Exhibit 99.1

Hong Kong Exchanges and Clearing Limited and The Stock Exchange of Hong Kong Limited take no responsibility for the contents of this announcement, make no representation as to its accuracy or completeness and expressly disclaim any liability whatsoever for any loss howsoever arising from or in reliance upon the whole or any part of the contents of this announcement.

(a joint stock limited company incorporated in the People’s Republic of China)

(Stock Code: 00525)

2016 ANNUAL RESULT ANNOUNCEMENT

The Board of Directors of Guangshen Railway Company Limited (the “Company”) is pleased to announce the audited results of the Company and its subsidiaries for the year ended 31 December 2016. This announcement, containing the full text of the 2016 Annual Report of the Company, complies with the relevant requirements of the Rules Governing the Listing of Securities on The Stock Exchange of Hong Kong Limited in relation to information to accompany preliminary announcement of annual results. Printed version of the Company’s 2016 Annual Report will be available on the websites of the HKExnews of The Stock Exchange of Hong Kong Limited at www.hkexnews.hk and of the Company at www.gsrc.com on 29 March 2017 and will be despatched to holders of H shares of the Company as soon as practicable. |

Chapter 1 Definitions In this report, unless the context otherwise requires, the expressions stated below will have the following meanings: The Company, Company, Guangshen Railway Reporting period, this period, this year Guangshen Railway Company Limited 12 months from January 1 to December 31, 2016 Same period last year, last year 12 months from January 1 to December 31, 2015 A Share Renminbi-denominated ordinary shares of the Company with a par value of RMB1.00 issued in the PRC and listed on the SSE for subscription in Renminbi H Share Overseas listed foreign shares of the Company with a par value of RMB1.00 issued in Hong Kong and listed on the SEHK for subscription in Hong Kong dollars ADS U.S. dollar-denominated American Depositary Shares representing ownership of 50 H shares issued by trustees in the United States under the authorization of the Company CSRC The China Securities Regulatory Commission SSRB The Shenzhen Securities Regulatory Bureau of the China Securities Regulatory Commission HKSFC The Securities and Futures Commission of Hong Kong SSE The Shanghai Stock Exchange SEHKThe Stock Exchange of Hong Kong Limited NYSE The New York Stock Exchange SFO The Securities and Futures Ordinance (Cap. 571 of the Laws of Hong Kong) Listing Rules The listing rules of SEHK and/or the listing rules of SSE (as the case may be) Articles The articles of associations of the Company Company Law The Company Law of the People’s Republic of China Securities Law The Securities Law of the People’s Republic of China CRC China Railway Corporation GRGC, largest shareholder Guangzhou Railway (Group) Company GZIR Guangdong Guangzhou Intercity Rail Transportation Company Limited WGPR Wuhan-Guangzhou Passenger Railway Line Co., Ltd.

GUANGSHEN RAILWAY 2016 ANNUAL REPORT 016 017 GSHER Guangzhou-Shenzhen-Hong Kong Express Rail Link Company Limited GZR Guangzhou-Zhuhai Railway Company Limited XSR Xiamen-Shenzhen Railway Company Limited GSR Ganzhou-Shaoguan Railway Company Limited GGR Guiyang-Guangzhou Railway Company Limited NGR Nanning-Guangzhou Railway Company Limited GMSR Guangmeishan Railway Limited Company SR Guangdong Sanmao Railway Limited Company PRDIR Guangdong Pearl River Delta Inter-city Railway Traffic Company Limited

Chapter 2 Company Profile and Major Financial Indicators I. GENERAL INFORMATION OF THE COMPANY (1) Company Information Chinese name Chinese name abbreviation English name Guangshen Railway Company Limited Legal representative of the Company Wu Yong (2) Contact Person and Contact Information Company Secretary Representative of Securities Affairs Name Guo Xiangdong Deng Yanxia Address No. 1052 Heping Road, Luohu District, Shenzhen, Guangdong Province No. 1052 Heping Road, Luohu District, Shenzhen, Guangdong Province Tel. (86) 755-25588150 (86) 755-25588150 Fax. (86) 755-25591480 (86) 755-25591480 E-mail ir@gsrc.com ir@gsrc.com (3) Basic Information Registered Address No. 1052 Heping Road, Luohu District, Shenzhen, Guangdong Province Postal Code of Registered Address 518010 Place of Business No. 1052 Heping Road, Luohu District, Shenzhen, Guangdong Province Postal Code of the Place of Business 518010 Company Website http://www.gsrc.com E-mail ir@gsrc.com (4) Places for Information Disclosure and Reserve Address Newspapers for information disclosure of the Company Websites specified by CSRC to publish the annual report China Securities Journal, Securities Times, Shanghai Securities News, Securities Daily http://www.sse.com.cn http://www.hkexnews.hk http://www.gsrc.com Reserve address of annual report No. 1052 Heping Road, Luohu District, Shenzhen, Guangdong Province

GUANGSHEN RAILWAY 2016 ANNUAL REPORT 018 019 (5) Share information of the Company Share information of the Company Type of the Shares Stock Exchange Stock Short Name Stock Code A Share SSE 601333 H Share SEHK 00525 ADS NYSE — GSH (6) Other Relevant Information Auditor Engaged by the Company (Domestic) Name PricewaterhouseCoopers Zhong Tian LLP Office Address 11/F PricewaterhouseCoopers Center, 2 Corporate Avenue, 202 Hu Bin Road, Huangpu District, Shanghai, China Name of signing auditors Zhou Weiran, Hua Jun Auditor Engaged by the Company (International) Legal advisor as to PRC law Legal advisor as to Hong Kong law Legal advisor as to United States law Name PricewaterhouseCoopers Office Address 22nd Floor, Prince’s Building, Central, Hong Kong Name Beijing Grandway Law Office Office Address 12/F, Block C, Skyworth Building, 8 South One Street, Hi-Tech Zone, Nanshan District, Shenzhen, China Name Cleary Gottlieb Steen & Hamilton (Hong Kong) Office Address 37th Floor, Hysan Place, 500 Hennessy Road, Causeway Bay, Hong Kong Name Shearman & Sterling LLP Office Address 12th Floor, Gloucester Tower, The Landmark, 15 Queen’s Road Central, Central, Hong Kong Registrar for A Share Name China Securities Depository and Clearing Corporation Limited Shanghai Branch Office Address 36th Floor, China Insurance Building, No. 166, Lujiazui East Road, Pudong New District, Shanghai, China Registrar for H Share Name Computershare Hong Kong Investor Services Limited Office Address Rooms 1712-1716, 17th Floor, Hopewell Centre, 183 Queen’s Road East, Wan Chai, Hong Kong Depository Name JPMorgan Chase Bank, N.A. Office Address 13th Floor, No. 4 New York Plaza, New York, USA Principal banker Name Construction Bank of China Shenzhen Branch Jiabin Road Sub-branch Office Address 1st to 4th Floors, Jinwei Building, Jiabin Road, Shenzhen, Guangdong Province, China

II. COMPANY PROFILE On March 6, 1996, the Company was registered and established in Shenzhen, the PRC in accordance with the Company Law. In May 1996, H shares and American Depositary Shares issued by the Company were listed on the SEHK and the NYSE respectively. In December 2006, the A Share issued by the Company were listed on the SSE. In January 2007, the Company used the proceeds from the issue of A shares to acquire the railway of Guangzhou-Pingshi section, taking the coverage of the Company’s operations into the national trunk line networks. Currently, the Company is the only PRC railway enterprise with its shares listed in Shanghai, Hong Kong and New York. The Company is mainly engaged in railway passenger and freight transportation businesses, the Hong Kong Through Train passenger services in cooperation with MTR Corporation Limited, and management services for commissioned transportation for other railway companies in the PRC. The Company is also engaged in the provision of integrated services in relation to railway facilities and technology, commercial trading and other industrial businesses that are consistent with the Company’s objectives. The Shenzhen-Guangzhou-Pingshi Railway, which is operated solely and independently by the Company, runs 481.2 kilometers long in operation and connects the entire Guangdong Province vertically. Of which, Guangzhou-Pingshi Railway is the southern part of Beijing-Guangzhou railway, forming an aorta connecting north and south China, whereas Guangzhou-Shenzhen Railway is the only railway passway from mainland China to Hong Kong, and links with the Beijing-Guangzhou, Beijing-Kowloon, Sanshui-Maoming, Pinghu- Nantou, and Pinghu-Yantian lines, as well as to the Xiamen-Shenzhen Railway and the East Rail Line in Hong Kong, forming an important integral part of the railway transportation network in the PRC. Passenger transportation is the principal business of the Company. As at December 31, 2016, the Company operated 253 pairs of passenger trains each day, including 102 pairs of intercity high-speed passenger trains between Guangzhou and Shenzhen (including 94 pairs of inter-city trains between Guangzhou East to Shenzhen (including 20 stand-by pairs), 8 pairs of Guangzhou East to the Chaozhou-Shantou cross-network EMU trains), 13 pairs of Hong Kong Through Trains (including 11 pairs of Canton-Kowloon Through Trains, 1 pair of Zhaoqing-Kowloon Through Trains and 1 pair of Beijing/Shanghai-Kowloon Through Trains) and 138 pairs of long-distance trains (including 10 pairs of Guangzhou-Foshan-Zhaoqing intercity trains, 3 pairs of Guangzhou to Guilin North, Nanning East and Guiyang North cross-network EMU trains). The Company adopts an ‘As-frequent-as-buses’ operation for Guangzhou-Shenzhen inter-city trains, one pair of China Railway High- speed trains (the ‘CRHs’) is dispatched every 10 minutes on average during peak hours between Guangzhou and Shenzhen. The through-trains passing Hong Kong jointly operated by the Company and MTR Corporation Limited are one of the important transportation means going between Guangzhou and Hong Kong. The Company organized and operated a number of long-distance trains running from and to Guangzhou and Shenzhen that linked with most of the provinces, autonomous regions and municipals across the nation. Freight transportation is an important business of the Company. The Company is well-equipped with comprehensive freight facilities and is able to efficiently transport full load cargo, single load cargo, containers, bulky and overweight cargo, dangerous cargo, fresh and live cargo, and oversized cargo, and the rail lines operated are closely knitted with the major ports in Guangzhou and Shenzhen and are connected to several large industrial zones, logistics zones and plants and mines in the Pearl River Delta region via the railroad sidings. The major market of the Company’s freight transportation business is domestic mid- to long- distance transportation, and the Company enjoys competitive advantages in domestic mid- to long-distance freight transportation. Railway operation service is an extended business of passenger and freight transportation expanded by the Company since the commencement of operation of WGPR in December 2009. So far, the Company has provided such service to WGPR, GZIR, GSHER, GZR, XSR, GSR, NGR, GGR and PRDIR. With the completion and commencement of operation of a series of high-speed railways and inter-city railways in ‘Pan Pearl River Delta’ successively, the geographical coverage of railway operation service provided by the Company will be more extensive. Railway operation service will also become a new business growth point of the Company.

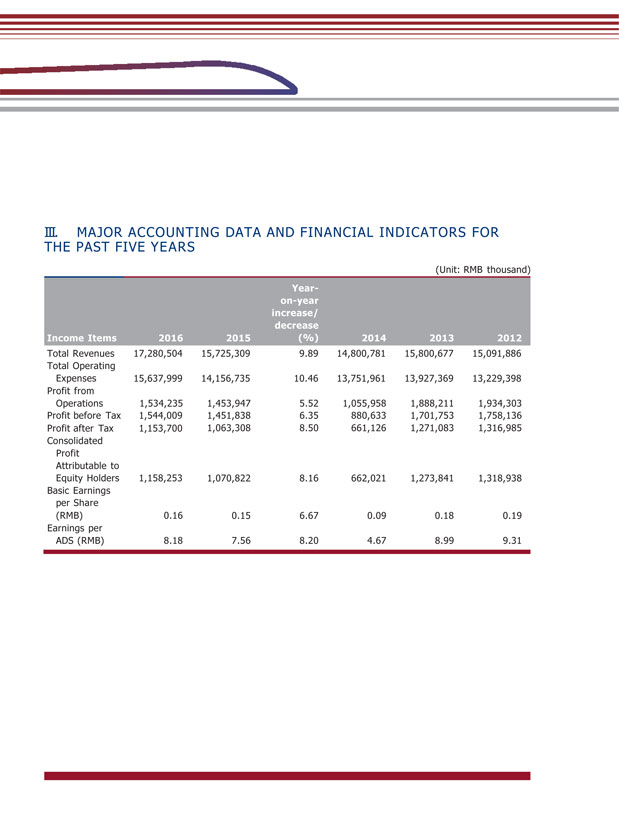

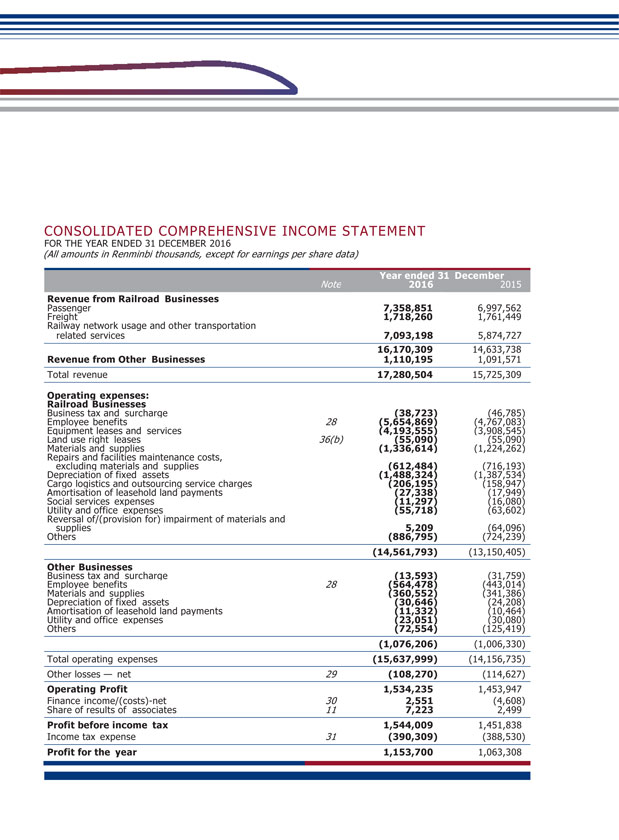

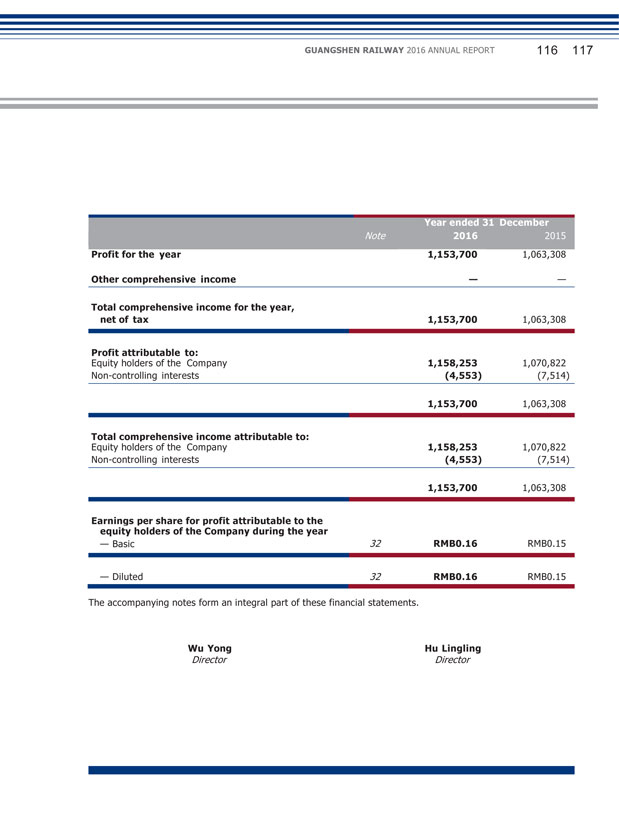

III. MAJOR ACCOUNTING DATA AND FINANCIAL INDICATORS FOR THE PAST FIVE YEARS (Unit: RMB thousand) Income Items 2016 2015 Year- on-year increase/ decrease (%) 2014 2013 2012 Total Revenues Total Operating Expenses 17,280,504 15,637,999 15,725,309 14,156,735 9.89 10.46 14,800,781 13,751,961 15,800,677 13,927,369 15,091,886 13,229,398 Profit from Operations 1,534,235 1,453,947 5.52 1,055,958 1,888,211 1,934,303 Profit before Tax 1,544,009 1,451,838 6.35 880,633 1,701,753 1,758,136 Profit after Tax 1,153,700 Consolidated 1,063,308 8.50 661,126 1,271,083 1,316,985 Attributable to Equity Holders 1,158,253 Basic Earnings 1,070,822 8.16 662,021 1,273,841 1,318,938 per Share (RMB) 0.16 0.15 6.67 0.09 0.18 0.19 ADS (RMB) 8.18 7.56 8.20 4.67 8.99 9.31

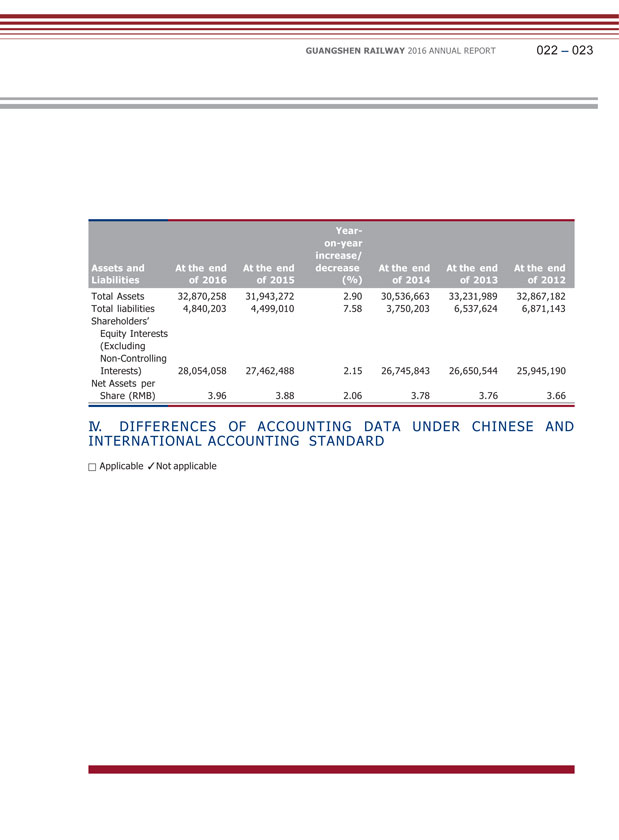

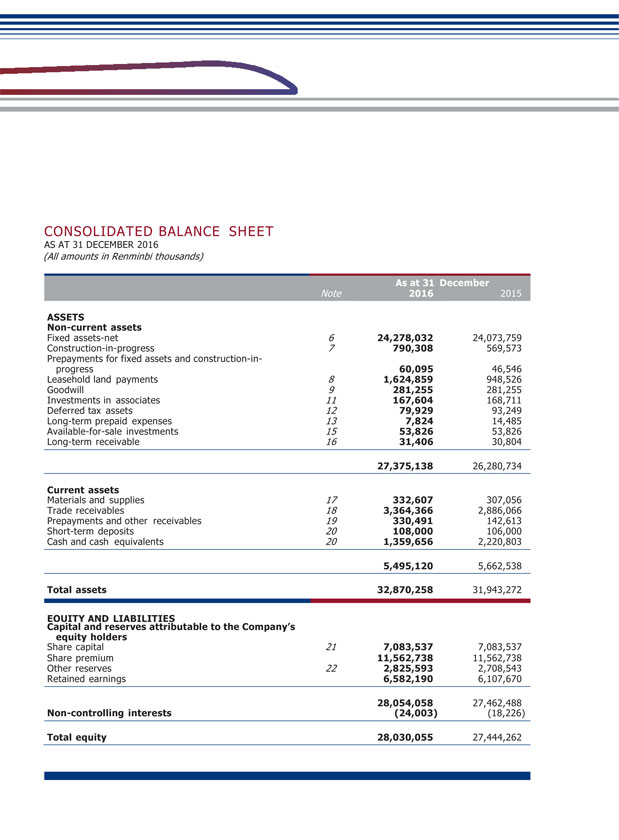

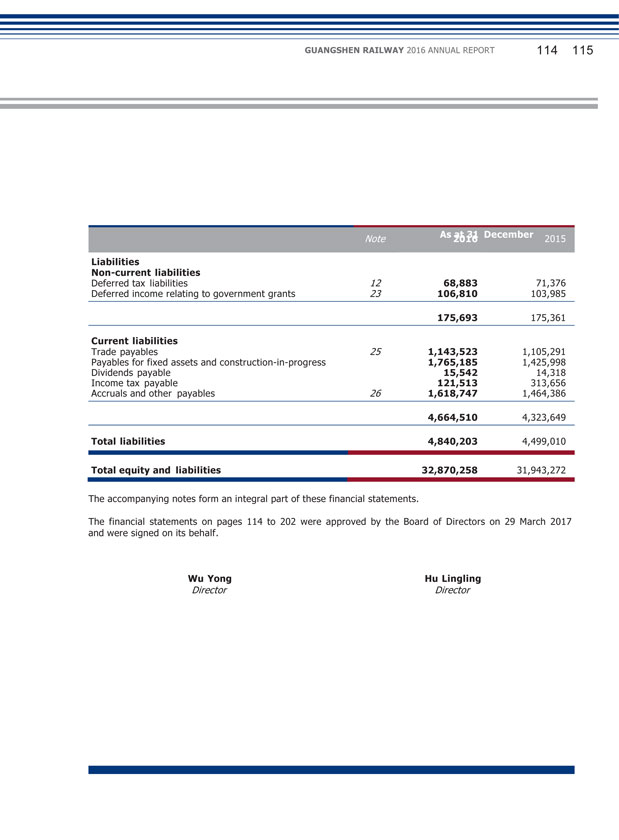

GUANGSHEN RAILWAY 2016 ANNUAL REPORT 022 023 Total Assets 32,870,258 31,943,272 2.90 30,536,663 33,231,989 32,867,182 Total liabilities 4,840,203 4,499,010 7.58 3,750,203 6,537,624 6,871,143 Shareholders’ Equity Interests (Excluding Non-Controlling Interests) 28,054,058 27,462,488 2.15 26,745,843 26,650,544 25,945,190 Net Assets per Share (RMB) 3.96 3.88 2.06 3.78 3.76 3.66 IV. DIFFERENCES OF ACCOUNTING DATA UNDER CHINESE AND INTERNATIONAL ACCOUNTING STANDARD Applicable Not applicable

Chapter 3 Summary of the Company’s Business PRINCIPAL ACTIVITIES, BUSINESS MODEL AND INDUSTRY FACT SHEET DURING THE REPORTING PERIOD Principal Activities and Business Model During the reporting period, as a railway transport enterprise, the Company has been operating the passenger and freight transportation businesses of the Shenzhen-Guangzhou-Pingshi Railway independently, operating the Hong Kong Through Train passenger services in cooperation with MTR Corporation Limited, and providing railway operation services for commissioned transportation for other railway companies such as WGPR, GZIR, GSHER, GZR ,XSR ,GSR, NGR, GGR and PRDIR. Industry Fact Sheet Being the aorta of the nation’s economy, the key important infrastructure and an significant project for people’s livelihood, as well as the backbone of integrated transportation system and one of the main transportation, railway is of crucial importance for nation’s economic and social development. Since the approval for implementation of Medium to Long Term Plan for Railway Network Development by the State Council in 2004, the railway in China developed rapidly. With the completion and commencement of a series of high-speed railways and inter-city railways in recent years, currently on the whole, the tight capacity of railway in China has been alleviated, the bottle-neck restriction has been eliminated and the economic and social development needs have been met in general. By the end of 2016, the national railway reached 124,000 kilometers in operation; while the high-speed railway ran over 22,000 kilometers in operation. In 2016, the national railway achieved a passenger delivery volume of 2,770 million persons, achieving a year- on-year increase of 11.2% of which, locomotives achieved a passenger delivery volume of 1,443 million persons, representing more than 52% of the total passenger delivery volume; the freight transportation of national railway stopped falling and stabilized, reaching a tonnage of freight of 2,650 million tonnes for the year, of which, the tonnage of container, commodity automobile and scattered cargo each recorded historical highs, with an increase of 40%, 53% and 25% respectively.

GUANGSHEN RAILWAY 2016 ANNUAL REPORT 024 025 II. EXPLANATION OF THE SIGNIFICANT CHANGE IN THE MAJOR ASSETS OF THE COMPANY DURING THE REPORTING PERIOD For the explanation of the significant change in the major assets of the Company during the reporting period, please read ‘Analysis of assets and liabilities’ in the chapter ‘Report of Directors (Including Management’s Discussion and Analysis)’ in this annual report for details.

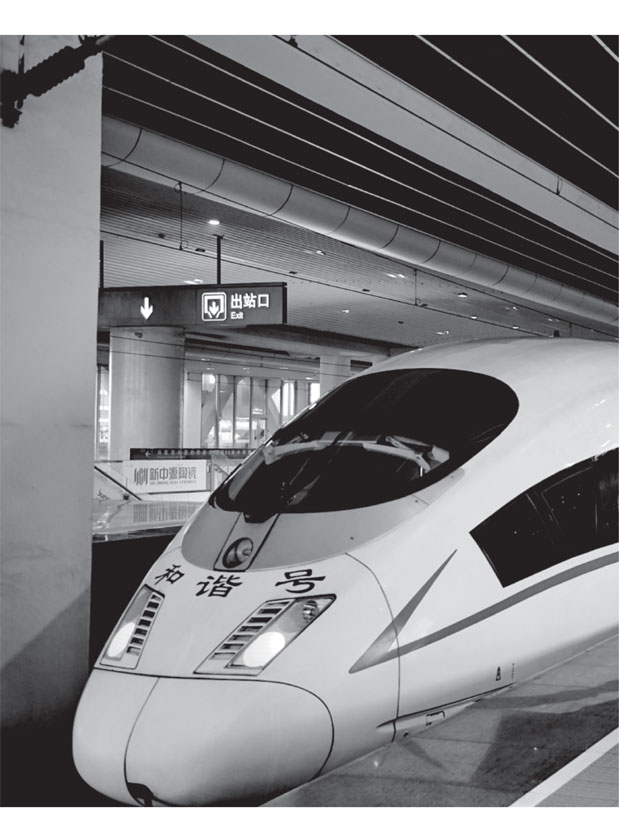

Chapter 4 Report of Directors (Including Management’s Discussion and Analysis) Chairman I. CHAIRMAN’S STATEMENT Dear Shareholders, I, on behalf of the Board, am hereby pleased to present the audited operating results of the Company for the year 2016 for the shareholders to review. In 2016, the Company achieved operating revenues of RMB17,281 million, representing a year-on-year increase of 9.89%; consolidated profits attributable to shareholders of RMB1,158 million, representing a year-on-year increase of 8.16%, and basic earnings per share of RMB0.16. The Company has been committed to enhancing corporate values and upholding long-term and stable cash dividend policy, which is in long-term and short-term interest of investors, to provide good and sustainable return for shareholders. The Board recommended the payment of final cash dividend of RMB0.08 per share for 2016, representing 50.00% of the basic earnings per share of this year. The proposal above shall be subject to approval at the 2016 annual general meeting. (1) Business Review 2016 is the first year for China to implement “The Thirteenth Five-Year Plan”, during which China’s economy operated at a slower pace and trended stably and positively. GDP growth rate remained within a reasonable range and the quality and efficiency of economic development were enhanced, providing strong and solid protection for the long-term and stable development of the Company. Nevertheless, with the still complicated and evolving domestic and international economic environment, the operation of the economy still faced greater downward pressure, which suppressed the demand growth of passenger and freight transportation. Meanwhile, the continuous enhancement of high-speed railways networks brought diversion-effect to passenger delivery volume of existing railway sections. All these brought challenges to the Company’s operation. In 2016, the Company achieved a passenger delivery volume of 84.8957 million persons, representing a year-on-year decrease of 0.55%, and a tonnage of freight of 15.3563 million tonnes, representing a year-on-year decrease of 9.03%.

GUANGSHEN RAILWAY 2016 ANNUAL REPORT 032 033 Under the above-mentioned operating environment, the Board, which lead the Company’s operation, has upheld stable and sound operation approach during the past year. All dedicated and proactive staff adopted a range of “increasing volume and income, reducing cost and consumption” measures. In regards of increasing income, the Company explored the market potential of passenger and freight transportation, added 5 pairs of cross-network EMU trains between Guangzhou East and Chaozhou-Shantou and 1 pair of long-distance trains between Shenzhen to Urumqi, commenced inter-city passenger transportation business at Pinghu Railway Station, fully pressed ahead with railway supply-side structural reform measures, increased the frequency of southern express lines for freight transportation, continuously expanded service scope of railway operation. In regards of cost reduction, general and non-productive expenses were reduced substantially under strengthened cost management, as a result, cost and expenses were under effective control. Upon the above efforts, the Company has overcome various difficulties and achieved better operating results, generally realized the annual operating objectives determined by the Board. In 2016, the Board has duly performed their duties under the Company’s Articles of Association. With their meticulous and conscientious effort, the Directors strived to enhance the corporate governance and operation management of the Company. The Company has convened 2 general meetings, 5 board meetings and 6 audit committee meetings during the year, in which sound decisions in relation to the Company’s profit distribution, financial budget, production and operation, connected transactions, system establishments as well as recruitment of senior management were made to enhance the Company’s continuous development. (2) Prospects Shareholders are reminded that the Company has made certain forward-looking statements in relation to domestic and international economic conditions and railway transportation market, as well as the work plans of the Company in 2017 and in the future in this annual report. These forward-looking statements are subject to the influences of various uncertainties and risks, and the actual outcome may be greatly different from the forward-looking statements. These statements do not constitute any commitment to the future operating results of the Company. Please be advised to consider the investment risks. In 2017, domestic and international economic conditions are not positive and the Chinese economy is still faced with greater downward pressure. Nevertheless, with the implementation of a range of “stabilizing growth, adjusting structure” policies and measures by the government, it is expected the Chinese economy will retain the pace of “progress with stability”, and GDP growth rate may slow down but remain within a reasonable range. In respect of industry developments, being the aorta of the nation’s economy and an important infrastructure of the nation, investments in railway has been intensified by the State in recent years. Various high-speed railways and inter-city railways will be completed and commence operation in 2017, and the capacity of railway transportation, especially passenger delivery capacity will continue to grow at a steady pace. Consequently, under the combined effect of the above factors, market demand of railway passenger transportation will grow at a faster pace in 2017.

In 2017, facing complicated and evolving business environment, with the railway spirit of “Safety, Quality, Development of Railway and Prosperity of Country” in the new era, the Company will uphold the operating objectives of the Company, adapt to the new normal of economic development proactively, adhere to market-oriented approach, focus on economic efficiency, preserve the main theme of scientific and harmonious development, enhance coordination in workplace safety, explore operational potentials, enhance service quality, improve assets management, strengthen cost control, standardize operation management, coordinate and control work in the areas of safety, transportation, operation, construction and stability. In 2017, the Company will meticulously materialize the spirit of the Central Economic Work Conference and CRC’s annual work conference through expediting the pace of reformation of the investment and financing system and proactively explore the reformative model of mixed ownership with diversified equity investment, in an effort to grow and prosper the Company and generate solid operating results. I, together with the members of the Board, believe that in the forthcoming year, the Company is going to attain new achievements in different aspects, create new values for our shareholders and make new contributions to the development of society under the strong support of all shareholders and various sectors of the society, along with the joint efforts of the Board, supervisory committee, management and all staff. By order of the Board Wu Yong Chairman of the Board Shenzhen, China 29 March 2017

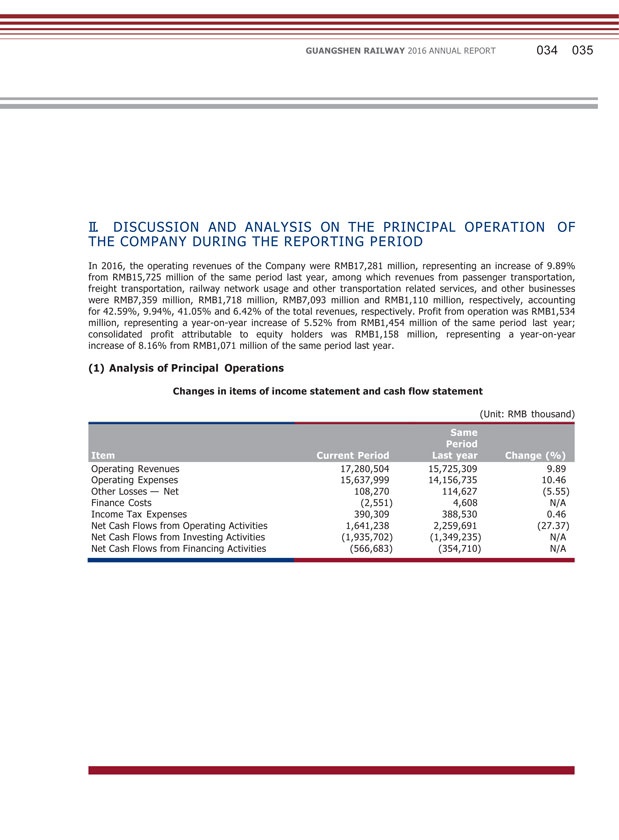

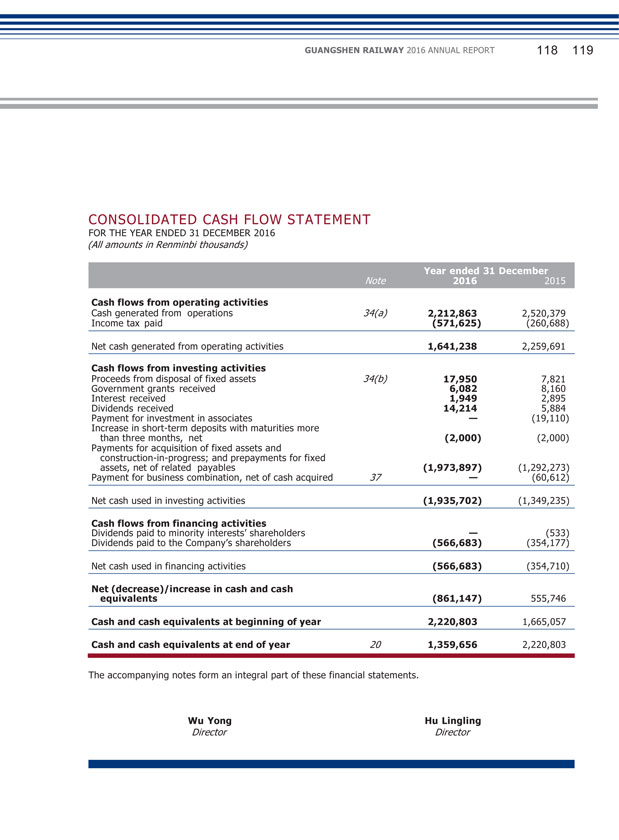

GUANGSHEN RAILWAY 2016 ANNUAL REPORT 034 035 II. DISCUSSION AND ANALYSIS ON THE PRINCIPAL OPERATION OF THE COMPANY DURING THE REPORTING PERIOD In 2016, the operating revenues of the Company were RMB17,281 million, representing an increase of 9.89% from RMB15,725 million of the same period last year, among which revenues from passenger transportation, freight transportation, railway network usage and other transportation related services, and other businesses were RMB7,359 million, RMB1,718 million, RMB7,093 million and RMB1,110 million, respectively, accounting for 42.59%, 9.94%, 41.05% and 6.42% of the total revenues, respectively. Profit from operation was RMB1,534 million, representing a year-on-year increase of 5.52% from RMB1,454 million of the same period last year; consolidated profit attributable to equity holders was RMB1,158 million, representing a year-on-year increase of 8.16% from RMB1,071 million of the same period last year. (1) Analysis of Principal Operations Changes in items of income statement and cash flow statement (Unit: RMB thousand) Item Current Period Same Period Last year Change (%) Operating Revenues 17,280,504 15,725,309 9.89 Operating Expenses 15,637,999 14,156,735 10.46 Other Losses — Net 108,270 114,627 (5.55) Finance Costs (2,551) 4,608 N/A Income Tax Expenses 390,309 388,530 0.46 Net Cash Flows from Operating Activities 1,641,238 2,259,691 (27.37) Net Cash Flows from Investing Activities (1,935,702) (1,349,235) N/A Net Cash Flows from Financing Activities (566,683) (354,710) N/A

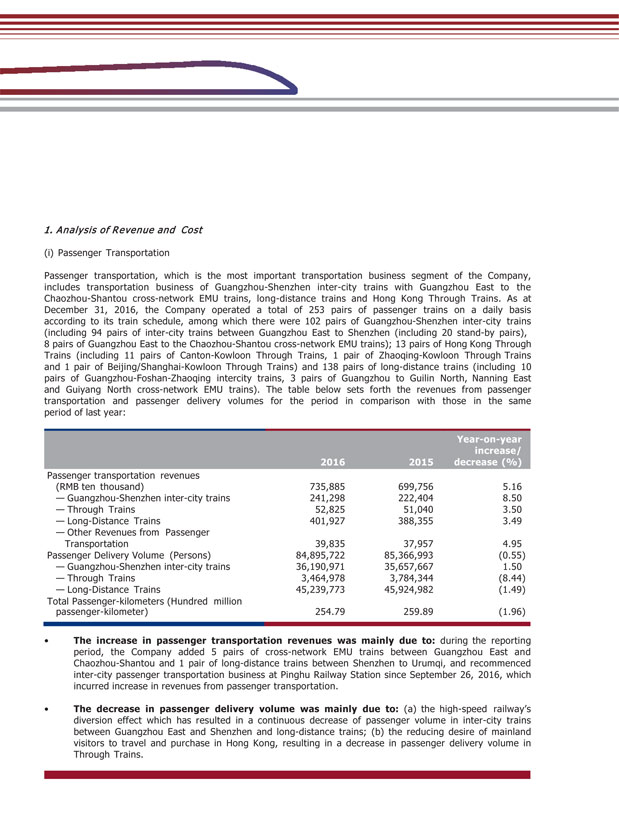

1. Analysis of Revenue and Cost (i) Passenger Transportation Passenger transportation, which is the most important transportation business segment of the Company, includes transportation business of Guangzhou-Shenzhen inter-city trains with Guangzhou East to the Chaozhou-Shantou cross-network EMU trains, long-distance trains and Hong Kong Through Trains. As at December 31, 2016, the Company operated a total of 253 pairs of passenger trains on a daily basis according to its train schedule, among which there were 102 pairs of Guangzhou-Shenzhen inter-city trains (including 94 pairs of inter-city trains between Guangzhou East to Shenzhen (including 20 stand-by pairs), 8 pairs of Guangzhou East to the Chaozhou-Shantou cross-network EMU trains); 13 pairs of Hong Kong Through Trains (including 11 pairs of Canton-Kowloon Through Trains, 1 pair of Zhaoqing-Kowloon Through Trains and 1 pair of Beijing/Shanghai-Kowloon Through Trains) and 138 pairs of long-distance trains (including 10 pairs of Guangzhou-Foshan-Zhaoqing intercity trains, 3 pairs of Guangzhou to Guilin North, Nanning East and Guiyang North cross-network EMU trains). The table below sets forth the revenues from passenger transportation and passenger delivery volumes for the period in comparison with those in the same period of last year: 2016 2015 Year-on-year increase/ decrease (%) Passenger transportation revenues (RMB ten thousand) 735,885 699,756 5.16 — Guangzhou-Shenzhen inter-city trains 241,298 222,404 8.50 — Through Trains 52,825 51,040 3.50 — Long-Distance Trains 401,927 388,355 3.49 — Other Revenues from Passenger Transportation 39,835 37,957 4.95 Passenger Delivery Volume (Persons) 84,895,722 85,366,993 (0.55) — Guangzhou-Shenzhen inter-city trains 36,190,971 35,657,667 1.50 — Through Trains 3,464,978 3,784,344 (8.44) — Long-Distance Trains 45,239,773 45,924,982 (1.49) Total Passenger-kilometers (Hundred million passenger-kilometer) 254.79 259.89 (1.96) • The increase in passenger transportation revenues was mainly due to: during the reporting period, the Company added 5 pairs of cross-network EMU trains between Guangzhou East and Chaozhou-Shantou and 1 pair of long-distance trains between Shenzhen to Urumqi, and recommenced inter-city passenger transportation business at Pinghu Railway Station since September 26, 2016, which incurred increase in revenues from passenger transportation. • The decrease in passenger delivery volume was mainly due to: (a) the high-speed railway’s diversion effect which has resulted in a continuous decrease of passenger volume in inter-city trains between Guangzhou East and Shenzhen and long-distance trains; (b) the reducing desire of mainland visitors to travel and purchase in Hong Kong, resulting in a decrease in passenger delivery volume in Through Trains.

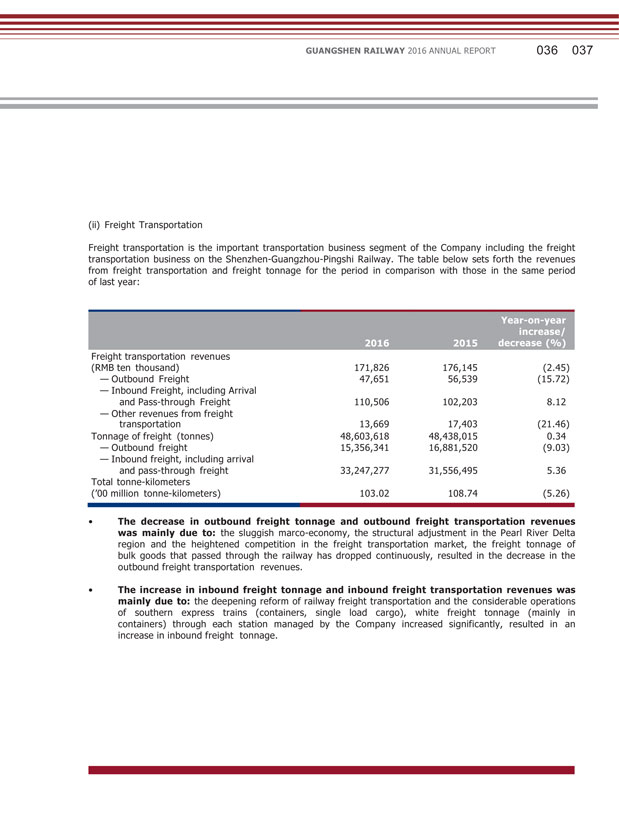

GUANGSHEN RAILWAY 2016 ANNUAL REPORT 036 037 (ii) Freight Transportation Freight transportation is the important transportation business segment of the Company including the freight transportation business on the Shenzhen-Guangzhou-Pingshi Railway. The table below sets forth the revenues from freight transportation and freight tonnage for the period in comparison with those in the same period of last year: 2016 2015 Year-on-year increase/ decrease (%) Freight transportation revenues (RMB ten thousand) 171,826 176,145 (2.45) — Outbound Freight 47,651 56,539 (15.72) — Inbound Freight, including Arrival and Pass-through Freight 110,506 102,203 8.12 — Other revenues from freight transportation 13,669 17,403 (21.46) Tonnage of freight (tonnes) 48,603,618 48,438,015 0.34 — Outbound freight 15,356,341 16,881,520 (9.03) — Inbound freight, including arrival and pass-through freight 33,247,277 31,556,495 5.36 Total tonne-kilometers (‘00 million tonne-kilometers) 103.02 108.74 (5.26) • The decrease in outbound freight tonnage and outbound freight transportation revenues was mainly due to: the sluggish marco-economy, the structural adjustment in the Pearl River Delta region and the heightened competition in the freight transportation market, the freight tonnage of bulk goods that passed through the railway has dropped continuously, resulted in the decrease in the outbound freight transportation revenues. • The increase in inbound freight tonnage and inbound freight transportation revenues was mainly due to: the deepening reform of railway freight transportation and the considerable operations of southern express trains (containers, single load cargo), white freight tonnage (mainly in containers) through each station managed by the Company increased significantly, resulted in an increase in inbound freight tonnage.

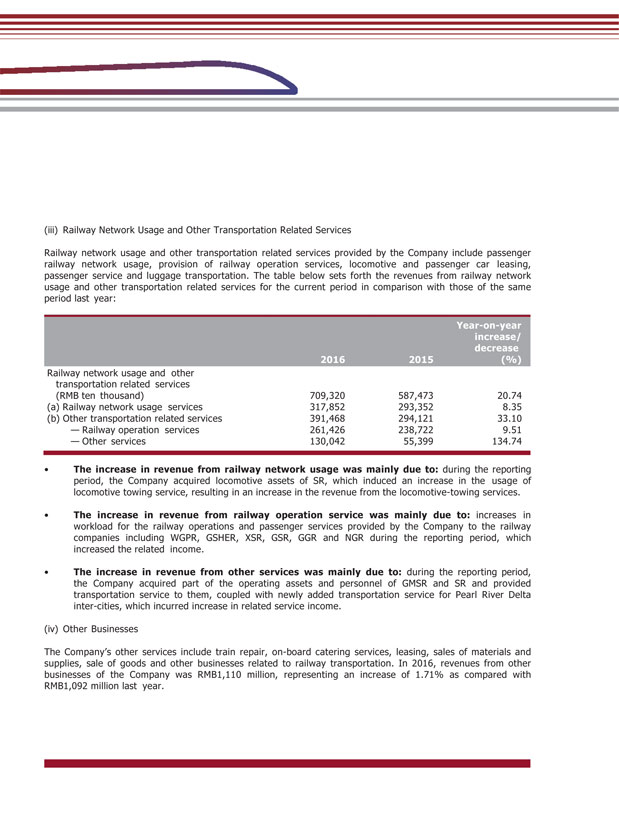

(iii) Railway Network Usage and Other Transportation Related Services Railway network usage and other transportation related services provided by the Company include passenger railway network usage, provision of railway operation services, locomotive and passenger car leasing, passenger service and luggage transportation. The table below sets forth the revenues from railway network usage and other transportation related services for the current period in comparison with those of the same period last year: 2016 2015 Year-on-year increase/ decrease (%) Railway network usage and other transportation related services (RMB ten thousand) 709,320 587,473 20.74 (a) Railway network usage services 317,852 293,352 8.35 (b) Other transportation related services 391,468 294,121 33.10 — Railway operation services 261,426 238,722 9.51 — Other services 130,042 55,399 134.74 • The increase in revenue from railway network usage was mainly due to: during the reporting period, the Company acquired locomotive assets of SR, which induced an increase in the usage of locomotive towing service, resulting in an increase in the revenue from the locomotive-towing services. • The increase in revenue from railway operation service was mainly due to: increases in workload for the railway operations and passenger services provided by the Company to the railway companies including WGPR, GSHER, XSR, GSR, GGR and NGR during the reporting period, which increased the related income. • The increase in revenue from other services was mainly due to: during the reporting period, the Company acquired part of the operating assets and personnel of GMSR and SR and provided transportation service to them, coupled with newly added transportation service for Pearl River Delta inter-cities, which incurred increase in related service income. (iv) Other Businesses The Company’s other services include train repair, on-board catering services, leasing, sales of materials and supplies, sale of goods and other businesses related to railway transportation. In 2016, revenues from other businesses of the Company was RMB1,110 million, representing an increase of 1.71% as compared with RMB1,092 million last year.

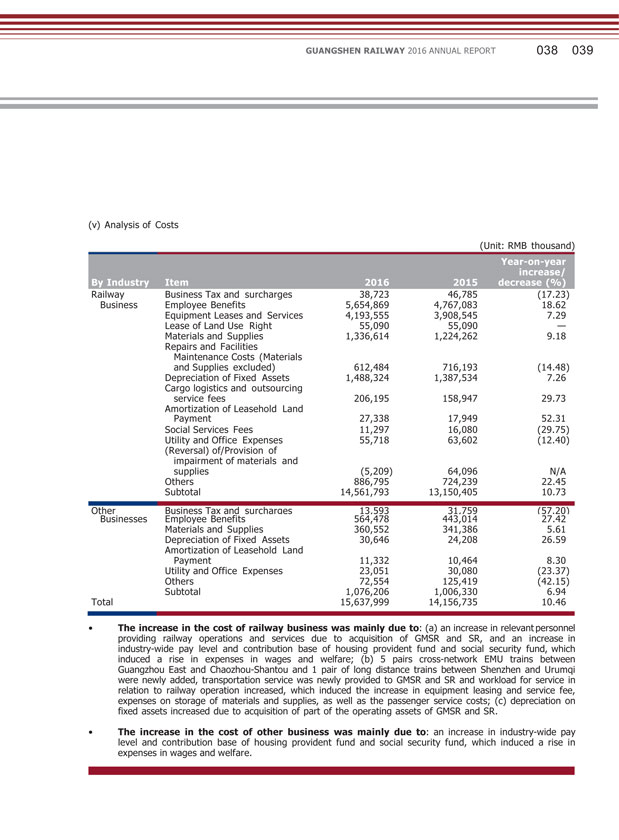

GUANGSHEN RAILWAY 2016 ANNUAL REPORT 038 039 (v) Analysis of Costs (Unit: RMB thousand) By Industry Item 2016 2015 Year-on-year increase/ decrease (%) Railway Business Tax and surcharges 38,723 46,785 (17.23) Business Employee Benefits 5,654,869 4,767,083 18.62 Equipment Leases and Services 4,193,555 3,908,545 7.29 Lease of Land Use Right 55,090 55,090 — Materials and Supplies 1,336,614 1,224,262 9.18 Repairs and Facilities Maintenance Costs (Materials and Supplies excluded) 612,484 716,193 (14.48) Depreciation of Fixed Assets 1,488,324 1,387,534 7.26 Cargo logistics and outsourcing service fees 206,195 158,947 29.73 Amortization of Leasehold Land Payment 27,338 17,949 52.31 Social Services Fees 11,297 16,080 (29.75) Utility and Office Expenses 55,718 63,602 (12.40) (Reversal) of/Provision of impairment of materials and supplies (5,209) 64,096 N/A Others 886,795 724,239 22.45 Subtotal 14,561,793 13,150,405 10.73 Other Business Tax and surcharges 13,593 31,759 (57.20) Businesses Employee Benefits 564,478 443,014 27.42 Materials and Supplies 360,552 341,386 5.61 Depreciation of Fixed Assets 30,646 24,208 26.59 Amortization of Leasehold Land Payment 11,332 10,464 8.30 Utility and Office Expenses 23,051 30,080 (23.37) Others 72,554 125,419 (42.15) Subtotal 1,076,206 1,006,330 6.94 Total 15,637,999 14,156,735 10.46 • The increase in the cost of railway business was mainly due to: (a) an increase in relevant personnel providing railway operations and services due to acquisition of GMSR and SR, and an increase in industry-wide pay level and contribution base of housing provident fund and social security fund, which induced a rise in expenses in wages and welfare; (b) 5 pairs cross-network EMU trains between Guangzhou East and Chaozhou-Shantou and 1 pair of long distance trains between Shenzhen and Urumqi were newly added, transportation service was newly provided to GMSR and SR and workload for service in relation to railway operation increased, which induced the increase in equipment leasing and service fee, expenses on storage of materials and supplies, as well as the passenger service costs; (c) depreciation on fixed assets increased due to acquisition of part of the operating assets of GMSR and SR. • The increase in the cost of other business was mainly due to: an increase in industry-wide pay level and contribution base of housing provident fund and social security fund, which induced a rise in expenses in wages and welfare.

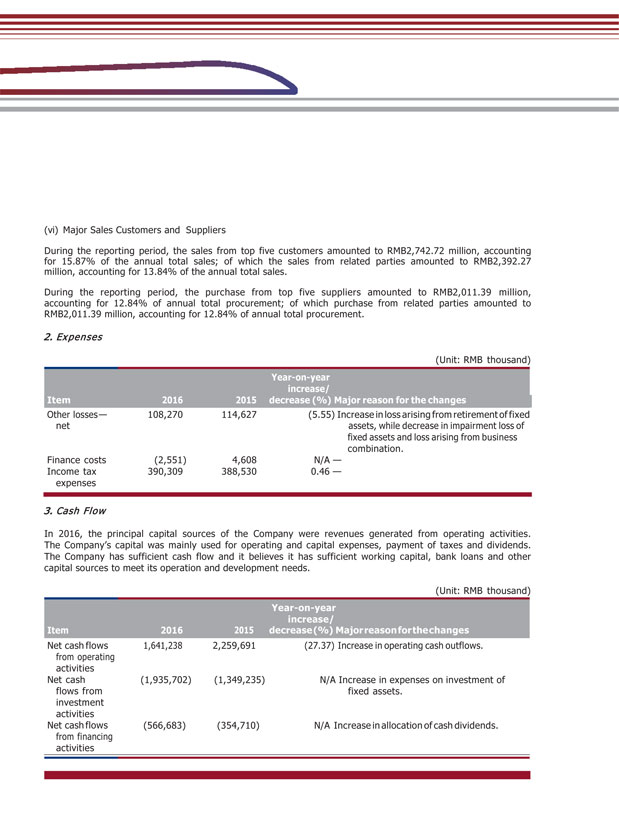

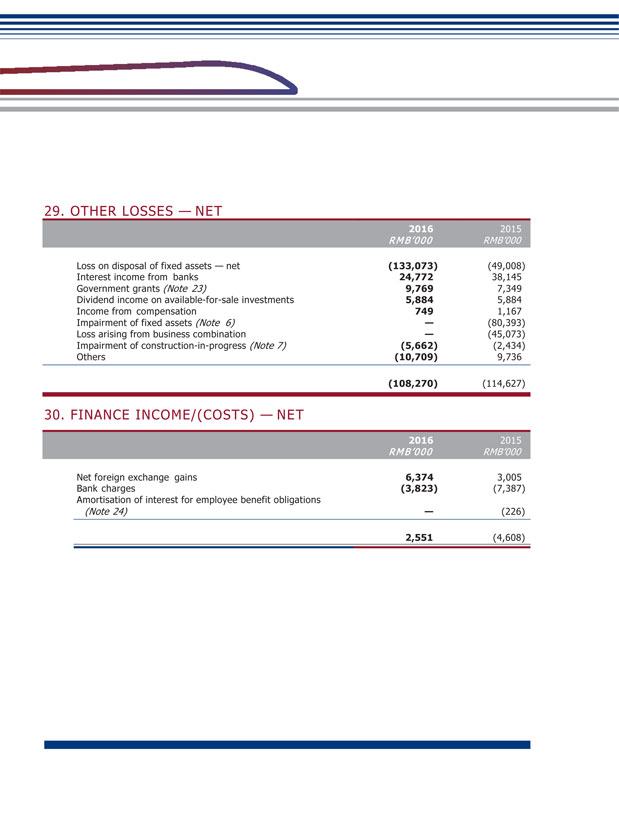

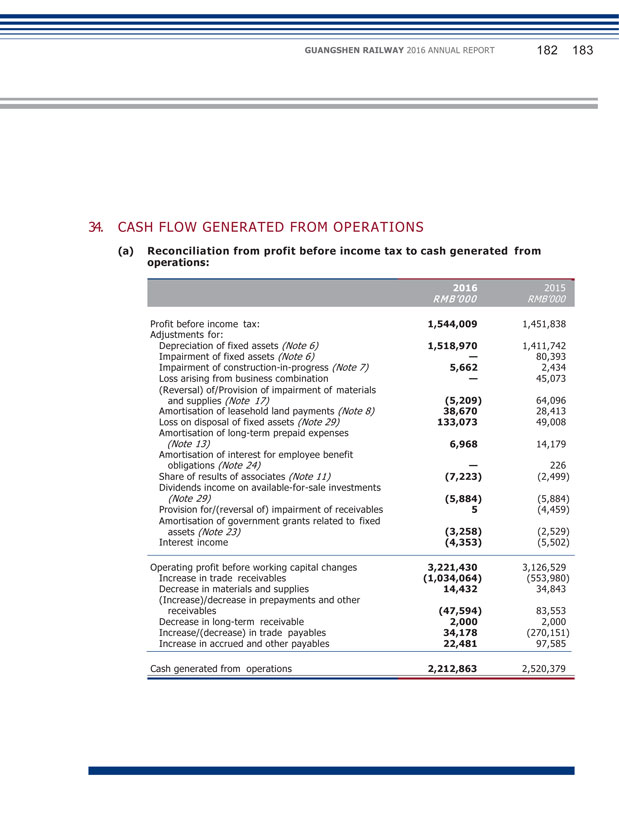

(vi) Major Sales Customers and Suppliers During the reporting period, the sales from top five customers amounted to RMB2,742.72 million, accounting for 15.87% of the annual total sales; of which the sales from related parties amounted to RMB2,392.27 million, accounting for 13.84% of the annual total sales. During the reporting period, the purchase from top five suppliers amounted to RMB2,011.39 million, accounting for 12.84% of annual total procurement; of which purchase from related parties amounted to RMB2,011.39 million, accounting for 12.84% of annual total procurement. 2. Expenses (Unit: RMB thousand) Item 2016 2015 decrease (%) Major reason for the changes Other losses — 108,270 114,627 (5.55) Increase in loss arising from retirement of fixed net assets, while decrease in impairment loss of fixed assets and loss arising from business combination. Finance costs (2,551) 4,608 N/A — Income tax 390,309 388,530 0.46 — expenses 3. Cash Flow In 2016, the principal capital sources of the Company were revenues generated from operating activities. The Company’s capital was mainly used for operating and capital expenses, payment of taxes and dividends. The Company has sufficient cash flow and it believes it has sufficient working capital, bank loans and other capital sources to meet its operation and development needs. (Unit: RMB thousand) Net cash flows from operating activities Net cash flows from investment activities Net cash flows from financing activities 1,641,238 2,259,691 (27.37) Increase in operating cash outflows. (1,935,702) (1,349,235) N/A Increase in expenses on investment of fixed assets. (566,683) (354,710) N/A Increase in allocation of cash dividends.

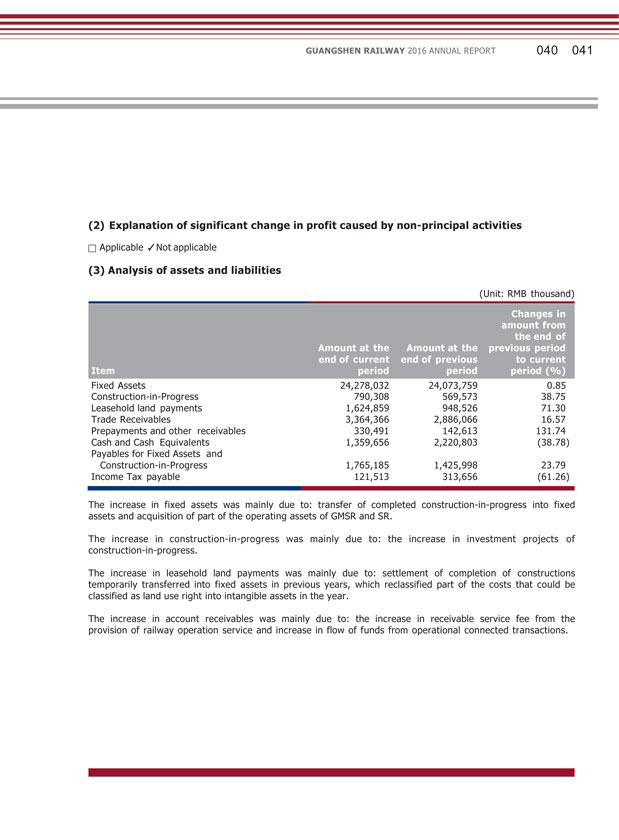

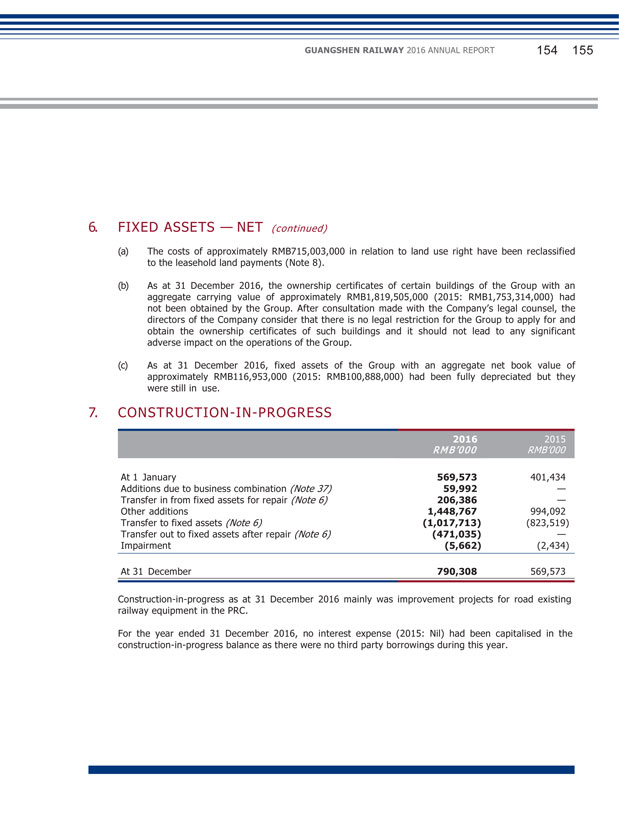

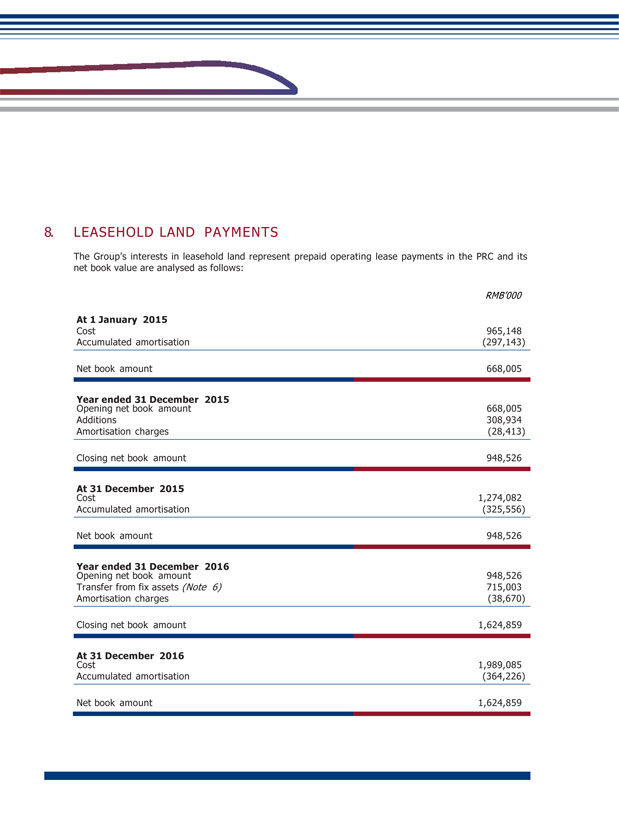

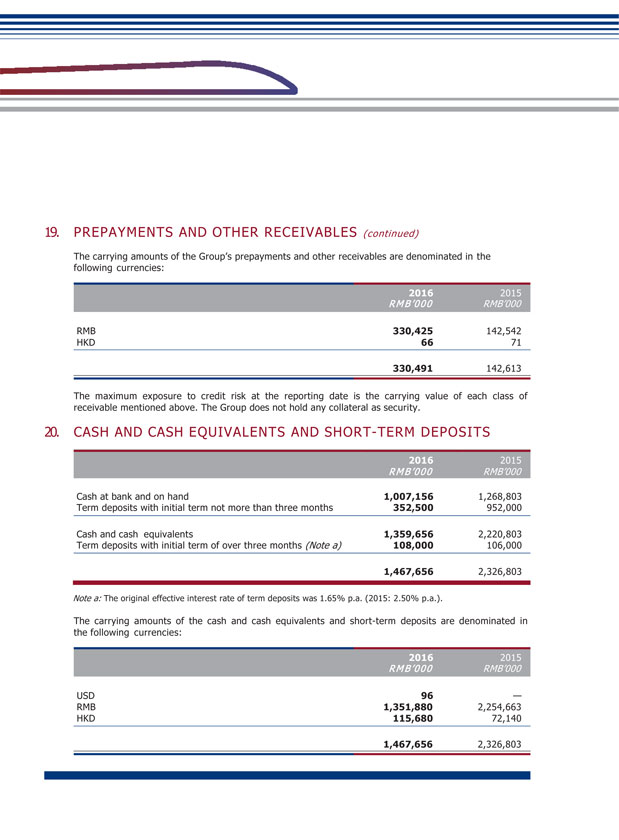

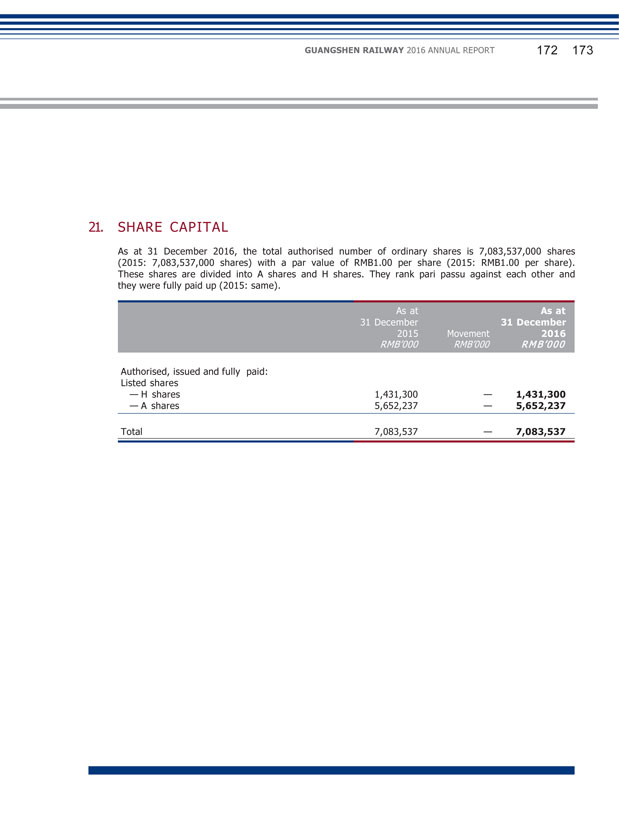

(2) Explanation of significant change in profit caused by non-principal activities Applicable Not applicable (3) Analysis of assets and liabilities (Unit: RMB thousand) Changes in amount from the end of Amount at the Amount at the previous period end of current end of previous to current Item period period period (%) Fixed Assets 24,278,032 24,073,759 0.85 Construction-in-Progress 790,308 569,573 38.75 Leasehold land payments 1,624,859 948,526 71.30 Trade Receivables 3,364,366 2,886,066 16.57 Prepayments and other receivables 330,491 142,613 131.74 Cash and Cash Equivalents 1,359,656 2,220,803 (38.78) Payables for Fixed Assets and Construction-in-Progress 1,765,185 1,425,998 23.79 Income Tax payable 121,513 313,656 (61.26) The increase in fixed assets was mainly due to: transfer of completed construction-in-progress into fixed assets and acquisition of part of the operating assets of GMSR and SR. The increase in construction-in-progress was mainly due to: the increase in investment projects of construction-in-progress. The increase in leasehold land payments was mainly due to: settlement of completion of constructions temporarily transferred into fixed assets in previous years, which reclassified part of the costs that could be classified as land use right into intangible assets in the year. The increase in account receivables was mainly due to: the increase in receivable service fee from the provision of railway operation service and increase in flow of funds from operational connected transactions.

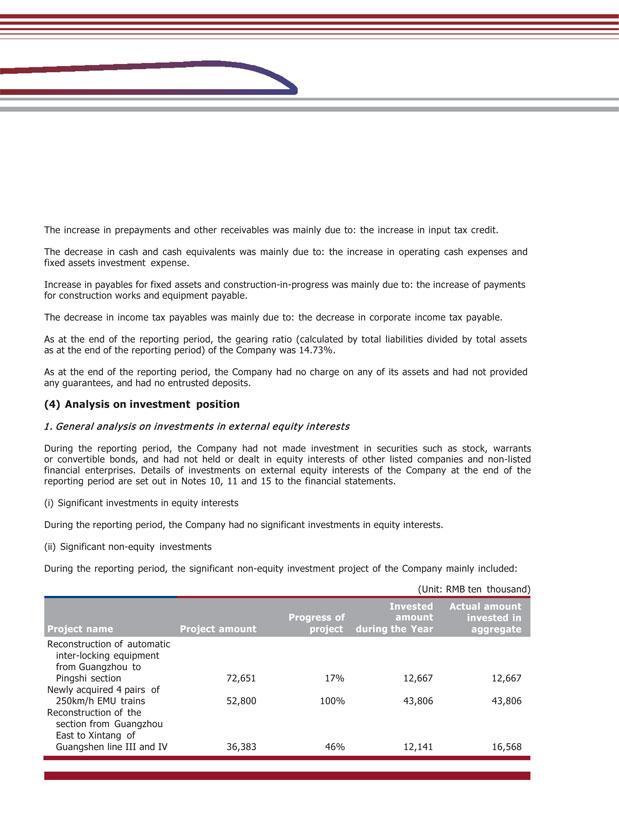

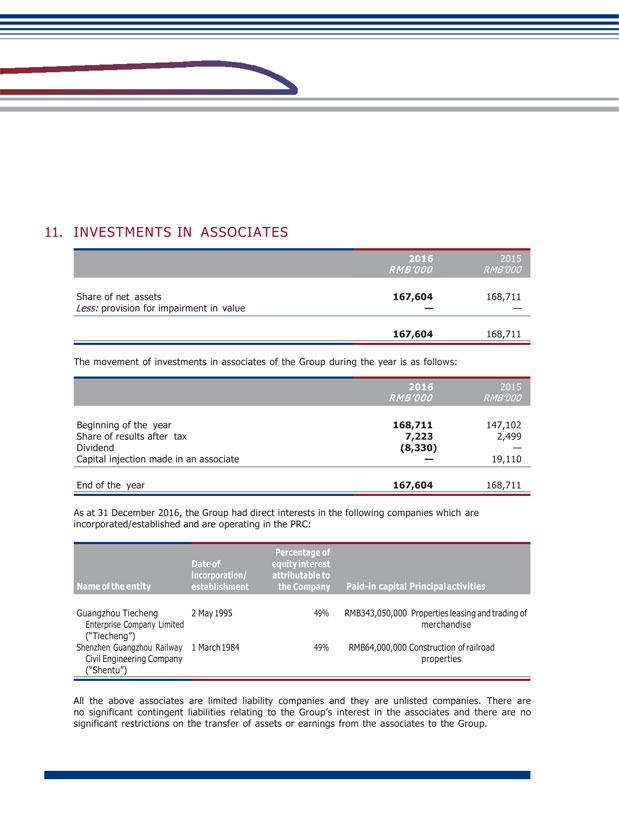

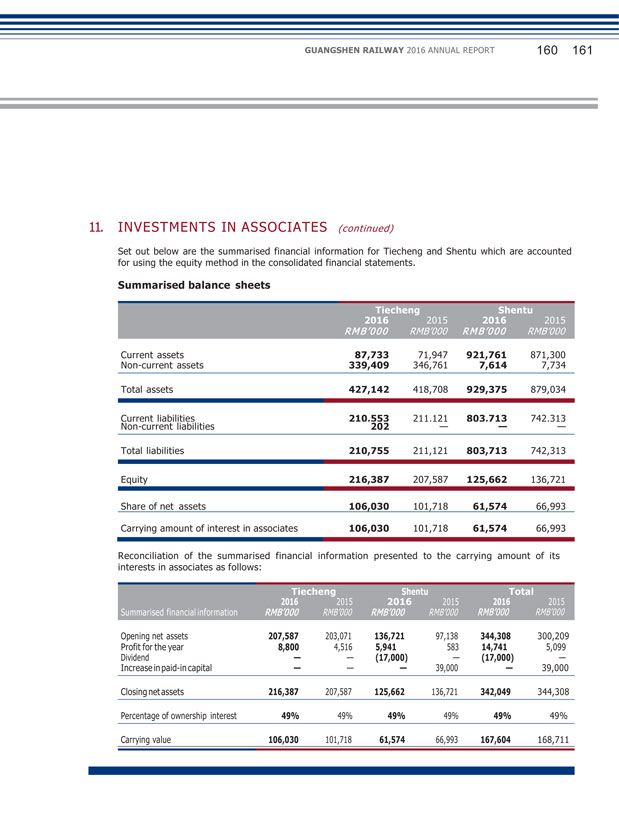

The increase in prepayments and other receivables was mainly due to: the increase in input tax credit. The decrease in cash and cash equivalents was mainly due to: the increase in operating cash expenses and fixed assets investment expense. Increase in payables for fixed assets and construction-in-progress was mainly due to: the increase of payments for construction works and equipment payable. The decrease in income tax payables was mainly due to: the decrease in corporate income tax payable. As at the end of the reporting period, the gearing ratio (calculated by total liabilities divided by total assets as at the end of the reporting period) of the Company was 14.73%. As at the end of the reporting period, the Company had no charge on any of its assets and had not provided any guarantees, and had no entrusted deposits. (4) Analysis on investment position 1. General analysis on investments in external equity interests During the reporting period, the Company had not made investment in securities such as stock, warrants or convertible bonds, and had not held or dealt in equity interests of other listed companies and non-listed financial enterprises. Details of investments on external equity interests of the Company at the end of the reporting period are set out in Notes 10, 11 and 15 to the financial statements. (i) Significant investments in equity interests During the reporting period, the Company had no significant investments in equity interests. (ii) Significant non-equity investments During the reporting period, the significant non-equity investment project of the Company mainly included: (Unit: RMB ten thousand) (Unit: RMB ten thousand) Reconstruction of automatic inter-locking equipment from Guangzhou to Pingshi section 72,651 17% 12,667 12,667 Newly acquired 4 pairs of section from Guangzhou

GUANGSHEN RAILWAY 2016 ANNUAL REPORT 042 043 (iii) Financial assets at fair value During the reporting period, the Company had no financial assets at fair value. (5) Major assets and disposal of equity interests During the reporting period, the Company had no major assets and disposal of equity interests. III. DISCUSSION AND ANALYSIS ON THE FUTURE DEVELOPMENT OF THE COMPANY (1) Industry competition scenario and development trend Industry development trend: Being the aorta of the nation’s economy, an important infrastructure of the nation and a popular form of transportation, railway is of crucial importance for nation’s economic and social development. Since the implementation of Medium to Long Term Plan for Railway Network Development in 2004, the railway in China developed rapidly. Currently on the whole, the tight capacity of railway in China has been alleviated, the bottle-neck restriction has been eliminated and the economic and social development needs have been met in in general. However, when benchmarking with the new general requirements of economic development, other transportation forms and the level of developed countries, China’s railway still faces deficiencies such as incomplete layout, low operational efficiency and severe structural conflicts. To expedite the establishment of a modern railway network with reasonable layout, wide coverage, high efficiency and convenience, safety and economic efficiencies, Medium to Long Term Plan for Railway Network Development (2016-2025) was jointly modified by National Development and Reform Commission, Ministry of Transport and China Railway Corporation in July 2016, highlighting a more ambitious “Eight East-West Lines and Eight South-North Lines” high-speed railway network for a new era. Consequently, it is estimated that in the long run in the future, development of railway transportation industry will remain at a high rate, and passenger and freight transportation capacity and market competitive position of railway will be gradually elevated. Industry competition scenario: The national railway is highly concentrated with a unified transportation management system. Competition mainly comes from other transportation industries such as highway, aviation and water transportation, and is expected to exist in the long run. However, as the marketization reform of the railway industry (including the reformation of the investment and financing system, the transportation management system and the pricing system) gradually deepens, the entry barrier to the industry will decrease, investors of the industry will become more diversified and the State’s high-speed railway network with Four East-West Lines and Four South-North Lines and numerous inter-city railways will complete construction and commence operation, the competition structure of the railway transportation industry is expected to experience substantial changes in the future, with more intense competition not only externally from the highway, aviation and water transportation industries but also within the industry itself. (2) Development strategies of the Company Under the sound leadership scientific decision-making by the Board, the Company will capitalize the historic opportunity of extensive railway construction, proactively adapt to the policy direction of railway system reform in order to establish a steadfast foothold in the Pan Pearl River Delta, perfect and enhance its business portfolio centered on railway passenger and freight transportation and complemented by the railway-related businesses. Striving to become a top-notch railway transportation services enterprise in the PRC and actualize its development objective of scaling up and consolidating its strengths, the Company will also focus on the improvement of quality of service in the continued efforts for the advancement of management innovation, service innovation and technology innovation.

Operating plans in 2017 At the fifteenth meeting of the seventh session of the Board held on March 29, 2017, the financial budget for 2017 were passed upon consideration. The Company plans to achieve passenger delivery volume of 85.10 million persons (excluding commissioned transportation), outbound freight tonnes of 16.10 million tonnes. To actualize the aforesaid objectives, the Company will focus on the following tasks: Production safety: based upon construction of route with illustrative standards on safety and quality; consistently adopt the approach of “safely first, prevention-led, integrated governance” to optimize safety management system, reinforce control over safe production process and intensify rectification of safety problems and investment in safety facilities and equipment and enhance the capability of safety protection. Passenger transportation: Firstly, enhance the passenger traffic volume analysis on Guangzhou- Shenzhen inter-city trains and cross-network EMU trains between Guangzhou East and Chaozhou-Shantou to timely adjust transportation coordination and improve the train routes and schedules, with a view to increase revenues; secondly, strengthen integrated research on railway passenger transportation market to proactively apply to competent authorities of the industry for adding long-distance trains from various stations managed by the Company to areas currently not covered by high-speed trains; thirdly, speed up large scale construction projects, including the reconstruction of the section from Guangzhou East to Xintang of Guangshen line III and IV, as well as the Xintang District public transport interchange in East Guangzhou, striving to complete and commence operation as soon as possible, stepping efforts in exploring new growth points for passenger transportation; fourthly, further improve service environment of passenger transportation, enhance customers’ service experience, aiming to enhance quality and increase efficiencies of passenger transportation. Freight transportation: Firstly, step up the efforts in implementing railway supply-side reform measures, fully leverage on relaxation policy on transportation fees and charges of coal and steel by China Raily Corporation, and actively visit large-scale enterprises of steel and electricity companies to stabilize and expand freight transportation volume of bulk goods; secondly, weigh on the advantage of scale transportation of railway, boost the development of trains schedule and network of “white freight” express trains, and on the basis of restoration of freight transportation for suspended trains during spring season, actively realize the addition of new trains from Guotang to Wulabo, Tangxi to Gaolan, with the focus on pressing ahead the coordination of container tonnage of “white freight” express trains for Dongguan Hsu Fu Chi Foods Co., Ltd.. Operational management: Firstly, enhance awareness of operation efficiencies and process management, stringently exert control on the cost budget, uplift management level of budget; secondly, strengthen budget management of funds and carried out centralized management to secure source, reduce cost and increase efficiency of funds; thirdly, enhance tax management and planning to promote risk prevention of value-added tax sales invoices and management of input tax credit invoices to strictly control tax risks.

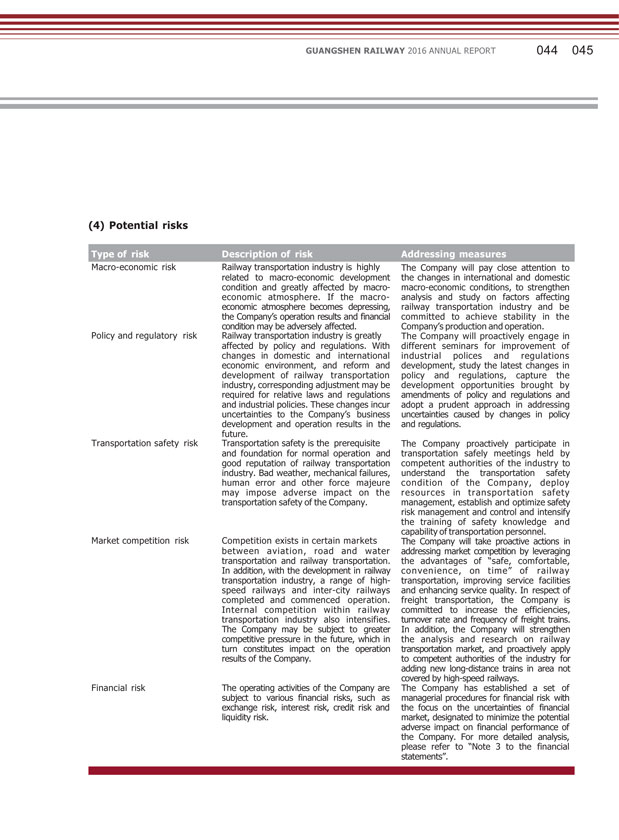

GUANGSHEN RAILWAY 2016 ANNUAL REPORT 044 045 (3) Potential risks Macro-economic risk Railway transportation industry is highly related to macro-economic development condition and greatly affected by macro- economic atmosphere. If the macro- economic atmosphere becomes depressing, the Company’s operation results and financial condition may be adversely affected. Policy and regulatory risk Railway transportation industry is greatly affected by policy and regulations. With changes in domestic and international economic environment, and reform and development of railway transportation industry, corresponding adjustment may be required for relative laws and regulations and industrial policies. These changes incur uncertainties to the Company’s business development and operation results in the future. Transportation safety risk Transportation safety is the prerequisite and foundation for normal operation and good reputation of railway transportation industry. Bad weather, mechanical failures, human error and other force majeure may impose adverse impact on the transportation safety of the Company. Market competition risk Competition exists in certain markets between aviation, road and water transportation and railway transportation. In addition, with the development in railway transportation industry, a range of high- speed railways and inter-city railways completed and commenced operation. Internal competition within railway transportation industry also intensifies. The Company may be subject to greater competitive pressure in the future, which in turn constitutes impact on the operation results of the Company. Financial risk The operating activities of the Company are subject to various financial risks, such as exchange risk, interest risk, credit risk and liquidity risk. The Company will pay close attention to the changes in international and domestic macro-economic conditions, to strengthen analysis and study on factors affecting railway transportation industry and be committed to achieve stability in the Company’s production and operation. The Company will proactively engage in different seminars for improvement of industrial polices and regulations development, study the latest changes in policy and regulations, capture the development opportunities brought by amendments of policy and regulations and adopt a prudent approach in addressing uncertainties caused by changes in policy and regulations. The Company proactively participate in transportation safely meetings held by competent authorities of the industry to understand the transportation safety condition of the Company, deploy resources in transportation safety management, establish and optimize safety risk management and control and intensify the training of safety knowledge and capability of transportation personnel. The Company will take proactive actions in addressing market competition by leveraging the advantages of “safe, comfortable, convenience, on time” of railway transportation, improving service facilities and enhancing service quality. In respect of freight transportation, the Company is committed to increase the efficiencies, turnover rate and frequency of freight trains. In addition, the Company will strengthen the analysis and research on railway transportation market, and proactively apply to competent authorities of the industry for adding new long-distance trains in area not covered by high-speed railways. The Company has established a set of managerial procedures for financial risk with the focus on the uncertainties of financial market, designated to minimize the potential adverse impact on financial performance of the Company. For more detailed analysis, please refer to “Note 3 to the financial statements”.

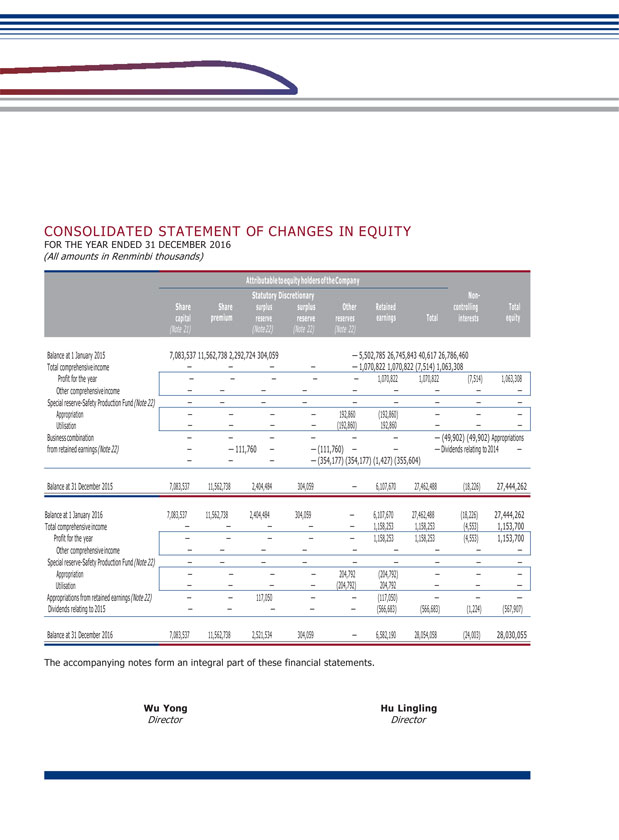

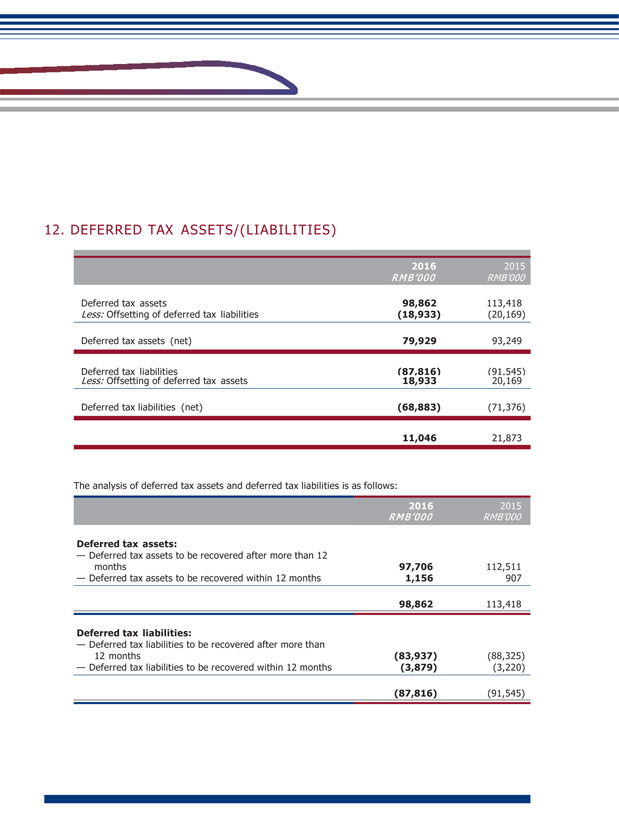

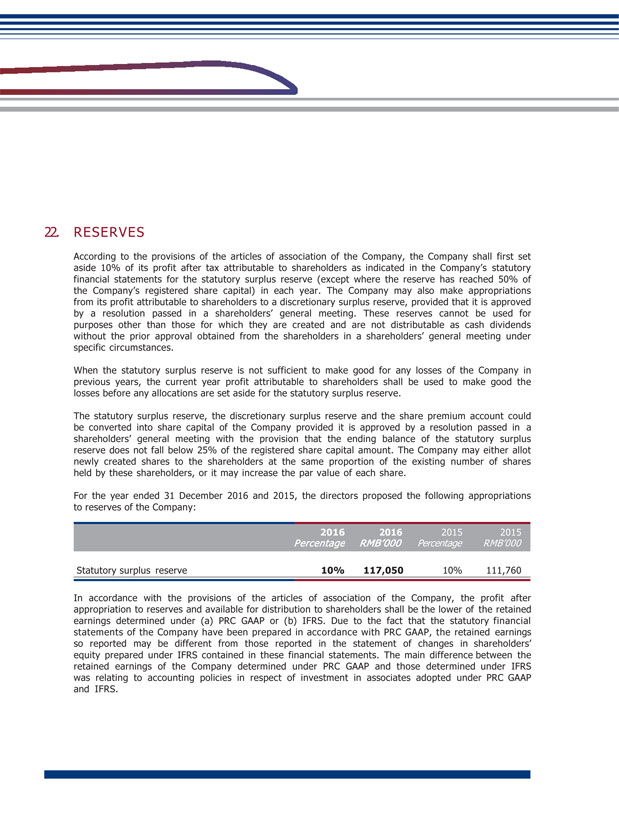

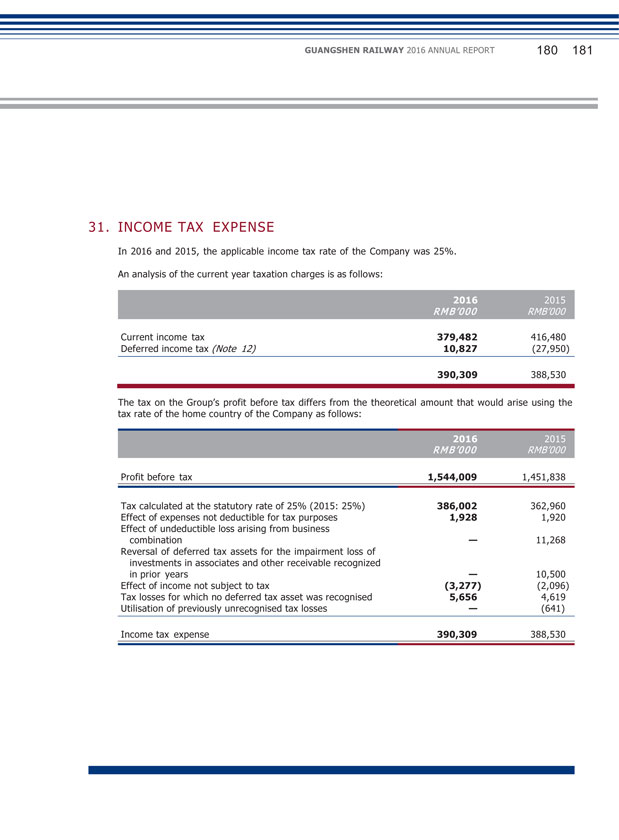

IV. EXPLANATION OF CONDITIONS AND REASONS NOT DISCLOSED BY THE COMPANY IN ACCORDANCE WITH STANDARDS DUE TO NON- APPLICABLE STANDARDS AND REGULATIONS OR SPECIAL REASONS SUCH AS NATIONAL SECRETS, COMMERCIAL SECRETS Applicable Not applicable V. OTHER DISCLOSURES (1) Taxation Details of income tax applicable to the Company during the reporting period are set out in Note 31 to the financial statements. (2) Interest Capitalized During the reporting period, no interest was capitalized in the fixed assets or construction-in-progress of the Company. (3) Properties and Fixed Assets During the reporting period, all properties held by the Company were all for the purpose of development, and their percentage ratio (as defined by Rule 14.04(9) of the Listing Rules) did not exceed 5%. Movements in the properties and fixed assets held by the Company during the reporting period are set out in Note 6 to the financial statements. (4) Undistributed Profit Details of movements in the undistributed profit of the Company during the reporting period are set out in the Statements of Changes in Equity.

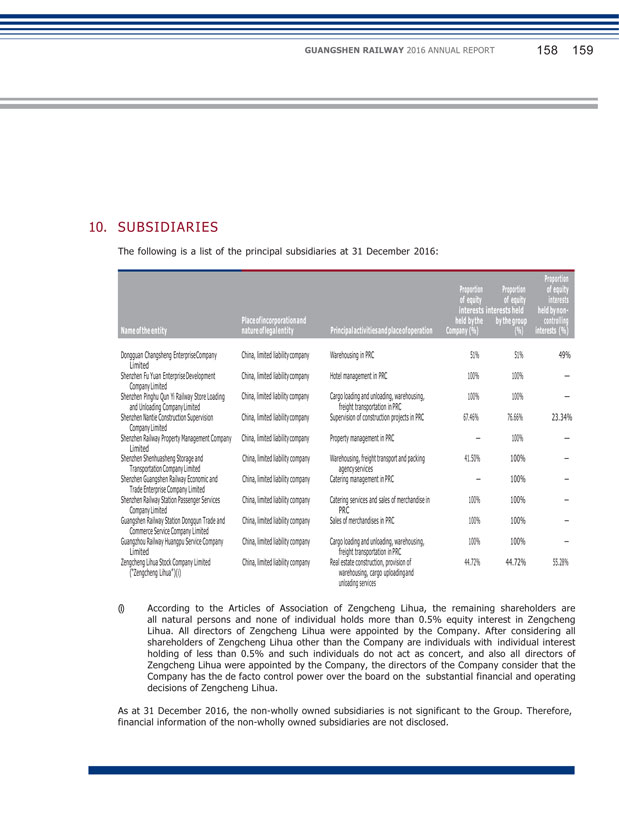

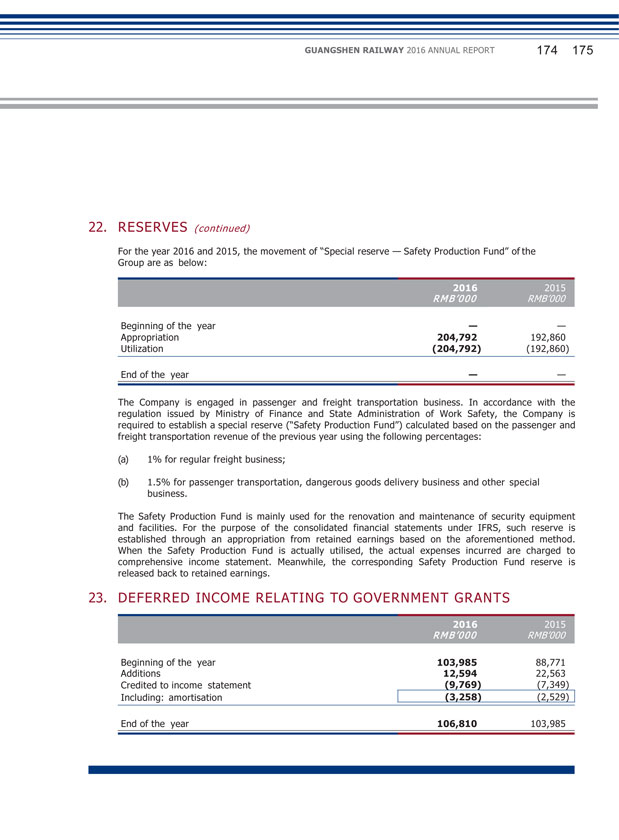

GUANGSHEN RAILWAY 2016 ANNUAL REPORT 046 047 (5) Surplus Reserve Details of movements in the surplus reserve of the Company during the reporting period are set out in the Statements of Changes in Equity and Note 22 to the financial statements. (6) Subsidiaries Details of the principal subsidiaries of the Company as at the end of the reporting period are set out in Note 10 to the financial statements. (7) Material investments held, material acquisitions and disposals of subsidiaries and associates, and future plans of material investments or acquisition of capital assets Except as disclosed in this annual report, during the reporting period, the Company had no material investment held, had not carried out any material acquisition or disposal of subsidiaries and associates, and had no definite plan for material investment or acquisition of capital assets. (8) Contingent liabilities At the end of the reporting period, the Company had no contingent liability. (9) Fixed Interest Rate At the end of the reporting period, the Company has no loan bearing fixed interest rates.

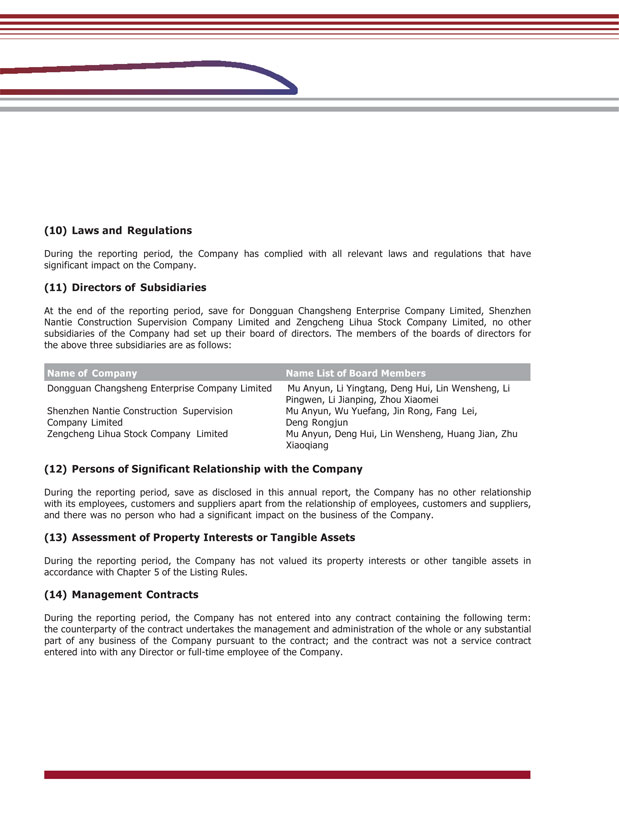

(10) Laws and Regulations During the reporting period, the Company has complied with all relevant laws and regulations that have significant impact on the Company. (11) Directors of Subsidiaries At the end of the reporting period, save for Dongguan Changsheng Enterprise Company Limited, Shenzhen Nantie Construction Supervision Company Limited and Zengcheng Lihua Stock Company Limited, no other subsidiaries of the Company had set up their board of directors. The members of the boards of directors for the above three subsidiaries are as follows: Dongguan Changsheng Enterprise Company Limited Mu Anyun, Li Yingtang, Deng Hui, Lin Wensheng, Li Pingwen, Li Jianping, Zhou Xiaomei Shenzhen Nantie Construction Supervision Company Limited Mu Anyun, Wu Yuefang, Jin Rong, Fang Lei, Deng Rongjun Zengcheng Lihua Stock Company Limited Mu Anyun, Deng Hui, Lin Wensheng, Huang Jian, Zhu Xiaoqiang (12) Persons of Significant Relationship with the Company During the reporting period, save as disclosed in this annual report, the Company has no other relationship with its employees, customers and suppliers apart from the relationship of employees, customers and suppliers, and there was no person who had a significant impact on the business of the Company. (13) Assessment of Property Interests or Tangible Assets During the reporting period, the Company has not valued its property interests or other tangible assets in accordance with Chapter 5 of the Listing Rules. (14) Management Contracts During the reporting period, the Company has not entered into any contract containing the following term: the counterparty of the contract undertakes the management and administration of the whole or any substantial part of any business of the Company pursuant to the contract; and the contract was not a service contract entered into with any Director or full-time employee of the Company.

GUANGSHEN RAILWAY 2016 ANNUAL REPORT 048 049 (15) Loans to Entities During the reporting period, the Company has not provided any loan to any entity. (16) Permitted Compensation Provisions At the end of the reporting period, the Company did not have any compensation provision for the benefit which had been enjoyed or being enjoyed by any one of the Directors (including former directors) of the Company, or any of the affiliated companies.

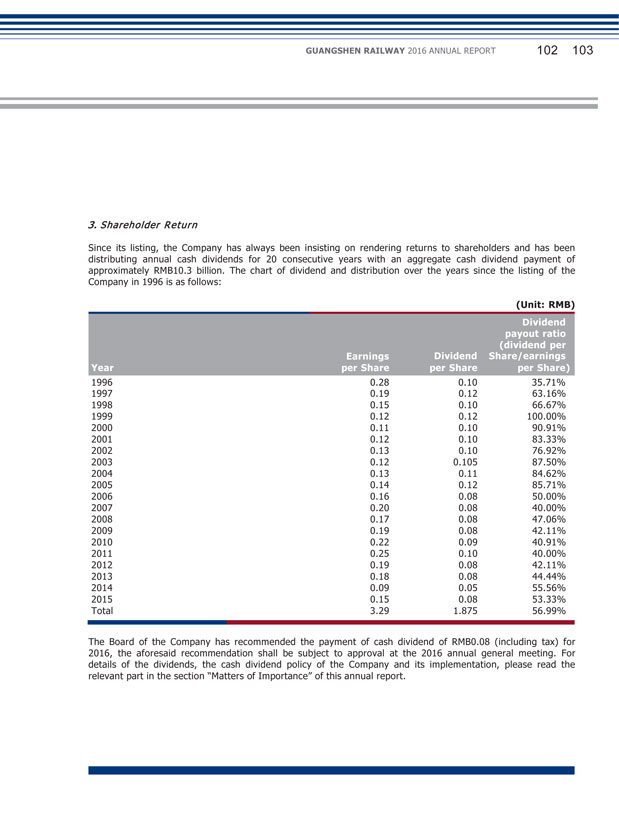

Chapter 5 Matters of Importance Chairman of the Supervisory Committee I. PLANS FOR PROFIT DISTRIBUTION OF ORDINARY SHARES OR COMMON RESERVE CAPITALIZATION (1) Formulation, implementation, adjustment of cash dividend distribution policy Pursuant to the related requirements of the ‘Notice on Further Implementing Issues concerning Cash Dividends Distribution of Listed Companies’ by CSRC and SSRB, the Company amended provisions related to profit distribution in the Articles in 2012. The amended Articles clearly stipulate the standards, percentages and related decision-making procedures for cash dividend distribution by the Company, the detailed conditions, decision-making procedures and mechanisms for adjustments to the profit distribution policy by the Company, which will provide systematic guarantee of the due diligence of the Independent Directors and the full expression of the minority shareholders’ requests and fully protect the legal interests of minority shareholders. Since its listing in 1996, the Company has consistently adhered to a sustained and stable profit distribution policy, emphasized on reasonable return to investors, and at the same time strived for the sustainable development of the Company. During the reporting period, the Company implemented the profit distribution plan of 2015 and distributed a cash dividend of RMB0.80 (tax inclusive) per 10 shares to all shareholders of the Company, totaling RMB566,682,960 on the basis of the total share capital at the end of 2015.

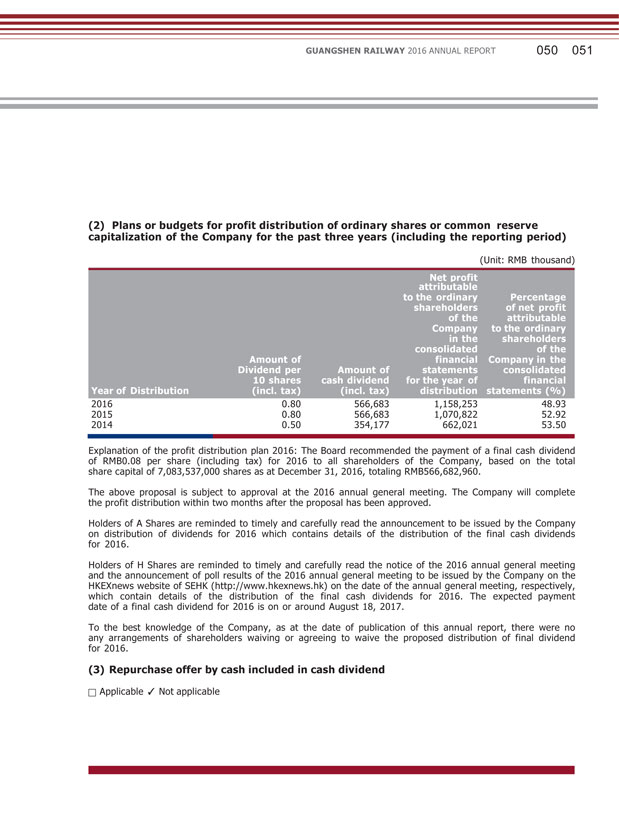

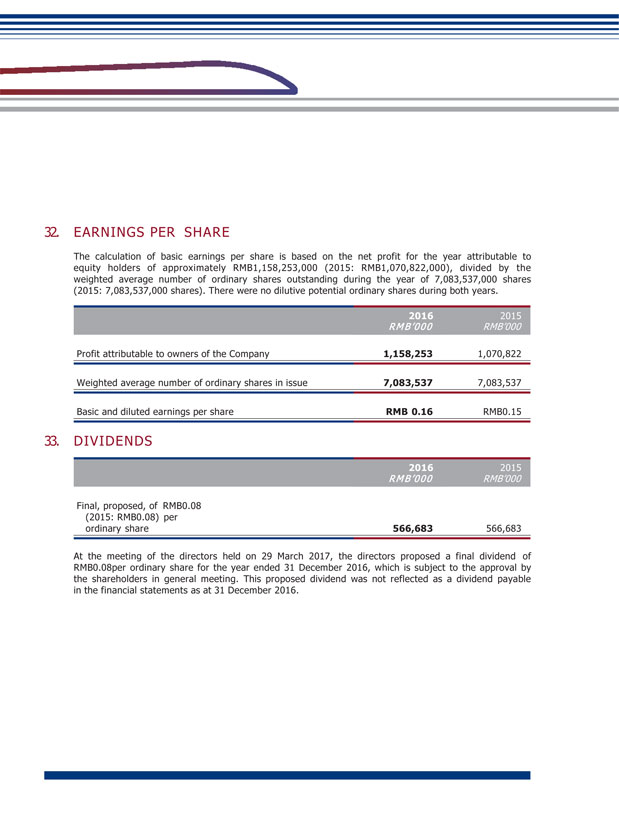

GUANGSHEN RAILWAY 2016 ANNUAL REPORT 050 051 (2) Plans or budgets for profit distribution of ordinary shares or common reserve capitalization of the Company for the past three years (including the reporting period) (Unit: RMB thousand) Net profit attributable to the ordinary Percentage shareholders of net profit of the attributable Company to the ordinary in the shareholders consolidated of the Amount of financial Company in the Dividend per Amount of statements consolidated 10 shares cash dividend for the year of financial Year of Distribution (incl. tax) (incl. tax) distribution statements (%) 2016 0.80 566,683 1,158,253 48.93 2015 0.80 566,683 1,070,822 52.92 2014 0.50 354,177 662,021 53.50 Explanation of the profit distribution plan 2016: The Board recommended the payment of a final cash dividend of RMB0.08 per share (including tax) for 2016 to all shareholders of the Company, based on the total share capital of 7,083,537,000 shares as at December 31, 2016, totaling RMB566,682,960. The above proposal is subject to approval at the 2016 annual general meeting. The Company will complete the profit distribution within two months after the proposal has been approved. Holders of A Shares are reminded to timely and carefully read the announcement to be issued by the Company on distribution of dividends for 2016 which contains details of the distribution of the final cash dividends for 2016. Holders of H Shares are reminded to timely and carefully read the notice of the 2016 annual general meeting and the announcement of poll results of the 2016 annual general meeting to be issued by the Company on the HKEXnews website of SEHK (http://www.hkexnews.hk) on the date of the annual general meeting, respectively, which contain details of the distribution of the final cash dividends for 2016. The expected payment date of a final cash dividend for 2016 is on or around August 18, 2017. To the best knowledge of the Company, as at the date of publication of this annual report, there were no any arrangements of shareholders waiving or agreeing to waive the proposed distribution of final dividend for 2016. (3) Repurchase offer by cash included in cash dividend Applicable Not applicable

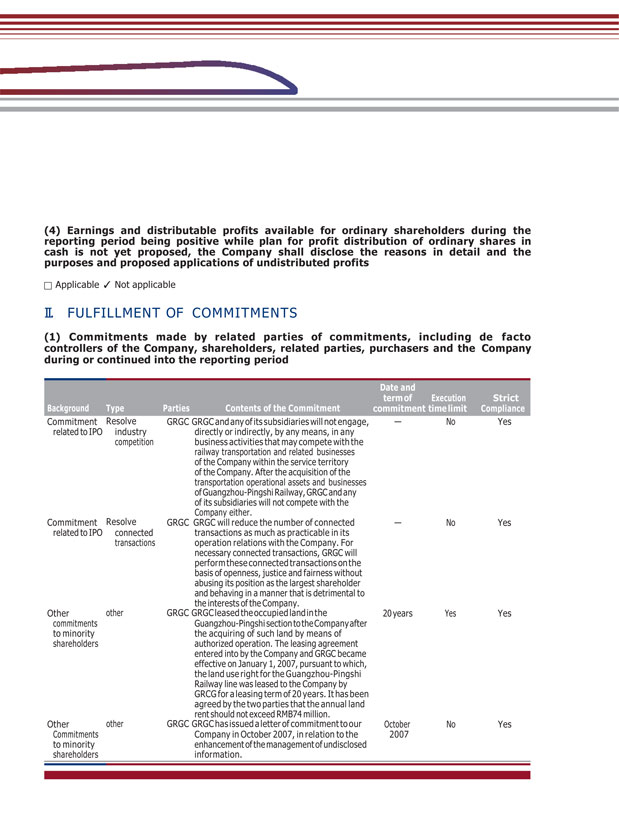

(4) Earnings and distributable profits available for ordinary shareholders during the reporting period being positive while plan for profit distribution of ordinary shares in cash is not yet proposed, the Company shall disclose the reasons in detail and the purposes and proposed applications of undistributed profits Applicable Not applicable II. FULFILLMENT OF COMMITMENTS (1) Commitments made by related parties of commitments, including de facto controllers of the Company, shareholders, related parties, purchasers and the Company during or continued into the reporting period during or continued into the reporting period Commitment related to IPO Commitment related to IPO Resolve industry competition Resolve connected transactions GRGC GRGC and any of its subsidiaries will not engage, directly or indirectly, by any means, in any business activities that may compete with the railway transportation and related businesses of the Company within the service territory of the Company. After the acquisition of the transportation operational assets and businesses of Guangzhou-Pingshi Railway, GRGC and any of its subsidiaries will not compete with the Company either. GRGC GRGC will reduce the number of connected transactions as much as practicable in its operation relations with the Company. For necessary connected transactions, GRGC will perform these connected transactions on the basis of openness, justice and fairness without abusing its position as the largest shareholder and behaving in a manner that is detrimental to the interests of the Company. — No Yes — No Yes Other commitments to minority shareholders other GRGC GRGC leased the occupied land in the Guangzhou-Pingshi section to the Company after the acquiring of such land by means of authorized operation. The leasing agreement entered into by the Company and GRGC became effective on January 1, 2007, pursuant to which, the land use right for the Guangzhou-Pingshi Railway line was leased to the Company by GRCG for a leasing term of 20 years. It has been agreed by the two parties that the annual land rent should not exceed RMB74 million. 20 years Yes Yes Other Commitments to minority shareholders other GRGC GRGC has issued a letter of commitment to our Company in October 2007, in relation to the enhancement of the management of undisclosed information. October 2007 No Yes

GUANGSHEN RAILWAY 2016 ANNUAL REPORT 052 053 (2) THE COMPANY’S EXPLANATION ON WHETHER ORIGINAL PROFIT FORECAST HAS BEEN MET IN RESPECT OF ASSETS OR PROJECTS AND THE RELATED REASONS FOR PROFIT FORECAST OF ASSETS OR PROJECTS AND IN THE EVENT OF REPORTING PERIOD BEING WITH THE PROFIT FORECAST PERIOD Achieved Not achieved Not applicable III. APPROPRIATION OF FUND AND PROGRESS OF DEBT CLEARANCE LISTING IN THE REPORTING PERIOD Applicable Not applicable IV. EXPLANATION ON ACCOUNTANT’S “NON-STANDARD AUDIT REPORT” BY THE COMPANY Applicable Not applicable V. THE COMPANY’S ANALYSIS AND EXPLANATION ON ACCOUNTING POLICIES, CHANGES IN ACCOUNTING ESTIMATES OR REASONS AND IMPACT OF RECTIFICATION ON SIGNIFICANT ACCOUNTING ERRORS (1) The Company’s explanation on accounting policies, reasons and impacts of changes in accounting estimate Applicable Not applicable (2) The Company’s explanations on reasons and impact of rectification on significant accounting errors Applicable Not applicable (3) The communication between predecessor accountant Applicable Not applicable

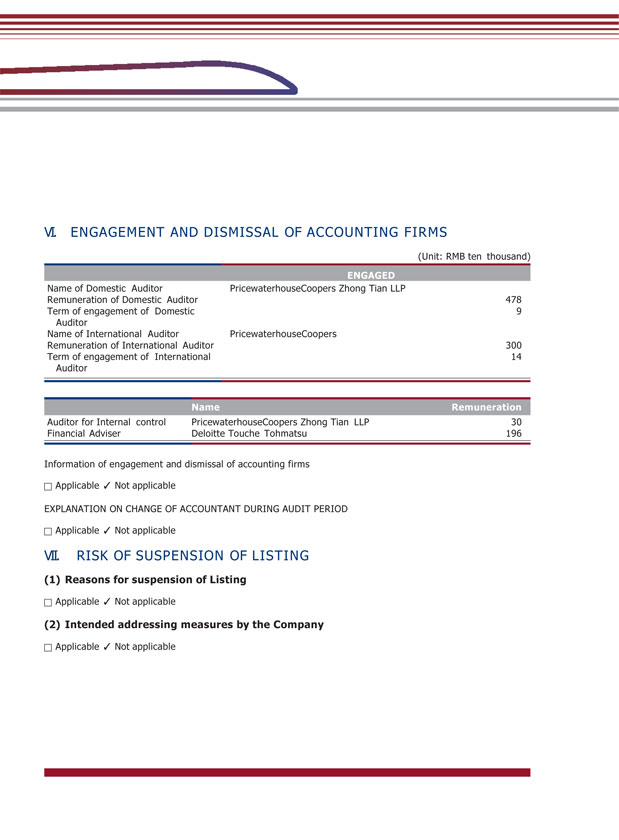

VI. ENGAGEMENT AND DISMISSAL OF ACCOUNTING FIRMS (Unit: RMB ten thousand) Name of Domestic Auditor PricewaterhouseCoopers Zhong Tian LLP Remuneration of Domestic Auditor 478 Term of engagement of Domestic 9 Auditor Name of International Auditor PricewaterhouseCoopers Remuneration of International Auditor 300 Term of engagement of International 14 Auditor Auditor for Internal control PricewaterhouseCoopers Zhong Tian LLP 30 Financial Adviser Deloitte Touche Tohmatsu 196 Information of engagement and dismissal of accounting firms Applicable Not applicable EXPLANATION ON CHANGE OF ACCOUNTANT DURING AUDIT PERIOD Applicable Not applicable VII. RISK OF SUSPENSION OF LISTING (1) Reasons for suspension of Listing Applicable Not applicable (2) Intended addressing measures by the Company Applicable Not applicable

GUANGSHEN RAILWAY 2016 ANNUAL REPORT 054 055 VIII. INFORMATION AND REASON FOR DELISTING Applicable Not applicable IX. BANKRUPTCY AND RESTRUCTURING Applicable Not applicable X. MATERIAL LITIGATION AND ARBITRATION The Company had material litigation and arbitration during the year The Company did not have material litigation and arbitration during the year XI. PUNISHMENT ON THE COMPANY, ITS DIRECTORS, SUPERVISORS, SENIOR MANAGEMENT, CONTROLLING SHAREHOLDERS, DE FACTO CONTROLLER, PURCHASER AND THE RECTIFICATION THEREOF Applicable Not applicable XII. EXPLANATION ON INTEGRITY OF THE COMPANY, ITS CONTROLLING SHAREHOLDERS AND DE FACTO CONTROLLER DURING THE REPORTING PERIOD During the reporting period, there is no explanation on integrity of the Company, its shareholders and de facto controller. XIII. THE COMPANY’S SHARE INCENTIVE SCHEME, EMPLOYEE STOCK OWNERSHIP PLAN, OR OTHER EMPLOYEES’ INCENTIVE MEASURES AND THEIR IMPACT Applicable Not applicable

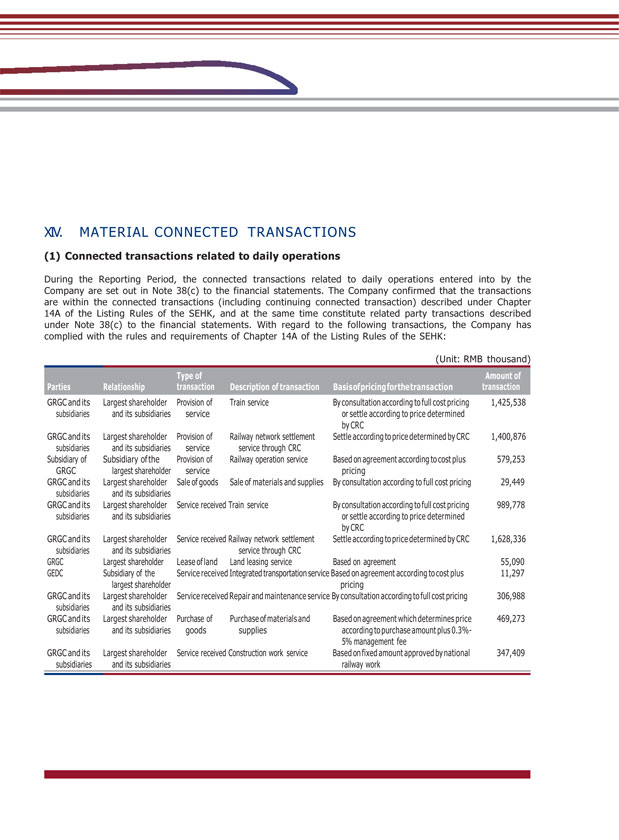

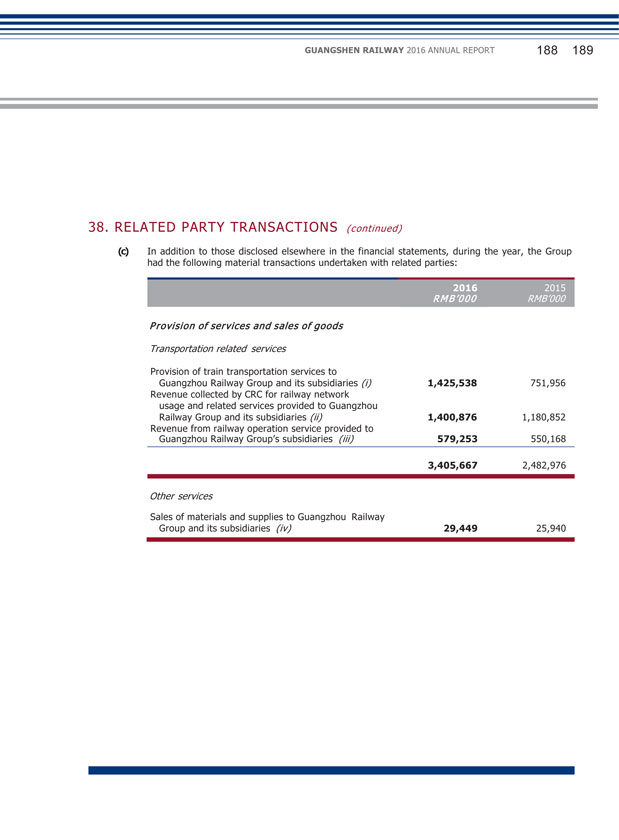

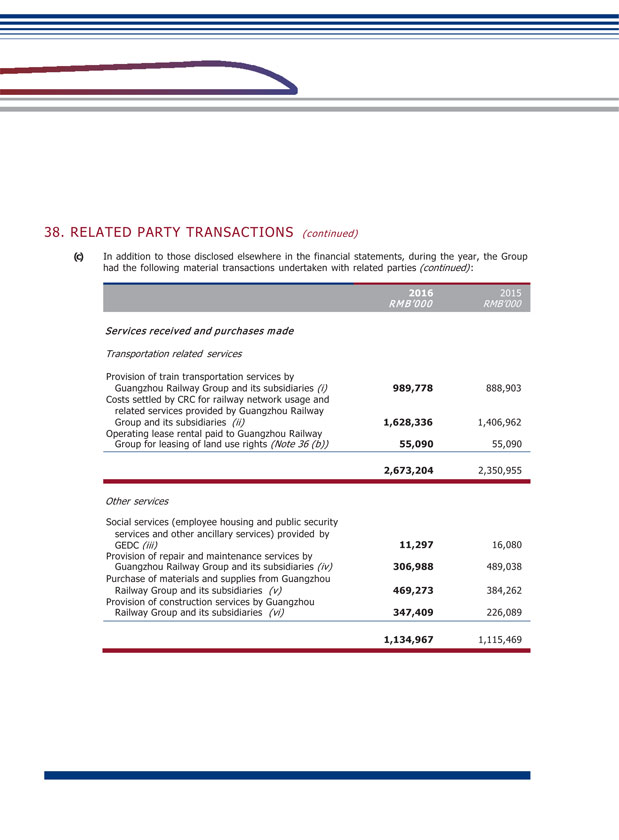

XIV. MATERIAL CONNECTED TRANSACTIONS (1) Connected transactions related to daily operations During the Reporting Period, the connected transactions related to daily operations entered into by the Company are set out in Note 38(c) to the financial statements. The Company confirmed that the transactions are within the connected transactions (including continuing connected transaction) described under Chapter 14A of the Listing Rules of the SEHK, and at the same time constitute related party transactions described under Note 38(c) to the financial statements. With regard to the following transactions, the Company has complied with the rules and requirements of Chapter 14A of the Listing Rules of the SEHK: (Unit: RMB thousand) GRGC and its subsidiaries Largest shareholder and its subsidiaries Provision of service Train service By consultation according to full cost pricing or settle according to price determined by CRC 1,425,538 GRGC and its subsidiaries Largest shareholder and its subsidiaries Provision of service Railway network settlement service through CRC Settle according to price determined by CRC 1,400,876 Subsidiary of GRGC Subsidiary of the largest shareholder Provision of service Railway operation service Based on agreement according to cost plus pricing 579,253 GRGC and its subsidiaries Largest shareholder and its subsidiaries Sale of goods Sale of materials and supplies By consultation according to full cost pricing 29,449 GRGC and its subsidiaries Largest shareholder and its subsidiaries Service received Train service By consultation according to full cost pricing or settle according to price determined by CRC 989,778 GRGC and its subsidiaries Largest shareholder and its subsidiaries Service received Railway network settlement service through CRC Settle according to price determined by CRC 1,628,336 GRGC Largest shareholder Lease of land Land leasing service Based on agreement 55,090 GEDC Subsidiary of the largest shareholder Service received Integrated transportation service Based on agreement according to cost plus pricing 11,297 GRGC and its subsidiaries Largest shareholder and its subsidiaries Service received Repair and maintenance service By consultation according to full cost pricing 306,988 GRGC and its subsidiaries Largest shareholder and its subsidiaries Purchase of goods Purchase of materials and supplies Based on agreement which determines price according to purchase amount plus 0.3%- 5% management fee 469,273 GRGC and its subsidiaries Largest shareholder and its subsidiaries Service received Construction work service Based on fixed amount approved by national railway work 347,409

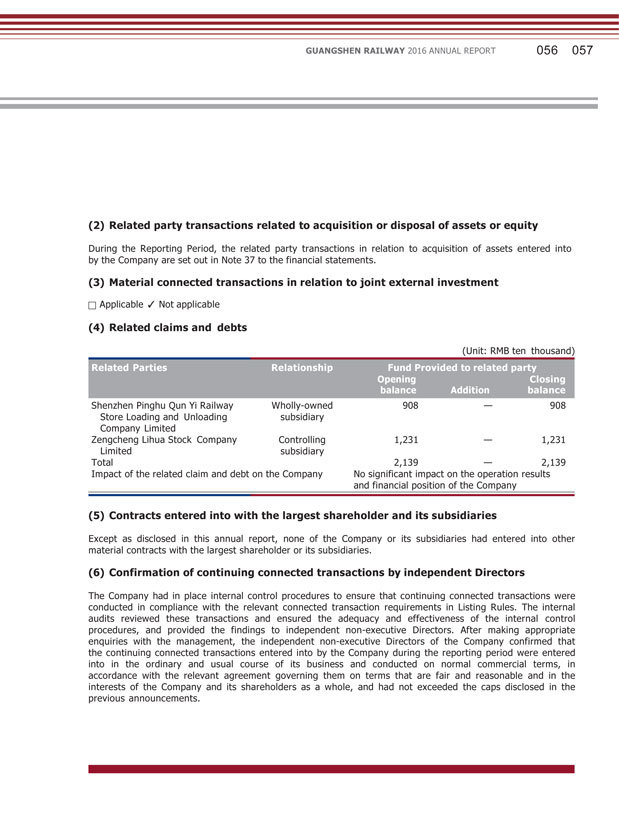

GUANGSHEN RAILWAY 2016 ANNUAL REPORT 056 057 (2) Related party transactions related to acquisition or disposal of assets or equity During the Reporting Period, the related party transactions in relation to acquisition of assets entered into by the Company are set out in Note 37 to the financial statements. (3) Material connected transactions in relation to joint external investment Applicable Not applicable (4) Related claims and debts (Unit: RMB ten thousand) Shenzhen Pinghu Qun Yi Railway Store Loading and Unloading Company Limited Zengcheng Lihua Stock Company Limited Wholly-owned subsidiary Controlling subsidiary 908 — 908 1,231 — 1,231 Total 2,139 — 2,139 Impact of the related claim and debt on the Company No significant impact on the operation results and financial position of the Company (5) Contracts entered into with the largest shareholder and its subsidiaries Except as disclosed in this annual report, none of the Company or its subsidiaries had entered into other material contracts with the largest shareholder or its subsidiaries. (6) Confirmation of continuing connected transactions by independent Directors The Company had in place internal control procedures to ensure that continuing connected transactions were conducted in compliance with the relevant connected transaction requirements in Listing Rules. The internal audits reviewed these transactions and ensured the adequacy and effectiveness of the internal control procedures, and provided the findings to independent non-executive Directors. After making appropriate enquiries with the management, the independent non-executive Directors of the Company confirmed that the continuing connected transactions entered into by the Company during the reporting period were entered into in the ordinary and usual course of its business and conducted on normal commercial terms, in accordance with the relevant agreement governing them on terms that are fair and reasonable and in the interests of the Company and its shareholders as a whole, and had not exceeded the caps disclosed in the previous announcements.

(7) Confirmation of continuing connected transactions by the auditor The auditors of the Company have carried out procedures on the above connected transactions for the year ended at the end of the reporting period in accordance with the Hong Kong Standard on Assurance Engagements 3000 ‘Assurance Engagement Other Than Audits or Reviews of Historical Financial Information’ and with reference to Practice Note 740 ‘Auditor’s Letter on Continuing Connected Transactions under the Hong Kong Listing Rules’ issued by the Hong Kong Institute of Certified Public Accountants and reported that, in respect of the above connected transactions: (i) nothing has come to the Company’s auditors’ attention that would cause them to believe that the disclosed continuing connected transactions had not been approved by the Board; (ii) for transactions involving the provision of goods or services by the Company, nothing has come to the Company’s auditors’ attention that would cause them to believe that such transactions were not, in all material respects, in accordance with the pricing policies of the Company; (iii) nothing has come to the Company’s auditors’ attention that would cause them to believe that such transactions were not entered into, in all material respects, in accordance with the terms of agreements governing such transactions; (iv) with respect to the aggregate amount of each of the continuing connected transactions, nothing has come to the Company’s auditors’ attention that would cause them to believe that the value of such continuing connected transactions have exceeded the maximum aggregate annual caps disclosed in the previous announcements.

GUANGSHEN RAILWAY 2016 ANNUAL REPORT 058 059 XV. MATERIAL CONTRACTS AND THE IMPLEMENTATION THEREOF (1) Trust, contracted businesses and leasing affairs 1. Trusted business Applicable Not applicable 2. Contracted business Applicable Not applicable 3. Leased affairs Applicable Not applicable (2) Guarantees or financial assistance Applicable Not applicable

(3) Entrusted cash asset management carried out by other person 1. Entrusted investment Applicable Not applicable 2. Entrusted loans Applicable Not applicable 3. Other investment and derivatives investment Applicable Not applicable (4) Pledges During the reporting period, the largest shareholder of the Company and its de facto controller have not pledged the interests in all or part of the shares of the Company held as support for the Company’s indebtedness, guarantees or other liabilities. (5) Loan agreements and their performances During the reporting period, the Company and its subsidiaries have not entered into any loan agreements nor violated any terms of loan agreements which had significant impact to its operation. (6) Other material contracts During the reporting period, save as disclosed in this annual report, the Company did not enter into any other material contracts.

GUANGSHEN RAILWAY 2016 ANNUAL REPORT 060 061 XVI. EXPLANATION OF OTHER MATERIAL EVENTS Applicable Not applicable XVII. ACTIVE FULFILLMENT OF SOCIAL RESPONSIBILITY (1) Poverty alleviation by listed companies Applicable Not applicable (2) Efforts of social responsibilities During the reporting period, the Company did not have significant environmental protection or other significant social safety issues. For Details of the fulfillment of social responsibilities in the areas of transportation safety, environmental protection and social welfare by the Company in the reporting period, please read the Social Responsibility Report 2016 disclosed on the website of SSE (http://www.sse.com.cn), the HKEXnews website of SEHK (http://www.hkexnews.hk) and the website of the Company (http://www. gsrc.com). (3) Explanation of environmental protection efforts by companies and its subsidiaries which are a key discharging units announced by environmental protection department Applicable Not applicable XVIII. CONVERTIBLE COMPANY BONDS Applicable Not applicable

Chapter 6 Changes in Ordinary Share Capital and Particulars of Shareholders General Manager I. PARTICULARS OF CHANGES IN ORDINARY SHARE CAPITAL (1) Changes in ordinary share capital During the reporting period, there was no change in the Company’s total number of ordinary shares and structure of share capital. (2) Changes in shares with selling restrictions Applicable Not applicable

GUANGSHEN RAILWAY 2016 ANNUAL REPORT 062 063 II. PARTICULARS OF SECURITIES ISSUE AND LISTING (1) Particulars of securities issue up to the reporting period The Company had not issued any securities for the 3 years prior to the end of the reporting period. Particulars of securities issue up to the reporting period (particulars of bonds with different interest rates during existing period shall be provided separately): Applicable Not applicable (2) Changes in the Company’s total number of ordinary shares and structure of shareholder and changes in structure of asset and liability of the Company During the reporting period, there was no change in the total number of ordinary shares and structure of shareholder, asset and liability of the Company as a result of bonus issue, increase in share capital, placing, allotment of new shares or other reasons. (3) Existing employee shares The Company had not issued shares to any of its employees. III. PARTICULARS OF SHAREHOLDERS AND DE FACTO CONTROLLERS (1) Number of Shareholders Number of ordinary shareholders as at the end of the reporting period (Number) Number of ordinary shareholders as at the end of the previous month before the date of disclosure of the annual report (Number) 253,828 264,107

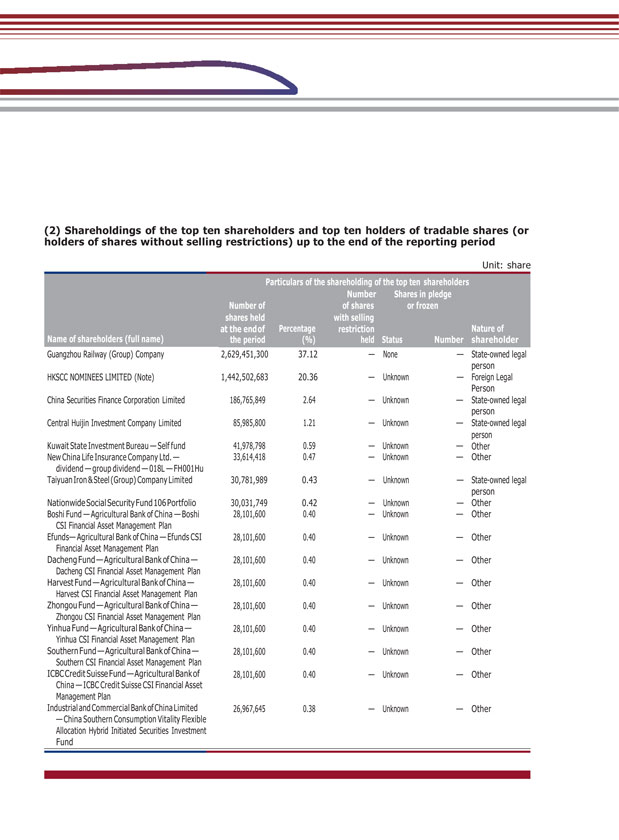

(2) Shareholdings of the top ten shareholders and top ten holders of tradable shares (or holders of shares without selling restrictions) up to the end of the reporting period Unit: share Particulars of the shareholding of the top ten shareholders Number Shares in pledge Number of of shares or frozen shares held with selling at the endof Percentage restriction Nature of Name of shareholders (full name) the period (%) held Status Number shareholder Guangzhou Railway (Group) Company 2,629,451,300 37.12 — None — State-owned legal person HKSCC NOMINEES LIMITED (Note) 1,442,502,683 20.36 — Unknown — Foreign Legal Person China Securities Finance Corporation Limited 186,765,849 2.64 — Unknown — State-owned legal person Central Huijin Investment Company Limited 85,985,800 1.21 — Unknown — State-owned legal person Kuwait State Investment Bureau — Self fund 41,978,798 0.59 — Unknown — Other New China Life Insurance Company Ltd. — 33,614,418 0.47 — Unknown — Other dividend — group dividend — 018L — FH001Hu Taiyuan Iron & Steel (Group) Company Limited 30,781,989 0.43 — Unknown — State-owned legal person NationwideSocial Security Fund 106 Portfolio 30,031,749 0.42 — Unknown — Other Boshi Fund — Agricultural Bank of China — Boshi 28,101,600 0.40 — Unknown — Other CSI Financial Asset Management Plan Efunds— Agricultural Bank of China — Efunds CSI 28,101,600 0.40 — Unknown — Other Financial Asset Management Plan Dacheng Fund — Agricultural Bank of China — 28,101,600 0.40 — Unknown — Other Dacheng CSI Financial Asset Management Plan Harvest Fund — Agricultural Bank of China — 28,101,600 0.40 — Unknown — Other Harvest CSI Financial Asset Management Plan Zhongou Fund — Agricultural Bank of China — 28,101,600 0.40 — Unknown — Other Zhongou CSI Financial Asset Management Plan Yinhua Fund — Agricultural Bank of China — 28,101,600 0.40 — Unknown — Other Yinhua CSI Financial Asset Management Plan Southern Fund — Agricultural Bank of China — 28,101,600 0.40 — Unknown — Other Southern CSI Financial Asset Management Plan ICBC Credit Suisse Fund —Agricultural Bank of 28,101,600 0.40 — Unknown — Other China — ICBC Credit Suisse CSI Financial Asset Management Plan Industrial and Commercial Bank of China Limited 26,967,645 0.38 — Unknown — Other — China Southern Consumption Vitality Flexible Allocation Hybrid Initiated Securities Investment Fund

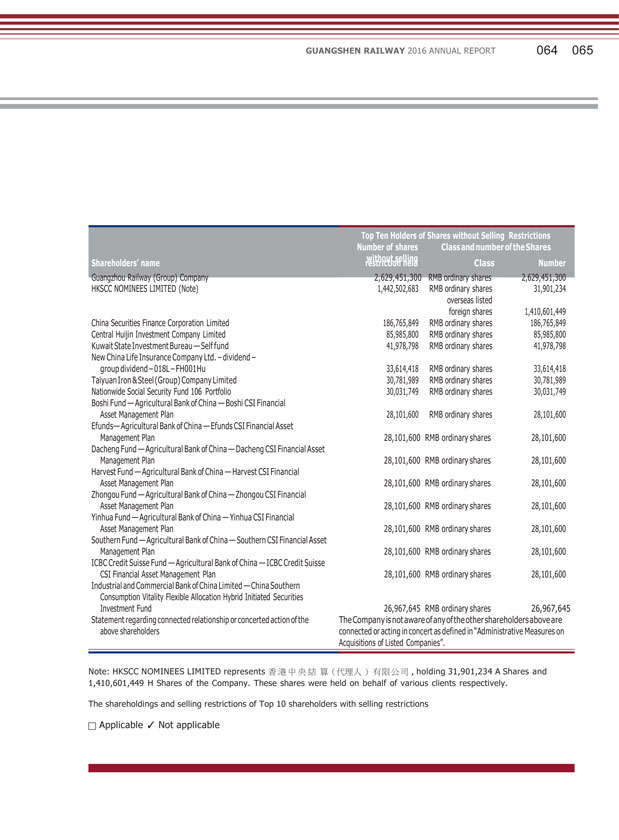

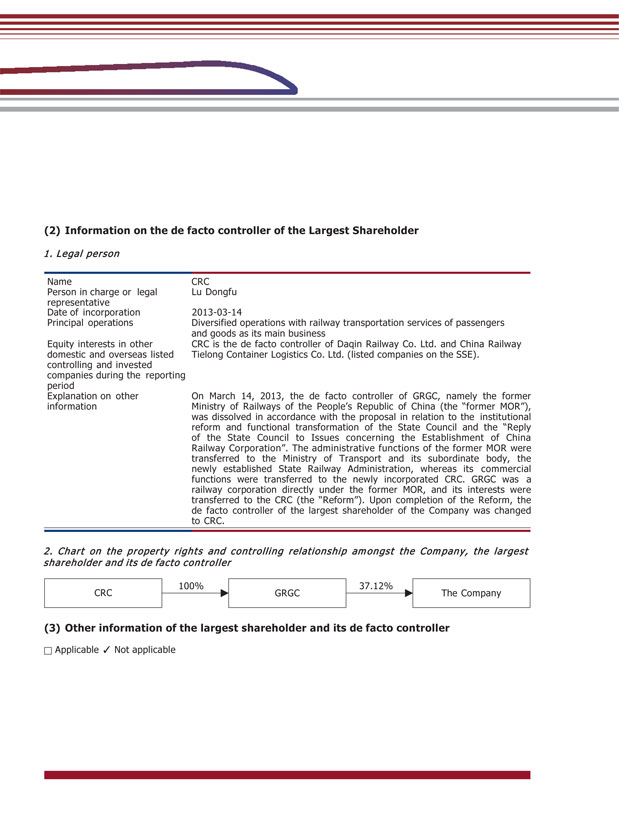

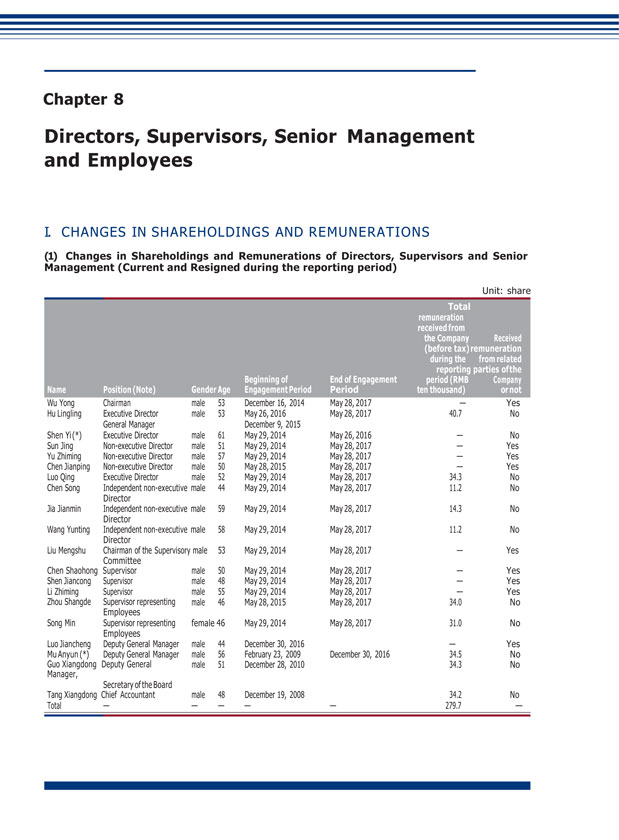

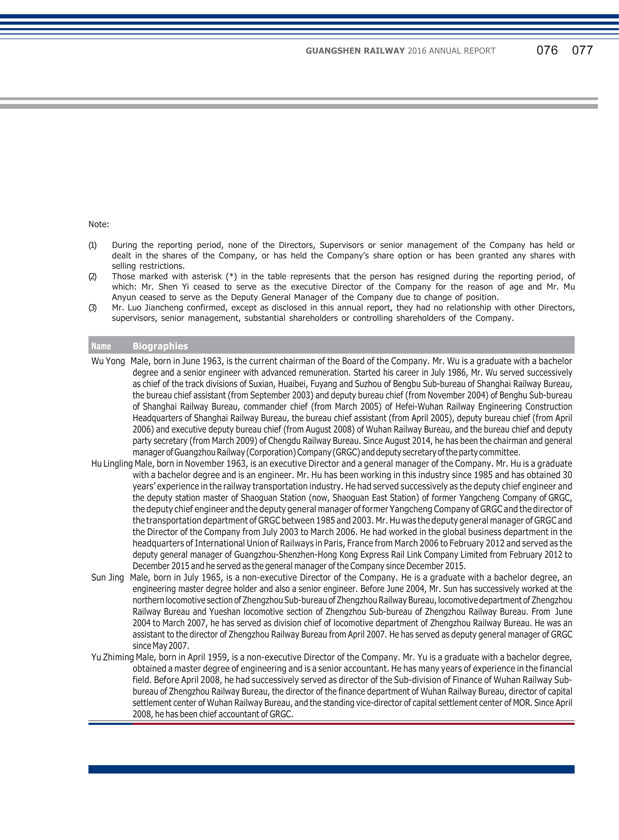

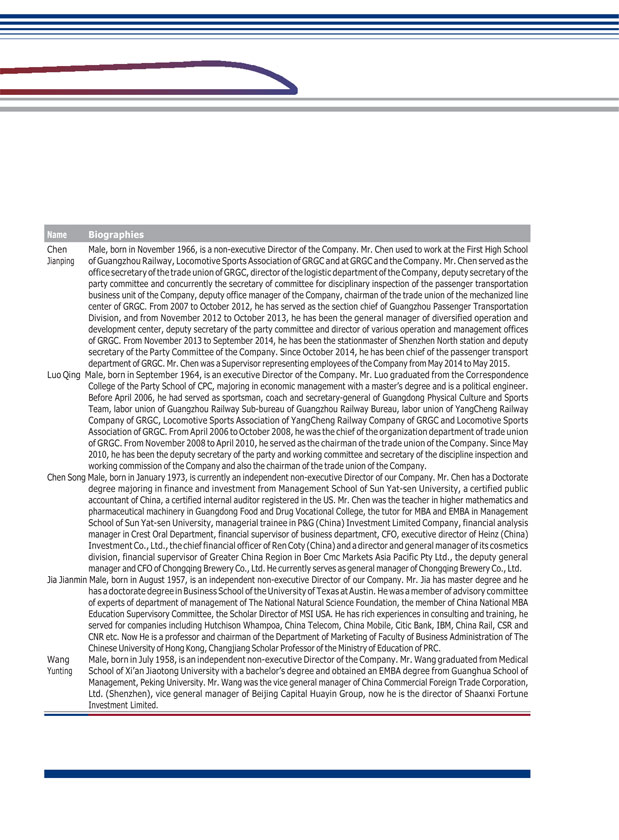

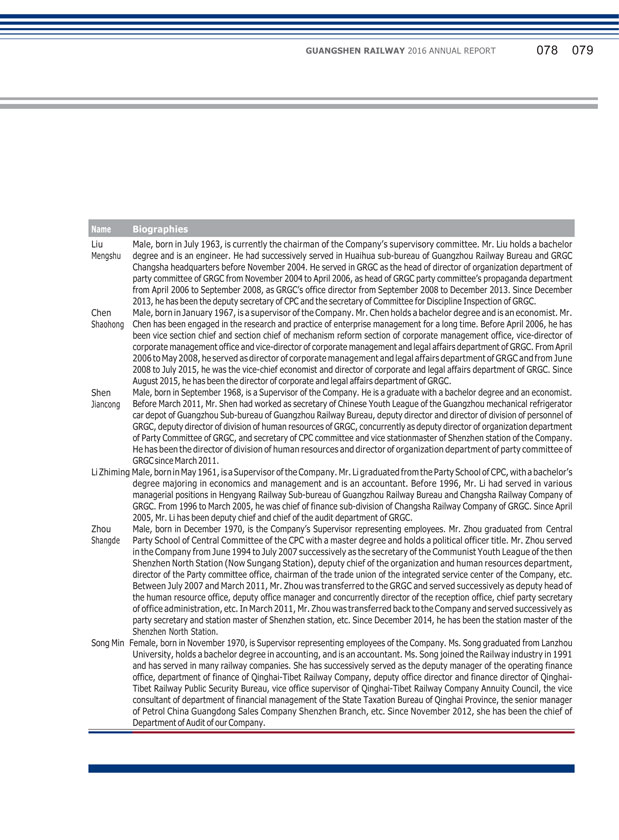

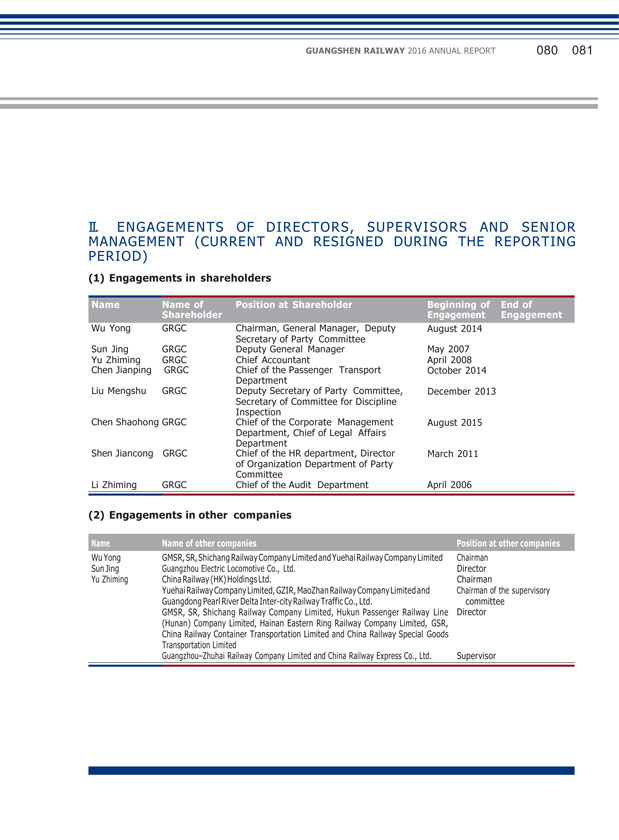

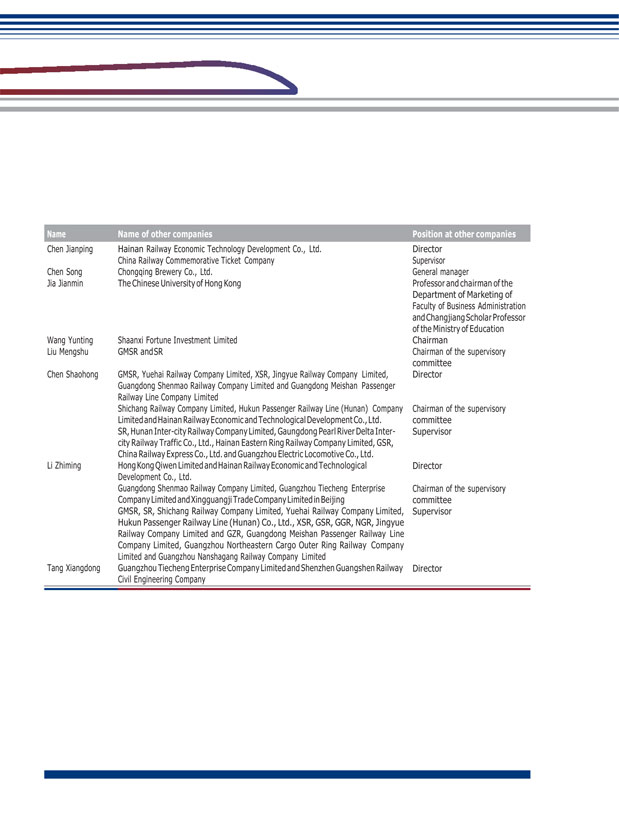

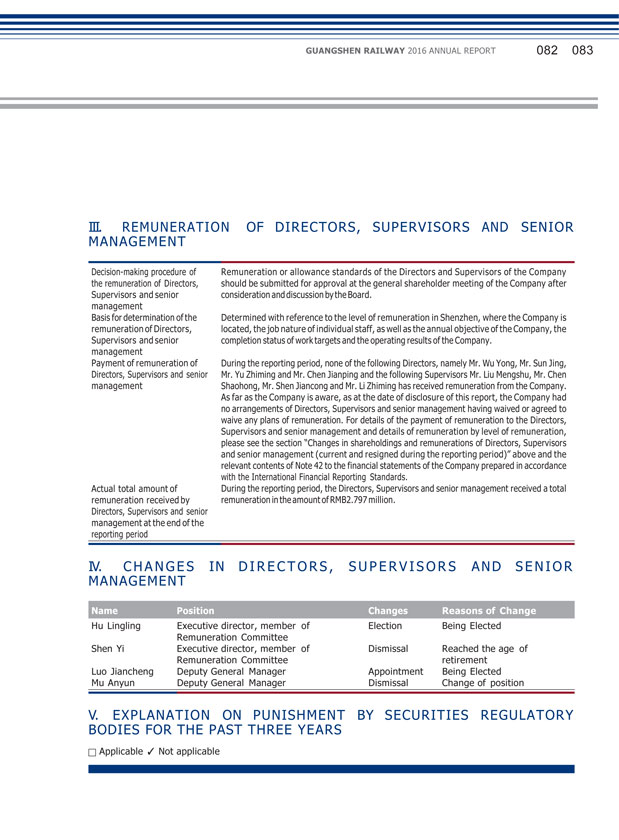

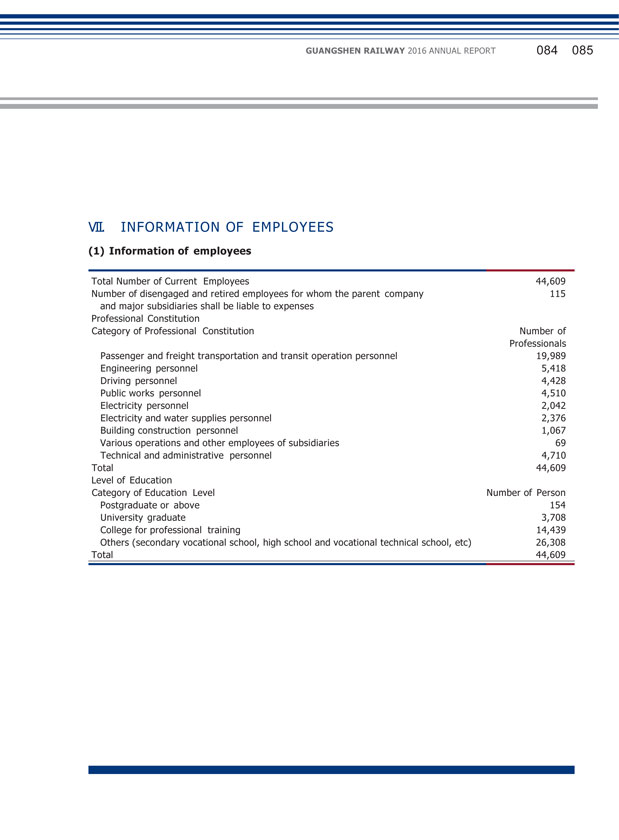

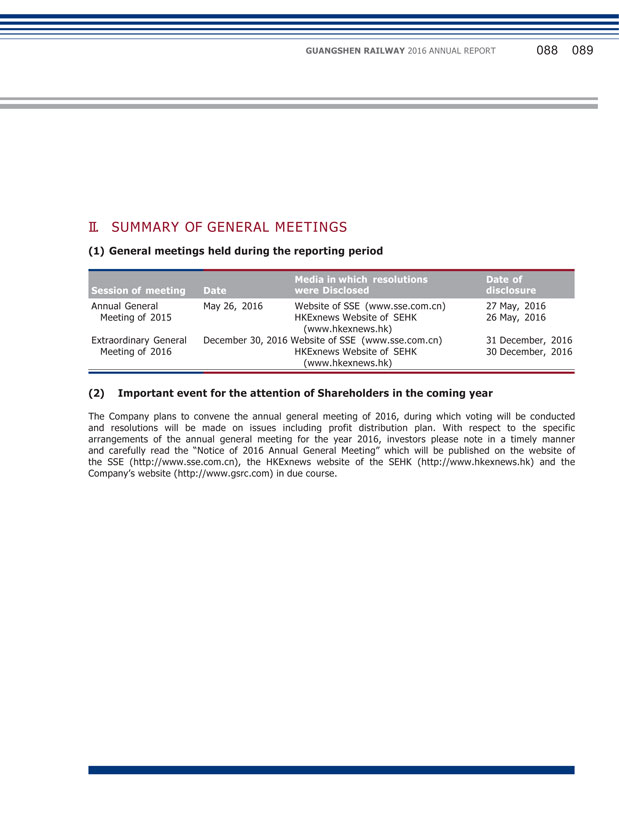

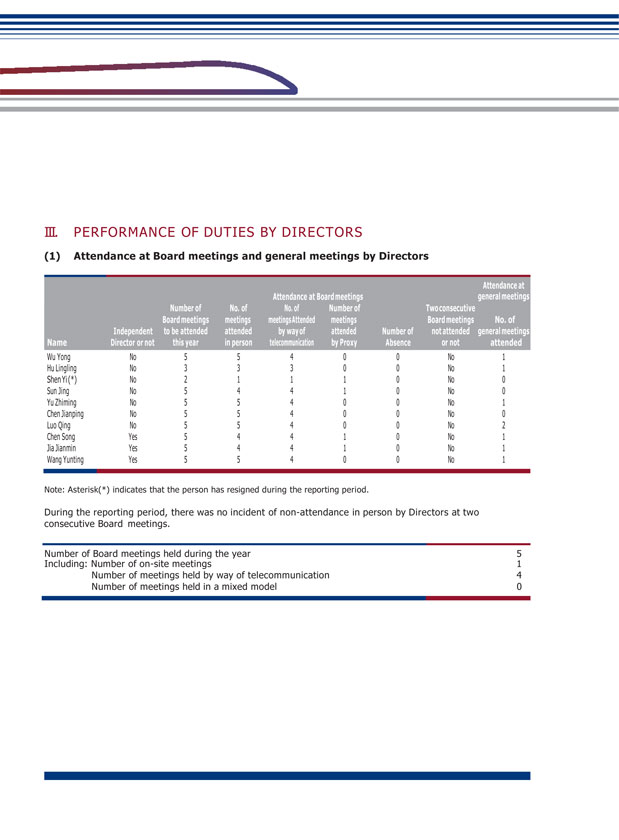

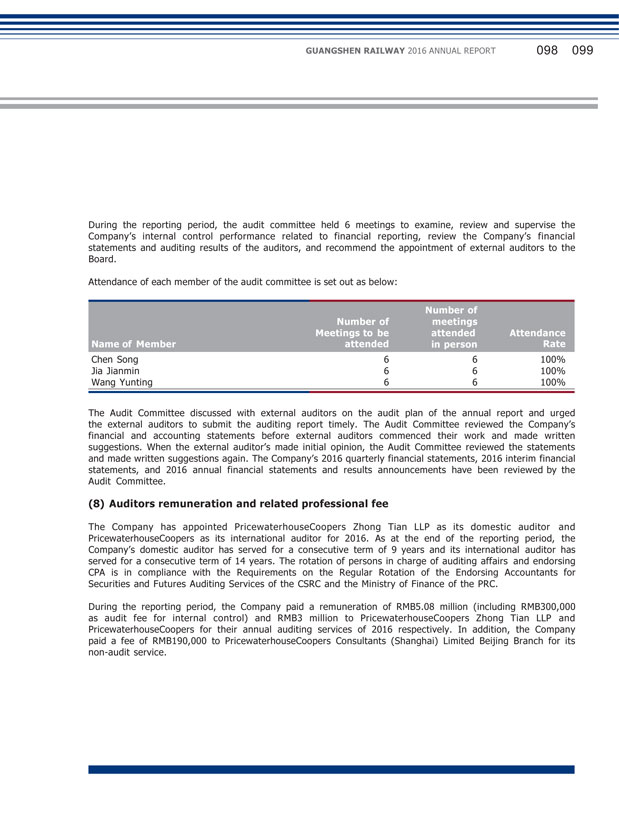

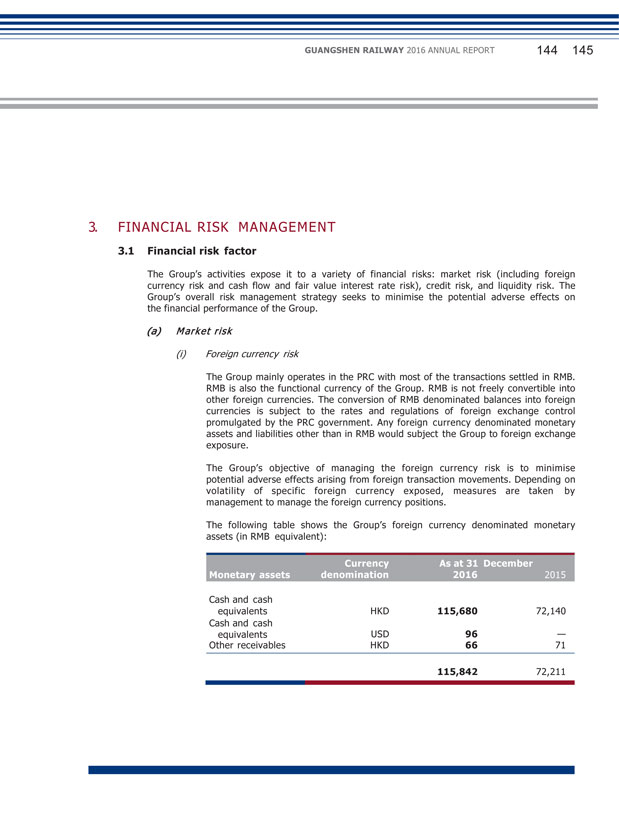

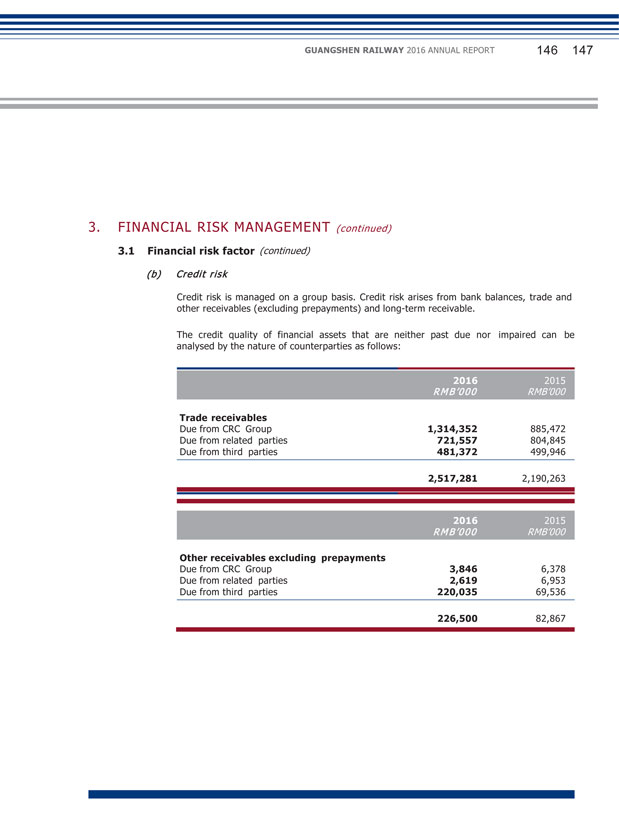

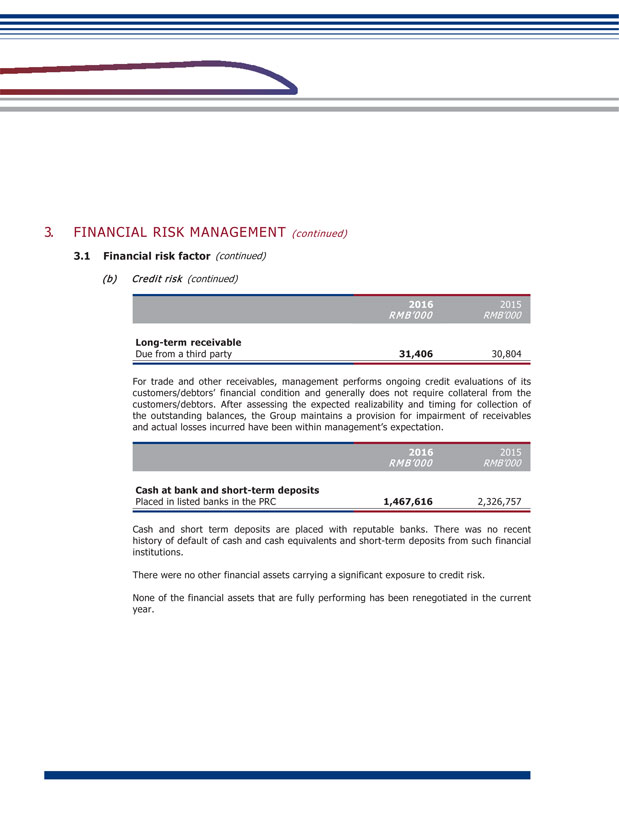

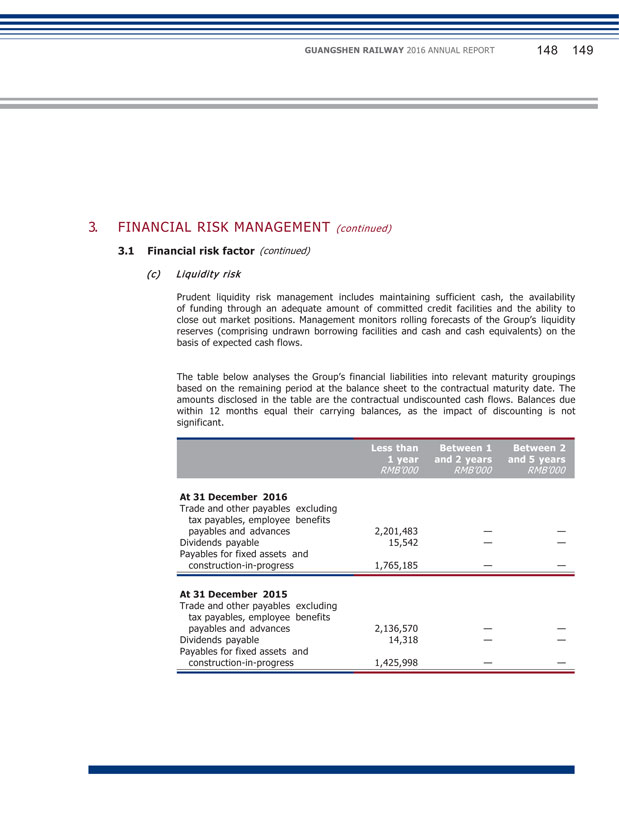

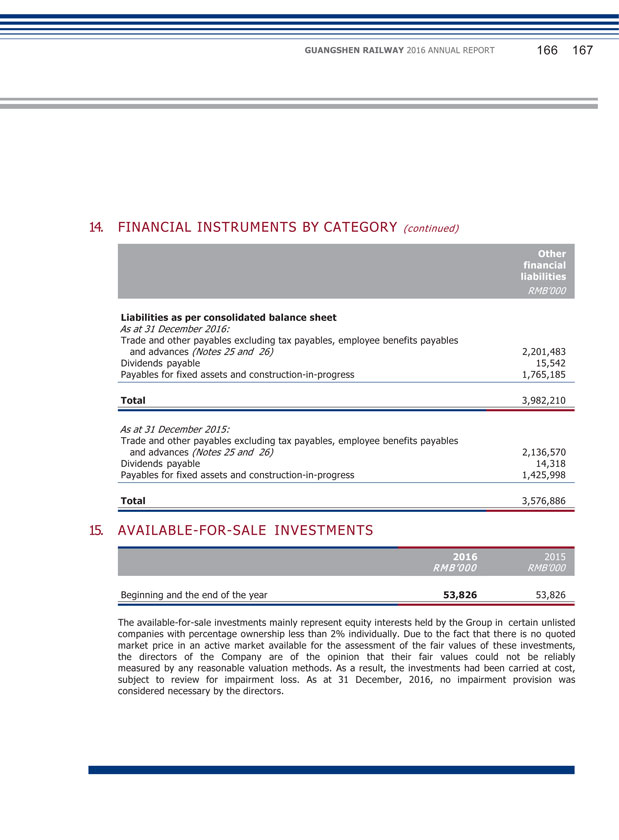

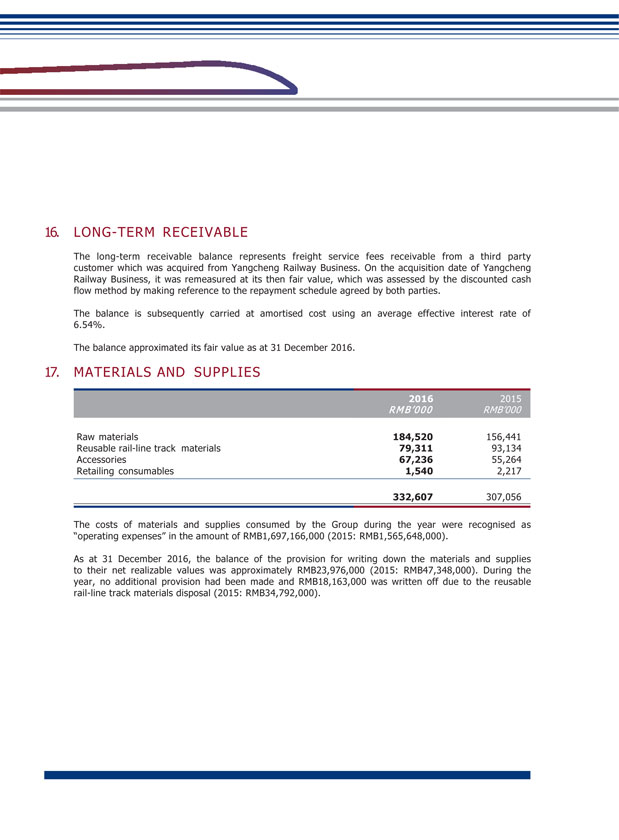

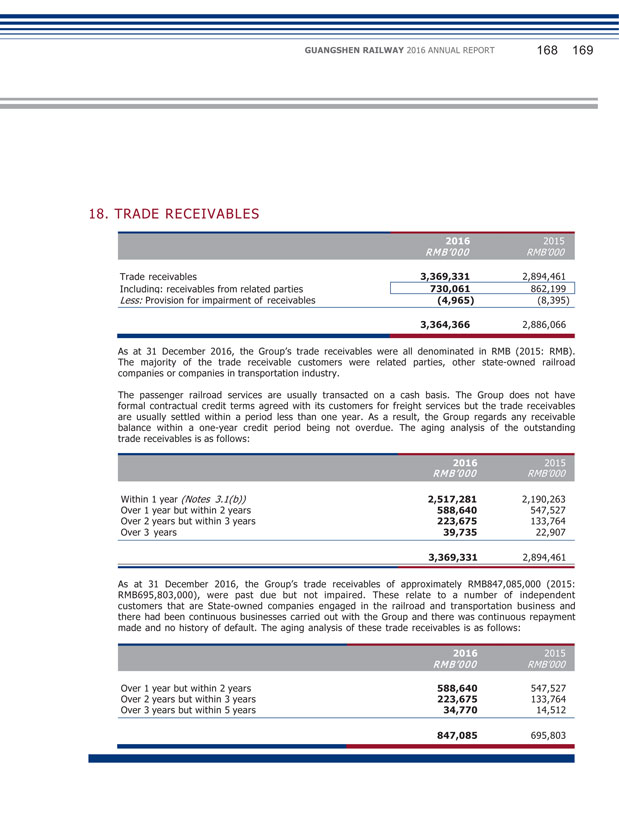

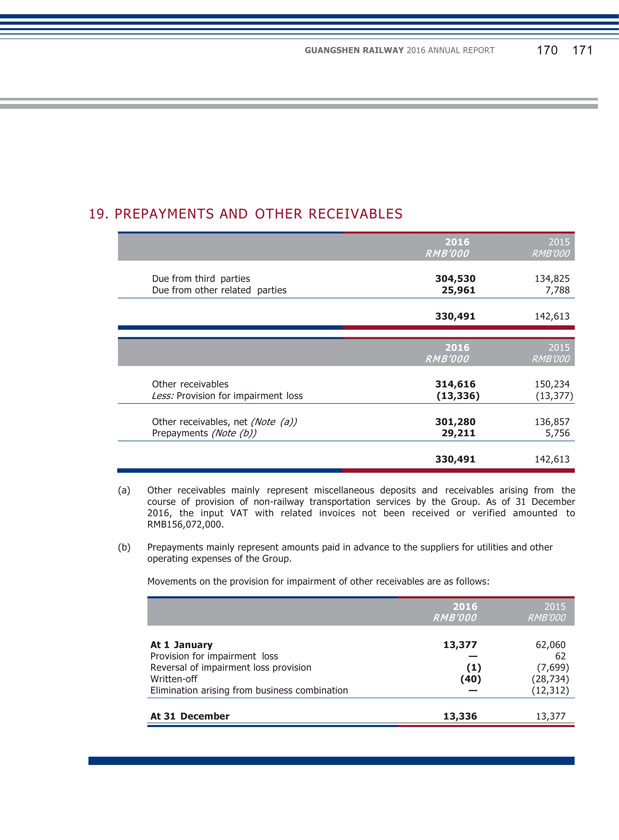

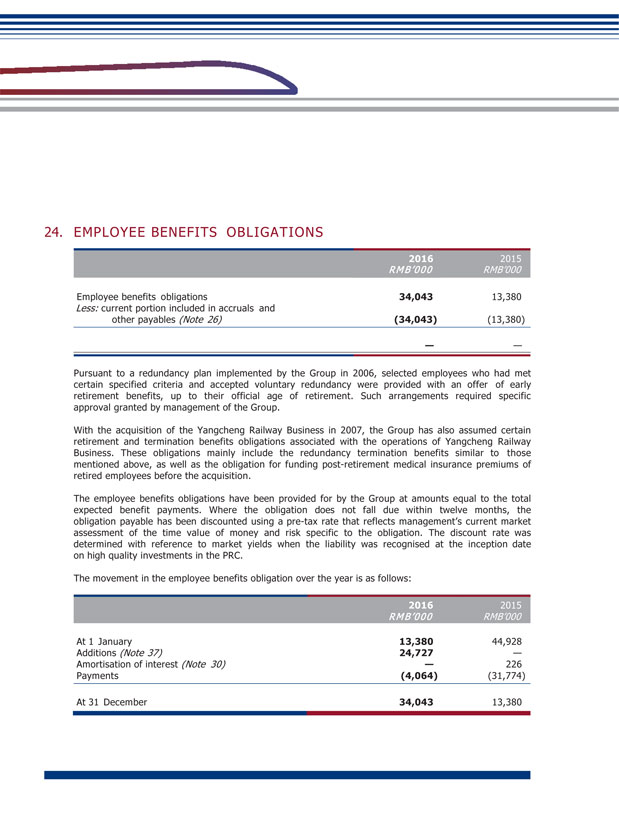

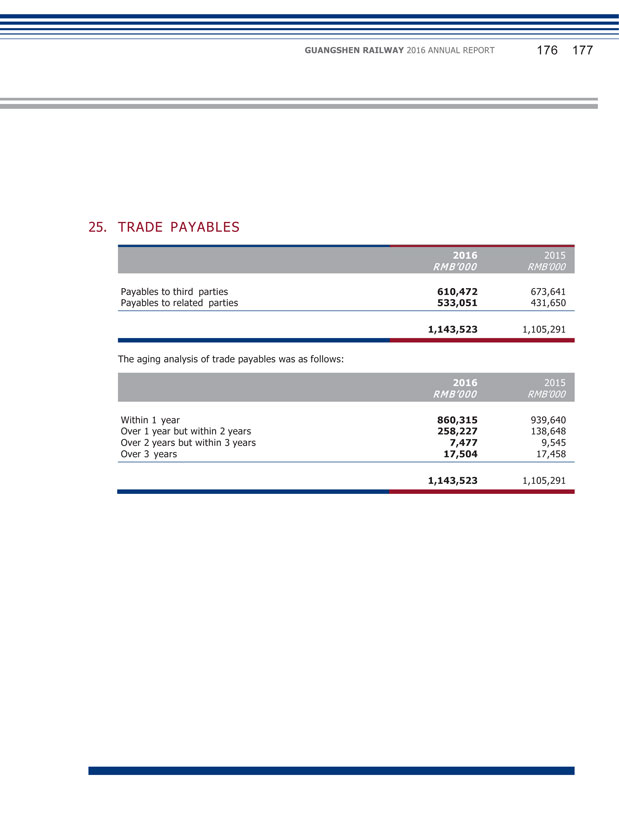

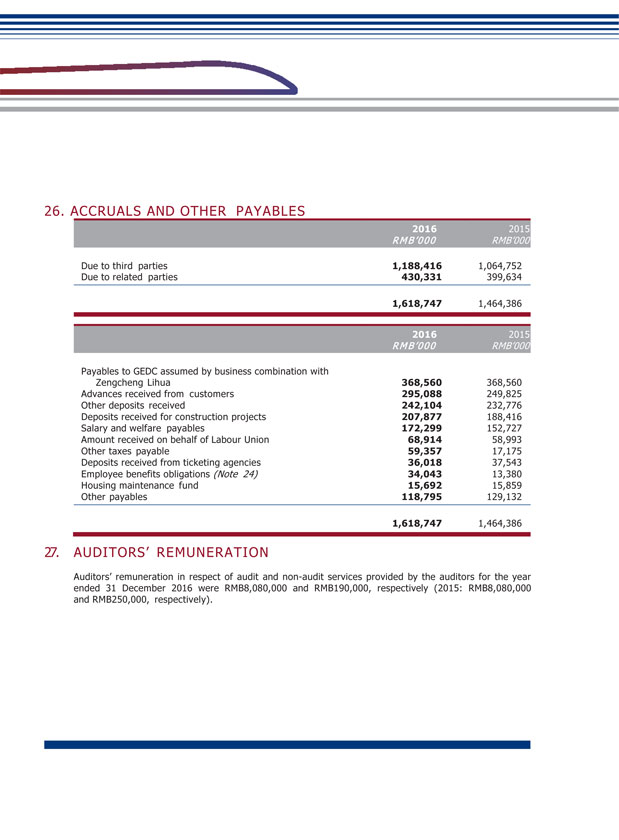

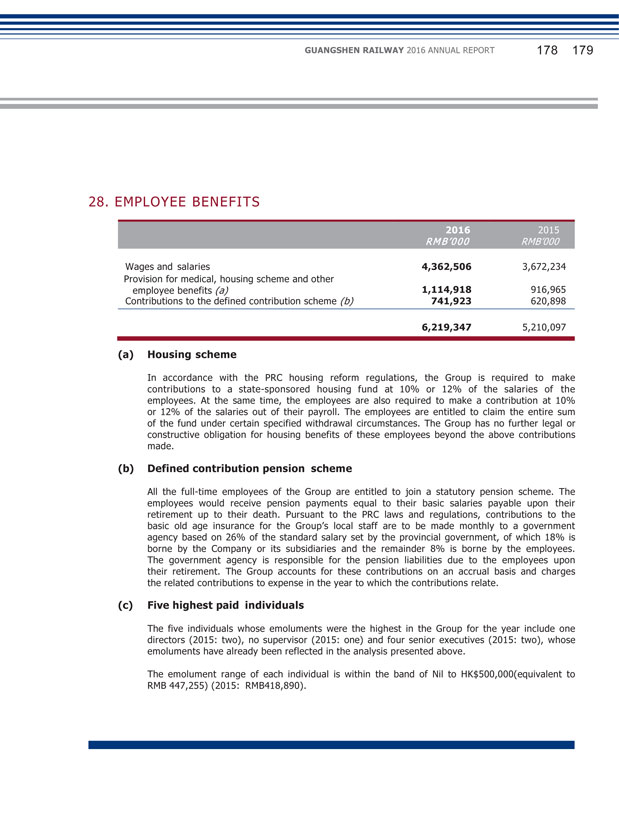

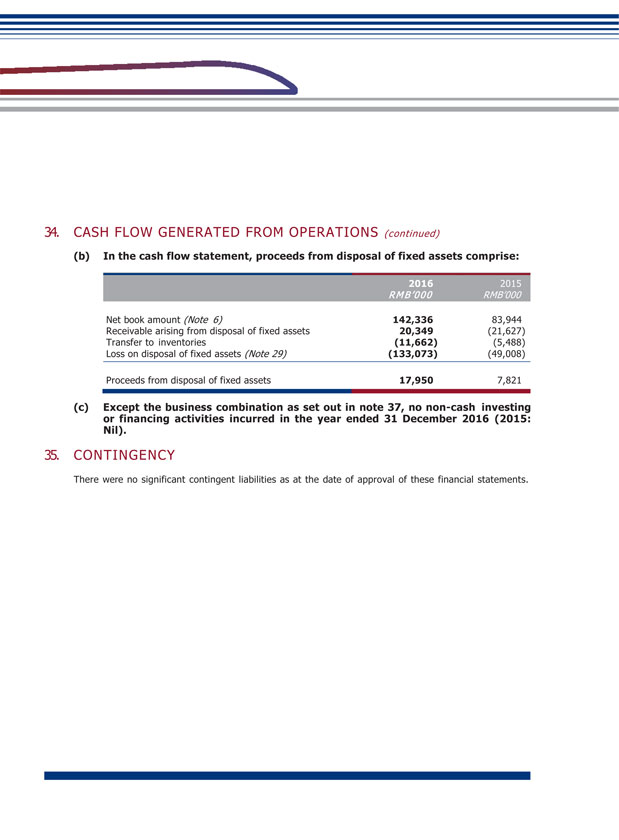

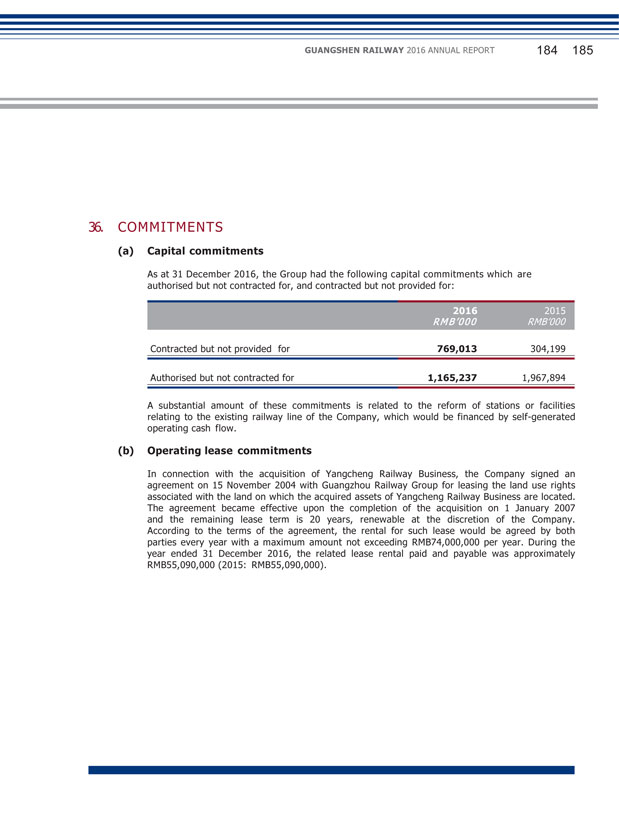

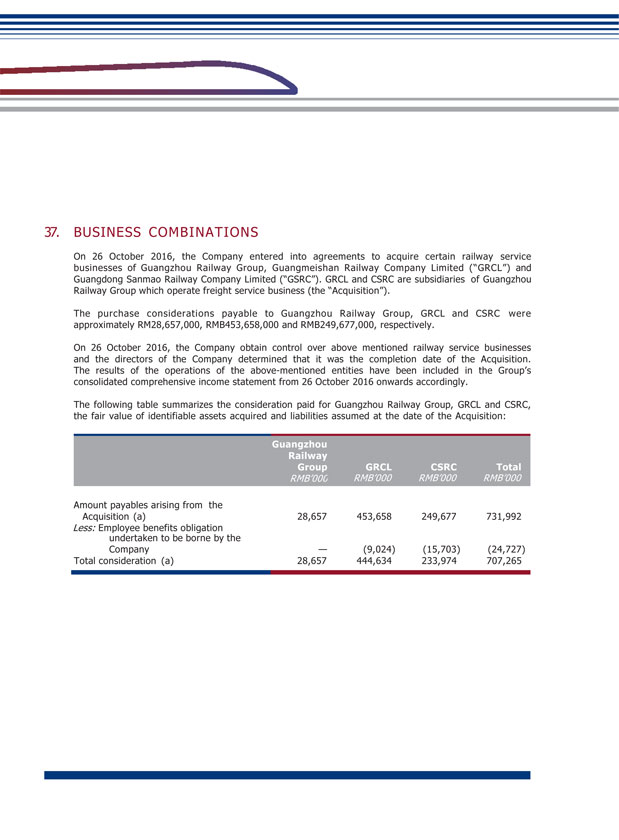

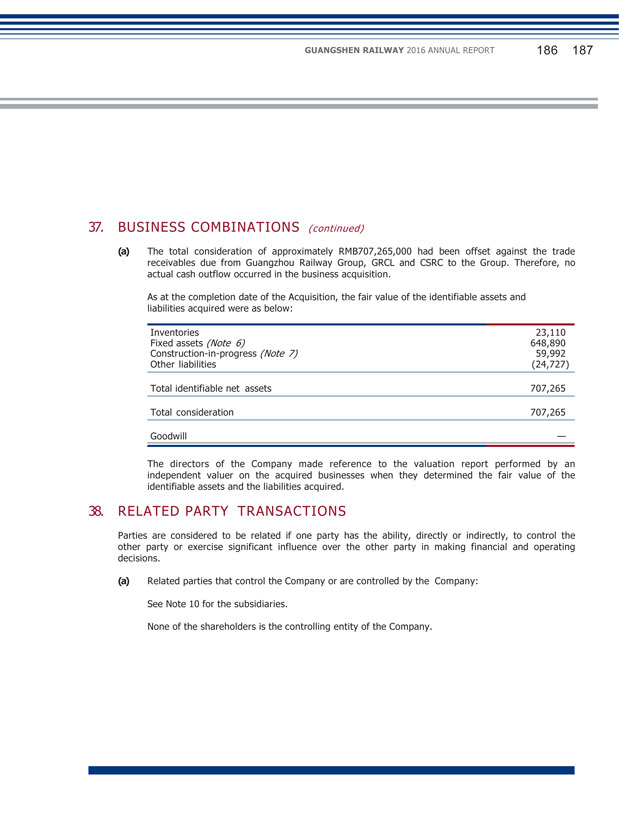

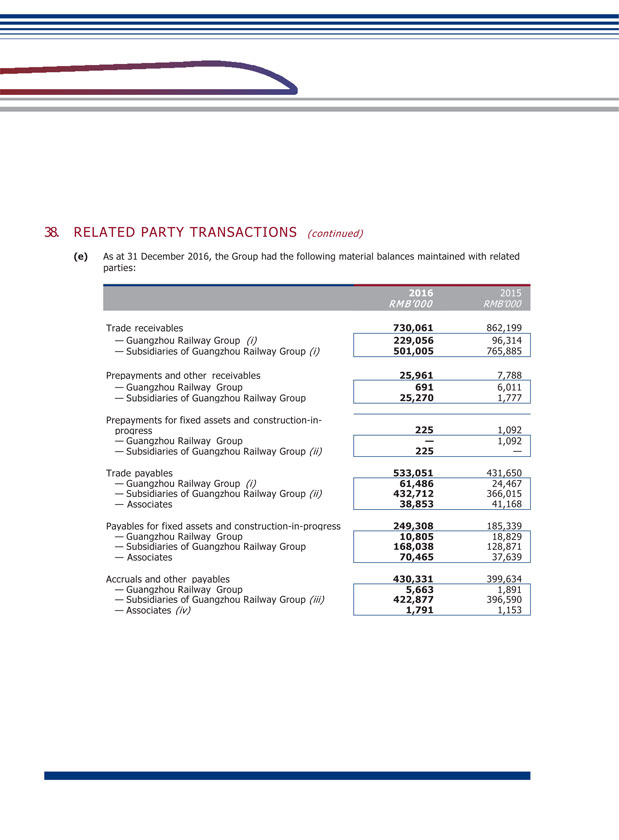

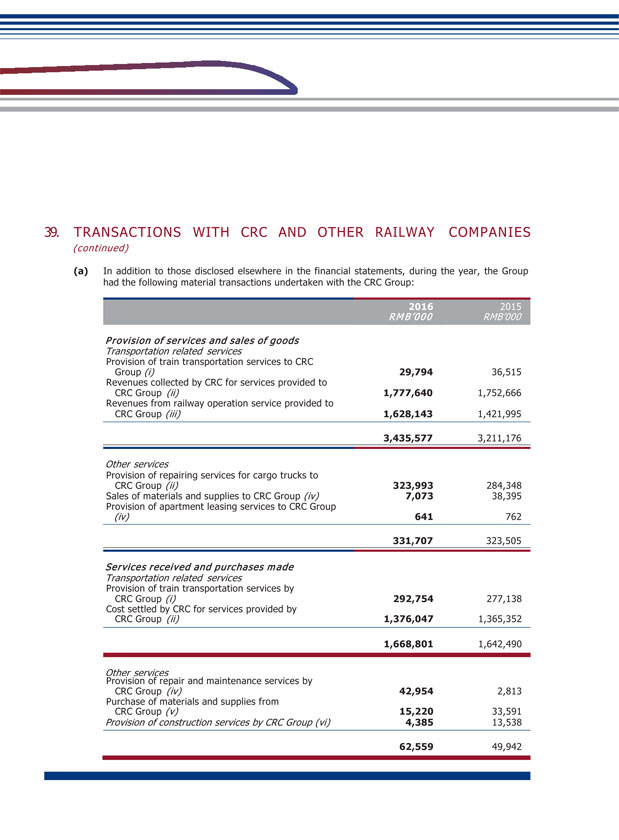

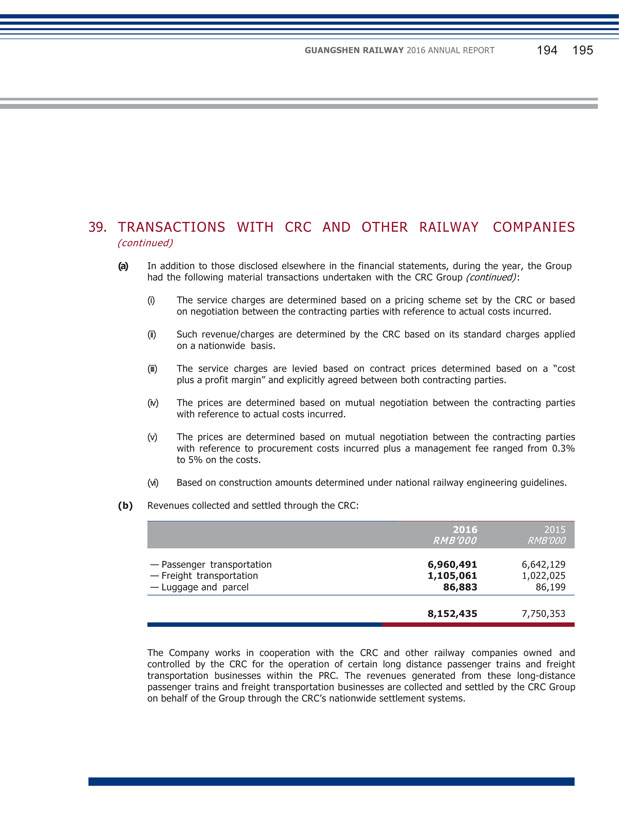

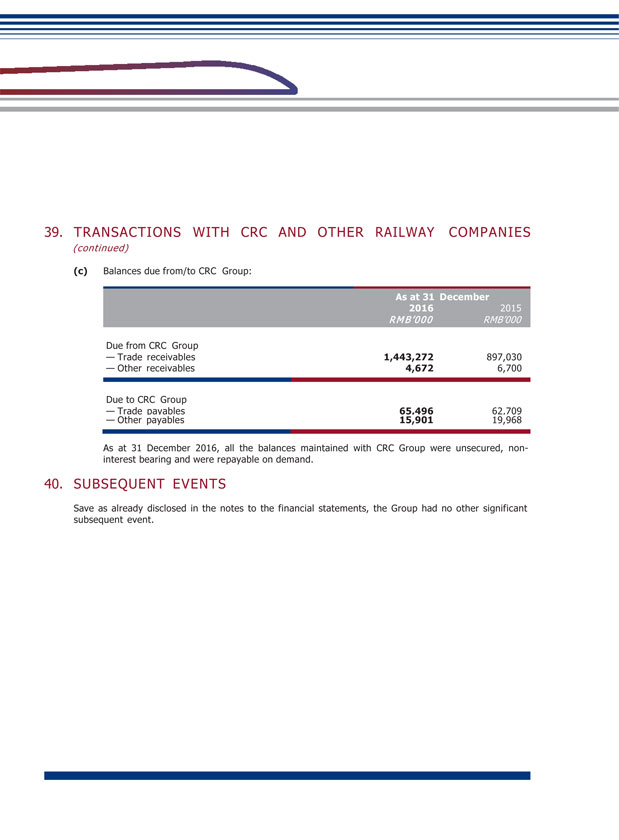

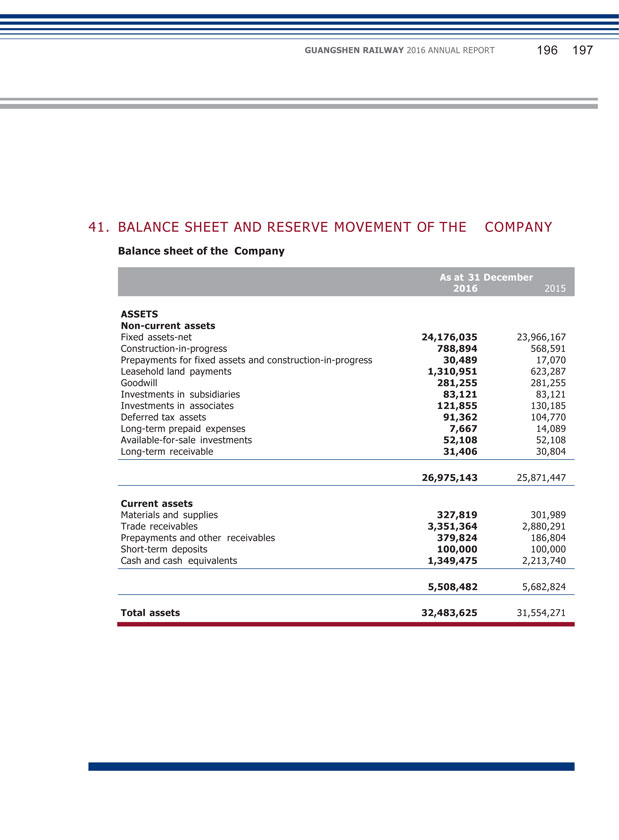

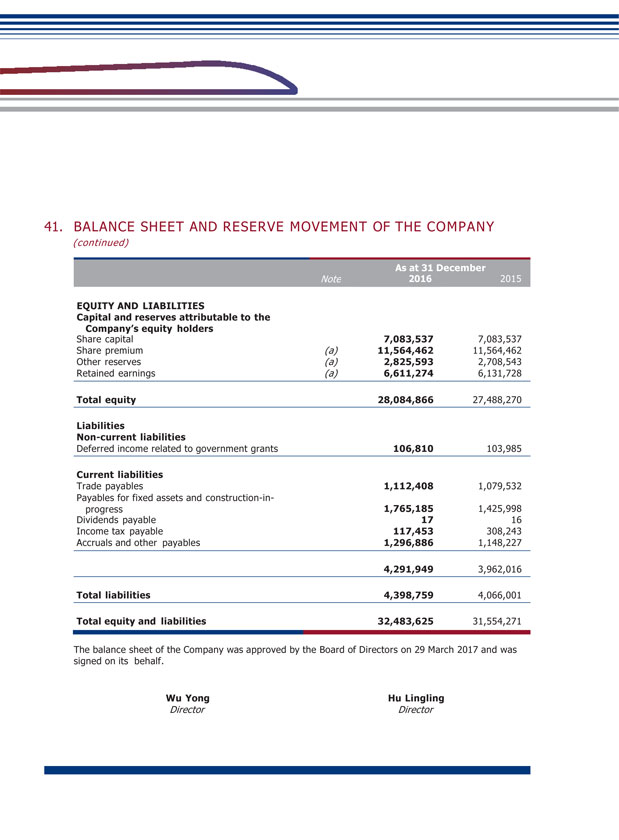

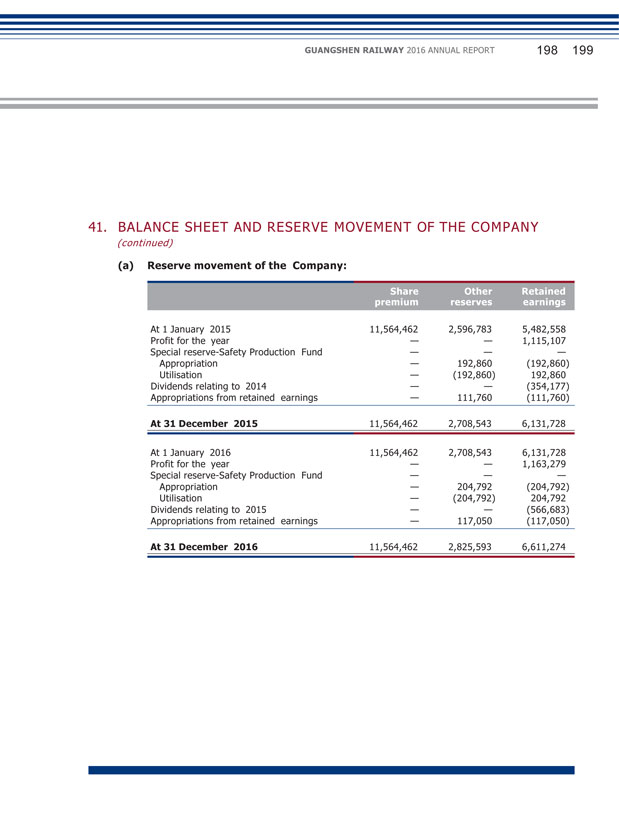

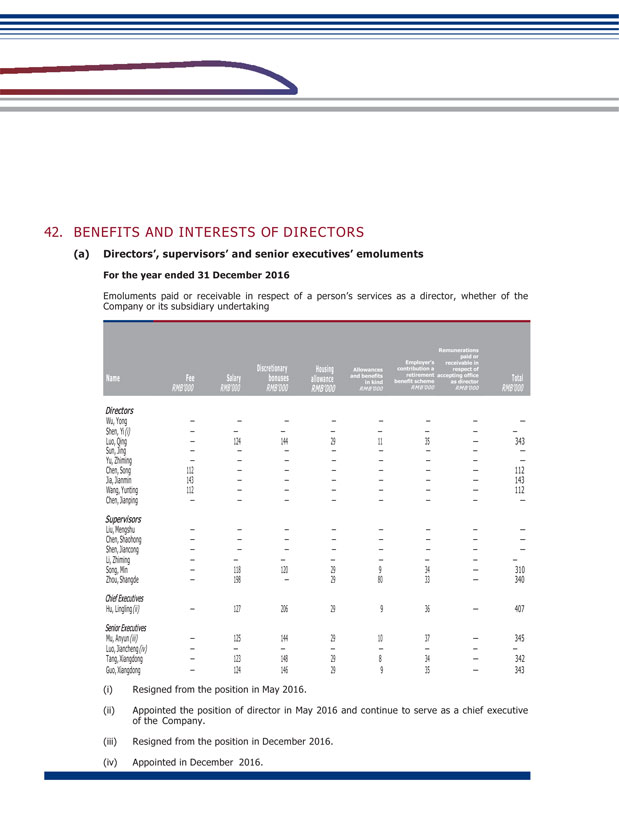

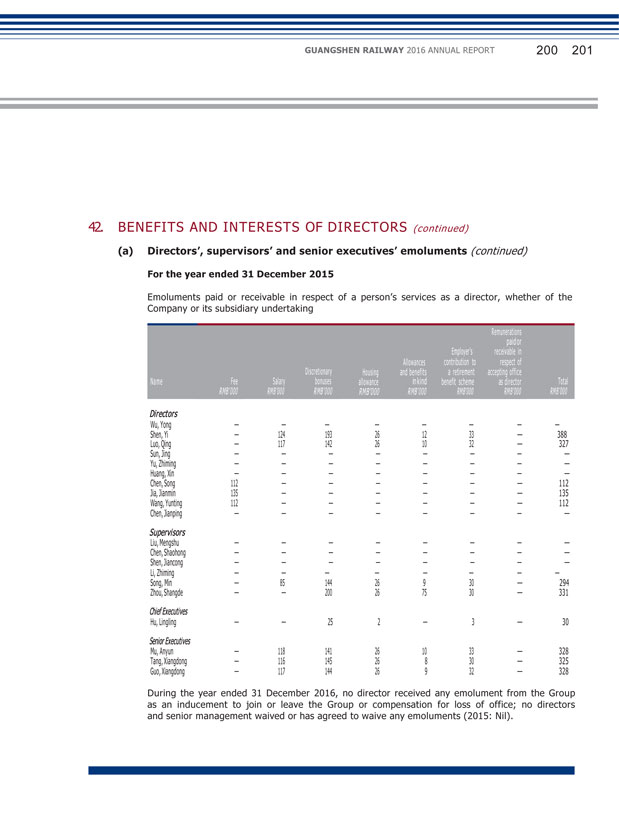

GUANGSHEN RAILWAY 2016 ANNUAL REPORT Top Ten Holders of Shares without Selling Restrictions Number of shares Class and number of the Shares without selling Shareholders’ name restriction held Class Number Guangzhou Railway (Group) Company 2,629,451,300 RMB ordinary shares 2,629,451,300 HKSCC NOMINEES LIMITED (Note) 1,442,502,683 RMB ordinary shares 31,901,234 overseas listed foreign shares 1,410,601,449 China Securities Finance Corporation Limited 186,765,849 RMB ordinary shares 186,765,849 Central Huijin Investment Company Limited 85,985,800 RMB ordinary shares 85,985,800 Kuwait State Investment Bureau — Self fund 41,978,798 RMB ordinary shares 41,978,798 New China Life Insurance Company Ltd. – dividend – group dividend – 018L – FH001Hu 33,614,418 RMB ordinary shares 33,614,418 Taiyuan Iron & Steel (Group) Company Limited 30,781,989 RMB ordinary shares 30,781,989 Nationwide Social Security Fund 106 Portfolio 30,031,749 RMB ordinary shares 30,031,749 Boshi Fund — Agricultural Bank of China — Boshi CSI Financial Asset Management Plan 28,101,600 RMB ordinary shares 28,101,600 Efunds— Agricultural Bank of China — Efunds CSI Financial Asset Management Plan 28,101,600 RMB ordinary shares 28,101,600 Dacheng Fund — Agricultural Bank of China — Dacheng CSI Financial Asset Management Plan 28,101,600 RMB ordinary shares 28,101,600 Harvest Fund — Agricultural Bank of China — Harvest CSI Financial Asset Management Plan 28,101,600 RMB ordinary shares 28,101,600 Zhongou Fund — Agricultural Bank of China — Zhongou CSI Financial Asset Management Plan 28,101,600 RMB ordinary shares 28,101,600 Yinhua Fund — Agricultural Bank of China — Yinhua CSI Financial Asset Management Plan 28,101,600 RMB ordinary shares 28,101,600 Southern Fund — Agricultural Bank of China — Southern CSI Financial Asset Management Plan 28,101,600 RMB ordinary shares 28,101,600 ICBC Credit Suisse Fund — Agricultural Bank of China — ICBC Credit Suisse CSI Financial Asset Management Plan 28,101,600 RMB ordinary shares 28,101,600 Industrial and Commercial Bank of China Limited — China Southern Consumption Vitality Flexible Allocation Hybrid Initiated Securities Investment Fund 26,967,645 RMB ordinary shares 26,967,645 Statement regarding connected relationship or concerted action of the TheCompany isnot aware of any of theother shareholders above are above shareholders connected or acting in concert as defined in “Administrative Measures on Acquisitions of Listed Companies”. Note: HKSCC NOMINEES LIMITED represents , holding 31,901,234 A Shares and 1,410,601,449 H Shares of the Company. These shares were held on behalf of various clients respectively. The shareholdings and selling restrictions of Top 10 shareholders with selling restrictions Applicable Not applicable