EXHIBIT 99.1

ICT GROUP

NASDAQ: ICTG

August 2005

Company Statements

This presentation contains certain forward-looking statements that are subject to risks and uncertainties. Forward-looking statements include without limitation certain information relating to the effect of competition in the telemarketing industry, ICT Group’s ability to execute its business strategy, the development of alliances upon terms acceptable to ICT Group and the achievement of the anticipated benefits of such alliances, as well as statements that are preceded by, followed by or include the words “believes,” “expects,” “estimates,” “anticipates,” “plans,” “should,” or similar expressions. For such statements, ICT Group claims the protection of the safe harbor for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995. Actual events or results may differ materially from those discussed in the forward-looking statements as a result of various factors, including without limitation, those discussed in ICT Group’s annual report on Form 10-K for the year ended December 31, 2004 and other documents filed by ICT Group with the Securities and Exchange Commission. ICT Group makes no undertaking and disclaims any obligation to update such forward-looking statements.

This presentation shows net income for 1996, 2002, 2003, 2004 and 2005 exclusive of special charges. In 1996 the Company reported a pre-tax, nonrecurring, non-cash charge of $12.7M which was primarily associated with the granting of options, concurrent with the Company’s IPO, to replace certain previously granted expiring options. In 2002 the Company incurred special charges of $12.6M, pre-tax. This included charges of $8.9M, pre-tax, associated with the closing and scaling back of facilities and staff in the U.S. and Europe. It also included $3.7M, pre-tax, of additional charges, including a $1.4M charge for a client claim, a $1.7M charge for the costs associated with the defense of a class action litigation and a $0.6M charge for costs associated with a postponed underwritten public offering. In 2003, the Company incurred special charges of $4.0M, pre-tax associated with a class action litigation which were partially offset by a $0.7M partial reversal of the 2002 restructuring charge. In 2004, the Company incurred special charges of $10.3M, pre-tax associated with costs incurred to defend and the settlement of a class action litigation.

In 1H05, the Company incurred special charges of $0.6M associated with the class action litigation.

August 2005

ICT GROUP

Company Overview

Leading global provider of outsourced customer management and BPO solutions

Focus on mid-sized opportunities within Fortune 500

Target select group of high-growth vertical industries

Extensive offshore operations supported from U.S. data centers

43 service centers in U.S. and 7 foreign countries

14,000 employees - 800 full-time

LTM Revenues: $364M

August 2005

ICT GROUP

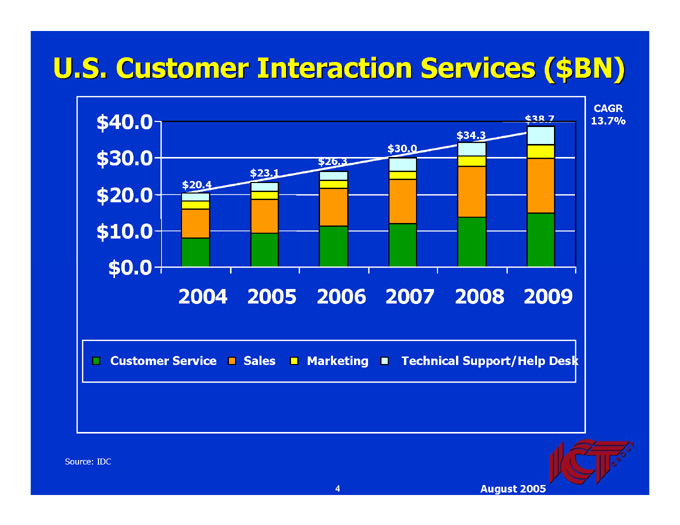

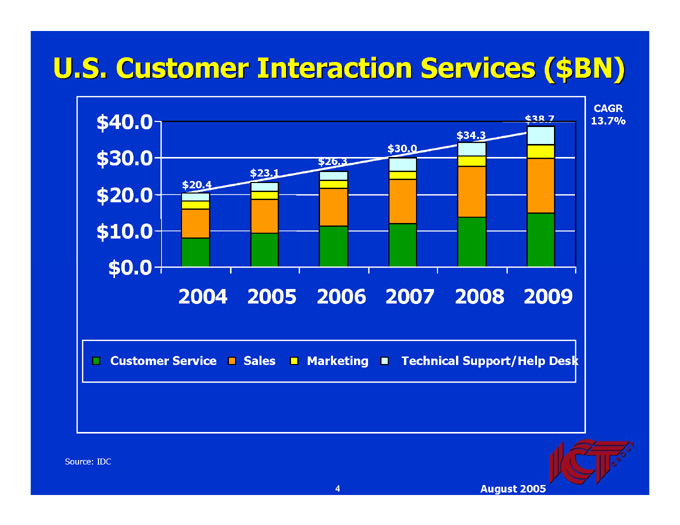

U.S. Customer Interaction Services ($BN)

CAGR 13.7%

$38.7

$34.3

$30.0

$26.3

$23.1

$20.4

$40.0

$30.0

$20.0

$10.0

$0.0

2004

2005

2006

2007

2008

2009

Customer Service

Sales

Marketing

Technical Support/Help Desk

Source: IDC

August 2005

ICT GROUP

Why Invest in ICT Now?

Shifted business model for accelerated revenue and earnings growth

Focused on broader-based outsourced services and lower-cost offshore operations

Leveraged existing strength in financial services and health care markets to expand into new verticals

Captured 26 customer service wins over last 18 months

Strong pipeline of new opportunities across multiple verticals

Expect EPS to more than double in 2005 on improved margins and 20% revenue growth

August 2005

ICT GROUP

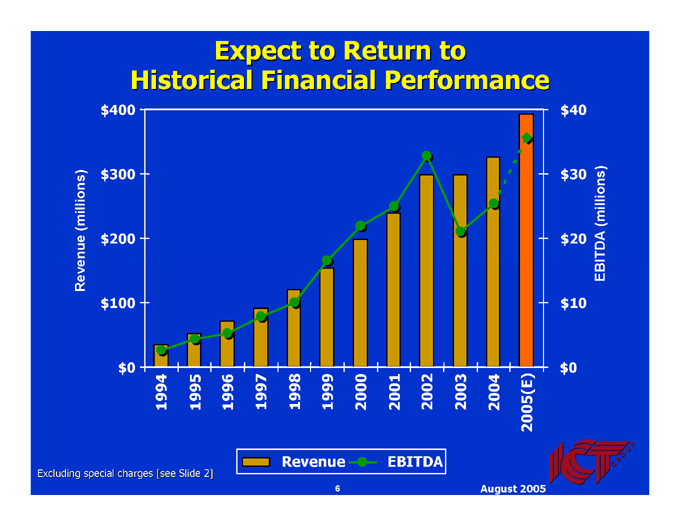

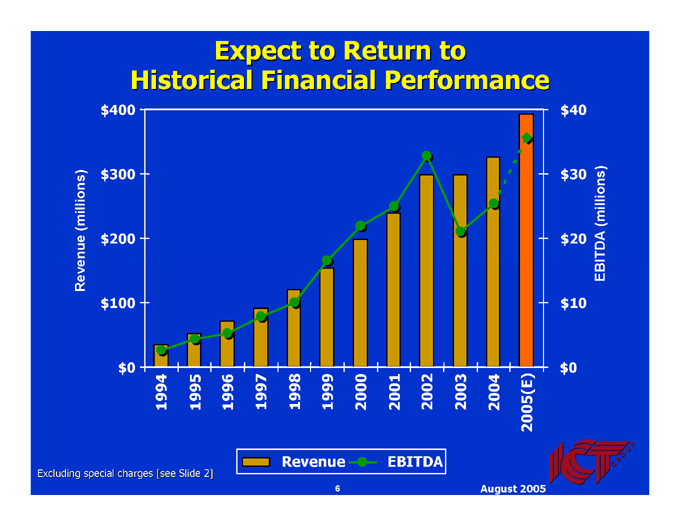

Expect to Return to Historical Financial Performance

EBITDA (millions)

Revenue (millions)

$400

$300

$200

$100

$0

$40

$30

$20

$10

$0

1994

1995

1996

1997

1998

1999

2000

2001

2002

2003

2004

2005(E)

Revenue

EBITDA

Excluding special charges [see Slide 2]

August 2005

ICT GROUP

Profitability Growth Drivers

Shift to more consistent services business while improving operating performance of sales business

Price increases to offset impact of FX rates

Higher margins at offshore operations in Philippines

Initial build-out largely complete: 1,250 stations

Layering additional services to leverage infrastructure

Increased capacity utilization:

$41,100 annualized revenue per workstation in 2Q05

Growth of higher margin marketing and technology services

August 2005

ICT GROUP

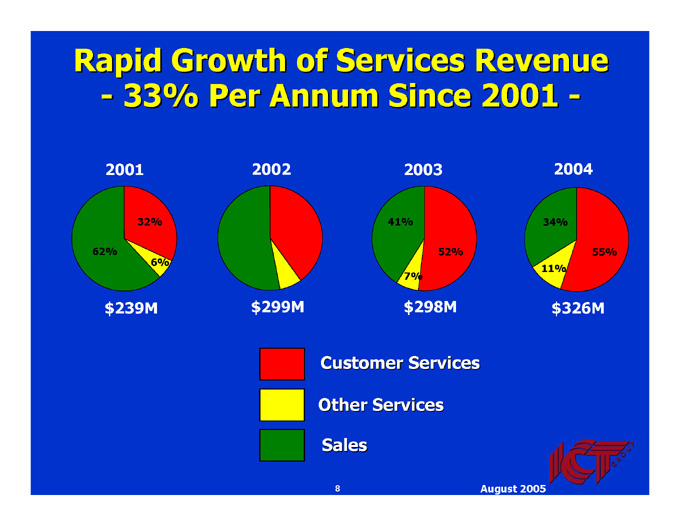

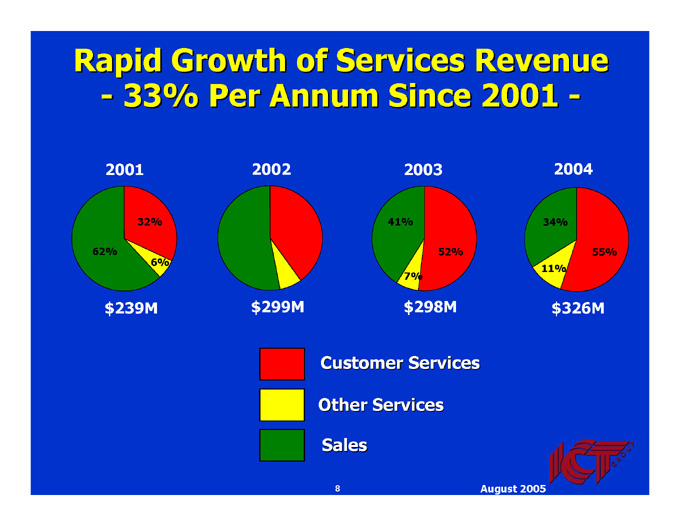

Rapid Growth of Services Revenue - 33% Per Annum Since 2001 -

2001

2002

2003

2004

32%

62%

6%

40%

53%

7%

41%

52%

7%

55%

34%

11%

$298M

$326M

$239M

$299M

Customer Services

Other Services

Sales

August 2005

ICT GROUP

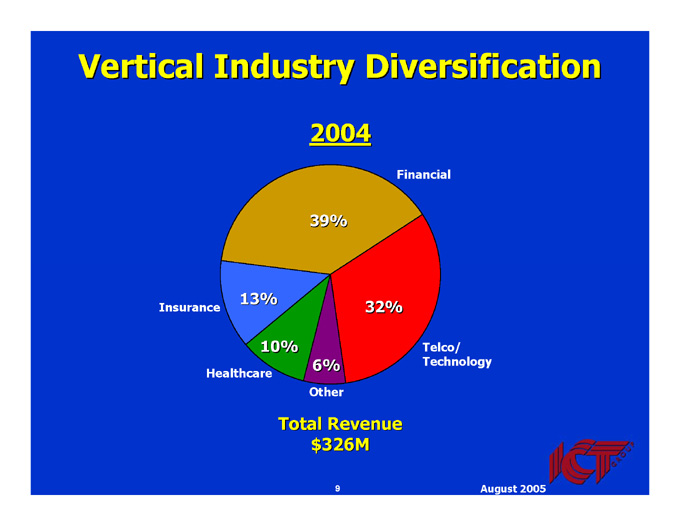

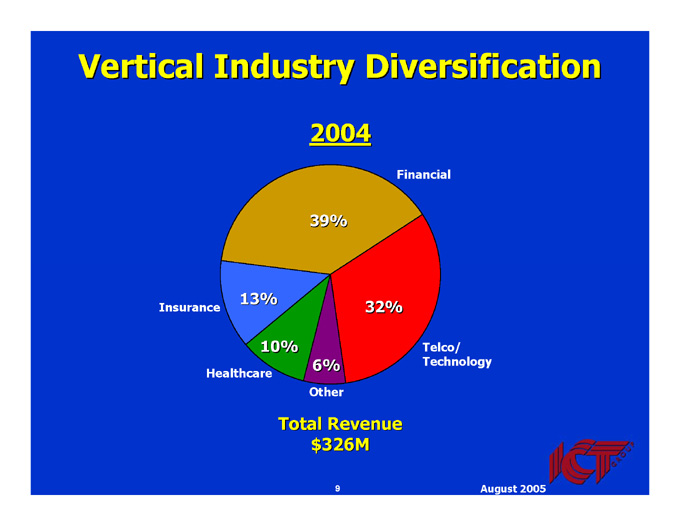

Vertical Industry Diversification

2004

39%

13%

32%

10%

6%

Financial

Insurance

Telco/Technology

Healthcare

Other

Total Revenue

$326M

August 2005

ICT GROUP

Diverse Offerings for Targeted Verticals

Financial Services

Credit Card Acquisition and Cross Sales

Credit Report Dispute Resolution

Retail Bank Customer Service

P&C and L,A&H Insurance Sales and Service

Mortgage Sales Originations and Service

First Party Collections

Health Care

Managed Care Enrollments and Service

Medical Device Technical/Product Support

Over-the-Counter Product Support

Quality Control and Adverse Event Reporting

Prescription Plan Enrollment and Service

August 2005

ICT GROUP

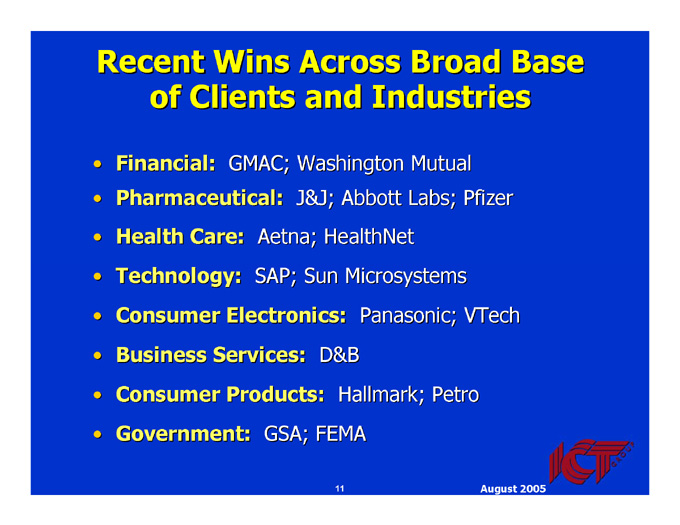

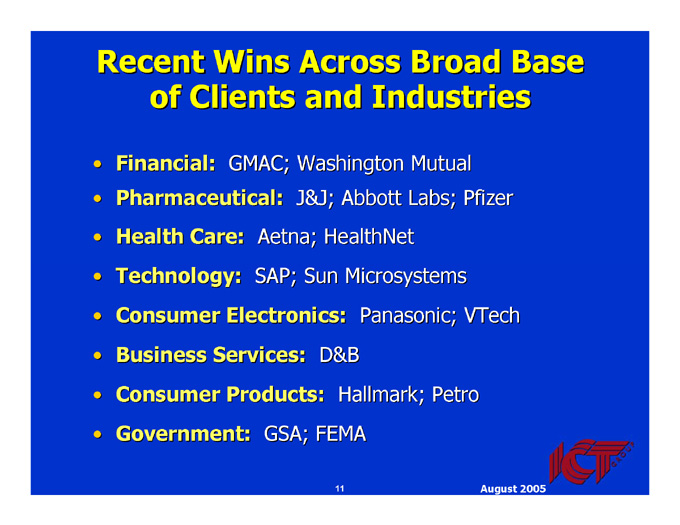

Recent Wins Across Broad Base of Clients and Industries

Financial: GMAC; Washington Mutual

Pharmaceutical: J&J; Abbott Labs; Pfizer

Health Care: Aetna; HealthNet

Technology: SAP; Sun Microsystems

Consumer Electronics: Panasonic; VTech

Business Services: D&B

Consumer Products: Hallmark; Petro

Government: GSA; FEMA

August 2005

ICT GROUP

Key Clients in Major Verticals

August 2005

ICT GROUP

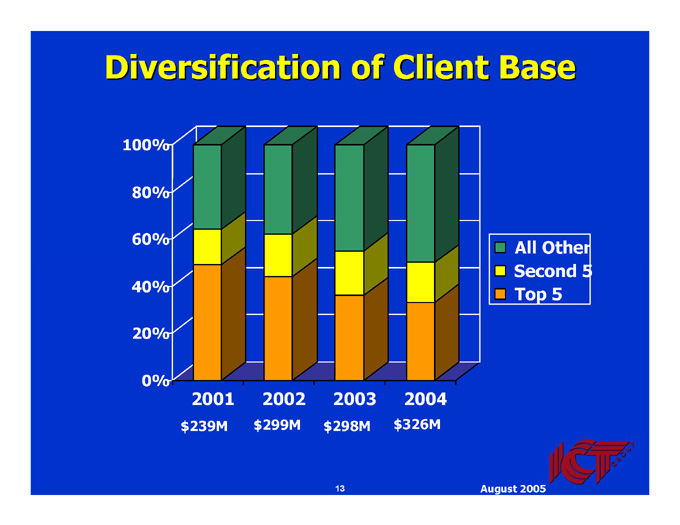

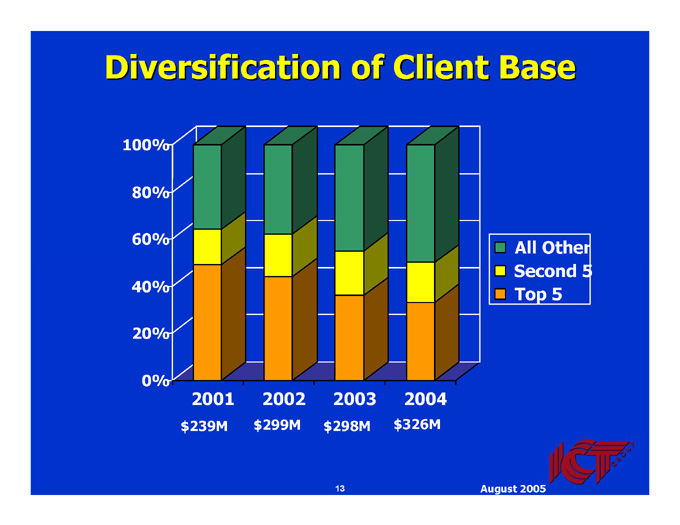

Diversification of Client Base

100%

80%

60%

40%

20%

0%

2003

2002

2001

2004

$299M

$239M

$298M

$326M

All Other

Second 5

Top 5

August 2005

ICT GROUP

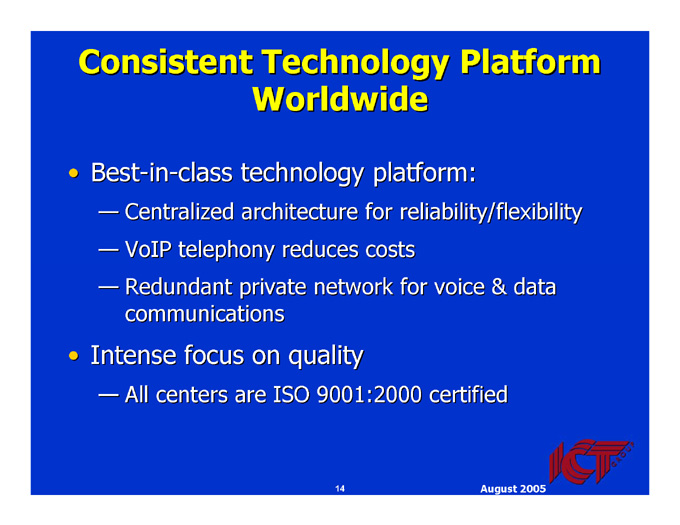

Consistent Technology Platform Worldwide

Best-in-class technology platform:

Centralized architecture for reliability/flexibility

VoIP telephony reduces costs

Redundant private network for voice & data communications

Intense focus on quality

All centers are ISO 9001:2000 certified

August 2005

ICT GROUP

Global Capabilities

Based on proven international expertise

Support targeted local country markets

Concurrently provide low cost near-shore and offshore solutions

Strengthens competitive position and improves profitability

Impact of increased call volumes from lower priced offshore operations now outweighs impact of lower pricing on revenue growth

August 2005

ICT GROUP

Global Strategy: Markets & Operations

U.K.

Ireland

Canada

U.S.

Philippines

Mexico

Caribbean

India

Australia

Served Market

Served Market with External Production

External Production

Planned External Production

August 2005

ICT GROUP

Philippines Operations

Preferred location for voice support

Fewer language barriers and more Americanized culture

1,500 seats in Philippines (2 centers) by year-end 2005

14% of total ICT production in 1H05 vs. 6% in 1H04

RCBC Building Makati City

Union Bank Building Ortigas District

August 2005

ICT GROUP

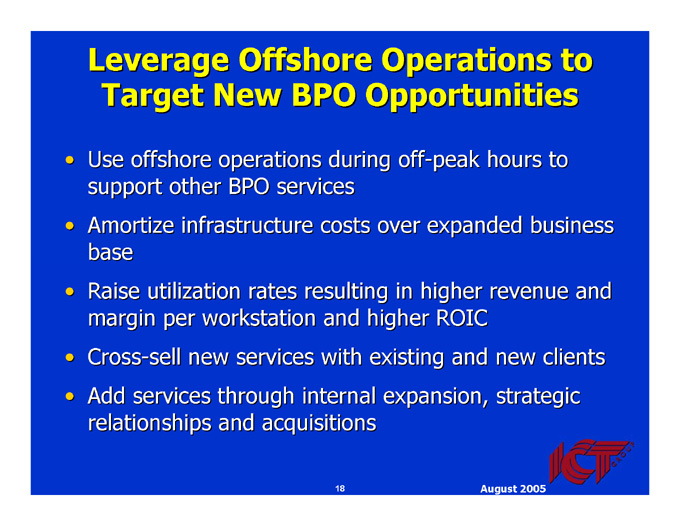

Leverage Offshore Operations to Target New BPO Opportunities

Use offshore operations during off-peak hours to support other BPO services

Amortize infrastructure costs over expanded business base

Raise utilization rates resulting in higher revenue and margin per workstation and higher ROIC

Cross-sell new services with existing and new clients

Add services through internal expansion, strategic relationships and acquisitions

August 2005

ICT GROUP

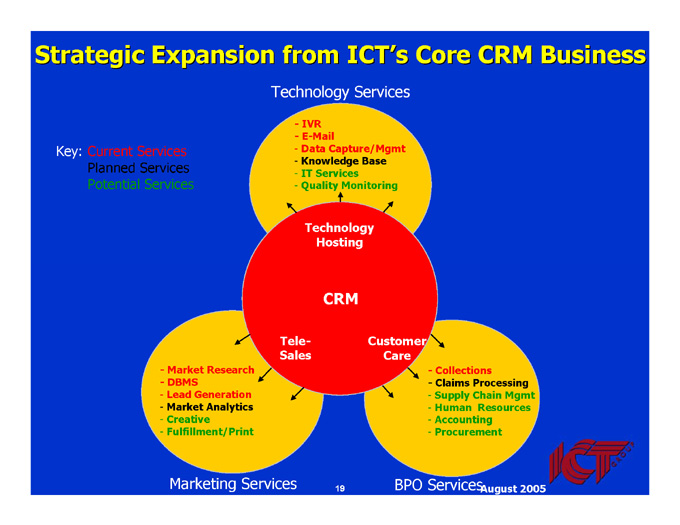

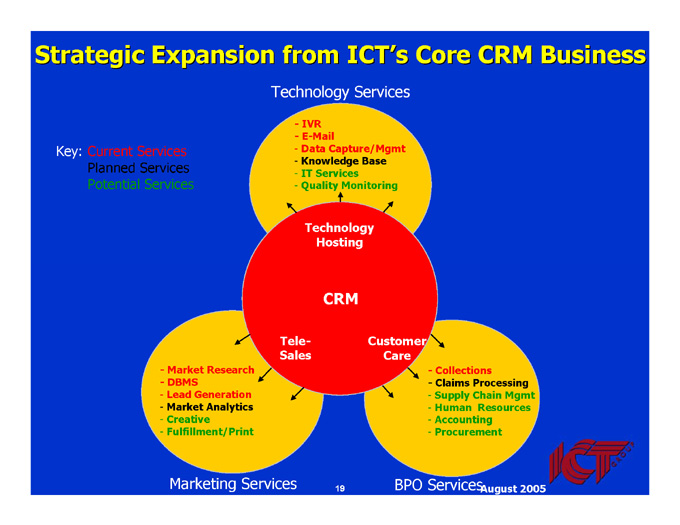

Strategic Expansion from ICT’s Core CRM Business

Technology Services

Key: Current Services

Planned Services

Potential Services

- IVR

- E-Mail

Data Capture/Mgmt

Knowledge Base

IT Services

Quality Monitoring

Technology

Hosting

CRM

Customer

Care

Tele- Sales

- Collections

- Claims Processing

- Supply Chain Mgmt

- Human Resources

- Accounting

- Procurement

- Market Research

- DBMS

- Lead Generation

- Market Analytics

- Creative

- Fulfillment/Print

BPO Services

Marketing Services

August 2005

ICT GROUP

Financial

Summary

August 2005

ICT GROUP

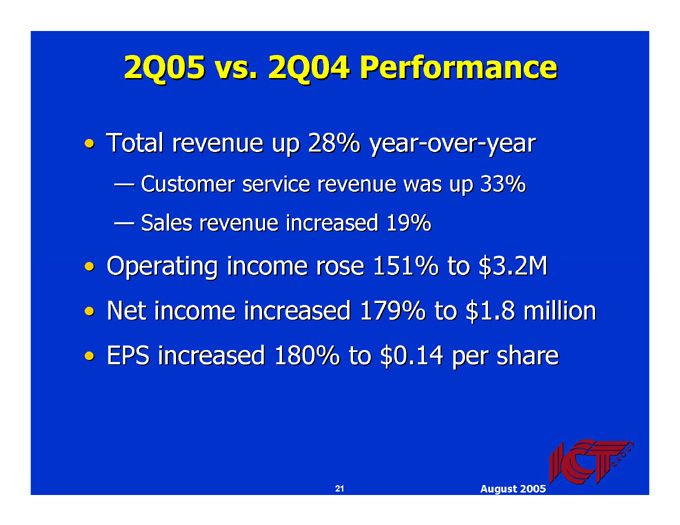

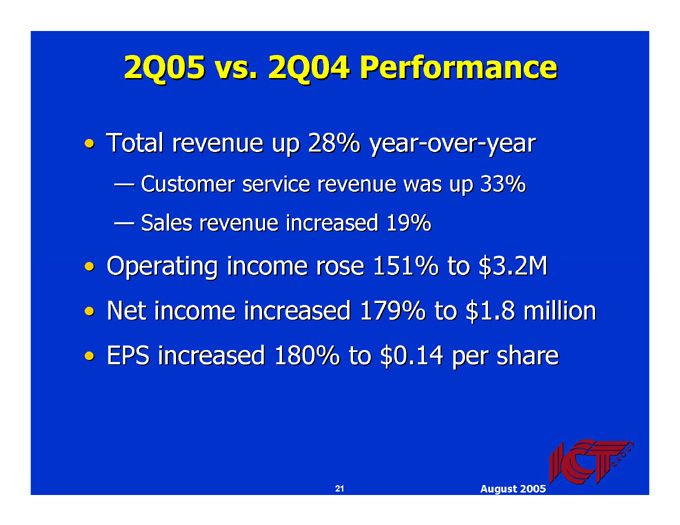

2Q05 vs. 2Q04 Performance

Total revenue up 28% year-over-year

Customer service revenue was up 33%

Sales revenue increased 19%

Operating income rose 151% to $3.2M

Net income increased 179% to $1.8 million

EPS increased 180% to $0.14 per share

August 2005

ICT GROUP

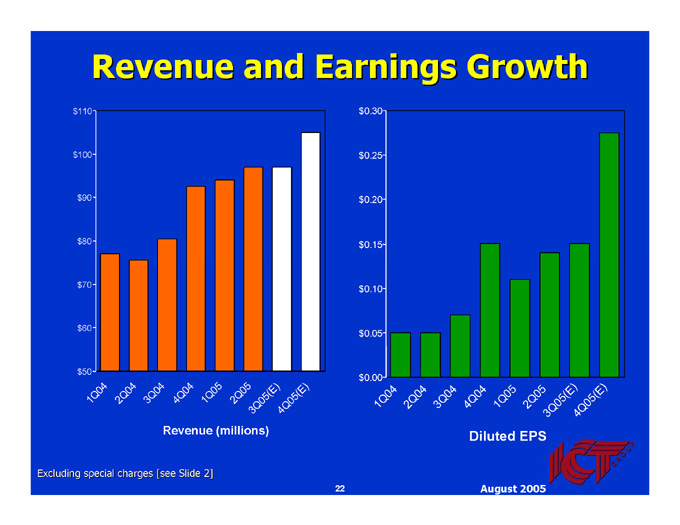

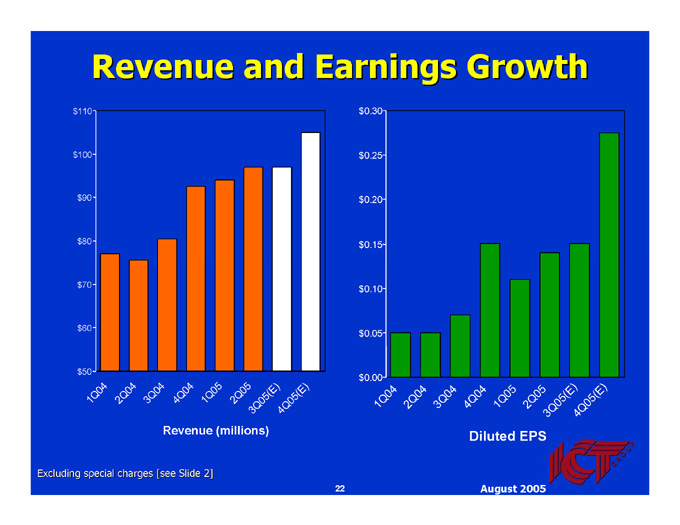

Revenue and Earnings Growth

$110

$100

$90

$80

$70

$60

$50

$0.30

$0.25

$0.20

$0.15

$0.10

$0.05

$0.00

1Q05

2Q04

3Q04

4Q04

1Q04

2Q05

3Q05(E)

4Q05(E)

1Q04

2Q04

3Q04

4Q04

1Q05

2Q05

3Q05(E)

4Q05(E)

Revenue (millions)

Diluted EPS

Excluding special charges [see Slide 2]

August 2005

ICT GROUP

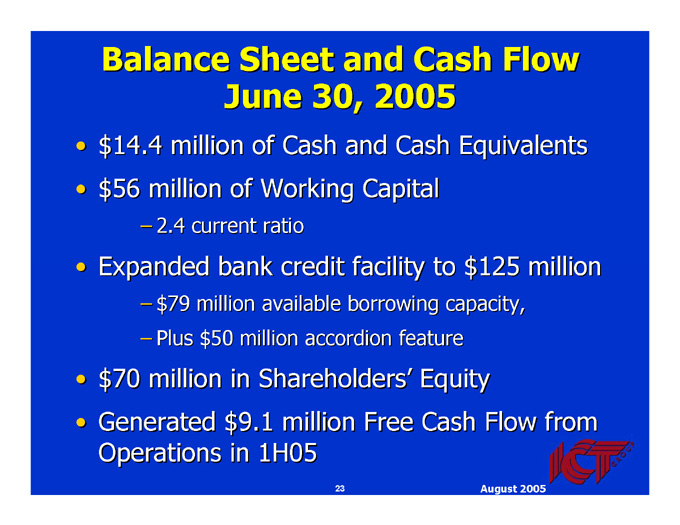

Balance Sheet and Cash Flow

June 30, 2005

$14.4 million of Cash and Cash Equivalents

$56 million of Working Capital

2.4 current ratio

Expanded bank credit facility to $125 million

$79 million available borrowing capacity,

Plus $50 million accordion feature

$70 million in Shareholders’ Equity

Generated $9.1 million Free Cash Flow from Operations in 1H05

August 2005

ICT GROUP

Summary

August 2005

ICT GROUP

Positive Outlook

Solid top-line growth and improved profitability

Three year internal growth targets of:

Revenue of 10-15% per annum

Operating margins to reach 7-8%

16 new and extended contracts in 2004: 10 in 1H05

Expanded near-shore and offshore operations

Broader technology, marketing and BPO service offerings

Strong financial position to invest in future internal growth and pursue strategic acquisitions to accelerate revenue, margin and earnings growth

August 2005

ICT GROUP

ICT GROUP

NASDAQ: ICTG

August 2005