SCHEDULE 14A INFORMATION

PROXY STATEMENT PURSUANT TO SECTION 14(A) OF THE

SECURITIES EXCHANGE ACT OF 1934

Filed by the Registrantx Filed by a Party other than the Registrant¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material Pursuant to Rule 240.14a-12 |

EP MedSystems, Inc.

(Name of Registrant as Specified in its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | (1) | Title of each class of securities to which transaction applies: |

| | (2) | Aggregate number of securities to which transaction applies: |

| | (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | Proposed maximum aggregate value of transaction: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | Amount Previously Paid: |

| | (2) | Form, Schedule or Registration Statement No.: |

EP MEDSYSTEMS, INC.

575 ROUTE 73, BUILDING D

WEST BERLIN, NEW JERSEY 08091

November 27, 2006

Dear Shareholder,

You are cordially invited to join us for our Annual Meeting of Shareholders to be held this year on December 21, 2006, at 10:00 a.m., eastern standard time, at the Company’s headquarters at 575 Route 73 North, Building D, West Berlin, New Jersey.

The Notice of Annual Meeting of Shareholders and the Proxy Statement that follow describe the business to be conducted at the meeting. You will be asked to elect two directors to the Board of Directors. We will also report on matters of current interest to our shareholders.

Whether you own a few or many shares of stock, it is important that your shares be represented. If you cannot personally attend the meeting, we encourage you to make certain that you are represented by signing the accompanying proxy card and promptly returning it in the enclosed, prepaid envelope.

|

| Sincerely, |

|

| /s/ David I. Bruce |

David I. Bruce President and Chief Executive Officer |

2

EP MEDSYSTEMS, INC.

575 Route 73, Building D

West Berlin, New Jersey 08091

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

to be held on December 21, 2006

To the Shareholders:

The Board of Directors of EP MedSystems, Inc. hereby gives notice that the Annual Meeting of Shareholders of EP MedSystems will be held on December 21, 2006 at 10:00 a.m., eastern standard time, at the Company’s headquarters at 575 Route 73 North, Building D, West Berlin, New Jersey (the “Annual Meeting”). The purpose of the meeting is to:

| 1. | Elect two Class II directors to our Board of Directors to serve until the 2009 Annual Meeting; |

| 2. | Act on any other matters as may properly come before the shareholders at the Annual Meeting, including any motion to adjourn to a later date to permit further solicitation of proxies, if necessary. |

The Board of Directors has fixed the close of business November 22, 2006 as the record date for the determination of shareholders entitled to notice of and to vote at the Annual Meeting or any adjournment.

You are cordially invited to attend the Annual Meeting in person. If you attend the meeting, you may vote in person if you wish, even though you have previously returned your proxy. A copy of EP MedSystems’ Proxy Statement is enclosed.

| | |

| By Order of the Board of Directors, |

|

| /s/ Matthew C. Hill |

Matthew C. Hill Chief Financial Officer and Secretary |

November 27, 2006

YOUR PROXY VOTE IS IMPORTANT. WHETHER OR NOT YOU PLAN TO ATTEND THE MEETING IN PERSON, IT IS IMPORTANT THAT THE ENCLOSED PROXY CARD BE RETURNED PROMPTLY. THEREFORE, PLEASE COMPLETE, DATE, AND SIGN THE ENCLOSED PROXY CARD AND RETURN IT IN THE ENCLOSED ENVELOPE, WHICH REQUIRES NO POSTAGE IF MAILED IN THE UNITED STATES. THIS WILL ENSURE REPRESENTATION OF YOUR SHARES AT THE MEETING.

3

EP MEDSYSTEMS, INC.

575 Route 73, Building D

West Berlin, New Jersey 08091

PROXY STATEMENT

FOR THE ANNUAL MEETING OF SHAREHOLDERS

to be held on December 21, 2006

INFORMATION ABOUT VOTING

General

This Proxy Statement and the accompanying Notice of Annual Meeting of Shareholders are being furnished in connection with the solicitation by the Board of Directors of EP MedSystems, Inc. (“EP MedSystems” or the “Company” or “us” or “we”) of proxies for use at the Annual Meeting of Shareholders to be held at 575 Route 73 North, Building D, West Berlin, New Jersey, at 10:00 a.m., eastern standard time, on December 21, 2006, and at any adjournments thereof (the “Annual Meeting”), for the purposes set forth in the preceding Notice of Annual Meeting of Shareholders. This Proxy Statement and accompanying proxy card are first being distributed to all shareholders entitled to vote on or about November 22, 2006.

Who can vote?

Only holders of record as of the close of business November 22, 2006 (the “Record Date”) of EP MedSystems’ Common Stock, no par value, stated value $.001 per share (the “Common Stock”), and Series A Convertible Preferred Stock, no par value, stated value $.001 per share (the “Series A Preferred Stock”), are entitled to vote at the Annual Meeting. On the Record Date, there were 30,365,236 shares of Common Stock.

How many votes can I cast?

You will be entitled to one vote per share of Common Stock owned by you on the Record Date, and one vote per share of Common Stock into which each share of Series A Preferred Stock owned by you on the Record Date may be converted.

How do I vote by proxy?

Follow the instructions on the enclosed proxy card to vote on the proposals to be considered at the Annual Meeting. Sign and date the proxy card and mail it back to us in the enclosed prepaid envelope. The proxyholders named on the proxy card will vote your shares as you instruct. If you sign and return the proxy card but do not vote on the proposals, the proxyholders will vote for you on the proposals. Unless you instruct otherwise, the proxyholders will vote“FOR” the nominees proposed by the Board of Directors.

What if other matters come up at the Annual Meeting?

The matters described in this proxy statement are the only matters the Board of Directors intends to bring before the Shareholders at the Annual Meeting. If other matters are properly presented at the Annual Meeting, the proxyholders will vote your shares in accordance with the judgment of the persons voting such proxies.

What can I do if I change my mind after I vote my shares?

At any time before the vote at the meeting, you can revoke your proxy either by (i) giving our Secretary a written notice revoking your proxy card, (ii) signing, dating and returning to our Secretary a new proxy card bearing a later date, or (iii) attending the Annual Meeting and voting in person. Your presence at the Annual Meeting will not revoke your proxy unless you vote in person. All written notices or new proxies should be sent to our Secretary at our principal executive offices.

4

Can I vote in person at the Annual Meeting rather than by completing the proxy card?

Although we encourage you to complete and return the proxy card to ensure that your vote is counted, you can attend the Annual Meeting and vote your shares in person.

What do I do if my shares are held in “street name”?

If your shares are held in the name of your broker, a bank, or other nominee, that party should give you instructions for voting your shares.

What are broker non-votes?

Broker non-votes are shares held in street name by brokers or nominees who indicate on their proxies that they do not have discretionary authority to vote those shares as to a particular matter. Broker non-votes are not counted for purposes of determining whether a proposal has been approved.

What is a quorum?

We will hold the Annual Meeting if a quorum is present. A quorum will be present if the holders of a majority of the shares of Common Stock and Series A Preferred Stock entitled to vote on the Record Date (treated as a combined single class) either sign and return their proxy cards or attend the Annual Meeting. Without a quorum, we cannot hold the meeting or transact business. If you sign and return your proxy card, your shares will be counted to determine whether we have a quorum even if you abstain or fail to vote on the proposals listed on the proxy card. Abstentions and broker non-votes may also be counted as present for purposes of determining if a quorum exists.

What vote is necessary for action?

Passage of Proposal 1 (election of directors) requires, for the directors, the affirmative vote of a plurality of the votes cast by the holders of the shares of our Common Stock voting in person or by proxy at the Annual Meeting. You will not be able to cumulate your votes in the election of directors. Abstentions and broker non-votes will be counted for purposes of determining whether a quorum is present, but will not be counted as votes cast in the tabulation of any voting results and will not affect the outcome of the vote.

Who pays for the proxy solicitation?

The cost of solicitation of proxies will be paid by the Company. Employees may contact you by telephone, by mail, or in person. None of our employees will receive any extra compensation for doing this. The Company may also employ a third party certified proxy solicitor to solicit proxies.

5

PROPOSAL 1

ELECTION OF DIRECTOR

EP MedSystems’ board of directors consists of five members and is divided into three classes of directors serving three-year terms. One class of directors is elected by shareholders to serve until the third annual meeting following such annual meeting or until their successors are elected and qualified. The current term of the Class II director expires on the date of the 2006 Annual Meeting of Shareholders, the current term of the Class III directors expires on the date of the 2007 Annual Meeting of Shareholders, and the current term of the Class I directors expires on the date of the 2008 Annual Meeting of Shareholders. The term of the Class II directors to be elected at this Annual Meeting will expire on the date of the 2009 Annual Meeting.

The Class II director whose term expires at the 2006 Annual Meeting of shareholder is Paul Ray. Mr. Ray has been nominated by the Board of Directors to stand for re-election as a Class II director at the Annual Meeting. The Board of Directors has no reason to believe that the nominee will be unable or unwilling to serve as a director. If, however, the nominee becomes unavailable, proxies will have discretionary authority to vote for a substitute Class II nominee.

On October 9, 2005, the Board of Directors terminated Reinhard Schmidt’s employment as its President, Chief Executive Officer and Chief Operating Officer for cause. Mr. Schmidt’s termination was not a result of the discovery of any financial or accounting irregularity by the investigation. Pursuant to Mr. Schmidt’s employment agreement, his position as a Class II Director of the Company ceased upon the termination of his employment. Pursuant to EPMedSystems’ by-laws, the Board of Directors is permitted to elect a person to fill such vacancy on the Board; provided, however, that the interim term of such new director is permitted to extend only until the next annual meeting of shareholders, at which point, if such person is nominated, the shareholders shall vote on the continued service of such person as a Class II director. On August 16, 2006, the Board of Directors elected David I. Bruce to serve as President and Chief Executive Officer of the Company and to fill the Class II director vacancy created as a result of Mr. Schmidt’s departure. The Board of Directors has nominated Mr. Bruce to stand for election as a Class II director at the Annual Meeting, and to hold office for a three-year term. The Board of Directors has no reason to believe that Mr. Bruce will be unable or unwilling to serve as a director. If, however, Mr. Bruce becomes unavailable, the proxies will have discretionary authority to vote for a substitute Class II nominee.

In the absence of instructions to the contrary, a properly signed and dated proxy will vote the shares represented by that proxy, “FOR” the election of Mr. Ray and Mr. Bruce as Class II directors.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” THE ELECTION OF THE NOMINEES FOR CLASS II DIRECTOR AS SET FORTH ABOVE.

Certain Information Concerning Nominees and Continuing Directors

The following information with respect to the principal occupation or employment, other affiliations, and business experience during the past five years of the nominees and each continuing director has been furnished to EP MedSystems by each director.

Nominees for Class II Director

PAUL L. RAY (age 60) has served as a director of EP MedSystems since July 2002. He is a Class II director whose term expires in 2006. Mr. Ray is co-founder of MedCap Ltd. and Konrad Capital, LLC. He formerly served as the President, CEO, and Chairman of Image Guided Technologies, Inc. (“IGT”) in Boulder, CO. Mr. Ray orchestrated IGT’s venture funding, its public offering and NASDAQ listing and finally the sale of IGT to Stryker Corporation in August of 2000. Mr. Ray has served as Commissioner and Chairman for The Colorado Advanced Technology Institute. Mr. Ray currently serves as a Director for the Colorado Technology Incubator and the Colorado Biotechnology Association. In addition, he was appointed in 1999 to

6

the position of Co-Vice Chairman of the Governor’s Commission on Science and Technology for the State of Colorado. In January 2003, Mr. Ray became a partner in the New York-based investment-banking firm of McKim and Company, LLC, where he serves as the lifesciences partner. Mr. Ray currently holds the position of President and Chief Executive Officer of Nervonix, Inc., which has developed imaging technology for pain management. Mr. Ray has over 32 years of experience in the medical industry, with an emphasis on medical devices, and has held senior management positions with Dow Corning Corporation, V. Mueller Allegiance, a division of Cardinal Medical, Collagen Corporation, and TMJ Implants.

David I. Bruce(age 47) President and Chief Executive Officer of EP MedSystems. Mr. Bruce joined EP MedSystems following nine years of increasing responsibility at Acuson Corporation and the Ultrasound Division of Siemens, including as General Manager of the intracardiac echo (ICE) catheter group with responsibility for both commercial operations and research and development. In partnership with leading electrophysiologists and interventional cardiologist, Mr. Bruce’s team developed and expanded the clinical adoption of ICE for guidance of advanced catheter-based cardiac treatments for atrial fibrillation and atrial septal defects, leading to a five-fold increase of installed customer sites and catheter sales revenue during the last four years.

Directors Continuing in Office

ABHIJEET LELE (age 41) has served as a director of EP MedSystems since April 2002. He is a Class III director whose term expires in 2007. Since October 1999, Mr. Lele has served as an investment manager with several private equity funds focusing on investments in private and public healthcare companies. He serves as a Managing Member of the general partner of EGS Private Healthcare Partnership, L.P. and EGS Private Healthcare Counterpart, L.P. (the “EGS Entities”), each of which is a shareholder of EP MedSystems. From 1994 to 1997, Mr. Lele was a consultant in the healthcare practice of McKinsey & Company. Before joining McKinsey & Company, Mr. Lele held operating positions in the pharmaceutical and biotechnology industries. He holds an MA in molecular biology from Cambridge University and an MBA with distinction from Cornell University. Mr. Lele also serves as a director of CryoCath Technologies (TSE:CYT), Stereotaxis, Inc. (NASDAQ: STXS), Medarex, Inc. (NASDAQ:MEDX) Optiscan Biomedical Corporation and Ekos Corporation.

DAVID A. JENKINS (age 48) is a founder and currently the Chairman of the Board of Directors of EP MedSystems. He is a Class III director whose term expires in 2007. Mr. Jenkins served as the Chief Executive Officer of EP MedSystems from its inception in 1993 until August 2002, and has been the Chairman since 1995. Mr. Jenkins also served as President of EP MedSystems from its inception in 1993 until August 2001. In October 2005, in connection with the termination of the Company’s CEO, Reinhard Schmidt, the Board appointed Mr. Jenkins to the positions of President, Chief Operating Officer and Chief Executive Officer. On August 16, 2006, with the hiring of David I. Bruce, Mr. Jenkins resigned the positions of Chief Executive Officer and Chief Operating Officer. He also served as President and a director of Transneuronix, Inc., a privately-held company engaged in the development of neuro-muscular stimulation devices, until its sale to Medtronic in 2005. Mr. Jenkins is also the managing member of the general partner of FatBoy Capital, LP, a shareholder of the Company. In addition, Mr. Jenkins is a director of Geodigm, Inc., a privately-held company.

RICHARD C. WILLIAMS (age 63) was elected to the Board of Directors in August of 2002. He is a Class I director whose term expires in 2008. Since 1989, Mr. Williams has served as the founder and President of Conner-Thoele Limited, a consulting and financial advisory firm specializing in the healthcare industry and pharmaceutical segment. From 2000 to April 2001, he also served as Vice Chairman - Strategic Planning and a director of King Pharmaceuticals Inc., a NYSE - listed specialty pharmaceutical company. From 1992 to 2000, prior to its acquisition by King Pharmaceuticals in 2000, Mr. Williams served as Chairman and a director of Medco Research, a NYSE cardiovascular pharmaceutical development company. From 1997 to 1999, he

7

was Co-Chairman and a director of Vysis, a Nasdaq - listed genetic biopharmaceutical company. Prior to founding Conner-Thoele Limited in 1989, Mr. Williams held various operational and financial management officer positions with Erbamont, N.V., Field Enterprises, Inc., Abbott Laboratories and American Hospital Supply Corporation. Mr. Williams is non-executive Chairman of the Board and interim CEO of Cellegy Pharmaceuticals, Inc., a Nasdaq - listed specialty pharmaceutical company. He is also Chairman and a director of ISTA Pharmaceuticals, Inc., a Nasdaq – listed ophthalmology company, and is a former member of the Listed Company Advisory Committee of New York Stock Exchange.

No family relationships exist between any of the directors or executive officers of EP MedSystems.

8

Compensation of Directors

Non-employee directors of EP MedSystems received amounts ranging from $50,000 to $51,000 for their service for the year ended December 31, 2005. Directors will be compensated for the year ended December 31, 2006 as follows: (i) a retainer of $15,000 per year is payable to each outside director payable in quarterly installments, (ii) a meeting fee of $1,500 per director is payable with respect to each regularly scheduled meeting, and (iii) a meeting fee of $1,500 is payable for each telephone meeting in excess of one hour. In addition, the directors are reimbursed for their reasonable travel expenses incurred in performance of their duties as directors and directors receive a grant of an option to purchase 60,000 shares of Common Stock when they join the Board of Directors.

Certain Information Concerning Board Meetings and Committees

During the year ended December 31, 2005, the Board of Directors met seven times. EP MedSystems’ Board of Directors has established standing Audit, Compensation, Plan, and Nominating committees. The Audit Committee met ten times, the Compensation Committee met seven times, the Plan Committee met one time, and the Nominating Committee met one time during fiscal year 2005. Each member of the Board of Directors attended 75% or more of the Board of Directors meetings, and each member of the Board of Directors who served on either the Audit, Compensation, Plan or Nominating Committee attended at least 75% of the committee meetings.

Audit Committee. Currently, Mr. Lele (chairman), Mr. Williams, and Mr. Ray are members of the Audit Committee. Pursuant to the current rules of the Nasdaq Stock Market applicable to EP MedSystems, all of the members of the Audit Committee are independent. The Board of Directors has determined that Mr. Lele, Mr. Williams and Mr. Ray are “independent directors” under current Nasdaq Stock Market Rules. The Board of Directors has determined that Mr. Lele qualifies as an “audit committee financial expert” as defined by the rules of the Securities and Exchange Commission. The Audit Committee oversees EP MedSystems’ accounting, financial reporting process, internal controls and audits, and consults with management, the internal auditors and the independent public accountants on, among other items, matters related to the annual audit, the published financial statements and the accounting principles applied. As part of its duties, the Audit Committee appoints, evaluates, and retains EP MedSystems’ independent public accountants. It also maintains direct responsibility for the compensation, termination, and oversight of EP MedSystems’ independent public accountants’ qualifications, performance, and independence. The Audit Committee approves all services provided to EP MedSystems by the independent public accountants and reviews all non-audit services to ensure they are permitted under current law. The Committee also monitors compliance with the Foreign Corrupt Practices Act and EP MedSystems’ policies on ethical business practices and reports on these items to the Board of Directors. The Audit Committee operates under a written charter adopted by the Board of Directors, and reviewed and reapproved at the committee meeting on October 12, 2006, a copy of which is available on our website at www.epmedsystems.com.

Compensation Committee. Currently, the members of the Compensation Committee are Mr. Ray (chairman), Mr. Williams and Mr. Lele. The Compensation Committee reviews, administers and determines compensation arrangements for EP MedSystems’ executive officers and administers the 1995 Long Term Incentive Plan, the 2002 Stock Option Plan, and the 2006 Stock Option Plan.

Plan Committee. Currently, Mr. Jenkins is the sole member of the Plan Committee. The Plan Committee administers the 1995 Director Option Plan and the 2006 Director Plan. Members of the Plan Committee are not eligible to participate in the 1995 Director Option Plan or the 2006 Director Plan.

Nominating Committee. Currently, the members of the Nominating Committee are Mr. Williams (chairman), Mr. Lele and Mr. Ray. The Board has determined that Mr. Lele, Mr. Williams and Mr. Ray are “independent directors” under current Nasdaq Stock Market Rules. The Nominating Committee’s responsibilities include recommending to the Board of Directors nominees for possible election to the Board of Directors. The Nominating Committee adopted a charter on July 11, 2005, a copy of which is available on our website atwww.epmedsystems.com. The Nominating Committee is slated to evaluate and reapprove the charter on December 12, 2006.

9

Director Nomination Process

Criteria for Board Membership. In selecting candidates for appointment, election or re-election to the Board of Directors, the Nominating Committee considers the appropriate balance of experience, skills and characteristics required of the Board of Directors, and seeks to insure that the Board of Directors has a sufficient number of independent directors to satisfy the Audit Committee requirement set forth in Nasdaq Stock Market Rule 4350-1(d)(2) and at least one of them qualifies as an “audit committee financial expert” under the rules of the Securities and Exchange Commission. Nominees for director are selected on the basis of their depth and breadth of experience, integrity, ability to make independent analytical inquiries, understanding of the Company’s business environment, and willingness to devote adequate time to Board of Directors duties.

Stockholder Nominees.The Nominating Committee will consider written proposals from stockholders for nominees for director. Any shareholder of the Company entitled to vote for the election of directors may nominate a person for election to the Company’s Board of Directors if such shareholder follows the procedures outlined in our Bylaws, which are summarized below. Shareholder nominations shall be made pursuant to notice in writing to the Secretary of the Company within the time frame described in the Bylaws of the Company and under the caption, “Stockholder Proposals” below. A shareholder’s notice to the Secretary shall set forth (a) as to each person whom the shareholder proposes to nominate for election or reelection as a director (i) the name, age, business address and residence address of the person, (ii) the number of shares of capital stock of the corporation which are beneficially owned by the person and (ii) any other information relating to the person that is required to be disclosed in solicitations for proxies for election of directors pursuant to Rule 14A under the Securities Exchange Act of 1934, as amended (including such person’s written consent to being named in the proxy statement as a nominee and to serving as a director if elected); (b) as to the shareholder giving the notice (i) the name and business address and residence address of the shareholder and (ii) the class and number of shares of the Company’s stock which are beneficially owned by the shareholder on the date of such shareholder notice. The presiding officer of the annual meeting will determine and declare at the annual meeting whether the nomination was made in accordance with these terms. If not, the defective nomination will be disregarded.

Process for Identifying and Evaluating Nominees. The Nominating Committee believes EP MedSystems is well-served by its current directors. In the ordinary course, absent special circumstances or a material change in the criteria for Board of Directors membership, the Nominating Committee will renominate incumbent directors who continue to be qualified for Board of Directors service and are willing to continue as directors. If an incumbent director is not standing for re-election, or if a vacancy on the Board of Directors occurs between annual stockholder meetings, the Nominating Committee will seek out potential candidates for Board of Directors appointment who meet the criteria for selection as a nominee and have the specific qualities or skills being sought. Director candidates will be selected based on input from members of the Board of Directors, senior management of EP MedSystems and, if the Nominating Committee deems appropriate, a third-party search firm. The Nominating Committee will evaluate each candidate’s qualifications and check relevant references; in addition, such candidates will be interviewed by at least one member of the Nominating Committee. Candidates meriting serious consideration will meet with all members of the Board. Based on this input, the Nominating Committee will evaluate which of the prospective candidates is qualified to serve as a director and whether the committee should recommend to the Board that this candidate be appointed to fill a current vacancy on the Board of Directors, or presented for the approval of the stockholders, as appropriate.

Board Nominees for the 2006 Annual Meeting. One nominee listed in this Proxy Statement is a current director standing for re-election. The second nominee listed in this Proxy Statement is a new director nominated to the Board of Directors to fill a vacancy.

10

Communications With Directors

Stockholders or other interested parties may communicate with any director or committee of the Board by writing to them c/o Secretary, EP MedSystems, Inc., 575 Route 73 North, Bldg. D, West Berlin, New Jersey 08091. Comments or questions regarding the Company’s accounting, internal controls or auditing matters will be referred to members of the Audit Committee. Comments or questions regarding the nomination of directors and other corporate governance matters will be referred to members of the Nominating Committee.

The Company has a policy of encouraging all directors to attend the annual stockholder meetings. One of our directors attended the 2004 annual meeting. Two of our directors are expected to be present at the Annual Meeting.

CODE OF ETHICS

We have adopted a written code of ethics that applies to all of our employees, including our principal executive officer, principal financial officer, principal accounting officer or controller and any persons performing similar functions. The code of ethics is included in our Code of Business Conduct and Ethics. All of our directors and employees, including our Chief Executive Officer and other senior executives, are required to comply with our Code of Business Conduct and Ethics to help ensure that our business is conducted in accordance with the highest standards of moral and ethical behavior. Our Code of Business Conduct and Ethics covers all areas of professional conduct, including customer relationships, conflicts of interest, insider trading, intellectual property, and confidential information, as well as requiring strict adherence to all laws and regulations applicable to our business. Employees are required to bring any violations and suspected violations of the Code of Business Conduct and Ethics to the attention of EP MedSystems, through management or by using EP MedSystems’ confidential compliance line. A copy of our Code of Business Conduct and Ethics is available on our website athttp://www.epmedsystems.com. We will also provide a copy of our code of ethics to any person without charge upon written request addressed to EP MedSystems, Inc., 575 Route 73 North, Bldg. D, West Berlin, New Jersey 08091, Attention: Matthew C. Hill, Chief Financial Officer.

11

EXECUTIVE COMPENSATION AND RELATED MATTERS

Executive Compensation

The following summary compensation table sets forth certain information concerning compensation paid or accrued to the Chief Executive Officer and each of EP MedSystems’ four most highly paid executive officers whose salary and bonus for all of their services in all capacities in 2005 exceeded $100,000.

Summary Compensation Table

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | Long Term Compensation | |

| | | Annual Compensation | | | Awards Payouts | |

Name And Principal Position | | Year | | Salary ($) | | Bonus ($) | | Other Annual

Compensation ($) | | | Restricted

Stock

Award(s) ($) | | | Securities

Underlying

Options/

SARs(#) | | | LTIP

Payouts ($) | | All Other

Compensation ($) | |

David Jenkins Chairman, President, Chief Executive Officer and Chief Operating Officer (1) | | 2005 | | $ | 25,000 | | | — | | $ | 4,392 | (2) | | $ | 82,560 | (3) | | 400,000 | | | — | | | — | |

Reinhard Schmidt President and Chief Executive Officer from August 2002 (1) | | 2005

2004

2003 | | $

$

$ | 210,861

257,200

257,720 | |

$

$ | —

37,500

37,500 | |

| —

—

— |

| |

| —

—

— |

| | —

—

— |

| | —

—

— | |

| —

—

— |

|

Matthew C. Hill Chief Financial Officer | | 2005

2004

2003 | | $

$

$ | 147,750

125,333

108,224 | | $

$ | 10,000

—

16,875 | |

| —

—

— |

| |

| —

—

— |

| | 15,000

30,000

103,750 | (5)

(6)

(7) | | —

—

— | |

| —

—

— |

|

C. Bryan Byrd Vice President, Engineering and Manufacturing | | 2005

2004

2003 | | $

$

$ | 176,381

172,500

172,500 | | $

| 21,000

—

— | |

$

| —

17,000

— |

(9)

| |

| —

—

— |

| | 12,000

6,000

73,000 | (8)

(10)

(11) | | —

—

— | |

| —

—

— |

|

John Huley Vice President, Sales | | 2005

2004 | | $

$ | 156,000

114,135 | | $

$ | 22,500

22,500 | |

| —

— |

| |

| —

— |

| | 40,000

150,000 | (12)

(13) | | —

— | |

$ | —

8,985 |

(14) |

Thomas Maguire Regulatory Quality Assurance | | 2005 | | $ | 116,687 | | $ | 11,250 | | | — | | | | — | | | — | | | — | | | — | |

| (1) | On October 9, 2005, the Board of Directors terminated Reinhard Schmidt’s employment as its President, Chief Executive Officer and Chief Operating Officer for cause. The Department of Commerce is investigating certain sales by the Company of its products to Iran in violation of United States law and the accuracy and completeness of voluntary statements filed with the Department of Commerce with respect thereto. Mr. Schmidt’s termination resulted from his certification and authorization of such statements, some of which the Company’s Audit Committee has determined in its independent investigation to have been in accurate or incomplete. The Audit Committee’s independent investigation has concluded. Mr. Schmidt’s termination was not a result of the discovery of any financial or accounting irregularities by the Audit Committee’s investigation. In connection with Mr. Schmidt’s termination, Mr. Jenkins assumed the role of President, Chief Executive Officer and Chief Operating Officer. Initially as compensation, Mr. Jenkins received options to purchase 400,000 shares of our common stock. (See footnote 4 below.) Subsequently, the Compensation Committee approved a compensation package which included Company paid healthcare and cash compensation equal to that of a director of the Company, a retainer of $15,000 per year, $1,500 per scheduled meeting and $1,500 per telephone meeting in excess of one hour. |

12

| (2) | The Company paid Mr. Jenkins’ healthcare costs in 2005. |

| (3) | On August 31, 2005, Mr. Jenkins exercised an option to purchase 96,000 share of common stock at an exercise price of $2.00. The price of the Company’s common stock on August 31, 2005 was $2.86. |

| (4) | On October 11, 2005, EP MedSystems granted Mr. Jenkins a nonqualified stock option to purchase 200,000 shares of common stock; 100,000 shares of common stock pursuant to the 1995 Long term Incentive Plan, and 100,000 shares of common stock pursuant to the 2002 Stock Option Plan, at an exercise price of $2.67 per share. On October 21, 2005, upon approval by the Board of Directors subject to approval by the Company’s shareholders of the 2006 Stock Option Plan, EP MedSystems granted Mr. Jenkins a nonqualified stock option to purchase 200,000 shares of common stock pursuant to the 2006 Stock Option Plan at an exercise price of $2.90. The options vested one third immediately and one third each year and the term is 10 years. |

| (5) | On March 2, 2005, EP MedSystems granted Mr. Hill an incentive stock option to purchase 15,000 shares of common stock pursuant to the 2002 Stock Option Plan at an exercise price of $3.73 per share. The options vest over 5 years and the term of the options is 10 years. |

| (6) | On March 4, 2004, EP MedSystems granted Mr. Hill an incentive stock option to purchase 5,000 shares of common stock pursuant to the 1995 Long Term Incentive Plan at an exercise price of $3.20 per share. On July 22, 2004, EP MedSystems granted Mr. Hill an incentive stock option to purchase 25,000 shares of common stock pursuant to the 1995 Long Term Incentive Plan at an exercise price of $3.15 per share. The options vest over 5 years and the term of the options is 10 years. |

| (7) | On March 5, 2003, EP MedSystems granted Mr. Hill an incentive stock option to purchase 50,000 shares of common stock pursuant to the 2002 Stock Option Plan at an exercise price of $1.32 per share. On August 15, 2003, EP MedSystems granted Mr. Hill an incentive stock option to purchase 3,750 shares of common stock pursuant to the 1995 Long Term Incentive Plan at an exercise price of $2.55 per share. On August 26, 2003, EP MedSystems granted Mr. Hill an incentive stock option to purchase 50,000 shares of common stock pursuant to the 1995 Long Term Incentive Plan at an exercise price of $2.25 per share. The options vest over 5 years and the term of the options is 10 years. |

| (8) | On March 2, 2005, EP MedSystems granted Mr. Byrd an incentive stock option to purchase 9,000 shares of common stock pursuant to the 2002 Stock Option Plan at an exercise price of $3.73 per share. On May 12, 2005, EP MedSystems granted Mr. Byrd an incentive stock option to purchase 3,000 shares of common stock pursuant to the 2002 Stock Option Plan at an exercise price of $3.03. The options vest over 5 years and the term is 10 years. |

| (9) | On May 26, 2004, Mr. Byrd exercised an option to purchase 10,000 shares of EP MedSystems common stock at an exercise price of $1.33 per share. The price of the Company’s common stock on May 26, 2004 was $3.03 per share. |

| (10) | On July 22, 2004, EP MedSystems granted Mr. Byrd an incentive stock option to purchase 6,000 shares of common stock pursuant to the 1995 Long Term Incentive Plan at an exercise price of $3.15 per share. The options vest over 5 years and the term of the options is 10 years. |

| (11) | On May 7, 2003, EP MedSystems granted Mr. Byrd an incentive stock option to purchase 50,000 shares of common stock pursuant to the 2002 Stock Option Plan at an exercise price of $2.14 per share. On July 22, 2003, EP MedSystems granted Mr. Byrd an incentive stock option to purchase 18,000 shares of common stock pursuant to the 1995 Long Term Incentive Plan at an exercise price of $2.91 per share. On November 19, 2003, EP MedSystems granted Mr. Byrd an incentive stock option to purchase 5,000 shares of common stock pursuant to the 1995 Long Term Incentive Plan at an exercise price of $3.75 per share. The options vest over 5 years and the term of the options is 10 years. |

| (12) | On July 11, 2005, EP MedSystems granted Mr. Huley an incentive stock option to purchase 20,000 shares of common stock pursuant to the 2002 Stock Option Plan at an exercise price of $3.62. On October 31, 2005, EP MedSystems granted Mr. Huley an incentive stock option to purchase 20,000 shares of common stock pursuant to the 2002 Stock Option Plan at an exercise price of $2.85. The options vest over 5 years and the term of the option is 10 years. |

| (13) | On May 10, 2004, EP MedSystems granted Mr. Huley an incentive stock option to purchase 150,000 shares of common stock pursuant to the 2002 Stock Option Plan at an exercise price of $3.18 per share. The option vest over 5 years and the term of the options is 10 years. |

| (14) | Reimbursement of relocation expenses. |

13

Stock Options

The following table sets forth certain information concerning grants of stock options to each of the executive officers identified in the Summary Compensation Table during the fiscal year ended December 31, 2005.

Option Grants in Fiscal Year 2005

| | | | | | | | | |

| | | Number of Shares

Underlying

Options Granted | | Percent of Total

Options Granted to

Employees in 2004 | | | Exercise

Price

Per Share | | Expiration Date |

David A. Jenkins Chairman, President, Chief Executive Officer and Chief Operating Officer | | 200,000

200,000 | | 21

21 | %

% | | 2.67

2.90 | | October 11, 2015

October 21, 2015 |

Matthew C. Hill (1) Chief Financial Officer | | 15,000 | | 2 | % | | 3.73 | | March 2, 2015 |

C. Bryan Byrd (1) Vice President, Engineering And Manufacturing | | 3,000

9,000 | | *

1 |

% | | 3.02

3.73 | | May 12, 2015

March 2, 2015 |

John Huley (1) Vice President, Sales | | 20,000

20,000 | | 2

2 | %

% | | 3.62

2.85 | | July 22, 2015

October 31, 2015 |

Thomas Maguire Vice President, Regulatory and Quality Assurance | | — | | — | | | — | | - |

| (1) | See applicable footnotes to above Summary Compensation Table. |

The exercise prices of the options granted during the fiscal year ended December 31, 2005 were equal to or greater than the fair market value of our common stock on the date of each grant.

Option Exercises and Holdings

The following table provides certain information with respect to each of the executive officers identified in the Summary Compensation Table concerning the exercise of stock options during the fiscal year ended December 31, 2005 and the value of unexercised stock options held as of such exercise date.

14

Aggregated Option Exercises in 2005 and Year-End Option Values

| | | | | | | | | | | | | | | |

| | | Shares

Acquired on

Exercise | | Value

Realized | | Number of Shares Underlying

Options at December 31, 2005 | | Value of Unexercised in-the

Money Options at

December 31, 2005(1) |

Name | | | | Exercisable | | Unexercisable | | Exercisable | | Unexercisable |

David A. Jenkins (2) Chairman, President, Chief Executive Officer and Chief Operating Officer | | 96,000 | | $ | 82,560 | | 202,000 | | 268,000 | | $ | 66,200 | | $ | 33,500 |

Matthew C. Hill (2) Chief Financial Officer | | — | | | — | | 50,500 | | 113,250 | | $ | 53,730 | | $ | 73,770 |

C. Bryan Byrd (2) Vice President, Engineering and Manufacturing | | — | | | — | | 57,200 | | 133,800 | | $ | 30,700 | | $ | 33,300 |

John Huley (2) Vice President, Sales | | — | | | — | | — | | 190,000 | | | — | | $ | 1,200 |

Thomas Maguire (2) Vice President, Regulatory and Quality Assurance | | — | | | — | | 5,000 | | 20,000 | | $ | 1,050 | | $ | 4,200 |

| (1) | Amounts calculated by subtracting the exercise price of the options from the market value of the underlying common stock using the closing sale price on the NASDAQ Capital Market of $2.91 per share on December 30, 2005. |

| (2) | See footnotes to above Summary Compensation Table. |

During the fiscal year ended December 31, 2005, 194,750 options were exercised.

Compensation Plans and Other Arrangements

1995 Long Term Incentive Plan

Our 1995 Long Term Incentive Plan (the “1995 Incentive Plan”) was adopted by our Board of Directors and shareholders in November 1995. There were 1,000,000 shares of our common stock reserved for issuance under the 1995 Incentive Plan. At December 31, 2005, options to purchase 835,208 shares of our common stock were outstanding at exercise prices ranging from $1.34 to $4.25 per share. The 1995 Incentive Plan provides for grants of “incentive” and “non-qualified” stock options to employees of EP MedSystems. The 1995 Incentive Plan is administered by the Compensation Committee, which determines the optionees and the terms of the options granted, including the exercise price, number of shares subject to the options and the exercisability thereof. The 1995 Incentive Plan terminated on November 30, 2005. Options may no longer be issued under the plan.

The exercise price of incentive stock options granted under the 1995 Incentive Plan must be equal to at least the fair market value of the common stock on the date of grant, and the term of such options may not exceed ten years. With respect to any optionee who owns stock representing more than 10% of the voting power of all classes of our outstanding capital stock, the exercise price of any incentive stock option must be equal to at least 110% of the fair market value of the common stock on the date of grant, and the term of the option may not exceed five years. The aggregate fair market value of common stock (determined as of the date of the option grant) for which an incentive stock option may for the first time become exercisable in any calendar year may not exceed $100,000. Options granted under the 1995 Incentive Plan are generally subject to vesting over five years, and vesting generally accelerates upon a change of control of the Company as defined therein.

1995 Director Option Plan

The Company’s 1995 Director Option Plan was adopted by our Board of Directors and our shareholders in November 1995. A total of 180,000 shares of our common stock were reserved for issuance under the 1995 Director Option Plan, and options to purchase 180,000 shares were outstanding as of

15

December 31, 2005 at exercise prices ranging from $2.10 to $2.50 per share. The 1995 Director Option Plan provides for grants of “director options” to eligible directors of EP MedSystems and for grants of “advisor options” to eligible members of the Scientific Advisory Board. Director options and advisor options become exercisable at the rate of 1,000 shares per month, commencing with the first month following the date of grant for so long as the optionee remains a director or advisor, as the case may be. The 1995 Director Option Plan is administered by the Plan Committee of EP MedSystems, which determines the optionees and the terms of the options granted, including the exercise price and the number of shares subject to the options. Options granted under the 1995 Incentive Plan are generally subject to vesting over five years, and vesting generally accelerates upon a change of control of the Company as defined therein. The 1995 Director Option Plan terminated on November 30, 2005. Options may no longer be issued under the plan.

2002 Stock Option Plan

The Company’s 2002 Stock Option Plan (the “2002 Plan”) was approved by our Board of Directors and our shareholders in August 2002 and amended in December 2005. A total of 1,000,000 shares of our common stock are reserved for issuance under the 2002 Plan. At December 31, 2005, options to purchase 826,500 shares were outstanding at exercise prices ranging from $1.32 to $3.73. The 2002 Plan provides for grants of incentive stock options to our employees and officers and for grants of non-qualified stock options to employees, officers, advisors and consultants of EP MedSystems. Options granted under the 1995 Incentive Plan are generally subject to vesting over five years, and vesting generally accelerates upon a change of control of the Company as defined therein. The 2002 Plan is administered by the Compensation Committee. The 2002 Plan will terminate on August 29, 2012, unless terminated earlier by our Board of Directors.

2006 Stock Option Plan

The Company’s 2006 Stock Option Plan (the “2006 Plan”) was approved by our Board of Directors in October 2005 and our shareholders in December 2005. A total of 1,000,000 shares of our common stock are reserved for issuance under the 2006 Plan. At December 31, 2005, options to purchase 200,000 shares were outstanding at an exercise prices of $2.90. The 2006 Plan provides for grants of incentive stock options to our employees and officers and for grants of non-qualified stock options to employees, officers, advisors and consultants of the Company. The 2006 Plan is administered by the Compensation Committee. Options granted under the 1995 Incentive Plan are generally subject to vesting over five years, and vesting generally accelerates upon a change in control of the Company as defined therein. The 2006 Plan will terminate on October 21, 2015, unless terminated earlier by our Board of Directors.

2006 Director Plan

The Company’s 2006 Director Plan (the “2006 Director Plan”) was adopted by our shareholders in December 2005. A total of 1,000,000 shares of our common stock are reserved for issuance under the 2006 Director Plan, and no options were outstanding as of December 31, 2005. The 2006 Director Plan provides for grants of “director options” to eligible directors of EP MedSystems and for grants of “advisor options” to eligible members of the Scientific Advisory Board. Director options and advisor options become exercisable at the rate of 1,000 shares per month, commencing with the first month following the date of grant for so long as the optionee remains a director or advisor, as the case may be. The 2006 Director Plan is administered by the Plan Committee of EP MedSystems, which determines the optionees and the terms of the options granted, including the exercise price and the number of shares subject to the options. The 2006 Director Option Plan will terminate on October 21, 2015, unless earlier terminated by the Board of Directors.

Employment Contracts and Termination of Employment and Change-in-Control Arrangements

We entered into an employment agreement, dated as of July 20, 2001 (and effective on commencement, August 20, 2001) with Reinhard Schmidt. Under the agreement, Mr. Schmidt served as President and Chief Operating Officer of EP MedSystems an initial term of 2 years at an annual salary of $200,000. The Board of Directors had discretion to approve salary increases and bonuses. On August 29, 2002, Mr. Schmidt added the duties of Chief Executive Officer, and the Compensation Committee of the

16

Board of Directors increased Mr. Schmidt’s compensation to $250,000. The agreement provided that unless terminated by either party providing the other with written notice of its intention not to renew at least 30 days prior to the scheduled expiration date, the agreement would be renewed automatically after the initial two-year term for successive one-year terms. The agreement further provides that if the agreement were terminated by EP MedSystems without cause or by Mr. Schmidt for good reason (including the occurrence of certain events within one year of change in control), Mr. Schmidt would be entitled to severance payments equal to Mr. Schmidt’s then-current base salary for a period of twelve months. On August 20, 2005, Mr. Schmidt’s employment agreement automatically renewed through August 2006.

On October 10, 2005, the Board of Directors terminated Mr. Schmidt’s employment as its President, Chief Executive Officer and Chief Operating Officer for cause. As previously reported, the Department of Commerce is investigating certain sales by the Company of its products to Iran in violation of United States law and the accuracy and completeness of voluntary statements filed with the Department of Commerce with respect thereto. Mr. Schmidt’s termination resulted from his certification and authorization of such statements, some of which the Company’s Audit Committee has uncovered in its independent investigation to have been inaccurate or incomplete. The Audit Committee’s independent investigation has been completed. Mr. Schmidt’s termination was not a result of the discovery of any financial or accounting irregularities by the Audit Committee’s investigation.

On May 12, 2005 our Board of Directors approved Senior Management Incentive Agreements with each of six senior officers. Those senior officers are Matthew C. Hill, our Chief Financial Officer and Secretary, C. Bryan Byrd, our Vice President, Engineering and Manufacturing, John Huley, our Vice President, Sales, Thomas Maguire, our Vice President, Regulatory and Quality Assurance, Richard Gibbons, our Director of Operations, and Kristine Fuimaono, our Director of Marketing. The agreements provide that if the senior officer is employed with EP MedSystems immediately prior to a change of control (as defined in the agreements) of EP MedSystems, we will pay to each of the senior officers an amount equal to two times the senior officer’s annual base salary (which excludes any incentive pay, premium pay, commissions, overtime, bonuses and other forms of variable compensation) at the time of such change of control. The agreements also confirm our policy previously approved by our Board of Directors that all options to purchase common stock of EP MedSystems granted to our employees (including all senior officers) will vest immediately prior to a change of control. The management incentive agreements also provide that if a senior officer’s benefits under the management incentive agreement would result in an Internal Revenue Code Section 280C(b)(1) “parachute payment,” such senior officer will receive an additional amount not to exceed 20% of the amount of the payments and benefits otherwise payable to the senior officer upon the occurrence of a change in control. All senior officers are employed by EP MedSystems on an “at-will” basis and none of the senior officers has an employment agreement with EP MedSystems.

17

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS

Report of the Audit Committee

The Audit Committee reviewed and discussed EP MedSystems’ audited financial statements for the fiscal year ended December 31, 2005 with EP MedSystems’ management. In addition, the Audit Committee discussed with EP MedSystems’ independent auditors, Grant Thornton LLP, the matters required by Statement on Auditing Standards No. 61, as may be modified or supplemented (as in effect on the date of EP MedSystems’ financial statements), which include the following:

| | • | | Grant Thornton LLP’s responsibility under generally accepted auditing standards; |

| | • | | Significant accounting policies; |

| | • | | Management’s judgments and accounting estimates; |

| | • | | Significant audit adjustments; |

| | • | | Other information in documents containing audited financial statements; |

| | • | | Disagreements with EP MedSystems’ management, including accounting principles, scope of audit and disclosures; |

| | • | | Major issues discussed with EP MedSystems’ management prior to retention of Grant Thornton LLP; and |

| | • | | Difficulties encountered in performing the audit. |

The Audit Committee received and discussed with Grant Thornton LLP written disclosures and the letter regarding any significant relationships that could impair Grant Thornton LLP’s independence (as required by Independence Standards Board Statement No. 1, as may be modified or supplemented, as in effect on the date of EP MedSystems’ financial statements), and considered the compatibility of non-audit services with Grant Thornton LLP’s independence. Based upon the above reviews and discussions, the Audit Committee recommended to the Board of Directors that EP MedSystems’ audited financial statements for the fiscal year ended December 31, 2005 be included in the Annual Report on Form 10-K for the fiscal year ended December 31, 2005.

|

| MEMBERS OF THE AUDIT COMMITTEE |

|

Abhijeet Lele, Chairman Richard C. Williams Paul L. Ray |

18

Relationship with Independent Auditors

Grant Thornton LLP (“Grant Thornton”) served as EP MedSystems’ independent certified public accountants for the fiscal year ended December 31, 2005. The Audit Committee of the Board of Directors has selected Grant Thornton to act as EP MedSystems’ independent auditors for the fiscal year ending December 31, 2005. A representative of Grant Thornton is expected to be present at the Annual Meeting, with the opportunity to make a statement, if the representative so desires, and is expected to be available to respond to appropriate questions from shareholders.

Audit and Other Fees Paid to Independent Auditors

Audit Fees

The aggregate fees billed by Grant Thornton LLP for professional services rendered for the audit of our annual financial statements for the years ended December 31, 2005 and 2004, the review of the financial statements included in our Forms 10-QSB and consents issued in connection with our filings on Form S-3 and Form S-8 for 2005 and 2004 totaled $162,734 and $192,724, respectively.

The aggregate fees billed by PricewaterhouseCoopers LLP for professional services rendered for the review of the financial statements included in our Forms 10-QSB and consents issued in connection with our filings on Form S-3, Form S-8 and Form 10-KSB for 2004 totaled $5,500, respectively.

Audit-Related Fees

The fees related to compliance with Section 404 of the Sarbanes-Oxley Act for the years ended December 31, 2005 and 2004 were approximately $4,000 and $0, respectively, are not disclosed in the paragraph captions “Audit Fees” above.

No fees were billed by PricewaterhouseCoopers LLP for assurance and related services that are reasonably related to the performance of the audit or review of our financial statements, for the years ended December 31, 2005 and 2004, and are not disclosed in the paragraph captions “Audit Fees” above.

Tax Fees

The aggregate fees billed by Grant Thornton LLP for professional services rendered for tax compliance, for the years ended December 31, 2005 and 2004 were $23,850 and $19,905, respectively. No fees were billed by Grant Thornton LLP for professional services rendered for tax advice and tax planning, for the years ended December 31, 2005 and 2004.

There were no aggregate fees billed by PricewaterhouseCoopers LLP for professional services rendered for tax compliance, for the years ended December 31, 2005 and 2004. There were no aggregate fees billed by PricewaterhouseCoopers LLP for professional services rendered for tax advice and tax planning, for the years ended December 31, 2005 and 2004.

All Other Fees

No fees were billed by Grant Thornton LLP for products and services, other than the services described in the paragraphs captions “Audit Fees”, “Audit-Related Fees”, and “Tax Fees” above for the years ended December 31, 2005 and 2004.

No fees were billed by PricewaterhouseCoopers LLP for products and services, other than the services described in the paragraphs captions “Audit Fees”, “Audit-Related Fees”, and “Tax Fees” above for the years ended December 31, 2005 and 2004.

19

Audit Committee Policies and Procedures

The Audit Committee has established its pre-approval policies and procedures, pursuant to which the Audit Committee approved the foregoing audit services provided by PricewaterhouseCoopers and Grant Thornton in 2005. Consistent with the Audit Committee’s responsibility for engaging our independent auditors, all audit and permitted non-audit services require pre-approval by the Audit Committee. The full Audit Committee approves proposed services and fee estimates for these services. The Audit Committee chairperson or his designee has been designated by the Audit Committee to approve any services arising during the year that were not pre-approved by the Audit Committee. Services approved by the Audit Committee chairperson are communicated to the full Audit Committee at its next regular meeting and the Audit Committee reviews services and fees for the fiscal year at each such meeting. Pursuant to these procedures, the Audit Committee approved the foregoing audit services provided by PricewaterhouseCoopers LLP and Grant Thornton LLP.

Report of the Compensation Committee

General

The Compensation Committee discharges the Board of Directors’ responsibilities relating to compensation of executive officers of the Company. The Compensation Committee reviews, administers and determines compensation arrangements for EP MedSystems’ executive officers and administers the 1995 Long Term Incentive Plan, the 2002 Stock Option Plan, and the 2006 Stock Option Plan. Currently, the members of the Compensation Committee are Mr. Ray (chairman), Mr. Williams and Mr. Lele. The Compensation Committee met seven times during fiscal year 2005 and approved various other matters by unanimous written consent. All compensation determinations for our executive officers with respect to the 2005 fiscal year were made by the Compensation Committee.

Overview

The overall objectives of the Company’s executive compensation plan is to:

| | • | | Attract, retain and motivate high-quality executives to lead the Company; |

| | • | | Reward executives for performance that increases shareholder value, such as growing net sales and profitability, increasing customer retention and penetration, attaining operational excellence and bringing new products to market; |

| | • | | Align the interests of executives with shareholders through the use of variable and equity-based compensation; and |

| | • | | Remain competitive with appropriate industry peers and other comparable companies in compensation for executives commensurate with their performance and results. |

The principal components of the compensation package for the Company’s executive officers are:

| | • | | Cash bonus to provide annual incentive for excellence in individual performance; and |

| | • | | Long-term incentive compensation through stock options. |

20

Base Salaries

Base salary is intended to be competitive with industry peers and other comparable companies. The Compensation Committee evaluates executive performance and reaches base salary compensation decisions based upon a subjective and careful analysis of each executive’s specific contributions as well as the recommendations of the Company’s chief executive officer. In determining the base salaries of executive officers, the Compensation Committee takes into consideration the level of responsibility and experience of each executive officer and the knowledge and skill required. Executive performance is evaluated and any base salary adjustment is based on an evaluation of the individual’s performance and contribution. Each year, the chief executive officer makes recommendations with respect to salary adjustments for all executive officers, which recommendations are reviewed, modified where appropriate and approved or rejected by the Compensation Committee. During the 2005 fiscal year, the Compensation Committee approved annual base salaries for each of Messrs. Jenkins, Schmidt, Hill, Byrd, Huley and Maguire of $25,000, $210,861, $147,750, $176,381, $156,000 and $116,687, respectively.

Cash Bonuses

In addition to base salaries, the Compensation Committee grants annual bonuses to executive officers in recognition of their efforts to position the Company to achieve future growth. After reviewing individual performances, the chief executive officer makes recommendations with respect to bonuses and other incentive awards, which recommendations are reviewed and, to the extent determined appropriate, approved by the Compensation Committee. During the 2005 fiscal year, the Compensation Committee granted annual performance bonuses to each of Messrs. Hill, Byrd, Huley and Maguire of $10,000, $21,000, $22,500 and $11,250, respectively.

Long Term Incentive Compensation

The Board of Directors adopted the 1995 Incentive Plan, the 2002 Plan and the 2006 Plan to: (i) align compensation rewards with the operating results and shareholder value; (ii) attract and retain qualified individuals; (iii) motivate participants to achieve long range goals; (iv) provide compensation opportunities competitive with the Company’s industry peers and other comparable companies; and (v) provide a higher return on equity expense by focusing award participation on those individuals with a demonstrated capacity to increase growth in equity value. The Compensation Committee believes that this strategy is consistent with the Company’s business goals, including shareholder return, employee retention, net sales growth and operational excellence.

The Compensation Committee selects the individuals to receive awards from among the eligible participants and the terms of the options granted, including the exercise price, number of shares subject to the options and the conditions to their exercise. The 1995 Incentive Plan terminated on November 30, 2005, and no further grants of options may be made under that plan. Options granted under the 2002 Plan and the 2006 Plan typically vest over five years and accelerate upon a change of control of the Company. During the 2005 fiscal year, the Compensation Committee approved awards of options to Messrs. Jenkins, Hill, Byrd, Huley and Maguire to purchase 400,000 shares, 15,000 shares, 12,000 shares, 40,000 shares and zero shares, respectively.

Chief Executive Officer Compensation

With respect to the determination of total compensation of the chief executive officer, significant factors taken into account by the Compensation Committee include individual performance and contribution to the Company, effectiveness of leadership, and significant strategic accomplishments and achievement of annual business goals. The compensation of Mr. Schmidt was determined in accordance with the procedures applicable to other senior executive officers described above.

From January 1, 2005 to October 9, 2005, during which time he served as the Company’s President, Chief Executive Officer and Chief Operating Officer, Mr. Schmidt was paid cash compensation in the amount of $210,861. On October 9, 2005, the Board of Directors terminated Reinhard Schmidt’s employment for cause. See “Employment Contracts and Termination of Employment and Change-in-Control Arrangements.”

21

In connection with Mr. Schmidt’s termination, Mr. Jenkins assumed the role of President, Chief Executive Officer and Chief Operating Officer. As compensation for his services, the Compensation Committee approved a compensation package for Mr. Jenkins which included options to purchase 400,000 shares of the Company’s common stock, and cash compensation equal to that of a director of the Company (a retainer of $15,000 per year, $1,500 per scheduled meeting and $1,500 per telephone meeting in excess of one hour). The Company also paid Mr. Jenkins’ healthcare costs in 2005. In August 2006, David Bruce replaced Mr. Jenkins as the Company’s President and Chief Executive Officer, and Mr. Jenkins resigned as Chief Operating Officer. Mr. Jenkins has since served on the Company’s Board of Directors as its Chairman.

From time to time, the Company enters into employment contracts or other compensation arrangements with executive officers. The Company had an employment agreement with Mr. Schmidt which was terminated on October 9, 2005. The Company did not have an employment agreement with any other executive officer in 2005. On May 12, 2005 the Board of Directors approved Senior Management Incentive Agreements with each of six senior officers. See “Employment Contracts and Termination of Employment and Change-in-Control Arrangements.”

The Compensation Committee intends to continue its policy of linking executive compensation with Company performance and stockholder returns to the extent possible through the measurement procedures described in this report. Section 162(m) of the Internal Revenue Code generally limits the tax deductibility of certain compensation in excess of one million dollars paid to a company’s chief executive officer and the four other most highly compensated executives. While the Company generally seeks to maximize the deductibility of compensation paid to its executive officers, it will maintain flexibility to take actions that may be based on considerations other than tax deductibility.

Paul L. Ray, Chairman

Abhijeet Lele

Richard C. Williams

22

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters.

Based upon information available to us, the following table sets forth certain information regarding beneficial ownership of our common stock as of November 23, 2006, by (i) each of our directors, (ii) each of the executive officers identified in the Summary Compensation Table, (iii) all directors and executive officers as a group and (iv) each person known to us to beneficially own more than five percent of our common stock. Except as otherwise indicated, the persons named in the table have sole voting and investment power with respect to all shares beneficially owned, subject to community property laws, where applicable.

| | | | | |

Name and Address of Beneficial Owner | | Shares of Common Stock

Beneficially Owned (1) | | Percent of Class | |

David A. Jenkins President,

Chief Executive Officer, Chief Operating Officer and Chairman

c/o EP MedSystems, Inc.

575 Route 73 N, Building D

West Berlin, New Jersey 08091 (2) | | 3,161,684 | | 10.3 | % |

Group comprised of Greenberg Healthcare Management,

LLC, EGS Partners, LLC, The Pharmaceutical/Medical Technology Fund, L.P., EGS Private Healthcare Associates, LLC, EGS Private Healthcare Partnership, L.P., Frederic Greenberg, and Abhijeet Lele 105 Rowayton Avenue Rowayton, CT 06853 (3) | | 2,590,378 | | 8.5 | % |

Group comprised of S.A.C. Capital Advisors, LLC, S.A.C Capital Associates, LLC, S.A.C. Capital Management, LLC and Steven A. Cohen. 172 Cummings Point Road Stamford, CT 06902 (4) | | 2,208,709 | | 7.2 | % |

Paul Ray

Director

c/o EP MedSystems, Inc.

575 Route 73 North, Building D

West Berlin, NJ 08091 (5) | | 54,000 | | * | |

Richard Williams

Director

c/o EP MedSystems, Inc.

West Berlin, NJ 08091 (6) | | 53,000 | | * | |

Thomas Maguire

Vice President, Regulatory and Quality Assurance

c/o EP MedSystems, Inc.

575 Route 73 N, Building D

West Berlin, New Jersey 08091 (7) | | 10,000 | | * | |

23

| | | | | |

Name and Address of Beneficial Owner | | Shares of Common Stock

Beneficially Owned (1) | | Percent of Class | |

Matthew C. Hill Chief Financial Officer c/o EP MedSystems, Inc. 575 Route 73, N, Building D West Berlin, NJ 08091 (8) | | 89,250 | | * | |

C. Bryan Byrd Vice President, Engineering and Manufacturing c/o EP MedSystems, Inc. 575 Route 73 N, Building D West Berlin, New Jersey 08091 (9) | | 171,600 | | * | |

John Huley Vice President, Sales c/o EP MedSystems, Inc. 575 Route 73 N, Building D West Berlin, New Jersey 08091 (10) | | 64,000 | | * | |

All executive officers and directors as a group (9 persons) (11) | | 6,193,912 | | 20.4 | % |

| * | Represents beneficial ownership of less than 1% of the common stock. |

| (1) | Applicable percentage ownership as of November 22, 2006 is based on 30,365,236 shares of common stock of the Company outstanding. Beneficial ownership is determined in accordance with Rule 13d-3 of the Exchange Act . Under Rule 13d-3, shares issuable within 60 days upon exercise of outstanding options, warrants, rights or conversion privileges are deemed outstanding for the purpose of calculating the number and percentage owned by the holder of those rights, but not deemed outstanding for the purpose of calculating the percentage owned by any other person. “Beneficial ownership” under Rule 13d-3 includes all shares over which a person has sole or shared dispositive or voting power. |

| (2) | Includes 312,000 shares issuable upon exercise of fully vested options. Also includes 160,000 shares held by Mr. Jenkins as trustee for the Dalin Class Trust, 42,500 shares held by Mr. Jenkins’ wife and 20,000 shares held by Mr. Jenkins’ wife as custodian for his children. Also includes 617,284 shares purchased on March 27, 2006 by FatBoy Capital, LP. Mr. Jenkins is a managing member of FatBoy Capital’s general partner. Mr. Jenkins disclaims beneficial ownership of (i) 42,500 shares held by his wife, (ii) 20,000 shares held by his wife as custodian for his children. |

| (3) | The information set forth with respect to the following EGS Entities is based on information contained in a Statement on Schedule 13D filed with the Commission on March 18, 2003 and other information known to the Company. The shares reflected in the table represent (i) 2,297,696 shares beneficially owned by EGS Private Healthcare Associates, LLC (“EGS Associates”), indirectly as the general partner of EGS Private Healthcare Partnership, L.P. (“EGS Partnership”), which is the record owner of 2,010,484 and EGS Private Healthcare Counterpart, L.P. (“EGS Counterpart”), which is the record owner of 287,212; (ii) 215,682 shares beneficially owned by Greenberg Healthcare Management, LLC (“Greenberg Management”), indirectly as the general partner of The Pharmaceutical/Medical Technology Fund, L.P. (“Pharma/Medical”); (iii) 2,513,378 shares beneficially owned by Frederic Greenberg indirectly, as managing member of Greenberg Management and EGS Associates, (iv) 20,000 shares beneficially owned by Frederic Greenberg; (v) 2,337,696 shares beneficially owned by Abhijeet Lele, indirectly, as managing member of EGS Private Healthcare Management, LLC, which is the General Partner of EGS Partnership and EGS Counterpart, and (vi) 57,000 shares issuable upon exercise of fully vested options beneficially held by Mr. Lele. |

| (4) | The information set forth with respect to the S.A.C. Capital Group is based on information contained in a statement on Schedule 13G/A filed with the Commission as of December 31, 2005. |

| (5) | Includes 54,000 shares issuable upon exercise of fully vested options. |

| (6) | Includes 53,000 shares issuable upon exercise of fully vested options. |

24

| (7) | Includes 10,000 shares issuable upon the exercise of fully vested options. |

| (8) | Includes 89,250 shares issuable upon exercise of fully vested options. |

| (9) | Includes 138,600 shares issuable upon exercise of fully vested options. |

| (10) | Includes 64,000 shares issuable upon exercise of fully vested options. |

| (11) | Includes 777,850 shares issuable upon exercise of fully vested options and warrants. |

25

Equity Compensation Plan Information

The following table sets forth, as of December 31, 2005, information about outstanding options and rights to purchase our common stock granted to participants in our equity compensation plans and the number of shares of our common stock remaining available for issuance under such equity compensation plans:

| | | | | | | |

Plan Category | | Number of Securities to be

Issued Upon Exercise of

Outstanding Options,

Warrants, and Rights | | Weighted-Average Exercise Price of

Outstanding Options,

Warrants, and Rights | | Number of Securities

Remaining Available for

Future Issuance Under

Equity compensation Plans

(Excluding Securities

Reflected in column (a) |

| | | (a) | | (b) | | (c) |

Equity compensation plans approved by security holders (1) | | 2,041,708 | | $ | 2.83 | | 1,963,500 |

Equity compensation plans not approved by security holders (2) | | 255,000 | | $ | 2.91 | | — |

| | | | | | | |

Total | | 2,296,708 | | $ | 2.83 | | 1,963,500 |

| | | | | | | |

| (1) | Consists of EP MedSystems (i) 1995 Long Term Incentive Plan, (ii) 1995 Director Option Plan, (iii) 2002 Stock Option Plan, (iv) 2006 Stock Option Plan, and (v) 2006 Directors Stock Option Plan. |

| (2) | These compensation plans or arrangements consist of options approved by our Board of Directors and granted to certain employees, directors and outside consultants from time to time to incentivize such persons in connection with EP MedSystems’s business. |

26

OTHER BUSINESS

The Board of Directors does not intend to present any business at the Annual Meeting other than as set forth in the accompanying Notice of Annual Meeting of Shareholders, and has no present knowledge that any others intend to present business at the Annual Meeting. If, however, other matters requiring the vote of the shareholders properly come before the Annual Meeting or any adjournment or postponement thereof, the persons named in the accompanying proxy will have discretionary authority to vote the proxies held by them in accordance with their judgment as to such matters.

MISCELLANEOUS

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Securities and Exchange Act of 1934 requires EP MedSystems’ executive officers, directors and beneficial owners of more than 10% of EP MedSystems’ common stock to file reports of ownership and changes in ownership with the Securities and Exchange Commission. Such persons are required to furnish EP MedSystems with copies of all Section 16(a) forms which they file. Based solely on our review of the copies of such forms received by us or oral or written representations from certain reporting persons that no Statements of Beneficial Ownership on Form 5 were required for these persons, we believe that, with respect to the year ended December 31, 2005, our executive officers, directors and greater than 10% beneficial owners complied with all such filing requirements.

Shareholder Proposals

Shareholder proposals intended for inclusion in the proxy materials for EP MedSystems’ 2007 Annual Meeting of Shareholders in reliance of Rule 14a-8 of the Exchange Act must be received by EP MedSystems no later than February 28, 2007, in such form as is required by the Securities and Exchange Commission. Shareholder proposals submitted outside of the process of Rule 14a-8 must be received by EP MedSystems no later than March 31, 2007. Such proposals should be directed to EP MedSystems, Inc. at its principal executive offices, 575 Route 73 North, Building D, West Berlin, New Jersey, 08091.

Stock Performance Graph

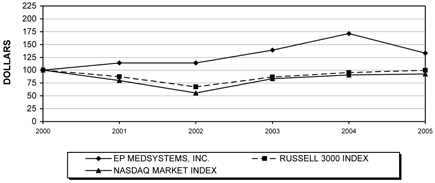

The following line graph and table compare, for the five most recently concluded fiscal years, the yearly percentage change in the cumulative total stockholder return, assuming reinvestment of dividends, on the Company’s common stock with the cumulative total return of companies on the NASDAQ Stock Market and an index comprised of certain companies in similar service industries (the “Selected Peer Group Index”).

27

COMPARISON OF CUMULATIVE TOTAL RETURN

AMONG EP MEDSYSTEMS, INC.,

RUSSELL 3000 INDEX AND NASDAQ MARKET INDEX

ASSUMES $100 INVESTED ON DEC. 31, 2000

ASSUMES DIVIDEND REINVESTED

FISCAL YEAR ENDING DEC. 31, 2005

COMPARISON OF FIVE-YEAR CUMULATIVE TOTAL RETURN AMONG EP MEDSYSTEMS, INC.,

THE NASDAQ MARKET INDEX AND THE SELECTED PEER GROUP

| | | | | | | | | | | | |

| | | December 31, |

| | | 2000 | | 2001 | | 2002 | | 2003 | | 2004 | | 2005 |