Exhibit 99.1

Hong Kong Exchanges and Clearing Limited and The Stock Exchange of Hong Kong Limited take no responsibility for the contents of this announcement, make no representation as to its accuracy or completeness and expressly disclaim any liability whatsoever for any loss howsoever arising from or in reliance upon the whole or any part of the contents of this announcement.

(a joint stock limited company incorporated in the People’s Republic of China)

(Stock Code: 00525)

2014 ANNUAL RESULT ANNOUNCEMENT

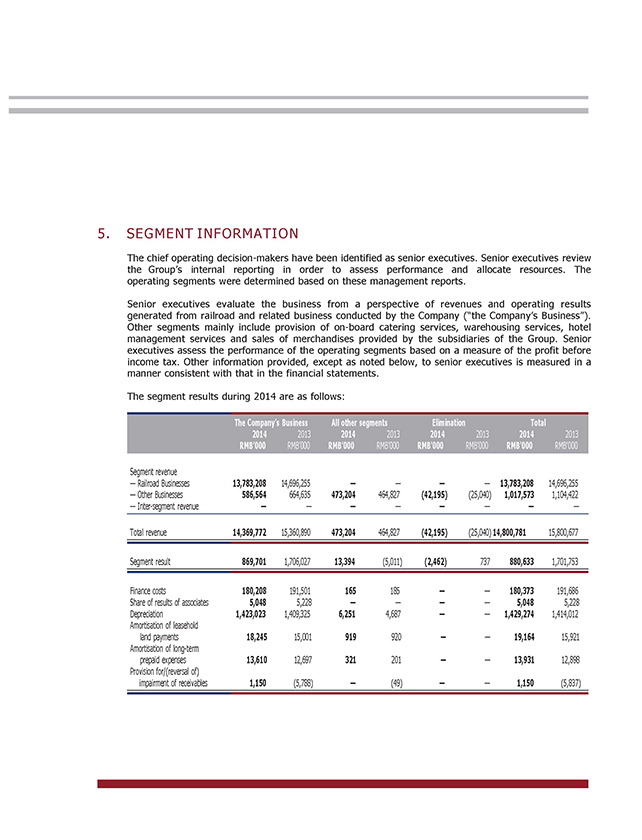

| The Board of Directors of Guangshen Railway Company Limited (the “Company”) is pleased to announce the audited results of the Company and its subsidiaries for the year ended 31 December 2014. This announcement, containing the full text of the 2014 Annual Report of the Company, complies with the relevant requirements of the Rules Governing the Listing of Securities on The Stock Exchange of Hong Kong Limited in relation to information to accompany preliminary announcement of annual results. Printed version of the Company’s 2014 Annual Report will be available on the websites of the HKExnews of The Stock Exchange of Hong Kong Limited at www.hkexnews.hk and of the Company at www.gsrc.com on 25 March 2015 and will be despatched to holders of H sh ares of the Company as soon as practicable. |

GUANGSHEN RAILWAY 2014 ANNUAL REPORT Chapter 1 Definitions and Statement of Material Risks I. DEFINITIONS In this report, unless the context otherwise requires, the expressions stated below will have the following meanings: The Company, Company, Guangshen Railway Reporting period, this period, this year Guangshen Railway Company Limited 12 months from January 1 to December 31, 2014 Same period last year, last year 12 months from January 1 to December 31, 2013 A Share Renminbi-denominated ordinary shares of the Company with a par value of RMB1.00 issued in the PRC and listed on the SSE for subscription in Renminbi H Share Overseas listed foreign shares of the Company with a par value of RMB1.00 issued in Hong Kong and listed on the SEHK for subscription in Hong Kong dollars. ADS U .S. dollar-denominated American Depositary Shares representing ownership of 50 H shares issued by trustees in the United States under the authorization of the Company CSRC The China Securities Regulatory Commission SSRB The Shenzhen Securities Regulatory Bureau of the China Securities Regulatory Commission HKSFC The Securities and Futures Commission of Hong Kong SSE The Shanghai Stock Exchange SEHK The Hong Kong Stock Exchange NYSE The New York Stock Exchange SFO The Securities and Futures Ordinance (Cap. 571 of the Laws of Hong Kong) Listing Rules The listing rules of SEHK and/or the listing rules of SSE (as the case may be) Articles The articles of associations of the Company Company Law The Company Law of the People’s Republic of China Securities Law The Securities Law of the People’s Republic of China CRC China Railway Corporation GRGC, largest shareholder Guangzhou Railway (Group) Company GEDC Guangzhou Railway (Group) Guangshen Railway Enterprise Development Company YCR Guangzhou Railway Group YangCheng Railway Enterprise Development Company GZIR Guangdong Guangzhou Intercity Rail Transportation Company Limited WGPR Wuhan-Guangzhou Passenger Railway Line Co., Ltd. GSHER Guangzhou-Shenzhen-Hong Kong Express Rail Link Company Limited GZR Guangzhou-Zhuhai Railway Company Limited XSR Xiamen-Shenzhen Railway Company Limited GSR Ganzhou-Shaoguan Railway Company Limited

| 014 | ||

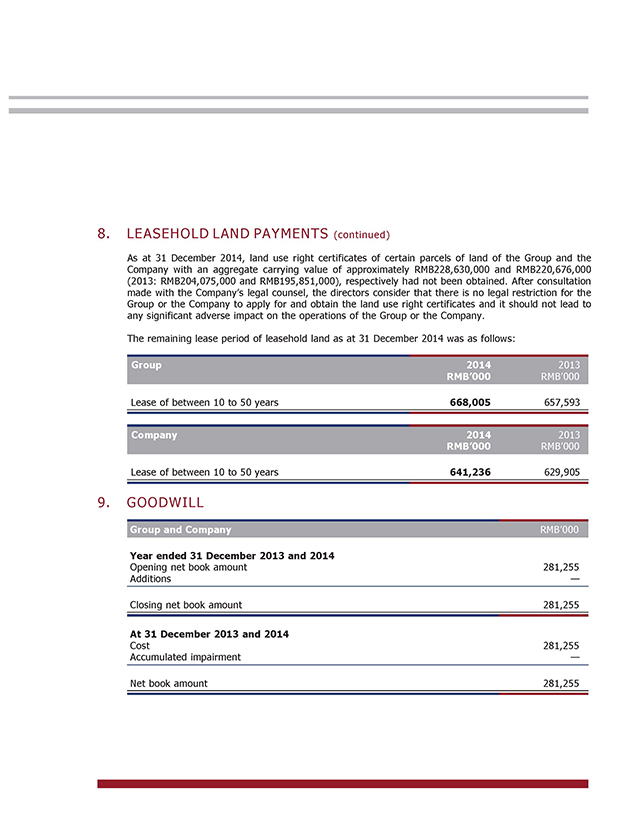

| 015 |

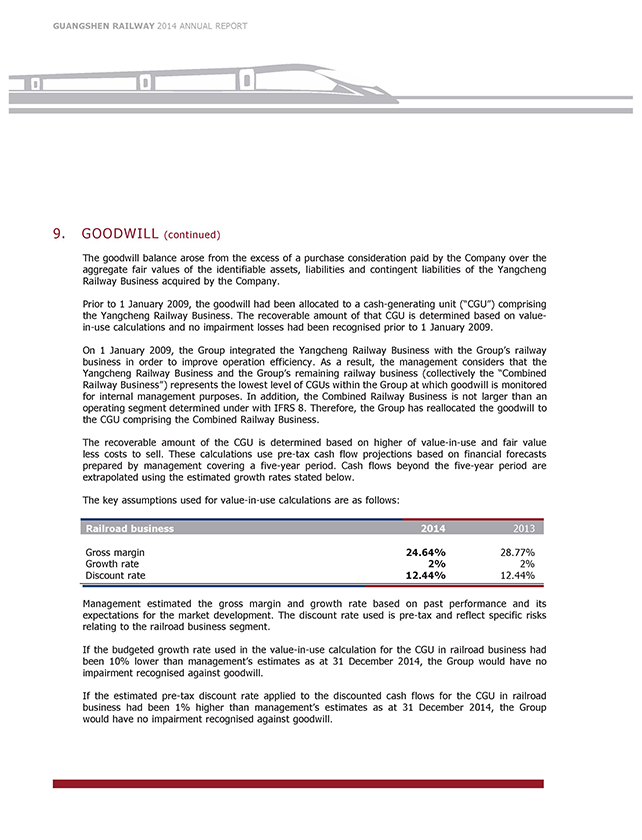

014 015 II. NOTICE OF MATERIAL RISKS This annual report contains details of existing operating risks. Please read ‘The Board’s Discussion and Analysis on the Future Development of the Company’ in the chapter ‘Report of Directors’ for details.

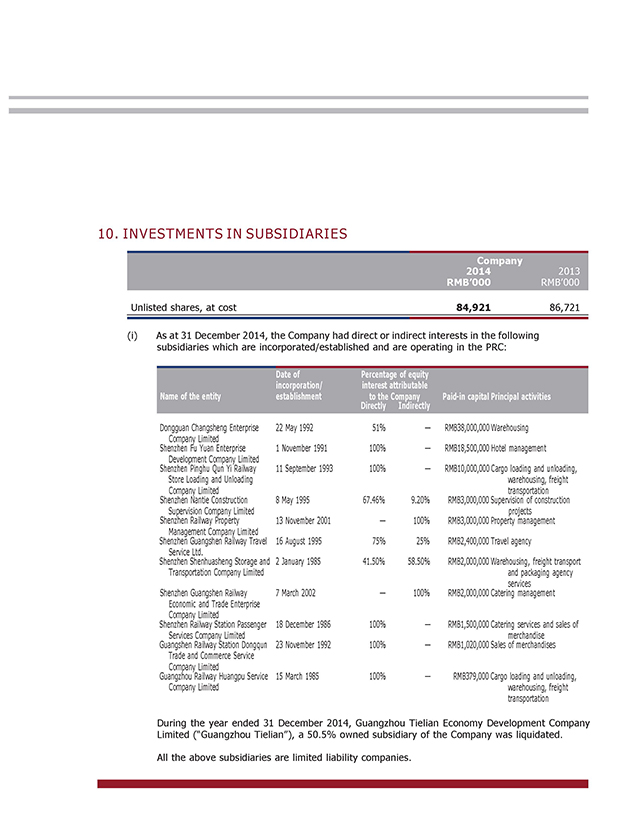

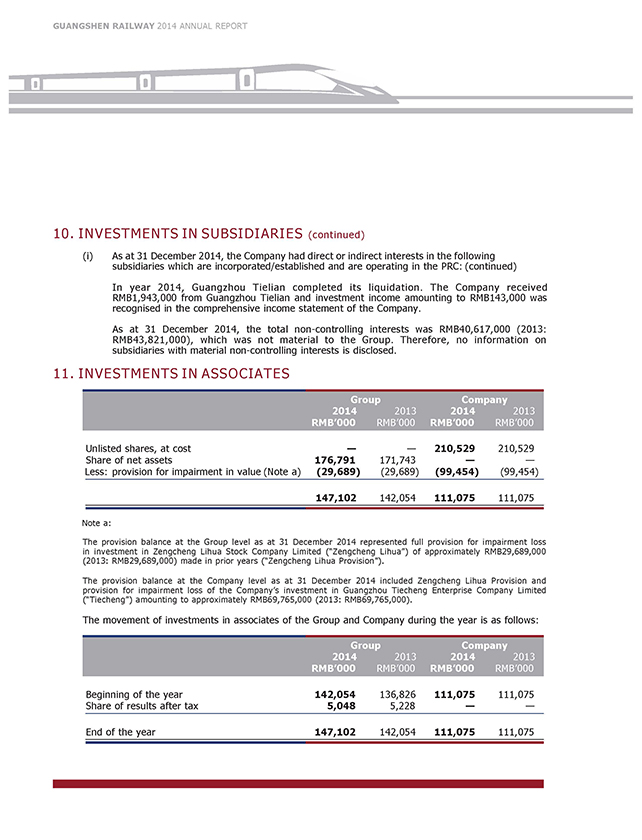

Chapter 2 Company Profile I. GENERAL INFORMATION OF THE COMPANY 1. Company Information Registered Chinese Name Abbreviation in Chinese Registered English Name Legal Representative Guangshen Railway Company Limited Wu Yong 2. Contact Person and Contact Information Company Secretary Representative of Securities Affairs Name Guo Xiangdong Deng Yanxia Address No. 1052, Heping Road, Shenzhen, Guangdong Province Tel (86) 755-25588150 Fax (86) 755-25591480 3. Email Basic Information ir@gsrc.com Registered address and place of business No. 1052, Heping Road, Shenzhen, Guangdong Province Postal code of the Company’s Registered address and place of business 518010

| 016 | ||

| 017 |

Website http://www.gsrc.com Email ir@gsrc.com 4. Places for Information Disclosure and Reserve Address Newspapers for information disclosure China Securities Journal, Securities Times, Shanghai Securities News, Securities Daily Websites publishing the annual report http://www.sse.com.cn http://www.hkexnews.hk http://www.gsrc.com Reserve address of the annual report No. 1052, Heping Road, Shenzhen, Guangdong Province

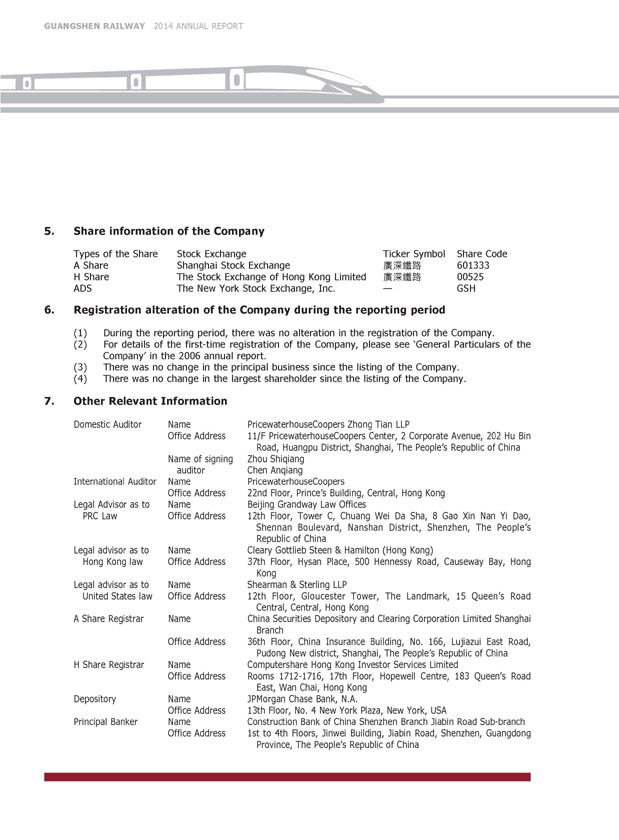

5. Share information of the Company Types of the Share Stock Exchange Ticker Symbol Share Code A Share Shanghai Stock Exchange 601333 H Share The Stock Exchange of Hong Kong Limited 00525 ADS The New York Stock Exchange, Inc. — GSH 6. Registration alteration of the Company during the reporting period (1) During the reporting period, there was no alteration in the registration of the Company. (2) For details of the first-time registration of the Company, please see ‘General Particulars of the Company’ in the 2006 annual report. (3) There was no change in the principal business since the listing of the Company. (4) There was no change in the largest shareholder since the listing of the Company. 7. Other Relevant Information Domestic Auditor Name PricewaterhouseCoopers Zhong Tian LLP Office Address 11/F PricewaterhouseCoopers Center, 2 Corporate Avenue, 202 Hu Bin Name of signing auditor Road, Huangpu District, Shanghai, The People’s Republic of China Zhou Shiqiang Chen Anqiang International Auditor Name PricewaterhouseCoopers Office Address 22nd Floor, Prince’s Building, Central, Hong Kong Legal Advisor as to PRC Law Legal advisor as to Hong Kong law Legal advisor as to United States law Name Beijing Grandway Law Offices Office Address 12th Floor, Tower C, Chuang Wei Da Sha, 8 Gao Xin Nan Yi Dao, Shennan Boulevard, Nanshan District, Shenzhen, The People’s Republic of China Name Cleary Gottlieb Steen & Hamilton (Hong Kong) Office Address 37th Floor, Hysan Place, 500 Hennessy Road, Causeway Bay, Hong Kong Name Shearman & Sterling LLP Office Address 12th Floor, Gloucester Tower, The Landmark, 15 Queen’s Road Central, Central, Hong Kong A Share Registrar Name China Securities Depository and Clearing Corporation Limited Shanghai Branch Office Address 36th Floor, China Insurance Building, No. 166, Lujiazui East Road, Pudong New district, Shanghai, The People’s Republic of China H Share Registrar Name Computershare Hong Kong Investor Services Limited Office Address Rooms 1712-1716, 17th Floor, Hopewell Centre, 183 Queen’s Road East, Wan Chai, Hong Kong Depository Name JPMorgan Chase Bank, N.A. Office Address 13th Floor, No. 4 New York Plaza, New York, USA Principal Banker Name Construction Bank of China Shenzhen Branch Jiabin Road Sub-branch Office Address 1st to 4th Floors, Jinwei Building, Jiabin Road, Shenzhen, Guangdong Province, The People’s Republic of China

| 018 | ||

| 019 |

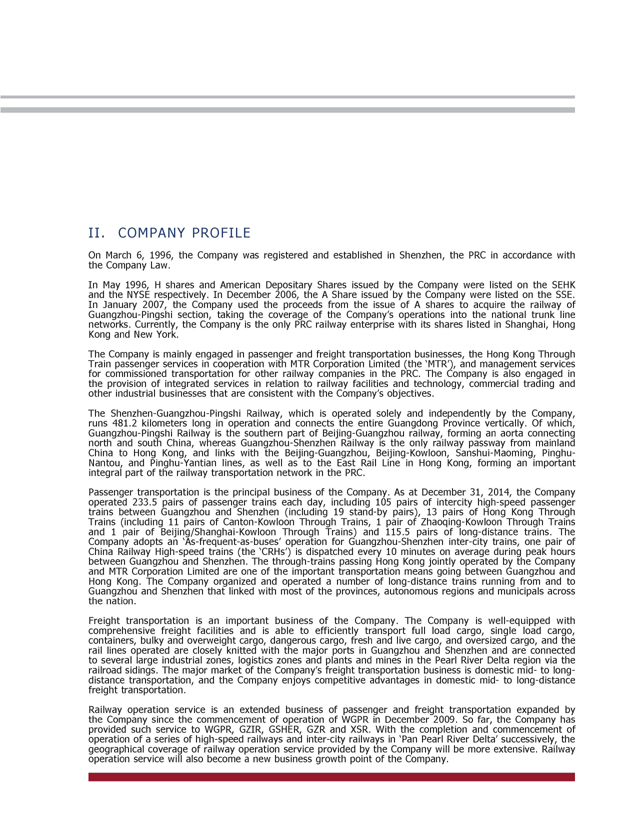

II. COMPANY PROFILE On March 6, 1996, the Company was registered and established in Shenzhen, the PRC in accordance with the Company Law. In May 1996, H shares and American Depositary Shares issued by the Company were listed on the SEHK and the NYSE respectively. In December 2006, the A Share issued by the Company were listed on the SSE. In January 2007, the Company used the proceeds from the issue of A shares to acquire the railway of Guangzhou-Pingshi section, taking the coverage of the Company’s operations into the national trunk line networks. Currently, the Company is the only PRC railway enterprise with its shares listed in Shanghai, Hong Kong and New York. The Company is mainly engaged in passenger and freight transportation businesses, the Hong Kong Through Train passenger services in cooperation with MTR Corporation Limited (the ‘MTR’), and management services for commissioned transportation for other railway companies in the PRC. The Company is also engaged in the provision of integrated services in relation to railway facilities and technology, commercial trading and other industrial businesses that are consistent with the Company’s objectives. The Shenzhen-Guangzhou-Pingshi Railway, which is operated solely and independently by the Company, runs 481.2 kilometers long in operation and connects the entire Guangdong Province vertically. Of which, Guangzhou-Pingshi Railway is the southern part of Beijing-Guangzhou railway, forming an aorta connecting north and south China, whereas Guangzhou-Shenzhen Railway is the only railway passway from mainland China to Hong Kong, and links with the Beijing-Guangzhou, Beijing-Kowloon, Sanshui-Maoming, Pinghu- Nantou, and Pinghu-Yantian lines, as well as to the East Rail Line in Hong Kong, forming an important integral part of the railway transportation network in the PRC. Passenger transportation is the principal business of the Company. As at December 31, 2014, the Company operated 233.5 pairs of passenger trains each day, including 105 pairs of intercity high-speed passenger trains between Guangzhou and Shenzhen (including 19 stand-by pairs), 13 pairs of Hong Kong Through Trains (including 11 pairs of Canton-Kowloon Through Trains, 1 pair of Zhaoqing-Kowloon Through Trains and 1 pair of Beijing/Shanghai-Kowloon Through Trains) and 115.5 pairs of long-distance trains. The Company adopts an ‘As-frequent-as-buses’ operation for Guangzhou-Shenzhen inter-city trains, one pair of China Railway High-speed trains (the ‘CRHs’) is dispatched every 10 minutes on average during peak hours between Guangzhou and Shenzhen. The through-trains passing Hong Kong jointly operated by the Company and MTR Corporation Limited are one of the important transportation means going between Guangzhou and Hong Kong. The Company organized and operated a number of long-distance trains running from and to Guangzhou and Shenzhen that linked with most of the provinces, autonomous regions and municipals across the nation. Freight transportation is an important business of the Company. The Company is well-equipped with comprehensive freight facilities and is able to efficiently transport full load cargo, single load cargo, containers, bulky and overweight cargo, dangerous cargo, fresh and live cargo, and oversized cargo, and the rail lines operated are closely knitted with the major ports in Guangzhou and Shenzhen and are connected to several large industrial zones, logistics zones and plants and mines in the Pearl River Delta region via the railroad sidings. The major market of the Company’s freight transportation business is domestic mid- to long- distance transportation, and the Company enjoys competitive advantages in domestic mid- to long-distance freight transportation. Railway operation service is an extended business of passenger and freight transportation expanded by the Company since the commencement of operation of WGPR in December 2009. So far, the Company has provided such service to WGPR, GZIR, GSHER, GZR and XSR. With the completion and commencement of operation of a series of high-speed railways and inter-city railways in ‘Pan Pearl River Delta’ successively, the geographical coverage of railway operation service provided by the Company will be more extensive. Railway operation service will also become a new business growth point of the Company.

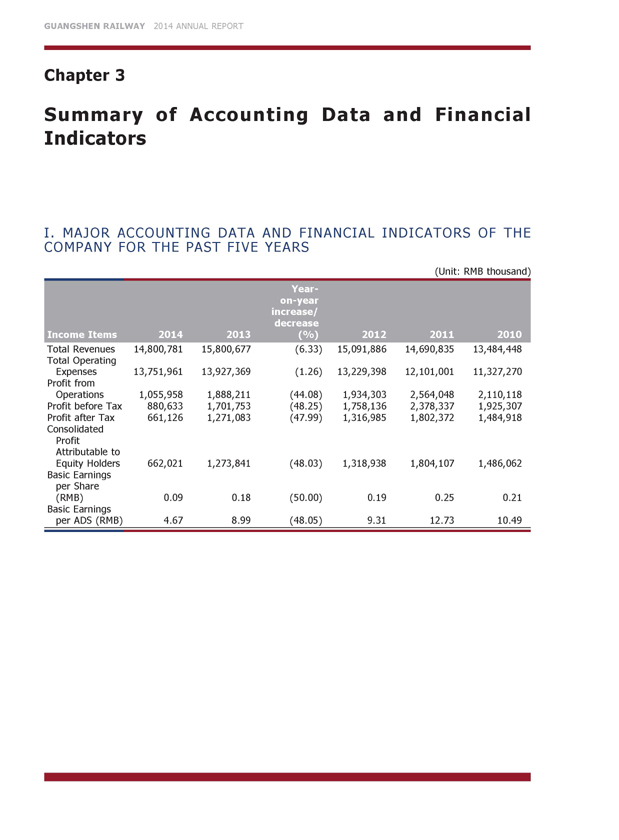

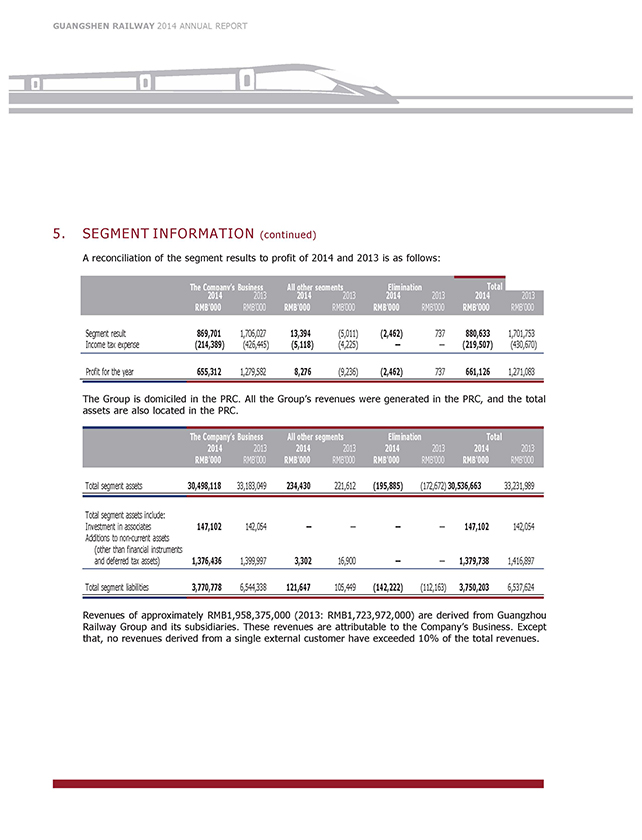

Chapter 3 Summary of Accounting Data and Financial Indicators I. MAJOR ACCOUNTING DATA AND FINANCIAL INDICATORS OF THE COMPANY FOR THE PAST FIVE YEARS (Unit: RMB thousand) Income Items 2014 2013 Year- on-year increase/ decrease (%) 2012 2011 2010 Total Revenues 14,800,781 15,800,677 (6.33) 15,091,886 14,690,835 13,484,448 Total Operating Expenses 13,751,961 13,927,369 (1.26) 13,229,398 12,101,001 11,327,270 Profit from Operations 1,055,958 1,888,211 (44.08) 1,934,303 2,564,048 2,110,118 Profit before Tax 880,633 1,701,753 (48.25) 1,758,136 2,378,337 1,925,307 Profit after Tax 661,126 1,271,083 (47.99) 1,316,985 1,802,372 1,484,918 Consolidated Profit Attributable to Equity Holders 662,021 1,273,841 (48.03) 1,318,938 1,804,107 1,486,062 Basic Earnings per Share (RMB) 0.09 0.18 (50.00) 0.19 0.25 0.21 Basic Earnings per ADS (RMB) 4.67 8.99 (48.05) 9.31 12.73 10.49

| 020 | ||

| 021 |

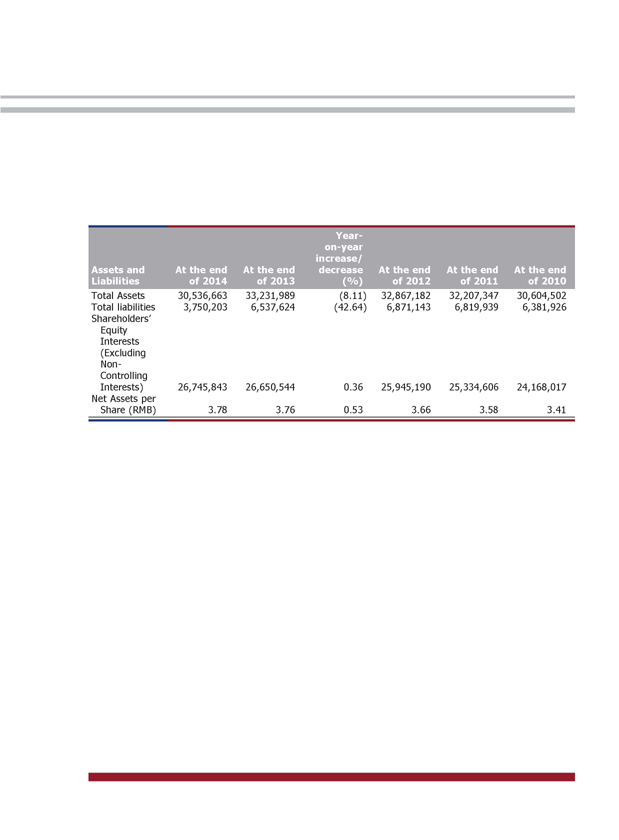

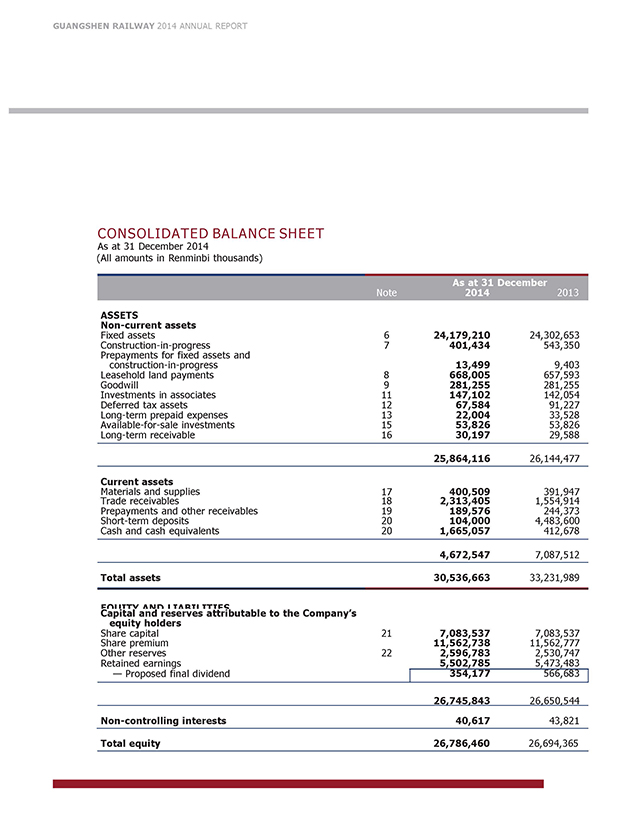

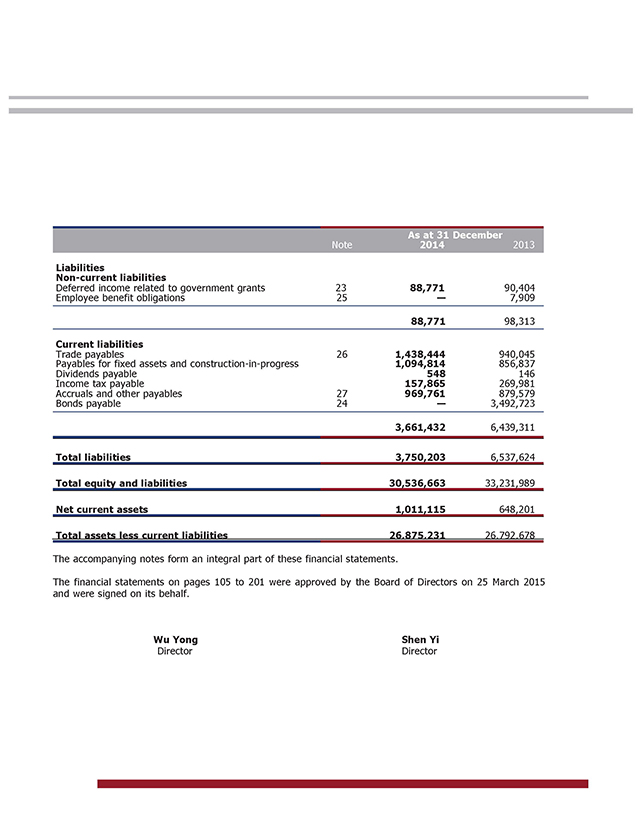

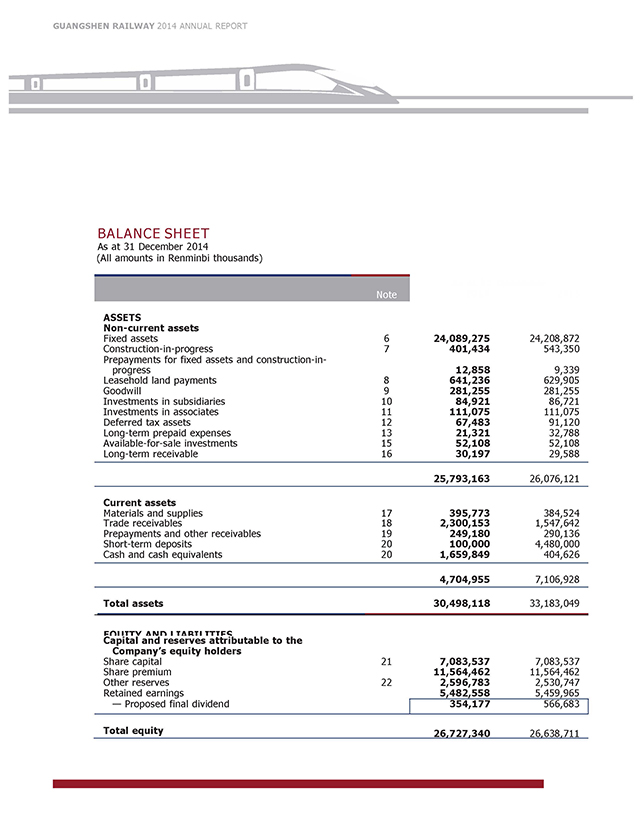

Assets and Liabilities At the end of 2014 At the end of 2013 Year- on-year increase/ decrease (%) At the end of 2012 At the end of 2011 At the end of 2010 Total Assets 30,536,663 33,231,989 (8.11) 32,867,182 32,207,347 30,604,502 Total liabilities 3,750,203 6,537,624 (42.64) 6,871,143 6,819,939 6,381,926 Shareholders’ Equity Interests (Excluding Non- Controlling Interests) 26,745,843 26,650,544 0.36 25,945,190 25,334,606 24,168,017 Net Assets per Share (RMB) 3.78 3.76 0.53 3.66 3.58 3.41

Chapter 4 Report of Directors Chairman 1. CHAIRMAN’S STATEMENT Dear Shareholders, I am hereby pleased to present the audited operating results of the Company and its subsidiaries for the year 2014 for the shareholders to review. 1. Business Review In 2014, in face of an unfavourable operating environment with stalled growth in the macro economy, sluggish demand in railway market and keen competition in the transportation market, the Company strived to achieve the operation targets set out by the Board, including the enhancement of coordination in workplace safety, exploration of operational potentials, improvement in passenger and freight services, improvement in assets management, strengthening of cost control and standardization of operation management, which have ensured the safety and stability of transport and production and the smooth progress in implementing different tasks. However, with the extension of the pilot scheme of “substituting business tax with value-added tax” to railway transportation industry on 1 January 2014, the Company’s operating revenues shrank significantly during the reporting period as compared with the previous year, resulting in a sharp decline in net profit year-on-year despite there was a slight decline of operating costs.

| 022 | ||

| 023 |

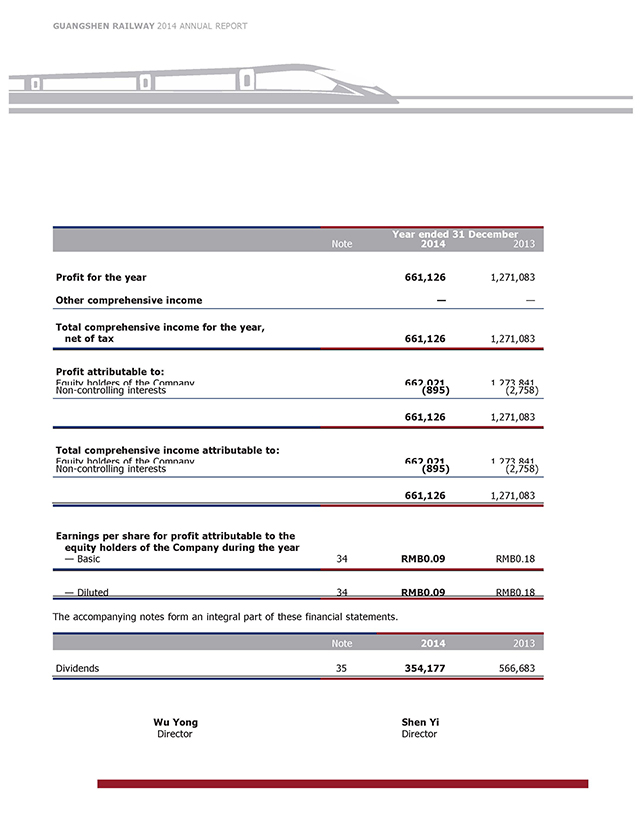

In 2014, the company achieved a passenger delivery volume of 90.1127 million persons, representing a year-on-year decrease of 0.93%; a tonnage of freight of 18.3178 million tonnes, representing a year-on- year decrease of 9.96%; operating revenues of RMB14,801 million, representing a year-on-year decrease of 6.33%; consolidated profits attributable to shareholders of RMB662 million, representing a year-on-year decrease of 48.03%, and basic earnings per share of RMB0.09. In 2014, the Board has duly performed their duties under the Company’s Articles of Association. With their meticulous and conscientious effort, the Directors strived to enhance the corporate governance and operation management of the Company. The company has convened 2 general meetings, 6 board meetings and 6 audit committee meetings during the year, in which sound decisions in relation to the Company’s financial budget, production and operation, connected transactions as well as system establishments were made to ensure the Company’s stable and continuous development. The Company upholds long-term and stable cash dividend policy. The Board recommends the payment of final cash dividend of RMB0.05 per share for 2014, representing 55.56% of the basic earnings per share of this year. The proposed final dividend for 2014 shall be subject to approval at the annual general meeting to be held on May 28, 2015. 2. Prospects In 2015, with the railway spirit of “Safety, Quality, Development of Railway and Prosperity of Country” in the new era, the Company will preserve the main theme of scientific and harmonious development, will implement the scientific decisions of the general meetings of shareholders and the Board and uphold the operating objectives of the Company, firmly promote safety and risk management, incessantly deepen the reform of transportation organization, forcefully develop the core businesses of passenger and freight transportation, enhance and perfect the service management of railway operation, proactively explore diverse business channels, as well as further perfect the Company’s governance, regulate the Company’s operation, promote the development of the Company in the areas of safety, operation, construction and stability, with the objective of shaping the Company into a listed company that epitomizes safety and control, quality service, sound efficiency, and scientific management. In respect of safe production: we will establish a solid belief in safe development, fully implement safety and risk management and firmly promote the establishment of a standard for safety and quality, fully implement the requirements of “management standardization, operation standardization, inspection and rectification normalization” and improve support for production safety, with the aim of ensuring safety, uninterruption and stability of railway transportation.

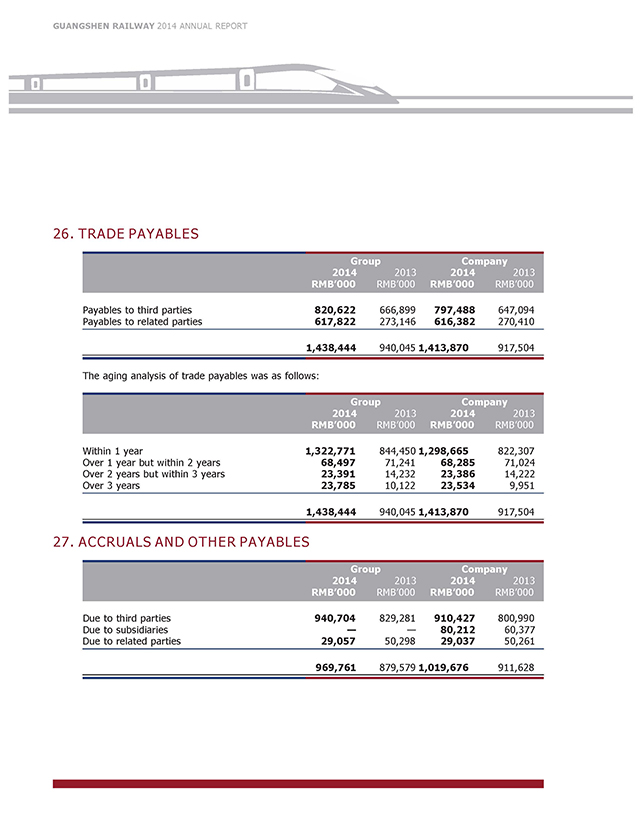

In respect of operation management: we will explore potential markets in passenger and freight transportation by fully implementing the reform in transportation system, improving key infrastructure to enhance passenger and freight transportation capacity, elevating the quality of transportation service, so as to fortify comprehensive competitiveness in core business as well as to increase revenue from passenger and freight transportation; we will also develop and extend railway operation services and enhance the mode of railway operation management, broaden the channels of sales, cultivate new growth point, strengthen budget management, standardize contract management and procurement procedures, fortify assets management, enhance control on costs and expenses, and increase operation management standard and efficiency. In respect of corporate governance: we will adhere to the principle of corporate governance by law, further perfect the governance structure and system of the Company as a corporate person, and maintain the legal interests of the Company and the shareholders; we will also augment the internal control system, improve the internal control environment, regulate the internal decision procedures and ensure the operation of the Company in compliance with the laws and regulations; and fortify the implementation of the information disclosure principle of “truthfulness, accuracy, completeness, timeliness and fairness” in an effort to enhance the quality of information disclosure and increase the transparency of the Company. I, together with the members of the Board, believe that in the forthcoming year, the Company is going to attain new achievements in different aspects, create new values for our shareholders and make new contributions to the development of society under the strong support of all shareholders and various sectors of the society, along with the joint efforts of the Board, supervisory committee, management and all the staff. By order of the Board Wu Yong Chairman of the Board Shenzhen, China 25 March 2015

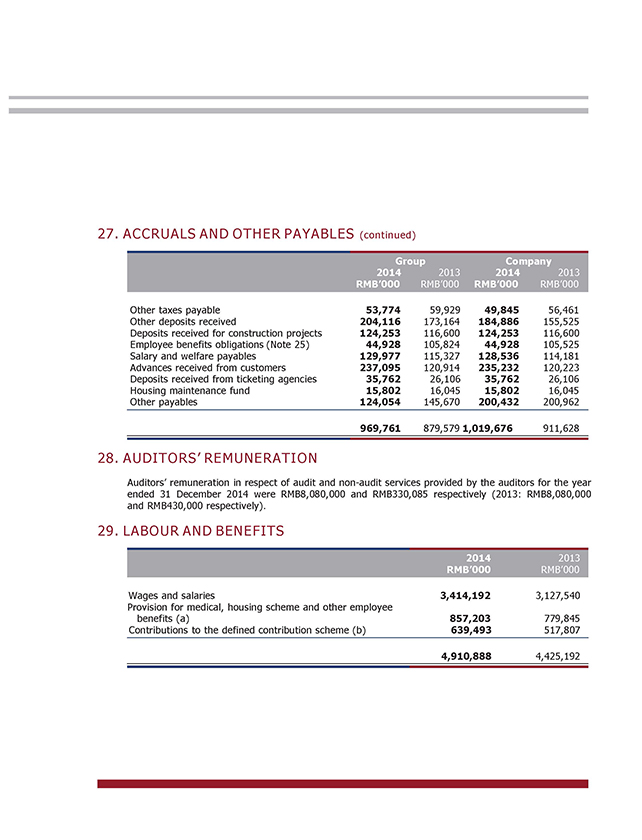

| 024 | ||

| 025 |

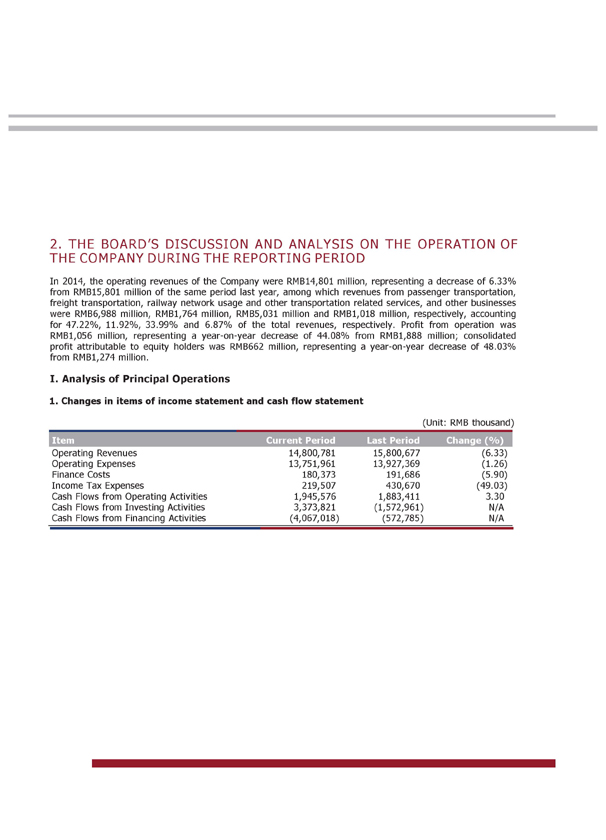

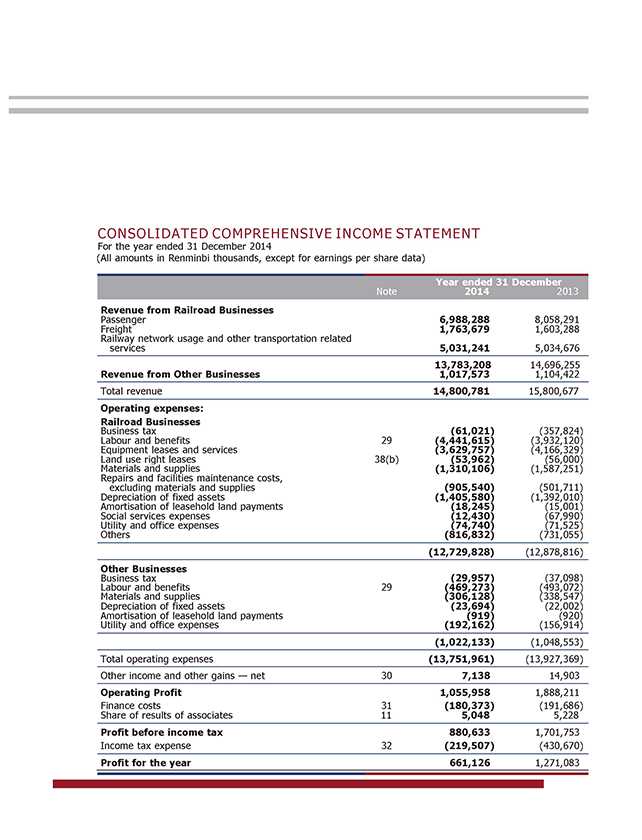

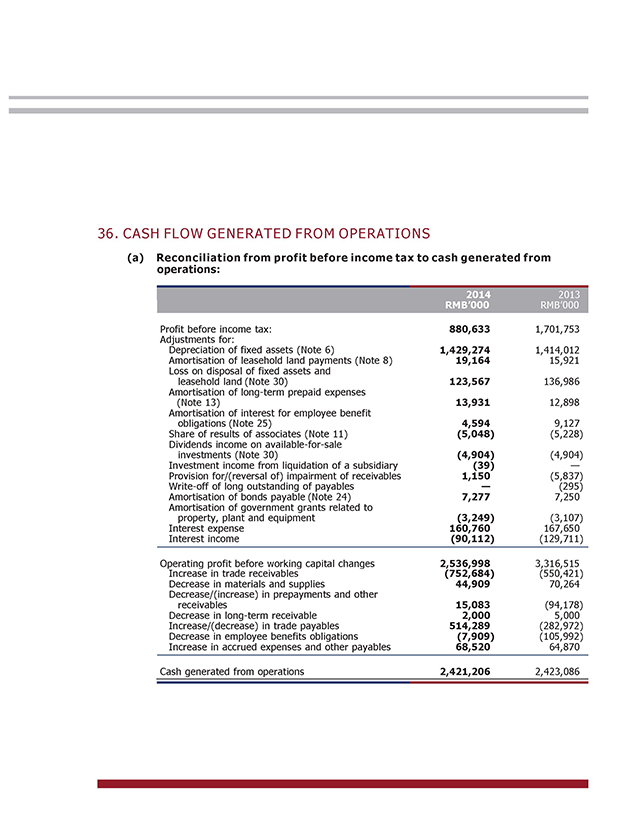

2. THE BOARD’S DISCUSSION AND ANALYSIS ON THE OPERATION OF THE COMPANY DURING THE REPORTING PERIOD In 2014, the operating revenues of the Company were RMB14,801 million, representing a decrease of 6.33% from RMB15,801 million of the same period last year, among which revenues from passenger transportation, freight transportation, railway network usage and other transportation related services, and other businesses were RMB6,988 million, RMB1,764 million, RMB5,031 million and RMB1,018 million, respectively, accounting for 47.22%, 11.92%, 33.99% and 6.87% of the total revenues, respectively. Profit from operation was RMB1,056 million, representing a year-on-year decrease of 44.08% from RMB1,888 million; consolidated profit attributable to equity holders was RMB662 million, representing a year-on-year decrease of 48.03% from RMB1,274 million. I. Analysis of Principal Operations 1. Changes in items of income statement and cash flow statement (Unit: RMB thousand) Item Current Period Last Period Change (%) Operating Revenues 14,800,781 15,800,677 (6.33) Operating Expenses 13,751,961 13,927,369 (1.26) Finance Costs 180,373 191,686 (5.90) Income Tax Expenses 219,507 430,670 (49.03) Cash Flows from Operating Activities 1,945,576 1,883,411 3.30 Cash Flows from Investing Activities 3,373,821 (1,572,961) N/A Cash Flows from Financing Activities (4,067,018) (572,785) N/A

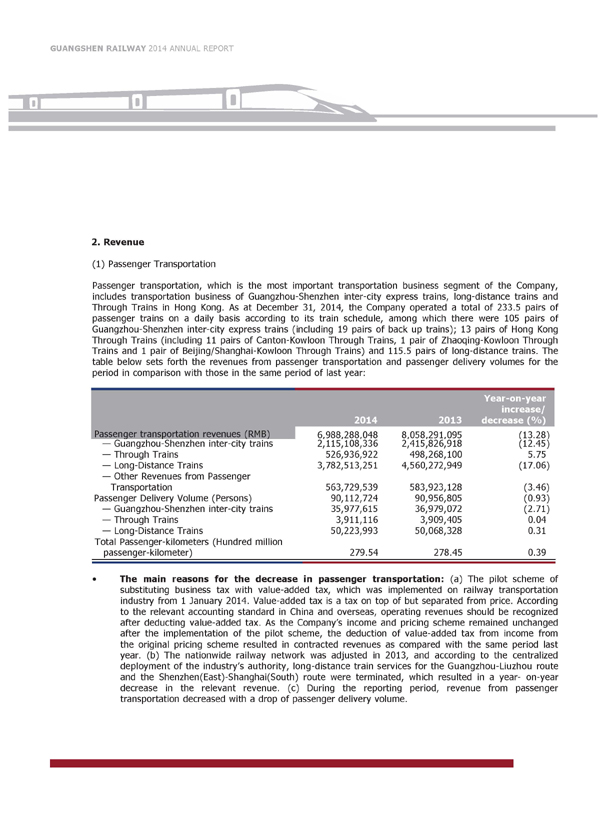

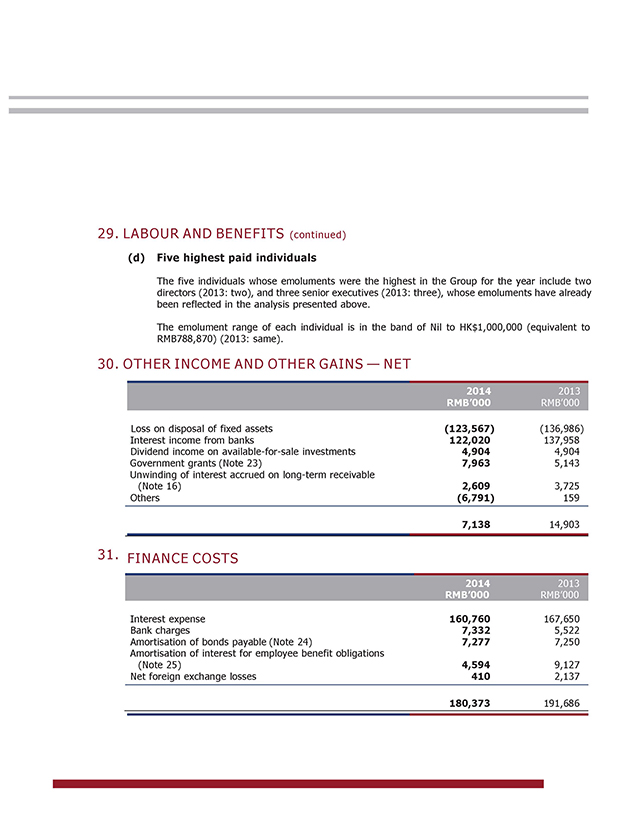

2. Revenue (1) Passenger Transportation Passenger transportation, which is the most important transportation business segment of the Company, includes transportation business of Guangzhou-Shenzhen inter-city express trains, long-distance trains and Through Trains in Hong Kong. As at December 31, 2014, the Company operated a total of 233.5 pairs of passenger trains on a daily basis according to its train schedule, among which there were 105 pairs of Guangzhou-Shenzhen inter-city express trains (including 19 pairs of back up trains); 13 pairs of Hong Kong Through Trains (including 11 pairs of Canton-Kowloon Through Trains, 1 pair of Zhaoqing-Kowloon Through Trains and 1 pair of Beijing/Shanghai-Kowloon Through Trains) and 115.5 pairs of long-distance trains. The table below sets forth the revenues from passenger transportation and passenger delivery volumes for the period in comparison with those in the same period of last year: Passenger transportation revenues (RMB) 2014 2013 Year-on-year increase/ decrease (%) 6,988,288,048 8,058,291,095 (13.28) — Guangzhou-Shenzhen inter-city trains 2,115,108,336 2,415,826,918 (12.45) — Through Trains 526,936,922 498,268,100 5.75 — Long-Distance Trains 3,782,513,251 4,560,272,949 (17.06) — Other Revenues from Passenger Transportation 563,729,539 583,923,128 (3.46) Passenger Delivery Volume (Persons) 90,112,724 90,956,805 (0.93) — Guangzhou-Shenzhen inter-city trains 35,977,615 36,979,072 (2.71) — Through Trains 3,911,116 3,909,405 0.04 — Long-Distance Trains 50,223,993 50,068,328 0.31 Total Passenger-kilometers (Hundred million passenger-kilometer) 279.54 278.45 0.39 • The main reasons for the decrease in passenger transportation: (a) The pilot scheme of substituting business tax with value-added tax, which was implemented on railway transportation industry from 1 January 2014. Value-added tax is a tax on top of but separated from price. According to the relevant accounting standard in China and overseas, operating revenues should be recognized after deducting value-added tax. As the Company’s income and pricing scheme remained unchanged after the implementation of the pilot scheme, the deduction of value-added tax from income from the original pricing scheme resulted in contracted revenues as compared with the same period last year. (b) The nationwide railway network was adjusted in 2013, and according to the centralized deployment of the industry’s authority, long-distance train services for the Guangzhou-Liuzhou route and the Shenzhen(East)-Shanghai(South) route were terminated, which resulted in a year- on-year decrease in the relevant revenue. (c) During the reporting period, revenue from passenger transportation decreased with a drop of passenger delivery volume.

| 026 | ||

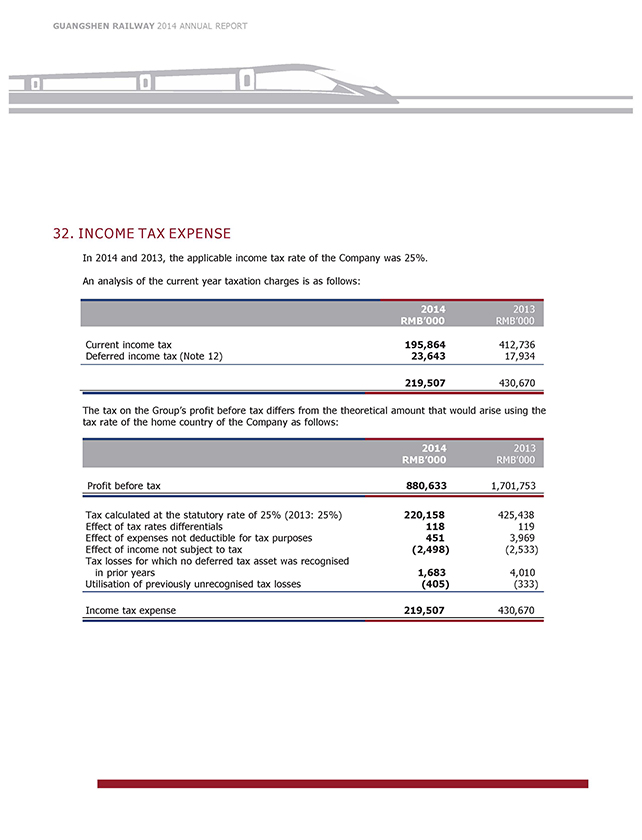

| 027 |

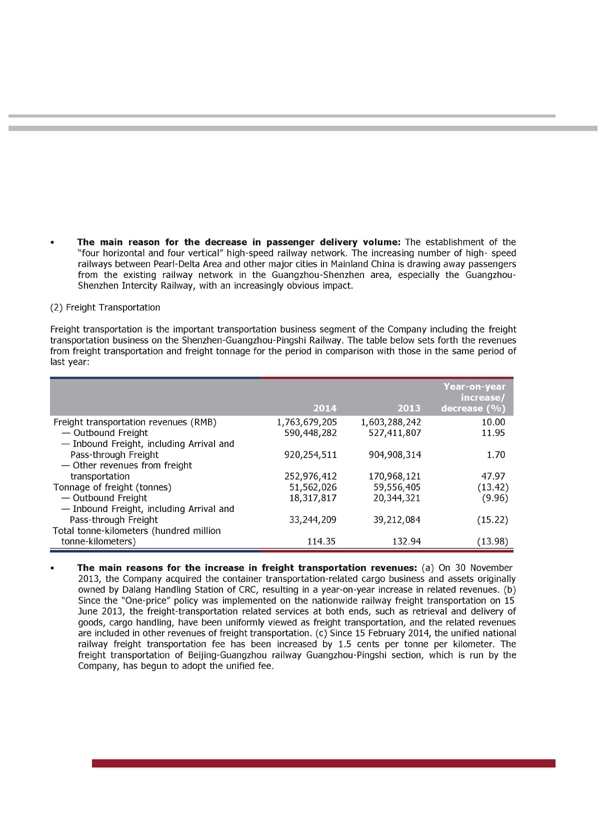

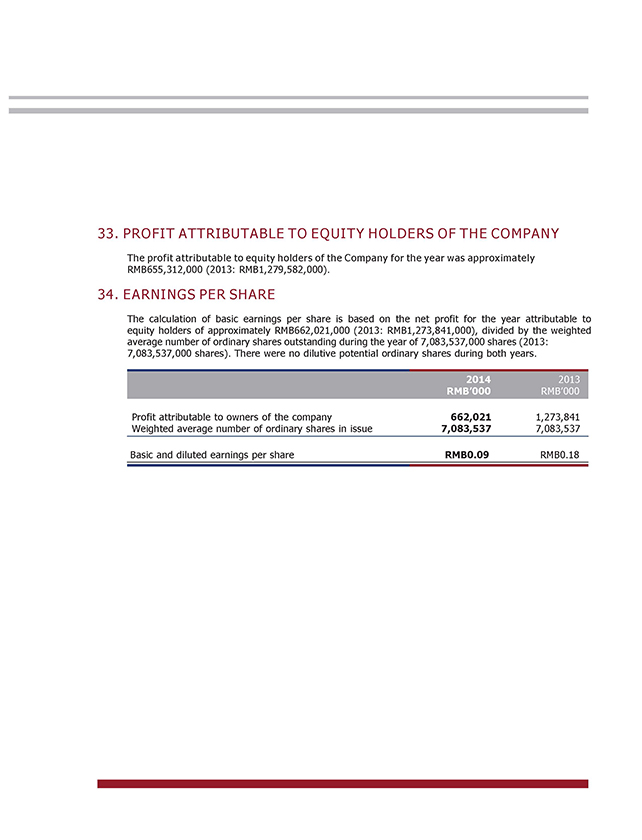

• The main reason for the decrease in passenger delivery volume: The establishment of the “four horizontal and four vertical” high-speed railway network. The increasing number of high- speed railways between Pearl-Delta Area and other major cities in Mainland China is drawing away passengers from the existing railway network in the Guangzhou-Shenzhen area, especially the Guangzhou-Shenzhen Intercity Railway, with an increasingly obvious impact. (2) Freight Transportation Freight transportation is the important transportation business segment of the Company including the freight transportation business on the Shenzhen-Guangzhou-Pingshi Railway. The table below sets forth the revenues from freight transportation and freight tonnage for the period in comparison with those in the same period of last year: 2014 2013 Year-on-year increase/ decrease (%) 2014 2013 2014 2013 Year-on-year increase/ Freight transportation revenues (RMB) 1,763,679,205 1,603,288,242 10.00 — Outbound Freight 590,448,282 527,411,807 11.95 — Inbound Freight, including Arrival and Pass-through Freight 920,254,511 904,908,314 1.70 — Other revenues from freight transportation 252,976,412 170,968,121 47.97 Tonnage of freight (tonnes) 51,562,026 59,556,405 (13.42) — Outbound Freight 18,317,817 20,344,321 (9.96) — Inbound Freight, including Arrival and Pass-through Freight 33,244,209 39,212,084 (15.22) Total tonne-kilometers (hundred million tonne-kilometers) 114.35 132.94 (13.98) • The main reasons for the increase in freight transportation revenues: (a) On 30 November 2013, the Company acquired the container transportation-related cargo business and assets originally owned by Dalang Handling Station of CRC, resulting in a year-on-year increase in related revenues. (b) Since the “One-price” policy was implemented on the nationwide railway freight transportation on 15 June 2013, the freight-transportation related services at both ends, such as retrieval and delivery of goods, cargo handling, have been uniformly viewed as freight transportation, and the related revenues are included in other revenues of freight transportation. (c) Since 15 February 2014, the unified national railway freight transportation fee has been increased by 1.5 cents per tonne per kilometer. The freight transportation of Beijing-Guangzhou railway Guangzhou-Pingshi section, which is run by the Company, has begun to adopt the unified fee.

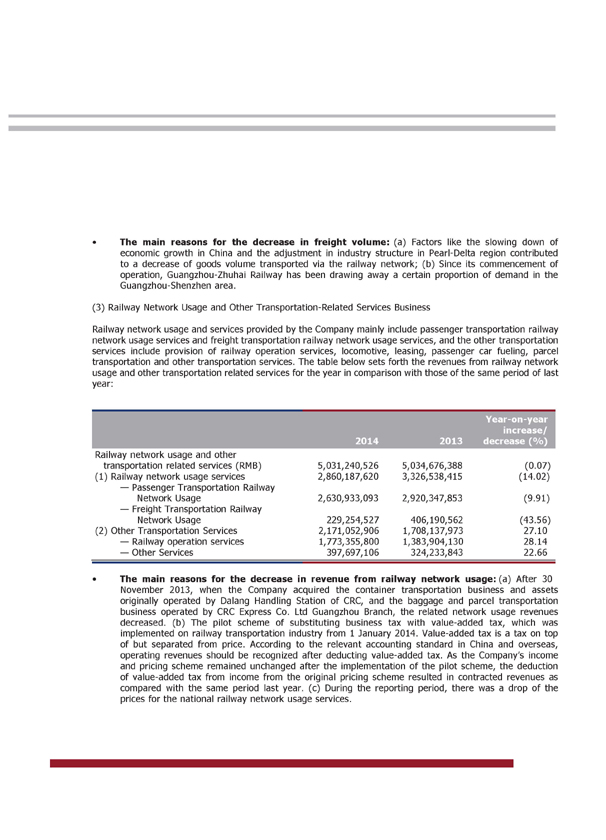

• The main reasons for the decrease in freight volume: (a) Factors like the slowing down of economic growth in China and the adjustment in industry structure in Pearl-Delta region contributed to a decrease of goods volume transported via the railway network; (b) Since its commencement of operation, Guangzhou-Zhuhai Railway has been drawing away a certain proportion of demand in the Guangzhou-Shenzhen area. (3) Railway Network Usage and Other Transportation-Related Services Business Railway network usage and services provided by the Company mainly include passenger transportation railway network usage services and freight transportation railway network usage services, and the other transportation services include provision of railway operation services, locomotive, leasing, passenger car fueling, parcel transportation and other transportation services. The table below sets forth the revenues from railway network usage and other transportation related services for the year in comparison with those of the same period of last year: 2014 2013 Year-on-year increase/ decrease (%) Railway network usage and other 2014 2013 Year-on-year increase/ decrease (%) transportation related services (RMB) 5,031,240,526 5,034,676,388 (0.07) (1) Railway network usage services 2,860,187,620 3,326,538,415 (14.02) — Passenger Transportation Railway Network Usage 2,630,933,093 2,920,347,853 (9.91) — Freight Transportation Railway Network Usage 229,254,527 406,190,562 (43.56) (2) Other Transportation Services 2,171,052,906 1,708,137,973 27.10 — Railway operation services 1,773,355,800 1,383,904,130 28.14 — Other Services 397,697,106 324,233,843 22.66 • The main reasons for the decrease in revenue from railway network usage: (a) After 30 November 2013, when the Company acquired the container transportation business and assets originally operated by Dalang Handling Station of CRC, and the baggage and parcel transportation business operated by CRC Express Co. Ltd Guangzhou Branch, the related network usage revenues decreased. (b) The pilot scheme of substituting business tax with value-added tax, which was implemented on railway transportation industry from 1 January 2014. Value-added tax is a tax on top of but separated from price. According to the relevant accounting standard in China and overseas, operating revenues should be recognized after deducting value-added tax. As the Company’s income and pricing scheme remained unchanged after the implementation of the pilot scheme, the deduction of value-added tax from income from the original pricing scheme resulted in contracted revenues as compared with the same period last year. (c) During the reporting period, there was a drop of the prices for the national railway network usage services.

| 028 | ||

| 029 |

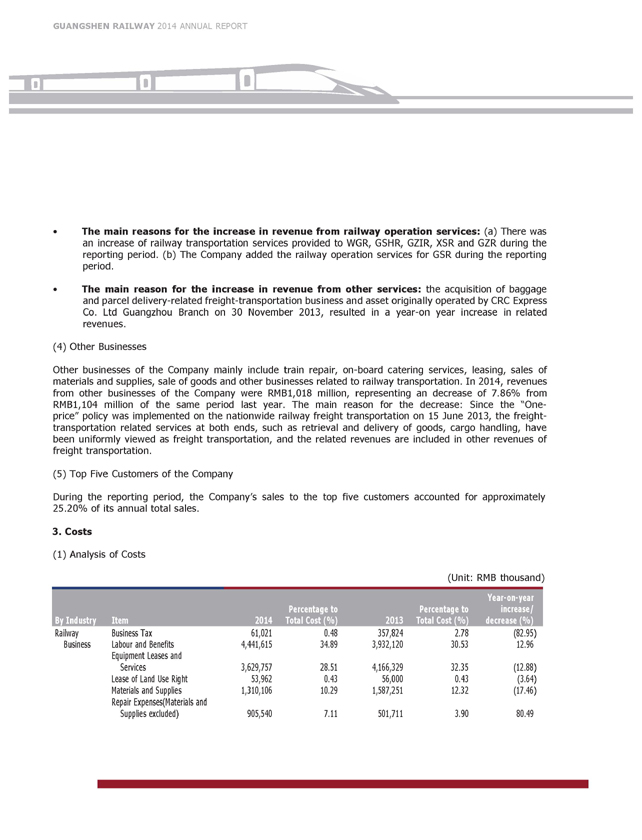

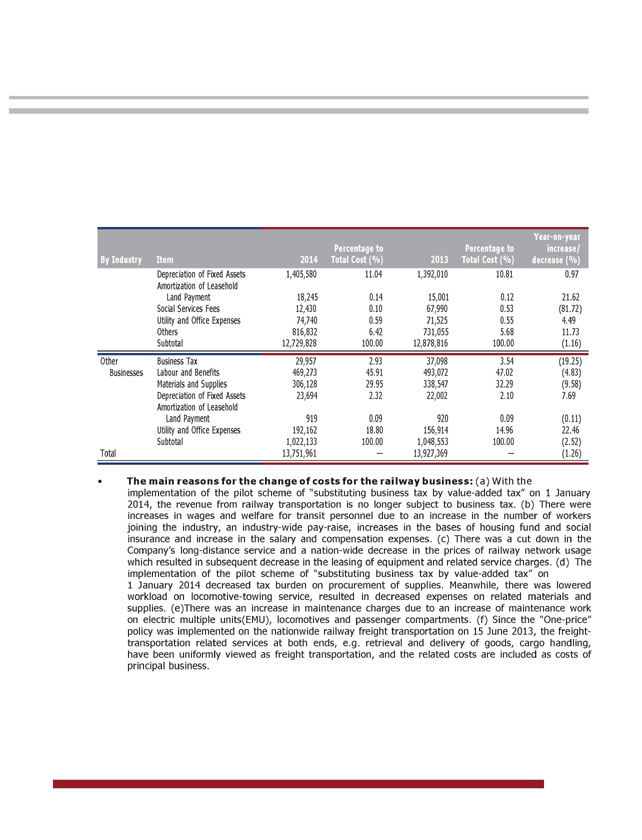

• The main reasons for the increase in revenue from railway operation services: (a) There was an increase of railway transportation services provided to WGR, GSHR, GZIR, XSR and GZR during the reporting period. (b) The Company added the railway operation services for GSR during the reporting period. • The main reason for the increase in revenue from other services: the acquisition of baggage and parcel delivery-related freight-transportation business and asset originally operated by CRC Express Co. Ltd Guangzhou Branch on 30 November 2013, resulted in a year-on year increase in related revenues. (4) Other Businesses Other businesses of the Company mainly include train repair, on-board catering services, leasing, sales of materials and supplies, sale of goods and other businesses related to railway transportation. In 2014, revenues from other businesses of the Company were RMB1,018 million, representing an decrease of 7.86% from RMB1,104 million of the same period last year. The main reason for the decrease: Since the “One- price” policy was implemented on the nationwide railway freight transportation on 15 June 2013, the freight- transportation related services at both ends, such as retrieval and delivery of goods, cargo handling, have been uniformly viewed as freight transportation, and the related revenues are included in other revenues of freight transportation. (5) Top Five Customers of the Company During the reporting period, the Company’s sales to the top five customers accounted for approximately 25.20% of its annual total sales. 3. Costs (1) Analysis of Costs (Unit: RMB thousand) By Industry Item 2014 Percentage to Total Cost (%) 2013 Percentage to Total Cost (%) Year-on-year increase/ decrease (%) Railway Business Tax 61,021 0.48 357,824 2.78 (82.95) Business Labour and Benefits 4,441,615 34.89 3,932,120 30.53 12.96 Equipment Leases and Services 3,629,757 28.51 4,166,329 32.35 (12.88) Lease of Land Use Right 53,962 0.43 56,000 0.43 (3.64) Materials and Supplies 1,310,106 10.29 1,587,251 12.32 (17.46) Repair Expenses(Materials and Supplies excluded) 905,540 7.11 501,711 3.90 80.49

By Industry Item 2014 Percentage to Total Cost (%) 2013 Percentage to Total Cost (%) Year-on-year increase/ decrease (%) Other Businesses Depreciation of Fixed Assets 1,405,580 11.04 1,392,010 10.81 0.97 Amortization of Leasehold Land Payment 18,245 0.14 15,001 0.12 21.62 Social Services Fees 12,430 0.10 67,990 0.53 (81.72) Utility and Office Expenses 74,740 0.59 71,525 0.55 4.49 Others 816,832 6.42 731,055 5.68 11.73 Subtotal 12,729,828 100.00 12,878,816 100.00 (1.16) Business Tax 29,957 2.93 37,098 3.54 (19.25) Labour and Benefits 469,273 45.91 493,072 47.02 (4.83) Materials and Supplies 306,128 29.95 338,547 32.29 (9.58) Depreciation of Fixed Assets 23,694 2.32 22,002 2.10 7.69 Amortization of Leasehold Land Payment 919 0.09 920 0.09 (0.11) Utility and Office Expenses 192,162 18.80 156,914 14.96 22.46 Subtotal 1,022,133 100.00 1,048,553 100.00 (2.52) Total 13,751,961 — 13,927,369 — (1.26) • The main reasons for the change of costs for the railway business: (a) With the implementation of the pilot scheme of “substituting business tax by value-added tax” on 1 January 2014, the revenue from railway transportation is no longer subject to business tax. (b) There were increases in wages and welfare for transit personnel due to an increase in the number of workers joining the industry, an industry-wide pay-raise, increases in the bases of housing fund and social insurance and increase in the salary and compensation expenses. (c) There was a cut down in the Company’s long-distance service and a nation-wide decrease in the prices of railway network usage which resulted in subsequent decrease in the leasing of equipment and related service charges. (d) The implementation of the pilot scheme of “substituting business tax by value-added tax” on 1 January 2014 decreased tax burden on procurement of supplies. Meanwhile, there was lowered workload on locomotive-towing service, resulted in decreased expenses on related materials and supplies. (e)There was an increase in maintenance charges due to an increase of maintenance work on electric multiple units(EMU), locomotives and passenger compartments. (f) Since the “One-price” policy was implemented on the nationwide railway freight transportation on 15 June 2013, the freight- transportation related services at both ends, e.g. retrieval and delivery of goods, cargo handling, have been uniformly viewed as freight transportation, and the related costs are included as costs of principal business.

| 030 | ||

| 031 |

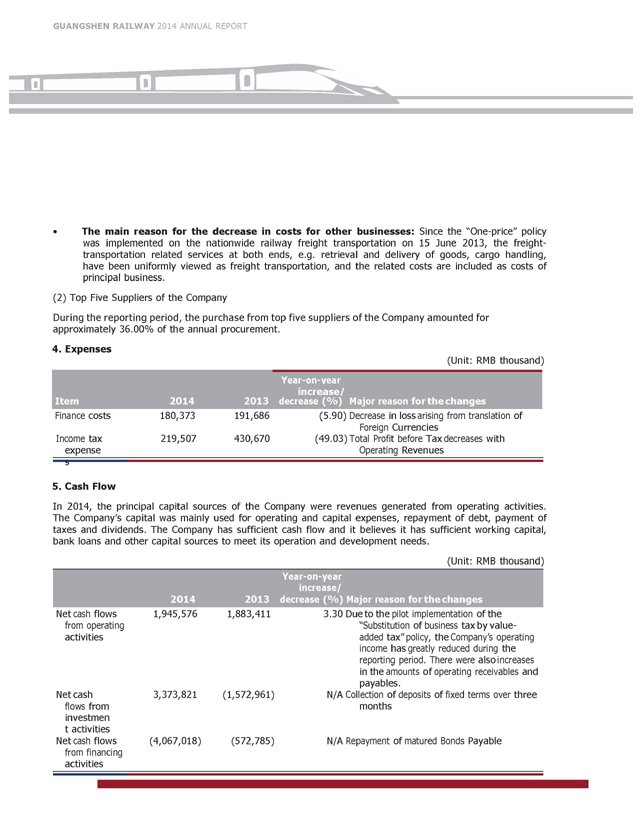

• The main reason for the decrease in costs for other businesses: Since the “One-price” policy was implemented on the nationwide railway freight transportation on 15 June 2013, the freight- transportation related services at both ends, e.g. retrieval and delivery of goods, cargo handling, have been uniformly viewed as freight transportation, and the related costs are included as costs of principal business. (2) Top Five Suppliers of the Company During the reporting period, the purchase from top five suppliers of the Company amounted for approximately 36.00% of the annual procurement. 4. Expenses (Unit: RMB thousand) Year-on-year increase/ Item 2014 2013 decrease (%) Major reason for the changes Finance costs 180,373 191,686 (5.90) Decrease in loss arising from translation of Income tax expenses Foreign Currencies 219,507 430,670 (49.03) Total Profit before Tax decreases with Operating Revenues 5. Cash Flow In 2014, the principal capital sources of the Company were revenues generated from operating activities. The Company’s capital was mainly used for operating and capital expenses, repayment of debt, payment of taxes and dividends. The Company has sufficient cash flow and it believes it has sufficient working capital, bank loans and other capital sources to meet its operation and development needs. Year-on-year increase/ (Unit: RMB thousand) 2014 2013 decrease (%) Major reason for the changes 2014 2013 Net cash flows from operating activities Year-on-year increase/ 2014 2013 decrease (%) Major reason for the changes Net cash flows from investment activities Net cash flows from financing activities 1,945,576 1,883,411 3.30 Due to the pilot implementation of the “Substitution of business tax by value- added tax” policy, the Company’s operating income has greatly reduced during the reporting period. There were also increases in the amounts of operating receivables and payables. 3,373,821 (1,572,961) N/A Collection of deposits of fixed terms over three months (4,067,018) (572,785) N/A Repayment of matured Bonds Payable

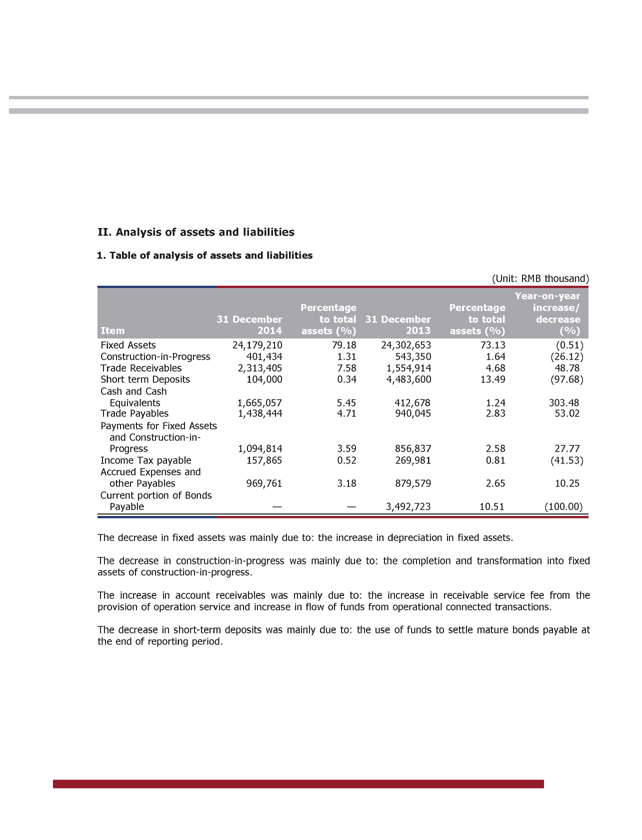

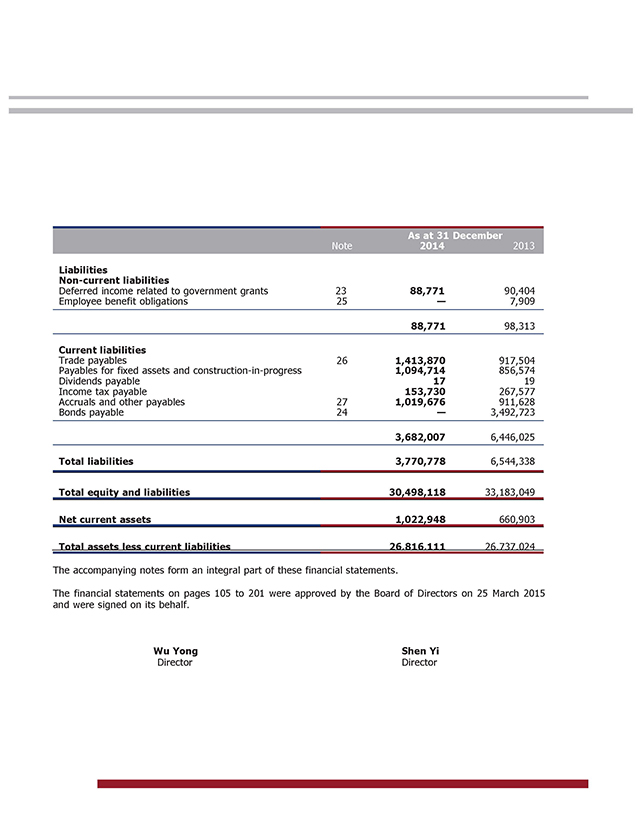

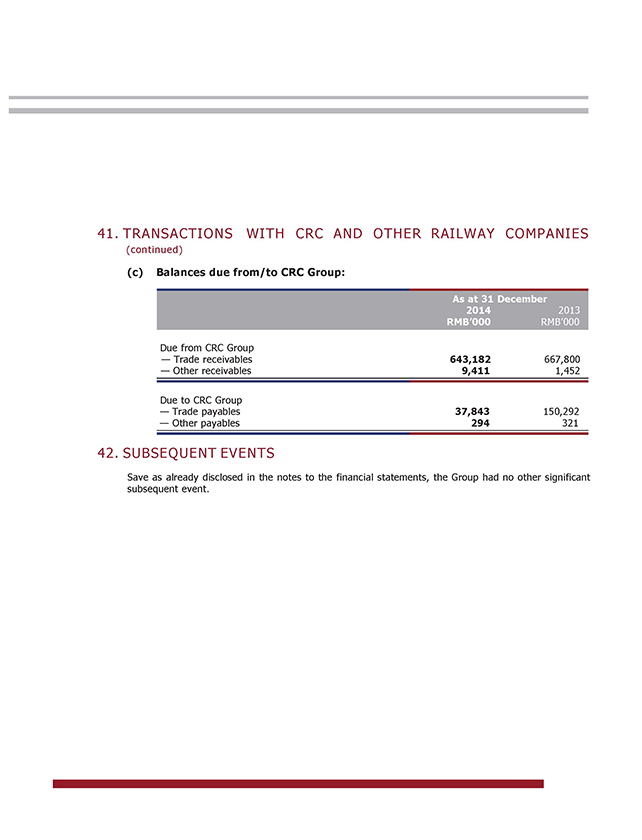

II. Analysis of assets and liabilities 1. Table of analysis of assets and liabilities (Unit: RMB thousand) Year-on-year Item 31 December 2014 Percentage to total assets (%) 31 December 2013 Percentage to total assets (%) increase/ decrease (%) Fixed Assets 24,179,210 79.18 24,302,653 73.13 (0.51) Construction-in-Progress 401,434 1.31 543,350 1.64 (26.12) Trade Receivables 2,313,405 7.58 1,554,914 4.68 48.78 Short term Deposits 104,000 0.34 4,483,600 13.49 (97.68) Cash and Cash Equivalents 1,665,057 5.45 412,678 1.24 303.48 Trade Payables 1,438,444 4.71 940,045 2.83 53.02 Payments for Fixed Assets and Construction-in- Progress 1,094,814 3.59 856,837 2.58 27.77 Income Tax payable 157,865 0.52 269,981 0.81 (41.53) Accrued Expenses and other Payables 969,761 3.18 879,579 2.65 10.25 Current portion of Bonds Payable — — 3,492,723 10.51 (100.00) The decrease in fixed assets was mainly due to: the increase in depreciation in fixed assets. The decrease in construction-in-progress was mainly due to: the completion and transformation into fixed assets of construction-in-progress. The increase in account receivables was mainly due to: the increase in receivable service fee from the provision of operation service and increase in flow of funds from operational connected transactions. The decrease in short-term deposits was mainly due to: the use of funds to settle mature bonds payable at the end of reporting period.

| 032 | ||

| 033 |

The increase in cash and cash equivalents was mainly due to: the collection of deposits of fixed term over three months. The increase in account payables was mainly due to: the increase of vehicles maintenance fees payable. Increase in payments for fixed assets and construction-in-progress was mainly due to: the increase of construction work payable. The decrease in income tax payables was mainly due to: the decrease in corporate income tax payable and business tax payable. The increase in accrued expenses and other payables was mainly due to: the increase in advance passenger tickets, ticket deposits and other deposits. The decrease of the current portion of bonds payable was mainly due to: settlement of bonds due payable with internal funds as at the end of the reporting period. As at the end of the reporting period, the gearing ratio (calculated by total liabilities divided by total assets) of the Company was 12.28%. As at the end of the reporting period, the Company had no charge on any of its assets and had not provided any guarantees, and had no entrusted deposits. 2. Assets at fair value and changes in the nature of measurement for the major assets As at the end of the reporting period, the Company had no assets at fair value and there was no change in the nature of measurement for the major assets. III. Analysis on investment position 1. General analysis on investments in external equity interests During the reporting period, the Company had not made investment in securities such as stock, warrants or convertible bonds, and had not held or dealt in equity interests of other listed companies and non-listed financial enterprises. Details of investments on external equity interests of the Company at the end of the reporting period are set out in Notes 10, 11 and 15 to the financial statements. 2. Entrusted investment and derivatives investment on non-financial companies During the reporting period, there was no entrusted investment or entrusted loan or derivatives investment by the Company.

3. General use of raised proceeds During the reporting period, the Company had not raised any funds and no fund raised previously carried forward to the reporting period. 4. Use of non-raised proceeds During the reporting period, there was no investment project using non-raised proceeds with investment amount exceeding 10% of the Company’s unaudited net assets of the previous year. 3. THE BOARD’S DISCUSSION AND ANALYSIS ON THE FUTURE DEVELOPMENT OF THE COMPANY 1. Industry development trend and competition scenario Industry development trend: being the aorta of the nation’s economy, an important infrastructure of the nation and a popular form of transportation, railway is of crucial importance for nation’s economic and social development. As current railway development in China falls short of satisfying the demand for nation’s economic and social development, leading to tight demand for railway passenger and freight transportation, the State Council has promulgated the Medium and Long-term Plan for Adjustment of Railway Network and the 12th Five-Year Development Plan for Integrated Transportation System in 2008 and 2012, respectively, which opened up a new peak in the construction of railways, especially high-speed railways and inter-city railways, in China. Accordingly, it is anticipated that in a rather long time coming, the railway transportation industry will greet a new period of development opportunities with the capacity for railway passenger and freight transportation and market competitive position achieving notable enhancements as the PRC sustains continued stable growth, the State’s high-speed railway network with Four East-West Lines and Four South- North Lines and numerous inter-city railways complete construction and commence operation, as well as the marketization reform of the railway industry proceeds. Industry competition scenario: The national railway is highly concentrated with a unified transportation management system. Competition mainly comes from other transportation industries such as highway, aviation and water transportation, and is expected to exist in the long run. However, as the marketization reform of the railway industry (including the reformation of the investment and financing system, the transportation management system and the pricing system) gradually deepens, the entry barrier to the industry will decrease, investors of the industry will become more diversified and the State’s high-speed railway network with Four East-West Lines and Four South-North Lines and numerous inter-city railways will complete construction and commence operation, the competition structure of the railway transportation industry is expected to experience substantial changes in the future, with more intense competition not only externally from the highway, aviation and water transportation industries but also within the industry itself.

| 034 | ||

| 035 |

2. Development strategies of the Company Under the sound leadership scientific decision-making by the Board, the Company will capitalize the historic opportunity of extensive railway construction, proactively adapt to the policy direction of railway system reform in order to establish a steadfast foothold in the Pan Pearl River Delta, perfect and enhance its business portfolio centered on railway passenger and freight transportation and complemented by the railway-related businesses. Striving to become a top-notch railway transportation services enterprise in the PRC and actualize its development objective of scaling up and consolidating its strengths, the Company will also focus on the improvement of quality of service in the continued efforts for the advancement of management innovation, service innovation and technology innovation. 3. Operating plans for 2015 At the fifth meeting of the seventh session of the Board held on March 25, 2015, the financial budget for 2015 were passed upon consideration. The Company plans to achieve passenger delivery volume of 86.53 million persons (excluding commissioned transportation), goods delivery volume of 19.32 million tonnes. To actualize the aforesaid objectives, the Company will focus on the following tasks: (1) In respect of safe production: Firstly, promote the construction of model route or station with illustrative standards on safety and quality through requirements of systematized management, standardized operation and regular inspections and corrections and three aspects, lifestyle, culture and hygiene. Secondly, transformation of safety infrastructures are to be promoted through increased investments in safety facilities and equipment. (2) In respect of passenger transport business: Firstly, by making use of the advantage of the shortened travelling time of Guangzhon-Shenzhen inter-city railway and the commencement of EMU travelling across Guangzhou and Chaozhou-shantou, the network and schedule of Guangzhon-Shenzhen inter-city railway will be further improved. Secondly, large-scale projects including the new Pinghu Intercity station on GZIR line I and line II, the Xintang District public transport interchange in East Guangzhou, connection of intercity and GZIR III and IV will be promoted for the development of new growth points in GZIR passenger transportation. Thirdly, passenger transportation facilities will be improved to elevate service quality from the viewpoint of the customers. (3) In respect of freight transportation business: Firstly, we will actively adapt to the dynamic of the market, seek to cooperate with more e-business customers to provide less-than-carload freight and take up large- scale cargo order for mass manufacturers. Secondly, we will implement pricing policy for railway freight transportation, improve the pricing adjustment mechanism, provide directional discounts, and elevate the company’s competitiveness in the railway freight transportation market.

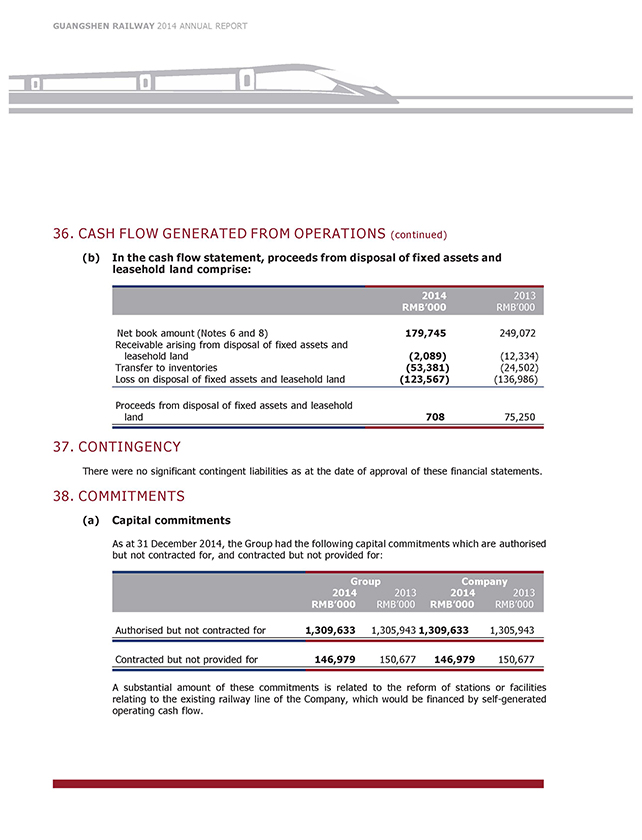

(4) In respect of diversified operation: firstly, the benefits from the operation of diversified assets are to be enhanced through pushing forward the progress of development of the supporting business venues of the Shenzhen (East) Station, the apartment building adjoining the station, and old and new Shilung Passenger Stations, as well as the development and leasing of the Tangtouxia Station. Secondly, transformation and upgrading of the enterprise will be carried out through constant development of market channels, and development of warehousing business for modern logistics using idle spaces in freight yards with diverse purpose of use. Thirdly, out-sourcing model will be employed when developing diversified businesses in order to streamline the company’s structure and lower costs on human resources and management. (5) In respect of financial management: Firstly, budget management will be strictly monitored. On the condition of ensuring the safety of transportation and quality of service, budgets expenses will be arranged reasonably with strict adherence to the principle of “weighing the importance and urgency, making sure of balanced allocation, focusing on the key items, and balancing income and expenses”. Secondly, cost control will be strengthened by regulating contract management and procurement activities, with an aim to effectively lower the procurement expenses of the Company, and to reduce the general and non-production expenses. Lastly, we will continue to strengthen our understanding of the value-added tax, follow strictly the requirements related to “substituting of business tax by Value-added Tax” for procurements of supplies, equipment and energies, so as to lessen the Company’s tax burden through reasonable and legitimate measures. 4. Future capital demand Currently, the Company has no investment projects of significant amount under way, and possesses adequate liquidity to maintain existing businesses. In 2015, apart from daily operating expense, the Company has planned for capital investment projects of approximately RMB1,463 million, which will be funded by its own accumulated funds from daily operating revenues. For details of capital commitments and operation commitments of the Company as at the end of the reporting period, please read Note 38 to the financial statements. 5. Potential risks (1) Risks of operating environment: as the main supplier for the Shenzhen-Guangzhou-Pingshi railway transportation business, the passenger and freight transportation service of the Company mainly draws businesses from Guangdong and Hong Kong. The economic development and growth of these places pose direct influences on the development of the Company’s passenger and freight transportation business. Any slowdown in the economy growth of Guangdong and Hong Kong will lead to insufficient market demand for the transportation service of the Company and thereby affect the passenger and freight transportation business of the Company.

| 036 | ||

| 037 |

(2) Risks of market competition: the passenger and freight transportation service of the Company competes with other modes of transportation such as highways, water transportation and aviation. In many aspects including price, convenience, running frequency, quality of service and safety, the Company competes with vehicle transportation companies, shipping companies and airlines. Furthermore, with the opening of numerous high-speed passenger special railway lines in China and the gradual maturity of the rail transportation network in the Pearl River Delta, there is notable changes in the competition related to passenger and freight transportation in areas covered by the Company’s passenger and freight transportation service, which brings along relatively high risks to the Company’s existing passenger and freight transportation business. (3) Risks of fluctuations and adjustments in transportation price: transportation price is one of the chief factors affecting the operating revenue of the Company. Any adjustments in the railway transportation price policy or any discrepancy between the implemented price with the expected price under the transportation price policy caused by market and other reasons will create risks to the operation of the Company. (4) Financial risks: operating activities of the Company may be exposed to foreign exchange risks, interest rate risks, credit risks, liquidity risks and other risks, which are set out in Note 3 to the financial statements, and the Company has not used any financial instruments to hedge these risks. (5) Risks of natural disasters: compared to other forms of transportation, railway transportation is less affected by natural disasters. However, serious natural disasters such as widespread and sustained rain, snow and cold temperature and floods pose relatively serious threats to railway transportation and bring relatively significant risks to the operation of the Company. 4. DURING THE REPORTING PERIOD, THERE WAS NO CHANGE IN THE COMPANY’S ACCOUNTING POLICIES, ACCOUNTING ESTIMATES, AUDIT METHODS AND RECTIFICATION OF MATERIAL ACCOUNTING ERRORS OF PREVIOUS ACCOUNTING PERIODS.

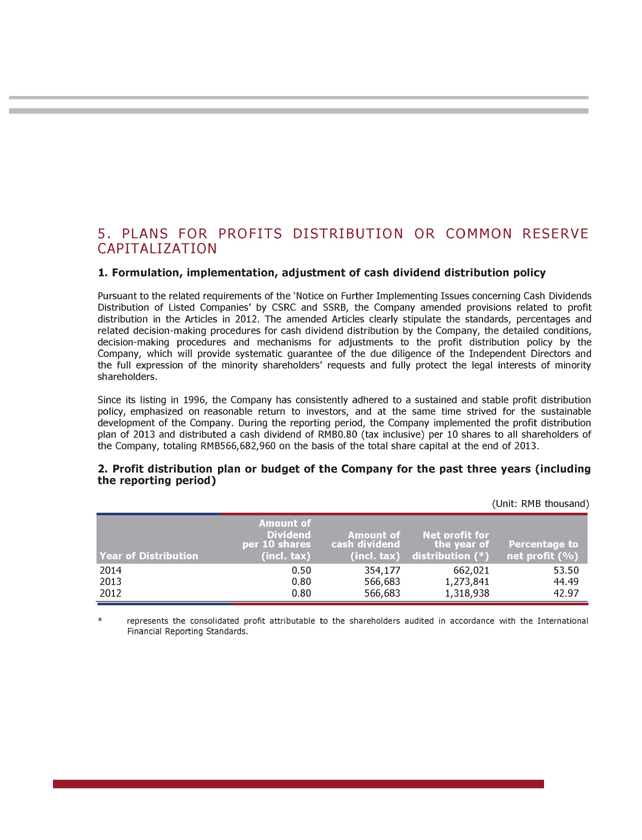

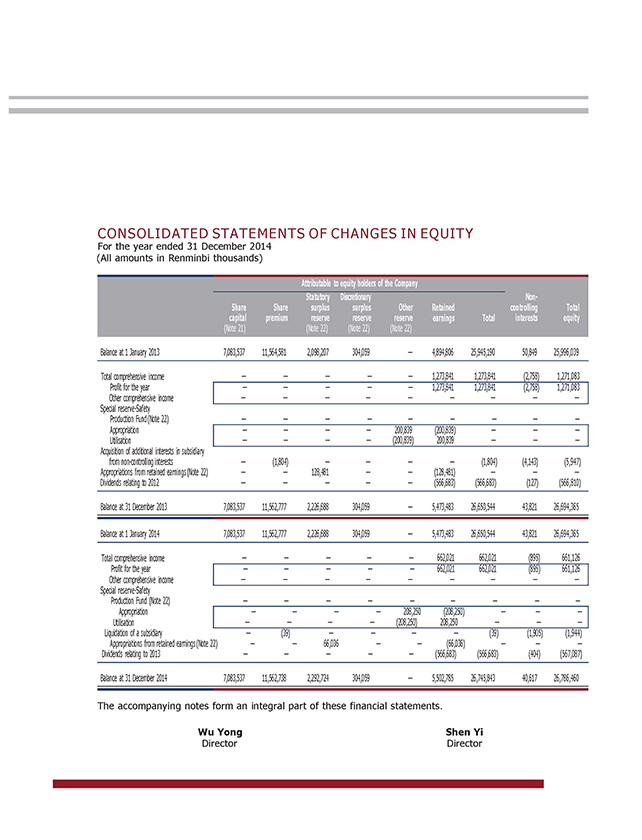

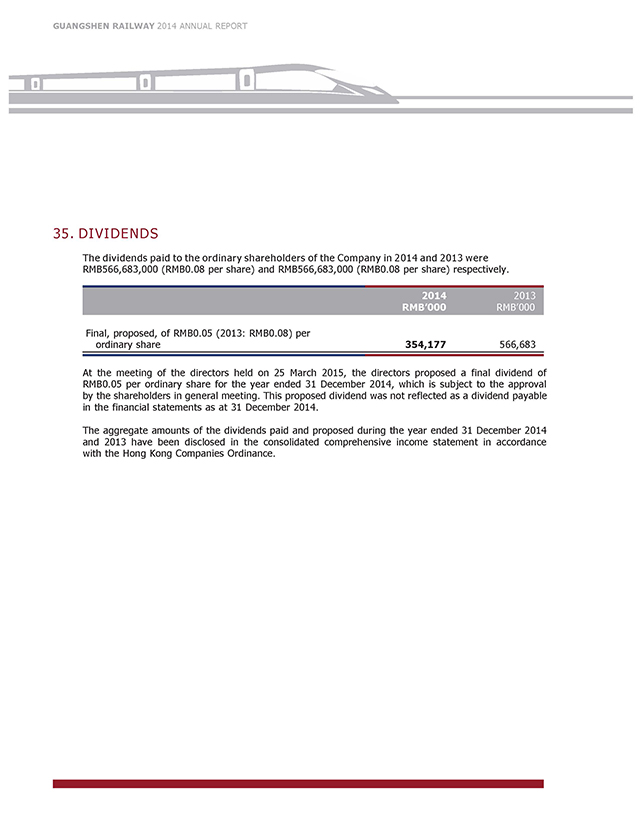

5. PLANS FOR PROFITS DISTRIBUTION OR COMMON RESERVE CAPITALIZATION 1. Formulation, implementation, adjustment of cash dividend distribution policy Pursuant to the related requirements of the ‘Notice on Further Implementing Issues concerning Cash Dividends Distribution of Listed Companies’ by CSRC and SSRB, the Company amended provisions related to profit distribution in the Articles in 2012. The amended Articles clearly stipulate the standards, percentages and related decision-making procedures for cash dividend distribution by the Company, the detailed conditions, decision-making procedures and mechanisms for adjustments to the profit distribution policy by the Company, which will provide systematic guarantee of the due diligence of the Independent Directors and the full expression of the minority shareholders’ requests and fully protect the legal interests of minority shareholders. Since its listing in 1996, the Company has consistently adhered to a sustained and stable profit distribution policy, emphasized on reasonable return to investors, and at the same time strived for the sustainable development of the Company. During the reporting period, the Company implemented the profit distribution plan of 2013 and distributed a cash dividend of RMB0.80 (tax inclusive) per 10 shares to all shareholders of the Company, totaling RMB566,682,960 on the basis of the total share capital at the end of 2013. 2. Profit distribution plan or budget of the Company for the past three years (including the reporting period) (Unit: RMB thousand) Amount of Dividend Amount of Net profit for Year of Distribution per 10 shares (incl. tax) cash dividend (incl. tax) the year of distribution (*) Percentage to net profit (%) 2014 0.50 354,177 662,021 53.50 2013 0.80 566,683 1,273,841 44.49 2012 0.80 566,683 1,318,938 42.97 * represents the consolidated profit attributable to the shareholders audited in accordance with the International Financial Reporting Standards.

| 038 | ||

| 039 |

Explanation of the profit distribution plan 2014: the Board recommended the payment of a final cash dividend of RMB0.05 per share (including tax) for 2014 to the shareholders of the Company, based on the total share capital of 7,083,537,000 shares as at December 31, 2014, totaling RMB354,176,850. The above proposal is subject to approval at the 2014 annual general meeting to be held on May 28, 2015. Holders of A Shares are reminded to timely and carefully read the announcement to be issued by the Company on distribution of dividends for 2014 which contains details of the distribution of the final dividends for 2014. Holders of H Shares are reminded to timely and carefully read the notice of the 2014 annual general meeting and the announcement of poll results of the 2014 annual general meeting to be issued by the Company on April 10, 2015 and May 28, 2015, respectively, which contain details of the distribution of the final dividends for 2014. To the best knowledge of the Company, as at the date of publication of this annual report, there were no any arrangements of shareholders waiving or agreeing to waive the proposed distribution of final dividend for 2014. 6. ACTIVE FULFILLMENT OF SOCIAL RESPONSIBILITY During the reporting period, the Company did not have significant environment protection or other significant social safety issues. For Details of the fulfillment of social responsibilities in the areas of transportation safety, environmental protection and social welfare by the Company in the reporting period, please read the Social Responsibility Report 2014 disclosed on the website of SSE (http://www.sse.com.cn), the website of SEHK (http://www.hkexnews.hk) and the website of the Company (http://www.gsrc.com). 7. OTHER DISCLOSURES 1. Taxation Details of income tax applicable to the Company during the reporting period are set out in Note 32 to the financial statements. 2. Interest Capitalized During the reporting period, no interest was capitalized in the fixed assets or construction-in-progress of the Company.

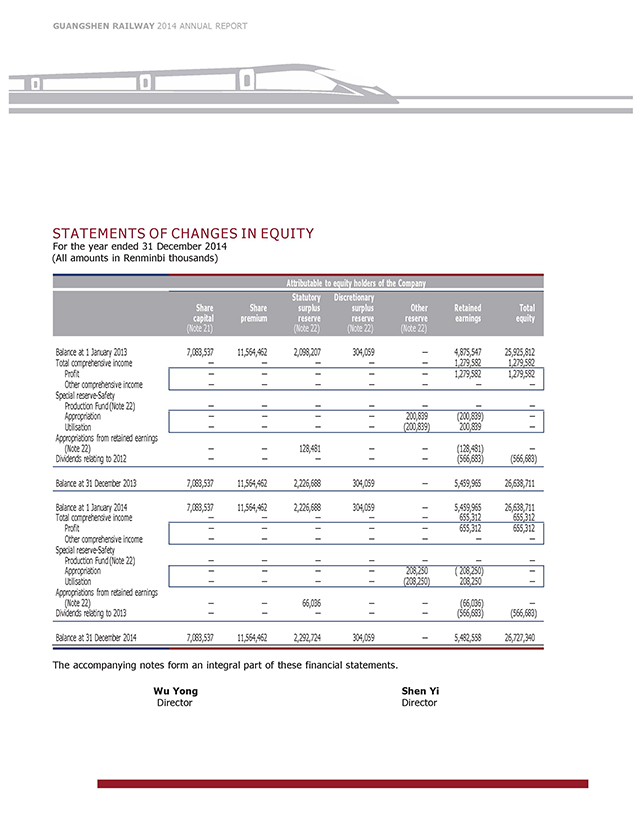

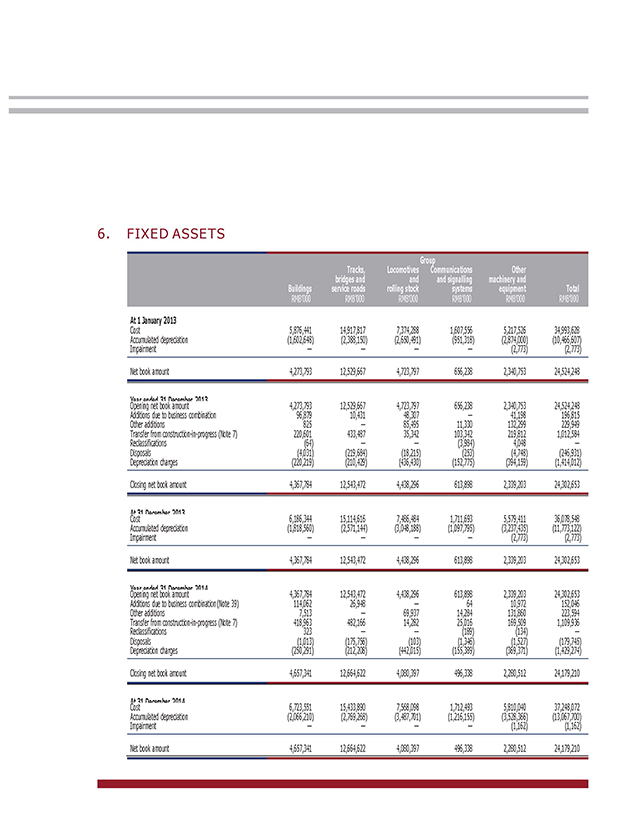

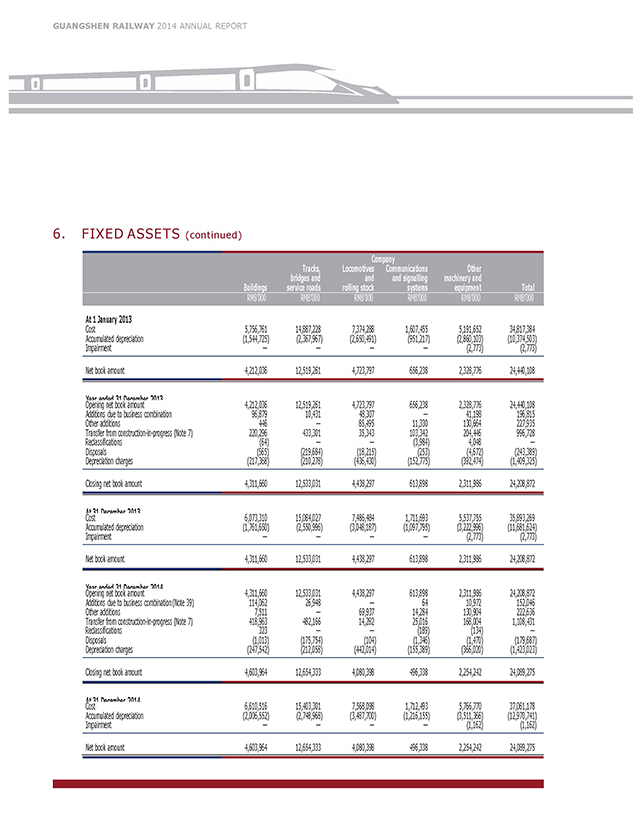

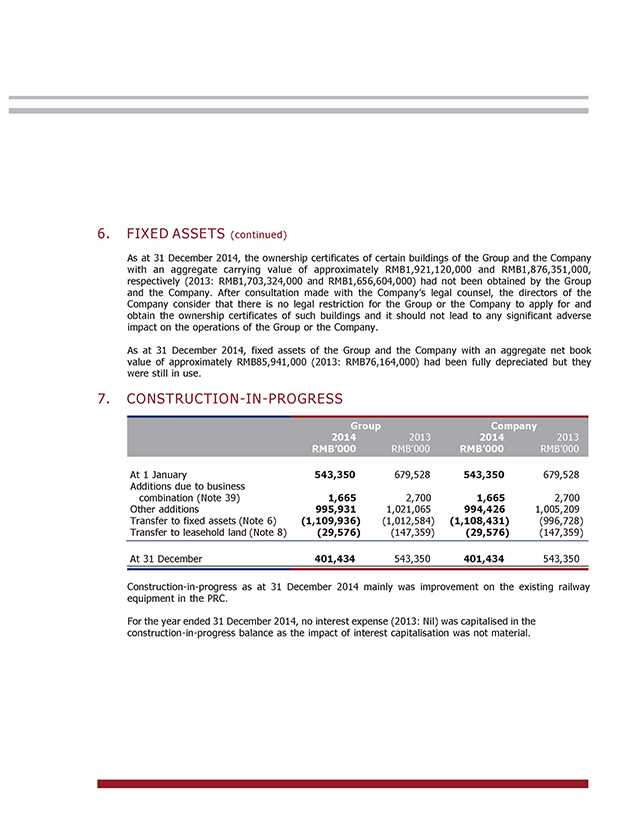

3. Properties and Fixed Assets During the reporting period, all properties held by the Company were all for the purpose of development, and their percentage ratio (as defined by Rule 14.04(9) of the Listing Rules) did not exceed 5%. Movements in the properties and fixed assets held by the Company during the reporting period are set out in Note 6 to the financial statements. 4. Undistributed Profit Details of movements in the undistributed profit of the Company during the reporting period are set out in the Statements of Changes in Equity. 5. Statutory Surplus Reserve Details of movements in the statutory surplus reserve of the Company during the reporting period are set out in the Statements of Changes in Equity and Note 22 to the financial statements. 6. Subsidiaries Details of the principal subsidiaries of the Company as at the end of the reporting period are set out in Note 10 to the financial statements. 7. Material investments held, material acquisitions and disposals of subsidiaries and associates, and future plans of material investments or acquisition of capital assets Except as disclosed in this year’s annual report, during the reporting period, the Company had no material investment held, had not carried out any material acquisition or disposal of subsidiaries and associates, and had no definite plan for material investment or acquisition of capital assets. 8. Contingent liabilities At the end of the reporting period, the Company had no contingent liability. 9. Fixed Interest Rate At the end of the reporting period, the Company has no loan bearing fixed interest rates.

| 040 | ||

| 041 |

10. Laws and Regulations During the reporting period, the Company has complied with all relevant laws and regulations that have significant impact on the Company. 11. Directors of Subsidiary Companies At the end of the reporting period, save for Dongguan Changsheng Enterprise Company Limited and Shenzhen Nantie Construction Supervision Company Limited, no other subsidiaries of the Company had set up their board of directors. The members of the boards of directors for the above two subsidiaries are as follows: Name of Company Name List of Board Members Dongguan Changsheng Enterprise Company Limited Mu Anyun, Zhang Yinghong, Deng Hui, Lin Wensheng, Li Pingwen, Li Jianping, Zhou Xiaomei Shenzhen Nantie Construction Supervision Company Limited Mu Anyun, Wu Yuefang, Hu Rongze, Fang Lei, Deng Rongjun 12. Persons of Significant Relationship with the Company During the reporting period, save as disclosed in the annual report of this year, the Company has no other relationship with its employees, customers and suppliers apart from the relationship of employees, customers and suppliers, and there was no person who had a significant impact on the business of the Company. 13. Assessment of Property Interests or Tangible Assets During the reporting period, the Company has not valued its property interests or other tangible assets in accordance with Chapter 5 of the Listing Rules. 14. Management Contracts During the reporting period, the Company has not entered into any contract containing the following term: the counterparty of the contract undertakes the management and administration of the whole or any substantial part of any business of the Company pursuant to the contract; and the contract was not a service contract entered into with any Director or full-time employee of the Company.

15. Loans to Entities During the reporting period, the Company has not provided any loan to any entity. 16. Permitted Compensation Provisions At the end of the reporting period, the Company did not have any compensation provision for the benefit which had been enjoyed or being enjoyed by any one of the Directors (including former directors) of the Company, or any of the affiliated companies.

| 042 | ||

| 043 |

Chapter 5 Matters of Importance Chairman of the Supervisory Committee I. MATERIAL LITIGATION, ARBITRATION AND MATTERS DOUBTFUL TO THE GENERAL MEDIA The Company was not involved in any material litigation, arbitration or any matters doubtful to media in the reporting period. II. APPROPRIATION OF FUND AND PROGRESS OF DEBT CLEARANCE LISTING IN THE REPORTING PERIOD During the reporting period, there was no non-operational appropriation of the Company’s fund by its controlling shareholders and their related parties. III. BANKRUPTCY AND RESTRUCTURING During the reporting period, the Company had no matters in relation to bankruptcy and restructuring.

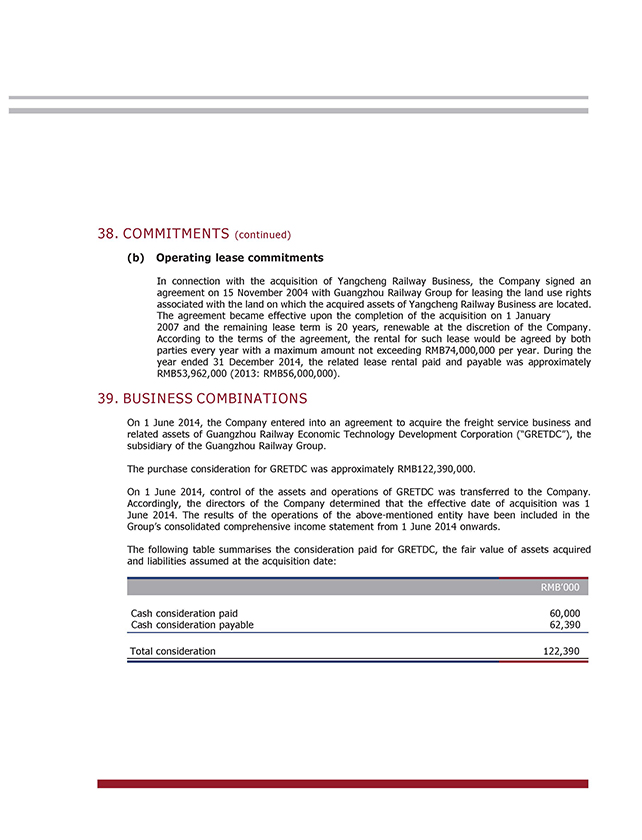

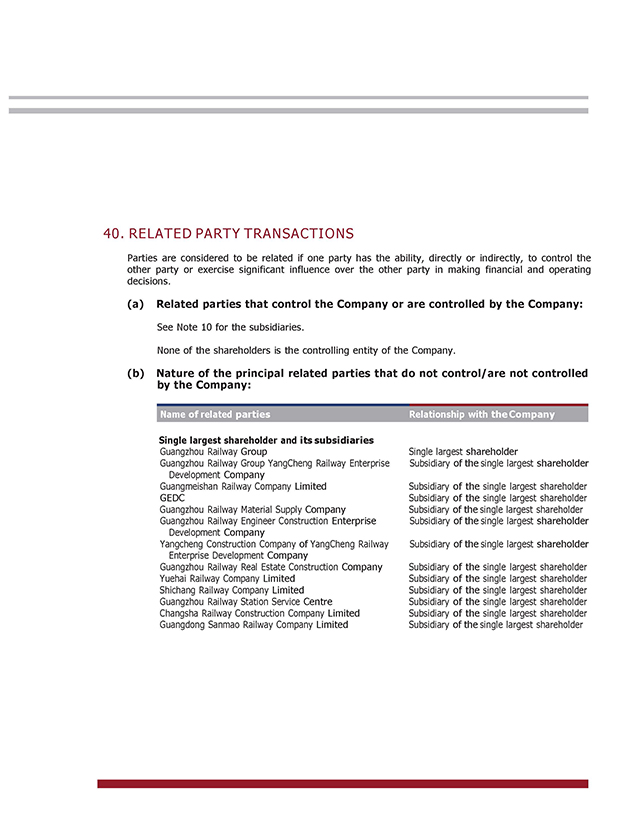

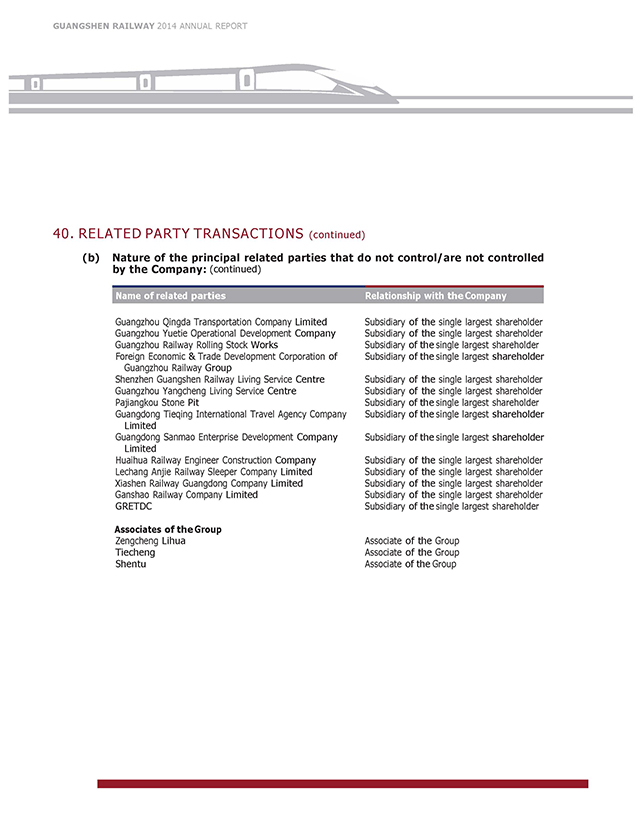

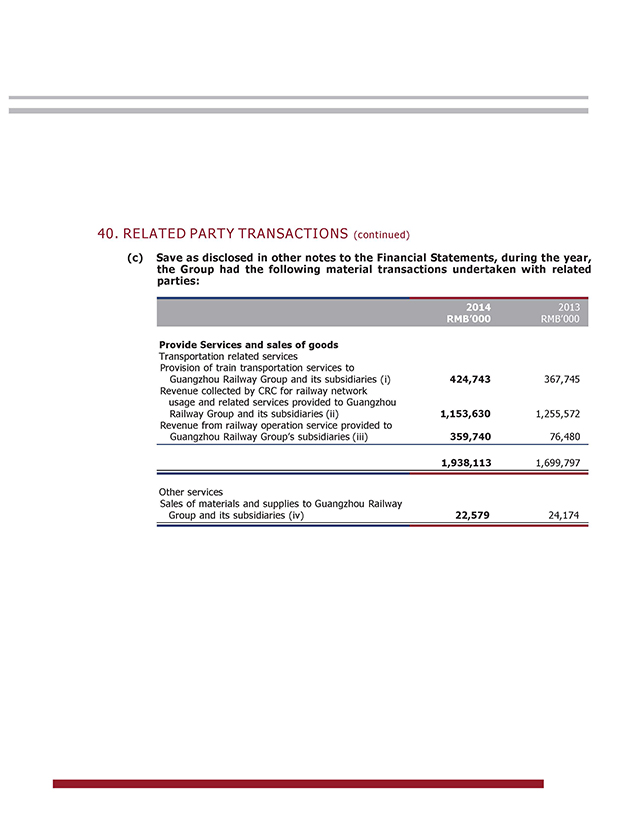

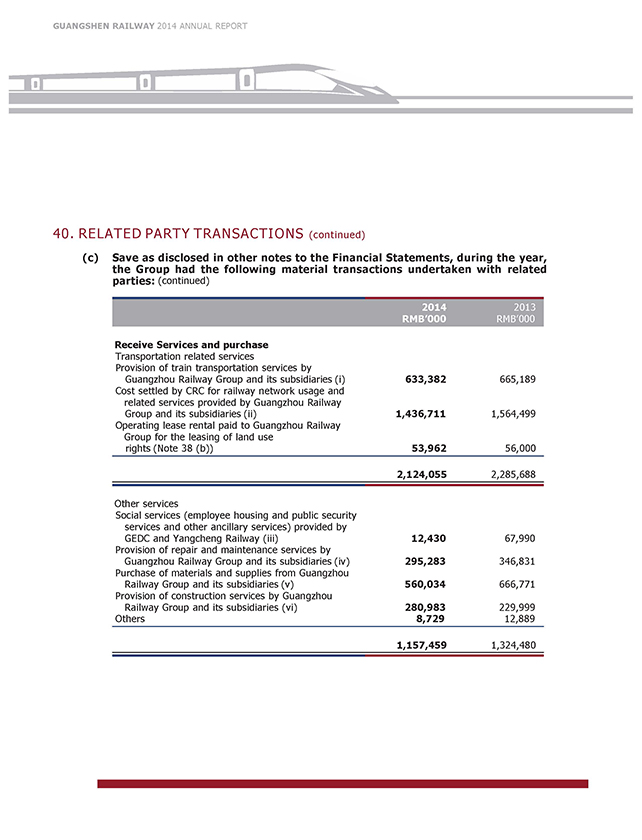

IV. TRANSACTIONS OF ASSETS AND MERGERS OF ENTERPRISES During the reporting period, apart from transactions of assets involved in the business combination as set out in Note 39 to the financial statements, the Company had no other significant transactions of assets or mergers of enterprises. V. THE COMPANY’S SHARE INCENTIVE SCHEME AND ITS IMPACT As at the end of the reporting period, the Company did not implement any share incentive scheme. VI. MATERIAL CONNECTED TRANSACTIONS 1. Connected transactions related to daily operations During the reporting period, save for the connected transactions as set out in Note 40 to the financial statements and those related to daily operation, the Company did not have any other major connected transaction related to daily operation. 2. Contracts entered into with the largest shareholder and its subsidiaries Except as disclosed in this annual report, none of the Company or its subsidiaries had entered into other material contracts with the largest shareholder or its subsidiaries. 3. Connected transactions related to acquisition or disposal of assets During the reporting period, apart from transactions of assets involved in the business combination as set out in Note 39 to the financial statements, the Company had no connected transactions related to acquisition or disposal of assets. 4. Material connected transactions related to joint external investment During the reporting period, the Company had no material connected transaction related to joint external investment.

| 044 | ||

| 045 |

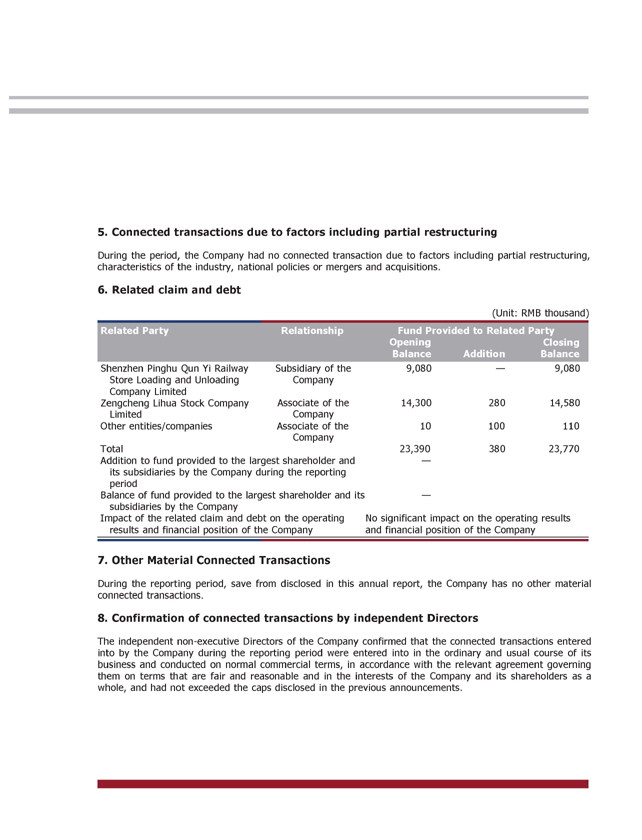

5. Connected transactions due to factors including partial restructuring During the period, the Company had no connected transaction due to factors including partial restructuring, characteristics of the industry, national policies or mergers and acquisitions. 6. Related claim and debt (Unit: RMB thousand) Related Party Relationship Fund Provided to Related Party Opening Balance Addition Closing Balance Shenzhen Pinghu Qun Yi Railway Store Loading and Unloading Company Limited Zengcheng Lihua Stock Company Limited Subsidiary of the Company Associate of the Company 9,080 — 9,080 14,300 280 14,580 Other entities/companies Associate of the Company 10 100 110 Total 23,390 380 23,770 Addition to fund provided to the largest shareholder and — its subsidiaries by the Company during the reporting period Balance of fund provided to the largest shareholder and its — subsidiaries by the Company Impact of the related claim and debt on the operating results and financial position of the Company No significant impact on the operating results and financial position of the Company 7. Other Material Connected Transactions During the reporting period, save from disclosed in this annual report, the Company has no other material connected transactions. 8. Confirmation of connected transactions by independent Directors The independent non-executive Directors of the Company confirmed that the connected transactions entered into by the Company during the reporting period were entered into in the ordinary and usual course of its business and conducted on normal commercial terms, in accordance with the relevant agreement governing them on terms that are fair and reasonable and in the interests of the Company and its shareholders as a whole, and had not exceeded the caps disclosed in the previous announcements.

In respect of each continuing connected transaction disclosed in Note 40 to the financial statements prepared in accordance with IFRS, the Company confirms that it is within the definition of “continuing connected transaction” under Chapter 14A of the Listing Rules, and it has complied with the disclosure requirements in accordance with Chapter 14A of the Listing Rules. Details of the other related party transactions entered by the Company during the year ended at the end of reporting period are set out in Note 40 to the financial statements prepared in accordance with IFRS. These transactions do not constitute connected transactions under the Listing Rules. 9. Confirmation of connected transactions by the auditor For the purpose of Rule 14A.38 of the Listing Rules, the auditors of the Company have carried out procedures on the above connected transactions for the year ended at the end of the reporting period in accordance with the Hong Kong Standard on Assurance Engagements 3000 ‘Assurance Engagement Other Than Audits or Reviews of Historical Financial Information’ and with reference to Practice Note 740 ‘Auditor’s Letter on Continuing Connected Transactions under the Hong Kong Listing Rules’ issued by the Hong Kong Institute of Certified Public Accountants and reported that, in respect of the above connected transactions: (1) nothing has come to our attention that causes us to believe that the disclosed continuing connected transactions had not been approved by the Board; (2) for transactions involving the provision of goods or services by the Company, nothing has come to our attention that causes us to believe that such transactions were not, in all material respects, in accordance with the pricing policies of the Company; (3) nothing has come to our attention that causes us to believe that such transactions were not entered into, in all material respects, in accordance with the terms of agreements governing such transactions; (4) with respect to the aggregate amount of each of the continuing connected transactions, nothing has come to our attention that causes us to believe that the value of such continuing connected transactions have exceeded the maximum aggregate annual caps disclosed in the previous announcements.

| 046 | ||

| 047 |

VII. MATERIAL CONTRACTS AND THE IMPLEMENTATION 1. Trust, contracted businesses and leasing affairs During the reporting period, the Company did not engage in any trust, contracted businesses and leasing affairs which contribute over 10% (including 10%) of the Company’s total profit for the year. 2. Guarantees or financial assistances During the reporting period, the Company did not have any guarantee or provide any financial assistance. 3. Pledges During the reporting period, the largest shareholder of the Company and its de facto controller have not pledged the interests in all or part of the shares of the Company held as support for the Company’s indebtedness, guarantees or other liabilities. 4. Loan agreements and their performances During the reporting period, the Company and its subsidiaries have not entered into any loan agreements nor violated any terms of loan agreements which had significant impact to its operation. 5. Other material contracts During the reporting period, save as disclosed in this annual report, the Company did not enter into any other material contracts. VIII. FULFILLMENT OF COMMITMENTS During the reporting period, GRGC, the largest shareholder of the Company, made the following commitments: 1. GRGC and any of its subsidiaries will not engage, directly or indirectly, by any means, in any business activities that may compete with the railway transportation and related businesses of the Company within the service territory of the Company. After the acquisition of the transportation operational assets and businesses of Guangzhou-Pingshi Railway, GRGC and any of its subsidiaries will not compete with the Company either.

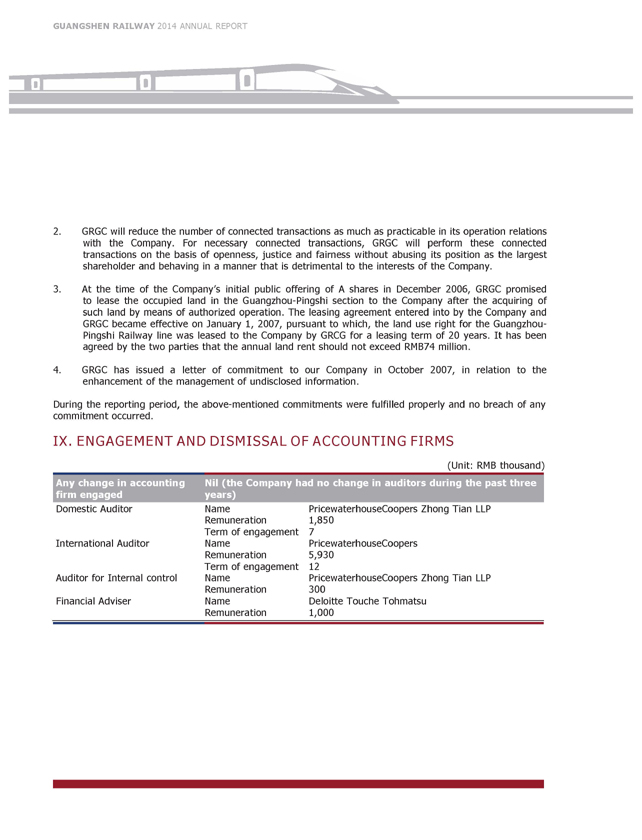

2. GRGC will reduce the number of connected transactions as much as practicable in its operation relations with the Company. For necessary connected transactions, GRGC will perform these connected transactions on the basis of openness, justice and fairness without abusing its position as the largest shareholder and behaving in a manner that is detrimental to the interests of the Company. 3. At the time of the Company’s initial public offering of A shares in December 2006, GRGC promised to lease the occupied land in the Guangzhou-Pingshi section to the Company after the acquiring of such land by means of authorized operation. The leasing agreement entered into by the Company and GRGC became effective on January 1, 2007, pursuant to which, the land use right for the Guangzhou- Pingshi Railway line was leased to the Company by GRCG for a leasing term of 20 years. It has been agreed by the two parties that the annual land rent should not exceed RMB74 million. 4. GRGC has issued a letter of commitment to our Company in October 2007, in relation to the enhancement of the management of undisclosed information. During the reporting period, the above-mentioned commitments were fulfilled properly and no breach of any commitment occurred. IX. ENGAGEMENT AND DISMISSAL OF ACCOUNTING FIRMS Any change in accounting firm engaged (Unit: RMB thousand) Nil (the Company had no change in auditors during the past three years) Domestic Auditor Name PricewaterhouseCoopers Zhong Tian LLP Remuneration 1,850 Term of engagement 7 International Auditor Name PricewaterhouseCoopers Remuneration 5,930 Term of engagement 12 Auditor for Internal control Name PricewaterhouseCoopers Zhong Tian LLP Remuneration 300 Financial Adviser Name Deloitte Touche Tohmatsu Remuneration 1,000

| 048 | ||

| 049 |

X. PUNISHMENT ON THE COMPANY, ITS DIRECTORS, SUPERVISORS, SENIOR MANAGEMENT, SHAREHOLDERS, DE FACTO CONTROLLER, PURCHASER AND THE RECTIFICATION THEREOF During the reporting period, none of the Company, its Directors, Supervisors, senior management, shareholders with a shareholding of more than 5%, de facto controller and purchaser was subject to any punishment by administrative institutions, judicial authorities, CSRC and stock exchanges. XI. RISK OF SUSPENSION AND TERMINATION OF LISTING During the reporting period, the Company did not face any risk of Suspension and Termination of Listing. XII. CONVERTIBLE BONDS At the end of the reporting period, the Company did not issue any convertible bonds. XIII. EXPLANATION OF OTHER MATERIAL EVENTS Save as disclosed in this annual report, there was no other material event during the reporting period.

Chapter 6 Changes in Share Capital and Particulars Shareholders Director General Manager Director General Manager I. PARTICULARS OF CHANGES IN SHARE CAPITAL 1. Changes in share capital During the reporting period, there has been no change in the Company’s total number of shares and structure of share capital. 2. Changes in shares with selling restrictions As at the end of the reporting period, the Company had no shares with selling restrictions.

| 050 | ||

| 051 |

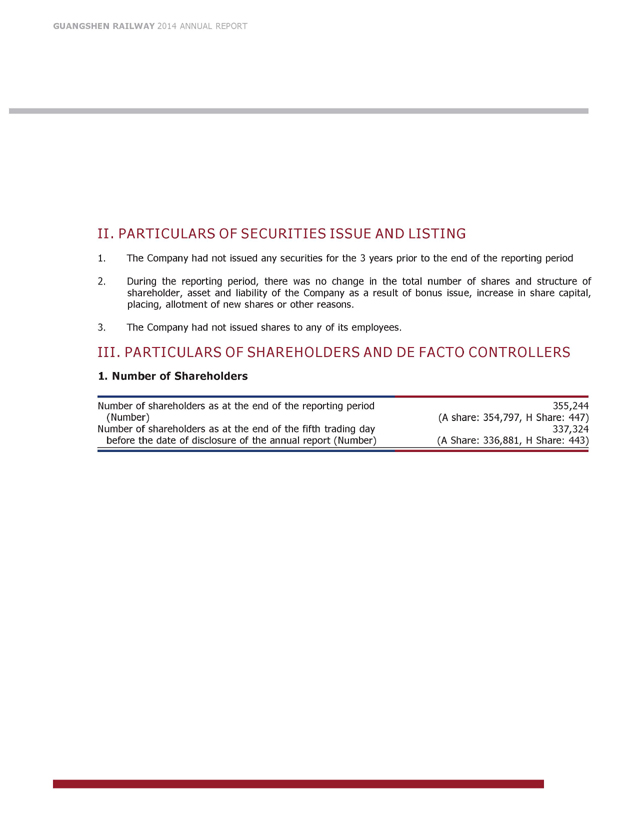

II. PARTICULARS OF SECURITIES ISSUE AND LISTING 1. The Company had not issued any securities for the 3 years prior to the end of the reporting period 2. During the reporting period, there was no change in the total number of shares and structure of shareholder, asset and liability of the Company as a result of bonus issue, increase in share capital, placing, allotment of new shares or other reasons. 3. The Company had not issued shares to any of its employees. III. PARTICULARS OF SHAREHOLDERS AND DE FACTO CONTROLLERS 1. Number of Shareholders Number of shareholders as at the end of the reporting period (Number) Number of shareholders as at the end of the fifth trading day before the date of disclosure of the annual report (Number) 355,244 (A share: 354,797, H Share: 447) 337,324 (A Share: 336,881, H Share: 443)

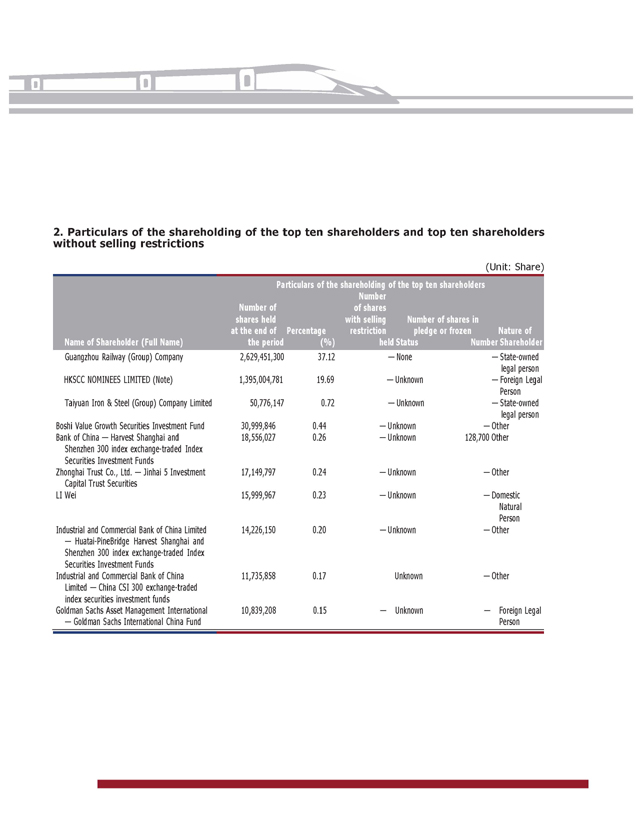

2. Particulars of the shareholding of the top ten shareholders and top ten shareholders without selling restrictions Number of Particulars of the shareholding of the top ten shareholders Number of shares (Unit: Share) shares held at the end of Percentage with selling restriction Number of shares in pledge or frozen Nature of Name of Shareholder (Full Name) the period (%) held Status Number Shareholder Particulars of the shareholding of the top ten shareholders Number of shares Number of shares Restriction pledge or frozen Nature of Number of shares in Guangzhou Railway (Group) Company 2,629,451,300 37.12 — None — State-owned legal person HKSCC NOMINEES LIMITED (Note) 1,395,004,781 19.69 — Unknown — Foreign Legal Person Taiyuan Iron & Steel (Group) Company Limited 50,776,147 0.72 — Unknown — State-owned legal person Boshi Value Growth Securities Investment Fund 30,999,846 0.44 — Unknown — Other Bank of China — Harvest Shanghai and Shenzhen 300 index exchange-traded Index Securities Investment Funds Zhonghai Trust Co., Ltd. — Jinhai 5 Investment Capital Trust Securities 18,556,027 0.26 — Unknown 128,700 Other 17,149,797 0.24 — Unknown — Other LI Wei 15,999,967 0.23 — Unknown — Domestic Natural Person Industrial and Commercial Bank of China Limited — Huatai-PineBridge Harvest Shanghai and Shenzhen 300 index exchange-traded Index Securities Investment Funds Industrial and Commercial Bank of China Limited — China CSI 300 exchange-traded index securities investment funds Goldman Sachs Asset Management International 10,839,208 0.15 — Unknown — Foreign Legal — Goldman Sachs International China Fund Person 14,226,150 0.20 — Unknown — Other 11,735,858 0.17 Unknown — Other

| 052 | ||

| 053 |

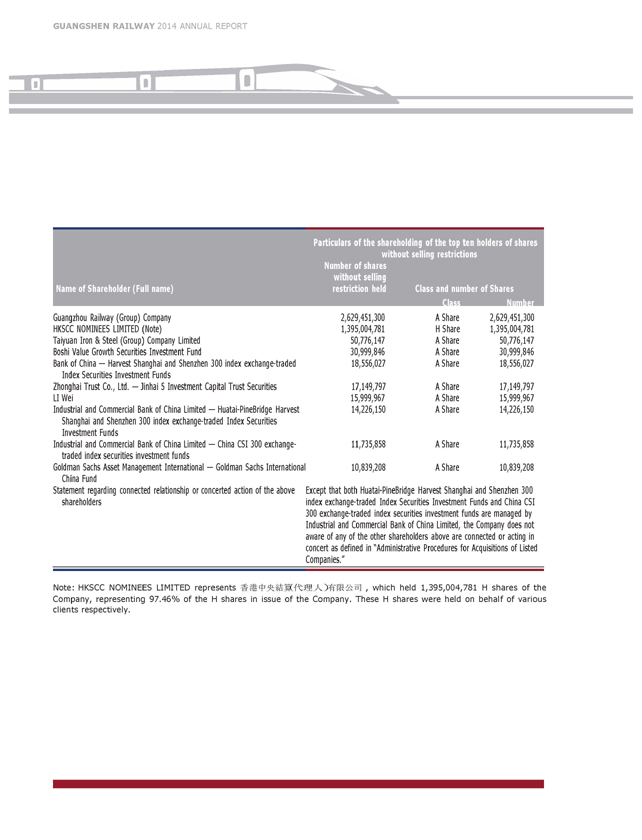

Name of Shareholder (Full name) Particulars of the shareholding of the top ten holders of shares without selling restrictions Number of shares without selling restriction held Class and number of Shares Class Number Guangzhou Railway (Group) Company 2,629,451,300 A Share 2,629,451,300 HKSCC NOMINEES LIMITED (Note) 1,395,004,781 H Share 1,395,004,781 Taiyuan Iron & Steel (Group) Company Limited 50,776,147 A Share 50,776,147 Boshi Value Growth Securities Investment Fund 30,999,846 A Share 30,999,846 Bank of China — Harvest Shanghai and Shenzhen 300 index exchange-traded Index Securities Investment Funds 18,556,027 A Share 18,556,027 Zhonghai Trust Co., Ltd. — Jinhai 5 Investment Capital Trust Securities 17,149,797 A Share 17,149,797 LI Wei 15,999,967 A Share 15,999,967 Industrial and Commercial Bank of China Limited — Huatai-PineBridge Harvest Shanghai and Shenzhen 300 index exchange-traded Index Securities Investment Funds Industrial and Commercial Bank of China Limited — China CSI 300 exchange- traded index securities investment funds Goldman Sachs Asset Management International — Goldman Sachs International China Fund 14,226,150 A Share 14,226,150 11,735,858 A Share 11,735,858 10,839,208 A Share 10,839,208 Statement regarding connected relationship or concerted action of the above shareholders Except that both Huatai-PineBridge Harvest Shanghai and Shenzhen 300 index exchange-traded Index Securities Investment Funds and China CSI 300 exchange-traded index securities investment funds are managed by Industrial and Commercial Bank of China Limited, the Company does not aware of any of the other shareholders above are connected or acting in concert as defined in “Administrative Procedures for Acquisitions of Listed Companies.” Note: HKSCC NOMINEES LIMITED represents , which held 1,395,004,781 H shares of the Company, representing 97.46% of the H shares in issue of the Company. These H shares were held on behalf of various clients respectively.

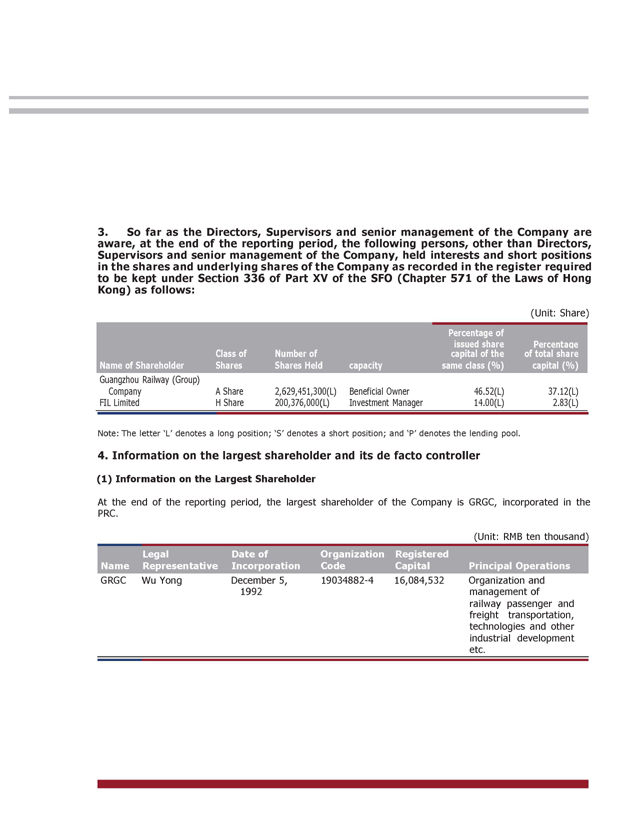

3. So far as the Directors, Supervisors and senior management of the Company are aware, at the end of the reporting period, the following persons, other than Directors, Supervisors and senior management of the Company, held interests and short positions in the shares and underlying shares of the Company as recorded in the register required to be kept under Section 336 of Part XV of the SFO (Chapter 571 of the Laws of Hong Kong) as follows: (Unit: Share) Percentage of issued share Percentage Name of Shareholder Class of Shares Number of Shares Held capacity capital of the same class (%) of total share capital (%) Guangzhou Railway (Group) Company A Share 2,629,451,300(L) Beneficial Owner 46.52(L) 37.12(L) FIL Limited H Share 200,376,000(L) Investment Manager 14.00(L) 2.83(L) Note: The letter ‘L’ denotes a long position; ‘S’ denotes a short position; and ‘P’ denotes the lending pool. 4. Information on the largest shareholder and its de facto controller (1) Information on the Largest Shareholder At the end of the reporting period, the largest shareholder of the Company is GRGC, incorporated in the PRC. Legal Date of Organization Registered (Unit: RMB ten thousand) Name Representative Incorporation Code Capital Principal Operations GRGC Wu Yong December 5, 1992 19034882-4 16,084,532 Organization and management of railway passenger and freight transportation, technologies and other industrial development etc.

| 054 | ||

| 055 |

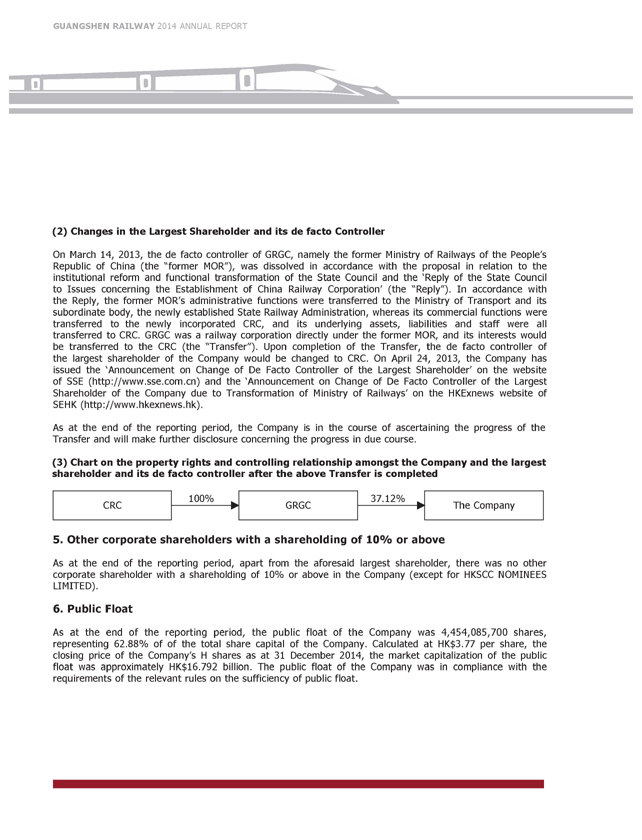

(2) Changes in the Largest Shareholder and its de facto Controller On March 14, 2013, the de facto controller of GRGC, namely the former Ministry of Railways of the People’s Republic of China (the “former MOR”), was dissolved in accordance with the proposal in relation to the institutional reform and functional transformation of the State Council and the ‘Reply of the State Council to Issues concerning the Establishment of China Railway Corporation’ (the “Reply”). In accordance with the Reply, the former MOR’s administrative functions were transferred to the Ministry of Transport and its subordinate body, the newly established State Railway Administration, whereas its commercial functions were transferred to the newly incorporated CRC, and its underlying assets, liabilities and staff were all transferred to CRC. GRGC was a railway corporation directly under the former MOR, and its interests would be transferred to the CRC (the “Transfer”). Upon completion of the Transfer, the de facto controller of the largest shareholder of the Company would be changed to CRC. On April 24, 2013, the Company has issued the ‘Announcement on Change of De Facto Controller of the Largest Shareholder’ on the website of SSE (http://www.sse.com.cn) and the ‘Announcement on Change of De Facto Controller of the Largest Shareholder of the Company due to Transformation of Ministry of Railways’ on the HKExnews website of SEHK (http://www.hkexnews.hk). As at the end of the reporting period, the Company is in the course of ascertaining the progress of the Transfer and will make further disclosure concerning the progress in due course. (3) Chart on the property rights and controlling relationship amongst the Company and the largest shareholder and its de facto controller after the above Transfer is completed CRC 100% GRGC 37.12% The Company 5. Other corporate shareholders with a shareholding of 10% or above As at the end of the reporting period, apart from the aforesaid largest shareholder, there was no other corporate shareholder with a shareholding of 10% or above in the Company (except for HKSCC NOMINEES LIMITED). 6. Public Float As at the end of the reporting period, the public float of the Company was 4,454,085,700 shares, representing 62.88% of of the total share capital of the Company. Calculated at HK$3.77 per share, the closing price of the Company’s H shares as at 31 December 2014, the market capitalization of the public float was approximately HK$16.792 billion. The public float of the Company was in compliance with the requirements of the relevant rules on the sufficiency of public float.

7. Duplication During the reporting period, Directors, chief executives or such other persons did not have duplicated interests. IV. REPURCHASE, SALE OR REDEMPTION OF THE LISTED SHARES OF THE COMPANY As of the end of the reporting period, there was no repurchase, sale or redemption by the Company, or any of its subsidiaries, of the listed shares of the Company. V. PRE-EMPTIVE RIGHT Under the Articles of the Company and the PRC Laws, there is no pre-emptive right, which requires the Company to offer new shares to its existing shareholders on a pro rata basis. VI. TRANSACTIONS INVOLVING ITS OWN SECURITIES As at the end of the reporting period, none of the Company and its subsidiaries has issued or granted any convertible securities, options, warrants or other similar rights, and redeemable securities and share option schemes. VII. TAX DEDUCTION FOR HOLDERS OF LISTED SECURITIES As at the end of the reporting period, holders of listed securities of the Company were not entitled to obtain any relief from taxation by reason of their holding of such securities pursuant to the laws of the PRC.

| 056 | ||

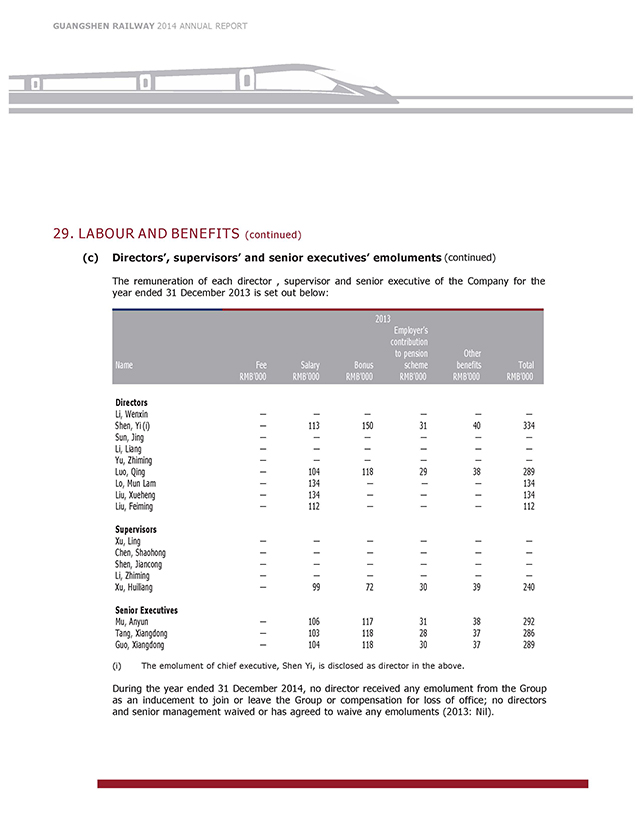

| 057 |