- NWFL Dashboard

- Financials

- Filings

- Holdings

-

Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

8-K Filing

Norwood Financial (NWFL) 8-KRegulation FD Disclosure

Filed: 8 Aug 24, 9:22am

Norwood Financial Corp Investor Presentation June 30, 2024 Exhibit 99.1

The information disclosed in this document includes various forward-looking statements that are made by Norwood Financial Corp (the “Company”) in reliance upon the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. The words “anticipates,” “projects,” “intends,” “estimates,” “expects,” “believes,” “plans,” “may,” “will,” “should,” “could,” and other similar expressions are intended to identify such forward-looking statements the Company cautions that these forward-looking statements are necessarily speculative and speak only as of the date made, and are subject to numerous assumptions, risks and uncertainties, all of which may change overtime. Actual results could differ materially from such forward-looking statements. Accordingly, you should not place undue reliance on forward-looking statements. The following factors, among others, could cause actual results to differ materially and adversely from such forward-looking statements: changes in the financial services industry and the U.S. and global capital markets, changes in economic conditions nationally, regionally and in the company’s markets, the nature and timing of actions of the Federal Reserve Board and other regulators, the nature and timing of legislation and regulation affecting the financial services industry, government intervention in the U.S. financial system, changes in federal and state tax laws, changes in levels of market interest rates, pricing pressures on loan and deposit products, credit risks of the Company’s lending activities, successful implementation, deployment and upgrades of new and existing technology, systems, services and products, customers’ acceptance of the Company’s products and services, and competition. Any statements made by the Company that are not historical facts should be considered to be forward-looking statements. The Company cautions that the foregoing list of important factors is not exhaustive. The Company is not obligated to update and does not undertake to update any of its forward looking statements, whether written or oral, that may be made from time to time by or on behalf of the Company or made herein. Forward Looking Statements & Disclaimers

Financial Highlights, June 30, 2024 Total Assets of $2.3 billion Increase of $35 million, or 3.18% annualized, in 2024 Increase of $94 million, or 4.39%, over the last twelve months Total Loans of $1.6 billion Increase of $37 million, or 4.6% annualized, in 2024 Increase of $63 million, or 4.0%, over the last twelve months Total Deposits of $1.8 billion Increase of $17 million, or 1.9% annualized, in 2024 Increase of $81 million, or 4.7%, over the last twelve months Balance Sheet

Financial Highlights, June 30, 2024 Commercial Loans Increase of 27 million, or 15.8% annualized, in 2024 Consumer Loans Increase of $7 million, or 1.4% annualized, in 2024 Residential Mortgages Increase of $3 million, or 2.4% annualized, in 2024 Loan Portfolio

Financial Highlights, June 30, 2024 Non-Interest Bearing Demand Deposits Decrease of $21 million in 2024 Non-Maturity, Interest-Bearing Deposits Increase of $11 million, or 3.3% annualized, in 2024 Time Deposits Increase of $41 million, or 11.7% annualized, in 2024 Deposits

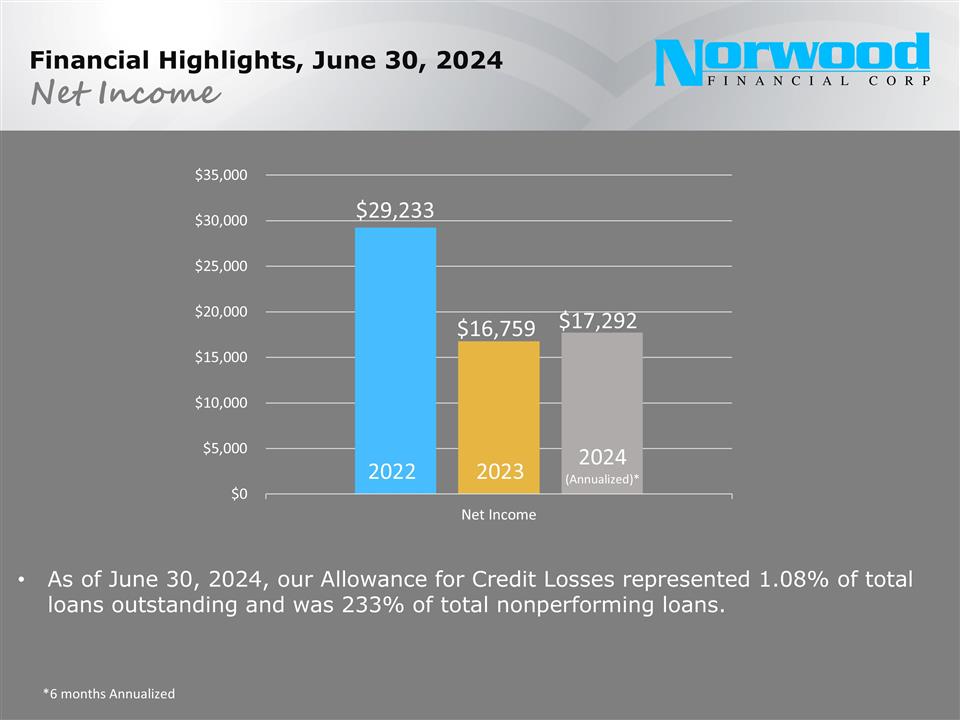

Financial Highlights, June 30, 2024 $29,233 $16,759 $17,292 Net Income As of June 30, 2024, our Allowance for Credit Losses represented 1.08% of total loans outstanding and was 233% of total nonperforming loans. *6 months Annualized

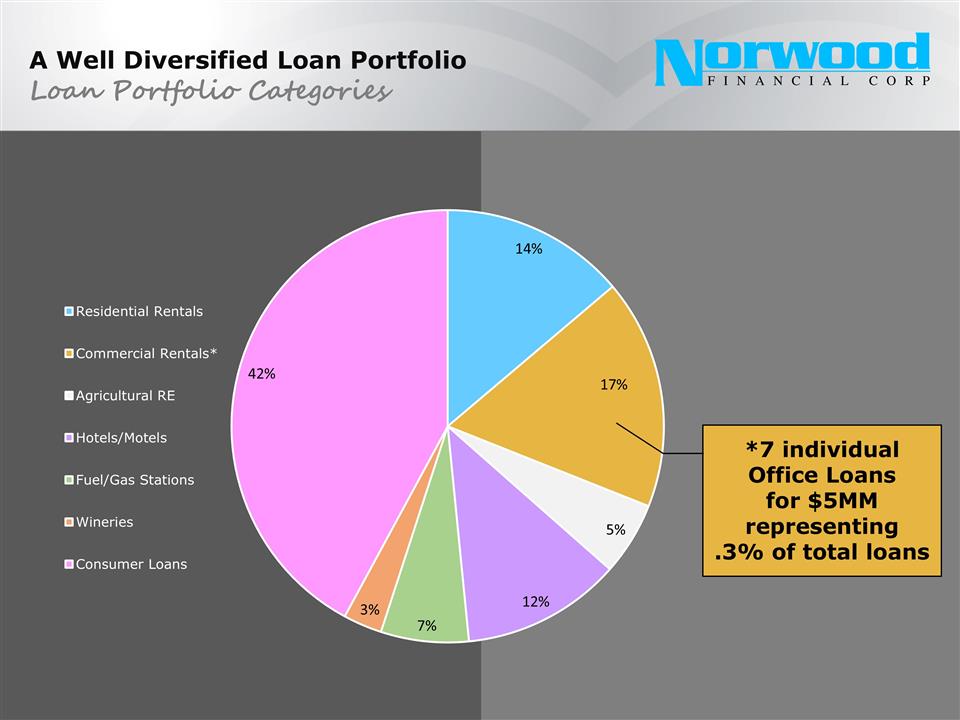

A Well Diversified Loan Portfolio Loan Portfolio Categories *7 individual Office Loans for $5MM representing .3% of total loans

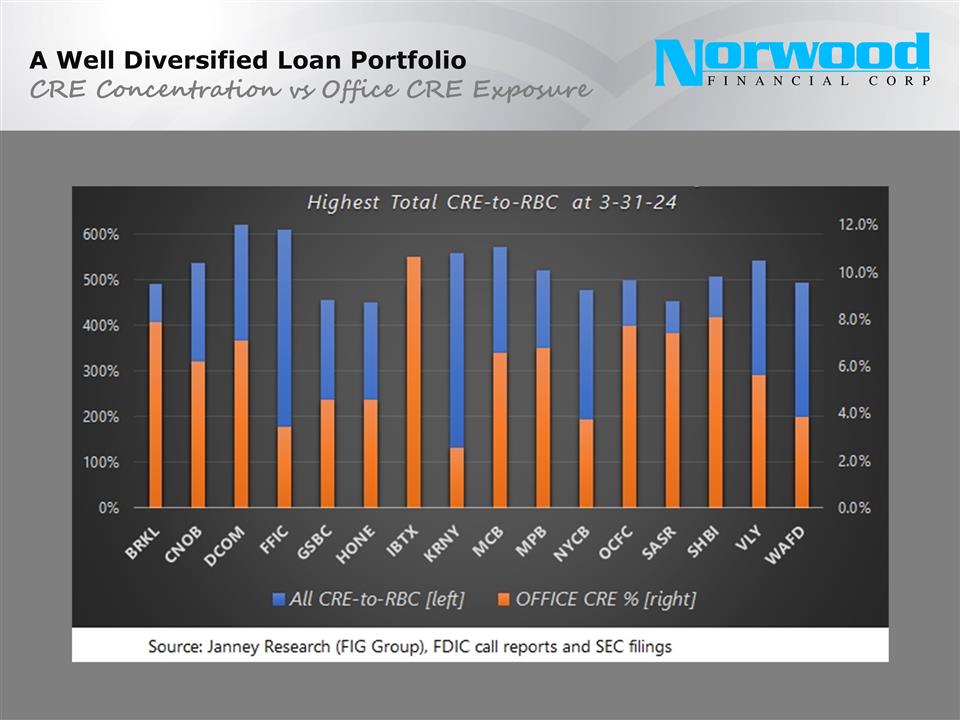

A Well Diversified Loan Portfolio CRE Concentration vs Office CRE Exposure

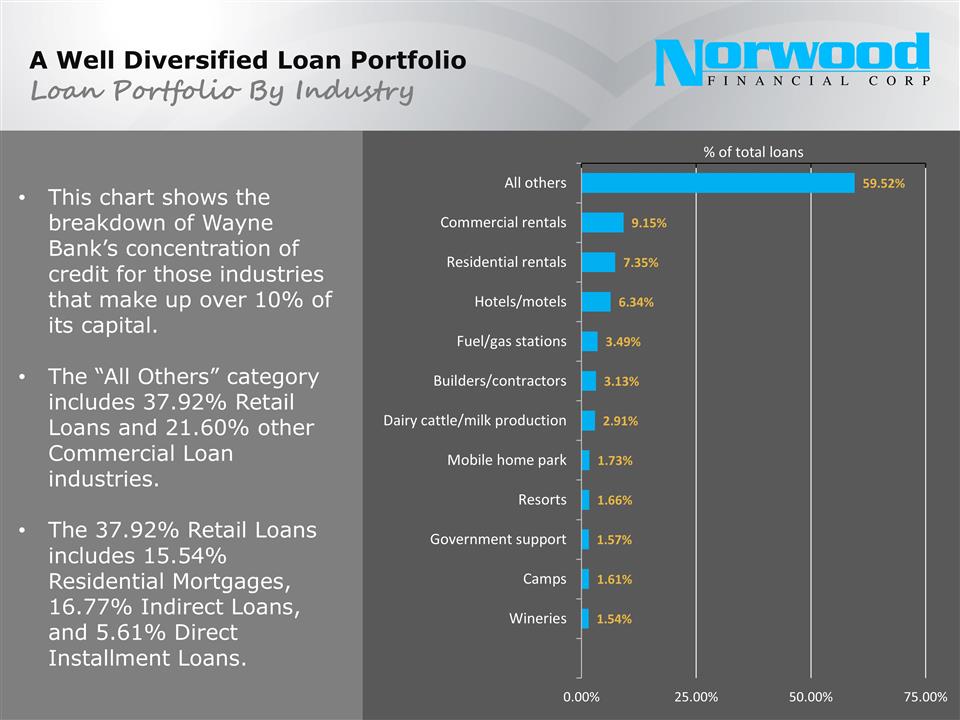

A Well Diversified Loan Portfolio Loan Portfolio By Industry This chart shows the breakdown of Wayne Bank’s concentration of credit for those industries that make up over 10% of its capital. The “All Others” category includes 37.92% Retail Loans and 21.60% other Commercial Loan industries. The 37.92% Retail Loans includes 15.54% Residential Mortgages, 16.77% Indirect Loans, and 5.61% Direct Installment Loans.

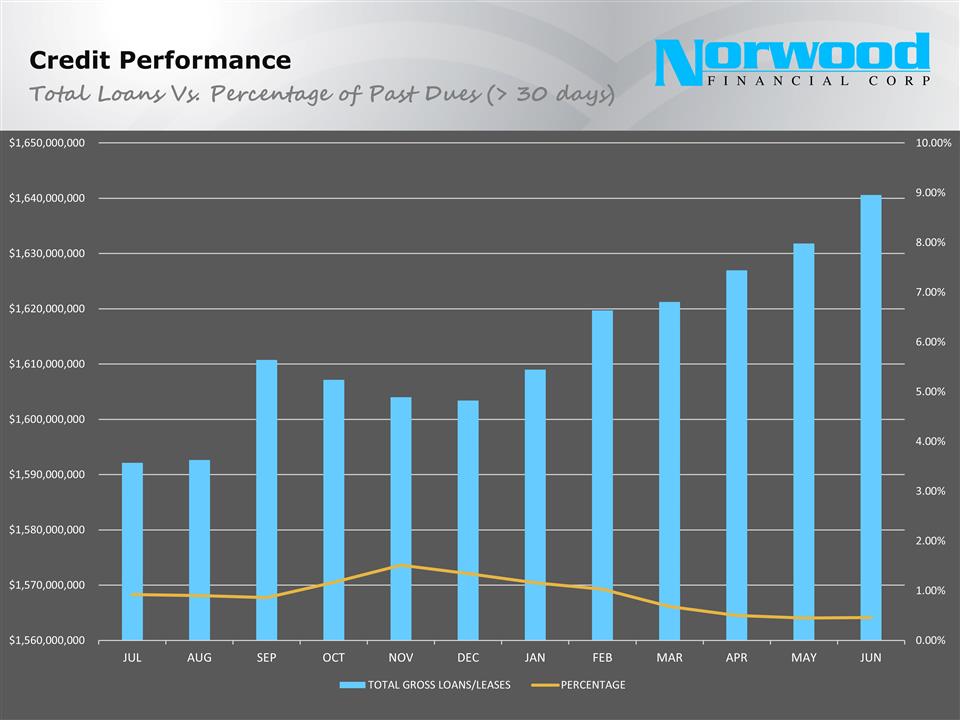

Credit Performance Total Loans Vs. Percentage of Past Dues (> 30 days)

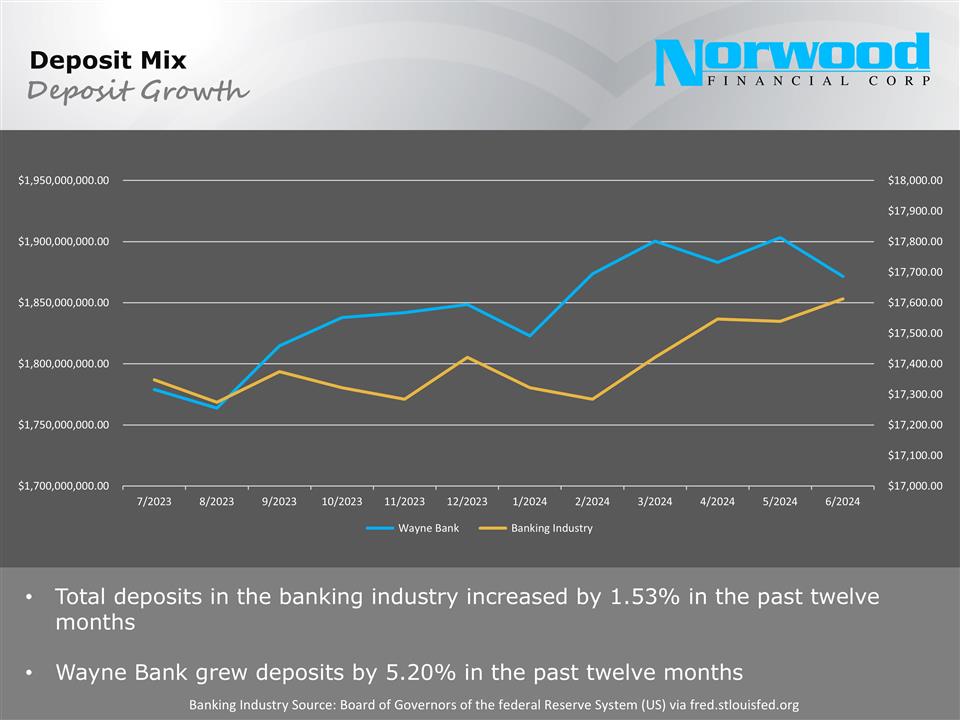

Deposit Mix Deposit Growth Total deposits in the banking industry increased by 1.53% in the past twelve months Wayne Bank grew deposits by 5.20% in the past twelve months Banking Industry Source: Board of Governors of the federal Reserve System (US) via fred.stlouisfed.org

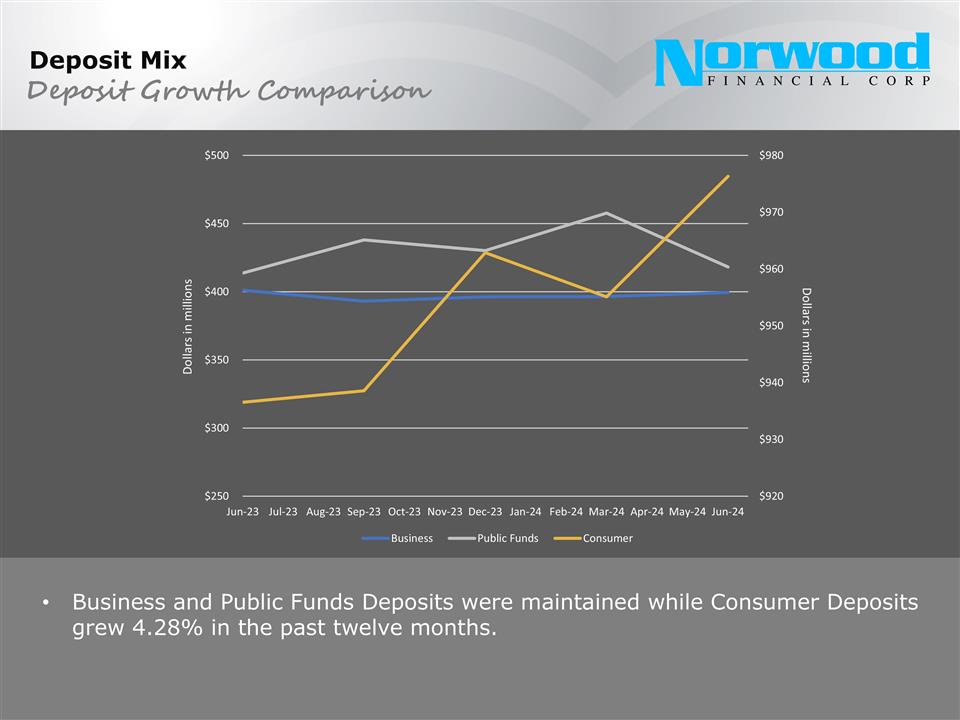

Deposit Mix Deposit Growth Comparison Business and Public Funds Deposits were maintained while Consumer Deposits grew 4.28% in the past twelve months.

A Legacy of Creating Shareholder Value 32 consecutive years of increases in cash dividends per share Most recent quarterly dividend of $.30/share paid on May 1, 2024 Market valuation metrics: Price/LTM EPS: 14.4X Price/book: 123% Price/tangible book: 147% Average daily trading volume of nearly 11,000 shares Index membership: Nasdaq Bank Index Russell 2000® Index The Facts

A Legacy of Creating Shareholder Value NWFL reentered the Russell 2000® Index in 2023. NWFL is expected to remain in the Russell 2000® Index in 2024. The Russell 2000® Index encompasses and tracks the performance of the 2,000 largest traded U.S. stocks, based on market capitalization. In the Russell 2000® Index

A Legacy of Creating Shareholder Value Pillar of the Community Awards are the Federal Home Loan Banks highest honor. They are presented to member FI’s who have demonstrated an outstanding commitment to community development as well as effective use of FHLBank’s community products. By utilizing the First Front Door program, Wayne Bank funded households and provided down payment and closing cost assistance to first-time homebuyers. By partnering with the Home4Good program, Wayne Bank supported over 20 projects and helped the homeless or people at risk of homelessness by providing grants to fund the initiative of securing homes for those in need. Wayne Bank supported small businesses in their market through Banking on Business, the Banking on Business Inclusion and Equity Fund, and the Community Lending Program to finance the startup, maintenance, and expansion of businesses. FHLB Pillars of the Community Award Winner

A Legacy of Creating Shareholder Value Featured in Forbes and Fortune