Exhibit 99.1

Please see transcript at the end of the presentation. Page 1

Please see transcript at the end of the presentation. Page 2

Please see transcript at the end of the presentation. Page 3

Please see transcript at the end of the presentation. Page 4

Please see transcript at the end of the presentation. Page 5

Please see transcript at the end of the presentation. Page 6

Please see transcript at the end of the presentation. Page 7

Please see transcript at the end of the presentation. Page 8

Please see transcript at the end of the presentation. Page 9

Please see transcript at the end of the presentation. Page 10

Please see transcript at the end of the presentation. Page 11

Please see transcript at the end of the presentation. Page 12

Please see transcript at the end of the presentation. Page 13

Please see transcript at the end of the presentation. Page 14

Please see transcript at the end of the presentation. Page 15

Please see transcript at the end of the presentation. Page 16

Please see transcript at the end of the presentation. Page 17

Please see transcript at the end of the presentation. Page 18

Please see transcript at the end of the presentation. Page 19

Please see transcript at the end of the presentation. Page 20

Please see transcript at the end of the presentation. Page 21

Please see transcript at the end of the presentation. Page 22

Please see transcript at the end of the presentation. Page 23

Please see transcript at the end of the presentation. Page 24

Please see transcript at the end of the presentation. Page 25

Transcript of President/CEO Presentation at Annual Shareholder Meeting - May 16, 2012

SLIDE #1

Good morning everybody and welcome. I always feel like for those of you who are long-time shareholders, Scotty McIntyre always prided himself in getting this meeting done quickly. I feel that my part is what makes it not happen anymore. Sorry Scotty.

SLIDE #2

Well, it’s safe to say we are all pretty happy that 2011 is over. We’re reminded that we’re very happy to have the talented people that we have. It really helped us get through last year. 2011, as probably some of you heard, is the worst for losses in the property and casualty industry in history. It didn’t come from really one spot or one area—earthquakes, the tsunami in Japan (both of these things we covered at last year’s meeting), blizzards, hail, tornadoes—some of these pictures are absolutely devastating. But as I said, we were pleased at the way that we were able to get through the last year.

SLIDE #3

We were amazed at the resiliency of our policyholders…

SLIDE #4

… completely proud of this photo—I think has at least one of our agents, underwriting, our claims people, and our policyholder. So, very, very pleased, with all of the devastation we went through last year, how we were able to get through it. We really provided terrific service through all of it.

SLIDE #5

Obviously, we were pretty adversely affected by the storms, as you can see here: a comparison between 2010, which was actually a very good year for us, and 2011. On the loss side you can see much, much higher direct losses.

A couple of minor positives would be ALAE, an insurance term, but it really represents the fees that we pay to outside legal firms to defend some of our cases. That was getting a little bit high in the last few years. A lot of our employees heard me harping about that, but on the positive side, actually went down a little bit, which is a plus.

ULAE is actually the cost of running our claims department. That went up a hair, but that’s mostly due to the acquisition costs. We’ll talk a little bit more about that in a minute. Our underwriting expenses: We always want to kind of keep right around 30 percent. That was a little bit up last year and mostly again due to the acquisition costs that we are hoping will come down over time.

So, a combined ratio at the bottom—the best way to look at that, property and casualty company for 2010, for every dollar we take in, we paid out 99.9 cents, which seemed like a lot but it’s not really as bad as paying out a dollar eight point six. Can’t really make that up with volume.

SLIDE #6

But a little more on the bright side—we actually had a very good fourth quarter last year. And we’re starting to see some little positives. You’ve probably seen some of those encouraging things in our stock price since we released the first quarter earnings. Our pure loss ratio—we

pulled all of our catastrophic losses—as you can see 43, 34 percent for the last two quarters were very good.

Our loss expense ratio—we just kind of lumped all of those together—but again, very much in line. And in the catastrophe effect—both of those numbers are actually a little bit high. We usually budget a little over five percent per quarter for CAT losses. Both of those were a little bit higher which tells us that it’s not just necessarily that the wind didn’t blow (why we had a good couple of quarters), so that’s very encouraging.

Net loss ratio expenses lowered—pretty good. Our operating expenses again were up a little bit. Most of it again was solely due to some acquisition expenses. The big positive we’re seeing—and probably all of us in here are insurance buyers, and this isn’t so good for that—but we’re starting to see some rate increases, which this industry badly needs. And the good part: with rate increases, we’re still retaining old policies—we always mention our retention, and our retention has been terrific.

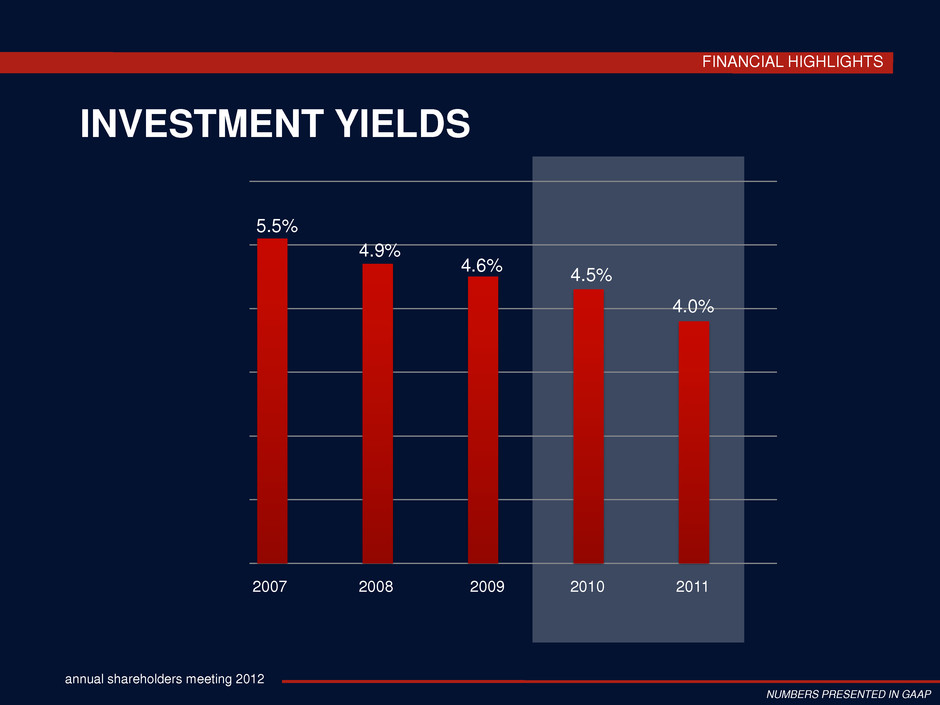

SLIDE #7

Kind of not such a good story—and this isn’t any knock on our investment department—but as you can see from 2007, kind of a steady decline in what we can expect to see from our investment portfolio. When I first started this business (going back to that combined ratio), you could easily have a combined 105, or 110, and still make money, because you could make money on the investment side, but that’s getting to be more and more difficult and if I had to bet we thought we’d drop below four percent—and that trend is kind of continuing. You’ve heard Ben Bernanke—it sounds like this is going to be the way things are at least for the next couple of years possibly.

SLIDE #8

Book value. We think this is an important measure and we’ve been able to increase that book value over time. If you look between 2010 and ’11, our book value dropped a little bit in 2011, but considering all of the storms we had and a lack of investment income we had, that’s actually pretty good. We were satisfied.

We also got a lot of acquisition expenses buried in there, so even though we dropped a little bit 2011, we find that pretty encouraging and if we look at the first quarter of 2012, our book values start to continue to climb. We always feel that our stock should trade, depending on the cycle, in excess of book value, so traditionally through the cycle we probably traded around 1.2 times our book value. Last I looked, we were trading about 75 percent book value. Even though that’s improved a lot in the last couple of days, we still think that our stock prices are a very good deal.

SLIDE #9

A little bit more on some of the positives we’re seeing. I mentioned rate increases. We really started seeing rate increases a little bit in the third quarter last year but much more pronounced in the fourth quarter and first quarter this year. Pretty much across the board, all across the country so it looks like the P & C market is starting to change around a little bit which is a plus. We also see lower loss ratios in the first quarter—almost every line from auto, property, liability, workers compensation—so that also is a plus.

One thing I always look at is especially frequency. How many losses are we having for every $10,000 worth of premium per 1,000 policies? Frequency and severity are trending down, which

is a plus.

I mentioned earlier how we reduce legal expenses. I’m sure we have a few attorneys in here who are tearing up a little bit over that, but for us that’s a good thing. We still got a lot of these legal services, but maybe not quite as much we had in the past. Another thing about the market changing a little bit, it allows us to try to improve our underwriting guidelines a little bit. When things are really cutthroat, it’s difficult to do the right thing. As we say with our underwriting, this has given us the ability to improve that a little bit.

And lastly, premium growth which is has been a real plus. If you look at this in 2010 to 2011 our premium increase was up about 33 percent. Now, 25 percent of that was from our Mercer Acquisition, which we expected when we obtained and installed that business. That’s terrific.

SLIDE #10

On another positive side, we actually had about 7½ percent; a little over 7½ percent for what we call organic growth, which is just from our existing agencies’ portion of our existing policies. Part of that is rate increases. Part of that is audit premium. A lot of our policies are written on an estimated basis and when people’s sales and payroll increase, then we have an additional audit. And our audit department has kind of been a “return premium” department for about the last two years with the economic issues that we’ve had the last couple of years, so… audit premiums up, so that’s a big plus, so a lot of things that have kind of moved in the right direction and we really haven’t had any organic growth for probably at least four or five years.

SLIDE #11

A little on Capital Management. We bought back about 700,000 shares of stock last year and the average price we paid was $17.69, which is $9.60 below our book value, which I think is a tremendous value. We also put in place a $100 million credit facility and, let’s see Diane Lyons, oh there she is, raise your hand. Diane worked long, hard, hours to put this together.

It was syndicated, which means there were other participants, along with KeyBank, but I’d also like to remind everybody that both Cedar Rapids Bank & Trust here in Cedar Rapids and Bankers Trust, both took a very meaningful percentage of that. So we’re very happy to be able to do business with not only KeyBank, that we’ve been doing business with for years, but also with some local places, as well. So that’s a big plus.

SLIDE #12

What this does really is it kind of helps us reduce the amount of cash that we have to have on hand. In the past we’ve always had a line of credit. We used that line of credit for the Mercer Acquisition so, then that went away and we had a cash stockpile for emergencies and for daily operations and things like that. So now we don’t have to put cash under our mattress anymore. The downside is what your mattress pays you and what your banker pays you is about the same thing, but it’s a whole lot better to have that money invested and not have to have a lot of cash sitting around. So we hope that’s going to help our investment return a little bit going forward.

SLIDE #13

Still on capital management, we had paid off some debts that Mercer Insurance had and some of that was paid off in the first quarter and then a little bit more right at the beginning of the second quarter, so all of those—and they were trust preferred debt obligations—and those had

been paid off, which is kind of a plus. Our debt to equity ratio is 7.3 percent, which is very low for this industry, but traditionally we’ve been at zero. So we hope to get that back to zero before too awful long. So now we have about $45 million (of that $100 million outstanding debt). Like I said, we’ve got to work on that going forward. We still continue—even though with a tough year last year—we remain at the same dividend level that we had before. Last year’s average dividend yield was 3.49 percent, which I think is not too bad. You kind of complain, as you will, about the share price, but those dividends are still very, very valuable, and a big plus.

SLIDE #14

We also, as we mentioned before, completed our acquisition of Mercer Insurance Group last March. The gray states in this slide are the states that we operate in and just kind of as a reminder, Mercer had kind of an interesting nationwide footprint, but it worked out perfectly for us. So we’ve added New Jersey and Pennsylvania in the east; Oregon, California, Nevada, Arizona, in the west. Mike Wilkins, raise your hand, Mike, our executive vice president has been very in charge of this integration and he’s done a tremendous job and really, everything is proceeding exactly the way we hoped.

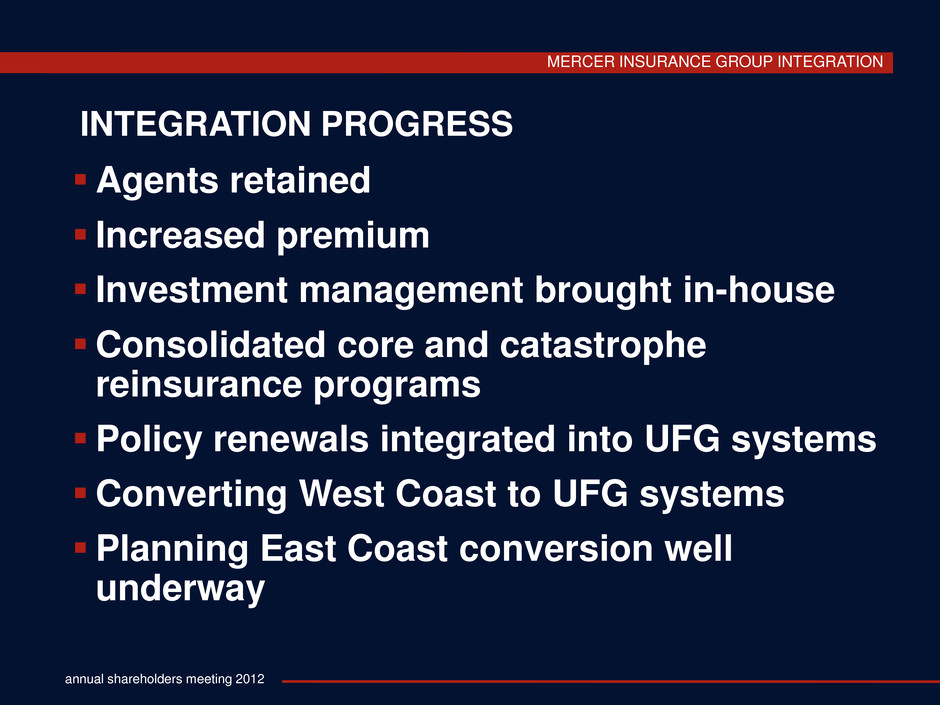

SLIDE #15

A couple of comments on the integration progress. Agents are retained. We didn’t expect to lose a lot of the agents, but that can sometimes happen when you’re a new company coming in. Some agents are not sure they want to transition into the new company, but I don’t think we’ve lost any agents at all. And those agents have actually grown in premium a little bit, and Mercer hadn't seen a lot of growth in the last few years, either, so that's certainly a plus. Mercer had outsourced their investment management—and we brought that all in-house, but we didn't pay our guys any more and so we saved about $400,000. Genius.

In reinsurance, we consolidated both of our core and catastrophe reinsurance programs. Mike Wilkins again was very involved in that, and we saved about a million and a half in premium there, but, excuse me, the premium we have to pay out there, and we actually improved our coverage a little bit so that was really a plus. So, next is to integrate the renewal policies into our system. We're starting by converting the West Coast. And I’m going to say it now Mike. They will start in June, the first part of June, rolling those policies onto our system. I looked at Mike to make sure I can say that in public—but I think that's going terrific. I wasn't sure how to characterize planning for the East Coast conversion—"well underway," "are underway?"—We're doing very well there, too, I think. A lot of good folks came along with the Mercer acquisition and we couldn't be more pleased.

SLIDE #16

2012 marks the 50th anniversary of United Life Insurance, which is quite a milestone. Even though most life insurance companies are hundreds of years old, 50 is still a pretty good number after starting from scratch.

SLIDE #17

Our life company helps us stabilize income -- people dying seems to be more predictable than storms. So through the market cycle, the life company provides us with a steady, regular income in the otherwise volatile property/casualty business. We’re known for very straightforward products. Our agents love the fact that they never have to worry about selling a product from United Life. Excellent customer service—there's probably no other area that when I travel around, that agents don't laud what great customer service our life company gives, which is

terrific. "Simple Solutions for Complex Times" is our tagline. And we have an extremely healthy surplus position. We had our A.M. Best meeting, and they haven't affirmed that yet, but a very strong surplus position, which we're very proud of.

SLIDE #18

There's a map of our life states that we operate in. In March of 2011, Mike Sheeley, which I think he's here. Raise your hand over there, Mike. These pillars don’t make it very easy to see people, do they? But Mike has been, came from our personal lines area to our life company and has done a terrific job so far and not only has he leveraged the new Mercer states, but he also added several other states in the east to complement one of our new and larger nationwide agencies. So we added California, Delaware, Maryland, New Jersey, North Carolina, Pennsylvania, Virginia and West Virginia.

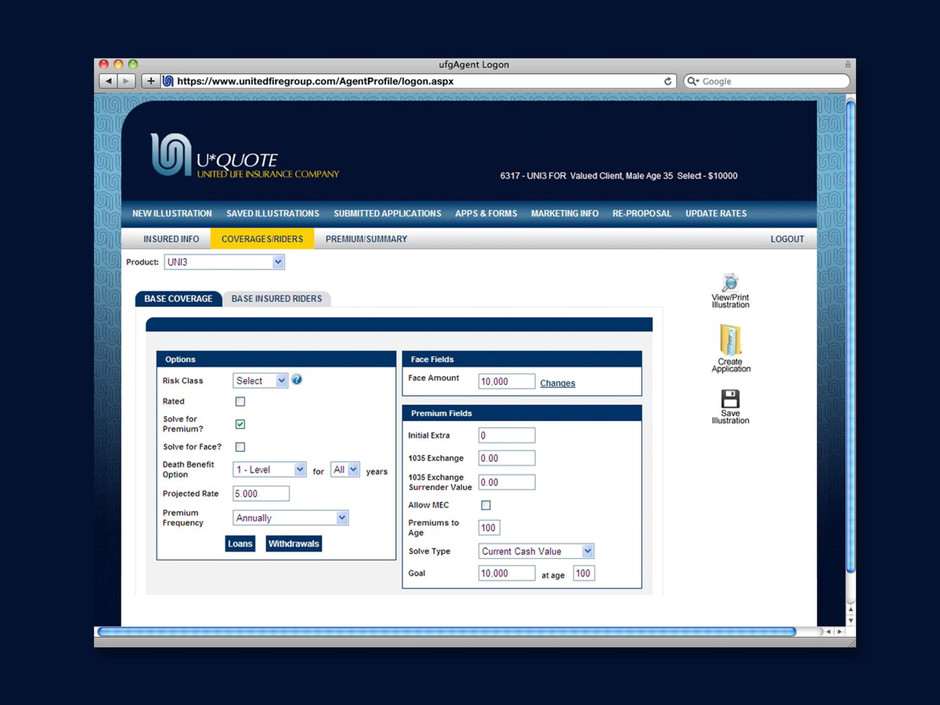

SLIDE #19

A lot of what we focused on last year is automation in our life company, trying to streamline the process, especially becoming more and more easy to do business with for new quotations and applications, and trying to enhance some of our efficiencies.

SLIDE #20

We mentioned in the meeting notes from the January shareholders meeting--and we did a lot of paperwork—and that's what helped us do—watch this—wait for it—"Inc." It doesn’t seem like much, but this is, as we said before, when you the shareholders approved this, we have a much more modern structure. I sometimes say hopefully we'll never necessarily need this structure, especially when it comes to raising capital, but this was the right thing to do and we’re kind of happy to have that process over with and so now we're officially called United Fire Group, Inc.

SLIDE #21

Spring brings May flowers. Unfortunately, it also brings more tornadoes and we've kind of already gotten started off this year with a series of storms in the Midwest, but specifically in Branson, Missouri, and we had about almost $12 million dollars’ worth of losses and had to reinsurance from that. The good news is that even with that in the first quarter, we still have a very good first quarter.

SLIDE #22

As you know, we highlighted that. I think you all got an annual report in your chair. We kind of highlighted those folks in Joplin, Missouri, and kind of representing all of the people that were affected by punishing storms throughout 2011 all over, all over the world, really.

SLIDE #23

This is actually one of our insureds here, after I think, when we went down there and told him that we were going to pay for his loss, probably. But really, every time that we have a loss, you know, unfortunately, it's what we're in business for, but we don't like losses but when we have the large catastrophes like this, especially multiple where we have to send storm teams to multiple parts of the country, I can't help but be very proud of all of the people and how they responded with strength and determination, certainly, but probably most importantly compassion, which, we're a big ol' mean insurance company, but I got a lot of nice reports on people who not only gave me my check but they did it in a very heartfelt manner, so I appreciate that.

SLIDE #24

So this is the legal disclaimer that I have to give every year. I decided this year to summarize it for you in case you don't want to read it. It basically says that I probably said something in my presentation that was forward-looking about the future and I was more than likely wrong. You shouldn't rely on what I say about the future, but if you did, they passed a law in 1995 that prevents me from going to jail as long as it was an honest mistake. Thank you very much and there will be time for questions when we're all done.