Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

| x | Annual report pursuant to section 13 or 15(d) of the Securities Exchange Act of 1934 |

For the fiscal year ended December 31, 2007

or

| ¨ | Transition report pursuant to section 13 or 15(d) of the Securities Exchange Act of 1934 |

Commission File Number 0-20807

ICT GROUP, INC.

(Exact name of registrant as specified in its charter.)

| Pennsylvania | 23-2458937 | |

(State or Other Jurisdiction of Incorporation or Organization) | (I.R.S. Employer Identification No.) | |

100 Brandywine Boulevard Newtown, PA | 18940 | |

| (Address of Principal Executive Offices) | (Zip Code) | |

Registrant’s telephone number including area code: (267) 685-5000

Securities registered pursuant to Section 12(b) of the Act: NONE

Securities registered pursuant to Section 12(g) of the Act:

Common Stock, par value $.01

(Title of Class)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. YES ¨ NO x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. YES ¨ NO x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports) and (2) has been subject to such filing requirements for the past 90 days. YES x NO ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the Registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. (See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act). (Check one):

Large Accelerated Filer ¨ Accelerated Filer x Non-accelerated Filer ¨ Smaller Reporting Company ¨

(Do not check if a smaller reporting company)

Indicate by checkmark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). YES ¨ NO x

The aggregate market value of the voting stock held by non-affiliates of the registrant as of June 29, 2007, was approximately $214,874,215. Such aggregate market value was computed by reference to the closing sale price of the Common Stock as reported on the National Market of The Nasdaq Stock Market on June 29, 2007. For purposes of this calculation only, the registrant has defined affiliates as consisting solely of all directors, executive officers and beneficial owners of more than ten percent of the common stock of the Company. In making such calculation, registrant is not making a determination of the affiliate or non-affiliate status of any holders of shares of Common Stock. The number of shares of the registrant’s Common Stock outstanding as of March 3, 2008, was 15,850,826.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant’s definitive Proxy Statement relating to its 2008 Annual Meeting of Shareholders, to be filed no later than April 29, 2008, are incorporated by reference in Part III hereof.

Unless the context indicates otherwise, “ICT Group,” “ICT,” the “Company,” “we,” “our,” and “us” refer to ICT Group, Inc., and where appropriate, one or more of its subsidiaries.

Table of Contents

FORM 10-K ANNUAL REPORT

For Fiscal Year Ended December 31, 2007

TABLE OF CONTENTS

Table of Contents

This document contains certain forward-looking statements that are subject to risks and uncertainties. Forward-looking statements include statements relating to the appropriateness of our reserves for contingencies, the realizability of our deferred tax assets, our restructuring reserves, our belief regarding our critical accounting policies, our ability to finance our operations and capital requirements into 2009, our expectation regarding work opportunity tax credits, our share-based awards, our ability to finance our long-term commitments, certain information relating to outsourcing trends as well as other trends in the outsourced business services industry and the overall domestic economy, our business strategy including the markets in which we operate, the services we provide, our ability to attract new clients and customers, our expectation to grow through both internal expansion and selective acquisition, the benefits of certain technologies we have acquired or may acquire in the future and the investment we plan to make in technology, our plans regarding international expansion, the implementation of quality standards, the seasonality of our business, the adequacy of our current facilities and the availability of additional or alternative space, our dividend policy, variations in operating results and liquidity, as well as information contained elsewhere in this document where statements are preceded by, followed by or include the words “will,” “should,” “believes,” “plans,” “intends,” “expects,” “anticipates” or similar expressions. For such statements, we claim the protection of the safe harbor for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995. The forward-looking statements in this document are subject to risks and uncertainties that could cause the assumptions underlying such forward-looking statements and the actual results to differ materially from those expressed in or implied by the statements. All forward-looking statements included in this report are based on information available to us as of the date of this report, and we assume no obligation to update these cautionary statements or any forward-looking statements.

| ITEM 1. | BUSINESS |

We are a leading global provider of outsourced customer management and business process outsourcing solutions. Our comprehensive, balanced mix of sales, service, marketing and technology solutions includes: customer care/retention, technical support and customer acquisition, cross-selling/upselling and collections as well as market research, database marketing, data entry/management, e-mail response management, remittance processing and other back-office business processing services.

We also offer a comprehensive suite of Customer Relationship Management (CRM) technologies, which are available on a hosted basis, for use by clients at their own in-house facilities, or on a co-sourced basis in conjunction with our fully integrated, Web-enabled operations centers. These technologies include: interactive voice response (IVR) and advanced speech recognition (ASR), outbound alert notification/messaging, automatic call distribution (ACD) voice processing, Voice over Internet Protocol (VoIP), contact management, automated e-mail management and processing, sales force and marketing automation and Web self-help, for the delivery of consistent, quality customer care across multiple channels.

Industry Overview

Outsourced business services have evolved significantly in recent years. Competitive pressures, advancements in technology and an accelerating trend toward outsourcing have resulted in the demand for more complex, interactive and highly customized customer management solutions, using a combination of home-shore, near-shore and offshore facilities. Outsourced service providers are now expected to serve more as a business “partner,” offering their clients value-added strategies rather than traditional commodity-based customer interaction and sales and service support applications.

1

Table of Contents

Our Approach

We have distinguished ourselves in the industry with our balanced growth strategy, industry expertise, customer-oriented focus, comprehensive portfolio of services, substantial resources across global operations and technology infrastructure capable of supporting future expansion. We continue to expand our worldwide network of state-of-the-art operations centers in order to deliver globally integrated customer care, end-to-end telesales and marketing and CRM technology services to meet the specific needs of our clients.

With over 20 years of expertise in outsourced customer management services, ICT Group is well positioned for continued growth in a large and growing market. By leveraging our experienced Management team, proven business model, global infrastructure, operating and technology investments and expertise in target industries, Management intends to advance our position as a leading global supplier of integrated customer management and related marketing, technology and back-office business process outsourcing solutions by:

Increasing International Presence and Further Developing Lower-cost Offshore Delivery Solutions. With an operations infrastructure across North America, Latin America, Europe and Asia, we offer clients increased flexibility and geographically diverse solutions. In 2007, we expanded offshore operations in the Philippines, where we currently operate five operations centers. A major component of our continued revenue growth and profitability strategy is to develop lower-cost offshore delivery capabilities in existing and new geographies, as well as creating lower-cost onshore alternatives to mitigate business risks for ICT Group and our customers.

At the same time, we plan to strengthen and build our position in international markets, including Latin and South America, Europe and Asia-Pacific. In Argentina, we plan to begin providing offshore English and Spanish support for the U.S. market and potentially multi-lingual support for the European market. In Europe and Australia, we are focused on expanding our customer care services business opportunities as well as leveraging our strong financial services vertical position, to deliver cost-effective offshore voice and back-office business process outsourcing (BPO) support services from VoIP-connected facilities in Canada, India, and the Philippines.

Leveraging and Strengthening our Vertical Market Expertise. We have historically targeted specific markets based on our vertical expertise and recognition of important industry-specific trends. Our Management believes that these vertical markets have both improving demand characteristics and increased outsourcing needs, which offer strong growth opportunities. Currently, we are focused on exploiting new business opportunities in the financial services and insurance, telecommunications and technology, healthcare, energy services, business and consumer products and services and Government markets. We will also use strategic relationships to develop new business in these targeted verticals as well as explore and develop new vertical markets.

Implement Technology and Process Enhancements to Reduce Operating Costs and Improve Efficiency. The Company plans to further develop and invest in its use of enabling technologies designed to reduce operating costs and improve performance and efficiency. In addition to continuing the migration of a portion of its IT/programming, quality verification and selected other corporate support functions to lower-cost offshore geographies, ICT Group will continue to invest in the development of such enabling technologies as: agent recruitment software, centralized workforce management, eLearning, digital call recording and voice mining for improved verification.

Broadening our Services Platform. Large multinational companies are looking for a broader complement of services from their external service providers. We will focus on expanding our higher-margin, value-added services to fulfill these broader client needs, helping to differentiate ICT Group from our competitors. We continue to increase revenue from our IVR services for both inbound response and outbound alert applications. We also provide back-office data entry/management, document imaging and scanning, mailroom operations support, remittance processing and e-mail response management services. We intend to continue to develop these services, organically and through the exploration of strategic alliances with, and select acquisitions of, businesses that provide complimentary outsourced services.

2

Table of Contents

Continuing Commitment to Quality Service. We have consistently emphasized quality service and extensive employee training by investing in quality assurance personnel and procedures. We intend to continue our commitment to providing quality service as well as our quality-focused service process engineering and continuous process development initiatives, as demonstrated by our certification with ISO 9001:2000 standards as well as our certification as a Level 1 Service Provider under the Payment Card Industry (PCI) Data Security Standard.

Our Services

Our services are provided through operations centers located across the globe and include customer care/retention, technical support and customer acquisition, cross-selling/upselling and collections as well as market research, database marketing, data entry/management, e-mail response management, remittance processing and other back-office business processing services and CRM technology hosting on behalf of customers operating in our target industries. Recent technological advancements have allowed us to better manage production output at each operations center by routing customer interactions to different centers depending on required skills and capacity. The technology assets may be located at a different physical location or country than the operations center. Accordingly, many of our operations centers are not limited to performing only one of the above-mentioned services. Rather, they can perform a variety of different services for a number of different customers/programs.

We offer the following services to our clients:

Customer Care Services and Technical Support. We provide outsourced customer care support services across a broad range of industries. In addition, we provide Tier I and Tier II technical support services for IT, telecommunications and consumer electronics companies, supporting both business- and consumer-based customers. Depending on client needs, we will assume sole or shared responsibility for the management of a client’s customer care operation—at the client’s facility or at one of our operations centers. As of December 31, 2007, we operated operations centers in the U.S., Canada, England, Ireland, Australia, Argentina, Costa Rica and the Philippines, which provided these services for our clients. Certain operations centers in the U.S., Mexico and Costa Rica provide bilingual English and Spanish services. Certain operations centers in Canada provide bilingual English and French services. Our operations centers in Ireland provide pan-European, multilingual services supporting the European marketplace.

Telesales. Our telesales business operation provides inbound and outbound telesales support activities primarily for clients in the financial services, insurance and telecommunications industries. As of December 31, 2007, this business is supported by operations centers located throughout the U.S., Canada, Ireland, England, Australia, Argentina, Costa Rica, Mexico, and the Philippines. Certain operations centers in the U.S. provide bilingual English and Spanish telesales. Certain operations centers in Canada provide bilingual English and French telesales. Our operations centers in Ireland provide pan-European, multilingual telesales supporting the European marketplace.

Marketing, Technology and BPO Solutions. We also support businesses across a range of industries with marketing research, collections, data entry/management, scanning and imaging, e-mail response management and remittance processing, and provide a comprehensive suite of CRM technologies, including IVR and advanced speech recognition, ACD voice processing, e-mail management and processing, outbound alert messaging/notification and other contact management technologies. As of December 31, 2007, this organization supported our clients from operations centers located in the U.S., Canada, Costa Rica, India and the Philippines. Our CRM technologies are available on a hosted basis for use by clients at their own in-house facilities, or on a co-sourced basis in conjunction with our fully integrated state-of-the-art customer operations centers.

Additional financial information regarding our geographic areas is presented in Note 16 to our consolidated financial statements included in this Annual Report on Form 10-K.

3

Table of Contents

Target Industries

Our domestic salesforce is organized by specific vertical industries, which enables our sales personnel to develop in-depth industry and product knowledge. Several of the industries that we serve are undergoing deregulation and consolidation, which provides us with additional opportunities as businesses search for cost-effective solutions for their customer care, telesales, marketing and CRM technology-related customer support needs. Selected industries we target include:

Financial Services

We provide retail banks, mortgage companies, credit rating agencies, insurance carriers and other financial services organizations with a wide range of services, including card holder acquisition, active account generation, account balance transfer, account retention, insurance telesales and customer service. Our Financial Marketing Services operation offers banking services, such as marketing and servicing home equity loans, lines of credit, loan-by-phone, checking and deposit account acquisition, mortgage loans and other traditional banking products.

Telecommunications

We provide customer service, technical support and telesales support for land line, cellular, cable and satellite services offered by major telecommunications companies.

Healthcare Services

Through our Healthcare Services business organization, we support pharmaceutical and medical device manufacturers, health insurance companies and other healthcare-related suppliers, for a variety of sales and customer care applications. For example, we provide patient assistance for prescription savings programs, technical/product support for medical device manufacturers and member enrollment services for healthcare insurance companies.

Other

We provide customer service and retention, telesales and value-added marketing, technology and back-office business processing support services for clients in the Government, retail, consumer products and energy industries. These applications include, but are not limited to: customer service, first-level customer technical support, customer care/retention, business-to-business lead generation and direct sales.

Technology

We invest heavily in systems and software technologies designed to improve our operations productivity, thereby lowering the effective cost per operations made or received, and to improve sales and customer service effectiveness by providing our sales and service representatives with real-time access to customer and product information. We believe we were one of the first fully automated teleservices companies and among the first to implement predictive dialing technology for outbound telemarketing and market research, to provide collaborative Web browsing services and to provide VoIP capabilities.

Through a global implementation of VoIP, we have obtained a redundant voice and data network infrastructure (based on VoIP technology) from our telecommunications vendors that can seamlessly route inbound and outbound voice traffic to our operations centers worldwide. As an example, our percentage of VoIP-enabled workstations has increased from approximately 20% in 2003 to 70% in 2007.

We utilize a scalable set of UNIX and Windows processors to support our inbound and outbound operations centers. Dedicated UNIX and Windows processors are used for inbound operations centers, while predictive dialing systems, networked to UNIX and Windows processors at our corporate data centers, are used for

4

Table of Contents

outbound operations centers. The predictive dialing systems support call and data management. The UNIX and Windows processors provide centralized list management, data consolidation, report generation and also interface with client order processing systems.

We use software to prepare inbound and outbound scripts, manage, update and reference client data files, collect statistical transaction and performance data and assist in the preparation of internal and external reports. This software includes our proprietary list management system (LMS) as well as Siebel Systems Contact Management system. Our use of the Siebel Systems software as well as Oracle’s database management system provides a scalable and robust suite of applications to support our clients’ business needs. We also use a proprietary IVR system that runs on industry standard operating systems and interfaces with our telephony system through Intel’s Dialogic interface cards. This IVR system provides an automated method to handle voice calls and interfaces with Nuance, an industry-leading speech recognition system.

Quality Assurance, Personnel and Training

We place heavy emphasis on the delivery of quality service on calls made or taken on behalf of our clients. This is accomplished through extensive employee training and development programs, augmented with highly developed quality assurance personnel and solid business practices. Our quality assurance and training departments are responsible for the development, implementation and enforcement of policies and procedures used in operating the operations centers. The selection and training of telephone service representatives, training and professional development of operations center management personnel, monitoring of calls and verification and editing of all sales are performed through our Quality Assurance and Training organizations. Through our Quality Assurance department our internal staff, as well as the staff of our clients, are able to perform real time on-site and remote call monitoring to maintain quality and efficiency. Sales confirmations are recorded, with the customer’s consent, in order to verify the accuracy and authenticity of transactions. Additionally, we are able to provide our clients with immediate updates on the progress of an ongoing program. Access to this data allows our operations Management and our clients to identify potential campaign shortfalls and to immediately modify or enhance the program. Digital recording technology has been deployed to all of our operations centers and allows the consolidation of all verification activities into geographically centralized locations and effectively creates a “third-party” verification center. Verification results are available to our operations Management and our client services Management by the end of each calling day. Each center can access the recordings for review with supervisory staff or the service representative. We are also currently testing as part of a pilot program certain voice-recognition software. This software will enhance a variety of our verification abilities when fully deployed.

Our commitment to providing quality service is further illustrated by our certification with ISO 9001:2000 standards, which are administered by the International Organization for Standardization and represent an international consensus on the essential features of a quality system to ensure the effective operation of a business. All domestic and international sales and service centers are ISO 9001:2000 compliant. Our ISO 9001:2000 certification is at the core of our Quality Management System, and is the key driver to our process driven, continuous improvement orientation. In 2007, we successfully obtained full certification as a Level 1 Service Provider under the Payment Card Industry (PCI) Data Security Standard. Our certification involved a complete audit with a 12-step approval process, ensuring that we have built and maintained a secure network, protected cardholder data, maintained a vulnerability management program, implemented strong access control measures, regularly monitored and tested networks and maintained an information security policy. These two certifications allow us to meet the critical and complex data security needs of our clients.

Employees

Management believes that a key driver of our success is the quality of our employees. We tailor our recruiting and training techniques toward the industries we serve. As part of the setup of each client program, service representatives receive a detailed review of each program in which they are to participate along with training regarding the background, structure and philosophy of the client that is sponsoring the program. As is

5

Table of Contents

typical in our business, most of our service representatives are part-time or temporary employees. As of December 31, 2007, we employed 19,006 people, most of whom were part-time or temporary employees. Except for our employees in Argentina, none of our employees are currently represented by a labor union. We consider our relations with our employees to be good.

Clients

We target those companies that we believe have the greatest potential to generate recurring revenue to the Company based on their ongoing direct sales and customer service needs. At December 31, 2007, we provided our services to over 150 clients.

Our customer care clients typically enter into multi-year contractual relationships that may contain provisions for early contract terminations, while we generally operate under month-to-month contractual relationships with our telesales clients. The pricing component of a contract is often comprised of a base service charge and separate charges for ancillary services. Our services are generally based upon per-minute or hourly rates. On occasion, we perform services for which we are paid incentives based on completed sales.

For each of the years ended December 31, 2007, 2006 and 2005, there were no customers which comprised more than 10% of our revenue. For the years ended December 31, 2007, 2006 and 2005, our top ten customers accounted for 49%, 48% and 48% of our total revenue, respectively.

Competition

The customer management and business process outsourcing services industry is very competitive and our principal competition in our primary markets comes from large service organizations, including, but not limited to: Convergys Corporation, Sykes Enterprises, TeleTech Holdings, Inc., APAC Customer Services, Inc, PeopleSupport, Inc., and StarTek, Inc. We also compete with numerous independent firms, some of which are as large or larger than we are, as well as the in-house operations of many of our clients or potential clients. In addition, many businesses that are significant consumers of these services utilize more than one service firm at a time and may reallocate work among various firms from time to time. Some of this work is contracted on an individual project basis, with the result that we and other firms seeking such business are required to compete with each other frequently as individual projects are initiated. Furthermore, we believe there is a trend among some businesses toward outsourcing the management of their operations centers to large, multi-service competitors, some of which may be substantially larger with greater financial resources than us.

Quarterly Results and Seasonality

We have experienced, and expect to continue to experience, quarterly variations in operating results, principally as a result of the timing of programs conducted by new and existing clients (particularly programs with substantial amounts of upfront project setup costs), and selling, general and administrative expenses to support the growth and development of existing and new business units.

Our business tends to be strongest in the second half of the year due to higher call volumes and improved financial results of client sales and service activity in anticipation of the holiday season, while the first quarter often reflects a slowdown relating to the cessation of that activity. As we continue to increase the percentage of revenue associated with service programs, we expect these variations to lessen. Our operating margins in the first quarter are typically lower due to higher payroll-related taxes with our workforce.

Government Regulation

Both the Federal and state Governments regulate telemarketing sales practices in the U.S. The Federal Telephone Consumer Protection Act of 1991 (the TCPA), enforced by the Federal Communications Commission (the FCC), imposes restrictions on unsolicited telephone calls to residential telephone subscribers. Under the

6

Table of Contents

TCPA, it is unlawful to initiate telephone solicitation to residential telephone subscribers before 8:00 A.M. or after 9:00 P.M. local time at the subscriber’s location, or to use automated telephone dialing systems or artificial or pre-recorded voices to certain subscribers. Additionally, the TCPA requires telemarketing firms to develop a written policy implementing a “do-not-call” registry, and to train its telemarketing personnel to comply with these restrictions. The TCPA creates a right of action for both consumers and state attorneys general. A court may award actual damages or minimum statutory damages of $500 for certain violations, which may be trebled for willful or knowing violations. Currently, we train our service representatives to comply with the regulations of the TCPA and program our call management system to avoid initiating telephone calls during restricted hours or to individuals maintained on an applicable do-not-call list.

The Federal Trade Commission (the FTC) regulates both general sales practices and telemarketing specifically. Under the Federal Trade Commission Act (the FTC Act), the FTC has broad authority to prohibit a variety of advertising or marketing practices that may constitute “unfair or deceptive acts and practices.” Pursuant to its general enforcement powers, the FTC can obtain a variety of types of equitable relief, including injunctions, refunds, disgorgement, the posting of bonds and bars from continuing to do business, for a violation of the acts and regulations it enforces.

The FTC also administers the Federal Telemarketing and Consumer Fraud and Abuse Prevention Act of 1994 (the TCFAPA). Under the TCFAPA, the FTC adopted the Telemarketing Sales Rule (TSR), which prohibits deceptive, unfair or abusive practices in telemarketing sales. Generally, the TSR prohibits misrepresentations of the cost, quantity, terms, restrictions, performance or characteristics of products or services offered by telephone solicitation or of refund, cancellation or exchange policies. The TSR also regulates the use of prize promotions in telemarketing to prevent deception and requires that a telemarketer identify promptly and clearly the seller on whose behalf the telemarketer is calling, the purpose of the call, the nature of the goods or services offered and, if applicable, that no purchase or payment is necessary to win a prize. The TSR also imposes limits on the use of predictive dialers which is the technology that automatically dials a certain number of telephone numbers and routes the connected calls to telephone sales representatives as they become available. Although this technology utilizes complex algorithms in an attempt to ensure that no consumers are contacted without available telephone sales representatives to handle the calls, this situation occasionally occurs, resulting in what is known as an “abandoned” call. The TSR establishes limits on the permissible numbers of such abandoned calls, and requires that telemarketers play a recorded message to all consumers who receive such calls. These regulations also create new limitations on the use of credit card account numbers and other consumer information, and require telemarketers to transmit caller identification information to consumers. These regulations also require the transmission of a telephone number and when made available by the telemarketer’s carrier, the name of the telemarketer or seller. The TSR also requires that telemarketers maintain records on various aspects of their business. Analogous restrictions apply to industries regulated by the FCC.

We also adhere to the standards required by the Do-Not-Call Implementation Act (the DNC Act). In response to the requirements set forth by the DNC Act, the FCC amended its TCPA rules. The amended rules became effective on June 26, 2003. The amendments, which were similar to the changes made to the TSR, authorized the creation of a National Do-Not-Call registry, placed a limit on the number of calls abandoned by the predictive dialer and required the transmission of a telephone number to be shown by caller ID.

To manage our adherence to these requirements, we have a Compliance Manager and a Compliance Committee which monitor our compliance.

Most states have enacted statutes similar to the TCFAPA generally prohibiting unfair or deceptive acts and practices. Additionally, some states have enacted laws and others are considering enacting laws targeted directly at telemarketing practices. For example, telephone sales in certain states are not final until a written contract is delivered to and signed by the buyer, and such a contract often may be canceled within three business days. At least one state also prohibits telemarketers from requiring credit card payment, and several other states require certain telemarketers to obtain licenses, post bonds or submit sales scripts to the state’s attorney general. Under

7

Table of Contents

the more general statutes, depending on the willfulness and severity of the violation, penalties can include imprisonment, fines and a range of equitable remedies such as consumer redress or the posting of bonds before continuing in business. Many of the statutes directed specifically at telemarketing practices provide for a private right of action for the recovery of damages or provide for enforcement by state agencies permitting the recovery of significant civil or criminal penalties, costs and attorneys’ fees. We cannot be assured that any such laws, if enacted, will not adversely affect or limit our current or future operations.

In addition to the laws regulating telephone sales activities, there are federal and state laws governing consumer privacy, such as the Gramm-Leach-Bliley Act and the Health Insurance Portability and Accountability Act. In addition, the USA PATRIOT Act imposes some requirements that affect some of our clients in the financial services sector.

The various industries that we serve are also subject to Government regulation. For example, our work on client programs involving the sale of insurance products implicates state licensing and regulatory requirements. In addition, our work on behalf of our pharmaceutical clients requires knowledge of Food and Drug Administration regulations regarding the reporting of adverse events.

In addition to Federal regulation, activity at the state and Federal level regarding laws that impact the teleservices industry has intensified over the past several years. States have enacted a variety of laws regulating marketing via telephone. Do-not-call lists, restricted hours or days, registration, request to continue solicitation and no rebuttal laws are common in many states. We have developed a system to facilitate compliance with all of these laws. Our Compliance Committee, comprised of members from our Quality Assurance, Operations, Client Services, Legal and IT departments, is responsible for compliance. Our participation on the Direct Marketing Association and the American Telemarketing Association Legislative Committees helps to enable our timely notification of proposed legislation.

Internationally, the various countries outside of the United States in which we have operations generally have less detailed regulatory frameworks for teleservices activities. Instead, many of these countries have laws and/or regulations regulating consumer privacy and the collection and use of consumer data. The most prominent of these is the European Union’s Data Privacy Directive.

In Canada, the Canadian Radio-Television and Telecommunications Commission enforces a variety of rules affecting the teleservices industry, including regulations on unsolicited communications via automatic dialing and announcing devices. On January 1, 2004, the Personal Information Protection and Electronic Documents Act (“PIPEDA”), a federal law regulating the collection and use of an individual’s personal information, became effective. PIPEDA requires, among other things, the establishment of a privacy policy and procedure and the appointment of a privacy officer. Our legal and compliance groups are currently monitoring provincial legislative activity in this area, as PIPEDA permits individual provinces to enact their own, more stringent privacy laws.

Investor Information

You can access financial and other information in the “Investors” section of our website. The website address is www.ictgroup.com. We make available through our website, free of charge, copies of our Annual Report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934 as soon as reasonably practicable after filing such material electronically or otherwise furnishing it to the Securities and Exchange Commission (the SEC). In addition, we make available through our website, free of charge, copies of our Code of Ethics for the Chief Executive Officer and Senior Financial Officers and our Code of Conduct. To the extent that there are any waivers of, or amendments to, either code, we intend to report the waiver or amendment in the “Investors” section of our website. These documents are also available in print form to any shareholder who requests them. Requests should be directed to the Legal Department of ICT Group, Inc., 100 Brandywine Boulevard, Newtown, PA 18940. The information on the website listed above is not and should not

8

Table of Contents

be considered part of this Annual Report on Form 10-K and is not incorporated by reference in this document. This website is only intended to be an inactive textual reference. You can also read and copy any materials we file with the SEC at the SEC’s Public Reference Room at 100 F Street N.E., Washington, D.C. 20459. You can contact the Public Reference Room at 1-800-SEC-0330. Because we file our documents electronically with the SEC, you can also access them at www.sec.gov.

We were incorporated in the Commonwealth of Pennsylvania in 1987. Our executive offices are located at 100 Brandywine Boulevard, Newtown, PA 18940. Our telephone number is (267) 685-5000.

| ITEM 1A. | RISK FACTORS |

An investment in our Company involves a substantial risk of loss. You should carefully consider the risks described below together with all of the other information included in this Annual Report on Form 10-K before making an investment decision. The risks and uncertainties described below are not the only ones facing us.

RISKS RELATING TO OUR BUSINESS

We may not be able to manage our growth effectively, which could adversely affect our results of operations.

We have experienced rapid growth over the past few years and currently expect to continue a high rate of growth. Rapid growth places a significant strain on our Management, operations and resources. Our future performance and profitability will depend on our ability to:

| • | build our infrastructure to meet the demands of our clients; |

| • | successfully recruit, train and retain qualified personnel in a cost-effective manner; |

| • | maintain state-of-the-art technology to compete effectively in the outsourced business services industry; |

| • | effectively oversee and manage our operations centers as we expand geographically, including internationally; |

| • | effectively manage the growth and implementation of our customer operations centers; |

| • | successfully introduce newer cost-effective near-shore, offshore and home-shore outsourced business service solutions; |

| • | select and serve new vertical markets; |

| • | successfully expand our service offerings from our core CRM business to include enhanced technology, marketing and business process outsourcing services; |

| • | successfully integrate any acquired businesses; |

| • | manage our business in light of general economic conditions and conditions which may affect in particular our clients and other companies in the markets we serve; |

| • | manage our operating costs as we expand and grow our business, and |

| • | maximize the income tax benefits from the locations in which we operate under tax holidays. |

9

Table of Contents

If we are unable to keep pace with technological changes, our business will be harmed.

Our business is highly dependent on our computer and telecommunications equipment and software capabilities. Our failure to maintain the competitiveness of our technological capabilities or to respond effectively to technological changes could have a material adverse effect on our business, results of operations or financial condition. Our continued growth and future profitability will be highly dependent on a number of factors, including our ability to:

| • | expand our existing solution offerings; |

| • | achieve cost efficiencies in our existing customer operations centers ; |

| • | introduce new solutions that leverage and respond to changing technological developments, and |

| • | keep current with technology advances. |

There can be no assurance that technologies or services developed by our competitors or vendors will not render our products or services non-competitive or obsolete, that we can successfully develop and market any new services or products, that any such new services or products will be commercially successful or that the integration of automated customer support capabilities will achieve intended cost reductions. In addition, the inability of equipment vendors and service providers to supply equipment and services on a timely basis could harm our operations and financial condition.

Our results of operations may be subject to significant fluctuations.

Our quarterly and annual operating results have fluctuated in the past and may vary in the future due to a wide variety of factors, including:

| • | the commencement and expiration or termination of contracts; |

| • | our revenue mix; |

| • | the amount and timing of new business; |

| • | the impact of litigation and associated costs; |

| • | the financial strength of our clients and the collectibility of our receivables; |

| • | our ability to successfully open new operations centers, to expand existing operations centers, or to close operations centers in a timely fashion; |

| • | our ability to move client programs between operations centers and countries in an efficient manner; |

| • | the profitability of our international operations; |

| • | the timing of additional selling, general and administrative expenses; |

| • | our ability to resolve vendor and customer disputes in a timely manner and manage the costs associated with them; |

| • | competitive conditions in our industry; |

| • | the impact of adverse weather conditions or natural disasters; |

| • | our ability to maximize the utilization of our capacity in our operations centers; |

| • | our sources of pre-tax income, which are either domestic or international, will impact our overall effective tax rate, and |

| • | changes in statutory income tax rates and tax laws and expiration of tax holidays in the jurisdictions in which we operate. |

10

Table of Contents

Our business tends to be strongest in the second half of the year due to higher call volumes and improved financial results of client sales and service activity in anticipation of the holiday season, while the first quarter often reflects a slowdown relating to the cessation of that activity. Our operating margins in the first quarter are typically lower due to higher payroll-related taxes with our workforce. In the past, during the first quarter, our business has generally leveled off or slowed from the previous quarter as a result of reduced client sales activity and client transitions to new marketing programs during the first quarter of the calendar year. In addition, we have generally expanded our operations in the first and third quarters, without a commensurate increase in revenue in those quarters, to support anticipated business growth beginning in the second and fourth quarters, respectively. However, more recently, we have experienced quarterly fluctuations in our business as a result of other factors, such as the timing of demand for the particular services we offer in the specific geographical areas we service.

Due to these factors, our quarterly revenue, expenses and results of operations could vary significantly in the future. You should take these factors into account when evaluating past periods and, because of the potential variability in our quarterly results, you should not rely upon results of past periods as an indication of our future performance. In addition, because our operating results may vary significantly from quarter to quarter, results may not meet the expectations of securities analysts and investors, and this could cause the price of our common stock to fluctuate significantly.

Our contracts often are short-term or may be subject to early termination by our clients, which could cause our operating results to fluctuate.

We generally operate under month-to-month contractual relationships with our teleservices clients. The potentially brief duration of certain teleservices programs we implement for clients could cause our operating results to fluctuate. In addition, while customer care services contracts are generally longer-term contractual relationships, those contracts often provide for early termination at the client’s discretion. Certain of those contracts require the client to pay a contractually agreed amount in the event of early termination, but others do not. We cannot assure you that we will be able to collect such amount or that such amount, if received, will sufficiently compensate us for our investment in the canceled program or for the revenue we may lose as a result of early termination.

We generate a significant portion of our revenue from a small number of major clients.

For the year ended December 31, 2007, our top ten clients accounted for 49% of our total revenue. The loss of one of these clients or the failure to maintain the current service levels for these customers could have a material adverse effect on our business, financial condition and results of operations. Many of our contracts are cancelable by the customer with limited notice, therefore these contracts do not necessarily ensure that we will generate a minimum level of revenue to cover our fixed operating costs.

Our business may be affected by the success of our clients’ products and services.

In most of our client programs, we generate revenue based, in large part, on the amount of time our customer service representatives devote to our clients’ customers. Consequently, the amount of revenue generated from any particular client program is dependent upon consumers’ interest in, and use of, the client’s products and/or services. There can be no assurance that our clients will continue to market products and services or develop new products and services that require them to use our services.

We depend on particular industries for a majority of our revenues.

We currently generate a majority of our revenue from clients in the financial services industry, healthcare industry and telecommunications industry. Our growth and financial results are largely dependent on continued demand for our services from clients in these industries and current trends in these industries to outsource certain

11

Table of Contents

business services. If any of these industries experiences a downturn, our clients in these sectors may do less business with us, or they may elect to perform the services provided by us in-house. In 2007, the revenues generated from our clients in the financial services industry were negatively impacted by the financial credit crisis. If there are any trends in any of these industries to reduce or eliminate the use of outsourced business services, our financial results could be negatively affected. Our revenue by industry is as follows:

| For the years ended December 31, | |||||||||

| 2007 | 2006 | 2005 | |||||||

Financial services | 49 | % | 49 | % | 51 | % | |||

Telecommunications | 26 | % | 19 | % | 19 | % | |||

Healthcare | 13 | % | 20 | % | 13 | % | |||

Other | 12 | % | 12 | % | 17 | % | |||

We may be unable to cost-effectively hire or retain qualified personnel, which could materially increase our costs.

Our business is labor intensive and is characterized by high personnel turnover. A higher turnover rate among our employees would increase our recruiting and training costs and decrease operating efficiencies and productivity. Some of our operations require specially trained employees and growth in our business will require us to recruit and train qualified personnel at an accelerated rate from time to time. We may not be able to successfully hire, train and retain sufficient qualified personnel to adequately staff for existing business or future growth, particularly when we undertake new client relationships in industries in which we have not previously provided services. In addition, a significant portion of our costs consists of wages paid to hourly workers. An increase in hourly wages, costs of employee benefits or employment taxes could materially adversely affect us.

Our profitability will be adversely affected if we do not maintain sufficient capacity utilization.

Our profitability is influenced significantly by how we utilize our workstation capacity. We attempt to maximize utilization during all periods. However, because much of our business is inbound, we typically experience significantly higher utilization during peak (weekday) periods than during off-peak (night and weekend) periods. In addition, we have experienced, and in the future may experience, at least in the short-term, idle peak period capacity when we open a new customer interaction center or terminate or complete a large client program. From time to time we assess the expected long-term capacity utilization of our centers. Accordingly, we may, if deemed necessary, consolidate or shut down under performing centers in order to maintain or improve targeted utilization and margins. There can be no assurance that we will be able to achieve or maintain optimal customer interaction center capacity utilization.

Interruptions or failures of our technology infrastructure could harm our business and reputation.

We are highly dependent on the stability of our computer and communications equipment, systems and software, and our telecommunications carrier networks. These systems could be interrupted by natural disasters, power losses, operating malfunctions or computer viruses and other disruptions caused by unauthorized or illegal access to our systems. If an interruption occurs, the contracts we have with our clients may provide for damages and for termination or re-negotiation. Our property damage insurance may not adequately compensate us for any losses we may incur. Although we have put in place a disaster recovery program, any interruption in or failure of our technology equipment systems could have a material adverse effect on our business.

A significant interruption in telephone service could harm our business.

Any significant interruption in telephone service or developments that limit the ability of telephone companies to provide us with increased capacity in the future and could harm our existing operations and prospects for future growth.

12

Table of Contents

Future acquisitions will involve risks.

While we historically have grown our business primarily through internal expansion, we expect to continue our growth through both internal expansion and selective acquisitions of companies that would augment our service offerings, facilitate our entry into new sectors and/or geographic markets and otherwise expand our business. We will not be able to acquire other businesses if we cannot identify suitable acquisition opportunities, reach mutually agreeable terms with acquisition candidates or obtain additional financing, if amounts in excess of the availability under our existing credit facility are necessary, to pay for any acquisitions that we undertake. The negotiation of potential acquisitions as well as the integration of acquired businesses could require us to incur significant costs and cause diversion of our Management’s time and resources. Future acquisitions could result in:

| • | dilutive issuances of equity securities; |

| • | a decline in our operating results; |

| • | incurrence of debt and contingent liabilities; |

| • | recording of goodwill and other intangibles that could become impaired, and |

| • | other acquisition-related expenses. |

Some or all of these items could have a material adverse effect on our business. Any businesses we acquire may not generate sales and profitability sufficient to justify our investment. If we fail to successfully integrate an acquired business, we may not be able to realize the synergies we anticipated in valuing that business. In addition, to the extent that consolidation becomes more prevalent in our industry, the prices for suitable acquisition candidates may increase to unacceptable levels and thus limit our ability to grow through acquisitions.

Our international operations are susceptible to business and political risks and changes in foreign currency exchange rates that could adversely affect our results of operations.

We operate our business in various countries outside the United States, including Canada, Ireland, the United Kingdom, Australia, Mexico, India, Argentina, Costa Rica and the Philippines. As of December 31, 2007, over 75% of our employees were located outside the United States and they generated a significant amount of our revenue. North American companies, in particular, have created a demand for offshore outsourcing capacity. As a result, we expect to continue expansion through start-up operations and acquisitions in additional countries. Expansion of our existing international operations and entry into additional countries will require Management attention and financial resources. In addition, there are certain risks inherent in conducting business internationally including: the imposition of trade barriers, foreign exchange restrictions, longer payment cycles, greater difficulties in accounts receivables collection, difficulties in complying with a variety of foreign laws, ensuring our compliance with the income tax holidays we currently benefit from, changes in legal or regulatory requirements, difficulties in staffing and managing foreign operations, political instability and potentially adverse tax consequences. To the extent we experience these risks, our business and results of operations could be adversely affected.

Our financial results may be impacted by risk associated with changes in foreign currency

We conduct our business in various foreign currencies and are exposed to market risk from changes in foreign currency exchange rates and interest rates, which could impact our results of operations and financial condition. While we do attempt to mitigate some of this risk through hedging arrangements, we may not be successful to the extent that these arrangements are ineffective or not fully effective. We also are subject to certain exposures arising from the translation and consolidation of the financial results of our foreign subsidiaries. A significant change in the value of the dollar against the currency of one or more countries in which we operate may have a material adverse effect on our results of operations.

13

Table of Contents

Future litigation may result in significant costs for defense purposes or for settlement purposes, both of which may not be covered by our current insurance programs. Litigation may also take away Management focus from the business and could significantly impact our financial results.

We disclose that our business, not unlike other businesses, may face litigation from time to time. In 2007 we settled litigation with a broker over contract claims. The total cost to the Company was $825,000 to settle the litigation along with $217,000 for incurred legal fees. Irrespective of the outcome of any potential lawsuits or potential actions, claims, or investigations relating to the same or any other subject matter, we may incur substantial defense costs and possibly settlement costs, which may not be covered in their entirety by insurance. Litigation may also take away Management focus from the business, which, in addition to the costs that we may incur, could result in harm to our business, financial condition, results of operations and cash flows.

Our business could be significantly disrupted if we lose members of our Management team.

We believe that our success depends to a significant degree upon the continued contributions of our executive officers and other key personnel, both individually and as a group. Our future performance will be substantially dependent on our ability to retain them. The loss of the services of any of our executive officers, particularly John J. Brennan, our Chief Executive Officer, could prevent us from executing our business strategy.

We may not be able to effectively win business against our competition.

The industries in which we compete are highly competitive. We compete with:

| • | the in-house business services operations of our clients or potential clients; |

| • | other outsourced business service providers, some of which have greater resources than we have, and |

| • | providers of other marketing and CRM formats and, in particular, other forms of direct marketing such as interactive shopping and data collection through television, the Internet and other media. |

Many businesses that are significant consumers of CRM solutions use more than one CRM solutions firm at a time and reallocate work among various firms from time to time. We and other firms seeking to perform outsourced CRM solutions are frequently required to compete with each other as individual programs are initiated. We cannot be certain that we will be able to compete effectively against our current competitors or that additional competitors, some of which may have greater resources than we have, will not enter the industry and compete effectively against us. As competition in the industry increases, we may face increasing pressure on the prices for our services.

If the trend toward outsourcing or the growth in the industries we serve decreases, our growth may suffer.

Our growth depends in part on continued demand for our services prompted by the outsourcing trend, as well as continued growth in the industries we serve. If interest in outsourcing wanes because of economic, political, or other conditions, or if there is a significant downturn in the industries in which we operate, our business and our growth could suffer.

Consumer resistance to our services could harm our industry.

As the outsourced business services industry continues to grow, the effectiveness of our customer solutions as a direct marketing tool may decrease as a result of consumer saturation and increased consumer resistance to customer acquisition activities, particularly direct sales.

14

Table of Contents

Government regulation of our industry and the industries we serve may increase our costs and restrict the operation and growth of our business.

Both the United States Federal and various state Governments regulate our business and the outsourced business services industry as a whole. The Federal Telemarketing and Consumer Fraud and Abuse Prevention Act of 1994 broadly authorizes the FTC to issue regulations restricting certain telemarketing practices and prohibiting misrepresentations in telephone sales. The FTC regulations implementing the TCFAPA are commonly referred to as the Telemarketing Sales Rule. Our operations outside the United States are also subject to regulation. Please refer to Part I, Item 1: “Government Regulation” of this Form 10-K for more detailed information. In addition to current laws, rules and regulations that regulate our business, bills are frequently introduced in Congress to regulate the use of credit information. We cannot predict whether additional Federal or state legislation will be enacted that regulates our business. Additional Federal or state legislation could limit our activities or increase our cost of doing business, which could cause our operating results to suffer.

Several of the industries we serve, particularly the financial services, healthcare and telecommunications industries, are subject to Government regulation. We could be subject to a variety of regulatory enforcement or private actions for our failure or the failure of our clients to comply with these regulations. Our results of operations could be adversely impacted if the effect of Government regulation of the industries we serve is to reduce the demand for our services or expose us to potential liability. We and our employees who sell insurance products are required to be licensed by various state insurance commissions for the particular type of insurance product sold and to participate in regular continuing education programs. Our participation in these insurance programs requires us to comply with certain state regulations, changes in which could materially increase our operating costs associated with complying with these regulations.

Security and privacy breaches of the systems we use to protect personal data could adversely affect our business, results of operations and financial condition.

Our databases contain personal data of our clients’ customers, including credit card and healthcare information. Any security or privacy breach of these databases could expose us to liability, increase our expenses relating to the resolution of these breaches and deter our clients from selecting our services. Our data security procedures may not effectively address evolving security risks or address the security and privacy concerns of existing or potential clients. Any failures in our security and privacy measures could adversely affect our business, financial condition and results of operations.

We may not be able to adequately protect our proprietary information or technology.

Third parties may infringe upon or misappropriate our trademarks, trade names, trade secrets or other intellectual property rights, which could adversely affect our business, results of operations and financial condition, and litigation may be necessary to enforce our intellectual property rights, protect our trade secrets or determine the validity and scope of the proprietary rights of others. The steps we have taken to deter misappropriation of our proprietary information and technology or client data may be insufficient to protect us, and we may be unable to prevent infringement of our intellectual property rights or misappropriation of our proprietary information. Any infringement or misappropriation could harm any competitive advantage we currently derive or may derive from our proprietary rights. In addition, because we operate in many foreign jurisdictions, we may not be able to protect our intellectual property in the foreign jurisdictions in which we operate.

Our technology and services may infringe upon the intellectual property rights of others.

Third parties may assert claims against us alleging that we are violating or infringing upon their intellectual property rights. Any claims and any resulting litigation could subject us to significant liability for damages. An adverse determination in any litigation of this type could require us to design around a third party’s patent, license alternative technology from another party or reduce or modify our product and service offerings. In

15

Table of Contents

addition, litigation is time-consuming and expensive to defend and could result in the diversion of our time and resources. Any claims from third parties may also result in limitations on our ability to use the intellectual property subject to these claims.

Terrorism and the possibility of further acts of violence or war may have a material adverse effect on our operations.

Terrorist attacks and the response to them by the United States and further acts of violence or war may affect the market on which our common stock trades, the markets in which we operate, our operations and profitability and your investment. Further terrorist attacks against the United States or other countries may occur. The potential near-term and long-term effect of these attacks on our business, the market for our common stock and the global economy is uncertain. The consequences of any terrorist attacks, or any armed conflicts that may result, are unpredictable, and we may not be able to foresee events that could have an adverse effect on our business or the trading price of our common stock.

A significant or prolonged economic downturn could have a materially adverse effect on our revenues and profit margin.

Our financial results are impacted by the level of business activity of our clients. Economic slowdowns in some markets, particularly in the United States, may cause reductions in technology and discretionary spending by our clients, which may result in reductions in the growth of new business as well as reductions in existing business. In 2007 the downturn in the financial services markets caused by the financial credit crisis impacted our consolidated results for 2007. If our clients enter bankruptcy or liquidate their operations, our revenue could be adversely affected. There can be no assurance that weakening economic conditions throughout the world will not adversely impact our results of operations and/or financial position.

RISKS RELATING TO OUR COMMON STOCK

A Voting Trust controlled by our Chief Executive Officer and one of our directors controls 28% of our outstanding common stock.

A Voting Trust controlled by John J. Brennan, our Chief Executive Officer, and his brother Donald P. Brennan, one of our directors, controls approximately 28% of our outstanding common stock. Additionally, John J. Brennan controls approximately 9% of our outstanding common stock through shares he personally owns and through voting agreements he has entered into with our employees. Eileen Brennan Oakley, daughter of Donald P. Brennan and Trustee of the 1996 and 1997 Brennan Family Trusts, controls approximately 7% of our outstanding common stock held by those Trusts. As a result, John J. Brennan, Donald P. Brennan and Eileen Brennan Oakley have substantial influence in determining the outcome of matters requiring shareholder approval.

Our stock price has been and may continue to be highly volatile.

From January 1, 2006, through March 3, 2008, the closing market price of our common stock fluctuated from a low of $8.01 to a high of $36.55. Because much of our common stock is owned by affiliates, the number of shares that is subject to daily trading on the market is limited. Therefore, the volatility of our stock price is exacerbated by relatively low trading volumes. The market price of our common stock may continue to be volatile and may be significantly affected by:

| • | actual or anticipated fluctuations in our operating results; |

| • | announcements of new services by us or our competitors; |

| • | developments with respect to conditions and trends in our industry or in the industries we serve; |

| • | Governmental regulation; |

16

Table of Contents

| • | general market conditions; |

| • | the loss of a significant client or a significant change in the volume of services or the locations at which we provide services to a client; |

| • | levels of liquidity in our stock’s trading volumes, and |

| • | other factors, many of which are beyond our control. |

These factors may adversely affect the trading price of our common stock, regardless of our actual operating performance, and could prevent you from selling your common stock at or above the price at which you purchased it. In addition, the stock market has, recently and from time to time, experienced significant price and volume fluctuations that have adversely affected the market prices of securities of companies without regard to their operating performances.

Anti-takeover provisions in our articles of incorporation, bylaws and Pennsylvania law and the right of our board of directors to issue preferred stock without shareholder approval could make a third-party acquisition of ICT Group difficult.

Provisions of our articles of incorporation and bylaws may have an anti-takeover effect and may delay, defer or prevent a tender offer or takeover attempt not approved by our board of directors, including those made at a premium over the prevailing market price of our common stock.

Our board of directors, limitations on calling a special meeting of our shareholders and the authority of our board to issue preferred stock and establish certain rights, preferences, privileges, limitations and other special rights thereof without any further vote or action by our shareholders could have the effect of delaying, impeding or discouraging the acquisition of control of us in a transaction not approved by our board of directors.

In general, Subchapter F of Chapter 25 of the Pennsylvania Business Corporation Law delays for five years and imposes conditions upon “business combinations” between an “interested shareholder” and us, unless prior approval of our board of directors is given. The term “business combination” is defined broadly to include various merger, consolidation, division, exchange or sale transactions, including transactions using our assets for purchase price amortization or refinancing purposes. An “interested shareholder,” in general, would be a beneficial owner of shares entitling that person to cast at least 20% of the votes that all shareholders would be entitled to cast in an election of directors.

We do not currently intend to pay dividends. As a result, shareholders are likely to benefit from an investment in our common stock only if it appreciates in value.

We have never declared or paid any cash dividends on our common stock. Moreover, we currently intend to retain any future earnings to finance future growth and working capital needs and, therefore, do not anticipate paying any cash dividends in the foreseeable future. As a result, obtaining a return on an investment in our common stock will depend upon any future appreciation in its value. We cannot guarantee that our common stock will appreciate in value or even maintain the price at which shareholders have purchased their shares.

| ITEM 1B. | UNRESOLVED STAFF COMMENTS |

None.

| ITEM 2. | PROPERTIES |

As of December 31, 2007, our corporate headquarters was located in Newtown, Pennsylvania in leased facilities consisting of approximately 105,000 square feet of office space rented under a lease that expires in 2017. In addition to the corporate headquarters staff, certain other divisional and operations personnel are located

17

Table of Contents

in the facility. We also lease all of the facilities used in our operations. These lease commitments expire generally between March 2008 and April 2014 and typically contain renewal options. Management believes that its existing facilities are suitable and adequate for our current operations, but additional facilities will be required to support growth. Management believes that suitable additional or alternative space will be available as needed on commercially reasonable terms.

The following table lists our various operating facilities and locations as of December 31, 2007.

Locations |

Conway, AR; Morrilton, AR; Nogales, AZ ; Colorado Springs, CO; Lakeland, FL; Louisville, KY; Wilton, ME; Amherst, NY; Lancaster, OH; Allentown, PA; Bloomsburg, PA; Erie, PA; Langhorne, PA ; Lockhaven, PA ; Horsham (PA), Spokane, WA; Carbonear, Newfoundland, Canada; Cornerbrook, Newfoundland, Canada; St. John’s, Newfoundland, Canada; Miramichi, New Brunswick, Canada; Riverview, New Brunswick, Canada; Halifax, Nova Scotia, Canada; New Glasgow, Nova Scotia, Canada; Sydney, Nova Scotia, Canada; Lindsay, Ontario, Canada; Peterborough, Ontario, Canada; Sherbrooke, Quebec, Canada; Athlone, Ireland; Dublin, Ireland; London, U.K.; Sydney, Australia; Mexico City, Mexico; Manila, Philippines (5); San Jose, Costa Rica; Buenos Aires, Argentina; Hyderabad, India. |

| ITEM 3. | LEGAL PROCEEDINGS |

On April 28, 2006, a broker with whom we executed an agreement in June 2001 filed a Demand for Arbitration and Statement of Claim against us with the American Arbitration Association. The Demand alleged various contract, quasi-contract and tort claims against us arising out of commissions we allegedly owed this broker pursuant to the June 2001 agreement for work we perform for one of our customers. The June 2001 agreement states that the decision of a majority of the arbitration panel shall be final and binding on the parties. Prior to the scheduled arbitration, which was scheduled for the end of May 2007, the Company agreed on a settlement with the broker for $825,000. This amount was accrued and paid during 2007. We also incurred legal expenses totaling $217,000 during 2007.

In addition to the above matter, from time to time, we are involved in litigation incidental to our business. Litigation can be expensive and disruptive to normal business operations. Accruals for litigation claims are provided to the extent that any losses are determined to be probable and estimable. Although the ultimate outcome of these claims or lawsuits cannot be ascertained, it is our opinion, based on present information and advice received from counsel, that the disposition or ultimate determination of such claims or lawsuits is not likely to have a material adverse effect on our Company.

| ITEM 4. | SUBMISSION OF MATTERS TO A VOTE OF SECURITY HOLDERS |

None.

18

Table of Contents

| ITEM 5. | MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES |

Market Information:

Our common stock trades on The NASDAQ Global Market under the symbol “ICTG.” The following table sets forth, for the periods indicated, the high and low closing sales prices as quoted on The NASDAQ Global Market.

| High | Low | |||||

Fiscal 2006: | ||||||

First Quarter | $ | 27.76 | $ | 15.73 | ||

Second Quarter | 28.71 | 23.50 | ||||

Third Quarter | 32.07 | 21.98 | ||||

Fourth Quarter | 36.55 | 30.72 | ||||

| Fiscal 2007: | ||||||

First Quarter | $ | 31.81 | $ | 17.50 | ||

Second Quarter | 22.85 | 18.00 | ||||

Third Quarter | 18.77 | 13.31 | ||||

Fourth Quarter | 15.16 | 9.88 | ||||

Holders:

As of March 3, 2008, there were 76 holders of record of the Company’s common stock, which does not reflect the number of shareholders whose shares are held in nominee or “street” name by brokers. On March 3, 2008, the closing sale price of the common stock as reported by The NASDAQ Global Market was $8.44.

Dividend Policy:

We have never declared or paid any cash dividends on our capital stock. Management currently intends to retain its earnings to finance future growth and working capital needs and, therefore, does not anticipate paying any cash dividends in the foreseeable future. Additionally, our credit agreement limits the payment of dividends.

19

Table of Contents

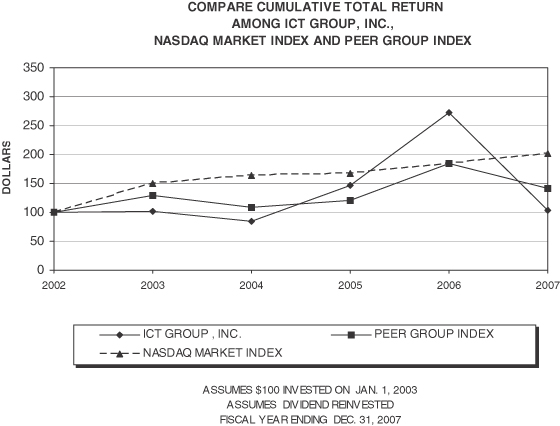

Performance Graph:

The graph below compares the cumulative total stockholder return on the Company’s common stock with the cumulative total return of the peer group selected by the Company and of the Nasdaq Stock Market (U.S.) Index (the Nasdaq index). The Peer Group consists of APAC Customer Services, Inc., Convergys Corporation, Sykes Enterprises, and Teletech Holdings, Inc, PeopleSupport, Inc., and StarTek, Inc. The Company believes that the Peer Group provides a better reference point for investors when evaluating the Company’s performance. The graph assumes that the value of the investment in the common stock of the Company, the stocks comprising the Nasdaq Index and the stocks comprising the Peer Group was $100 at January 1, 2003.

| Fiscal Year Ended | ||||||||||||||||||

| 1/1/2003 | 12/31/2003 | 12/31/2004 | 12/31/2005 | 12/31/2006 | 12/31/2007 | |||||||||||||

ICT Group, Inc. | $ | 100.00 | $ | 101.29 | $ | 83.79 | $ | 146.25 | $ | 272.56 | $ | 103.11 | ||||||

NASDAQ Market Index | 100.00 | 150.36 | 163.00 | 166.58 | 183.68 | 201.91 | ||||||||||||

Peer Group | 100.00 | 129.60 | 108.19 | 120.03 | 185.09 | 141.46 | ||||||||||||

20

Table of Contents

| ITEM 6. | SELECTED FINANCIAL DATA |

The following selected financial data are derived from the consolidated financial statements of the Company. The data should be read in conjunction with “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in Item 7 and the consolidated financial statements and related notes thereto included in Item 8 of this Form 10-K.

| For the Year Ended December 31, | |||||||||||||||||||

| 2007 | 2006 | 2005 | 2004 | 2003 | |||||||||||||||

| (In thousands, except per share amounts) | |||||||||||||||||||

Statement of Operations Data: | |||||||||||||||||||