- NWFL Dashboard

- Financials

- Filings

- Holdings

-

Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

8-K Filing

Norwood Financial (NWFL) 8-KRegulation FD Disclosure

Filed: 29 Jan 25, 9:00am

January 2025 Investor Presentation Janney Investor Conference Exhibit 99.1

Forward-Looking Statements The information disclosed in this document includes various forward-looking statements that are made by Norwood Financial Corp (the “Company”) in reliance upon the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. The words “anticipates,” “projects,” “intends,” “estimates,” “expects,” “believes,” “plans,” “may,” “will,” “should,” “could,” and other similar expressions are intended to identify such forward-looking statements. The Company cautions that these forward-looking statements are necessarily speculative and speak only as of the date made, and are subject to numerous assumptions, risks and uncertainties, all of which may change overtime. Actual results could differ materially from such forward-looking statements. Accordingly, you should not place undue reliance on forward-looking statements. The following factors, among others, could cause actual results to differ materially and adversely from such forward-looking statements: our inability to successfully reposition our fixed-income securities portfolio utilizing the proceeds from this offering, changes in the financial services industry and the U.S. and global capital markets, changes in economic conditions nationally, regionally and in the Company’s markets, the nature and timing of actions of the Federal Reserve Board and other regulators, the nature and timing of legislation and regulation affecting the financial services industry, government intervention in the U.S. financial system, changes in federal and state tax laws, changes in levels of market interest rates, pricing pressures on loan and deposit products, credit risks of the Company’s lending activities, successful implementation, deployment and upgrades of new and existing technology, systems, services and products, customers’ acceptance of the Company’s products and services, and competition. Any statements made by the Company that are not historical facts should be considered to be forward-looking statements. The Company cautions that the foregoing list of important factors is not exhaustive. The Company is not obligated to update and does not undertake to update any of its forward looking statements, whether written or oral, that may be made from time to time by or on behalf of the Company or made herein. Non-GAAP Disclaimer This presentation includes certain financial measures derived from consolidated financial data but not presented in accordance with U.S. generally accepted accounting principles (“GAAP”). The Company believes that these non-GAAP measures, when taken together with its financial results presented in accordance with GAAP, provide meaningful supplemental information regarding its operating performance and facilitate internal comparisons of its historical operating performance on a more consistent basis These non-GAAP financial measures however are subject to inherent limitations, may not be comparable to similarly titled measures used by other companies and should not be considered in isolation or as an alternative to GAAP measures. Please refer to the Appendix for reconciliations of the non-GAAP financial measures to their most directly comparable GAAP financial measures. Forward-Looking Statements & Disclaimers

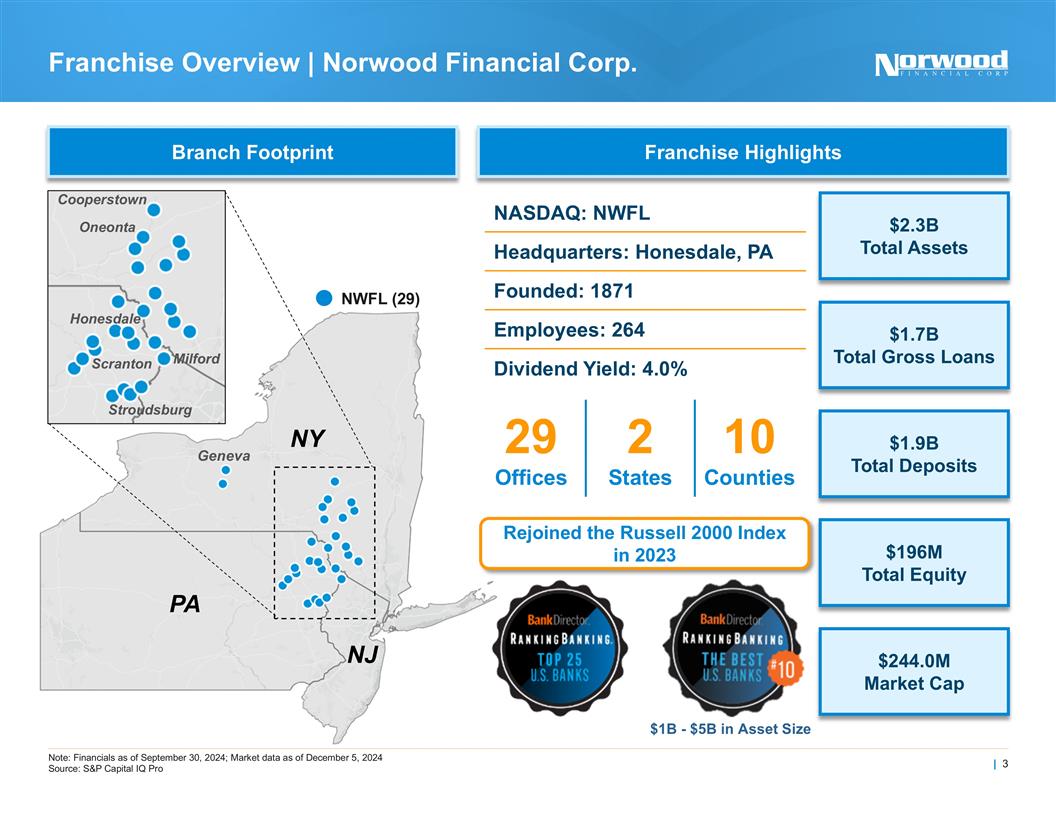

Note: Financials as of September 30, 2024; Market data as of December 5, 2024 Source: S&P Capital IQ Pro Franchise Overview | Norwood Financial Corp. Branch Footprint Franchise Highlights PA NJ NY Geneva Honesdale Milford Stroudsburg NWFL (29) $2.3B Total Assets $1.7B Total Gross Loans $1.9B Total Deposits $196M Total Equity $244.0M Market Cap NASDAQ: NWFL Headquarters: Honesdale, PA Founded: 1871 Employees: 264 Dividend Yield: 4.0% 29 Offices 2 States 10 Counties Rejoined the Russell 2000 Index in 2023 $1B - $5B in Asset Size Cooperstown Oneonta Scranton

Strength. Security. Stability. 150 Years in Business Rewarding Shareholders Growth & Expansion A Community Pillar Key Tenets for Success Customers Employees Community Shareholders Operates under three brands: Wayne Bank, the Bank of Cooperstown and Bank of the Finger Lakes Committed to the same community banking mission and core values instated upon our founding in 1871 Focused on achieving above-peer performance targets bolstered by our competitive strength in markets of operation Opportunity to reposition the balance sheet to benefit in 2025 and beyond Record of 32 consecutive years of increasing cash dividends Consistent record of organic growth bolstered by three successful acquisitions between 2011 and 2020 Focused on expanding fee income lines such as wealth/trust, mortgage and treasury management services Mission Statement: “Helping the community grow by serving businesses and their employees” The Bank and its employees are key contributors to several local charities Focused on small business and local relationships

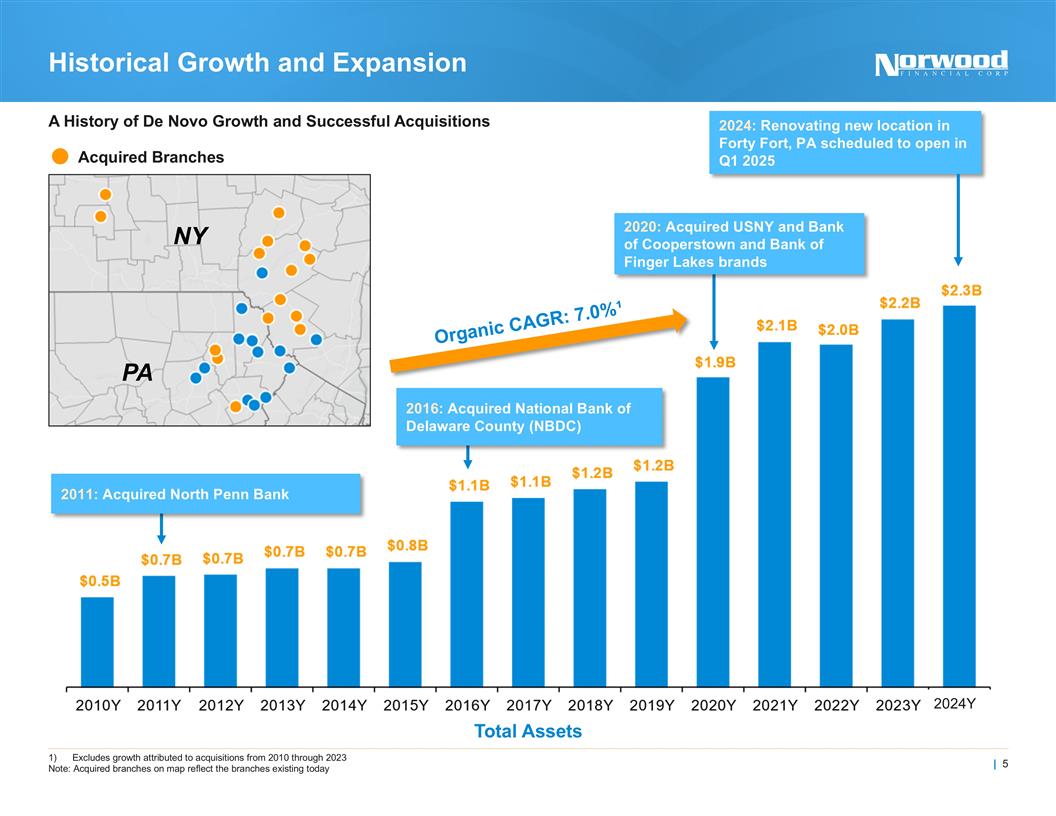

Excludes growth attributed to acquisitions from 2010 through 2023 Note: Acquired branches on map reflect the branches existing today A History of De Novo Growth and Successful Acquisitions Historical Growth and Expansion Total Assets 2024: Renovating new location in Forty Fort, PA scheduled to open in Q1 2025 2020: Acquired USNY and Bank of Cooperstown and Bank of Finger Lakes brands 2016: Acquired National Bank of Delaware County (NBDC) 2011: Acquired North Penn Bank Acquired Branches PA NY Organic CAGR: 7.0%¹ 2024Y

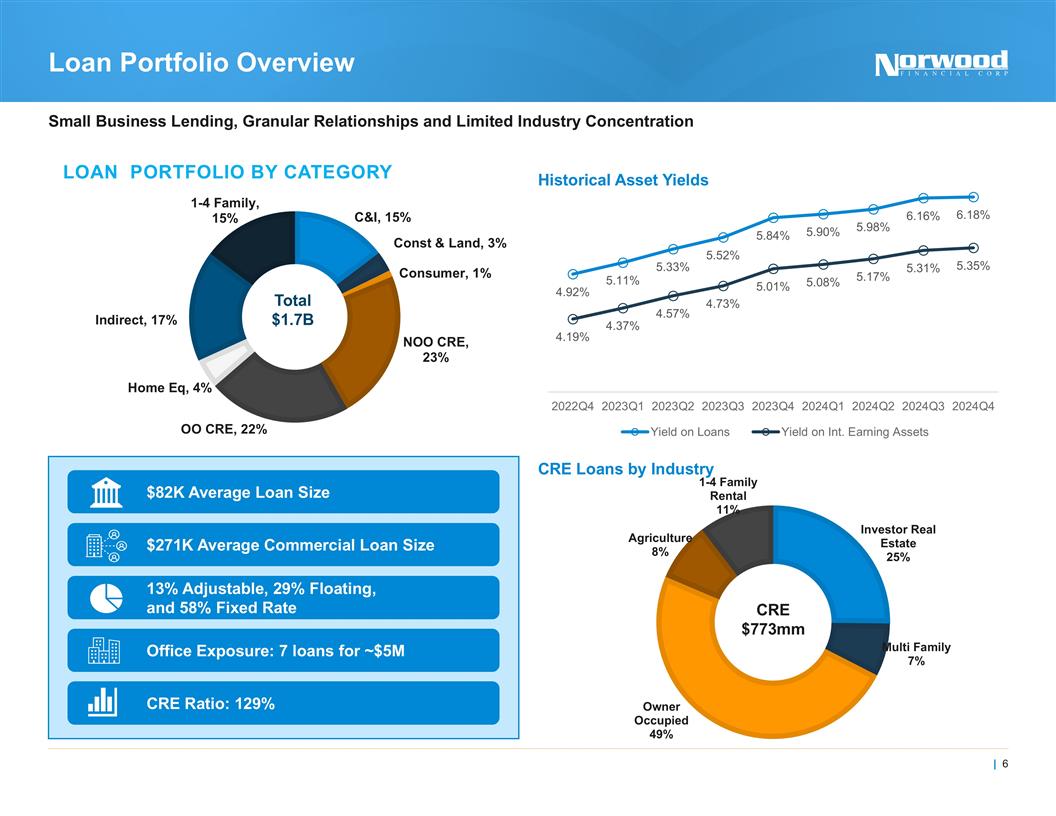

CRE Loans by Industry Historical Asset Yields Small Business Lending, Granular Relationships and Limited Industry Concentration Loan Portfolio Overview $82K Average Loan Size $271K Average Commercial Loan Size 13% Adjustable, 29% Floating, and 58% Fixed Rate CRE Ratio: 129% Office Exposure: 7 loans for ~$5M CRE $773mm

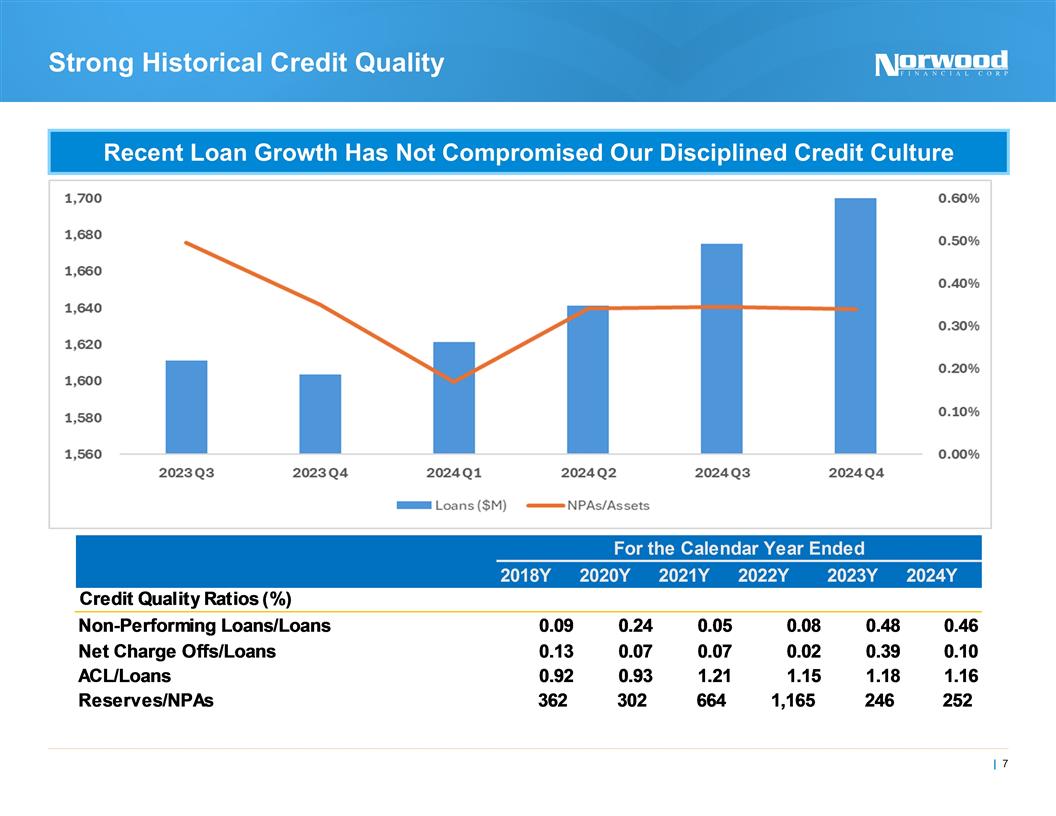

Strong Historical Credit Quality Recent Loan Growth Has Not Compromised Our Disciplined Credit Culture

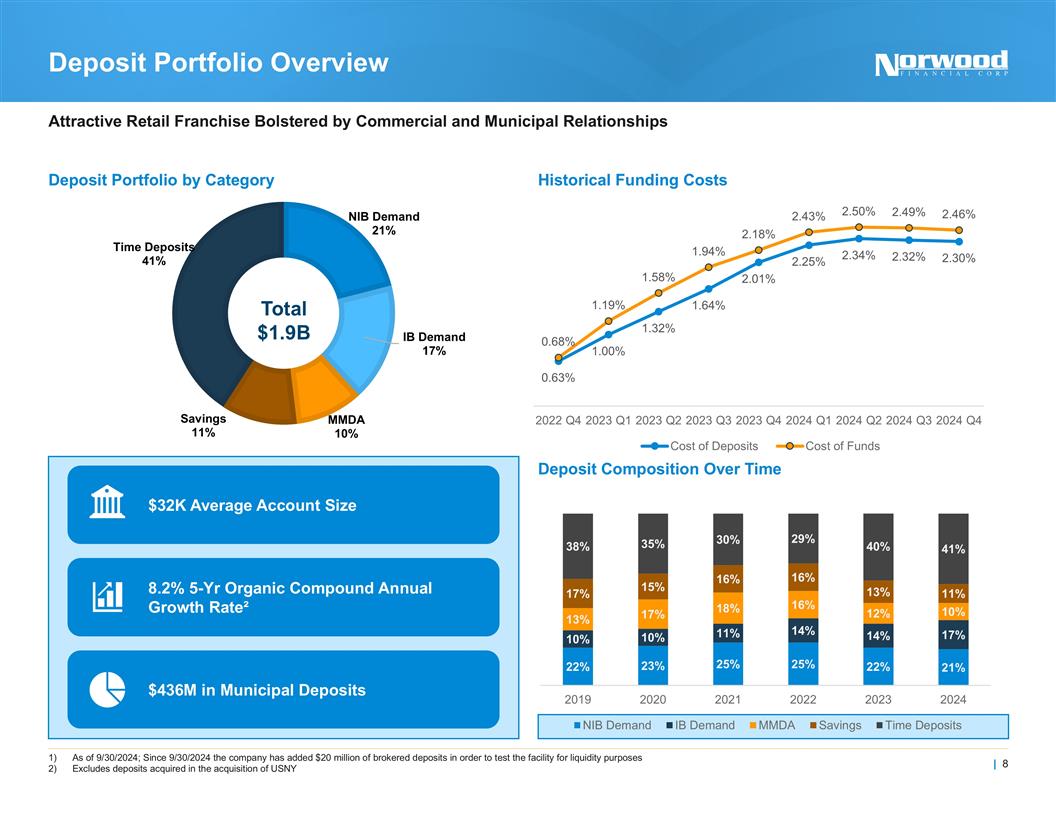

As of 9/30/2024; Since 9/30/2024 the company has added $20 million of brokered deposits in order to test the facility for liquidity purposes Excludes deposits acquired in the acquisition of USNY Deposit Composition Over Time Historical Funding Costs Deposit Portfolio by Category Attractive Retail Franchise Bolstered by Commercial and Municipal Relationships Deposit Portfolio Overview Total $1.9B $436M in Municipal Deposits $32K Average Account Size 8.2% 5-Yr Organic Compound Annual Growth Rate²

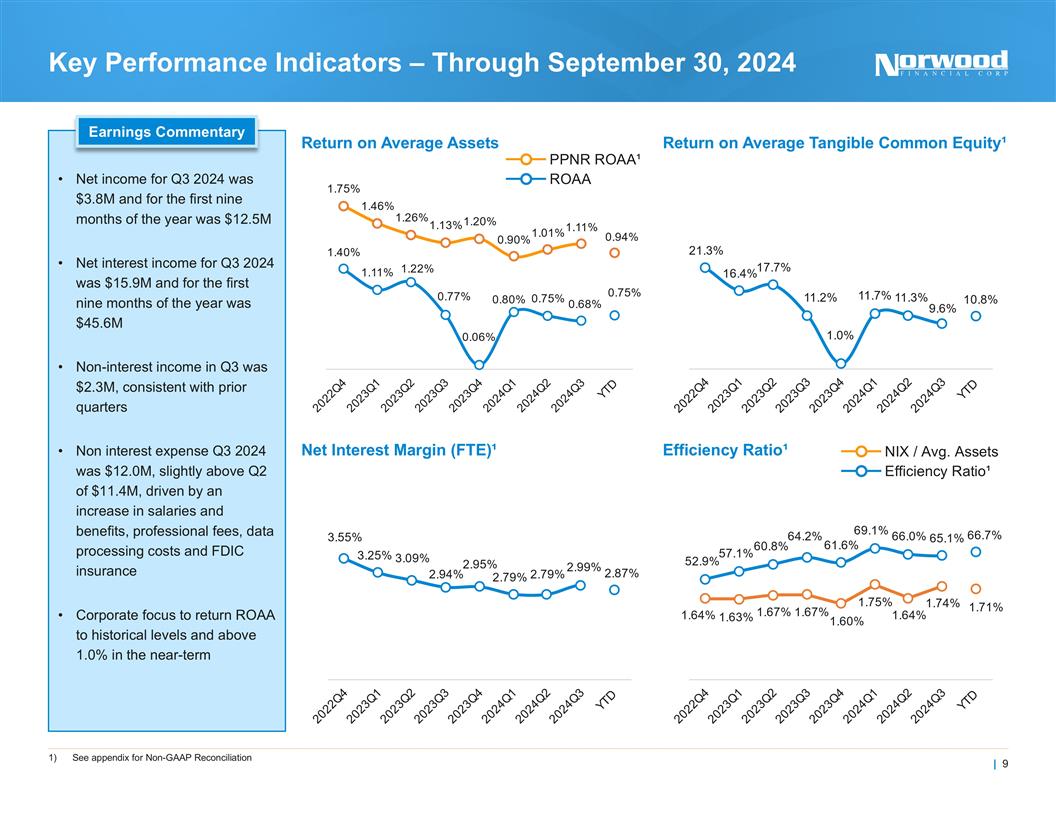

See appendix for Non-GAAP Reconciliation Efficiency Ratio¹ Net Interest Margin (FTE)¹ Return on Average Tangible Common Equity¹ Return on Average Assets Key Performance Indicators – Through September 30, 2024 Net income for Q3 2024 was $3.8M and for the first nine months of the year was $12.5M Net interest income for Q3 2024 was $15.9M and for the first nine months of the year was $45.6M Non-interest income in Q3 was $2.3M, consistent with prior quarters Non interest expense Q3 2024 was $12.0M, slightly above Q2 of $11.4M, driven by an increase in salaries and benefits, professional fees, data processing costs and FDIC insurance Corporate focus to return ROAA to historical levels and above 1.0% in the near-term Earnings Commentary PPNR ROAA¹ ROAA NIX / Avg. Assets Efficiency Ratio¹

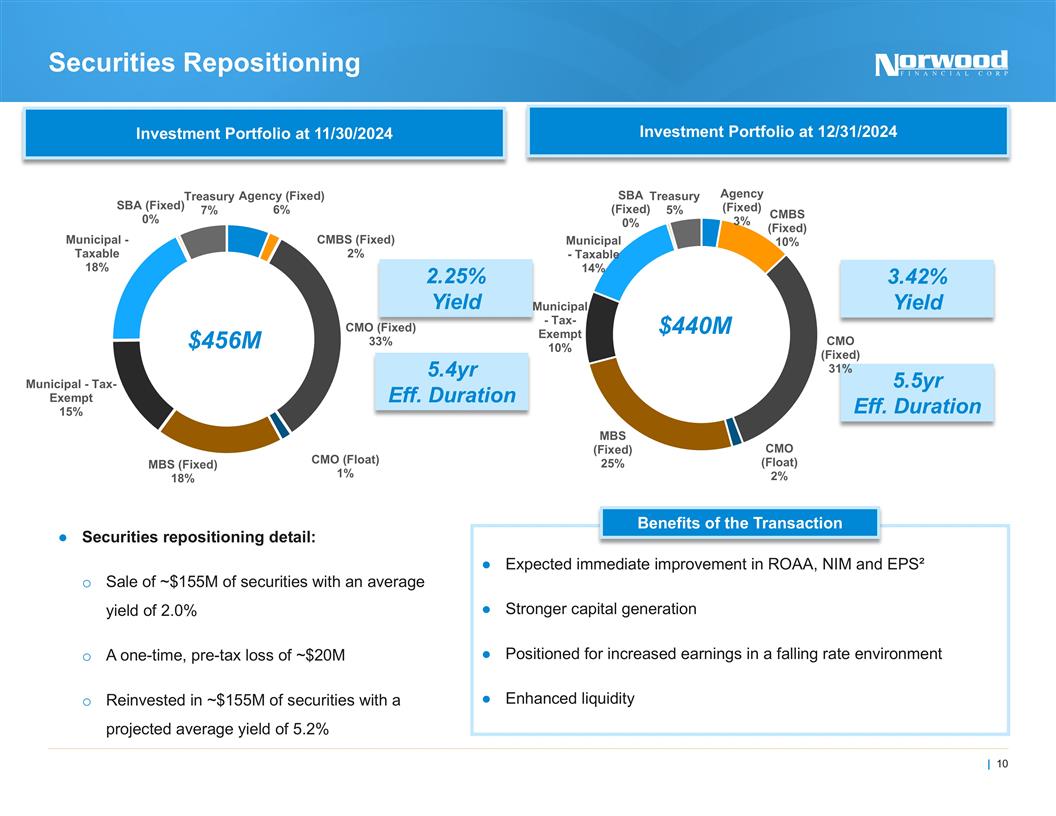

Securities Repositioning Investment Portfolio at 12/31/2024 Securities repositioning detail: Sale of ~$155M of securities with an average yield of 2.0% A one-time, pre-tax loss of ~$20M Reinvested in ~$155M of securities with a projected average yield of 5.2% Benefits of the Transaction Expected immediate improvement in ROAA, NIM and EPS² Stronger capital generation Positioned for increased earnings in a falling rate environment Enhanced liquidity $440M 3.42% Yield 5.5yr Eff. Duration 2.25% Yield 5.4yr Eff. Duration Investment Portfolio at 11/30/2024

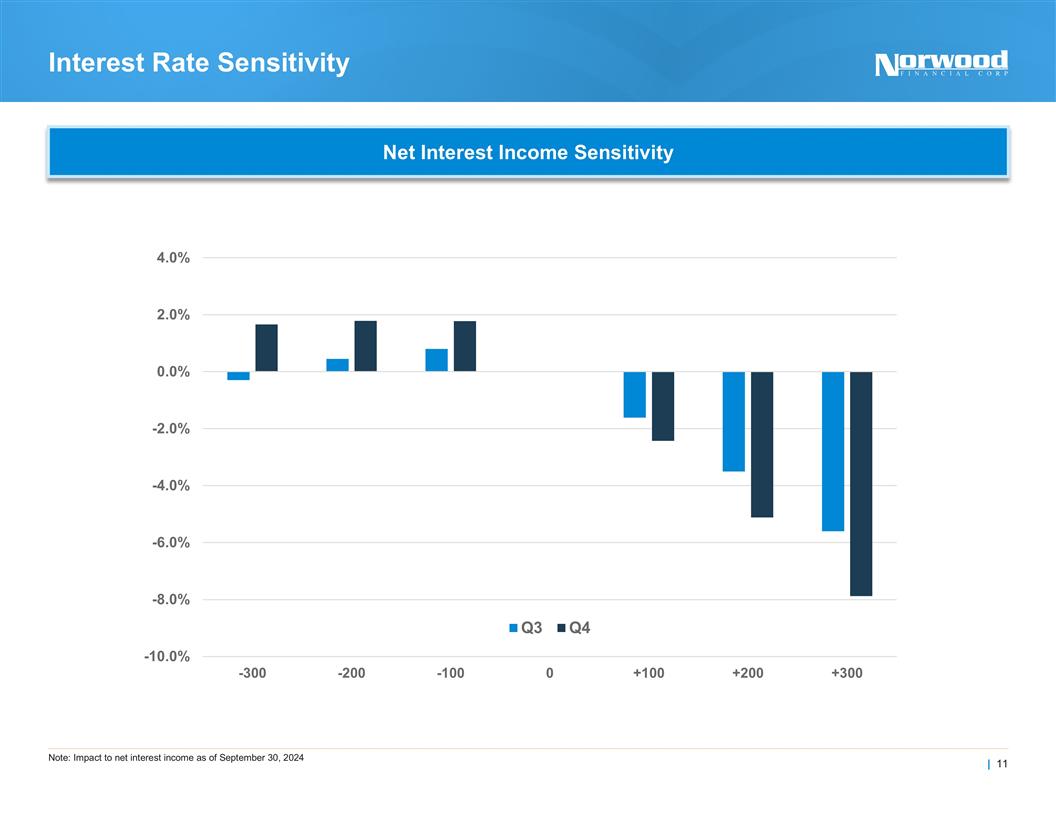

Note: Impact to net interest income as of September 30, 2024 Interest Rate Sensitivity Net Interest Income Sensitivity

Investment Proposition

Appendix

Today’s Presenters Jim Donnelly, President, Chief Executive Officer, and Director Mr. Donnelly became President, Chief Executive Officer, and Director of the Company in 2022. Mr. Donnelly joined the Company with over 30 years of banking experience, most recently with Bangor Savings Bank where he served as its Executive Vice President and Chief Commercial Officer. Mr. Donnelly brings substantial experience and leadership skills in the areas of commercial lending, retail and mortgage banking, credit, financial management, wealth management and franchise growth through acquisition and market expansion. Mr. Donnelly has a long and distinguished history of community service, including in the areas of healthcare, higher education, and the United Way. John McCaffery, Executive Vice President and Chief Financial Officer Mr. McCaffery became Executive Vice President and Chief Financial Officer of the Company in June 2024. Mr. McCaffery joined the Company with over 30 years of leadership and finance experience at various financial institutions, including two stints as CFO. His most recent position was Senior Vice President and Treasurer for Metropolitan Commercial Bank. Prior to that position, Mr. McCaffery served as Executive Vice President and Chief Financial Officer for Newtek Bank, N.A. and Bridge Bancorp. Upon the merger between Bridge Bancorp and Dime Community Bancorp, Mr. McCaffery was appointed Senior Executive Vice President and Chief Risk Officer. Mr. McCaffery brings a wealth of experience and expertise in capital raising, M&A transactions and integrations, growth and restructuring, regulatory and financial compliance, and development of high performing teams.

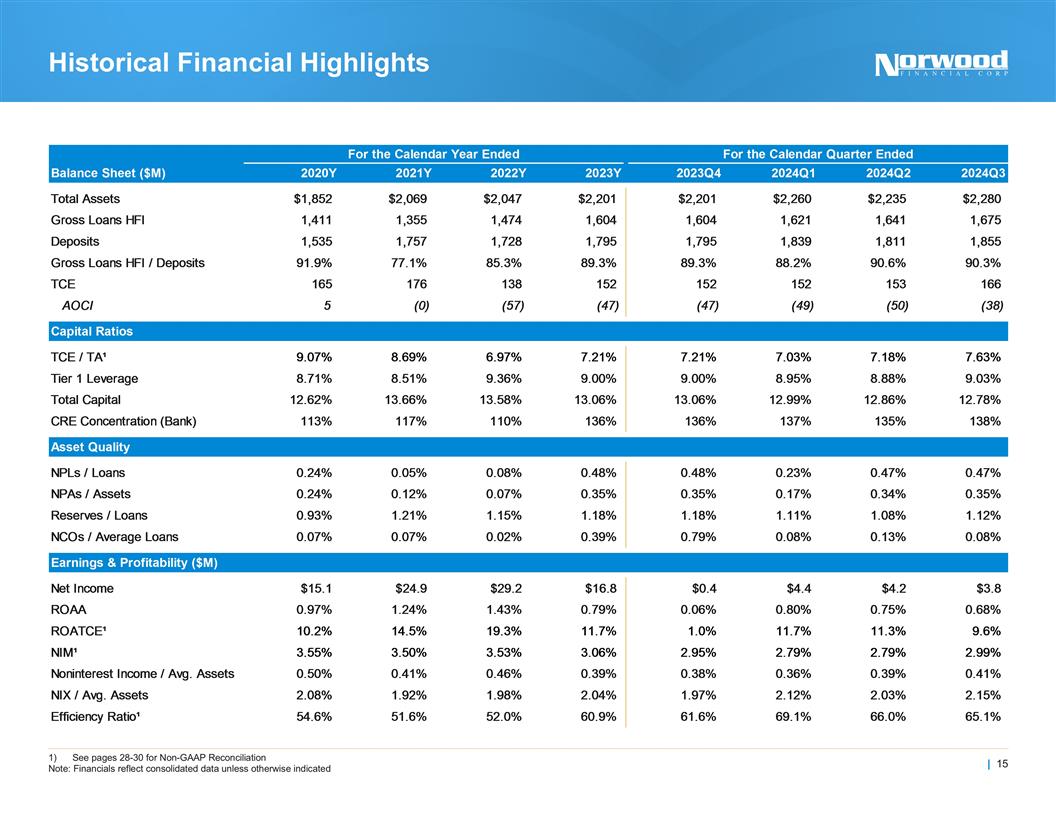

See pages 28-30 for Non-GAAP Reconciliation Note: Financials reflect consolidated data unless otherwise indicated Historical Financial Highlights

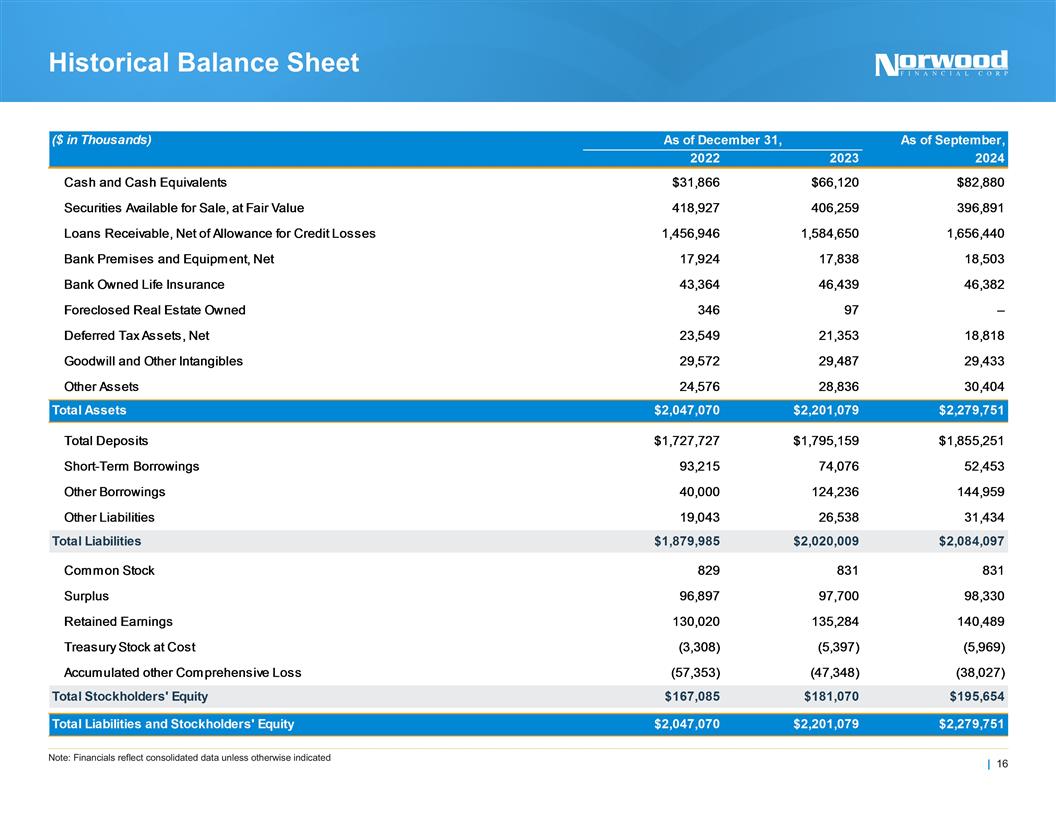

Note: Financials reflect consolidated data unless otherwise indicated Historical Balance Sheet

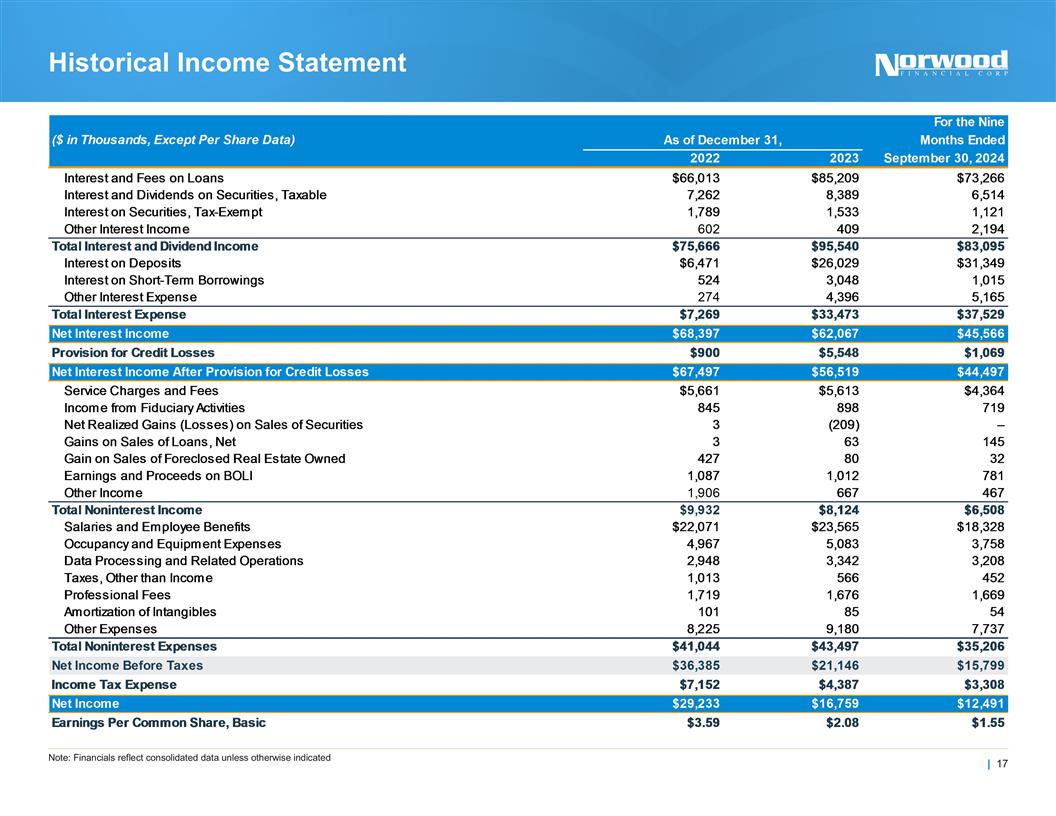

Note: Financials reflect consolidated data unless otherwise indicated Historical Income Statement

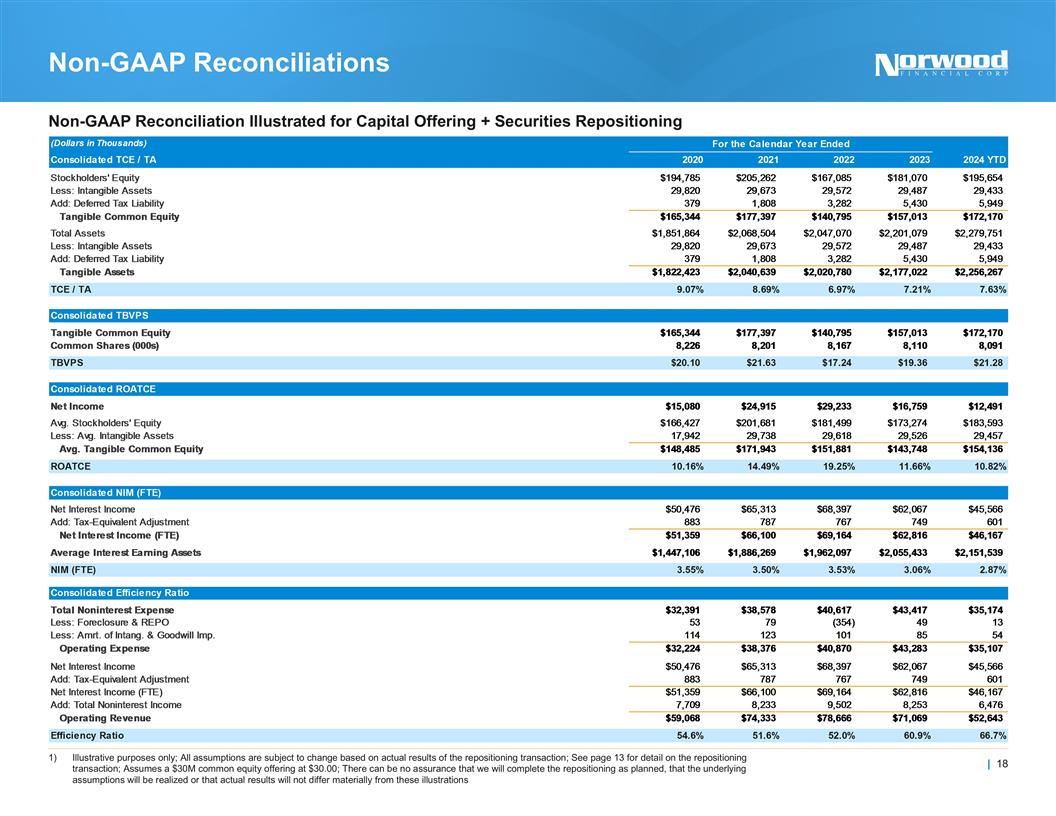

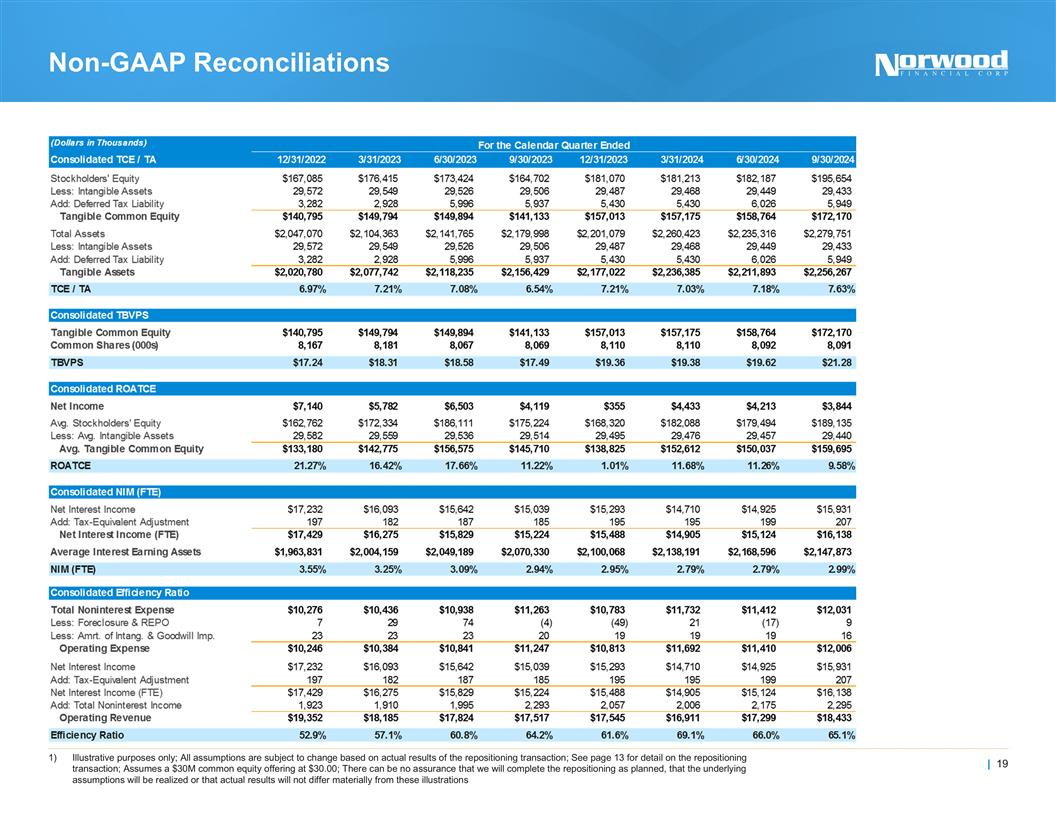

Illustrative purposes only; All assumptions are subject to change based on actual results of the repositioning transaction; See page 13 for detail on the repositioning transaction; Assumes a $30M common equity offering at $30.00; There can be no assurance that we will complete the repositioning as planned, that the underlying assumptions will be realized or that actual results will not differ materially from these illustrations Non-GAAP Reconciliation Illustrated for Capital Offering + Securities Repositioning Non-GAAP Reconciliations

Illustrative purposes only; All assumptions are subject to change based on actual results of the repositioning transaction; See page 13 for detail on the repositioning transaction; Assumes a $30M common equity offering at $30.00; There can be no assurance that we will complete the repositioning as planned, that the underlying assumptions will be realized or that actual results will not differ materially from these illustrations Non-GAAP Reconciliations

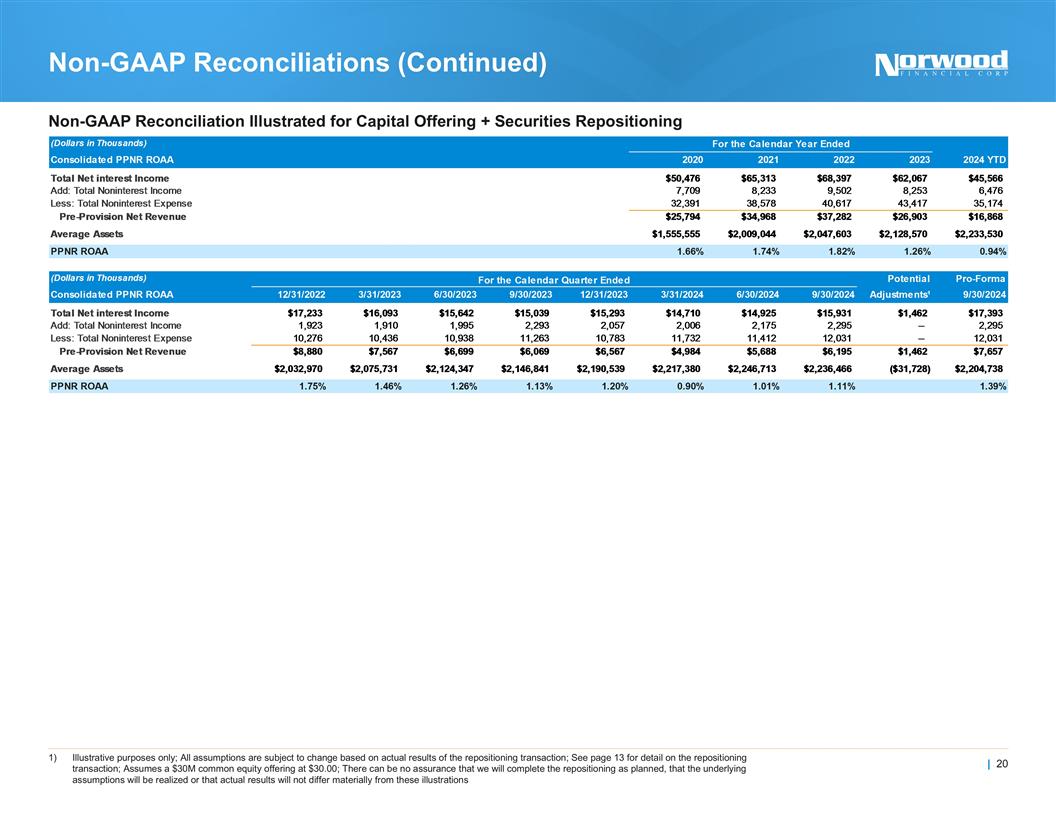

Illustrative purposes only; All assumptions are subject to change based on actual results of the repositioning transaction; See page 13 for detail on the repositioning transaction; Assumes a $30M common equity offering at $30.00; There can be no assurance that we will complete the repositioning as planned, that the underlying assumptions will be realized or that actual results will not differ materially from these illustrations Non-GAAP Reconciliation Illustrated for Capital Offering + Securities Repositioning Non-GAAP Reconciliations (Continued)

Thank You