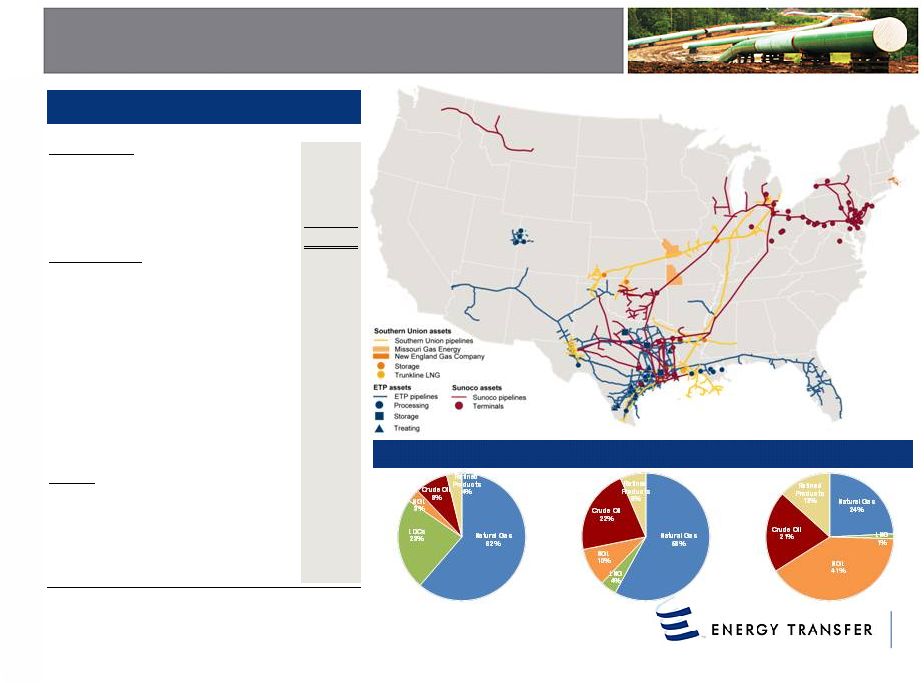

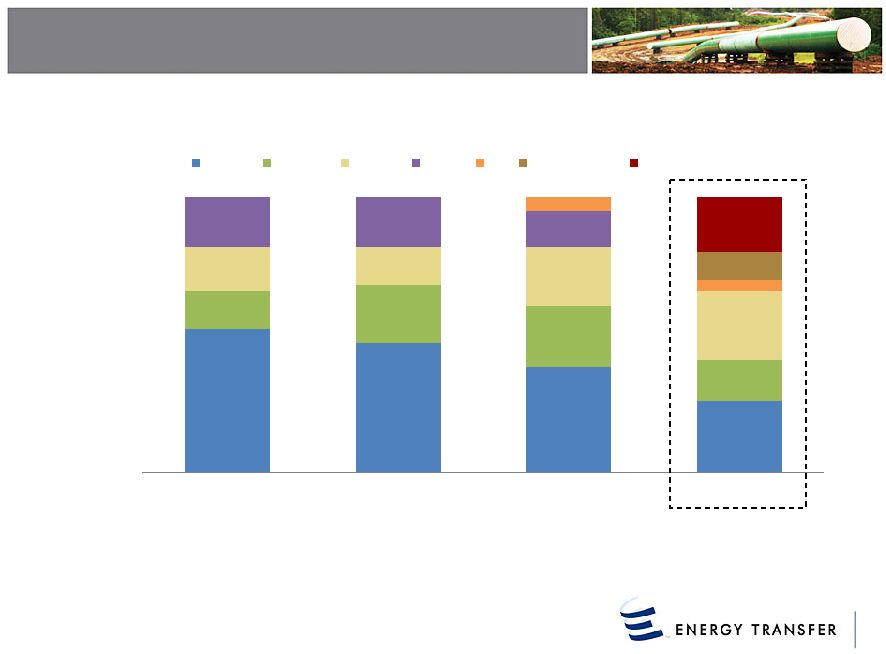

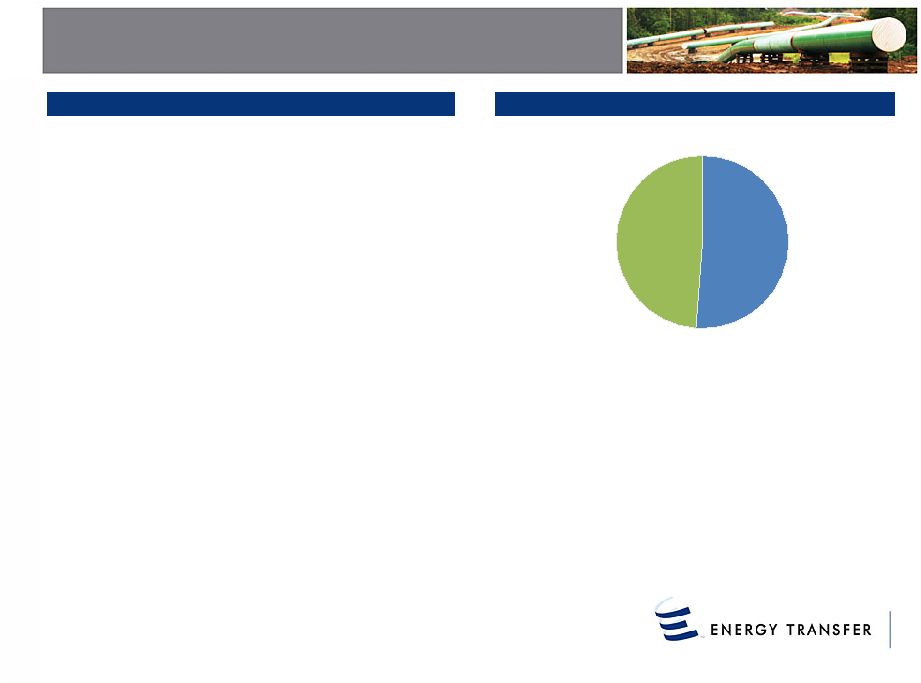

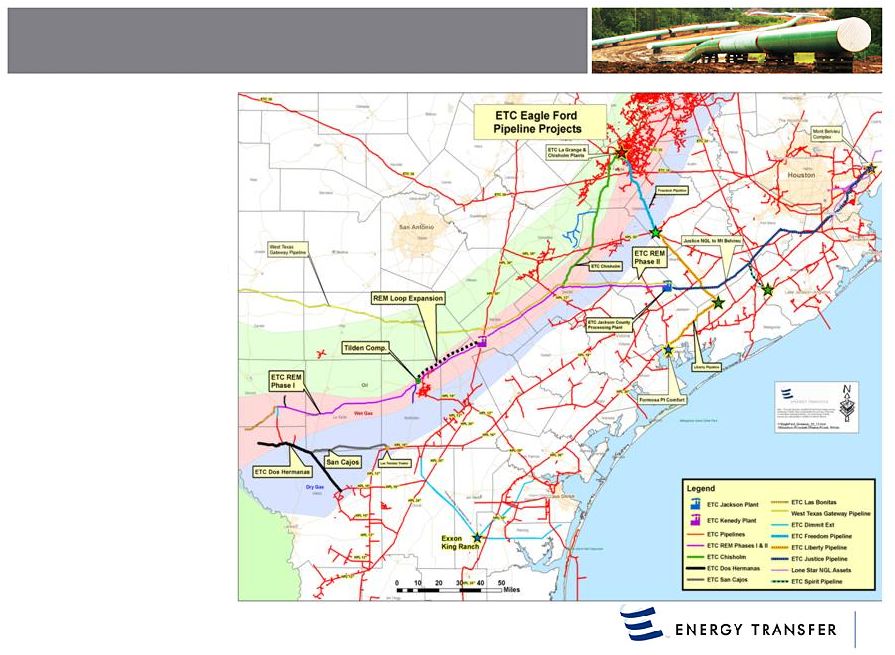

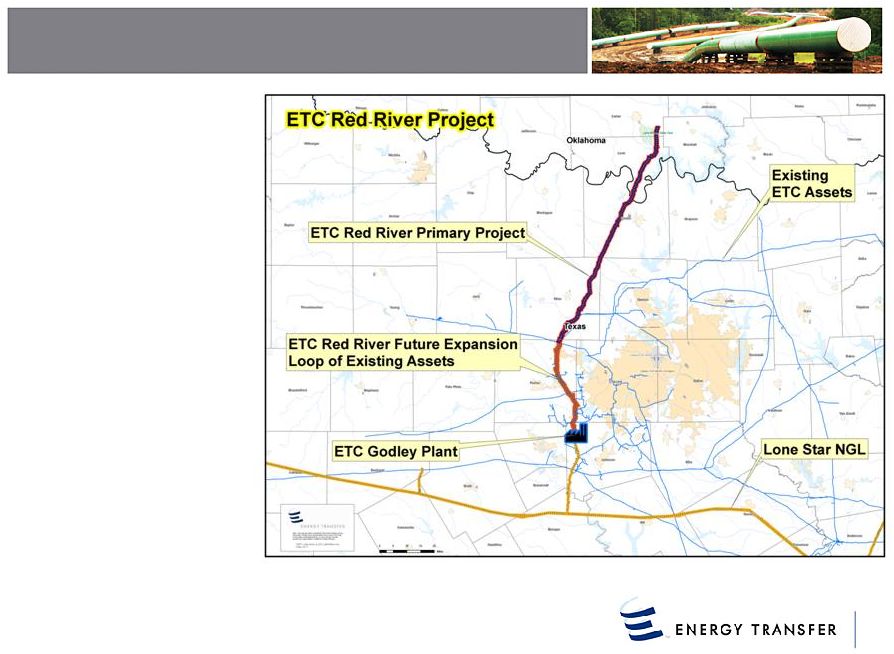

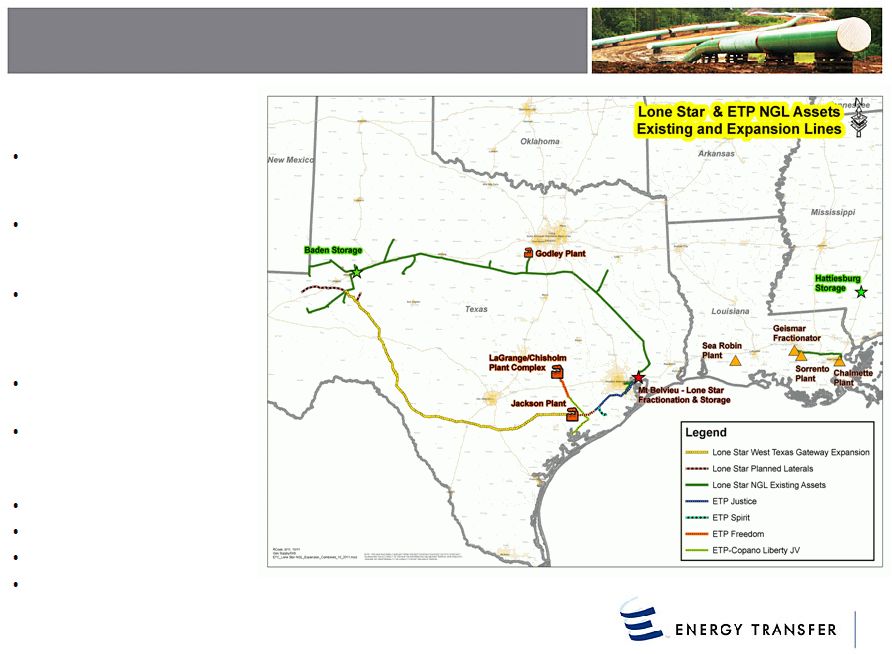

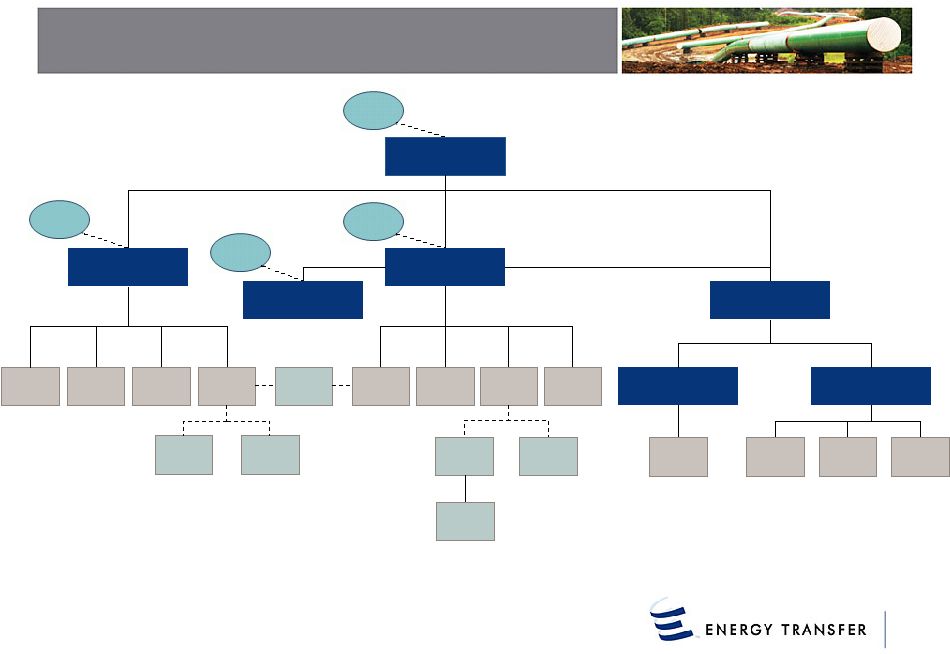

ETP Has Rapidly Evolved… • ETP has undertaken several initiatives to expand the services we can provide to our customers with an emphasis on geographic and fee-based diversification –Joint acquisition of LDH Energy (“LDHE”) in May 2011 with Regency Energy Partners LP (“RGP”) • Diversified into natural gas liquids and enhanced NGL capabilities with emphasis on fee based income –Contribution of propane business to AmeriGas in January 2012 • Minimized exposure to weather sensitive non-core business and deleveraged balance sheet through tender offer –ETE’s acquisition of Southern Union (“SUG”) and drop down of a 50% interest in Citrus to ETP in March 2012 • Expanded geographic reach with emphasis on fee based income –Announced the pending acquisition of Sunoco, Inc. (“SUN”) in April 2012; scheduled to close October 2012 • Creates “best in class” natural gas, crude oil, NGL and refined product logistics and transportation platform –Announced the pending dropdown of a portion of SUG to ETP HoldCo Corp, a new ETP-controlled entity to be jointly owned by ETP and ETE, in June 2012 • Transfers operational control of SUG assets to ETP and begins simplification of overall structure 2004 – 2007 2008 – 2009 2010 – 2011 2012 Acquired TUFCO Pipeline, Houston Pipeline and Transwestern Interstate Pipeline Completed the first 42-inch diameter natural gas pipeline in the state of Texas in 2007 Initiated open season for new interstate gas pipeline, Midcontinent Express Pipeline (“MEP”), a 50/50 joint venture with Kinder Morgan Energy Partners (“KMP”) MEP completed and placed in- service Completed Phoenix and San Juan projects, expanding Transwestern Pipeline Initiated open season for new interstate gas pipeline, Tiger Pipeline Initiated open season for new interstate gas pipeline, Fayetteville Express Pipeline (“FEP”), a 50/50 joint venture with KMP FEP and Tiger completed ahead of schedule and significantly under budget ETP and Regency acquired LDHE and formed Lone Star NGL JV Lone Star NGL JV announced new Mont Belvieu fractionation plant and West Texas NGL pipeline projects to significantly expand liquids platform Expansion of Eagle Ford shale projects with the Rich Eagle Ford Mainline (“REM”) pipeline and new processing facility in Jackson County, TX Completed contribution of propane business to AmeriGas Partners, L.P. ETP acquired 50% interest in Citrus, which owns Florida Gas Transmission Announced a second Mont Belvieu fractionation plant and expansion of Eagle Ford projects supported by long-term fee- based contracts ETP announces acquisition of SUN, expanding into crude oil, NGLs and refined product logistics and transportation 5 |