| FREE WRITING PROSPECTUS | ||

| FILED PURSUANT TO RULE 433 | ||

| REGISTRATION FILE NO.: 333-193376-03 | ||

| March 10, 2014 | ||||||

| FREE WRITING PROSPECTUS | ||||||

| STRUCTURAL AND COLLATERAL TERM SHEET | ||||||

| $927,464,814 | ||||||

| (Approximate Total Mortgage Pool Balance) | ||||||

| $805,735,000 | ||||||

| (Approximate Offered Certificates) | ||||||

| COMM 2014-LC15 | ||||||

Deutsche Mortgage & Asset Receiving Corporation Depositor | ||||||

Ladder Capital Financial LLC German American Capital Corporation Natixis Real Estate Capital LLC Sponsors and Mortgage Loan Sellers | ||||||

| Deutsche Bank Securities | ||||||

| Sole Bookrunner and Lead Manager | ||||||

| Natixis Securities Americas LLC | RBS | KeyBanc Capital Markets | ||||

| Co-Managers | ||||||

| The depositor has filed a registration statement (including the prospectus) with the SEC (SEC File No. 333-193376) for the offering to which this communication relates. Before you invest, you should read the prospectus in the registration statement and other documents the depositor has filed with the SEC for more complete information about the depositor, the issuing trust and this offering. You may get these documents for free by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, the depositor or Deutsche Bank Securities Inc., any other underwriter, or any dealer participating in this offering will arrange to send you the prospectus if you request it by calling toll-free 1-800-503-4611 or by email to the following address: prospectus.cpdg@db.com. The offered certificates referred to in these materials, and the asset pool backing them, are subject to modification or revision (including the possibility that one or more classes of certificates may be split, combined or eliminated at any time prior to issuance or availability of a final prospectus) and are offered on a “when, as and if issued” basis. You understand that, when you are considering the purchase of these certificates, a contract of sale will come into being no sooner than the date on which the relevant class has been priced and we have verified the allocation of certificates to be made to you; any “indications of interest” expressed by you, and any “soft circles” generated by us, will not create binding contractual obligations for you or us. | ||||||

COMM 2014-LC15 Mortgage Trust

Capitalized terms used but not defined herein have the meanings assigned to them in the other Free Writing Prospectus expected to be dated March 10, 2014, relating to the offered certificates (hereinafter referred to as the “Free Writing Prospectus”).

| KEY FEATURES OF SECURITIZATION |

| Key Features: | Pooled Collateral Facts(1): | ||||||

| Sole Bookrunner & Lead | Deutsche Bank Securities Inc. | Initial Outstanding Pool Balance: | $927,464,814 | ||||

| Manager: | Number of Mortgage Loans: | 48 | |||||

| Co-Managers: | Natixis Securities Americas LLC | Number of Mortgaged Properties: | 197 | ||||

| KeyBanc Capital Markets Inc. | Average Mortgage Loan Cut-off Date Balance: | $19,322,184 | |||||

RBS Securities, Inc. | Average Mortgaged Property Cut-off Date Balance: | $4,707,943 | |||||

| Mortgage Loan Sellers: | Ladder Capital Finance LLC (“LCF”) (43.7%), | Weighted Avg Mortgage Loan U/W NCF DSCR: | 1.48x | ||||

| German American Capital Corporation* (“GACC”) | Range of Mortgage Loan U/W NCF DSCR: | 1.25x – 2.59x | |||||

| (37.7%), Natixis Real Estate Capital LLC (“Natixis”) | Weighted Avg Mortgage Loan Cut-off Date LTV(2): | 66.3% | |||||

| (18.6%) | Range of Mortgage Loan Cut-off Date LTV(2): | 38.5% – 75.2% | |||||

| *An indirect wholly owned subsidiary of Deutsche Bank AG. | Weighted Avg Mortgage Loan Maturity Date or ARD LTV(2): | 56.9% | |||||

| Master Servicer: | Wells Fargo Bank, National Association | Range of Mortgage Loan Maturity Date or ARD LTV(2): | 0.3% – 72.3% | ||||

| Operating Advisor: | Situs Holdings, LLC | Weighted Avg U/W NOI Debt Yield: | 10.2% | ||||

| Special Servicer: | Rialto Capital Advisors, LLC | Range of U/W NOI Debt Yield: | 7.9% – 23.0% | ||||

| Certificate Administrator: | Wells Fargo Bank, National Association | Weighted Avg Mortgage Loan | |||||

| Trustee: | U.S. Bank National Association | Original Term to Maturity (months)(3): | 112 | ||||

| Rating Agencies: | Moody’s Investors Service, Inc., DBRS, Inc. and | Weighted Avg Mortgage Loan | |||||

| Kroll Bond Rating Agency, Inc. | Remaining Term to Maturity (months)(3): | 112 | |||||

| Determination Date: | The 6th day of each month, or if such 6th day is not a | Weighted Avg Mortgage Loan Seasoning (months): | 1 | ||||

| business day, the following business day, | % Mortgage Loans with Amortization for Full Term(4): | 48.8% | |||||

| commencing in April 2014. | % Mortgage Loans with Partial Interest Only: | 41.4% | |||||

| Distribution Date: | 4th business day following the Determination Date in | % of Mortgage Loans with Full Interest Only(5): | 8.7% | ||||

| each month, commencing in April 2014. | % of Mortgage Loans with Full Amortization: | 1.1% | |||||

| Cut-off Date: | Payment Date in March 2014 (or related origination | % Mortgage Loans with Upfront or Ongoing Tax Reserves: | 96.9% | ||||

| date, if later). Unless otherwise noted, all Mortgage | % Mortgage Loans with Upfront or | ||||||

| Loan statistics are based on balances as of the Cut- | Ongoing Replacement Reserves(6): | 91.7% | |||||

| off Date. | % Mortgage Loans with Upfront or Ongoing Insurance Reserves: | 66.2% | |||||

| Settlement Date: | On or about March 25, 2014 | % Mortgage Loans with Upfront or Ongoing TI/LC Reserves(7): | 86.6% | ||||

| Settlement Terms: | DTC, Euroclear and Clearstream, same day funds, | % Mortgage Loans with Upfront Engineering Reserves: | 41.8% | ||||

| with accrued interest. | % Mortgage Loans with Upfront or Ongoing Other Reserves: | 55.7% | |||||

| ERISA Eligible: | All of the Offered Certificates are expected to be | (1) | With respect to the One Kendall Square Loan, the 1760 Third Avenue Loan, the PennCap Portfolio Loan, the JL Holdings – Burger King Portfolio – 90 Loan and the McKinley Mall Loan, LTV, DSCR and Debt Yield calculations include the related pari passu companion loans. With respect to the JL Holdings – Burger King Portfolio – 90 Loan and the Moss-Bauer Apartments loan, LTV, DSCR and Debt Yield calculations do not include any related subordinate companion loans. With respect to the Moss-Bauer Apartments loan, the Cut-off Date LTV and debt yield calculations are calculated net of a $700,000 holdback reserve. | ||||

| ERISA eligible. | |||||||

| SMMEA Eligible: | None of the Offered Certificates will be SMMEA eligible. | ||||||

| Day Count: | 30/360 | ||||||

| Tax Treatment: | REMIC | ||||||

| Rated Final Distribution Date: | April 2047 | ||||||

| Minimum Denominations: | $10,000 (or $100,000 with respect to Class X-A) and | ||||||

| in each case in multiples of $1 thereafter. | |||||||

| Clean-up Call: | 1% | (2) | With respect to the Greenway loan, the Cut-off Date LTV and Maturity Date or ARD LTV have been calculated based on an “As Stabilized” appraised value of $7.3 million which reflects the completion of renovations. At closing, the borrower reserved $383,000 to complete the renovations. The “As-is” Cut-off Date LTV and “As-is” Maturity Date or ARD LTV are 81.6% and 67.2%, respectively. | ||||

| (3) | For the ARD loan, the original term to maturity and remaining term to maturity are through the anticipated repayment date. | ||||||

| (4) | Excludes loans that fully amortize during the loan term. | ||||||

| (5) | Interest only through the maturity or anticipated repayment date. | ||||||

| (6) | Includes FF&E Reserves. | ||||||

| (7) | Represents the percent of the allocated Initial Outstanding Pool Balance of retail, office, industrial and mixed use properties only. | ||||||

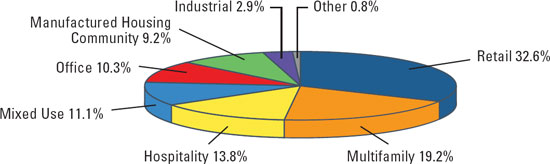

| Distribution of Collateral by Property Type |

The depositor has filed a registration statement (including the prospectus) with the SEC (SEC File No. 333-193376) for the offering to which this communication relates. Before you invest, you should read the prospectus in the registration statement and other documents the depositor has filed with the SEC for more complete information about the depositor, the issuing trust and this offering. You may get these documents for free by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, the depositor or Deutsche Bank Securities Inc., any other underwriter, or any dealer participating in this offering will arrange to send you the prospectus if you request it by calling toll-free 1-800-503-4611 or by email to the following address: prospectus.cpdg@db.com. The offered certificates referred to in these materials, and the asset pool backing them, are subject to modification or revision (including the possibility that one or more classes of certificates may be split, combined or eliminated at any time prior to issuance or availability of a final prospectus) and are offered on a “when, as and if issued” basis. You understand that, when you are considering the purchase of these certificates, a contract of sale will come into being no sooner than the date on which the relevant class has been priced and we have verified the allocation of certificates to be made to you; any “indications of interest” expressed by you, and any “soft circles” generated by us, will not create binding contractual obligations for you or us.

3

COMM 2014-LC15 Mortgage Trust

| SUMMARY OF THE CERTIFICATES |

OFFERED CERTIFICATES

Class(1) | Ratings (Moody’s/DBRS/KBRA) | Initial Certificate Balance or Notional Amount(2) | Initial Subordination Levels | Weighted Average Life (years)(3) | Principal Window (months)(3) | Certificate Principal to Value Ratio(4) | Underwritten NOI Debt Yield(5) | ||||||||

| Class A-1 | Aaa(sf) / AAA(sf) / AAA(sf) | $50,244,000 | 30.000%(6) | 2.74 | 1 - 58 | 46.4% | 14.6% | ||||||||

| Class A-2 | Aaa(sf) / AAA(sf) / AAA(sf) | $126,105,000 | 30.000%(6) | 4.90 | 58 - 60 | 46.4% | 14.6% | ||||||||

| Class A-SB | Aaa(sf) / AAA(sf) / AAA(sf) | $69,565,000 | 30.000%(6) | 7.25 | 60 - 112 | 46.4% | 14.6% | ||||||||

| Class A-3 | Aaa(sf) / AAA(sf) / AAA(sf) | $160,000,000 | 30.000%(6) | 9.75 | 112 - 118 | 46.4% | 14.6% | ||||||||

| Class A-4 | Aaa(sf) / AAA(sf) / AAA(sf) | $243,311,000 | 30.000%(6) | 9.87 | 118 - 120 | 46.4% | 14.6% | ||||||||

Class X-A(7) | Aaa(sf) / AAA(sf) / AAA(sf) | $706,031,000 | (8) | N/A | N/A | N/A | N/A | N/A | |||||||

Class A–M(9)(10) | Aaa(sf) / AAA(sf) / AAA(sf) | $56,806,000 | 23.875% | 9.96 | 120 - 120 | 50.5% | 13.4% | ||||||||

Class B(9)(10) | Aa3(sf) / AA(sf) / AA-(sf) | $66,084,000 | 16.750% | 9.96 | 120 - 120 | 55.2% | 12.3% | ||||||||

Class PEZ(9)(10) | A1(sf) / A(sf) / A-(sf) | $156,510,000 | 13.125%(6) | 9.96 | 120 - 120 | 57.6% | 11.7% | ||||||||

Class C(9)(10) | A3(sf) / A(sf) / A-(sf) | $33,620,000 | 13.125%(6) | 9.96 | 120 - 120 | 57.6% | 11.7% | ||||||||

NON-OFFERED CERTIFICATES

Class(1) | Ratings (Moody’s/DBRS/KBRA) | Initial Certificate Balance or Notional Amount(2) | Initial Subordination Levels | Weighted Average Life (years)(3) | Principal Window (months)(3) | Certificate Principal to Value Ratio(4) | Underwritten NOI Debt Yield(5) | ||||||||

Class X-B(7) | NR / AAA(sf) / AAA(sf) | $150,714,000 | (8) | N/A | N/A | N/A | N/A | N/A | |||||||

Class X-C(7) | NR / AAA(sf) / NR | $70,719,814 | (8) | N/A | N/A | N/A | N/A | N/A | |||||||

| Class D | NR / BBB(low)(sf) / BBB-(sf) | $51,010,000 | 7.625% | 9.96 | 120 - 120 | 61.2% | 11.0% | ||||||||

| Class E | NR / BB(low)(sf) / BB-(sf) | $25,505,000 | 4.875% | 9.96 | 120 - 120 | 63.1% | 10.7% | ||||||||

| Class F | NR / B(sf) / B(sf) | $11,594,000 | 3.625% | 9.96 | 120 - 120 | 63.9% | 10.6% | ||||||||

| Class G | NR / NR / NR | $33,620,814 | 0.000% | 10.34 | 120 - 180 | 66.3% | 10.2% | ||||||||

| (1) | The pass–through rates applicable to the Class A–1, Class A–2, Class A–SB, Class A–3, Class A-4, Class A–M, Class B, Class C, Class D, Class E, Class F and Class G Certificates will equal one of: (i) a fixed per annum rate, (ii) the weighted average of the net mortgage rates on the mortgage loans (in each case, adjusted, if necessary, to accrue on the basis of a 360–day year consisting of twelve 30–day months) as of their respective due dates in the month preceding the month in which such distribution date occurs, (iii) a rate equal to the lesser of a specified pass–through rate and the weighted average of the net mortgage rates on the mortgage loans (in each case, adjusted, if necessary, to accrue on the basis of a 360–day year consisting of twelve 30–day months) as of their respective due dates in the month preceding the month in which such distribution date occurs, or (iv) the weighted average of the net mortgage rates on the mortgage loans (in each case, adjusted, if necessary, to accrue on the basis of a 360–day year consisting of twelve 30–day months) as of their respective due dates in the month preceding the month in which such distribution date occurs, less a specified rate. The Class PEZ Certificates will not have a pass-through rate, but will be entitled to receive the sum of the interest distributable on the percentage interest of the Class A–M, Class B and Class C trust components represented by the Class PEZ Certificates. The pass-through rate on the Class A–M, Class B and Class C trust components will at all times be the same as the pass-through rate of the Class A–M, Class B and Class C Certificates. |

| (2) | Approximate; subject to a permitted variance of plus or minus 5%. |

| (3) | The weighted average life and principal window during which distributions of principal would be received as set forth in the table with respect to each class of certificates with a certificate balance is based on (i) modeling assumptions and prepayment assumptions described in the Free Writing Prospectus, (ii) assumptions that there are no prepayments or losses on the mortgage loans and (iii) assumptions that there are no extensions of maturity dates and the mortgage loans with anticipated repayment dates are repaid on their respective anticipated repayment dates. |

| (4) | “Certificate Principal to Value Ratio” for any class with a Certificate Balance is calculated as the product of (a) the weighted average mortgage loan Cut–off Date LTV of the mortgage pool, multiplied by (b) a fraction, the numerator of which is the total initial Certificate Balance of the related class of Certificates and all other classes, if any, that are senior to such class, and the denominator of which is the total initial Certificate Balance of all Certificates. The Certificate Principal to Value Ratios of the Class A–1, Class A–2, Class A–SB, Class A–3 and Class A-4 Certificates are calculated in the aggregate for those classes as if they were a single class. |

| (5) | “Underwritten NOI Debt Yield” for any class with a Certificate Balance is calculated as the product of (a) the weighted average U/W NOI Debt Yield for the mortgage pool, multiplied by (b) a fraction, the numerator of which is the total initial Certificate Balance and the denominator of which is the total initial Certificate Balance of the related class of Certificates and all other classes, if any, that are senior to such class. The Underwritten NOI Debt Yields of the Class A–1, Class A–2, Class A–SB, Class A–3 and Class A–4 Certificates are calculated in the aggregate for those classes as if they were a single class. |

| (6) | The initial subordination levels for the Class A–1, Class A–2, Class A–SB, Class A–3 and Class A-4 are represented in the aggregate. The initial subordination levels for the Class PEZ and Class C Certificates are equal to the initial subordination level of the underlying Class C trust component which will have an initial outstanding balance on the closing date of $33,620,000. |

| (7) | The pass–through rate applicable to the Class X–A, Class X–B and Class X–C Certificates for each Distribution Date will generally be equal to the excess of (i) the weighted average of the net mortgage rates on the mortgage loans (in each case, adjusted, if necessary to accrue on the basis of a 360 day year consisting of twelve 30–day months), over (ii)(A) with respect to the Class X–A Certificates, the weighted average of the pass–through rates of the Class A–1, Class A–2, Class A–SB, Class A-3, Class A-4 and Class A–M Certificates (based on their Certificate Balances and without regard to any exchange of Class A–M, Class B and Class C Certificates for Class PEZ Certificates), as further described in the Free Writing Prospectus, (B) with respect to the Class X–B Certificates, the weighted average of the pass–through rates of the Class B, Class C and Class D Certificates (based on their Certificate Balances and without regard to any exchange of Class A–M, Class B and Class C Certificates for Class PEZ Certificates), as further described in the Free Writing Prospectus and (C) with respect to the Class X–C Certificates, the weighted average of the pass–through rates of the Class E, Class F and Class G Certificates (based on their Certificate Balances), as further described in the Free Writing Prospectus. |

| (8) | None of the Class X–A, Class X–B and Class X–C Certificates (the “Class X Certificates”) will have Certificate Balances. None of the Class X–A, Class X–B or Class X–C Certificates is entitled to distributions of principal. The interest accrual amounts on the Class X–A Certificates will be calculated by reference to a notional amount equal to the sum of the total Certificate Balances of each of the Class A–1, Class A–2, Class A–SB, Class A–3, Class A–4 and Class A–M Certificates (without regard to any exchange of Class A–M, Class B and Class C Certificates for Class PEZ Certificates). The interest accrual amounts on the Class X–B Certificates will be calculated by reference to a notional amount equal to the Certificate Balances of each the Class B, Class C and Class D Certificates (without regard to any exchange of Class A–M, Class B and Class C Certificates for Class PEZ Certificates). The interest accrual amounts on the Class X–C Certificates will be calculated by reference to a notional amount equal to the sum of the total Certificate Balances of each of the Class E, Class F and Class G Certificates. |

The depositor has filed a registration statement (including the prospectus) with the SEC (SEC File No. 333-193376) for the offering to which this communication relates. Before you invest, you should read the prospectus in the registration statement and other documents the depositor has filed with the SEC for more complete information about the depositor, the issuing trust and this offering. You may get these documents for free by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, the depositor or Deutsche Bank Securities Inc., any other underwriter, or any dealer participating in this offering will arrange to send you the prospectus if you request it by calling toll-free 1-800-503-4611 or by email to the following address: prospectus.cpdg@db.com. The offered certificates referred to in these materials, and the asset pool backing them, are subject to modification or revision (including the possibility that one or more classes of certificates may be split, combined or eliminated at any time prior to issuance or availability of a final prospectus) and are offered on a “when, as and if issued” basis. You understand that, when you are considering the purchase of these certificates, a contract of sale will come into being no sooner than the date on which the relevant class has been priced and we have verified the allocation of certificates to be made to you; any “indications of interest” expressed by you, and any “soft circles” generated by us, will not create binding contractual obligations for you or us.

4

COMM 2014-LC15 Mortgage Trust

| SUMMARY OF THE CERTIFICATES |

| (9) | Up to the full Certificate Balance of the Class A–M, Class B and Class C Certificates may be exchanged for Class PEZ Certificates, and Class PEZ Certificates may be exchanged for up to the full Certificate Balance of the Class A–M, Class B and Class C Certificates. |

| (10) | On the closing date, the issuing entity will issue the Class A–M, Class B and Class C trust components, which will have outstanding principal balances on the closing date of $56,806,000, $66,084,000 and $33,620,000, respectively. The Class A–M, Class B, Class PEZ and Class C Certificates will, at all times, represent undivided beneficial ownership interests in a grantor trust that will hold such trust components. Each class of the Class A–M, Class B and Class C Certificates will, at all times, represent a beneficial interest in a percentage of the outstanding principal balance of the Class A–M, Class B and Class C trust components, respectively. The Class PEZ Certificates will, at all times, represent a beneficial interest in the remaining percentages of the outstanding principal balances of the Class A–M, Class B and Class C trust components. Following any exchange of Class A–M, Class B and Class C Certificates for Class PEZ Certificates or any exchange of Class PEZ Certificates for Class A–M, Class B and Class C Certificates as described in the Free Writing Prospectus, the percentage interest of the outstanding principal balances of the Class A–M, Class B and Class C trust component that is represented by the Class A–M, Class B, Class PEZ and Class C Certificates will be increased or decreased accordingly. The initial Certificate Balance of each of the Class A–M, Class B and Class C Certificates represents the Certificate Balance of such class without giving effect to any exchange. The initial Certificate Balance of the Class PEZ Certificates is equal to the aggregate of the initial Certificate Balance of the Class A–M, Class B and Class C Certificates and represents the maximum Certificate Balance of the Class PEZ Certificates that could be issued in an exchange. The Certificate Balances of the Class A–M, Class B and Class C Certificates to be issued on the closing date will be reduced, in required proportions, by an amount equal to the Certificate Balance of the Class PEZ Certificates issued on the closing date. |

| Short–Term Certificate Principal Paydown Summary(1)(2) |

| Class | Mortgage Loan Seller | Mortgage Loan | Property Type | Cut–off Date Balance | Remaining Term to Maturity (Mos.) | Cut-off Date LTV Ratio | U/W NCF DSCR | U/W NOI Debt Yield | ||||||||

| A-1/A-2 | GACC | Value Place Richmond | Hospitality | $5,480,965 | 58 | 63.0% | 2.09x | 15.9% | ||||||||

| A-1/A-2 | Natixis | Briar Creek | Multifamily | $4,087,500 | 58 | 75.0% | 1.45x | 10.0% | ||||||||

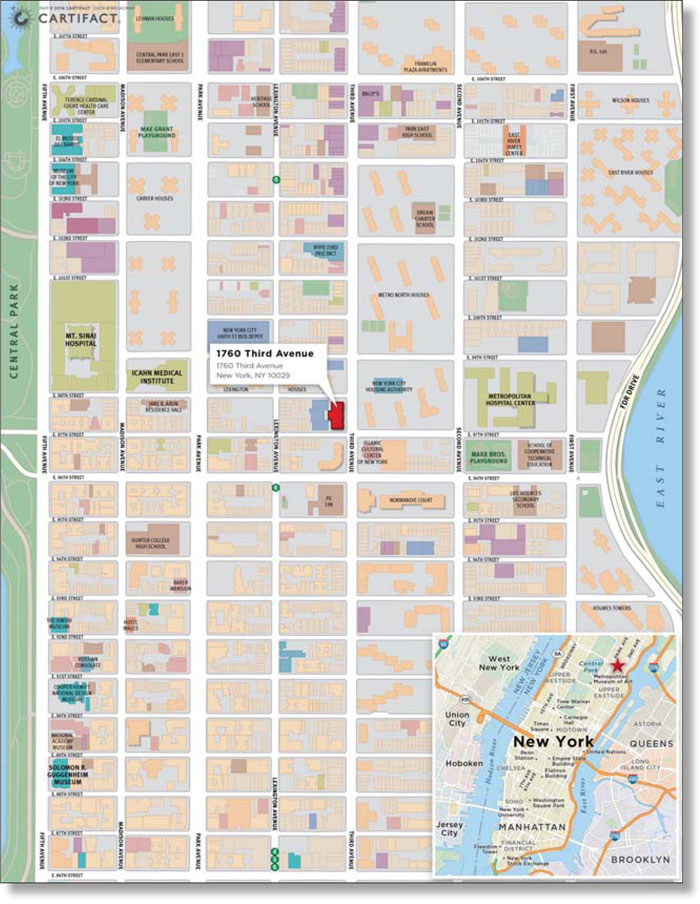

| A-2 | Natixis | 1760 Third Avenue | Multifamily | $75,000,000 | 59 | 66.4% | 1.67x | 7.9% | ||||||||

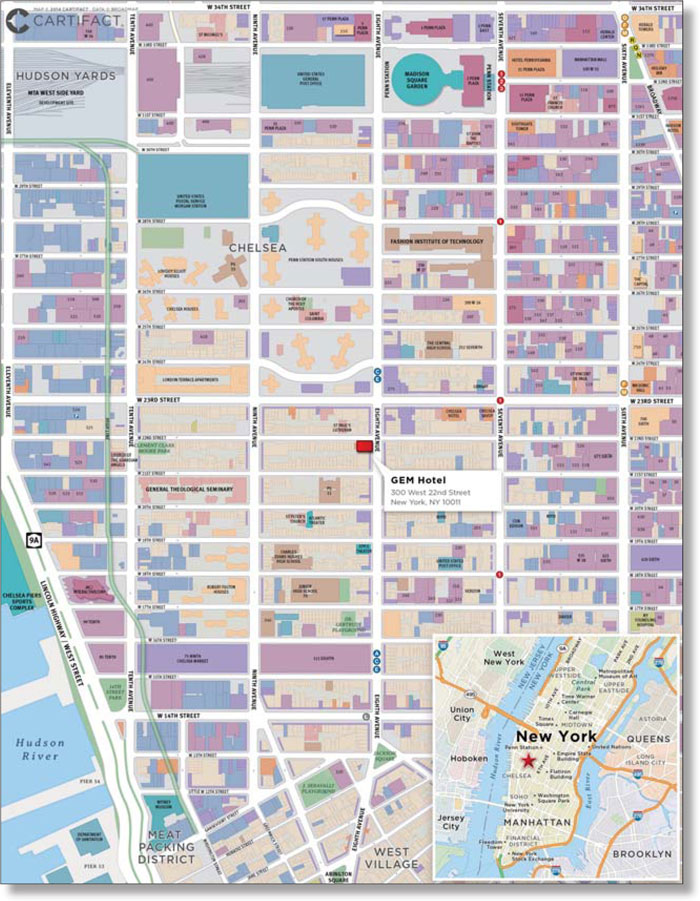

| A-2/A-SB | LCF | GEM Hotel | Hospitality | $29,300,000 | 60 | 65.5% | 1.52x | 10.3% | ||||||||

| A-2/A-SB | LCF | Arrowridge Business Park | Industrial | $8,450,000 | 60 | 74.8% | 1.40x | 11.0% | ||||||||

| A-2/A-SB | Natixis | 93 Palladium Way | Industrial | $5,260,000 | 60 | 60.5% | 2.10x | 15.1% |

| (1) | This table identifies loans with balloon payments due during the principal paydown window assuming 0% CPR and no losses for the indicated Certificates. See “Yield and Maturity Considerations – Yield Considerations” in the Free Writing Prospectus. |

| (2) | With respect to the 1760 Third Avenue Loan, LTV, DSCR and Debt Yield calculations include the related pari passu companion loan. |

The depositor has filed a registration statement (including the prospectus) with the SEC (SEC File No. 333-193376) for the offering to which this communication relates. Before you invest, you should read the prospectus in the registration statement and other documents the depositor has filed with the SEC for more complete information about the depositor, the issuing trust and this offering. You may get these documents for free by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, the depositor or Deutsche Bank Securities Inc., any other underwriter, or any dealer participating in this offering will arrange to send you the prospectus if you request it by calling toll-free 1-800-503-4611 or by email to the following address: prospectus.cpdg@db.com. The offered certificates referred to in these materials, and the asset pool backing them, are subject to modification or revision (including the possibility that one or more classes of certificates may be split, combined or eliminated at any time prior to issuance or availability of a final prospectus) and are offered on a “when, as and if issued” basis. You understand that, when you are considering the purchase of these certificates, a contract of sale will come into being no sooner than the date on which the relevant class has been priced and we have verified the allocation of certificates to be made to you; any “indications of interest” expressed by you, and any “soft circles” generated by us, will not create binding contractual obligations for you or us.

5

COMM 2014-LC15 Mortgage Trust

| TRANSACTION HIGHLIGHTS |

■ | $927,464,814 (Approximate) New–Issue Multi–Borrower CMBS: |

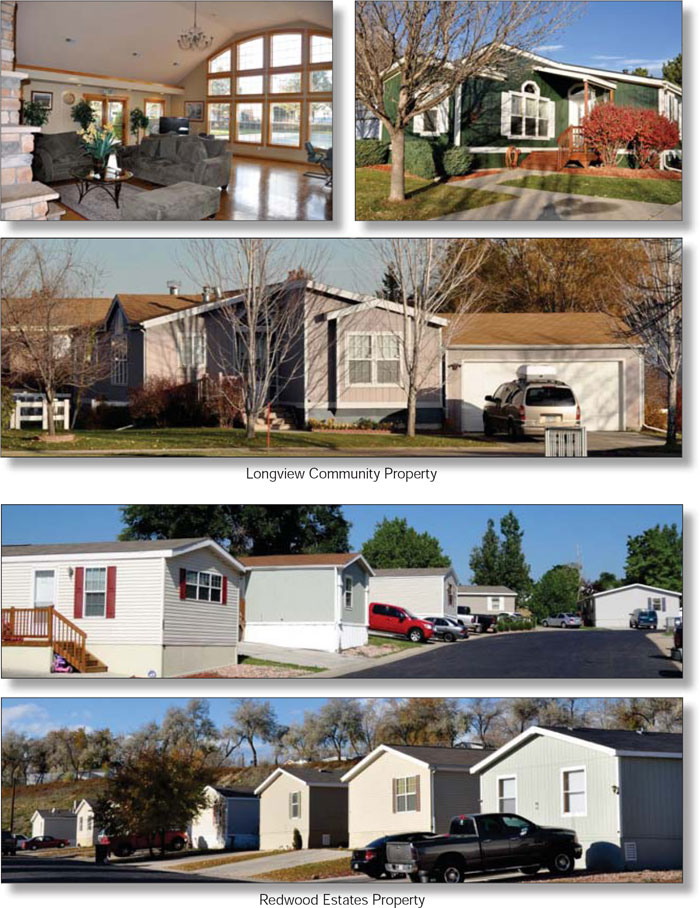

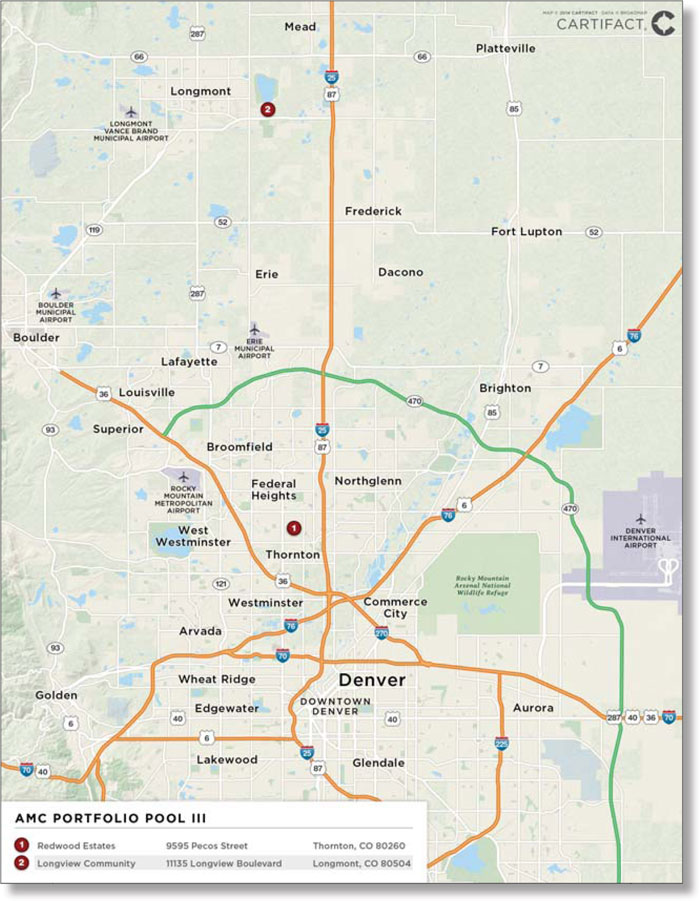

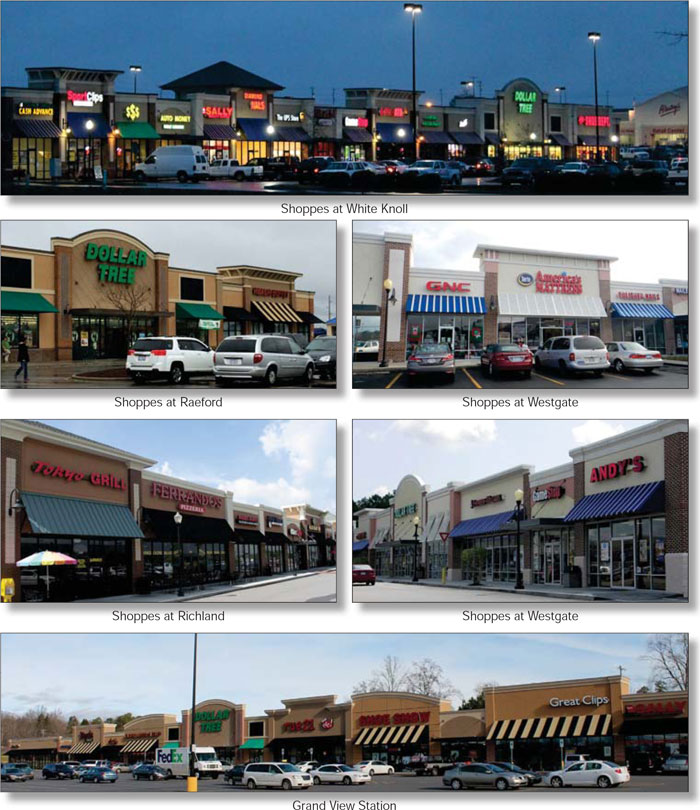

| – | Overview: The mortgage pool consists of 48 fixed–rate commercial, multifamily and manufactured housing community loans that have an aggregate Cut–off Date Balance of $927,464,814 (the “Initial Outstanding Pool Balance”), have an average Cut–off Date Balance of $19,322,184 per Mortgage Loan and are secured by 197 Mortgaged Properties located throughout 23 states. |

| – | LTV: 66.3% weighted average Cut–off Date LTV and 56.9% weighted average Maturity Date or ARD LTV. |

| – | DSCR: 1.59x weighted average Debt Service Coverage Ratio, based on Underwritten NOI. 1.48x weighted average Debt Service Coverage Ratio, based on Underwritten NCF. |

| – | Debt Yield: 10.2% weighted average debt yield, based on Underwritten NOI. 9.6% weighted average debt yield, based on Underwritten NCF. |

| – | Credit Support: 30.000% credit support for the Class A–1, Class A–2, Class A–SB, Class A–3 and Class A–4 Certificates in the aggregate, which are each rated Aaa(sf) / AAA(sf) / AAA(sf) by Moody’s/DBRS/KBRA. |

■ | Loan Structural Features: |

| – | Amortization: 91.3% of the Mortgage Loans by Cut–off Date Balance have scheduled amortization: |

■ | 48.8% of the Mortgage Loans by Cut–off Date Balance have amortization for the entire term with a balloon payment due at Maturity or ARD. |

■ | 41.4% of the Mortgage Loans by Cut–off Date Balance have scheduled amortization following a partial interest–only period with a balloon payment due at Maturity or ARD. |

■ | 8.7% of the Mortgage Loans by Cut-off Date Balance are interest-only for the entire term or through the ARD. |

■ | 1.1% of the Mortgage Loans by Cut–off Date Balance fully amortize during the term of the loan. |

| – | Hard Lockboxes: 69.8% of the Mortgage Loans by Cut–off Date Balance have Hard Lockboxes in place. |

■ | Cash Traps: 88.9% of the Mortgage Loans by Cut–off Date Balance have cash traps triggered by certain declines in net cash flow, all at levels greater than or equal to 1.05x, that fund an excess cash flow reserve. |

| – | Reserves: The Mortgage Loans require amounts to be escrowed for reserves upfront or on an ongoing basis as follows: |

■ | Real Estate Taxes: 44 Mortgage Loans representing 96.9% of the total Cut–off Date Balance. |

■ | Insurance Reserves: 36 Mortgage Loans representing 66.2% of the total Cut–off Date Balance. |

■ | Replacement Reserves (Including FF&E Reserves): 41 Mortgage Loans representing 91.7% of the total Cut–off Date Balance. |

■ | Tenant Improvement / Leasing Commissions: 20 Mortgage Loans representing 86.6% of the total allocated Cut–off Date Balance of office, retail, industrial and mixed use properties only. |

| – | Defeasance: 86.2% of the Mortgage Loans by Cut–off Date Balance permit defeasance only after a lockout period and prior to an open period. |

| – | Yield Maintenance: 12.7% of the Mortgage Loans by Cut–off Date Balance permit prepayment only after a lockout period and prior to an open period with a Yield Maintenance Charge. |

| – | Defeasance or Yield Maintenance: 1.1% of the Mortgage Loans by Cut–off Date Balance permit yield maintenance, then either defeasance or prepayment with a Yield Maintenance Charge, in either case only after a lockout period and prior to an open period. |

■ | Multiple–Asset Types > 5.0% of the Total Pool: |

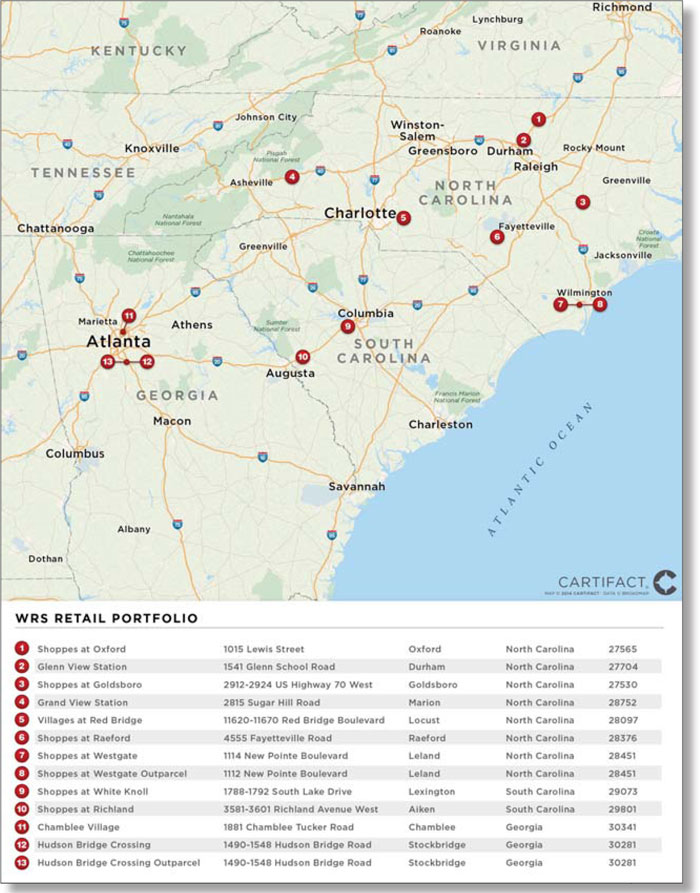

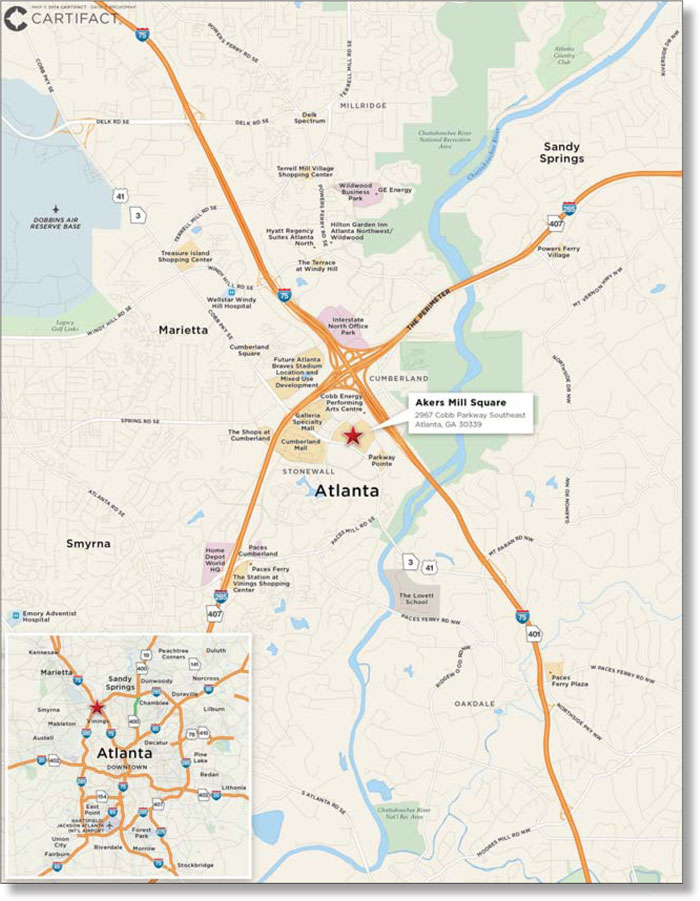

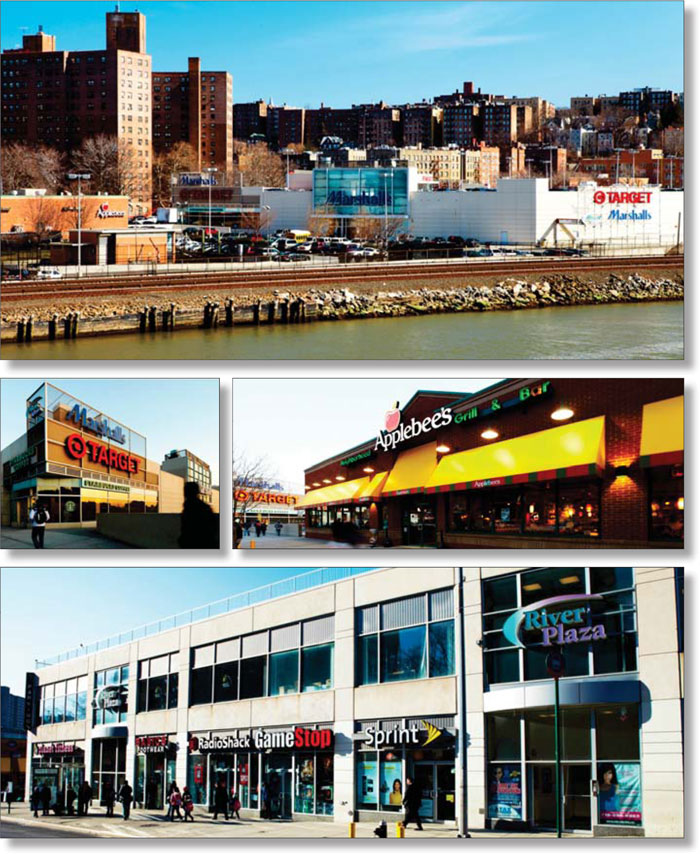

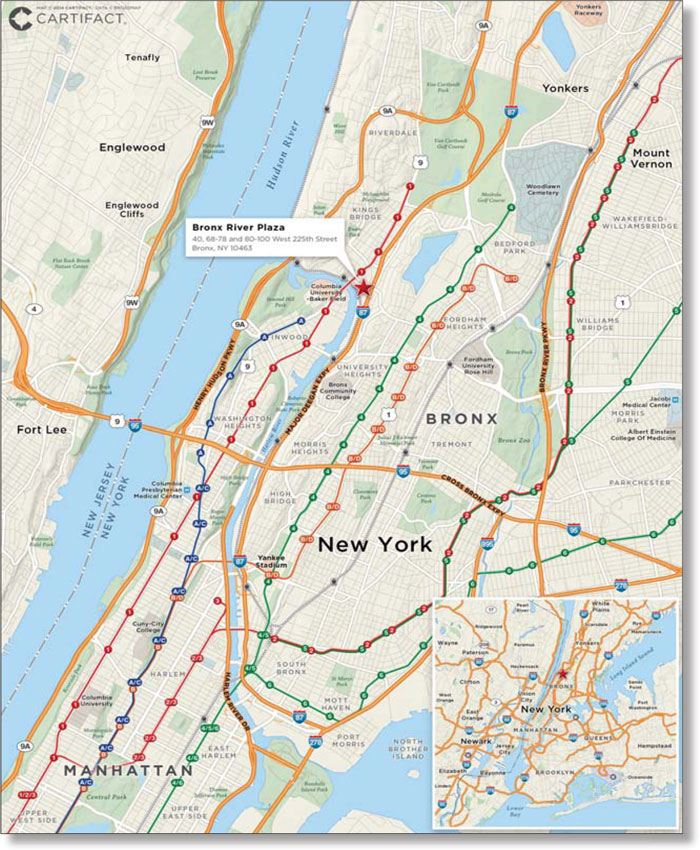

| – | Retail: 32.6% of the Mortgaged Properties by allocated Cut–off Date Balance are retail properties. |

| – | Multifamily: 19.2% of the Mortgaged Properties by allocated Cut–off Date Balance are multifamily properties. |

| – | Hospitality: 13.8% of the Mortgaged Properties by allocated Cut–off Date Balance are hospitality properties. |

| – | Mixed Use: 11.1% of the Mortgaged Properties by allocated Cut–off Date Balance are mixed use properties. |

| – | Office: 10.3% of the Mortgaged Properties by allocated Cut–off Date Balance are office properties. |

| – | Manufactured Housing Community: 9.2% of the Mortgaged Properties by allocated Cut–off Date Balance are manufactured housing community properties. |

■ | Geographic Diversity: The 197 Mortgaged Properties are located throughout 23 states with only two states having at least 10.0% by allocated Cut–off Date Balance: New York (24.0%) and Massachusetts (10.7%). |

The depositor has filed a registration statement (including the prospectus) with the SEC (SEC File No. 333-193376) for the offering to which this communication relates. Before you invest, you should read the prospectus in the registration statement and other documents the depositor has filed with the SEC for more complete information about the depositor, the issuing trust and this offering. You may get these documents for free by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, the depositor or Deutsche Bank Securities Inc., any other underwriter, or any dealer participating in this offering will arrange to send you the prospectus if you request it by calling toll-free 1-800-503-4611 or by email to the following address: prospectus.cpdg@db.com. The offered certificates referred to in these materials, and the asset pool backing them, are subject to modification or revision (including the possibility that one or more classes of certificates may be split, combined or eliminated at any time prior to issuance or availability of a final prospectus) and are offered on a “when, as and if issued” basis. You understand that, when you are considering the purchase of these certificates, a contract of sale will come into being no sooner than the date on which the relevant class has been priced and we have verified the allocation of certificates to be made to you; any “indications of interest” expressed by you, and any “soft circles” generated by us, will not create binding contractual obligations for you or us.

6

| COMM 2014-LC15 Mortgage Trust | |

| STRUCTURE OVERVIEW | |

| Principal Payments: | Payments in respect of principal of the Certificates will be distributed, first, to the Class A–SB Certificates, until the Certificate Balance of such Class is reduced to the planned principal balance for the related Distribution Date set forth on Annex A–3 to the Free Writing Prospectus, then, to the Class A–1, Class A–2, Class A–3, Class A-4 and Class A–SB Certificates, in that order, until the Certificate Balance of each such Class is reduced to zero, then, to the Class A–M trust component (and correspondingly to the Class A–M Certificates and the Class PEZ Certificates, pro rata, based on their respective percentage interests in the Class A–M trust component) until the principal balance of the Class A–M trust component has been reduced to zero, then, to the Class B trust component (and correspondingly to the Class B Certificates and the Class PEZ Certificates, pro rata, based on their respective percentage interests in the Class B trust component) until the principal balance of the Class B trust component has been reduced to zero, then, to the Class C trust component (and correspondingly to the Class C Certificates and the Class PEZ Certificates, pro rata, based on their respective percentage interests in the Class C trust component), until the principal balance of the Class C trust component has been reduced to zero, and then, to the Class D, Class E, Class F and Class G Certificates, in that order, until the Certificate Balance of each such Class is reduced to zero. Notwithstanding the foregoing, if the total principal balance of the Class A–M trust component, Class B trust component and Class C trust component and the Certificate Balances of the Class D through Class G Certificates have been reduced to zero as a result of loss allocation, payments in respect of principal of the Certificates will be distributed, first, to the Class A–1, Class A–2, Class A–3, Class A–4 and Class A–SB Certificates, on a pro rata basis, based on the Certificate Balance of each such Class, then, to the extent of any recoveries on realized losses, to the Class A–M trust component (and correspondingly to the Class A–M Certificates and the Class PEZ Certificates, pro rata, based on their respective percentage interests in the Class A–M trust component), then, to the extent of any recoveries on realized losses, to the Class B trust component (and correspondingly to the Class B Certificates and the Class PEZ Certificates, pro rata, based on their respective percentage interests in the Class B trust component), then, to the extent of any recoveries on realized losses, to the Class C trust component (and correspondingly to the Class C Certificates and the Class PEZ Certificates, pro rata, based on their respective percentage interests in the Class C trust component), then, to the extent of any recoveries on realized losses, to the Class D, Class E, Class F and Class G Certificates, in that order, in each case until the Certificate Balance of each such Class or total principal balance of each such trust component is reduced to zero (or previously allocated realized losses have been fully reimbursed). |

| The Class X–A, Class X–B and Class X–C Certificates will not be entitled to receive distributions of principal; however, (i) the notional amount of the Class X–A Certificates will be reduced by the aggregate amount of principal distributions and realized losses allocated to the Class A–1, Class A–2, Class A–SB, Class A–3, Class A–4 and the Class A–M Certificates (without regard to any exchange of Class A–M, Class B and Class C Certificates for Class PEZ Certificates); (ii) the notional amount of the Class X–B Certificates will be reduced by the principal distributions and realized losses allocated to the Class B, Class C and Class D Certificates (without regard to any exchange of Class A–M, Class B and Class C Certificates for Class PEZ Certificates); and (iii) the notional amount of the Class X–C Certificates will be reduced by the principal distributions and realized losses allocated to the Class E, Class F and Class G Certificates. | |

| Interest Payments: | On each Distribution Date, interest accrued for each Class of the Certificates or trust component at the applicable pass–through rate will be distributed in the following order of priority, to the extent of available funds: first, to the Class A–1, Class A–2, Class A–SB, Class A–3, Class A–4, Class X–A, Class X–B and Class X–C Certificates, on a pro rata basis, based on the accrued and unpaid interest on each such Class, then, to the Class A–M trust component (and correspondingly to the Class A–M Certificates and the Class PEZ Certificates, pro rata, based on their respective percentage interests of the accrued and unpaid interest on the Class A–M trust component), then, to the Class B trust |

The depositor has filed a registration statement (including the prospectus) with the SEC (SEC File No. 333-193376) for the offering to which this communication relates. Before you invest, you should read the prospectus in the registration statement and other documents the depositor has filed with the SEC for more complete information about the depositor, the issuing trust and this offering. You may get these documents for free by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, the depositor or Deutsche Bank Securities Inc., any other underwriter, or any dealer participating in this offering will arrange to send you the prospectus if you request it by calling toll-free 1-800-503-4611 or by email to the following address: prospectus.cpdg@db.com. The offered certificates referred to in these materials, and the asset pool backing them, are subject to modification or revision (including the possibility that one or more classes of certificates may be split, combined or eliminated at any time prior to issuance or availability of a final prospectus) and are offered on a “when, as and if issued” basis. You understand that, when you are considering the purchase of these certificates, a contract of sale will come into being no sooner than the date on which the relevant class has been priced and we have verified the allocation of certificates to be made to you; any “indications of interest” expressed by you, and any “soft circles” generated by us, will not create binding contractual obligations for you or us.

7

| COMM 2014-LC15 Mortgage Trust | |

| STRUCTURE OVERVIEW | |

component (and correspondingly to the Class B Certificates and the Class PEZ Certificates, pro rata, based on their respective percentage interests of the accrued and unpaid interest on the Class B trust component), then, to the Class C trust component (and correspondingly to the Class C Certificates and the Class PEZ Certificates, pro rata, based on their respective percentage interests of the accrued and unpaid interest on the Class C trust component), and then, to the Class D, Class E, Class F and Class G Certificates, in that order, in each case until the interest payable to each such Class is paid in full. The pass–through rates applicable to the Class A–1, Class A–2, Class A–SB, Class A–3, Class A–4, Class A–M, Class B, Class C, Class D, Class E, Class F and Class G Certificates for each Distribution Date will equal one of: (i) a fixed per annum rate, (ii) the weighted average of the net mortgage rates on the mortgage loans (in each case, adjusted, if necessary, to accrue on the basis of a 360–day year consisting of twelve 30–day months) as of their respective due dates in the month preceding the month in which such distribution date occurs, (iii) a rate equal to the lesser of a specified pass–through rate and the weighted average of the net mortgage rates on the mortgage loans (in each case, adjusted, if necessary, to accrue on the basis of a 360–day year consisting of twelve 30–day months) as of their respective due dates in the month preceding the month in which such distribution date occurs, or (iv) the weighted average of the net mortgage rates on the mortgage loans (in each case, adjusted, if necessary, to accrue on the basis of a 360–day year consisting of twelve 30–day months) as of their respective due dates in the month preceding the month in which such distribution date occurs, less a specified rate. The pass-through rate on the Class A–M, Class B and Class C trust components will at all times be the same as the pass-through rate of the Class A–M, Class B and Class C Certificates. The Class PEZ Certificates will not have a pass-through rate, but will be entitled to receive the sum of interest distributable on the percentage interest of the Class A–M, Class B and Class C trust components represented by the PEZ Certificates. The pass–through rate applicable to the Class X–A, Class X–B and Class X–C Certificates for each Distribution Date will generally be equal to the excess of (i) the weighted average of the net mortgage rates on the mortgage loans (in each case, adjusted, if necessary, to accrue on the basis of a 360–day year consisting of twelve 30–day months), over (ii)(A) with respect to the Class X–A Certificates, the weighted average of the pass–through rates of the Class A–1, Class A–2, Class A–SB, Class A–3, Class A–4 and Class A–M Certificates (based on their Certificate Balances and without regard to any exchange of Class A–M, Class B and Class C Certificates for Class PEZ Certificates), as further described in the Free Writing Prospectus, (B) with respect to the Class X–B Certificates, the weighted average of the pass–through rates of the Class B, Class C and Class D Certificates (based on their Certificate Balances and without regard to any exchange of Class A–M, Class B and Class C Certificates for Class PEZ Certificates), as further described in the Free Writing Prospectus and (C) with respect to the Class X–C Certificates, the weighted average of the pass–through rates of the Class E, Class F and Class G Certificates (based on their Certificate Balances), as further described in the Free Writing Prospectus. | |

| Prepayment Interest Shortfalls: | Net prepayment interest shortfalls will be allocated pro rata based on interest entitlements, in reduction of the interest otherwise payable with respect to each of the interest–bearing certificate classes. |

| Loss Allocation: | Losses will be allocated to each Class of Certificates in reverse alphabetical order starting with Class G through and including Class D, then, to the Class C trust component (and correspondingly to the Class C Certificates and the Class PEZ Certificates, pro rata, based on their respective percentage interests in the Class C trust component), then, to the Class B trust component (and correspondingly to the Class B Certificates and the Class PEZ Certificates, pro rata, based on their respective percentage interests in the Class B trust component), then, to the Class A–M trust component (and correspondingly |

The depositor has filed a registration statement (including the prospectus) with the SEC (SEC File No. 333-193376) for the offering to which this communication relates. Before you invest, you should read the prospectus in the registration statement and other documents the depositor has filed with the SEC for more complete information about the depositor, the issuing trust and this offering. You may get these documents for free by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, the depositor or Deutsche Bank Securities Inc., any other underwriter, or any dealer participating in this offering will arrange to send you the prospectus if you request it by calling toll-free 1-800-503-4611 or by email to the following address: prospectus.cpdg@db.com. The offered certificates referred to in these materials, and the asset pool backing them, are subject to modification or revision (including the possibility that one or more classes of certificates may be split, combined or eliminated at any time prior to issuance or availability of a final prospectus) and are offered on a “when, as and if issued” basis. You understand that, when you are considering the purchase of these certificates, a contract of sale will come into being no sooner than the date on which the relevant class has been priced and we have verified the allocation of certificates to be made to you; any “indications of interest” expressed by you, and any “soft circles” generated by us, will not create binding contractual obligations for you or us.

8

| COMM 2014-LC15 Mortgage Trust | |||

| STRUCTURE OVERVIEW | |||

to the Class A–M Certificates and the Class PEZ Certificates, pro rata, based on their respective percentage interests in the Class A–M trust component), and then to Class A–1, Class A–2, Class A–SB Class A–3 and Class A–4 Certificates on a pro rata basis based on the Certificate Balance of each such class. The notional amount of any Class of Class X Certificates will be reduced by the aggregate amount of realized losses allocated to Certificates and trust components that are components of the notional amount of such Class of Class X Certificates. | |||

Prepayment Premiums: | A percentage of all prepayment premiums (either fixed prepayment premiums or yield maintenance amounts) collected will be allocated to each of the Class A–1, Class A–2, Class A–SB, Class A–3, Class A–4 and Class D Certificates and the Class A–M, Class B and Class C trust components (the “YM P&I Certificates”) then entitled to principal distributions, which percentage will be equal to the product of (a) a fraction, not greater than one, the numerator of which is the amount of principal distributed to such Class or trust component on such Distribution Date and the denominator of which is the total amount of principal distributed to the holders of the Class A–1, Class A-2, Class A-SB, Class A–3, Class A–4 and Class D Certificates and the Class A–M, Class B and Class C trust components on such Distribution Date, and (b) a fraction (expressed as a percentage which can be no greater than 100% nor less than 0%), the numerator of which is the excess of the pass–through rate of each such Class of Certificates or trust component currently receiving principal over the relevant Discount Rate, and the denominator of which is the excess of the Mortgage Rate of the related Mortgage Loan over the relevant Discount Rate. | ||

| Prepayment Premium Allocation Percentage for all YM P&I Certificates = | |||

| (Pass–Through Rate – Discount Rate) | X | The percentage of the principal distribution amount to such Class or trust component as described in (a) above | |

| (Mortgage Rate – Discount Rate) | |||

| The remaining percentage of the prepayment premiums will be allocated to the Class X Certificates in the manner described in the Free Writing Prospectus. In general, this formula provides for an increase in the percentage of prepayment premiums allocated to the YM P&I Certificates then entitled to principal distributions relative to the Class X Certificates as Discount Rates decrease and a decrease in the percentage allocated to such Classes as Discount Rates rise. | |||

All prepayment premiums (either fixed prepayment premiums or yield maintenance amounts) allocated in respect of (i) the Class A–M trust component as described above will be allocated between the Class A–M Certificates and the Class PEZ Certificates, pro rata, based on their respective percentage interests in the Class A–M trust component, (ii) the Class B trust component as described above will be allocated between the Class B Certificates and the Class PEZ Certificates, pro rata, based on their respective percentage interests in the Class B trust component, and (iii) the Class C trust component as described above will be allocated between the Class C Certificates and the Class PEZ Certificates, pro rata, based on their respective percentage interests in the Class C trust component. | |||

The depositor has filed a registration statement (including the prospectus) with the SEC (SEC File No. 333-193376) for the offering to which this communication relates. Before you invest, you should read the prospectus in the registration statement and other documents the depositor has filed with the SEC for more complete information about the depositor, the issuing trust and this offering. You may get these documents for free by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, the depositor or Deutsche Bank Securities Inc., any other underwriter, or any dealer participating in this offering will arrange to send you the prospectus if you request it by calling toll-free 1-800-503-4611 or by email to the following address: prospectus.cpdg@db.com. The offered certificates referred to in these materials, and the asset pool backing them, are subject to modification or revision (including the possibility that one or more classes of certificates may be split, combined or eliminated at any time prior to issuance or availability of a final prospectus) and are offered on a “when, as and if issued” basis. You understand that, when you are considering the purchase of these certificates, a contract of sale will come into being no sooner than the date on which the relevant class has been priced and we have verified the allocation of certificates to be made to you; any “indications of interest” expressed by you, and any “soft circles” generated by us, will not create binding contractual obligations for you or us.

9

| COMM 2014-LC15 Mortgage Trust | |

| STRUCTURE OVERVIEW | |

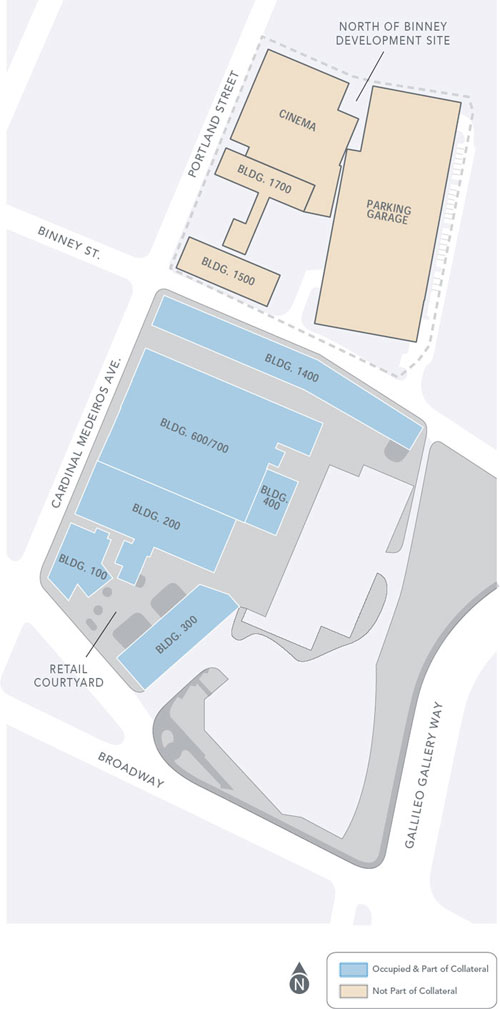

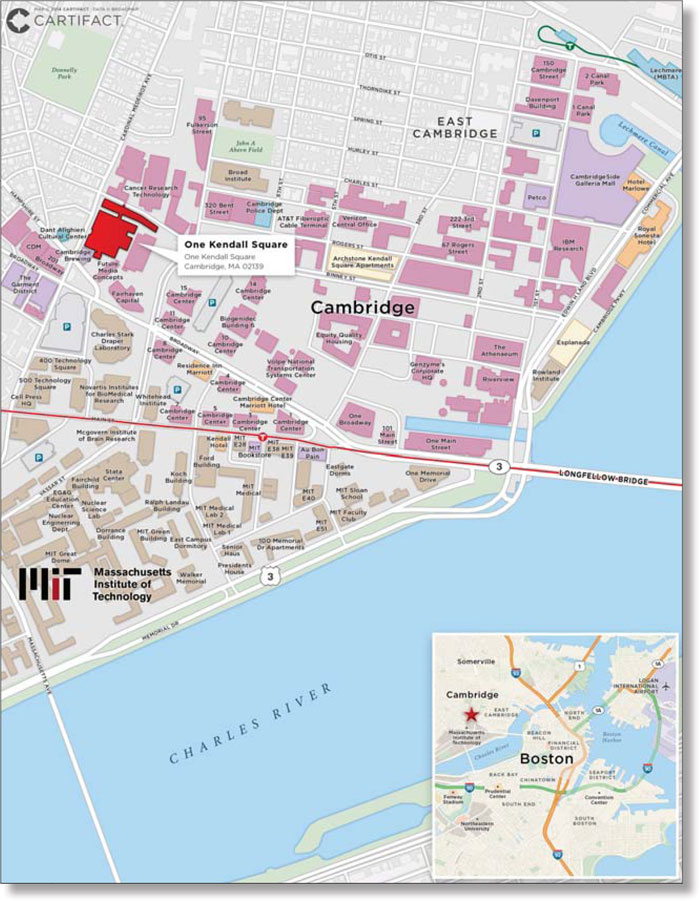

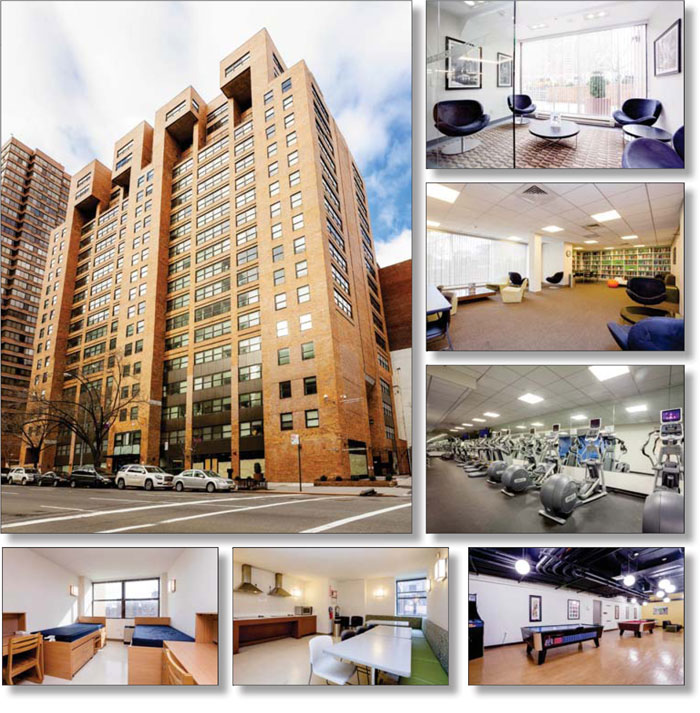

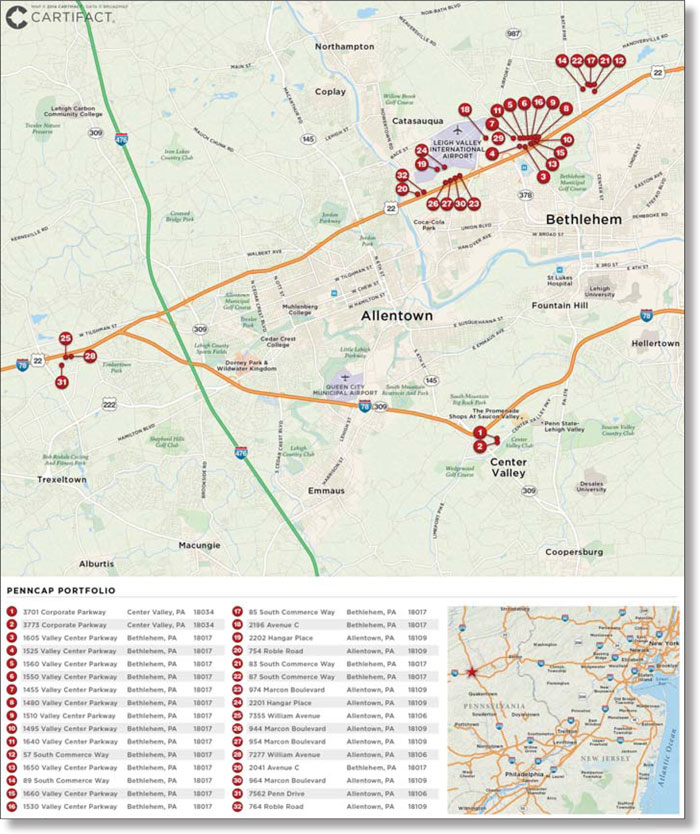

| Loan Combinations/Split Loan Structures: | The Mortgaged Property identified on Annex A–1 to the Free Writing Prospectus as One Kendall Square secures a Mortgage Loan with an outstanding principal balance as of the Cut–off Date of $83,000,000, evidenced by Note A-2 (the “One Kendall Square Loan”), representing approximately 8.9% of the Initial Outstanding Pool Balance, and also secures, on a pari passu basis, a companion loan that has an outstanding principal balance as of the Cut-off Date of $120,000,000, evidenced by Note A-1, which is expected to be included in the COMM 2014-UBS2 commercial mortgage securitization. The One Kendall Square Loan and related companion loan are pari passu in right of payment and are collectively referred to herein as the “One Kendall Square Loan Combination.” The One Kendall Square Loan Combination is expected to be serviced pursuant to the COMM 2014-UBS2 pooling and servicing agreement and the related intercreditor agreement. For additional information regarding the One Kendall Square Loan Combination, see “Description of the Mortgage Pool—Loan Combinations/Split Loan Structures—The One Kendall Square Loan Combination” in the Free Writing Prospectus. The Mortgaged Property identified on Annex A–1 to the Free Writing Prospectus as 1760 Third Avenue secures a Mortgage Loan with an outstanding principal balance as of the Cut–off Date of $75,000,000, evidenced by Note A-2 (the “1760 Third Avenue Loan”), representing approximately 8.1% of the Initial Outstanding Pool Balance, and also secures, on a pari passu basis, a companion loan that has an outstanding principal balance as of the Cut-off Date of $65,000,000, evidenced by Note A-1, which was included in the COMM 2014-CCRE15 commercial mortgage securitization. The 1760 Third Avenue Loan and related companion loan are pari passu in right of payment and are collectively referred to herein as the “1760 Third Avenue Loan Combination.” The 1760 Third Avenue Loan Combination will be serviced pursuant to the pooling and servicing agreement for this transaction and the related intercreditor agreement. For additional information regarding the 1760 Third Avenue Loan Combination, see “Description of the Mortgage Pool—Loan Combinations/Split Loan Structures—The 1760 Third Avenue Loan Combination” in the Free Writing Prospectus. The portfolio of Mortgaged Properties identified on Annex A–1 to the Free Writing Prospectus as the PennCap Portfolio secures a Mortgage Loan with an outstanding principal balance as of the Cut–off Date of $33,700,000, evidenced by Note A-2 (the “PennCap Portfolio Loan”), representing approximately 3.6% of the Initial Outstanding Pool Balance, and also secures, on a pari passu basis, a companion loan that has an outstanding principal balance as of the Cut-off Date of $90,000,000, evidenced by Note A-1, which is currently included in the WFRBS 2014-LC14 commercial mortgage securitization. The PennCap Portfolio Loan and related companion loan are pari passu in right of payment and are collectively referred to herein as the “PennCap Portfolio Loan Combination.” The PennCap Portfolio Loan Combination will be serviced pursuant to the WFRBS 2014-LC14 pooling and servicing agreement and the related intercreditor agreement. For additional information regarding the PennCap Portfolio Loan Combination, see “Description of the Mortgage Pool—Loan Combinations/Split Loan Structures—The PennCap Portfolio Loan Combination” in the Free Writing Prospectus. The portfolio of Mortgaged Properties identified on Annex A–1 to the Free Writing Prospectus as the JL Holdings – Burger King Portfolio – 90 secures a Mortgage Loan with an outstanding principal balance as of the Cut–off Date of $26,900,000, evidenced by Note A-1 (the “JL Holdings – Burger King Portfolio – 90 Loan”), representing approximately 2.9% of the Initial Outstanding Pool Balance, and also secures (i) on a pari passu basis, a companion loan that has an outstanding principal balance as of the Cut-off |

The depositor has filed a registration statement (including the prospectus) with the SEC (SEC File No. 333-193376) for the offering to which this communication relates. Before you invest, you should read the prospectus in the registration statement and other documents the depositor has filed with the SEC for more complete information about the depositor, the issuing trust and this offering. You may get these documents for free by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, the depositor or Deutsche Bank Securities Inc., any other underwriter, or any dealer participating in this offering will arrange to send you the prospectus if you request it by calling toll-free 1-800-503-4611 or by email to the following address: prospectus.cpdg@db.com. The offered certificates referred to in these materials, and the asset pool backing them, are subject to modification or revision (including the possibility that one or more classes of certificates may be split, combined or eliminated at any time prior to issuance or availability of a final prospectus) and are offered on a “when, as and if issued” basis. You understand that, when you are considering the purchase of these certificates, a contract of sale will come into being no sooner than the date on which the relevant class has been priced and we have verified the allocation of certificates to be made to you; any “indications of interest” expressed by you, and any “soft circles” generated by us, will not create binding contractual obligations for you or us.

10

| COMM 2014-LC15 Mortgage Trust | |

| STRUCTURE OVERVIEW | |

Date of $22,900,000, evidenced by Note A-2, which is currently held by LCF and (ii) on a subordinate basis, a companion loan that has an outstanding principal balance as of the Cut-off Date of $10,000,000, which is currently held by ARC Realty Finance Operating Partnership L.P. The JL Holdings – Burger King Portfolio – 90 Loan and related pari passu companion loan are pari passu in right of payment with one another and are generally senior in right of payment to the related subordinate companion loan as and to the extent described in “Description of the Mortgage Pool—Loan Combinations/Split Loan Structures—The JL Holdings – Burger King Portfolio – 90 Loan Combination” in the Free Writing Prospectus. The JL Holdings – Burger King Portfolio – 90 Loan, related pari passu companion loan and related subordinate companion loan (together, the “JL Holdings – Burger King Portfolio – 90 Loan Combination) will be serviced pursuant to the pooling and servicing agreement for this transaction and the related intercreditor agreements. For additional information regarding the JL Holdings – Burger King Portfolio – 90 Loan Combination, see “Description of the Mortgage Pool—Loan Combinations/Split Loan Structures—JL Holdings – Burger King Portfolio – 90 Loan Combination” in the Free Writing Prospectus. The Mortgaged Property identified on Annex A–1 to the Free Writing Prospectus as McKinley Mall secures a Mortgage Loan with an outstanding principal balance as of the Cut–off Date of $10,000,000, evidenced by Note A-2 (the “McKinley Mall Loan”), representing approximately 1.1% of the Initial Outstanding Pool Balance, and also secures, on a pari passu basis, a companion loan that has an outstanding principal balance as of the Cut-off Date of $28,000,000, evidenced by Note A-1, which was included in the COMM 2014-CCRE14 commercial mortgage securitization. The McKinley Mall Loan and related companion loan are pari passu in right of payment and are collectively referred to herein as the “McKinley Mall Loan Combination.” The McKinley Mall Loan Combination will be serviced pursuant to the COMM 2014-CCRE14 pooling and servicing agreement and the related intercreditor agreement. For additional information regarding the McKinley Mall Loan Combination, see “Description of the Mortgage Pool—Loan Combinations/Split Loan Structures—The McKinley Mall Loan Combination” in the Free Writing Prospectus. The Mortgaged Property identified on Annex A-1 to the Free Writing Prospectus as Moss-Bauer Apartments secures a Mortgage Loan (the “Moss-Bauer Apartments Loan”) with an outstanding principal balance as of the Cut-off Date of $9,400,000, evidenced by Note A, representing approximately 1.0% of the Initial Outstanding Pool Balance, and also secures on a subordinate basis, a companion loan that has an outstanding principal balance as of the Cut-off Date of $600,000, that is not part of the mortgage pool, is currently held by GACC and is expected to be acquired by an affiliate of Rialto Capital Advisors, LLC. The subordinate companion loan will be subordinate in right of payment to the Moss-Bauer Apartments Loan. The holder of the Moss-Bauer Apartments subordinate companion loan has certain rights with respect to the Moss-Bauer Apartments Loan as described under “Description of the Mortgage Pool—Loan Combinations/Split Loan Structures—The Moss-Bauer Apartments Loan Combination” in the Free Writing Prospectus. The Moss-Bauer Apartments Loan is generally senior in right of payment to the related subordinate companion loan (together, the “Moss-Bauer Apartments Loan Combination”). The Moss-Bauer Apartments Loan Combination will be serviced pursuant to the pooling and servicing agreement for this transaction and the related intercreditor agreement. For additional information regarding the Moss-Bauer Apartments Loan Combination, see “Description of the Mortgage Pool—Loan Combinations/Split Loan Structures—The Moss-Bauer Apartments Loan Combination” in the Free Writing Prospectus. | |

The depositor has filed a registration statement (including the prospectus) with the SEC (SEC File No. 333-193376) for the offering to which this communication relates. Before you invest, you should read the prospectus in the registration statement and other documents the depositor has filed with the SEC for more complete information about the depositor, the issuing trust and this offering. You may get these documents for free by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, the depositor or Deutsche Bank Securities Inc., any other underwriter, or any dealer participating in this offering will arrange to send you the prospectus if you request it by calling toll-free 1-800-503-4611 or by email to the following address: prospectus.cpdg@db.com. The offered certificates referred to in these materials, and the asset pool backing them, are subject to modification or revision (including the possibility that one or more classes of certificates may be split, combined or eliminated at any time prior to issuance or availability of a final prospectus) and are offered on a “when, as and if issued” basis. You understand that, when you are considering the purchase of these certificates, a contract of sale will come into being no sooner than the date on which the relevant class has been priced and we have verified the allocation of certificates to be made to you; any “indications of interest” expressed by you, and any “soft circles” generated by us, will not create binding contractual obligations for you or us.

11

| COMM 2014-LC15 Mortgage Trust | |

| STRUCTURE OVERVIEW | |

| Control Rights: | Certain Classes of Certificates (the “Control Eligible Certificates”) will have certain control rights over servicing matters with respect to each Mortgage Loan (other than with respect to the One Kendall Square Loan Combination, the PennCap Portfolio Loan Combination, the McKinley Mall Loan Combination and, so long as the holder of the related subordinate companion loan is the related Loan Combination Directing Holder, the JL Holdings – Burger King Portfolio – 90 Loan Combination), the 1760 Third Avenue Loan Combination and the Moss-Bauer Apartments Loan Combination. The majority owner or appointed representative of the Class of Control Eligible Certificates that is the Controlling Class (such owner or representative, the “Directing Holder”), will be entitled to direct the Special Servicer to take, or refrain from taking certain actions with respect to a Mortgage Loan as to which it has control rights. Furthermore, the Directing Holder will also have the right to receive notice and consent to certain material actions that the Master Servicer and the Special Servicer proposes to take with respect to such a Mortgage Loan. For a description of the directing holder for the One Kendall Square Loan Combination, the PennCap Portfolio Loan Combination, the McKinley Mall Loan Combination and the JL Holdings – Burger King Portfolio – 90 Loan Combination, which are each referred to herein as a “Loan Combination Directing Holder”, see “Description of the Mortgage Pool—Loan Combinations/Split Loan Structures” and “Description of the Pooling and Servicing Agreement—The Directing Holder” in the Free Writing Prospectus. |

Control Eligible Certificates: | Class E, Class F and Class G Certificates. |

| Controlling Class: | The Controlling Class will be the most subordinate Class of Control Eligible Certificates then outstanding that has an aggregate Certificate Balance, as notionally reduced by any Appraisal Reduction Amounts allocable to such Class, equal to no less than 25% of the initial Certificate Balance of such Class. The Controlling Class as of the Settlement Date will be the Class G Certificates. The holder of the control rights with respect to the One Kendall Square Loan Combination, the PennCap Portfolio Loan Combination, the McKinley Mall Loan Combination and the JL Holdings – Burger King Portfolio – 90 Loan Combination will be the related Loan Combination Directing Holder. |

| Appraised–Out Class: | Any Class of Control Eligible Certificates that has been determined, as a result of Appraisal Reductions Amounts allocable to such Class, to no longer be the Controlling Class. |

Remedies Available to Holders of an Appraised–Out Class: | Holders of the majority of any Class of Control Eligible Certificates that is determined at any time of determination to no longer be the Controlling Class as a result of an allocation of an Appraisal Reduction Amounts in respect of such Class will have the right, at their sole expense, to require the Special Servicer to order a second appraisal for any Mortgage Loan for which an Appraisal Reduction Event has occurred. Upon receipt of the second appraisal, the Special Servicer will be required to determine, in accordance with the Servicing Standard, whether, based on its assessment of the second appraisal, a recalculation of the Appraisal Reduction Amount is warranted. If warranted, the Special Servicer will direct the Master Servicer to recalculate the Appraisal Reduction Amount based on the second appraisal, and if required by such recalculation, the Special Servicer will reinstate the Appraised–Out Class as the Controlling Class. The Holders of an Appraised–Out Class requesting a second appraisal will not be entitled to exercise any rights of the Controlling Class until such time, if any, as the Class is reinstated as the Controlling Class. |

The depositor has filed a registration statement (including the prospectus) with the SEC (SEC File No. 333-193376) for the offering to which this communication relates. Before you invest, you should read the prospectus in the registration statement and other documents the depositor has filed with the SEC for more complete information about the depositor, the issuing trust and this offering. You may get these documents for free by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, the depositor or Deutsche Bank Securities Inc., any other underwriter, or any dealer participating in this offering will arrange to send you the prospectus if you request it by calling toll-free 1-800-503-4611 or by email to the following address: prospectus.cpdg@db.com. The offered certificates referred to in these materials, and the asset pool backing them, are subject to modification or revision (including the possibility that one or more classes of certificates may be split, combined or eliminated at any time prior to issuance or availability of a final prospectus) and are offered on a “when, as and if issued” basis. You understand that, when you are considering the purchase of these certificates, a contract of sale will come into being no sooner than the date on which the relevant class has been priced and we have verified the allocation of certificates to be made to you; any “indications of interest” expressed by you, and any “soft circles” generated by us, will not create binding contractual obligations for you or us.

12

| COMM 2014-LC15 Mortgage Trust | |

| STRUCTURE OVERVIEW | |

Directing Holder: | It is expected that RREF II CMBS AIV, LP will be the initial Directing Holder for each Mortgage Loan other than the One Kendall Square Loan Combination, the PennCap Portfolio Loan Combination, the McKinley Mall Loan Combination and the JL Holdings – Burger King Portfolio – 90 Loan Combination. See “Description of the Mortgage Pool—Loan Combinations” and “Description of the Pooling and Servicing Agreement—The Directing Holder” in the Free Writing Prospectus for a description of the Loan Combination Directing Holder for the One Kendall Square Loan Combination, the PennCap Portfolio Loan Combination, the McKinley Mall Loan Combination and the JL Holdings – Burger King Portfolio – 90 Loan Combination. |

| Control Termination Event: | Will occur when no Class of Control Eligible Certificates has a Certificate Balance (as notionally or actually reduced by any Appraisal Reduction Amounts and Realized Losses) equal to or greater than 25% of the Certificate Balance as of the Settlement Date and, in the case of the JL Holdings – Burger King Portfolio – 90 Loan Combination, the holder of the related subordinate companion loan is no longer the related Loan Combination Directing Holder. Upon the occurrence and the continuance of a Control Termination Event, the Controlling Class will no longer have any Control Rights. The Directing Holder will no longer have the right to direct certain actions of the Special Servicer and will no longer have consent rights with respect to certain material actions that the Master Servicer or Special Servicer proposes to take with respect to a Mortgage Loan. Upon the occurrence and continuation of a Control Termination Event, the Directing Holder (i.e., the majority owner or representative of the senior most Class of Control Eligible Certificates) will retain non–binding consultation rights with respect to certain material actions that the Special Servicer proposes to take with respect to a Mortgage Loan as to which the Directing Holder previously had control rights. Such consultation rights will continue until the occurrence of a Consultation Termination Event. |

| Consultation Termination Event: | Will occur when, without giving regard to the application of any Appraisal Reduction Amounts (i.e., giving effect to principal reduction through Realized Losses only), there is no Class of Control Eligible Certificates that has an aggregate Certificate Balance equal to 25% or more of the initial Certificate Balance of such Class and, in the case of the JL Holdings – Burger King Portfolio – 90 Loan Combination, the holder of the related subordinate companion loan is no longer the related Loan Combination Directing Holder. Upon the occurrence and continuance of a Consultation Termination Event, the Directing Holder will have no rights under the Pooling and Servicing Agreement other than those rights that all Certificateholders have. |

Appointment and Replacement of Special Servicer: | The Directing Holder will appoint the initial Special Servicer as of the Settlement Date. Prior to the occurrence and continuance of a Control Termination Event, the Special Servicer (other than with respect to the One Kendall Square Loan Combination, the PennCap Portfolio Loan Combination, the McKinley Mall Loan Combination and, so long as the holder of the related subordinate companion loan is the related Loan Combination Directing Holder, the JL Holdings – Burger King Portfolio – 90 Loan Combination) may generally be replaced at any time by the Directing Holder. Upon the occurrence and during the continuance of a Control Termination Event, the Directing Holder will no longer have the right to replace the Special Servicer and such replacement (other than with respect to the One Kendall Square Loan Combination, the PennCap Portfolio Loan Combination, the McKinley Mall Loan Combination and, so long as the holder of the related subordinate companion loan is the related Loan Combination King Portfolio – 90 Loan Combination and the McKinley Mall Loan Combination. |

The depositor has filed a registration statement (including the prospectus) with the SEC (SEC File No. 333-193376) for the offering to which this communication relates. Before you invest, you should read the prospectus in the registration statement and other documents the depositor has filed with the SEC for more complete information about the depositor, the issuing trust and this offering. You may get these documents for free by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, the depositor or Deutsche Bank Securities Inc., any other underwriter, or any dealer participating in this offering will arrange to send you the prospectus if you request it by calling toll-free 1-800-503-4611 or by email to the following address: prospectus.cpdg@db.com. The offered certificates referred to in these materials, and the asset pool backing them, are subject to modification or revision (including the possibility that one or more classes of certificates may be split, combined or eliminated at any time prior to issuance or availability of a final prospectus) and are offered on a “when, as and if issued” basis. You understand that, when you are considering the purchase of these certificates, a contract of sale will come into being no sooner than the date on which the relevant class has been priced and we have verified the allocation of certificates to be made to you; any “indications of interest” expressed by you, and any “soft circles” generated by us, will not create binding contractual obligations for you or us.

13

| COMM 2014-LC15 Mortgage Trust | |

| STRUCTURE OVERVIEW | |

Directing Holder, the JL Holdings – Burger King Portfolio – 90 Loan Combination) will occur based on a vote of holders of all voting eligible Classes of Certificates as described below. See “Description of the Mortgage Pool—Loan Combinations” and “Description of the Pooling and Servicing Agreement” in the Free Writing Prospectus for a description of the special servicer appointment and replacement rights with respect to the One Kendall Square Loan Combination, the PennCap Portfolio Loan Combination, the JL Holdings – Burger King Portfolio – 90 Loan Combination and the McKinley Mall Loan Combination. | |

| Replacement of Special Servicer by Vote of Certificateholders: | Other than with respect to the One Kendall Square Loan Combination, the PennCap Portfolio Loan Combination and the McKinley Mall Loan Combination, if a Control Termination Event has occurred and is continuing, upon (i) the written direction of holders of Certificates evidencing not less than 25% of the voting rights of all Classes of Certificates entitled to principal (taking into account the application of Appraisal Reduction Amounts to notionally reduce the Certificate Balances of Classes to which such Appraisal Reduction Amounts are allocable) requesting a vote to replace the Special Servicer with a replacement Special Servicer, (ii) payment by such requesting holders to the Certificate Administrator of all reasonable fees and expenses to be incurred by the Certificate Administrator in connection with administering such vote and (iii) delivery by such holders to the Certificate Administrator of written confirmations from each Rating Agency that the appointment of the replacement Special Servicer will not result in a downgrade of the Certificates, the Certificate Administrator will be required to promptly provide written notice to all certificateholders of such request and conduct the solicitation of votes of all Certificates in such regard. Upon the written direction (within 180 days) of (i) Holders of at least 75% of a Certificateholder Quorom or (ii) the Holders of more than 50% of the voting rights of each Class of Non–Reduced Certificates, the Trustee will immediately replace the Special Servicer (other than with respect to the One Kendall Square Loan Combination, the PennCap Portfolio Loan Combination and the McKinley Mall Loan Combination) with the replacement Special Servicer. “Certificateholder Quorum” means, in connection with any solicitation of votes in connection with the replacement of the Special Servicer as described above, the holders of Certificates evidencing at least 75% of the aggregate voting rights (taking into account Realized Losses and the application of any Appraisal Reduction Amounts to notionally reduce the Certificate Balance of the Certificates) of all classes of Certificates entitled to principal, on an aggregate basis. In addition, after the occurrence of a Consultation Termination Event, if the Operating Advisor determines that the Special Servicer is not performing its duties in accordance with the Servicing Standard, the Operating Advisor will have the right to recommend the replacement of the Special Servicer (other than with respect to the One Kendall Square Loan Combination, the PennCap Portfolio Loan Combination and the McKinley Mall Loan Combination). The Operating Advisor’s recommendation to replace the Special Servicer (other than with respect to the One Kendall Square Loan Combination, the PennCap Portfolio Loan Combination and the McKinley Mall Loan Combination) must be confirmed by a majority of the voting rights of all Classes of Certificates entitled to principal (taking into account the application of Appraisal Reduction Amounts to notionally reduce the Certificate Balances of Classes to which such Appraisal Reduction Amounts are allocable) within 180 days from the time such recommendation is posted to the Certificate Administrator website and is subject to the receipt of written confirmations from each Rating Agency that the appointment of the replacement Special Servicer will not result in a downgrade of the Certificates. The Special Servicer for the JL Holdings – Burger King Portfolio – 90 Loan Combination may not be replaced as described above in this “Replacement of the Special Servicer by Vote of Certificateholders” section while the holder of the related subordinate companion loan is the related Loan Combination Directing Holder. See “Description of the Mortgage Pool—Loan Combinations” and “Description of the Pooling and Servicing Agreement” in the Free Writing Prospectus for |

The depositor has filed a registration statement (including the prospectus) with the SEC (SEC File No. 333-193376) for the offering to which this communication relates. Before you invest, you should read the prospectus in the registration statement and other documents the depositor has filed with the SEC for more complete information about the depositor, the issuing trust and this offering. You may get these documents for free by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, the depositor or Deutsche Bank Securities Inc., any other underwriter, or any dealer participating in this offering will arrange to send you the prospectus if you request it by calling toll-free 1-800-503-4611 or by email to the following address: prospectus.cpdg@db.com. The offered certificates referred to in these materials, and the asset pool backing them, are subject to modification or revision (including the possibility that one or more classes of certificates may be split, combined or eliminated at any time prior to issuance or availability of a final prospectus) and are offered on a “when, as and if issued” basis. You understand that, when you are considering the purchase of these certificates, a contract of sale will come into being no sooner than the date on which the relevant class has been priced and we have verified the allocation of certificates to be made to you; any “indications of interest” expressed by you, and any “soft circles” generated by us, will not create binding contractual obligations for you or us.

14

| COMM 2014-LC15 Mortgage Trust | |

| STRUCTURE OVERVIEW | |

| a description of the special servicer appointment and replacement rights with respect to the One Kendall Square Loan Combination, the PennCap Portfolio Loan Combination, the JL Holdings – Burger King Portfolio – 90 Loan Combination and the McKinley Mall Loan Combination. | |

Cap on Workout and Liquidation Fees: | The workout fees and liquidation fees payable to a Special Servicer under the Pooling and Servicing Agreement will be an amount equal to the lesser of: (1) 1.0% of each collection of interest and principal following a workout or liquidation and (2) $1,000,000 per workout or liquidation. All Modification Fees actually paid to the Special Servicer in connection with a workout or liquidation or in connection with any prior workout or partial liquidation that occurred within the prior 18 months will be deducted from the total workout and/or liquidation fees payable (other than Modification Fees earned while the Mortgage Loan was not in special servicing). In addition, the total amount of workout and liquidation fees actually payable by the Trust under the Pooling and Servicing Agreement will be capped in the aggregate at $1,000,000 for each Mortgage Loan. If a new special servicer begins servicing the Mortgage Loan, all amounts paid to the prior special servicer will be disregarded for purposes of calculating the cap. |