- NWFL Dashboard

- Financials

- Filings

- Holdings

-

Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEFA14A Filing

Norwood Financial (NWFL) DEFA14AAdditional proxy soliciting materials

Filed: 25 Mar 22, 9:08am

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D. C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934 (Amendment No. )

Filed by the Registrant ☒ Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☐ | Preliminary Proxy Statement | |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| ☐ | Definitive Proxy Statement | |

| ☒ | Definitive Additional Materials | |

| ☐ | Soliciting Material Pursuant to §240.14a-12 | |

NORWOOD FINANCIAL CORP

(Name of Registrant as Specified in its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of filing fee (Check the appropriate box):

| ☒ | No fee required. | |||

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||

| (1) | Title of each class of securities to which transaction applies:

| |||

| (2) | Aggregate number of securities to which transaction applies:

| |||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11. (set forth the amount on which the filing fee is calculated and state how it was determined):

| |||

| (4) | Proposed maximum aggregate value of transaction:

| |||

| (5) | Total fee paid:

| |||

| ☐ | Fee paid previously with preliminary materials. | |||

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

| (1) | Amount previously paid:

| |||

| (2) | Form, Schedule or Registration Statement No.:

| |||

| (3) | Filing Party:

| |||

| (4) | Date Filed:

| |||

NORWOOD FINANCIAL CORP 2021

ANNUAL REPORT

A P I L L A R I N O U R CO M M U N I T I E S F O R 1 5 0 Y E A R S

1871 2021

DEAR STOCKHOLDERS,

We are pleased to share with you the Company’s performance and achievements in this Annual Report. For the year ended December 31, 2021, net income totaled a record level of $24,915,000, an increase of $9,835,000 from the $15,080,000 earned in the prior year. The increase reflects the benefits derived from the acquisition of UpState New York Bancorp, Inc. (“UpState”), earnings related to the Paycheck Protection Program (“PPP”), and a lower level of the provision for loan losses. Earnings per share on a fully diluted basis were $3.04 compared to $2.09 for the year ended December 31, 2020. Our earnings for 2021 resulted in a return on average assets of 1.24%, and a return on average tangible equity of 14.49%, compared to 0.97% and 10.16%, respectively, for the year ended December 31, 2020.

We also increased our cash dividend declared in the fourth quarter of 2021 to $0.28 per share, which represents a 7.7% increase compared to the fourth quarter of 2020. This makes 30 consecutive years of an increase in the Company’s cash dividend, a remarkable achievement. We believe 2021 was a very successful year for the Company. I encourage you to read the Management’s Discussion and Analysis and the Financial Statement with Footnotes for a full report on our performance.

The year’s most exciting news was the celebration of Wayne Bank’s 150-year anniversary on November 4. We honored this impressive milestone throughout our markets with product promotions, a custom anniversary logo, giveaways for our customers, and more. Of special note, was a congratulatory graphic message from NASDAQ, which ran on the NASDAQ Tower in Times Square in New York City. We will continue the celebration through November 2022. The longevity of the Company demonstrates our commitment to serving our stockholders, customers, employees, and communities.

Last year was also the Company’s first full year with markets made up of 30 Community Offices across two states, ten counties, and three brands: Wayne Bank, Bank of Cooperstown, and Bank of the

WE ARE A COMMUNITY BANK THAT IS DEDICATED TO INVESTING

,, IN THE RESIDENTS, BUSINESSES, AND ORGANIZATIONS WHO MAKE OUR COMMUNITIES A BETTER PLACE TO LIVE.”

RITELLI d CEO

NOVEMBER 4, 1871

Founded with the modest capital of $25,000 as Wayne County Savings Bank in the old Weston Building, the site of the former Erk Hardware Building, west of Main Street in the Keystone block.

1898

The Bank constructs a new larger building at 717 Main Street in Honesdale (current location).

MILESTONES THROUGH THE YEARS

1875

The Bank moves into a new building on Main Street, due to rapid growth.

Finger Lakes. Though geographically and demographically diverse from one another, each of our Community Offices are staffed by bankers who are accessible, knowledgeable, and committed to helping their neighbors, local businesses, and hometown organizations grow and thrive. This resulted in healthy growth for our deposit base and loan portfolio in 2021. Deposits now total over $1.7 billion and loans are $1.4 billion.

As the COVID-19 pandemic continued to affect our nation throughout 2021, we remained steadfast in our mission of supporting our customers, communities, and local businesses. We assisted over 1,900 local businesses in obtaining PPP loans to provide emergency relief to business owners. As an official Small Business Administration Lender, Wayne Bank supported existing customers, as well as other businesses across our markets, with over $156 million of loans funded. We assisted our customers in receiving loan forgiveness from the SBA with over 90% forgiven to date. We also continued our longstanding tradition of investing in our communities, by donating to hundreds of local schools, food banks, first responders, and neighborhood organizations. In addition, the Bank assisted many local governments and school districts to manage their funds.

Technology remained a priority for the Bank and customers appreciated the convenience of our free digital banking services, as usage increased significantly from the prior year. At the end of 2021, Mobile Banking users totaled almost 40,000, an 18% increase, and Mobile Deposit Capture increased by 20% to almost 7,000 users. We also added a new service in the fourth quarter with the launch of Zelle®. Zelle® is a fast, safe, and easy way to send and receive money in minutes with friends, family, and businesses. Customers can easily access and register for Zelle® through Bill Pay in our online banking and mobile banking app, and many quickly signed up.

Another exciting change occurred in the fourth quarter with the launch of Wayne Bank’s new website at wayne.bank. The website includes a fresh, modern design with significant usability and accessibility improvements. I encourage you to visit this redesigned site on any of your devices.

Wayne Bank is committed to investing in the communities we serve, and the decision was made to relocate our Penn Yan, New York Community Office in the second half of 2022. Once construction is completed, the new full-service office will feature a spacious and contemporary design with improved parking and drive-up banking services. This will provide numerous benefits for our Penn Yan customers, staff, and the local community, and we are excited to complete this initiative.

30

OFFICES

2

STATES

10

COUNTIES

250+

EMPLOYEES

$2B

ASSETS

1924

Construction is finished, and the new Bank is opened. This building is still where Wayne Bank’s Main Office is located. The vault costs $12,530 and is installed by the Herring-Hall-Marvin Safe Company of New York City. The vault is still in use today.

1972

“Harris” Building, is purchased and demolished to add a multi-lane drive-thru to the Main Office.

1923

The present building proves to be too small, so a new building is constructed on the site of the present building. While it is being constructed, Bank business is conducted from the Dodge Hotel building at 913 Main Street.

1931

Wayne Bank acquires the Waymart State Bank in Waymart, PA

1954

Wayne Bank opens a new Waymart Community Office.

THE FOUR PILLARS WAYNE BANK IS BUILT UPON

We believe in lending money to the local businesses and residents within the communities we serve.

We believe in funding those loans with local deposits gathered through our Community Offices.

We believe in operating as efficiently and effectively as we can.

We believe in utilizing our capital to earn a return for our stockholders, customers, and communities.

The growth and prosperity of our organization has always been due to our outstanding employees, and we honored the dedication of those individuals who celebrated milestone years of service with Wayne Bank in 2021. Congratulations to Gail Simpson, Roscoe Community Office Head Teller, for her remarkable 50 years of service. Dawnette Hotaling, Senior Vice President and NY Retail Market Manager, also celebrated an impressive 40 years of service. Adding employees celebrating twenty, fifteen, ten, and five year anniversaries, the group represents 260 years of community banking excellence.

The year’s progress provided many opportunities for employee growth and numerous employees were promoted for their hard work and dedication. The most senior promotions included Vincent G. O’Bell to Senior Vice President and Chief Lending Officer, Steven Daniels to Senior Vice President and Retail Lending Manager, Jim King to Senior Vice President and Commercial Loan Officer, Michael Scaglione to Senior Vice President and Commercial Loan Officer, and Kara Suchy to Senior Vice President and Director of Internal Audit. In addition, we strengthened the Company with a number of strategic new hires including Michael Rollison, Senior Vice President and Commercial Team Leader for Wayne and Pike Counties, and Paul Dunda, Senior Vice President and Senior Operations Officer.

After twelve years in this role, I will retire this year as President and Chief Executive Officer of Norwood Financial Corp and Wayne Bank. It has been my sincere honor and privilege to serve this Company, our Board of Directors, stockholders, employees, customers, and communities. I am fortunate to have spent twenty-seven remarkable years with Wayne Bank and will continue to serve as director of the Company and the Bank, following my retirement during the first half of 2022.

1980

A second Honesdale Community Office opens on Willow Avenue.

1996

Shohola and Lakewood Community Offices open.

1999

Stroud Mall Community Office opens.

2006

Tannersville Community Office opens.

MILESTONES THROUGH THE YEARS

1985

Hawley Community Office opens.

1993

The Bank’s name is officially changed from Wayne County Bank and Trust to Wayne Bank. Milford Community Office opens.

Wayne Bank offers Visa Debit Cards, eliminating the need for customers to carry cash or write checks when making a purchase.

2001

Teller computers are installed. Prior to this, teller work was done on calculators.

NORWOOD FINANCIAL CORP BOARD OF DIRECTORS

WILLIAM WILLIAM W. DAVIS, DAVIS, JR JR. DR DR. ANDREW ANDREW A. FORTE FORTE LEWIS LEWIS J. CRITELLI CRITELLI JOSEPH JOSEPH W. ADAMS ADAMS Susan Campfield JEFFREY JEFFREY GIFFORD GIFFORD

Chairman of the Board Vice Chairman President and CEO Director Director Director

MEG MEG L. HUNGERFORD HUNGERFORD KEVIN KEVIN M. LAMONT LAMONT RALPH RALPH A. MATERGIA, MATERGIA, ESQ ESQ. ALEXANDRA ALEXANDRA NOLAN NOLAN DR DR. KENNETH KENNETH A. PHILLIPS HILLIPS RUSSELL RUSSELL L. RIDD, RIDD,

Director Director Director Director Director Director Emeritus

The Board of Directors is currently undertaking a process to choose my successor and I am confident that the new President and CEO will continue to uphold the four pillars this Bank was built on: To lend money to the local businesses and residents within the communities we serve; To fund those loans with local deposits gathered through our Community Offices; to operate as efficiently and effectively as we can; and to utilize our capital to earn a return for our stockholders, customers, and communities.

We truly appreciate the support and confidence of our stockholders. We thank you for your ownership interest in Norwood as we continue to work to enhance shareholder value. Please keep us in mind for all your financial needs.

2016

Wayne Bank acquires Delaware Bancshares, Inc. with 12 Community Offices in Delaware and

Sullivan Counties, NY. NOVEMBER 4,2021 Wayne Bank celebrates 150 years of serving our communities.

2011 2013 2020

Wayne Bank acquires Wayne Bank launches Wayne Bank acquires UpState New York North Penn Bancorp, branded mobile app for Bancorp, Inc., including the Bank of the Inc. and with it, the smart phones and tablets. Finger Lakes and Bank of Cooperstown Central Scranton, Clarks brands. As units of Wayne Bank, these brands Summit, and Effort add Community Office locations in Geneva, Community Offices. Penn Yan, Cooperstown, and Oneonta, NY.

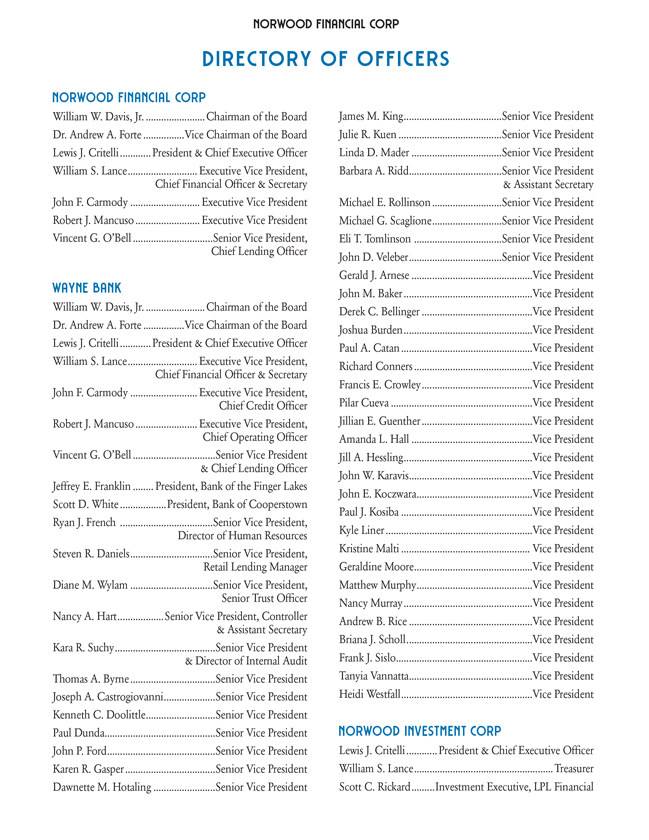

NORWOOD FINANCIAL CORP

DIRECTORY OF OFFICERS

NORWOOD FINANCIAL CORP

William W. Davis, Jr. Chairman of the Board Dr. Andrew A. Forte Vice Chairman of the Board Lewis J. Critelli President & Chief Executive Officer William S. Lance Executive Vice President, Chief Financial Officer & Secretary John F. Carmody Executive Vice President Robert J. Mancuso Executive Vice President Vincent G. O’Bell Chief Lending Officer WAYNE BANK William W.Davis, Jr. Chairman of the Board Dr. Andrew A. Forte Vice Chairman of the Board Lewis J. Critelli President & ChiefExecutive Officer William S. Lance Executive Vice President, Chief Financial Officer & Secretary John F. Carmody Executive Vice President, Chief Credit Officer Robert J. Mancuso Executive Vice President, Chief Operating Officer Vincent G. O’Bell SeniorVice President & Chief Lending Officer Jeffrey E. Franklin President, Bank of the Finger Lakes Scott D. White President, Bank of Cooperstown Ryan J. French Senior Vice President,Director of Human Resources Steven R. DanielsSenior Vice President, Retail Lending Manager Diane M. Wylam Senior Vice President, Senior Trust Officer Nancy A. Hart Senior Vice President, Controller& Assistant SecretaryKara R. Suchy Senior Vice President & Director of Internal Audit Thomas A. Byrne Senior Vice President Joseph A.Castrogiovanni Senior Vice President Kenneth C. Doolittle Senior Vice President Paul Dunda Senior Vice President John P.Ford Senior Vice President Karen R. Gasper Senior Vice President Dawnette M. Hotaling Senior Vice President James M. King Senior Vice President Julie R. Kuen Senior Vice President Linda D. Mader Senior Vice President Barbara A.Ridd Senior Vice President & Assistant Secretary Michael E. Rollinson Senior Vice President Michael G. Scaglione Senior Vice President Eli T. Tomlinson Senior Vice President John D. Veleber Senior Vice President Gerald J. Arnese Vice President John M.Baker Vice President Derek C. Bellinger Vice President Joshua Burden Vice President Paul A. Catan Vice President RichardConners Vice President Francis E. Crowley Vice President Pilar Cueva Vice President Jillian E. Guenther Vice PresidentAmanda L. Hall Vice President Jill A. Hessling Vice President

John W. Karavis Vice President John E. Koczwara Vice President Paul J. Kosiba Vice President Kyle LinerVice President KristineMalti Vice President Geraldine Moore Vice President Matthew Murphy Vice President Nancy Murray Vice President Andrew B. Rice Vice President Briana J. Scholl Vice President Frank J. Sislo Vice President Tanyia Vannatta Vice President HeidiWestfall Vice President NORWOOD INVESTMENT CORP

Lewis J. Critelli President & Chief Executive Officer William S. Lance Treasurer Scott C. Rickard Investment Executive, LPL Financial

ONTARIO GENEVA ✮

COOPERSTOWN PENN YAN ✮

YATES ✮

OTSEGO

ONEONTA

✮ STAMFORD

FRANKLIN ✮ ROXBURY

✮ ✮

HAMDEN ANDES WALTON ✮ ✮

✮

DELAWARE

ROSCOE

✮

WAYNE LIBERTY CALLICOON ✮ WAYMART MONTICELLO

SULLIVAN ✮

HONESDALE WURTSBORO CLARKS SUMMIT WILLOW AVE

LACKAWANNA HAWLEY

SHOHOLA MILFORD

CENTRAL EXETER STATION

HANOVER PIKE TOWNSHIP MONROE

TANNERSVILLE

LUZERNE MARSHALLS CREEK

STROUD MALL EFFORT

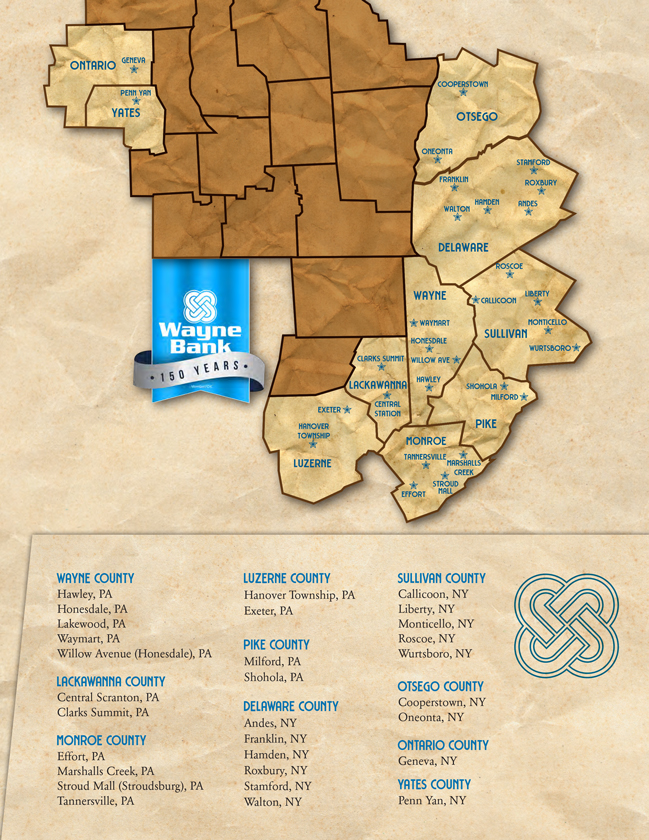

WAYNE COUNTY LUZERNE COUNTY SULLIVAN COUNTY

Hawley, PA Hanover Township, PA Callicoon, NY Honesdale, PA Exeter, PA Liberty, NY Lakewood, PA Monticello, NY Waymart, PA PIKE COUNTY Roscoe, NY Willow Avenue (Honesdale), PA Wurtsboro, NY

Milford, PA

LACKAWANNA COUNTY Shohola, PA

OTSEGO COUNTY

Central Scranton, PA Cooperstown, NY Clarks Summit, PA DELAWARE COUNTY

Oneonta, NY Andes, NY

MONROE COUNTY Franklin, NY ONTARIO COUNTY

Effort, PA Hamden, NY

Geneva, NY Marshalls Creek, PA Roxbury, NY

Stroud Mall (Stroudsburg), PA Stamford, NY YATES COUNTY Tannersville, PA Walton, NY Penn Yan, NY

WWW.WAYNE.BANK BANKOFTHEFINGERLAKES.COM BANKOFCOOPERSTOWN.COM