- NWFL Dashboard

- Financials

- Filings

- Holdings

-

Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

8-K Filing

Norwood Financial (NWFL) 8-KRegulation FD Disclosure

Filed: 13 Nov 23, 8:30am

Norwood Financial Corp Investor Presentation September 30, 2023 Exhibit 99.1

The information disclosed in this document includes various forward-looking statements that are made by Norwood Financial Corp (the “Company”) in reliance upon the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. The words “anticipates,” “projects,” “intends,” “estimates,” “expects,” “believes,” “plans,” “may,” “will,” “should,” “could,” and other similar expressions are intended to identify such forward-looking statements the Company cautions that these forward-looking statements are necessarily speculative and speak only as of the date made, and are subject to numerous assumptions, risks and uncertainties, all of which may change overtime. Actual results could differ materially from such forward-looking statements. Accordingly, you should not place undue reliance on forward-looking statements. The following factors, among others, could cause actual results to differ materially and adversely from such forward-looking statements: changes in the financial services industry and the U.S. and global capital markets, changes in economic conditions nationally, regionally and in the company’s markets, the nature and timing of actions of the Federal Reserve Board and other regulators, the nature and timing of legislation and regulation affecting the financial services industry, government intervention in the U.S. financial system, changes in federal and state tax laws, changes in levels of market interest rates, pricing pressures on loan and deposit products, credit risks of the Company’s lending activities, successful implementation, deployment and upgrades of new and existing technology, systems, services and products, customers’ acceptance of the Company’s products and services, and competition. Further, given its ongoing and dynamic nature, it is difficult to predict the continuing effects that the COVID-19 pandemic will have on our business and results of operations. The pandemic and related local and national economic disruption may, among other effects, result in a material adverse change for the demand for our products and services; increased levels of loan delinquencies, problem assets and foreclosures; branch disruptions, unavailability of personnel and increased cybersecurity risks as employees work remotely. Any statements made by the Company that are not historical facts should be considered to be forward-looking statements. The Company cautions that the foregoing list of important factors is not exhaustive. The Company is not obligated to update and does not undertake to update any of its forward looking statements, whether written or oral, that may be made from time to time by or on behalf of the Company or made herein. Forward Looking Statements & Disclaimers

Financial Highlights, September 30, 2023 Total Assets of $2.2 billion Increase of $161 million over last twelve months Increase of $133 million in 2023 Total Loans of $1.6 billion Increase of $179 million over last twelve months Increase of $137 million in 2023 Total Deposits of $1.7 billion Decrease of $22 million over last twelve months Increase of $19 million in 2023 Balance Sheet

Financial Highlights, September 30, 2023 Commercial Loans Increase of $59 million over last twelve months Increase of $50 million in 2023 Consumer Loans Increase of $99 million over last twelve months Increase of $70 million in 2023 Residential Mortgages Increase of $21 million over last twelve months Increase of $17 million in 2023 Loan Portfolio

Financial Highlights, September 30, 2023 Demand Deposits Decrease of $23 million over last twelve months Decrease of $4 million in 2023 NOW, Money Market, Savings Decrease of $156 million over last twelve months Decrease of $98 million in 2023 CD’s Increase of $158 million over last twelve months Increase of $121 million in 2023 Deposits

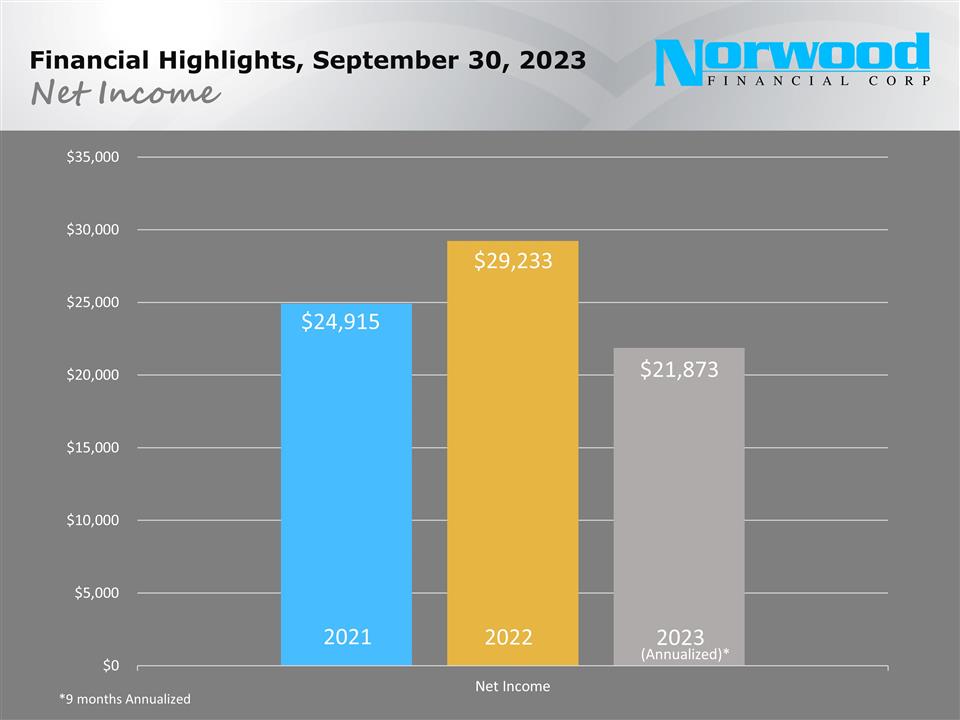

Financial Highlights, September 30, 2023 $24,915 $29,233 $21,873 Net Income *9 months Annualized

Financial Highlights, September 30, 2023 WAYNE BANK NATIONAL PEER Return on Assets 1.03% 1.11% Return on Equity 13.30% 12.88% Dividend Payout Ratio 41.85% 28.93% Net Interest Margin 3.09% 3.40% Loans to Deposits 91.27% 82.03% Efficiency Ratio 60.62% 62.14% Overhead Expense Ratio 1.97% 2.40% Average Yield on Total Loans 5.34% 5.68% Average Rate Paid on Deposits 1.74% 1.95% Non-Current Loans/Total Loans 0.65% 0.38% Peer Comparison

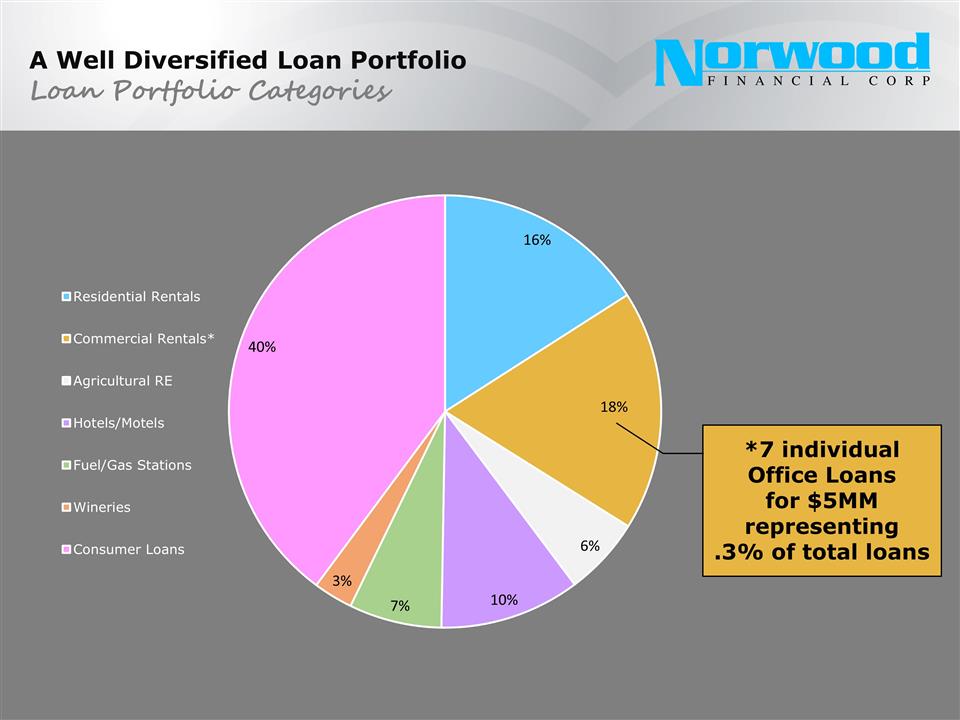

A Well Diversified Loan Portfolio Loan Portfolio Categories *7 individual Office Loans for $5MM representing .3% of total loans

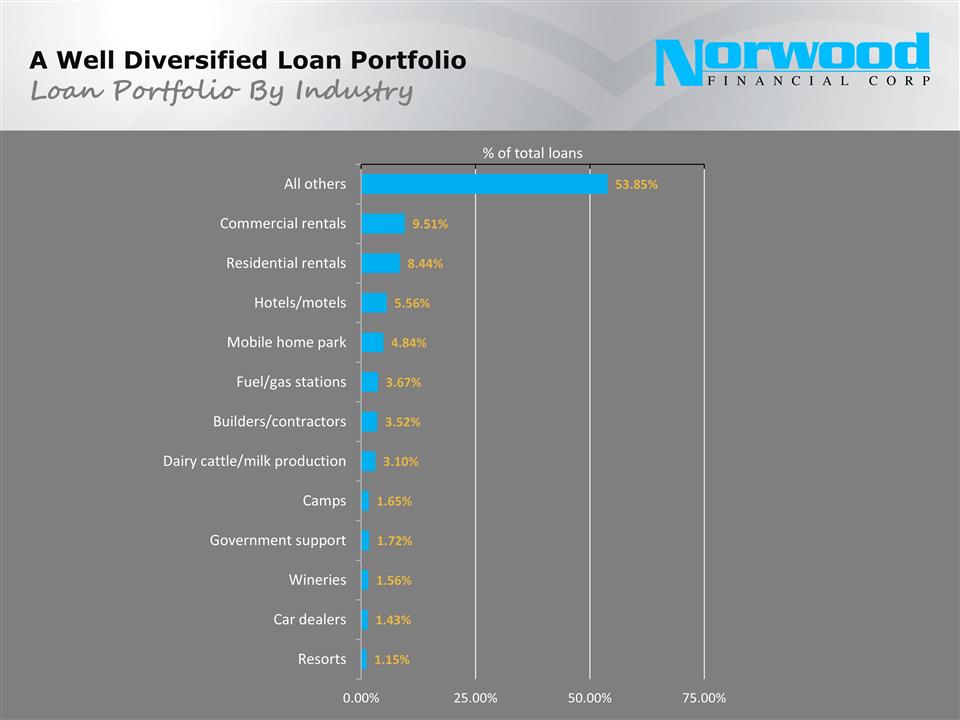

A Well Diversified Loan Portfolio Loan Portfolio By Industry

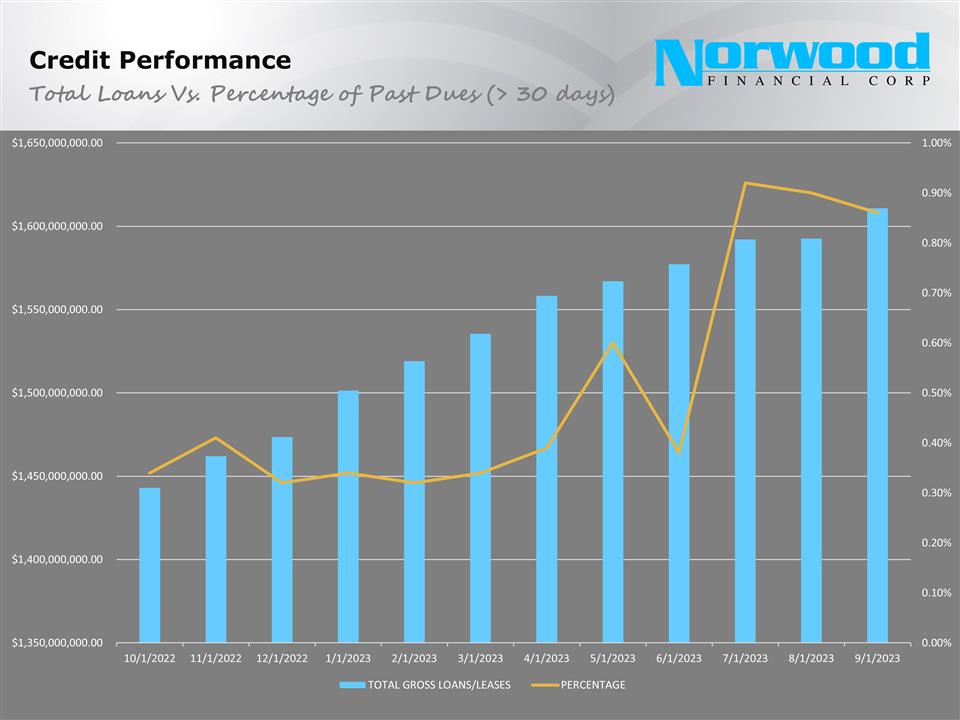

Credit Performance Total Loans Vs. Percentage of Past Dues (> 30 days)

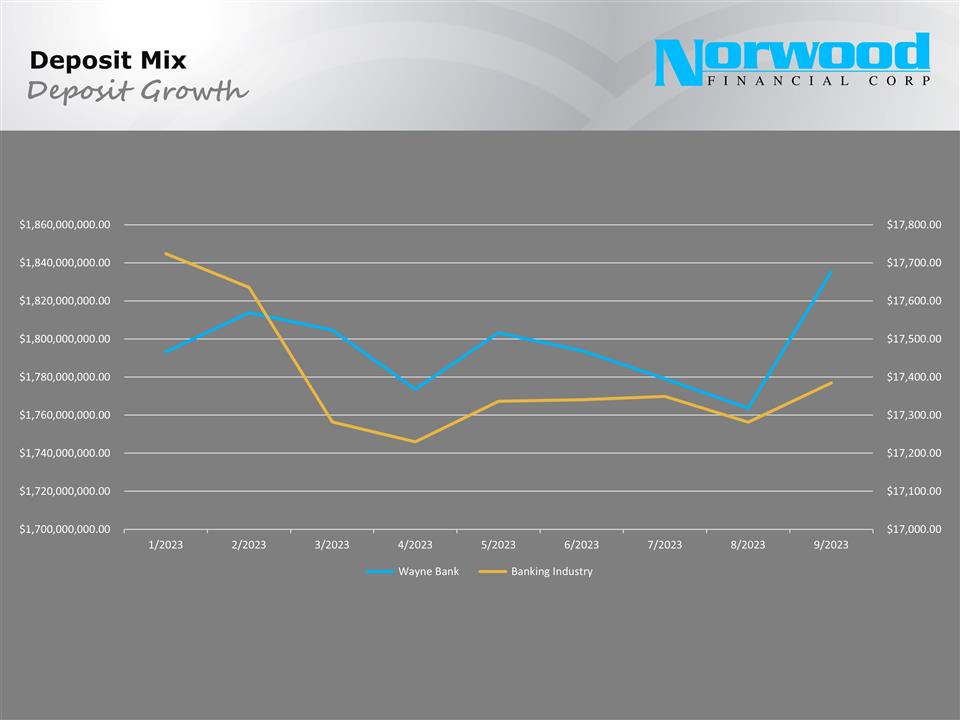

Deposit Mix Deposit Growth

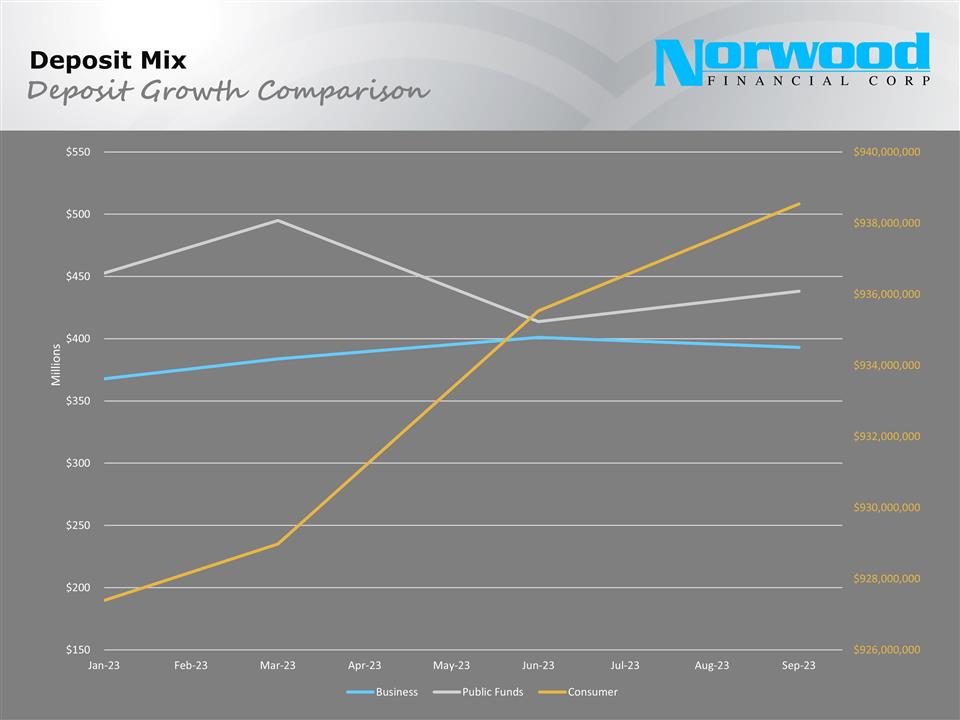

Deposit Mix Deposit Growth Comparison

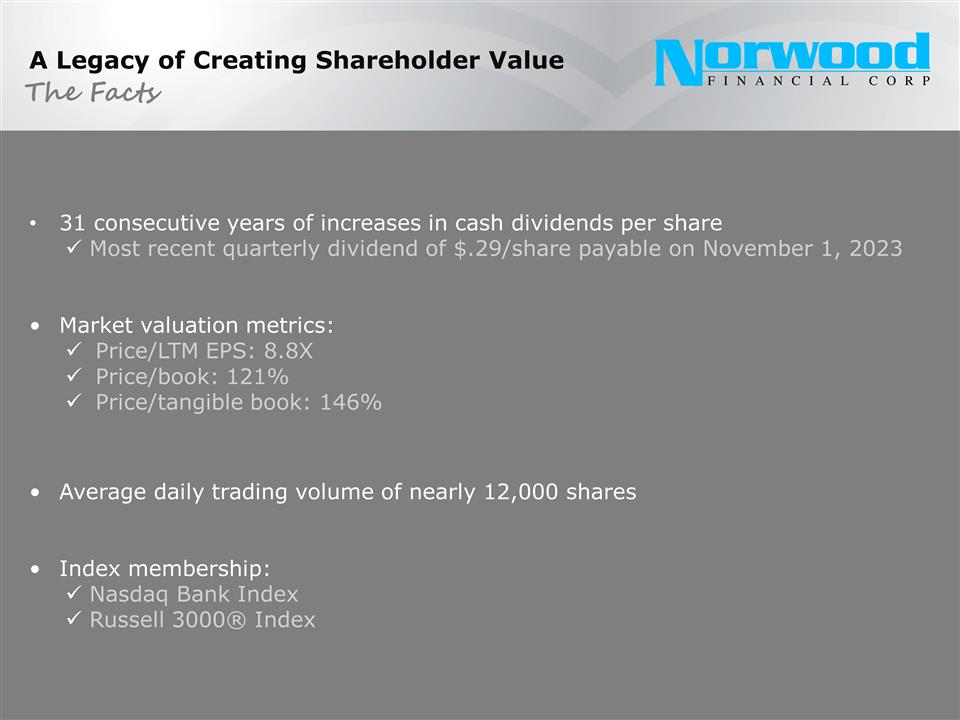

A Legacy of Creating Shareholder Value 31 consecutive years of increases in cash dividends per share Most recent quarterly dividend of $.29/share payable on November 1, 2023 Market valuation metrics: Price/LTM EPS: 8.8X Price/book: 121% Price/tangible book: 146% Average daily trading volume of nearly 12,000 shares Index membership: Nasdaq Bank Index Russell 3000® Index The Facts

A Legacy of Creating Shareholder Value NWFL entered the Russell 3000® Index on 6/23/2023. On 6/23/2023, NWFL had the highest level of stock trades in a single day in its history. The Russell 3000® Index encompasses and tracks the performance of the 3,000 largest traded U.S. stocks, based on market capitalization. In the Russell 3000® Index

A Legacy of Creating Shareholder Value Ranked #20 in the Top 25 Banks in the U.S. by Bank Director Magazine. Also ranked #10 out of 122 banks in the $2 billion to $5 billion asset size category, which is up from #71 rank in 2022 Evaluated on profitability, capital adequacy, asset quality, and total shareholder return. A Top 25 Best U.S. Bank

A Legacy of Creating Shareholder Value Ranked #84 out of 200 banks in the $2 billion to $10 billion asset size category by American Banker. Evaluated on profitability, efficiency, capital adequacy, and asset quality based on a 3-year average return. A Top 100 Performing U.S. Bank