- ANSS Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

425 Filing

ANSYS (ANSS) 425Business combination disclosure

Filed: 31 Mar 08, 12:00am

© 2008 ANSYS, Inc. All rights reserved. 1 Ansoft Transaction Highlights March 31, 2008 Exhibit 99.2 |

© 2008 ANSYS, Inc. All rights reserved. 2 Safe Harbor Statement Certain statements contained in the presentation regarding matters that are not historical facts, including statements regarding the parties’ ability to consummate the proposed transaction and timing thereof, expectations that the proposed acquisition, if completed, would be modestly accretive to non-GAAP earnings per share, statements regarding the impact of the pending acquisition, the projected growth in the CAE industry, the combined company’s ability to deliver customer-driven engineering simulation solutions and the ability of the combined company to lead the evolution and innovation of engineering simulation, statements regarding the impact of the transaction on our employees and operational plans, are “forward-looking” statements (as defined in the Private Securities Litigation Reform Act of 1995). Because such statements are subject to risks and uncertainties, actual results may differ materially from those expressed or implied by such forward-looking statements. All forward-looking statements in this presentation are subject to risks and uncertainties. These include the risk that the acquisition may not be consummated, the risk that the businesses of ANSYS and Ansoft may not be combined successfully, or that such combination may take longer or cost more to accomplish than expected, the risk that the pricing of the senior credit facility will be less favorable than ANSYS had anticipated, the risk that operating costs, customer loss and business disruption following the acquisition may be greater than expected, the risk of a general economic downturn in one or more of the combined company’s primary geographic regions, the risk that the assumptions underlying ANSYS’ anticipated revenues and expenditures will change or prove inaccurate, the risk that ANSYS has overestimated its ability to maintain growth and profitability and control costs, uncertainties regarding the demand for ANSYS’ products and services in future periods, the risk that ANSYS has overestimated the strength of the demand among its customers for the combined company’s products, risks of problems arising from customer contract cancellations, uncertainties regarding customer acceptance of new products, the risk that the combined company’s operating results will be adversely affected by possible delays in developing, completing or shipping new or enhanced products, risks that enhancements to the combined company’s products may not produce anticipated sales, uncertainties regarding fluctuations in quarterly results, including uncertainties regarding the timing of orders from significant customers, disruptions from the transaction making it more difficult to maintain relationships with customers and employees, and other factors that are detailed from time to time in reports filed by ANSYS, Inc. and Ansoft Corporation with the Securities and Exchange Commission, including the Annual Reports on Form 10-K and the quarterly reports on Form 10-Q, current reports on Form 8-K and other documents ANSYS and Ansoft have filed. ANSYS and Ansoft undertake no obligation to publicly update or revise any forward-looking statements, whether changes occur as a result of new information or future events, after the date they were made. |

© 2008 ANSYS, Inc. All rights reserved. 3 Where to Find Additional Information • In connection with the merger, ANSYS intends to file with the SEC a registration statement on Form S-4, which will include a prospectus/proxy statement of ANSYS and Ansoft and other relevant materials in connection with the proposed transactions. Investors and security holders of ANSYS and Ansoft are urged to read the prospectus/proxy statement and the other relevant material when they become available because they will contain important information about ANSYS, Ansoft and the proposed transaction. The prospectus/proxy statement and other relevant materials (when they become available), and any and all documents filed by ANSYS or Ansoft with the SEC, may be obtained free of charge at the SEC’s web site at www.sec.gov. In addition, investors and security holders may obtain free copies of the documents filed with the SEC by ANSYS by directing a written request to ANSYS, Inc., Southpointe, 275 Technology Drive, Canonsburg, Pennsylvania 15317, Attention: Investor Relations. Investors and security holders may obtain free copies of the documents filed with the SEC by Ansoft by directing a written request to Ansoft Corporation, 225 West Station Square Drive, Suite 200, Pittsburgh, PA 15219, Attention: Investor Relations. INVESTORS AND SECURITY HOLDERS ARE URGED TO READ THE PROSPECTUS/PROXY STATEMENT AND THE OTHER RELEVANT MATERIALS WHEN THEY BECOME AVAILABLE BEFORE MAKING ANY VOTING OR INVESTMENT DECISION WITH RESPECT TO THE PROPOSED TRANSACTIONS. • This communication shall not constitute an offer to sell or the solicitation of an offer to sell or the solicitation of an offer to buy any securities, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of such jurisdiction. No offering of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended. • ANSYS, Ansoft and their respective executive officers, directors and trustees may be deemed to be participants in the solicitation of proxies from the security holders of Ansoft in connection with the merger. Information about the executive officers and directors of ANSYS and their ownership of ANSYS common stock is set forth in the proxy statement for ANSYS’s 2007 Annual Meeting of Stockholders, which was filed with the SEC on April 9, 2007. Information about the executive officers and directors of Ansoft and their ownership of Ansoft common stock is set forth in the proxy statement for Ansoft’s 2007 Annual Meeting of Stockholders, which was filed with the SEC on July 26, 2007. Investors and security holders may obtain additional information regarding the direct and indirect interests of ANSYS, Ansoft and their respective executive officers, directors and trustees in the merger by reading the prospectus/proxy statement referred to above. |

© 2008 ANSYS, Inc. All rights reserved. 4 Transaction Summary Transaction Details: >>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>> Per Share Consideration: $16.25 in cash and 0.431882 shares of ANSYS stock for each Ansoft share – implied total value of $32.50 per Ansoft share (1) Total Consideration: Approximately $832 million (1) – $416 million in cash and 11.1 million shares of ANSYS common stock Senior Management: James E. Cashman III, President and CEO Maria T. Shields, CFO Board of Directors: 9 directors; 1 from Ansoft Headquarters: Canonsburg, PA Transaction Timing: Expected to close in second quarter of 2008, subject to customary closing conditions and regulatory and Ansoft stockholder approval (1) Based on 10-day trailing average closing price of ANSYS common stock On March 31, 2008, ANSYS announced its planned acquisition of Ansoft Corporation, a leading developer of high-performance Electronic Design Automation (EDA) software in a cash and stock transaction. The addition of Ansoft’s technology is complementary and expands ANSYS’ simulation capabilities |

© 2008 ANSYS, Inc. All rights reserved. 5 Company Highlights • Engineering simulation software widely used by engineers and designers across a broad spectrum of industries globally • NASDAQ: ANSS • $387 million (1) • 88% • 1,400 • Global Industrials • License / Maintenance / Service • High-performance EDA simulation software widely used by engineers and designers across a broad spectrum of industries globally • NASDAQ: ANST • $98 million (1) • 12% • 300 • Computer, Communications, Automotive, Semiconductor, Consumer Electronics, Military and Industrials • License / Maintenance Business Description: Exchange and Ticker Symbol: Trailing 12 Months Revenue: Pro Forma Ownership: Employees: Customer base: Business Model: (1) ANSYS as of 12/31/07 (non-GAAP results); Ansoft as of 01/31/08 (unaudited results) |

© 2008 ANSYS, Inc. All rights reserved. 6 Financial Highlights Revenue Growth 15% 23% 14% 15% 15% (1) ANSYS fiscal year ending 12/31 (non-GAAP results); Ansoft fiscal year ending 4/30, trailing 12-month as of 1/31/08 (unaudited, non-GAAP results) Revenue Growth 25% 19% 17% 78% 37% Both companies consistently delivered double-digit revenue growth while expanding operating margin $135 $158 $282 $387 $114 40% 39% 43% 32% 37% $0 $50 $100 $150 $200 $250 $300 $350 $400 $450 2003 2004 2005 2006 2007 0% 5% 10% 15% 20% 25% 30% 35% 40% 45% 50% $68 $77 $89 $98 $55 29% 34% 37% 10% 19% $0 $20 $40 $60 $80 $100 $120 2004 2005 2006 2007 Trailing 12- Month 0% 5% 10% 15% 20% 25% 30% 35% 40% |

© 2008 ANSYS, Inc. All rights reserved. 7 Overview of Ansoft • Founded in 1984 • IPO in 1996 • Headquartered in Pittsburgh, PA • 300+ employees • Offices worldwide – US, France, Germany, Italy, Sweden, UK, China, Japan, Korea, Singapore and Taiwan • Broad customer base with over 2,000 customers – communications, semiconductor, automotive/industrial, computer, consumer electronics and defense/aerospace industries • Strong financial profile – Consistent, strong revenue growth and profitable business model – trailing 12-month revenue growth of 15% and operating margin of 37% (1) • High Performance Electronics Software – HFSS™ – Nexxim® – SIwave™ – Q3D Extractor® – Turbo Package Analyzer™ • Electromechanical Software – Maxwell 3D® and 2D – SIMPLORER® – RMxprt™ Ansoft is a leading developer of high-performance EDA software, used by electrical engineers to design state-of-the-art technology products – Ansoft Designer® – AnsoftLinks™ – Full-Wave Spice™ – Optimetrics™ (1) As of 01/31/08 (unaudited results) |

© 2008 ANSYS, Inc. All rights reserved. 8 1. Highly Complementary Combination • Brand – Strong brand name recognition of all product lines • Customers – Opportunity for add-on sales; Ansoft has > 2,000 customers • Products – Ansoft adds electromagnetic and circuit simulation that offers broader technical capability and further extends ANSYS Multiphysics vision and strategy 2. Expands Breadth in Simulation Technology • Adds complementary physics that address convergence of ME and EE product design and development 3. Creates Comprehensive Portfolio of Simulation Products • Combines strong electromagnetics and circuit simulation capabilities with ANSYS mechanical and fluids simulation offerings • Strengthens long-term commitment to engineering simulation • Increases customer value by integrating capabilities into open architecture for maximum customer flexibility and efficiency 4. Combines Two Teams with Deep Industry Expertise & World-Class Engineering Talent • Continued focus on innovation – target approximately 15% of combined revenue spending on R&D • 21 development centers on 3 continents • Technology developed over 25 years Strategic Rationale |

© 2008 ANSYS, Inc. All rights reserved. 9 5. Strong Sales Channel Benefits • Direct sales presences are largely complementary • Opportunities for growth through ANSYS direct and indirect channels • Over 15,600 combined customers 6. Complementary Cultures • Strong mutual commitment to customers, employees and partners • Innovative technology and execution • 1,700 combined employees 7. Complementary Financial Profiles • Combination of solid revenue growth profiles from both companies • Strong operating margins for both companies • Similar focus on profitability 8. Financial Impact • $485 million in combined trailing 12-month non-GAAP revenues • Modestly accretive to non-GAAP earnings per share in its first full year of combined operations Strategic Rationale |

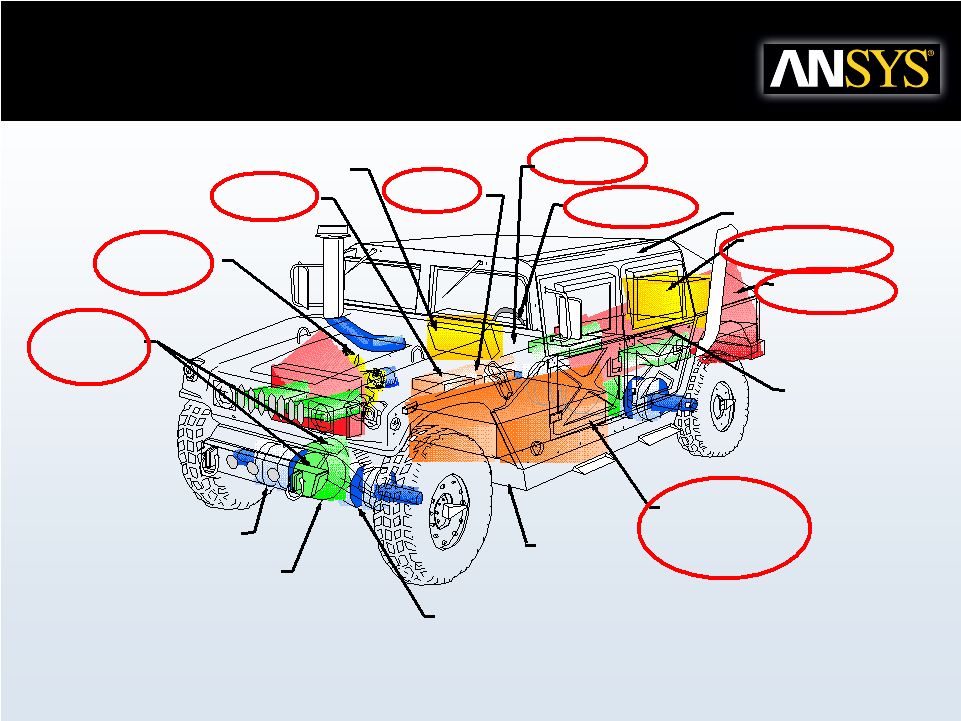

© 2008 ANSYS, Inc. All rights reserved. 10 Broad and Integrated Solutions • Complete Systems • Multiphysics • Simulated Environments |

© 2008 ANSYS, Inc. All rights reserved. 11 55kw MOTOR GENERATOR 24 VOLT DC-DC CONVERTER SYSTEM CONTROLLER CONVE NTIONAL DRIVER CONTROLS UNMODIFIED FOUR OCCUPANT SEATI NG AND PAYLOAD AREA 55 KW EXTERNAL POWER SOURCE INDEPENDENT 55kw WHEEL MOTORS & CONTROLLERS STOCK POWER DISK BRAKES INDEPENDENT 4-WHEEL DRIVE FIXED RATIO RIGHT ANGLE GEAR REDUCTION 60-INCH WATER-FORDING CAPABILITY UNITIZED 288 VOLT LEAD ACID BATTERY TRAY WITH INTEGRATED MONITORING AND CONTROL SYSTEM 300-MILE RANGE DIESEL FUEL CAPACITY ELECTRONIC INSTRUMENT PANEL (OP TION) AUXILIARY POWER DISTRIBUTION SYSTEM (OPTION) POWER DISTRIBUTION Mechanical & Electronic Convergence |

© 2008 ANSYS, Inc. All rights reserved. 12 Broad Customer Presence >13,600 Total Customers >200,000 Commercial Seats >200,000 University Seats >200 Channel Partners >150 Industry Partners >2,000 Total Customers >10,000 Commercial Seats Representative Customers |

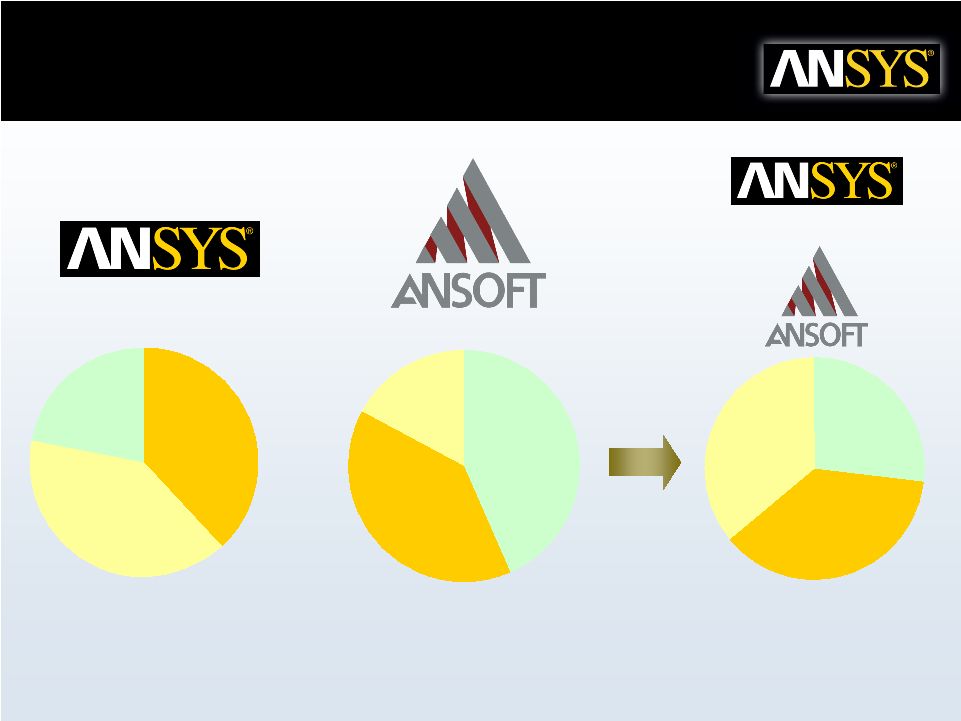

© 2008 ANSYS, Inc. All rights reserved. 13 Geographic Revenue Diversification – Trailing Twelve Months (1) Europe 41% GIA 23% North America 36% Europe 17% GIA 45% North America 38% + + Europe 36% GIA 27% North America 37% (1) ANSYS as of 12/31/07 (non-GAAP results); Ansoft as of 01/31/08 (unaudited results) |

© 2008 ANSYS, Inc. All rights reserved. 14 Value for All Key Constituencies • Customers – Expanded “Best in Class” capabilities – Focused long-term commitment to engineering simulation – Customer-driven open solutions to provide customers maximum flexibility • Employees – Reinforces world-class engineering focus – Provides critical mass and increased stability – Provides career growth opportunities • Stockholders – After closing, expected to be modestly accretive to non-GAAP earnings per share in its first full year of combined operations |

© 2008 ANSYS, Inc. All rights reserved. 15 Key Financial Metrics • Strong revenue growth – Trailing 12-month revenues of $387 million (ANSYS) and $98 million (Ansoft) (1) – ANSYS grew at +37% and Ansoft grew at +15% (2) • Strong revenue visibility – $148 million in combined deferred revenues (3) • Strong cash flow generation from combined business • Supportable leverage • Strong combined gross and operating margins (1) ANSYS as of 12/31/07 (non-GAAP results); Ansoft as of 01/31/08 (unaudited results) (2) Year-over-year (3) ANSYS as of 12/31/07, Ansoft as of 1/31/08 (unaudited results) growth; ANSYS as of 12/31/07 (non-GAAP results); Ansoft as of 01/31/08 (unaudited results) |

© 2008 ANSYS, Inc. All rights reserved. 16 Financial Benefits • Revenue Opportunity Driven By – Installed base together with expanded product offering allows for cross-selling and up-selling – Complementary verticals allow larger addressable user base • Potential Ongoing Cost Savings Opportunities – Ability to optimize existing R&D activities for mutual product development initiatives – Efficiencies in administrative and development activities – Efficiencies in sales and service activities – Reduction of redundant infrastructures and facilities |

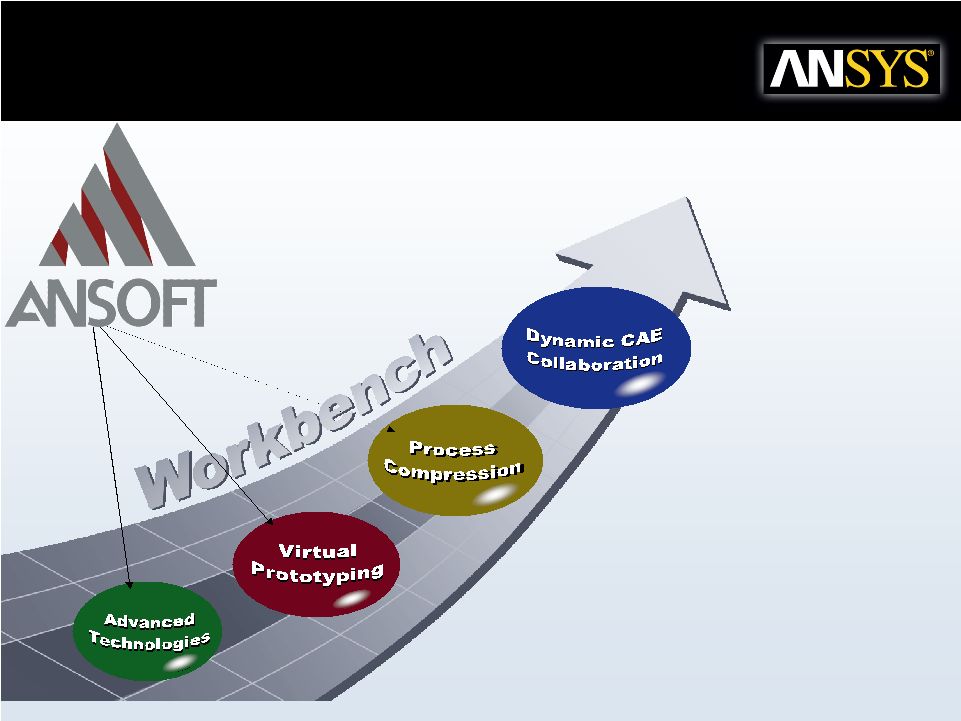

© 2008 ANSYS, Inc. All rights reserved. 17 High-level integration plan in place • Shared vision for execution • Minimal anticipated disruption – No product rationalization – Data integration within ANSYS Workbench to support Multiphysics – Expanded ANSYS global sales and service infrastructure Key Integration Focus • Minimize disruption to existing customers and business operations • Maintain employee motivation • Adopt best practices enterprise-wide • Enhance customer value proposition • Pursue revenue and cost synergies High-Level Integration |

© 2008 ANSYS, Inc. All rights reserved. 18 The Combined ANSYS and Ansoft: • Extends the breadth, functionality, usability and interoperability of the overall portfolio to create the most comprehensive, innovative industry and product solutions • Increases operational efficiency and lowers design and engineering costs for customers • Expands ANSYS vertical industry expertise • Extends ANSYS cross selling opportunities to Ansoft users • Expands ANSYS global sales channel to drive future growth • Provides ANSYS and Ansoft stockholders increased value through long- term increased revenue growth and EPS accretion Summary |

© 2008 ANSYS, Inc. All rights reserved. 19 Ansoft Transaction Highlights March 31, 2008 |