1. EXERCISE OF WARRANT.

a. Subject to the terms and conditions hereof, this Warrant may be exercised by the Holder on any day, in whole or in part, by (i) delivery of a written notice, in the form attached hereto as EXHIBIT A (the "EXERCISE NOTICE"), of the Holder's election to exercise this Warrant (ii) unless the Holder is electing a “cashless” exercise, payment to the Company of the applicable portion of the Warrant Value (as adjusted) as to which this Warrant is being exercised (the "AGGREGATE EXERCISE PRICE") in cash or wire transfer of immediately available funds, which may be paid, at the sole discretion of the Holder, in U.S. Dollars or in New Israeli Shekels, at the representative exchange rate in effect on that day, and (iii) the delivery to the Company of this Warrant. Execution and delivery of the Exercise Notice with respect to less than the entire Warrant Value shall have the same effect as cancellation of the original Warrant and issuance of a new Warrant evidencing the right to purchase a number of Warrant Shares equal to the quotient derived from dividing the unpaid portion of the Warrant Value by the Exercise Price. On or before the first Business Day following the date on which the Company has received each of the Exercise Notice, this Warrant and the Aggregate Exercise Price (the "EXERCISE DELIVERY DOCUMENTS"), the Company shall transmit by facsimile an acknowledgment of confirmation of receipt of the Exercise Delivery Documents to the Holder and the Company's transfer agent (the "TRANSFER AGENT").

Subject to the paragraph below, on or before the third Business Day following the date on which the Company has received all of the Exercise Delivery Documents (the "SHARE DELIVERY DATE"), the Company shall (X) provided that the Transfer Agent is participating in The Depository Trust Company ("DTC") Fast Automated Securities Transfer Program, upon the request of the Holder, credit such aggregate number of Ordinary Shares to which the Holder is entitled pursuant to such exercise to the Holder's or its designee's balance account with DTC through its Deposit Withdrawal Agent Commission system, or (Y) if the Transfer Agent is not participating in the DTC Fast Automated Securities Transfer Program, issue and dispatch by overnight courier to the address as specified in the Exercise Notice, a certificate, registered in the name of the Holder or its designee, for the number of Ordinary Shares to which the Holder is entitled pursuant to such exercise. Upon delivery of the Exercise Delivery Documents, the Holder shall be deemed for all corporate purposes to have become the holder of record of the Warrant Shares with respect to which this Warrant has been exercised, irrespective of the date that such shares are credited to the Holder’s account or the date of delivery of the certificates evidencing such Warrant Shares, as applicable.

Notwithstanding the paragraph above, in the absence of an effective registration statement or applicable exemption, the Holder shall receive physical share certificates upon exercise of this Warrant. Provided that the person exercising the Warrants signs and delivers a letter substantially in the form attached hereto as Exhibit B, certificates representing Shares issued upon the exercise of Warrants shall be issued in physical form and bear the following legend:

THE SECURITIES REPRESENTED HEREBY HAVE NOT BEEN REGISTERED UNDER THE UNITED STATES SECURITIES ACT OF 1933, AS AMENDED (THE “U.S. SECURITIES ACT”). THE HOLDER HEREOF, BY PURCHASING SUCH SECURITIES AGREES FOR THE BENEFIT OF THE COMPANY THAT SUCH SECURITIES MAY BE OFFERED, SOLD, PLEDGED OR OTHERWISE TRANSFERRED ONLY (A) TO THE COMPANY, (B) OUTSIDE THE UNITED STATES IN ACCORDANCE WITH REGULATION S UNDER THE U.S. SECURITIES ACT AND IN COMPLIANCE WITH APPLICABLE LOCAL LAWS AND REGULATIONS, (C) PURSUANT TO ANOTHER EXEMPTION FROM REGISTRATION AFTER PROVIDING A SATISFACTORY LEGAL OPINION TO THE COMPANY, THAT SUCH REGISTRATION IS NOT REQUIRED UNDER THE SECURITIES ACT.

If this Warrant is submitted in connection with any exercise pursuant to this Section 1(a) and the Warrant Value represented by this Warrant submitted for exercise is at such time, greater than the applicable Aggregate Exercise Price, then the Company shall as soon as practicable and in no event later than five Business Days after any exercise and at its own expense, issue a new Warrant (in accordance with Section 6(d)), bearing the same legend as this Warrant, representing the Warrant Value less the Aggregate Exercise Price. No fractional Ordinary Shares are to be issued upon the exercise of this Warrant, but rather the number of Ordinary Shares to be issued shall be rounded up or down to the nearest whole number. The Company shall pay any and all taxes which may be payable with respect to the issuance and delivery of Warrant Shares upon exercise of this Warrant.

b. EXERCISE PRICE. For purposes of this Warrant, "EXERCISE PRICE" means $0.20 U.S Dollars, subject to adjustment as provided herein. Notwithstanding the foregoing, should the Company's annual gross revenues as recorded on the Company's unaudited consolidated financial statements for the year ended December 31, 2014 (as produced by the Company's Chief Financial Officer by no later than January 20, 2015 (the "CFO Report")) be less than $19,000,000, the Exercise Price shall be $0.17 US Dollars, and an additional number of shares necessary to reflect such reduced exercise price shall be issuable to the Holder, subject to adjustment as provided herein. For the avoidance of doubt: (a) The Exercise Price shall be reduced also in the event that the Company's annual gross revenues as recorded on the Company's audited financial statements for the year ended December 31, 2014 is lower than $19,000,000 (notwithstanding the gross annual revenues as recorded in the CFO Report), and an additional number of shares necessary to reflect such reduced exercise price shall be issuable to the Holder, and (b) any additional shares required to be issued in accordance with a reduced exercise price pursuant to this Section 1(b) may be issued following the Expiration Date.

c. CASHLESS EXERCISE. The Holder may notify the Company in an Exercise Notice of its election to utilize cashless exercise, in which event the Company shall issue to the Holder the number of Warrant Shares determined as follows:

X = Y [(A-B)/A]

where:

X = the number of Warrant Shares to be issued to the Holder.

Y = the number of Warrant Shares with respect to which this Warrant is being exercised.

A = the average of the Closing Sale Prices for the three Trading Days immediately prior to (but not including) the Exercise Date.

B = the applicable Exercise Price.

For purposes of Rule 144 promulgated under the Securities Act, it is intended, understood and acknowledged that the Warrant Shares issued in a cashless exercise transaction shall be deemed to have been acquired by the Holder, and the holding period for the Warrant Shares shall be deemed to have commenced, on the date this Warrant was originally issued.

“CLOSING SALE PRICE” means the last closing trade price for the Ordinary Shares on a Trading Market, as reported by Bloomberg, or, if the Trading Market begins to operate on an extended hours basis and does not designate the closing trade price then the last trade price of such security prior to 4:00 p.m., New York time, as reported by Bloomberg, or if the foregoing does not apply, the last closing trade price of such security in the over-the-counter market on the electronic bulletin board for such security as reported by Bloomberg, or, if no trade price is reported for such security by Bloomberg, the average of the bid prices, or the ask prices, respectively, of any market makers for such security as reported in the “pink sheets” by Pink OTC Markets Inc. (formerly the National Quotation Bureau, Inc.). If the Closing Sale Price cannot be calculated for a security on a particular date on any of the foregoing bases, the Closing Sale Price of such security on such date shall be the fair market value as mutually determined by the Company and the Holder. All such determinations to be appropriately adjusted for any stock dividend, stock split, stock combination or other similar transaction during the applicable calculation period.

"TRADING DAY" means (i) a day on which the Ordinary Shares are traded on a Trading Market (other than the OTC Bulletin Board), or (ii) if the Ordinary Shares are not listed on a Trading Market (other than the OTC Bulletin Board), a day on which the Ordinary Shares are traded in the over-the-counter market, as reported by the OTC Bulletin Board, or (iii) if the Ordinary Shares are not quoted on any Trading Market, a day on which the Ordinary Shares are quoted in the over-the-counter market as reported by the Pink OTC Markets Inc. (or any similar organization or agency succeeding to its functions of reporting prices).

2. ADJUSTMENT TO WARRANT VALUE. Notwithstanding anything in this Warrant to the contrary, the Warrant Value shall be adjusted proportionately to the aggregate portion of (a) the Loan converted pursuant to the Loan Agreement and (b) the Second Warrant exercised pursuant to the Second Warrant Agreement. For illustrative purposes only, (a) should the Purchaser convert 75% of the Loan pursuant to the Loan Agreement and exercise 75% of the value of the Second Warrant pursuant to the Second Warrant Agreement, the Warrant Value shall be reduced to $750,000; or (b) should the Purchaser convert 100% of the Loan pursuant to the Loan Agreement and not exercise the Second Warrant, the Warrant Value shall be reduced to $600,000. Furthermore, in the event that the Purchaser converts and/or exercises less than an aggregate of 50% of (a) the Loan and (b) the value of the Second Warrant (a “CANCELLATION EVENT”), this Warrant shall be cancelled in its entirety and the Purchaser will not be entitled to exercise the Warrant.

3. ADJUSTMENT OF EXERCISE PRICE. If the Company at any time after the date of issuance of this Warrant subdivides (by any stock split, stock dividend, recapitalization or otherwise) one or more classes of its outstanding share capital into a greater number of shares, the Exercise Price in effect immediately prior to such subdivision will be proportionately reduced and the number of Warrant Shares issuable hereunder will be proportionately increased. If the Company at any time after the date of issuance of this Warrant combines (by combination, reverse stock split or otherwise) one or more classes of its outstanding share capital into a smaller number of shares, the Exercise Price in effect immediately prior to such combination will be proportionately increased and the number of Warrant Shares issuable hereunder will be proportionately decreased. Any adjustment under this Section 2 shall become effective at the close of business on the date the subdivision or combination becomes effective. . The number of Ordinary Shares granted to the Holder shall be adjusted proportionately in the event that the Company pays a share dividend or dividend of any other security that is convertible into shares of the Company.

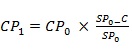

In the event that the Company pays a cash dividend to its shareholders, the exercise price will be adjusted as set forth below:

Where:

CR0 | = the exercise price in effect immediately before the open of business on the ex-dividend date for the cash dividend. |

CR1 | = the exercise price in effect immediately after the open of business on the ex-dividend date. |

SP0 | = the Company’s last reported sale price on the trading day immediately preceding the ex-dividend date. |

| C | = the amount per share of cash dividend |

In the event the Company intends to issue shares (or any convertible security) at a price below the Exercise Price (the "Offered Shares"), within six months from the date hereof, the Company shall first deliver written notice of its intention to do so to the Holder, specifying (i) the number of Offered Shares; and (ii) the proposed consideration per share. The Holder shall then have the option, exercisable for a period of thirty days from the date of delivery of such written notice by the Company, to purchase all or part of the Offered Shares, for the same consideration per share and on the same terms and conditions set forth in the written notice.

4. RIGHTS UPON CONSOLIDATION OR MERGER. In case of any consolidation or merger to which the Company shall be a party, other than a consolidation or merger in which the Company shall be the surviving or continuing corporation and in which the Ordinary Shares are not reclassified, changed or exchanged for any security, cash or other property, or in case of any sale or conveyance to another entity of all or substantially all of the property of the Company, or in the case of any statutory exchange of securities with another entity (including any exchange effected in connection with a merger of any other corporation with the Company), the Holder shall have the right thereafter to convert this Warrant into the kind and amount of securities, cash or other property which it would have owned or have been entitled to receive immediately after such consolidation, merger, statutory exchange, sale or conveyance had this Warrant been exercised immediately prior to the effective date of such transaction and, if necessary, appropriate adjustment shall be made in the application of the provisions set forth in Section 2 with respect to the rights and interests thereafter of the Holder to the end that the provisions set forth in Section 2 shall thereafter correspondingly be made applicable, as nearly as may reasonably be, in relation to any shares of stock or other securities or property thereafter deliverable upon the exercise of this Warrant.

5. NONCIRCUMVENTION. The Company hereby covenants and agrees that the Company will not, by amendment of its Articles of Association or through any reorganization, transfer of assets, consolidation, merger, dissolution, issue or sale of securities, or any other voluntary action, avoid or seek to avoid the observance or performance of any of the terms of this Warrant, and will at all times in good faith carry out all the provisions of this Warrant and take all action as may be required to protect the rights of the holder of this Warrant. Without limiting the generality of the foregoing, the Company (i) will not increase the par value of any Ordinary Shares receivable upon the exercise of this Warrant above the Exercise Price then in effect, (ii) will take all such actions as may be necessary or appropriate in order that the Company may validly and legally issue fully paid and nonassessable Ordinary Shares upon the exercise of this Warrant, and (iii) will, so long as any part of the Warrant is outstanding, reserve and keep available out of its authorized and unissued Ordinary Shares, solely for the purpose of effecting the exercise of the Warrant, 100% of the number of Ordinary Shares as shall from time to time be necessary to effect the exercise of the Warrant.

6. WARRANT HOLDER NOT DEEMED A SHAREHOLDER. Except as otherwise specifically provided herein, no holder, solely in such Person's capacity as a holder, of this Warrant shall be entitled to vote or receive dividends or be deemed the holder of shares of the Company for any purpose, nor shall anything contained in this Warrant be construed to confer upon the holder hereof, solely in such Person's capacity as a holder of this Warrant, any of the rights of a shareholder of the Company or any right to vote, give or withhold consent to any corporate action (whether any reorganization, issue of stock, reclassification of share capital, consolidation, merger, conveyance or otherwise), receive notice of meetings, receive dividends or subscription rights, or otherwise, prior to the issuance to the holder of this Warrant of the Warrant Shares which such Person is then entitled to receive upon the due exercise of this Warrant. In addition, nothing contained in this Warrant shall be construed as imposing any liabilities on such holder to purchase any securities (upon exercise of this Warrant or otherwise) or as a shareholder of the Company, whether such liabilities are asserted by the Company or by creditors of the Company.

7. REISSUANCE OF WARRANTS.

a. TRANSFER OF WARRANT. Subject to Section 13 below, if this Warrant is to be transferred, the holder shall surrender this Warrant to the Company, whereupon the Company will forthwith issue and deliver upon the order of the holder of this Warrant a new Warrant (in accordance with Section 7(d)), registered as the holder of this Warrant may request, representing the Warrant Value being transferred by the Holder and, if less than the full Warrant Value set forth herein is being transferred, a new Warrant (in accordance with Section 7(d)) to the holder of this Warrant representing the portion of the Warrant Value not being transferred.

b. LOST, STOLEN OR MUTILATED WARRANT. Upon receipt by the Company of evidence reasonably satisfactory to the Company of the loss, theft, destruction or mutilation of this Warrant, and, in the case of loss, theft or destruction, of any indemnification undertaking by the holder of this Warrant to the Company in customary form and, in the case of mutilation, upon surrender and cancellation of this Warrant, the Company shall execute and deliver to the Holder a new Warrant (in accordance with Section 7(d)) representing the right to purchase the Warrant Shares then underlying this Warrant.

c. WARRANT EXCHANGEABLE FOR MULTIPLE WARRANTS. This Warrant is exchangeable, upon the surrender hereof by the holder of this Warrant at the principal office of the Company, for a new Warrant or Warrants (in accordance with Section 7(d)) representing the Warrant Value, and each such new Warrant will represent the such portion of Warrant Value as is designated by the holder of this Warrant at the time of such surrender.

d. ISSUANCE OF NEW WARRANTS. Whenever the Company is required to issue a new Warrant pursuant to the terms of this Warrant, such new Warrant (i) shall be of like tenor with this Warrant, (ii) shall represent, as indicated on the face of such new Warrant, the Warrant Value (or in the case of a new Warrant being issued pursuant to Section 7(a) or Section 7(c), the Warrant Value designated by the holder of this Warrant which, when added to the Warrant Value of the other new Warrants issued in connection with such issuance, does not exceed the total Warrant Value of this Warrant), (iii) shall have an issuance date, as indicated on the face of such new Warrant, which is the same as the Issuance Date, and (iv) shall have the same rights and conditions as this Warrant.

8. NOTICES. Whenever notice is required to be given under this Warrant, unless otherwise provided herein, such notice shall be given in accordance with Section 7(f) of the Securities Purchase Agreement. The Company shall provide the holder of this Warrant with prompt written notice of all actions taken pursuant to this Warrant, including in reasonable detail a description of such action and the reason therefor. Without limiting the generality of the foregoing, the Company will give written notice to the holder of this Warrant (i) promptly upon any adjustment of the Exercise Price, setting forth in reasonable detail, and certifying, the calculation of such adjustment and (ii) at least fifteen days prior to the date on which the Company takes a record (A) with respect to any dividend or distribution upon the Ordinary Shares, or (B) with respect to any consolidation or merger provided in each case that such information shall be made known to the public prior to or in conjunction with such notice being provided to such holder.

9. AMENDMENT AND WAIVER. Except as otherwise provided herein, the provisions of this Warrant may be amended and the Company may take any action herein prohibited, or omit to perform any act herein required to be performed by it, only if the Company has obtained the written consent of the holder of this Warrant. No failure to exercise, nor any delay in exercising, on the part of any party hereto of any right or remedy hereunder shall operate as a waiver thereof, nor shall any single or partial exercise of any right or remedy prevent any further or other exercise thereof or the exercise of any other right or remedy.

10. GOVERNING LAW. This Warrant shall be governed by and construed in accordance with the internal laws of the State of Israel, without giving effect to any statutes concerning choice or conflict of law. Any controversy or claim arising out of or in connection with this agreement or any breach or alleged breach hereof shall be exclusively resolved by the competent courts of Tel Aviv, Israel, and each of the parties hereby irrevocably submits to the exclusive jurisdiction of such courts.

11. CONSTRUCTION; HEADINGS. This Warrant shall be deemed to be jointly drafted by the Company and the Purchaser and shall not be construed against any person as the drafter hereof. The headings of this Warrant are for convenience of reference and shall not form part of, or affect the interpretation of, this Warrant.

12. REMEDIES, OTHER OBLIGATIONS, BREACHES AND INJUNCTIVE RELIEF. The remedies provided in this Warrant shall be cumulative and in addition to all other remedies available under this Warrant, the Securities Purchase Agreement and the Registration Rights Agreement, at law or in equity (including a decree of specific performance and/or other injunctive relief), and nothing herein shall limit the right of the holder of this Warrant right to pursue actual damages for any failure by the Company to comply with the terms of this Warrant. The Company acknowledges that a breach by it of its obligations hereunder will cause irreparable harm to the holder of this Warrant and that the remedy at law for any such breach may be inadequate. The Company therefore agrees that, in the event of any such breach or threatened breach, the holder of this Warrant shall be entitled, in addition to all other available remedies, to an injunction restraining any breach, without the necessity of showing economic loss and without any bond or other security being required.

13. TRANSFER. Subject to compliance with any applicable securities laws, this Warrant may be offered for sale, sold, transferred or assigned without the consent of the Company, as permitted by Section 7(g) of the Securities Purchase Agreement.

14. CERTAIN DEFINITIONS. For purposes of this Warrant, the following terms shall have the following meanings:

"BUSINESS DAY" means any day other than Saturday, Sunday or other day on which commercial banks in the City of New York are authorized or required by law to remain closed.

"EXPIRATION DATE" means February 5, 2015, provided the Warrant has not been cancelled earlier in accordance with Section 2 herein.

"LOAN" means the Loan of $300,000 provided under the Loan Agreement.

"LOAN AGREEMENT" means the Convertible Loan Agreement between the Company and the Purchaser dated December __, 2012 (or the warrant that will replace such Convertible Loan Agreement, in accordance with the terms thereof).

"ORDINARY SHARES" means the Company's Ordinary Shares, par value NIS 1.0 per share.

"PERSON" means an individual, a limited liability company, a partnership, a joint venture, a corporation, a trust, an unincorporated organization, any other entity and a government or any department or agency thereof.

"REGISTRATION RIGHTS AGREEMENT" means that certain registration rights agreement between the Company and the Purchasers.

"SECOND WARRANT" means the Second Warrant as defined in the Securities Purchase Agreement.

"SECOND WARRANT AGREEMENT" means the Second Warrant Agreement as defined in the Securities Purchase Agreement.

"TRADING MARKET" means The New York Stock Exchange, Inc., the NYSE MKT LLC, the Nasdaq Global Select Market, Nasdaq Global Market or the Nasdaq Capital Market.

[SIGNATURE PAGE FOLLOWS]

[Signature page – First Warrant]

IN WITNESS WHEREOF, the Company has caused this Warrant to Purchase Ordinary Shares to be duly executed as of the Issuance Date set out above.

ELBIT VISION SYSTEMS LTD.

By:

Name:

Title:

EXHIBIT A

EXERCISE NOTICE

TO BE EXECUTED BY THE REGISTERED HOLDER TO EXERCISE THIS WARRANT TO PURCHASE ORDINARY SHARES

ELBIT VISION SYSTEMS LTD.

The undersigned holder hereby exercises the right to purchase _________________ of the Ordinary Shares ("WARRANT SHARES") of Elbit Vision Systems Ltd., a company organized under the laws of the State of Israel (the "Company"), evidenced by the attached Warrant to Purchase Ordinary Shares (the "WARRANT"). Capitalized terms used herein and not otherwise defined shall have the respective meanings set forth in the Warrant.

1. Form of Exercise Price. The Holder intends that payment of the Exercise Price shall be made as:

____________ a "CASH EXERCISE" with respect to _________________ Warrant Shares.; or

____________ a "CASHLESS EXERCISE" with respect to _________________ Warrant Shares.

2. Payment of Exercise Price. If using a “Cash Exercise: The holder is hereby delivering to the Company payment in the amount of $_________ or NIS _________ representing the Aggregate Exercise Price for such Warrant Shares.

3. Delivery of Warrant Shares. The Company shall deliver to the holder __________ Warrant Shares in accordance with the terms of the Warrant.

In addition to this exercise form, the Holder must also provide an executed letter, substantially in the form attached as Schedule "B" to the Warrant, a copy of which is available upon request from the Company.

Date: _______________ __, ______

_____________________________

Name of Registered Holder

By:

Name:

Title:

EXHIBIT B

Form of Letter to be delivered by

U.S. Purchaser upon Exercise of Warrants

[Company]

[Address]

Dear Sirs:

We are delivering this letter in connection with the purchase of common shares (the "Shares") of Elbit Vision Systems Ltd., (the "Company"), a corporation existing under the laws of Israel, upon the exercise of warrants of the Company ("Warrants"), issued on [Date] by the Company to Avi Gross,

We hereby confirm that:

| | (i) | we are an institutional "accredited investor" within the meaning of Rule 501 (a)(1),(2),(3) or (7) of Regulation D under the United States Securities Act of 1933 (the "U.S. Securities Act"); |

| | (ii) | we are purchasing the Shares for our own account; |

| | (iii) | we have such knowledge and experience in financial and business matters that we are capable of evaluating the merits and risks of purchasing the Shares; |

| | (iv) | we are not acquiring the Shares with a view to distribution thereof or with any present intention of offering or selling any of the Shares, except (A) to the Company, (B) outside the United States in accordance with Rule 904 under the U.S. Securities Act or (C) inside the United States in accordance with Rule 144 under the U.S. Securities Act, if applicable, and in compliance with applicable state securities laws; |

| | (v) | we acknowledge that we have had access to such financial and other information as we deem necessary in connection with our decision to purchase the Shares; and |

| | (vi) | we acknowledge that we are not purchasing the Shares as a result of any general solicitation or general advertising, including advertisements, articles, notices or other communications published in any newspaper, magazine or similar media or broadcast over radio, television, or any seminar or meeting whose attendees have been invited by general solicitation or general advertising. |

We understand that the Shares are being offered in a transaction not involving any public offering within the United States within the meaning of the U.S. Securities Act and that the Shares have not been and will not be registered under the U.S. Securities Act. We further understand that any Shares acquired by us will be in the form of definitive physical certificates and that such certificates will bear a legend reflecting the substance of paragraph (iv) above.

We acknowledge that you will rely upon our confirmations, acknowledgments and agreements set forth herein, and we agree to notify you promptly in writing if any of our representations or warranties herein ceases to be accurate or complete.

| | _______________________ Avi Gross Address: |