| FREE WRITING PROSPECTUS | ||

| FILED PURSUANT TO RULE 433 | ||

| REGISTRATION FILE NO.: 333-193376-02 | ||

February 26, 2014 | ||||

FREE WRITING PROSPECTUS | ||||

| STRUCTURAL AND COLLATERAL TERM SHEET | ||||

| $1,235,745,402 | ||||

| (Approximate Total Mortgage Pool Balance) | ||||

| $1,073,553,000 | ||||

| (Approximate Offered Certificates) | ||||

COMM 2014-UBS2 | ||||

Deutsche Mortgage & Asset Receiving Corporation Depositor | ||||

German American Capital Corporation UBS Real Estate Securities Inc. KeyBank National Association Cantor Commercial Real Estate Lending, L.P. Sponsors and Mortgage Loan Sellers | ||||

Deutsche Bank Securities | UBS Securities LLC | |||

Joint Bookrunning Managers and Co-Lead Managers | ||||

Cantor Fitzgerald & Co. | Drexel Hamilton | KeyBanc Capital Markets | ||

Co-Managers | ||||

| The depositor has filed a registration statement (including the prospectus) with the SEC (SEC File No. 333-193376) for the offering to which this communication relates. Before you invest, you should read the prospectus in the registration statement and other documents the depositor has filed with the SEC for more complete information about the depositor, the issuing trust and this offering. You may get these documents for free by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, the depositor or Deutsche Bank Securities Inc., any other underwriter, or any dealer participating in this offering will arrange to send you the prospectus if you request it by calling toll-free 1-800-503-4611 or by email to the following address: prospectus.cpdg@db.com. The offered certificates referred to in these materials, and the asset pool backing them, are subject to modification or revision (including the possibility that one or more classes of certificates may be split, combined or eliminated at any time prior to issuance or availability of a final prospectus) and are offered on a “when, as and if issued” basis. You understand that, when you are considering the purchase of these certificates, a contract of sale will come into being no sooner than the date on which the relevant class has been priced and we have verified the allocation of certificates to be made to you; any “indications of interest” expressed by you, and any “soft circles” generated by us, will not create binding contractual obligations for you or us. | ||||

COMM 2014-UBS2 Mortgage Trust

Capitalized terms used but not defined herein have the meanings assigned to them in the other Free Writing Prospectus expected to be dated February 26, 2014, relating to the offered certificates (hereinafter referred to as the “Free Writing Prospectus”).

| KEY FEATURES OF SECURITIZATION |

| Key Features: | Pooled Collateral Facts(1): | |||||

| Joint Bookrunners & Co-Lead | Deutsche Bank Securities Inc. | Initial Outstanding Pool Balance: | $1,235,745,402 | |||

| Managers: | UBS Securities LLC | Number of Mortgage Loans: | 59 | |||

| Co-Managers: | Cantor Fitzgerald & Co. | Number of Mortgaged Properties: | 95 | |||

| KeyBanc Capital Markets Inc. | Average Mortgage Loan Cut-off Date Balance: | $20,944,837 | ||||

| Drexel Hamilton, LLC | Average Mortgaged Property Cut-off Date Balance: | $13,007,846 | ||||

| Mortgage Loan Sellers: | German American Capital Corporation* (“GACC”) | Weighted Avg Mortgage Loan U/W NCF DSCR: | 1.48x | |||

| (54.5%), UBS Real Estate Securities Inc. | Range of Mortgage Loan U/W NCF DSCR: | 1.21x – 2.33x | ||||

| (“UBSRES”) (30.6%), KeyBank National Association | Weighted Avg Mortgage Loan Cut-off Date LTV(2): | 66.5% | ||||

| (“KeyBank”) (8.0%), Cantor Commercial Real Estate | Range of Mortgage Loan Cut-off Date LTV(2): | 43.1% – 75.0% | ||||

| Lending, L.P. (“CCRE”) (6.9%) | Weighted Avg Mortgage Loan Maturity Date or ARD LTV(2): | 58.5% | ||||

| *An indirect wholly owned subsidiary of Deutsche Bank AG. | Range of Mortgage Loan Maturity Date or ARD LTV(2): | 38.4% – 68.3% | ||||

| Master Servicer: | KeyBank National Association | Weighted Avg U/W NOI Debt Yield: | 10.1% | |||

| Operating Advisor: | Park Bridge Lender Services LLC | Range of U/W NOI Debt Yield: | 7.8% – 18.0% | |||

| Special Servicer: | LNR Partners, LLC | Weighted Avg Mortgage Loan | ||||

| Certificate Administrator: | Deutsche Bank Trust Company Americas | Original Term to Maturity (months)(3): | 114 | |||

| Trustee: | U.S. Bank National Association | Weighted Avg Mortgage Loan | ||||

| Rating Agencies: | Moody’s Investors Service, Inc., DBRS, Inc. and Kroll Bond Rating Agency, Inc. | Remaining Term to Maturity (months)(3): Weighted Avg Mortgage Loan Seasoning (months): | 112 1 | |||

| Determination Date: | The 6th day of each month, or if such 6th day is not a business day, the following business day, commencing in April 2014. | % Mortgage Loans with Amortization for Full Term: % Mortgage Loans with Partial Interest Only: | 36.4% 56.0% | |||

| Distribution Date: | 4th business day following the Determination Date in each month, commencing in April 2014. | % of Mortgage Loans with Full Interest Only(4): % Mortgage Loans with Upfront or Ongoing Tax Reserves: | 7.6% 83.3% | |||

| Cut-off Date: | Payment Date in March 2014 (or related origination date, if later). Unless otherwise noted, all Mortgage Loan statistics are based on balances as of the Cut-off Date. | % Mortgage Loans with Upfront or Ongoing Replacement Reserves(5): % Mortgage Loans with Upfront or Ongoing Insurance Reserves: | 91.4% 38.7% | |||

| Settlement Date: | On or about March 18, 2014 | % Mortgage Loans with Upfront or Ongoing TI/LC Reserves(6): | 80.6% | |||

| Settlement Terms: | DTC, Euroclear and Clearstream, same day funds, with accrued interest. | % Mortgage Loans with Upfront Engineering Reserves: % Mortgage Loans with Upfront or Ongoing Other Reserves: | 38.7% 44.8% | |||

| ERISA Eligible: | All of the Offered Certificates are expected to be ERISA eligible. | (1) | With respect to the Google and Amazon Office Portfolio Loan and the One Kendall Square Loan, LTV, DSCR and Debt Yield calculations include the related pari passu companion loans. | |||

| SMMEA Eligible: | None of the Offered Certificates will be SMMEA eligible. | |||||

| Day Count: | 30/360 | |||||

| Tax Treatment: | REMIC | (2) | With respect to the Creekside Mixed Use Development loan and the Hampton Inn Rehoboth Beach loan, the Cut-off Date LTV and Maturity Date or ARD LTV have been calculated based on “As Stabilized” appraised values of $33.8 million and $14.6 million, respectively. The “As-is” Cut-off Date LTV and “As-is” Maturity Date or ARD LTV are 75.9% and 63.5%, respectively, for the Creekside Mixed Use Development loan and 77.5% and 58.6%, respectively, for the Hampton Inn Rehoboth Beach loan. With respect to the Arlington Farms Apartments loan, the Cut-off Date LTV and Maturity Date or ARD LTV have been calculated based on an “As Complete” appraised value of $6.76 million. The “As-is” Cut-off Date LTV and “As-is” Maturity Date or ARD LTV are 77.9% and 64.9%, respectively. | |||

| Rated Final Distribution Date: | March 2047 | |||||

| Minimum Denominations: | $10,000 (or $100,000 with respect to Class X-A) and in each case in multiples of $1 thereafter. | |||||

| Clean-up Call: | 1% | |||||

| (3) | For the ARD loan, the original term to maturity and remaining term to maturity are through the anticipated repayment date. | |||||

| (4) | Interest only through the maturity or anticipated repayment date. | |||||

| (5) | Includes FF&E Reserves. | |||||

| (6) | Represents the percent of the allocated Initial Outstanding Pool Balance of retail, office, industrial and mixed use properties only. | |||||

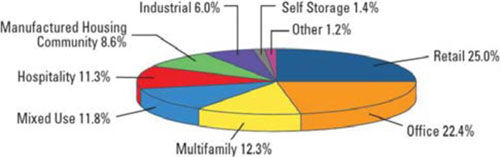

| Distribution of Collateral by Property Type |

The depositor has filed a registration statement (including the prospectus) with the SEC (SEC File No. 333-193376) for the offering to which this communication relates. Before you invest, you should read the prospectus in the registration statement and other documents the depositor has filed with the SEC for more complete information about the depositor, the issuing trust and this offering. You may get these documents for free by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, the depositor or Deutsche Bank Securities Inc., any other underwriter, or any dealer participating in this offering will arrange to send you the prospectus if you request it by calling toll-free 1-800-503-4611 or by email to the following address: prospectus.cpdg@db.com. The offered certificates referred to in these materials, and the asset pool backing them, are subject to modification or revision (including the possibility that one or more classes of certificates may be split, combined or eliminated at any time prior to issuance or availability of a final prospectus) and are offered on a “when, as and if issued” basis. You understand that, when you are considering the purchase of these certificates, a contract of sale will come into being no sooner than the date on which the relevant class has been priced and we have verified the allocation of certificates to be made to you; any “indications of interest” expressed by you, and any “soft circles” generated by us, will not create binding contractual obligations for you or us.

3

COMM 2014-UBS2 Mortgage Trust

SUMMARY OF THE CERTIFICATES |

OFFERED CERTIFICATES

Class(1) | Ratings (Moody’s/DBRS/KBRA) | Initial Certificate Balance or Notional Amount(2) | Initial Subordination Levels | Weighted Average Life (years)(3) | Principal Window (months)(3) | Certificate Principal to Value Ratio(4) | Underwritten NOI Debt Yield(5) |

| Class A-1 | Aaa(sf) / AAA(sf) / AAA(sf) | $50,034,000 | 30.000%(6) | 2.86 | 1 - 57 | 46.5% | 14.4% |

| Class A-2 | Aaa(sf) / AAA(sf) / AAA(sf) | $110,593,000 | 30.000%(6) | 4.87 | 57 - 59 | 46.5% | 14.4% |

| Class A-3 | Aaa(sf) / AAA(sf) / AAA(sf) | $18,667,000 | 30.000%(6) | 6.93 | 82 - 84 | 46.5% | 14.4% |

| Class A-SB | Aaa(sf) / AAA(sf) / AAA(sf) | $93,739,000 | 30.000%(6) | 7.43 | 59 - 117 | 46.5% | 14.4% |

| Class A-4 | Aaa(sf) / AAA(sf) / AAA(sf) | $237,000,000 | 30.000%(6) | 9.78 | 117 - 118 | 46.5% | 14.4% |

| Class A-5 | Aaa(sf) / AAA(sf) / AAA(sf) | $354,988,000 | 30.000%(6) | 9.84 | 118 - 119 | 46.5% | 14.4% |

Class X-A(7) | Aaa(sf) / AAA(sf) / AAA(sf) | $934,532,000(8) | N/A | N/A | N/A | N/A | N/A |

Class A-M(9)(10) | Aaa(sf) / AAA(sf) / AAA(sf) | $69,511,000 | 24.375% | 9.89 | 119 - 119 | 50.3% | 13.4% |

Class B(9)(10) | Aa3(sf) / AA(sf) / AA-(sf) | $89,592,000 | 17.125% | 9.89 | 119 - 119 | 55.1% | 12.2% |

Class PEZ(9)(10) | A1(sf) / A(low)(sf) / A-(sf) | $208,532,000 | 13.125%(6) | 9.89 | 119 - 119 | 57.8% | 11.6% |

Class C(9)(10) | A3(sf) / A(low)(sf) / A-(sf) | $49,429,000 | 13.125%(6) | 9.89 | 119 - 119 | 57.8% | 11.6% |

NON-OFFERED CERTIFICATES

Class(1) | Ratings (Moody’s/DBRS/KBRA) | Initial Certificate Balance or Notional Amount(2) | Initial Subordination Levels | Weighted Average Life (years)(3) | Principal Window (months)(3) | Certificate Principal to Value Ratio(4) | Underwritten NOI Debt Yield(5) |

Class X-B(7) | NR / AAA(sf) / AAA(sf) | $214,711,000(8) | N/A | N/A | N/A | N/A | N/A |

| Class D | NR / BBB(low)(sf) / BBB-(sf) | $75,690,000 | 7.000% | 9.89 | 119 - 119 | 61.8% | 10.9% |

| Class E | NR / BB(low)(sf) / BB-(sf) | $27,804,000 | 4.750% | 9.95 | 119 - 120 | 63.3% | 10.6% |

| Class F | NR / B(low)(sf) / B(sf) | $20,081,000 | 3.125% | 9.98 | 120 - 120 | 64.4% | 10.4% |

| Class G | NR / NR / NR | $38,617,401 | 0.000% | 9.98 | 120 - 120 | 66.5% | 10.1% |

| (1) | The pass–through rates applicable to the Class A–1, Class A–2, Class A–3, Class A–SB, Class A–4, Class A–5, Class A–M, Class B, Class C, Class D, Class E, Class F and Class G Certificates will equal one of: (i) a fixed per annum rate, (ii) the weighted average of the net mortgage rates on the mortgage loans (in each case, adjusted, if necessary, to accrue on the basis of a 360–day year consisting of twelve 30–day months) as of their respective due dates in the month preceding the month in which such distribution date occurs, (iii) a rate equal to the lesser of a specified pass–through rate and the weighted average of the net mortgage rates on the mortgage loans (in each case, adjusted, if necessary, to accrue on the basis of a 360–day year consisting of twelve 30–day months) as of their respective due dates in the month preceding the month in which such distribution date occurs, or (iv) the weighted average of the net mortgage rates on the mortgage loans (in each case, adjusted, if necessary, to accrue on the basis of a 360–day year consisting of twelve 30–day months) as of their respective due dates in the month preceding the month in which such distribution date occurs, less a specified rate. The Class PEZ Certificates will not have a pass-through rate, but will be entitled to receive the sum of the interest distributable on the percentage interest of the Class A–M, Class B and Class C trust components represented by the Class PEZ Certificates. The pass-through rate on the Class A–M, Class B and Class C trust components will at all times be the same as the pass-through rate of the Class A–M, Class B and Class C Certificates. |

| (2) | Approximate; subject to a permitted variance of plus or minus 5%. |

| (3) | The weighted average life and principal window during which distributions of principal would be received as set forth in the table with respect to each class of certificates with a certificate balance is based on (i) modeling assumptions and prepayment assumptions described in the Free Writing Prospectus, (ii) assumptions that there are no prepayments or losses on the mortgage loans and (iii) assumptions that there are no extensions of maturity dates and that mortgage loans with anticipated repayment dates are repaid on their respective anticipated repayment dates. |

| (4) | “Certificate Principal to Value Ratio” for any class with a Certificate Balance is calculated as the product of (a) the weighted average mortgage loan Cut–off Date LTV of the mortgage pool, multiplied by (b) a fraction, the numerator of which is the total initial Certificate Balance of the related class of Certificates and all other classes, if any, that are senior to such class, and the denominator of which is the total initial Certificate Balance of all Certificates. The Certificate Principal to Value Ratios of the Class A–1, Class A–2, Class A–3, Class A–SB, Class A–4 and Class A–5 Certificates are calculated in the aggregate for those classes as if they were a single class. |

| (5) | “Underwritten NOI Debt Yield” for any class with a Certificate Balance is calculated as the product of (a) the weighted average U/W NOI Debt Yield for the mortgage pool, multiplied by (b) a fraction, the numerator of which is the total initial Certificate Balance and the denominator of which is the total initial Certificate Balance of the related class of Certificates and all other classes, if any, that are senior to such class. The Underwritten NOI Debt Yields of the Class A–1, Class A–2, Class A–3, Class A–SB, Class A–4 and Class A–5 Certificates are calculated in the aggregate for those classes as if they were a single class. |

| (6) | The initial subordination levels for the Class A–1, Class A–2, Class A–3, Class A–SB, Class A–4 and Class A–5 are represented in the aggregate. The initial subordination levels for the Class PEZ and Class C Certificates are equal to the initial subordination level of the underlying Class C trust component which will have an initial outstanding balance on the closing date of $49,429,000. |

| (7) | The pass–through rate applicable to the Class X–A and Class X–B Certificates for each Distribution Date will generally be equal to the excess of (i) the weighted average of the net mortgage rates on the mortgage loans (in each case, adjusted, if necessary to accrue on the basis of a 360 day year consisting of twelve 30–day months), over (ii)(A) with respect to the Class X–A Certificates, the weighted average of the pass–through rates of the Class A–1, Class A–2, Class A–3, Class A–SB, Class A–4, Class A–5 and Class A–M Certificates (based on their Certificate Balances and without regard to any exchange of Class A–M, Class B and Class C Certificates for Class PEZ Certificates), as further described in the Free Writing Prospectus and (B) with respect to the Class X–B Certificates, the weighted average of the pass–through rates of the Class B, Class C and Class D Certificates (based on their Certificate Balances and without regard to any exchange of Class A–M, Class B and Class C Certificates for Class PEZ Certificates), as further described in the Free Writing Prospectus. |

| (8) | The Class X–A and Class X–B Certificates (the “Class X Certificates”) will not have Certificate Balances. None of the Class X–A and Class X–B Certificates are entitled to distributions of principal. The interest accrual amounts on the Class X–A Certificates will be calculated by reference to a notional amount equal to the sum of the total Certificate Balances of each of the Class A–1, Class A–2, Class A–3, Class A–SB, Class A–4, Class A–5 and Class A–M Certificates (without regard to any exchange of Class A–M, Class B, and Class C Certificates for Class PEZ Certificates). The interest accrual amounts on the Class X–B Certificates will be calculated by reference to a notional amount equal to the Certificate Balances of each the Class B, Class C and Class D Certificates (without regard to any exchange of Class A–M, Class B, and Class C Certificates for Class PEZ Certificates). |

| (9) | Up to the full Certificate Balance of the Class A–M, Class B and Class C Certificates may be exchanged for Class PEZ Certificates, and Class PEZ Certificates may be exchanged for up to the full Certificate Balance of the Class A–M, Class B and Class C Certificates. |

The depositor has filed a registration statement (including the prospectus) with the SEC (SEC File No. 333-193376) for the offering to which this communication relates. Before you invest, you should read the prospectus in the registration statement and other documents the depositor has filed with the SEC for more complete information about the depositor, the issuing trust and this offering. You may get these documents for free by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, the depositor or Deutsche Bank Securities Inc., any other underwriter, or any dealer participating in this offering will arrange to send you the prospectus if you request it by calling toll-free 1-800-503-4611 or by email to the following address: prospectus.cpdg@db.com. The offered certificates referred to in these materials, and the asset pool backing them, are subject to modification or revision (including the possibility that one or more classes of certificates may be split, combined or eliminated at any time prior to issuance or availability of a final prospectus) and are offered on a “when, as and if issued” basis. You understand that, when you are considering the purchase of these certificates, a contract of sale will come into being no sooner than the date on which the relevant class has been priced and we have verified the allocation of certificates to be made to you; any “indications of interest” expressed by you, and any “soft circles” generated by us, will not create binding contractual obligations for you or us.

4

COMM 2014-UBS2 Mortgage Trust

SUMMARY OF THE CERTIFICATES |

| (10) | On the closing date, the issuing entity will issue the Class A–M, Class B and Class C trust components, which will have outstanding principal balances on the closing date of $69,511,000, $89,592,000 and $49,429,000, respectively. The Class A–M, Class B, Class PEZ and Class C Certificates will, at all times, represent undivided beneficial ownership interests in a grantor trust that will hold such trust components. Each class of the Class A–M, Class B and Class C Certificates will, at all times, represent a beneficial interest in a percentage of the outstanding principal balance of the Class A–M, Class B and Class C trust components, respectively. The Class PEZ Certificates will, at all times, represent a beneficial interest in the remaining percentages of the outstanding principal balances of the Class A–M, Class B and Class C trust components. Following any exchange of Class A–M, Class B and Class C Certificates for Class PEZ Certificates or any exchange of Class PEZ Certificates for Class A–M, Class B and Class C Certificates as described in the Free Writing Prospectus, the percentage interest of the outstanding principal balances of the Class A–M, Class B and Class C trust component that is represented by the Class A–M, Class B, Class PEZ and Class C Certificates will be increased or decreased accordingly. The initial Certificate Balance of each of the Class A–M, Class B and Class C Certificates represents the Certificate Balance of such class without giving effect to any exchange. The initial Certificate Balance of the Class PEZ Certificates is equal to the aggregate of the initial Certificate Balance of the Class A–M, Class B and Class C Certificates and represents the maximum Certificate Balance of the Class PEZ Certificates that could be issued in an exchange. The Certificate Balances of the Class A–M, Class B and Class C Certificates to be issued on the closing date will be reduced, in required proportions, by an amount equal to the Certificate Balance of the Class PEZ Certificates issued on the closing date. |

Short–Term Certificate Principal Paydown Summary(1) |

| Class | Mortgage Loan Seller | Mortgage Loan | Property Type | Cut–off Date Balance | Remaining Term to Maturity (Mos.) | Cut-off Date LTV Ratio | U/W NCF DSCR | U/W NOI Debt Yield | |

| A-1/A-2 | UBSRES | Hood Commons | Retail | $11,203,565 | 57 | 67.9% | 1.93x | 13.6% | |

| A-2 | UBSRES | Summer Lake Estates | Multifamily | $6,283,440 | 58 | 64.1% | 1.34x | 8.8% | |

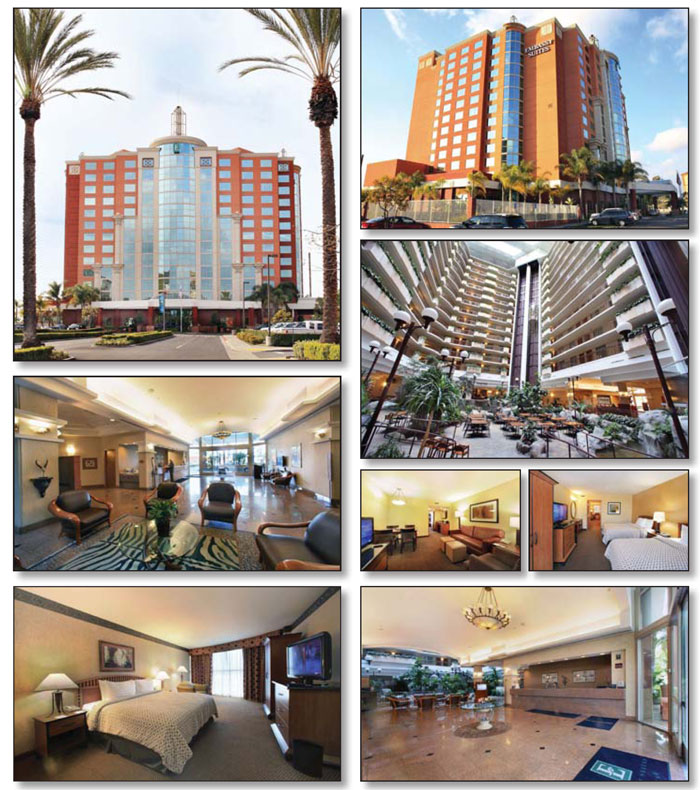

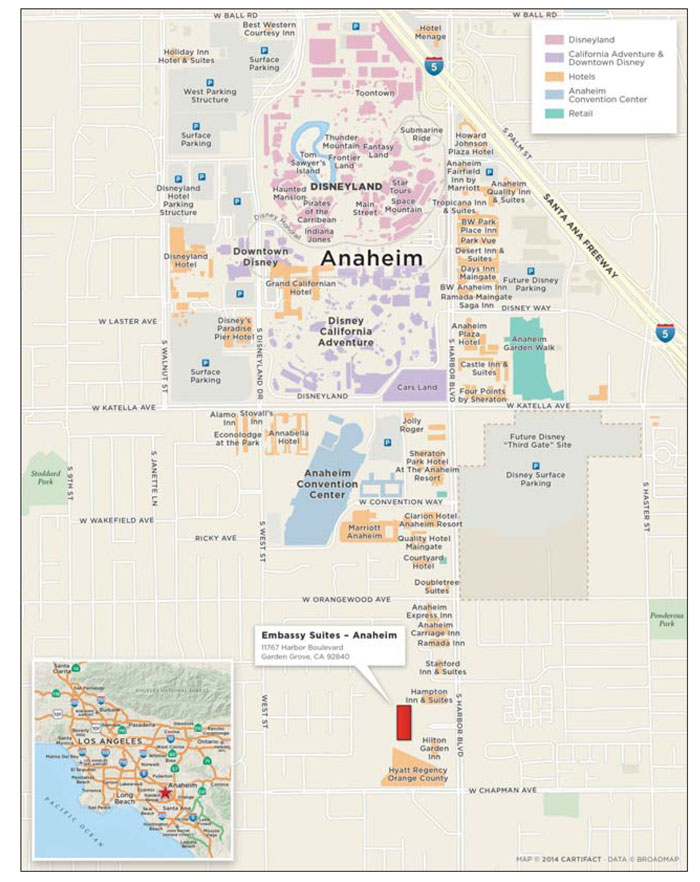

| A-2/A-SB | UBSRES | Embassy Suites - Anaheim | Hospitality | $50,000,000 | 59 | 66.1% | 1.85x | 12.0% | |

| A-2/A-SB | GACC | Tops Markets Grocery Anchored Portfolio | Retail | $34,948,224 | 59 | 63.4% | 1.72x | 12.1% | |

| A-2/A-SB | GACC | GRM Arlington | Industrial | $6,288,420 | 59 | 71.5% | 1.73x | 13.9% | |

| A-2/A-SB | KeyBank | MVP Parking Portfolio | Other | $4,291,534 | 59 | 43.1% | 2.03x | 15.1% | |

| A-3/A-SB | KeyBank | Forest Hills Apartments | Multifamily | $5,800,000 | 82 | 67.1% | 1.33x | 9.5% | |

| A-3/A-SB | KeyBank | LA Fitness Portfolio | Retail | $16,100,000 | 84 | 60.2% | 1.59x | 12.3% | |

| (1) | This table identifies loans with balloon payments due during the principal paydown window assuming 0% CPR and no losses for the indicated Certificates. See “Yield and Maturity Considerations – Yield Considerations” in the Free Writing Prospectus. |

The depositor has filed a registration statement (including the prospectus) with the SEC (SEC File No. 333-193376) for the offering to which this communication relates. Before you invest, you should read the prospectus in the registration statement and other documents the depositor has filed with the SEC for more complete information about the depositor, the issuing trust and this offering. You may get these documents for free by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, the depositor or Deutsche Bank Securities Inc., any other underwriter, or any dealer participating in this offering will arrange to send you the prospectus if you request it by calling toll-free 1-800-503-4611 or by email to the following address: prospectus.cpdg@db.com. The offered certificates referred to in these materials, and the asset pool backing them, are subject to modification or revision (including the possibility that one or more classes of certificates may be split, combined or eliminated at any time prior to issuance or availability of a final prospectus) and are offered on a “when, as and if issued” basis. You understand that, when you are considering the purchase of these certificates, a contract of sale will come into being no sooner than the date on which the relevant class has been priced and we have verified the allocation of certificates to be made to you; any “indications of interest” expressed by you, and any “soft circles” generated by us, will not create binding contractual obligations for you or us.

5

COMM 2014-UBS2 Mortgage Trust

TRANSACTION HIGHLIGHTS |

■ | $1,235,745,402 (Approximate) New–Issue Multi–Borrower CMBS: |

| – | Overview: The mortgage pool consists of 59 fixed–rate commercial, multifamily and manufactured housing community loans that have an aggregate Cut–off Date Balance of $1,235,745,402 (the “Initial Outstanding Pool Balance”), have an average Cut–off Date Balance of $20,944,837 per Mortgage Loan and are secured by 95 Mortgaged Properties located throughout 24 states. |

| – | LTV: 66.5% weighted average Cut–off Date LTV and 58.5% weighted average Maturity Date or ARD LTV. |

| – | DSCR: 1.58x weighted average Debt Service Coverage Ratio, based on Underwritten NOI. 1.48x weighted average Debt Service Coverage Ratio, based on Underwritten NCF. |

| – | Debt Yield: 10.1% weighted average debt yield, based on Underwritten NOI. 9.4% weighted average debt yield, based on Underwritten NCF. |

| – | Credit Support: 30.000% credit support for the Class A–1, Class A–2, Class A–3, Class A–SB, Class A–4 and Class A–5 Certificates in the aggregate, which are each rated Aaa(sf) / AAA(sf) / AAA(sf) by Moody’s/DBRS/KBRA. |

■ | Loan Structural Features: |

| – | Amortization: 92.4% of the Mortgage Loans by Cut–off Date Balance have scheduled amortization: |

■ | 36.4% of the Mortgage Loans by Cut–off Date Balance have amortization for the entire term with a balloon payment due at Maturity or ARD. |

■ | 56.0% of the Mortgage Loans by Cut–off Date Balance have scheduled amortization following a partial interest–only period with a balloon payment due at Maturity or ARD. |

■ | 7.6% of the Mortgage Loans by Cut-off Date Balance are interest-only for the entire term or through the ARD. |

| – | Hard Lockboxes: 65.8% of the Mortgage Loans by Cut–off Date Balance have Hard Lockboxes in place. |

■ | Cash Traps: 91.9% of the Mortgage Loans by Cut–off Date Balance have cash traps triggered by certain declines in net cash flow, all at levels greater than or equal to 1.05x, that fund an excess cash flow reserve. |

| – | Reserves: The Mortgage Loans require amounts to be escrowed for reserves upfront or on an ongoing basis as follows: |

■ | Real Estate Taxes: 51 Mortgage Loans representing 83.3% of the total Cut–off Date Balance. |

■ | Insurance Reserves: 35 Mortgage Loans representing 38.7% of the total Cut–off Date Balance. |

■ | Replacement Reserves (Including FF&E Reserves): 53 Mortgage Loans representing 91.4% of the total Cut–off Date Balance. |

■ | Tenant Improvement / Leasing Commissions: 25 Mortgage Loans representing 80.6% of the total allocated Cut–off Date Balance of office, retail, industrial and mixed use properties only. |

| – | Defeasance: 66.4% of the Mortgage Loans by Cut–off Date Balance permit defeasance only after a lockout period and prior to an open period. |

| – | Yield Maintenance: 24.5% of the Mortgage Loans by Cut–off Date Balance permit prepayment only after a lockout period and prior to an open period with a Yield Maintenance Charge. |

| – | Defeasance or Yield Maintenance: 9.2% of the Mortgage Loans by Cut–off Date Balance permit yield maintenance, then either defeasance or prepayment with a Yield Maintenance Charge, in either case only after a lockout period and prior to an open period. |

■ | Multiple–Asset Types > 5.0% of the Total Pool: |

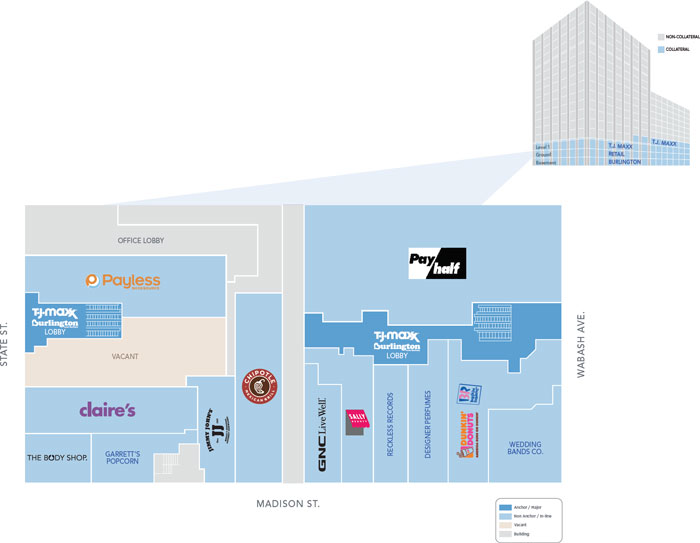

| – | Retail: 25.0% of the Mortgaged Properties by allocated Cut–off Date Balance are retail properties. |

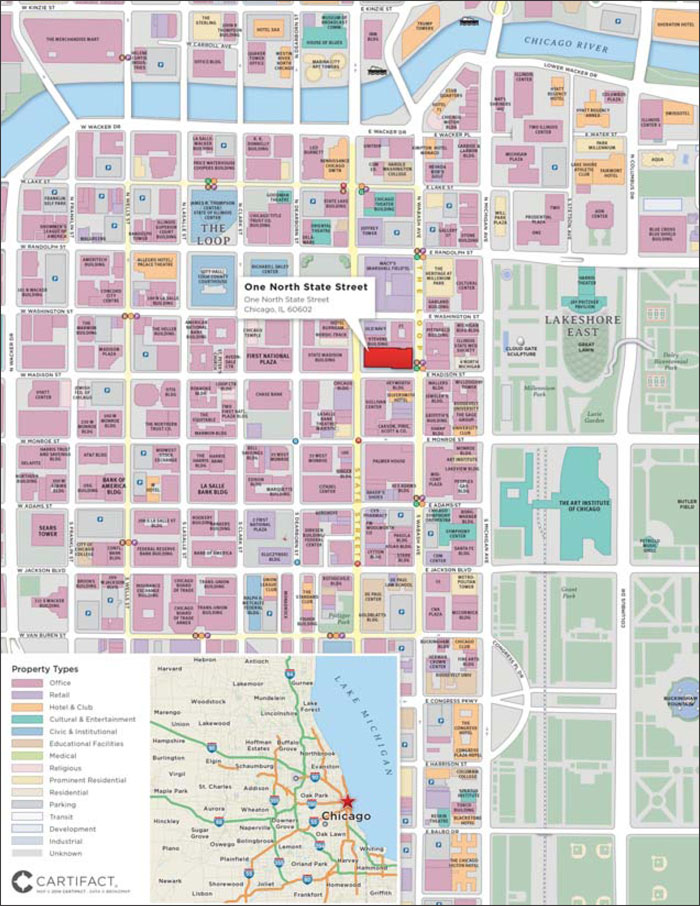

| – | Office: 22.4% of the Mortgaged Properties by allocated Cut–off Date Balance are office properties. |

| – | Multifamily: 12.3% of the Mortgaged Properties by allocated Cut–off Date Balance are multifamily properties. |

| – | Mixed Use: 11.8% of the Mortgaged Properties by allocated Cut–off Date Balance are mixed use properties. |

| – | Hospitality: 11.3% of the Mortgaged Properties by allocated Cut–off Date Balance are hospitality properties. |

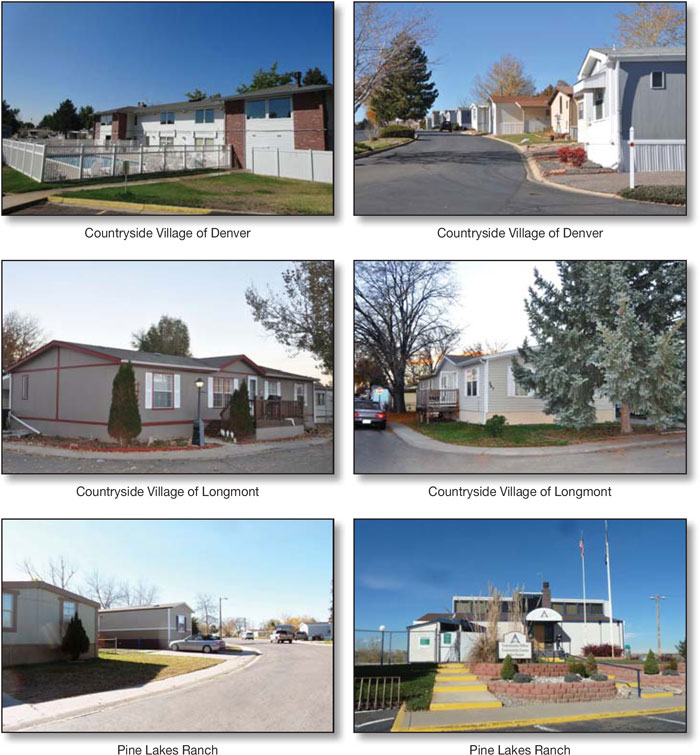

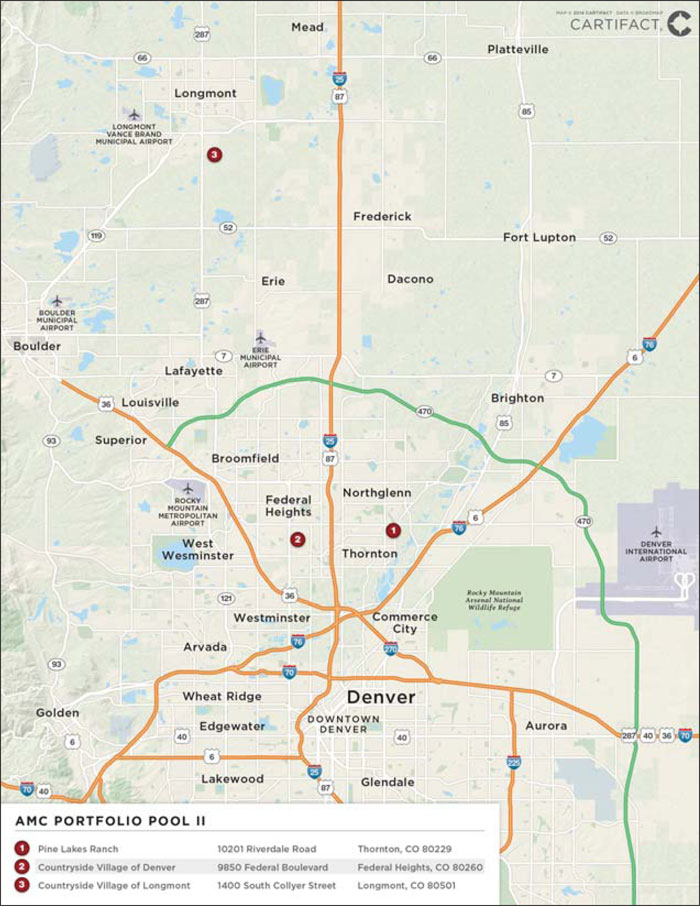

| – | Manufactured Housing Community: 8.6% of the Mortgaged Properties by allocated Cut–off Date Balance are manufactured housing community properties. |

| – | Industrial: 6.0% of the Mortgaged Properties by allocated Cut–off Date Balance are industrial properties. |

■ | Geographic Diversity: The 95 Mortgaged Properties are located throughout 24 states with only two states having at least 10.0% by allocated Cut–off Date Balance: California (18.9%) and Massachusetts (12.3%). |

The depositor has filed a registration statement (including the prospectus) with the SEC (SEC File No. 333-193376) for the offering to which this communication relates. Before you invest, you should read the prospectus in the registration statement and other documents the depositor has filed with the SEC for more complete information about the depositor, the issuing trust and this offering. You may get these documents for free by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, the depositor or Deutsche Bank Securities Inc., any other underwriter, or any dealer participating in this offering will arrange to send you the prospectus if you request it by calling toll-free 1-800-503-4611 or by email to the following address: prospectus.cpdg@db.com. The offered certificates referred to in these materials, and the asset pool backing them, are subject to modification or revision (including the possibility that one or more classes of certificates may be split, combined or eliminated at any time prior to issuance or availability of a final prospectus) and are offered on a “when, as and if issued” basis. You understand that, when you are considering the purchase of these certificates, a contract of sale will come into being no sooner than the date on which the relevant class has been priced and we have verified the allocation of certificates to be made to you; any “indications of interest” expressed by you, and any “soft circles” generated by us, will not create binding contractual obligations for you or us.

6

| COMM 2014-UBS2 Mortgage Trust | |||||

| STRUCTURE OVERVIEW | |||||

| Principal Payments: | Payments in respect of principal of the Certificates will be distributed, first, to the Class A–SB Certificates, until the Certificate Balance of such Class is reduced to the planned principal balance for the related Distribution Date set forth on Annex A–3 to the Free Writing Prospectus, then, to the Class A–1, Class A–2, Class A–3, Class A–4, Class A–5 and Class A–SB Certificates, in that order, until the Certificate Balance of each such Class is reduced to zero, then, to the Class A–M trust component (and correspondingly to the Class A–M Certificates and the Class PEZ Certificates, pro rata, based on their respective percentage interests in the Class A–M trust component) until the principal balance of the Class A–M trust component has been reduced to zero, then, to the Class B trust component (and correspondingly to the Class B Certificates and the Class PEZ Certificates, pro rata, based on their respective percentage interests in the Class B trust component) until the principal balance of the Class B trust component has been reduced to zero, then, to the Class C trust component (and correspondingly to the Class C Certificates and the Class PEZ Certificates, pro rata, based on their respective percentage interests in the Class C trust component), until the principal balance of the Class C trust component has been reduced to zero, and then, to the Class D, Class E, Class F and Class G Certificates, in that order, until the Certificate Balance of each such Class is reduced to zero. Notwithstanding the foregoing, if the total principal balance of the Class A–M trust component, Class B trust component and Class C trust component and the Certificate Balances of the Class D through Class G Certificates have been reduced to zero as a result of loss allocation, payments in respect of principal of the Certificates will be distributed, first, to the Class A–1, Class A–2, Class A–3, Class A–SB, Class A–4 and Class A–5 Certificates, on a pro rata basis, based on the Certificate Balance of each such Class, then, to the extent of any recoveries on realized losses, to the Class A-M trust component (and correspondingly to the Class A–M Certificates and the Class PEZ Certificates, pro rata, based on their respective percentage interests in the Class A–M trust component), then, to the extent of any recoveries on realized losses, to the Class B trust component (and correspondingly to the Class B Certificates and the Class PEZ Certificates, pro rata, based on their respective percentage interests in the Class B trust component), then, to the extent of any recoveries on realized losses, to the Class C trust component (and correspondingly to the Class C Certificates and the Class PEZ Certificates, pro rata, based on their respective percentage interests in the Class C trust component), then, to the extent of any recoveries on realized losses, to the Class D, Class E, Class F and Class G Certificates, in that order, in each case until the Certificate Balance of each such Class or trust component is reduced to zero (or previously allocated realized losses have been fully reimbursed). The Class X–A and Class X–B Certificates will not be entitled to receive distributions of principal; however, (i) the notional amount of the Class X–A Certificates will be reduced by the aggregate amount of principal distributions and realized losses allocated to the Class A–1, Class A–2, Class A–3, Class A–SB, Class A–4, Class A–5 and the Class A–M Certificates (without regard to any exchange of Class A-M, Class B and Class C Certificates for Class PEZ Certificates); and (ii) the notional amount of the Class X–B Certificates will be reduced by the principal distributions and realized losses allocated to the Class B, Class C and Class D Certificates (without regard to any exchange of Class A–M, Class B and Class C Certificates for Class PEZ Certificates. | ||||

| Interest Payments: | On each Distribution Date, interest accrued for each Class of the Certificates or trust component at the applicable pass–through rate will be distributed in the following order of priority, to the extent of available funds: first, to the Class A–1, Class A–2, Class A–3, Class A–SB, Class A–4, Class A–5, Class X–A and Class X–B Certificates, on a pro rata basis, based on the accrued and unpaid interest on each such Class, then, to the Class A–M trust component (and correspondingly to the Class A–M Certificates and the Class PEZ Certificates, pro rata, based on their respective percentage interests of the accrued and unpaid interest on the Class A–M trust component), then, to the Class B trust component (and correspondingly to the Class B Certificates and the Class PEZ Certificates, pro rata, based on their respective percentage interests of the accrued and | ||||

The depositor has filed a registration statement (including the prospectus) with the SEC (SEC File No. 333-193376) for the offering to which this communication relates. Before you invest, you should read the prospectus in the registration statement and other documents the depositor has filed with the SEC for more complete information about the depositor, the issuing trust and this offering. You may get these documents for free by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, the depositor or Deutsche Bank Securities Inc., any other underwriter, or any dealer participating in this offering will arrange to send you the prospectus if you request it by calling toll-free 1-800-503-4611 or by email to the following address: prospectus.cpdg@db.com. The offered certificates referred to in these materials, and the asset pool backing them, are subject to modification or revision (including the possibility that one or more classes of certificates may be split, combined or eliminated at any time prior to issuance or availability of a final prospectus) and are offered on a “when, as and if issued” basis. You understand that, when you are considering the purchase of these certificates, a contract of sale will come into being no sooner than the date on which the relevant class has been priced and we have verified the allocation of certificates to be made to you; any “indications of interest” expressed by you, and any “soft circles” generated by us, will not create binding contractual obligations for you or us.

7

| COMM 2014-UBS2 Mortgage Trust | ||

| STRUCTURE OVERVIEW | ||

unpaid interest on the Class B trust component), then, to the Class C trust component (and correspondingly to the Class C Certificates and the Class PEZ Certificates, pro rata, based on their respective percentage interests of the accrued and unpaid interest on the Class C trust component), and then, to the Class D, Class E, Class F and Class G Certificates, in that order, in each case until the interest payable to each such Class is paid in full. The pass–through rates applicable to the Class A–1, Class A–2, Class A–3, Class A–SB, Class A–4, Class A–5, Class A–M, Class B, Class C, Class D, Class E, Class F and Class G Certificates for each Distribution Date will equal one of: (i) a fixed per annum rate, (ii) the weighted average of the net mortgage rates on the mortgage loans (in each case, adjusted, if necessary, to accrue on the basis of a 360–day year consisting of twelve 30–day months) as of their respective due dates in the month preceding the month in which such distribution date occurs, (iii) a rate equal to the lesser of a specified pass–through rate and the weighted average of the net mortgage rates on the mortgage loans (in each case, adjusted, if necessary, to accrue on the basis of a 360–day year consisting of twelve 30–day months) as of their respective due dates in the month preceding the month in which such distribution date occurs, or (iv) the weighted average of the net mortgage rates on the mortgage loans (in each case, adjusted, if necessary, to accrue on the basis of a 360–day year consisting of twelve 30–day months) as of their respective due dates in the month preceding the month in which such distribution date occurs, less a specified rate. The pass-through rate on the Class A–M, Class B and Class C trust components will at all times be the same as the pass-through rate of the Class A–M, Class B and Class C Certificates. The Class PEZ Certificates will not have a pass-through rate, but will be entitled to receive the sum of interest distributable on the percentage interest of the Class A–M, Class B and Class C trust components represented by the PEZ Certificates. The pass–through rate applicable to the Class X–A and Class X–B Certificates for each Distribution Date will generally be equal to the excess of (i) the weighted average of the net mortgage rates on the mortgage loans (in each case, adjusted, if necessary, to accrue on the basis of a 360–day year consisting of twelve 30–day months), over (ii)(A) with respect to the Class X–A Certificates, the weighted average of the pass–through rates of the Class A–1, Class A–2, Class A–3, Class A–SB, Class A–4, Class A–5 and Class A–M Certificates (based on their Certificate Balances and without regard to any exchange of Class A–M, Class B and Class C Certificates for Class PEZ Certificates), as further described in the Free Writing Prospectus and (B) with respect to the Class X–B Certificates, the weighted average of the pass–through rates of the Class B, Class C and Class D Certificates (based on their Certificate Balances and without regard to any exchange of Class A–M, Class B and Class C Certificates for Class PEZ Certificates), as further described in the Free Writing Prospectus. | ||

| Prepayment Interest Shortfalls: | Net prepayment interest shortfalls will be allocated pro rata based on interest entitlements, in reduction of the interest otherwise payable with respect to each of the interest–bearing certificate classes. | |

| Loss Allocation: | Losses will be allocated to each Class of Certificates in reverse alphabetical order starting with Class G through and including Class D, then, to the Class C trust component (and correspondingly to the Class C Certificates and the Class PEZ Certificates, pro rata, based on their respective percentage interests in the Class C trust component), then, to the Class B trust component (and correspondingly to the Class B Certificates and the Class PEZ Certificates, pro rata, based on their respective percentage interests in the Class B trust component), then, to the Class A–M trust component (and correspondingly to the Class A–M Certificates and the Class PEZ Certificates, pro rata, based on their respective percentage interests in the Class A–M trust component), and then to Class A–1, Class A–2, Class A–3, Class A–SB, Class A–4 and Class A–5 Certificates on a pro rata basis based on the Certificate Balance of each such class. The notional amount of | |

The depositor has filed a registration statement (including the prospectus) with the SEC (SEC File No. 333-193376) for the offering to which this communication relates. Before you invest, you should read the prospectus in the registration statement and other documents the depositor has filed with the SEC for more complete information about the depositor, the issuing trust and this offering. You may get these documents for free by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, the depositor or Deutsche Bank Securities Inc., any other underwriter, or any dealer participating in this offering will arrange to send you the prospectus if you request it by calling toll-free 1-800-503-4611 or by email to the following address: prospectus.cpdg@db.com. The offered certificates referred to in these materials, and the asset pool backing them, are subject to modification or revision (including the possibility that one or more classes of certificates may be split, combined or eliminated at any time prior to issuance or availability of a final prospectus) and are offered on a “when, as and if issued” basis. You understand that, when you are considering the purchase of these certificates, a contract of sale will come into being no sooner than the date on which the relevant class has been priced and we have verified the allocation of certificates to be made to you; any “indications of interest” expressed by you, and any “soft circles” generated by us, will not create binding contractual obligations for you or us.

8

| COMM 2014-UBS2 Mortgage Trust | |||||

| STRUCTURE OVERVIEW | |||||

either Class of Class X Certificates will be reduced by the aggregate amount of realized losses allocated to Certificates and trust components that are components of the notional amount of such Class of Class X Certificates. | |||||

Prepayment Premiums: | A percentage of all prepayment premiums (either fixed prepayment premiums or yield maintenance amounts) collected will be allocated to each of the Class A–1, Class A–2, Class A–3, Class A–SB, Class A–4, Class A–5 and Class D Certificates and the Class A–M, Class B and Class C trust components (the “YM P&I Certificates”) then entitled to principal distributions, which percentage will be equal to the product of (a) a fraction, not greater than one, the numerator of which is the amount of principal distributed to such Class or trust component on such Distribution Date and the denominator of which is the total amount of principal distributed to the holders of the Class A–1, Class A–2, Class A–3, Class A–SB, Class A–4, Class A–5 and Class D Certificates and the Class A–M, Class B and Class C trust components on such Distribution Date, and (b) a fraction (expressed as a percentage which can be no greater than 100% nor less than 0%), the numerator of which is the excess of the pass–through rate of each such Class of Certificates or trust component currently receiving principal over the relevant Discount Rate, and the denominator of which is the excess of the Mortgage Rate of the related Mortgage Loan over the relevant Discount Rate. | ||||

| Prepayment Premium Allocation Percentage for all YM P&I Certificates = | |||||

| (Pass–Through Rate – Discount Rate) | The percentage of the principal distribution amount to such Class or trust component as described in (a) above | ||||

| (Mortgage Rate – Discount Rate) | X | ||||

The remaining percentage of the prepayment premiums will be allocated to the Class X Certificates in the manner described in the Free Writing Prospectus. In general, this formula provides for an increase in the percentage of prepayment premiums allocated to the YM P&I Certificates then entitled to principal distributions relative to the Class X Certificates as Discount Rates decrease and a decrease in the percentage allocated to such Classes as Discount Rates rise. All prepayment premiums (either fixed prepayment premiums or yield maintenance amounts) allocated in respect of (i) the Class A–M trust component as described above will be allocated between the Class A–M Certificates and the Class PEZ Certificates, pro rata, based on their respective percentage interests in the Class A–M trust component, (ii) the Class B trust component as described above will be allocated between the Class B Certificates and the Class PEZ Certificates, pro rata, based on their respective percentage interests in the Class B trust component, and (iii) the Class C trust component as described above will be allocated between the Class C Certificates and the Class PEZ Certificates, pro rata, based on their respective percentage interests in the Class C trust component. | |||||

The depositor has filed a registration statement (including the prospectus) with the SEC (SEC File No. 333-193376) for the offering to which this communication relates. Before you invest, you should read the prospectus in the registration statement and other documents the depositor has filed with the SEC for more complete information about the depositor, the issuing trust and this offering. You may get these documents for free by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, the depositor or Deutsche Bank Securities Inc., any other underwriter, or any dealer participating in this offering will arrange to send you the prospectus if you request it by calling toll-free 1-800-503-4611 or by email to the following address: prospectus.cpdg@db.com. The offered certificates referred to in these materials, and the asset pool backing them, are subject to modification or revision (including the possibility that one or more classes of certificates may be split, combined or eliminated at any time prior to issuance or availability of a final prospectus) and are offered on a “when, as and if issued” basis. You understand that, when you are considering the purchase of these certificates, a contract of sale will come into being no sooner than the date on which the relevant class has been priced and we have verified the allocation of certificates to be made to you; any “indications of interest” expressed by you, and any “soft circles” generated by us, will not create binding contractual obligations for you or us.

9

| COMM 2014-UBS2 Mortgage Trust | ||

| STRUCTURE OVERVIEW | ||

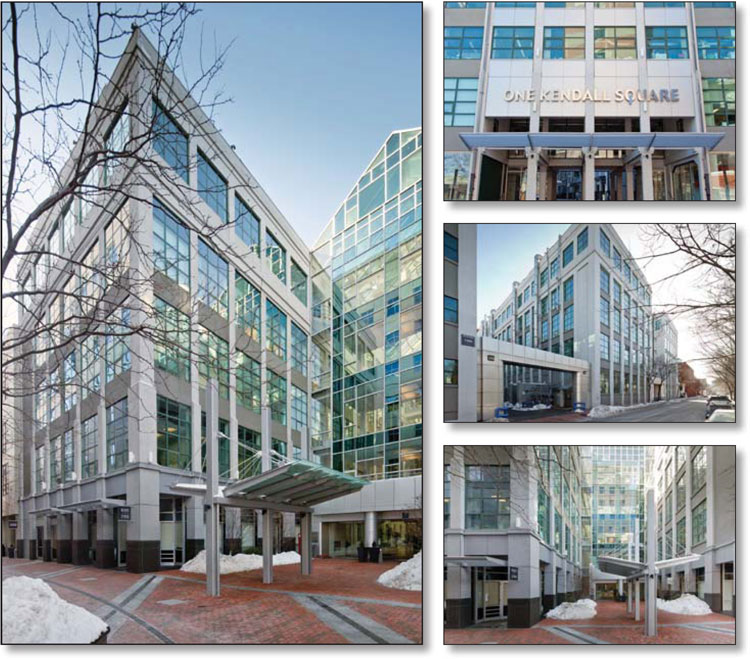

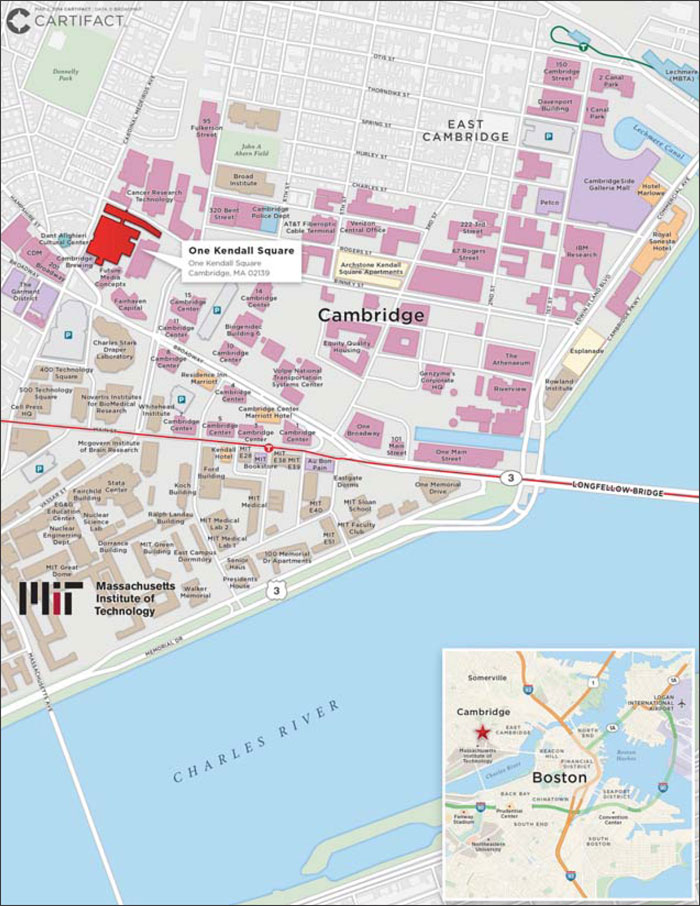

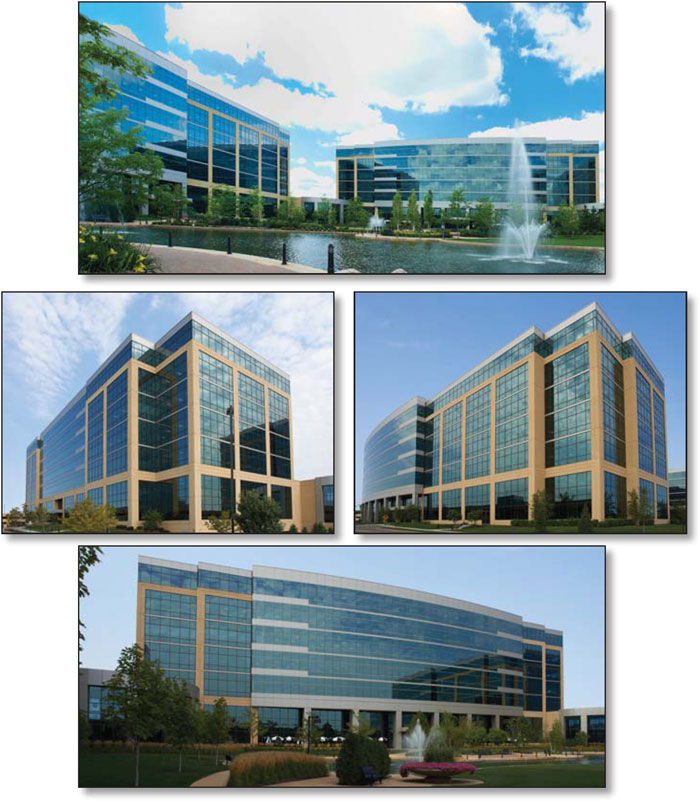

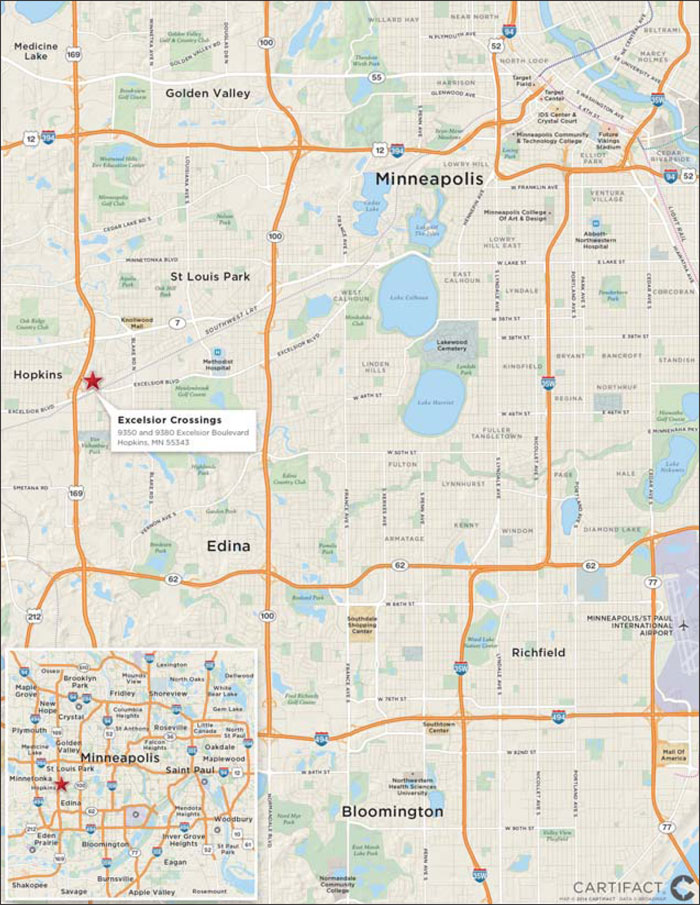

| Loan Combinations: | The portfolio of Mortgaged Properties identified on Annex A–1 to the Free Writing Prospectus as Google and Amazon Office Portfolio secures a Mortgage Loan with an outstanding principal balance as of the Cut–off Date of $120,000,000, evidenced by Note A-3 (the “Google and Amazon Office Portfolio Loan”), representing approximately 9.7% of the Initial Outstanding Pool Balance, and also secures on a pari passu basis three companion loans that have an aggregate outstanding principal balance as of the Cut-off Date of $332,200,000, evidenced by Note A-1, Note A-2 and Note A-4. Note A-1 has a principal balance as of the Cut-off Date of $155,000,000 and is currently included in the COMM 2014-CCRE14 Mortgage Trust securitization. Note A-2 has a principal balance as of the Cut-off Date of $110,000,000 and is currently included in the COMM 2014-CCRE15 Mortgage Trust securitization. Note A-4, which has a principal balance as of the Cut-off Date of $67,200,000, is currently held by GACC and may be sold or further divided at any time (subject to compliance with the terms of the related intercreditor agreement). The Google and Amazon Office Portfolio Loan and related companion loans are pari passu in right of payment and are collectively referred to herein as the “Google and Amazon Office Portfolio Loan Combination.” The Google and Amazon Office Portfolio Loan Combination will be serviced pursuant to the COMM 2014-CCRE14 pooling and servicing agreement and the related intercreditor agreement. For additional information regarding the Google and Amazon Office Portfolio Loan Combination, see “Description of the Mortgage Pool—Loan Combinations—The Google and Amazon Office Portfolio Loan Combination” in the Free Writing Prospectus. The Mortgaged Property identified on Annex A–1 to the Free Writing Prospectus as One Kendall Square secures a Mortgage Loan with an outstanding principal balance as of the Cut–off Date of $120,000,000, evidenced by Note A-1 (the “One Kendall Square Loan”), representing approximately 9.7% of the Initial Outstanding Pool Balance, and also secures on a pari passu basis a companion loan that has an outstanding principal balance as of the Cut-off Date of $83,000,000, evidenced by Note A-2, which is currently held by GACC and may be sold or further divided at any time (subject to compliance with the terms of the related intercreditor agreement). The One Kendall Square Loan and related companion loan are pari passu in right of payment and are collectively referred to herein as the “One Kendall Square Loan Combination.” The One Kendall Square Loan Combination will be serviced pursuant to the pooling and servicing agreement related to this transaction (the “Pooling and Servicing Agreement”) and the related intercreditor agreement. For additional information regarding the One Kendall Square Loan Combination, see “Description of the Mortgage Pool—Loan Combinations—The One Kendall Square Loan Combination” in the Free Writing Prospectus. | |

| Control Rights: | Certain Classes of Certificates (the “Control Eligible Certificates”) will have certain control rights over servicing matters with respect to each Mortgage Loan (other than with respect to the Google and Amazon Office Portfolio Loan Combination) and the One Kendall Square Loan Combination. The majority owner or appointed representative of the Class of Control Eligible Certificates that is the Controlling Class (such owner or representative, the “Directing Holder”), will be entitled to direct the Special Servicer to take, or refrain from taking certain actions with respect to a Mortgage Loan. Furthermore, the Directing Holder will also have the right to receive notice and consent to certain material actions that the Master Servicer and the Special Servicer proposes to take with respect to such Mortgage Loan. For a description of the directing holder for the Google and Amazon Office Portfolio Loan Combination, which are each referred to herein as a “Loan Combination Directing Holder”, see “Description of the Mortgage Pool—Loan Combinations” and “Description of the Pooling and Servicing Agreement—The Directing Holder” in the Free Writing Prospectus. | |

The depositor has filed a registration statement (including the prospectus) with the SEC (SEC File No. 333-193376) for the offering to which this communication relates. Before you invest, you should read the prospectus in the registration statement and other documents the depositor has filed with the SEC for more complete information about the depositor, the issuing trust and this offering. You may get these documents for free by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, the depositor or Deutsche Bank Securities Inc., any other underwriter, or any dealer participating in this offering will arrange to send you the prospectus if you request it by calling toll-free 1-800-503-4611 or by email to the following address: prospectus.cpdg@db.com. The offered certificates referred to in these materials, and the asset pool backing them, are subject to modification or revision (including the possibility that one or more classes of certificates may be split, combined or eliminated at any time prior to issuance or availability of a final prospectus) and are offered on a “when, as and if issued” basis. You understand that, when you are considering the purchase of these certificates, a contract of sale will come into being no sooner than the date on which the relevant class has been priced and we have verified the allocation of certificates to be made to you; any “indications of interest” expressed by you, and any “soft circles” generated by us, will not create binding contractual obligations for you or us.

10

| COMM 2014-UBS2 Mortgage Trust | ||

| STRUCTURE OVERVIEW | ||

| Control Eligible Certificates: | Class E, Class F and Class G Certificates. | |

Controlling Class: | The Controlling Class will be the most subordinate Class of Control Eligible Certificates then outstanding that has an aggregate Certificate Balance, as notionally reduced by any Appraisal Reduction Amounts allocable to such Class, equal to no less than 25% of the initial Certificate Balance of such Class. The Controlling Class as of the Settlement Date will be the Class G Certificates. The holder of the control rights with respect to the Google and Amazon Office Portfolio Loan Combination will be the related Loan Combination Directing Holder. | |

| Appraised–Out Class: | Any Class of Control Eligible Certificates that has been determined, as a result of Appraisal Reductions Amounts allocable to such Class, to no longer be the Controlling Class. | |

Remedies Available to Holders of an Appraised–Out Class: | Holders of the majority of any Class of Control Eligible Certificates that is determined at any time of determination to no longer be the Controlling Class as a result of an allocation of an Appraisal Reduction Amounts in respect of such Class will have the right, at their sole expense, to require the Special Servicer to order a second appraisal for any Mortgage Loan for which an Appraisal Reduction Event has occurred. Upon receipt of the second appraisal, the Special Servicer will be required to determine, in accordance with the Servicing Standard, whether, based on its assessment of the second appraisal, a recalculation of the Appraisal Reduction Amount is warranted. If warranted, the Special Servicer will direct the Master Servicer to recalculate the Appraisal Reduction Amount based on the second appraisal, and if required by such recalculation, the Special Servicer will reinstate the Appraised–Out Class as the Controlling Class. The Holders of an Appraised–Out Class requesting a second appraisal will not be entitled to exercise any rights of the Controlling Class until such time, if any, as the Class is reinstated as the Controlling Class. | |

| Directing Holder: | It is anticipated that (i) affiliates of AllianceBernstein L.P. will purchase no less than the majority of Class E, Class F, Class G and Class V certificates, (ii) affiliates of Raith Capital Management, LLC will purchase the minority of Class E, Class F, Class G and Class V certificates and (iii) an affiliate of Raith Capital Management, LLC will be the initial Directing Holder with respect to each Mortgage Loan (other than the Google and Amazon Office Portfolio Loan Combination) and the One Kendall Square Loan Combination. See “Description of the Mortgage Pool—Loan Combinations” and “Description of the Pooling and Servicing Agreement—The Directing Holder” in the Free Writing Prospectus for a description of the Loan Combination Directing Holder for the Google and Amazon Office Portfolio Loan Combination. | |

| Control Termination Event: | Will occur when no Class of Control Eligible Certificates has a Certificate Balance (as notionally or actually reduced by any Appraisal Reduction Amounts and Realized Losses) equal to or greater than 25% of the Certificate Balance as of the Settlement Date. Upon the occurrence and the continuance of a Control Termination Event, the Controlling Class will no longer have any Control Rights. The Directing Holder will no longer have the right to direct certain actions of the Special Servicer and will no longer have consent rights with respect to certain material actions that the Master Servicer or Special Servicer proposes to take with respect to a Mortgage Loan. | |

The depositor has filed a registration statement (including the prospectus) with the SEC (SEC File No. 333-193376) for the offering to which this communication relates. Before you invest, you should read the prospectus in the registration statement and other documents the depositor has filed with the SEC for more complete information about the depositor, the issuing trust and this offering. You may get these documents for free by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, the depositor or Deutsche Bank Securities Inc., any other underwriter, or any dealer participating in this offering will arrange to send you the prospectus if you request it by calling toll-free 1-800-503-4611 or by email to the following address: prospectus.cpdg@db.com. The offered certificates referred to in these materials, and the asset pool backing them, are subject to modification or revision (including the possibility that one or more classes of certificates may be split, combined or eliminated at any time prior to issuance or availability of a final prospectus) and are offered on a “when, as and if issued” basis. You understand that, when you are considering the purchase of these certificates, a contract of sale will come into being no sooner than the date on which the relevant class has been priced and we have verified the allocation of certificates to be made to you; any “indications of interest” expressed by you, and any “soft circles” generated by us, will not create binding contractual obligations for you or us.

11

| COMM 2014-UBS2 Mortgage Trust | ||

| STRUCTURE OVERVIEW | ||

Upon the occurrence and continuation of a Control Termination Event, the Directing Holder (i.e., the majority owner or representative of the senior most Class of Control Eligible Certificates) will retain non–binding consultation rights with respect to certain material actions that the Special Servicer proposes to take with respect to a Mortgage Loan. Such consultation rights will continue until the occurrence of a Consultation Termination Event. | ||

| Consultation Termination Event: | Will occur when, without giving regard to the application of any Appraisal Reduction Amounts (i.e., giving effect to principal reduction through Realized Losses only), there is no Class of Control Eligible Certificates that has an aggregate Certificate Balance equal to 25% or more of the initial Certificate Balance of such Class. Upon the occurrence and continuance of a Consultation Termination Event, the Directing Holder will have no rights under the Pooling and Servicing Agreement other than those rights that all Certificateholders have. | |

Appointment and Replacement of Special Servicer: | The Directing Holder will appoint the initial Special Servicer as of the Settlement Date. Prior to the occurrence and continuance of a Control Termination Event, the Special Servicer (other than with respect to the Google and Amazon Office Portfolio Loan Combination) may generally be replaced at any time by the Directing Holder. Upon the occurrence and during the continuance of a Control Termination Event, the Directing Holder will no longer have the right to replace the Special Servicer and such replacement (other than with respect to the Google and Amazon Office Portfolio Loan Combination) will occur based on a vote of holders of all voting eligible Classes of Certificates as described below. See “Description of the Mortgage Pool—Loan Combinations” and “Description of the Pooling and Servicing Agreement” in the Free Writing Prospectus for a description of the special servicer appointment and replacement rights with respect to the Google and Amazon Office Portfolio Loan Combination. | |

Replacement of Special Servicer by Vote of Certificateholders: | Other than with respect to the Google and Amazon Office Portfolio Loan Combination, if a Control Termination Event has occurred and is continuing, upon (i) the written direction of holders of Certificates evidencing not less than 25% of the voting rights of all Classes of Certificates entitled to principal (taking into account the application of Appraisal Reduction Amounts to notionally reduce the Certificate Balances of Classes to which such Appraisal Reduction Amounts are allocable) requesting a vote to replace the Special Servicer with a replacement Special Servicer, (ii) payment by such requesting holders to the Certificate Administrator of all reasonable fees and expenses to be incurred by the Certificate Administrator in connection with administering such vote and (iii) delivery by such holders to the Certificate Administrator of written confirmations from each Rating Agency that the appointment of the replacement Special Servicer will not result in a downgrade of the Certificates, the Certificate Administrator will be required to promptly provide written notice to all certificateholders of such request and conduct the solicitation of votes of all Certificates in such regard. Upon the written direction (within 180 days) of (i) Holders of at least 75% of a Certificateholder Quorom or (ii) the Holders of more than 50% of the voting rights of each Class of Non–Reduced Certificates, the Trustee will immediately replace the Special Servicer (other than with respect to the Google and Amazon Office Portfolio Loan Combination) with the replacement Special Servicer. “Certificateholder Quorum” means, in connection with any solicitation of votes in connection with the replacement of the Special Servicer as described above, the holders of Certificates evidencing at least 75% of the aggregate voting rights (taking into account Realized Losses and the application of any Appraisal Reduction Amounts to notionally | |

The depositor has filed a registration statement (including the prospectus) with the SEC (SEC File No. 333-193376) for the offering to which this communication relates. Before you invest, you should read the prospectus in the registration statement and other documents the depositor has filed with the SEC for more complete information about the depositor, the issuing trust and this offering. You may get these documents for free by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, the depositor or Deutsche Bank Securities Inc., any other underwriter, or any dealer participating in this offering will arrange to send you the prospectus if you request it by calling toll-free 1-800-503-4611 or by email to the following address: prospectus.cpdg@db.com. The offered certificates referred to in these materials, and the asset pool backing them, are subject to modification or revision (including the possibility that one or more classes of certificates may be split, combined or eliminated at any time prior to issuance or availability of a final prospectus) and are offered on a “when, as and if issued” basis. You understand that, when you are considering the purchase of these certificates, a contract of sale will come into being no sooner than the date on which the relevant class has been priced and we have verified the allocation of certificates to be made to you; any “indications of interest” expressed by you, and any “soft circles” generated by us, will not create binding contractual obligations for you or us.

12

| COMM 2014-UBS2 Mortgage Trust | ||

| STRUCTURE OVERVIEW | ||

reduce the Certificate Balance of the Certificates) of all classes of Certificates entitled to principal, on an aggregate basis. In addition, after the occurrence of a Consultation Termination Event, if the Operating Advisor determines that the Special Servicer is not performing its duties in accordance with the Servicing Standard, the Operating Advisor will have the right to recommend the replacement of the Special Servicer (other than with respect to the Google and Amazon Office Portfolio Loan Combination). The Operating Advisor’s recommendation to replace the Special Servicer (other than with respect to the Google and Amazon Office Portfolio Loan Combination) must be confirmed by a majority of the voting rights of all Classes of Certificates entitled to principal (taking into account the application of Appraisal Reduction Amounts to notionally reduce the Certificate Balances of Classes to which such Appraisal Reduction Amounts are allocable) within 180 days from the time such recommendation is posted to the Certificate Administrator website and is subject to the receipt of written confirmations from each Rating Agency that the appointment of the replacement Special Servicer will not result in a downgrade of the Certificates. See “Description of the Mortgage Pool—Loan Combinations” and “Description of the Pooling and Servicing Agreement” in the Free Writing Prospectus for a description of the special servicer appointment and replacement rights with respect to the Google and Amazon Office Portfolio Loan Combination. | ||

Cap on Workout and Liquidation Fees: | The workout fees and liquidation fees payable to a Special Servicer under the Pooling and Servicing Agreement will be an amount equal to the lesser of: (1) 1.0% of each collection of interest and principal following a workout or liquidation and (2) $1,000,000 per workout or liquidation. All Modification Fees actually paid to the Special Servicer in connection with a workout or liquidation or in connection with any prior workout or partial liquidation that occurred within the prior 18 months will be deducted from the total workout and/or liquidation fees payable (other than Modification Fees earned while the Mortgage Loan was not in special servicing). In addition, the total amount of workout and liquidation fees actually payable by the Trust under the Pooling and Servicing Agreement will be capped in the aggregate at $1,000,000 for each Mortgage Loan. If a new special servicer begins servicing the Mortgage Loan, all amounts paid to the prior special servicer will be disregarded for purposes of calculating the cap. | |

| Special Servicer Compensation: | The special servicing fee will equal 0.25% per annum of the stated principal balance of the related specially serviced loan or REO property. The Special Servicer and its affiliates will be prohibited from receiving or retaining any compensation or any other remuneration under the Pooling and Servicing Agreement (including in the form of commissions, brokerage fees, rebates, or as a result of any other fee–sharing arrangement) from any person (including the issuing entity, any borrower, any manager, any guarantor or indemnitor in respect of a Mortgage Loan or Serviced Loan Combination, if any, and any purchaser of any Mortgage Loan, Serviced Companion Loan or REO Property) in connection with the disposition, workout or foreclosure of any Mortgage Loan or Serviced Loan Combination, the management or disposition of any REO Property, or the performance of any other special servicing duties under the Pooling and Servicing Agreement, other than as expressly permitted in the Pooling and Servicing Agreement and other than commercially reasonable treasury management fees, banking fees and insurance commissions or fees received or retained by the Special Servicer or any of its Affiliates in connection with any services performed by such party with respect to any mortgage loan. Subject to certain limited exceptions, the Special Servicer will also be required to report any compensation or other remuneration the Special Servicer or its affiliates have received from any person and such information will be disclosed in the Certificateholders’ monthly distribution date statement. | |

| Operating Advisor: | With respect to the Mortgage Loans (other than with respect to the Google and Amazon Office Portfolio Loan Combination) and prior to the occurrence of a Control Termination | |

The depositor has filed a registration statement (including the prospectus) with the SEC (SEC File No. 333-193376) for the offering to which this communication relates. Before you invest, you should read the prospectus in the registration statement and other documents the depositor has filed with the SEC for more complete information about the depositor, the issuing trust and this offering. You may get these documents for free by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, the depositor or Deutsche Bank Securities Inc., any other underwriter, or any dealer participating in this offering will arrange to send you the prospectus if you request it by calling toll-free 1-800-503-4611 or by email to the following address: prospectus.cpdg@db.com. The offered certificates referred to in these materials, and the asset pool backing them, are subject to modification or revision (including the possibility that one or more classes of certificates may be split, combined or eliminated at any time prior to issuance or availability of a final prospectus) and are offered on a “when, as and if issued” basis. You understand that, when you are considering the purchase of these certificates, a contract of sale will come into being no sooner than the date on which the relevant class has been priced and we have verified the allocation of certificates to be made to you; any “indications of interest” expressed by you, and any “soft circles” generated by us, will not create binding contractual obligations for you or us.

13

| COMM 2014-UBS2 Mortgage Trust | ||

| STRUCTURE OVERVIEW | ||

Event, the Operating Advisor will have access to any final asset status report and all information available with respect to the transaction on the Certificate Administrator’s website but will not have any approval or consultation rights. After the occurrence and during the continuance of a Control Termination Event, the Operating Advisor will have consultation rights with respect to certain major decisions and will have additional monitoring responsibilities on behalf of the entire trust. The Operating Advisor will be subject to termination if holders of at least 15% of the aggregate voting rights of the Certificates (in connection with termination and replacement relating to the Mortgage Loans) vote to terminate and replace the Operating Advisor and such vote is approved by holders of more than 50% of the applicable voting rights that exercise their right to vote, provided that holders of at least 50% of the applicable voting rights have exercised their right to vote. The holders initiating such vote will be responsible for the fees and expenses in connection with the vote and replacement. The Operating Advisor will not have consultation rights in respect of the Google and Amazon Office Portfolio Loan Combination. | ||

Liquidated Loan Waterfall: | On liquidation of any Mortgage Loan, all net liquidation proceeds will be applied so that amounts allocated as a recovery of accrued and unpaid interest will not, in the first instance, include any amount by which the interest portion of P&I Advances previously made was reduced as a result of Appraisal Reduction Amounts. After the adjusted interest amount is so allocated, any remaining net liquidation proceeds will be allocated to pay principal on the Mortgage Loan until the unpaid principal amount of the Mortgage Loan has been reduced to zero. Any remaining liquidation proceeds would then be allocated as a recovery of accrued and unpaid interest corresponding to the amount by which the interest portion of P&I Advances previously made was reduced as a result of Appraisal Reduction Amounts. | |

The depositor has filed a registration statement (including the prospectus) with the SEC (SEC File No. 333-193376) for the offering to which this communication relates. Before you invest, you should read the prospectus in the registration statement and other documents the depositor has filed with the SEC for more complete information about the depositor, the issuing trust and this offering. You may get these documents for free by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, the depositor or Deutsche Bank Securities Inc., any other underwriter, or any dealer participating in this offering will arrange to send you the prospectus if you request it by calling toll-free 1-800-503-4611 or by email to the following address: prospectus.cpdg@db.com. The offered certificates referred to in these materials, and the asset pool backing them, are subject to modification or revision (including the possibility that one or more classes of certificates may be split, combined or eliminated at any time prior to issuance or availability of a final prospectus) and are offered on a “when, as and if issued” basis. You understand that, when you are considering the purchase of these certificates, a contract of sale will come into being no sooner than the date on which the relevant class has been priced and we have verified the allocation of certificates to be made to you; any “indications of interest” expressed by you, and any “soft circles” generated by us, will not create binding contractual obligations for you or us.

14

COMM 2014-UBS2 Mortgage Trust

| OVERVIEW OF MORTGAGE POOL CHARACTERISTICS |

Distribution of Cut–off Date Balances(1) |

| % of Initial Outstanding Pool Balance | Weighted Averages | |||||||||||||||

| Range of Cut–off Date Balances | Number of Mortgage Loans | Aggregate Cut–off Date Balance | Mortgage Rate | Stated Remaining Term (Mos.)(2) | U/W NCF DSCR | Cut–off Date LTV Ratio(3) | LTV Ratio at Maturity or ARD(3) | |||||||||

| $2,850,000 | - | $9,999,999 | 27 | $149,411,622 | 12.1% | 5.1722% | 110 | 1.53x | 67.1% | 56.6% | ||||||

| $10,000,000 | - | $24,999,999 | 17 | $222,672,757 | 18.0% | 5.0327% | 113 | 1.52x | 68.4% | 58.5% | ||||||

| $25,000,000 | - | $49,999,999 | 8 | $273,039,006 | 22.1% | 5.1011% | 111 | 1.48x | 68.6% | 61.4% | ||||||

| $50,000,000 | - | $59,999,999 | 2 | $109,907,080 | 8.9% | 4.9730% | 92 | 1.57x | 62.4% | 56.3% | ||||||

| $60,000,000 | - | $120,000,000 | 5 | $480,714,937 | 38.9% | 4.9648% | 118 | 1.44x | 65.2% | 57.9% | ||||||

| Total/Weighted Average | 59 | $1,235,745,402 | 100.0% | 5.0329% | 112 | 1.48x | 66.5% | 58.5% | ||||||||

Distribution of Mortgage Rates(1) |

| % of Initial Outstanding Pool Balance | Weighted Averages | |||||||||||||||

| Range of Mortgage Rates | Number of Mortgage Loans | Aggregate Cut–off Date Balance | Mortgage Rate | Stated Remaining Term (Mos.)(2) | U/W NCF DSCR | Cut–off Date LTV Ratio(3) | LTV Ratio at Maturity or ARD(3) | |||||||||

| 4.2750% | - | 4.7499% | 2 | $71,110,645 | 5.8% | 4.5488% | 109 | 1.42x | 60.7% | 50.4% | ||||||

| 4.7500% | - | 4.9999% | 18 | $546,630,407 | 44.2% | 4.8752% | 116 | 1.46x | 66.6% | 59.7% | ||||||

| 5.0000% | - | 5.2499% | 21 | $350,976,342 | 28.4% | 5.0578% | 113 | 1.45x | 67.7% | 59.6% | ||||||

| 5.2500% | - | 5.7990% | 18 | $267,028,008 | 21.6% | 5.4521% | 106 | 1.60x | 66.2% | 56.7% | ||||||

| Total/Weighted Average | 59 | $1,235,745,402 | 100.0% | 5.0329% | 112 | 1.48x | 66.5% | 58.5% | ||||||||

Property Type Distribution(1)(4) |

| Weighted Averages | ||||||||||||||||||||

| Property Type | Number of Mortgaged Properties | Aggregate Cut–off Date Balance | % of Initial Outstanding Pool Balance | Number of Units, Rooms, Beds, Pads or NRA | Cut–off Date Balance per Unit/Room/Bed Pad/NRA | Mortgage Rate | Stated Remaining Term (Mos.)(2) | Occupancy | U/W NCF DSCR | Cut–off Date LTV Ratio(3) | LTV Ratio at Maturity or ARD(3) | |||||||||

| Retail | 26 | $308,965,807 | 25.0% | 2,575,735 | $221 | 4.8765% | 108 | 94.8% | 1.46x | 67.0% | 57.6% | |||||||||

Anchored(5) | 24 | $298,585,529 | 24.2% | 2,422,574 | $226 | 4.8641% | 107 | 95.2% | 1.45x | 67.1% | 57.8% | |||||||||

| Unanchored | 2 | $10,380,278 | 0.8% | 153,161 | $73 | 5.2341% | 119 | 82.5% | 1.78x | 63.5% | 52.7% | |||||||||

| Office | 7 | $277,200,000 | 22.4% | 2,233,853 | $269 | 4.9577% | 118 | 99.5% | 1.56x | 65.7% | 59.2% | |||||||||

| Suburban | 5 | $238,100,000 | 19.3% | 1,792,201 | $297 | 4.9650% | 118 | 100.0% | 1.48x | 65.2% | 58.1% | |||||||||

| CBD | 1 | $31,200,000 | 2.5% | 390,479 | $80 | 4.9020% | 118 | 96.3% | 2.28x | 68.3% | 68.3% | |||||||||

| Medical | 1 | $7,900,000 | 0.6% | 51,173 | $154 | 4.9590% | 119 | 96.2% | 1.29x | 69.2% | 58.3% | |||||||||

| Multifamily | 33 | $152,092,797 | 12.3% | 3,125 | $159,913 | 5.2532% | 115 | 95.7% | 1.38x | 67.7% | 59.6% | |||||||||

| Garden | 26 | $61,449,321 | 5.0% | 1,994 | $38,633 | 5.1458% | 109 | 93.7% | 1.59x | 67.0% | 59.0% | |||||||||

| Mid Rise | 5 | $57,218,309 | 4.6% | 258 | $360,783 | 5.0497% | 119 | 98.2% | 1.23x | 66.7% | 60.2% | |||||||||

| Student Housing | 2 | $33,425,167 | 2.7% | 873 | $39,020 | 5.7990% | 118 | 95.2% | 1.27x | 70.8% | 59.8% | |||||||||

| Mixed Use | 2 | $145,265,615 | 11.8% | 801,696 | $298 | 4.9291% | 119 | 93.7% | 1.35x | 64.5% | 57.3% | |||||||||

| Office/Lab/Retail | 1 | $120,000,000 | 9.7% | 610,110 | $333 | 4.8200% | 119 | 93.2% | 1.34x | 62.3% | 56.2% | |||||||||

| Office/Retail/Multifamily | 1 | $25,265,615 | 2.0% | 191,586 | $132 | 5.4475% | 117 | 96.5% | 1.42x | 74.8% | 62.5% | |||||||||

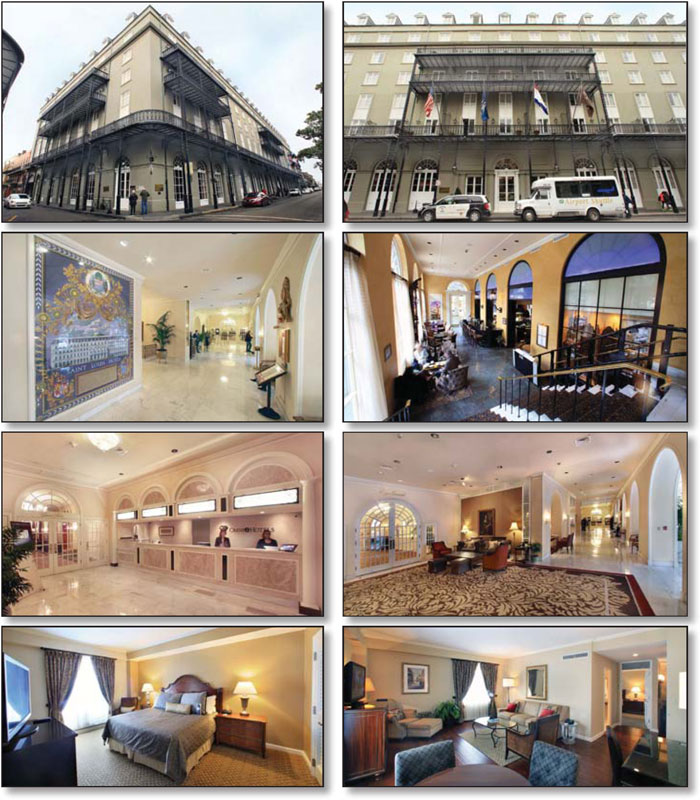

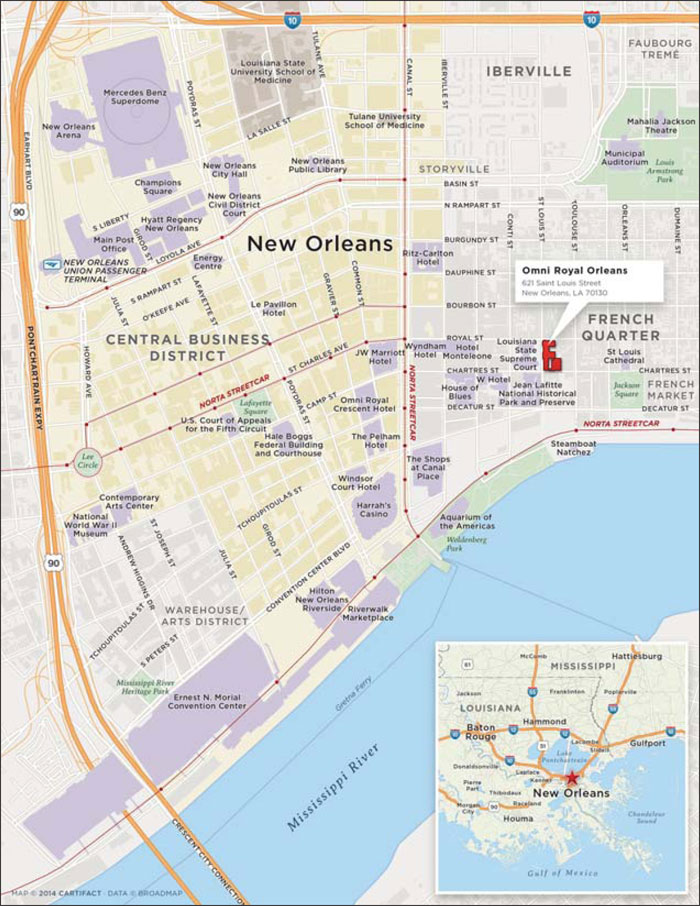

| Hospitality | 5 | $139,414,675 | 11.3% | 963 | $153,971 | 5.3797% | 97 | 77.5% | 1.77x | 62.8% | 55.4% | |||||||||

| Full Service | 2 | $114,907,463 | 9.3% | 720 | $164,291 | 5.3782% | 93 | 78.6% | 1.80x | 62.1% | 56.5% | |||||||||

| Limited Service | 3 | $24,507,212 | 2.0% | 243 | $105,586 | 5.3867% | 119 | 72.4% | 1.61x | 65.9% | 50.1% | |||||||||

| Manufactured Housing Community | 8 | $106,733,859 | 8.6% | 2,412 | $54,818 | 4.9358% | 118 | 91.0% | 1.30x | 74.0% | 66.3% | |||||||||

| Industrial | 5 | $74,231,170 | 6.0% | 1,233,369 | $102 | 5.1258% | 114 | 100.0% | 1.44x | 66.5% | 57.2% | |||||||||

| Self Storage | 4 | $17,418,965 | 1.4% | 268,060 | $79 | 5.1572% | 118 | 86.3% | 1.60x | 65.0% | 54.4% | |||||||||