- ANSS Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

ANSYS (ANSS) DEF 14ADefinitive proxy

Filed: 5 Apr 19, 8:35am

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☒

Check the appropriate box:

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☒ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☐ | Soliciting Material Pursuant to Section 240.14a-12 |

| ANSYS, Inc. |

(Name of Registrant as Specified In Its Charter) |

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

Payment of Filing Fee (Check the appropriate box):

| ☒ | No fee required. | |

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. | |

| (1) | Title of each class of securities to which transaction applies: | |

| (2) | Aggregate number of securities to which transaction applies: | |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |

| (4) | Proposed maximum aggregate value of transaction: | |

| (5) | Total fee paid: | |

| ☐ | Fee paid previously with preliminary materials. | |

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |

| (1) | Amount Previously Paid: | |

| (2) | Form, Schedule or Registration Statement No.: | |

| (3) | Filing Party: | |

| (4) | Date Filed: | |

|  |

| Dear Stockholders, | April 5, 2019 |

| Sincerely, | Sincerely, | |

|  | |

| Ronald W. Hovsepian | Ajei S. Gopal | |

| Lead Independent Director | President and CEO |

| 2019 ANSYS Proxy Statement 1 |

| 1. | The election of two Class II directors for three-year terms; |

| 2. | The ratification of the selection of Deloitte & Touche LLP as the Company’s independent registered public accounting firm for fiscal 2019; |

| 3. | The advisory vote to approve compensation of our named executive officers; and |

| 4. | Such other business as may properly come before the annual meeting and any adjournments or postponements thereof. |

| How to Cast Your Vote | |

| Your vote is important to the future of ANSYS. If you are a registered stockholder, please vote your shares as soon as possible by one of the following methods: | |

| Vote Online www.proxyvote.com |

| Vote by Phone 1.800.690.6903 |

| Vote by Mail Mail your signed proxy card |

If you are a street name stockholder (i.e., you hold your shares through a broker, bank or other nominee), please vote your shares as soon as possible by following the instructions from your broker, bank or other nominee. See “Other Matters—Questions and Answers About the Proxy Materials and the 2019 annual meeting” for details on voting requirements and additional information about the 2019 annual meeting. | |

IMPORTANT NOTICE REGARDING THE INTERNET AVAILABILITY OF PROXY MATERIALS FOR THE ANNUAL MEETING OF STOCKHOLDERS TO BE HELD ON MAY 17, 2019 The Notice of Annual Meeting of Stockholders, Proxy Statement and Annual Report for the fiscal year ended December 31, 2018 are available at www.proxyvote. com. If you receive a Notice of Internet Availability of Proxy Materials by mail, you will not receive a paper copy of the Notice of Annual Meeting of Stockholders, Proxy Statement and Annual Report unless you specifically request a copy. You may request paper copies by following the instructions on the Notice of Internet Availability of Proxy Materials. We began making our proxy materials available on April 5, 2019. | |

| 2019 ANSYS Proxy Statement 2 |

| 5 | |

| 5 | |

| 5 | |

| 6 | |

| 6 | |

| 7 | |

| 8 | |

| 8 | |

| 9 | |

| 9 | |

| 10 | |

| 11 | |

| CORPORATE GOVERNANCE AT ANSYS | |

| 12 | |

| 12 | |

| 13 | |

| 14 | |

| 17 | |

| 17 | |

| 17 | |

| 17 | |

| 17 | |

| 18 | |

| 18 | |

| 18 | |

| 18 | |

| 18 | |

| 19 | |

| 19 | |

| 19 | |

| 20 | |

| 20 | |

| 20 | |

| 20 | |

| 20 | |

| 21 | |

| 21 |

3 2019 ANSYS Proxy Statement |

| 22 | |

| 22 | |

| 23 | |

| 24 | |

| 24 | |

| 25 | |

| 35 | |

| 36 | |

| 36 | |

| 38 | |

| 39 | |

| 41 | |

| 41 | |

| 43 | |

| 44 | |

| 44 | |

| 44 | |

| 45 | |

| 45 | |

| 48 |

2019 ANSYS Proxy Statement 4 |

| 2019 ANNUAL MEETING OF STOCKHOLDERS | |

| Time and Date | May 17, 2019, at 11:30 a.m. Eastern Time |

| Live Webcast Address | www.virtualshareholdermeeting.com/anss2019 |

| Record Date | March 21, 2019 |

| Voting | Stockholders of ANSYS as of the record date, March 21, 2019, are entitled to vote on the proposals at the 2019 annual meeting. Each share of ANSYS common stock is entitled to one vote for each director nominee and one vote for each of the other proposals to be voted upon at the 2019 annual meeting. |

| • | Lower Development Costs. We help customers get to an accurate answer faster, so they can do more in less time while using fewer resources than before. |

| • | Reduce Time to Market. Our software can drastically shorten development time and prototype iterations. |

| • | Optimize Product Performance. We consistently enable our customers to perfect product reliability, performance and safety. |

2019 ANSYS Proxy Statement 5 |

| Proposals | Board Recommendation | More Information | |

| 1 | Proposal 1 — Election of Class II Directors The Board and the Nominating and Corporate Governance Committee believe that the two Class II director nominees possess the necessary qualifications and expertise to provide effective oversight and advice to management. | FOR | pg. 14 |

| 2 | Proposal 2 — Ratification of Selection of Independent Registered Public Accounting Firm for Fiscal 2019 The Audit Committee approved the retention of Deloitte & Touche LLP as the Corporation’s independent auditor for fiscal year 2019. As a matter of good corporate governance, stockholders are being asked to ratify the Audit Committee’s selection of the independent auditor. | FOR | pg. 24 |

| 3 | Proposal 3 — Advisory Vote to Approve Compensation of Our Named Executive Officers The Company’s executive compensation policies and programs are designed to create a direct link between stockholder interests and management, with incentives specifically tailored to the achievement of financial, operational, and stock performance goals. | FOR | pg. 26 |

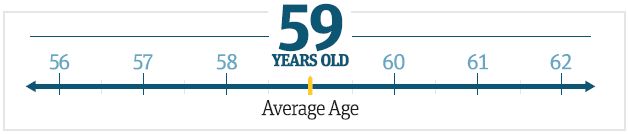

| Name | Age | Director Since | Occupation | Independent | Current Committee Memberships |

| Class I - Term Expires 2021 | |||||

| Guy E. Dubois | 64 | 2015 | Former Senior Advisor at Silver Lake | YES | CC† |

| Alec D. Gallimore | 55 | 2017 | Robert J. Vlasic Dean of Engineering at the University of Michigan | YES | AC |

| Nicole Anasenes | 45 | 2018 | CFO and COO of Squarespace | YES | AC |

| Class II - Term Expires 2019 | |||||

| Michael C. Thurk* | 66 | 2007 | Managing Partner of Mariposa Consulting, LLC | YES | AC / NCG |

| Ronald W. Hovsepian** | 57 | 2012 | Executive Partner at Flagship Pioneering | YES | CC / NCG |

| Barbara V. Scherer | 63 | 2013 | Former Senior Vice President, Finance and Administration and CFO of Plantronics, Inc. | YES | AC† |

| Class III - Term Expires 2020 | |||||

| James E. Cashman* | 65 | 2000 | Chairman of the Board of ANSYS | NO | – |

| William R. McDermott | 57 | 2007 | CEO of SAP | YES | NCG† / CC |

| Ajei S. Gopal | 57 | 2011 | President and CEO of ANSYS | NO | – |

| Glenda M. Dorchak*** | 64 | 2018 | Former CEO of Value America | YES | CC |

| AC | Audit Committee; |

| CC | Compensation Committee; |

| NCG | Nominating and Corporate Governance Committee; |

| † | Committee Chair |

| * | Mr. Thurk is not standing for re-election at the 2019 annual meeting, and Mr. Cashman has resigned from the Board effective April 30, 2019. |

| ** | The Board has approved Mr. Hovsepian to be Chairman of the Board effective April 30, 2019. |

| *** | The Board has appointed Ms. Dorchak to the Nominating and Corporate Governance Committee, effective upon the date of the 2019 annual meeting |

6 2019 ANSYS Proxy Statement |

2019 ANSYS Proxy Statement 7 |

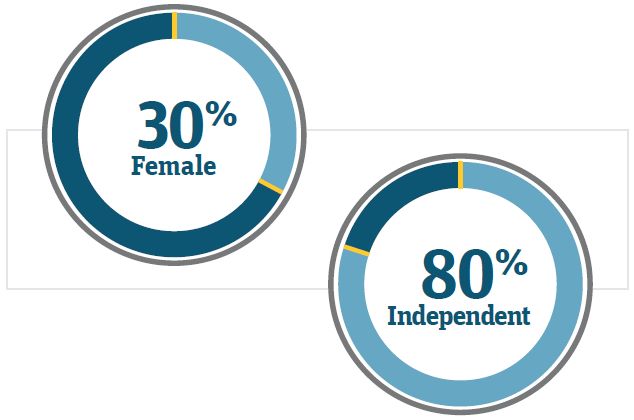

| • | Lead independent director (Independent Chairman effective April 30, 2019) |

| • | Separate CEO and Chairman/Lead Independent Director roles |

| • | More than 85% of the Board at the time of the 2019 annual meeting will be comprised of independent directors |

| • | Majority voting in director elections with resignation policy |

| • | 100% independent committee members |

| • | Robust Board evaluation process |

| • | Stockholder engagement program |

| • | Proxy access |

| • | Annual Say-on-Pay Vote |

| • | Stock ownership guidelines for directors and officers |

| • | Board risk oversight |

| • | Independent directors meet without management present |

| • | Clawback policy |

| • | Anti-hedging and anti-pledging policies |

| • | Code of Business Conduct and Ethics for directors, officers, and employees |

| • | Periodic review of committee charters and governance policies |

| • | Director overboarding policy |

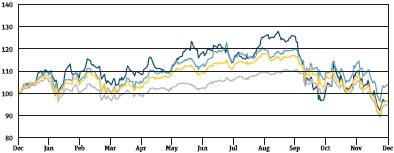

| ANSYS, Inc |  | S&P 500 Software & Services Index |

| NASDAQ Composite Index |  | S&P 500 |

| • | The annualized value of maintenance and lease contracts with start dates or anniversary dates during the period, plus |

| • | The value of perpetual license contracts with start dates during the period, plus |

| • | The annualized value of fixed-term services contracts with start dates or anniversary dates during the period, plus |

| • | The value of work performed during the period on fixed-deliverable services contracts. |

8 2019 ANSYS Proxy Statement |

| Pay For Performance | Objectives | 2018 Say-on-Pay | |||

• | Paying for performance is the guiding principle of ANSYS’ total rewards strategy | • | Create a competitive total rewards package based on the attainment of short- and long- term goals | • | Over 95% of our stockholders voting on the 2018 Say-on-Pay proposal approved the compensation of our named executive officers |

• | Target actual total compensation at the 50th percentile of the market | • | Retain and attract qualified executive officers who will lead us to long-term success and enhance stockholder value | ||

| 40% – Time-Based Restricted Stock Units |

| 42% – Performance-Based Restricted Stock Units |

| 7% – Base Salary |

| 11% – Performance-Based Cash Bonus |

| 93% – Performance-Based Compensation |

| 39% – Time-Based Restricted Stock Units |

| 40% – Performance-Based Restricted Stock Units |

| 11% – Base Salary |

| 10% – Performance-Based Cash Bonus |

| 89% – Performance-Based Compensation |

2019 ANSYS Proxy Statement 9 |

| What We Do | What We Don’t Do | ||

| Performance-based cash and equity incentives |  | No “single trigger” change of control benefits |

| Significant portion of executive compensation at risk based on Company performance |  | No post-termination retirement- or pension-type non-cash benefits or perquisites for our executive officers that are not available to our employees generally |

| Clawback provision on performance-based compensation |  | No tax gross-ups for change in control benefits |

| Stock ownership guidelines for directors and executive officers |  | No repricing or replacing of underwater options |

| Caps on performance-based cash and equity incentive compensation |  | No hedging or pledging of Company securities |

| 100% independent directors on the Compensation Committee |  | No current dividends paid on unvested awards |

| Independent compensation consultant engaged by the Compensation Committee |  | No excessive risk-taking with compensation incentives |

| Annual review and approval of our compensation strategy | ||

| Limited perquisites | ||

| • | Numerous interactions with our top 50 holders, who represent over 75% of shares outstanding; and |

| • | Over 90% of our stock being categorized as low turnover. |

10 2019 ANSYS Proxy Statement |

| • | Employees (including through employee surveys and executive communication meetings). |

| • | Stockholders (including investor and analyst days and face-to-face meetings and discussions with investors). Our program’s priority areas are informed by these engagements, the Software and IT Services sector standard of the Sustainability Accounting Standards Board (SASB), the questionnaires we receive from investor groups, reports from ESG rating agencies, and the practices of our industry peers. |

| • | Company-wide Market Competitive Compensation. We aim to offer market-competitive compensation throughout our organization. |

| • | Soliciting Employee Input. We conducted a global employee engagement survey and use its feedback to improve the work environment and employee satisfaction. 93% of our employees worldwide participated in the 2018 survey. |

| • | Association with Academic Institutions and Community Involvement. ANSYS values its partnerships with academic institutions. Engineering schools are users of our products, and in addition we collaborate with them, including through online courses, as a means to attract new employees for the future. We support, with the participation of our employees, community-related programs to build positive, long-term relationships with the communities in which our employees work and live around the globe. |

| • | Diversity and Inclusion Initiatives. A diverse and inclusive culture is essential for the success of our business. We have established the ANSYS Women in Technology program to raise awareness for the need to recruit, develop and train women in our organization and to empower employees to build their careers and network at ANSYS. |

| • | Employee Training. We support talent development initiatives like tuition assistance, paying for selected professional association memberships and events, and conducting annual performance assessments. The ANSYS Learning Center, introduced based on 2017 employee engagement survey feedback, provides on- line access to a catalog of professional development courses for employees. |

| • | Health and Wellness. We promote the health and well-being of our employees with initiatives such as wellness fairs, flu shots, health screenings, onsite gym sponsorship, half marathons and relaxation sessions. |

| • | For Customers. ANSYS products support customers in development of energy efficient products (notably through reducing material usage and emissions, increasing energy efficiency, or electrifying transportation), and support innovative and sustainable design for energy systems. ANSYS also offers solutions to support development of emerging technologies like autonomous vehicles, industrial internet of things (IoT), and additive manufacturing. |

| • | For ANSYS. Some of our sustainability initiatives include our LEED-certified corporate headquarters, recycling and water and energy conservation initiatives such as replacement of inefficient old equipment with more efficient technology, air containment strategies, motion-sensitive lighting, “bike-to-work” initiatives, and electronic waste recycling. |

| • | Data Privacy. Our global data privacy director and ANSYS privacy and information security teams work closely to address potential risks to the security of personal and protected data. |

| • | Data Security. The ANSYS Information Security Office maintains our global enterprise information security program based on adaptive industry standard frameworks that are risk-based and supported by a corporate culture that values security. |

2019 ANSYS Proxy Statement 11 |

| PROPOSAL 1 | Election of Directors |

| Name | Age | Director Since |

| Class I - Term Expires 2021 | ||

| Guy E. Dubois | 64 | 2015 |

| Alec D. Gallimore | 55 | 2017 |

| Nicole Anasenes | 45 | 2018 |

| Class II - Term Expires 2019 | ||

| Michael C. Thurk* | 66 | 2007 |

| Ronald W. Hovsepian | 57 | 2012 |

| Barbara V. Scherer | 63 | 2013 |

| Class III - Term Expires 2020 | ||

| William R. McDermott | 57 | 2007 |

| Ajei S. Gopal | 57 | 2011 |

| Glenda M. Dorchak | 64 | 2018 |

| * | Mr. Thurk’s service as a director on the Board will cease immediately prior to the conclusion of the 2019 annual meeting. |

12 2019 ANSYS Proxy Statement |

Ronald W. Hovsepian Age 57 Independent Director since 2012 Chairman of the Board effective April 30, 2019 Compensation Committee Nominating and Corporate Governance Committee | Qualifications Mr. Hovsepian’s qualifications to serve on the ANSYS Board of Directors include his extensive experience in the technology and software industries as a CEO, senior manager, and venture capital investor, in sales, marketing, and product development. Experience Mr. Hovsepian has served as the Lead Independent Director of the Board since October 2014 and will become its Chairman on April 30, 2019. From October 2014 through December 2016, Mr. Hovsepian was also the Non-Executive Chairman of the Board. Since October 2018, he has served as an Executive Partner at Flagship Pioneering, a leading venture capital firm investing in scientific ventures for life. Mr. Hovsepian was appointed President, CEO and Director of Synchronoss Technologies from January to April 2017. Previously, Mr. Hovsepian served as President and CEO of Intralinks, Inc., from December 2011 to January 2017, and President and CEO of Novell, Inc. from 2005 to 2011. He joined Novell in 2003 as Executive Vice President and President, Worldwide Field Operations. Prior to his time at Novell, Mr. Hovsepian spent his time from 2000 to 2003 in the venture capital industry. He started his career at IBM and served in a number of executive positions over approximately 16 years. Mr. Hovsepian served as a member of the board for ANN Inc. from 1998 to August 2015. In that time, he also served as the Non-Executive Chairman of the board of ANN Inc. from 2005 to 2015. Principal Occupation Mr. Hovsepian serves as an Executive Partner at Flagship Pioneering. Other Directorships Mr. Hovsepian serves on the Boards of ECi Software Solutions, PegaSystems and Skillsoft. |

Barbara V. Scherer Age 63 Independent Director since 2013 Chair of the Audit Committee | Qualifications Ms. Scherer’s qualifications to serve on the ANSYS Board of Directors include her practical and strategic insight into complex financial reporting and management issues and significant operational expertise, gained over a career spanning more than 30 years, including 25 in senior financial leadership roles in the technology industry. Experience Ms. Scherer was Senior Vice President, Finance and Administration and Chief Financial Officer of Plantronics, Inc., a global leader in audio communication devices for businesses and consumers from 1998 to 2012, and was Vice President, Finance and Administration and Chief Financial Officer from 1997 to 1998. Prior to Plantronics, Ms. Scherer held various executive management positions spanning 11 years in the disk drive industry, was an associate with The Boston Consulting Group, and was a member of the corporate finance team at ARCO in Los Angeles. From 2004 through 2010, she served as a director of Keithley Instruments, a publicly traded test and measurement company, until its acquisition by Danaher Corporation. Principal Occupation Independent corporate director Other Directorships Ms. Scherer is a director of Netgear, Inc., where she serves on the Compensation Committee and chairs the Audit Committee, and is a director of Ultra Clean Holdings, Inc., where she serves on the Audit Committee and the Nominating and Corporate Governance Committee. |

2019 ANSYS Proxy Statement 13 |

Nicole Anasenes Age 45 Independent Director since 2018 Audit Committee | Qualifications Ms. Anasenes’ qualifications to serve on the ANSYS Board of Directors include her extensive experience in financial and operational matters, including in large technology companies. Experience Ms. Anasenes has spent her 20+ year career in building and transforming technology businesses. Since 2016, she has served as the Chief Financial Officer and Chief Operating Officer of Squarespace. From 2013 to 2015, she was Chief Financial Officer of Infor, one of the largest providers of enterprise applications in the world. Before joining Infor, from 2002 to 2013, she worked at IBM in various leadership positions in corporate finance, M&A and market development. Her roles spanned hardware, software and services and included driving businesses in both mature and emerging markets. Principal Occupation Ms. Anasenes is the Chief Financial Officer and Chief Operating Officer of Squarespace. |

Glenda Dorchak Age 64 Independent Director since 2018 Compensation Committee Nominating and Corporate Governance Committee (as of the date of the 2019 annual meeting) | Qualifications Ms. Dorchak’s qualifications to serve on the ANSYS Board of Directors include serving in the top positions of innovative technology and communications companies. Experience Ms. Dorchak is a technology industry veteran with deep leadership and operating expertise running hardware and software businesses in the computing and communications technology sectors that enable today’s Internet of Things (IoT). From 1974 to 1984, she held a broad set of management and executive roles at IBM, including General Manager PC Direct North America and global customer relationship marketing executive for the Personal Systems Group. She joined Intel Corporation as Vice President & Chief Operating Officer Intel Communications Group in 2001 and later held several VP & General Manager roles including General Manager of the Consumer Electronics Group. Her focus on connected embedded products and technologies continued with CEO and Chairman roles at software provider Intrinsyc from 2006 to 2008, and Vice Chair and CEO roles at software provider VirtualLogix from 2009 to 2010. Ms. Dorchak served from 2012 to 2013 as EVP & General Manager Global Business for Spansion, a leading provider of non-volatile memory solutions that was acquired by Cypress Semiconductor. Ms. Dorchak also served as a member of the Board of Energy Focus from 2015 to February 2019. Principal Occupation Independent corporate director. Other Directorships Ms. Dorchak is a director of Mellanox Technologies, Ltd. and Quantenna Communications Inc. |

14 2019 ANSYS Proxy Statement |

Guy E. Dubois Age 64 Independent Director since 2015 Chair of the Compensation Committee | Qualifications Mr. Dubois’ qualifications to serve on the ANSYS Board of Directors include his service in senior leadership positions at software and technology companies, his extensive background in international operations, and his experience as a director of a publicly held company and as chairman of a board of directors. Experience From 2013 to 2015, Mr. Dubois was a Senior Advisor at Silver Lake, a leading private equity technology investor. From July 2011 to July 2012, he was CEO at TEMENOS, a banking software provider. From 2009 to 2011, Mr. Dubois served as President and CEO of MACH Group, a hub-based mobile communications exchange solutions provider. From 2007 to 2008, Mr. Dubois was the EVP and President of the global products division of Amdocs. From 2005 to 2007, he was President and CEO of Cramer Systems. Between 2001 and 2005, he was EVP at Peoplesoft, where he led strategy and business development outside North America. Previously, Mr. Dubois held senior positions with Vantive, Sybase and Digital Equipment Corporation. Principal Occupation Independent corporate director. Other Directorships Mr. Dubois currently serves as a director of Guidewire Software, Inc. and as Chairman of the Board of The Access Group. |

Alec D. Gallimore Age 55 Independent Director since 2017 Audit Committee | Qualifications Dr. Gallimore’s qualifications to serve on the ANSYS Board of Directors include his extensive background in engineering, research and how simulation can be used to create innovative products. Alec D. Glimore Age 55 Independent Director since 2017 Audit Committee Experience Dr. Gallimore holds several posts at the University of Michigan, including the Robert J. Vlasic Dean of Engineering, the Chief Academic and Executive Officer of Michigan Engineering, the Richard F. and Eleanor A. Towner Professor of Engineering, an Arthur F. Thurnau Professor for teaching excellence, and as a professor in both the Department of Aerospace Engineering and the Applied Physics program. He is also director of the NASA-funded Michigan Space Grant Consortium and co-director of the Plasmadynamics and Electric Propulsion Laboratory. Dr. Gallimore has graduated 40 Ph.D. students and 14 master’s students, has written more than 340 technical articles, and holds several patents. He has served on a number of NASA and US Department of Defense boards and studies, including as a member of the United States Air Force Scientific Advisory Board. Principal Occupation As described above, Dr. Gallimore holds several posts at the University of Michigan. |

2019 ANSYS Proxy Statement 15 |

Ajei S. Gopal Age 57 President and Chief Executive Officer Director since 2011 | Qualifications Dr. Gopal’s qualifications to serve on the ANSYS Board of Directors include his background in both technology and senior management of large software and technology companies, and his experience in global operations and business development. Experience Dr. Gopal has been serving as the Company’s President and CEO since January 2017. From August 2016 through December 2016, Dr. Gopal served as the Company’s President and Chief Operating Officer. He was appointed as an independent member of the Board in 2011, and served in that capacity until his employment by the Company as of August 2016. From April 2013 until he joined the Company, Dr. Gopal was an operating partner at Silver Lake, including a secondment to serve as interim President and COO at Symantec Corporation. From 2011 until 2013, he was Senior Vice President at Hewlett Packard. Prior to that, Dr. Gopal was Executive Vice President at CA Technologies from 2006. From 2004 to 2006, he worked for Symantec Corporation, where he served as Executive Vice President and Chief Technology Officer. Earlier, Dr. Gopal served as CEO and a member of the board of ReefEdge Networks, a company he co-founded in 2000. Before that, he worked at IBM from 1991 to 2000, initially at IBM Research, and later in IBM’s Software Group. Principal Occupation President and CEO of ANSYS, Inc. and a member of its Board of Directors. Other Directorships Dr. Gopal serves on the board of Citrix Systems, Inc. and is a member of its Compensation Committee. |

William R. McDermott Age 57 Independent Director since 2007 Chair of the Nominating and Corporate Governance Committee Compensation Committee | Qualifications Mr. McDermott’s qualifications to serve on the ANSYS Board of Directors include his 20+ years in top positions with large, leading global software and technology companies as well as his extensive general management, international and customer-facing insights. Experience Mr. McDermott was appointed CEO of SAP in May 2014. From February 2010 to May 2014, Mr. McDermott was co-CEO of SAP, the world’s business software market leader. He leads the company’s more than 96,000 employees and 2+ million-person ecosystem. Mr. McDermott’s innovation-led strategy for SAP has resulted in expansive increases in customers, total revenue, market value and profitable growth. SAP employees’ approval for Mr. McDermott on the website Glassdoor hovers around 99%. As the only American in history to lead Europe’s most valuable technology company, Mr. McDermott advises world leaders and policymakers on issues including youth unemployment, digital government and international trade policy. Prior to SAP, Mr. McDermott served as Executive Vice President of Worldwide Sales and Operations at Siebel Systems and as President of Gartner, Inc. He spent 17 years at Xerox Corporation holding various senior management positions, including as its youngest president and corporate officer. Principal Occupation Mr. McDermott is the CEO of SAP SE and a member of its Executive Board. Other Directorships Mr. McDermott serves on the board of Under Armour, Inc. and Dell SecureWorks. |

16 2019 ANSYS Proxy Statement |

• | The Audit Committee provides primary oversight over financial, commercial, operational and strategic risks, including but not limited to financial reporting, legal and regulatory compliance, internal controls and cyber-security; |

| • | The Compensation Committee provides primary oversight over the Company’s compensation practices and policies; and |

| • | The Nominating and Corporate Governance Committee provides primary oversight over corporate governance practices, succession planning, and the corporate responsibility program (which also covers environmental and social matters). |

| Chair | Ms. Scherer |

| Members | Ms. Anasenes |

| Gallimore | |

| Mr. Thurk | |

Meetings Held in 2018 | 5 |

| • | Selecting our independent registered public accounting firm to audit financial statements and to perform services related to the audit; |

| • | Reviewing the scope and results of the audit; |

| • | Reviewing with the Company’s management and our independent registered public accounting firm the Company’s quarterly and annual operating results, including the Company’s audited financial statements; |

| • | Reviewing our periodic disclosures related to the Company’s financial statements; |

| • | Considering the adequacy of our internal accounting procedures; |

| • | Overseeing the adequacy and effectiveness of disclosure controls and procedures; |

| • | Overseeing internal audit and compliance with the Sarbanes-Oxley Act of 2002; |

| • | Overseeing our risk management policies and practices; |

| • | Overseeing related party transactions; |

| • | Overseeing procedures for addressing complaints and anonymous employee submissions and related controls; and |

| • | Monitoring legal and regulatory compliance. |

| Chair | Mr. Dubois |

| Members | Ms. Dorchak |

Hovsepian | |

Mr. McDermott | |

Meetings Held in 2018 | 6 |

| • | Reviewing and approving the compensation of our CEO; |

| • | Reviewing and approving the compensation of our other executive officers; |

| • | Overseeing risks related to the Company’s overall compensation practices; |

| • | Approving and administering our equity plans; and |

| • | Reviewing, and recommending to the Board for approval, the compensation of our non-employee directors. |

| Chair | Mr. McDermott |

Members* | Mr. Hovsepian |

| Mr. Thurk | |

Meetings Held in 2018 | 6 |

| • | Overseeing the qualification and nomination process for potential director candidates; |

| • | Reviewing the continued qualifications of existing directors; |

| • | Developing, reviewing and monitoring the implementation of the Company’s corporate governance guidelines; |

| • | Overseeing the annual performance evaluation for the Board; |

| • | Overseeing succession planning for our executives; |

| • | Reviewing the directors and officers insurance policy and indemnification arrangements; |

| • | Reviewing the structure of the Board and its committees; and |

| • | Overseeing the Company’s corporate responsibility program. |

| • | $40,000 per year for service as a Board member; |

| • | $40,000 per year for service as the Lead Independent Director (or Chairman of the Board, as of April 30, 2019); |

| • | $25,000 per year for service as Chair of the Audit Committee; |

| • | $20,000 per year for service as Chair of the Compensation Committee; |

| • | $15,000 per year for service as Chair of the Nominating and Corporate Governance Committee; |

| • | $10,000 per year for service as a member of the Audit Committee; |

| • | $10,000 per year for service as a member of the Compensation Committee; |

| • | $5,000 per year for service as a member of the Nominating and Corporate Governance Committee; |

Name (1) | Fees Earned or Paid in Cash ($) | Stock Awards ($)(2)(3) | All Other Compensation ($) | Total ($) |

| Nicole Anasenes(4) | $20,750 | $228,495 | – | $249,245 |

| James E. Cashman(5) | $0 | $0 | $228,739 | $228,739 |

| Glenda M. Dorchak(4) | $20,750 | $228,495 | – | $249,245 |

| Guy E. Dubois | $56,175 | $300,338 | – | $356,513 |

| Alec D. Gallimore | $50,000 | $300,338 | – | $350,338 |

| Ronald W. Hovsepian | $93,088 | $300,338 | – | $393,426 |

| William R. McDermott | $65,000 | $300,338 | – | $365,338 |

| Bradford C. Morley(6) | $26,775 | – | – | $26,775 |

| Barbara V. Scherer | $59,263 | $300,338 | – | $359,601 |

| Michael C. Thurk | $53,088 | $300,338 | – | $353,426 |

| Patrick J. Zilvitis(6) | $24,863 | – | – | $24,863 |

| PROPOSAL 2 |

| • | Reviewed and discussed the audited financial statements with the Company’s management; |

| • | Discussed with Deloitte & Touche LLP the matters required to be discussed by the auditors with the Audit Committee under the rules adopted by the Public Company Accounting Oversight Board (“PCAOB”); and |

| • | Received the written disclosures and the letter from Deloitte & Touch LLP required by PCAOB Ethics and Independence Rule 3526, Communication with Audit Committees Concerning Independence, and has discussed with Deloitte & Touche LLP its independence. |

| • | Deloitte’s historical and recent performance on the ANSYS audit, including input from those ANSYS employees with substantial contact with Deloitte throughout the year about Deloitte’s quality of service provided, and the independence, objectivity, and professional skepticism demonstrated throughout the engagement by Deloitte and its audit team; |

| • | The quality and candor of Deloitte’s communications with the Audit Committee and management |

| • | External data relating to audit quality and performance, including recent PCAOB reports on Deloitte; |

| • | Deloitte’s independence; |

| • | Deloitte’s global capabilities, technical expertise, and knowledge of the Company’s global operations and industry; |

| • | The appropriateness of Deloitte’s fees, on both an absolute basis and as compared to its peer firms and the fees charged to other public software company peers; |

| • | Deloitte’s tenure as our independent auditor and its familiarity with our global operations and businesses, accounting policies and practices and internal control over financial reporting; and |

| • | Deloitte’s capability and expertise in handling the breadth and complexity of our global operations, including the Company’s acquisitions and phased implementation of enterprise CRM and HRIS systems on a worldwide basis over the next several years. |

| 2018 | 2017 | |

| Audit fees | $1,247,207 | $999,650 |

| Audit-related fees | $205,000 | $197,500 |

| Tax fees | $808,607 | $547,357 |

| All other fees | $157,267 | – |

| Total | $2,418,081 | $1,744,507 |

| Name | Age | Title |

| Ajei S. Gopal | 57 | President and Chief Executive Officer |

| Maria T. Shields | 54 | Senior Vice President and Chief Financial Officer |

| Richard S. Mahoney | 56 | Senior Vice President, Worldwide Sales and Customer Excellence |

| Prithviraj Banerjee | 58 | Chief Technology Officer |

| Shane Emswiler | 44 | Vice President and General Manager, Mechanical, Fluids and Electronics Business Units |

| Janet Lee | 55 | Vice President, General Counsel and Secretary |

| Matthew C. Zack | 49 | Vice President, Business Development and Corporate Marketing |

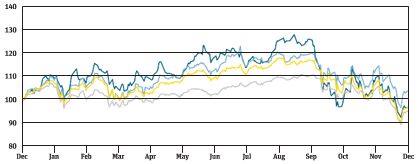

| ANSYS, Inc |  | S&P 500 Software & Services Index | |

| NASDAQ Composite Index |  | S&P 500 |

| What We Do | What We Don’t Do | ||

| Performance-based cash and equity incentives | | No “single trigger” change of control benefits | |

| Significant portion of executive compensation at risk based on Company performance | No post-termination retirement- or pension-type non-cash benefits or perquisites for our executive officers that are not available to our employees generally | ||

| Clawback provision on performance-based compensation | No tax gross-ups for change in control benefits | ||

| Stock ownership guidelines for directors and executive officers | No repricing or replacing of underwater options | ||

| Caps on performance-based cash and equity incentive compensation | No hedging or pledging of Company securities | ||

| 100% independent directors on the Compensation Committee | No current dividends paid on unvested awards | ||

| Independent compensation consultant engaged by the Compensation Committee | No excessive risk-taking with compensation incentives | ||

| Annual review and approval of our compensation strategy | |||

| Limited perquisites |

| Equity | Performance-Based Restricted Stock Units (PSUs) | • Objective performance measure based on Total Stockholder Return relative to the Nasdaq Composite Index* over a 3-year cumulative performance period. • Objective performance measure based on fiscal year non-GAAP revenue* and operating margin* over 3 consecutive one-year performance periods. • Vest three-years after grant date, contingent upon metric achievement and continued employment. |

| Time-Based Restricted Stock Units (RSUs) | • Vest ratably over a 3 year period while employed | |

| Cash | Salary | • Generally eligible for increases annually |

| Performance Bonus | • Target performance bonus ranges from 60% - 100% of salary • Performance metrics based on Annual Contract Value (ACV)**; Operating Income** and Individual Metrics • Cash bonuses paid annually |

| • | Assisting in developing a peer group of publicly-traded companies to be used to help assess executive compensation; |

| • | Assisting in assuring a competitive compensation framework; |

| • | Meeting regularly with the Compensation Committee to review all elements of executive compensation, including the competitiveness of our executive compensation program; and |

| • | Assisting in the risk assessment of our compensation program. |

| • | U.S.-based, publicly traded companies in the software industry, with a focus on companies that develop engineering simulation and other highly technical/innovative software products |

| • | Comparable revenue size (0.5x – 2.5x ANSYS’ revenue of ~$1B) |

| • | Comparable market capitalization (0.3x – 3.0x ANSYS’ current market cap of ~$14B) |

| • | Refine the list of companies based on organic revenue growth, market cap to revenue multiple and profitability (e.g., EBITDA, operating income) |

| 2018 Peer Review Group | |

| Akamai Technologies | Red Hat |

| Aspen Technology | ServiceNow |

| Autodesk | Splunk |

| Cadence Design | Synopsys |

| Citrix Systems | Tableau Software |

| Guidewire Software | Tyler Technologies |

| LogMeIn | Ultimate Software |

| Nuance | VeriSign |

| Pegasystems | Workday |

| PTC | |

| • | Base salary; |

| • | Performance-based cash bonus; |

| • | Performance-based and time-based equity grants in the form of PSUs and RSUs; and |

| • | Severance and change in control-related benefits. |

| • | Performance against corporate, individual and organizational objectives for the fiscal year; |

| • | Importance of particular skill sets and professional abilities to the achievement of long-term strategic goals; and |

| • | Contribution as a leader, corporate representative and member of the senior management team. |

| 40% – Time-Based Restricted Stock Units |  | 39% – Time-Based Restricted Stock Units | ||

| 42% – Performance-Based Restricted Stock Units |  | 40% – Performance-Based Restricted Stock Units | ||

| 7% – Base Salary |  | 11% – Base Salary | ||

| 11% – Performance-Based Cash Bonus |  | 10% – Performance-Based Cash Bonus | ||

| 93% – Performance-Based Compensation |  | 89% – Performance-Based Compensation |

| • | The officer’s role, level of responsibility, leadership and experience; |

| • | Employee retention; |

| • | Internal equity considerations; |

| • | External competitiveness of the officer’s base salary and overall total compensation (as compared to the peer group for similar positions, if applicable); and |

| • | Individual performance. |

| NEO | 2018 Base Salary | % Increase | % of Peer Group Median |

| Ajei Gopal | $775,000 | 3.33% | 127% |

| Maria Shields | $399,600 | 2.99% | 97% |

| Richard Mahoney | $381,100 | 3.00% | 91% |

| Shane Emswiler | $268,800 | 2.97% | 93% |

| Janet Lee | $319,300 | 3.00% | 90% |

| 2018 Executive Incentive Plan: Metric Weighting | |||

| ACV | Operating Income | Individual Results | |

| CEO | 42.5% | 42.5% | 15% |

Exec. Leadership Team | 37.5% | 37.5% | 25% |

| 2018 Executive Incentive Plan: Metrics | |||

| ACV performance (in thousands) | |||

| Achievement | Amount | +/- Target | Payout as % of Target |

| Maximum | $1,347,500 | 110% | 150%(1) |

| Target | $1,225,000 | 100% | 100% |

| Threshold | $1,163,750 | 95% | 85% |

| Non-GAAP OI Performance (in thousands) | |||

| Achievement | Amount | +/- Target | Payout as % of Target |

| Maximum | $572,660 | 110% | 150% (1) |

| Target | $520,600 | 100% | 100% |

| Threshold | $494,570 | 95% | 85% |

| • | The annualized value of maintenance and lease contracts with start dates or anniversary dates during the period, plus |

| • | The value of perpetual license contracts with start dates during the period, plus |

| • | The annualized value of fixed-term services contracts with start dates or anniversary datesduring the period, plus |

| • | The value of work performed during the period on fixed-deliverable services contracts. |

| NEO | 2018 Target Bonus as % of Salary | 2018 Target Cash Bonus | Total Cash Compensation compared to Peer Median |

| Ajei Gopal | 100% | $775,000 | 121% |

| Maria Shields | 75% | $299,700 | 88% |

| Richard Mahoney | 100% | $381,100 | 94% |

Shane Emswiler | 60% | $161,280 | 102% |

| Janet Lee | 60% | $191,580 | 84% |

| 2018 Executive Incentive Plan: Metrics | ||

| ACV performance (in thousands) | ||

| Target Amount | Achievement Amount | +/- Target |

| $1,225,000 | $1,292,805 | 105.48% |

| Non-GAAP OI Performance (in thousands) | ||

| Target Amount | Achievement Amount | +/- Target |

| $520,600 | $536,267 | 103.01% |

NEO | 2018 Cash Bonus Paid | 2018 Cash Bonus Paid as % of Salary | 2018 Cash Bonus Paid as % of Target |

| Ajei Gopal | $1,148,257 | 148% | 148% |

| Maria Shields | $366,106 | 92% | 122% |

| Richard Mahoney | $489,361 | 128% | 128% |

Shane Emswiler | $207,096 | 77% | 128% |

| Janet Lee | $234,030 | 73% | 122% |

| • | The Company’s TSR relative to the Index; and |

| • | Revenue and operating margin (operating income as a percentage of revenue), each calculated in accordance with GAAP and ASC 605, and adjusted to: (i) reflect results at planned foreign currency exchange rates, (ii) exclude the impact of any acquisitions not contemplated in the Company’s financial plan, and (iii) include non-GAAP adjustments described on pages 42 of the Form 10-K. |

| Award | Metric | Weighting as a % of Total PSU Value |

| PSU Award 1 | Relative Total Stockholder Return | 20% |

| PSU Award 2 | Revenue and Operating Margin | 80% |

Sample ANSYS Total Shareholder Return | Sample Performance Measurement Index | Difference between Sample ANSYS TSR and Index | 2019 Performance Multiplier |

| 40 | 15 | +25 | 200% |

| 40 | 30 | +10 | 140% |

| 40 | 40 | 0 | 100% |

| 40 | 42 | -2 | 94% |

| 40 | 56 | -16 | 52% |

| 40 | 65 | -25 | 25% |

| 40 | 70 | -30 | 0% |

| -10 | -20 | +10 | 100% |

| -10 | -5 | -5 | 0% |

Revenue Attainment (in millions) | < 1,150 | 1,150 | 1,155 | 1,160 | 1,165 | 1,170 | 1,175 | 1,180 | 1,185 | 1,190 | 1,195 | |

Operating Margin | 45.5% | 0% | 40% | 55% | 70% | 85% | 100% | 125% | 150% | 175% | 200% | 200% |

| 44.0% | 0% | 36% | 50% | 63% | 77% | 90% | 125% | 150% | 175% | 200% | 200% | |

| 43.5% | 0% | 32% | 44% | 56% | 68% | 80% | 112% | 135% | 175% | 200% | 200% | |

| 43.0% | 0% | 24% | 33% | 42% | 51% | 60% | 100% | 120% | 157% | 180% | 200% | |

| 42.5% | 0% | 0% | 0% | 0% | 0% | 0% | 0% | 0% | 140% | 160% | 180% | |

| ANSYS Executive Officer Stock Ownership Guidelines | |

| CEO | 5x Annual Salary |

| Executive Leadership Team | 3x Annual Salary |

| Senior Leadership Team | 2x Annual Salary |

| Timeframe to achieve guideline | 5 years |

| Shares that count against guideline | 1/2 in shares of stock; balance can be in-the- money options |

| • | Our base salary component of compensation does not encourage risk taking because it is a fixed amount. |

| • | Our performance-based cash bonus awards are based, in part, on the achievement of at least two quantitative performance measures, thus diversifying the risk associated with any single indicator of performance. |

| • | Awards under our performance-based cash bonus programs are based on overall performance and qualitative individual goals that vary depending on each executive’s role, which limits the risk associated with awarding cash bonuses based solely on Company financial performance metrics. |

| • | Assuming achievement of a threshold level of performance, payouts under our performance-based plans result in some compensation at levels below full target achievement rather than an “all-or- nothing” approach, which could engender excessive risk taking. |

| • | We award our executives PSUs that are earned based, in part, on the performance of our common stock over a cumulative 3-year period providing them with strong incentives to increase stockholder value over the long-term. This plan is capped at 200% of target awards to prevent excessive compensation or risk taking on the part of the participants. |

| • | Our Compensation Committee determines achievement levels under the Company’s performance-based cash bonus program in its discretion after reviewing Company and executive performance and which program similarly caps pay-outs to prevent excessive compensation or risk-taking. |

| • | We maintain a robust clawback policy. |

| • | Our executive stock ownership policy requires executives to hold equity equal to a minimum of two or three times their base salary, or, in the case of our CEO, equal to a minimum of five times his base salary, and at least half of that minimum must be comprised of shares of our stock, which aligns an appropriate portion of their personal wealth to our long-term performance. Executives must attain the levels described above within five years of becoming subject to this policy. |

| Name and Principal Position | Year | Salary ($) | Bonus ($)(1) | Stock Awards ($)(2) | Option Awards($)(3) | Non-Equity Incentive Plan ($)(4) | Change in Pension Value & Non-qualified Deferred Earnings ($) | All Other ($)(5) | Total |

| Ajei S. Gopal, President and Chief Executive Officer | 2018 | $768,750 | $210,000 | $8,214,921 | — | $938,257 | — | $32,256 | $10,164,184 |

| 2017 | $750,000 | $205,537 | $8,339,153 | — | $769,463 | — | $234,903 | $10,299,056 | |

| 2016 | $183,333 | $201,000 | $5,000,000 | $5,000,000 | — | — | $29,616 | $10,413,949 | |

| Maria T. Shields, Senior Vice President and Chief Financial Officer | 2018 | $396,700 | $93,656 | $2,939,148 | — | $272,450 | — | $10,813 | $3,712,767 |

| 2017 | $384,750 | $90,938 | $3,161,198 | — | $263,428 | — | $11,413 | $3,911,727 | |

| 2016 | $370,833 | $268,470 | $1,393,672 | — | — | $11,818 | $2,044,793 | ||

Richard S. Mahoney, Senior Vice President, Worldwide Sales and Customer Excellence | 2018 | $378,325 | $142,913 | $3,001,612 | $346,448 | $20,586 | $3,889,884 | ||

| 2017 | $370,000 | $138,750 | $2,305,657 | — | $334,943 | — | $53,683 | $3,203,033 | |

| 2016 | $21,109 | — | $554,940 | $738,987 | — | — | — | $1,315,036 | |

| Shane Emswiler, Vice President and General Manager, Mechanical, Fluids and Electronics Business Units | 2018 | $266,864 | $60,480 | $1,731,187 | — | $146,616 | — | $10,041 | $2,215,188 |

| 2017 | $259,153 | $97,875 | $1,723,856 | — | $94,508 | — | $8,649 | $2,184,041 | |

| Janet Lee, Vice President, General Counsel and Secretary | 2018 | $316,975 | $59,869 | $1,191,803 | — | $174,161 | — | $84,969 | $1,827,777 |

| Named Executive Officer | Maximum Value |

| Gopal | |

| 2018 PSU Award - TSR | $2,051,832 |

| 2018 PSU Award – Revenue and Operating Margin (2018) Tranche | $2,320,296 |

| 2017 PSU Award – Revenue and Operating Margin (2018) Tranche | $3,356,683 |

| Shields | |

| 2018 PSU Award - TSR | $675,762 |

| 2018 PSU Award – Revenue and Operating Margin (2018) Tranche | $764,252 |

| 2017 PSU Award – Revenue and Operating Margin (2018) Tranche | $1,127,568 |

| 2016 PSU Award – Revenue and Operating Margin (2018) Tranche | $333,392 |

| Mahoney | |

| 2018 PSU Award - TSR | $796,571 |

| 2018 PSU Award – Revenue and Operating Margin (2018) Tranche | $900,753 |

| 2017 PSU Award – Revenue and Operating Margin (2018) Tranche | $928,075 |

| Emswiler | |

| 2018 PSU Award - TSR | $434,528 |

| 2018 PSU Award – Revenue and Operating Margin (2018) Tranche | $491,359 |

| 2017 PSU Award – Revenue and Operating Margin (2018) Tranche | $693,888 |

| Lee | |

| 2018 PSU Award - TSR | $373,932 |

| 2018 PSU Award – Revenue and Operating Margin (2018) Tranche | $423,055 |

| Name | Grant Date | Compensation Committee Approval Date | Estimated Future Payouts Under Non-Equity Incentive Plan Award | Estimated Future Payouts Under Equity Incentive Plan Awards | All Other Stock | All Other Option | Exercise or Base Price of Option Award ($/Sh) | Grant Date Fair Value of Stock and Option Awards ($) | ||||

Threshold ($) | Target ($) | Maximum ($) | Threshold (#) | Target (#) | Maximum (#) | Awards: Number of Shares of Stock Or Units (#) | Awards: Number of Securities Underlying Options | |||||

Ajei S. Gopal, President and Chief Executive Officer | (1) | 2/15/18 | 559,938 | 658,750 | 1,317,500 | |||||||

| (2) 3/3/2018 | 2/15/18 | 1,712 | 7,134 | 14,267 | $1,160,148 | |||||||

| (3) 3/3/2018 | 2/15/18 | 446 | 5,350 | 10,700 | $1,025,916 | |||||||

| (4) 3/3/2018 | 2/15/18 | 26,751 | $4,350,515 | |||||||||

| (5) 3/5/2017 | 2/15/18 | 2,477 | 10,320 | 20,640 | $1,678,342 | |||||||

Maria T. Shields, Senior Vice President and Chief Financial Officer | (1) | 2/15/18 | 191,059 | 224,775 | 337,163 | |||||||

| (2) 3/3/2018 | 2/15/18 | 564 | 2,350 | 4,699 | $382,126 | |||||||

| (3) 3/3/2018 | 2/15/18 | 147 | 1,762 | 3,524 | $337,881 | |||||||

| (4) 3/3/2018 | 2/15/18 | 8,812 | $1,433,096 | |||||||||

| (5) 3/5/2017 | 2/15/18 | 832 | 3,467 | 6,933 | $563,784 | |||||||

| (6) 3/5/2016 | 2/15/18 | 328 | 1,367 | 2,050 | $222,261 | |||||||

Richard S. Mahoney, Senior Vice President, Worldwide Sales and Customer Excellence | (1) | 2/15/18 | 242,951 | 285,825 | 428,738 | |||||||

| (2) 3/3/2018 | 2/15/18 | 665 | 2,769 | 5,539 | $450,377 | |||||||

| (3) 3/3/2018 | 2/15/18 | 173 | 2,077 | 4,154 | $398,286 | |||||||

| (4) 3/3/2018 | 2/15/18 | 10,385 | $1,688,913 | |||||||||

| (5) 3/5/2017 | 2/15/18 | 685 | 2,853 | 5,707 | $464,038 | |||||||

Shane Emswiler, Vice President and General Manager, Mechanical, Fluids and Electronics Business Units | (1) | 2/15/18 | 102,816 | 120,960 | 181,440 | |||||||

| (2) 3/3/2018 | 2/15/18 | 363 | 1,511 | 3,021 | $245,680 | |||||||

| (3) 3/3/2018 | 2/15/18 | 94 | 1,133 | 2,266 | $217,264 | |||||||

| (4) 3/3/2018 | 2/15/18 | 5,665 | $921,299 | |||||||||

| (5) 3/5/2017 | 2/15/18 | 512 | 2,133 | 4,267 | $346,944 | |||||||

Janet Lee, Vice President, General Counsel and Secretary | (1) | 2/15/18 | 122,132 | 143,685 | 215,528 | |||||||

| (2) 3/3/2018 | 2/15/18 | 312 | 1,301 | 2,601 | $211,527 | |||||||

| (3) 3/3/2018 | 2/15/18 | 81 | 975 | 1,950 | $186,966 | |||||||

| (4) 3/3/2018 | 2/15/18 | 4,878 | $793,309 | |||||||||

| Option Awards | Stock Awards |

Number of Securities Underlying Unexercised Options (#) Exercisable | Number of Securities Underlying Unexercised Options (#) Unexercisable | Equity Incentive Plan Awards: Number of Securities Underlying Unexercised Unearned Options (#) | Option Exercise Price ($) | Option Expiration Date | Number of Shares or Units of Stock That Have Not Vested (#) | Market Value of Shares or Units of Stock That Have Not Vested ($) (16) | Equity Incentive Plan Awards: Number of Unearned Shares, Units or Other Rights That Have Not Vested (#) | Equity Incentive Plan Awards: Market or Payout Value of Unearned Shares, Units or Other Rights That Have Not Vested ($) (16) | ||

Ajei S. Gopal, President and Chief Executive Officer | 104,440 | 104,442 | 95.09 | 8/31/2026 | (1) | |||||

17,527 | 2,505,309 | (2) | ||||||||

29,025 | 4,148,834 | (3) | ||||||||

26,751 | 3,823,788 | (4) | ||||||||

34,400 | 4,917,136 | 17,200 | 2,458,568 | (5) | ||||||

7,740 | 1,106,356 | 5,160 | 737,570 | (6) | ||||||

14,266 | 2,039,182 | 28,535 | 4,078,793 | (7) | ||||||

10,700 | 1,529,458 | (8) | ||||||||

Maria T. Shields, Senior Vice President and Chief Financial Officer | 12,000 | 48.97 | 11/15/2020 | |||||||

| 31,000 | 58.67 | 11/14/2021 | ||||||||

| 18,000 | 67.44 | 11/14/2022 | ||||||||

| 1,900 | 271,586 | (9) | ||||||||

| 4,100 | 586,054 | (10) | ||||||||

| 12,459 | 1,780,889 | (3) | ||||||||

| 8,812 | 1,259,587 | (4) | ||||||||

| 5,738 | 820,190 | (11) | ||||||||

| 4,099 | 585,911 | (12) | ||||||||

| 11,556 | 1,651,815 | 5,778 | 825,907 | (5) | ||||||

| 2,600 | 371,644 | 1,733 | 247,715 | (6) | ||||||

| 4,699 | 671,675 | 9,399 | 1,343,493 | (7) | ||||||

| 3,524 | 503,721 | (8) | ||||||||

| Richard S. Mahoney, Senior Vice President, Worldwide Sales and Customer Excellence | 7,500 | 15,000 | 92.49 | 12/30/2026 | (13) | |||||

3,000 | 428,820 | (14) | ||||||||

8,025 | 1,147,094 | (3) | ||||||||

10,385 | 1,484,432 | (4) | ||||||||

9,512 | 1,359,645 | 4,756 | 679,823 | (5) | ||||||

2,140 | 305,892 | 1,427 | 203,975 | (6) | ||||||

5,539 | 791,745 | 11,077 | 1,583,346 | (7) | ||||||

4,154 | 593,773 | (8) | ||||||||

Shane Emswiler, Vice President and General Manager, Mechanical, Fluids and Electronics Business Units | 912 | 130,361 | (9) | |||||||

| 3,000 | 428,820 | (10) | ||||||||

| 1,096 | 156,662 | (15) | ||||||||

| 5,665 | 809,755 | (4) | ||||||||

| 7,112 | 1,016,589 | 3,556 | 508,295 | (5) | ||||||

| 1,600 | 228,704 | 1,067 | 152,517 | (6) | ||||||

| 3,021 | 431,882 | 6,043 | 863,786 | (7) | ||||||

| 2,266 | 323,902 | (8) | ||||||||

| Janet Lee, Vice President, General Counsel and Secretary | 2,465 | 352,347 | (17) | |||||||

4,878 | 697,261 | (4) | ||||||||

2,601 | 371,787 | 5,203 | 743,717 | (7) | ||||||

1,950 | 278,733 | (8) |

| Option Awards | Stock Awards | |||

| Name | Number of Shares Acquired on Exercise (#) | Value Realized on Exercise ($) | Number of Shares Acquired on Vesting (#) | Value Realized on Vesting ($) |

| Ajei S. Gopal, President and Chief Executive Officer | 0 | 0 | 37,522 | 6,514,799 |

| Maria T. Shields, Senior Vice President and Chief Financial Officer | 25,000 | 2,887,286 | 20,466 | 3,331,405 |

| Richard S. Mahoney, Senior Vice President, Worldwide Sales and Customer Excellence | 7,500 | 412,787 | 7,027 | 1,114,265 |

Shane Emswiler, Vice President and General Manager, Mechanical, Fluids and Electronics Business Units | 0 | 0 | 11,650 | 1,893,950 |

| Janet Lee, Vice President, General Counsel and Secretary | 0 | 0 | 822 | $143,176 |

| Event | Ajei S. Gopal | Maria T. Shields | Richard S. Mahoney | Shane Emswiler | Janet Lee |

| Retirement | |||||

| No Payments | N/A | N/A | N/A | N/A | N/A |

| Total | $0 | $0 | $0 | $0 | $0 |

Termination without Cause and Involuntary Termination for Good Reason (other than related to a Change in Control)(1) | |||||

| Cash Severance Payment | $1,550,000 | $199,800 | $190,550 | $134,400 | $159,650 |

| Annual Bonus at Target | $1,550,000 | $599,400 | $799,200 | $322,560 | $383,160 |

| Accelerated RSUs | $7,820,390 | $0 | $0 | $0 | $0 |

| Outplacement Services | $0 | $15,000 | $15,000 | $15,000 | $15,000 |

| Continued Health Care Benefits | $48,376 | $24,188 | $18,859 | $17,133 | $22,029 |

| Total | $10,968,766 | $838,388 | $1,023,609 | $489,093 | $579,839 |

Death(2) | |||||

| Accelerated RSUs | $10,477,931 | $3,510,892 | $3,060,345 | $2,383,096 | $1,049,608 |

| Prorated PSUs (assumed at target) | $7,023,490 | $3,754,951 | $2,122,270 | $1,460,043 | $294,284 |

| Total | $17,501,421 | $7,265,844 | $5,182,615 | $3,843,139 | $1,343,892 |

Disability(2) | |||||

| Accelerated RSUs | $10,477,931 | $3,510,892 | $3,060,345 | $2,383,096 | $1,049,608 |

| Prorated PSUs (assumed at target) | $7,023,490 | $3,754,951 | $2,122,270 | $1,460,043 | $294,284 |

| Total | $17,501,421 | $7,265,844 | $5,182,615 | $3,843,139 | $1,343,892 |

| Voluntary Termination and Termination for Cause | |||||

| No Payments | $N/A | $N/A | $N/A | $N/A | $N/A |

| Total | $0 | $0 | $0 | $0 | $0 |

Change in Control with Termination(3) | |||||

Prorated Annual Cash Incentive Compensation | $1,550,000 | $599,400 | $763,600 | $322,560 | $383,160 |

| Accelerated Stock Options | $4,997,550 | $0 | $756,750 | $0 | $0 |

| Accelerated RSUs | $10,477,931 | $3,510,892 | $3,060,345 | $2,383,096 | $1,049,608 |

| PSUs (assumed at target) | $12,219,083 | $5,479,105 | $3,919,558 | $2,550,335 | $882,940 |

| Cash Severance Payment | $1,550,000 | $399,600 | $381,100 | $268,800 | $319,300 |

| Continued Health Care Benefits | $48,376 | $24,188 | $18,859 | $17,133 | $22,029 |

| Outplacement Services | $0 | $15,000 | $15,000 | $15,000 | $15,000 |

| Total | $30,842,940 | $10,028,185 | $8,915,212 | $5,556,924 | $2,672,037 |

| • | Dr. Gopal’s annual total compensation – $10,164,184 |

| • | Median employee’s annual total compensation – $142,631 |

| • | Ratio of Dr. Gopal’s to the median employee’s annual total compensation 71:1 |

| Shares Beneficially Owned | ||

| Name and Address of Beneficial Owner | Number | Percent |

The Vanguard Group, Inc. 100 Vanguard Boulevard, Malvern, PA 19355 | 8,838,844 (1) | 10.55% |

BlackRock Inc. 55 East 52nd Street, New York, NY 10055 | 6,466,673 (2) | 7.72% |

| Shares Beneficially Owned | ||

| Beneficial Owner | Number(1) | Percent(1) |

Ajei S. Gopal(2) | 179,122 | * |

Maria T. Shields(3) | 132,903 | * |

| Shane Emswiler(4) | 15,894 | * |

Janet Lee(5) | 2,390 | * |

Richard Mahoney(6) | 21,273 | * |

James E. Cashman(7) | 429,220 | * |

| Nicole Anasenes | 0 | * |

| Glenda Dorchak | 0 | * |

Guy E. Dubois(8) | 6,934 | * |

| Alec. D. Gallimore | 564 | * |

Ronald H. Hovsepian(9) | 28,777 | * |

William R. McDermott(10) | 41,874 | * |

Barbara V. Scherer(11) | 13,565 | * |

Michael C. Thurk(12) | 52,054 | * |

All Executive Officers and Directors as a group (16 persons)(13) | 928,887 | 1.11% |

| • | To vote before the virtual annual meeting, visit http://www proxyvote.com until 11:59 p.m. Eastern Time the day prior to the meeting. Enter your 16-digit control number as indicated. |

| • | For a description of other ways to vote before the annual meeting, see “How Do I Vote” herein. |

| • | To attend the virtual annual meeting and vote during the annual meeting, visit www.virtualshareholdermeeting.com/anss2019. Enter your 16-digit control number as indicated. Stockholders will be able to log in beginning at 11:15 a.m. Eastern Time on May 17, 2019. |

| • | The election of two Class II directors for three-year terms; |

| • | The ratification of the selection of Deloitte & Touche LLP as the Company’s independent registered public accounting firm for fiscal 2019; and |

| • | The advisory vote to approve compensation of our named executive officers. |

| • | FOR the nominees for election as Class II directors; |

| • | FOR the ratification of the selection of Deloitte &Touche LLP as the Company’s independent registered public accounting firm for fiscal 2019; and |

| • | FOR the advisory vote to approve compensation of our named executive officers. |

| • | Instruct the proxy holder or holders on how to vote your shares by using www.proxyvote.com, or the toll-free telephone number listed on the Notice 24 hours a day seven days a week, until 11:59 p.m. Eastern Time on May 16, 2019 (have your proxy card in hand when you call or visit the website); |

| • | Instruct the proxy holder or holders on how to vote your shares by |

| • | Vote by written ballot on-line in person at the 2019 annual meeting. |

| • | Giving written notice of revocation to the Secretary of the Company at or before the 2019 annual meeting (mail to: ANSYS, Inc., Southpointe, 2600 ANSYS Drive, Canonsburg, PA, 15317); |

| • | Entering a new vote via Internet or by telephone by 11:59p.m. Eastern Time on May 16, 2019; |

| • | Returning a later-dated proxy card which must be received by the time of the 2019 annual meeting; or |

| • | Completing a written ballot on-line in person at the 2019 annual meeting. |

| • | Submitting new voting instructions to your broker, bank or other nominee pursuant to instructions provided by such broker, bank or other nominee; or |

| • | Completing a written ballot at the 2019 annual meeting on-line (provided that you have obtained a legal proxy from your broker, bank or other nominee giving you the right to vote the shares). |

| • | Proposal 1: In an uncontested election, each director nominee will be elected by an affirmative vote of the majority of the votes cast. A majority of the votes cast means the number of votes cast “FOR” such nominee’s election exceeds the number of votes cast “AGAINST” that nominee’s election. You may vote “FOR,” “AGAINST,” or “ABSTAIN” with respect to each director nominee. Broker non-votes and abstentions are not treated as votes cast and will have no effect on the outcome of the election. |

| • | Proposal 2: The appointment of Deloitte & Touche LLP as the Company’s independent auditor for fiscal 2019 will be ratified if the proposal receives the affirmative vote of at least a majority of the votes cast. You may vote “FOR,” “AGAINST,” or “ABSTAIN” with respect to this proposal. Abstentions are not considered votes cast and will have no effect on the vote outcome. The ratification of the appointment of the independent auditor is considered a “routine” matter, so there will be no broker non-votes with respect to Proposal 2. If the stockholders do not ratify the appointment of Deloitte & Touche LLP, the Board or Audit Committee may reconsider the appointment. |

| • | Proposal 3: The advisory vote to approve the compensation of our named executive officers must receive the affirmative vote of at least a majority of the votes cast to be approved. You may vote “FOR,” “AGAINST,” or “ABSTAIN” with respect to this proposal. Broker non-votes and abstentions are not treated as votes cast and will have no effect on the vote outcome. |

| • | WHO: A stockholder or group of up to 20 stockholders holding at least 3% of the Company’s outstanding capital stock for three years. |

| • | WHAT: Stockholders can nominate up to 20% of the Board, or at least two individuals (if greater than 20%). |

| • | WHEN: Stockholder nominations must be received by the Secretary at the principal executive office of the Company not later than the close of business on the 120th day nor earlier than the 150th day prior to the anniversary date of the prior year’s annual meeting. |

| • | HOW: Stockholders must provide written notice to the Secretary of the Company expressly nominating its nominee(s) and electing to have its nominee(s) included in the Company’s proxy materials and provide the information detailed in Article II, Section 4 of the By-Laws including, without limitation, the following: (a) information concerning the stockholder nominee and the stockholder that is required to be disclosed in the Company’s proxy statement by the rules and regulations promulgated under the Exchange Act, by the By-Laws, by the Certificate of |

ANSYS, Inc. 2600 ANSYS Drive Canonsburg, PA 15317 U.S.A. © 2019 ANSYS, Inc. All Rights Reserved. | If you’ve ever seen a rocket launch, flown on an airplane, driven a car, used a computer, touched a mobile device, crossed a bridge or put on wearable technology, chances are you’ve used a product where ANSYS software played a critical role in its creation. ANSYS is the global leader in engineering simulation. We help the world’s most innovative companies deliver radically better products to their customers. By offering the best and broadest portfolio of engineering simulation software, we help them solve the most complex design challenges and engineer products limited only by imagination. Visit www.ansys. com for more information. Any and all ANSYS, Inc. brand, product, service and feature names, logos and slogans are registered trademarks or trademarks of ANSYS, Inc. or its subsidiaries in the United States or other countries. All other brand, product, service and feature names or trademarks are the property of their respective owners. |