Norwood Financial Corp Investor Presentation February 1, 2023 Janney West Coast Bank CEO Forum Exhibit 99.1

Forward Looking Statements & Disclaimers The information disclosed in this document includes various forward-looking statements that are made by Norwood Financial Corp. (the “Company”) in reliance upon the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. The words “anticipates,” “projects,” “intends,” “estimates,” “expects,” “believes,” “plans,” “may,” “will,” “should,” “could,” and other similar expressions are intended to identify such forward-looking statements the Company cautions that these forward-looking statements are necessarily speculative and speak only as of the date made, and are subject to numerous assumptions, risks and uncertainties, all of which may change overtime. Actual results could differ materially from such forward-looking statements. Accordingly, you should not place undue reliance on forward-looking statements. The following factors, among others, could cause actual results to differ materially and adversely from such forward-looking statements: changes in the financial services industry and the U.S. and global capital markets, changes in economic conditions nationally, regionally and in the company’s markets, the nature and timing of actions of the Federal Reserve Board and other regulators, the nature and timing of legislation and regulation affecting the financial services industry, government intervention in the U.S. financial system, changes in federal and state tax laws, changes in levels of market interest rates, pricing pressures on loan and deposit products, credit risks of the Company’s lending activities, successful implementation, deployment and upgrades of new and existing technology, systems, services and products, customers’ acceptance of the Company’s products and services, and competition. Further, given its ongoing and dynamic nature, it is difficult to predict the continuing effects that the COVID-19 pandemic will have on our business and results of operations. The pandemic and related local and national economic disruption may, among other effects, result in a material adverse change for the demand for our products and services; increased levels of loan delinquencies, problem assets and foreclosures; branch disruptions, unavailability of personnel and increased cybersecurity risks as employees work remotely. Any statements made by the Company that are not historical facts should be considered to be forward-looking statements. The Company cautions that the foregoing list of important factors is not exhaustive. The Company is not obligated to update and does not undertake to update any of its forward looking statements, whether written or oral, that may be made from time to time by or on behalf of the Company or made herein.

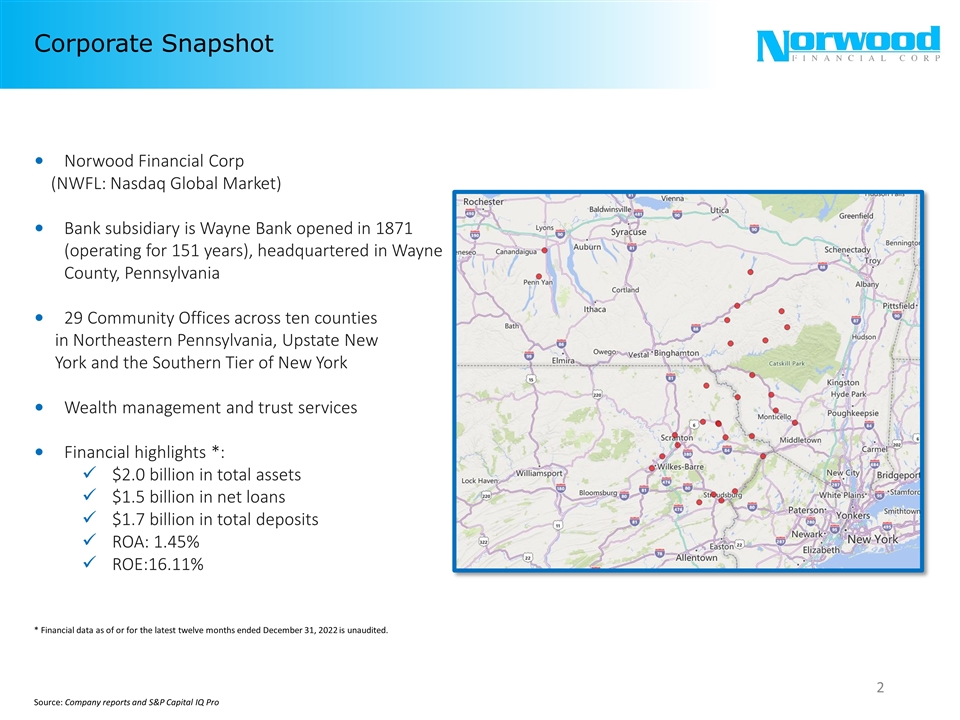

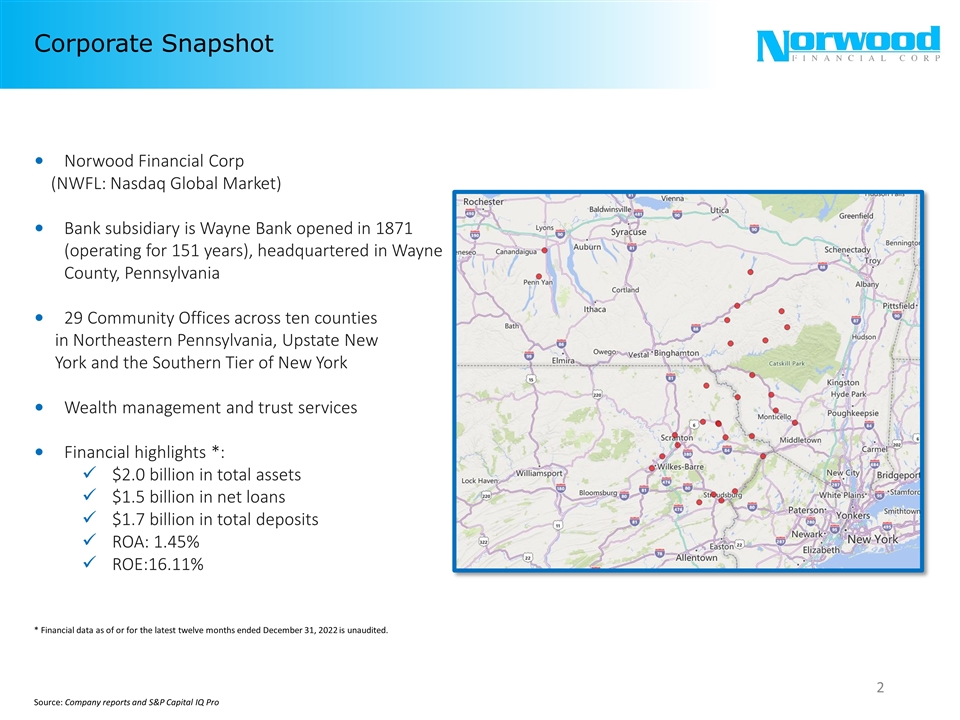

Corporate Snapshot Source: Company reports and S&P Capital IQ Pro Norwood Financial Corp (NWFL: Nasdaq Global Market) Bank subsidiary is Wayne Bank opened in 1871 (operating for 151 years), headquartered in Wayne County, Pennsylvania 29 Community Offices across ten counties in Northeastern Pennsylvania, Upstate New York and the Southern Tier of New York Wealth management and trust services Financial highlights *: $2.0 billion in total assets $1.5 billion in net loans $1.7 billion in total deposits ROA: 1.45% ROE:16.11% * Financial data as of or for the latest twelve months ended December 31, 2022 is unaudited.

Who We Are and What We Stand For Source: Norwood Financial Corp Our Mission Statement “Helping the community grow by serving businesses and their employees.” Our Core Values We believe in lending money to the local businesses and residents within the communities we serve. We believe in funding those loans with local deposits gathered through our Community Offices. We believe in operating as efficiently and effectively as we can. We believe in utilizing our capital to earn a return for our stockholders, customers, and communities.

A Leading Market Share in a Sizable, Quality Market Source: S&P Capital IQ Pro and FDIC, deposit market share as of June 30, 2022 The Wayne Bank primary market of ten counties is home to 1.2 million people and is projected to grow by 2.69% between 2022 and 2027. The average household income is projected to grow by 12% from 2022 to $96,553 in 2027. Wayne Bank has a nearly 6% share of the $32 billion deposit market in the counties in which Wayne Bank operates. Wayne Bank holds the fourth market share position and is the top market share holder among community banks in the markets in which Wayne Bank operates. There are approximately 26,000 businesses operating in our market areas, with nearly 75% of the businesses employing less than 10 people. There are a total of ten NAICS codes with greater than 1,000 businesses in our market area, with a blend of tourism, sciences and manufacturing. Leading Deposit Market Share Diverse Industry Quality Demographics

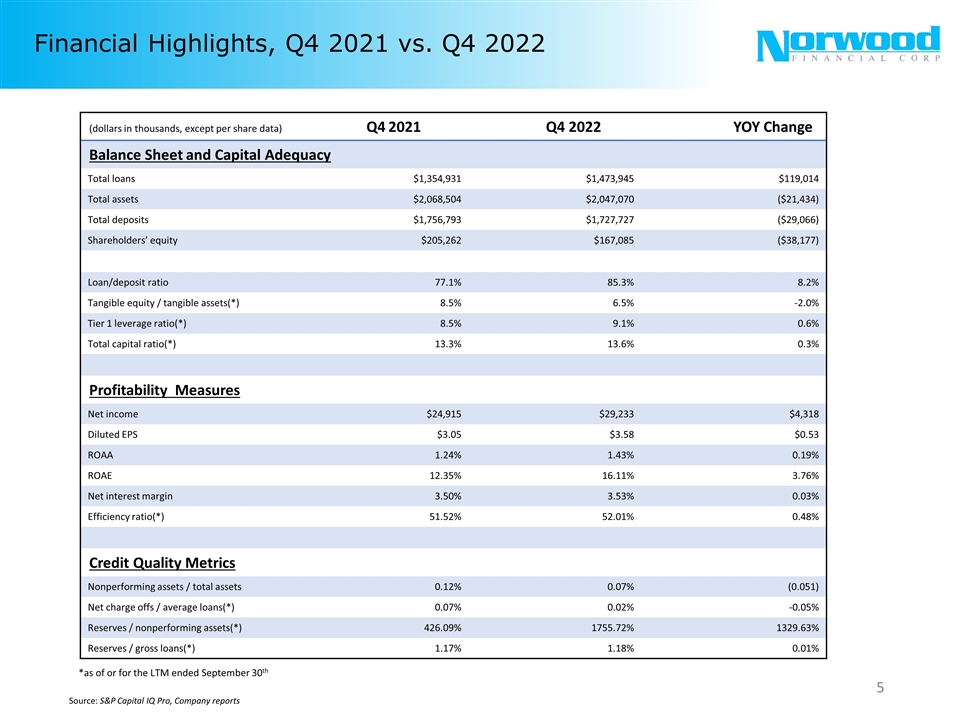

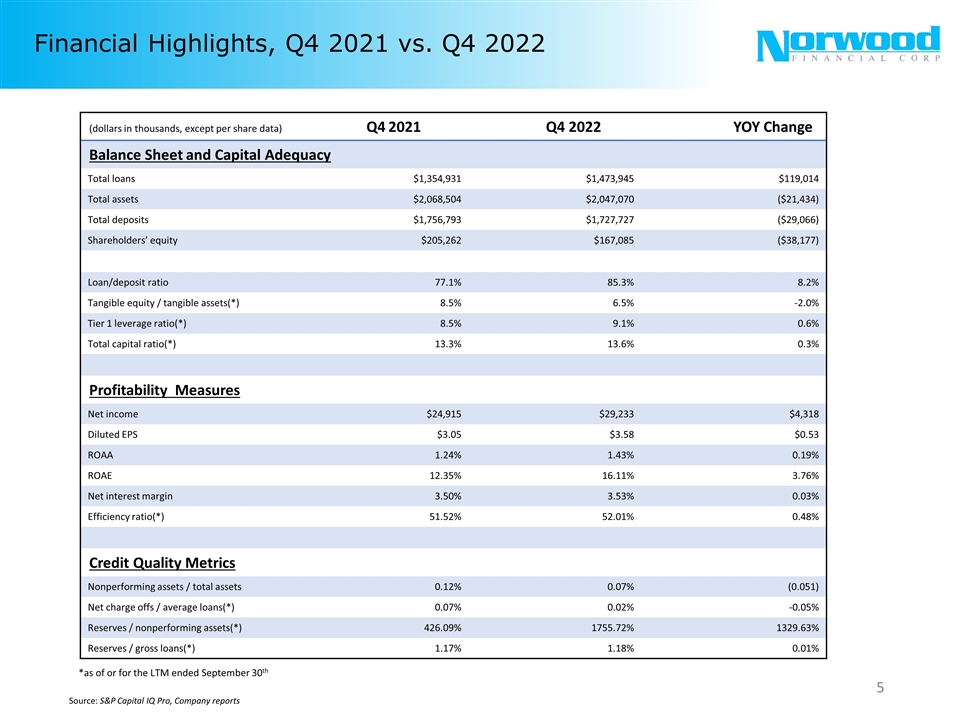

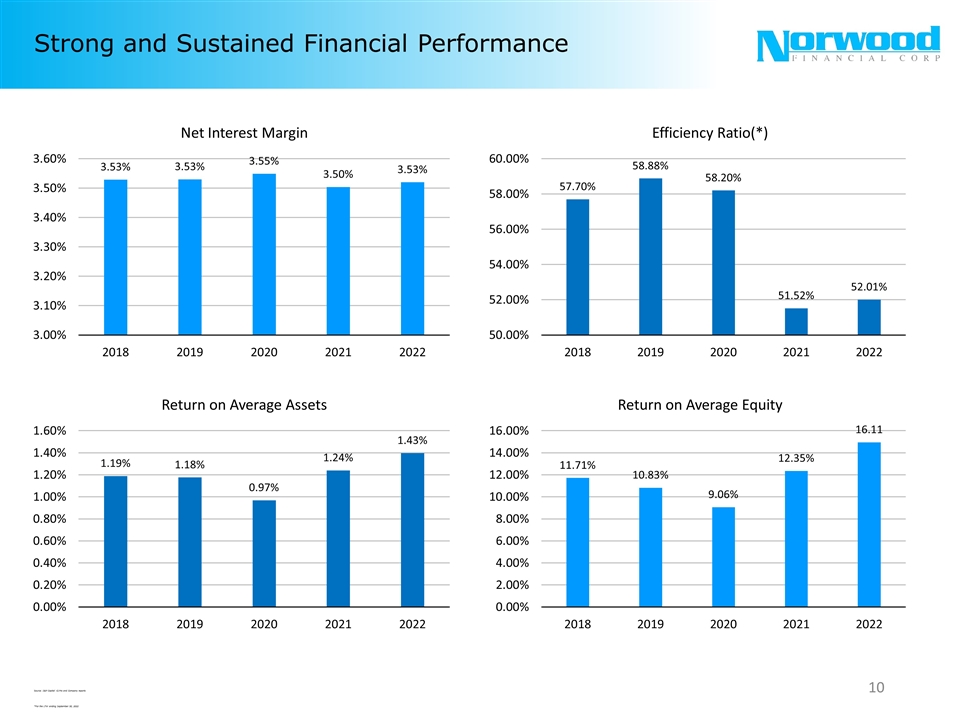

Financial Highlights, Q4 2021 vs. Q4 2022 Source: S&P Capital IQ Pro, Company reports (dollars in thousands, except per share data) Q4 2021 Q4 2022 YOY Change Balance Sheet and Capital Adequacy Total loans $1,354,931 $1,473,945 $119,014 Total assets $2,068,504 $2,047,070 ($21,434) Total deposits $1,756,793 $1,727,727 ($29,066) Shareholders’ equity $205,262 $167,085 ($38,177) Loan/deposit ratio 77.1% 85.3% 8.2% Tangible equity / tangible assets(*) 8.5% 6.5% -2.0% Tier 1 leverage ratio(*) 8.5% 9.1% 0.6% Total capital ratio(*) 13.3% 13.6% 0.3% Profitability Measures Net income $24,915 $29,233 $4,318 Diluted EPS $3.05 $3.58 $0.53 ROAA 1.24% 1.43% 0.19% ROAE 12.35% 16.11% 3.76% Net interest margin 3.50% 3.53% 0.03% Efficiency ratio(*) 51.52% 52.01% 0.48% Credit Quality Metrics Nonperforming assets / total assets 0.12% 0.07% (0.051) Net charge offs / average loans(*) 0.07% 0.02% -0.05% Reserves / nonperforming assets(*) 426.09% 1755.72% 1329.63% Reserves / gross loans(*) 1.17% 1.18% 0.01% *as of or for the LTM ended September 30th

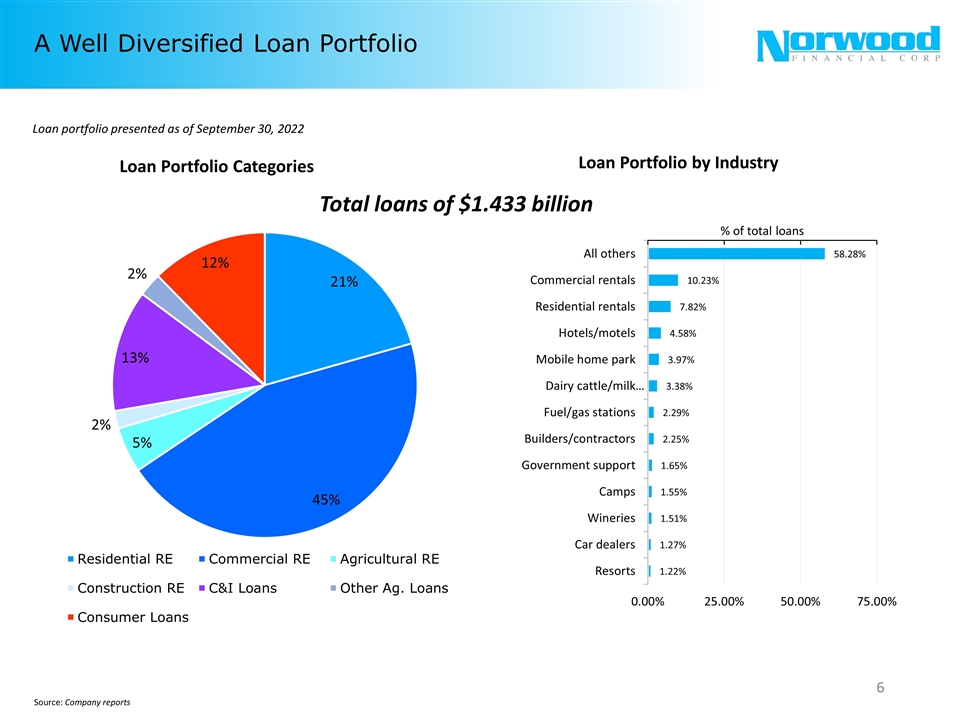

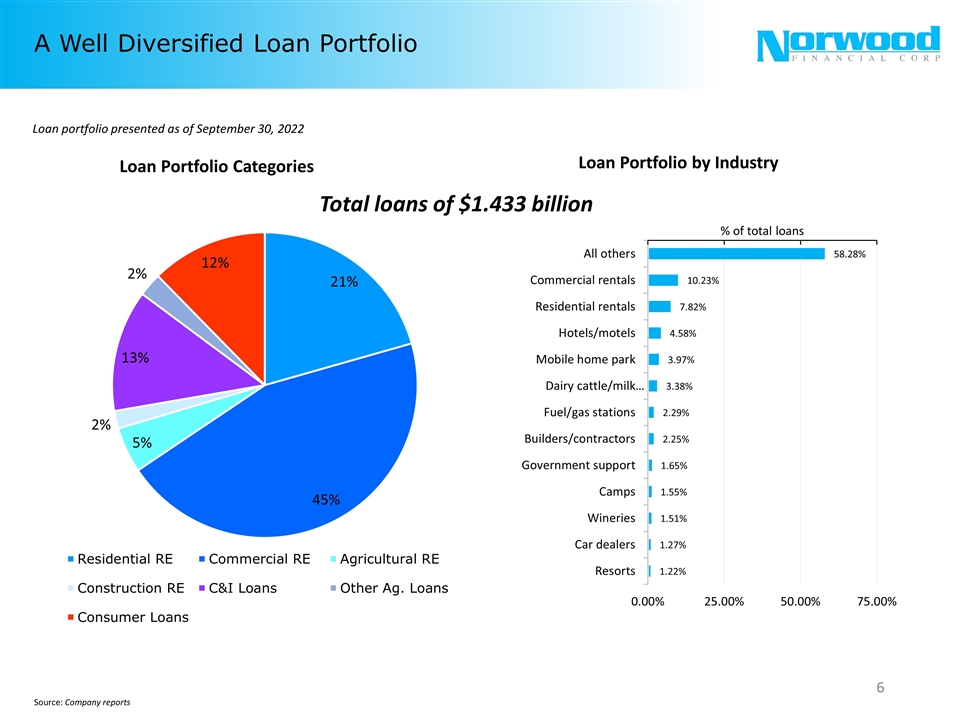

A Well Diversified Loan Portfolio Source: Company reports Loan portfolio presented as of September 30, 2022 Total loans of $1.433 billion

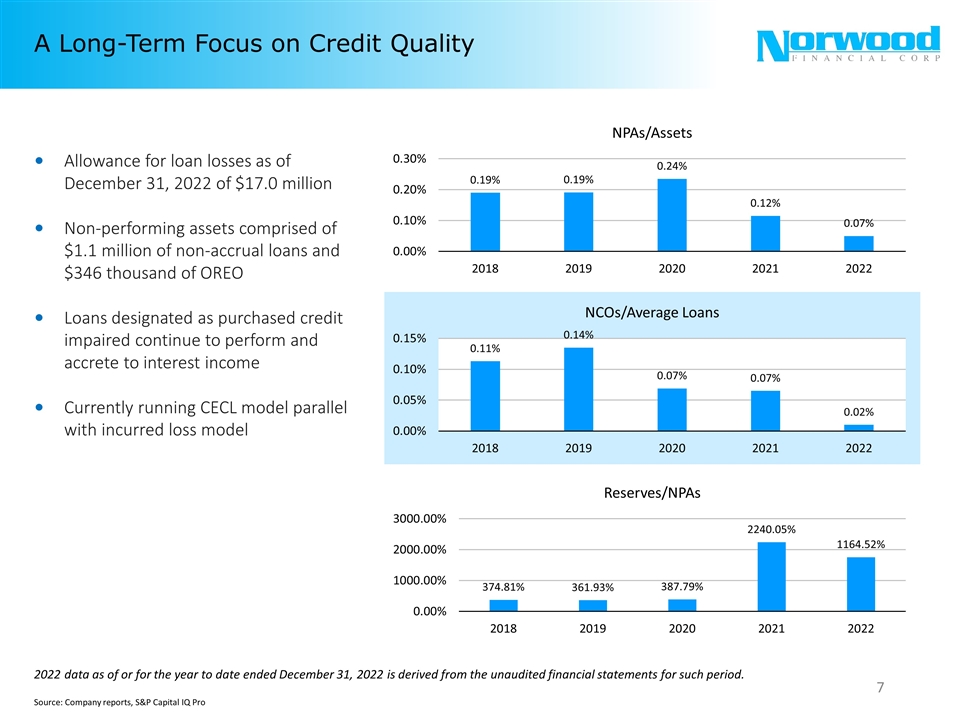

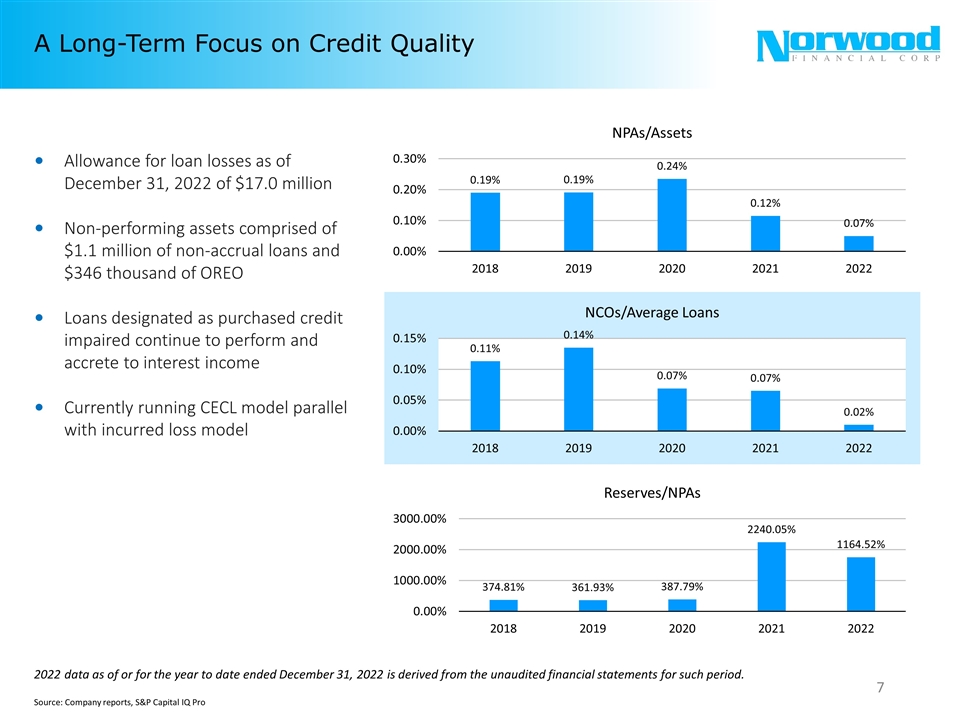

A Long-Term Focus on Credit Quality Source: Company reports, S&P Capital IQ Pro Allowance for loan losses as of December 31, 2022 of $17.0 million Non-performing assets comprised of $1.1 million of non-accrual loans and $346 thousand of OREO Loans designated as purchased credit impaired continue to perform and accrete to interest income Currently running CECL model parallel with incurred loss model 2022 data as of or for the year to date ended December 31, 2022 is derived from the unaudited financial statements for such period.

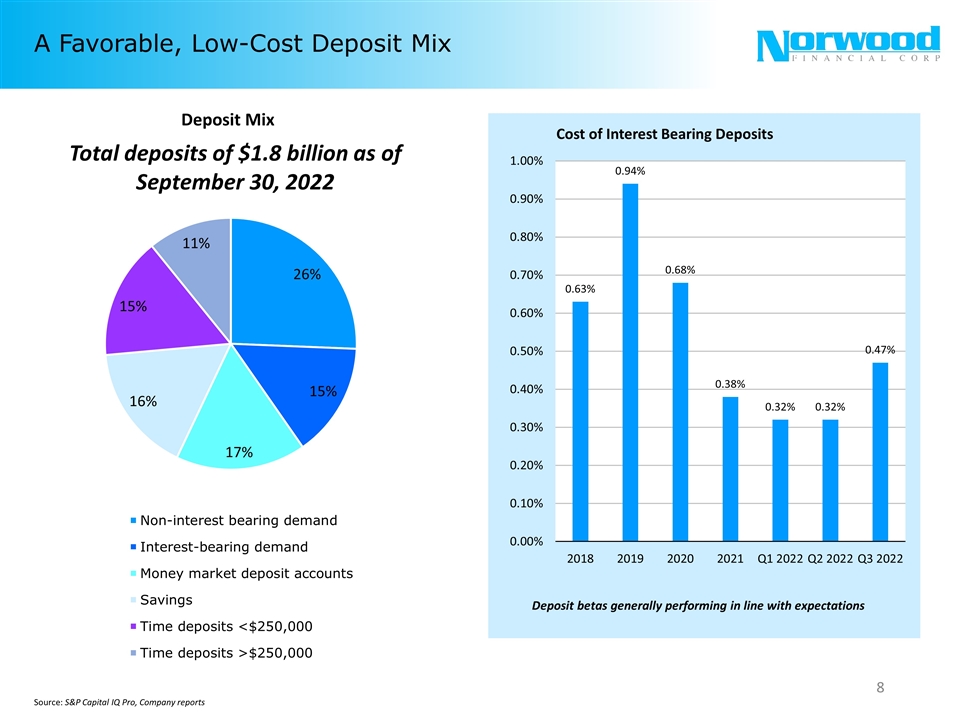

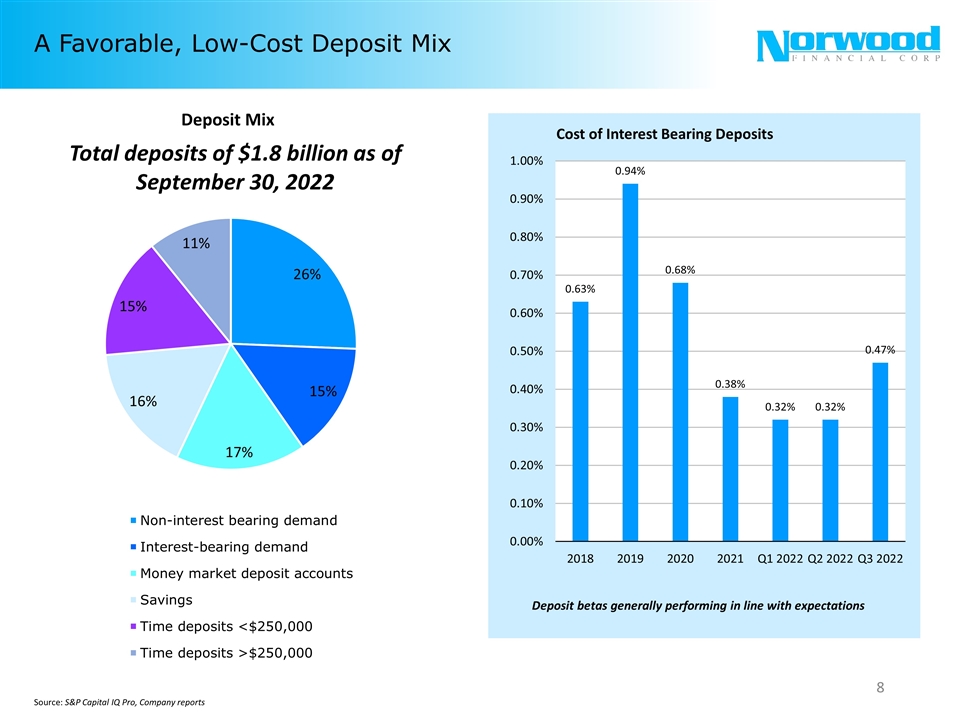

A Favorable, Low-Cost Deposit Mix Source: S&P Capital IQ Pro, Company reports Total deposits of $1.8 billion as of September 30, 2022 Deposit betas generally performing in line with expectations

Prudent Management of Liquidity Source: S&P Capital IQ Pro, Company reports $505 million in available for sale (AFS) securities No evidence of credit quality issues No securities designated as held to maturity Diligent management of the loan pipeline $250 million in unfunded commitments under lines of credit and commitments to grant loans $642 million in available borrowing capacity with the FHLB $40 million in credit facilities with three financial institutions

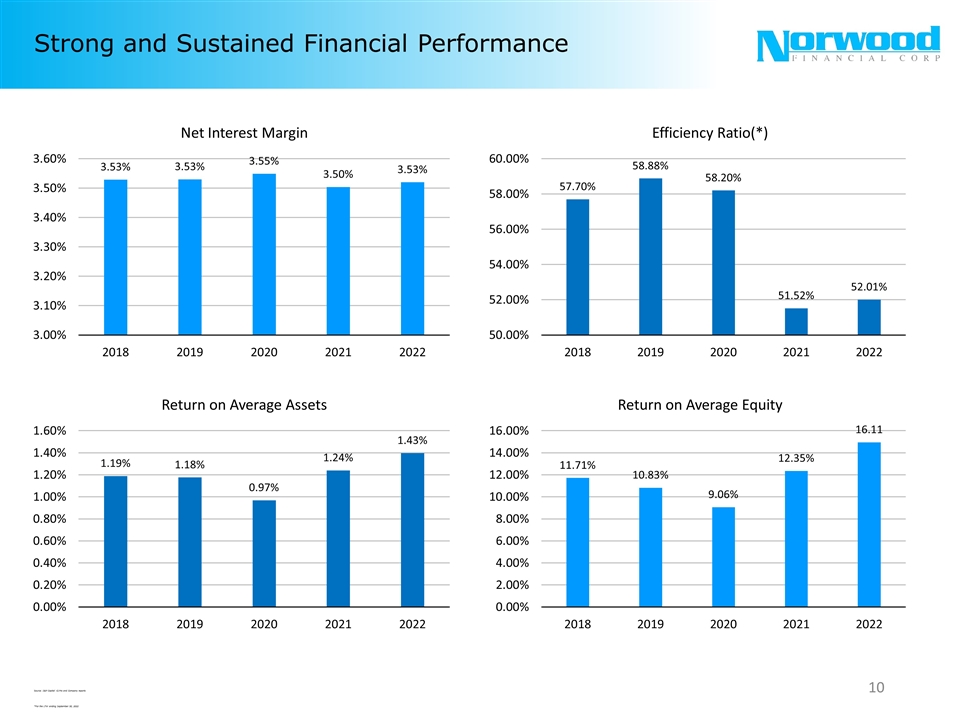

Strong and Sustained Financial Performance Source: S&P Capital IQ Pro and Company reports *For the LTM ending September 30, 2022

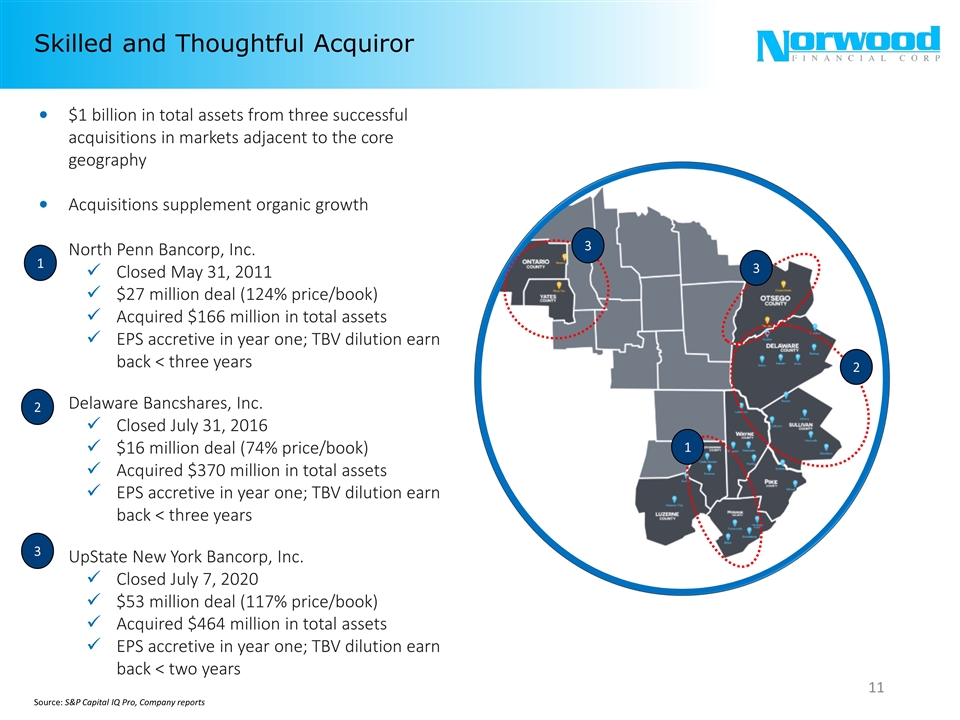

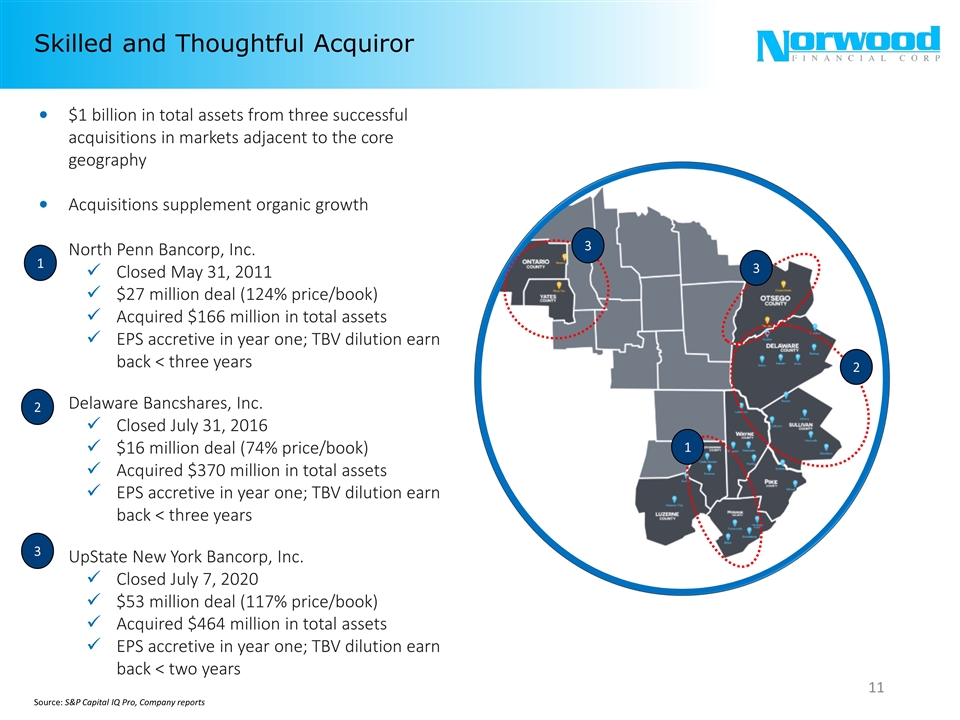

Skilled and Thoughtful Acquiror Source: S&P Capital IQ Pro, Company reports $1 billion in total assets from three successful acquisitions in markets adjacent to the core geography Acquisitions supplement organic growth North Penn Bancorp, Inc. Closed May 31, 2011 $27 million deal (124% price/book) Acquired $166 million in total assets EPS accretive in year one; TBV dilution earn back < three years Delaware Bancshares, Inc. Closed July 31, 2016 $16 million deal (74% price/book) Acquired $370 million in total assets EPS accretive in year one; TBV dilution earn back < three years UpState New York Bancorp, Inc. Closed July 7, 2020 $53 million deal (117% price/book) Acquired $464 million in total assets EPS accretive in year one; TBV dilution earn back < two years 1 2 3 1 2 3 3

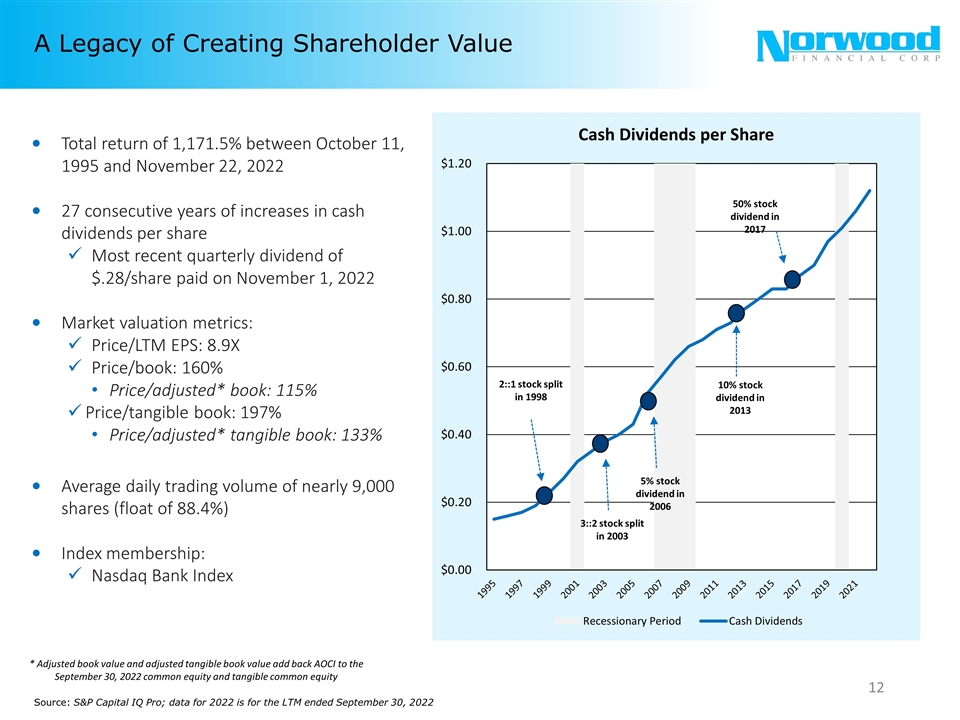

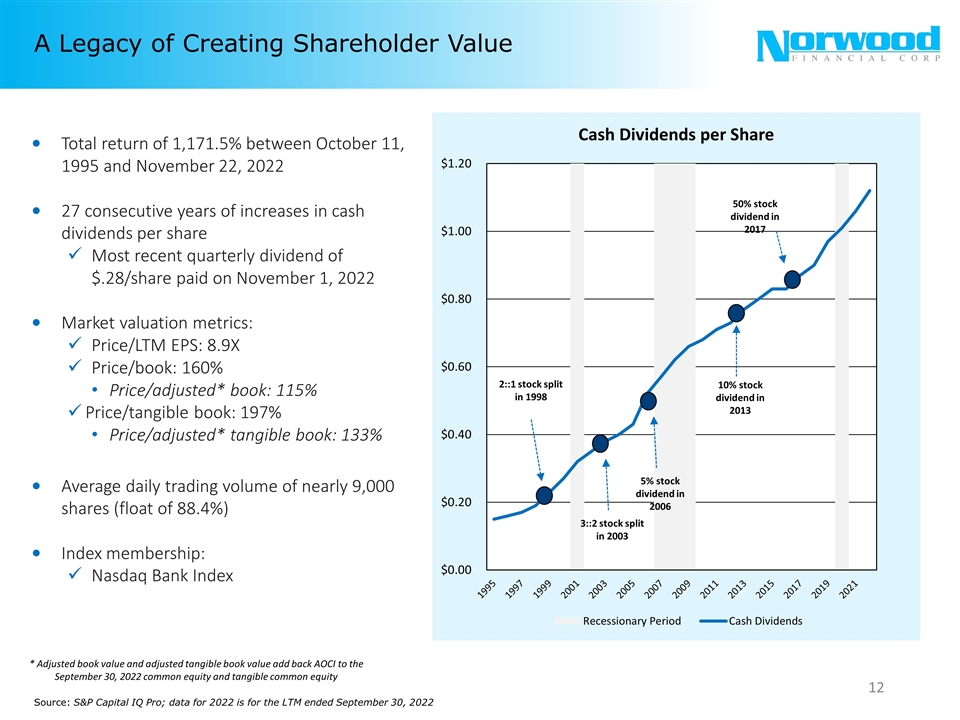

A Legacy of Creating Shareholder Value Source: S&P Capital IQ Pro; data for 2022 is for the LTM ended September 30, 2022 10% stock dividend in 2013 50% stock dividend in 2017 Total return of 1,171.5% between October 11, 1995 and November 22, 2022 27 consecutive years of increases in cash dividends per share Most recent quarterly dividend of $.28/share paid on November 1, 2022 Market valuation metrics: Price/LTM EPS: 8.9X Price/book: 160% Price/adjusted* book: 115% Price/tangible book: 197% Price/adjusted* tangible book: 133% Average daily trading volume of nearly 9,000 shares (float of 88.4%) Index membership: Nasdaq Bank Index * Adjusted book value and adjusted tangible book value add back AOCI to the September 30, 2022 common equity and tangible common equity 5% stock dividend in 2006 3::2 stock split in 2003 2::1 stock split in 1998

Our Strategies Connect Our Past to Our Future Source: Norwood Financial Corp Our Past Our Now Our Future Focused on a limited number of local communities Personalized services provided in person Getting to “yes” for our business clients Generating solid financial performance and operating metrics Effectively managing growth and succession Creating shareholder value Improve customer facing technology to bank the next generation of clients Prepare a brand message that is geographically agnostic Recruit, retain and empower our people Utilize risk management tools to manage thru economic uncertainty Deliver both capital appreciation and cash dividends to shareholders Frictionless processes to create personalized client experiences Services delivered by a highly engaged and diverse employee base Increased scale over a wider geography to grow to a $5 billion bank Unwavering commitment to delivering top quartile performance and increasing shareholder value

Investment Thesis and Concluding Thoughts Source: Bank Director.com; Company reports Top quartile financial performance relative to peers (and ranked by Bank Director as one of the Top 100 performing banks in the U.S.) Earnings accretive acquisitions to add additional scale and human capital to the core franchise Dedicated and diverse Board and management team with deep ties to the communities we understand, serve and support Strong risk management practices to mitigate exposures during economic downturns A legacy of delivering both capital appreciation and cash dividends to our shareholders

Our Contact Information For more information regarding the Company: Norwood Financial Corp Investor Relations 717 Main Street Honesdale, Pennsylvania 18431 www.wayne.bank info@waynebank.com James O. Donnelly (“Jim”) President & Chief Executive Officer jim.donnelly@waynebank.com Direct line: (570) 253-8512 William S. Lance (“Bill”) Executive Vice President & Chief Financial Officer william.lance@waynebank.com Direct line: (570) 253-8505 Note: on the website, make sure you add Jim to the Board (not currently shown) Also need to make all of your SEC filings into multiple file formats (including .pdf)