- NWFL Dashboard

- Financials

- Filings

- Holdings

-

Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

425 Filing

Norwood Financial (NWFL) 425Business combination disclosure

Filed: 15 Dec 10, 12:00am

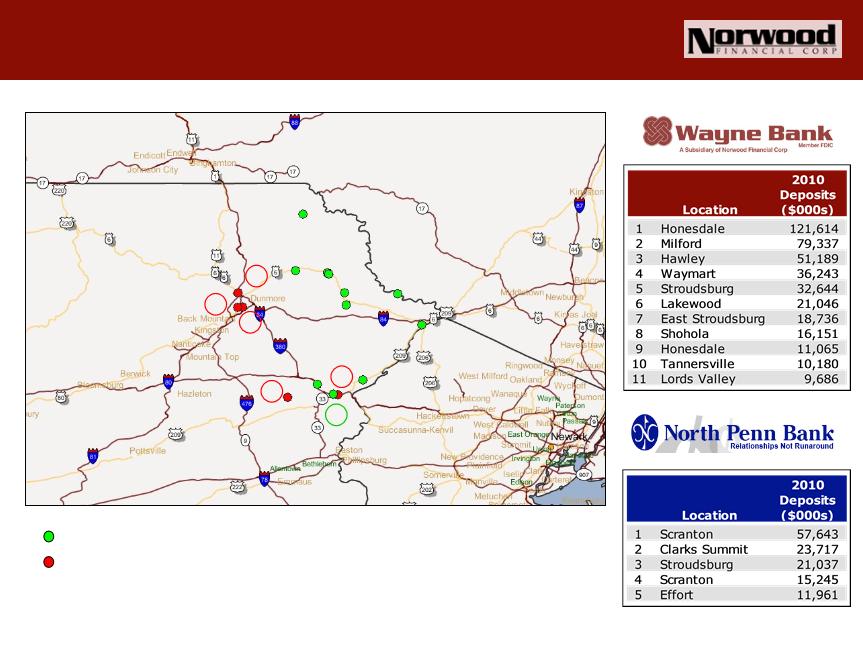

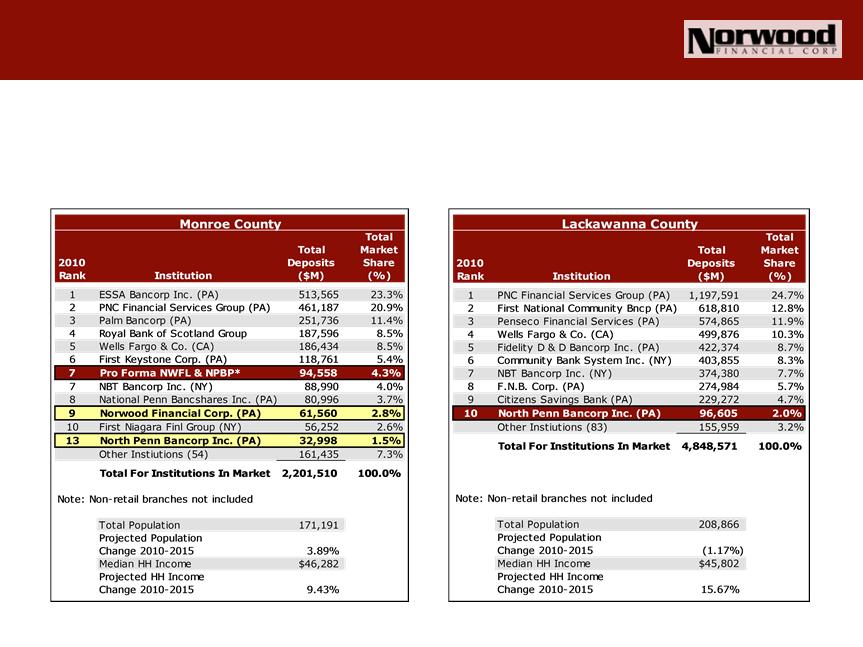

Transaction: | Norwood Financial Corp. (“NWFL”) will acquire 100% of the stock of North Penn Bancorp, Inc. (“NPBP”) |

Consideration: | Shareholders of NPBP will be eligible to receive cash, NWFL common stock(1), or a mix of both valued at $19.12 per share. The stock portion(1), of the total consideration equates to 55%. |

Transaction Value: | $27.1 million(2) |

Key Provisions: | NPBP will be merged into Wayne Bank and its offices will be rebranded as Wayne Bank |

Board Representation: | One board seat will be provided to a current NPBP director |

Due Diligence: | Completed comprehensive due diligence, including detailed review of loan utilizing NWFL senior personnel |

Termination Fee: | $1.125 million |

Conditions to Closing: | Customary regulatory and NPBP shareholder approval |

Expected Closing: | Second Quarter of 2011 |

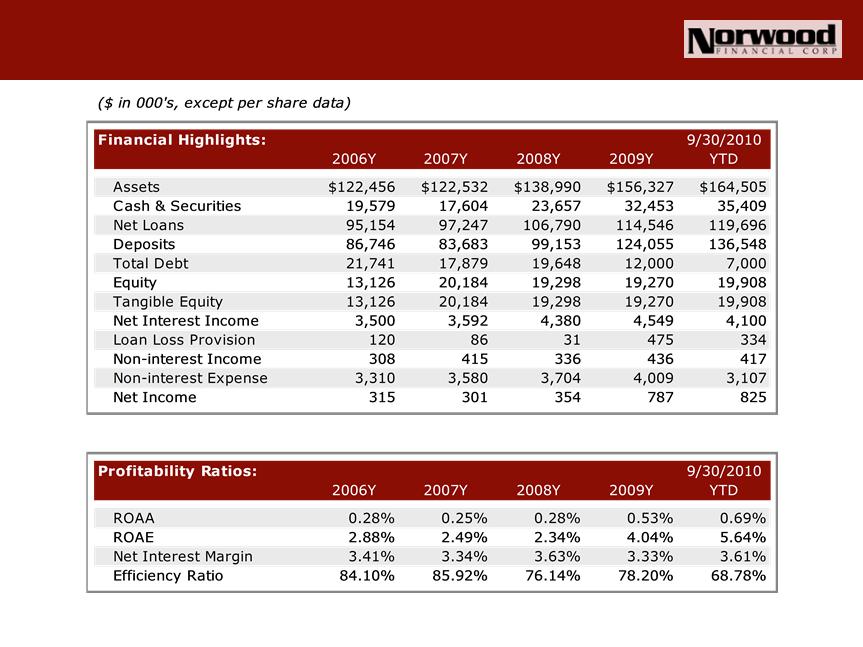

Purchase Price Overview ($000s in thousands) | |

Purchase Price: | |

Common Stock (1) | $24,572 |

Stock Options (2) | $1,551 |

Restricted Stock Awards (3) | $975 |

Total Purchase Price | $27,098 |

Purchase Price to NPBP’s:(4) | |

Tangible Book Value | 128.3% |

LTM Net Income | 20.5x |

Core Deposit Premium | 4.7% |

As of 9/30/2010 | Pro Forma 9/30/2010 | “Well Capitalized” | |

BV per Share | $24.79 | $24.65 | -- |

TBV per Share | $24.79 | $22.90 | -- |

TCE/TA | 12.8% | 11.0% | -- |

Leverage Ratio | 12.2% | 10.4% | 5.00% |

Tier 1 Capital | 18.1% | 14.8% | 6.00% |

Total Capital | 19.4% | 15.8% | 10.00% |

Lewis J. Critelli President & Chief Executive Officer (570) 253-8512 | William S. Lance Senior Vice President & Chief Financial Officer (570) 253-8505 |