FORM 6-K

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16 of

the Securities Exchange Act of 1934

For the Six Months Ended June 30, 2004

ATLAS PACIFIC LIMITED

(Translation of registrant’s name into English)

43 YORK STREET, SUBIACO WESTERN AUSTRALIA 6008

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Form 20-F X Form 40-F

Indicate by check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes No X

If “Yes” is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b): 82- .

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| | | | |

| | | ATLAS PACIFIC LIMITED |

| | |

Date: September 16, 2004 | | By: | | /s/ Simon Charles Bunbury Adams

|

| | | Name: | | Simon Charles Bunbury Adams |

| | | Title: | | Chief Financial Officer |

Exhibit 99.1

ATLAS PACIFIC LIMITED

A.B.N. 32 009 220 053

AND ITS CONTROLLED ENTITIES

HALF YEAR FINANCIAL REPORT

30TH JUNE 2004

INDEX

| | | | | | |

| 1. | | Directors’ Report | | 1 |

| | | |

| | | 1.1. | | Activities and Review of Operations | | 1 |

| | | |

| | | 1.2. | | Significant Changes | | 3 |

| | | |

| | | 1.3. | | Dividends | | 3 |

| | | |

| | | 1.4. | | International Financial Reporting Standards | | 3 |

| | | |

| | | 1.5. | | Matters Subsequent to 30th June 3004 | | 4 |

| | | |

| | | 1.6. | | Directors’ Meetings | | 4 |

| | | |

| | | 1.7. | | Directors’ Benefits | | 5 |

| | | |

| | | 1.8. | | Directors’ Shareholdings | | 5 |

| | |

| 2. | | Statement of Financial Performance | | 6 |

| | |

| 3. | | Statement of Financial Position | | 7 |

| | |

| 4. | | Statement of Cashflow | | 8 |

| | |

| 5. | | Notes to accounts | | 9 |

| | |

| 6. | | Directors’ Declaration | | 13 |

| | |

| 7. | | Auditor’s Report | | 14 |

| | |

| 8. | | Appendix 4D information | | 15 |

DIRECTORS REPORT

ATLAS PACIFIC LIMITED AND ITS CONTROLLED ENTITIES

FOR THE HALF YEAR ENDED 30TH JUNE 2004

The Directors present the financial report of Atlas Pacific Limited (“the Company”) and the consolidated accounts of the economic entity, being the Company and its controlled entities for the half year ended 30th June 2003 and the auditors report thereon.

DIRECTORS’ REPORT

The Directors of the Company during or since the end of the half year are:

| | |

Name

| | Period of Directorship

|

George Robert Warwick Snow, B.Ec., F.A.I.C.D. Chairman | | Director since 28 October 1997 Chairman since 28 July 2004 |

| |

Walter Frederick James, M.I.E. Aust, F.A.I.C.D. Former Chairmar | | Director since 23 March 1999 Chairman since 1 January 2003 Retired 28 July 2004 |

| |

Stephen John Arrow Non-Executive Director | | Director since 29 June 1999 |

| |

Ian Mackenzie Murchison Non-Executive Director | | Director since 28 July 2004 |

| |

Joseph James Uel Taylor, B.Sc. (Biology), Ph.D. Managing Director | | Director since 13 September 2000 |

ACTIVITIES AND REVIEW OF OPERATIONS

The only activity of the economic entity is that of the development and management of a pearl farming business located in Indonesia. There has been no significant change in the activities of the economic entity since the last year end report.

The Company announces an after tax loss of $409,347 which was achieved on sales of $3,214,343 for the six months to 30th June 2004. During the corresponding period last year, i.e. six months ended 30th June 2003, the results were a profit of $906,643 on sales revenue of $5,504,730.

The decrease in corresponding period profit is a result of lower pearl prices and a higher cost of production relating to the pearls that were sold. $2,915,947 of the sales revenue is from the sale of pearls of which $1,899,465 (six months to 30th June 2003 - $4,598,668) is from the sale of “sellable” grade pearls. Both the total weight of “sellable grade pearls” and the price per unit was lower for the current period when compared to the first six months of 2003. The lower average price for the sellable grade pearls sold in 2004 is mainly market driven but is also a reflection of the lower proportion of high value round, high lustre silver pearls compared to prior years. All of these pearls were sold through private sales by Pearlautore International. In previous years, an auction has been held during the first part of the year but this auction was not held by Pearlautore International this year.

1

DIRECTORS REPORT

ATLAS PACIFIC LIMITED AND ITS CONTROLLED ENTITIES

FOR THE HALF YEAR ENDED 30TH JUNE 2004

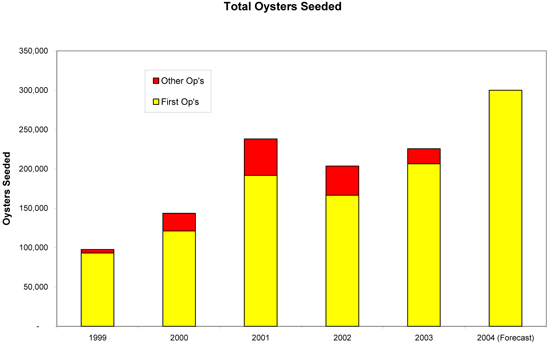

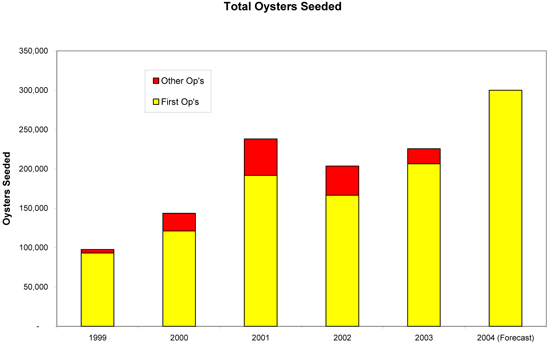

The Company’s Alyui Bay operations in West Papua have performed above expectations for the six months to 30th June 2004. This facility is now functioning as a dedicated pearl production site with the hatchery production and grow-out of juvenile oysters along with ancillary functions such as boat building, equipment manufacture and research having been relocated to the Company’s two other sites at N. Bali (Penyabangan) and N. Maluku (Bacan). Up to 30th June 2004, more than 230,000 of the Company’s virgin (first time operated) oysters had been seeded. The target for the full 2004 year is 300,000 operations and we expect that this will be easily achieved. This will be a record number of oysters that will have been seeded and more importantly, these will all be virgin oysters which have traditionally produced a superior quality pearl than the reoperated oysters. Moreover, quality indicators such as oyster survival and pearl retention rates post-operation have improved dramatically in the last 12 to 18 months. The following chart demonstrates the increase in the number of oysters seeded from 1999 to 2004.

The climatic conditions throughout Indonesia for growing oysters have been very good in 2004. Retention rates for the nuclei that are inserted into the oysters have been high and mortality rates for mature oysters at Alyui Bay have been relatively low. There are in excess of 730,000 mature oysters at Alyui Bay of which nearly 500,000 carrying pearls at various stages of development. The Company employs more than 200 staff at Alyui Bay and it operates seven cleaning vessels which operate two shifts each day. The Company believes that this farm is now reaching full potential in terms of production capacity.

During the six months to 30thJune 2004, the Company’s joint hatchery and grow-out facility at Banyupoh in North Bali produced in excess of 158,000 six month old oysters. 61,000 oysters have been transferred to Alyui during this period and a further 204,000 juvenile oyster which are older than six months remain in at the site ready for transportation to Alyui Bay during the remainder of 2004. Development of the Company’s independent land and water leases at Penyabangan are well under way with the administration and accommodation buildings completed and the hatchery building due for commissioning in October 2004. The facilities at Penyabangan have been developed to compliment and later replace the joint venture arrangement that is in place in relation to the Banyupoh hatchery which expires in August 2005.

Performance at the joint venture hatchery and grow out facilities give the Company every confidence in maintaining production targets over the next two years. More importantly, control of quality in terms of juvenile oyster production and selective breeding is firmly within the Company’s control. Later this year a significant joint research programme with James Cook University of North Queensland will commence. This programme will specifically target the development of breeding lines which will produce higher quality pearls.

2

DIRECTORS REPORT

ATLAS PACIFIC LIMITED AND ITS CONTROLLED ENTITIES

FOR THE HALF YEAR ENDED 30TH JUNE 2004

| 3. | Community, Environment and Security |

The Company continues to maintain strong relationships with the local communities at each of its farms. This is seen as a key strategy for the long term security of the business and these communities are treated as significant stake holders in the pearling operations. The farms and administration centres run by the company provide significant employment to local villagers with over 430 Indonesians employed overall.

The Company maintains a strong focus on the protection of the environment at each farm site. This is essential for the good management of the oyster populations.

The challenges relating to security in Indonesia have been clearly publicised in the media and these risks remain for many countries in S.E. Asia. The Company continues to review the security risk to its staff and assets and has taken steps to provide additional security where possible. Efforts continue in relation to the promotion of good relations between the Company and local and regional stakeholders and national authorities in Indonesia as a means of minimising the security risk.

SIGNIFICANT CHANGES

There have been no significant changes in the state of affairs of the economic entity during the period.

DIVIDENDS

No dividend has been declared or paid in the six months to 30th June 2004.

INTERNATIONAL FINANCIAL REPORTING STANDARDS (IFRS)

The Australian Accounting Standards Board (AASB) is adopting IFRS for application to the reporting periods commencing from 1st January 2005. The adoption of the new accounting standards will be first reflected in the Group’s financial statements for the half-year ending 30th June 2005 and the year ending 31st December 2005.

The Company’s CFO and accountant are managing the transition to the new reporting standards including the gathering of relevant financial information and implementation of appropriate control systems. The implementation timetable for these new standards will ensure compliance by the Company in time for the correct reporting of this information. A number of accounting policy changes has been identified. Choices of accounting policies, including elective exemptions under AASB 1, First-time Adoption of Australian International Financial Reporting Pronouncements, are available in some cases and these are still being analysed to determine the most appropriate accounting policy for the Group.

Major changes that have been identified to date, which will effect the Group’s existing accounting policies, include the following:

Under AASB112 Income Taxes, deferred tax balances are determined using the balance sheet method which calculates temporary differences in tax based on the carrying amounts of the entity’s assets and liabilities in the statement of financial position and their associated tax bases.

This will result in a change to the current accounting policy for income tax under which deferred tax balances are determined using the income statement method, items are only tax-effected if they are included in the determination of pre-tax accounting profit or loss and/or taxable income or loss and current and deferred taxes cannot be recognised directly in equity.

3

DIRECTORS REPORT

ATLAS PACIFIC LIMITED AND ITS CONTROLLED ENTITIES

FOR THE HALF YEAR ENDED 30TH JUNE 2004

Under AASB 32 Financial Instruments: Disclosure and Presentation the current classification of financial instruments issued by entities in the consolidated entity will not change.

Under AASB 39 Financial Instruments: Recognition and Measurement there may be major impacts as a result of:

| | • | Foreign exchange contracts held for hedging purposes being accounted for as cash flow hedges. Changes in the fair value of those contracts will be recognised directly in equity until the hedged transaction occurs, in which case the amounts recognised in equity will be included in the initial cost of the assets acquired. Currently, the costs or gains arising under contracts together with any realised or unrealised gains from remeasurement are included in assets or liabilities as deferred losses or deferred gains. |

The above should not be regarded as a complete list of changes in accounting policies that will result from the transition to IFRS as not all standards have been fully analysed to date. The impact of the transition to IFRS has not been quantified in this document.

MATTERS SUBSEQUENT TO 30TH JUNE 2004

In July 2004, the Company commenced the first of this year’s harvest. The details of this harvest will be made available when the grading and valuation process is complete.

On 28th July 2004, Mr. Walter James resigned as Chairman and director of the Company. On the same date, Mr. Ian Murchison was appointed as a director of the Company. Mr. George Snow has assumed the role as Chairman.

The results of significant operation activities are made available to shareholders and other interested parties through announcements to the Australian and Nasdaq Stock Exchanges.

DIRECTORS MEETINGS

The attendance at meetings of the Company’s Directors including meetings of the Audit Committee is shown below:

| | | | | | | | | | |

Director1

| | Period

| | Number of Directors

Meetings

| | Audit Committee

Meetings

|

| | | Held

| | Attended

| | Held

| | Attended

|

W.F. James | | 01/01/04 -

30/06/04 | | 6 | | 6 | | 1 | | 1 |

G.R.W. Snow | | 01/01/04 -

30/06/04 | | 6 | | 5 | | 1 | | 1 |

S.J. Arrow | | 01/01/04 -

30/06/04 | | 6 | | 4 | | 1 | | 1 |

J.J.U. Taylor | | 01/01/04 -

30/06/03 | | 6 | | 6 | | 1 | | 1 |

As at the date of this report the economic entity has an audit committee which is made up of all members of the Board. The Directors have the right, in connection with their duty and responsibilities as directors, to seek independent professional advice at the Company’s expense.

4

DIRECTORS REPORT

ATLAS PACIFIC LIMITED AND ITS CONTROLLED ENTITIES

FOR THE HALF YEAR ENDED 30TH JUNE 2004

DIRECTORS BENEFITS

Pursuant to a lease agreement, Arrow Pearling Company Pty Ltd, a company of which Mr S.J. Arrow is the substantial shareholder and director, provided office accommodation and services for the Australian based operations. An amount of $18,072 was paid to this company for these services during the half year ended 30th June 2004 (six months to 30th June 2003 - $21,184). The Company’s lease with Arrow Pearling Company ceased on 30thJune 2004.

Pursuant to a separate agreement, Arrow Pearling Company Pty Ltd earned fees of $149,934 during the half year which represents a royalty for training pearl technicians and other pearling services (six months to 30 June 2003 - $114,621). This agreement was entered into in March 1999 prior to Mr. Arrow becoming a board member and it was entered into on commercial terms.

Pursuant to an agreement Claire Taylor, the spouse of Joseph Taylor earned consultancy fees of $3,725 during the half year ended 30th June 2004. These fees were payable as consideration for the supply of marketing and sales services to the entity’s Indonesian subsidiary (six months to 30 June 2003 - nil). This agreement was entered into in February 2004 on commercial terms.

Apart from the foregoing, since the previous financial year end, no Director of the Company has received or has become entitled to receive a benefit (other than the emoluments disclosed in the annual financial statements or the fixed salary of a full-time employee of the Company) by reason of a contract made by the Company or a related company with the Director or with a firm of which he is a member, or with a company in which he has a substantial financial interest.

DIRECTORS SHAREHOLDINGS AS AT 17th AUGUST 2004

The relevant interest of each Director in the share capital of the Company, as notified by the Directors to the Australian Stock Exchange in accordance Corporations Act 2001, at the date of this report is as follows:

Current Holdings

| | | | |

| | | Ordinary Shares

|

| | | Direct

| | Indirect

|

W.F. James | | — | | — |

G.R.W. Snow | | — | | 14,025,744 |

S.J. Arrow | | — | | 1,952,934 |

I.M. Murchison1 | | — | | 650,000 |

J.J.U. Taylor | | 65,000 | | — |

| 1. | Ian Murchison was appointed to the Board on 28th July 2004 |

|

| ON BEHALF OF THE BOARD |

|

| |

| G.R.W. SNOW |

| Chairman |

17th August 2004 |

5

STATEMENT OF FINANCIAL PERFORMANCE

ATLAS PACIFIC LIMITED

AND ITS CONTROLLED ENTITIES

FOR THE HALF YEAR ENDED 30TH JUNE 2004

| | | | | | | | |

| | | | | Consolidated

| |

| | | Note

| | 2004

| | | 2003

| |

| | | | | (6 months) | | | (6 months) | |

| | | | | $ | | | $ | |

Revenue from sale of goods | | 2 | | 3,214,344 | | | 5,504,730 | |

Other revenues from ordinary activities | | 2 | | 537,276 | | | 451,301 | |

| | | | |

|

| |

|

|

Total revenue | | 2 | | 3,751,620 | | | 5,956,031 | |

| | | | |

|

| |

|

|

Expenses from ordinary activities | | | | | | | | |

Cost of goods sold | | | | 2,971,628 | | | 3,256,443 | |

Marketing expenses | | | | 314,398 | | | 344,409 | |

Administration expenses | | | | 697,567 | | | 832,315 | |

Depreciation/amortisation expenses | | | | 12,897 | | | 138,058 | |

Other expenses from ordinary activities | | | | 164,477 | | | 18,920 | |

| | | | |

|

| |

|

|

Total expenses | | | | 4,160,967 | | | 4,590,145 | |

| | | | |

|

| |

|

|

Profit/(loss) from ordinary activities before related income tax expense | | | | (409,347 | ) | | 1,365,886 | |

Income tax expense relating to ordinary activities | | | | — | | | 459,243 | |

| | | | |

|

| |

|

|

Profit/(loss) from ordinary activities after related income tax attributable to members of the parent entity | | | | (409,347 | ) | | 906,643 | |

| | | | |

|

| |

|

|

Basic earnings per share | | 3 | | (0.47 | ) cents | | 1.03 | cents |

Diluted earnings per share | | 3 | | (0.47 | ) cents | | 1.03 | cents |

6

STATEMENT OF FINANCIAL POSITION

ATLAS PACIFIC LIMITED

AND ITS CONTROLLED ENTITIES

AS AT 30TH JUNE 2004

| | | | | | | | | |

| | | | | | Consolidated

|

| | | Note

| | | 30/06/04

| | 31/12/03

| | 30/06/03

|

| | | | | | $ | | $ | | $ |

CURRENT ASSETS | | | | | | | | | |

Cash | | | | | 3,358,841 | | 4,301,918 | | 3,793,191 |

Receivables | | | | | 2,468,700 | | 1,253,030 | | 1,998,423 |

Inventories | | | | | 533,762 | | 3,333,948 | | 2,536,204 |

Self generating and regenerating assets | | (a | ) | | 2,290,991 | | 2,165,998 | | 342,702 |

| | | | | |

| |

| |

|

Total Current Assets | | | | | 8,652,294 | | 11,054,894 | | 8,670,520 |

| | | | | |

| |

| |

|

NON-CURRENT ASSETS | | | | | | | | | |

Inventories | | | | | 152,628 | | 121,836 | | 93,952 |

Self generating and regenerating assets | | (a | ) | | 10,240,020 | | 8,406,627 | | 10,833,678 |

Property, plant and equipment | | | | | 2,587,554 | | 2,458,214 | | 2,311,285 |

Intangibles | | | | | — | | — | | 122,847 |

Deferred Tax Asset | | | | | 150,563 | | 150,563 | | 25,792 |

| | | | | |

| |

| |

|

Total Non-Current Assets | | | | | 13,130,765 | | 11,137,240 | | 13,387,554 |

| | | | | |

| |

| |

|

Total Assets | | | | | 21,783,059 | | 22,192,134 | | 22,058,074 |

| | | | | |

| |

| |

|

CURRENT LIABILITIES | | | | | | | | | |

Accounts payable | | | | | 801,138 | | 766,680 | | 975,829 |

Current tax liabilities | | | | | — | | — | | — |

Provisions | | | | | 89,060 | | 122,946 | | 118,533 |

| | | | | |

| |

| |

|

Total Current Liabilities | | | | | 890,198 | | 889,926 | | 1,094,362 |

| | | | | |

| |

| |

|

NON-CURRENT LIABILITIES | | | | | | | | | |

Deferred tax liability | | | | | 406 | | 406 | | — |

| | | | | |

| |

| |

|

Total Non-Current Liabilities | | | | | 406 | | 406 | | — |

| | | | | |

| |

| |

|

Total Liabilities | | | | | 890,604 | | 890,332 | | 1,094,362 |

| | | | | |

| |

| |

|

Net Assets | | | | | 20,892,455 | | 21,301,802 | | 20,963,712 |

| | | | | |

| |

| |

|

SHAREHOLDERS EQUITY | | | | | | | | | |

Contributed equity | | 5 | | | 18,849,092 | | 18,849,092 | | 18,849,092 |

Retained profit | | 6 | | | 2,043,363 | | 2,452,710 | | 2,114,620 |

| | | | | |

| |

| |

|

Total Shareholders Equity | | | | | 20,892,455 | | 21,301,802 | | 20,963,712 |

| | | | | |

| |

| |

|

| (a) | Self generating and regenerating assets (SGARAs) are defined as non-human living assets of an entity. Under accounting standard AASB1037, the Company is required to list these assets as a separate category of assets to other non living inventory. The assets that are recorded as SGARAs are the oysters that produce the pearls sold by the Company. |

The Statement of Financial Position is to be read in conjunction with the notes to and forming part of the half year financial report.

7

STATEMENT OF CASH FLOWS

ATLAS PACIFIC LIMITED AND ITS CONTROLLED ENTITIES

FOR THE HALF YEAR ENDED 30THJUNE 2004

| | | | | | | | |

| | | | | Consolidated

| |

| | | Notes

| | 2004

| | | 2003

| |

| | | | | (6 months) $ | | | (6 months) $ | |

| | | | | |

Cash flows from operating activities | | | | | | | | |

Cash payments in the course of operations | | | | (2,980,515 | ) | | (3,740,080 | ) |

Taxes Paid | | | | (476,497 | ) | | (2,986,199 | ) |

Receipts from sale of pearls, oysters and other operating activities | | | | 3,012,113 | | | 5,641,910 | |

Interest and other items of a similar nature received | | | | 96,264 | | | 110,691 | |

| | | | |

|

| |

|

|

Net cash used in operating activities | | | | (348,635 | ) | | (973,668 | ) |

| | | | |

|

| |

|

|

Cash flows from investing activities | | | | | | | | |

Payments for property, plant and equipment | | | | (395,949 | ) | | (474,836 | ) |

| | | | |

|

| |

|

|

Net cash used in investing activities | | | | (395,949 | ) | | (474,836 | ) |

| | | | |

|

| |

|

|

Cash flows from financing activities | | | | | | | | |

Payment of dividends | | | | — | | | (878,103 | ) |

| | | | |

|

| |

|

|

Net cash provided by (used in) financing activities | | | | — | | | (878,103 | ) |

| | | | |

|

| |

|

|

Net increase/(decrease) in cash held | | | | (744,584 | ) | | (2,326,617 | ) |

Cash at the beginning of the half-year | | | | 4,301,918 | | | 6,119,808 | |

Effects of exchange differences on the balance of cash held in foreign currencies | | | | (198,493 | ) | | — | |

| | | | |

|

| |

|

|

Cash at the end of the half-year | | 8 | | 3,358,841 | | | 3,793,191 | |

| | | | |

|

| |

|

|

Non cash transactions | | | | | | | | |

Nil | | | | | | | | |

The statement of cash flows is to be read in conjunction with the notes to and forming part of the half year financial report.

8

NOTES TO AND FORMING PART OF THE FINANCIAL STATEMENTS

ATLAS PACIFIC LIMITED AND ITS CONTROLLED ENTITIES

FOR THE HALF YEAR ENDED 30TH JUNE 2004

| 1. | BASIS OF PREPARATION OF HALF YEAR FINANCIAL STATEMENTS |

This general purpose half year consolidated financial report has been prepared in accordance with the requirements of the Corporations Act 2001 and Accounting Standard 1029 “Interim Financial Reporting” and other mandatory professional reporting requirements. It is recommended that this half year financial report be read in conjunction with the 31st December 2002 Financial Statements and Report and any public announcements by Atlas Pacific Limited and its Controlled Entities during the half year in accordance with continuous disclosure obligations arising under the Corporations Act 2001.

These accounts have been prepared on the basis of historical cost and except where stated, do not take into account changing money values or current valuations of non-current assets.

The accounting policies have been consistently applied by the entities in the economic entity and except where there is a change in accounting policy, are consistent with those of the previous financial year and corresponding half year.

For the purpose of preparing the half year financial report, the half year has been treated as a discrete reporting period.

A reference to Dollars or $ means Australian Dollars.

| | | | |

| | | Consolidated

|

| | | 2004

| | 2003

|

| | | (6 months) $ | | (6 months) $ |

| | | |

2. REVENUE | | | | |

The profit/(from normal operating activities) before income tax has been determined after crediting as revenue: | | | | |

Sales | | 3,214,344 | | 5,504,730 |

Interest received - other parties | | 82,846 | | 110,691 |

Foreign exchange fluctuation | | 430,821 | | 304,045 |

Other | | 23,609 | | 36,565 |

| | |

| |

|

| | | 3,751,620 | | 5,956,031 |

| | |

| |

|

9

NOTES TO AND FORMING PART OF THE FINANCIAL STATEMENTS

ATLAS PACIFIC LIMITED AND ITS CONTROLLED ENTITIES

FOR THE HALF YEAR ENDED 30TH JUNE 2004

| | | | | | |

| | | Consolidated

| |

| | | 2004

| | | 2003

| |

| | | (6 months) | | | (6 months) | |

3. EARNINGS PER SHARE | | | | | | |

Basic earnings/(loss) per share | | (0.47 | ) cents | | 1.03 | cents |

| | |

|

| |

|

|

Diluted earnings per share | | (0.47 | ) cents | | 1.03 | cents |

| | |

|

| |

|

|

Weighted average number of ordinary shares used for basic earnings per share | | 87,810,254 | | | 87,810,254 | |

| | |

|

| |

|

|

Diluted earnings per share for 2002 is calculated after taking into consideration all options on issue that remained unconverted at 30th June 2002 as potential ordinary shares.

| | | | | | |

| | | Consolidated

| |

| | | 2004

| | | 2003

| |

| | | (6 months) $ | | | (6 months) $ | |

| | | |

4. DIVIDENDS | | | | | | |

Dividend Payments - | | | | | | |

A dividend of two (2) cents per share franked to one (1) cent per share was declared and paid in the six months ending 30th June 2003: | | — | | | 878,103 | |

| | |

|

| |

|

|

| | |

5. SHARE CAPITAL | | | | | | |

Issued: | | | | | | |

(87,810,254 ordinary shares fully paid) | | 18,849,092 | | | 18,849,092 | |

| | |

|

| |

|

|

No shares, or other securities have been issued by the company during 2004. | | | | | | |

| | |

6. RETAINED PROFIT | | | | | | |

Retained profit at the beginning of the half year | | 2,452,710 | | | 2,086,080 | |

Net Profit attributable to Members | | (409,347 | ) | | 906,643 | |

Dividend | | — | | | (878,103 | ) |

| | |

|

| |

|

|

Retained profit at the end of the half year | | 2,043,363 | | | 2,114,620 | |

| | |

|

| |

|

|

10

NOTES TO AND FORMING PART OF THE FINANCIAL STATEMENTS

ATLAS PACIFIC LIMITED AND ITS CONTROLLED ENTITIES

FOR THE HALF YEAR ENDED 30TH JUNE 2004

The undertaking of the Company is predominantly in the pearling industry.

| | | | | | | | | | | | |

| | | Indonesia

| | | Australia

| | | Eliminations

| | | Total

| |

30/06/2004 | | | | | | | | | | | | |

Revenue | | | | | | | | | | | | |

External segment revenue | | 300,709 | | | 2,913,634 | | | — | | | 3,214,343 | |

Inter-segment revenue | | — | | | — | | | — | | | — | |

| | |

|

| |

|

| |

|

| |

|

|

Total segment revenue | | 300,709 | | | 2,913,634 | | | — | | | 3,214,343 | |

Other unallocated revenue | | | | | | | | | | | 537,277 | |

| | | | | | | | | | | |

|

|

Total Revenue | | | | | | | | | | | 3,751,620 | |

| | | | | | | | | | | |

|

|

Result | | | | | | | | | | | | |

Segment Results | | (157,991 | ) | | (134,616 | ) | | (221,349 | ) | | (513,956 | ) |

Unallocated corporate expenses | | | | | | | | | | | 104,609 | |

| | | | | | | | | | | |

|

|

Net Profit | | | | | | | | | | | (409,347 | ) |

| | | | | | | | | | | |

|

|

30/06/2003 | | | | | | | | | | | | |

Revenue | | | | | | | | | | | | |

External segment revenue | | 59,066 | | | 5,896,965 | | | — | | | 5,956,031 | |

Inter-segment revenue | | 3,053,799 | | | — | | | (3,053,799 | ) | | — | |

| | |

|

| |

|

| |

|

| |

|

|

Total segment revenue | | 3,112,865 | | | 5,896,965 | | | (3,053,799 | ) | | 5,956,031 | |

Other unallocated revenue | | | | | | | | | | | — | |

| | | | | | | | | | | |

|

|

Total Revenue | | | | | | | | | | | 5,956,031 | |

| | | | | | | | | | | |

|

|

Result | | | | | | | | | | | | |

Segment Results | | 80,070 | | | 1,101,593 | | | — | | | 1,181,663 | |

Unallocated corporate expenses | | | | | | | | | | | (275,020 | ) |

| | | | | | | | | | | |

|

|

Net Profit | | | | | | | | | | | 906,643 | |

| | | | | | | | | | | |

|

|

| 8. | NOTES TO THE STATEMENT OF CASH FLOWS |

Reconciliation of cash

For the purposes of the statement of cash flows, cash includes cash on hand and at bank and short-term deposits at call, net of outstanding bank overdrafts. Cash as at the end of financial period as shown in the statement of cash flows is reconciled to the related items in the balance sheet as follows:

| | | | |

| | | Consolidated

|

| | | 2004

| | 2003

|

Cash at Bank | | 3,358,841 | | 3,293,191 |

Bills of exchange | | — | | 500,000 |

| | |

| |

|

Cash and cash equivalents as per statement of cash flows | | 3,358,841 | | 3,793,191 |

| | |

| |

|

11

NOTES TO AND FORMING PART OF THE FINANCIAL STATEMENTS

ATLAS PACIFIC LIMITED AND ITS CONTROLLED ENTITIES

FOR THE HALF YEAR ENDED 30TH JUNE 2004

The Company has a commitment to pay rent for its office accommodation up to the end of its current lease, which expires in June 2007. The annual rental for this accommodation is $18,000.

| 10. | POST BALANCE DATE EVENTS |

In July 2004, the Company commenced the first of this year’s harvest. The details of this harvest will be made available when the grading and valuation process is complete.

On 28th July 2004, Mr. Walter James resigned as Chairman and director of the Company. On the same date, Mr. Ian Murchison was appointed as a director of the Company. Mr. George Snow has assumed the role as Chairman.

The results of significant operation activities are made available to shareholders and other interested parties through announcements to the Australian and Nasdaq Stock Exchanges.

12

ATLAS PACIFIC LIMITED AND ITS CONTROLLED ENTITIES

DIRECTORS DECLARATION

The Directors declare that the financial statements and notes set out on pages 6 to 12:

| (a) | comply with Accounting Standards AASB1029 “Interim Financial Reporting” and the Corporations Regulations 2001 and other mandatory professional reporting requirements, |

| (b) | give a true and fair view of the consolidated entity’s financial position as at 30th June 2004 and of its performance, as represented by the results of its operations and its cash flows, for the half-year ended on that date; |

In the Directors opinion there are reasonable grounds to believe that Atlas Pacific Limited will be able to pay its debts as and when they become due and payable.

This declaration is made in accordance with a resolution of the Directors.

Perth, Western Australia

17th August 2004

13

ATLAS PACIFIC LIMITED AND ITS CONTROLLED ENTITIES

INDEPENDENT REVIEW REPORT TO THE MEMBERS

To the members of Atlas Pacific Limited

Scope

We have reviewed the financial report being the Statement of Financial Performance, Statement of Financial Position, Statement of Cash Flows and Directors’ Declaration of Atlas Pacific Limited for the half-year ended 30th June 2004. The disclosing entity’s directors are responsible for the financial report. We have performed an independent review of the financial statements in order to state whether, on the basis of the procedures described, anything has come to our attention that would indicate that the financial report is not presented fairly in accordance with Accounting Standard AASB 1029: Interim Financial Reporting, other mandatory professional reporting requirements in Australia and statutory requirements, so as to present a view which is consistent with our understanding of the disclosing entity’s financial position, and performance as represented by the results of its operations and its cash flows, and in order for the disclosing entity to lodge the financial statements with the Australian Securities & Investments Commission.

Our review has been conducted in accordance with Australian Auditing Standards applicable to review engagements. A review is limited primarily to inquiries of the disclosing entity’s personnel and analytical procedures applied to the financial data. These procedures do not provide all the evidence that would be required in an audit, thus the level of assurance provided is less than given in an audit. We have not performed an audit and, accordingly, we do not express an opinion.

Statement

Based on our review, which is not an audit, we have not become aware of any matter that makes us believe that the half-year financial report of Atlas Pacific Limited is not in accordance with:

| | (a) | the Corporations Act 2001, including: |

| | (i) | giving a true and fair view of the disclosing entity’s financial position as at 30th June 2004 and of its performance for the half-year ended on that date; and |

| | (ii) | complying with Accounting Standard AASB 1029: Interim Financial Reporting and the Corporations Regulations; and |

| | (b) | other mandatory professional reporting requirements in Australia. |

BDO

Chartered Accountants

Perth, 18th August 2004

14

RESULTS FOR ANOUNCEMENT TO THE MARKET

AS PER APPENDIX 4D

AUSTRALIAN STOCK EXCHANGE LISTING RULES

ATLAS PACIFIC AND ITS CONTROLLED ENTITTES

FOR THE HALF YEAR ENDED 30TH JUNE 2004

| 1 | The reporting period and the previous corresponding period as detailed in this financial statement are 30thJune 2003 and 30th June 2002 respectively |

| | | | | | | | | | |

| | | 2004

| | | 2003

| | % Change

| | | Up/Down

|

| | | | |

2 Key Financial Data | | | | | | | | | | |

| | | | |

2.1 Revenue | | 3,751,620 | | | 5,956,031 | | 37 | % | | Down |

| | | | |

2.2 Profit/(loss)from ordinary activities after tax attributable to members | | (409,347 | ) | | 906,643 | | 145 | % | | Down |

| | | | |

2.3 Net profit/(loss) attributable to members | | (409,347 | ) | | 906,643 | | 145 | % | | Down |

| | | | |

2.4 Dividends | | | | | | | | | | |

|

The Directors advise that an interim dividend will not be paid by the Company at this time. The payment of dividends by the Company is subject to the availability of sufficient funds taking into consideration future capital requirements for operational and expansion needs. At this time, the Board does not believe that the cash reserves are sufficient to declare an interim dividend. |

| | | | |

3 Net Tangible Assets | | | | | | | | | | |

| | | | |

| | | Consolidated

|

| | | 2004

| | 2003

|

Net tangible assets per ordinary share | | 24 cents | | 24 cents |

| 4 | Control was neither gained nor lost over any related party during the six months to 30thJune 2004 |

15

Exhibit 99.2

| | | | |

| | | | | Level 8, 256 St George’s Terrace Perth WA 6000 |

| | Chartered Accountants | | PO Box 7426 Cloisters Square Perth WA 6850 |

| | & Advisers | | Tel: (61-8) 9360 4200 |

| | | | Fax: (61-8) 9481 2524 |

| | | | Email: bdo@bdowa.com.au |

| | | | www.bdo.com.au |

ATLAS PACIFIC LIMITED AND ITS CONTROLLED ENTITIES

INDEPENDENT REVIEW REPORT TO THE MEMBERS

Scope

We have reviewed the financial report being the Statement of Financial Performance, Statement of Financial Position, Statement of Cash Flows and Directors’ Declaration of Atlas Pacific Limited for the half-year ended 30th June 2004. The disclosing entity’s directors are responsible for the financial report. We have performed an independent review of the financial statements in order to state whether, on the basis of the procedures described, anything has come to our attention that would indicate that the financial report is not presented fairly in accordance with Accounting Standard AASB 1029: Interim Financial Reporting, other mandatory professional reporting requirements in Australia and statutory requirements, so as to present a view which is consistent with our understanding of the disclosing entity’s financial position, and performance as represented by the results of its operations and its cash flows, and in order for the disclosing entity to lodge the financial statements with the Australian Securities & Investments Commission.

Our review has been conducted in accordance with Australian Auditing Standards applicable to review engagements. A review is limited primarily to inquiries of the disclosing entity’s personnel and analytical procedures applied to the financial data. These procedures do not provide all the evidence that would be required in an audit, thus the level of assurance provided is less than given in an audit. We have not performed an audit and, accordingly, we do not express an opinion.

Statement

Based on our review, which is not an audit, we have not become aware of any matter that makes us believe that the half-year financial report of Atlas Pacific Limited is not in accordance with:

| | (a) | the Corporations Act 2001, including: |

| | (i) | giving a true and fair view of the disclosing entity’s financial position as at 30th June 2004 and of its performance for the half-year ended on that date; and |

| | (ii) | complying with Accounting Standard AASB 1029: Interim Financial Reporting and the Corporations Regulations; and |

| | (b) | other mandatory professional reporting requirements in Australia. |

BDO

Chartered Accountants

|

|

|

| G F Brayshaw |

| Partner |

Perth, 18 August 2004

| | |

| | Audit Report 18Aug04 |

| | |

BDO is a national association of

separate partnerships and entities. | |  |

15