanium scrap | | | 39 | % | | | 51 | % | | | 41 | % |

Alloys | | | 6 | % | | | 6 | % | | | 7 | % |

| | | | | | | | | | | | |

| | | |

Total | | | 100 | % | | | 100 | % | | | 100 | % |

| | | | | | | | | | | | |

Sponge - The primary raw materials used in the production of titanium sponge are titanium-containing rutile ore, chlorine, magnesium and petroleum coke. Rutile ore is currently available from a limited number of suppliers around the world, principally located in Australia, South Africa and Sri Lanka. We purchase the majority of our supply of rutile ore from Australia and South Africa. Although rutile ore supplies have tightened in the past year, we believe the availability of rutile ore will be adequate for the foreseeable future and do not anticipate any interruptions of our rutile supplies.

We currently obtain chlorine from a single supplier near our sponge plant in Henderson, Nevada. While we do not anticipate any chlorine supply problems, we have taken steps to mitigate this risk in the event of supply disruption, including establishing the feasibility of certain equipment modifications to enable us to utilize material from alternative chlorine suppliers or to purchase and utilize an intermediate product which will allow us to eliminate the purchase of chlorine if needed. Magnesium and petroleum coke are generally available from a number of suppliers.

We are currently the largest U.S. producer of titanium sponge, with an annual sponge production capacity of approximately 12,600 metric tons of premium-grade titanium sponge at our Henderson plant. We operated our sponge plant significantly below full capacity during 2009 and 2010, but we anticipate increased production volumes during 2011 as we ramp-up production to meet anticipated demand. We supplement our internally produced sponge with purchases from third parties. In recent years, other sponge producers have also undertaken additional capacity expansion projects.

We are party to long-term sponge supply agreements that require us to make minimum annual purchases. These long-term supply agreements, together with our current sponge production capacity in Henderson, should provide us with a total annual available sponge supply at levels ranging from 19,000 metric tons up to 24,000 metric tons through 2025, which we expect will meet our sponge supply requirements. We will continue to purchase sponge from a variety of sources in 2011, including those sources under existing supply agreements. We continuously evaluate alternatives to strategically balance our internal and external sources for titanium sponge.

Scrap - We recycle titanium scrap into melted products that will be sold to our customers or used as intermediate feedstock for our mill production process. Our titanium scrap is generated from our melted and mill product production processes, purchased from certain of our customers under contractual agreements or acquired in the open metals market. Such scrap consists of alloyed and commercially pure solids and turnings. Scrap obtained through customer arrangements provides a “closed-loop” arrangement resulting in certainty of supply and price stability. Externally purchased scrap comes from a wide range of sources, including customers, collectors, processors and brokers. We purchased 27% of our scrap requirements from the open metals market in 2010, and we expect our open market scrap purchases to account for 25% to 30% of our scrap requirements during 2011. We will continue to manage our scrap consumption and utilization percentages based upon the market values of scrap relative to sponge and alloy costs as we strive to minimize our overall product costs. We also routinely sell scrap, usually in a form or grade we cannot economically recycle for use in our production operations.

8

Overall market forces can significantly impact the supply or cost of externally produced scrap, as the amount of scrap generated in the supply chain varies during titanium business cycles. Early in the titanium cycle, the demand for titanium melted and mill products begins to increase the externally produced scrap requirements for titanium manufacturers. This demand precedes the increase in scrap generation by downstream customers and the supply chain. The reduced availability of scrap at this stage of the cycle places upward pressure on the market price of scrap. The opposite situation occurs when demand for titanium melted and mill products begins to decline, resulting in greater availability of scrap supply and downward pressure on the market price of scrap. During the middle of the cycle, scrap generation and consumption are in relative equilibrium, minimizing disruptions in supply or significant changes in the available supply and market price for scrap. Increasing or decreasing cycles tend to cause significant changes in both the supply and market price of scrap. These supply chain dynamics result in changes in selling prices for melted and mill products which generally tend to correspond with the changes in raw material costs.

All of our major competitors utilize scrap as a raw material in their titanium melt operations, and steel manufacturers also use titanium scrap as an alloy to produce interstitial-free steels, stainless steels and high-strength-low-alloy steels. Prices for most forms and grades of titanium scrap increased during the last quarter of 2009 and the first three quarters of 2010, as both the steel and titanium markets began to recover from the global recession which impacted demand throughout most of 2009. During late 2010, prices stabilized somewhat, although we expect that strong demand will lead to further increases early in 2011.

Other - Various alloy additions used in the production of titanium products, such as vanadium and molybdenum, are also available from a number of suppliers. Consistent demand from steel manufacturers for vanadium and molybdenum resulted in stable costs for these alloys in 2010 at levels similar to those of the second half of 2009. We expect these cost trends to continue into 2011.

Customer agreements. We have long-term agreements (“LTAs”) with certain major customers, including, among others, The Boeing Company (“Boeing”), Rolls-Royce plc and its German and U.S. affiliates (“Rolls-Royce”), United Technologies Corporation (“UTC,” Pratt & Whitney and related companies), the Safran companies (“Safran,” Snecma and related companies), Wyman-Gordon Company (“Wyman-Gordon,” a unit of Precision Castparts Corporation (“PCC”)) and VALTIMET SAS. These agreements expire at various times through 2030, are subject to certain conditions and generally provide for (i) minimum market shares of the customers’ titanium requirements or firm annual volume commitments, (ii) formula-determined prices (including some elements based on market pricing) and (iii) price adjustments for certain raw material, labor and energy cost fluctuations. Generally, LTAs require our service and product performance to meet specified criteria and contain a number of other terms and conditions customary in transactions of these types. Certain provisions of these LTAs have been amended in the past and may be amended in the future to meet changing business conditions. Our 2010 sales revenues to customers under LTAs were 62% of our total sales revenues.

In certain events of nonperformance by us or the customer, an LTA may be terminated early. Although it is possible that some portion of the business would continue on a non-LTA basis, LTAs are designed to limit selling price volatility to the customer and to us, while providing us with a committed volume base throughout the titanium industry business cycles and certain mechanisms to adjust pricing for changes in certain cost elements. As a result, the termination or expiration without renewal of one or more of the LTAs could result in a material adverse effect on our business, results of operations, financial position or liquidity.

Markets and customer base. As discussed previously, we produce a wide range of melted and mill titanium products for our customers, and selling prices generally reflect raw material and other productions costs as well as reasonable profit margins. Selling prices are generally influenced by industry and global economic conditions. Products sold under certain LTAs with raw material indexed pricing adjustments, as well as our non-contract sales, were impacted by these factors.

9

The demand for our titanium products is global, and our global productive capabilities allow us to respond to our customers’ needs. The following table summarizes our sales revenue by geographical location:

| | | | | | | | | | | | |

| | | Year ended December 31, | |

| | | 2008 | | | 2009 | | | 2010 | |

| | | (Percentage of total sales revenue) | |

| | | |

Sales revenue to customers within: | | | | | | | | | | | | |

North America | | | 59 | % | | | 65 | % | | | 64 | % |

Europe | | | 29 | % | | | 27 | % | | | 27 | % |

Other | | | 12 | % | | | 8 | % | | | 9 | % |

| | | | | | | | | | | | |

| | | |

Total | | | 100 | % | | | 100 | % | | | 100 | % |

| | | | | | | | | | | | |

Further information regarding our external sales, net income, long-lived assets and total assets can be found in our Consolidated Balance Sheets, Consolidated Statements of Income and Notes 6 and 18 to the Consolidated Financial Statements.

Our concentration of customers, primarily in commercial aerospace, may impact our overall exposure to credit and other risks because all of these customers may be similarly affected by the same economic or other conditions. The following table provides supplemental sales revenue information:

| | | | | | | | | | | | |

| | | Year ended December 31, | |

| | | 2008 | | | 2009 | | | 2010 | |

| | | (Percentage of total sales revenue) | |

| | | |

Ten largest customers | | | 49 | % | | | 57 | % | | | 54 | % |

| | | |

Significant customers: | | | | | | | | | | | | |

PCC and PCC-related entities(1) | | | 10 | % | | | 15 | % | | | 16 | % |

Boeing | | | 12 | % | | | 17 | % | | | 10 | % |

| | | |

Total LTAs | | | 56 | % | | | 64 | % | | | 62 | % |

| | | |

Significant LTAs: | | | | | | | | | | | | |

Rolls-Royce(1) | | | 13 | % | | | 13 | % | | | 16 | % |

Boeing | | | 12 | % | | | 17 | % | | | 10 | % |

| (1) | PCC and PCC-related entities (primarily Wyman-Gordon) serve as suppliers to certain commercial aerospace manufacturers, including Rolls-Royce. Certain sales we make directly to PCC and PCC-related entities also count towards, and are reflected in, the table above as sales to Rolls-Royce under the Rolls-Royce LTA. |

The following table provides supplemental sales revenue information by industry sector:

| | | | | | | | | | | | |

| | | Year ended December 31, | |

| | | 2008 | | | 2009 | | | 2010 | |

| | | (Percentage of total sales revenue) | |

| | | |

Commercial aerospace | | | 59 | % | | | 60 | % | | | 62 | % |

Military | | | 16 | % | | | 20 | % | | | 18 | % |

Industrial and emerging markets | | | 15 | % | | | 11 | % | | | 13 | % |

Other titanium products | | | 10 | % | | | 9 | % | | | 7 | % |

| | | | | | | | | | | | |

Total | | | 100 | % | | | 100 | % | | | 100 | % |

| | | | | | | | | | | | |

10

The primary market for titanium products in the commercial aerospace sector consists of two major manufacturers of large commercial airframes, Boeing Commercial Airplanes Group (a unit of Boeing) and Airbus, as well as manufacturers of large civil aircraft engines including Rolls-Royce, General Electric Aircraft Engines, Pratt & Whitney and Safran. We sell directly to these major manufacturers, as well as to companies (including forgers such as Wyman-Gordon) that use our titanium to produce parts and other materials for such manufacturers. If any of the major aerospace manufacturers were to significantly reduce aircraft and/or jet engine build rates from those currently expected, there could be a material adverse effect, both directly and indirectly, on our business, results of operations, financial position and liquidity.

The market for titanium in the military sector includes sales of melted and mill titanium products engineered for applications for military aircraft (both engines and airframes), armor and component parts, armor appliqué on ground combat vehicles and other integrated armor or structural components. We sell directly to many of the major manufacturers associated with military programs on a global basis.

Outside of commercial aerospace and military sectors, we manufacture a wide range of products for customers in the chemical process, oil and gas, consumer, sporting goods, healthcare, automotive and power generation sectors. Additionally, we sell certain other products such as titanium fabrications, titanium scrap and titanium tetrachloride. We will also continue to work with existing and potential customers to identify and develop new or improved applications for titanium that take advantage of its unique properties and qualities.

Our backlog was approximately $440 million at December 31, 2009 and $580 million at December 31, 2010. Over 90% of our 2010 year-end backlog is scheduled for shipment during 2011. Our order backlog may not be a reliable indicator of future business activity.

Competition. The titanium metals industry is highly competitive on a worldwide basis. Producers of melted and mill products are located primarily in the United States, Japan, France, Germany, Italy, Russia, China and the United Kingdom. There are also several producers of titanium sponge in the world that are currently in some stage of increasing sponge production capacity. We believe entry as a new producer of titanium sponge would require a significant capital investment, substantial technical expertise and significant lead time. Additionally, producers of other metal products, such as steel and aluminum, maintain forging, rolling and finishing facilities that could be used or modified to process titanium products.

Our principal competitors in the aerospace titanium market are Allegheny Technologies Incorporated (“ATI”) and RTI International Metals, Inc. (“RTI”), both based in the United States, and Verkhnaya Salda Metallurgical Production Organization (“VSMPO”), based in Russia. UNITI (a joint venture between ATI and VSMPO), RTI and certain Japanese producers are our principal competitors in the industrial and emerging markets. We compete primarily on the basis of price, quality of products, technical support and the availability of products to meet customers’ delivery schedules.

In the U.S. market, the increasing presence of foreign participants has become a significant competitive factor. Prior to 1993, imports of foreign titanium products into the U.S. were not significant, primarily attributable to relative currency exchange rates and, with respect to Japan, Russia, Kazakhstan and Ukraine, import duties (including antidumping duties). However, since 1993, imports of titanium sponge, ingot and mill products, principally from Russia and Kazakhstan, have increased and have had a significant competitive impact on the U.S. titanium industry.

Trade and tariffs - Generally, imports of titanium products into the U.S. are subject to a 15% “normal trade relations” tariff. For tariff purposes, titanium products are broadly classified as either wrought (billet, bar, sheet, strip, plate and tubing) or unwrought (sponge, ingot and slab). Because a significant portion of end-use products made from titanium products are ultimately exported, we, along with our principal competitors and many customers, actively utilize the duty-drawback mechanism to recover most of the tariff paid on imports.

From time-to-time, the U.S. government has granted preferential trade status to certain titanium products imported from particular countries (notably wrought titanium products from Russia, which carried no U.S. import duties from approximately 1993 until 2004). It is possible that such preferential status could be granted again in the future.

11

The Japanese government has raised the elimination or harmonization of tariffs on titanium products, including titanium sponge, for consideration in multi-lateral trade negotiations through the World Trade Organization (the so-called “Doha Round”). As part of the Doha Round, the United States has proposed the staged elimination of all industrial tariffs, including those on titanium. The Japanese government has specifically asked that titanium in all its forms be included in the tariff elimination program. We have urged that no change be made to these tariffs, either on wrought or unwrought products. Tariffs on titanium imported from other countries might also be eliminated pursuant to bilateral and/or multilateral free trade agreements that are currently the subject of ongoing negotiations to which the U.S. government is a party.

We will continue to resist efforts to eliminate duties on titanium products, although we may not be successful in these activities. Further reductions in, or the complete elimination of, any or all of these tariffs could lead to increased imports of foreign sponge, ingot, slab and mill products into the U.S. and an increase in the amount of such products on the market generally, which could adversely affect pricing for titanium sponge, ingot, slab and mill products and thus our business, results of operations, financial position or liquidity.

The Specialty Metals Law, 10 U.S.C. 2533b, provides that, subject to various exceptions, the Department of Defense (“DoD”) may not procure certain defense articles (aircraft, missiles, spacecraft, ships, tanks, weapons and ammunition) containing specialty metals, including titanium, unless those defense articles are manufactured with specialty metals melted or produced in the United States. In 2009, the DoD adopted regulations regarding the implementation of this specialty metals law that may reduce its effectiveness. We will continue to resist attempts to undermine this specialty metals law. A weakening in the enforcement of this specialty metals law could increase foreign competition for sales of titanium for defense products, adversely affecting our business, results of operations, financial position or liquidity.

Research and development. Our research and development activities are directed toward expanding the use of titanium and titanium alloys in all market sectors. Key research activities include the development of new alloys, development of technology required to enhance the performance of our products in the traditional industrial and aerospace markets and applications development for emerging markets. In addition, we continue to work in partnership with the United States Defense Advanced Research Projects Agency (“DARPA”) and others to explore means to reduce the cost of titanium production. The work with DARPA complements our research, development and exploration of innovative technologies and improvements to the existing processes such as Vacuum Distillation of sponge and Vacuum Arc Remelting processes. We conduct the majority of our research and development activities at our Henderson Technical Laboratory, with additional activities at our Witton, England facility. We incurred research and development costs of $4.3 million in 2008, $7.8 million in 2009 and $6.7 million in 2010.

Patents and trademarks. We hold U.S. and non-U.S. patents applicable to certain of our titanium alloys and manufacturing technology, which expire at various times from 2011 through 2026 and we have certain other patent applications pending. We continually seek patent protection with respect to our technology base and have occasionally entered into cross-licensing arrangements with third parties. However, the majority of our titanium alloys and manufacturing technologies do not benefit from patent protection. We believe the trademarks TIMET® and TIMETAL®, which are protected by registration in the U.S. and other countries, are important to our business.

Employees. Our employee headcount varies due to the cyclical nature of the aerospace industry and its impact on our business. Our employee headcount includes both our full and part-time employees. The following table shows our approximate employee headcount at the end of the past 3 years:

| | | | | | | | | | | | |

| | | Employees at December 31, | |

| | | 2008 | | | 2009 | | | 2010 | |

U.S. | | | 1,775 | | | | 1,455 | | | | 1,605 | |

Europe | | | 895 | | | | 750 | | | | 780 | |

| | | | | | | | | | | | |

| | | |

Total | | | 2,670 | | | | 2,205 | | | | 2,385 | |

| | | | | | | | | | | | |

12

Our production and maintenance workers in Henderson and our production, maintenance, clerical and technical workers in Toronto, Ohio (approximately half of our total U.S. employees) are represented by the United Steelworkers of America under contracts expiring in January 2014 and June 2011, respectively. Employees at our other U.S. facilities are not covered by collective bargaining agreements. A majority of the salaried and hourly employees at our European facilities are represented by various European labor unions. Our labor agreement with our U.K. managerial and professional employees expires in March 2011, and our labor agreement with our U.K. production and maintenance employees expires in December 2011. Our labor agreements with our French and Italian employees are renewed annually. We currently consider our employee relations to be good. However, it is possible that there could be future work stoppages or other labor disruptions that could materially and adversely affect our business, results of operations, financial position or liquidity.

Regulatory and environmental matters. Our operations are governed by various federal, state, local and foreign environmental, security and worker safety and health laws and regulations. In the U.S., such laws include the Occupational, Safety and Health Act, the Clean Air Act, the Clean Water Act, the Toxic Substances Control Act and the Resource Conservation and Recovery Act. We use and manufacture substantial quantities of substances that are considered hazardous, extremely hazardous or toxic under environmental and worker safety and health laws and regulations. We have used and manufactured such substances throughout the history of our operations. Although we have substantial controls and procedures designed to reduce continuing risk of environmental, health and safety issues, we could incur substantial cleanup costs, fines and civil or criminal sanctions, third party property damage or personal injury claims as a result of violations or liabilities under these laws, common law theories of liability or non-compliance with environmental permits required at our facilities. In addition, government environmental requirements or the enforcement thereof may become more stringent in the future. It is possible that some, or all, of these risks could result in liabilities that would be material to our business, results of operations, financial position or liquidity.

Our policy is to maintain compliance in all material respects with applicable requirements of environmental and worker health and safety laws and strive to improve environmental, health and safety performance. We incurred capital expenditures related to health, safety and environmental compliance and improvement of approximately $2.1 million in 2008, $1.7 million in 2009 and $3.2 million in 2010.

From time to time, we may be subject to health, safety or environmental regulatory enforcement under various statutes, resolution of which typically involves the establishment of compliance programs. Occasionally, resolution of these matters may result in the payment of penalties or the expenditure of additional funds on compliance. Furthermore, the imposition of more strict standards or requirements under environmental, health or safety laws and regulations could result in expenditures in excess of amounts currently estimated to be required for such matters.

As a result of Environmental Protection Agency (“EPA”) inspections, in April 2009 the EPA issued a Notice of Violation (“Notice”) to us alleging that we violated certain provisions of the Resource Conservation and Recovery Act and the Toxic Substances Control Act (“TSCA”) at our Henderson plant. We responded to the EPA and are currently in discussions with them concerning the nature and extent of required follow-up testing and potential remediation that may be required to address the allegations of non-compliance. During 2010, we submitted detailed proposals for testing that will provide information to assist us in determining the scope and method of any remediation that may be required under the Notice. In addition, we submitted proposals for work intended to resolve two of the alleged violations identified in the Notice.

In May 2010, the EPA notified us alleging two unrelated violations of the recordkeeping and reporting requirements of TSCA at our Henderson plant and also initiated an investigation of our Morgantown plant under these provisions of TSCA. In June 2010, with EPA approval, we conducted a voluntary self-audit of TSCA compliance at all of our U.S. facilities and disclosed the results of the self-audit to the EPA, including our findings with respect to areas of non-compliance.

13

As part of our continuing environmental assessment with respect to our plant site in Henderson, Nevada, in 2008 we completed and submitted to the Nevada Department of Environmental Protection (“NDEP”) a Remedial Alternative Study (“RAS”) with respect to the groundwater located beneath the plant site. The RAS, which was submitted pursuant to an existing agreement between the NDEP and us, addressed the presence of certain contaminants in the plant site groundwater that require remediation. The NDEP completed its review of the RAS and our proposed remedial alternatives, and the NDEP issued its record of decision in February 2009, which selected our preferred groundwater remedial alternative action plan. We commenced implementation of the plan in the fourth quarter of 2009. In connection with our implementation of the plan, we are undertaking soil remediation to address source areas associated with conveyance ditches previously used by several companies in the BMI complex, the cost of which is covered by insurance. See Note 16 to the Consolidated Financial Statements.

Related parties. At December 31, 2010, Contran Corporation and other entities or persons related to Harold C. Simmons held approximately 51.9% of our outstanding common stock. See Notes 1 and 15 to the Consolidated Financial Statements.

Available information. We maintain an Internet website atwww.timet.com. Our Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q and Current Reports on Form 8-K, and any amendments thereto, are or will be available free of charge on our website as soon as reasonably practicable after they are filed or furnished, as applicable, with the SEC. Additionally, our (i) Corporate Governance Guidelines, (ii) Code of Business Conduct and Ethics and (iii) Audit Committee, Management Development and Compensation Committee and Nominations Committee charters are also available on our website. Information contained on our website is not part of this Annual Report. We will provide these documents to shareholders upon request. Requests should be directed to the attention of our Investor Relations Department at our corporate offices located at 5430 LBJ Freeway, Suite 1700, Dallas, Texas 75240.

The general public may read and copy any materials on file with the SEC at the SEC’s Public Reference Room at 100 F Street, NE, Washington, DC 20549 and may obtain information on the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330. We are an electronic filer, and the SEC maintains an Internet website atwww.sec.gov that contains reports, proxy and information statements, and other information regarding issuers that file electronically with the SEC.

Listed below are certain risk factors associated with our business. In addition to the potential effect of these risk factors discussed below, any risk factor that could result in reduced earnings, liquidity or operating losses, could in turn adversely affect our ability to meet our liabilities or adversely affect the quoted market prices for our securities.

The cyclical nature of the commercial aerospace industry, which represents a significant portion of our business, creates uncertainty regarding our future profitability. In addition, adverse changes to, or interruptions in, our relationships with our major commercial aerospace customers could reduce our revenues and impact our profitability and liquidity. The commercial aerospace sector has a significant influence on titanium companies, particularly mill product producers. The cyclical nature of the commercial aerospace sector has been the principal driver of the fluctuations in the performance of most titanium product producers. Our business is more dependent on commercial aerospace demand than is the overall titanium industry. We shipped approximately 66% of our mill products to commercial aerospace customers in 2010, whereas we estimate approximately 48% of the overall titanium industry’s mill products were shipped to commercial aerospace customers in 2010. Our melted and mill product sales to commercial aerospace customers accounted for 59% of our total sales in 2008, 60% in 2009 and 62% in 2010. We estimate that 2011 industry mill product shipments into the commercial aerospace sector will be higher than 2010 levels. Events that could adversely affect the commercial aerospace sector, such as future terrorist attacks, world health crises, a general economic downturn or unforeseen reductions in orders from commercial airlines, could significantly decrease our results of operations, financial condition and liquidity. See “Business –Titanium industry –Commercial aerospace sector.”

14

Sales under LTAs with customers in the commercial aerospace sector accounted for approximately 37% of our 2010 total sales. These LTAs expire at various times beginning in 2011 through 2030. If we are unable to maintain our relationships with our major commercial aerospace customers, including Boeing, Rolls-Royce, Safran, UTC and Wyman-Gordon, under the LTAs we have with these customers, our sales could decrease substantially, negatively impacting our profitability. See “Business –Customer agreements” and “Business -Markets and customer base.

The titanium metals industry is highly competitive, and we may not be able to compete successfully. The global titanium markets in which we operate are highly competitive. Competition is based on a number of factors, such as price, product quality and service. Some of our competitors may be able to drive down market prices because their costs are lower than our costs. In addition, some of our competitors’ financial, technological and other resources may be greater than our resources, and such competitors may be better able to withstand changes in market conditions. Our competitors may be able to respond more quickly than we can to new or emerging technologies and changes in customer requirements. Further, consolidation of our competitors or customers in any of the industries in which we compete may result in reduced demand for our products. In addition, producers of metal products, such as steel and aluminum, maintain forging, rolling and finishing facilities. Such facilities could be used or modified to process titanium mill products, which could lead to increased competition and decreased pricing for our titanium products. In addition, many factors, including excess capacity resulting from reduced demand in the titanium industry, work to intensify the price competition for available business at low points in the business cycle.

Our dependence upon certain critical raw materials that are subject to price and availability fluctuations could lead to increased costs or delays in the manufacture and sale of our products. We rely on a limited number of suppliers around the world, and principally on those located in Australia and South Africa, for our supply of titanium-containing rutile ore, one of the primary raw materials used in the production of titanium sponge. While chlorine, another of the primary raw materials used in the production of titanium sponge, is generally widely available, we currently obtain our chlorine from a single supplier near our sponge plant in Henderson. Also, we cannot supply all our needs for all grades of titanium sponge and scrap internally and are therefore dependent on third parties for a substantial portion of our raw material requirements. All of our major competitors utilize sponge and scrap as raw materials in their melt operations. Titanium scrap is also used in certain steel-making operations, and demand for these steel products, especially from China, also influences demand for titanium scrap. Purchase prices and availability of these critical materials are subject to volatility. At any given time, we may be unable to obtain an adequate supply of these critical materials on a timely basis, on price and other terms acceptable to us, or at all. To help stabilize our supply of titanium sponge, we have entered into LTAs with certain sponge suppliers that contain fixed annual supply obligations. These LTAs contain minimum annual purchase requirements and, in certain cases, include take-or-pay provisions which require us to pay penalties if we do not meet the minimum annual purchase requirements. See “Business –Products and Operations –Raw materials,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations – Liquidity and Capital Resources –Contractual commitments” and Note 16 to the Consolidated Financial Statements.

Although overall inflationary trends in recent years have been moderate, during the same period certain critical raw material costs in our industry, including titanium sponge and scrap, have been volatile. While we are able to mitigate some of the adverse impact of fluctuating raw material costs through LTAs with suppliers and customers, rapid increases in raw material costs may adversely affect our results of operations and liquidity.

15

We may be forced to decrease prices or may not be able to implement price increases. We change prices on certain of our products from time-to-time. Prices for our products are dependent on market conditions, economic factors, raw material costs and availability, competitive factors, operating costs and other factors, some of which are beyond our control. Pricing under our LTAs, which were designed in part to limit price volatility to our customers and us, are generally revised on an annual basis, while changes in our raw material and other operating costs can occur throughout the year. These factors may require us to reduce the prices we charge our customers, or they may limit our ability to implement price increases. In some instances, we may realize cost savings in connection with the price reductions, but the cost savings may lag behind price reductions due to long manufacturing lead times and the terms of existing contracts, or the cost savings may not fully offset the impact of the price reductions. In other instances, cost increases may precede the time at which we are able to implement a price increase, or the price increase may not fully offset the impact of the cost increases. These factors have had in the past, and may have in the future, an adverse impact on our revenues, operating results, financial condition and liquidity.

Our failure to develop new markets would result in our continued dependence on the cyclical commercial aerospace sector, and our operating results would, accordingly, remain cyclical. In an effort to reduce dependence on the commercial aerospace market and to increase participation in other markets, we have devoted certain resources to developing new markets and applications for our products. Developing these emerging market applications involves substantial risk and uncertainties due to the fact that titanium must compete with less expensive alternative materials in these potential markets or applications. We may not be successful in developing new markets or applications for our products, significant time may be required for such development and uncertainty exists as to the extent to which we will face competition in this regard.

Because we are subject to environmental and worker safety laws and regulations, we may be required to remediate the environmental effects of our operations or take steps to modify our operations to comply with these laws and regulations, the costs of which could reduce our profitability. Various federal, state, local and foreign environmental and worker safety laws and regulations govern our operations. Throughout the history of our operations, we have used and manufactured, and currently use and manufacture, substantial quantities of substances that are considered hazardous, extremely hazardous or toxic under environmental and worker safety and health laws and regulations. Although we have substantial controls and procedures designed to reduce the risk of environmental, health and safety issues, we could incur substantial cleanup costs, fines and civil or criminal sanctions, third party property damage or personal injury claims as a result of violations or liabilities under these laws or non-compliance with environmental permits required at our facilities. In addition, government environmental requirements or the enforcement thereof may become more stringent in the future. Some or all of these risks may result in liabilities that could reduce our profitability.

Reductions in, or the complete elimination of, any or all tariffs on imported titanium products into the United States could lead to increased imports of foreign sponge, ingot, slab and mill products into the U.S. and an increase in the amount of such products on the market generally, which could decrease pricing for our products. In the U.S. titanium market, the increasing presence of foreign participants has become a significant competitive factor, and, imports of titanium sponge, ingot and mill products, principally from Russia and Kazakhstan, have had a significant competitive impact on the U.S. titanium industry.

Generally, imports of titanium products into the U.S. are subject to a 15% “normal trade relations” tariff. For tariff purposes, titanium products are broadly classified as either wrought (billet, bar, sheet, strip, plate and tubing) or unwrought (sponge, ingot and slab). From time-to-time, the U.S. government has granted preferential trade status to certain titanium products imported from particular countries (notably wrought titanium products from Russia, which carried no U.S. import duties from approximately 1993 until 2004). It is possible that such preferential status could be granted again in the future, and we may not be successful in resisting efforts to eliminate duties or tariffs on titanium products. See trade and tariff discussion in “Business –Competition.”

16

We may be unable to reach or maintain satisfactory collective bargaining agreements with unions representing a significant portion of our employees. Our production and maintenance workers in Henderson and our production, maintenance, clerical and technical workers in Toronto, are represented by the United Steelworkers of America under contracts expiring in January 2014 and June 2011, for the respective locations. A majority of the salaried and hourly employees at our European facilities are represented by various European labor unions. Our labor agreement with our managerial and professional U.K. employees expires in March 2011, and our labor agreement with our U.K. production and maintenance employees expires in December 2011. The agreements with our French and Italian employees are renewed annually. A prolonged labor dispute or work stoppage at our major production facilities could materially impact our operating results. We may not succeed in concluding collective bargaining agreements with the unions on terms acceptable to us or maintaining satisfactory relations under existing collective bargaining agreements. If our employees were to engage in a strike, work stoppage or other slowdown, we could experience a significant disruption of our operations or higher ongoing labor costs.

Global climate change legislation could negatively impact our financial results or limit our ability to operate our business. We operate production facilities in several countries, and we believe all of our worldwide production facilities are in substantial compliance with applicable environmental laws. In many of the countries in which we operate, legislation has been passed, or proposed legislation is being considered, to limit green house gases through various means, including emissions permits and/or energy taxes. In several of our production facilities, we consume large amounts of energy, including electricity and natural gas. The permit system currently in effect in the various countries in which we operate has not had a material adverse effect on our financial results. However, if green house gas legislation were to be enacted in one or more countries, it could negatively impact our future results of operations through increased costs of production, particularly as it relates to our energy requirements. If such increased costs of production were to materialize, we may be unable to pass price increases onto our customers to compensate for those costs, which may decrease our liquidity, operating income and results of operations.

| ITEM 1B: | UNRESOLVED STAFF COMMENTS |

Not applicable.

17

Set forth below is a listing of our major production facilities. In addition to our U.S. sponge capacity discussed below, our worldwide melting capacity aggregates approximately 68,450 metric tons (estimated 19% of worldwide annual practical capacity) as of December 31, 2010, and our mill product capacity aggregates approximately 27,700 metric tons (estimated 15% of worldwide annual practical capacity) as of December 31, 2010. Of our worldwide melting capacity, 46% is represented by EB melting furnaces, 53% by vacuum arc remelting (“VAR”) furnaces and 1% by a vacuum induction melting (“VIM”) furnace.

| | | | | | | | | | | | | | |

| | | | | December 31, 2010

Annual Practical Capacity(3) | |

Manufacturing Location | | Products Manufactured | | Sponge | | | Melted

Products | | | Mill

Products | |

| | | | | | | | (metric tons) | | | | |

Henderson, Nevada(1) | | Sponge, Ingot | | | 12,600 | | | | 12,250 | | | | — | |

Morgantown, Pennsylvania(1) | | Slab, Ingot | | | — | | | | 40,700 | | | | — | |

Toronto, Ohio(1) | | Billet, Bar, Plate, Sheet, Strip | | | — | | | | — | | | | 15,000 | |

Vallejo, California(2) | | Ingot (including non- titanium superalloys) | | | — | | | | 1,600 | | | | — | |

Ugine, France(2) (4) | | Ingot, Billet | | | — | | | | 3,200 | | | | 2,600 | |

Waunarlwydd, Wales(1) | | Bar, Plate, Sheet | | | — | | | | — | | | | 3,100 | |

Witton, England(2) | | Ingot, Billet, Bar | | | — | | | | 10,700 | | | | 7,000 | |

| (3) | Practical capacities are variable based on product mix and in some cases are not additive. These capacities are as of December 31, 2010. |

| (4) | Practical capacities are based on the approximate maximum equivalent product that CEZUS is contractually obligated to provide. |

During the past three years, our major production facilities have operated at varying levels of practical capacity. Overall our plants operated at 81% of our practical capacity in 2008, 47% in 2009 and 60% in 2010, with our melting operations at 61% utilization and our mill product operations at 60% utilization during 2010. While practical capacity and utilization measures can vary significantly based upon the mix of products produced, we anticipate operating our plants at increased production levels in 2011.

United States production. We produce premium-grade titanium sponge at our facility in Henderson. Our U.S. melting facilities in Henderson, Morgantown and Vallejo produce ingot and slab, which are either used as feedstock for our mill products operations or sold to third parties. We produce titanium mill products in the U.S. at our forging and rolling facility in Toronto, which receives ingot and slab principally from our U.S. melting facilities.

Under various conversion services agreements with third-party vendors, we have access to a dedicated annual capacity at certain of our vendors’ facilities. Our access to outside conversion services includes dedicated annual rolling capacity of at least 4,500 metric tons until 2026, with the option to increase the output capacity to 9,000 metric tons. Additionally, we have access to dedicated annual forging capacity of 8,900 metric tons through at least 2019. These agreements provide us with long-term secure sources for processing round and flat products, resulting in a significant increase in our existing mill product conversion capabilities, which allows us to assure our customers of our long-term ability to meet their needs.

18

European production. We conduct our operations in Europe primarily through our wholly owned subsidiaries, TIMET UK, Ltd. and Loterios S.p.A., and our 70% owned subsidiary, TIMET Savoie. TIMET UK’s Witton laboratory and manufacturing facilities are leased pursuant to long-term operating leases expiring in 2014 and 2024, respectively. TIMET UK’s melting facility in Witton produces VAR ingot used primarily as feedstock for our Witton forging operations. TIMET UK forges the ingot into billet products for sale to third parties or into an intermediate product for further processing into bar or plate at our facility in Waunarlwydd.

TIMET Savoie has the right to utilize portions of the Ugine plant of Compagnie Européenne du Zirconium-CEZUS, S.A. (“CEZUS”), the owner of the 30% noncontrolling interest in TIMET Savoie, pursuant to a conversion services agreement which runs through 2015. TIMET Savoie’s capacity is to a certain extent dependent upon the level of activity in CEZUS’ zirconium business, which may from time to time provide TIMET Savoie with capacity in excess of that which CEZUS is contractually required to provide. Our agreement with CEZUS requires them to provide us with melt capacity up to 3,200 metric tons annually and mill product capacity up to 2,600 metric tons annually.

Loterios manufactures large industrial use fabrications, generally on a project engineering and design basis, and therefore, measures of annual capacity are not practical or meaningful.

From time to time, we are involved in litigation relating to our business. See Note 16 to the Consolidated Financial Statements.

19

PART II

| ITEM 5: | MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES |

Our common stock is traded on the New York Stock Exchange (symbol: TIE). The high and low sales prices for our common stock during 2009, 2010 and the first two months of 2011 are set forth below. All prices (as well as all share numbers referenced herein) have been adjusted to reflect previously affected stock splits.

| | | | | | | | |

| | | High | | | Low | |

Year ended December 31, 2009: | | | | | | | | |

First quarter | | $ | 9.89 | | | $ | 4.04 | |

Second quarter | | $ | 11.52 | | | $ | 5.25 | |

Third quarter | | $ | 10.63 | | | $ | 7.34 | |

Fourth quarter | | $ | 13.18 | | | $ | 8.39 | |

Year ended December 31, 2010: | | | | | | | | |

First quarter | | $ | 17.39 | | | $ | 10.54 | |

Second quarter | | $ | 21.29 | | | $ | 13.80 | |

Third quarter | | $ | 22.93 | | | $ | 16.87 | |

Fourth quarter | | $ | 21.10 | | | $ | 16.60 | |

January 1, 2011 to February 18, 2011 | | $ | 20.69 | | | $ | 16.51 | |

On February 18, 2011, the closing price of TIMET common stock was $20.14 per share, and there were approximately 2,130 stockholders of record of TIMET common stock.

Our Series A Preferred Stock is not mandatorily redeemable but is redeemable at our option. Holders of the Series A Preferred Stock are entitled to receive cumulative cash dividends at the rate of 6.75% of the $50 per share liquidation preference per annum per share (equivalent to $3.375 per annum per share), when, as and if declared by our board of directors. Whether or not declared, cumulative dividends on Series A Preferred Stock are deducted from net income to arrive at net income attributable to common stockholders. Prior to 2008, an aggregate of 1.6 million shares of our Series A Preferred Stock were converted into 21.3 million shares of our common stock, and a nominal number of our Series A Preferred shares were converted into a nominal number of shares of our common stock in 2008. No Series A Preferred Stock was converted during 2009. During 2010, 0.1 million shares of our Series A Preferred Stock were converted into 0.8 million shares of our common stock. As a result of these conversions, a nominal number of shares of Series A Preferred Stock remain outstanding as of December 31, 2009 and 2010.