Exhibit 13.1

ANSYS, Inc. 2006 Annual Report 3

FINANCIAL HIGHLIGHTS

The following table sets forth selected financial data for the last five years that should be read in conjunction with the consolidated financial statements and notes thereto included in this Annual Report. The results of acquired companies have been included in the consolidated financial statements since their respective dates of acquisition.

| | | | | | | | | | | | | | | |

| | | Year Ended December 31, |

| (in thousands, except per share data) | | 2006* | | 2005 | | 2004 | | 2003 | | 2002 |

Total revenue | | $ | 263,640 | | $ | 158,036 | | $ | 134,539 | | $ | 113,535 | | $ | 91,011 |

Operating income | | | 36,156 | | | 58,840 | | | 45,978 | | | 30,317 | | | 27,074 |

Net income | | | 14,156 | | | 43,903 | | | 34,567 | | | 21,313 | | | 18,959 |

Earnings per share – basic | | $ | 0.39 | | $ | 1.38 | | $ | 1.12 | | $ | 0.71 | | $ | 0.65 |

Weighted average shares – basic | | | 36,343 | | | 31,749 | | | 30,955 | | | 29,916 | | | 29,196 |

Earnings per share – diluted | | $ | 0.37 | | $ | 1.30 | | $ | 1.05 | | $ | 0.67 | | $ | 0.61 |

Weighted average shares – diluted | | | 38,199 | | | 33,692 | | | 32,978 | | | 31,876 | | | 31,188 |

Total assets | | $ | 878,043 | | $ | 305,509 | | $ | 239,646 | | $ | 180,559 | | $ | 127,001 |

Working capital | | | 35,856 | | | 167,892 | | | 121,877 | | | 69,835 | | | 57,707 |

Long-term liabilities | | | 163,950 | | | 4,062 | | | 1,800 | | | 761 | | | 824 |

Stockholders’ equity | | | 534,793 | | | 224,977 | | | 175,469 | | | 127,074 | | | 91,393 |

Cash provided by operating activities | | | 89,697 | | | 67,825 | | | 51,366 | | | 38,806 | | | 22,116 |

| * | The amounts reflected for 2006 and the related comparability to other years presented were significantly impacted by the May 1, 2006 acquisition of Fluent Inc. See further information within the “Acquisitions” section of Management’s Discussion and Analysis and in Note 3 to the Consolidated Financial Statements. |

ANSYS, Inc. 2006 Annual Report 12

FINANCIAL CONTENT

| | |

Management’s Discussion and Analysis of Financial Condition and Results of Operations | | 13 |

| |

Reports of Independent Registered Public Accounting Firm | | 35, 36 |

| |

Management’s Report on Internal Control Over Financial Reporting | | 36 |

| |

Consolidated Balance Sheets | | 37 |

| |

Consolidated Statements of Income | | 38 |

| |

Consolidated Statements of Cash Flows | | 39 |

| |

Consolidated Statements of Stockholders’ Equity | | 40 |

| |

Notes to Consolidated Financial Statements | | 41 |

| |

Quarterly Financial Information (Unaudited) | | 59 |

| |

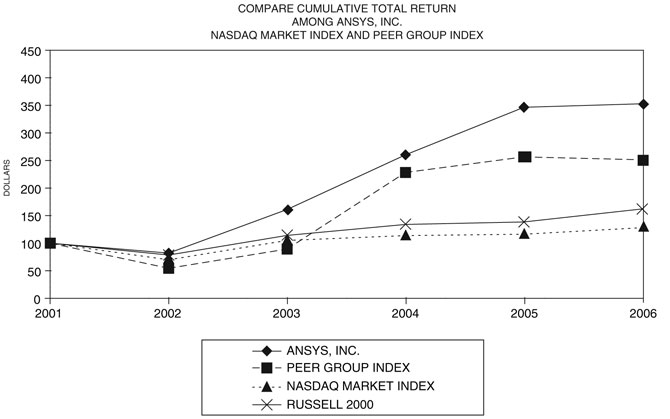

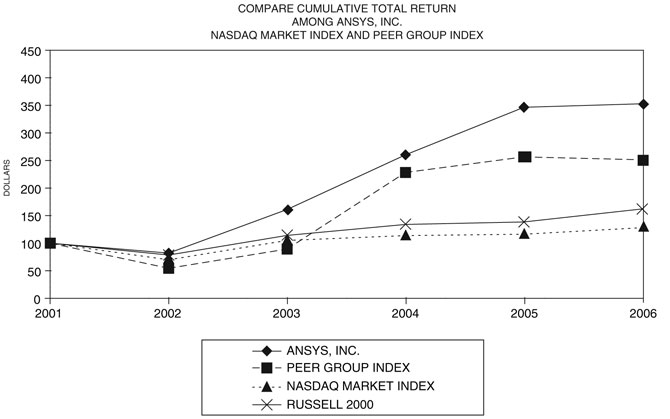

Performance Graph | | 60 |

| |

Corporate Information | | 61 |

ANSYS, Inc. 2006 Annual Report 13

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

Overview

ANSYS, Inc.’s (hereafter the “Company” or “ANSYS”) results for the year ended December 31, 2006 reflect revenue of $263.6 million and basic and diluted earnings per share of $0.39 and $0.37, respectively. These results were most significantly impacted by the May 1, 2006 acquisition of Fluent Inc. (hereafter “Fluent”). The results of operations include the results of Fluent for the period from the date of the acquisition through December 31, 2006. In addition to the impact from Fluent’s operations, the results for the year ended December 31, 2006 include a one-time $28.1 million non-tax deductible charge related to Fluent’s in-process research and development on the acquisition date. The Company’s financial position is strong with $104 million in cash and short-term investments, and working capital of $36 million as of December 31, 2006.

The Company experienced higher revenues both from the Fluent acquisition and from the Company’s other software products and services, and an improvement in margins relating to the non-Fluent operations. These results were partially offset by additional expenses related to the adoption of Statement No. 123R, “Share-Based Payment” (“Statement No. 123R”).

In connection with the acquisition of Fluent on May 1, 2006, the Company borrowed $198 million (incurring interest expense) and used existing cash, cash equivalents and short-term investments (decreasing interest income).

ANSYS develops and globally markets engineering simulation software and services widely used by engineers and designers across a broad spectrum of industries, including aerospace, automotive, manufacturing, electronics, biomedical and defense. Headquartered at Southpointe in Canonsburg, Pennsylvania, the Company and its subsidiaries employ approximately 1,400 people as of December 31, 2006 and focus on the development of open and flexible solutions that enable users to analyze designs directly on the desktop, providing a common platform for fast, efficient and cost-conscious product development, from design concept to final-stage testing and validation. The Company distributes its ANSYS®, ANSYS® Workbench™, ANSYS®CFX®, ANSYS®DesignSpace®, ANSYS®ICEM CFD™, ANSYS®AUTODYN®, ANSYS®ICEPAK™ and FLUENT® products through a global network of channel partners and direct sales offices in strategic, global locations. It is the Company’s intention to continue to maintain this mixed sales and distribution model.

The Company licenses its technology to businesses, educational institutions and governmental agencies. Growth in the Company’s revenue is affected by the strength of global economies, general business conditions, customer budgetary constraints and the competitive position of the Company’s products. The Company believes that the features, functionality and integrated multiphysics capabilities of its software products are as strong as they have ever been. However, the software business is generally characterized by long sales cycles. These long sales cycles increase the difficulty of predicting sales for any particular quarter. As a result, the Company believes that its overall performance is best measured by fiscal year results rather than by quarterly results.

The following discussion should be read in conjunction with the audited consolidated financial statements and notes thereto included elsewhere in this Annual Report. The Company’s discussion and analysis of its financial condition and results of operations are based upon the Company’s consolidated financial statements, which have been prepared in accordance with accounting principles generally accepted in the United States of America. The preparation of these financial statements requires the Company to make estimates and judgments that affect the reported amounts of assets, liabilities, revenues and expenses, and related disclosure of contingent assets and liabilities. On an ongoing basis, the Company evaluates its estimates, including those related to fair value of stock awards, bad debts, contract revenue, valuation of goodwill, valuation of intangible assets, income taxes, and contingencies and litigation. The Company bases its estimates on historical experience, estimated future cash flows and on various other assumptions that are believed to be reasonable under the circumstances, the results of which form the basis for making judgments about the carrying value of assets and liabilities that are not readily apparent from other sources. Actual results may differ from these estimates.

This Annual Report contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934, including the following statements, as well as statements that contain such words as “anticipates,” “intends,” “believes,” “plans” and other similar expressions:

| | • | | The Company’s estimates regarding the expected adverse impact on reported revenue related to the purchase accounting treatment of deferred revenue |

| | • | | The Company’s intentions related to investments in global sales and marketing as well as research and development |

| | • | | Increased exposure to volatility of foreign exchange rates |

| | • | | Exposure to changes in domestic and foreign tax laws in future periods |

| | • | | Plans related to future capital spending |

| | • | | The Company’s intentions regarding its mixed sales and distribution model |

| | • | | The sufficiency of existing cash and cash equivalent balances to meet future working capital and capital expenditure requirements |

| | • | | The Company’s estimates regarding the effect that Statement No. 123R will have on the financial results of the Company for fiscal year 2007 |

| | • | | Management’s assessment of the ultimate liabilities arising from various investigations, claims and legal proceedings |

| | • | | Management’s assessment of its ability to realize deferred tax assets |

| | • | | Management’s intention regarding the reinvestment of undistributed foreign earnings |

| | • | | The Company’s estimate of increases to goodwill in 2007 related to contingent payments associated with the acquisition of Century Dynamics, Inc. |

ANSYS, Inc. 2006 Annual Report 14

| | • | | The Company’s statements regarding the strength of its financial position |

| | • | | The Company’s statements regarding the benefits of its acquisitions |

Forward-looking statements should not be unduly relied upon because they involve known and unknown risks, uncertainties and other factors, some of which are beyond the Company’s control. The Company’s actual results could differ materially from those set forth in the forward-looking statements. Certain factors that might cause such a difference include risks and uncertainties detailed in “Important Factors Regarding Future Results” beginning on page 28.

Acquisitions

On May 1, 2006, the Company completed its acquisition of Fluent, a global provider of computational fluid dynamics (CFD)-based computer-aided engineering software and services. Under the terms of the merger agreement, the Company issued 5,999,948 shares of its common stock, valued at approximately $274 million based on the average closing market price on the two days preceding and the two days following the announcement of the acquisition (February 16, 2006), and paid approximately $315 million in cash to acquire Fluent. The total purchase price of approximately $598 million includes approximately $9 million in transaction fees. The Company used a combination of existing cash and $198 million from committed bank financing to fund the transaction.

The acquisition of Fluent enhances the breadth, functionality, usability and interoperability of the Company’s portfolio of simulation solutions. Over time, the acquisition of Fluent is expected to increase operational efficiency, lower design and engineering costs for customers, and accelerate development and delivery of new and innovative products to the marketplace. In addition to the $9 million in transaction-related costs, the Company incurred financing costs of $1.9 million related to the long-term debt utilized to fund the acquisition.

The operating results of Fluent have been included in the Company’s consolidated financial statements since the date of acquisition, May 1, 2006. The total purchase price was allocated to the foreign and domestic assets and liabilities of Fluent based upon management’s estimates of the fair market values of the assets acquired and the liabilities assumed. These estimates are subject to change upon final valuation of Fluent’s assets and liabilities. The preliminary allocation included $213.9 million to identifiable intangible assets (including $88.0 million to developed software to be amortized over seven years, $65.9 million to customer contracts and related relationships to be amortized over nine and a half years, and $60.0 million to trade name) and $381.6 million to goodwill, which is not tax deductible. The Fluent trade name is one of the most recognized in the CFD software industry. The trade name represents a reputation of superior technical capability and strong support service that has been recognized by Fluent customers. Because the trade name continues to gain strength in the marketplace today, as evidenced by Fluent’s increased sales over the past several years, the Company expects the trade name to contribute to cash flows indefinitely and, accordingly, has assigned an indefinite life to the trade name.

In valuing deferred revenue on the Fluent balance sheet as of the acquisition date, the Company applied the fair value provisions of Emerging Issues Task Force Issue No. 01-3 (“EITF No. 01-3”), “Accounting in a Business Combination for Deferred Revenue of an Acquiree.” In accordance with EITF No. 01-3, acquired deferred revenue of $31.5 million was recorded on the opening balance sheet. This amount was $20.1 million lower than the historical carrying value. Although this purchase accounting requirement will have no impact on the Company’s business or cash flow, it will adversely impact the Company’s reported software license revenue under accounting principles generally accepted in the United States of America (“GAAP”), primarily for the first 12 months post-acquisition. The adverse impact on reported revenue was $18.4 million for the period of May 1, 2006 through December 31, 2006. The adverse impact on reported revenue for the year ending December 31, 2007 is expected to be approximately $1.9 million.

The following table summarizes the preliminary fair values of the assets acquired and liabilities assumed at the date of acquisition:

| | | | |

| (in thousands) | | At May 1, 2006 | |

Cash and other net tangible assets and liabilities | | $ | 26,735 | |

Goodwill | | | 381,574 | |

Identifiable intangible assets | | | 213,900 | |

Net deferred tax liabilities | | | (51,863 | ) |

In-process research and development | | | 28,100 | |

| | | | |

Total preliminary purchase price allocation | | $ | 598,446 | |

| | | | |

The Company expensed acquired in-process research and development (IPR&D) of $28.1 million that represents incomplete Fluent research and development projects that had not reached technological feasibility and had no alternative future use as of the acquisition date.

ANSYS, Inc. 2006 Annual Report 15

Technological feasibility is established when an enterprise has completed all planning, designing, coding and testing activities that are necessary to establish that a product can be produced to meet its design specifications, including functions, features and technical performance requirements. The value assigned to IPR&D was determined by considering the importance of each project to the overall development plan, estimating costs to develop the purchased IPR&D into commercially viable products, estimating the resulting net cash flows from the projects when completed and discounting the net cash flows to their present values based on the percentage of completion of the IPR&D projects. Since the acquisition date, May 1, 2006, through December 31, 2006, the Company has incurred $2.0 million in development expense related to its purchased IPR&D and estimates it will spend an additional $4.5 million to complete the IPR&D projects. The estimated completion date of the Company’s IPR&D is the first quarter of 2009.

The following unaudited pro forma information presents the 2006 and 2005 results of operations of the Company as if the acquisition had occurred at the beginning of each period. The unaudited pro forma results are not necessarily indicative of results that would have occurred had the acquisition been in effect for the years presented, nor are they necessarily indicative of future results. These pro forma results exclude the impacts of IPR&D expense and the purchase accounting adjustment to deferred revenue that are discussed above.

| | | | | | |

| | | Year Ended December 31, |

| (in thousands, except per share data) | | 2006 | | 2005 |

Total revenue | | $ | 320,614 | | $ | 279,905 |

Net income | | | 52,301 | | | 37,729 |

Earnings per share: | | | | | | |

Basic | | $ | 1.36 | | $ | 1.00 |

Diluted | | $ | 1.30 | | $ | 0.95 |

In October 2005, the Company acquired substantially all of the assets and certain liabilities of Harvard Thermal, Inc. (hereafter “HTI”), a provider of thermal analysis software tools, for an up-front purchase price of approximately $1.3 million in cash and stock. In addition, the acquisition agreement provides for future payments of up to $400,000, contingent upon the attainment of certain performance criteria, of which $100,000 was recorded as an addition to goodwill during the first quarter of 2006 and paid primarily through the issuance of treasury stock. The acquisition of HTI expands the Company’s product offerings and allows it to deliver a more complete and comprehensive simulation solution to its customers. The operating results for HTI have been included with the Company’s operating results from the date of acquisition.

The total purchase price was allocated to the domestic assets and liabilities of HTI based upon estimated fair market values as of the date of acquisition. Approximately $515,000 was allocated to identifiable intangible assets, comprised primarily of core technology, and $1.0 million was allocated to goodwill, which is not tax deductible. The identified intangible assets are being amortized over three years.

Had the acquisition of HTI occurred on January 1, 2005, the 2005 results would not be materially different from those presented in these financial statements. Accordingly, the Company has not presented pro forma information on revenue, net income or earnings per share.

On January 5, 2005, the Company acquired Century Dynamics, Inc. (hereafter “CDI”), a leading provider of sophisticated simulation software for solving linear, nonlinear, explicit and multi-body hydrodynamics problems, for an initial purchase price of $5.1 million in cash. In addition, the agreement provides for a future cash payment contingent upon the attainment of certain 2005 performance criteria. This payment totaled $4.5 million and was accounted for as an addition to both goodwill and other accrued expenses and liabilities in 2005. It was paid to the previous owners of CDI in the first quarter of 2006. The agreement also provides for certain other contingent payments in 2006 and 2007. These amounts resulted in an increase to goodwill of $400,000 in 2006 and are expected to result in an increase to goodwill of $100,000 in 2007. The acquisition of CDI expands the Company’s product offerings and allows it to deliver a more complete and comprehensive solution to its customers.

The initial cash purchase price was allocated to the foreign and domestic assets and liabilities of CDI based upon estimated fair market values and foreign currency translation rates as of the date of acquisition. Approximately $2.7 million was allocated to identifiable intangible assets (including $1.5 million to core technology, $450,000 to non-compete agreements, $300,000 to customer contracts and $500,000 to trademarks) and $2.7 million to goodwill, which is not tax deductible. In the third quarter of 2005, a customer exercised its option to pay the Company approximately $300,000 under the contract that was valued on the acquisition date. As a result, the customer contract was removed from intangible assets as of December 31, 2005. The identified intangible assets are being amortized over three to five years. The operating results of CDI have been included in the Company’s consolidated financial statements since the date of acquisition.

Had the acquisition occurred on January 1, 2005, the 2005 results would not be materially different from those presented in these consolidated financial statements. Accordingly, the Company has not presented pro forma information on revenue, net income or earnings per share.

ANSYS, Inc. 2006 Annual Report 16

Results of Operations

The operating results of Fluent, HTI and CDI have been included in the results of operations since the acquisition dates of May 2006, October 2005 and January 2005, respectively.

For purposes of the following discussion and analysis, the table below sets forth certain consolidated financial data for the years 2006, 2005 and 2004.

| | | | | | | | | | | |

| | | Year Ended December 31, |

| (in thousands) | | 2006 | | | 2005 | | | 2004 |

Revenue: | | | | | | | | | | | |

Software licenses | | $ | 156,960 | | | $ | 85,680 | | | $ | 71,326 |

Maintenance and service | | | 106,680 | | | | 72,356 | | | | 63,213 |

Total revenue | | | 263,640 | | | | 158,036 | | | | 134,539 |

Cost of sales: | | | | | | | | | | | |

Software licenses | | | 7,306 | | | | 5,292 | | | | 4,840 |

Amortization of software and acquired technology | | | 14,909 | | | | 3,576 | | | | 3,030 |

Maintenance and service | | | 34,512 | | | | 15,171 | | | | 13,437 |

Total cost of sales | | | 56,727 | | | | 24,039 | | | | 21,307 |

Gross profit | | | 206,913 | | | | 133,997 | | | | 113,232 |

Operating expenses: | | | | | | | | | | | |

Selling, general and administrative | | | 86,901 | | | | 43,285 | | | | 39,824 |

Research and development | | | 49,406 | | | | 30,688 | | | | 26,281 |

Amortization | | | 6,350 | | | | 1,184 | | | | 1,149 |

In-process research and development | | | 28,100 | | | | — | | | | — |

Total operating expenses | | | 170,757 | | | | 75,157 | | | | 67,254 |

Operating income | | | 36,156 | | | | 58,840 | | | | 45,978 |

Interest (expense) income, net | | | (3,013 | ) | | | 4,294 | | | | 1,650 |

Other (expense) income, net | | | (82 | ) | | | (23 | ) | | | 273 |

Income before income tax provision | | | 33,061 | | | | 63,111 | | | | 47,901 |

Income tax provision | | | 18,905 | | | | 19,208 | | | | 13,334 |

Net income | | $ | 14,156 | | | $ | 43,903 | | | $ | 34,567 |

ANSYS, Inc. 2006 Annual Report 17

Year Ended December 31, 2006 Compared to Year Ended December 31, 2005

Revenue:

| | | | | | | | | | | |

| | | Year Ended December 31, | | Change |

| (in thousands, except percentages) | | 2006 | | 2005 | | Amount | | % |

Revenue: | | | | | | | | | | | |

Software licenses | | $ | 156,960 | | $ | 85,680 | | $ | 71,280 | | 83.2 |

Maintenance and service | | | 106,680 | | | 72,356 | | | 34,324 | | 47.4 |

Total revenue | | | 263,640 | | | 158,036 | | | 105,604 | | 66.8 |

The increase in revenue is due primarily to the following:

| | • | | Fluent-related revenue of $79.1 million for the period from the acquisition (May 1, 2006) through December 31, 2006. Software license revenue was $54.3 million and maintenance and service revenue was $24.8 million. |

| | • | | Newly generated software license revenue of $17.0 million, including $3.3 million related to an order with a long-standing major customer during the 2006 first quarter |

| | • | | Increase of $9.2 million in product maintenance revenue, primarily associated with annual maintenance subscriptions sold in connection with new perpetual license sales in recent quarters |

| | • | | Revenue of $600,000 related to the biennial ANSYS users’ conference |

| | • | | Decrease of $300,000 in engineering consulting revenue |

On average, for the year ended December 31, 2006, the U.S. Dollar was 1.0% weaker, when measured against the Company’s primary foreign currencies, than for the year ended December 31, 2005. The U.S. Dollar weakened against the British Pound, Euro, Canadian Dollar, Swedish Krona and Chinese Renminbi while it strengthened against the Indian Rupee and Japanese Yen. These fluctuations resulted in a $600,000 increase in revenue and a $100,000 decrease in operating income during 2006 as compared with 2005.

International and domestic revenues, as a percentage of total revenue, were 64.2% and 35.8%, respectively, during the year ended December 31, 2006 and 66.8% and 33.2%, respectively, during the year ended December 31, 2005.

A substantial portion of the Company’s license and maintenance revenue is derived from annual lease and maintenance contracts. These contracts are generally renewed on an annual basis and have a high rate of customer renewal. In addition to the recurring revenue base associated with these contracts, a majority of customers purchasing new perpetual licenses also purchase related annual maintenance contracts. As a result of the significant recurring revenue base, the Company’s license and maintenance revenue growth rate in any period does not necessarily correlate to the growth rate of new license and maintenance contracts sold during that period. To the extent the rate of customer renewal for lease and maintenance contracts remains at current levels, incremental lease contracts and maintenance contracts sold with new perpetual licenses will result in license and maintenance revenue growth.

As previously mentioned above, in accordance with EITF No. 01-3, acquired deferred software revenue of $31.5 million was recorded on the Fluent opening balance sheet. This amount was $20.1 million lower than the historical carrying value. The adverse impact on reported revenue was $18.4 million for the period of May 1, 2006 through December 31, 2006. The adverse impact on reported revenue for the year ending December 31, 2007 is expected to be approximately $1.9 million.

ANSYS, Inc. 2006 Annual Report 18

Cost of Sales and Gross Profit:

| | | | | | | | | | | | | | | |

| | | Year Ended December 31, | | Change |

| | | 2006 | | 2005 | |

| (in thousands, except percentages) | | Amount | | % of

Revenue | | Amount | | % of

Revenue | | Amount | | % |

Cost of sales: | | | | | | | | | | | | | | | |

Software licenses | | $ | 7,306 | | 2.8 | | $ | 5,292 | | 3.3 | | $ | 2,014 | | 38.1 |

Amortization of software and acquired technology | | | 14,909 | | 5.6 | | | 3,576 | | 2.3 | | | 11,333 | | 316.9 |

Maintenance and service | | | 34,512 | | 13.1 | | | 15,171 | | 9.6 | | | 19,341 | | 127.5 |

Total cost of sales | | | 56,727 | | 21.5 | | | 24,039 | | 15.2 | | | 32,688 | | 136.0 |

Gross profit | | | 206,913 | | 78.5 | | | 133,997 | | 84.8 | | | 72,916 | | 54.4 |

The change in cost of sales is primarily due to the following:

| | • | | Fluent-related total cost of sales was $29.2 million for the period from the acquisition (May 1, 2006) through December 31, 2006. Cost of goods sold was $1.2 million, software amortization was $11.3 million and the cost of providing technical support and engineering consulting services was $16.7 million. |

| | • | | Increase in salaries and headcount related costs, including incentive compensation, of $2.6 million |

| | • | | Increase in third party software royalties of $600,000 |

| | • | | Increase in third party technical support costs of $200,000 |

The increase in the gross profit was a result of the increase in revenue offset by a smaller increase in related cost of sales.

Operating Expenses:

| | | | | | | | | | | | | | | |

| | | Year Ended December 31, | | Change |

| | | 2006 | | 2005 | |

| (in thousands, except percentages) | | Amount | | % of

Revenue | | Amount | | % of

Revenue | | Amount | | % |

Operating expenses: | | | | | | | | | | | | | | | |

Selling, general and administrative | | $ | 86,901 | | 33.0 | | $ | 43,285 | | 27.4 | | $ | 43,616 | | 100.8 |

Research and development | | | 49,406 | | 18.7 | | | 30,688 | | 19.4 | | | 18,718 | | 61.0 |

Amortization | | | 6,350 | | 2.4 | | | 1,184 | | 0.8 | | | 5,166 | | 436.3 |

In-process research and development | | | 28,100 | | 10.7 | | | — | | — | | | 28,100 | | — |

Total operating expenses | | | 170,757 | | 64.8 | | | 75,157 | | 47.6 | | | 95,600 | | 127.2 |

Selling, General and Administrative: Fluent-related selling, general and administrative costs were $35.8 million for the period from the acquisition (May 1, 2006) through December 31, 2006. Expenses increased $4.0 million in 2006 as compared to 2005 as a result of stock-based compensation expense associated with the 2006 adoption of Statement No. 123R. Salary and headcount related costs, including incentive compensation, increased by $3.2 million during the year ended December 31, 2006 as compared to the year ended December 31, 2005. Additionally, the cost relating to the biennial ANSYS users’ conference during 2006 was $550,000.

The Company anticipates that it will make investments throughout 2007 in its global sales and marketing organization and its global business infrastructure to enhance major account sales activities and to support both its worldwide sales distribution and marketing strategies and the growth of the business in general.

ANSYS, Inc. 2006 Annual Report 19

Research and Development:Fluent-related research and development costs were $12.6 million for the period from the acquisition (May 1, 2006) through December 31, 2006. Salary and headcount related costs, including incentive compensation, increased by $4.7 million during the year ended December 31, 2006 as compared to the 2005 year. Expenses increased $1.4 million as a result of stock-based compensation expense associated with the 2006 adoption of Statement No. 123R.

The Company has traditionally invested significant resources in research and development activities and intends to continue to make significant investments in this area, particularly as it relates to ongoing integration and expansion of the portfolio of software technologies it offers.

Amortization:Fluent-related amortization was $5.9 million for the period from the acquisition (May 1, 2006) through December 31, 2006. Amortization unrelated to Fluent decreased by $800,000 as a result of certain customer lists and non-compete agreements that became fully amortized ($900,000), partially offset by amortization associated with non-compete agreements related to other business acquisitions completed during 2006 ($100,000).

In-Process Research and Development:This non-tax deductible charge represents the fair value assigned to incomplete Fluent research and development projects that had not reached technological feasibility and had no alternative future value when acquired on May 1, 2006.

Interest (Expense) Income, net: Net interest expense for the year ended December 31, 2006 was $3.0 million as compared with interest income for the year ended December 31, 2005 of $4.3 million. In connection with the acquisition of Fluent on May 1, 2006, the Company borrowed $198 million and assumed certain capital leases. These borrowings incurred interest expense, including the amortization of debt financing costs, of $7.7 million during the period from the date of acquisition (May 1, 2006) through December 31, 2006. The interest expense was partially offset by interest income of $4.8 million, including interest income from Fluent of $400,000.

Other (Expense) Income, net: Other expense for the year ended December 31, 2006 was $82,000 as compared to other expense of $23,000 for the year ended December 31, 2005. The Fluent-related other expense was $360,000 for the period from acquisition (May 1, 2006) through December 31, 2006 and related primarily to foreign currency exchange losses. The remaining net decrease was the result of the following two factors:

Foreign Currency Transaction – During 2006, the Company had a net foreign exchange loss, excluding Fluent, of $400,000 as compared with a loss of $200,000 in 2005. During 2006, the U.S. Dollar weakened against the British Pound, Canadian Dollar, Euro, Swedish Krona and Chinese Renminbi, while it strengthened against the Indian Rupee and Japanese Yen. As the Company’s presence in foreign locations continues to expand, the Company, for the foreseeable future, will have increased exposure to volatility of foreign exchange rates. The Company is most impacted by movements among and between the Canadian Dollar, British Pound, Euro, Japanese Yen and U.S. Dollar.

Other – Income from other non-operating transactions increased $500,000 during the year ended December 31, 2006 as compared to the year ended December 31, 2005.

Income Tax Provision: The Company recorded income tax expense of $18.9 million and had income before income tax provision of $33.1 million for the year ended December 31, 2006. This represents an effective tax rate of 57.2%. In connection with the May 1, 2006 acquisition of Fluent, the Company recorded a non-tax deductible charge related to in-process research and development of $28.1 million. This non-tax deductible charge increased the Company’s effective tax rate from 30.9% to 57.2% for the year ended December 31, 2006 as compared to 30.4% for the year ended December 31, 2005. These rates are lower than the federal and state combined statutory rate as a result of export benefits, as well as the generation of research and experimentation credits. Additionally, Fluent has historically had an effective tax rate that has been higher than the Company’s. Because Fluent’s operating results from the date of acquisition reflect a net loss that is primarily related to acquisition-related amortization and the purchase accounting adjustments to deferred revenue, the related tax benefits on this loss have reduced the Company’s overall effective tax rate during the year ended December 31, 2006. The effective tax rates in 2006 and 2005 were also favorably impacted by the tax benefits discussed in the following paragraphs.

During the third quarter of 2006, the Company filed its 2005 U.S. federal and state tax returns. In conjunction with the completion of these returns, the Company adjusted its estimate for 2005 taxes to reflect the actual results and recorded a $413,000 tax benefit. The effect of this adjustment reduced the effective tax rate for the year ended December 31, 2006 from 58.4% to 57.2%.

During the third quarter of 2005, the Company filed its 2004 U.S. federal and state tax returns. In conjunction with the completion of these returns, the Company adjusted its estimate for 2004 taxes to reflect the actual results and recorded a $500,000 tax benefit. The effect of this adjustment reduced the effective tax rate for the year ended December 31, 2005 from 31.2% to 30.4%.

ANSYS, Inc. 2006 Annual Report 20

In October 2004, the American Jobs Creation Act of 2004 was signed into law and included replacement legislation for export benefits that the Company previously received under the Foreign Sales Corporation Repeal and Extraterritorial Income Exclusion Act. The phase-out of export benefits associated with the legislation is summarized as follows:

| | |

| | | Export Benefit Phase-out |

2004 | | No effect |

2005 | | 80% of otherwise-applicable benefits |

2006 | | 60% of otherwise-applicable benefits |

2007 - beyond | | Export benefits fully eliminated |

In addition to repealing the export tax benefits, the American Jobs Creation Act of 2004 provides significant tax relief for domestic manufacturers. Effective for taxable years beginning after December 31, 2004, qualifying entities may deduct a certain percentage (as defined below) of the lesser of their qualified production activities income or their taxable income for a taxable year. The deduction, however, is limited to 50% of an employer’s W-2 wages for the tax year. Beginning in 2010, when the 9% deduction is fully phased in, corporations facing a marginal tax rate of 35% will be subject to an effective tax rate of 31.85% on qualifying income.

| | |

| | | Manufacturing Income Deduction Phase-in |

2004 | | No effect |

2005 – 2006 | | 3% applicable deduction for qualified income |

2007 – 2009 | | 6% applicable deduction for qualified income |

2010 – beyond | | 9% applicable deduction for qualified income |

In 2006 and 2005, export benefits reduced the Company’s effective tax rate by 4.5% and 2.9%, respectively. The adverse impact of the above legislation on the Company’s effective tax rate in 2006 was approximately 1.7% and was not significant in 2005. The Company expects the impact of the above legislation on the 2007 effective tax rate to be similar to that of 2006. Any other prospective changes regarding tax benefits associated with the Company’s export sales or other federal and state tax planning vehicles may adversely impact the Company’s effective tax rate and decrease its net income in future periods.

The Company makes significant estimates in determining its worldwide income tax provision. These estimates involve complex tax regulations in a number of jurisdictions across the Company’s global operations and are subject to many transactions and calculations in which the ultimate tax outcome is uncertain. Although the Company believes that its estimates are reasonable, the final outcome of tax matters could be different than the estimates reflected in the historical income tax provision and related accruals. Such differences could have a material impact on income tax expense and net income in the period in which such determination is made.

Net Income:The Company’s net income for the year ended December 31, 2006 was $14.2 million, or $0.37 diluted earnings per share, as compared to net income of $43.9 million, or $1.30 diluted earnings per share, in 2005. The Company’s net income was significantly impacted by the $28.1 million non-tax deductible in-process research and development charge related to the Fluent acquisition. The weighted average common and common equivalent shares used in computing diluted earnings per share were 38.2 million in 2006 and 33.7 million in 2005.

ANSYS, Inc. 2006 Annual Report 21

Year Ended December 31, 2005 Compared to Year Ended December 31, 2004

Revenue:

| | | | | | | | | | | |

| | | Year Ended December 31, | | Change |

(in thousands, except percentages) | | 2005 | | 2004 | | Amount | | % |

Revenue: | | | | | | | | | | | |

Software licenses | | $ | 85,680 | | $ | 71,326 | | $ | 14,354 | | 20.1 |

Maintenance and service | | | 72,356 | | | 63,213 | | | 9,143 | | 14.5 |

Total revenue | | | 158,036 | | | 134,539 | | | 23,497 | | 17.5 |

The increase in revenue is primarily due to the following:

| | • | | Newly generated software license revenue of $10.9 million |

| | • | | Increase of $7.3 million in product maintenance revenue, primarily associated with annual maintenance subscriptions sold in connection with new perpetual license sales in recent quarters |

| | • | | Post-acquisition revenue of $6.1 million ($3.5 million in license revenue and $2.6 million in maintenance and service revenue) related to CDI which was purchased on January 5, 2005 |

| | • | | Decrease of $800,000 in engineering consulting revenue |

On average, for the year ended December 31, 2005, the U.S. Dollar was 0.5% stronger, when measured against the Company’s primary foreign currencies, than for the year ended December 31, 2004. The U.S. Dollar strengthened against the British Pound, Japanese Yen and Euro while it weakened against the Indian Rupee and Canadian Dollar. As a result of these fluctuations, the net adverse impact on revenue and operating income during 2005, as compared with 2004, was $300,000 and $600,000, respectively.

International and domestic revenues, as a percentage of total revenue, were 66.8% and 33.2%, respectively, during the year ended December 31, 2005, and 65.3% and 34.7%, respectively, in the year ended December 31, 2004.

Cost of Sales and Gross Profit:

| | | | | | | | | | | | | | | |

| | | Year Ended December 31, | | Change |

| | | 2005 | | 2004 | |

(in thousands, except percentages) | | Amount | | % of

Revenue | | Amount | | % of

Revenue | | Amount | | % |

Cost of sales: | | | | | | | | | | | | | | | |

Software licenses | | $ | 5,292 | | 3.3 | | $ | 4,840 | | 3.6 | | $ | 452 | | 9.3 |

Amortization of software and acquired technology | | | 3,576 | | 2.3 | | | 3,030 | | 2.2 | | | 546 | | 18.0 |

Maintenance and service | | | 15,171 | | 9.6 | | | 13,437 | | 10.0 | | | 1,734 | | 12.9 |

Total cost of sales | | | 24,039 | | 15.2 | | | 21,307 | | 15.8 | | | 2,732 | | 12.8 |

Gross profit | | | 133,997 | | 84.8 | | | 113,232 | | 84.2 | | | 20,765 | | 18.3 |

The change in cost of sales is primarily due to the following:

| | • | | Increased third party technical support and consulting fees of $1.0 million |

| | • | | Non-amortization expenses related to CDI of $800,000 |

| | • | | Increased third party software royalties of $300,000 |

| | • | | Increased amortization of $500,000 related to technology acquired in the CDI acquisition |

The increase in gross profit was a result of the increase in revenue offset by a smaller increase in related cost of sales.

ANSYS, Inc. 2006 Annual Report 22

Operating Expenses:

| | | | | | | | | | | | | | | |

| | | Year Ended December 31, | | Change |

| | | 2005 | | 2004 | |

| (in thousands, except percentages) | | Amount | | % of

Revenue | | Amount | | % of

Revenue | | Amount | | % |

Operating expenses: | | | | | | | | | | | | | | | |

Selling, general and administrative | | $ | 43,285 | | 27.4 | | $ | 39,824 | | 29.6 | | $ | 3,461 | | 8.7 |

Research and development | | | 30,688 | | 19.4 | | | 26,281 | | 19.5 | | | 4,407 | | 16.8 |

Amortization | | | 1,184 | | 0.8 | | | 1,149 | | 0.9 | | | 35 | | 3.0 |

Total operating expenses | | | 75,157 | | 47.6 | | | 67,254 | | 50.0 | | | 7,903 | | 11.8 |

Selling, General and Administrative: Selling, general and administrative expenses increased by $2.5 million due to CDI. Excluding the CDI personnel, salaries, headcount related costs and incentive compensation increased by $1.6 million. These costs were partially offset by a decrease in third party commissions and consulting of $400,000 and a decrease in costs associated with the biennial ANSYS users’ conference of $400,000, which was held in 2004.

Research and Development: The change in research and development primarily resulted from a $2.1 million increase in salary and headcount related expenses, excluding CDI personnel, and $1.5 million in additional costs related to CDI development. In addition, incentive compensation increased $500,000. The 2005 and 2004 costs were reduced by $300,000 and $500,000, respectively, for amounts capitalized related to internal software development activities.

Amortization: Amortization expense increased by $260,000 due to the acquisition of CDI in January 2005. This increase was partially offset by the amortization of certain acquired intangible assets that ceased in August 2005 upon becoming fully amortized.

Interest (Expense) Income, net: Net interest income for the year ended December 31, 2005 was $4.3 million as compared with interest income for the year ended December 31, 2004 of $1.7 million. The investment of larger cash balances, in addition to higher interest rates, caused the increase in interest income.

Other (Expense) Income, net: Other expense for the year ended December 31, 2005 was $23,000 as compared to other income of $273,000 for the year ended December 31, 2004. The net decrease was the result of the following two factors:

Foreign Currency Transaction – During 2005, the Company had a net foreign exchange loss of $200,000 as compared with a gain of $200,000 in 2004. During 2005, the U.S. Dollar strengthened against the British Pound, Japanese Yen and Euro while it weakened against the Indian Rupee and Canadian Dollar. During 2004, on average, the U.S. Dollar weakened against each of the currencies.

Other – Income from other non-operating transactions increased $100,000 during the year ended December 31, 2005 compared to 2004.

Income Tax Provision: The Company’s effective tax rate was 30.4% in 2005 as compared to 27.8% in 2004. These rates are lower than the federal and state combined statutory rate as a result of export benefits as well as the generation of research and experimentation credits. The effective tax rates in 2005 and 2004 were also favorably impacted by the tax benefits discussed in the following paragraphs.

During the third quarter of 2005, the Company filed its 2004 U.S. federal and state tax returns. In conjunction with the completion of these returns, the Company adjusted its estimate for 2004 taxes to reflect the actual results and recorded a $500,000 tax benefit.

During 2004, the Company and the Internal Revenue Service (“IRS”) settled and closed the audits of the Company’s 2001, 2002 and 2003 federal income tax returns. The Company provides in the financial statements an estimate for income taxes based on its tax filing positions and interpretations of existing tax law. Changes in estimates are reflected in the year of settlement or expiration of the statute of limitations. As a result of the federal income tax returns for 2001, 2002 and 2003 being settled and closed, the Company adjusted its estimated accrued income tax balance related to those years by recording a one-time tax benefit and reducing the tax accrual by $1.1 million in 2004.

ANSYS, Inc. 2006 Annual Report 23

Net Income:The Company’s net income increased 27.0% to $43.9 million, or $1.30 diluted earnings per share, in 2005 as compared to net income of $34.6 million, or $1.05 diluted earnings per share, in 2004. The weighted average common and common equivalent shares used in computing diluted earnings per share were 33.7 million in 2005 and 33.0 million in 2004.

Liquidity and Capital Resources

As of December 31, 2006, the Company had cash, cash equivalents and short-term investments totaling $104.5 million and working capital of $35.9 million as compared to cash, cash equivalents and short-term investments of $194.2 million and working capital of $167.9 million at December 31, 2005. The short-term investments are generally investment-grade and liquid, which allows the Company to minimize interest rate risk and to facilitate liquidity in the event an immediate cash need arises.

The significant differences that affect the consolidated statements of cash flows related to stock-based compensation accounting under Statement No. 123R in 2006 and under APB No. 25 in 2005 are as follows:

| | • | | A $5.2 million excess tax benefit from stock options was reported as a financing activity in 2006, whereas all stock option-related tax benefits were reported as an operating activity in 2005. |

| | • | | $5.6 million in stock-based compensation expense was recorded in 2006, whereas such expense was not recorded in 2005. This amount was added as an adjustment to net income to arrive at cash provided by operating activities in 2006. |

The Company’s operating activities provided cash of $89.7 million in 2006, $67.8 million in 2005 and $51.4 million in 2004. The $21.9 million increase in the Company’s cash flow from operations in 2006 as compared to 2005 was primarily related to:

| | • | | An increase in net income, adjusted for non-cash charges and benefits, of $15.6 million from $50.8 million for the year ended December 31, 2005 to $66.4 million for the year ended December 31, 2006, comprised primarily of the following: |

| | • | | A net income decrease of $29.7 million from $43.9 million in 2005 to $14.2 million in 2006 |

| | • | | Increased deferred tax benefits of $13.2 million, primarily related to the amortization of non-tax deductible intangible assets acquired in the Fluent acquisition |

| | • | | A $28.1 million non-tax deductible in-process research and development charge |

| | • | | New non-cash amortization charges of $11.3 million related to developed software and $5.9 million related to customer relationships |

| | • | | Stock-based compensation charges of $5.6 million |

| | • | | An increase in the utilization of acquired net operating loss tax carryforwards of $5.9 million |

| | • | | Additional depreciation expense of $2.3 million |

| | • | | Changes in working capital whereby $23.3 million was provided during the year ended December 31, 2006 as compared with $17.1 million provided during the year ended December 31, 2005 |

The $16.5 million increase in the Company’s cash flow from operations in 2005 as compared to 2004 was primarily the result of $7.8 million in increased earnings, adjusted for non-cash expenses such as depreciation, amortization and deferred income taxes, and $8.6 million in working capital fluctuations.

The Company’s investing activities used net cash of $294.6 million during 2006 as compared with cash provided of $28.2 million during 2005. During 2006, the Company paid $296.6 million, net of cash acquired, for Fluent. Net cash provided by maturities in excess of short-term investment purchases was $18.0 million and $37.3 million during 2006 and 2005, respectively. Total capital spending was $7.0 million during 2006 and $4.5 million during 2005. Business acquisition payments unrelated to Fluent increased from $4.4 million in 2005 to $8.3 million in 2006. The 2006 payments include $3.5 million related to business acquisitions of certain independent channel partners.

Cash provided by investing activities was $28.2 million in 2005 and cash used by investing activities was $53.2 million in 2004. In 2005, the Company had $37.3 million more in maturing short-term investments than in related purchases and spent $4.5 million on capital expenditures and $4.4 million on business acquisitions. In 2004, the Company purchased $49.5 million more in short-term investments than related maturities and spent $3.2 million on capital expenditures.

Financing activities provided cash of $130.8 million for the year ended December 31, 2006 as compared with cash used of $1.5 million during the year ended December 31, 2005. This increase in cash provided was primarily a result of $198 million in cash provided from term loans to finance the Fluent acquisition, partially offset by $76.1 million in term loan principal payments and $1.9 million in loan issuance costs. In addition, tax benefits of $5.2 million related to stock-based compensation were reported in cash flows from financing activities during 2006. In 2005, these benefits were reported within cash flows from operating activities.

ANSYS, Inc. 2006 Annual Report 24

Financing activities used cash of $1.5 million in 2005 and provided cash of $5.9 million in 2004. During each of these years, the Company received proceeds from the exercise of stock options and the issuance of common stock under the Employee Stock Purchase Plan. During 2005, the Company used $7.5 million in cash to repurchase stock.

The Company believes that existing cash and cash equivalent balances of $104.3 million, together with cash generated from operations, will be sufficient to meet the Company’s working capital, capital expenditure and debt service requirements through at least the next fiscal year. The Company’s cash requirements in the future may also be financed through additional equity or debt financings. There can be no assurance that such financings can be obtained on favorable terms, if at all.

The Company continues to generate positive cash flows from operating activities and believes that the best use of its excess cash is to repay its long-term debt, to grow the business and, under certain favorable conditions, to repurchase stock. Additionally, the Company has in the past and expects in the future to acquire or make investments in complementary companies, products, services and technologies. As previously discussed under “Acquisitions,” on May 1, 2006, the Company completed its acquisition of Fluent, a global provider of CFD-based computer-aided engineering software and services.

The Company does not have any special purpose entities or off-balance sheet financing.

The Company’s significant contractual obligations as of December 31, 2006 are summarized below:

| | | | | | | | | | | | | | | |

| | | Payments Due by Period |

| (in thousands) | | Total | | Within 1 year | | 2 – 3 years | | 4 – 5 years | | After 5 years |

Long-term debt1 | | $ | 144,729 | | $ | 20,409 | | $ | 48,151 | | $ | 76,169 | | $ | — |

Capital lease obligations | | | 1,533 | | | 818 | | | 681 | | | 34 | | | — |

Corporate office operating lease2 | | | 11,058 | | | 1,241 | | | 2,670 | | | 2,859 | | | 4,288 |

Other operating leases3 | | | 31,676 | | | 8,747 | | | 12,580 | | | 6,952 | | | 3,397 |

Unconditional purchase obligations | | | 6,980 | | | 2,619 | | | 3,343 | | | 1,018 | | | — |

Other long-term obligations4 | | | 4,284 | | | 16 | | | 2,782 | | | 1,407 | | | 79 |

Total contractual obligations | | $ | 200,260 | | $ | 33,850 | | $ | 70,207 | | $ | 88,439 | | $ | 7,764 |

(1) | Includes estimated interest payments of $7.2 million within 1 year, $11.9 million within 2-3 years and $3.7 million within 4-5 years. The interest rate is set through March 30, 2007 at 6.12% on $61.9 million of the total outstanding balance, which was based on three-month LIBOR + 0.75%. For the remaining outstanding balance of $60.0 million, the Company secured a fixed interest rate of 6.06% through September 28, 2007, which is based on 12-month LIBOR + 0.75%. The estimated payments assume an interest rate of 6.12% for periods beyond these fixed rates and are calculated assuming contractual quarterly principal payments are made with no additional prepayments. |

(2) | In May 2004, the Company entered into the first amendment to its corporate headquarters lease agreement, with an effective date of January 1, 2004. Under the new amendment, the corporate office facility lease agreement includes a commitment through 2014, with an option for five additional years. |

(3) | Other operating leases primarily include noncancellable lease commitments for the Company’s other domestic and international offices as well as certain operating equipment. |

(4) | Includes long-term retention bonus of $4.1 million and pension obligations of $160,000 for two of the Company’s foreign locations. |

The Company expended $1.8 million, $800,000 and $1.1 million related to uncondtional purchase obligations that existed as of the beginning of each year for the years ended December 31, 2006, 2005 and 2004, respectively.

The Company has an uncommitted and unsecured $10.0 million line of credit with a bank. Interest on any borrowings is at the bank’s prime rate or LIBOR, plus an applicable margin. The bank may demand repayment of the entire amount outstanding under the line of credit at any time and for any reason without notice. The Company, in lieu of a fee for the line of credit, has agreed to maintain certain deposits, which range from $5 million to $10 million, depending on the deposit type, with the bank. No borrowings have occurred under this line of credit.

The Company has ongoing employment agreements with certain employees, including the Chairman of the Board of Directors and the Chief Executive Officer. The terms of these employment agreements generally include annual compensation, severance payment provisions and non-competition clauses. The employment agreements terminate upon the occurrence of certain events described in the contracts.

Additionally, the Company had an outstanding irrevocable standby letter of credit for $1.9 million at December 31, 2006. This letter of credit is subject to annual renewal and was issued as a guarantee for damages that could be awarded related to a legal matter in which the Company was involved. The fair value of the letter of credit approximates the contract value based on the nature of the fee arrangements with the issuing bank. No material losses on this commitment have been incurred, nor are any anticipated.

ANSYS, Inc. 2006 Annual Report 25

Critical Accounting Policies and Estimates

The Company believes that the following critical accounting policies affect the more significant judgments and estimates used in the preparation of its consolidated financial statements.

Revenue is derived principally from the licensing of computer software products and from related maintenance contracts. The Company recognizes revenue in accordance with SOP 97-2, “Software Revenue Recognition,” and related interpretations. Revenue from perpetual licenses is classified as license revenue and is recognized upon delivery of the licensed product and the utility that enables the customer to request authorization keys, provided that acceptance has occurred and a signed contractual obligation has been received, the price is fixed and determinable, and collectibility of the receivable is probable. Revenue is recorded net of the distributor fee for sales through the ANSYS distribution network. Revenue for software lease licenses is classified as license revenue and is recognized over the period of the lease contract. The Company estimates the value of post-contract customer support (“PCS”) sold together with perpetual licenses based on separate sales of PCS. Revenue from PCS contracts is classified as maintenance and service revenue and is recognized ratably over the term of the contract. Revenue from training, support and other services is recognized as the services are performed.

The Company makes judgments as to its ability to collect outstanding receivables and provides allowances for a portion of receivables when collection becomes doubtful. Provisions are made based upon a specific review of all significant outstanding invoices from both value and delinquency perspectives. For those invoices not specifically reviewed, provisions are provided at differing rates, based upon the age of the receivable and the geographical area of origin. In determining these percentages, the Company analyzes its historical collection experience and current economic trends in the customer’s industry and geographic region. If the historical data used to calculate the allowance for doubtful accounts does not reflect the future ability to collect outstanding receivables, additional provisions for doubtful accounts may be needed and future results of operations could be materially affected.

The Company makes significant estimates in determining its worldwide income tax provision. These estimates involve complex tax regulations in a number of jurisdictions across the Company’s global operations and are subject to many transactions and calculations in which the ultimate tax outcome is uncertain. Although the Company believes that its estimates are reasonable, the final outcome of tax matters could be different than the estimates reflected in the historical income tax provision and related accruals. Such differences could have a material impact on income tax expense and net income in the period in which such determination is made.

The Company tests goodwill and intangible assets with indefinite lives for impairment at least annually by comparing the fair value of each asset to its carrying value. Fair value is estimated using the discounted cash flow and other valuation methodologies. In preparing the estimate of fair value, the Company relies on a number of factors, including historical operating results, business plans, anticipated future cash flows, economic projections and other market data. Because there are inherent uncertainties involved in these factors, the Company’s estimates of fair value are imprecise and the resulting carrying value of goodwill and intangible assets may be misstated.

The Company is involved in various investigations, claims and legal proceedings that arise in the ordinary course of its business activities. The Company reviews the status of these matters, assesses its financial exposure and records a related accrual if the potential loss from an investigation, claim or legal proceeding is probable and the amount is reasonably estimable. Significant judgment is involved in the determination of probability and in the determination of whether an exposure is reasonably estimable. As a result of the uncertainties involved in making these estimates, the Company may have to revise its estimates as facts and circumstances change. The revision of these estimates could have a material impact on the Company’s financial position and results of operations.

The Company grants options to purchase its common stock to employees and directors under the Company’s stock option plan. Eligible employees can also purchase shares of the Company’s common stock at 85% of the lower of the fair market value on the first or last day of each six-month offering period under the Company’s employee stock purchase plan. The benefits provided under these plans are share-based payments subject to the provisions of Statement No. 123R. Effective January 1, 2006, the Company used the fair value method to apply the provisions of Statement No. 123R with a modified prospective application, which provides for certain changes to the method for valuing share-based compensation. Prior to this adoption, the Company had elected to account for stock-based compensation arrangements through the intrinsic value method under the provisions of Accounting Principles Board Opinion No. 25,“Accounting for Stock-Based Compensation.” Under the intrinsic value method, compensation expense is measured as the excess, if any, of the market value of the underlying common stock over the amount the employee is required to pay on the date both the number of shares and the price to be paid are known. For the years ended December 31, 2005 and 2004, no compensation expense had been recognized in the consolidated statements of income as option grants generally were made with exercise prices equal to the fair value of the underlying common stock on the award date, which was typically the date of compensation measurement.

ANSYS, Inc. 2006 Annual Report 26

The valuation provisions of Statement No. 123R apply to new awards and to awards that are outstanding on the effective date and subsequently modified or cancelled. Under the modified prospective application, prior periods are not revised for comparative purposes. Share-based compensation expense recognized under Statement No. 123R for 2006 was $5.6 million. As of December 31, 2006, total unrecognized estimated compensation expense related to non-vested stock options granted prior to that date was $25.2 million, which is expected to be recognized over a weighted average period of 2.3 years. Net stock options, after forfeitures and cancellations, granted during 2006, 2005 and 2004 represented 2.47%, 1.50% and 1.61%, respectively, of outstanding shares as of the beginning of each fiscal year. Net stock options, after forfeitures and cancellations, granted during 2006, 2005 and 2004 represented 2.05%, 1.47% and 1.56%, respectively, of outstanding shares as of the end of each fiscal year.

Upon adoption of Statement No. 123R, the value of each share-based award was estimated on the date of grant using the Black-Scholes option-pricing model (“Black-Scholes model”), which is the same model that was used for the pro forma information required to be disclosed under Statement No. 123. The determination of the fair value of share-based payment awards on the date of grant using an option-pricing model is affected by the Company’s stock price as well as assumptions regarding a number of complex and subjective variables. These variables include the Company’s expected stock price volatility over the term of the awards, actual and projected employee stock option exercise behaviors, risk-free interest rates and expected dividends. The table below presents the assumptions used in calculating the compensation expense recorded within the Company’s Consolidated Statement of Income in compliance with Statement No. 123R as of December 31, 2006 and those used in presenting the pro forma information included within the footnotes of the Company’s Annual Report on Form 10-K for the years ended December 31, 2005 and 2004. The interest rates used were determined by using the five-year Treasury Note yield on the date of grant.

| | | | | | |

Assumption used in Black-

Scholes option-pricing model | | Compensation Expense December 31, 2006 | | Pro Forma Disclosure December 31, 2005 | | Pro Forma Disclosure December 31, 2004 |

Risk-free interest rate | | 4.58% to 5.10% | | 3.81% | | 3.67% |

Expected dividend yield | | 0% | | 0% | | 0% |

Expected volatility | | 43% | | 50% | | 53% |

Expected term | | 5.1 years | | 5.1 years | | 5.3 years |

The Company issues both nonqualified and incentive stock options; however, incentive stock options comprise a significant portion of outstanding stock options. The tax benefits associated with incentive stock options are unpredictable, as they are predicated upon an award recipient triggering an event that disqualifies the award and that then results in a tax deduction to the Company. Statement No. 123R requires that these tax benefits be recorded at the time of the triggering event. The triggering events for each option holder are not easily projected. In order to estimate the tax benefits related to incentive stock options, the Company makes many assumptions and estimates, including the number of incentive stock options that will be exercised during the period by U.S. employees, the number of incentive stock options that will be disqualified during the period and the fair market value of the Company’s stock price on the exercise dates. Each of these items is subject to significant uncertainty. Additionally, a significant portion of the tax benefits related to disqualified incentive stock options are accounted for as increases to equity (additional paid-in capital) rather than as reductions in income tax expense, especially in the periods most closely following the adoption date of Statement No. 123R. Although all such benefits continue to be realized through the Company’s tax filings, this accounting treatment has the effect of increasing tax expense and reducing net income. For example, the Company realized a tax benefit of $4.0 million during the year ended December 31, 2006 related to disqualified incentive stock options; however, only $70,000 of such amount was recorded as a reduction in income tax expense. Although there are significant limitations in estimating the impact of Statement No. 123R, including those discussed above, the Company currently estimates that the impact of Statement No. 123R will be a decrease in 2007 operating income of approximately $9.0 million – $9.5 million and a decrease in 2007 net income of approximately $7.5 – $8.0 million, or approximately $0.18 – $0.20 per diluted share.

If factors change and the Company employs different assumptions in the application of Statement No. 123R in future periods, the compensation expense that the Company will record under Statement No. 123R may differ significantly from what the Company has recorded in the current period. Therefore, it is important for investors to be aware of the high degree of subjectivity involved when using option pricing models to estimate share-based compensation under Statement No. 123R. Option-pricing models were developed for use in estimating the value of traded options that have no vesting or hedging restrictions, are fully transferable and do not cause dilution. Because the Company’s share-based payments have characteristics significantly different from those of freely traded options and because changes in the input assumptions can materially affect the Company’s estimates of fair values, in the Company’s opinion, existing valuation models, including the Black-Scholes models, may not provide reliable measures of the fair values of the Company’s share-based compensation. Consequently, there is a risk that the Company’s estimates of the fair values of the Company’s share-based compensation awards on the grant dates may bear little resemblance to the actual values realized upon the exercise, expiration, early termination or forfeiture of those share-based payments in the future. Certain share-based payments, such as employee stock options, may expire worthless or otherwise result in zero intrinsic value as compared to the fair values originally estimated on the grant date and reported in the Company’s financial statements. Alternatively, value may be realized from these instruments that is

ANSYS, Inc. 2006 Annual Report 27

significantly in excess of the fair values originally estimated on the grant date and reported in the Company’s financial statements. There is currently no market-based mechanism or other practical application to verify the reliability and accuracy of the estimates stemming from these valuation models nor is there a means to compare and adjust the estimates to actual values. Although the fair value of employee share-based awards is determined in accordance with Statement No. 123R and the Securities and Exchange Commission’s Staff Accounting Bulletin No. 107 (“SAB 107”) using an option-pricing model, that value may not be indicative of the fair value observed in a willing buyer/seller market transaction.

Estimates of share-based compensation expenses are significant to the Company’s financial statements, but these expenses are based on the aforementioned option valuation model and will never result in the payment of cash by the Company. For this reason, and because the Company does not view share-based compensation as related to its operational performance, the Board of Directors and management exclude estimated share-based compensation expense when evaluating the Company’s underlying business performance.

The guidance in Statement No. 123R and SAB 107 is relatively new, and best practices are not well established. The application of these principles may be subject to further interpretation and refinement over time. There are significant differences among valuation models, and there is a possibility that the Company will adopt different valuation models in the future. This may result in a lack of consistency in future periods and may materially affect the fair value estimate of share-based payments. It may also result in a lack of comparability with other companies that use different models, methods and assumptions.

Recently Issued and Adopted Accounting Pronouncements

The Company adopted Statement No. 123R as of January 1, 2006. The statement requires a public entity to measure the cost of employee services received in exchange for an award of equity instruments based on the grant-date fair value of the award. The cost is recognized over the period during which an employee is required to provide service in exchange for the award, typically the vesting period. Refer to additional disclosures regarding the adoption of this statement within Critical Accounting Policies above and in Notes 2 and 11 to the Consolidated Financial Statements.

In December 2004, the FASB issued Statement No. 153, “Exchanges of Nonmonetary Assets” (“Statement No. 153”). Statement No. 153 addresses the measurement of exchanges of nonmonetary assets and redefines the scope of transactions that should be measured based on the fair value of the assets exchanged. Statement No. 153 is effective for fiscal periods beginning after June 15, 2005. The adoption of this statement did not have a material impact on the Company’s financial position, results of operations or cash flows.

On June 7, 2005, the FASB issued Statement No. 154, “Accounting Changes and Error Corrections,” (“Statement No. 154”) a replacement of APB Opinion No. 20, “Accounting Changes,” and FASB Statement No. 3, “Reporting Accounting Changes in Interim Financial Statements.” Statement No. 154 changes the requirements for the accounting for and reporting of changes in accounting principles. Previously, most voluntary changes in accounting principles required recognition via a cumulative effect adjustment within net income in the period of the change. Statement No. 154 requires retrospective application to prior periods’ financial statements unless it is impracticable to determine either the period-specific effects or the cumulative effect of the change. Statement No. 154 is effective for accounting changes made in fiscal years beginning after December 15, 2005; however, the statement does not change the transition provisions of any existing accounting pronouncements. Statement No. 154 did not have a material effect on the Company’s financial position, results of operations or cash flows.

In July 2006, the FASB issued Interpretation No. 48,“Accounting for Uncertainty in Income Taxes” (“FIN 48”). This interpretation clarifies the accounting for uncertainty in income taxes recognized in a company’s financial statements in accordance with FASB Statement No. 109, “Accounting for Income Taxes.” This interpretation prescribes a recognition threshold and measurement attribute for the financial statement recognition and measurement of a tax position taken or expected to be taken in a tax return. This interpretation also provides guidance on derecognition, classification, interest and penalties, accounting in interim periods, disclosure and transition. The interpretation is effective for fiscal periods beginning after December 15, 2006. The Company will be required to apply the provisions of FIN 48 to all tax positions upon initial adoption with any cumulative effect adjustment to be recognized as an adjustment to retained earnings. The Company is in the process of determining the impact of this interpretation on its financial position, results of operations and cash flows.

ANSYS, Inc. 2006 Annual Report 28

In September 2006, the FASB issued Statement No. 157, “Fair Value Measurements” (“Statement No. 157”). This statement defines fair value, establishes a framework for measuring fair value in generally accepted accounting principles and expands disclosure about fair value measurements. This statement is effective for fiscal periods beginning after November 15, 2007 and interim periods within those fiscal years. The Company is in the process of determining the impact of Statement No. 157 on its financial position, results of operations and cash flows.

In September 2006, the Securities and Exchange Commission issued Staff Accounting Bulletin No. 108, “Considering the Effects of Prior Year Misstatements in Current Year Financial Statements” (“SAB No. 108”). SAB No. 108 provides guidance on how prior year misstatements should be taken into consideration when quantifying misstatements in current year financial statements for purposes of determining whether the current year’s financial statements are materially misstated. The adoption of SAB No. 108 did not have a material impact on the Company’s financial position, results of operations or cash flows.

In February 2007, the FASB issued Statement No. 159, “The Fair Value Option for Financial Assets and Financial Liabilities” (“Statement No. 159”). Statement No. 159 permits entities to choose to measure many financial assets and financial liabilities at fair value. Unrealized gains and losses on items for which the fair value option has been elected are reported in earnings. Statement No. 159 is effective for fiscal years beginning after November 15, 2007. The Company is currently assessing the impact of Statement No. 159 on its financial position, results of operations and cash flows.

Important Factors Regarding Future Results

Information provided by the Company or its spokespersons, including information contained in this Annual Report to Stockholders, may from time to time contain forward-looking statements concerning projected financial performance, market and industry sector growth, product development and commercialization or other aspects of future operations. Such statements will be based on the assumptions and expectations of the Company’s management at the time such statements are made. The Company cautions investors that its performance (and, therefore, any forward-looking statement) is subject to risks and uncertainties. Various important factors including, but not limited to, the following may cause the Company’s future results to differ materially from those projected in any forward-looking statement.

Potential Fluctuations in Operating Results.The Company may experience significant fluctuations in future quarterly operating results. Fluctuations may be caused by many factors including, but not limited to, the timing of new product releases or product enhancements by the Company or its competitors; the size and timing of individual orders, including a fluctuation in the demand for and the ability to complete large contracts; software errors or other product quality problems; competition and pricing changes; customer order deferrals in anticipation of new products or product enhancements; changes in demand for the Company’s products; changes in operating expenses; changes in the mix of software license and maintenance and service revenue; personnel changes; and general economic conditions. A substantial portion of the Company’s operating expenses is related to personnel, facilities and marketing programs. The level of personnel and related expenses cannot be adjusted quickly and is based, in significant part, on the Company’s expectation for future revenue. The Company does not typically experience significant order backlog. Further, the Company has often recognized a substantial portion of its revenue in the last month of a quarter, with this revenue frequently concentrated in the last weeks or days of a quarter. During certain quarterly periods, the Company has been dependent upon receiving large orders of perpetual licenses involving the payment of a single up-front fee and, more recently, has shifted the business emphasis of its products to provide a collaborative solution to the Company’s customers. This emphasis has increased the Company’s average order size and the related sales cycle time for the larger orders. This shift may have the effect of increasing the volatility of the Company’s revenue and profit from period to period. As a result, product revenue in any quarter is substantially dependent upon sales completed in the latter part of that quarter, and revenue for any future quarter is not predictable with any significant degree of accuracy.

Seasonal Variations. The Company’s business has experienced significant seasonality, including quarterly reductions in software sales resulting from the slowdown during the summer months throughout the world, particularly in Europe, as well as from the seasonal purchasing and budgeting patterns of the Company’s global customers.