2012 CONSOLIDATED FINANCIAL REPORT |

| | |

| MANAGEMENT’S DISCUSSION & ANALYSIS | 10 |

| | |

| MANAGEMENT’S REPORT ON INTERNAL CONTROL OVER FINANCIAL REPORTING | 29 |

| | |

| REPORTS OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM | 30 |

| | |

| CONSOLIDATED BALANCE SHEETS | 32 |

| | |

| CONSOLIDATED STATEMENTS OF INCOME | 33 |

| | |

| CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME | 34 |

| | |

| CONSOLIDATED STATEMENTS OF STOCKHOLDERS’ EQUITY | 35 |

| | |

| CONSOLIDATED STATEMENTS OF CASH FLOWS | 36 |

| | |

| NOTES TO CONSOLIDATED FINANCIAL STATEMENTS | 38 |

| | |

| INVESTOR INFORMATION | 74 |

NORWOOD FINANCIAL CORP - 2012 CONSOLIDATED FINANCIAL REPORT

MANAGEMENT’S DISCUSSION AND ANALYSIS

Introduction

This Management’s Discussion and Analysis and related financial data are presented to assist in the understanding and evaluation of the financial condition and results of operations for Norwood Financial Corp (the Company) and its subsidiary Wayne Bank (the Bank) as of December 31, 2012 and 2011 and for the years ended December 31, 2012, 2011, and 2010. This section should be read in conjunction with the consolidated financial statements and related footnotes.

Forward-Looking Statements

The Private Securities Litigation Reform Act of 1995 contains safe harbor provisions regarding forward-looking statements. When used in this discussion, the words believes, anticipates, contemplates, expects, and similar expressions are intended to identify forward-looking statements. Such statements are subject to certain risks and uncertainties, which could cause actual results to differ materially from those projected. Those risks and uncertainties include changes in Federal and State laws, changes in interest rates, risks associated with the acquisition of North Penn Bancorp, Inc. (“North Penn”) the ability to control costs and expenses, demand for real estate, changes in regulatory environment and general economic conditions. The Company undertakes no obligation to publicly release the results of any revisions to those forward-looking statements which may be made to reflect events or circumstances after the date hereof or to reflect the occurrence of unanticipated events.

Critical Accounting Policies

Note 2 to the Company’s consolidated financial statements (incorporated by reference in Item 8 of the Form 10-K) lists significant accounting policies used in the development and presentation of its financial statements. This discussion and analysis, the significant accounting policies, and other financial statement disclosures identify and address key variables and other qualitative and quantitative factors that are necessary for an understanding and evaluation of the Company and its results of operations.

Material estimates that are particularly susceptible to significant change in the near term relate to the determination of the allowance for loan losses, the potential impairment of restricted stock, accounting for stock options, the valuation of deferred tax assets, the determination of other-than-temporary impairment on securities, the determination of goodwill impairment and the fair value of financial instruments. Please refer to the discussion of the allowance for loan losses calculation under “Non-performing Assets and Allowance for Loan Losses” in the “Financial Condition” section.

The deferred income taxes reflect temporary differences in the recognition of the revenue and expenses for tax reporting and financial statement purposes, principally because certain items are recognized in different periods for financial reporting and tax return purposes. Although realization is not assured, the Company believes it is more likely than not that all deferred tax assets will be realized.

In estimating other-than-temporary impairment losses on securities, the Company considers 1) the length of time and extent to which the fair value has been less than cost and 2) the financial condition of the issuer. The Company does not have the intent to sell these securities and it is more likely than not that it will not sell the securities before recovery of their cost basis. The Company believes that the unrealized losses at December 31, 2012 and 2011 represent temporary impairment of the securities.

The fair value of financial instruments is based upon quoted market prices, when available. For those instances where a quoted price is not available, fair values are based upon observable market based parameters as well as unobservable parameters. Any such valuation is applied consistently over time.

NORWOOD FINANCIAL CORP - 2012 CONSOLIDATED FINANCIAL REPORT

In connection with the acquisition of North Penn, we recorded goodwill in the amount of $9.7 million, representing the excess of amounts paid over the fair value of the net assets of the institution acquired at the date of acquisition. Goodwill is tested and deemed impaired when the carrying value of goodwill exceeds its implied fair value.

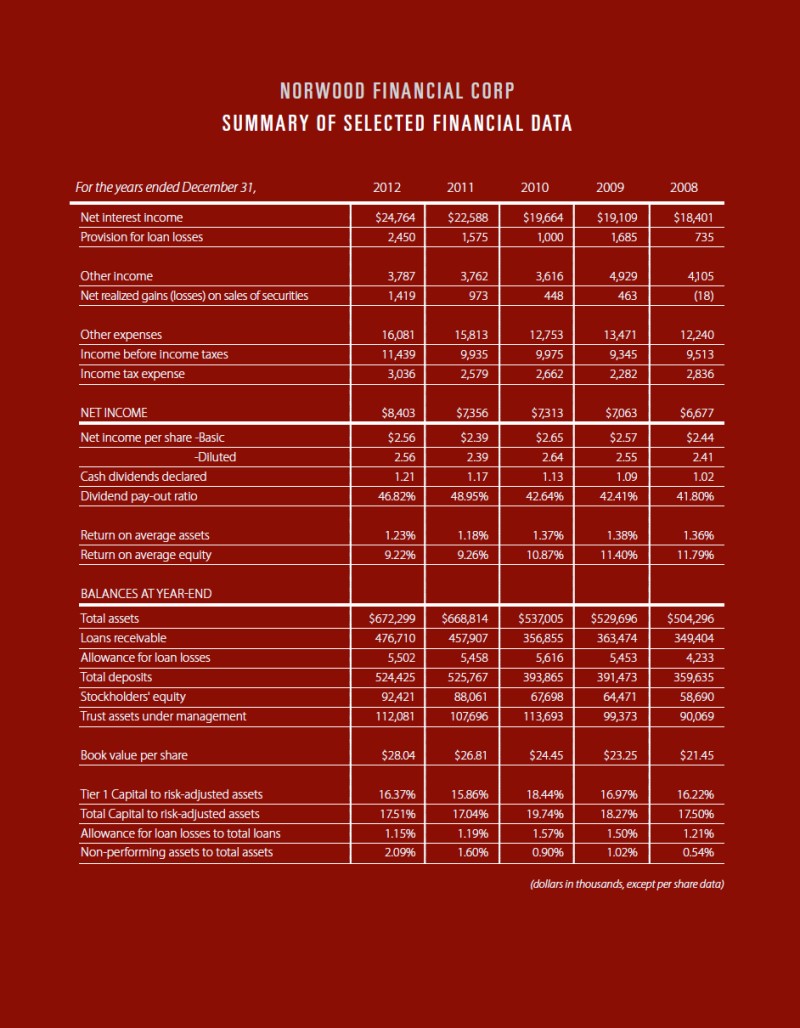

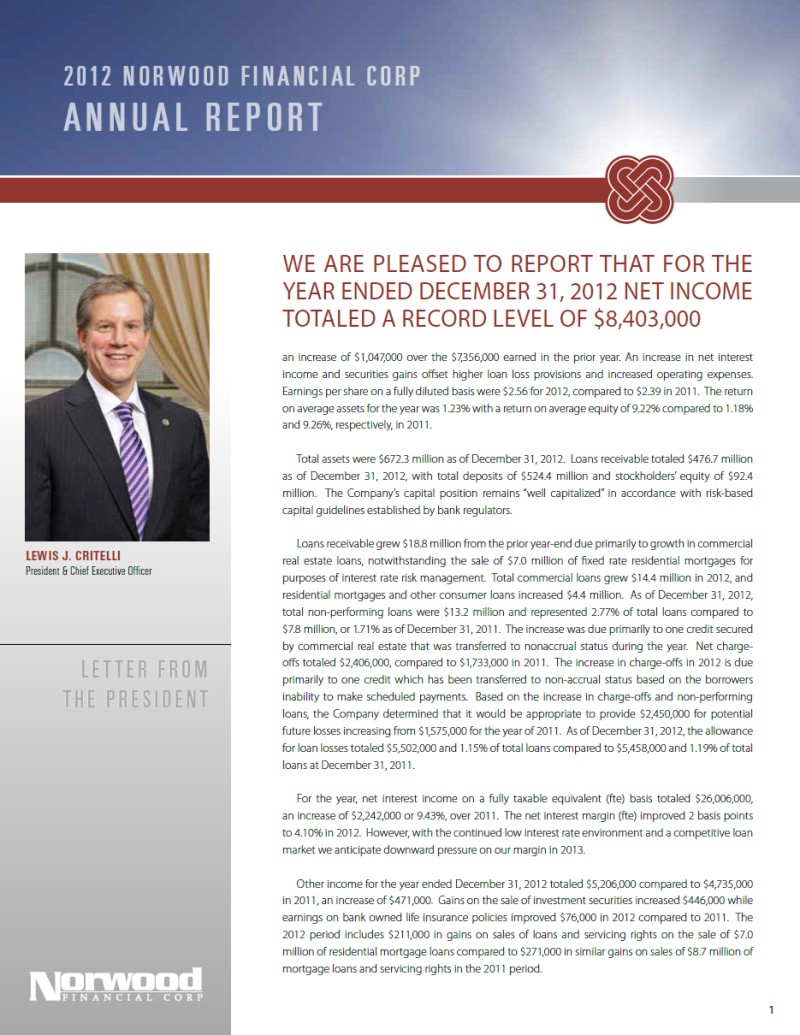

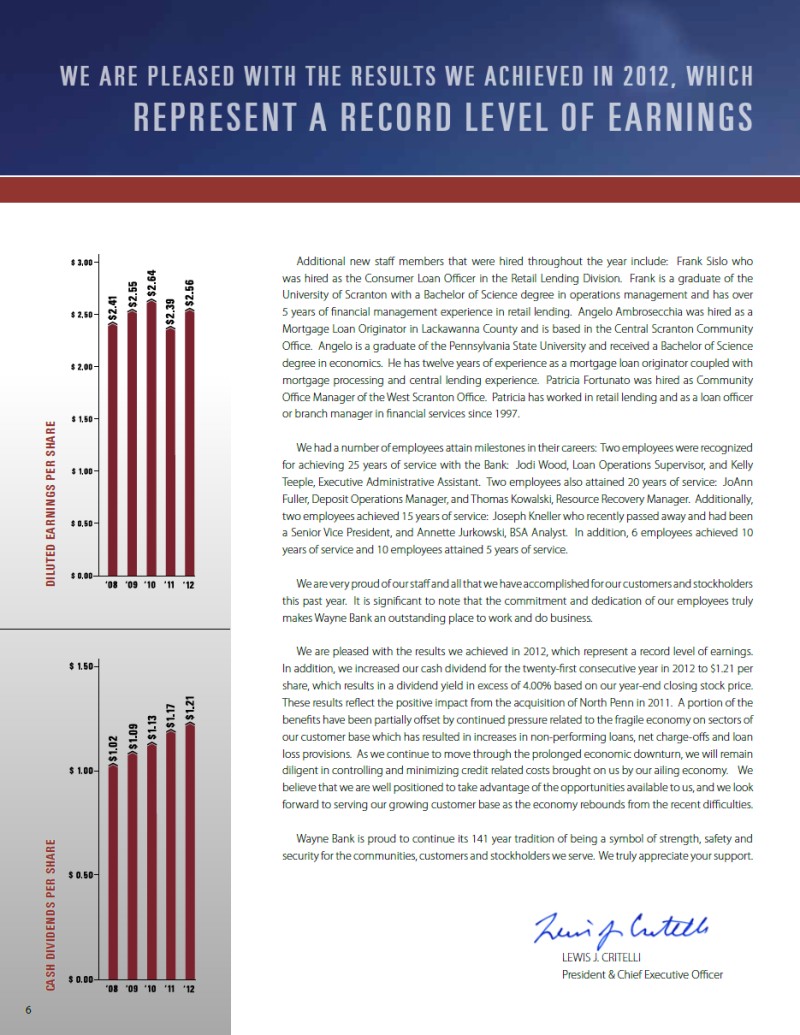

Results of Operations – Summary

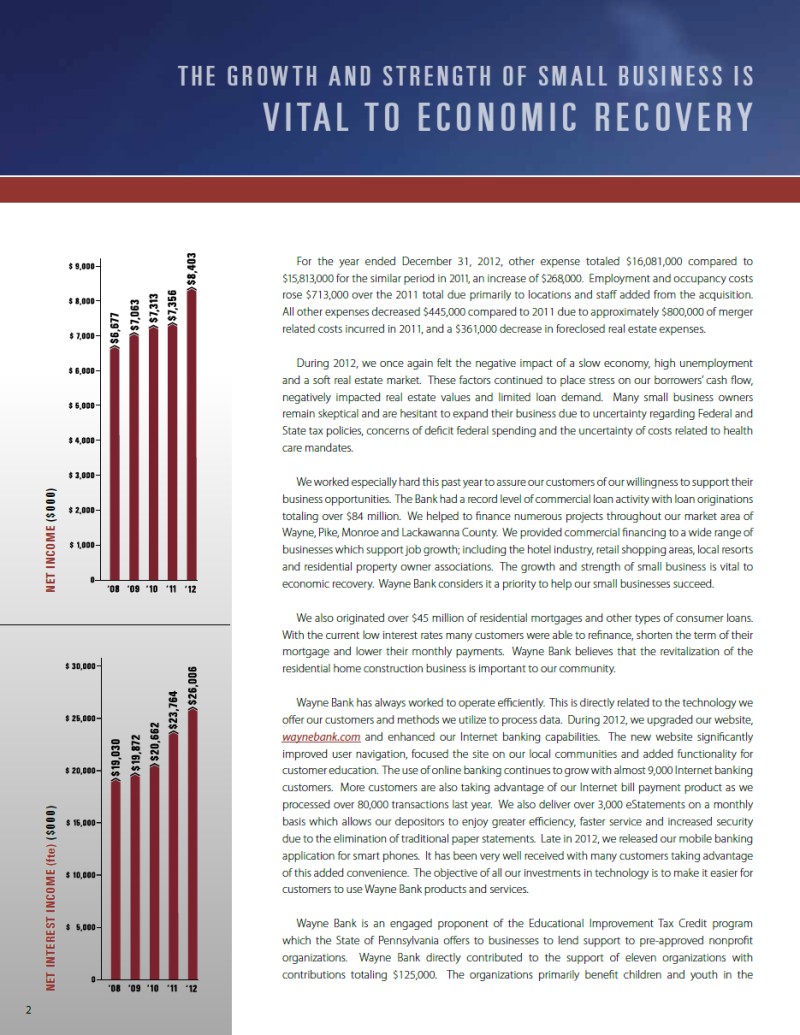

Net income for the Company for the year ended December 31, 2012 totaled $8,403,000 which represents an increase of $1,047,000, or 14.2%, over the $7,356,000 earned in 2011. The resulting basic and diluted earnings per share were $2.56 in 2012, increasing from $2.39 in 2011. The return on average assets (ROA) for the year ended December 31, 2012 was 1.23% with a return on average equity (ROE) of 9.22% compared to an ROA of 1.18% and an ROE of 9.26% in the prior year. The improved earnings were attributable to an increase in net interest income and securities gains which offset higher loan loss provisions and increased operating expenses.

Net interest income on a fully taxable equivalent basis (fte) totaled $26,006,000 in 2012, which was $2,242,000, or 9.4%, higher than the $23,764,000 reported in 2011. The improved earnings can be attributed to a $52.0 million increase in average earning assets which exceeded the $38.5 million increase in average interest-bearing liabilities, and the spread earned. Effective asset/liability management strategies also contributed to the improved earnings as a fourteen basis point decrease in the yield earned was offset by a nineteen basis point reduction in the cost of funds.

Average loans outstanding increased $63.8 million in 2012 which partially reflects growth related to the acquisition of North Penn in 2011. Average commercial loans increased $52.2 million due primarily to $45.2 million of growth in commercial real estate loans. Retail loans grew $11.7 million during the year due to a $13.2 million increase in residential mortgage loans. The growth in residential mortgage loans is after the sale of $7.0 million of long-term fixed-rate loans which were sold to reduce the risk of rising interest rates. Growth and reinvestment at current market rates resulted in reduced yield on average loans, but loan growth generated a $2,251,000 increase in interest income in spite of a 29 basis point reduction in the yield earned. Income from the securities portfolio decreased $520,000 as lower yields were earned on new investments in comparison to portfolio runoff. During 2012, the yield on securities available for sale decreased 27 basis points. Average interest bearing liabilities grew $38.5 million in 2012 due to growth in deposits. Average interest bearing deposits increased $51.5 million, but a 15 basis point reduction in the average rate paid resulted in a $191,000 decrease in the cost of these funds. Average borrowings declined $13.0 million during the year as the Company continued to pay down long-term debt. The reduced balances and the reduction in the cost of borrowings resulted in a $341,000 savings in interest expense.

Other income for the year ended 2012 totaled $5,206,000 which was $471,000 higher than the $4,735,000 reported in the prior year. Gains on the sales of investment securities totaled $1,419,000 on sales of $40.9 million in 2012 compared to net gains of $973,000 on sales of $31.2 million in 2011, as the continued low rate environment provided opportunities to reposition the portfolio. The 2012 period also includes $211,000 of gains and servicing rights on the sale of $7.0 million residential mortgage loans to reduce the Company’s exposure to rising interest rates. Earnings on bank-owned life insurance policies increased $76,000 compared to the prior year due to policies acquired in the North Penn transaction and a $3.0 million policy purchased in 2012.

NORWOOD FINANCIAL CORP - 2012 CONSOLIDATED FINANCIAL REPORT

For the year ended December 31, 2012, other expenses totaled $16,081,000 compared to $15,813,000 for the similar period of 2011, an increase of $268,000, or 1.7%. The higher level of costs includes increases of $555,000 in salaries and benefit costs, and a $158,000 increase in occupancy and equipment costs. These increases reflect the full-year effect of the additional offices and staff acquired from North Penn. Professional fees decreased $472,000 compared to 2011 due primarily to merger related costs incurred in the prior period, while foreclosed real estate expenses declined $361,000. Income tax expense for the year of 2012 totaled $3,036,000 for an effective tax rate of 26.5% compared to $2,579,000 and 26.0% in 2011 due to a $1.5 million increase in pre-tax income.

The following table sets forth changes in net income (in thousands):

| Net income 2011 | | $ | 7,356 | |

| Net interest income | | | 2,176 | |

| Provision for loan losses | | | (875 | ) |

| Net gains on sale of securities | | | 446 | |

| Other income | | | 25 | |

| Salaries and employee benefits | | | (555 | ) |

| Occupancy, furniture and equipment | | | (158 | ) |

| Foreclosed real estate owned | | | 361 | |

| Professional fees | | | 472 | |

| Other expenses | | | (388 | ) |

| Income tax expense | | | (457 | ) |

| Net income for 2012 | | $ | 8,403 | |

Net income for the Company for the year ended December 31, 2011 totaled $7,356,000, an increase of $43,000 over the $7,313,000 earned in 2010. Basic and diluted earnings per share were $2.39 in 2011, decreasing from $2.65 basic and $2.64 diluted in 2010. The return on average assets (ROA) for the year ended December 31, 2011 was 1.18% with a return on average equity (ROE) of 9.26% compared to an ROA of 1.37% and an ROE of 10.87% in the prior year. The relatively flat earnings are due to significant one-time costs resulting from the acquisition of North Penn Bancorp, Inc. during 2011. See Note 15 to the Consolidated Financial Statements for a more detailed analysis of the acquisition. Net interest income on a fully taxable equivalent basis (fte) increased $3,102,000 in 2011 which offset the $3,060,000 increase in operating expenses.

Net interest income on a fully taxable equivalent basis (fte) totaled $23,764,000 in 2011, an increase of $3,102,000, or 15.0%, over 2010. Average loans outstanding increased $58.5 million due primarily to loans acquired from North Penn and added $3,359,000 of interest income due to growth. The net interest margin improved 4 basis points in 2011 to 4.08% as a 39 basis point reduction in the cost of funds exceeded the 25 basis point reduction on the yield earned. The reduction in the cost of funds was due to the continued low interest rate environment and the downward repricing on deposits and borrowed funds, most notably certificates of deposit which mature and reinvest at current market rates.

Loans receivable increased $101.0 million in 2011 due primarily to the North Penn transaction. Total commercial loans, primarily real estate related, grew $77.8 million while retail loans increased $23.2 million during the year. The low interest rate environment in place during the year led to sales of residential mortgage loans for purposes of interest rate risk management, and the Company sold $8.7 million of fixed rate loans. As a result of the continued slow down in the local economy, the Company experienced an increase in non-performing loans from the $4,079,000 reported in 2011 to $7,815,000 as of December 31, 2011, which includes $1.9 million of loans acquired from North Penn. As of year-end, non-performing loans represented 1.71% of total loans compared to 1.14% at December 31, 2010. Net charge-offs totaled $1,733,000 in 2011, increasing from $837,000

NORWOOD FINANCIAL CORP - 2012 CONSOLIDATED FINANCIAL REPORT

in the prior year. The increase was due primarily to one loan which had been carried in non-accrual status and has since been transferred to foreclosed real estate. Based on the increase in charge-offs and non-performing loans, the Company determined that it would be appropriate to allocate $1,575,000 to the allowance for loan losses for potential future losses. As of December 31, 2011, the allowance for loan losses totaled $5,458,000 and 1.19% of total loans decreasing from $5,616,000 and 1.57% of total loans at December 31, 2010. The decrease in the ratio of the allowance to total loans is a result of the accounting treatment for mergers whereby the loans are acquired at fair value and the sellers’ allowance is eliminated.

Other income totaled $4,735,000 in 2011 compared to $4,064,000 in 2010. Gains on the sale of investment securities increased $525,000 as the low rate environment created opportunities to reposition the portfolio. Net gains of $973,000 on sales of $31.2 million of investment securities were recorded in 2011 compared to gains of $448,000 on sales of $23.5 million in 2010. Earnings on bank owned life insurance policies improved $72,000 compared to 2010 due to the additional policies acquired in the North Penn transaction. The 2011 period also includes $271,000 of gains on sales of $8.7 million of mortgage loans and servicing rights compared to $307,000 of net gains in 2010 on sales of $12.4 million of mortgage loans and servicing rights.

Other expenses were $15,813,000 in 2011 compared to $12,753,000 for 2010. The majority of the increased costs recognized in 2011 were merger related, whether one-time costs for investment bankers, attorneys or consultants, or staffing and occupancy costs necessary to operate the five branch offices that were added in the acquisition. Foreclosed real estate costs also increased $537,000 in 2011 as several properties were acquired through foreclosure, resulting in write-downs on the properties of $177,000 and other costs such as real estate taxes and maintenance of $400,000. Additionally, the Company upgraded all of its information systems which led to increased costs in 2011. Income tax expense for the year 2011 totaled $2,579,000 for an effective tax rate of 26.0% compared to $2,662,000 and 26.7% in the prior year due to an increased level of tax exempt income on loans, investments and bank owned life insurance policies.

The following table sets forth changes in net income (in thousands):

| Net income 2010 | | $ | 7,313 | |

| Net interest income | | | 2,924 | |

| Provision for loan losses | | | (575 | ) |

| Net gains on sale of securities | | | 525 | |

| Other income | | | 146 | |

| Salaries and employee benefits | | | (1,341 | ) |

| Occupancy, furniture and equipment | | | (277 | ) |

| Foreclosed real estate owned | | | (537 | ) |

| Professional fees | | | (633 | ) |

| Other expenses | | | (272 | ) |

| Income tax expense | | | 83 | |

| Net income for 2011 | | $ | 7,356 | |

NORWOOD FINANCIAL CORP - 2012 CONSOLIDATED FINANCIAL REPORT

FINANCIAL CONDITION

Total Assets

Total assets as of December 31, 2012, were $672.3 million compared to $668.8 million as of year-end 2011, an increase of $3.5 million. Loans outstanding increased $18.8 million but this growth was offset by a decrease in the securities portfolio and interest-bearing deposits with banks.

Loans Receivable

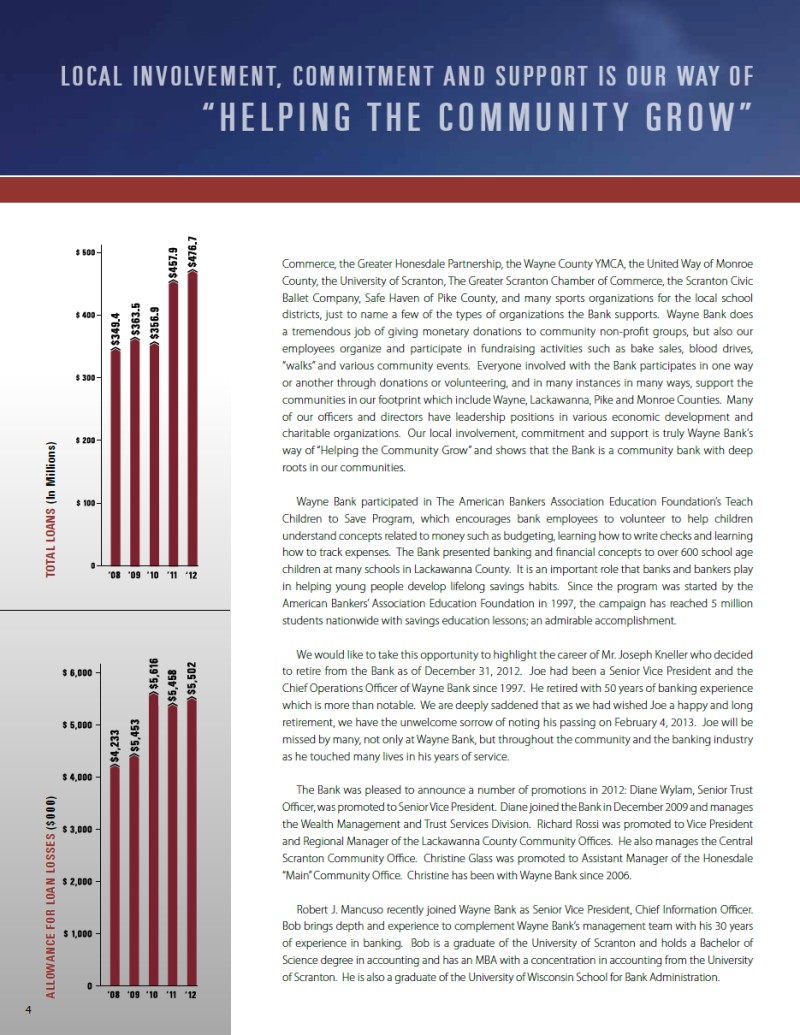

As of December 31, 2012, loans receivable totaled $476.7 million compared to $457.9 million as of year-end 2011, an increase of $18.8 million. Commercial real estate loans provided $12.0 million, or 63.8% of the growth, while retail loans provided $4.5 million, or 23.9% of the total growth.

Residential real estate loans, which includes home equity lending, totaled $150.0 million as of December 31, 2012, compared to $148.1 million as of year-end 2011, an increase of $1.9 million. Residential mortgage refinancing activity continued in 2012 as customers took advantage of the low interest rate environment. The Company does not originate any non-traditional mortgage products such as interest-only loans or option adjustable rate mortgages and has no sub-prime mortgage exposure. The Company evaluates sales of its long-term, fixed-rate residential loan production for interest rate risk management, with $7.0 million of long-term, fixed-rate loans sold into the secondary market during 2012. In the current low interest rate environment, the Company expects to continue selling mortgage loans in 2013. The Company experienced a slow down and net decrease in home equity lending in 2012 as consumers paid off home equity loans with proceeds from mortgage refinancing. The slow down in home equity lending is also indicative of lower real estate values.

Commercial loans consist principally of loans made to small businesses within the Company’s market and are usually secured by real estate or other assets of the borrower. Commercial real estate loans totaled $274.5 million as of December 31, 2012, increasing from $262.5 million as of December 31, 2011. The terms for commercial real estate loans are typically 15 to 20 years, with adjustable rates based on a spread to the prime rate or fixed for the initial three to five year period then adjusting to a spread to the prime rate. The majority of the Company’s commercial real estate portfolio is owner occupied and includes the personal guarantees of the principals. Commercial loans consisting principally of lines of credit and term loans secured by equipment or other assets increased $2.4 million to $25.1 million as of December 31, 2012.

The Company’s indirect lending portfolio (included in consumer loans to individuals) increased $1.1 million to $8.5 million as of December 31, 2012. The Company has de-emphasized indirect automobile lending and as a result of the soft economy has also experienced a general slow down in

other indirect financing.

Allowance for Loan Losses and Non-Performing Assets

The allowance for loan losses totaled $5,502,000 as of December 31, 2012 and represented 1.15% of total loans receivable compared to $5,458,000 and 1.19% of total loans as of year-end 2011. Net charge-offs for 2012 totaled $2,406,000 and represented .50% of average loans compared to $1,733,000 and .42% of average loans in 2011.

Non-performing assets consist of non-performing loans and real estate owned as a result of foreclosure, which is held for sale. Loans are placed on non-accrual status when management believes that a borrower’s financial condition is such that collection of interest is doubtful. Commercial and real estate related loans are generally placed on non-accrual when interest is 90 days delinquent. When loans are placed on non-accrual, accrued interest is reversed from current earnings.

NORWOOD FINANCIAL CORP - 2012 CONSOLIDATED FINANCIAL REPORT

As of December 31, 2012, non-performing loans totaled $13,200,000 and represented 2.77% of total loans compared to $7,815,000 or 1.71% as of December 31, 2011. The increase in the level of non-performing loans is due primarily to the transfer of one credit with a carrying value of $5.1 million based on the borrowers’ inability to make scheduled payments. Based on the level of non-performing loans, high unemployment, a soft real estate market and a slow economy, the Company added $2,450,000 to the allowance for loan losses for the year ended December 31, 2012 compared to $1,575,000 in 2011.

Foreclosed real estate owned totaled $852,000 as of December 31, 2012 and $2,910,000 as of December 31, 2011. The decrease is principally due to the sale of a commercial property located in Luzerne County which was carried at $2,000,000 as of December 31, 2011.

The Company’s loan review process assesses the adequacy of the allowance for loan losses on a quarterly basis. The process includes a review of the risks inherent in the loan portfolio. It includes an analysis of impaired loans and a historical review of losses. Other factors considered in the analysis include: concentrations of credit in specific industries in the commercial portfolio; the local and regional economic condition; trends in delinquencies, internal risk rating classification, large dollar loans of over $2 million and growth in the portfolio. For loans acquired, including those that are not deemed impaired at acquisition, credit discounts representing the principal losses expected over the life of the loan are a component of the initial fair value. Subsequent to the purchase date, the methods utilized to estimate the required allowance for credit losses for these loans is similar to originated loans; however, the Company records a provision for loan losses only when the required allowance exceeds any remaining credit discounts.

The Company has limited exposure to higher-risk loans. There are no option ARM products, interest only loans, sub-prime loans or loans with initial teaser rates in its residential real estate portfolio. The Company has $12.0 million of junior lien home equity loans. For 2012, net charge-offs for this portfolio totaled $165,000.

As of December 31, 2012, the Company considered its concentration of credit risk profile to be acceptable. The three highest concentrations are in the hospitality lodging industry, property owners associations and restaurants.

Due to weaker economic conditions the Company has seen an increase in its adversely classified loans. The Company assesses a loss factor against the classified loans, which is based on prior experience. Classified loans which are considered impaired are measured on a loan by loan basis. The Company values such loans by either the present value of expected cash flows, the loan’s obtainable market price or the fair value of collateral if the loan is collateral dependent.

At December 31, 2012, the recorded investment in impaired loans, not requiring an allowance for loan losses was $11,074,000 (net of charge-offs against the allowance for loan losses of $1,656,000) and those impaired loans requiring an allowance totaled $551,000 (net of a charge-off against the allowance for loan losses of $710,000). The recorded investment in impaired loans not requiring an allowance for loan losses was $6,807,000 (net of $698,000) and $6,823,000 (net of $0) requiring an allowance for loan losses as of December 31, 2011.

As a result of its analysis, after applying these factors, management considers the allowance as of December 31, 2012, adequate. However, there can be no assurance that the allowance for loan losses will be adequate to cover significant losses, that might be incurred in the future.

NORWOOD FINANCIAL CORP - 2012 CONSOLIDATED FINANCIAL REPORT

The following table sets forth information with respect to the Company’s allowance for loan losses at the dates indicated:

| | | Year ended December 31, | |

| | | (dollars in thousands) | |

| | | 2012 | | 2011 | | 2010 | | 2009 | | 2008 | |

| | | | | | | | | | | | | | | | | |

| Allowance balance at beginning of period | | $ | 5,458 | | $ | 5,616 | | $ | 5,453 | | $ | 4,233 | | $ | 4,081 | |

| Charge-offs: | | | | | | | | | | | | | | | | |

Commercial | | | (24 | ) | | (2 | ) | | (85 | ) | | (17 | ) | | (7 | ) |

Real Estate | | | (2,354 | ) | | (1,735 | ) | | (699 | ) | | (358 | ) | | (465 | ) |

Consumer | | | (59 | ) | | (109 | ) | | (82 | ) | | (139 | ) | | (171 | ) |

| Total | | | (2,437 | ) | | (1,846 | ) | | (866 | ) | | (514 | ) | | (643 | ) |

| Recoveries: | | | | | | | | | | | | | | | | |

Commercial | | | — | | | 5 | | | — | | | 11 | | | — | |

Real Estate | | | 7 | | | 51 | | | 2 | | | 4 | | | 1 | |

Consumer | | | 24 | | | 57 | | | 27 | | | 34 | | | 59 | |

| Total | | | 31 | | | 113 | | | 29 | | | 49 | | | 60 | |

| Provision expense | | | 2,450 | | | 1,575 | | | 1,000 | | | 1,685 | | | 735 | |

| Allowance balance at end of period | | $ | 5,502 | | $ | 5,458 | | $ | 5,616 | | $ | 5,453 | | $ | 4,233 | |

| Allowance for loan losses as a percent | | | | | | | | | | | | | | | | |

| of total loans outstanding | | | 1.15 | % | | 1.19 | % | | 1.57 | % | | 1.50 | % | | 1.21 | % |

| Net loans charged off as a percent of | | | | | | | | | | | | | | | | |

| average loans outstanding | | | .50 | % | | .42 | % | | .24 | % | | .13 | % | | .17 | % |

| Allowance coverage of non-performing loans | | | .4 | x | | .7 | x | | 1.4 | x | | 1.1 | x | | 2.0 | x |

The following table sets forth information regarding non-performing assets.

| | | December 31, | |

| | | (dollars in thousands) | |

| | | 2012 | | | 2011 | | | 2010 | | | 2009 | | | 2008 | |

| Non-accrual loans: | | | | | | | | | | | | | | | |

| Commercial | | $ | 328 | | | $ | 404 | | | $ | 513 | | | $ | — | | | $ | — | |

| Real estate | | | 12,872 | | | | 7,411 | | | | 3,527 | | | | 4,916 | | | | 2,087 | |

| Total | | | 13,200 | | | | 7,815 | | | | 4,040 | | | | 4,916 | | | | 2,087 | |

| | | | | | | | | | | | | | | | | | | | | |

| Accruing loans which are contractually | | | | | | | | | | | | | | | | | | | | |

| past due 90 days or more | | | — | | | | — | | | | 39 | | | | 99 | | | | — | |

| | | | | | | | | | | | | | | | | | | | | |

| Total non-performing loans | | | 13,200 | | | | 7,815 | | | | 4,079 | | | | 5,015 | | | | 2,087 | |

| Foreclosed real estate | | | 852 | | | | 2,910 | | | | 748 | | | | 392 | | | | 660 | |

| Total non-performing assets | | $ | 14,052 | | | $ | 10,725 | | | $ | 4,827 | | | $ | 5,407 | | | $ | 2,747 | |

| | | | | | | | | | | | | | | | | | | | | |

| Non-performing loans to total loans | | | 2.77 | % | | | 1.71 | % | | | 1.14 | % | | | 1.38 | % | | | .60 | % |

| | | | | | | | | | | | | | | | | | | | | |

| Non-performing loans to total assets | | | 1.96 | % | | | 1.17 | % | | | .76 | % | | | .95 | % | | | .41 | % |

| | | | | | | | | | | | | | | | | | | | | |

| Non-performing assets to total assets | | | 2.09 | % | | | 1.60 | % | | | .90 | % | | | 1.02 | % | | | .54 | % |

NORWOOD FINANCIAL CORP - 2012 CONSOLIDATED FINANCIAL REPORT

SECURITIES

The securities portfolio consists of issues of United States Government agencies, including mortgage-backed securities, municipal obligations, and corporate debt. The Company classifies its investments into two categories: held to maturity (HTM) and available for sale (AFS). The Company does not have trading securities. Securities classified as HTM are those in which the Company has the ability and the intent to hold the security until contractual maturity. As of December 31, 2012, the HTM portfolio totaled $173,000 and consisted of one municipal obligation. Securities classified as AFS are eligible to be sold due to liquidity needs or interest rate risk management. These securities are adjusted to and carried at their fair value with any unrealized gains or losses recorded net of deferred income taxes, as an adjustment to capital and reported in the equity section of the Balance Sheet as other comprehensive income. As of December 31, 2012, $145.4 million of securities were so classified and carried at their fair value, with unrealized appreciation, net of tax, of $2,797,000 included in accumulated other comprehensive income as a component of stockholders’ equity.

As of December 31, 2012, the average life of the portfolio was 4.0 years. The Company has maintained a relatively short average life in the portfolio in order to generate cash flow to support loan growth and maintain liquidity levels. During 2012, the majority of cash flow generated from the proceeds of called U.S. agency securities and security sales were reinvested in tax-free municipal bonds and mortgage-backed securities to generate a cash flow ladder of available liquidity. Purchases for the year totaled $67.3 million, while maturities and cash flow totaled $30.6 million and proceeds from sales were $40.9 million. The purchases were funded principally by cash flow generated from the portfolio.

The carrying value of the securities portfolio at December 31 is as follows:

| | | 2012 | | 2011 | |

| | | (dollars in thousands) | |

| | | Carrying Value | | % of

portfolio | | Carrying Value | | % of

portfolio | |

| | | | | | | | | | | | |

| U.S. Government agencies | | $ | 13,092 | | 9.0 | % | $ | 13,398 | | 8.9 | % |

| States and political subdivisions | | | 58,959 | | 40.5 | % | | 56,917 | | 37.8 | % |

| Corporate obligations | | | 8,868 | | 6.1 | % | | 8,809 | | 5.9 | % |

| Mortgage-backed securities – government sponsored entities | | | 64,325 | | 44.2 | % | | 70,965 | | 47.2 | % |

| Equity securities – financial services | | | 319 | | 0.2 | % | | 263 | | 0.2 | % |

| | | | | | | | | | | | |

| Total | | $ | 145,563 | | 100.0 | % | $ | 150,352 | | 100.0 | % |

The portfolio had $977,000 of adjustable rate instruments, which includes adjustable rate corporate securities as of December 31, 2012 compared to $5.1 million at year end 2011. The portfolio contained no private label mortgage backed securities, collateralized debt obligations (CDOs), trust preferreds, and no off-balance sheet derivatives were in use. The U.S. Government agency portfolio consists principally of callable notes with final maturities of generally less than five years. As of December 31, 2012, the portfolio included $1.0 million of step-up bonds. The mortgage backed securities includes pass-through bonds and collateralized mortgage obligations (CMO’s) with Fannie Mae, Freddie Mac and Government National Mortgage Association (GNMA). The Company has no exposure to common or preferred stock of Fannie Mae or Freddie Mac.

The Company evaluates the securities in its portfolio for other-than-temporary-impairment (OTTI) as fair value declines below cost. In estimating OTTI management considers (1) the length of time and the extent of the decline in fair value and (2) the financial condition and near-term prospects of the issuer. As of December 31, 2012, the Company held 32 investment securities which had a combined unrealized loss of $206,000.

NORWOOD FINANCIAL CORP - 2012 CONSOLIDATED FINANCIAL REPORT

Management believes that these losses are principally due to changes in interest rates and represent temporary impairment as the Company does not have the intent to sell these securities and it is more likely than not that it will not have to sell the securities before recovery of their cost basis. The Company holds a small portfolio of equity securities of other financial institutions the value of which has been impacted by weakened conditions of the financial market. As of December 31, 2012, the Company held no equity securities which had an unrealized loss. No impairment charges have been recognized in 2012.

FAIR VALUE OF FINANCIAL INSTRUMENTS

The Company uses fair value measurements to record fair value adjustments to certain financial instruments and determine fair value disclosures (see Note 14 of Notes to the Consolidated Financial Statements).

Approximately $145.4 million, which represents 21.6% of total assets at December 31, 2012, consisted of financial instruments recorded at fair value on a recurring basis. This amount consists entirely of the Company’s available for sale securities portfolio. The Company uses valuation methodologies involving market-based or market derived information, collectively Level 1 and 2 measurements, to measure fair value. There were no transfers into or out of Level 3 for any instruments for the years ending December 31, 2012 and 2011.

The Company utilizes a third party provider to perform valuations of the investments. Methods used to perform the valuations include: pricing models that vary based on asset class, available trade and bid information, actual transacted prices, and proprietary models for valuations of state and municipal obligations. In addition, the Company has a sample of fixed-income securities valued by another independent source. The Company does not adjust values received from its providers, unless it is evident that fair value measurement is not consistent with the Company’s policies.

The Company also utilizes a third party provider to provide the fair value of certain loan servicing rights. Fair value for the purpose of this measurement is defined as the amount at which the asset could be exchanged in a current transaction between willing parties, other than in a forced liquidation. The fair value of mortgage servicing rights as of December 31, 2012 and 2011 was $243,000 and $308,000, respectively.

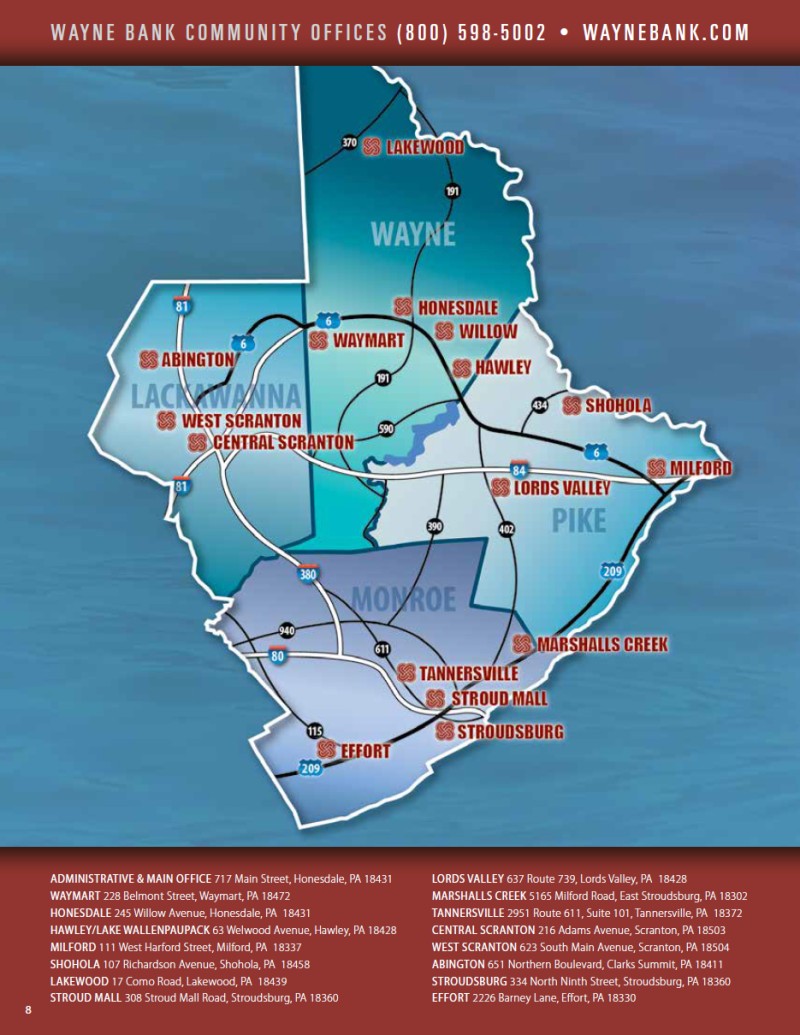

DEPOSITS

The Company, through the sixteen branches of the Bank, provides a full range of deposit products to its retail and business customers. These products include interest-bearing and non-interest bearing transaction accounts, statement savings and money market accounts. Time deposits consist of certificates of deposit (CDs) with terms of up to five years and include Individual Retirement Accounts. The Bank participates in the Jumbo CD ($100,000 and over) markets with local municipalities and school districts, which are typically awarded on a competitive bid basis. The Company has no brokered deposits.

Total deposits as of December 31, 2012, totaled $524.4 million, decreasing $1.3 million from $525.8 million as of year-end 2011. The decrease was principally due to the run-off of certificates of deposit.

Time deposits over $100,000, which consist principally of school district funds, other public funds and short-term deposits from large commercial customers with maturities generally less than one year, totaled $71.3 million as of December 31, 2012, compared to $80.6 million at year-end 2011. The decrease reflects the Company’s strategy to reduce excess liquidity and therefore not price these deposits aggressively. These deposits are subject to competitive bid and the Company bases its bid on current interest rates, loan demand, investment portfolio structure and the relative cost of other funding sources.

As of December 31, 2012, non-interest bearing demand deposits totaled $82.1 million compared to $72.0 million at year-end 2011. Cash management accounts in the form of securities sold under agreements to

NORWOOD FINANCIAL CORP - 2012 CONSOLIDATED FINANCIAL REPORT

repurchase included in short-term borrowings, totaled $28.7 million at year end 2012 compared to $21.8 million as of December 31, 2011. These balances represent commercial and municipal customers’ funds invested in overnight securities. The Company considers these accounts as a source of core funding.

MARKET RISK

Interest rate sensitivity and the repricing characteristics of assets and liabilities are managed by the Asset and Liability Management Committee (ALCO). The principal objective of the ALCO is to maximize net interest income within acceptable levels of risk, which are established by policy. Interest rate risk is monitored and managed by using financial modeling techniques to measure the impact of changes in interest rates.

Net interest income, which is the primary source of the Company’s earnings, is impacted by changes in interest rates and the relationship of different interest rates. To manage the impact of the rate changes, the balance sheet should be structured so that repricing opportunities exist for both assets and liabilities at approximately the same time intervals. The Company uses net interest simulation to assist in interest rate risk management. The process includes simulating various interest rate environments and their impact on net interest income. As of December 31, 2012, the level of net interest income at risk in a 200 basis points increase was within the Company’s policy limit of a decline less than 8% of net interest income. Due to the inability to reduce many deposit rates by the full 200 basis points, the Company’s net interest income at risk (14.7%) was outside the policy limit in a 200 basis point declining scenario. The Company feels that the risk is both minimal and acceptable.

Imbalances in repricing opportunities at a given point in time reflect interest-sensitivity gaps measured as the difference between rate-sensitive assets and rate-sensitive liabilities. These are static gap measurements that do not take into account any future activity, and as such are principally used as early indicators of potential interest rate exposures over specific intervals.

At December 31, 2012, the Bank had a positive 90 day interest sensitivity gap of $54.3 million or 8.1% of total assets. A positive gap indicates that the balance sheet has a higher level of rate-sensitive assets (RSA) than rate-sensitive liabilities (RSL) at the specific time interval. This would indicate that in an increasing rate environment, the yield on interest-earning assets would increase faster than the cost of interest-bearing liabilities in the 90 day time frame. The level of RSA and RSL for an interval is managed by ALCO strategies, including adjusting the average life of the investment portfolio through purchase and sales, pricing of deposit liabilities to attract long or short term time deposits, utilizing borrowings to fund loan growth, loan pricing to encourage variable rate products and evaluation of loan sales of long term fixed rate mortgages.

The Company analyzes and measures the time periods in which RSA and RSL will mature or reprice in accordance with their contractual terms and assumptions. Management believes that the assumptions used are reasonable. The interest rate sensitivity of assets and liabilities could vary substantially if differing assumptions were used or if actual experience differs from the assumptions used in the analysis. For example, although certain assets and liabilities may have similar maturities or periods to repricing, they may react in differing degrees to changes in market interest rates. The interest rates on certain types of assets and liabilities may fluctuate in advance of changes in market interest rates, while interest rates on other types may lag behind changes in market rates. Interest rates may change at different rates changing the shape of the yield curve. The level of rates on the investment securities may also be affected by the spread relationship between different investments. This was evident in 2011 as the spread between certain asset classes were at historical highs in relation to treasuries due to market liquidity and credit concerns. Further, in the event of a significant change in interest rates, prepayment and early withdrawal levels would likely deviate significantly from those assumed. Finally, the ability of borrowers to service their adjustable-rate debt may decrease in the event of an interest rate increase. It should be noted that the operating results of the Company are not subject to foreign currency exchange or commodity price risk.

NORWOOD FINANCIAL CORP - 2012 CONSOLIDATED FINANCIAL REPORT

The following table displays interest-sensitivity as of December 31, 2012 (in thousands):

| | | 3 Months | | | | 3-12 | | | | | | Over | | | | |

| | | Or Less | | | Months | | | 1-3 Years | | | 3 Years | | | Total | |

| Federal funds sold and | | | | | | | | | | | | | | | | |

| interest-bearing deposits | | $ | 1,428 | | | $ | — | | | $ | — | | | $ | — | | | $ | 1,428 | |

| Securities | | | 9,572 | | | | 26,973 | | | | 54,895 | | | | 54,123 | | | | 145,563 | |

| Loans Receivable | | | 117,093 | | | | 110,969 | | | | 135,533 | | | | 113,115 | | | | 476,710 | |

| Total Rate Sensitive Assets (RSA) | | | 128,093 | | | | 137,942 | | | | 190,428 | | | | 167,238 | | | | 623,701 | |

| | | | | | | | | | | | | | | | | | | | | |

| Non-maturity interest-bearing deposits | | | 36,976 | | | | 41,859 | | | | 111,185 | | | | 41,070 | | | | 231,090 | |

| Time Deposits | | | 30,292 | | | | 73,132 | | | | 78,704 | | | | 29,132 | | | | 211,260 | |

| Borrowings | | | 6,516 | | | | 14,725 | | | | 19,943 | | | | 10,000 | | | | 51,184 | |

| Total Rate Sensitive Liabilities (RSL) | | | 73,784 | | | | 129,716 | | | | 209,832 | | | | 80,202 | | | | 493,534 | |

| | | | | | | | | | | | | | | | | | | | | |

| Interest sensitivity gap | | $ | 54,309 | | | $ | 8,226 | | | $ | (19,404 | ) | | $ | 87,036 | | | $ | 130,167 | |

| Cumulative gap | | | 54,309 | | | | 62,535 | | | | 43,131 | | | | 130,167 | | | | | |

| RSA/RSL-cumulative | | | 173.6 | % | | | 130.7 | % | | | 110.4 | % | | | 126.4 | % | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| As of December 31, 2011 | | | | | | | | | | | | | | | | | | | | |

| Interest sensitivity gap | | $ | 76,745 | | | $ | (21,350 | ) | | $ | (6,566 | ) | | $ | 68,689 | | | $ | 117,518 | |

| Cumulative gap | | | 76,745 | | | | 55,395 | | | | 48,829 | | | | 117,518 | | | | | |

| RSA/RSL-cumulative | | | 213.2 | % | | | 125.2 | % | | | 111.8 | % | | | 125.3 | % | | | | |

| | | | | | | | | | | | | | | | | | | | | |

Certain interest-bearing deposits with no stated maturity dates are included in the interest-sensitivity table above. The balances allocated to the respective time periods represent an estimate of the total outstanding balance that has the potential to migrate either through withdrawal or transfer to time deposits, thereby impacting the interest-sensitivity position of the Company. The estimates were derived from industry-wide statistical information and do not represent historic results.

LIQUIDITY

Liquidity is the ability to fund customers’ borrowing needs and their deposit withdrawal requests while supporting asset growth. The Company’s primary sources of liquidity include deposit generation, asset maturities, cash flow from payments on loans and securities and access to borrowing from the Federal Home Loan Bank and other correspondent banks.

As of December 31, 2012, the Company had cash and cash equivalents of $12.3 million in the form of cash, due from banks, balances with the Federal Reserve Bank, and short-term deposits with other institutions. In addition, the Company had total securities available for sale of $145.4 million, which could be used for liquidity needs. This totals $157.7 million and represents 23.5% of total assets compared to $171.7 million and 25.7% of total assets as of December 31, 2011. The Company also monitors other liquidity measures, all of which were within the Company’s policy guidelines as of December 31, 2012. Based upon these measures, the Company believes its liquidity position is adequate.

The Company maintains established lines of credit with the Federal Home Loan Bank of Pittsburgh (FHLB), the Atlantic Central Bankers Bank (ACBB) and other correspondent banks, which support liquidity needs. The total available under all the lines was $43 million, with $-0- outstanding at December 31, 2012 and December 31, 2011. The maximum borrowing capacity from FHLB was $254.6 million. As of December 31, 2012, the Company had $22.5 million in term borrowings from the FHLB, compared to $27.7 million at December 31, 2011.

NORWOOD FINANCIAL CORP - 2012 CONSOLIDATED FINANCIAL REPORT

OFF-BALANCE SHEET ARRANGEMENTS

The Company’s financial statements do not reflect various commitments that are made in the normal course of business, which may involve some liquidity risk. These commitments consist mainly of unfunded loans and letters of credit made under the same standards as on-balance sheet instruments. Unused commitments, as of December 31, 2012 totaled $66.4 million. They consisted of $17.6 million of commitments for residential and commercial real estate, construction and land developments loans, $17.8 million in unused home equity lines of credit, $6.1 million in performance and standby letters of credit and $24.9 million in other unused commitments, principally commercial lines of credit. Because these instruments have fixed maturity dates and many of them will expire without being drawn upon, they do not represent any significant liquidity risk.

Management believes that any amounts actually drawn upon can be funded in the normal course of operations. The Company has no investment in or financial relationship with any unconsolidated entities that are reasonably likely to have a material effect on liquidity or the availability of capital resources.

The following table represents the aggregate of on and off-balance sheet contractual obligations to make future payments (in thousands):

CONTRACTUAL OBLIGATIONS

| | | December 31, 2012 | |

| | | Total | | | Less than

1 year | | | 1-3 years | | | 4-5 years | | | Over 5 years | |

| | | | | | | | | | | | | | | | |

| Time deposits | | $ | 211,260 | | | $ | 103,601 | | | $ | 78,704 | | | $ | 28,955 | | | $ | — | |

| Long-term debt | | | 22,487 | | | | 5,000 | | | | 7,487 | | | | 10,000 | | | | — | |

| Operating leases | | | 3,238 | | | | 321 | | | | 621 | | | | 428 | | | | 1,868 | |

| | | | | | | | | | | | | | | | | | | | | |

| | | $ | 236,985 | | | $ | 108,745 | | | $ | 86,812 | | | $ | 39,560 | | | $ | 1,868 | |

RESULTS OF OPERATIONS

NET INTEREST INCOME

Net interest income is the most significant source of revenue for the Company and represented 71.5% of total revenue for the year ended December 31, 2012. Net interest income (fte) totaled $26,006,000 for the year ended December 31, 2012 compared to $23,764,000 for 2011, an increase of $2,242,000 or 9.4%. The resulting fte net interest spread and net interest margin were 3.91% and 4.10% respectively in 2012 compared to 3.86% and 4.08%, respectively in 2011.

Interest income (fte) for the year ended December 31, 2012 totaled $30,656,000 compared to $28,946,000 in 2011. The fte yield on average earning assets was 4.83%, decreasing 14 basis points from the 4.97% reported last year. The continued low interest rate environment impacted the yield earned as new growth was added at historically low rates. This most notably affected taxable securities which earned 2.17% in 2012 compared to 2.61% in 2011 as cash flow from the portfolio was reinvested at the lower rates. Loan yields were also impacted by growth at lower than historical rates and earned 5.38% in 2012 compared to 5.67% in the prior year. The reduced yield was offset by a $52.0 million increase in average earning assets, resulting in the $1,710,000 increase in interest income (fte).

Interest expense was $4,650,000 in 2012 which resulted in an average cost of interest bearing liabilities of 0.92% compared to total interest expenses of $5,182,000 in 2011 with an average cost of 1.11%. The continued low rate environment also impacted rates paid on deposits as the Company reduced rates paid on money market, time and cash management accounts to market levels. Total interest bearing deposits cost 0.80% in 2012 which

NORWOOD FINANCIAL CORP - 2012 CONSOLIDATED FINANCIAL REPORT

was 15 basis points lower than the 0.95% cost in the prior year due primarily to a 21 basis point reduction in time deposits as certificates repriced to current market rates upon maturity and new growth was added at the reduced levels. Short term borrowings (including cash management accounts) and long term debt also repriced downward in 2012.

Interest income (fte) for the year ended December 31, 2011 totaled $28,946,000 compared to $26,685,000 in 2010. The fte yield on average earning assets was 4.97%, decreasing 25 basis points from the 5.22% reported last year. The continued low interest rate environment impacted the yield earned as new growth was added at historically low rates. This most notably affected taxable securities which earned 2.61% in 2011 compared to 3.12% in 2010 as cash flow from the portfolio was reinvested at the lower rates. Loan yields were also impacted by growth at lower than historical rates and earned 5.67% in 2011 compared to 5.98% in the prior year. A $3.8 million increase in average interest bearing deposits with banks which yielded .26% in 2011 also contributed to the reduced yield. The reduced yield was offset by a $71.5 million increase in average earning assets, resulting in the $2,261,000 increase in interest income (fte).

Interest expense was $5,182,000 in 2011 which resulted in an average cost of interest bearing liabilities of 1.11% compared to total interest expenses of $6,023,000 in 2010 with an average cost of 1.50%. The continued low rate environment also impacted rates paid on deposits as the Company reduced rates paid on money market, time and cash management accounts to market levels. Total interest bearing deposits cost .95% in 2011 which was 33 basis points lower than the 1.28% cost in the prior year due primarily to a 43 basis point reduction in time deposits as certificates repriced to current market rates upon maturity and new growth was added at the reduced levels. Short term borrowings (including cash management accounts) and long term debt also repriced downward in 2011.

OTHER INCOME

Other income totaled $5,206,000 for the year ended December 31, 2012 compared to $4,735,000 in 2011, an increase of $471,000 or 10.0%. Net gains on the sales of securities provided $446,000 of the increase as the Company took advantage of opportunities in the credit markets to reposition the portfolio. Earnings on bank owned life insurance policies increased $76,000 due to policies acquired from North Penn and a new purchase late in 2012.

Other income totaled $4,735,000 for the year ended December 31, 2011 compared to $4,064,000 in 2010, an increase of $671,000 or 16.5%. Net gains on the sales of securities provided $525,000 of the increase as the Company took advantage of opportunities in the credit markets to reposition the portfolio. Earnings on bank owned life insurance policies increased $72,000 due to policies acquired from North Penn.

NORWOOD FINANCIAL CORP - 2012 CONSOLIDATED FINANCIAL REPORT

Other Income (dollars in thousands)

For the year ended December 31

| | | 2012 | | | 2011 | | | 2010 | |

| Service charges on deposit accounts | | $ | 148 | | | $ | 159 | | | $ | 151 | |

| ATM Fees | | | 190 | | | | 236 | | | | 288 | |

| NSF Fees | | | 922 | | | | 996 | | | | 1,058 | |

| Safe deposit box rental | | | 58 | | | | 57 | | | | 53 | |

| Loan related service fees | | | 431 | | | | 386 | | | | 292 | |

| Debit card | | | 565 | | | | 474 | | | | 413 | |

| Fiduciary activities | | | 355 | | | | 409 | | | | 405 | |

| Commissions on mutual funds & annuities | | | 191 | | | | 140 | | | | 116 | |

| Gain on sales of mortgage loans and servicing rights | | | 211 | | | | 271 | | | | 307 | |

| Earnings on and proceeds from bank-owned life insurance | | | 539 | | | | 463 | | | | 391 | |

| Other income | | | 177 | | | | 171 | | | | 142 | |

| | | | 3,787 | | | | 3,762 | | | | 3,616 | |

| Net realized gains on sales of securities | | | 1,419 | | | | 973 | | | | 448 | |

| | | | | | | | | | | | | |

| Total | | $ | 5,206 | | | $ | 4,735 | | | $ | 4,064 | |

OTHER EXPENSES

Other expenses totaled $16,081,000 for the year ended December 31, 2012 compared to $15,813,000 in 2011. The $268,000, or 1.7%, increase in costs in 2012 includes over $700,000 of operating expenses related to the five new offices acquired in the North Penn transaction. These increases were offset by the reduction of approximately $800,000 of merger related costs incurred in 2011 and a $361,000 reduction in costs connected with foreclosed real estate properties. The Company’s efficiency ratio, which measures total other expenses as a percentage of net interest income (fte) plus other income, was 51.5% in 2012 compared to 55.5% in 2011, reflecting the costs related to the acquisition in 2011.

Other expenses totaled $15,813,000 for the year ended December 31, 2011 compared to $12,753,000 in 2010. The $3,060,000, or 24.0%, increase in costs in 2011 includes approximately $800,000 of one-time merger related costs incurred pertaining to the North Penn acquisition, as well as over $600,000 of operating expenses related to the five new offices acquired in the transaction. The majority of the one-time costs are included in professional fees while branch operating costs are included in employment and occupancy expenses. Data processing costs increased $52,000 due partially to a system conversion completed in 2011, while foreclosed real estate costs increased $537,000 over the prior year as several properties were acquired through foreclosure, resulting in write-downs and other costs related to the properties. The Company’s efficiency ratio, which measures total other expenses as a percentage of net interest income (fte) plus other income, was 55.5% in 2011 compared to 51.6% in 2010, reflecting the increased costs related to the acquisition.

INCOME TAXES

Income tax expense for the year ended December 31, 2012 was $3,036,000 for an effective tax rate of 26.5% compared to an expense of $2,579,000 and an effective tax rate of 26.0% in 2011. The increased effective rate reflects the $1.5 million improvement in income before taxes which is calculated at the statutory 34% rate.

Income tax expense for the year ended December 31, 2011 totaled $2,579,000 which resulted in an effective tax rate of 26.0% compared to $2,662,000 and 26.7% for 2010. The reduced rate reflected an increase in tax-exempt income earned in 2011 from loans, investment securities and bank owned life insurance.

NORWOOD FINANCIAL CORP - 2012 CONSOLIDATED FINANCIAL REPORT

CAPITAL AND DIVIDENDS

Total stockholders’ equity as of December 31, 2012, was $92.4 million, compared to $88.1 million as of year-end 2011. The increase was due primarily to retention of earnings of $4,434,000 after cash dividends declared of $3,969,000. Accumulated other comprehensive income decreased $518,000 in 2012 as previously unrealized gains were recognized in 2012. As of December 31, 2012 the Company had a leverage capital ratio of 11.77%, Tier 1 risk-based capital of 16.37% and total risk-based capital of 17.51% compared to, 11.29%, 15.86% and 17.04%, respectively, in 2011.

The Company’s stock is traded on the Nasdaq Global market under the symbol, NWFL. As of December 31, 2012, there were approximately 1,700 shareholders based on transfer agent mailings.

The following table sets forth the price range and cash dividends declared per share regarding common stock for the period indicated:

| | | Closing Price Range | | | Cash dividends | |

| | | High | | | Low | | | | |

| Year 2012 | | | | | | | | | |

| First Quarter | | $ | 28.00 | | | $ | 25.50 | | | $ | .30 | |

| Second Quarter | | | 28.50 | | | | 25.94 | | | | .30 | |

| Third Quarter | | | 30.20 | | | | 26.75 | | | | .30 | |

| Fourth Quarter | | | 31.91 | | | | 29.50 | | | | .31 | |

| | | | | | | | | | | | | |

| Year 2011 | | | | | | | | | | | | |

| First Quarter | | $ | 27.96 | | | $ | 26.25 | | | $ | .29 | |

| Second Quarter | | | 28.10 | | | | 26.15 | | | | .29 | |

| Third Quarter | | | 27.00 | | | | 24.02 | | | | .29 | |

| Fourth Quarter | | | 27.50 | | | | 23.30 | | | | .30 | |

The book value of the common stock was $28.04 as of December 31, 2012 compared to $26.81 as of December 31, 2011. As of year-end 2012, the stock price was $29.75, compared to $27.47 as of December 31, 2011.

NON-GAAP FINANCIAL MEASURES

This annual report contains or references tax-equivalent interest income and net interest income, which are non-GAAP financial measures. Tax-equivalent interest income and net interest income are derived from GAAP interest income and net interest income using an assumed tax rate of 34%. We believe the presentation of interest income and net interest income on a tax-equivalent basis ensures comparability of interest income and net interest income arising from both taxable and tax-exempt sources and is consistent with industry practice. Tax-equivalent net interest income is reconciled to GAAP net interest income on page 29. Although the Company believes that these non-GAAP financial measures enhance investors’ understanding of our business and performance, these non-GAAP financial measures should not be considered an alternative to GAAP measures.

NORWOOD FINANCIAL CORP - 2012 CONSOLIDATED FINANCIAL REPORT

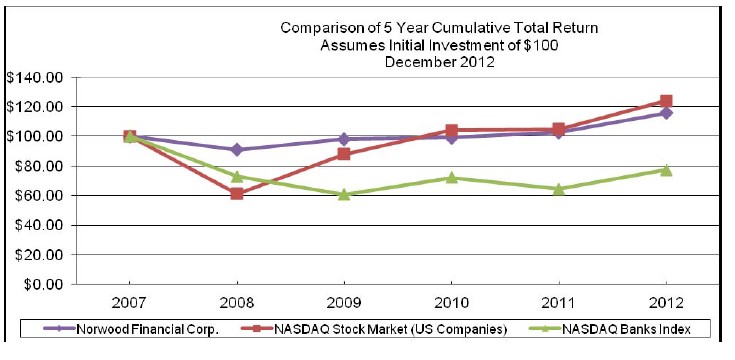

STOCK PERFORMANCE GRAPH

Set forth below is a stock performance graph comparing the cumulative total shareholder return on the Common Stock with (a) the cumulative total stockholder return on stocks included in the Nasdaq Stock Market index and (b) the cumulative total stockholder return on stocks included in the Nasdaq Bank index, as prepared by the Center for Research in Securities Prices (“CRSP”) at the University of Chicago. All three investment comparisons assume the investment of $100 at the market close on December 31, 2007 and the reinvestment of dividends paid. The graph provides comparison at December 31, 2007 and each fiscal year through December 31, 2012.

There can be no assurance that the Company’s future stock performance will be the same or similar to the historical performance shown in the above graph. The Company neither makes nor endorses any predictions as to stock performance.

LEGEND

Symbol | CSRP Total Returns Index for: | | 12/31/07 | | | 12/31/08 | | | 12/31/09 | | | 12/31/10 | | | 12/31/11 | | | 12/31/12 | |

| ♦ | Norwood Financial Corp | | $ | 100 | | | $ | 90.91 | | | $ | 97.99 | | | $ | 99.16 | | | $ | 102.48 | | | $ | 115.72 | |

| ■ | CRSP Nasdaq U.S. Index | | | 100 | | | | 61.17 | | | | 87.93 | | | | 104.13 | | | | 104.69 | | | | 123.85 | |

| ▲ | Nasdaq Bank Index | | | 100 | | | | 72.91 | | | | 60.66 | | | | 72.13 | | | | 64.51 | | | | 77.18 | |

Notes:

A. Data complete through last fiscal year.

B. Corporate Performance Graph with peer group uses peer group only performance (excludes only company).

C. Peer group indices use beginning of period market capitalization weighting.

D. Prepared by Zacks Investment Research, Inc. Used with permission. All rights reserved. Copyright 1980-2013

E. Index Data: Copyright NASDAQ, OMX, Inc. Used with permission. All rights reserved.

F. Index Data: Calculated (or Derived) based from CRSP NASDAQ Banks Index, Center for Research in Security Prices (CRSP), Graduate School of Business, The University of Chicago. Copyright 2013. Used with permission. All rights reserved.

NORWOOD FINANCIAL CORP - 2012 CONSOLIDATED FINANCIAL REPORT

NORWOOD FINANCIAL CORP

SUMMARY OF QUARTERLY RESULTS (UNAUDITED)

(Dollars in thousands, except per share amounts)

2012 | December 31 | | September 30 | | June 30 | | March 31 | |

| | | | | | | | | | | | | |

| Interest income | | $ | 7,157 | | | $ | 7,409 | | | $ | 7,445 | | | $ | 7,403 | |

| Interest expense | | | 1,078 | | | | 1,157 | | | | 1,198 | | | | 1,216 | |

Net interest income | | | 6,079 | | | | 6,252 | | | | 6,247 | | | | 6,187 | |

| Provision for loan losses | | | 800 | | | | 900 | | | | 400 | | | | 350 | |

| Other income | | | 1,016 | | | | 960 | | | | 921 | | | | 889 | |

| Net realized gains on sales of securities | | | 100 | | | | 631 | | | | 285 | | | | 402 | |

| Other expense | | | 4,053 | | | | 3,957 | | | | 3,957 | | | | 4,147 | |

| Income before income taxes | | | 2,342 | | | | 2,986 | | | | 3,096 | | | | 2,981 | |

| Income tax expense | | | 583 | | | | 786 | | | | 838 | | | | 795 | |

| NET INCOME | | $ | 1,759 | | | $ | 2,200 | | | $ | 2,258 | | | $ | 2,186 | |

| Basic earnings per share | | $ | .53 | | | $ | .67 | | | $ | .69 | | | $ | .67 | |

| | | | | | | | | | | | | | | | | |

| Diluted earnings per share | | $ | .53 | | | $ | .67 | | | $ | .69 | | | $ | .67 | |

| | | | | | | | | | | | | | | | | |

| 2011 | | | | | | | | | | | | | | | | |

| | December 31 | | September 30 | | June 30 | | March 31 | |

| | | | | | | | | | | | | | | | | |

| Interest income | | $ | 7,470 | | | $ | 7,655 | | | $ | 6,619 | | | $ | 6,026 | |

| Interest expense | | | 1,244 | | | | 1,392 | | | | 1,301 | | | | 1,245 | |

Net interest income | | | 6,226 | | | | 6,263 | | | | 5,318 | | | | 4,781 | |

| Provision for loan losses | | | 500 | | | | 425 | | | | 430 | | | | 220 | |

| Other income | | | 823 | | | | 962 | | | | 981 | | | | 996 | |

| Net realized gain on sales of securities | | | 205 | | | | 544 | | | | 12 | | | | 212 | |

| Other expense | | | 3,989 | | | | 4,354 | | | | 3,936 | | | | 3,534 | |

| Income before income taxes | | | 2,765 | | | | 2,990 | | | | 1,945 | | | | 2,235 | |

| Income tax expense | | | 768 | | | | 775 | | | | 461 | | | | 575 | |

| NET INCOME | | $ | 1,997 | | | $ | 2,215 | | | $ | 1,484 | | | $ | 1,660 | |

| | | | | | | | | | | | | | | | | |

| Basic earnings per share | | $ | .61 | | | $ | .67 | | | $ | .50 | | | $ | .60 | |

| | | | | | | | | | | | | | | | | |

| Diluted earnings per share | | $ | .61 | | | $ | .67 | | | $ | .50 | | | $ | .60 | |

| | | | | | | | | | | | | | | | | |

NORWOOD FINANCIAL CORP - 2012 CONSOLIDATED FINANCIAL REPORT

NORWOOD FINANCIAL CORP CONSOLIDATED AVERAGE BALANCE SHEETS WITH

RESULTANT INTEREST AND RATES

(Tax-Equivalent Basis, dollars in thousands)

| Year Ended December 31 | | 2012 | | | 2011 | | | 2010 | |

| | | Average Balance(2) | | | Interest(1) | | | Avg Rate | | | Average Balance(2) | | | Interest(1) | | | Avg Rate | | | Average Balance(2) | | | Interest(1) | | | Avg Rate | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| ASSETS | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Interest Earning Assets: | | | | | | | | | | | | | | | | | | | | | | | | | �� | | |

Federal funds sold | | $ | - | | | $ | - | | | | - | % | | $ | 551 | | | $ | 1 | | | | 0.18 | % | | $ | 3,000 | | | $ | 10 | | | | 0.33 | % |

Interest bearing deposits

with banks | | | 12,748 | | | | 32 | | | | 0.25 | | | | 20,258 | | | | 52 | | | | 0.26 | | | | 16,415 | | | | 47 | | | | 0.29 | |

Securities held to maturity | | | 172 | | | | 14 | | | | 8.14 | | | | 170 | | | | 14 | | | | 8.24 | | | | 280 | | | | 24 | | | | 8.57 | |

Securities available for sale: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Taxable | | | 89,786 | | | | 1,950 | | | | 2.17 | | | | 96,891 | | | | 2,528 | | | | 2.61 | | | | 95,121 | | | | 2,969 | | | | 3.12 | |

Tax-exempt | | | 53,571 | | | | 2,923 | | | | 5.46 | | | | 50,245 | | | | 2,865 | | | | 5.70 | | | | 40,332 | | | | 2,340 | | | | 5.80 | |

Total securities

available for sale | | | 143,357 | | | | 4,873 | | | | 3.40 | | | | 147,136 | | | | 5,393 | | | | 3.67 | | | | 135,453 | | | | 5,309 | | | | 3.92 | |

| Loans receivable (3,4) | | | 478,317 | | | | 25,737 | | | | 5.38 | | | | 414,473 | | | | 23,486 | | | | 5.67 | | | | 355,980 | | | | 21,295 | | | | 5.98 | |

Total interest

earning assets | | | 634,594 | | | | 30,656 | | | | 4.83 | | | | 582,588 | | | | 28,946 | | | | 4.97 | | | | 511,128 | | | | 26,685 | | | | 5.22 | |

| Non-interest earning assets: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Cash and due from banks | | | 9,163 | | | | | | | | | | | | 8,394 | | | | | | | | | | | | 7,402 | | | | | | | | | |

| Allowance for loan losses | | | (5,683 | ) | | | | | | | | | | | (5,575 | ) | | | | | | | | | | | (4,476 | ) | | | | | | | | |

| Other assets | | | 44,123 | | | | | | | | | | | | 37,018 | | | | | | | | | | | | 22,638 | | | | | | | | | |

Total non-interest

earning assets | | | 47,603 | | | | | | | | | | | | 39,837 | | | | | | | | | | | | 24,564 | | | | | | | | | |

| TOTAL ASSETS | | $ | 682,197 | | | | | | | | | | | $ | 622,425 | | | | | | | | | | | $ | 535,692 | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| LIABILITIES AND STOCKHOLDERS' EQUITY | | | | | | | | | | | | | | | | | | | | | | | | |

| Interest Bearing Liabilities: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Interest bearing demand and

money market | | $ | 169,232 | | | | 522 | | | | 0.31 | | | $ | 140,934 | | | | 554 | | | | 0.39 | | | $ | 107,997 | | | | 571 | | | | 0.53 | |

Savings | | | 68,068 | | | | 84 | | | | 0.12 | | | | 67,862 | | | | 164 | | | | 0.24 | | | | 48,588 | | | | 109 | | | | 0.22 | |

Time | | | 219,232 | | | | 3,054 | | | | 1.39 | | | | 196,253 | | | | 3,133 | | | | 1.60 | | | | 177,761 | | | | 3,603 | | | | 2.03 | |

Total interest-bearing deposits | | | 456,532 | | | | 3,660 | | | | 0.80 | | | | 405,049 | | | | 3,851 | | | | 0.95 | | | | 334,346 | | | | 4,283 | | | | 1.28 | |

Short-term borrowings | | | 23,679 | | | | 53 | | | | 0.22 | | | | 28,521 | | | | 92 | | | | 0.32 | | | | 25,932 | | | | 117 | | | | 0.45 | |

Other borrowings | | | 26,611 | | | | 937 | | | | 3.52 | | | | 34,774 | | | | 1,239 | | | | 3.56 | | | | 41,712 | | | | 1,623 | | | | 3.89 | |

Total interest bearing

liabilities | | | 506,822 | | | | 4,650 | | | | 0.92 | | | | 468,344 | | | | 5,182 | | | | 1.11 | | | | 401,990 | | | | 6,023 | | | | 1.50 | |

| Non-interest bearing liabilities: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Non-interest bearing demand

deposits | | | 80,161 | | | | | | | | | | | | 69,721 | | | | | | | | | | | | 61,966 | | | | | | | | | |

| Other liabilities | | | 4,101 | | | | | | | | | | | | 4,941 | | | | | | | | | | | | 4,433 | | | | | | | | | |

Total non-interest

bearing liabilities | | | 91,113 | | | | | | | | | | | | 74,662 | | | | | | | | | | | | 66,399 | | | | | | | | | |

| Stockholders' equity | | | 79,.419 | | | | | | | | | | | | 79,419 | | | | | | | | | | | | 67,303 | | | | | | | | | |

TOTAL LIABILITIES AND

STOCKHOLDERS' EQUITY | | $ | 682,197 | | | | | | | | | | | $ | 662,425 | | | | | | | | | | | $ | 535,692 | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Net interest income | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

(tax-equivalent basis) | | | | | | | 26,006 | | | | 3.91 | % | | | | | | | 23,764 | | | | 3.86 | % | | | | | | | 20,662 | | | | 3.72 | % |

| Tax-equivalent basis adjustment | | | | | | | (1,242 | ) | | | | | | | | | | | (1,176 | ) | | | | | | | | | | | (998 | ) | | | | |

Net Interest Income | | | | | | $ | 24,764 | | | | | | | | | | | $ | 22,588 | | | | | | | | | | | $ | 19,664 | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Net Interest margin | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

(tax-equivalent basis) | | | | | | | | | | | 4.10 | % | | | | | | | | | | | 4.08 | % | | | | | | | | | | | 4.04 | % |

| 1 | Interest and yields are presented on a tax-equivalent basis using a marginal tax rate of 34%. |

| 2 | Average balances have been calculated based on daily balances. |

| 3 | Loan balances include non-accrual loans and are net of unearned income. |

| 4 | Loan yields include the effect of amortization of purchased credit marks and deferred fees net of costs. |

NORWOOD FINANCIAL CORP - 2012 CONSOLIDATED FINANCIAL REPORT

RATE/VOLUME ANALYSIS

The following table shows the fully taxable equivalent effect of changes in volumes and rates on interest income and interest expense.

| | | Increase/(Decrease) | |

| (dollars in thousands) | | 2012 compared to 2011 | | | 2011 compared to 2010 | |

| | | Variance due to | | | Variance due to | |

| | | Volume | | | Rate | | | Net | | | Volume | | | Rate | | | Net | |

| INTEREST EARNING ASSETS: | |

| Federal funds sold | | $ | (1 | ) | | $ | - | | | $ | (1 | ) | | $ | (6 | ) | | $ | (3 | ) | | $ | (9 | ) |

| Interest bearing deposits | | | (19 | ) | | | (1 | ) | | | (20 | ) | | | 10 | | | | (5 | ) | | | 5 | |

| Securities held to maturity | | | - | | | | - | | | | - | | | | (9 | ) | | | (1 | ) | | | (10 | ) |

| Securities available for sale: | | | | | | | | | | | | | | | | | | | | | | | | |

| Taxable | | | (176 | ) | | | (402 | ) | | | (578 | ) | | | 54 | | | | (495 | ) | | | (441 | ) |

| Tax-exempt securities | | | 185 | | | | (127 | ) | | | 58 | | | | 566 | | | | (41 | ) | | | 525 | |

| Total securities available for sale | | | 9 | | | | (529 | ) | | | (520 | ) | | | 620 | | | | (536 | ) | | | 84 | |

| Loans receivable | | | 3,480 | | | | (1,229 | ) | | | 2,251 | | | | 3,359 | | | | (1,168 | ) | | | 2,191 | |

| Total interest earning assets | | | 3,469 | | | | (1,759 | ) | | | 1,710 | | | | 3,974 | | | | (1,713 | ) | | | 2,261 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| INTEREST BEARING LIABILITIES: | |

| Interest-bearing demand and money market | | | 100 | | | | (132 | ) | | | (32 | ) | | | 150 | | | | (167 | ) | | | (17 | ) |

| Savings | | | - | | | | (80 | ) | | | (80 | ) | | | 46 | | | | 9 | | | | 55 | |

| Time | | | 344 | | | | (423 | ) | | | (79 | ) | | | 349 | | | | (819 | ) | | | (470 | ) |

| Total interest-bearing deposits | | | 444 | | | | (635 | ) | | | (191 | ) | | | 545 | | | | (977 | ) | | | (432 | ) |

| Short-term borrowings | | | (14 | ) | | | (25 | ) | | | (39 | ) | | | 11 | | | | (36 | ) | | | (25 | ) |

| Other borrowings | | | (288 | ) | | | (14 | ) | | | (302 | ) | | | (255 | ) | | | (129 | ) | | | (384 | ) |

| Total interest bearing liabilities | | | 142 | | | | (674 | ) | | | (532 | ) | | | 301 | | | | (1,142 | ) | | | (841 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Net interest income (tax-equivalent basis) | | $ | 3,327 | | | $ | (1,085 | ) | | $ | 2,242 | | | $ | 3,673 | | | $ | (571 | ) | | $ | 3,102 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

Changes in net interest income that could not be specifically identified as either a rate or volume change were allocated proportionately to changes in volume and changes in rate.

NORWOOD FINANCIAL CORP - 2012 CONSOLIDATED FINANCIAL REPORT

MANAGEMENT’S REPORT ON INTERNAL CONTROL OVER FINANCIAL REPORTING

TO THE STOCKHOLDERS OF NORWOOD FINANCIAL CORP

Management of Norwood Financial Corp and its subsidiary (Norwood) is responsible for establishing and maintaining adequate internal control over financial reporting as defined in Rules 13a-15(f) and 15d-15(f) under the Securities Exchange Act of 1934. Norwood’s internal control over financial reporting is designed to provide reasonable assurance regarding the reliability of financial reporting and the preparation of the consolidated financial statements for external purposes in accordance with accounting principles generally accepted in the United States of America.

Norwood’s internal control over financial reporting includes those policies and procedures that (1) pertain to the maintenance of records that, in reasonable detail, accurately and fairly reflect the transactions and dispositions of the assets of Norwood; (2) provide reasonable assurance that transactions are recorded as necessary to permit preparation of financial statements in accordance with generally accepted accounting principles, and that our receipts and expenditures are being made only in accordance with authorizations of Norwood’s management and directors; and (3) provide reasonable assurance regarding prevention or timely detection of unauthorized acquisition, use or disposition of Norwood’s assets that could have a material effect on the consolidated financial statements.

Because of its inherent limitations, internal control over financial reporting may not prevent or detect misstatements. Also, projections of any evaluation of effectiveness to future periods are subject to the risk that controls may become inadequate because of changes in conditions, or that the degree of compliance with the policies or procedures may deteriorate.

Management assessed the effectiveness of Norwood’s internal control over financial reporting as of December 31, 2012. In making this assessment, management used the criteria set forth by the Committee of Sponsoring Organizations of the Treadway Commission in “Internal Control – Integrated Framework.” Based on our assessment and those criteria, management determined that Norwood maintained effective internal control over financial reporting as of December 31, 2012.

Norwood’s Independent registered certified public accounting firm has audited the effectiveness of Norwood’s internal control over financial reporting. Their report appears on page 31.

NORWOOD FINANCIAL CORP - 2012 CONSOLIDATED FINANCIAL REPORT

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

Board of Directors and Stockholders

of Norwood Financial Corp.

Honesdale, Pennsylvania

We have audited the accompanying consolidated balance sheets of Norwood Financial Corp. and its subsidiary as of December 31, 2012 and 2011, and the related consolidated statements of income, comprehensive income, stockholders’ equity, and cash flows for each of the three years. These financial statements are the responsibility of Norwood Financial Corp. and its subsidiary’s management. Our responsibility is to express an opinion on these financial statements based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the consolidated financial statements referred to above present fairly, in all material respects, the financial position of Norwood Financial Corp. and its subsidiary as of December 31, 2012 and 2011, and the results of their operations and their cash flows for each of the three years in the period ended December 31, 2012 in conformity with U.S. generally accepted accounting principles.

We have also audited, in accordance with the standards of the Public Company Accounting Oversight Board (United States), Norwood Financial Corp. and its subsidiary’s internal control over financial reporting as of December 31, 2012, based on criteria established in Internal Control – Integrated Framework issued by the Committee of Sponsoring Organizations of the Treadway Commission, and our report dated March 12, 2013, expressed an unqualified opinion on the effectiveness of Norwood Financial Corp. and its subsidiary’s internal control over financial reporting.

S.R. Snodgrass, A. C.

2100 Corporate Drive

Suite 400

Wexford, PA

March 12, 2013

NORWOOD FINANCIAL CORP - 2012 CONSOLIDATED FINANCIAL REPORT

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

Board of Directors and Stockholders

of Norwood Financial Corp.

Honesdale, Pennsylvania

We have audited Norwood Financial Corp. (the “Company”) and its subsidiary’s internal control over financial reporting as of December 31, 2012 based on criteria established in Internal Control – Integrated Framework issued by the Committee of Sponsoring Organizations of the Treadway Commission. Norwood Financial Corp’s. and its subsidiary’s management is responsible for maintaining effective internal control over financial reporting and for its assessment of the effectiveness of internal control over financial reporting included in the accompanying Management’s Report on Internal Control Over Financial Reporting. Our responsibility is to express an opinion on the Company’s internal control over financial reporting based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether effective internal control over financial reporting was maintained in all material respects. Our audit included obtaining an understanding of internal control over financial reporting, assessing the risk that a material weakness exists, and testing and evaluating the design and operating effectiveness of internal control based on the assessed risk. Our audit also included performing such other procedures as we considered necessary in the circumstances. We believe that our audits provide a reasonable basis for our opinion.

A company’s internal control over financial reporting is a process designed to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with generally accepted accounting principles. A company’s internal control over financial reporting includes those policies and procedures that (a) pertain to the maintenance of records that, in reasonable detail, accurately and fairly reflect the transactions and dispositions of the assets of the company; (b) provide reasonable assurance that transactions are recorded as necessary to permit preparation of financial statements in accordance with generally accepted accounting principles, and that receipts and expenditures of the company are being made only in accordance with authorizations of management and directors of the company; and (c) provide reasonable assurance regarding prevention or timely detection of unauthorized acquisition, use, or disposition of the company’s assets that could have a material effect on the financial statements.