Exhibit 99.1

2023 Results First Quarter 2024 Looking Forward DISCUSSION

The foregoing material may contain forward-looking statements. We caution that such statements may be subject to a number of uncertainties and actual results could differ materially, and therefore, you should not place undue reliance on any forward-looking statements. Norwood Financial Corp does not undertake and specifically disclaims any obligation to publically release the results of any revisions that may be made to any forward-looking statements to reflect the occurrence of anticipated or unanticipated events or circumstances after the date of such statements.

Loan yield increased 73 basis points to 5.46% Yield on total interest-earning assets increased 78 basis points to 4.68% Total interest-bearing liabilities increased 169 basis points to 2.21% Including 147 basis point increase in cost of deposits Cost of certificates of deposit increased 228 basis points to 3.25% $26 million increase in cost of funds

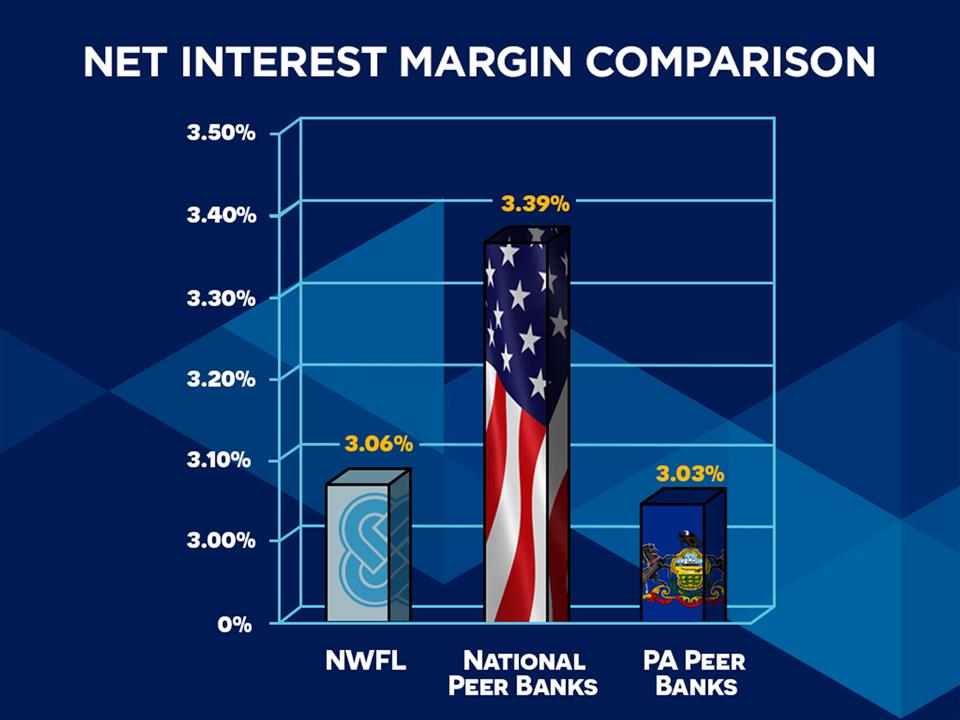

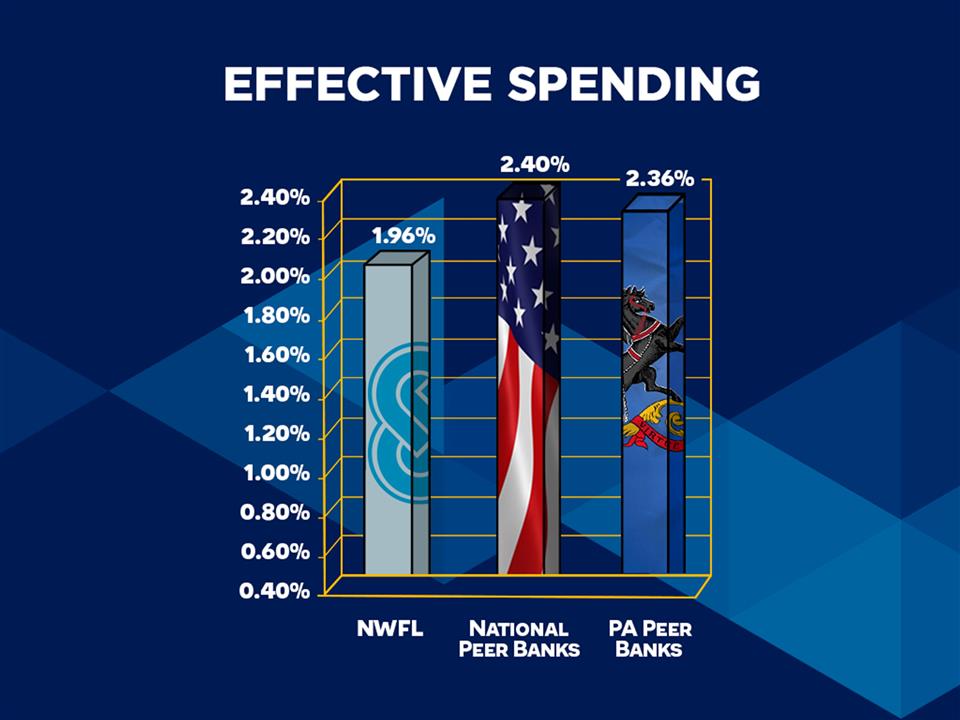

NWFL yield on loans increased 73 basis points National Peer Banks yield on loans increased 99 basis points NWFL yield cost of deposits increased 147 basis points National Peer Banks cost of deposits increased 158 basis points

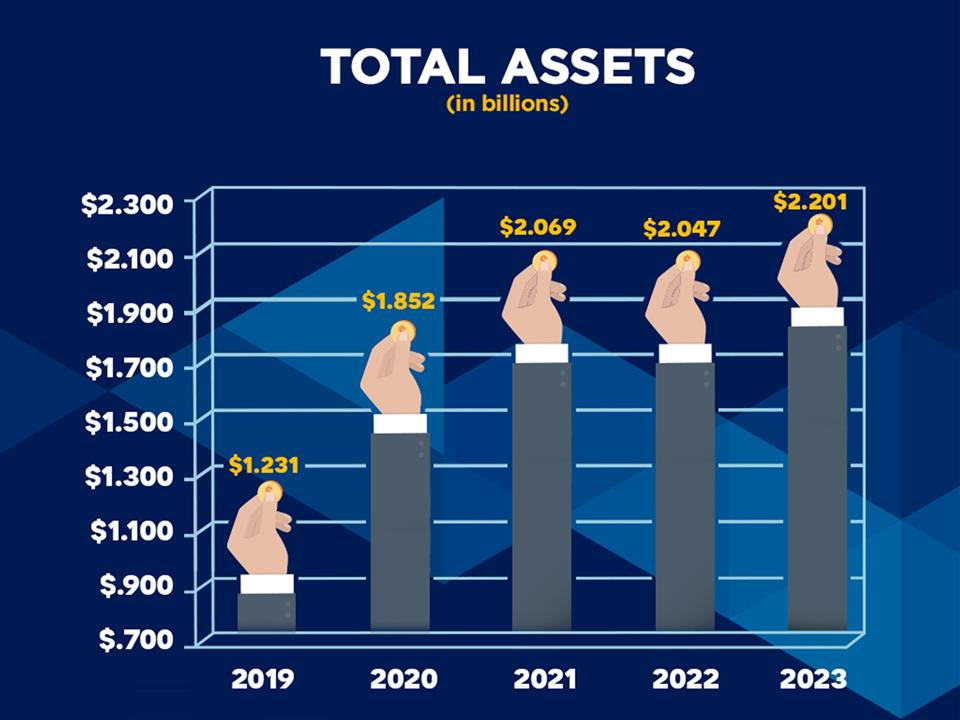

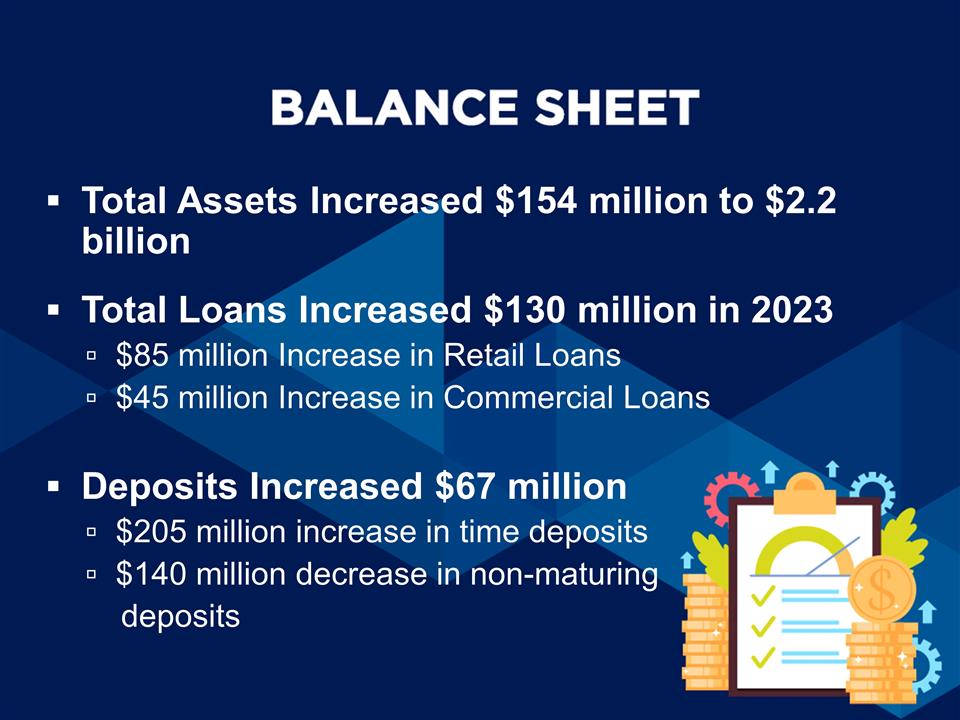

Total Assets Increased $154 million to $2.2 billion Total Loans Increased $130 million in 2023 $85 million Increase in Retail Loans $45 million Increase in Commercial Loans Deposits Increased $67 million $205 million increase in time deposits $140 million decrease in non-maturing deposits

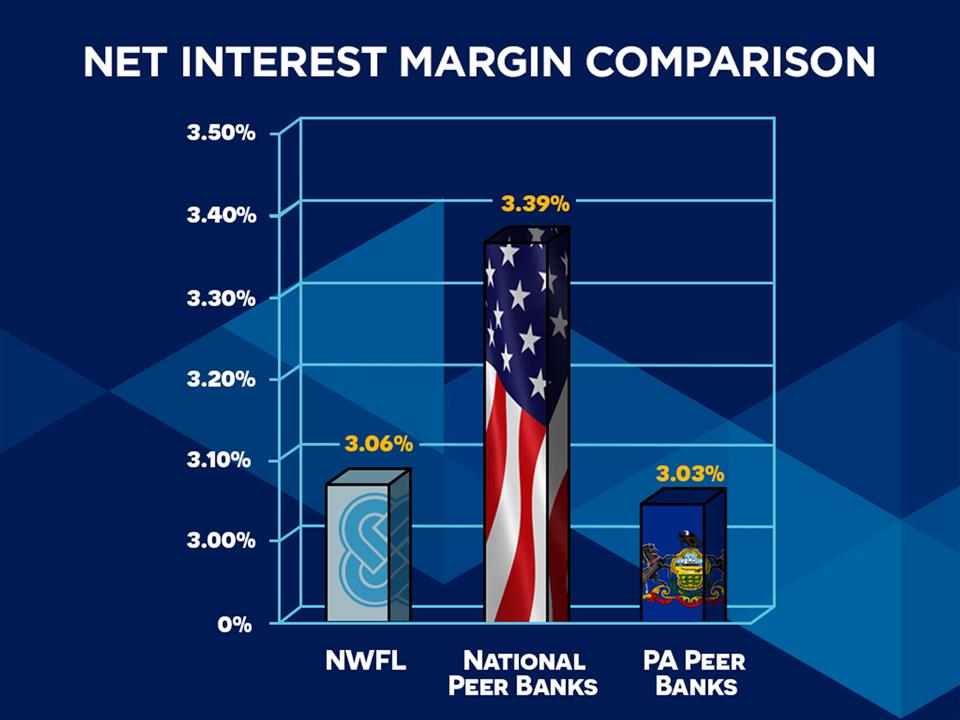

Yield on interest earning assets increased 78 basis points to 4.68% Cost of total interest bearing liabilities increased 169 basis points to 2.21%

In 2021, Program Announced to Buy Back up to 5% of Outstanding Shares In 2023, Over 108,000 Shares of Stock were Repurchased.

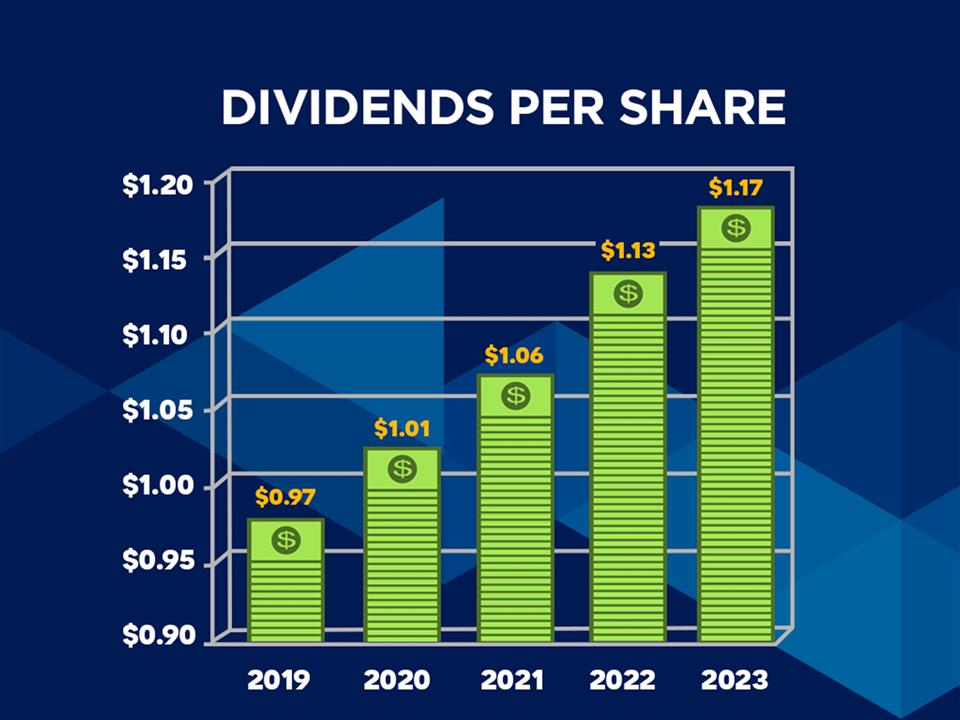

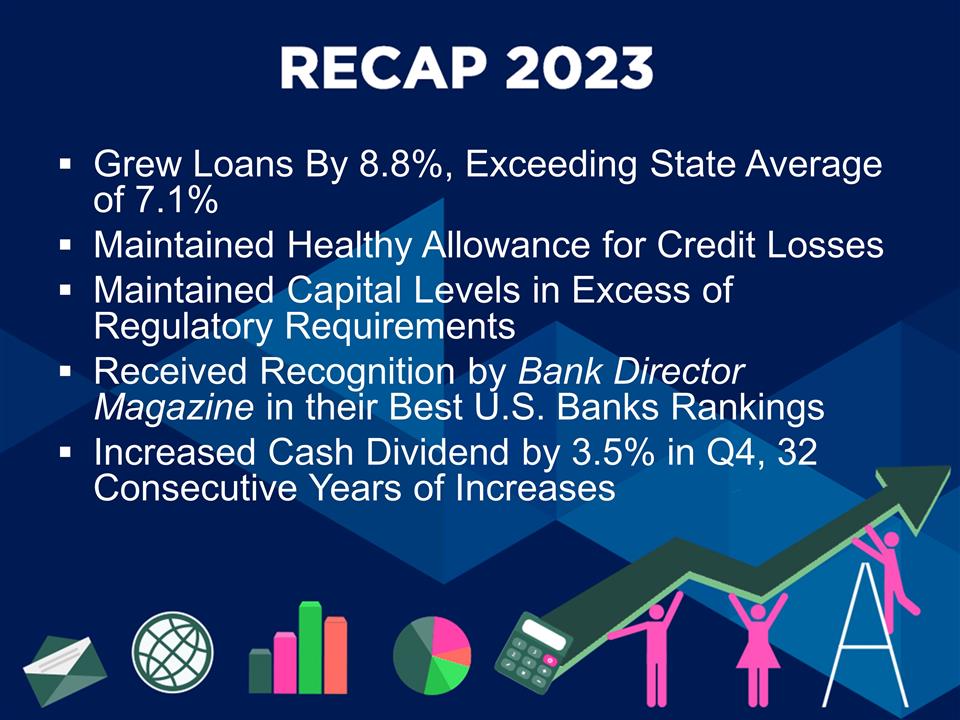

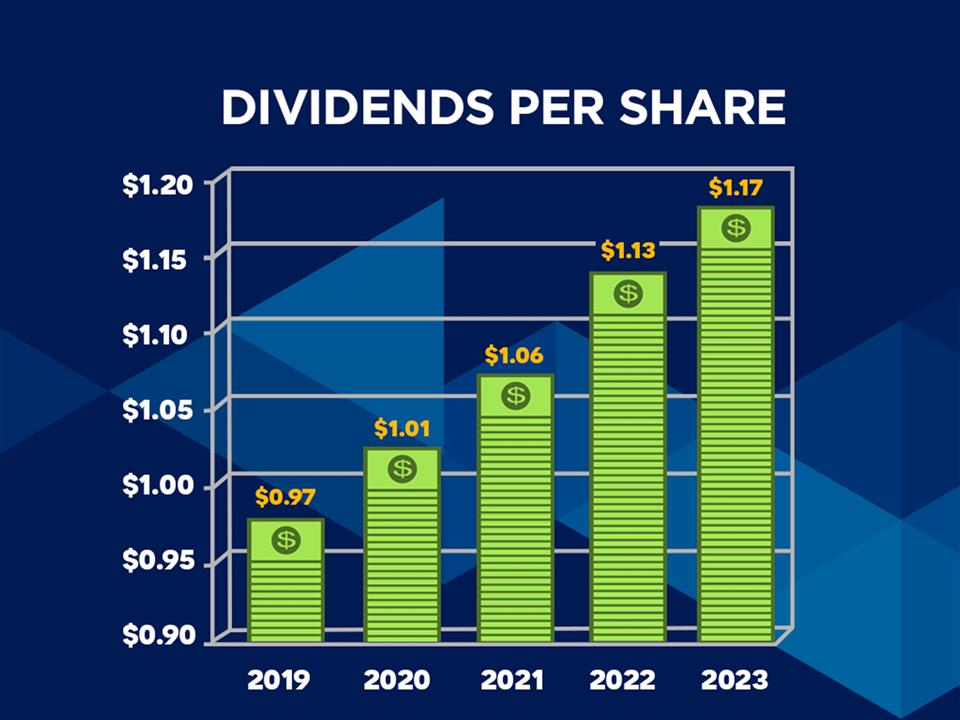

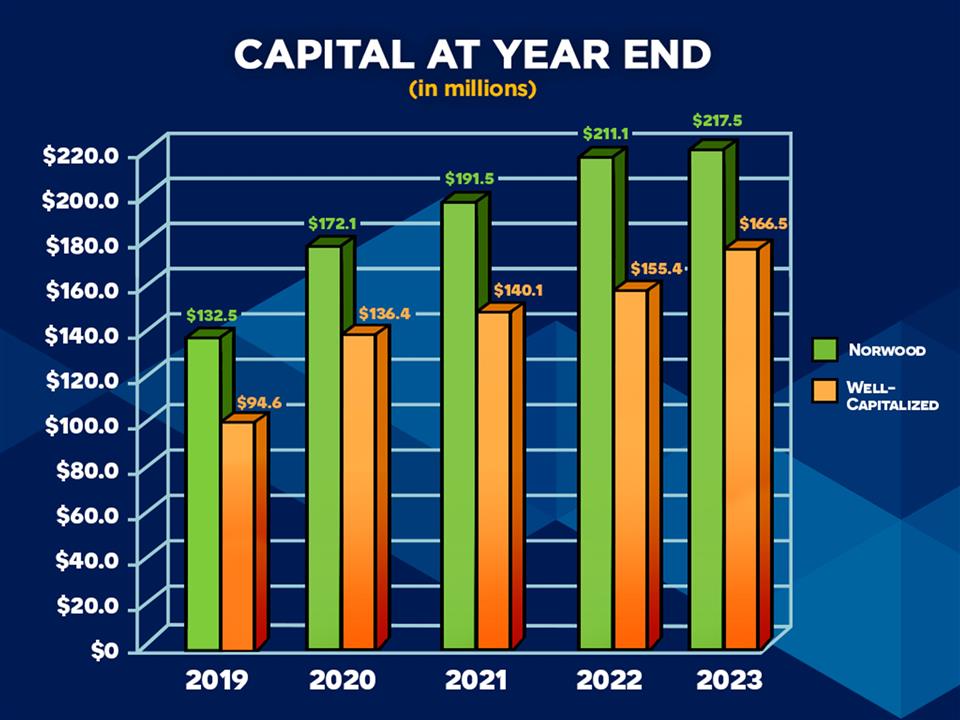

Grew Loans By 8.8%, Exceeding State Average of 7.1% Maintained Healthy Allowance for Credit Losses Maintained Capital Levels in Excess of Regulatory Requirements Received Recognition by Bank Director Magazine in their Best U.S. Banks Rankings Increased Cash Dividend by 3.5% in Q4, 32 Consecutive Years of Increases

Earnings of $4,433,000 EPS of $0.55 ROA = 0.80% ROAE = 9.79%

Total Assets of $2.3 billion Total Loans of $1.6 billion Total Deposits of $1.8 billion Stockholder’s Equity of $181.2 million

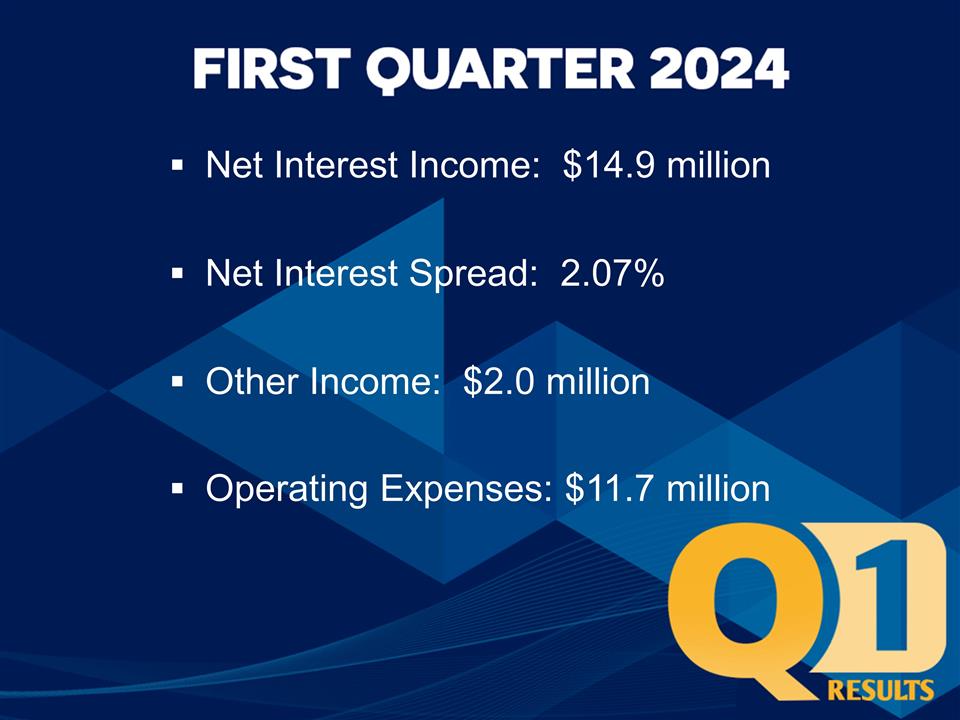

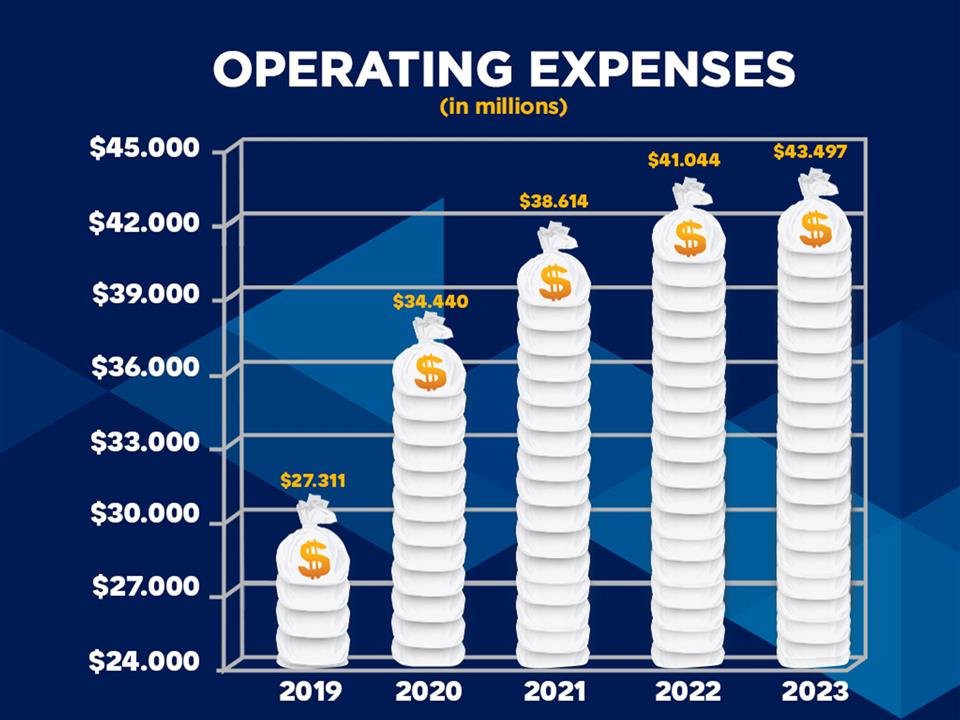

Net Interest Income: $14.9 million Net Interest Spread: 2.07% Other Income: $2.0 million Operating Expenses: $11.7 million

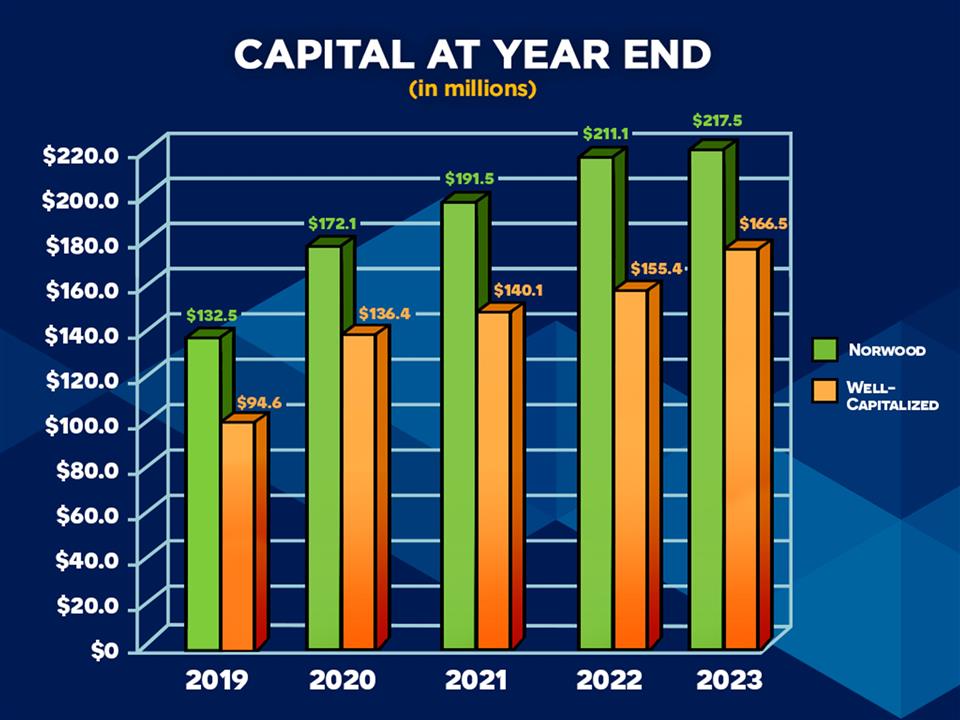

4.5% Annual Loan Increase 9.8% Annual Deposit Increase Well-Controlled Operating Expenses Well-Capitalized

COVID Spending Concluded 11 Fed Rate Hikes From March 2022 – July 2023 Pandemic, High-Inflation, Economic Uncertainty Wayne Bank Remains Strong & Resilient

Over $162 million Commercial Loans Over 1,000 Retail Loans for Over $69 million

Build Lasting Relationships with Customers Help Local Businesses Grow and Thrive Reinvest in Communities we Serve Expand into New Markets Reward Shareholders