QuickLinks -- Click here to rapidly navigate through this document

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K/A

(Amendment No. 1)

| (Mark One) | |

| ý | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2007 |

or |

o |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to |

Commission file number: 000-28308

CollaGenex Pharmaceuticals, Inc.

(Exact Name of Registrant as Specified in Its Charter)

| Delaware | | 52-1758016 |

(State or Other Jurisdiction of

Incorporation or Organization) | | (I.R.S. Employer

Identification Number) |

41 University Drive |

|

|

| Newtown, Pennsylvania | | 18940 |

| (Address of Principal Executive Offices) | | (Zip Code) |

Registrant's telephone number, including area code:

(215) 579-7388 |

Securities registered pursuant to Section 12(b) of the Act:

Title of Each Class

| | Name of Each Exchange on Which Registered

|

|---|

Common Stock, $0.01 par value

(excluding Preferred Stock Purchase Rights, $0.01 par value) | | NASDAQ Global Market |

Securities registered pursuant to Section 12(g) of the Act:None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o No ý

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No ý

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ý No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405) is not contained herein, and will not be contained, to the best of the registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ý

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of "large accelerated filer," "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer o | | Accelerated filer ý | | Non-accelerated filer o

(Do not check if a smaller reporting company) | | Smaller reporting company o |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No ý

The aggregate market value of the registrant's voting shares of common stock held by non-affiliates of the registrant on June 29, 2007, based on $12.40 per share, the last reported sale price on the NASDAQ Global Market on that date, was $238.1 million.

The number of shares outstanding of each of the registrant's classes of common stock, as of March 3, 2008:

Class

| | Number of Shares

|

|---|

| Common Stock, $0.01 par value per share | | 21,576,533 |

Explanatory Note

This Amendment No. 1 to the Annual Report on Form 10-K of CollaGenex Pharmaceuticals, Inc. ("CollaGenex," the "Company," or "we," "us" or "our") for the fiscal year ended December 31, 2007, as originally filed on March 17, 2008, is being filed for the purpose of providing the information required by Part III of Form 10-K. This Amendment No. 1 on Form 10-K/A does not change our previously reported financial statements and other financial disclosure. Part II is being amended solely to furnish our stock performance graph and to amend the cross reference to our equity plan compensation information. Part IV is being amended solely to add new certifications in accordance with Rule 13a-14(a) of the Exchange Act.

Cautionary Note Regarding Forward-Looking Statements

Statements contained or incorporated by reference in this Amendment No. 1 on Form 10-K/A that are not based on historical fact are "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act, as amended. These forward-looking statements regarding future events and our future results are based on current expectations, estimates, forecasts, and projections and the beliefs and assumptions of our management including, without limitation, our expectations regarding revenues, results of operations, selling, general and administrative expenses, research and development expenses, the sufficiency of our cash for future operations, and the success of our preclinical, clinical and development programs and our dermatology franchise. Forward-looking statements may be identified by the use of forward-looking terminology such as "believe," "could increase the likelihood," "hope," "target," "project," "goals," "potential," "predict," "might," "expect," "intend," "is planned," "should," "will enable," "would be expected," "look forward," "may provide," "would," "may," "could," "will," "expect," "estimate," "anticipate," "continue," or similar terms, variations of such terms or the negative of those terms. These statements are not guarantees of future performance and involve certain risks, uncertainties and assumptions that are difficult to predict. Our actual results and timing of certain events could differ materially from those anticipated in these forward-looking statements as a result of certain factors, including, but not limited to, those set forth under "Risk Factors" and elsewhere in our Annual Report on Form 10-K filed on March 17, 2008 with the Securities and Exchange Commission. It is routine for internal projections and expectations to change as the year or each quarter in the year progresses, and therefore it should be clearly understood that the internal projections and beliefs upon which we base our expectations are made as of the date of this Amendment No. 1 on Form 10-K/A and may change prior to the end of each quarter or the year. While we may elect to update forward-looking statements at some point in the future, we do not undertake any obligation to update any forward-looking statements whether as a result of new information, future events or otherwise.

1

PART II

Item 5. Market For Registrant's Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities.

Market Information

Since June 20, 1996, our common stock has traded on the NASDAQ Global Market under the symbol "CGPI."

The following table sets forth the high and low closing sale prices per share for our common stock for each of the quarters in the period beginning January 1, 2006 through December 31, 2007, as reported on the NASDAQ Global Market:

Quarter Ended

| | High

| | Low

|

|---|

| March 31, 2006 | | $ | 14.80 | | $ | 11.27 |

| June 30, 2006 | | $ | 14.67 | | $ | 10.52 |

| September 30, 2006 | | $ | 13.22 | | $ | 8.52 |

| December 31, 2006 | | $ | 14.65 | | $ | 11.35 |

March 31, 2007 |

|

$ |

15.58 |

|

$ |

12.70 |

| June 30, 2007 | | $ | 14.48 | | $ | 9.91 |

| September 30, 2007 | | $ | 13.49 | | $ | 8.98 |

| December 31, 2007 | | $ | 10.68 | | $ | 7.49 |

Holders

As of March 3, 2008, the approximate number of holders of record of our common stock was 83 and the approximate number of beneficial holders of our common stock was 2,865 as of March 3, 2008.

Dividends

We have never declared or paid any cash dividends on our common stock. Except as set forth below, we intend to retain earnings, if any, to fund future growth and the operation of our business. On May 12, 1999, we consummated a $20.0 million financing through the issuance of our Series D Cumulative Convertible Preferred Stock, or Series D Stock. As a result of such financing, we had certain common stock dividend obligations and continue to have certain cumulative cash dividend obligations to the holders of the Series D Stock, who now hold Series D-1 Stock as a result of the Restructuring and Exchange Agreement we executed with such holders on December 15, 2005. Such arrangement also limits our ability to declare dividends to our common stockholders. In addition, our ability to declare dividends to our common stockholders is further limited by the terms of our credit facility with SVB, which expires on October 9, 2008.

Equity Compensation Plan Information

Information relating to compensation plans under which our equity securities are authorized for issuance is set forth under "EQUITY COMPENSATION PLAN INFORMATION" in Item 12 of this Annual Report on Form 10-K.

2

Performance Graph

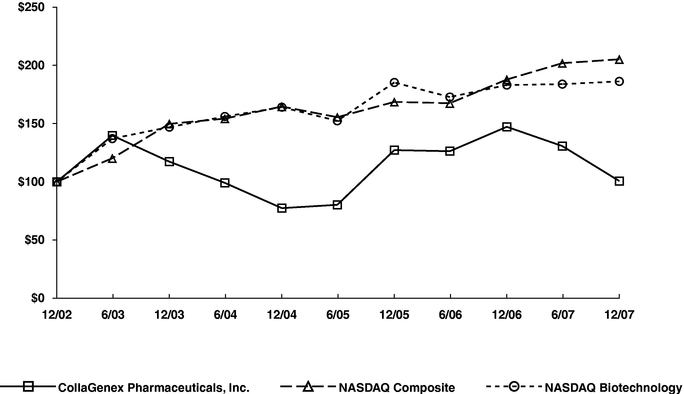

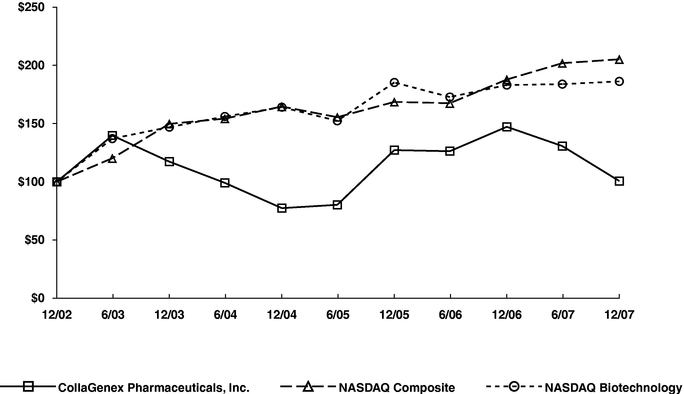

The following graph compares the cumulative 5-year total return provided stockholders on our common stock relative to the cumulative total returns of the NASDAQ Composite Index and the NASDAQ Biotechnology Index. An investment of $100 (with reinvestment of all dividends) is assumed to have been made in our common stock and in each of the indexes on December 31, 2002 and its relative performance is tracked through December 31, 2007. The stock price performance included in this graph is not necessarily indicative of future stock price performance.

COMPARISON OF 5 YEAR CUMULATIVE TOTAL RETURN*

Among CollaGenex Pharmaceuticals, Inc., The NASDAQ Composite Index

And The NASDAQ Biotechnology Index

- *

- $100 invested on December 31, 2002 in stock or index-including reinvestment of dividends. Fiscal year ending December 31.

| | 12/02

| | 6/03

| | 12/03

| | 6/04

| | 12/04

| | 6/05

| | 12/05

| | 6/06

| | 12/06

| | 6/07

| | 12/07

|

|---|

| CollaGenex Pharmaceuticals, Inc. | | 100.00 | | 139.73 | | 117.28 | | 99.05 | | 77.34 | | 80.19 | | 127.19 | | 126.24 | | 147.21 | | 130.66 | | 100.63 |

| NASDAQ Composite | | 100.00 | | 120.21 | | 149.75 | | 154.24 | | 164.64 | | 155.46 | | 168.60 | | 167.47 | | 187.83 | | 201.89 | | 205.22 |

| NASDAQ Biotechnology | | 100.00 | | 137.09 | | 146.95 | | 156.06 | | 164.05 | | 152.37 | | 185.29 | | 172.78 | | 183.09 | | 183.86 | | 186.22 |

The information included under the heading "Performance Graph" in Item 5 of this Annual Report on Form 10-K is "furnished" and not "filed" and shall not be deemed to be "soliciting material" or subject to Regulation 14A, shall not be deemed "filed" for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Securities Exchange Act of 1934, as amended.

3

PART III

Item 10. Directors, Executive Officers and Corporate Governance

Directors

The current members of our Board of Directors are as follows:

Name

| | Age

| | Served as a

Director Since

| | Position(s) with the Company

|

|---|

| Colin W. Stewart | | 56 | | 2003 | | President and Chief Executive Officer |

Peter R. Barnett, D.M.D. |

|

56 |

|

1997 |

|

Director |

Robert C. Black |

|

65 |

|

1999 |

|

Director |

James E. Daverman |

|

58 |

|

1995 |

|

Chairman of the Board and Director |

Robert J. Easton |

|

63 |

|

1993 |

|

Director |

George M. Lasezkay, Pharm.D., J.D. |

|

56 |

|

2005 |

|

Director |

W. James O'Shea |

|

58 |

|

2000 |

|

Director |

Name

| | Age

| | Served as a Director Since

| | Position(s) with the Company

|

|---|

| Robert A. Beardsley, Ph.D. | | 47 | | 2004 | | Director |

Our directors are elected to one-year terms at our annual meetings of stockholders. The principal occupations and business experience, for at least the past five years, of each of our current directors are as follows:

Mr. Stewart joined CollaGenex in December 2003 as President and Chief Executive Officer and has been a member of our Board since December 2003. From October 1998 until joining CollaGenex, Mr. Stewart served as the President and Chief Executive Officer of Muro Pharmaceutical, Inc., a pharmaceutical manufacturer and distributor. From 1988 to 1998, Mr. Stewart was employed by the ASTA Medica Group in a number of sales, marketing and general management positions of increasing responsibility. Prior to 1988, Mr. Stewart was employed by Sterling-Winthrop, Ltd., a United Kingdom pharmaceutical company, for 13 years in sales and general management.

Dr. Barnett has been a member of our Board since February 1997. Since March 2004, Dr. Barnett has been the President and owner of Star Ranch Dental Spa, a dental practice. From November 2003 to present, Dr. Barnett has served as an independent consultant in the managed care field. From November 2002 through October 2003, Dr. Barnett served as President, Chief Executive Officer and director of Group Dental Service, Inc., a dental insurance company. From September 2001 to November 2002, he served as an independent healthcare consultant. From June 2000 to September 2001, Dr. Barnett was the President, Chief Executive Officer and a member of the Board of Directors of HealthASPex, Inc., a claims technology firm. From January 1995 until May 2000, Dr. Barnett was the president and Chief Operating Officer of United Dental Care, Inc., a managed dental benefits firm.

4

Mr. Black has been a member of our Board since September 1999. He was President of the Zeneca Pharmaceuticals Division of AstraZeneca, Inc., a pharmaceutical company, until his retirement in June 1999.

Mr. Daverman has been a member of our Board since November 1995 and became its Chairman in January 2004. Mr. Daverman is managing general partner of Redfish Partners, L.P., an investment and consulting company. Mr. Daverman also is a Senior Advisor to Robert W. Baird and Co. Incorporated, an investment banking organization, and Chairman of the Advisory Boards of Baird Venture Partners and Baird Capital Partners, Baird's private equity businesses. Until his retirement in October 2003, Mr. Daverman served as managing general partner of Marquette Venture Partners, a venture capital investment company that he co-founded in 1986. Mr. Daverman also serves as Chairman of the Board of Directors of Marshall Erdman & Associates, Inc. and is a member of the Board of Directors of PharMEDium Healthcare Corporation.

Mr. Easton has been a member of our Board since November 1993. Since October 2006, he has been with Apex BioVentures, a SPAC in formation which he co-founded. Since January 2007, he has served as Chairman of Easton Strategy, a financial consulting firm and from May 2000 to October 2006, he served as Chairman of Easton Associates, a healthcare consulting firm. From May 1996 to May 2000, Mr. Easton was the managing director of IBM Healthcare Consulting, Inc., a health care consulting firm. Mr. Easton serves on the board of directors of Cepheid, Inc., a company that develops, manufactures and markets fully integrated diagnostics systems, as well as several privately held companies.

Dr. Lasezkay has been a member of our Board since September 2005. Since 2002, Dr. Lasezkay has provided business development and strategic advisory services to biotechnology and emerging pharmaceutical companies through his consulting firm, Turning Point Consultants. From 1989 to 2002, Dr. Lasezkay served in various positions at Allergan, Inc., a global health care company, including Corporate Vice President, Corporate Development from 1998 to 2002, Vice President, Corporate Development from 1996 to 1998 and Assistant General Counsel from 1995 to 1996. Dr. Lasezkay serves on the board of directors of Valentis, Inc., a public biotechnology company, as well as several other private development stage pharmaceutical companies.

Mr. O'Shea has been a member of our Board since September 2000. Since October 1999, Mr. O'Shea has served as President and Chief Operating Officer and, as of March 1, 2007, assumed the position of Vice Chairman of Sepracor, Inc., a research-based pharmaceutical company. Mr. O'Shea also serves on the board of directors of Surface Logix Inc.

Dr. Beardsley has been a member of our Board since December 2004. Since January 2003, Dr. Beardsley has served as President and Chief Executive Officer of Kereos, Inc., a pharmaceutical research and development company. From May 2002 to September 2002, Dr. Beardsley was the acting Chief Executive Officer of Metaphore Pharmaceuticals, a pharmaceutical company. From August 2000 to July 2006, Dr. Beardsley was a managing member of Simile Investors. Dr. Beardsley serves on the board of directors of several privately held companies.

5

Executive Officers

The following table identifies our current executive officers:

Name

| | Age

| | Capacities in

Which Served

| | In Current

Position Since

|

|---|

| Colin W. Stewart | | 56 | | President, Chief Executive Officer and Director | | December 2003 |

Nancy C. Broadbent(1) |

|

52 |

|

Senior Vice President, Chief Financial Officer and Treasurer |

|

February 2006 |

David F. Pfeiffer(2) |

|

45 |

|

Senior Vice President, Sales and Marketing |

|

December 2000

(Vice President, Marketing since June 1997) |

Klaus Theobald(3) |

|

52 |

|

Senior Vice President and Chief Medical Officer |

|

January 2004 |

Andrew K. W. Powell(4) |

|

50 |

|

Vice President, General Counsel and Secretary |

|

September 2004 |

J. Gregory Ford(5) |

|

46 |

|

Vice President, Business Development and Strategic Planning |

|

August 2004 |

- (1)

- Ms. Broadbent joined CollaGenex in March 1996 as Chief Financial Officer and Treasurer. She was promoted to Senior Vice President in February 2006.

- (2)

- Mr. Pfeiffer joined CollaGenex in June 1997 as Vice President, Marketing. He was promoted to Senior Vice President, Sales and Marketing in December 2000. From September 1995 until June 1997, Mr. Pfeiffer served as Director of Marketing, Health Management Services for SmithKline Beecham.

- (3)

- Dr. Theobald joined CollaGenex in January 2004 as Senior Vice President and Chief Medical Officer. Prior to joining CollaGenex, from February 2003 to January 2004, Dr. Theobald was pursuing personal interests. From June 2002 to February 2003, Dr. Theobald was the president and chief executive officer of Allergenics, Inc., a biotechnology company focused on oral protein delivery. From March 2001 to April 2002, Dr. Theobald was the chief medical officer of Genesis Therapeutics, a subsidiary of Aventis Behring. From May 1996 to May 2002, Dr. Theobald held various senior positions at Aventis Behring and its predecessor companies.

- (4)

- Mr. Powell joined CollaGenex in September 2004 as Vice President, General Counsel and Secretary. From June 1989 to July 2004, Mr. Powell was associate general counsel for Baxter International Inc., a global healthcare and biotechnology company.

- (5)

- Mr. Ford joined CollaGenex in August 2004 as Vice President, Business Development and Strategic Planning. From April 2003 to April 2004, Mr. Ford was Vice President, Global Business Development for SkyePharma U.S., Inc., a pharmaceutical company. From March 2002 to April 2003, Mr. Ford was President and a member of the board of directors of SkyePharma Canada Inc., formerly RTP Pharma, Inc.

Family Relationships

No family relationships exist between any of our executive officers and our directors. Our executive officers are elected annually by our Board and serve until their successors are duly elected and qualified.

6

Involvement in Certain Legal Proceedings

Dr. Theobald previously served as chief executive officer and a director of Allergenics, Inc., a company engaged in the development of anti-allergy drugs. Allergenics filed for bankruptcy in 2003 under Chapter 7 of the U.S. Bankruptcy Code. The case was heard before the U.S. Bankruptcy Court for the Northern District of California, San Francisco Division. The assets of the company have been liquidated pending final distribution to creditors.

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Exchange Act requires our directors, officers and stockholders who beneficially own more than 10% of any class of our equity securities registered pursuant to Section 12 of the Exchange Act to file initial reports of ownership and reports of changes in ownership with respect to our equity securities with the Securities and Exchange Commission. All reporting persons are required by the Securities and Exchange Commission's regulations to furnish us with copies of all reports that such reporting persons file with the Securities and Exchange Commission pursuant to Section 16(a).

Based solely on our review of the copies of such forms received by us and upon written representations of our reporting persons received by us each such reporting person has filed all of his respective reports pursuant to Section 16(a) on a timely basis.

Code of Business Conduct and Ethics

We have adopted a written code of business conduct and ethics that applies to our directors, officers and employees, including our principal executive officer, principal financial officer, principal accounting officer or controller, or persons performing similar functions. We make available our code of business conduct and ethics free of charge through our website which is located atwww.collagenex.com. We intend to disclose any amendments to, or waivers from, our code of business conduct and ethics that are required to be publicly disclosed pursuant to rules of the Securities and Exchange Commission and the Nasdaq Stock Market by filing such amendment or waiver with the Securities and Exchange Commission and by posting it on our website.

Director Nomination Process

The process followed by the Nominating and Corporate Governance Committee to identify and evaluate director candidates includes requests to the members of the Board and others for recommendations, meetings from time to time to evaluate biographical information and background material relating to potential candidates and interviews of selected candidates by members of the Nominating and Corporate Governance Committee and the Board.

In considering whether to recommend any particular candidate for inclusion in the Board's slate of recommended director nominees, the Nominating and Corporate Governance Committee applies the criteria attached to the Nominating and Corporate Governance Committee Charter. These criteria include the candidate's integrity, business acumen, knowledge of our business and industry, experience, diligence, conflicts of interest and the ability to act in the interests of all our stockholders. The Nominating and Corporate Governance Committee does not assign specific weights to particular criteria and no particular criterion is a prerequisite for each prospective nominee. We believe that the backgrounds and qualifications of our directors, considered as a group, should provide a composite mix of experience, knowledge and abilities that will allow the Board to fulfill its responsibilities.

Stockholders may recommend individuals to the Nominating and Corporate Governance Committee for consideration as potential director candidates by submitting the names of the candidate(s), together with appropriate biographical information and background materials and a

7

statement as to whether the stockholder or group of stockholders making the recommendation has beneficially owned more than 5% of our common stock for at least a year as of the date such recommendation is made, to Nominating and Corporate Governance Committee, c/o Secretary, CollaGenex Pharmaceuticals, Inc., 41 University Drive, Newtown, Pennsylvania 18940. Assuming that appropriate biographical and background material has been provided on a timely basis, the Nominating and Corporate Governance Committee will evaluate stockholder-recommended candidates by following substantially the same process, and applying substantially the same criteria, as it follows for candidates submitted by others.

There have been no material changes to the procedures by which our stockholders may recommend to the Nominating and Corporate Governance Committee nominees for election to the Board since we filed our Annual Report on Form 10-K for the fiscal year ended December 31, 2006.

Audit Committee

Our Board of Directors has established an audit committee that operates under a written charter that has been approved by the Board. A current copy of the charter is posted on the Corporate Governance section of our website located atwww.collagenex.com. The Audit Committee currently consists of Dr. Barnett, who serves as its Chairman, Dr. Beardsley, Mr. Daverman and Dr. Lasezkay, each of whom the Board has determined to be independent as defined under the rules of NASDAQ and the independence requirements contemplated by Rule 10A-3 under the Exchange Act. The Board has determined that each of Mr. Daverman, Dr. Barnett and Dr. Beardsley is an "audit committee financial expert" as defined by applicable SEC rules.

Item 11. Executive Compensation.

EXECUTIVE COMPENSATION

COMPENSATION DISCUSSION AND ANALYSIS

Overview and Philosophy

Our compensation programs are designed to attract and retain high quality and talented executive officers, and to reward individual contribution, loyalty, teamwork and integrity. Our programs are intended to motivate executive officers to attain both short and long-term performance goals with the objective of increasing stockholder value over the long term.

We stress a philosophy that is performance driven. We believe that the performance of our Named Executives (as defined in the Summary Compensation Table on page 16) should be viewed in the context of general economic conditions, our industry, the competitive landscape and our performance. We also believe that their compensation should not be based on the short-term performance of our stock price because we expect that the price of our stock in the long-term will better reflect our true operating performance, and ultimately, the effectiveness of the management of CollaGenex by our Named Executives.

In determining total compensation, we do not have an exact formula for allocating between cash and non-cash compensation. We try, however, to balance long-term equity and short-term cash compensation by offering reasonable base salaries and opportunities for growth through our stock option and other equity incentive programs. We believe that our total compensation of Named Executives is competitive with comparable positions at companies in our industry and of comparable size.

Our compensation philosophy emphasizing performance permeates total compensation for both executives and non-executives. We believe that the design of executive compensation programs affects all of our employees and, because the performance of every employee is important to our success, we are cognizant of the effect that executive compensation may have on each member of our team.

8

The Compensation Committee of our Board of Directors, in accordance with its written charter, oversees all aspects of our director, officer and other executive compensation policies. The Compensation Committee also approves the individual compensation of our executive officers, including the Named Executives. The Compensation Committee reviews and approves annual and long-term performance goals under our incentive compensation plans and oversees the annual review and evaluation of the corporate and individual performance of each Named Executive. In addition, the Compensation Committee meets at least annually with the Chief Executive Officer to review his performance and to discuss his assessment of the performance of the other Named Executives.

In 2007, we retained Towers Perrin, a compensation consultant, to review our compensation levels, policies and procedures and to benchmark both the nature and overall level of compensation paid to our Named Executives and our directors using data drawn from comparable companies in the specialty pharmaceutical sector.

We do not require executives or directors to maintain any specific level of ownership in our stock, and, except as is required under the laws relating to insider trading, we do not restrict executives from hedging the economic risk of owning our shares.

Role of Chief Executive Officer in Compensation Decisions

At the request of the Compensation Committee, our Chief Executive Officer attends all or portions of periodic meetings of the Compensation Committee, but does not attend portions of any meeting in which the Compensation Committee is discussing his compensation or performance. In addition, our Compensation Committee seeks input from our Chief Executive Officer with respect to, among other things:

- •

- the development of corporate and business performance objectives against which the payment of executive bonuses will be made and his assessment of the extent to which other Named Executives have achieved such objectives; and

- •

- executive compensation trends among specialty pharmaceutical companies, including the overall blend of salary, bonus and equity compensation within such group and his recommendations pertaining to our executive compensation program.

The Chief Executive Officer submits to the Compensation Committee the goals of the Named Executives to which executive bonuses are linked. These goals are subject to the review and approval of the Compensation Committee. The Chief Executive Officer also conducts periodic discussions with each Named Executive regarding such Named Executive's progress in relation to established metrics and goals.

Elements of Compensation

Our compensation program is designed to reward each Named Executive based upon a combination of corporate performance and individual performance. Corporate performance is generally evaluated by reviewing the extent to which strategic goals are met, including the achievement of: specified operational and financial goals, such as revenue and net income (loss) targets; specific research, clinical, regulatory, commercial or compliance milestones; and business development and financing initiatives. We generally evaluate individual performance by reviewing the extent to which goals relating to specific, pre-determined individual performance criteria are achieved in each Named Executive's area of responsibility. Within each Named Executive's area of responsibility, individual performance goals are aligned with the corporate performance goals discussed above.

Executive compensation generally consists of a combination of:

9

- •

- annual cash bonuses;

- •

- stock options;

- •

- other benefits, such as health, dental, disability and life insurance;

- •

- perquisites such as travel, relocation and temporary living expenses, as necessary; and

- •

- severance and change-in-control payments.

We do not have any formal or informal policy or target for allocating compensation between long-term and short-term compensation, between cash and non-cash compensation or among the different forms of non-cash compensation. Instead, the Compensation Committee determines subjectively what it believes to be the appropriate level and mix of the various compensation components.

Base Salary. Base salaries are established for our Named Executives at levels that are intended to reflect the scope of each Named Executive's responsibilities and relevant background, training and experience. We believe that base salaries, which provide current income to each Named Executive, are a fundamental element of our executive compensation program. When establishing the base salaries of our Named Executives, the Compensation Committee takes into account the seniority of the individual, the functional role of the position, the level of the individual's responsibility and the base salaries and overall compensation paid to comparable officers in other companies with which we compete for executives. Base salaries are reviewed at least annually by our Compensation Committee, and are adjusted from time to time to ensure that our executive compensation structure remains aligned with our compensation objectives.

Annual Incentive Cash Bonus. We use annual incentive cash bonuses to motivate our Named Executives to achieve and exceed specified goals in a time frame that is typically one year in duration. The level of bonus pay for any Named Executive is related to each Named Executive's achievement of specified goals.

The goals of each Named Executive are focused upon the achievement of specific research, clinical, regulatory, commercial, financial, compliance or operational milestones. Goals are proposed as a result of periodic discussions between the Chief Executive Officer and each of the other Named Executives, and are subject to approval by the Compensation Committee. The goals of the Chief Executive Officer are set by the Compensation Committee on the basis of the recommendation of the Chief Executive Officer and as a result of his detailed discussions with the Compensation Committee.

The goals of individual Named Executives are tailored to specified activities appropriate to their individual roles within our organization. The activities specified are also considered to be conducive to the creation of stockholder value and designed to contribute to our current and future financial success. We believe that optimal stockholder value creation results from appropriately balancing strategic and tactical goals for each Named Executive.

Goals may relate to objective financial metrics, such as the achievement of a specified level of sales, objective non-financial achievements, such as the approval of a product candidate or the allowance of a patent, or to qualitative performance, such as assembling and integrating a new team into our operational structure. Goals are intended to be the result of sustained focused effort on the part of the Named Executive, and it is our expectation that, in normal circumstances, each Named Executive would achieve substantially all of their goals, and may overachieve a subset of those goals. We would not expect to retain any Named Executive who consistently failed to achieve any substantial portion of their goals. In 2006, the range of goal achievement among our Named Executives was approximately 130% to 140%, while in 2007, the goal achievement range was approximately 85% to 140%.

10

Our Chief Executive Officer and each Named Executive communicate regularly regarding our progress and that of the individual Named Executive in relation to articulated goals. Every effort is made to ensure appropriate focus on the part of each Named Executive, and to ensure that identified goals are tailored to address changes in circumstances during any year. The Chief Executive Officer initially assesses the degree to which each Named Executive achieves goals in any year, and then presents his assessment to the Compensation Committee. The Compensation Committee then reviews and approves the Chief Executive Officer's recommendation or modifies the recommendation, if necessary.

Annual cash incentive bonus targets are set by the Compensation Committee as a percentage of each Named Executive's base salary. For the Chief Executive Officer, in 2007, this target percentage was 50% of base salary, and will remain at 50% in 2008. For the other Named Executives in 2007 it was 40% and will also remain at 40% in 2008. Overachievement of goals can result in an annual bonus that exceeds 100% of bonus target, up to a maximum pay out of 140% of bonus target. For example, a Named Executive with a base salary of $200,000 would have a target bonus of $80,000 (i.e., 40% of $200,000). If that Named Executive was assessed to have overachieved his or her goals by 25%, then his or her bonus payout would be $100,000 (i.e., 125% of $80,000), equivalent to 50% of base salary. At the same time, partial achievement of goals can result in an annual bonus that is less than 100% of bonus target. If, for example, the same Named Executive was assessed to have underachieved specified goals by 25%, then his or her bonus payout would be $60,000 (i.e., 75% of $80,000), equivalent to 30% of base salary.

In January and March of 2007, we paid bonuses to our Named Executives (which related to their performances in 2006) representing the following percentages of base salary earned in 2006.

Name

| | Target Bonus

Level (%)

| | 2007 Bonus

Payments

| | Percentage of 2006

Base Salary

| |

|---|

| Colin W. Stewart | | 50 | % | $ | 258,246 | | 68.5 | % |

| Nancy C. Broadbent | | 40 | % | $ | 143,360 | | 56.0 | % |

| David F. Pfeiffer | | 40 | % | $ | 137,670 | | 52.0 | % |

| Klaus Theobald | | 40 | % | $ | 139,932 | | 52.0 | % |

| Andrew K.W. Powell | | 40 | % | $ | 123,786 | | 52.0 | % |

In January and March of 2008, we paid bonuses to our Named Executives (which related to their performances in 2007) representing the following percentages of base salary earned in 2007.

Name

| | Target Bonus Level (%)

| | 2008 Bonus Payments

| | Percentage of 2007 Base Salary

| |

|---|

| Colin W. Stewart | | 50 | % | $ | 176,248 | | 42.5 | % |

| Nancy C. Broadbent | | 40 | % | $ | 138,424 | | 52.0 | % |

| David F. Pfeiffer | | 40 | % | $ | 104,614 | | 38.0 | % |

| Klaus Theobald | | 40 | % | $ | 133,400 | | 46.0 | % |

| Andrew K.W. Powell | | 40 | % | $ | 138,700 | | 56.0 | % |

We do not have a policy with respect to adjustment or recovery of compensation if relevant performance measures are later restated or otherwise adjusted.

Stock Options. We use equity compensation as a component of our overall compensation because we believe that granting competitively sized equity awards, in which each Named Executive realizes value based upon growth in the stock price, allows us to achieve our objectives of promoting sustained and long-term performance, increasing stockholder value and fostering retention of our Named Executives. Furthermore, we believe that equity compensation is a critical component of competitive compensation in the pharmaceutical industry in which we operate.

11

Executives who join us are awarded initial stock option grants. Additionally, the Compensation Committee approves annual grants of options to the Named Executives and certain other high-performing executives based on each individual executive's level of responsibility and perceived overall contribution to the generation of stockholder value. We do not use a quantitative formula to relate option grants to the degree to which an individual achieved his or her goals for a particular year. Goal achievement and non-goal specific activities are factored into making the assessment of an executive's overall contribution. We intend that the annual aggregate value of awards (using the Black-Scholes or equivalent valuation methodology) of options to executives will be set near competitive levels for companies represented in the compensation data we review. Typically option grants vest in equal annual installments over a five-year period beginning on the first anniversary of the date of grant.

Each year, the Compensation Committee approves an annual stock option pool, that includes a pool of options for directors, a pool for Named Executives, a pool for specified senior managers and a pool to be allocated among a limited number of high-performing non-officer employees from each of our field and home office teams. This pool of stock options is valued according to applicable accounting conventions, and included in the annual budget. The annual budget is then subject to the approval of the Board.

The Compensation Committee's procedure for timing of stock option grants provides assurance that grant timing is not being manipulated to result in a price that is favorable to employees. It is our policy that the annual stock option grant date for all eligible employees, including the Named Executives, is linked to the first Board meeting in each calendar year, which is normally in late February or early March. This date is established well in advance and then confirmed by the Compensation Committee, typically at the Compensation Committee's meeting in December of the preceding year. The late February or early March grant date timing is driven by the fact that it coincides with our calendar-year-based performance management cycle, allowing us to deliver the equity awards close in time to performance appraisals, which increases the impact of the awards by strengthening the link between pay and performance.

Aside from the annual stock option grant, it is our policy that options will normally be granted:

- •

- to non-management members of the Board on the date of our annual general meeting in each calendar year; and

- •

- to new hires on their date of hire.

We have adopted a policy relating to the grant of options that provides that in approving the date of any option grant outside these "normal" dates, our Board must take into account whether the designated date may give rise to any legal or financial reporting obligations, or may otherwise give rise to concerns related to the timing of option grants, and whether such designated date is in our best interests. Since adopting this policy in 2006, we have not made any awards outside the "normal" dates described above.

The Compensation Committee sets the exercise price of all stock options to equal the closing price of our common stock on the NASDAQ Global Market on the date of grant and under no circumstances will the date on which the grant of an option is recorded in our records precede the date on which such option was actually granted.

Following the end of the fiscal year ended December 31, 2007, we entered into an Agreement and Plan of Merger, dated as of February 25, 2008, with Galderma Laboratories, Inc., a Delaware corporation, and Galderma Acquisition Inc., a Delaware corporation, which contemplated a cash tender offer by Galderma for all of the outstanding shares of our common stock followed by a merger of Galderma Acquisition Inc. into CollaGenex, with CollaGenex continuing as the surviving entity. Under the terms of this merger agreement, each option to purchase a share of our common stock, whether under any of our stock option plans or pursuant to individual award agreements, outstanding

12

immediately prior to the effective time of the merger (whether or not vested) would be cancelled at the effective time of the merger and each holder would be entitled to receive, in full satisfaction of such option, a cash amount equal to the excess, if any, of (i) the price offered for each share of our common stock in the cash tender offer made by Galderma over (ii) the exercise price payable in respect of such share of our common stock issuable under such option. Any option with an exercise price equal to or greater than the price offered for each share of our common stock in the cash tender offer would be canceled without consideration and be of no further force or effect.

Upon effectivness of our merger with Galderma, the Named Executives would be entitled to receive payments of approximately the following amounts in connection with the cancellation of their outstanding options: Colin W. Stewart, $3,324,237; Nancy C. Broadbent, $1,721,002; David F. Pfeiffer, $1,733,935; Klaus Theobald, $977,218; and Andrew K.W. Powell, $944,801.

In December 2007, prior to our entry into the merger agreement with Galderma, our Compensation Committee, in accordance with our "normal" practice for the annual grant of options to our Named Executives, approved certain options for grant to our Named Executives. We entered into the merger agreement with Galderma prior to the grant of these options, and in connection with our entry into the merger agreement, our Board determined not to grant these options.

Benefits and Other Compensation. We provide our Named Executives with other benefits, reflected in the All Other Compensation column in the Summary Compensation Table, that we believe are reasonable, competitive and consistent with our overall executive compensation program. We believe that these benefits generally allow our executives to optimize the value received from all of the compensation and benefit programs offered. The costs of these benefits constitute only a small percentage of each Named Executive's total compensation, and include premiums paid on disability and life insurance policies, our contributions to medical insurance coverage and 401(k) matching.

Perquisites. We do not generally provide significant perquisites or personal benefits to our Named Executives.

Change of Control Payments. Our Named Executives are party to change of control agreements that specify accelerated vesting of stock options and the payment of certain other amounts upon a change of control. We provide for these change of control arrangements because we recognize that, as is the case with many publicly held corporations, the possibility of a change in control of CollaGenex exists and such possibility, and the uncertainty and questions which it may raise among our Named Executives, could result in the departure or distraction of Named Executives to the detriment of our stockholders and us. Our Compensation Committee has determined that providing such change-of-control-related benefits reinforces and encourages the continued employment and dedication of our Named Executives without distraction from the possibility of a change in control and related events and circumstances. We believe that such agreements are important to attract and retain the best possible executive talent.

Under the change of control agreements, in the event the employment of Ms. Broadbent or any of Messrs. Stewart, Pfeiffer, Theobald or Powell is terminated as a result of an involuntary termination within 24 months of a change of control, each as defined in the agreements, Ms. Broadbent and Messrs. Stewart, Pfeiffer, Theobald and Powell are entitled to receive, among other things, (i) a lump sum payment of two times base salary and two times the average bonus paid (two and a half times base salary and average bonus paid in the case of Mr. Stewart) for the three fiscal years prior to the termination date, as defined in the agreements, (ii) health coverage and benefits for a period of 24 months and (iii) certain outplacement/administrative support for a period of 18 months. In addition, under the change of control agreements, if a change of control occurs while Ms. Broadbent or any of Messrs. Stewart, Pfeiffer, Theobald or Powell is employed by us, regardless of whether their employment relationship with us continues following such change of control, then all stock options

13

granted to these individuals prior to the change of control will become fully vested and exercisable as of the date of the change of control to the extent such stock options are outstanding and unexercisable at the time of such termination.

In addition, each change of control agreement provides for an additional payment if a Named Executive would be subject to an excise tax, interest or penalty based on a payment provided for in the applicable change of control agreement.

The transactions contemplated by our merger agreement with Galderma would, if consummated, constitute a "change of control" for purposes of these change of control agreements. For a further description of the foregoing arrangements, see "Potential Payments Upon Termination or Change in Control."

Tax and Accounting Considerations

It is our policy generally to qualify compensation paid to executive officers for deductibility under section 162(m) of the Internal Revenue Code. Section 162(m) generally prohibits us from deducting the compensation of executive officers that exceeds $1,000,000 unless that compensation is based on the satisfaction of objective performance goals. Our 2005 Equity Incentive Plan is structured to permit awards under such plan to qualify as performance-based compensation and to maximize the tax deductibility of such awards. However, we reserve the discretion to pay compensation to our executive officers that may not be deductible.

We account for equity compensation paid to our employees under the rules of Statement of Financial Accounting Standards No. 123 (revised 2004), Share Based Payment, referred to as SFAS 123(R), that requires us to measure and recognize compensation expense in our consolidated financial statements for all share-based payments based upon an estimate of their fair value over the service period of the award. We record cash compensation as an expense at the time the obligation is accrued. We do not give consideration to the accounting impact of executive compensation when determining the nature or size of awards.

14

Non-Employee Director Compensation

Non-employee director compensation is set by the Board at the recommendation of the Compensation Committee. In 2006, the Compensation Committee recommended, and the Board approved, a new compensation and benefit program for non-management directors. In developing its recommendations, the Compensation Committee was guided by the following goals: compensation should fairly pay directors for work required in a company of our size and scope; compensation should align directors' interests with the long-term interest of stockholders; and the structure of the compensation should be simple, transparent and easy for stockholders to understand. At that time, the Board determined that each non-employee director would receive an annual retainer, a fee for each regularly scheduled board meeting attended in person, an annual fee for each committee on which the non-management director served and a fee for each committee the non-employee director chaired. In April 2007, the Board reexamined and approved a similar compensation and benefit program for non-employee directors, adding a fee for each committee meeting attended. The Board also approved reimbursement to directors for reasonable and necessary expenses incurred in connection with attendance at meetings of the Board and other Company business.

Upon appointment, each new non-management director is granted an option to purchase shares of Common Stock. Upon re-election at our annual meetings of stockholders, each non-management director is also granted an option to purchase shares of Common Stock. The number of options which a non-management director has the right to exercise each year may be reduced proportionately based on such non-management director's attendance at meetings of the Board if the non-management director fails to attend at least 75% of the meetings of the Board held in any calendar year.

For a further description of the compensation paid to non-management directors for 2007 and to be paid in 2008, see "DIRECTOR COMPENSATION."

15

SUMMARY COMPENSATION TABLE

The following table sets forth information regarding compensation earned by our Chief Executive Officer, our Chief Financial Officer and each of our three other most highly compensated executive officers during our fiscal years ended December 31, 2007 and December 31, 2006. We refer to these executive officers as our "Named Executives" elsewhere in this Annual Report on Form 10-K.

Name and Principal Position

| | Year

| | Salary

($)

| | Option

Awards(1)($)

| | Non-Equity

Incentive Plan

Compensation

(2)($)

| | All Other

Compensation

($)

| | Total

($)

|

|---|

Colin W. Stewart

President, Chief Executive Officer and Director |

|

2007

2006 |

|

414,700

377,000 |

|

337,834

894,358 |

|

176,248

258,246 |

|

3,910

3,844 |

(3)

(4) |

932,692

1,533,448 |

Nancy C. Broadbent

Senior Vice President, Chief Financial Officer and Treasurer |

|

2007

2006 |

|

266,200

255,300 |

|

198,377

162,871 |

|

138,424

143,360 |

|

10,709

8,550 |

(5)

(6) |

613,710

570,081 |

David F. Pfeiffer

Senior Vice President, Sales and Marketing |

|

2007

2006 |

|

275,300

264,750 |

|

176,886

146,359 |

|

104,614

137,670 |

|

10,709

8,550 |

(7)

(8) |

567,509

557,329 |

Klaus Theobald

Senior Vice President and Chief Medical Officer |

|

2007

2006 |

|

290,000

269,100 |

|

279,633

189,665 |

|

133,400

139,932 |

|

3,910

3,844 |

(9)

(10) |

706,943

602,541 |

Andrew K.W. Powell

Vice President, General Counsel and Secretary |

|

2007

2006 |

|

247,500

238,050 |

|

153,530

106,800 |

|

138,700

123,786 |

|

3,910

3,844 |

(11)

(12) |

543,640

472,480 |

- (1)

- Valuation based on the dollar amount recognized for financial statement reporting purposes pursuant to SFAS No. 123(R) with respect to fiscal 2007 and 2006, except that such amounts do not reflect an estimate of forfeitures related to service-based vesting conditions. With respect to the Named Executives, the amounts reported for fiscal 2007 and 2006 reflect additional expense resulting from the requirements of the Securities and Exchange Commission to report option grants made prior to such dates using the modified prospective transition method pursuant to SFAS 123(R). The assumptions used by us with respect to the valuation of option grants are more

16

fully explained in Note 9 to our consolidated financial statements. The individual awards reflected in the summary compensation table are summarized below.

Name

| | Grant Date

| | Number of

Shares

Subject to

Options

| | Number of

Shares Vested

in 2006

| | 2006 Expense

Recognized under

SFAS No. 123(R)($)

| | Number of

Shares Vested

in 2007

| | 2007 Expense

Recognized under

SFAS No. 123(R)($)

|

|---|

| Colin W. Stewart | | 12/8/2003

3/10/2005

2/9/2006

2/26/2007 | | 300,000

70,900

85,000

85,000 | | 94,161

14,172

15,142

— | | 722,212

55,495

116,651

— | | 60,000

14,180

17,000

— | | —

55,485

141,875

140,474 |

| Nancy C. Broadbent | | 1/25/2002

1/24/2003

1/29/2004

3/10/2005

2/9/2006

2/26/2007 | | 30,000

24,000

26,000

26,300

40,000

35,000 | | 514

5,826

4,257

7,008

7,270

— | | 3,142

43,622

32,658

27,442

56,007

— | | —

6,000

6,500

5,260

8,000

— | | —

1,225

21,407

16,245

91,284

68,216 |

| David F. Pfeiffer | | 1/25/2002

1/24/2003

1/29/2004

3/10/2005

2/9/2006

2/26/2007 | | 40,000

24,000

26,000

24,400

30,000

35,000 | | 171

5,912

4,257

6,501

5,573

— | | 1,045

44,266

32,658

25,457

42,933

— | | —

6,000

6,500

4,880

6,000

— | | —

984

21,407

15,072

71,207

68,216 |

| Klaus Theobald | | 1/21/2004

3/10/2005

2/9/2006

2/26/2007 | | 80,000

22,600

30,000

35,000 | | 16,000

5,421

5,573

— | | 125,504

21,228

42,933

— | | 16,000

4,520

6,000

— | | 125,497

21,218

64,702

68,216 |

| Andrew K.W. Powell | | 9/23/2004

3/10/2005

2/9/2006

2/26/2007 | | 70,000

5,700

25,000

25,000 | | 14,000

1,139

4,454

— | | 68,027

4,460

34,313

— | | 14,000

1,140

5,000

— | | 68,002

4,461

38,519

42,548 |

- (2)

- Non-equity incentive plan compensation consisted of cash incentive payments made to our Named Executives in accordance with the achievement of predetermined individual goals under our annual incentive cash bonus plan. The payments with respect to fiscal year 2006 and fiscal year 2007 were made on the dates and in the amounts specified in the following table:

Cash Incentive Payments for Fiscal Year 2006

Recipient

| | Payments made January 31, 2007

($)

| | Payments made March 31, 2007

($)

| | Total

($)

|

|---|

| Colin W. Stewart | | 145,146 | | 113,100 | | 258,246 |

| Nancy C. Broadbent | | 97,280 | | 46,080 | | 143,360 |

| David F. Pfeiffer | | 74,130 | | 63,540 | | 137,670 |

| Klaus Theobald | | 139,932 | | — | | 139,932 |

| Andrew K.W. Powell | | 123,786 | | — | | 123,786 |

Cash Incentive Payments for Fiscal Year 2007

Recipient

| | Payments made January 31, 2008

($)

| | Payments made March 31, 2008

($)

| | Total

($)

|

|---|

| Colin W. Stewart | | 134,778 | | 41,470 | | 176,248 |

| Nancy C. Broadbent | | 79,860 | | 58,564 | | 138,424 |

| David F. Pfeiffer | | 99,108 | | 5,506 | | 104,614 |

| Klaus Theobald | | 133,400 | | — | | 133,400 |

| Andrew K.W. Powell | | 128,600 | | 10,100 | | 138,700 |

17

- (3)

- Amount consists of $2,700 in Company 401(k) matching contribution and disability insurance premiums of $1,210 paid on Mr. Stewart's behalf.

- (4)

- Amount consists of $2,640 in Company 401(k) matching contribution and disability insurance premiums of $1,204 paid on Mr. Stewart's behalf.

- (5)

- Amount consists of $2,700 in Company 401(k) matching contribution, medical insurance premiums of $6,799 and disability insurance premiums of $1,210 paid on Ms. Broadbent's behalf.

- (6)

- Amount consists of $2,640 in Company 401(k) matching contribution, medical insurance premiums of $4,706 and disability insurance premiums of $1,204 paid on Ms. Broadbent's behalf.

- (7)

- Amount consists of $2,700 in Company 401(k) matching contribution, medical insurance premiums of $6,799 and disability insurance premiums of $1,210 paid on Mr. Pfeiffer's behalf.

- (8)

- Amount consists of $2,640 in Company 401(k) matching contribution, medical insurance premiums of $4,706 and disability insurance premiums of $1,204 paid on Mr. Pfeiffer's behalf.

- (9)

- Amount consists of $2,700 in Company 401(k) matching contribution and disability insurance premiums of $1,210 paid on Mr. Theobald's behalf.

- (10)

- Amount consists of $2,640 in Company 401(k) matching contribution and disability insurance premiums of $1,204 paid on Mr. Theobald's behalf.

- (11)

- Amount consists of $2,700 in Company 401(k) matching contribution and disability insurance premiums of $1,210 paid on Mr. Powell's behalf.

- (12)

- Amount consists of $2,640 in Company 401(k) matching contribution and disability insurance premiums of $1,204 paid on Mr. Powell's behalf.

GRANTS OF PLAN-BASED AWARDS

The following table sets forth information regarding grants of awards made to our Named Executives during the fiscal year ended December 31, 2007:

| |

| |

| |

| |

| | All Other

Option Awards:

Number of

Securities

Underlying

Options(2)(#)

| |

| |

|

|---|

| |

| | Estimated Possible Payments Under Non-Equity Incentive Plan Awards(1)

| |

| |

|

|---|

| |

| | Exercise or

Base Price of

Option Awards

($/Sh)

| |

|

|---|

Name

| |

| | Grant Date Fair

Value of Option

Awards($)(3)

|

|---|

| | Grant Date

| | Threshold($)

| | Target($)

| | Maximum($)

|

|---|

| Colin W. Stewart | | 12/15/2006 | | 0 | | 207,350 | | 290,290 | | — | | — | | — |

| | | 2/26/2007 | | — | | — | | — | | 85,000 | | 14.28 | | 769,038 |

Nancy C. Broadbent |

|

12/15/2006 |

|

0 |

|

106,480 |

|

149,072 |

|

— |

|

— |

|

— |

| | | 2/26/2007 | | — | | — | | — | | 35,000 | | 14.28 | | 316,663 |

David F. Pfeiffer |

|

12/15/2006 |

|

0 |

|

110,120 |

|

154,168 |

|

— |

|

— |

|

— |

| | | 2/26/2007 | | — | | — | | — | | 35,000 | | 14.28 | | 316,663 |

Klaus Theobald |

|

12/15/2006 |

|

0 |

|

116,000 |

|

162,400 |

|

— |

|

— |

|

— |

| | | 2/26/2007 | | — | | — | | — | | 35,000 | | 14.28 | | 316,663 |

Andrew K.W. Powell |

|

12/15/2006 |

|

0 |

|

99,000 |

|

138,600 |

|

— |

|

— |

|

— |

| | | 2/26/2007 | | — | | — | | — | | 25,000 | | 14.28 | | 226,188 |

- (1)

- All awards in these columns were granted under our annual incentive cash bonus plan, which was established December 15, 2006. The actual amounts awarded are reported in the "Non-Equity Incentive Plan Compensation" column in the Summary Compensation Table, above. See "Executive Compensation—Compensation Discussion and Analysis—Elements of Compensation—Annual Incentive Cash Bonus" for a description of this plan.

- (2)

- The shares of common stock underlying such options vest in five equal annual installments commencing on the first anniversary of the date of grant.

- (3)

- Amounts represent the total grant date fair value of stock options granted under SFAS No. 123(R). The assumptions used by us with respect to the valuation of option grants are more fully explained in Note 9 to our consolidated financial statements.

18

OUTSTANDING EQUITY AWARDS AT FISCAL YEAR-END

The following table sets forth information regarding outstanding stock option awards held by our Named Executives at the end of the fiscal year ended December 31, 2007:

Name

| | Number of

Securities

Underlying

Unexercised

Options(#)

Exercisable

| | Number of

Securities

Underlying

Unexercised

Options(#)

Unexercisable

| | Option

Exercise

Price

($)

| | Option

Expiration

Date

|

|---|

| Colin W. Stewart | | 240,000

28,360

17,000

— | (1)

(2)

(3)

(4) | 60,000

42,540

68,000

85,000 | | 10.25

5.67

11.34

14.28 | | 12/8/2013

3/10/2015

2/9/2016

2/26/2017 |

| Nancy C. Broadbent. | | 16,667

25,000

25,000

35,000

30,000

24,000

19,500

10,520

8,000

— |

(5)

(6)

(7)

(8) | —

—

—

—

—

—

6,500

15,780

32,000

35,000 | | 6.25

10.06

18.063

5.188

7.97

10.16

10.23

5.67

11.34

14.28 | | 2/12/2008

1/15/2009

2/16/2010

2/27/2011

1/25/2012

1/24/2013

1/29/2014

3/10/2015

2/9/2016

2/26/2017 |

| David F. Pfeiffer | | 20,000

25,000

50,000

35,000

40,000

24,000

19,500

9,760

6,000

— |

(9)

(10)

(11)

(12) | —

—

—

—

—

—

6,500

14,640

24,000

35,000 | | 6.25

10.06

18.63

5.188

7.97

10.16

10.23

5.67

11.34

14.28 | | 2/12/2008

1/15/2009

2/16/2010

2/27/2011

1/25/2012

1/24/2013

1/29/2014

3/10/2015

2/9/2016

2/26/2017 |

| Klaus Theobald | | 48,000

9,040

6,000

— | (13)

(14)

(15)

(16) | 32,000

13,560

24,000

35,000 | | 10.46

5.67

11.34

14.28 | | 1/21/2014

3/10/2015

2/9/2016

2/26/2017 |

| Andrew K.W. Powell | | 42,000

2,280

5,000

— | (17)

(18)

(19)

(20) | 28,000

3,420

20,000

25,000 | | 6.70

5.67

11.34

14.28 | | 9/23/2014

3/10/2015

2/9/2016

2/26/2017 |

- (1)

- The shares of common stock underlying this option vest in five equal annual installments beginning December 8, 2004. In certain circumstances, if the closing price of our common stock exceeds a pre-determined share price for a certain number of consecutive days, a portion of such options will vest.

- (2)

- The shares of common stock underlying this option vest in five equal annual installments beginning March 10, 2006.

- (3)

- The shares of common stock underlying this option vest in five equal annual installments beginning February 9, 2007.

- (4)

- The shares of common stock underlying this option vest in five equal annual installments beginning February 26, 2008.

- (5)

- The shares of common stock underlying this option vest in four equal annual installments beginning January 29, 2005.

- (6)

- The shares of common stock underlying this option vest in five equal annual installments beginning March 10, 2006.

- (7)

- The shares of common stock underlying this option vest in five equal annual installments beginning on February 9, 2007.

- (8)

- The shares of common stock underlying this option vest in five equal annual installments beginning February 26, 2008.

- (9)

- The shares of common stock underlying this option vest in four equal annual installments beginning January 29, 2005.

- (10)

- The shares of common stock underlying this option vest in five equal annual installments beginning March 10, 2006.

19

- (11)

- The shares of common stock underlying this option vest in five equal annual installments beginning February 9, 2007.

- (12)

- The shares of common stock underlying this option vest in five equal annual installments beginning February 26, 2008.

- (13)

- The shares of common stock underlying this option vest in five equal annual installments beginning January 21, 2005.

- (14)

- The shares of common stock underlying this option vest in five equal annual installments beginning March 10, 2006.

- (15)

- The shares of common stock underlying this option vest in five equal annual installments beginning February 9, 2007.

- (16)

- The shares of common stock underlying this option vest in five equal annual installments beginning February 26, 2008.

- (17)

- The shares of common stock underlying this option vest in five equal annual installments beginning September 23, 2005.

- (18)

- The shares of common stock underlying this option vest in five equal annual installments beginning March 10, 2006.

- (19)

- The shares of common stock underlying this option vest in five equal annual installments beginning February 9, 2007.

- (20)

- The shares of common stock underlying this option vest in five equal annual installments beginning February 26, 2008.

OPTION EXERCISES AND STOCK VESTED

The following table sets forth information regarding stock options exercised by our Named Executives during the fiscal year ended December 31, 2007.

Name

| | Number of Shares

Acquired on Exercise(#)

| | Value Realized

on Exercise(1)($)

|

|---|

| Colin W. Stewart | | — | | — |

| Nancy C. Broadbent | | 8,333 | | 58,331 |

| David F. Pfeiffer | | 60,000 | | 111,456 |

| Klaus Theobald | | — | | — |

| Andrew K.W. Powell | | — | | — |

- (1)

- The aggregate dollar amount realized upon the exercise of an option represents the difference between the aggregate market price of the shares of our common stock underlying that option on the date of exercise and the aggregate exercise price of the option.

Employment, Severance and Change of Control Arrangements

We do not have formal employment agreements with any of our Named Executives. The employment of each Named Executive with us is on an at-will basis. Other than the change of control agreements discussed below, none of our Named Executives is currently party to a change in control or severance agreement with us. Our Board has the discretion to modify the compensation of each Named Executive.

As a condition to their employment, each Named Executive entered into a non-solicitation, invention assignment and non-disclosure agreement. Under these agreements, our Named Executive have agreed (i) not to solicit our employees during their employment and for a period of 24 months after the termination of their employment and (ii) to protect our confidential and proprietary information and to assign intellectual property developed during the course of their employment to us.

In addition, Ms. Broadbent and Mr. Pfeiffer have agreed that during the term of their employment and for a period of two years thereafter, they will not directly or indirectly provide services to or for any business engaged in research regarding the development, manufacture, testing, marketing or sale of collagenase inhibiting drugs for application in periodontal disease or any other application which, during the period of their employment with us, is either marketed or in advanced clinical development by us.

We have executed indemnification agreements with each of our Named Executives pursuant to which we have agreed to indemnify such parties to the full extent permitted by law, subject to certain

20

exceptions, if any such party becomes subject to an action because such party is our officer, employee, agent or fiduciary.

On October 16, 2006, we entered into change of control agreements with Ms. Broadbent and Messrs. Stewart, Pfeiffer, Theobald and Powell. Under the change of control agreements, in the event the employment of Ms. Broadbent or any of Messrs. Stewart, Pfeiffer, Theobald or Powell is terminated as a result of an involuntary termination within 24 months of a change of control, each as defined in the agreements, Ms. Broadbent and Messrs. Stewart, Pfeiffer, Theobald and Powell are entitled to receive, among other things, (i) a lump sum payment of two times base salary and two times the average bonus paid (two and a half times base salary and average bonus paid, in the case of Mr. Stewart) for the three fiscal years prior to the termination date, as defined in the agreements, (ii) health coverage and benefits for a period of 24 months and (iii) certain outplacement/administrative support for a period of 18 months. In addition, under the change of control agreements, if a change of control occurs while Ms. Broadbent or any of Messrs. Stewart, Pfeiffer, Theobald or Powell is employed by us, regardless of whether their employment relationship with us continues following such change of control, then all stock options granted to these individuals prior to the change of control will become fully vested and exercisable as of the date of the change of control to the extent such stock options are outstanding and unexercisable at the time of such termination.

In addition, each of the change of control agreements provides for an additional payment if a Named Executive would be subject to an excise tax, interest or penalty based on a payment provided for in the applicable change of control agreement.

The transactions contemplated by our merger agreement with Galderma would, if consummated, constitute a "change of control" for purposes of these change of control agreements.

Potential Payments Upon Termination or Change in Control

The following table describes the potential payments and benefits upon an involuntary termination within 24 months of a change of control, for each of the following Named Executives as if their employment was terminated as of December 31, 2007:

Name

| | Estimated Total

Value of Cash

Payment (Salary

and Bonus)

| | Estimated Total

Value of Benefits

Coverage

Continuation(1)

| | Outplacement

and

Administrative

Support(2)

| | Estimated Total

Value of Equity

Acceleration(3)

| | Total

Termination

Benefits

|

|---|

| Colin W. Stewart | | $ | 1,638,982 | | $ | 30,000 | | $ | 20,000 | | $ | 275,092 | | $ | 1,964,074 |

| Nancy C. Broadbent | | $ | 831,158 | | $ | 30,000 | | $ | 15,000 | | $ | 357,133 | | $ | 1,233,291 |

| David F. Pfeiffer | | $ | 809,864 | | $ | 30,000 | | $ | 15,000 | | $ | 376,560 | | $ | 1,231,424 |

| Klaus Theobald | | $ | 906,888 | | $ | 30,000 | | $ | 15,000 | | $ | 87,688 | | $ | 1,039,576 |

| Andrew K.W. Powell | | $ | 773,071 | | $ | 30,000 | | $ | 15,000 | | $ | 221,616 | | $ | 1,039,687 |

- (1)

- Consists of medical, dental, vision, life and disability insurance coverage. The value is based upon the type of insurance coverage we carried for each Named Executive as of December 31, 2007 and is valued at the premiums in effect on December 31, 2007.

- (2)

- Assumes outplacement/administrative support for a period of 18 months plus reimbursement of up to $5,000 of out-of-pocket expenses incurred by each Named Executive.

- (3)

- Assumes the exercise and sale of all in-the-money outstanding options held by each Named Executive on December 31, 2007, on which the closing price of our common stock on the NASDAQ Global Market was $9.55.

21

DIRECTOR COMPENSATION

As described more fully below, the table below sets forth the compensation paid to our non-employee directors for the fiscal year ended December 31, 2007:

Name

| | Fees Earned or

Paid in Cash(1)($)

| | Option Awards

(2)(3)(4)($)

| | Total($)

|

|---|

| Peter R. Barnett | | $ | 49,750 | | $ | 80,662 | | $ | 130,412 |

| Robert A. Beardsley | | $ | 34,750 | | $ | 80,662 | | $ | 115,412 |

| Robert C. Black | | $ | 43,750 | | $ | 80,662 | | $ | 124,412 |

| James E. Daverman | | $ | 51,875 | | $ | 120,992 | | $ | 172,867 |

| Robert J. Easton | | $ | 47,000 | | $ | 80,662 | | $ | 127,662 |

| George M. Lasezkay | | $ | 33,750 | | $ | 80,662 | | $ | 114,412 |

| W. James O'Shea | | $ | 38,000 | | $ | 80,662 | | $ | 118,662 |

- (1)

- The fees earned by each non-employee director consist of the following: (i) an annual retainer of $18,750, except Mr. Daverman, who received an annual retainer of $28,125; (ii) a fee per Board meeting attended of $2,000, except Mr. Daverman who received a fee per Board meeting attended of $3,000; (iii) an annual fee per committee served of $1,000; and (iv) an annual fee of $5,000 for chairing each of the Compensation and Nominating and Corporate Governance Committees and $10,000 for chairing the Audit Committee.

- (2)

- Valuation based on the dollar amount recognized for financial statement reporting purposes pursuant to SFAS No. 123(R) with respect to fiscal 2007, except that such amounts do not reflect an estimate of forfeitures related to service-based vesting conditions. With respect to the non-employee directors listed above, the amounts reported in these columns reflect additional expense resulting from the requirements of the Securities and Exchange Commission to report option grants made prior to 2006 using the modified prospective transition method pursuant to SFAS No. 123(R). The assumptions used by us with respect to the valuation of option grants are

22

more fully explained in Note 9 to our consolidated financial statements.

The individual awards reflected in the director compensation table are summarized below:

Name

| | Grant Date

| | Number of

Shares Subject

to Options

| | Amount Vested

in 2007

| | 2007 Expense

Recognized under

SFAS No. 123(R)($)

|

|---|

| Peter R. Barnett | | 5/20/2003

5/25/2004

5/25/2005

5/24/2006

5/23/2007 | | 12,000

12,000

12,000

12,000

12,000 | | 1,150

3,000

3,000

3,000

1,823 | | 9,152

22,572

8,666

21,417

12,257 |

| Robert A. Beardsley | | 12/7/2004

5/25/2005

5/24/2006

5/23/2007 | | 25,000

12,000

12,000

12,000 | | 6,250

3,000

3,000

1,823 | | 20,687

8,666

21,417

12,257 |

| Robert C. Black | | 5/20/2003

5/25/2004

5/25/2005

5/24/2006

5/23/2007 | | 12,000

12,000

12,000

12,000

12,000 | | 1,150

3,000

3,000

3,000

1,823 | | 9,152

22,572

8,666

21,417

12,257 |

| James E. Daverman | | 5/20/2003

1/29/2004

5/25/2004

5/25/2005

5/24/2006

5/23/2007 | | 12,000

1,907

18,000

18,000

18,000

18,000 | | 1,150

77

4,500

4,500

4,500

2,730 | | 9,152

3,655

33,858

12,999

32,125

18,385 |

| Robert J. Easton | | 5/20/2003

5/25/2004

5/25/2005

5/24/2006

5/23/2007 | | 12,000

12,000

12,000

12,000

12,000 | | 1,150