SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a)

of the Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

¨ | Preliminary Proxy Statement | ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |||

x | Definitive Proxy Statement | |||||

¨ | Definitive Additional Materials | |||||

¨ | Soliciting Material Pursuant to 14a-11(c) or 14a-12 |

BOSTON COMMUNICATIONS GROUP, INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| x | No fee required. |

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: |

| (2) | Aggregate number of securities to which transaction applies: |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of transaction: |

| (5) | Total fee paid: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount Previously Paid: |

| (2) | Form, Schedule or Registration Statement No.: |

| (3) | Filing Party: |

| (4) | Date Filed: |

Boston Communications Group, Inc.

100 Sylvan Road

Woburn, Massachusetts 01801

Notice of Annual Meeting of Shareholders

to be Held On Tuesday, June 3, 2003

The Annual Meeting of Shareholders of Boston Communications Group, Inc. (the “Company”) will be held on Tuesday, June 3, 2003, at the Company, 100 Sylvan Road, Woburn, Massachusetts at 9:00 a.m., local time, to consider and act upon the following matters:

| 1. | To elect Gerald S. McGowan, Gerald Segel and Daniel E. Somers as Class I Directors, to serve for a three-year term. |

| 2. | To approve an amendment to the Company’s 2000 Stock Option Plan increasing the number of shares of Common Stock available for issuance thereunder from 1,250,000 to 1,750,000 shares. |

| 3. | To ratify the selection of Ernst & Young LLP by the Board of Directors as the Company’s independent auditors for the current fiscal year. |

| 4. | To transact such other business as may properly come before the meeting or any adjournment thereof. |

The Board of Directors has no knowledge of any other business to be transacted at the meeting.

Shareholders of record at the close of business on April 24, 2003 will be entitled to notice of and to vote at the meeting or any adjournment thereof. The stock transfer books of the Company will remain open.

By Order of the Board of Directors,

Alan J. Bouffard,

Clerk

Woburn, Massachusetts

April 29, 2003

WHETHER OR NOT YOU EXPECT TO ATTEND THE MEETING, PLEASE COMPLETE, DATE AND SIGN THE ENCLOSED PROXY AND MAIL IT PROMPTLY IN THE ENCLOSED ENVELOPE IN ORDER TO ENSURE REPRESENTATION OF YOUR SHARES. NO POSTAGE NEED BE AFFIXED IF THE PROXY IS MAILED IN THE UNITED STATES.

Boston Communications Group, Inc.

100 Sylvan Road

Woburn, Massachusetts 01801

Proxy Statement for the Annual Meeting of Shareholders

to be Held on June 3, 2003

This Proxy Statement is furnished in connection with the solicitation of proxies by the Board of Directors of Boston Communications Group, Inc. (the “Company”) for use at the Annual Meeting of Shareholders to be held on June 3, 2003 and at any adjournments of that meeting (the “Annual Meeting”). All proxies will be voted in accordance with the shareholders’ instructions, and if no choice is specified, the proxies will be voted in favor of the matters set forth in the accompanying Notice of Meeting. Any proxy may be revoked by a shareholder at any time before its exercise by delivery of written revocation or a subsequently dated proxy to the Clerk of the Company or by voting in person at the Annual Meeting. Attendance at the Annual Meeting will not be deemed to revoke a proxy unless the stockholder gives affirmative notice at the Annual Meeting that the stockholder intends to revoke the proxy and vote in person.

The Company’s 2002 Annual Report to Shareholders is being mailed to shareholders concurrently with this Proxy Statement on or about April 29, 2003.

A copy of the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2002, as filed with the Securities and Exchange Commission, except for exhibits, will be furnished, without charge to any shareholder upon written request to the Company, Boston Communications Group, Inc., 100 Sylvan Road, Woburn, Massachusetts 01801.

Voting Securities and Votes Required

At the close of business on April 24, 2003, the record date for the determination of shareholders entitled to notice of and to vote at the Annual Meeting, there were outstanding and entitled to vote an aggregate of 17,958,430 shares of common stock, $.01 par value per share, of the Company (the “Common Stock”), constituting all of the voting stock of the Company. Holders of Common Stock are entitled to one vote per share.

The presence or representation by proxy of the holders of a majority of the number of shares of Common Stock issued, outstanding and entitled to vote at the Annual Meeting constitutes a quorum for the transaction of business at the Annual Meeting. Shares of Common Stock represented in person or by proxy (including shares which abstain or do not vote with respect to one or more of the matters presented for shareholder approval) will be counted for purposes of determining whether a quorum is present.

The affirmative vote of the holders of a plurality of the shares of Common Stock present or represented and voting at the Annual Meeting is required for the election of directors. The affirmative vote of the holders of a majority of the shares of Common Stock present or represented and voting at the Annual Meeting is required for approval of the amendment to the 2000 Stock Option Plan and the ratification of the selection of Ernst & Young LLP as the Company’s independent auditors for the current fiscal year.

Shares that abstain from voting as to a particular matter, and shares held in “street name” by brokers or nominees who indicate on their proxies that they do not have discretionary authority to vote such shares as to a particular matter, will not be counted as votes in favor of such matter and will also not be counted as votes cast or shares voting on such matter. Accordingly, abstentions and “broker non-votes” will have no effect on the voting on matters, such as the ones presented for shareholder approval at this Annual Meeting, that require the affirmative vote of a certain percentage of the shares voting on the matter.

Security Ownership of Certain Beneficial Owners and Management

The following table sets forth certain information as of February 28, 2003, with respect to the beneficial ownership of the Company’s Common Stock by (i) each person known by the Company to beneficially own more than 5% of the outstanding shares of Common Stock, (ii) each director and each person nominated to become a director of the Company, (iii) each executive officer of the Company named in the Summary Compensation Table set forth under the caption “Executive Compensation” below and (iv) all current directors and executive officers of the Company as a group. On February 28, 2003 there were 17,759,782 shares of Common Stock outstanding.

Beneficial Owner | Number of Shares Beneficially Owned(1) | Percentage of Common Stock Outstanding (2) | |||

Barclays Global Investors (3) 45 Fremont Street San Francisco, CA 94105 | 1,277,699 | 7.19 | % | ||

Cannell Capital LLC(4) 150 California Street San Francisco, CA 94111 | 978,600 | 5.51 | % | ||

Paul J. Tobin (5) | 510,166 | 2.86 | % | ||

E.Y. Snowden (6) | 386,298 | 2.13 | % | ||

Frederick von Mering (7) | 305,132 | 1.70 | % | ||

Brian E. Boyle (8) | 264,000 | 1.48 | % | ||

William D. Wessman (9) | 115,001 | * |

| ||

Karen A. Walker (10) | 50,295 | * |

| ||

Jerrold D. Adams (11) | 80,450 | * |

| ||

Paul R. Gudonis (12) | 49,000 | * |

| ||

Gerald Segel (13) | 47,000 | * |

| ||

Gerald S. McGowan (14) | 38,000 | * |

| ||

Daniel E. Somers | — | * |

| ||

All current directors and executive officers as a group (15) (12 persons) | 2,163,378 | 11.45 | % |

| * | Less than 1% |

| (1) | Each person has sole investment and voting power with respect to the shares indicated, except as otherwise noted. The number of shares of Common Stock beneficially owned is determined under the rules of the Securities and Exchange Commission and is not necessarily indicative of beneficial ownership for any other purpose. The inclusion herein of any shares of Common Stock deemed beneficially owned does not constitute an admission of beneficial ownership of such shares. |

| (2) | The number of shares deemed outstanding with respect to a named person includes 17,759,782 shares outstanding as of February 28, 2003 plus any shares subject to options held by the person in question that are currently exercisable or exercisable within 60 days after February 28, 2003. |

| (3) | This information is based solely upon a Schedule 13G filed by Barclays Global Investors with the Securities and Exchange Commission on February 12, 2003. |

| (4) | This information is based solely upon a Schedule 13G filed by Cannell Capital LLC with the Securities and Exchange Commission on February 14, 2003. |

2

| (5) | Includes 68,335 shares issuable pursuant to stock options. Includes 246,831 shares held by the Paul J. Tobin 1988 Trust, 182,000 shares held by the Margaret M. Tobin 1988 Trust, and 13,000 shares held by the Tobin Children’s Trust. Mr. Tobin is the trustee of the Paul J. Tobin 1988 Trust. Mr. Tobin’s wife, Margaret M. Tobin, is trustee of the Margaret M. Tobin 1988 Trust. |

| (6) | Includes 373,334 shares issuable pursuant to stock options. Of these, 173,400 are held in trust for the benefit of Mr. Snowden’s children. |

| (7) | Includes 165,322 shares issuable pursuant to stock options. |

| (8) | Includes 138,000 shares issuable pursuant to stock options. Also includes 126,000 shares owned by Sand Drift, Ltd. of which Mr. Boyle is a limited partner. Mr. Boyle disclaims beneficial ownership of these shares, except to the extent of his direct pecuniary interest therein. |

| (9) | Includes 113,801 shares issuable pursuant to stock options. |

| (10) | Includes 49,268 shares issuable pursuant to stock options. |

| (11) | Includes 74,450 shares issuable pursuant to stock options. |

| (12) | Includes 47,000 shares issuable pursuant to stock options. |

| (13) | Consists of 47,000 shares issuable pursuant to stock options. |

| (14) | Includes 16,000 shares issuable pursuant to stock options. |

| (15) | Includes 1,126,511 shares issuable pursuant to stock options. |

ELECTION OF DIRECTORS

The Company’s Board of Directors is divided into three classes, with members of each class holding office for staggered three-year terms. The Board currently consists of three Class I Directors, whose terms expire at the 2003 Annual Meeting of Shareholders, three Class II Directors, whose terms expire at the 2004 Annual Meeting of Shareholders, and three Class III Directors whose terms expire at the 2005 Annual Meeting of Shareholders (in all cases subject to the election of their successors and to their earlier death, resignation or removal).

The persons named in the enclosed proxy will vote to elect Gerald S. McGowan, Gerald Segel and Daniel E. Somers as Class I Directors to serve for a three-year term expiring at the 2006 Annual Meeting of Shareholders, unless authority to vote for the election of the nominees is withheld by marking the proxy to that effect. All nominations to the Board of Directors are made by the Nominating Committee. The Nominating Committee will consider for nomination to the Board of Directors candidates suggested by the stockholders, provided that such recommendations are delivered to the Company, with an appropriate biographical summary, no later than the deadline for submission of stockholder proposals. Each nominee has indicated his willingness to serve, if elected, but if any nominee should be unable to stand for election, proxies may be voted for a substitute nominee designated by the Nominating Committee.

Set forth below are the name, age and certain other information with respect to each director and nominee for director of the Company.

The Board of Directors recommends a vote FOR the election of the nominees.

Nominees for Class I Directors

Gerald S. McGowan, 56, has served as a Director of the Company since November, 2001. Mr. McGowan is a founding principal of the Washington, D.C. law firm, Lukas, McGowan, Nace & Gutierrez where he practiced law for over 20 years. Mr. McGowan was instrumental in founding several telecommunications companies, including Dial Call, Integrated Northcoast and McLang Cellular. From 1996 to 1997 Mr. McGowan was a member of the Board of Directors of the Overseas Private Investment Corporation. From 1992 to 1994 Mr. McGowan was a member of the Board of Directors of the Cellular Telecommunications Industry Association. From January, 1998 until July, 2001 Mr. McGowan was the United States Ambassador to Portugal. Mr. McGowan received his B.S. and J.D. degrees from Georgetown University.

3

Gerald Segel, 82, has served as a Director of the Company since October, 1996. Mr. Segel was Chairman of Tucker Anthony Incorporated from January 1987 until his retirement in May 1990. From 1983 to January 1987 he served as President of Tucker Anthony Incorporated. Mr. Segel is also a director of Hologic, Inc. Mr. Segel received his B.A. from Harvard University.

Daniel E. Somers, 55, became a Director of the Company in March, 2003. Mr. Somers has been Vice Chairman of Blaylock & Partners LP, a minority-owned investment-banking group in New York since January 2002. He retired in October 2001 as President and Chief Executive Officer at AT&T Broadband, which provides local and long distance service, high-speed Internet access and home entertainment service. Previously, Mr. Somers was Senior Executive Vice President and Chief Financial Officer of AT&T from May 1997 to December 1999. Prior to joining AT&T, Mr. Somers was Chairman and Chief Executive Officer of Bell Cablemedia, plc, of London for two years. From 1992 to 1995, he was Executive Vice President and Chief Financial Officer of Bell Canada International, Inc. Prior to joining Bell Canada, Mr. Somers held a number of senior executive, financial and operating-management positions with Radio Atlantic Holdings Ltd. and Imasco Ltd. Mr. Somers received a B.S. degree in finance from Stonehill College in 1969. Mr. Somers is Vice Chairman of the Board of Trustees of Stonehill College, and a director of Lubrizol, Inc. and Raindance Communications, Inc.

Class II Directors

Jerrold D. Adams, 63, has served as a Director of the Company since April 1996. From July 1999 to March 2000, Mr. Adams was Acting General Manager of the Company’s Systems Division. From March 1997 to March 1999, Mr. Adams was President and Chief Executive Officer of AirNet Communications Corp., which designs, develops and manufactures wireless infrastructure for the U.S. and international PCS markets. From 1991 until February 1997, Mr. Adams was President and Chief Operating Officer of Iridium, Inc., an international consortium developing a worldwide communications system for portable hand-held telephones. Prior to that, Mr. Adams served as Director of PCN Operations in Europe of Motorola from 1990 to 1991, Senior Vice President of McCaw Cellular, a national non-wireline cellular company, from 1988 to 1990, and General Manager of Metro One, a New York non-wireline cellular carrier, from 1986 to 1988. Mr. Adams received his B.A. from Coe College and attended the Wharton School of Business and the University of Illinois. Mr. Adams is currently serving as Chairman of the Board of Trustees for Coe College.

Paul R. Gudonis, 49, has served as a Director of the Company since April 1996. Mr. Gudonis currently serves as an Executive Vice President for Level 3 Communications, an international communications and information services company. Mr. Gudonis served as Chairman and Chief Executive Officer of Genuity Inc. (formerly, GTE Internetworking), which provided business Internet services, from June, 2000 when it became an independent public company until February, 2003, when its assets were acquired by Level 3 Communications, following Genuity’s filing for bankruptcy protection under Chapter 11 in November, 2002. Prior to that, Mr. Gudonis had served as President of GTE Internetworking since July 1997, when GTE acquired BBN Corporation, the parent company of BBN Planet, of which Mr. Gudonis had been President since November 1994. From 1991 to November 1994 Mr. Gudonis served as General Manager of the Communications Industry Group International division of EDS Corporation. From January 1989 until October 1990, Mr. Gudonis served as Senior Vice President and General Manager of APPEX Corp. Mr. Gudonis received his B.S. from Northwestern University and his M.B.A. from Harvard Graduate School of Business Administration.

Frederick E. von Mering, 50, has served as a Director of the Company since 1989 and as its Vice President, Corporate Development since April 1999. From 1989 until March 1999, Mr. von Mering served as the Company’s Chief Financial Officer. From 1980 to 1986, Mr. von Mering served as Regional Vice President and General Manager for the paging division of Metromedia, Inc., a communications company. From 1975 to 1979, Mr. von Mering was employed at Coopers & Lybrand LLP. Mr. von Mering received his B.A. in accounting from Boston College and his M.B.A. from Babson College.

4

Class III Directors

Brian E. Boyle, 55, has served as a Director and Vice Chairman of the Company since February 1996. Mr. Boyle was employed by the Company from January 1994 to February 1996 as Chairman, New Wireless Services and from February 1996 through August, 2001 as Vice Chairman. Mr. Boyle is Chairman of GoldK, Inc., which provides online management of 401(k) plans. Mr. Boyle also served as CEO of GoldK, Inc. from January 2000 through November 2002. From July 1990 to September 1993, Mr. Boyle served as Chairman and Chief Executive Officer of Credit Technologies, Inc. (now Lightbridge, Inc.), a supplier of customer application software for the wireless telephone industry. Prior to 1990, Mr. Boyle founded and operated a number of organizations servicing the telecommunications industry, including APPEX Corp. (now EDS Personal Communications Division of EDS Corporation, a global telecommunications service company) and Leasecomm Corp. (now MicroFinancial Incorporated), a micro-ticket leasing company. Mr. Boyle earned his B.A. in mathematics and economics from Amherst College and his Ph.D. in operations research from M.I.T. Mr. Boyle is a Director of MicroFinancial Incorporated, as well as of several private companies.

Edward H. (“E.Y.”) Snowden, 48, has served as a Director of the Company and served as its President and Chief Executive Officer since February 1998. Prior to joining the Company, Mr. Snowden served as President and Chief Operating Officer of American Personal Communications, L.P. d/b/a Sprint Spectrum, a telecommunications company, from February 1994 to December 1997. From June 1990 until February 1994, Mr. Snowden was an Area Vice President at Pacific Bell, Inc., a telecommunications company. Mr. Snowden was the President and then Chief Executive Officer at Universal Optical Company, Inc. from March 1986 to March 1988. Mr. Snowden received his B.S. from Stanford University and his M.B.A. from Harvard Graduate School of Business Administration.

Paul J. Tobin, 60, has served as Chairman of the Board of Directors since February 1996. Mr. Tobin served as the Company’s President and Chief Executive Officer from 1990 until February 1996, and from April 1997 to February 1998. Prior to joining the Company, Mr. Tobin served as President of Cellular One Boston/Worcester from July 1984 to January 1990 and as a Regional Marketing Manager for Satellite Business Systems, a joint venture of IBM, Comsat Corp. and Aetna Life & Casualty from April 1980 to June 1984. Mr. Tobin received his B.S. in economics from Stonehill College and his M.B.A. in marketing and finance from Northeastern University. Mr. Tobin also serves as a member of the Board of Trustees at Stonehill College.

Board and Committee Meetings

The Board of Directors held seven meetings during 2002. Each director attended at least 75% of the aggregate number of Board meetings and meetings held by all committees on which he then served.

The Company has a standing Audit Committee of the Board of Directors composed solely of independent directors. The current members of the Audit Committee are Messrs. Adams, Gudonis, McGowan, Segel and Somers. The Audit Committee held seven meetings during the fiscal year ended December 31, 2002. Information regarding the functions performed by the Audit Committee is set forth in the “Report of the Audit Committee,” included in this proxy statement.

The Company has a standing Compensation Committee of the Board of Directors composed solely of independent directors. The current members of the Compensation Committee are Messrs. Adams, Gudonis, McGowan, Segel and Somers. The Compensation Committee held four meetings during the fiscal year ended December 31, 2002. Information regarding the Company’s compensation practices for 2002 is set forth in the “Report of the Compensation Committee,” included in this proxy statement.

The Company has a standing Nominating Committee of the Board of Directors composed solely of independent directors. The current members of the Nominating Committee are Messrs. Adams, Gudonis, McGowan, Segal and Somers. The Nominating Committee held one meeting during the fiscal year ended December 31, 2002.

5

The Company has also established a standing Corporate Governance Committee of the Board of Directors composed solely of independent directors. The current members of the Corporate Governance Committee are Messrs. Adams, Gudonis, McGowan, Segal and Somers. The Corporate Governance Committee held its first meeting on January 20, 2003.

Director Compensation and Stock Options

Non-employee directors (which consist of Messrs. Adams, Boyle, Gudonis, McGowan, Segel and Somers) receive an annual retainer of $6,000 payable in four equal quarterly installments, plus $1,000 per meeting attended for their services as members of the Board of Directors and are reimbursed for their expenses incurred in connection with attending Board and committee meetings. They also receive an initial grant of 15,000 non-qualified stock options vesting in three equal annual installments commencing on the first anniversary of the date of grant, plus a quarterly grant of 3,000 fully-vested non-qualified stock options (2,000 in 2002) during their term of service on the Board. These options are granted at the fair market value on the date of grant. Directors who serve on the Audit Committee, Compensation Committee, Nominating Committee or Corporate Governance Committee receive $500 for each such committee meeting attended. The Chairperson of each such committee receives an annual retainer of $2,000.

Options to purchase shares of Common Stock may be granted to members of the Board of Directors pursuant to the Company’s stock option plans. On January 25, 2002 the Company granted to each of Messrs. Snowden and von Mering an option to purchase 10,000 shares of the Company’s Common Stock at an exercise price of $7.58 per share. On January 25, 2002 the Company granted to Mr. Tobin an option to purchase 20,000 shares of the Company’s Common Stock at an exercise price of $7.58 per share. On February 15, 2002 the Company granted to each of Messrs. Adams, Boyle, Gudonis, McGowan and Segel an option to purchase 2,000 shares of the Company’s Common Stock at an exercise price of $8.04 per share. On May 15, 2002 the Company granted to each of Messrs. Adams, Boyle, Gudonis, McGowan and Segel an option to purchase 2,000 shares of the Company’s Common Stock at an exercise price of $9.87 per share. On July 12, 2002 the Company granted to each of Messrs. Snowden and Tobin an option to purchase 2,500 shares of the Company’s Common Stock at an exercise price of $7.09 per share. On July 12, 2002 the Company granted to Mr. von Mering an option to purchase 2,000 shares of the Company’s Common Stock at an exercise price of $7.09 per share. On August 15, 2002 the Company granted to each of Messrs. Adams, Boyle, Gudonis, McGowan and Segel an option to purchase 2,000 shares of the Company’s Common Stock at an exercise price of $9.13 per share. On November 15, 2002 the Company granted to each of Messrs. Adams, Boyle, Gudonis, McGowan and Segel an option to purchase 2,000 shares of the Company’s Common Stock at an exercise price of $13.00 per share. All options granted to directors in 2002 were granted at an exercise price equal to the fair market value on the date of grant.

Report of the Audit Committee of the Board of Directors

The Audit Committee of the Company’s Board of Directors is composed of five members and acts under a written charter which was most recently amended by the Board of Directors on March 19, 2003. A copy of this charter is attached to this proxy statement as Appendix A. The members of the Audit Committee are independent directors, as defined by its charter and the rules of the NASDAQ Stock Market.

The Audit Committee reviewed the Company’s audited financial statements for the fiscal year ended December 31, 2002 and discussed these financial statements with the Company’s management. As appropriate, the Audit Committee reviews and evaluates, and discusses with the Company’s management, internal accounting, financial and auditing personnel and the independent auditors, the following:

| • | the plan for, and the independent auditors’ report on, each audit of the Company’s financial statements; |

| • | the Company’s financial disclosure documents, including all financial statements and reports filed with the Securities and Exchange Commission or sent to shareholders; |

| • | management’s selection, application and disclosure of critical accounting policies; |

| • | changes in the Company’s accounting practices, principles, controls or methodologies; |

6

| • | significant developments or changes in accounting rules applicable to the Company; and |

| • | the adequacy of the Company’s internal controls and accounting, financial and auditing personnel. |

The Audit Committee also reviewed and discussed the audited financial statements and the matters required by Statement on Auditing Standards 61 (Communication with Audit Committees) with Ernst & Young LLP, the Company’s independent auditors. SAS 61 requires the Company���s independent auditors to discuss with the Company’s Audit Committee, among other things, the following:

| • | methods to account for significant unusual transactions; |

| • | the effect of significant accounting policies in controversial or emerging areas for which there is a lack of authoritative guidance or consensus; |

| • | the process used by management in formulating particularly sensitive accounting estimates and the basis for the auditors’ conclusions regarding the reasonableness of those estimates; and |

| • | disagreements with management over the application of accounting principles, the basis for management’s accounting estimates and the disclosures in the financial statements. |

The Company’s independent auditors also provided the Audit Committee with the written disclosures and the letter required by Independence Standards Board Standard No. 1 (Independence Discussions with Audit Committees). Independence Standards Board Standard No. 1 requires auditors annually to disclose in writing all relationships that, in the auditor’s professional opinion, may reasonably be thought to bear on independence, confirm their perceived independence and engage in a discussion of independence. The Audit Committee discussed with the independent auditors the matters disclosed in this letter and their independence from the Company.

Based on its discussions with management and the independent auditors, and its review of the representations and information provided by management and the independent auditors, the Audit Committee recommended to the Company’s Board of Directors that the audited financial statements be included in the Company’s Annual Report on Form 10-K for the year ended December 31, 2002.

Management is responsible for the Company’s financial reporting process including its system of internal control and for the preparation of consolidated financial statements in accordance with generally accepted accounting principles. The Company’s independent auditors, Ernst & Young LLP, are responsible for auditing those financial statements. The Audit Committee’s responsibility is to monitor and review these processes. It is not the Audit Committee’s duty or responsibility to conduct auditing or accounting reviews or procedures. Therefore, the Audit Committee has relied, without independent verification, on management’s representation that the financial statements have been prepared with integrity and objectivity and in conformity with accounting principles generally accepted in the United States of America and on the representations of Ernst & Young LLP included in their report on the Company’s financial statements. The Audit Committee’s oversight does not provide it with an independent basis to determine that management has maintained appropriate accounting and financial reporting principles or policies, or appropriate internal controls and procedures designed to assure compliance with accounting standards and applicable laws and regulations. Furthermore, the Audit Committee’s deliberations and discussions with management and Ernst & Young LLP do not assure that the Company’s financial statements are presented in accordance with generally accepted accounting principles, that the audit of the Company’s financial statements has been carried out in accordance with generally accepted auditing standards or that Ernst & Young LLP are, in fact, independent of the Company and management.

By the Audit Committee of the Board of Directors of Boston Communications Group, Inc.

Audit Committee Members

Jerrold D. Adams

Paul R. Gudonis

Gerald S. McGowan

Gerald Segel

Daniel E. Somers

7

Executive Compensation

The following table sets forth certain compensation information, for the fiscal years indicated, of the Company’s Chief Executive Officer during the year ended December 31, 2002 and the four other most highly compensated executive officers in 2002 (collectively, the “Named Executive Officers”):

SUMMARY COMPENSATION TABLE

Annual Compensation | Long Term Compensation | |||||||||||

Name and Principal Position | Fiscal Year | Salary ($) | Bonus ($)(1) | Other Annual Compensation ($) (2) | Securities Underlying Options (3) | All Other Compensation ($) (2) | ||||||

Paul J. Tobin Chairman of the Board of Directors | 2002 2001 2000 | 180,000 163,661 161,326 | 20,000 5,000 — | — — — | 22,500 25,000 40,000 | — — — | ||||||

Edward H. Snowden President, Chief Executive Officer, Director | 2002 2001 2000 | 315,000 296,667 275,000 | 180,000 49,375 149,500 | — — — | 12,500 15,000 10,000 | — — — | ||||||

Frederick E. von Mering Vice President, Corporate Development Director | 2002 2001 2000 | 176,319 167,208 156,013 | 60,000 24,687 74,750 | — — — | 12,000 14,000 20,000 | — — — | ||||||

William D. Wessman Executive Vice President, Chief Technology Officer | 2002 2001 2000 | 200,545 188,867 174,207 | 60,000 24,687 74,750 | — — — | 42,500 15,000 62,500 | — — — | ||||||

Karen A. Walker Vice President, Chief Financial Officer | 2002 2001 2000 | 183,366 172,689 157,355 | 60,000 24,687 74,750 | — — — | 42,500 15,000 30,000 | — — — | ||||||

| (1) | Bonuses earned in a fiscal year but which were paid in the subsequent fiscal year are reflected in the year in which they were earned. |

| (2) | In accordance with the rules of the Securities and Exchange Commission, other compensation in the form of perquisites and other personal benefits has been omitted because such perquisites and other personal benefits constitute less than the lesser of $50,000 or ten percent of the total salary and bonus reported for the executive officer during such fiscal year. |

| (3) | The Company did not make any restricted stock awards, grant any stock appreciation rights or make any long-term incentive plan payouts during 2002, 2001 or 2000. |

8

Option Grants

The following table sets forth certain information concerning option grants during the fiscal year ended December 31, 2002 to the Named Executive Officers and the number and value of the unexercised options held by such persons on December 31, 2002.

OPTION GRANTS IN LAST FISCAL YEAR

INDIVIDUAL GRANTS

Potential Realizable Value at Assumed Annual Rates of Stock Price Appreciation for Option Term (3) | |||||||||||||

Name | Number of Securities Underlying Options Granted (1) | % of Total Options Granted to Employees in Fiscal Year | Exercise Price $/share (2) | Expiration Date | 5% ($) | 10% ($) | |||||||

Paul J. Tobin | 20,000 2,500 | (4) (5) | 3.69 .46 | 7.58 7.09 | 1/25/12 7/12/12 | 95,340 11,147 | 240,611 28,249 | ||||||

Edward H. Snowden | 10,000 2,500 | (4) (5) | 1.85 .46 | 7.58 7.09 | 1/25/12 7/12/12 | 47,670 11,147 | 120,806 28,249 | ||||||

Frederick E. von Mering | 10,000 2,000 | (4) (5) | 1.85 .37 | 7.58 7.09 | 1/25/12 7/12/12 | 47,670 8,918 | 120,806 22,599 | ||||||

William D. Wessman | 10,000 2,500 30,000 | (4) (5) (5) | 1.85 .46 5.54 | 7.58 7.09 8.89 | 1/25/12 7/12/12 9/4/12 | 47,670 11,147 167,726 | 120,806 28,249 425,051 | ||||||

Karen A. Walker | 10,000 2,500 30,000 | (4) (5) (5) | 1.85 .46 5.54 | 7.58 7.09 8.89 | 1/25/12 7/12/12 9/4/12 | 47,670 11,147 167,726 | 120,806 28,249 425,051 | ||||||

| (1) | No restricted stock or stock appreciation rights were granted in 2002. |

| (2) | The exercise price is equal to the fair market value of the Company’s Common Stock on the date of grant. |

| (3) | Amounts represent hypothetical gains that could be achieved for the respective options if exercised at the end of the option term. These gains are based on assumed rates of stock appreciation of 5% and 10% compounded annually from the date the respective options were granted to their expiration date. The assumed rates of appreciation are mandated by the rules of the Securities and Exchange Commission and do not represent the Company’s estimate or projection of future stock prices. This table does not take into account any appreciation or depreciation in the price of the Common Stock to date. Actual gain, if any, on stock option exercises will depend on future performance of the Common Stock and the date on which the options are exercised. Values shown are net of the option exercise price, but do not include deductions for tax or other expenses associated with the exercise. |

| (4) | The stock options vested on 2/28/2003. |

| (5) | The stock options vest in three equal annual installments over a three-year period commencing on the first anniversary of the date of grant. |

9

Option Exercises and Holdings

The following table sets forth certain information concerning each exercise of stock options during the year ended December 31, 2002 by each of the Named Executive Officers, and the number and value of unexercised options held by each of the Named Executive Officers on December 31, 2002.

AGGREGATED OPTION EXERCISES IN LAST FISCAL YEAR

AND FISCAL YEAR-END OPTION VALUES

Number of Securities Underlying Options at Fiscal Year End | Value of Unexercised In-the-Money Options at Fiscal Year End ($)(2) | |||||||||||

Name | Shares Acquired on Exercise | Value Realized ($) (1) | Exercisable | Unexercisable | Exercisable | Unexercisable | ||||||

Paul J. Tobin | — | — | 41,668 | 65,832 | 184,287 | 298,513 | ||||||

Edward H. Snowden | 42,900 | 272,143 | 372,101 | 32,499 | 2,101,775 | 164,544 | ||||||

Frederick E. von Mering | — | — | 151,989 | 34,665 | 1,003,981 | 158,476 | ||||||

William D. Wessman | — | — | 83,802 | 79,998 | 541,024 | 369,099 | ||||||

Karen A. Walker | 29,600 | 205,974 | 32,135 | 76,765 | 123,054 | 310,190 | ||||||

| (1) | Based on the closing sale price of Common Stock as reported by the NASDAQ National Market on the date of exercise less the option exercise price. |

| (2) | The per share value of unexercised in-the-money options is calculated by subtracting the per share option exercise price from the last per share sale price of the Company’s Common Stock on the NASDAQ National Market on December 31, 2002 ($12.71). |

Employment Agreements with Named Executive Officers

On February 10, 1998, the Company entered into an employment letter agreement with E.Y. Snowden, pursuant to which Mr. Snowden was made the President and Chief Executive Officer and a Director of the Company. The agreement provides for an initial base salary of $250,000 plus an initial performance-based bonus of up to 40% of base salary. These amounts have increased since the original date of the employment agreement. In addition, pursuant to the agreement, Mr. Snowden was granted a non-qualified stock option to purchase 400,000 shares of Common Stock at an exercise price of $7.0625 per share, vesting in five equal annual installments commencing on February 10, 1998. If Mr. Snowden’s employment is terminated without cause, or if there is a change of control which results in his demotion, diminution in responsibilities, or removal from the Board, then the Company will pay, as severance, his base salary until such time as he is otherwise employed, up to a maximum of twelve months.

10

Securities Authorized for Issuance Under Equity Compensation Plans. The following table provides information about the securities authorized for issuance under the Company’s equity compensation plans as of December 31, 2002.

Equity Compensation Plan Information

Plan Category | Number of securities to be issued upon exercise of outstanding options, | Weighted-average exercise price of outstanding options, warrants and rights | Number of securities remaining available for future issuance under equity compensation plans (excluding securities reflected in column (a) | |||

Equity compensation plans approved by security holders | 2,261,311(1) | $8.43 | 284,869(2) | |||

Equity compensation plans not approved by security holders(3) | 630,984 | $8.13 | 422,591 | |||

Total | 2,892,295(1) | $8.37 | 707,460(2) |

| (1) | Includes 39,534 shares purchased by employees under the Company’s 2001 Employee Stock Purchase Plan on February 28, 2003 at a price of $7.56 per share. |

| (2) | Includes 122,033 shares available for future issuance under the Company’s 2001 Employee Stock Purchase Plan. |

| (3) | Historically, there have been four equity compensation plans which were approved by the Board of Directors of the Company but not by the security holders. In February 1998 the Board of Directors granted a non-qualified stock option for the purchase of up to 400,000 shares of the Company’s common stock to E.Y. Snowden pursuant to his employment agreement. (See Employment Agreements with Named Executive Officers, above.) This option was issued at an exercise price of $7.0625 per share (the fair market value on the date of grant), and vested in five equal annual installments commencing on February 10, 1998. The option is for a term of ten years from the date of grant. In June 1999 the Board of Directors approved the grant of non-qualified stock options for the purchase of up to 110,000 shares of common stock in connection with the engagement of Jerrold D. Adams as Acting General Manager of the Company’s Systems Division. Mr. Adams completed this engagement in March, 2000. Options for the purchase of up to 64,075 shares of common stock have been granted at a weighted average exercise price of $11.93 per share. These options were fully vested at the date of grant and are for a term of ten years from the date of grant. In February 2000 the Board of Directors approved a plan reserving 150,000 shares of common stock for issuance upon exercise of non-qualified options. An option for the purchase of these shares was originally granted to Andrew D. Price in order to induce Mr. Price to join the Company as Chief Operating Officer. The option was issued at an exercise price of $7.313 per share, and vested in three equal annual installments commencing on February 1, 2001. The option was for a term of ten years from the date of grant. Upon the termination of Mr. Price’s employment in November 2001, options for 50,000 shares had vested, and the balance was cancelled. Options were issued to other employees of the Company pursuant to the plan at the fair market value on the date of grant. These options generally vest in three equal annual installments commencing on the first anniversary of the date of grant. As of December 31, 2002 there were outstanding options for 85,334 shares at a weighted average exercise price of $7.78. In April 2001 the Board of Directors approved a plan of non-qualified stock options, consisting of 500,000 shares. The plan is a broadly-based plan. Options granted under the plan are for a term of ten years from the date of grant. These options generally vest in three equal annual installments commencing on the first anniversary of the date of grant. Options are issued at the fair market value on the date of grant. As of December 31, 2002 there were outstanding options for 141,000 shares at a weighted average exercise price of $10.20. In the event of a merger, liquidation or acquisition of the Company, the Board of Directors shall provide that the outstanding options be assumed or that equivalent options be substituted for the outstanding options by the acquiring or succeeding corporation, or, if the acquiring or succeeding corporation does not agree to do so, that all of the unexercised options shall be exercisable in full prior to the merger, liquidation or acquisition or that the optionholders receive a cash payment equal to the difference between the acquisition price and the exercise price. |

The shares reserved for issuance under all of the foregoing stock options have been registered with the SEC on Forms S-8.

11

REPORT OF THE COMPENSATION COMMITTEE

The Compensation Committee of the Board of Directors (the “Compensation Committee”) is currently composed of five non-employee directors, Jerrold D. Adams, Paul R. Gudonis, Gerald S. McGowan, Gerald Segel and Daniel E. Somers. The Compensation Committee is responsible for establishing and administering the policies which govern both annual compensation and performance-based equity ownership of the Company’s employees, including its executive officers. In addition, the Compensation Committee administers and has authority to grant stock options under the Company’s stock option plans to all employees, directors and officers of the Company, including those persons who are required to file reports (“Reporting Persons”) pursuant to Section 16(a) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). The Compensation Committee also administers the Company’s 1996 Employee Stock Purchase Plan and the Company’s 2001 Employee Stock Purchase Plan.

This report is submitted by the Compensation Committee and addresses the Company’s policies for 2002 as they apply to the Company’s executive officers.

Policies and Philosophy

The Company’s executive compensation program is structured and administered to achieve three broad goals in a manner consistent with shareholder interests. First, the Compensation Committee structures executive compensation programs and decisions regarding individual compensation in a manner that the Compensation Committee believes will enable the Company to attract and retain key executives. Second, the Compensation Committee establishes compensation programs that are designed to reward executives for the achievement of specified business objectives of the Company. Finally, the Compensation Committee designs the Company’s executive compensation programs to provide executives with long-term equity ownership opportunities in the Company in an attempt to align executive and shareholder interests.

In evaluating both individual and corporate performance for purposes of determining salary and bonus levels and stock option grants, the Compensation Committee places significant emphasis on the extent to which strategic and business plan goals are met, including the progress and success of the Company with respect to matters such as achieving operating budgets, establishing strategic marketing, distribution and development alliances, product development and enhancement of the Company’s strategic position, as well as on the Company’s overall financial performance.

Executive Compensation in Fiscal 2002

The compensation programs for the Company’s executives established by the Compensation Committee consist of three elements based upon the foregoing objectives: (i) base salary and benefits competitive with the marketplace, (ii) bonus grants and (iii) stock-based equity incentives in the form of participation in the Company’s stock plans. The Compensation Committee believes that providing a base salary and benefits to its executive officers that are competitive with the marketplace enables the Company to attract and retain key executives. In addition, the Compensation Committee believes that bonuses based on both corporate and individual performance provide incentives to its executive officers that align their interests with those of the Company as a whole. The Compensation Committee generally provides executive officers discretionary stock option awards to reward them for achieving specified business objectives and to provide them with long-term ownership opportunities that are aligned with the ownership interests of the Company’s shareholders. In evaluating the salary level, bonuses and equity incentives to award to each current executive officer, the Compensation Committee examines the progress which the Company has made in areas under the particular executive officer’s supervision, such as development or sales, and the overall performance of the Company.

In determining the salary and bonus targets of each executive officer, including the Named Executive Officers, the Compensation Committee and the Board of Directors consider numerous factors such as (i) the

12

individual’s performance, including the expected contribution of the executive officer to the Company’s goals, (ii) the Company’s long-term needs and goals, including attracting and retaining key management personnel, and (iii) the Company’s competitive position, including the compensation of executive officers at comparable companies that are familiar to members of the Compensation Committee. The companies used by the Compensation Committee to compare executive compensation are not the companies included in the Stock Performance Graph below, but instead are companies of which the members of the Compensation Committee have specific knowledge and are considered as of the time those companies were at similar stages of development as the Company. To the extent determined to be appropriate, the Compensation Committee also considers general economic conditions and the historic compensation levels of the individual. The Compensation Committee believes that the salary levels of its executive officers are in the middle third when compared to the compensation levels of companies at similar stages of development as the Company.

The Company has an Executive Incentive Compensation Plan for all members of senior management that consists of two components: Bonus Incentive Compensation and Stock Incentive Compensation. The Bonus Incentive Compensation consists of a targeted potential amount for each executive, with 80% based upon the Company’s financial performance on a quarterly basis and 20% based upon individual qualitative performance. For 2002, targeted financial goals were met and, therefore, the potential bonus amount for each member of senior management was paid out in full. The Stock Incentive Compensation consists of stock option grants to each executive officer with the vesting schedule of such grants determined by the Company’s financial performance. For 2002, stock options granted as Stock Incentive Compensation vested in full on February 28, 2003, because the Company exceeded the EBIT goals specified in the Plan.

In October, 2002, the Company approved a Supplemental Executive Retirement Plan for the Company’s senior management team. There are fourteen participants in the plan, including the Company’s executive officers. The plan provides retirement income to participants beginning at age 65, payable to age 80. The amount of the payment is calculated to be 3.89% of final average earnings times the number of years of service with the Company, to a maximum of 70% of final average earnings, reduced by the amount of social security benefits, any benefits from a defined benefit plan of a former employer and any benefits from a defined contribution plan with a matching employer contribution other than a 401K plan. Vesting of benefits begins after five years of service on the senior management team, at which time 25% of the accrued benefit is vested. An additional 15% is vested for each additional year of service, with accrued benefits being fully vested after ten years of service. Benefits become fully vested upon death prior to retirement or upon merger or acquisition of the Company. Early retirement is permitted only with the consent of the Board of Directors, and, if allowed, the benefit is reduced by 6% times the number of years prior to age 65 that retirement occurs.

Benefits

The Company’s executive officers are entitled to receive medical benefits and to participate in the Company’s 401(k) Savings Plan on the same basis as other full-time employees of the Company. The Company provides to its executive officers life insurance with the amount of coverage equal to two times annual base salary, full salary continuation for up to six months in the event of short term disability, and long term care insurance to provide for nursing home or home health care for up to six years. The Company’s 1996 Employee Stock Purchase Plan and 2001 Employee Stock Purchase Plan, which are available to nearly all employees, including executive officers and directors who are employees, allow participants to purchase shares at a discount of 15% from the fair market value at the beginning or end of the applicable purchase period.

Compensation of the Chief Executive Officer in Fiscal 2002

The compensation philosophy applied by the Compensation Committee in establishing the compensation for the Company’s President and Chief Executive Officer is the same as for the other senior management of the Company — to provide a competitive compensation opportunity that rewards performance.

13

Mr. Snowden served in the positions of President, Chief Executive Officer and a director of the Company during the year ended December 31, 2002 and he received a salary of $315,000 for fiscal 2002. The Compensation Committee believes that this amount is in the middle third of the compensation of Chief Executive Officers at other publicly-traded companies at the same stage of development as the Company. The Company paid Mr. Snowden a bonus of $180,000 for performance in 2002, based upon the achievement of individual and Company performance goals set by the Compensation Committee. On January 25, 2002 the Company granted to Mr. Snowden an option to purchase 10,000 shares of the Company’s Common Stock at an exercise price of $7.58 per share (the fair market value on the date of grant), which vested in full on February 28, 2003. On July 12, 2002 the Company granted to Mr. Snowden an option to purchase 2,500 shares of the Company’s Common Stock at an exercise price of $7.09 per share (the fair market value on the date of grant), which vests in three equal annual installments.

Compliance with Section 162(m) of the Internal Revenue Code of 1986

Section 162(m) of the Internal Revenue Code or 1986, as amended (the “Code”), generally disallows tax deductions to publicly-traded corporations for compensation over $1,000,000 paid to the corporation’s Chief Executive Officer or any of its other four most highly compensated executive officers. Certain compensation, including qualifying performance-based compensation, will not be subject to this disallowance if certain requirements are met. The Company currently intends to structure the compensation arrangements of its executive officers in a manner that will avoid disallowances under Section 162(m). In addition, the Compensation Committee reserves the right to use its judgment to authorize compensation payments that may be subject to the limit when the Compensation Committee believes such payments are appropriate and in the best interests of the Company and its stockholders, after taking into consideration changing business conditions and the performance of its employees.

COMPENSATION COMMITTEE

Jerrold D. Adams

Paul R. Gudonis

Gerald S. McGowan

Gerald Segel

Daniel E. Somers

Reports Under Section 16(a) of the Exchange Act

Based solely on its review of copies of reports filed by Reporting Persons required to file such reports pursuant to Section 16(a) of the Exchange Act, the Company believes that all filings required to be made by Reporting Persons of the Company were timely made in accordance with the requirements of the Exchange Act, except as follows: In October, 2002, Forms 4 were filed reporting the grant by the Company of 30,000 stock options in September 2002 to each of Mr. Wessman and Ms. Walker, and the sale by Mr. Snowden of 2,200 shares of stock in January, 2002, which were inadvertently not reported previously. On December 18, 2002 Mr. Tobin reported the sale by the Margaret M. Tobin Trust of 65,600 shares which occurred on December 10 – 13, 2002, but about which no information was received from the broker until December 17, 2002.

14

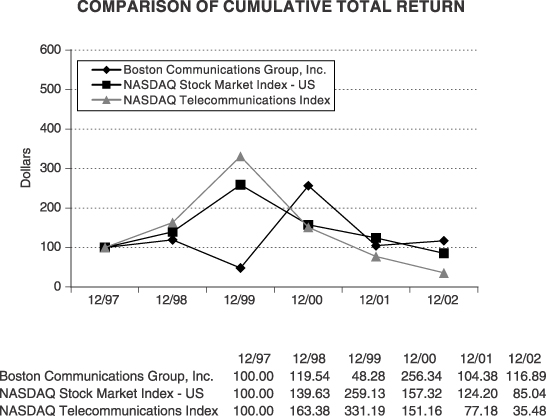

STOCK PERFORMANCE GRAPH

The following graph compares the cumulative total shareholder return on the Common Stock of the Company during the period from December 31, 1997 to December 31, 2002 with the cumulative total return over the same period of the NASDAQ National Market (U.S. Companies) (the “NASDAQ Composite Index”) and the NASDAQ Telecommunications Index. This comparison assumes the investment of $100 on December 31, 1997 in the Company’s Common Stock, the NASDAQ Composite Index and the NASDAQ Telecommunications Index and assumes dividends, if any, are reinvested.

15

AMENDMENT OF 2000 STOCK OPTION PLAN

The Company’s 2000 Stock Option Plan (the “2000 Option Plan”) currently provides for the issuance of up to 1,250,000 shares of Common Stock. On January 20, 2003, the Board of Directors of the Company voted to amend the 2000 Option Plan, and to recommend the amendment to the stockholders of the Company for approval, to increase the number of shares authorized for issuance thereunder by 500,000 shares to 1,750,000 shares of Common Stock (subject to adjustment in the event of stock splits and other similar events). The Board of Directors’ primary reason for adopting the amendment was to enhance the Company’s ability to attract, retain and motivate key personnel.

The Board of Directors believes that the continued growth and profitability of the Company depends, in large part, upon the ability of the Company to maintain a competitive position in attracting, retaining and motivating key personnel, and that the approval of the amendment of the 2000 Option Plan furthers these objectives. Accordingly, the Board of Directors believes approval of the amendment of the 2000 Option Plan is in the best interests of the Company and its shareholders and recommends a vote FOR this proposal.

Summary of the 2000 Option Plan

The following summary of the 2000 Option Plan, as amended by the amendment for which shareholder approval is sought by this proxy statement, is qualified in all respects by reference to the full text of the 2000 Option Plan, a copy of which is attached as Appendix B to the electronic copy of this Proxy Statement filed with the Commission and which may be accessed from the Commission’s home page (www.sec.gov). In addition, the 2000 Option Plan may be obtained by making a written request to the General Counsel of the Company.

Description of Awards

The 2000 Option Plan provides for the grant of incentive stock options intended to qualify under Section 422 of the Internal Revenue Code of 1986, as amended (the “Code”) and nonstatutory stock options (collectively “Awards”).

Incentive Stock Options and Nonstatutory Stock Options

Optionees receive the right to purchase a specified number of shares of Common Stock at a specified option price and subject to such other terms and conditions as are specified in connection with the option grant. Subject to the limitations described below, options may be granted at an exercise price which may be less than, equal to or greater than the fair market value of the Common Stock on the date of grant. Under present law, however, incentive stock options and options intended to qualify as performance-based compensation under Section 162(m) of the Code may not be granted at an exercise price less than the fair market value of the Common Stock on the date of grant or less than 110% of the fair market value in the case of incentive stock options granted to optionees holding more than 10% of the voting power of the Company. Options may not be granted for a term in excess of ten years. The 2000 Option Plan permits the Board to determine the manner of payment of the exercise price of options, including through payment by cash, by check, in connection with a “cashless exercise” through a broker, by surrender to the Company of shares of Common Stock, by delivery to the Company of a promissory note, or through payment of any other lawful consideration determined by the Board of Directors.

Eligibility to Receive Awards

Officers, employees and directors of, and consultants and advisors to and any individuals who have accepted an offer for employment with the Company and its subsidiaries are eligible to be granted Awards under the 2000 Option Plan. Under present law, however, incentive stock options may only be granted to employees. The maximum number of shares with respect to which an Award may be granted to any participant under the 2000 Option Plan may not exceed 100,000 shares per calendar year.

16

As of April 1, 2003, approximately 330 persons were eligible to receive Awards under the 2000 Option Plan, including the Company’s six executive officers and six non-employee directors. The granting of Awards under the 2000 Option Plan is discretionary, and the Company cannot now determine the number or type of Awards to be granted in the future to any particular person or group. However, during the fiscal year 2002, under all of the Company’s plans options to purchase 142,500 shares were granted to executive officers, options to purchase 132,000 shares were granted to Named Executive Officers and options to purchase 399,075 shares were granted to non-officer employees.

On December 31, 2002, the last reported sale price of the Company Common Stock on the NASDAQ National Market was $12.71.

Administration

The 2000 Option Plan is administered by the Board of Directors. The Board has the authority to adopt, amend and repeal the administrative rules, guidelines and practices relating to the 2000 Option Plan and to interpret the provisions of the 2000 Option Plan. Pursuant to the terms of the 2000 Option Plan, the Board of Directors may delegate authority under the 2000 Option Plan to one or more committees of the Board, and subject to certain limitations, to one or more executive officers of the Company. The Board has authorized the Compensation Committee to administer certain aspects of the 2000 Option Plan, including the granting of Awards to executive officers. Subject to any applicable limitations contained in the 2000 Option Plan, the Board of Directors, the Compensation Committee, or any other committee or executive officer to whom the Board delegates authority, as the case may be, selects the recipients of Awards and determines (i) the number of shares of Common Stock covered by options and the dates upon which such options become exercisable, (ii) the exercise price of options, and (iii) the duration of options.

The Board of Directors is required to make appropriate adjustments in connection with the 2000 Option Plan and any outstanding Awards to reflect stock dividends, stock splits and certain other events. In the event of a merger, liquidation or other Acquisition Event (as defined in the 2000 Option Plan), the Board of Directors is authorized to provide for outstanding Options or other stock-based Awards to be assumed or substituted for by the acquirer, or, if an acquirer shall not assume or substitute for Options, to accelerate the Awards to make them fully exercisable prior to consummation of the Acquisition Event or, in certain circumstances, to provide for termination of the options and a cash out of the value of any outstanding options. If any Award expires or is terminated, surrendered, canceled or forfeited, the unused shares of Common Stock covered by such Award will again be available for grant under the 2000 Option Plan. The 2000 Option Plan expressly prohibits repricing of options.

Amendment or Termination

No Award may be made under the 2000 Option Plan after February 16, 2010, but Awards previously granted may extend beyond that date. The Board of Directors may at any time amend, suspend or terminate the 2000 Option Plan, except that no Award designated as subject to Section 162(m) of the Code by the Board of Directors after the date of such amendment shall become exercisable, realizable or vested (to the extent such amendment was required to grant such Award) unless and until such amendment shall have been approved by the Company’s shareholders.

17

Federal Income Tax Consequences

The following generally summarizes the United States federal income tax consequences that generally will arise with respect to awards granted under the plan. This summary is based on the tax laws in effect as of the date of this proxy statement. Changes to these laws could alter the tax consequences described below.

Incentive Stock Options

A participant will not have income upon the grant of an incentive stock option. Also, except as described below, a participant will not have income upon exercise of an incentive stock option if the participant has been employed by the Company or its corporate parent or 50% or more-owned corporate subsidiary at all times beginning with the option grant date and ending three months before the date the participant exercises the option. If the participant has not been so employed during that time, then the participant will be taxed as described below under “Nonstatutory Stock Options.” The exercise of an incentive stock option may subject the participant to the alternative minimum tax.

A participant will have income upon the sale of the stock acquired under an incentive stock option at a profit (if sales proceeds exceed the exercise price). The type of income will depend on when the participant sells the stock. If a participant sells the stock more than two years after the option was granted and more than one year after the option was exercised, then all of the profit will be long-term capital gain. If a participant sells the stock prior to satisfying these waiting periods, then the participant will have engaged in a disqualifying disposition and a portion of the profit will be ordinary income and a portion may be capital gain. This capital gain will be long-term if the participant has held the stock for more than one year and otherwise will be short-term. If a participant sells the stock at a loss (sales proceeds are less than the exercise price), then the loss will be a capital loss. This capital loss will be long-term if the participant held the stock for more than one year and otherwise will be short-term.

Nonstatutory Stock Options

A participant will not have income upon the grant of a nonstatutory stock option. A participant will have compensation income upon the exercise of a nonstatutory stock option equal to the value of the stock on the day the participant exercised the option less the exercise price. Upon sale of the stock, the participant will have capital gain or loss equal to the difference between the sales proceeds and the value of the stock on the day the option was exercised. This capital gain or loss will be long-term if the participant has held the stock for more than one year and otherwise will be short-term.

Tax Consequences to the Company

There will be no tax consequences to the Company except that the Company will be entitled to a deduction when a participant has compensation income. Any such deduction will be subject to the limitations of Section 162(m) of the Code.

18

RATIFICATION OF SELECTION OF INDEPENDENT AUDITORS

The Board of Directors, at the recommendation of the Audit Committee, has selected the firm of Ernst & Young LLP as the Company’s independent auditors for the current fiscal year. Ernst & Young LLP has served as the Company’s independent auditors since 1988.

Although shareholder ratification of the Board of Directors’ selection of Ernst & Young LLP is not required by law, the Board of Directors believes that it is advisable to give shareholders the opportunity to ratify this selection. If this proposal is not approved at the Annual Meeting, the Board of Directors may reconsider its selection of Ernst & Young LLP.

Representatives of Ernst & Young LLP are expected to be present at the Annual Meeting. They will have the opportunity to make a statement if they desire to do so and will also be available to respond to appropriate questions from shareholders.

Fees Paid to Independent Auditors

Audit Fees

Ernst & Young LLP billed the Company an aggregate of $197,200 in fees for professional services rendered in connection with the audit of the Company’s financial statements for the most recent fiscal year and the reviews of the financial statements included in each of the Company’s Quarterly Reports on Form 10-Q during the fiscal year ended December 31, 2002.

Financial Information Systems Design and Implementation Fees

Ernst & Young LLP did not perform or bill the Company for any professional services rendered to the Company and its affiliates for the fiscal year ended December 31, 2002 in connection with financial information systems design or implementation, the operation of the Company’s information system or the management of its local area network.

All Other Fees

Ernst & Young LLP did not perform or bill the Company for any other services rendered for the most recent fiscal year.

The following summarizes the fees paid to Ernst & Young LLP for the years ended December 31, 2002 and December 31, 2001:

2002 | 2001 | |||||

Audit | $ | 197,200 | $ | 155,700 | ||

Audit-Related |

| 6,400 | ||||

Tax |

| — | ||||

Other |

| 2,500 | ||||

Total Fees | $ | 197,200 | $ | 164,600 | ||

The Board of Directors recommends a vote FOR the ratification of Ernst & Young LLP as the Company’s independent auditors for the year ending December 31, 2003.

19

OTHER MATTERS

The Board of Directors does not know of any other matters which may come before the Annual Meeting. However, if any other matters are properly presented to the Annual Meeting, it is the intention of the persons named in the accompanying proxy to vote, or otherwise act, in accordance with their judgment on such matters.

All costs of solicitation of proxies will be borne by the Company. In addition to solicitations by mail, the Company’s directors, officers and regular employees, without additional remuneration, may solicit proxies by telephone, telegraph and personal interviews. The Company has retained Georgeson Shareholder to assist with the solicitation of proxies for a fee of $4,500, plus reimbursement of out-of-pocket expenses. Brokers, custodians and fiduciaries will be requested to forward proxy soliciting material to the owners of shares held in their names, and the Company will reimburse them for out-of-pocket expenses incurred on behalf of the Company.

Proposals of shareholders intended to be presented at the 2004 Annual Meeting of Shareholders must be received by the Company at its principal office in Woburn, Massachusetts not later than December 31, 2003 for inclusion in the proxy statement for that meeting.

If a shareholder of the Company wishes to present a proposal before the 2004 Annual Meeting of Shareholders and the Company has not received notice of such matter prior to December 31, 2003, the Company shall have discretionary authority to vote on such matter, if the Company includes a specific statement in the proxy statement or form of proxy, to the effect that it has not received such notice in a timely fashion.

By Order of the Board of Directors,

Alan J. Bouffard,

Clerk

April 29, 2003

THE BOARD OF DIRECTORS HOPES THAT SHAREHOLDERS WILL ATTEND THE MEETING. WHETHER OR NOT SHAREHOLDERS PLAN TO ATTEND, SHAREHOLDERS ARE URGED TO COMPLETE, DATE, SIGN AND RETURN THE ENCLOSED PROXY IN THE ACCOMPANYING ENVELOPE. SHAREHOLDERS WHO ATTEND THE MEETING MAY VOTE THEIR SHARES PERSONALLY EVEN THOUGH THEY HAVE SENT IN THEIR PROXIES.

The SEC has also adopted a “householding” rule which we may implement for future shareholder communications. This rule permits us to deliver a single proxy or information statement to a household, even though two or more shareholders live under the same roof or a shareholder has shares registered in multiple accounts. This rule enables us to reduce the expense of printing and mailing associated with proxy statements and reduces the amount of duplicative information you may currently receive. If this rule applies to you and you wish to continue receiving separate proxy materials without participating in the “householding” rule, please check the designated box on the enclosed proxy card. If we do not hear from you within 60 days, we will assume that we have your implied consent to deliver one set of proxy materials under the new rule. This implied consent will continue for as long as you remain a shareholder of the company, unless you inform us in writing otherwise. If you revoke your consent, we will begin sending separate copies within 30 days of the receipt of your revocation.

Some banks, brokers and other nominee record holders are already “householding” proxy statements and annual reports. This means that only one copy of our proxy statement or annual report may have been sent to multiple shareholders in your household. We will promptly deliver a separate copy of either document to you if you call or write us at the following address or phone number: Boston Communications Group, Inc. 100 Sylvan Road, Woburn, Massachusetts 01801, 781-904-5219. If you want to receive separate copies of the annual report and proxy statement in the future, or if you are receiving multiple copies and would like to receive only one copy for your household, you should contact your bank, broker, or other nominee record holder, or you may contact us at the above address and phone number.

20

APPENDIX A

BOSTON COMMUNICATIONS GROUP, INC.

AUDIT COMMITTEE CHARTER

A. Purpose

The purpose of the Audit Committee is to assist the Board of Directors’ oversight of:

| • | the integrity of the Company’s financial statements; |

| • | the Company’s compliance with legal and regulatory requirements; |

| • | the independent auditor’s qualifications and independence; and |

| • | the performance of the Company’s internal audit function and independent auditors. |

B. Structure and Membership

| 1. | Number. The Audit Committee shall consist of at least three members of the Board of Directors. |

| 2. | Independence. Except as otherwise permitted by the applicable rules of The Nasdaq Stock Market and Section 301 of the Sarbanes-Oxley Act of 2002 (and the applicable rules thereunder), each member of the Audit Committee shall be “independent” as defined by such rules and Act. |

| 3. | Financial Literacy. Each member of the Audit Committee shall be able to read and understand fundamental financial statements, including the Company’s balance sheet, income statement, and cash flow statement, at the time of his or her appointment to the Audit Committee. Unless otherwise determined by the Board of Directors (in which case disclosure of such determination shall be made in the Company’s annual report filed with the SEC), at least one member of the Audit Committee shall be an “audit committee financial expert” (as defined by applicable Nasdaq and SEC rules). All members of the Audit Committee shall participate in continuing education programs as set forth in the rules developed by the Nasdaq Listing and Hearings Review Council |

| 4. | Chair. Unless the Board of Directors elects a Chair of the Audit Committee, the Audit Committee shall elect a Chair by majority vote. |

| 5. | Compensation. The compensation of Audit Committee members shall be as determined by the Board of Directors. No member of the Audit Committee may receive any consulting, advisory or other compensatory fee from the Company other than fees paid in his or her capacity as a member of the Board of Directors or a committee of the Board. |

| 6. | Selection and Removal. Members of the Audit Committee shall be appointed by the Board of Directors. The Board of Directors may remove members of the Audit Committee from such committee, with or without cause. |

C. Authority and Responsibilities

General

The Audit Committee shall discharge its responsibilities, and shall assess the information provided by the Company’s management and the independent auditor, in accordance with its business judgment. Management is

1

responsible for the preparation, presentation, and integrity of the Company’s financial statements and for the appropriateness of the accounting principles and reporting policies that are used by the Company. The independent auditors are responsible for auditing the Company’s financial statements and for reviewing the Company’s unaudited interim financial statements. The authority and responsibilities set forth in this Charter do not reflect or create any duty or obligation of the Audit Committee to plan or conduct any audit, to determine or certify that the Company’s financial statements are complete, accurate, fairly presented, or in accordance with generally accepted accounting principles or applicable law, or to guarantee the independent auditor’s report.

Oversight of Independent Auditors

| 1. | Selection. The Audit Committee shall be solely and directly responsible for appointing, evaluating and, when necessary, terminating the engagement of the independent auditor. The Audit Committee may, in its discretion, seek stockholder ratification of the independent auditor it appoints. |

| 2. | Independence. The Audit Committee shall take, or recommend that the full Board of Directors take, appropriate action to oversee the independence of the independent auditor. In connection with this responsibility, the Audit Committee shall obtain and review a formal written statement from the independent auditor describing all relationships between the independent auditor and the Company, including the disclosures required by Independence Standards Board Standard No. 1. The Audit Committee shall actively engage in dialogue with the independent auditor concerning any disclosed relationships or services that might impact the objectivity and independence of the auditor. |

| 3. | Compensation. The Audit Committee shall have sole and direct responsibility for setting the compensation of the independent auditor. The Audit Committee is empowered, without further action by the Board of Directors, to cause the Company to pay the compensation of the independent auditor established by the Audit Committee. |

| 4. | Preapproval of Services. The Audit Committee shall preapprove all audit services (audit and non-audit) to be provided to the Company by the independent auditor; provided, however, that de minimis non-audit services may instead be approved in accordance with applicable SEC rules. The Audit Committee shall require the Company to disclose in its SEC periodic reports the approval by the Audit Committee of any non-audit services to be performed by the independent auditor. |

| 5. | Oversight. The independent auditor shall report directly to the Audit Committee and the Audit Committee shall have sole and direct responsibility for overseeing the independent auditor, including resolution of disagreements between Company management and the independent auditor regarding financial reporting. In connection with its oversight role, the Audit Committee shall, from time to time as appropriate obtain and consider the reports required to be made by the independent auditor pursuant to paragraph (k) of Section 10A of the Securities Exchange Act of 1934 regarding: |

| – | critical accounting policies and practices; |