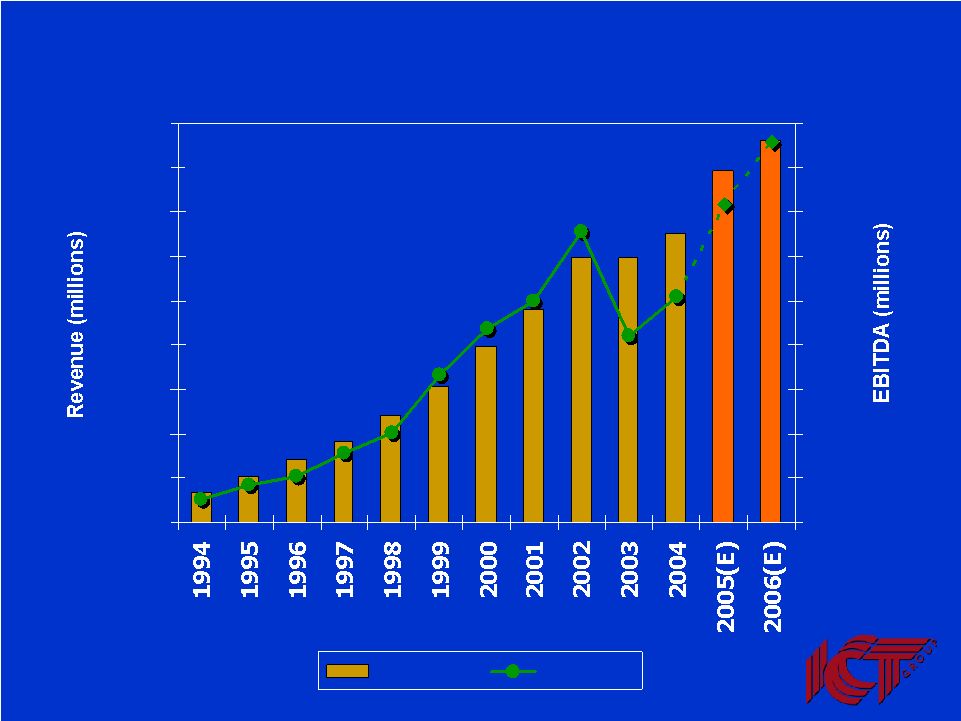

2 November 8, 2005 Company Statements Company Statements This presentation contains certain forward-looking statements that are subject to risks and uncertainties. Forward-looking statements include without limitation certain information relating to the effect of competition in the telemarketing industry, ICT Group’ s ability to execute its business strategy, the development of alliances upon terms acceptable to ICT Group and the achievement of the anticipated benefits of such alliances, as well as statements that are preceded by, followed by or include the words “believes,” “expects,” “estimates,” “anticipates,” “plans,” “should,” or similar expressions. For such statements, ICT Group claims the protection of the safe harbor for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995. Actual events or results may differ materially from those discussed in the forward-looking statements as a result of various factors, including without limitation, those discussed in ICT Group’ s annual report on Form 10-K for the year ended December 31, 2004 and other documents filed by ICT Group with the Securities and Exchange Commission. ICT Group makes no undertaking and disclaims any obligation to update such forward- looking statements. This presentation shows net income for 1996, 2002, 2003, 2004 and 2005 exclusive of special charges. In 1996 the Company reported a pre-tax, nonrecurring, non-cash charge of $12.7M which was primarily associated with the granting of options, concurrent with the Company’ s IPO, to replace certain previously granted expiring options. In 2002 the Company incurred special charges of $12.6M, pre-tax. This included charges of $8.9M, pre-tax, associated with the closing and scaling back of facilities and staff in the U.S. and Europe. It also included $3.7M, pre-tax, of additional charges, including a $1.4M charge for a client claim, a $1.7M charge for the costs associated with the defense of a class action litigation and a $0.6M charge for costs associated with a postponed underwritten public offering. In 2003, the Company incurred special charges of $4.0M, pre-tax associated with a class action litigation which were partially offset by a $0.7M partial reversal of the 2002 restructuring charge. In 2004, the Company incurred special charges of $10.3M, pre-tax associated with costs incurred to defend and the settlement of a class action litigation. In 2005, the Company received a $4.1M insurance recovery and incurred special charges of $0.6M, pre-tax associated with the class action litigation. |