Exhibit 99.1

Robert W. Baird & Co.’s 2006 Growth Stock Conference

ICT Group, Inc.

May 9, 2006 NASDAQ: ICTG

Company Statements

This presentation contains certain forward-looking statements that are subject to risks and uncertainties. Forward-looking statements include without limitation certain information relating to the effect of competition in its industry, ICT Group’s ability to execute its business strategy, the development of alliances upon terms acceptable to ICT Group and the achievement of the anticipated benefits of such alliances, as well as statements that are preceded by, followed by or include the words “believes,” “expects,” “estimates,” “anticipates,” “plans,” “should,” or similar expressions. For such statements, ICT Group claims the protection of the safe harbor for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995. Actual events or results may differ materially from those discussed in the forward-looking statements as a result of various factors, including without limitation, those discussed in ICT Group’s annual report on Form 10-K for the year ended December 31, 2005 and other documents filed by ICT Group with the Securities and Exchange Commission. ICT Group makes no undertaking and disclaims any obligation to update such forward-looking statements.

This presentation shows ICT Group financials for 2003, 2004 and 2005 exclusive of special charges. In 2003, the Company incurred special charges of $4.7M, pre-tax associated with a class action litigation which were partially offset by a $0.7M partial reversal of a 2002 restructuring charge. In 2004, the Company incurred special charges of $10.3M, pre-tax associated with costs incurred to defend and the settlement of a class action litigation. In 2005, the Company received $4.2M of insurance recoveries and incurred $0.6M of litigation costs, pre-tax associated with the class action litigation.

2

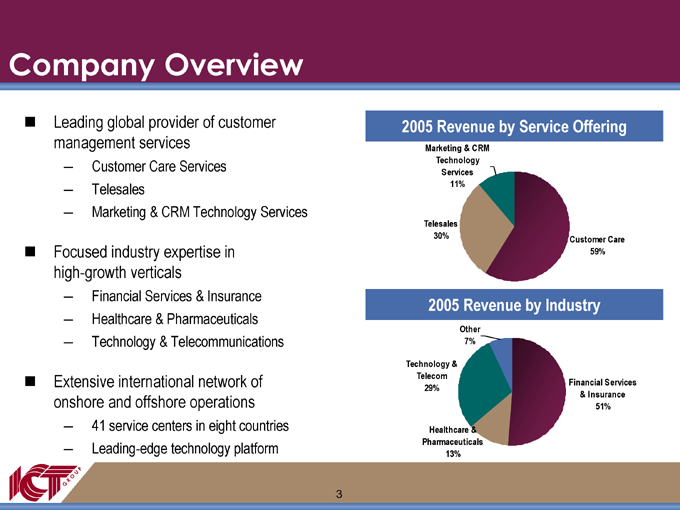

Company Overview

Leading global provider of customer management services

Customer Care Services

Telesales

Marketing & CRM Technology Services

Focused industry expertise in high-growth verticals

Financial Services & Insurance

Healthcare & Pharmaceuticals

Technology & Telecommunications

Extensive international network of onshore and offshore operations

41 service centers in eight countries

Leading-edge technology platform

2005 Revenue by Service Offering

Marketing & CRM

Technology Services 11%

Customer Care 59%

Telesales 30%

2005 Revenue by Industry

Other 7%

Financial Services & Insurance 51%

Healthcare & Pharmaceuticals 13%

Technology & Telecom 29%

3

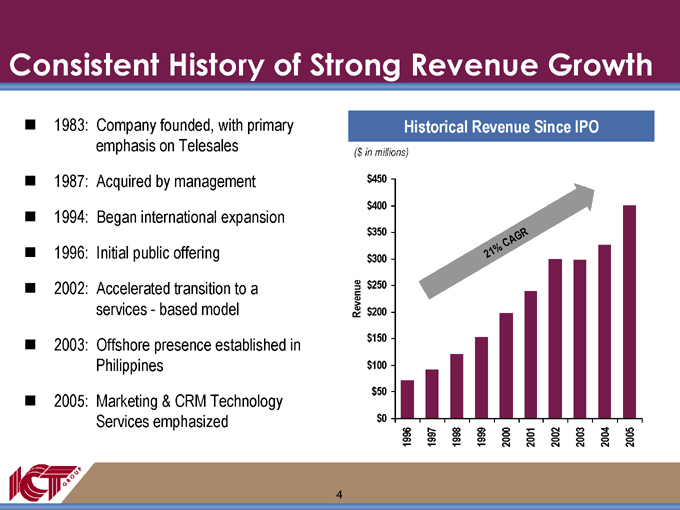

Consistent History of Strong Revenue Growth

1983: Company founded, with primary emphasis on Telesales

1987: Acquired by management

1994: Began international expansion

1996: Initial public offering

2002: Accelerated transition to a services—based model

2003: Offshore presence established in Philippines

2005: Marketing & CRM Technology Services emphasized

Historical Revenue Since IPO

($ in millions) $450 $400 $350 $300

Revenue $250 $200

$150 $100 $50 $0

21%

CA

GR

1996

1997

1998

1999

2000

2001

2002

2003

2004

2005

4

Positioned for Strong and Consistent Growth

Rapid Industry Growth

Differentiated Vertical Expertise

Global Footprint

Technology Leadership

Broadening Service Platform

Acquisition Strategy

Experienced Management

5

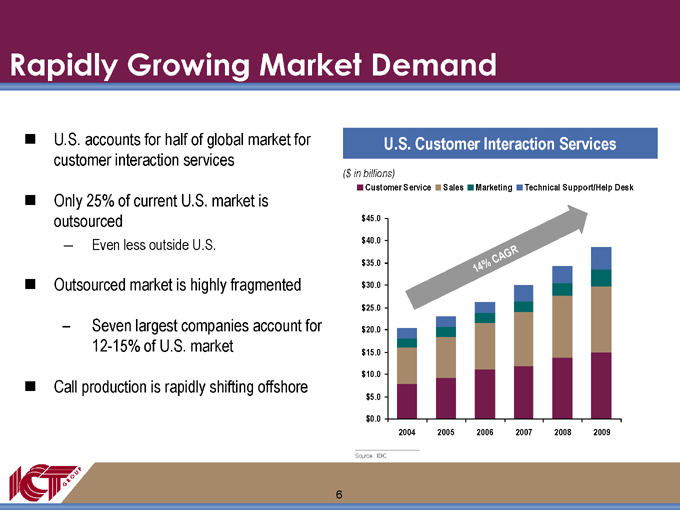

Rapidly Growing Market Demand

U.S. accounts for half of global market for customer interaction services

Only 25% of current U.S. market is outsourced

Even less outside U.S.

Outsourced market is highly fragmented

Seven largest companies account for 12-15% of U.S. market

Call production is rapidly shifting offshore

U.S. Customer Interaction Services

($ in billions)

Customer Service

Sales Marketing

Technical Support/Help Desk $45.0 $40.0 $35.0 $30.0 $25.0 $20.0 $15.0 $10.0 $5.0 $0.0

14%

CA

GR

2004

2005

2006

2007

2008

2009

Source: IDC.

6

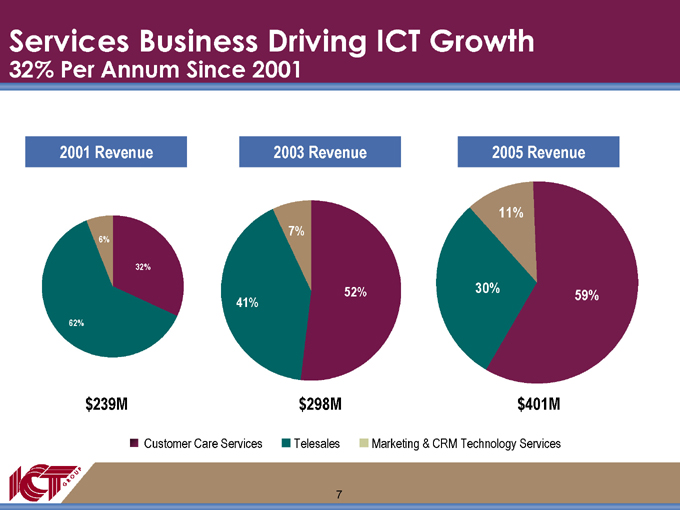

Services Business Driving ICT Growth

32% Per Annum Since 2001

2001 Revenue

6%

32%

62% $239M

2003 Revenue

7%

52%

41% $298M

2005 Revenue

11%

59%

30% $401M

Customer Care Services

Telesales

Marketing & CRM Technology Services

7

Dedicated Expertise in Attractive Verticals

8

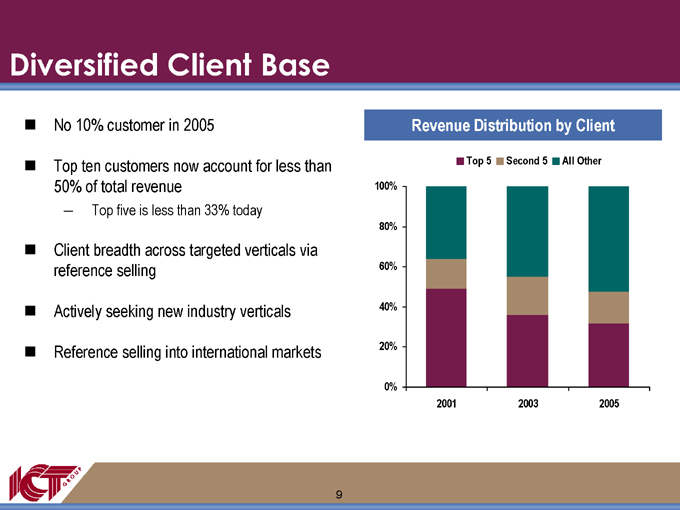

Diversified Client Base

No 10% customer in 2005

Top ten customers now account for less than 50% of total revenue

Top five is less than 33% today

Client breadth across targeted verticals via reference selling

Actively seeking new industry verticals

Reference selling into international markets

Revenue Distribution by Client

Top 5

Second 5

All Other

100% 80% 60% 40% 20% 0%

2001

2003

2005

9

Global Strategy: Markets and Operations

U.S.

Mexico

Central America

Argentina

Caribbean

Canada

Ireland

U.K.

India

Australia

Philippines

Onshore Market

Onshore Market/Offshore Production

Offshore Production

Planned/Under Evaluation

10

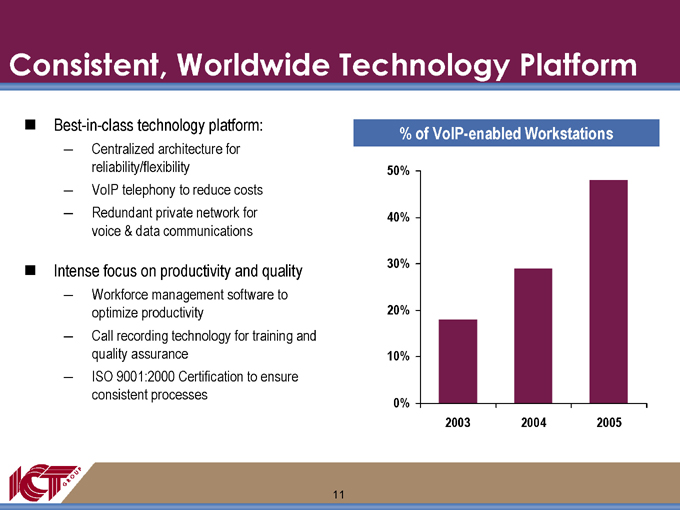

Consistent, Worldwide Technology Platform

Best-in-class technology platform:

Centralized architecture for reliability/flexibility

VoIP telephony to reduce costs

Redundant private network for voice & data communications

Intense focus on productivity and quality

Workforce management software to optimize productivity

Call recording technology for training and quality assurance

ISO 9001:2000 Certification to ensure consistent processes

% of VolP-enabled Workstations

50% 40% 30% 20% 10% 0%

2003

2004

2005

11

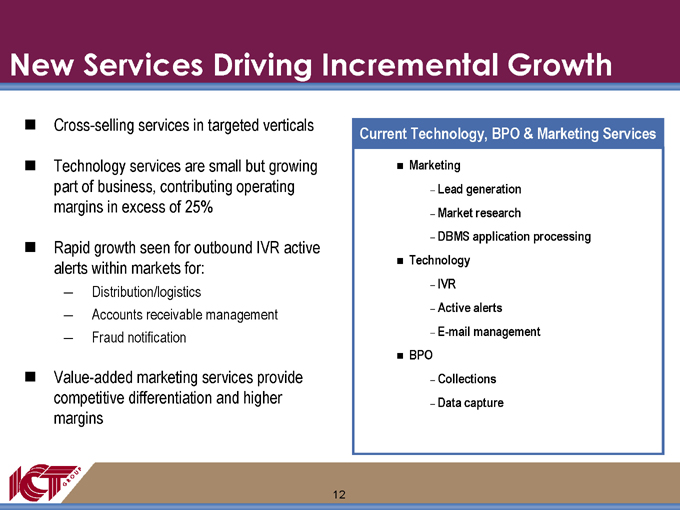

New Services Driving Incremental Growth

Cross-selling services in targeted verticals

Technology services are small but growing part of business, contributing operating margins in excess of 25%

Rapid growth seen for outbound IVR active alerts within markets for:

Distribution/logistics

Accounts receivable management

Fraud notification

Value-added marketing services provide competitive differentiation and higher margins

Current Technology, BPO & Marketing Services

Marketing

Lead generation

Market research

DBMS application processing

Technology

IVR

Active alerts

E-mail management

BPO

Collections

Data capture

12

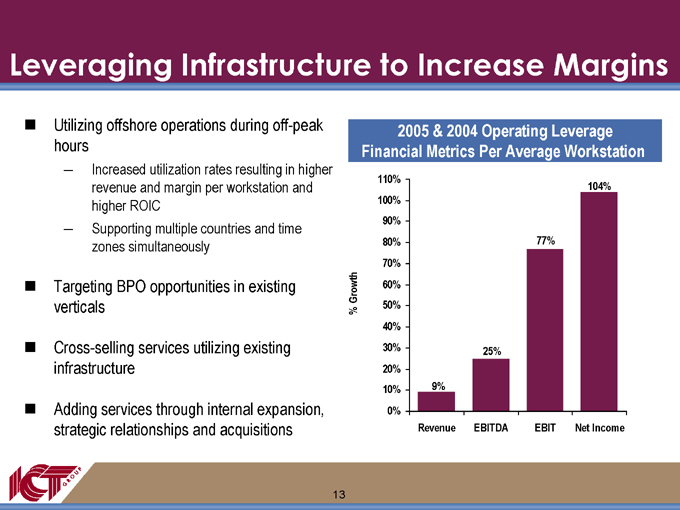

Leveraging Infrastructure to Increase Margins

Utilizing offshore operations during off-peak hours

Increased utilization rates resulting in higher revenue and margin per workstation and higher ROIC

Supporting multiple countries and time zones simultaneously

Targeting BPO opportunities in existing verticals

Cross-selling services utilizing existing infrastructure

Adding services through internal expansion, strategic relationships and acquisitions

2005 & 2004 Operating Leverage Financial Metrics Per Average Workstation

% Growth

110% 100% 90% 80% 70% 60% 50% 40% 30% 20% 10% 0%

9%

Revenue

25%

EBITDA

77%

EBIT

104%

Net Income

13

Strategic Acquisitions to Complement and Expand ICT’s Core CRM Business

Key: Current Services Potential Services

E-Mail Management IVR

Active Alerts Knowledge Base Quality Monitoring

CRM Technology Services

Technology Services

Marketing Services

Market Research DBMS

Lead Generation Data Analytics Voice Mining Business Intelligence

Tele-Sales

CRM

Customer Care

Collections Data Capture

Application Processing Claims Processing Mortgage Processing

BPO Services

14

Key Growth Drivers

Broadening base of higher margin, value-added services

Expanding number of targeted vertical markets

Opening new geographic markets for production and revenue growth

Accelerating growth through acquisitions and strategic alliances

15

Financial Overview

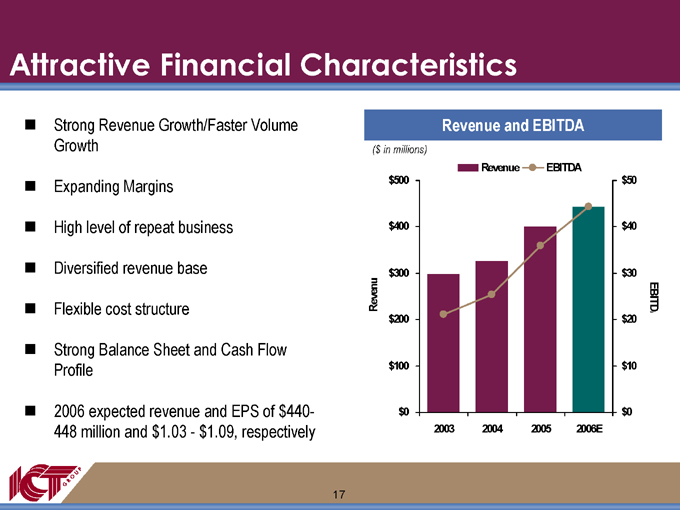

Attractive Financial Characteristics

Strong Revenue Growth/Faster Volume Growth

Expanding Margins

High level of repeat business

Diversified revenue base

Flexible cost structure

Strong Balance Sheet and Cash Flow Profile

2006 expected revenue and EPS of $440-448 million and $1.03—$1.09, respectively

Revenue and EBITDA

($ in millions)

Revenue

EBITDA

Revenu $500 $400 $300 $200 $100 $0

2003

2004

2005

2006E

$50 $40 $30 $20 $10 $0

EBITD

17

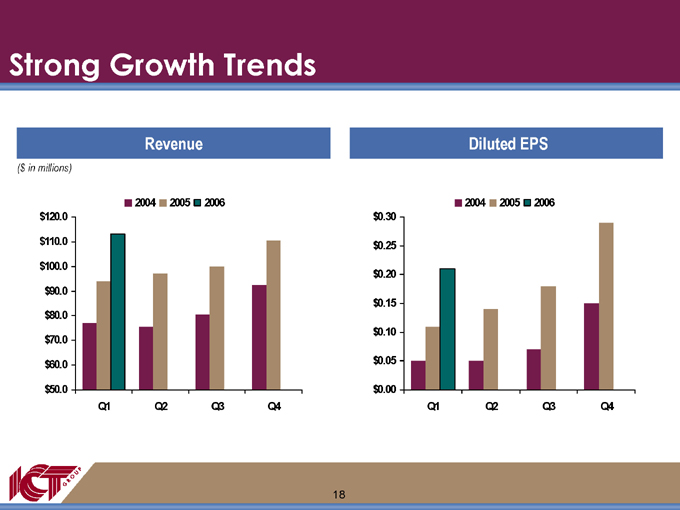

Strong Growth Trends

Revenue

($ in millions)

2004

2005

2006 $120.0 $110.0 $100.0 $90.0 $80.0 $70.0 $60.0 $50.0

Q1

Q2

Q3

Q4

Diluted EPS

2004

2005

2006 $0.30 $0.25 $0.20 $0.15 $0.10 $0.05 $0.00

Q1

Q2

Q3

Q4

18

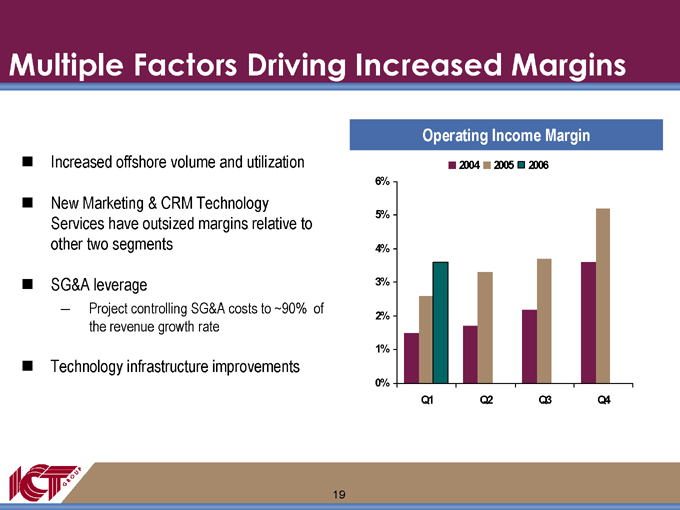

Multiple Factors Driving Increased Margins

Increased offshore volume and utilization

New Marketing & CRM Technology Services have outsized margins relative to other two segments

SG&A leverage

Project controlling SG&A costs to ~90% of the revenue growth rate

Technology infrastructure improvements

Operating Income Margin

2004

2005

2006

6% 5% 4% 3% 2% 1% 0%

Q1

Q2

Q3

Q4

19

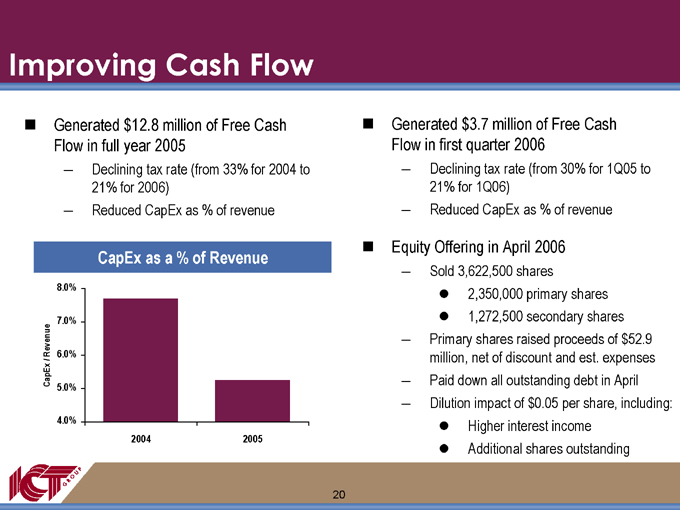

Improving Cash Flow

Generated $12.8 million of Free Cash Flow in full year 2005

Declining tax rate (from 33% for 2004 to 21% for 2006)

Reduced CapEx as % of revenue

CapEx as a % of Revenue

8.0%

7.0%

Revenue

6.0%

CapEx / 5.0% 4.0%

2004

2005

Generated $3.7 million of Free Cash Flow in first quarter 2006

Declining tax rate (from 30% for 1Q05 to 21% for 1Q06)

Reduced CapEx as % of revenue

Equity Offering in April 2006

Sold 3,622,500 shares

2,350,000 primary shares

1,272,500 secondary shares

Primary shares raised proceeds of $52.9 million, net of discount and est. expenses

Paid down all outstanding debt in April

Dilution impact of $0.05 per share, including:

Higher interest income

Additional shares outstanding

20

Positive Outlook for ICT Group

Solid top-line growth and improved profitability with three year internal targets of:

Revenue up 40-50% by 2008 (from 2005 level)

Operating margins to double by 2008 (from 2005 level)

Strong pipeline of new business opportunities

Expanding near-shore and offshore operations

Broader Marketing & CRM Technology services and BPO service offering platform

Strong financial position to invest in future internal growth and pursue strategic acquisitions to accelerate revenue, margin and earnings growth

21

Robert W. Baird & Co.’s 2006 Growth Stock Conference

ICT Group, Inc.

May 9, 2006 NASDAQ: ICTG