To Pursue a Spin-Off of New Diversey October 17, 2016 Exhibit 99.2

Safe Harbor and Regulation G Statement This presentation contains “forward-looking statements” within the meaning of the safe harbor provisions of the Private Securities Litigation Reform Act of 1995 concerning our business, consolidated financial condition and results of operations. Forward-looking statements are subject to risks and uncertainties, many of which are outside our control, which could cause actual results to differ materially from these statements. Therefore, you should not rely on any of these forward-looking statements. Forward-looking statements can be identified by such words as “anticipates,” “believes,” “plan,” “assumes,” “could,” “should,” “estimates,” “expects,” “intends,” “potential,” “seek,” “predict,” “may,” “will” and similar references to future periods. All statements other than statements of historical facts included in this presentation regarding our strategies, prospects, financial condition, operations, costs, plans and objectives are forward-looking statements. Examples of forward-looking statements include, among others, statements we make regarding expected future operating results, expectations regarding the results of restructuring and other programs, anticipated levels of capital expenditures and expectations of the effect on our financial condition of claims, litigation, environmental costs, contingent liabilities and governmental and regulatory investigations and proceedings. The following are important factors that we believe could cause actual results to differ materially from those in our forward-looking statements: the tax benefits associated with the Settlement agreement (as defined in our 2015 Annual Report on Form 10-K), global economic and political conditions, changes in our credit ratings, changes in raw material pricing and availability, changes in energy costs, competitive conditions, success of our restructuring activities, currency translation and devaluation effects, the success of our financial growth, profitability, cash generation and manufacturing strategies and our cost reduction and productivity efforts, the success of new product offerings, the effects of animal and food-related health issues, pandemics, consumer preferences, environmental matters, regulatory actions and legal matters, and the other information referenced in the “Risk Factors” section appearing in our most recent Annual Report on Form 10-K, as filed with the Securities and Exchange Commission, and as revised and updated by our Quarterly Reports on Form 10-Q and Current Reports on Form 8-K. Any forward-looking statement made by us is based only on information currently available to us and speaks only as of the date on which it is made. We undertake no obligation to publicly update any forward-looking statement, whether written or oral, that may be made from time to time, whether as a result of new information, future developments or otherwise. Our management uses non-U.S. GAAP financial measures to evaluate the Company’s performance, which exclude items we consider unusual or special items. We believe the use of such financial measures and information may be useful to investors. We believe that the use of non-U.S. GAAP measures helps investors to gain a better understanding of core operating results and future prospects, consistent with how management measures and forecasts the Company's performance, especially when comparing such results to previous periods or forecasts. Please see the Appendix to this presentation, as well as Sealed Air’s July 28, 2016 earnings press release and Quarterly Report on Form 10-Q for the quarter ended June 30, 2016, for important information about the use of non-U.S. GAAP financial measures relevant to this presentation, including applicable reconciliations to U.S. GAAP financial measures. Information reconciling forward-looking non-U.S. GAAP measures to U.S. GAAP measures is not available without unreasonable effort. Website Information We routinely post important information for investors on our website, www.sealedair.com, in the "Investor Relations" section. We use this website as a means of disclosing material, non-public information and for complying with our disclosure obligations under Regulation FD. Accordingly, investors should monitor the Investor Relations section of our website, in addition to following our press releases, SEC filings, public conference calls, presentations and webcasts. The information contained on, or that may be accessed through, our website is not incorporated by reference into, and is not a part of, this document. 1

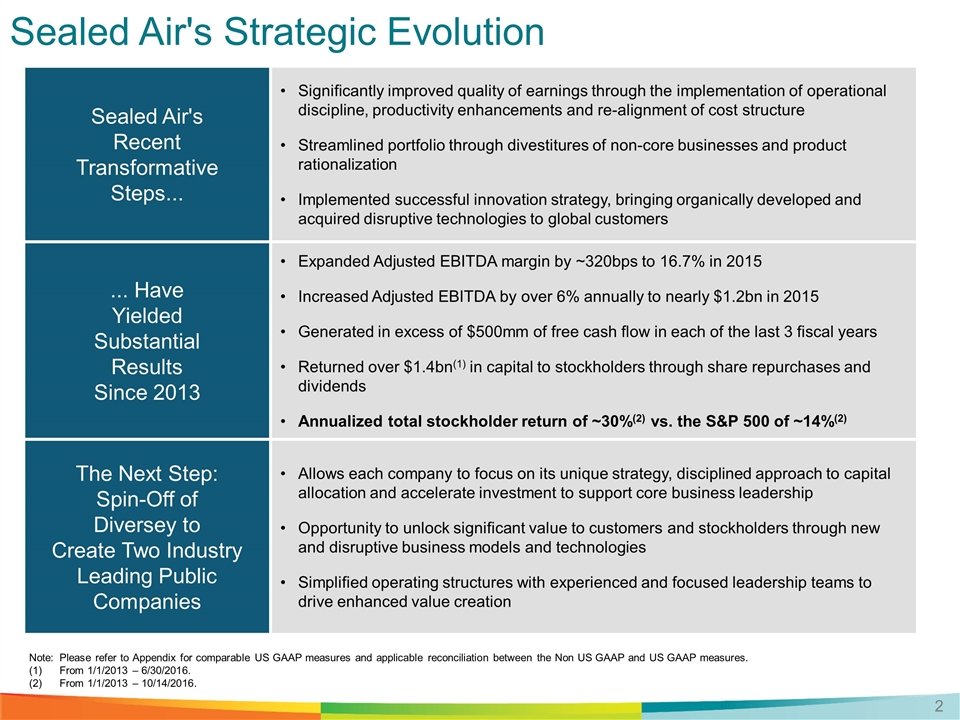

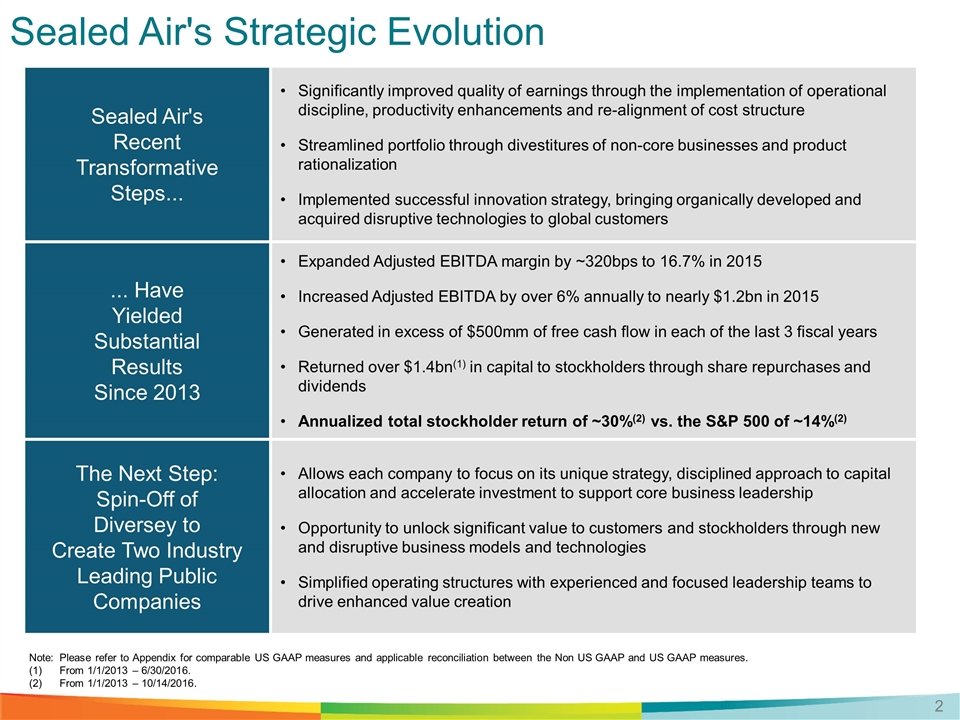

Sealed Air's Strategic Evolution 2 Sealed Air's Recent Transformative Steps... Significantly improved quality of earnings through the implementation of operational discipline, productivity enhancements and re-alignment of cost structure Streamlined portfolio through divestitures of non-core businesses and product rationalization Implemented successful innovation strategy, bringing organically developed and acquired disruptive technologies to global customers ... Have Yielded Substantial Results Since 2013 Expanded Adjusted EBITDA margin by ~320bps to 16.7% in 2015 Increased Adjusted EBITDA by over 6% annually to nearly $1.2bn in 2015 Generated in excess of $500mm of free cash flow in each of the last 3 fiscal years Returned over $1.4bn(1) in capital to stockholders through share repurchases and dividends Annualized total stockholder return of ~30%(2) vs. the S&P 500 of ~14%(2) The Next Step: Spin-Off of Diversey to Create Two Industry Leading Public Companies Allows each company to focus on its unique strategy, disciplined approach to capital allocation and accelerate investment to support core business leadership Opportunity to unlock significant value to customers and stockholders through new and disruptive business models and technologies Simplified operating structures with experienced and focused leadership teams to drive enhanced value creation Note:Please refer to Appendix for comparable US GAAP measures and applicable reconciliation between the Non US GAAP and US GAAP measures. (1) From 1/1/2013 – 6/30/2016. (2) From 1/1/2013 – 10/14/2016.

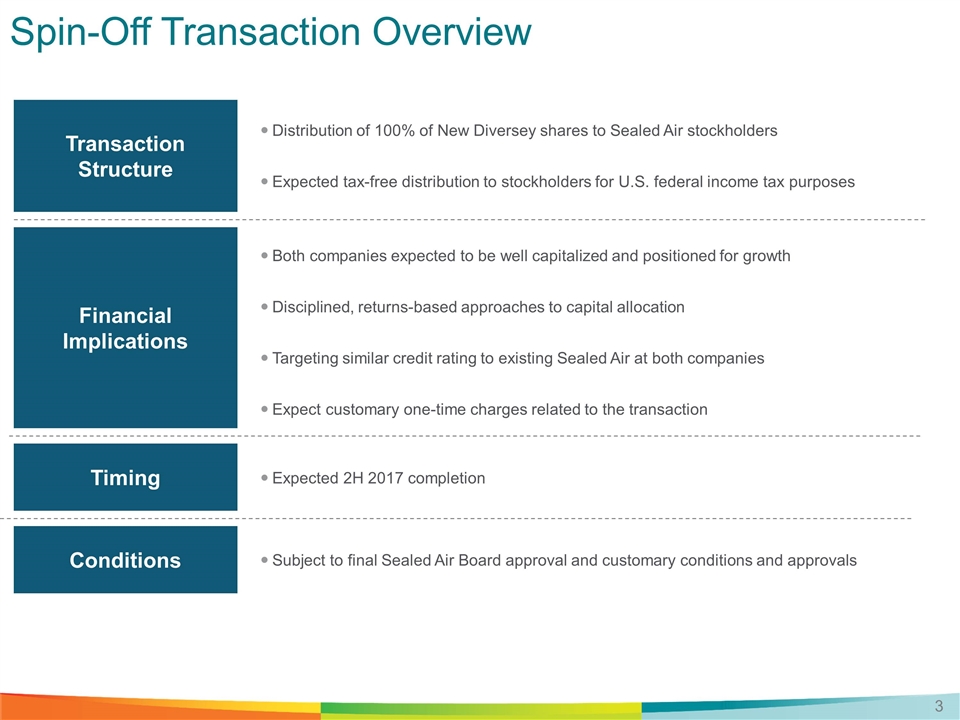

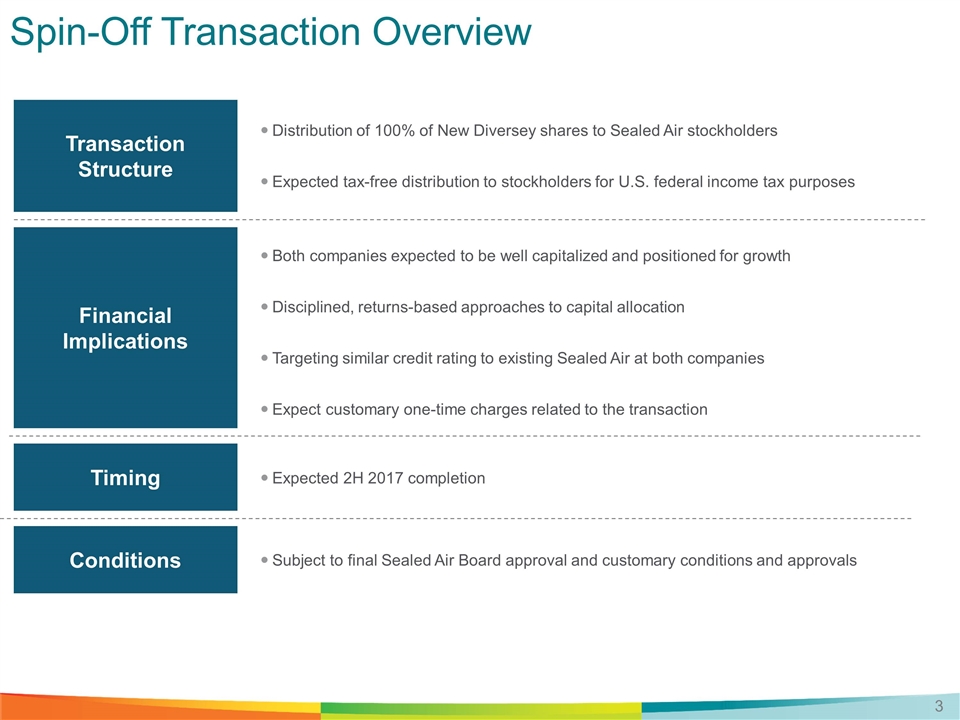

Spin-Off Transaction Overview Financial Implications Timing Distribution of 100% of New Diversey shares to Sealed Air stockholders Expected tax-free distribution to stockholders for U.S. federal income tax purposes Expected 2H 2017 completion Subject to final Sealed Air Board approval and customary conditions and approvals Both companies expected to be well capitalized and positioned for growth Disciplined, returns-based approaches to capital allocation Targeting similar credit rating to existing Sealed Air at both companies Expect customary one-time charges related to the transaction Transaction Structure Conditions 3

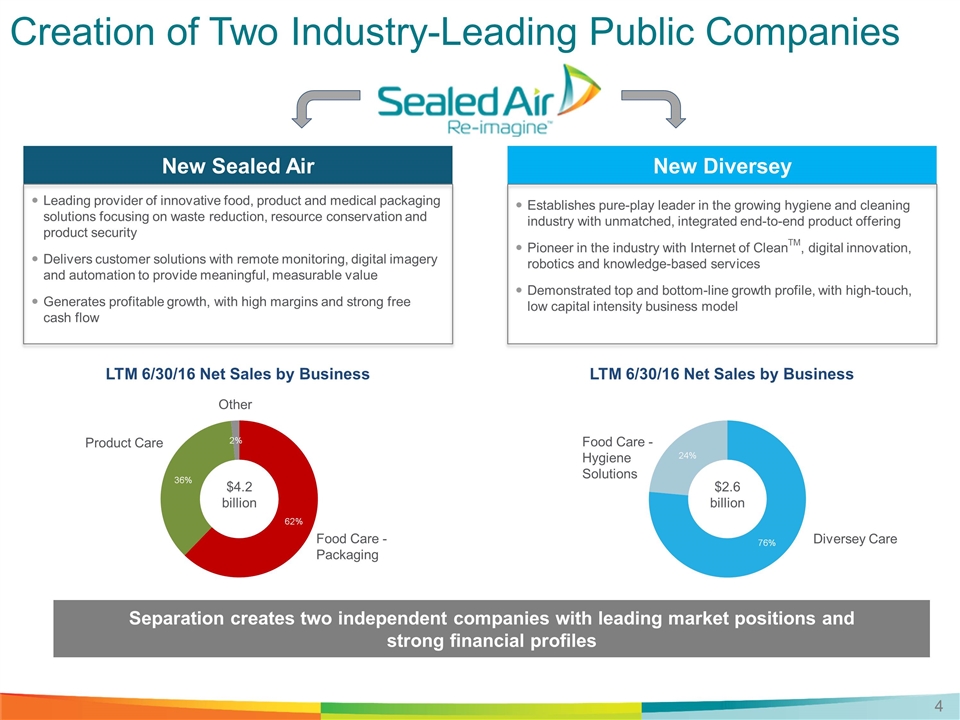

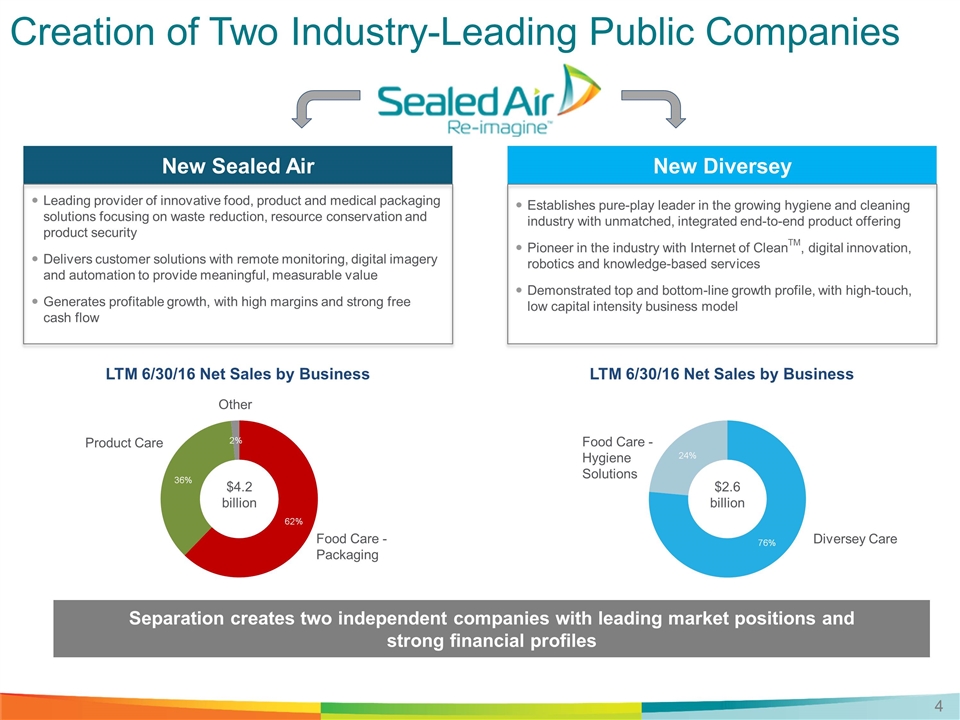

Creation of Two Industry-Leading Public Companies New Sealed Air Leading provider of innovative food, product and medical packaging solutions focusing on waste reduction, resource conservation and product security Delivers customer solutions with remote monitoring, digital imagery and automation to provide meaningful, measurable value Generates profitable growth, with high margins and strong free cash flow Separation creates two independent companies with leading market positions and strong financial profiles New Diversey Establishes pure-play leader in the growing hygiene and cleaning industry with unmatched, integrated end-to-end product offering Pioneer in the industry with Internet of CleanTM, digital innovation, robotics and knowledge-based services Demonstrated top and bottom-line growth profile, with high-touch, low capital intensity business model $2.6 billion Food Care - Hygiene Solutions Diversey Care LTM 6/30/16 Net Sales by Business 4 $4.2 billion Product Care Food Care - Packaging LTM 6/30/16 Net Sales by Business Other

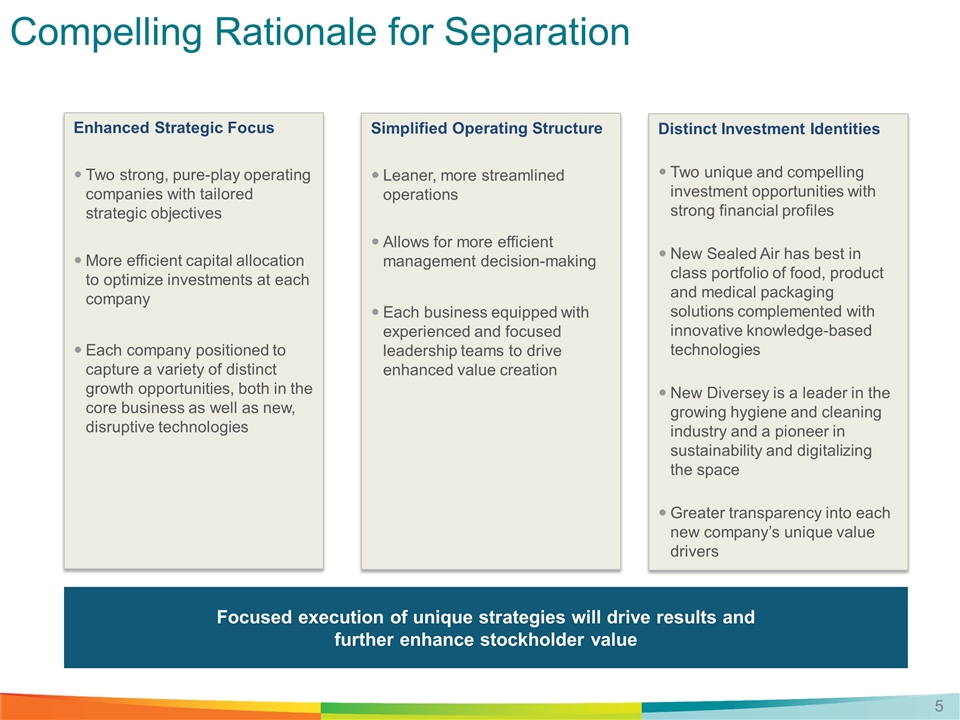

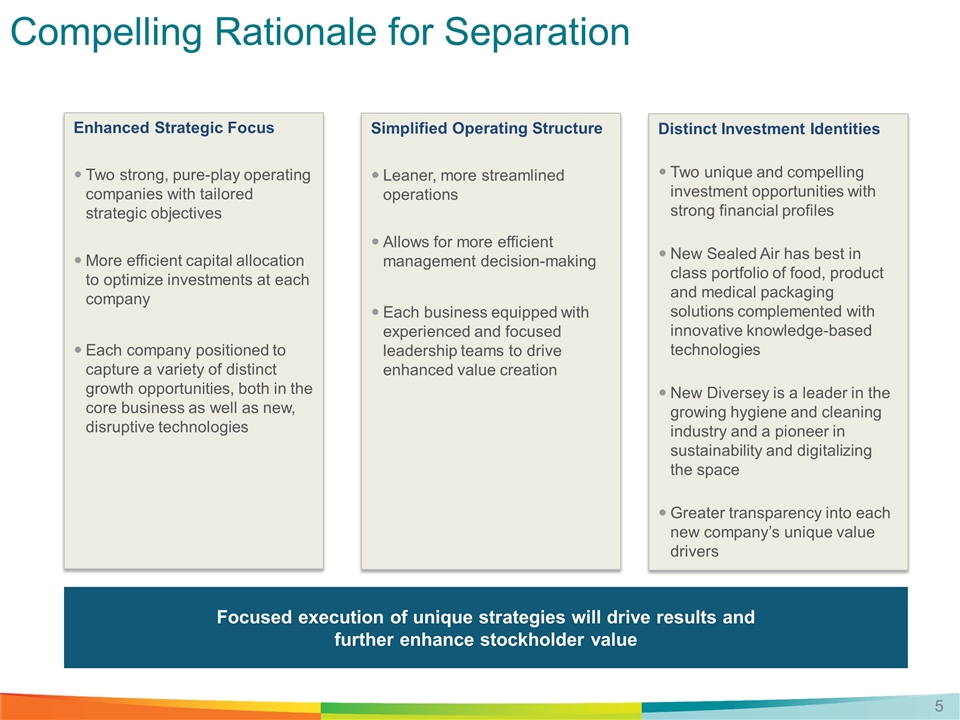

Compelling Rationale for Separation Focused execution of unique strategies will drive results and further enhance stockholder value Enhanced Strategic Focus Two strong, pure-play operating companies with tailored strategic objectives More efficient capital allocation to optimize investments at each company Each company positioned to capture a variety of distinct growth opportunities, both in the core business as well as new, disruptive technologies Distinct Investment Identities Two unique and compelling investment opportunities with strong financial profiles New Sealed Air has best in class portfolio of food, product and medical packaging solutions complemented with innovative knowledge-based technologies New Diversey is a leader in the growing hygiene and cleaning industry and a pioneer in sustainability and digitalizing the space Greater transparency into each new company’s unique value drivers Simplified Operating Structure Leaner, more streamlined operations Allows for more efficient management decision-making Each business equipped with experienced and focused leadership teams to drive enhanced value creation 5

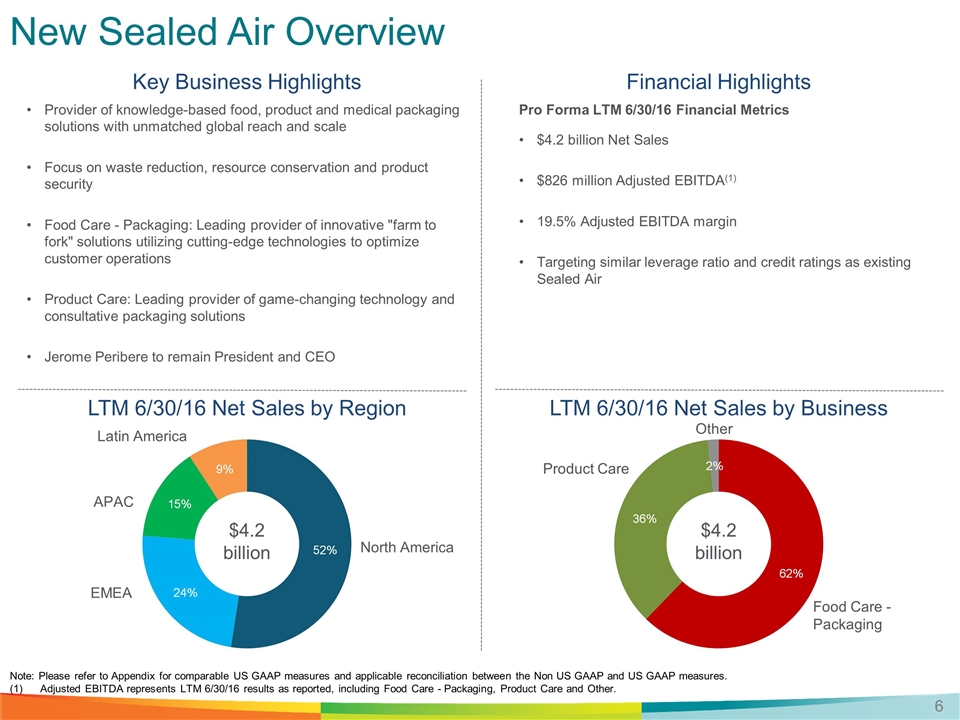

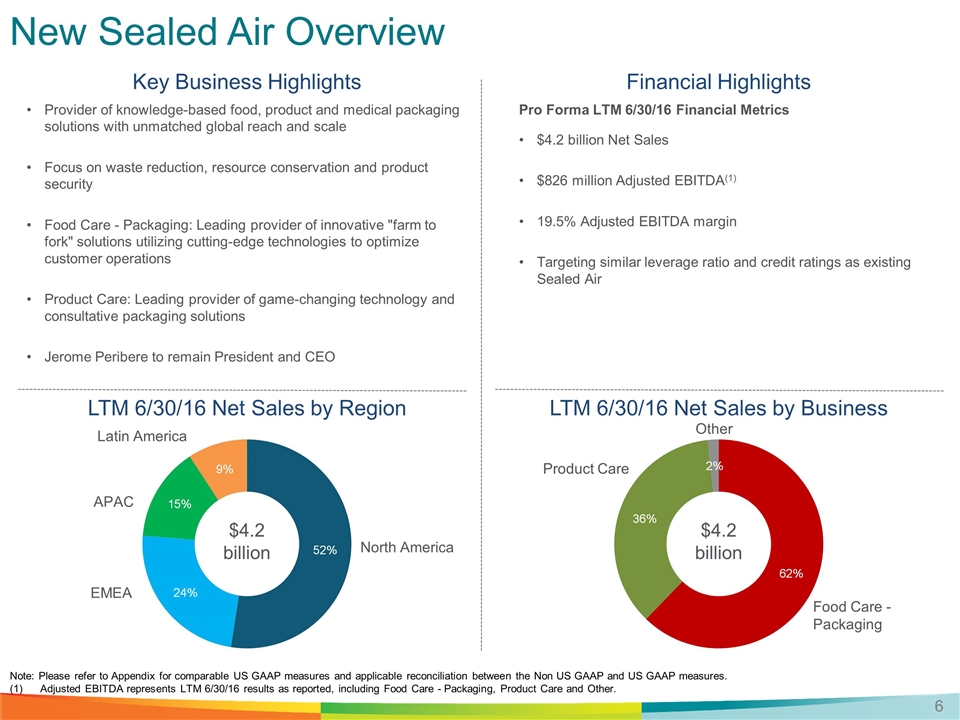

$4.2 billion New Sealed Air Overview Key Business Highlights Financial Highlights Pro Forma LTM 6/30/16 Financial Metrics $4.2 billion Net Sales $826 million Adjusted EBITDA(1) 19.5% Adjusted EBITDA margin Targeting similar leverage ratio and credit ratings as existing Sealed Air Product Care Food Care - Packaging Provider of knowledge-based food, product and medical packaging solutions with unmatched global reach and scale Focus on waste reduction, resource conservation and product security Food Care - Packaging: Leading provider of innovative "farm to fork" solutions utilizing cutting-edge technologies to optimize customer operations Product Care: Leading provider of game-changing technology and consultative packaging solutions Jerome Peribere to remain President and CEO LTM 6/30/16 Net Sales by Business 6 LTM 6/30/16 Net Sales by Region EMEA North America APAC Latin America $4.2 billion Other Note: Please refer to Appendix for comparable US GAAP measures and applicable reconciliation between the Non US GAAP and US GAAP measures. Adjusted EBITDA represents LTM 6/30/16 results as reported, including Food Care - Packaging, Product Care and Other.

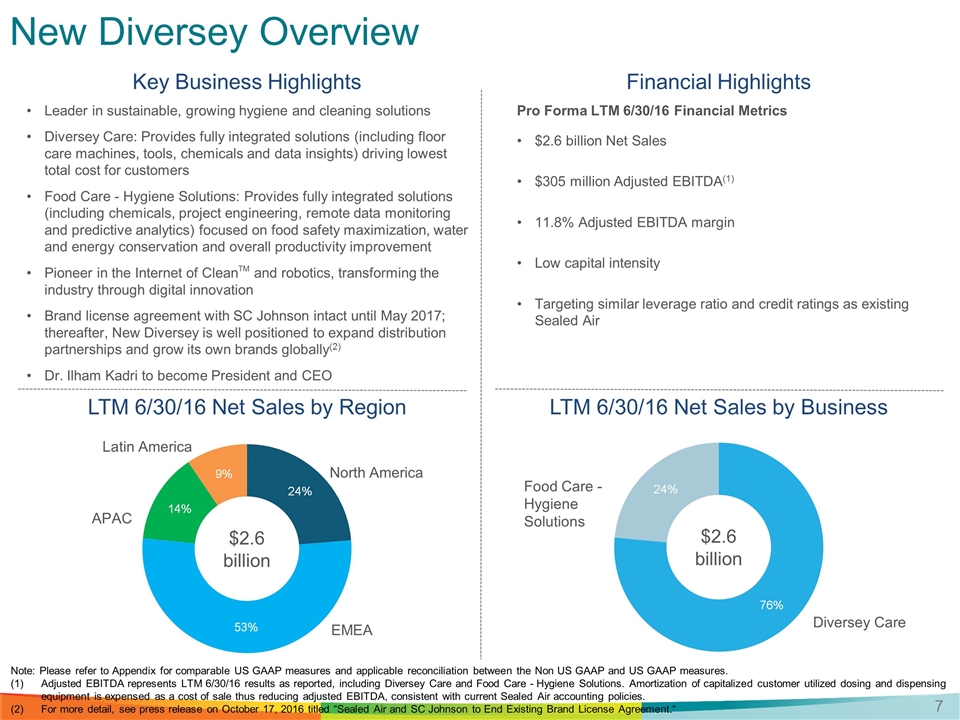

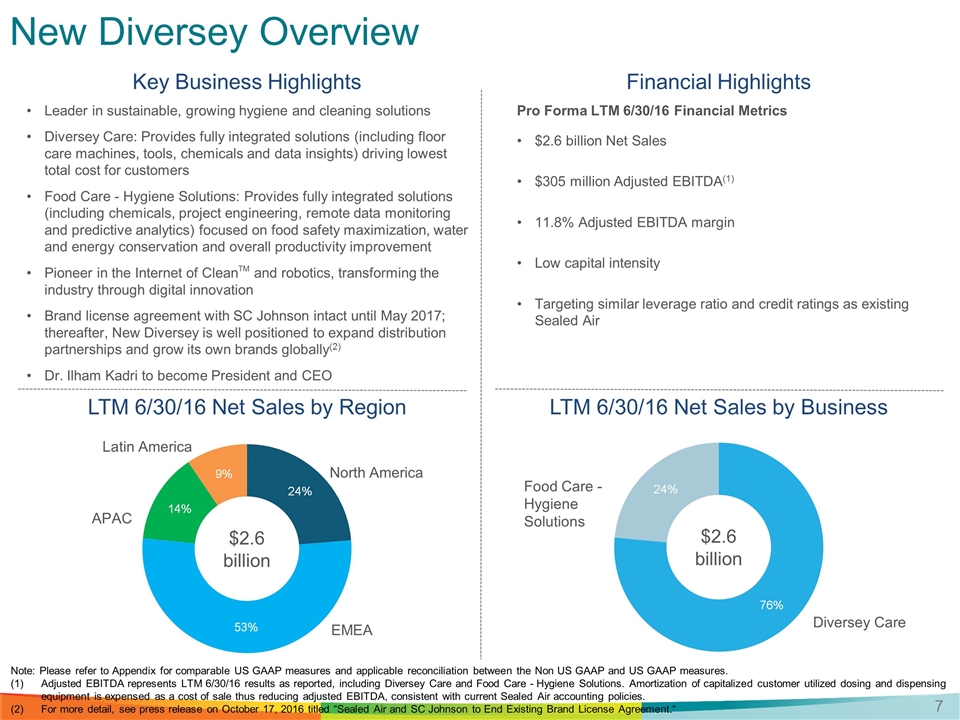

$2.6 billion New Diversey Overview Key Business Highlights Financial Highlights Pro Forma LTM 6/30/16 Financial Metrics $2.6 billion Net Sales $305 million Adjusted EBITDA(1) 11.8% Adjusted EBITDA margin Low capital intensity Targeting similar leverage ratio and credit ratings as existing Sealed Air Food Care - Hygiene Solutions Diversey Care Leader in sustainable, growing hygiene and cleaning solutions Diversey Care: Provides fully integrated solutions (including floor care machines, tools, chemicals and data insights) driving lowest total cost for customers Food Care - Hygiene Solutions: Provides fully integrated solutions (including chemicals, project engineering, remote data monitoring and predictive analytics) focused on food safety maximization, water and energy conservation and overall productivity improvement Pioneer in the Internet of CleanTM and robotics, transforming the industry through digital innovation Brand license agreement with SC Johnson intact until May 2017; thereafter, New Diversey is well positioned to expand distribution partnerships and grow its own brands globally(2) Dr. Ilham Kadri to become President and CEO 7 LTM 6/30/16 Net Sales by Business LTM 6/30/16 Net Sales by Region $2.6 billion EMEA North America APAC Latin America Note: Please refer to Appendix for comparable US GAAP measures and applicable reconciliation between the Non US GAAP and US GAAP measures. Adjusted EBITDA represents LTM 6/30/16 results as reported, including Diversey Care and Food Care - Hygiene Solutions. Amortization of capitalized customer utilized dosing and dispensing equipment is expensed as a cost of sale thus reducing adjusted EBITDA, consistent with current Sealed Air accounting policies. For more detail, see press release on October 17, 2016 titled “Sealed Air and SC Johnson to End Existing Brand License Agreement.“

Two Independent Companies to Enhance Stockholder Value Today marks an exciting new phase of Sealed Air’s evolution Separation of Sealed Air into two public companies allows for Enhanced strategic focus Simplified operating structure Distinct investment identities Each business equipped with experienced and proven management teams and highly skilled employees to drive growth and create value for all stakeholders Timing is optimal given financial performance, near-to-medium term opportunities and strength in the capital markets Expected 2H 2017 completion 8

Appendix

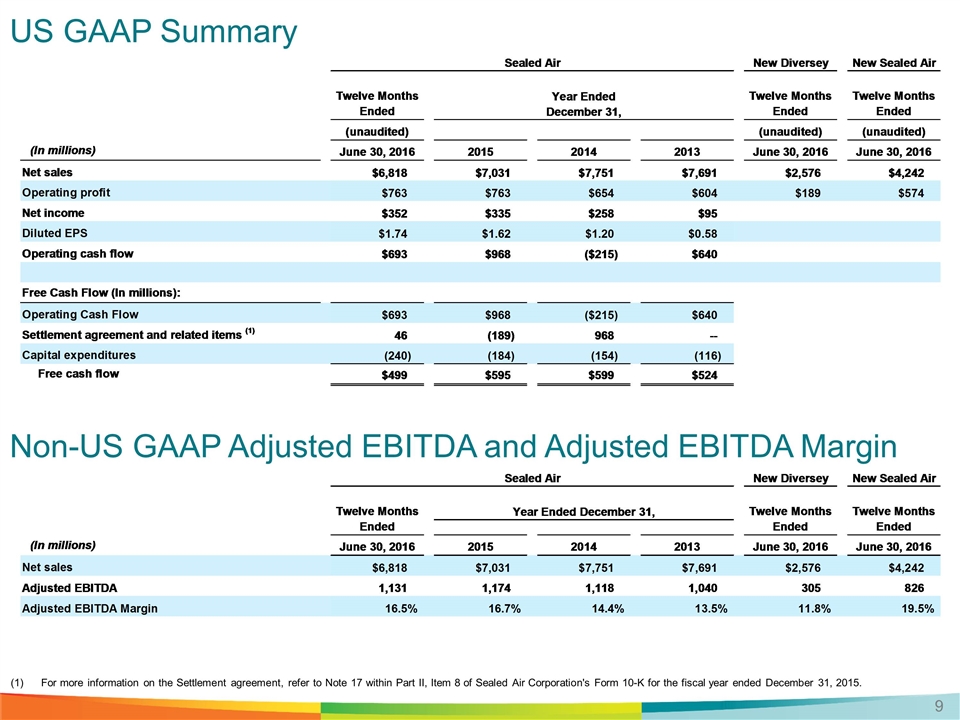

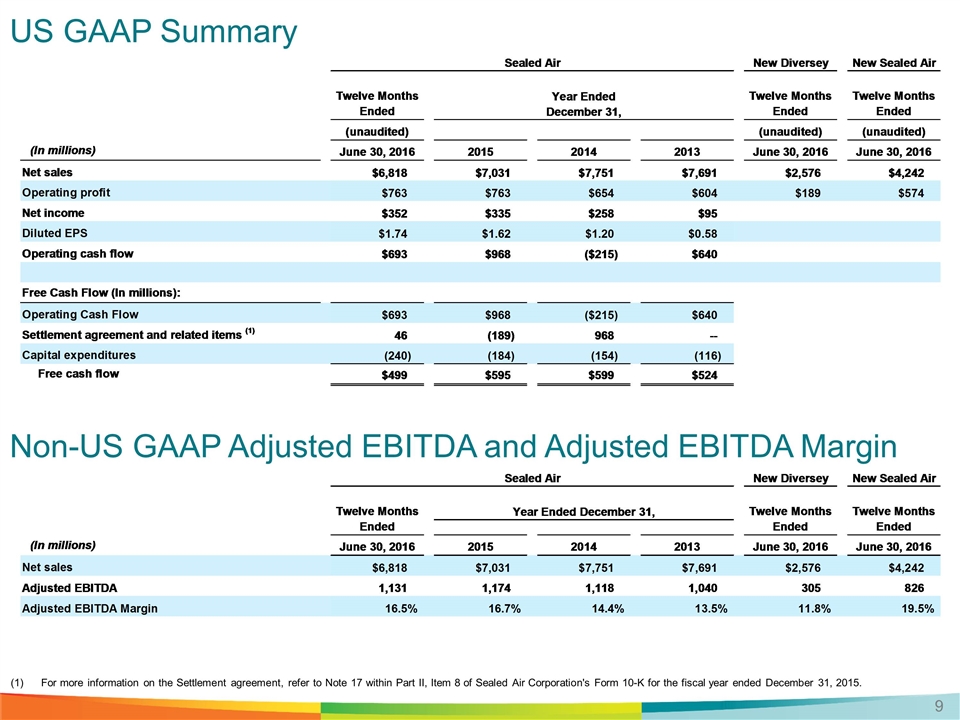

US GAAP Summary 9 Non-US GAAP Adjusted EBITDA and Adjusted EBITDA Margin For more information on the Settlement agreement, refer to Note 17 within Part II, Item 8 of Sealed Air Corporation's Form 10-K for the fiscal year ended December 31, 2015.

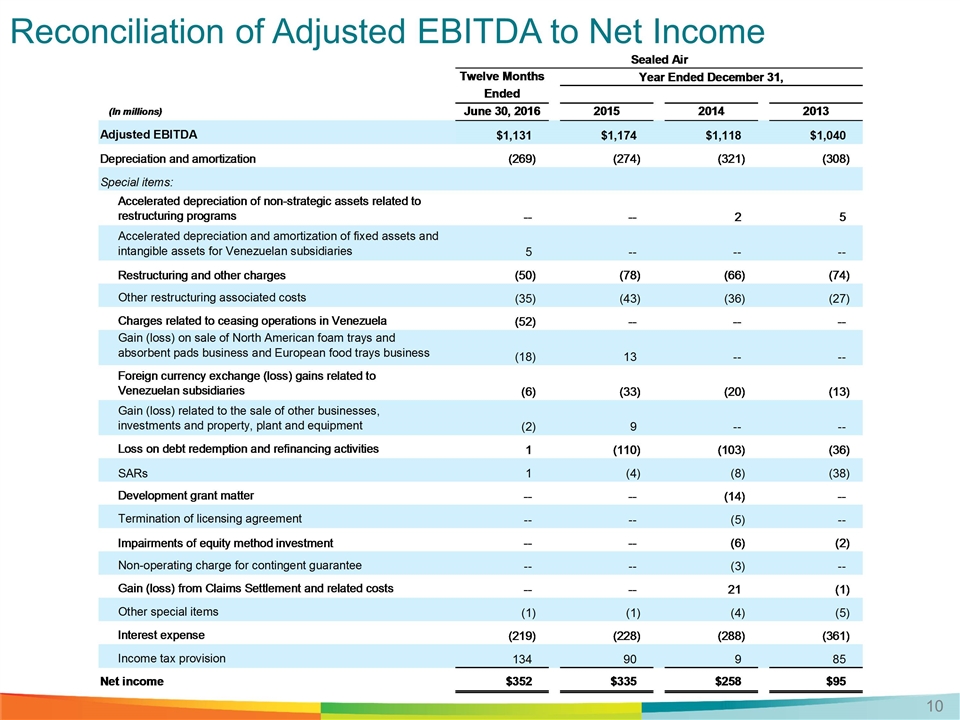

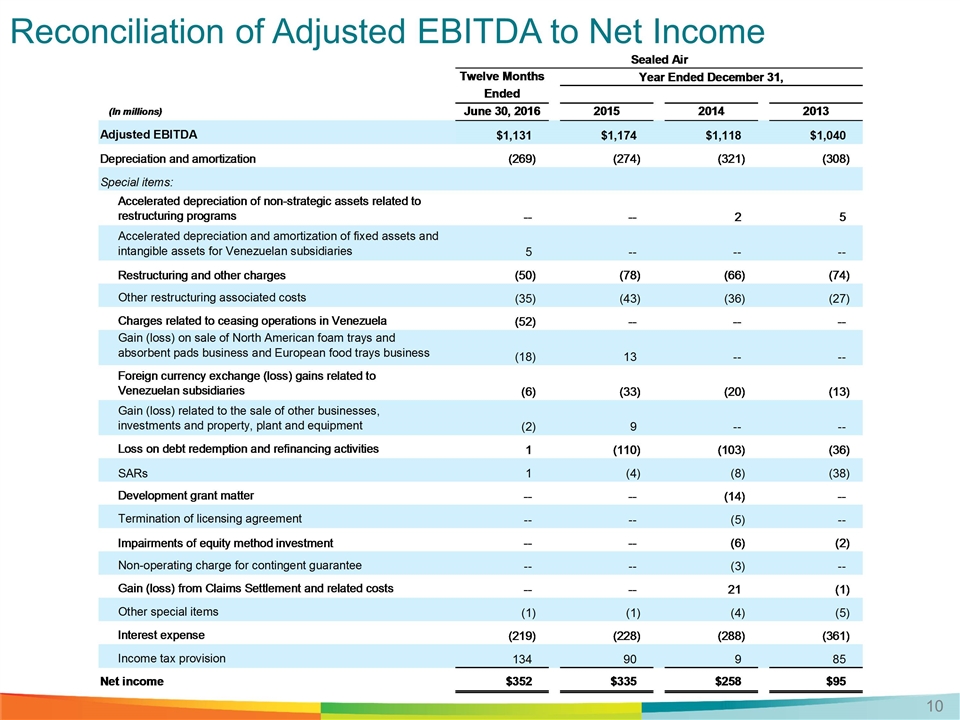

Reconciliation of Adjusted EBITDA to Net Income 10

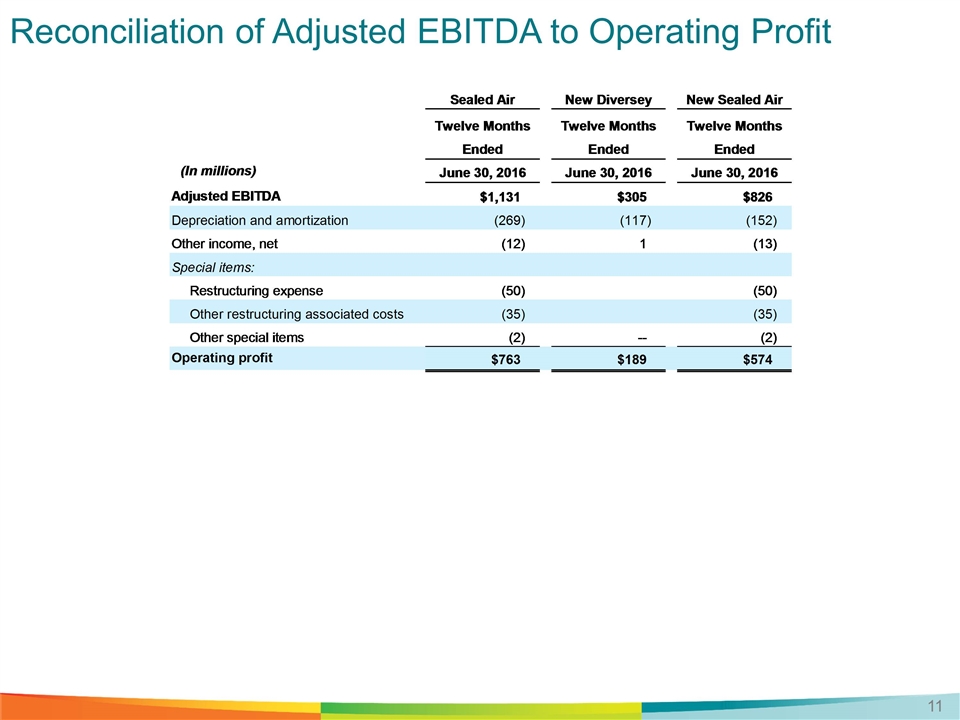

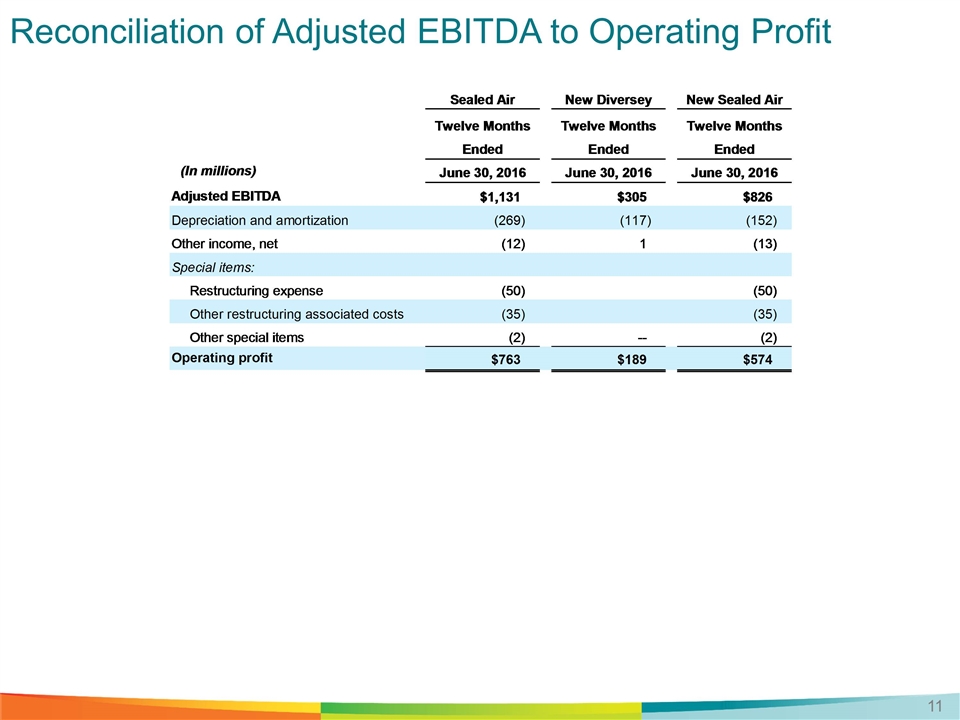

Reconciliation of Adjusted EBITDA to Operating Profit 11