2014 ANNUAL MEETING RANDY A. RAMLO CHIEF EXECUTIVE OFFICER MAY 21, 2014 1

2013 HIGHLIGHTS GAAP combined ratio improved to 94.8% from 101.2% P&C statutory capital increased from $586 million to $666 million Book value grew from $28.90 per share to $30.87 per share GAAP expense ratio deteriorated slightly from 31.5% to 31.8% Pure loss ratio improved in both commercial lines and personal lines Policy retention remained high at 82% 2

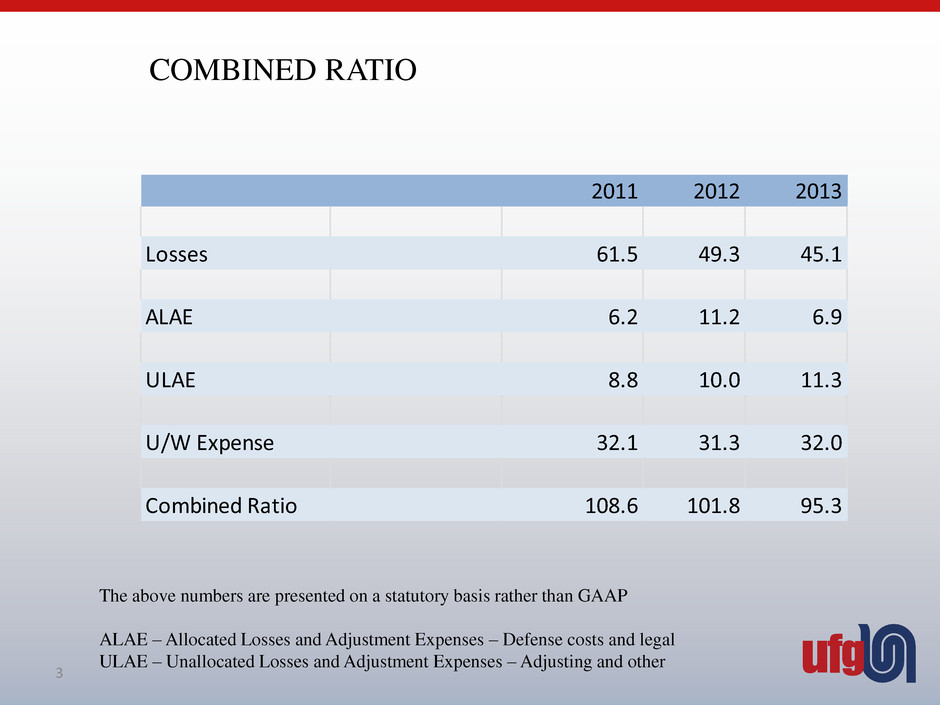

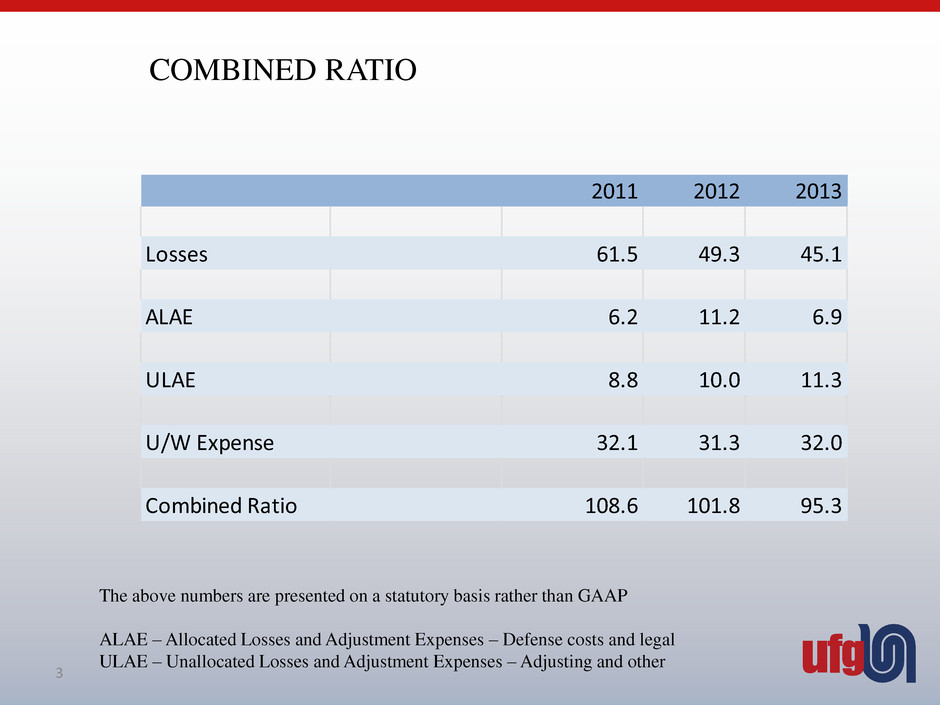

COMBINED RATIO The above numbers are presented on a statutory basis rather than GAAP ALAE – Allocated Losses and Adjustment Expenses – Defense costs and legal ULAE – Unallocated Losses and Adjustment Expenses – Adjusting and other 2011 2012 2013 Losses 61.5 49.3 45.1 ALAE 6.2 11.2 6.9 ULAE 8.8 10.0 11.3 U/W Expense 32.1 31.3 32.0 Combined Ratio 108.6 101.8 95.3 3

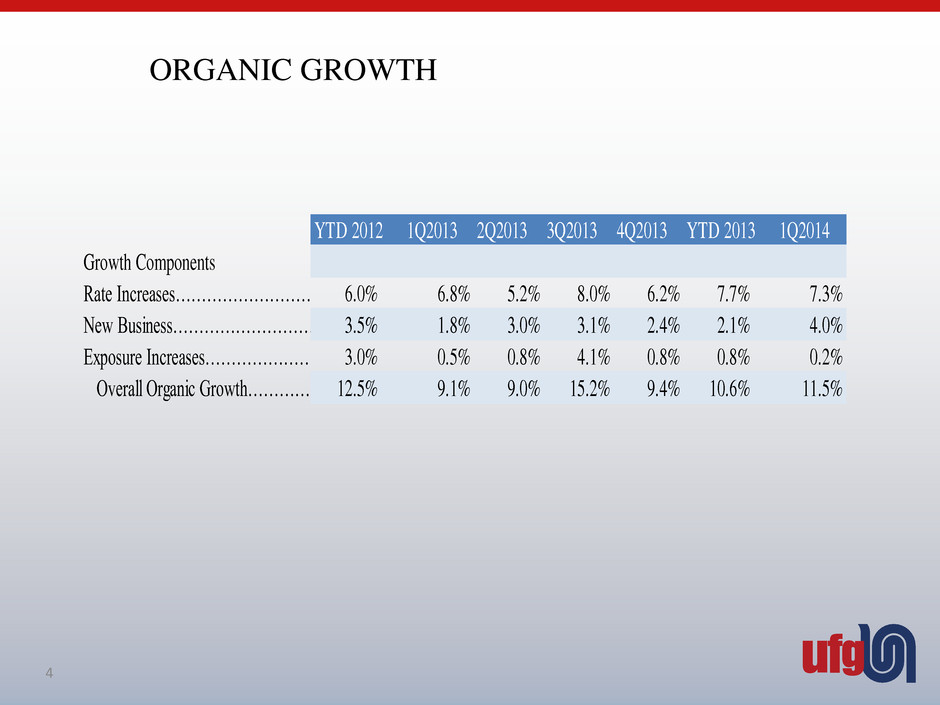

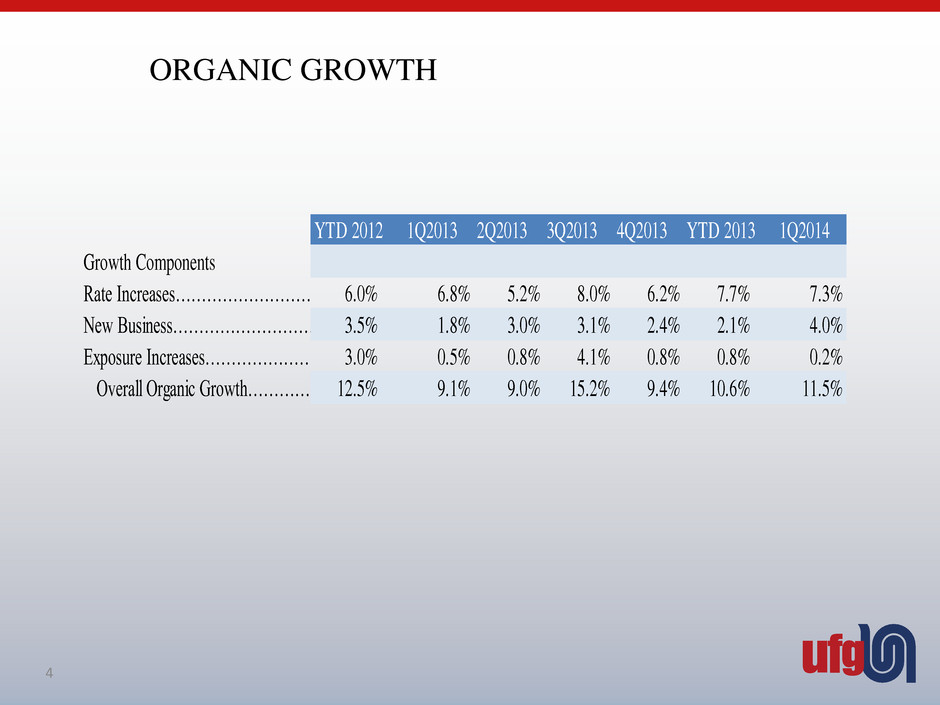

ORGANIC GROWTH YTD 2012 1Q2013 2Q2013 3Q2013 4Q2013 YTD 2013 1Q2014 Growth Components Rate Increases…………………………. 6.0% 6.8% 5.2% 8.0% 6.2% 7.7% 7.3% New Business… .. 3.5% 1.8% 3.0% 3.1% 2.4% 2.1% 4.0% Exposure Increases………………….. 3.0% 0.5% 0.8% 4.1% 0.8% 0.8% 0.2% Overall Organic Growth 12.5% 9.1% 9.0% 15.2% 9.4% 10.6% 11.5% 4

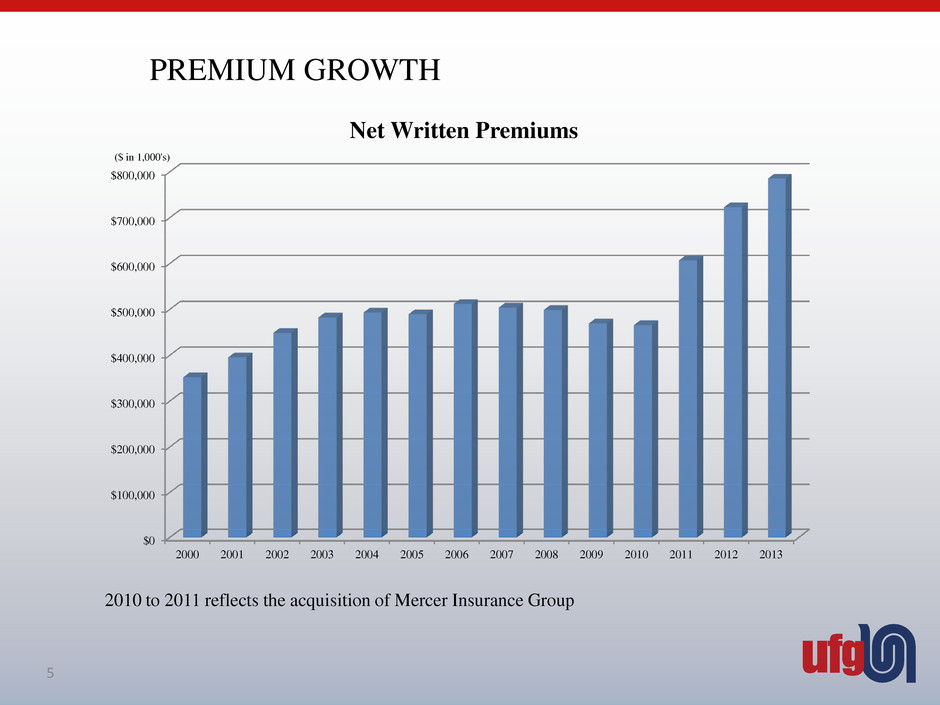

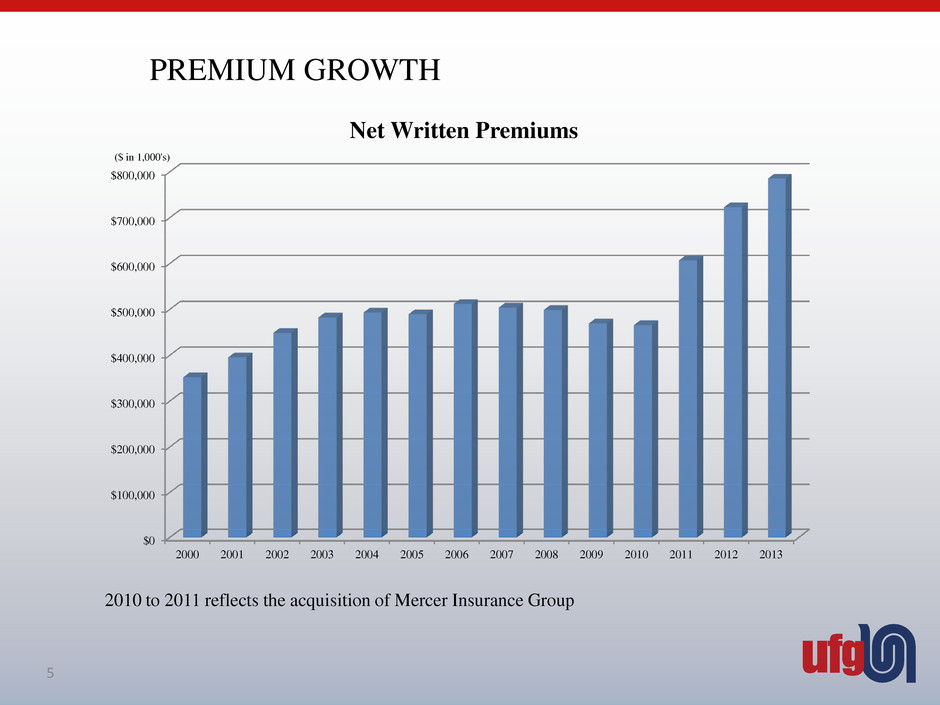

PREMIUM GROWTH $0 $100,000 $200,000 $300,000 $400,000 $500,000 $600,000 $700,000 $800,000 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 Net Written Premiums ($ in 1,000's) 5 2010 to 2011 reflects the acquisition of Mercer Insurance Group

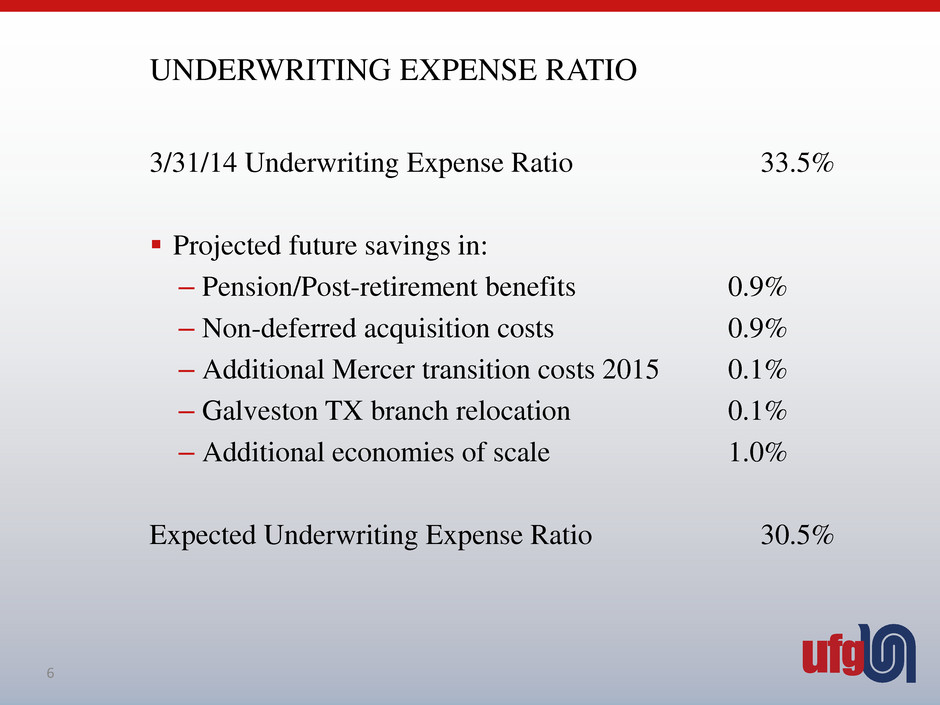

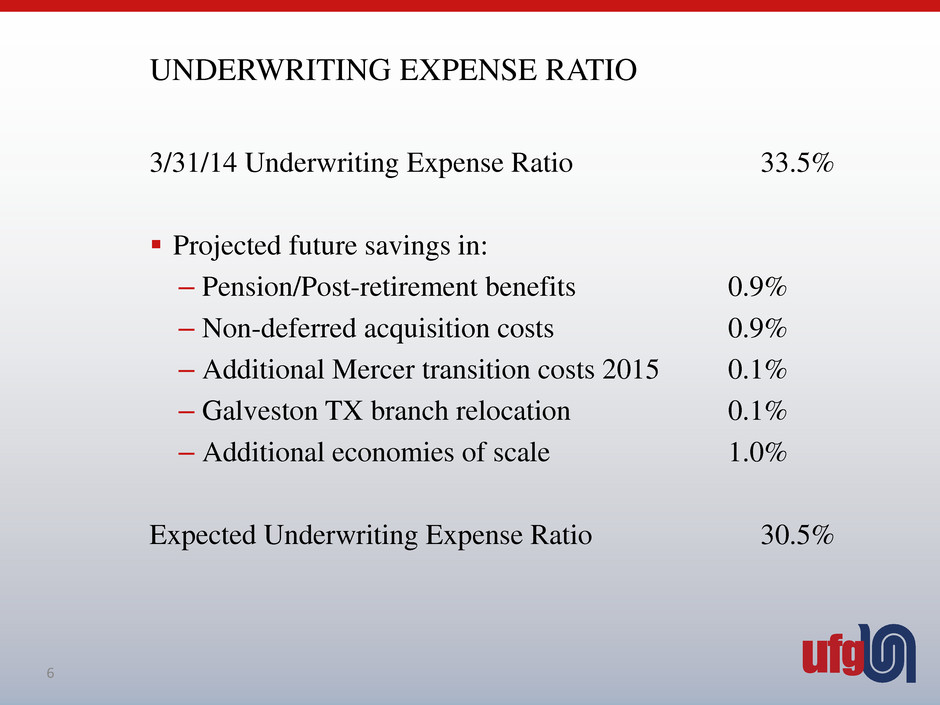

UNDERWRITING EXPENSE RATIO 3/31/14 Underwriting Expense Ratio 33.5% Projected future savings in: – Pension/Post-retirement benefits 0.9% – Non-deferred acquisition costs 0.9% – Additional Mercer transition costs 2015 0.1% – Galveston TX branch relocation 0.1% – Additional economies of scale 1.0% Expected Underwriting Expense Ratio 30.5% 6

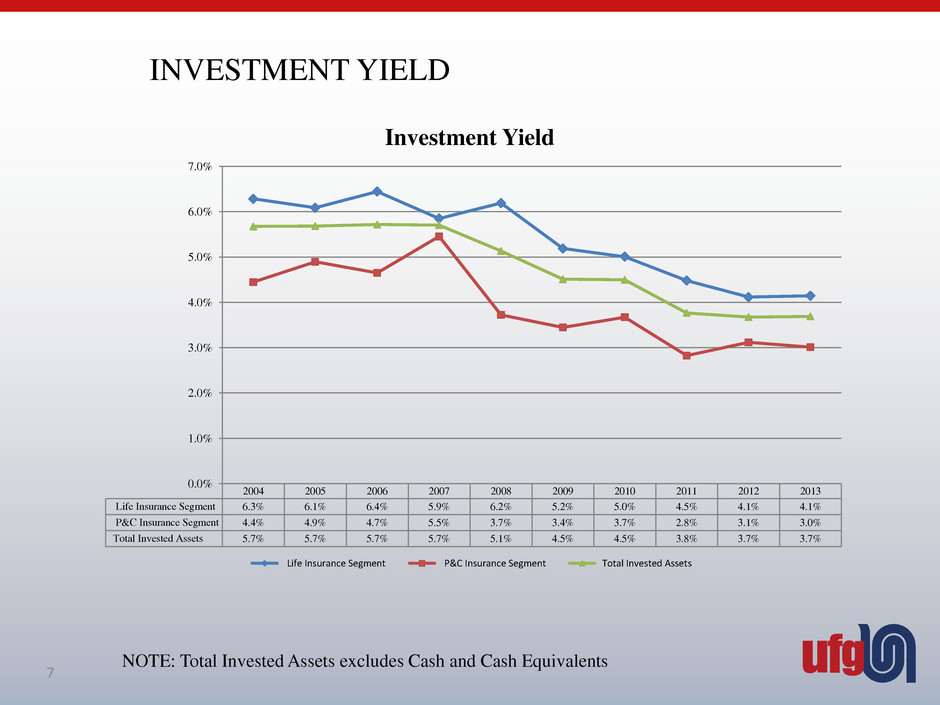

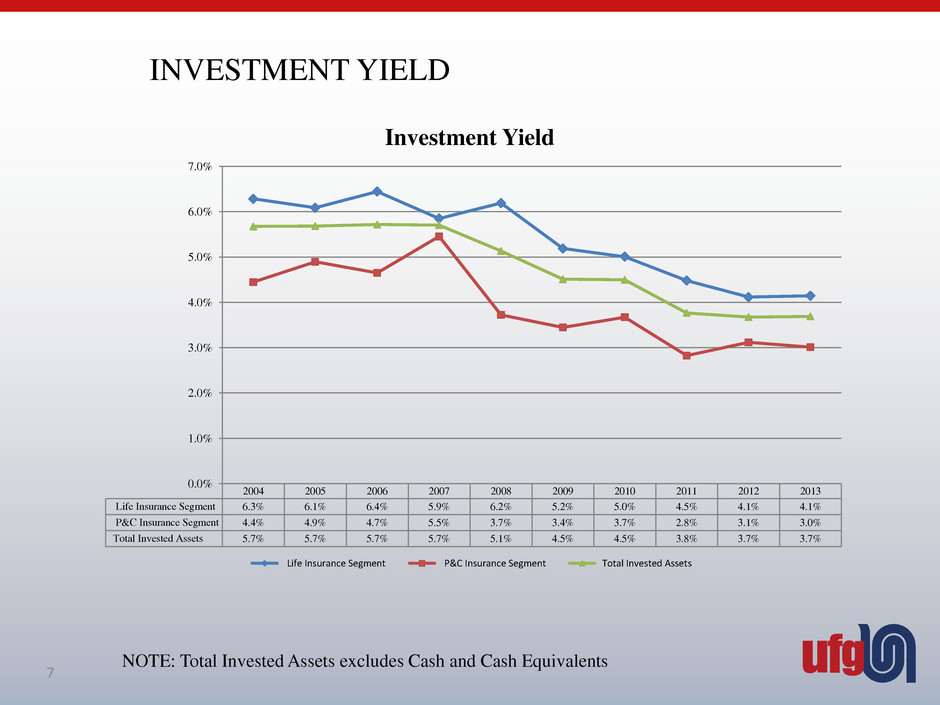

INVESTMENT YIELD 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 Life Insurance Segment 6.3% 6.1% 6.4% 5.9% 6.2% 5.2% 5.0% 4.5% 4.1% 4.1% P&C Insurance Segment 4.4% 4.9% 4.7% 5.5% 3.7% 3.4% 3.7% 2.8% 3.1% 3.0% Total Invested Assets 5.7% 5.7% 5.7% 5.7% 5.1% 4.5% 4.5% 3.8% 3.7% 3.7% 0.0% 1.0% 2.0% 3.0% 4.0% 5.0% 6.0% 7.0% Investment Yield Life Insurance Segment P&C Insurance Segment Total Invested Assets 7 NOTE: Total Invested Assets excludes Cash and Cash Equivalents

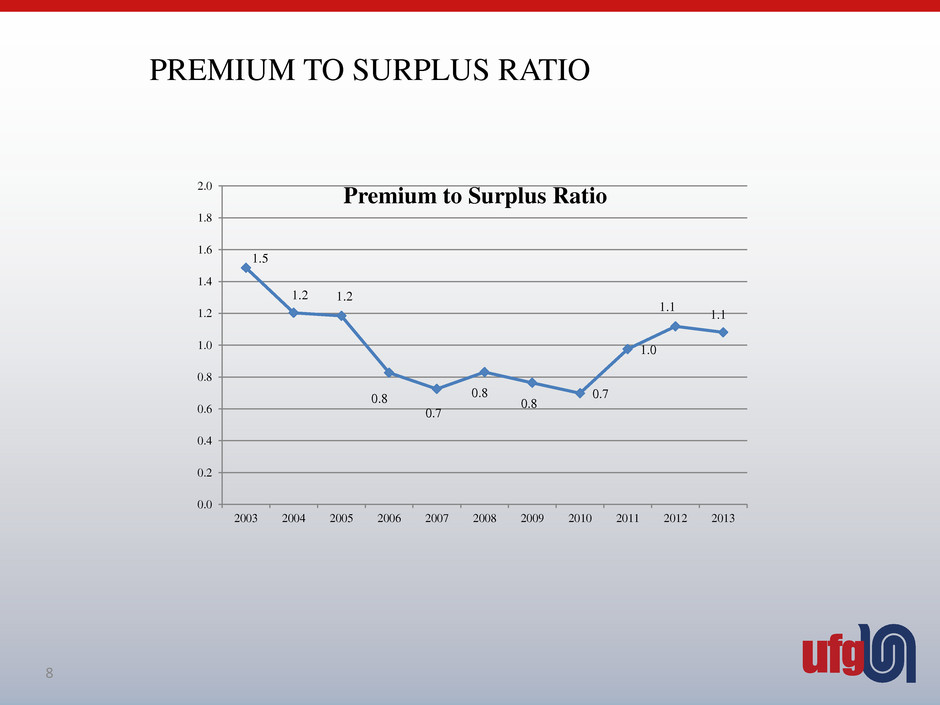

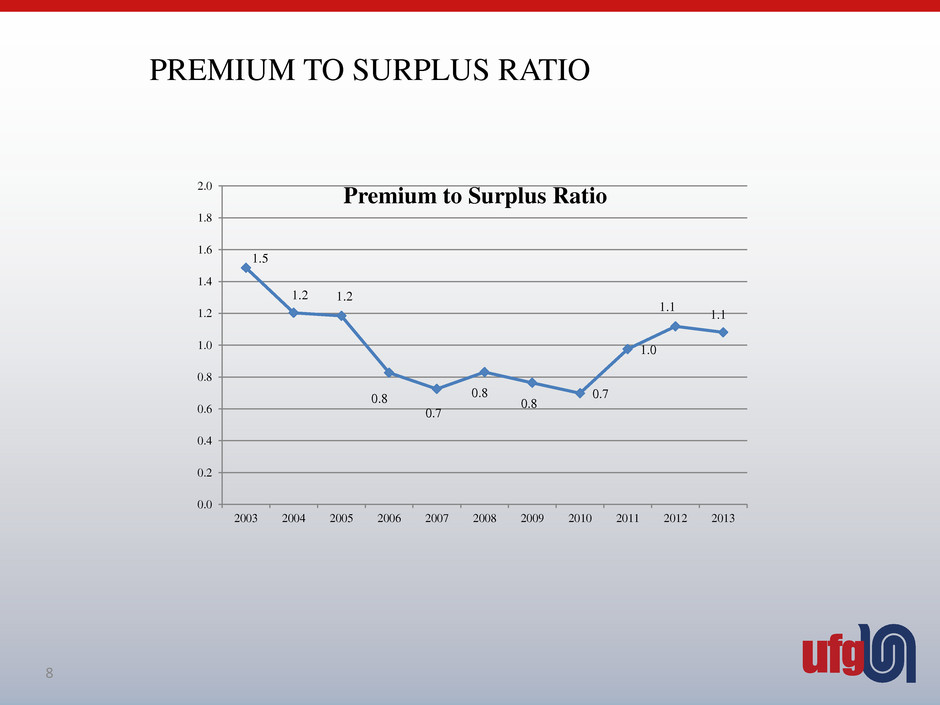

PREMIUM TO SURPLUS RATIO 8 1.5 1.2 1.2 0.8 0.7 0.8 0.8 0.7 1.0 1.1 1.1 0.0 0.2 0.4 0.6 0.8 1.0 1.2 1.4 1.6 1.8 2.0 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 Premium to Surplus Ratio

LIFE COMPANY Consistent earnings potential and more predictable earnings stream than P&C business – $26 million dividend to parent in the last two years Geographic expansion – nine new states since 2011 Extremely strong capitalization according to A.M. Best Lapse ratio of 5.5 percent Qualified care rider that allows insured to apply part of his/her death benefit to long term care if he/she is unable to perform some of the basic functions Automation commitment (ease of doing business) – Mobile App for agents • Policy information • Quick quotes • Contacts • Company news Collaborative initiatives with P&C 9

ECONOMY / MARKET CONDITIONS Positive rate environment for ten quarters Rate increases are expected through Q32014 Positive audit premium for the last ten quarters Our insureds continue to add exposures at renewal Policy count growth opportunities 10

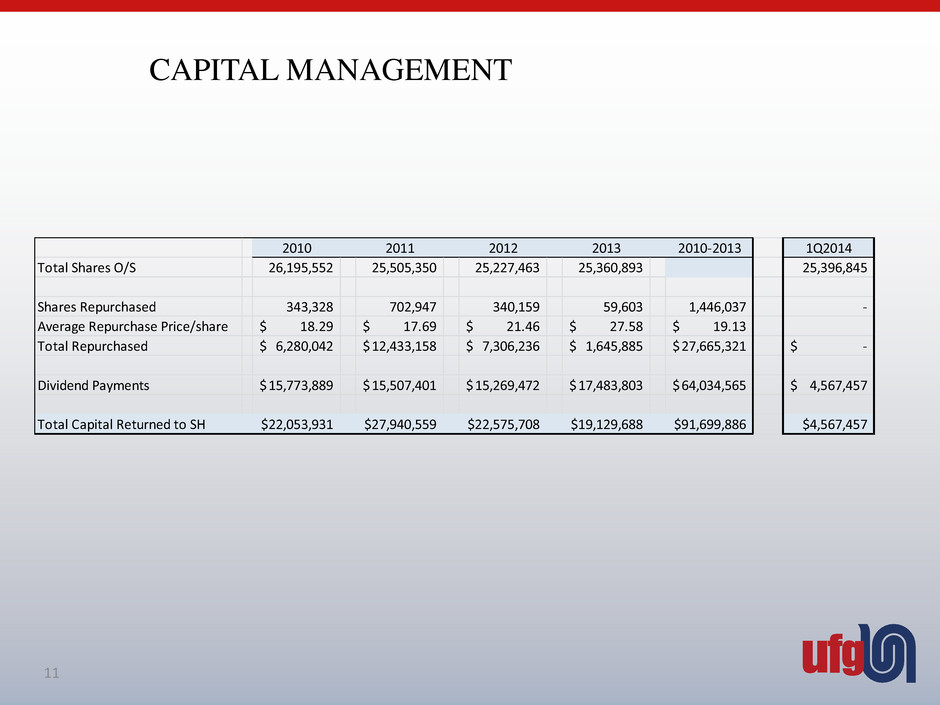

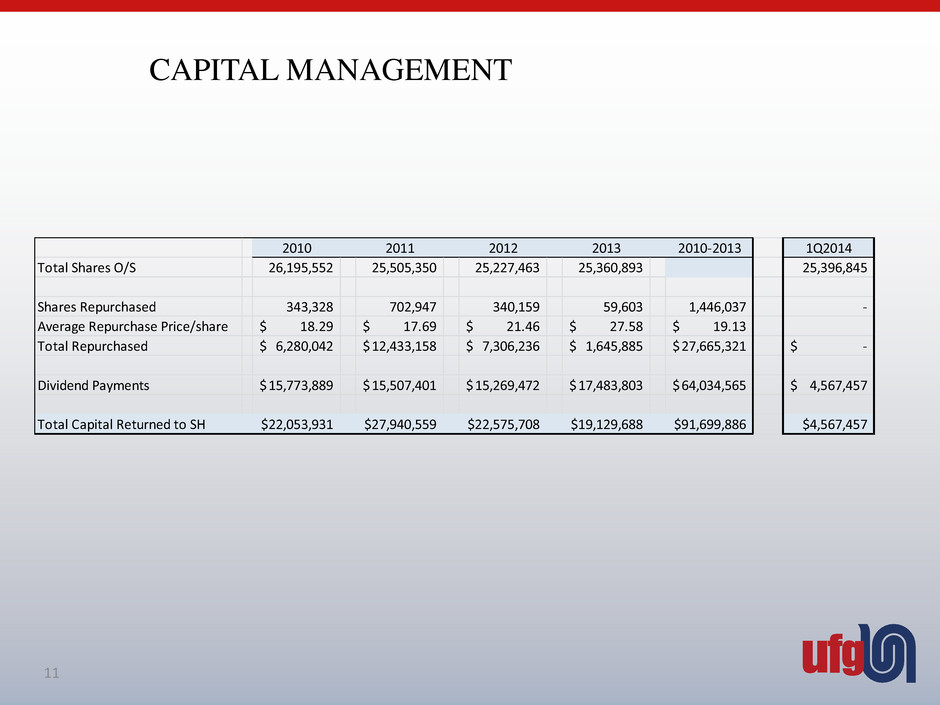

CAPITAL MANAGEMENT 11 2010 2011 2012 2013 2010-2013 1Q2014 Total Shares O/S 26,195,552 25,505,350 25,227,463 25,360,893 25,396,845 Shares Repurchased 343,328 702,947 340,159 59,603 1,446,037 - Average Repurchase Price/share 18.29$ 17.69$ 21.46$ 27.58$ 19.13$ Total Repurchased 6,280,042$ 12,433,158$ 7,306,236$ 1,645,885$ 27,665,321$ -$ Dividend Payments 15,773,889$ 15,507,401$ 15,269,472$ 17,483,803$ 64,034,565$ 4,567,457$ Total Capital Returned to SH $22,053,931 $27,940,559 $22,575,708 $19,129,688 $91,699,886 $4,567,457

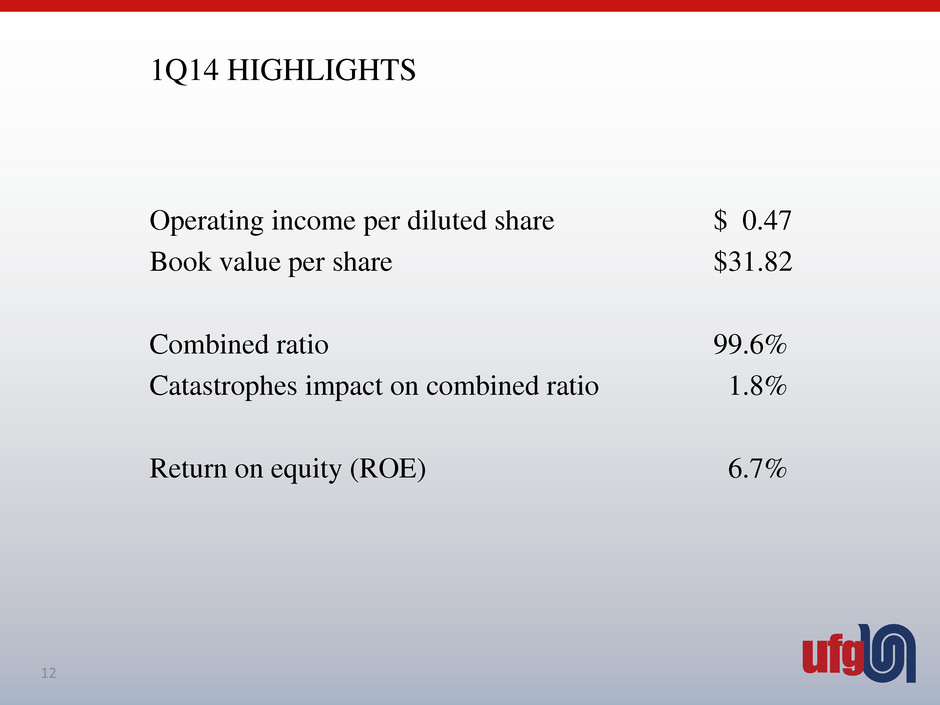

1Q14 HIGHLIGHTS Operating income per diluted share $ 0.47 Book value per share $31.82 Combined ratio 99.6% Catastrophes impact on combined ratio 1.8% Return on equity (ROE) 6.7% 12

STOCK PRICE 13 $18.48 $34.21 $28.01 Book Value per Share at 3/31/2014: $31.82 $10 $15 $20 $25 $30 $35

CURRENT OBJECTIVES • Objectives • Increase ROE • Increase Written Premiums • Provide best-in-class service • Be a “best place to work” so as to recruit and retain the best employees • Expand our agency plant and penetration • Leverage our existing product portfolio • Expand our geographic footprint • Enter the Excess & Surplus lines • New Branch in Los Angeles as of February 1, 2014 • Continue to capitalize on strategic growth opportunities 2020 Vision 14

BRANDING ‘REFRESH’ PROJECT “Refreshed” logo More unified look and feel across all regional offices Unified message (both internal and external) UFG rather than United Fire Group Newly appointed VP of Marketing 15

VALUE PROPOSITION Your business insurance needs are complex – let us make your solution simple… United Fire Group offers a simple business solution to your individual business insurance requirements. Through our partnerships with independent insurance agents, we can help design a simple and cost-effective solution to your complex insurance needs, as well as provide a risk management program to help safeguard your business investment. For those with personal insurance needs, we also offer home, auto and life products. While doing business in 43 states and the District of Columbia, we are readily accessible and eager to assist. 16

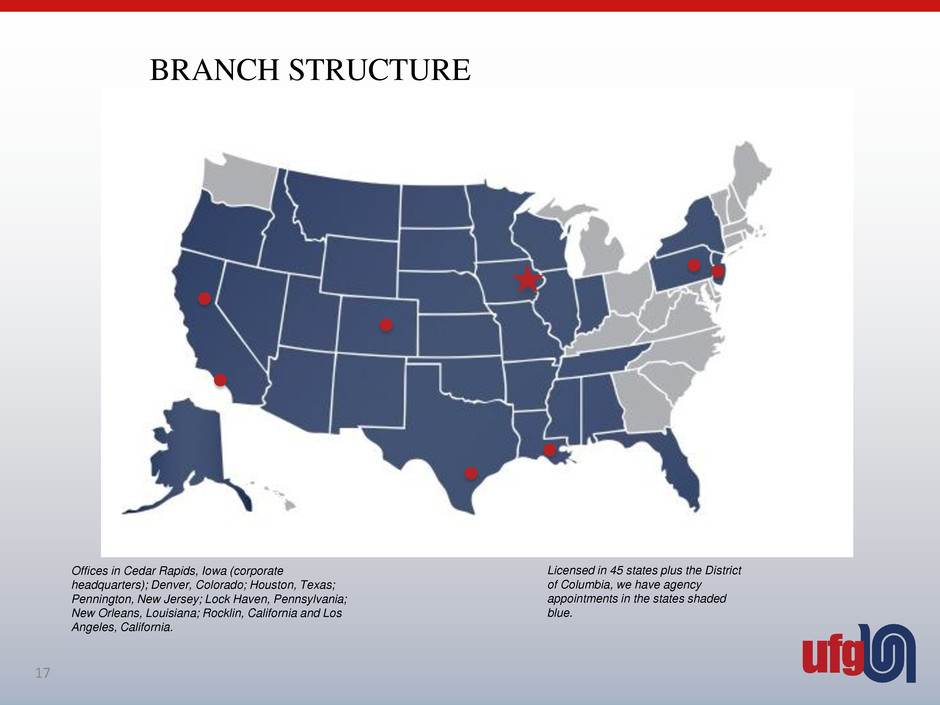

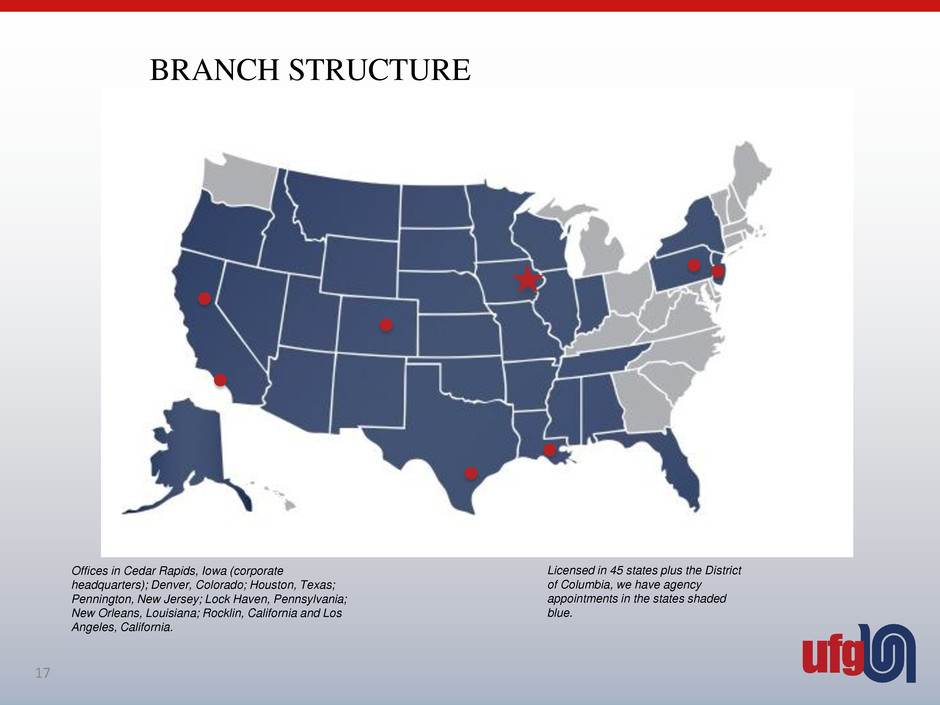

BRANCH STRUCTURE Offices in Cedar Rapids, Iowa (corporate headquarters); Denver, Colorado; Houston, Texas; Pennington, New Jersey; Lock Haven, Pennsylvania; New Orleans, Louisiana; Rocklin, California and Los Angeles, California. Licensed in 45 states plus the District of Columbia, we have agency appointments in the states shaded blue. 17

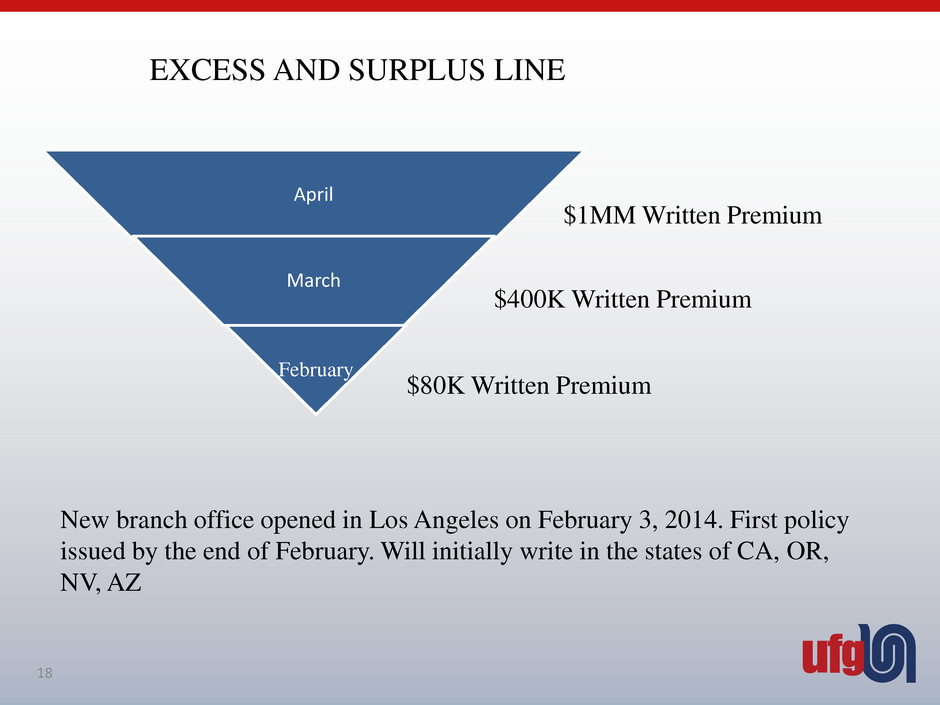

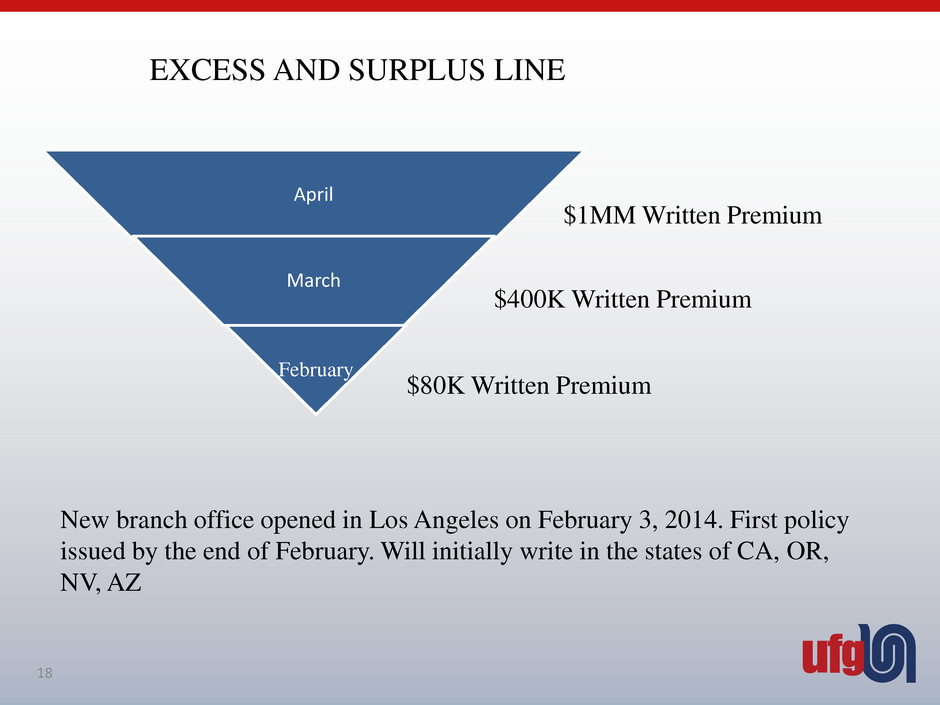

EXCESS AND SURPLUS LINE April March February $80K Written Premium $400K Written Premium $1MM Written Premium New branch office opened in Los Angeles on February 3, 2014. First policy issued by the end of February. Will initially write in the states of CA, OR, NV, AZ 18

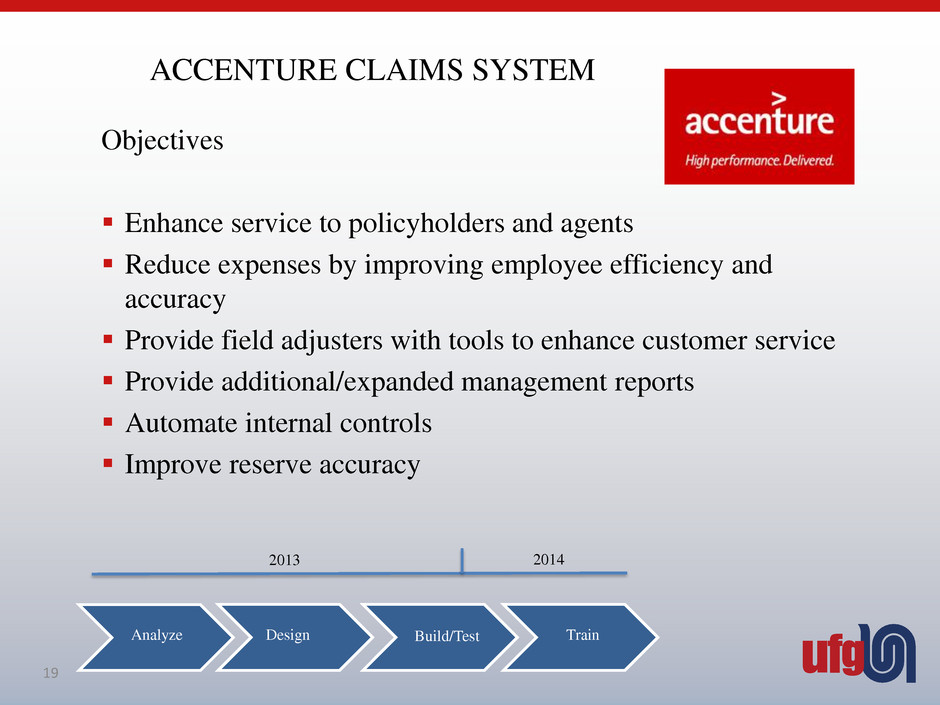

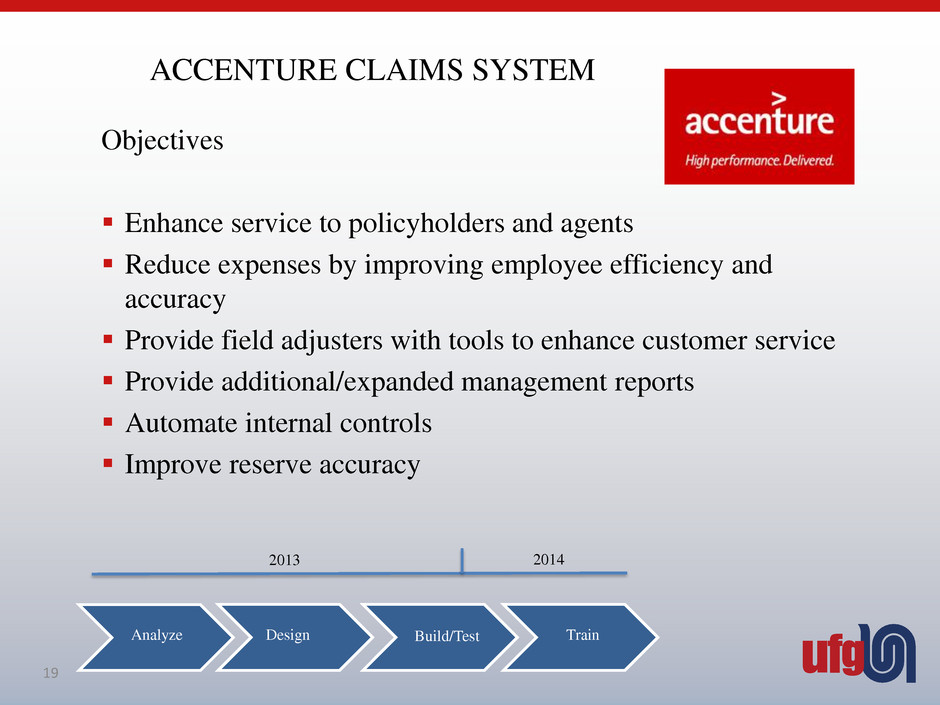

ACCENTURE CLAIMS SYSTEM Objectives Enhance service to policyholders and agents Reduce expenses by improving employee efficiency and accuracy Provide field adjusters with tools to enhance customer service Provide additional/expanded management reports Automate internal controls Improve reserve accuracy Analyze Design Build/Test Train 2013 2014 19

NATIONAL RECOGNITION Rated A (Excellent) by A.M. Best Company Named a Super Regional Property/Casualty Insurer™ every year since 2006 by Insurance Journal magazine Placed on National Underwriter’s 2012 list of Top 100 insurance groups in property and casualty premium rankings (third consecutive year) Placed on the Des Moines Register’s 2012 list of Top 100 places in Iowa to work Received the 2013 Interface Partner Award from Applied Systems® (fifth consecutive year) Placed on Forbes’ 2014 list of “America’s 50 Most Trustworthy Financial Companies” 20

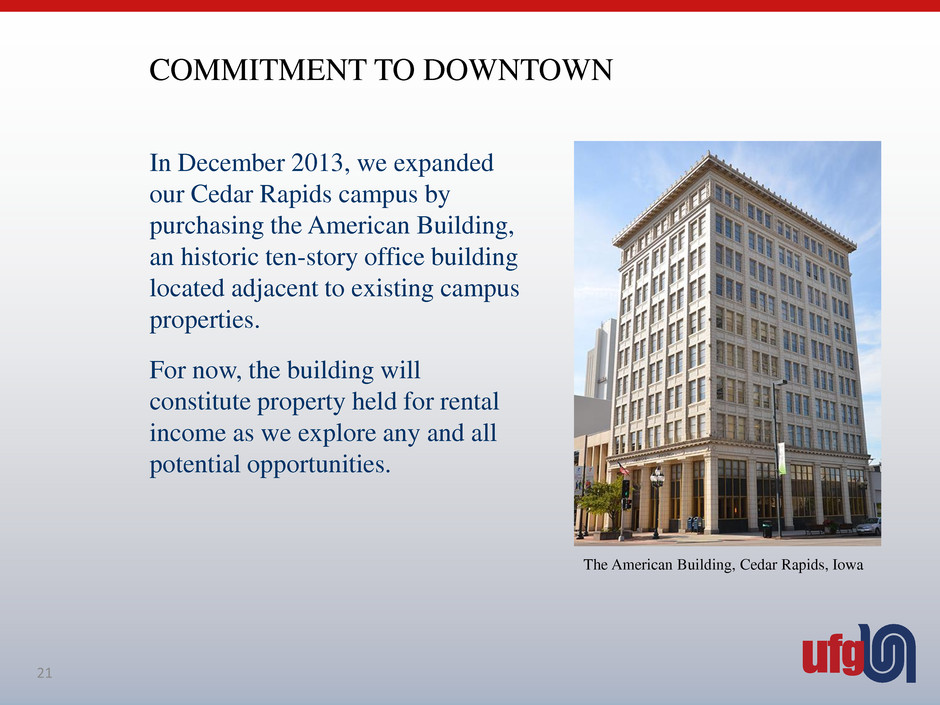

COMMITMENT TO DOWNTOWN In December 2013, we expanded our Cedar Rapids campus by purchasing the American Building, an historic ten-story office building located adjacent to existing campus properties. For now, the building will constitute property held for rental income as we explore any and all potential opportunities. The American Building, Cedar Rapids, Iowa 21

22 Thank You!

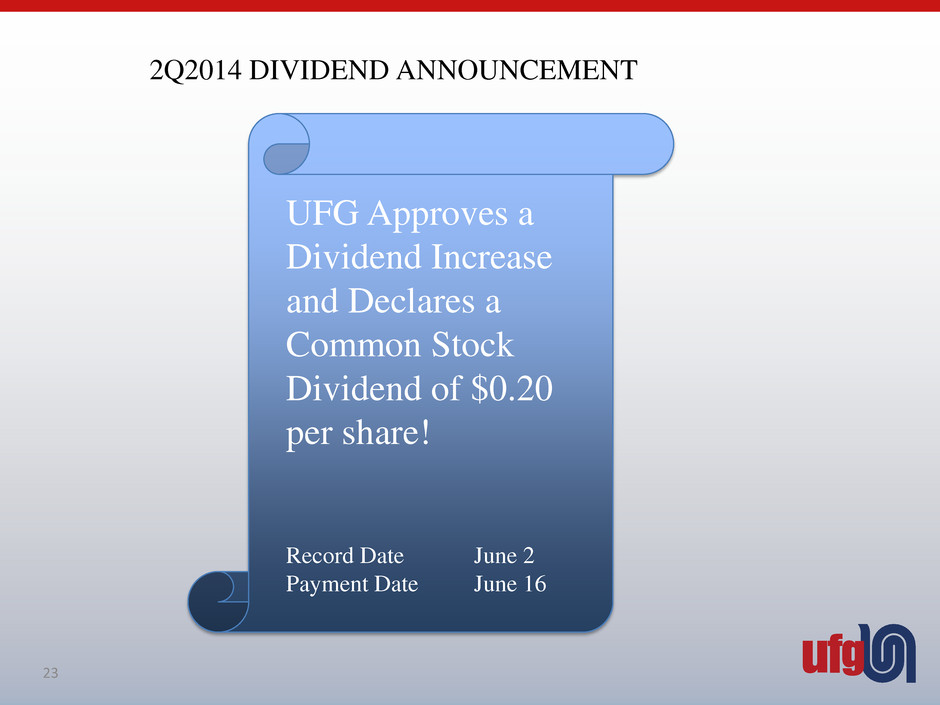

2Q2014 DIVIDEND ANNOUNCEMENT 23 UFG Approves a Dividend Increase and Declares a Common Stock Dividend of $0.20 per share! Record Date June 2 Payment Date June 16