Financial and Corporate Update Exhibit 99.1

Speakers David Hung, M.D. – Founder, President and CEO Marion McCourt – Chief Operating Officer Jennifer Jarrett – Chief Financial Officer Mohammad Hirmand, M.D. – Interim Chief Medical Officer

Additional Information Forward-Looking Statements This presentation contains forward-looking statements. All statements relating to events or results that may occur in the future, including but not limited to statements regarding our future results of operations and financial position, our anticipated future non-GAAP revenue, estimated future sales of XTANDI®, market opportunity for our products and product candidates, potential regulatory approvals or events, and clinical trial events or progress, are forward-looking statements. These statements involve known and unknown risks, uncertainties and other important factors that may cause our actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements. Words such as “believe,” “opportunity,” “potential,” “expected,” “potentially,” “may,” “goals,” and similar expressions are intended to identify these forward-looking statements. These statements involve known and unknown risks, uncertainties and other important factors, including risks inherent in obtaining regulatory approvals, that may cause our actual results, performance or achievements to be materially different from those expressed or implied by the forward-looking statements. Because forward-looking statements are inherently subject to risks and uncertainties, you should not rely on these forward -looking statements as predictions of future events. For a further description of the risks and uncertainties that could cause actual results to differ from those expressed in forward-looking statements, including risks relating to relating to our business in general, see our Annual Report on Form 10-K filed with the Securities and Exchange Commission, or SEC, on February 26, 2016, and Quarterly Report on Form 10-Q for the quarter ended March 31, 2016, filed with the SEC on May 5, 2016. Except as required by applicable law, we do not plan to publicly update or revise any forward-looking statements contained herein, whether as a result of any new information, future events, changed circumstances or otherwise. Additional Information This presentation is neither an offer to buy nor a solicitation of an offer to sell any securities of Medivation. No tender offer for the shares of Medivation has commenced at this time. In connection with its proposed transaction, Sanofi may file tender offer documents, consent solicitation documents or other documents with the U.S. Securities and Exchange Commission (“SEC”). If a tender offer and/or consent solicitation is commenced, Medivation will file with the SEC a Solicitation/Recommendation Statement on Schedule 14D-9 with respect to such tender offer and may file a solicitation of revocation in connection with such consent solicitation. Once filed, stockholders will be able to obtain, as applicable, the tender offer statement on Schedule TO, the offer to purchase, the Solicitation/Recommendation Statement of Medivation on Schedule 14D-9, any consent solicitation, any solicitation of revocation and related materials with respect to any tender offer or consent solicitation, free of charge, at the website of the SEC at www.sec.gov, and from any information agent and/or dealer manager named in the tender offer materials. Stockholders may also obtain, at no charge, any such documents filed with or furnished to the SEC by Medivation under the “SEC Filings” tab in the “Investor Relations” section of Medivation’s website atwww.medivation.com. Stockholders are advised to read these documents, if and when they become available, including any amendments thereto, as well as any other documents relating to any tender offer and/or consent solicitation that are filed with the SEC, carefully and in their entirety prior to making any decisions with respect to whether to tender shares or submit consents because the documents will contain important information. Certain Information Regarding Participants Medivation, its directors and certain of its executive officers may be deemed to be participants in the solicitation of revocations in connection with any Sanofi solicitation. Information regarding the names of Medivation’s directors and executive officers and their respective interests in Medivation by security holdings or otherwise is set forth in Medivation’s proxy statement for the 2016 Annual Meeting of Shareholders, as amended, filed with the SEC on April 29, 2016. Additional information can also be found in Medivation’s Annual Report on Form 10-K for the year ended December 31, 2015, filed with the SEC on February 26, 2016 and in Medivation’s latest Quarterly Report on Form 10-Q.

David Hung, M.D. Founder, President and CEO

Marion McCourt Chief Operating Officer

Jennifer Jarrett Chief Financial Officer

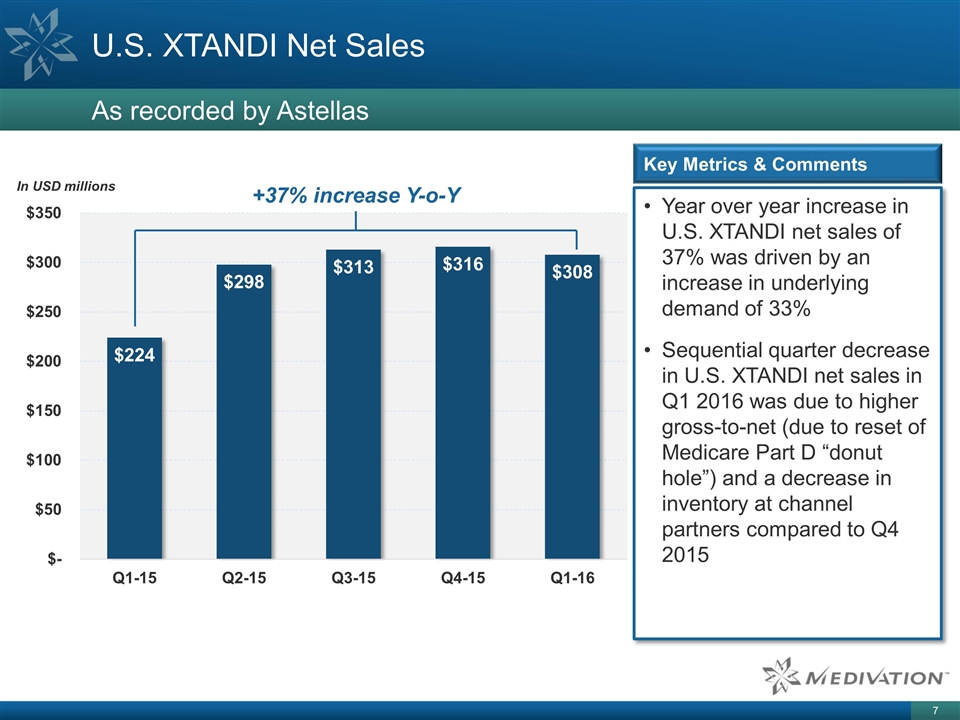

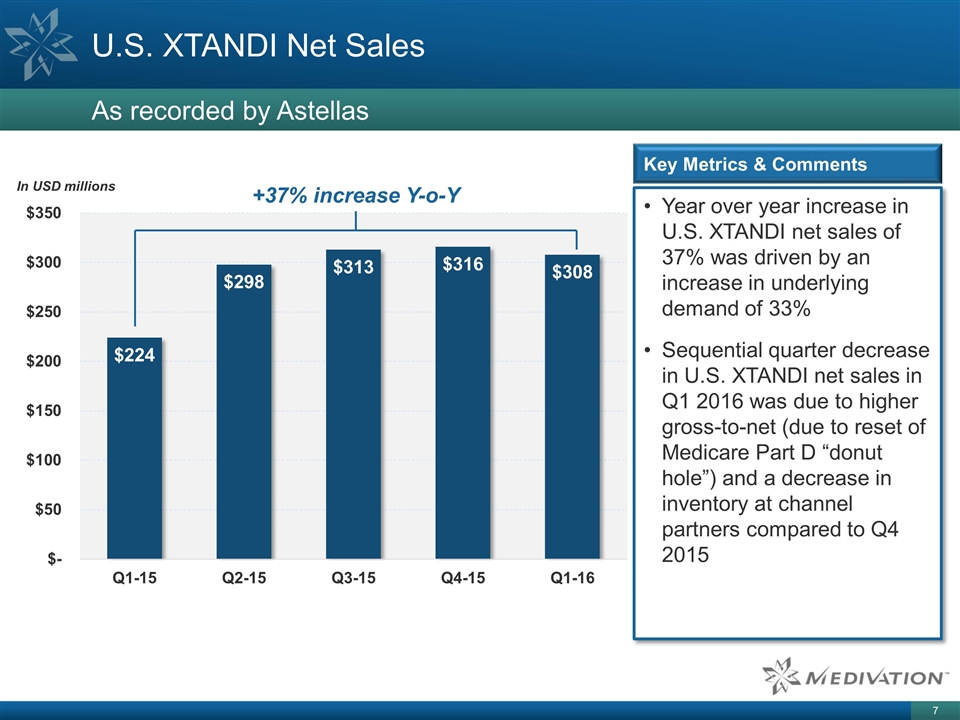

Year over year increase in U.S. XTANDI net sales of 37% was driven by an increase in underlying demand of 33% Sequential quarter decrease in U.S. XTANDI net sales in Q1 2016 was due to higher gross-to-net (due to reset of Medicare Part D “donut hole”) and a decrease in inventory at channel partners compared to Q4 2015 U.S. XTANDI Net Sales As recorded by Astellas Key Metrics & Comments +37% increase Y-o-Y

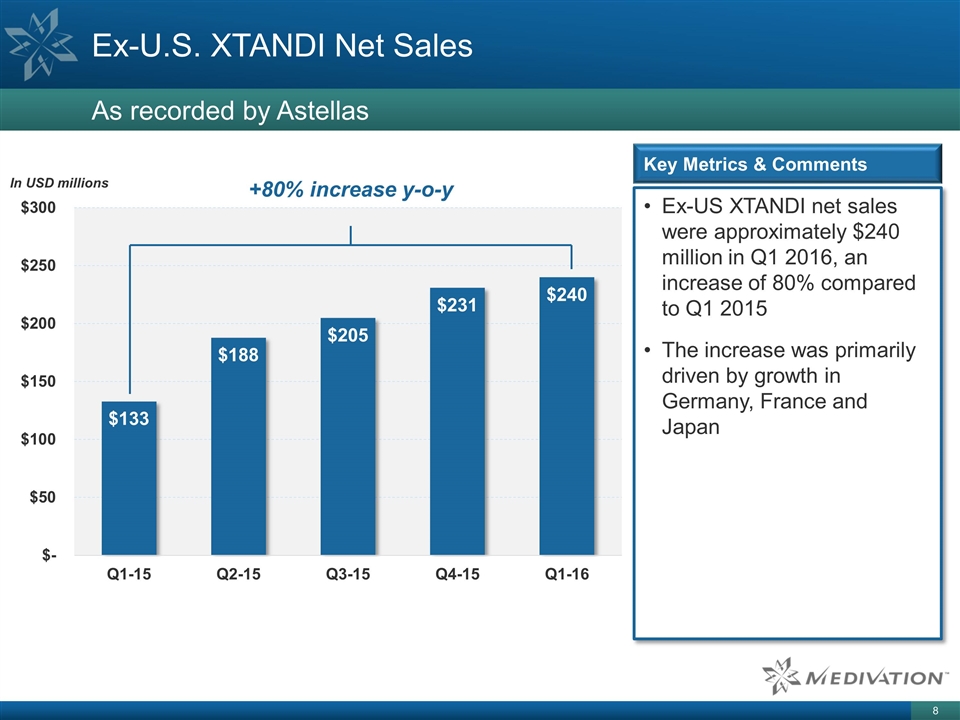

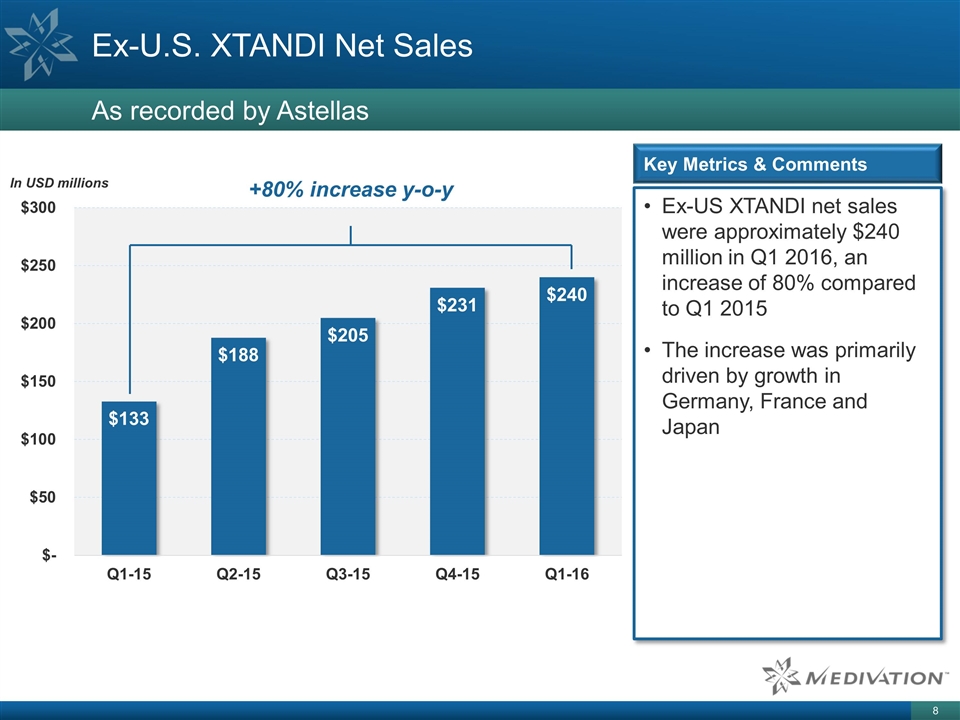

+80% increase y-o-y Ex-U.S. XTANDI Net Sales As recorded by Astellas Ex-US XTANDI net sales were approximately $240 million in Q1 2016, an increase of 80% compared to Q1 2015 The increase was primarily driven by growth in Germany, France and Japan Key Metrics & Comments

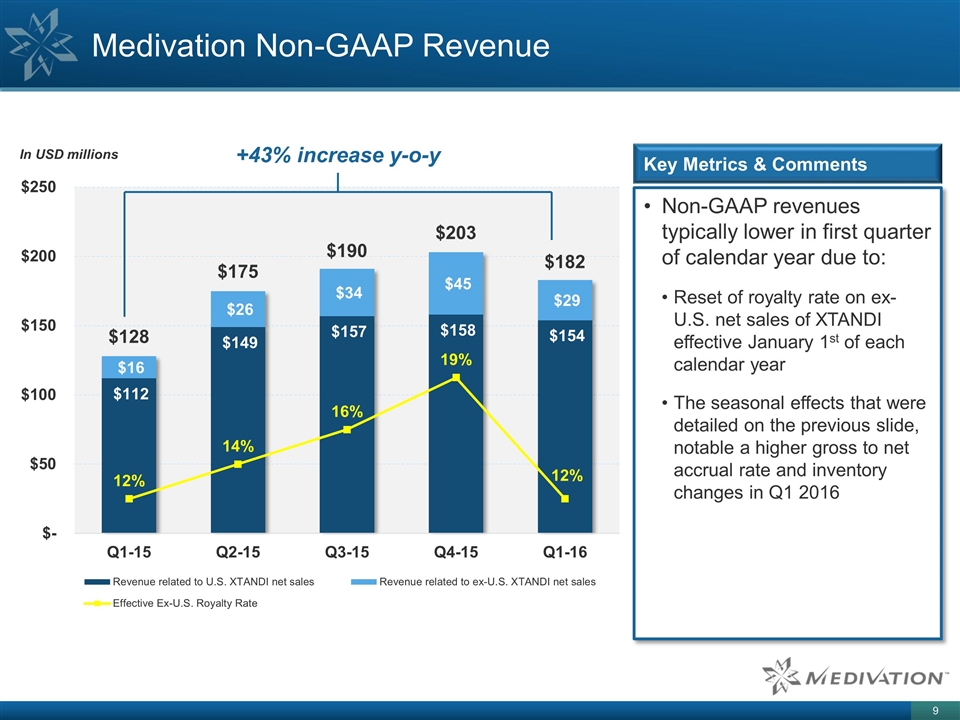

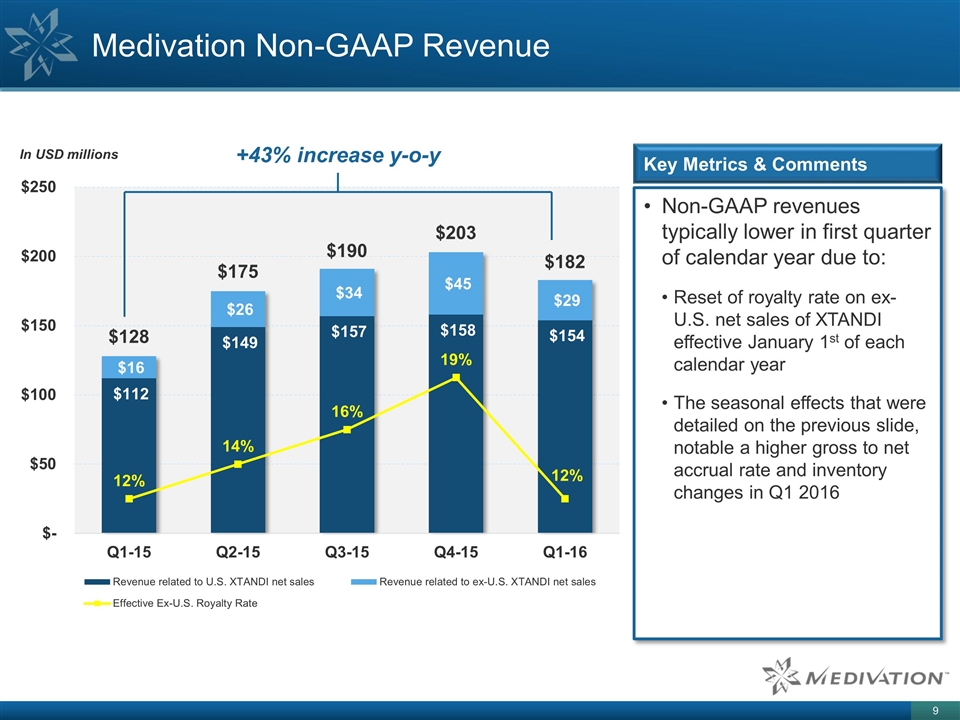

Medivation Non-GAAP Revenue Non-GAAP revenues typically lower in first quarter of calendar year due to: Reset of royalty rate on ex-U.S. net sales of XTANDI effective January 1st of each calendar year The seasonal effects that were detailed on the previous slide, notable a higher gross to net accrual rate and inventory changes in Q1 2016 Key Metrics & Comments +43% increase y-o-y

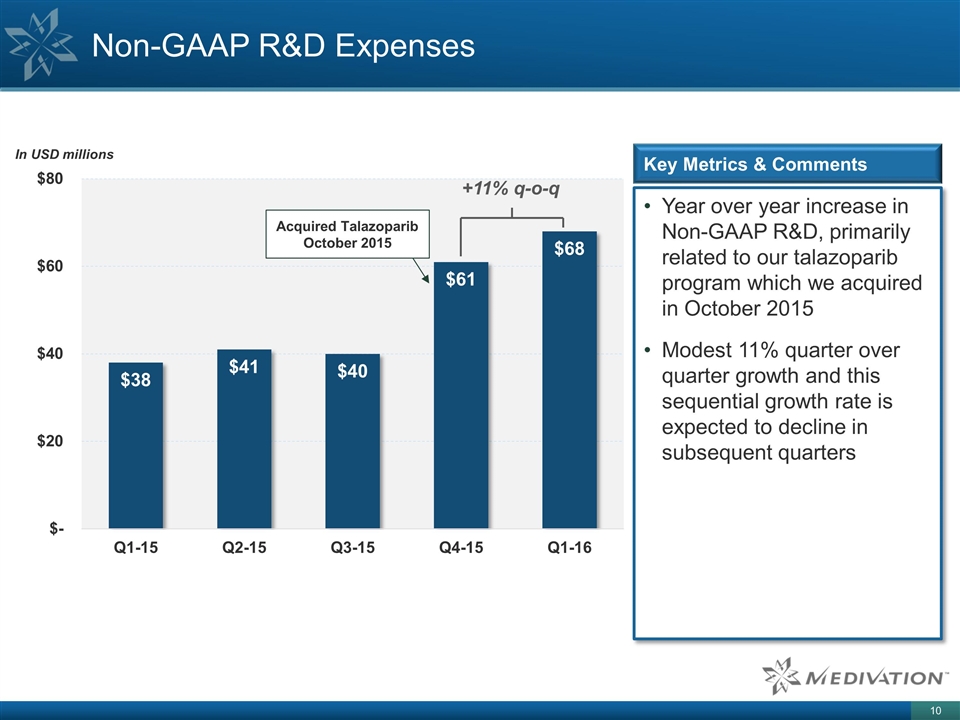

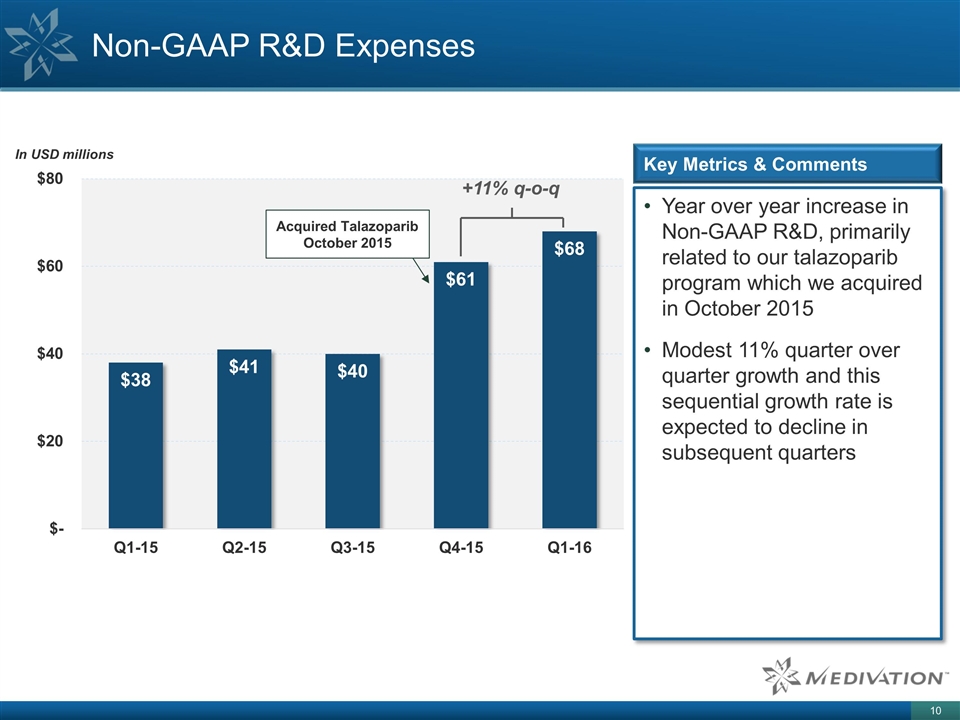

Non-GAAP R&D Expenses Year over year increase in Non-GAAP R&D, primarily related to our talazoparib program which we acquired in October 2015 Modest 11% quarter over quarter growth and this sequential growth rate is expected to decline in subsequent quarters Key Metrics & Comments Acquired Talazoparib October 2015 +11% q-o-q

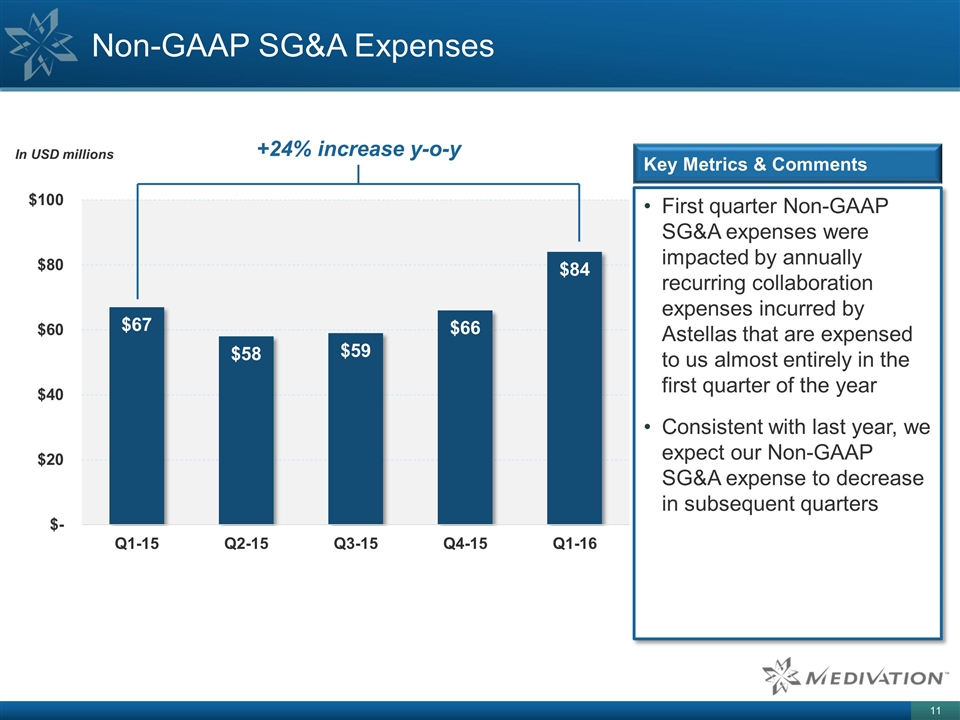

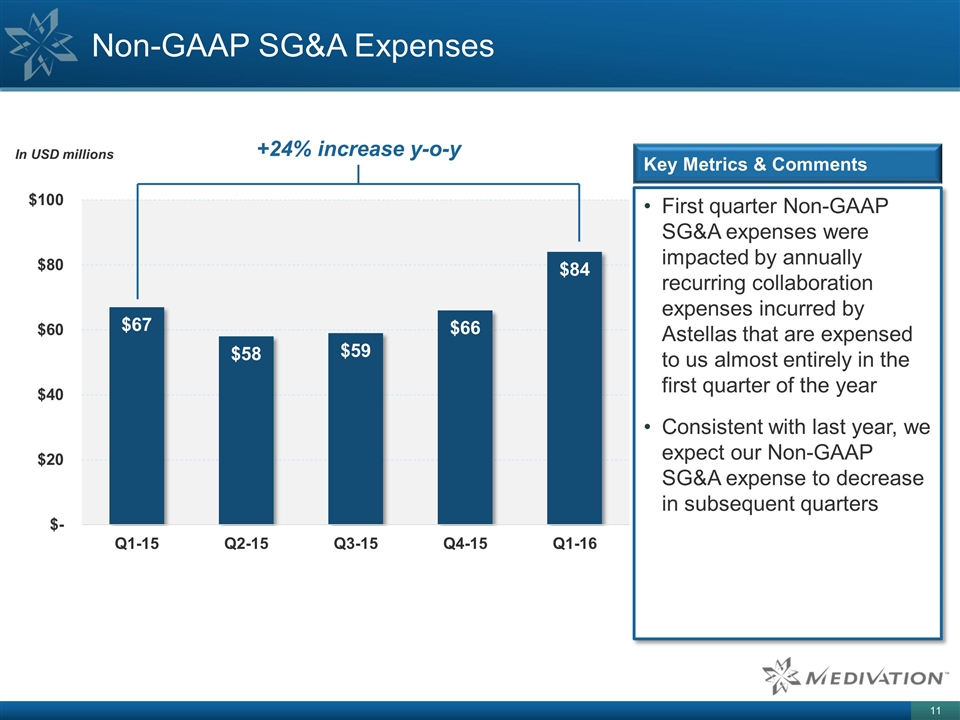

Non-GAAP SG&A Expenses First quarter Non-GAAP SG&A expenses were impacted by annually recurring collaboration expenses incurred by Astellas that are expensed to us almost entirely in the first quarter of the year Consistent with last year, we expect our Non-GAAP SG&A expense to decrease in subsequent quarters Key Metrics & Comments +24% increase y-o-y

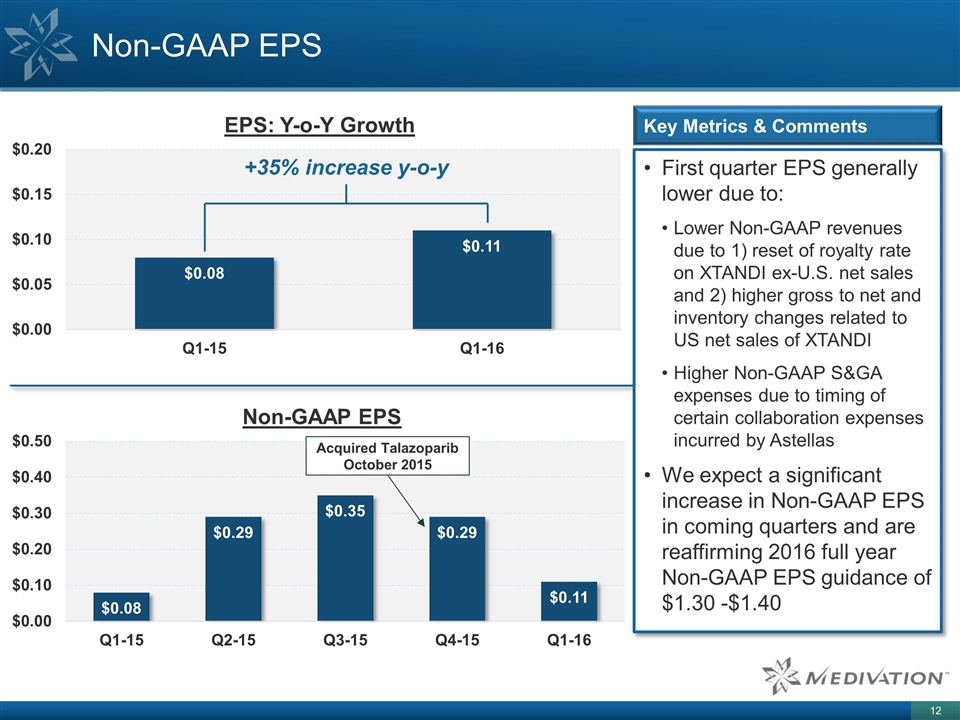

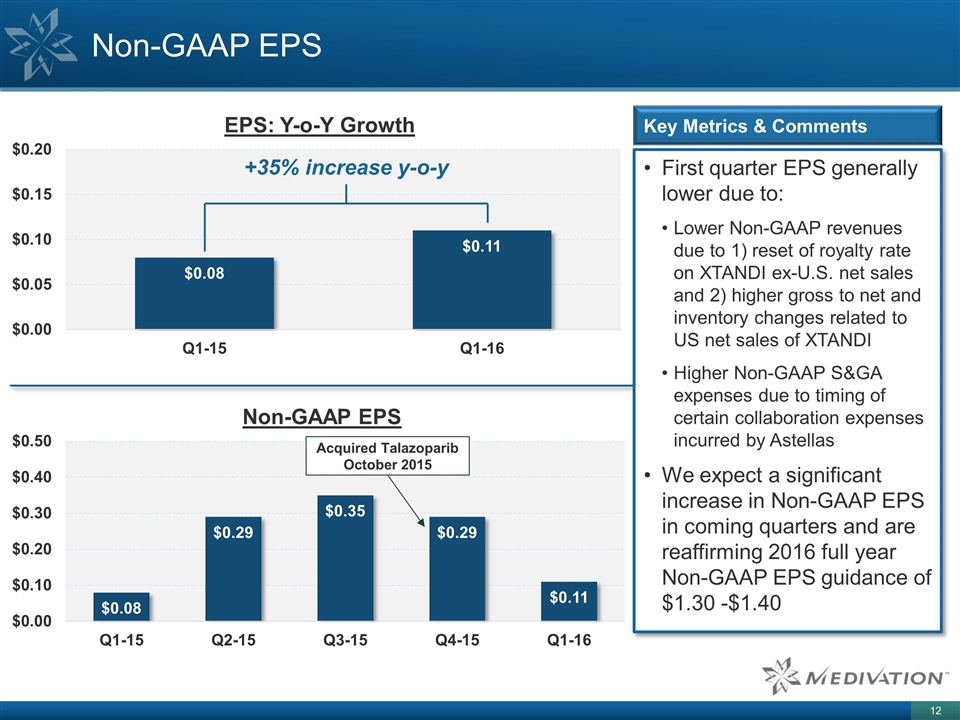

Non-GAAP EPS First quarter EPS generally lower due to: Lower Non-GAAP revenues due to 1) reset of royalty rate on XTANDI ex-U.S. net sales and 2) higher gross to net and inventory changes related to US net sales of XTANDI Higher Non-GAAP S&GA expenses due to timing of certain collaboration expenses incurred by Astellas We expect a significant increase in Non-GAAP EPS in coming quarters and are reaffirming 2016 full year Non-GAAP EPS guidance of $1.30 -$1.40 Key Metrics & Comments +35% increase y-o-y

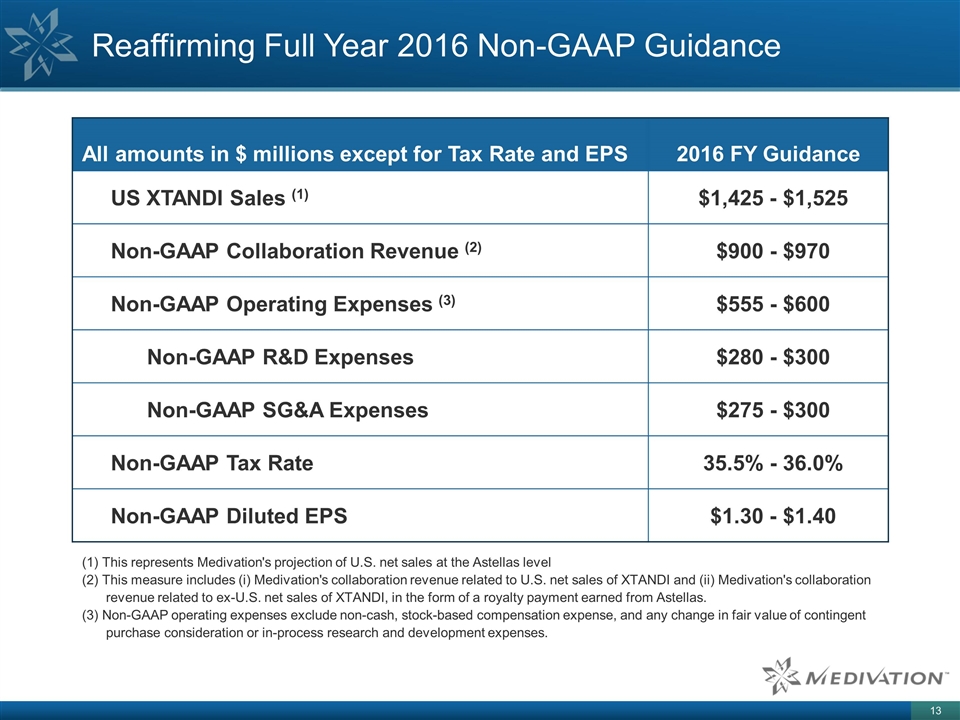

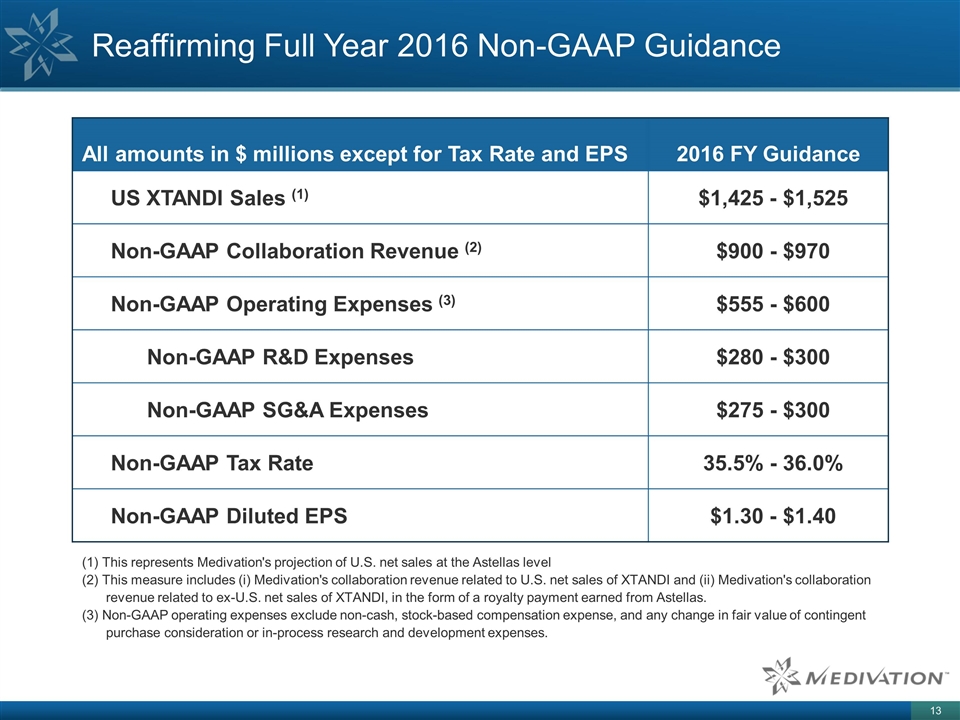

Reaffirming Full Year 2016 Non-GAAP Guidance All amounts in $ millions except for Tax Rate and EPS 2016 FY Guidance US XTANDI Sales (1) $1,425 - $1,525 Non-GAAP Collaboration Revenue (2) $900 - $970 Non-GAAP Operating Expenses (3) $555 - $600 Non-GAAP R&D Expenses $280 - $300 Non-GAAP SG&A Expenses $275 - $300 Non-GAAP Tax Rate 35.5% - 36.0% Non-GAAP Diluted EPS $1.30 - $1.40 (1) This represents Medivation's projection of U.S. net sales at the Astellas level (2) This measure includes (i) Medivation's collaboration revenue related to U.S. net sales of XTANDI and (ii) Medivation's collaboration revenue related to ex-U.S. net sales of XTANDI, in the form of a royalty payment earned from Astellas. (3) Non-GAAP operating expenses exclude non-cash, stock-based compensation expense, and any change in fair value of contingent purchase consideration or in-process research and development expenses.

Non-GAAP Financial Measures

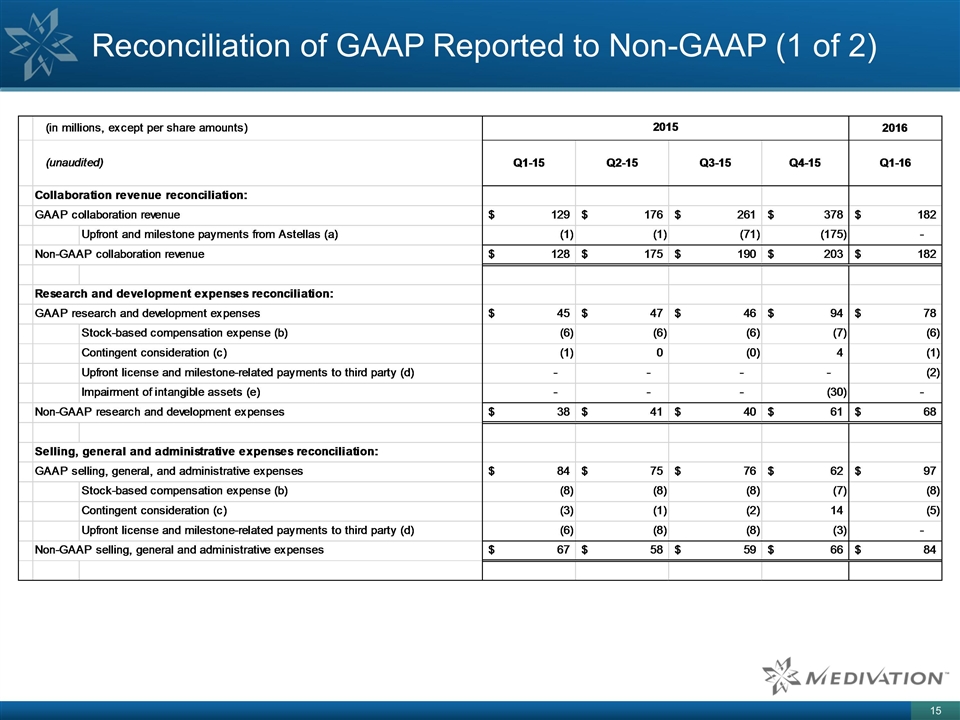

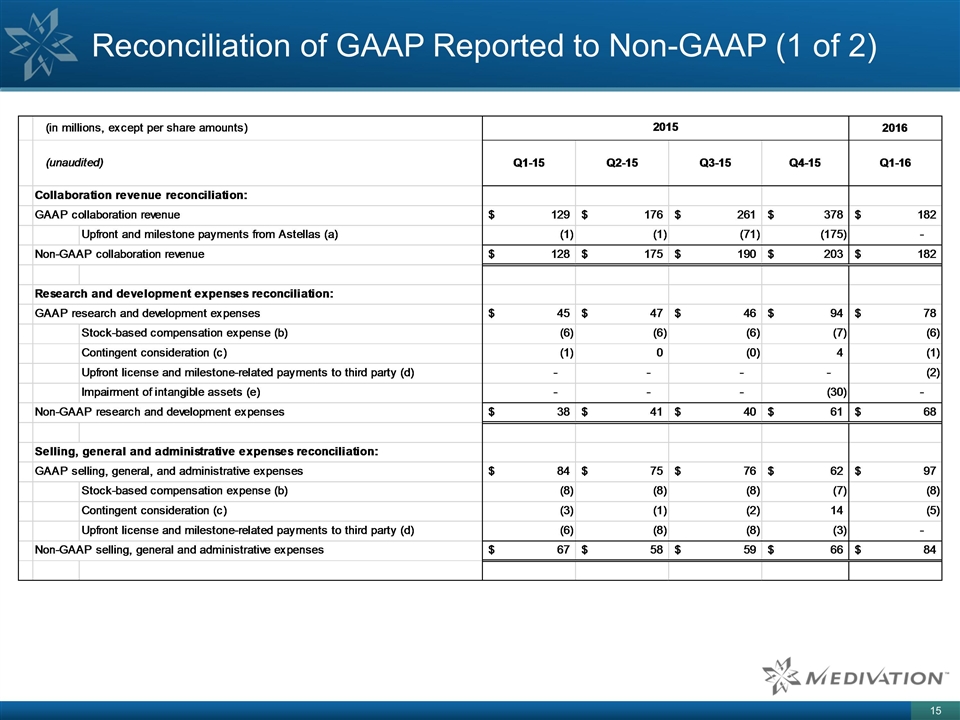

Reconciliation of GAAP Reported to Non-GAAP (1 of 2)

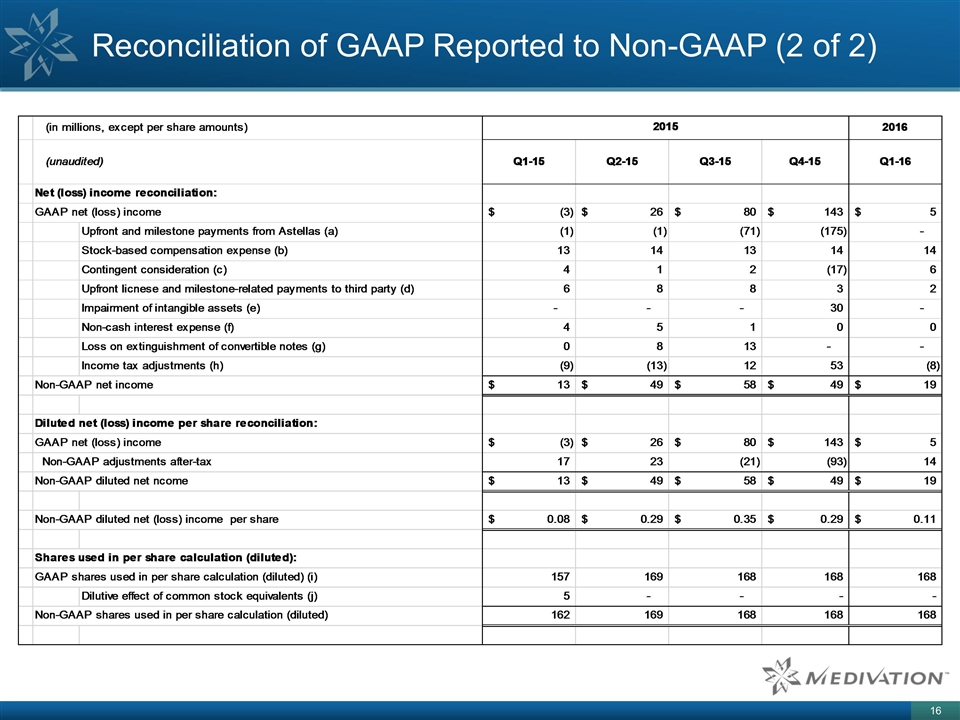

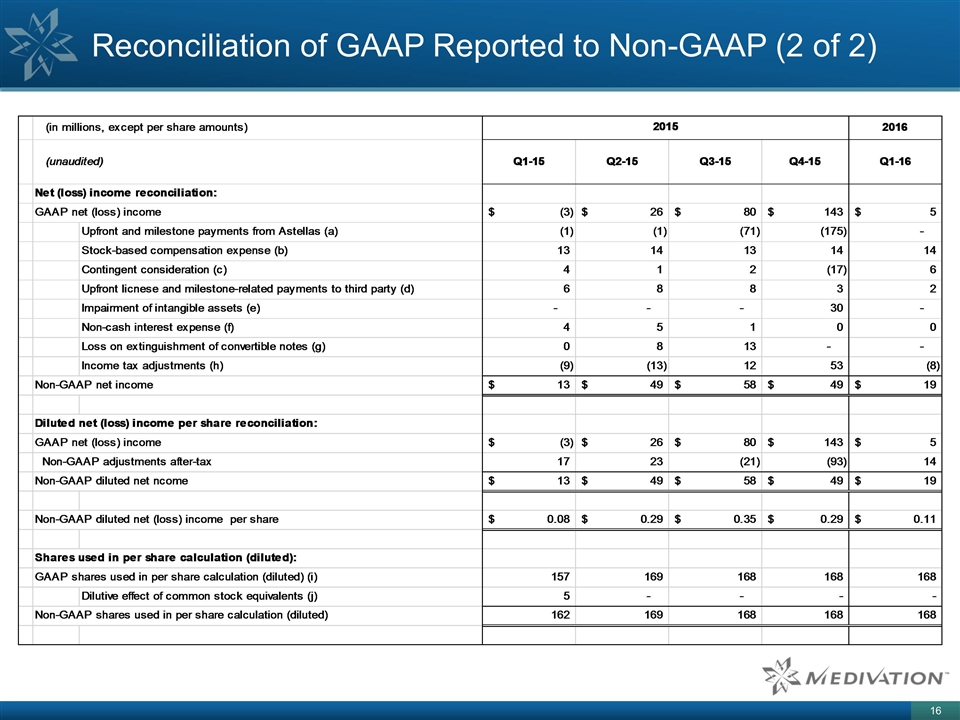

Reconciliation of GAAP Reported to Non-GAAP (2 of 2)

Explanation of Adjustments to Reconciliation Tables a) Upfront and milestone payments from Astellas: Upfront and milestone payments are excluded from non-GAAP financial measures because they occur at irregular intervals and are not related to Medivation’s long term core business going forward; such exclusion allows for better representation of the ongoing economics of the business, facilitates period over period comparison and is reflective of how Medivation manages its business. b) Stock-based compensation expense: Stock-based compensation expense is excluded from non-GAAP financial measures because of the nature of this charge, varying available valuation methodologies, subjective assumptions and the variety of award types; such exclusion facilitates comparison of Medivation’s operating results to peer companies. c) Contingent consideration: The effects of contingent consideration valuation are excluded from non-GAAP financial measures; because of the nature of this item, which is related to the change in fair value of the liability for contingent consideration related to the acquisition of worldwide rights to talazoparib from BioMarin Pharmaceutical, Inc., and Medivation's license agreement with CureTech, Inc. for pidiluzimab; such exclusion facilitates comparisons of Medivation's operating results to peer companies. d) Upfront license and milestone-related payments to third party and other adjustments: These payments and adjustments are excluded from non-GAAP financial measures because they occur at irregular intervals and are not related to Medivation’s long term core business going forward; such exclusion facilitates understanding of the ongoing economics of the business, facilitates period over period comparison and is reflective of how Medivation manages its business. e) Impairment of intangible assets: The effects of impairment of intangible assets are excluded from non-GAAP financial measures because of the nature of this item, which is related to impairment of our IPR&D asset related to pidiluzimab; such exclusion facilitates comparisons of Medivation's operating results to peer companies. f) Non-cash interest expense related to the Convertible Notes and Revolving Credit Facility: The effects of non-cash interest expense related to the Convertible Notes and the Revolving Credit Facility are excluded from non-GAAP financial measures because these expenses are non-cash expenses; such exclusion facilitates comparison of Medivation’s cash operating results to peer companies and is reflective of how Medivation manages its business. g) Loss on extinguishment of Convertible Notes: The effects of loss on extinguishment of the Convertible Notes are excluded from non-GAAP financial measures because this expense is a non-cash charge; such exclusion facilitates comparison of Medivation's cash operating results to peer companies and is reflective of how Medivation manages its business. h) Income tax adjustments: Adjustments to income tax expense for non-GAAP financial measures consist of the income tax effect of the non-GAAP adjustments. i) Interest and shares underlying Convertible Notes: In periods in which Medivation reports GAAP or non-GAAP net income, the effect of contingently issuable shares is considered in the calculation of diluted net income per share. Beginning in the second quarter of 2015, the "cash settlement" method is used to determine the dilutive effect of the Convertible Notes. Under this method, interest is not added back to the numerator, and only the contingently issuable shares related to the conversion spread are included in the denominator, if dilutive. The computation of diluted net income per common share for the second and third quarter of 2015 includes the effect of approximately 2.4 million and 0.8 million common shares, respectively, related to the conversion spread for both non-GAAP and GAAP purposes. The Convertible Notes had no effect on the diluted net income per share calculation for the three months ended December 31, 2015 for both GAAP and non-GAAP purposes because Medivation completed the settlement of all of its Convertible Notes during the third quarter of 2015. j) Diluted effect of common stock equivalents: In periods in which Medivation reports a GAAP net loss, all common stock equivalents are deemed anti-dilutive and basic and diluted common shares are equal. Because Medivation had non-GAAP net income for the three months ended March 31, 2015, the dilutive effect of common stock equivalents is included in the diluted net income per share calculation for that period. Because Medivation had a GAAP net loss for the three months ended March 31, 2015, the dilutive effect of common stock equivalents is excluded in the diluted net loss per common share calculation for that period because such shares have an anti-dilutive effect.