- BJRI Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

BJ's Restaurants (BJRI) DEF 14ADefinitive proxy

Filed: 28 Apr 23, 9:31am

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Onl y (as permitted by Rule 14a-6(e)(2)) |

| ☒ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☐ | Soliciting Material Pursuant to §240.14a-12 |

| ☒ | No fee required. |

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| ☐ | Fee paid previously with preliminary materials. |

TABLE OF CONTENTS

| Compensation Discussion and Analysis | 33 | |

| 33 | ||

| 34 | ||

| 35 | ||

| 35 | ||

| 36 | ||

| 37 | ||

| 37 | ||

| 38 | ||

| 38 | ||

| 38 | ||

| 39 | ||

| 40 | ||

| 41 | ||

| 45 | ||

| 46 | ||

| 47 | ||

| 49 | ||

| 50 | ||

| Compensation Committee Report | 51 | |

| 51 | ||

| 52 | ||

| 54 | ||

| 55 | ||

| 55 | ||

| 56 | ||

| 57 | ||

| 58 | ||

| 62 | ||

| 62 | ||

| Delinquent Section 16(A) Reports | 63 | |

| Shareholder Proposals for 2024 Annual Meeting | 63 | |

| Annual Report | 64 | |

| Other Matters | 64 | |

| Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting of Shareholders to be held on June 15, 2023 | 64 | |

BJ’S RESTAURANTS, INC.

7755 Center Avenue, Suite 300

Huntington Beach, California 92647

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

To Be Held June 15, 2023

Dear Shareholders:

You are cordially invited to attend the BJ’s Restaurants, Inc. Annual Meeting of Shareholders on Thursday, June 15, 2023, at 9:00 a.m. (Pacific Daylight Time). The meeting will be held at the Restaurant Support Center of BJ’s Restaurants, Inc., 7755 Center Avenue, 4th Floor, Huntington Beach, California 92647.

We are holding the meeting to:

| (1) | Elect eleven members of our Board of Directors to serve until our next Annual Meeting of Shareholders and until their successors are elected and qualified; |

| (2) | Approve, on an advisory and non-binding basis, the frequency of future advisory shareholder votes on executive compensation; |

| (3) | Approve, on an advisory and non-binding basis, the compensation of our Named Executive Officers; |

| (4) | Ratify the appointment of KPMG LLP as our independent registered public accounting firm (“independent auditor”) for fiscal 2023; and |

| (5) | Transact any other business as may properly come before the meeting or any adjournments or postponements thereof. |

If you owned our common stock at the close of business on April 18, 2023 (the “Record Date”), you may attend and vote at the meeting. For a period of at least ten days prior to the meeting, a complete list of shareholders entitled to vote at the meeting will be open for examination by any shareholder during ordinary business hours at our Restaurant Support Center located at 7755 Center Avenue, Suite 300, Huntington Beach, California 92647.

We are pleased to take advantage of the U.S. Securities and Exchange Commission rule that allows companies to furnish proxy materials to their shareholders over the Internet. As a result, we are mailing to our shareholders a Notice of Internet Availability of Proxy Materials (the “Notice”) instead of a paper copy of this Proxy Statement and our Annual Report for fiscal 2022. We believe that this process allows us to provide our shareholders with the information they need in a timelier manner, while lowering the costs of printing and distributing our proxy materials and reducing the environmental impact. The Notice contains instructions on how to access those documents over the Internet. The Notice also contains instructions on how to request a paper copy of our proxy materials, including this Proxy Statement, our Annual Report and a proxy card.

Your vote is important. Whether or not you plan to attend the meeting, you are urged to vote your shares as early as possible by mail, telephone or internet as instructed on your proxy card or Notice.

Registered holders may vote by:

| 1. | Internet: go to http://www.investorvote.com/BJRI |

| 2. | Toll-free telephone: call 1-800-652-VOTE (8683) within the United States, Canada and Puerto Rico any time on a touch tone telephone. |

| 3. | Mail (if you received a paper copy of the proxy materials by mail): mark, sign, date and promptly mail the proxy card in the postage-paid envelope. |

Any proxy may be revoked at any time prior to the final vote at the Annual Meeting of Shareholders.

Beneficial Shareholders. If your shares are held in the name of a broker, bank or other holder of record, follow the voting instructions you receive from the holder of record to vote your shares.

On behalf of the Board of Directors and BJ’s Restaurants, Inc.’s management team, thank you for your support.

Sincerely,

| Gerald W. Deitchle | Gregory S. Levin | |

| Chairman of the Board | Chief Executive Officer and President |

April 28, 2023

Huntington Beach, California

IF YOU PLAN TO ATTEND THE MEETING

Please note that attendance will be limited to shareholders. Admission will be on a first-come, first-served basis. To the extent attendance is in person, shareholders may be asked to present valid picture identification, such as a driver’s license or passport. Shareholders holding stock in brokerage accounts (“street name” holders) will need to bring a copy of a brokerage statement reflecting stock ownership as of the Record Date. Cameras, recording devices and other electronic devices will not be permitted at the Annual Meeting.

Information Concerning Solicitation of Proxies and Voting

BJ’S RESTAURANTS, INC.

7755 Center Avenue, Suite 300

Huntington Beach, California 92647

PROXY STATEMENT

ANNUAL MEETING OF SHAREHOLDERS

June 15, 2023

INFORMATION CONCERNING SOLICITATION OF PROXIES AND VOTING

The following information is provided in connection with the solicitation of proxies by and on behalf of the Board of Directors of BJ’s Restaurants, Inc. with respect to our 2023 Annual Meeting of Shareholders and adjournments or postponements thereof. The Annual Meeting will be held on Thursday, June 15, 2023, at the Restaurant Support Center of BJ’s Restaurants, Inc., 7755 Center Avenue, 4th Floor, Huntington Beach, California 92647 at 9:00 a.m., Pacific Daylight Time, for the purposes stated in the Notice of Annual Meeting of Shareholders preceding this Proxy Statement.

SOLICITATION AND REVOCATION OF PROXIES

A form of proxy is being furnished to each shareholder and is solicited on behalf of our Board of Directors for use at the Annual Meeting. The proxy materials, including this Proxy Statement, proxy card and our Annual Report for fiscal 2022, are being distributed and made available on or about April 28, 2023. This Proxy Statement contains important information for you to consider when deciding how to vote on the matters brought before the 2023 Annual Meeting. Please read it carefully.

In accordance with the rules and regulations adopted by the U.S. Securities and Exchange Commission (“SEC”), we have elected to provide our shareholders access to our proxy materials over the Internet. Accordingly, a Notice of Internet Availability of Proxy Materials (the “Notice”) will be mailed on or about April 28, 2023, to our shareholders who owned our common stock at the close of business on April 18, 2023 (the “Record Date”). Shareholders will have the ability to access the proxy materials on a website referred to in the Notice or request a printed set of the proxy materials be sent to them by following the instructions on the Notice.

The Notice will also provide instructions on how you can elect to receive future proxy materials electronically or in printed form by mail. If you choose to receive future proxy materials electronically, you will receive an email next year with instructions containing a link to the proxy materials and a link to the proxy voting site. Your election to receive proxy materials electronically or in printed form by mail will remain in effect until you terminate such election. Choosing to receive future proxy materials electronically will allow us to provide you with the information you need in a timelier manner, will save us the cost of printing and mailing documents to you, and will conserve natural resources.

We will bear the cost of the solicitation of proxies, including the charges and expenses of brokerage firms and others forwarding the solicitation materials to beneficial owners of stock. We may reimburse persons holding shares in their names or the names of their nominees for the benefit of others, such as brokerage firms, banks, depositaries, and other fiduciaries, for costs incurred in forwarding solicitation materials to their principals. The costs of such solicitation are not expected to exceed $10,000. Our directors, officers and regular administrative employees may solicit proxies personally, by telephone or by electronic communication but will not be separately compensated for such solicitation services.

Shareholders are requested to complete, date and sign the proxy card provided to them and return it promptly to us. Alternatively, internet and telephone voting will be available through 11:00 p.m., Pacific Daylight Time, on

| 1 | 2023 Proxy Statement |

Solicitation and Revocation of Proxies

June 14, 2023. Any proxy given may be revoked by a shareholder at any time before it is voted at the Annual Meeting and all adjournments thereof by filing with our Secretary a notice in writing revoking it, or by duly executing and submitting a proxy bearing a later date via the internet, telephone or mail. Proxies may also be revoked by any shareholder present at the Annual Meeting who expresses a desire to vote their shares in person.

Unless contrary instructions are specified, if the proxy is completed and submitted (and not revoked) prior to the Annual Meeting, the shares represented by the proxy will be voted (i) FOR the election of all eleven of the nominee-directors specified herein; (ii) FOR the approval of the proposal to conduct future advisory votes on executive compensation EVERY YEAR (on an advisory and non-binding basis), (iii) FOR the approval of the compensation of Named Executive Officers (on an advisory and non-binding basis); and (iv) FOR the ratification of the appointment of KPMG LLP as our independent registered public accounting firm for fiscal year 2023. Where a specification is indicated as provided in the proxy, the shares represented by the proxy will be voted and cast in accordance with the specification made therein. As to other matters, if any, to be voted upon, the persons designated as proxies will take such actions as recommended by our Board of Directors. The persons named as proxies were selected by our Board of Directors, and each of them is one of our officers.

Your execution of a proxy card or submission of your vote via the internet or telephone will not affect your right as a shareholder to attend the Annual Meeting and to vote in person.

If your shares are registered directly in your name, you are considered the shareholder of record with respect to those shares. If your shares are held in a stock brokerage account or by a bank, trust or other nominee, then the broker, bank, trust or other nominee is considered to be the shareholder of record with respect to those shares, while you are considered the beneficial owner of those shares. In that case, your shares are said to be held in “street name.” Street name holders generally cannot vote their shares directly and must instead instruct the broker, bank, trust or other nominee how to vote their shares.

If you are a street name holder and fail to instruct the shareholder of record how you want to vote your shares on a particular matter, those shares are considered to be “uninstructed.” New York Stock Exchange rules determine the circumstances under which member brokers of the New York Stock Exchange may exercise discretion to vote “uninstructed” shares held by them on behalf of their clients who are street name holders. These rules apply to brokers holding our shares even though our Common Stock is traded on the NASDAQ Select Global Market. With respect to the election of the nominees for director, the proposal to approve the frequency of future advisory shareholder votes on executive compensation (on an advisory and non-binding basis), and the proposal to approve the compensation of Named Executive Officers (on an advisory and non-binding basis), the rules do not permit member brokers to exercise voting discretion as to the uninstructed shares. With respect to the proposal to ratify the selection of KPMG LLP as our independent auditor for our 2023 fiscal year, the rules treat such a proposal as “routine” and permit member brokers to exercise voting discretion as to the uninstructed shares.

For matters with respect to which the broker, bank or other nominee does not have, or has but does not exercise, voting discretion, the uninstructed shares will be referred to as a “broker non-vote.” Under our Bylaws and California law, shares represented by proxies that reflect abstentions or “broker non-votes” will be counted as shares that are present and entitled to vote for purposes of determining the presence of a quorum. If you properly submit your proxy but abstain from voting for one or more director nominees or abstain from voting on the other proposals, your shares will be counted as present at the Annual Meeting for the purpose of determining a quorum and for the purpose of calculating the vote on the particular matter(s) with respect to which you abstained from voting. If you do not submit your proxy or voting instructions and also do not vote by ballot at the Annual Meeting, your shares will not be counted as present at the meeting for the purpose of determining a quorum unless you hold your shares in street name and the broker, bank, trust or other nominee has discretion to vote your shares and does so.

If you do not vote your shares for one or more of the director nominees (whether by broker non-vote or otherwise), this will have no effect on the outcome of the vote. With respect to the proposal to approve the frequency of future advisory shareholder votes on executive compensation (on an advisory and non-binding basis), the proposal to approve the compensation of Named Executive Officers (on an advisory and non-binding basis), and the proposal to ratify the selection of KPMG LLP as our independent auditor, selecting abstain

| BJ’s Restaurants, Inc. | 2 |

Solicitation and Revocation of Proxies

when voting will have the same effect as a vote against the proposal, but if you do not vote your shares (or, for shares held in street name, if you do not submit voting instructions and your broker, bank, trust or other nominee does not or may not vote your shares), this will have no effect on the outcome of the vote.

HOUSEHOLDING OF ANNUAL MEETING MATERIALS

Some banks, brokers, and other nominee record holders may participate in the practice of “householding” proxy statements and annual reports. This means that only one copy of the Notice, this Proxy Statement and the Annual Report for Fiscal 2022 may have been sent to multiple shareholders in your household. If you would like to obtain another copy of either document, please contact our Investor Relations Department at 7755 Center Avenue, Suite 300, Huntington Beach, California 92647, telephone (714) 500-2400. If you want to receive separate copies of the proxy statement and annual report in the future, or if you are receiving multiple copies and would like to receive only one copy for your household, you should contact your bank, broker, or other nominee record holder, or you may contact us at the above address or telephone number.

SHAREHOLDER VOTING RIGHTS

Only holders of record of shares of our Common Stock, no par value, on the Record Date, which is the close of business on April 18, 2023, will be entitled to notice of, and to vote at, the Annual Meeting. On the Record Date, there were 23,529,573 shares of Common Stock issued and outstanding, with one vote per share.

With respect to the election of directors, assuming a quorum is present, the eleven candidates receiving the highest number of votes are elected. See “Election of Directors.” To approve the proposal to approve the frequency of future advisory shareholder votes on executive compensation (on an advisory and non-binding basis), the proposal to approve compensation of Named Executive Officers (on an advisory and non-binding basis), and the proposal to ratify the appointment of KPMG LLP, assuming a quorum is present, the affirmative vote of shareholders holding a majority of the voting power represented and voting at the Annual Meeting (which shares voting affirmatively also constitute at least a majority of the required quorum) is required. A quorum is the presence in person or by proxy of shares representing a majority of the voting power of our Common Stock.

| 3 | 2023 Proxy Statement |

Proposal 1: Election of Directors • Director Nomination Process

ELECTION OF DIRECTORS

(PROPOSAL NO. 1 ON PROXY CARD)

The number of directors on our Board of Directors shall not be fewer than seven nor more than thirteen in accordance with our Bylaws. The exact number is fixed from time to time by our Board of Directors and is currently set at twelve and will be reduced to eleven effective upon the election of directors at the Annual Meeting.

All directors are subject to election at each Annual Meeting of Shareholders. At this Annual Meeting, eleven directors will be elected to serve until the next Annual Meeting of Shareholders and until their respective successors are elected and qualified. The nominees for election as directors at this Annual Meeting are set forth in the table below. All nominees are recommended by our Board of Directors for election at the Annual Meeting, and all nominees currently serve on our Board of Directors. In the event that any of the nominees for director should become unable to serve if elected, it is intended that shares represented by proxies which are executed and returned will be voted for such substitute nominee(s) as may be recommended by our existing Board of Directors. The Board of Directors may elect to fill interim vacancies of directors. Each of our officers is elected by, and serves at the discretion of, the Board of Directors, subject to the terms of any employment agreement.

The eleven nominees receiving the highest number of votes cast “For” their election at the Annual Meeting will be elected as our directors. Proxies cannot be voted for a greater number of persons than the number of nominees named in this Proxy Statement. Under our majority voting policy, any director nominee who receives a greater number of “Withhold” votes than “For” votes with respect to their election shall tender their resignation within 15 days of the final vote. See the description of our majority voting policy in “Corporate Governance – Majority Voting Policy” below.

Subject to certain exceptions specified below, shareholders of record on the Record Date are entitled to cumulate their votes in the election of our directors (i.e., they are entitled to the number of votes determined by multiplying the number of shares held by them times the number of directors to be elected) and may cast all of their votes so determined for one nominee or spread their votes among two or more nominees as they see fit. No shareholder shall be entitled to cumulate votes for a given candidate for director unless such candidate’s name has been placed in nomination prior to the vote and the shareholder has given notice at the Annual Meeting, prior to the voting, of the shareholder’s intention to cumulate his or her votes. If any one shareholder has given such notice, all shareholders may cumulate their votes for candidates in nomination. Discretionary authority to cumulate votes is hereby solicited by the Board of Directors if any shareholder gives notice of such shareholder’s intention to exercise the right to cumulative voting. In that event, the Board of Directors will instruct the proxy holders to vote all shares represented by proxies in a manner that will result in the approval of the maximum number of directors from the nominees selected by the Board of Directors that may be elected with the votes held by the proxy holders.

Director Nomination Process

The Board of Directors and the Governance and Nominating Committee periodically review and assess the size and composition of the Board in light of the collective skills and experience of current Board members and the perceived needs of the Board at a particular point in time. Our Corporate Governance Guidelines set forth the general qualifications for Board membership and procedures for identification of prospective Board candidates. The Governance and Nominating Committee, with the input of other members of the Board, develops and reviews background information on candidates for the Board and makes recommendations to the Board regarding such candidates. The Committee considers candidates for Board membership suggested by its members and other Board members, as well as candidates suggested by members of our management and by our shareholders. The Board may periodically retain search firms to assist in identifying and evaluating potential candidates for our Board. A shareholder who wishes to recommend a prospective nominee for the Board should notify any member of the Governance and Nominating Committee in writing with whatever supporting material the shareholder considers appropriate.

The Governance and Nominating Committee considers whether to nominate any person nominated by a shareholder pursuant to the provisions of our Bylaws relating to shareholder nominations. Our Bylaws provide that only persons who are nominated in accordance with specified Bylaw procedures shall be eligible for election as

| BJ’s Restaurants, Inc. | 4 |

Proposal 1: Election of Directors • Director Nomination Process

directors. Nominations of persons for election to the Board of Directors may be made at a meeting of shareholders by, or at the direction of, the Board of Directors or by any shareholder entitled to vote for the election of directors who complies with certain notice procedures set forth in the Bylaws. To be timely in the case of an annual meeting, a shareholder’s notice must be delivered to or mailed and received at our principal executive offices not later than the close of business on the 60th day and no earlier than the close of business on the 90th day prior to the first anniversary of the date on which we first mailed proxy materials for the preceding year’s annual meeting. However, in the event that the date of the annual meeting is more than 30 days before or after the one year anniversary of the date on which the preceding annual meeting was called, notice by the shareholder must be received no earlier than the close of business on the 10th day following the day on which public disclosure of the date of the annual meeting was first made. The shareholder’s notice must set forth certain information concerning the proposed nominee(s) and the shareholder giving notice, as set forth in the Bylaws.

Once the Governance and Nominating Committee has identified a prospective nominee, the Committee makes an initial determination as to whether to conduct a full evaluation of the candidate. This initial determination is based on whatever information is provided to the Committee with the recommendation of the prospective candidate, as well as the Committee’s own knowledge of the prospective candidate, which may be supplemented by inquiries to the person making the recommendation or others. The preliminary determination is based primarily on the need for additional Board members to fill vacancies, provide specific expertise or expand the size of the Board and the likelihood that the prospective nominee can satisfy the evaluation factors described below. If the Committee determines, in consultation with the Chairman of the Board and other Board members, as appropriate, that additional consideration is warranted, it may request a third-party search firm to gather additional information about the prospective nominee’s background and experience and to report its findings to the Committee. The Committee then evaluates the prospective nominee against the following standards and qualifications:

| • | the ability of the prospective nominee to represent the interests of all of our shareholders; |

| • | the prospective nominee’s standards of integrity, commitment and independence of thought and judgment; |

| • | the prospective nominee’s ability to dedicate sufficient time, energy and attention to the diligent performance of his or her duties, including the prospective nominee’s service on other public company boards; |

| • | the prospective nominee’s ability to qualify as a director when we apply for and hold certain business and liquor licenses where such qualification is required; |

| • | the extent to which the prospective nominee contributes to the range of talent, skill and expertise appropriate for the Board; |

| • | NASDAQ listing requirements and applicable state and federal laws or regulations relating to Board composition; and |

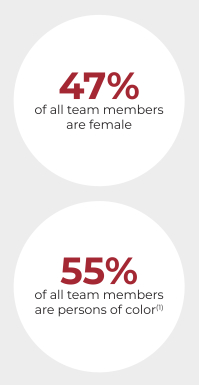

| • | the extent to which the prospective nominee helps the Board reflect the diversity of our shareholders, team members, guests, other stakeholders, and communities. |

The Committee also considers such other relevant factors as it deems appropriate, including the current composition of the Board, the balance of independent and non-independent directors, specific business and financial expertise, experience as a director of a public company, the need for Audit Committee expertise, the evaluations of other prospective nominees, and diversity. The Board considers a number of factors relating to Board diversity, including but not limited to the sex, gender identity, race, ethnicity, geography and age of prospective nominees. The Board is committed to increasing its diversity as the Board expects to reduce its total size due to retirements over the next three years and through the recruitment of qualified members with diverse backgrounds to fill Board vacancies as they occur, in anticipation of achieving at least 30 percent gender diversity by the next shareholder meeting.

In connection with this evaluation, the Committee determines whether to interview the prospective nominee(s), and if warranted, one or more members of the Committee, and others as appropriate, interview the prospective nominee(s) in person or by telephone. After completing this evaluation and interview, the Committee makes a

| 5 | 2023 Proxy Statement |

Proposal 1: Election of Directors • Director Nomination Process

recommendation to the full Board as to the person(s) who should be nominated by the Board, and the Board determines the nominee(s) after considering the recommendation and report of the Committee.

The Board has adopted age limits for members of our Board which require that any person who has reached the age of 75 shall not be nominated for initial election to the Board. However, the Governance and Nominating Committee may recommend, and the Board may approve the nomination for re-election of a director at or after the age of 75 if, in light of all the circumstances, the Board believes it is in our best interests and the best interests of our shareholders.

We have entered into an employment agreement with Mr. Levin that requires us to take all reasonable action within our control to cause him to continue to be appointed or elected to our Board of Directors during the term of his employment under the employment agreement.

Relationship with BJ’s Act III, LLC

On May 5, 2020, we completed the sale of 375,000 shares of common stock and a warrant to purchase up to 875,000 shares of common stock to SC 2018 Trust, LLC (“SC LLC”). Following the closing of such sale, SC LLC contributed the purchased shares and warrant to BJ’s Act III, LLC, a newly formed subsidiary of Act III Holdings, LLC, which is owned by SC LLC and other limited liability companies either controlled by Ronald M. Shaich or wholly owned by trusts established by Ronald M. Shaich.

SC LLC and BJ’s Act III, LLC are parties to an Amended and Restated Investor Rights Agreement, dated November 24, 2020 (the “Investor Rights Agreement”), pursuant to which they (and any transferees who agree to become parties thereto) (together, the “Investors”) were granted certain rights and obligations which include the following:

Board Observer. The Investors have the right to designate one person (the “Observer”) to serve as an observer at meetings of the Board and at meetings of the Governance and Nominating Committee; provided that the Investors shall not have the right to designate an Observer during any period in which a director suggested by the Investors is serving as a member of the Board or the Governance and Nominating Committee, respectively (an “Investor Approved Board Member”). We have no obligation to nominate or appoint as a director any person suggested by the Investors or to continue to nominate Mr. Pascal for election. Investors’ right to designate an Observer shall terminate at such time as Investors fail to collectively beneficially own the lesser of 4.25% of the then outstanding common stock or rights convertible or exercisable into common stock (on an as-converted or exercised basis) or 187,500 shares of common stock (the “Ownership Threshold”).

Standstill. Until the later of May 5, 2023, or at such time as the Investors no longer meet the Ownership Threshold, the Investors are prohibited from, among other things, (i) effecting a tender offer, merger or acquisition of the Company, (ii) soliciting proxies or seeking a director/management change in the Company, and (iii) acquiring securities, assets or indebtedness of the Company in connection with any of the actions described in clauses (i) and (ii) above (collectively, the “Standstill Provisions”); provided, however, that if an Investor Approved Board Member is no longer serving as a member of the Board for reasons other than such person’s voluntary resignation, incapacity or death (and no Investor Approved Board Member is appointed following such resignation, incapacity or death), the Standstill Provisions shall terminate on the earlier of May 5, 2023, or at such time as the Investors no longer meet the Ownership Threshold.

On April 13, 2023, we entered into an agreement with the Investors to terminate the Investor Rights Agreement effective upon completion of the Annual Meeting. At such time, the Investors will no longer have Board Observation Rights or be subject to the Standstill Provisions.

On January 17, 2022, we entered into a consulting agreement for services relating to certain off-premise sales building initiatives with Act III Management, LLC, an affiliate of BJ’s Act III, LLC, for $100,000, with a possible additional phase for $45,000. During fiscal 2022, we moved forward with the additional phase, and in October we signed an extension to the agreement for a second additional phase for $50,000, bringing the total agreement to $195,000. All phases were completed and the agreement expired on December 31, 2022.

| BJ’s Restaurants, Inc. | 6 |

Proposal 1: Election of Directors • Director Nominees

Director Nominees

Director Nominee Highlights.

| Independent Directors | Tenure | Age | ||||||||||

|  |  | ||||||||||

| Gender | Ethnic Diversity | |||||||||||

|  | |||||||||||

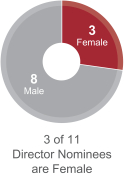

| Board Nominee Diversity Matrix (As of April 28, 2023) | ||||||||||||||||

Total Number of Directors | 11 | |||||||||||||||

|

| Female | Male | Non-Binary | | Did Not Disclose Gender | | ||||||||||

Part I: Gender Identity |

|

|

|

|

|

|

|

|

|

|

|

| ||||

Directors | 3 | 8 | — | — | ||||||||||||

Part II: Demographic Background |

|

|

|

|

|

|

|

|

|

|

|

| ||||

African American or Black | — | 1 | — | — | ||||||||||||

Alaskan Native or Native American | — | — | — | — | ||||||||||||

Asian | 1 | — | — | — | ||||||||||||

Hispanic or Latino | — | 1 | — | — | ||||||||||||

Native Hawaiian or Pacific Islander | — | — | — | — | ||||||||||||

White | 2 | 6 | — | — | ||||||||||||

Two or More Races or Ethnicities | — | — | — | — | ||||||||||||

LGBTQ+ | — | |||||||||||||||

Did not disclose demographic background | — | |||||||||||||||

| 7 | 2023 Proxy Statement |

Proposal 1: Election of Directors • Director Nominees

We remain committed to diversity on our Board and expect that as certain of our directors reach retirement age, our overall Board composition will more closely reflect the diversity of our team members and guests.

Director Nominee Biographies and Qualifications. The following table sets forth certain information concerning the nominees for election as directors:

Nominee | Principal Occupation | Age | ||

Gerald W. Deitchle | Chairman of the Board, BJ’s Restaurants, Inc. | 71 | ||

Gregory S. Levin | Chief Executive Officer and President, BJ’s Restaurants, Inc. | 55 | ||

Peter A. Bassi | Retired Chairman, Yum! Restaurants International | 73 | ||

Larry D. Bouts | Investor/Business Advisor; Former Chairman and Chief Executive Officer, Six Flags Theme Parks | 74 | ||

Bina Chaurasia | Chief Administrative and Operating Officer, Tanium | 60 | ||

James A. Dal Pozzo | Former Chairman of the Board and Chief Executive Officer, The Jacmar Companies | 64 | ||

Noah A. Elbogen | Partner and Chief Financial Officer, Act III Holdings, LLC | 40 | ||

Lea Anne S. Ottinger | Strategic Business Consultant; Managing Partner, LMR Advisors | 64 | ||

Julius W. Robinson, Jr. | Chief Sales and Marketing Officer (United States and Canada), Marriott International, Inc. | 50 | ||

Janet M. Sherlock | Chief Digital and Technology Officer, Ralph Lauren Corporation | 57 | ||

Gregory A. Trojan | Retired Chief Executive Officer, BJ’s Restaurants, Inc. | 63 | ||

Each nominee brings unique capabilities to the Board, and the Board believes the nominees as a group have the experience and skills in areas such as general business management, corporate governance, leadership development, restaurant management, finance, risk management and corporate communications that are necessary to effectively oversee our Company. In addition, the Board believes that each of our directors possesses high standards of ethics, integrity and professionalism, sound judgment, community leadership and a commitment to representing the long-term interests of our shareholders. The following is a summary of the business background of each nominee as well as other information about each nominee’s qualifications to serve as a director of our Company:

GERALD (“JERRY”) W. DEITCHLE (Chairman of the Board)

| ||

Age: 71 Director since 2004

Committees: • N/A | Director Qualifications: With eight years of prior experience as our President and Chief Executive Officer and as our Chairman since June 2008, in addition to over 45 years of executive and financial management experience with large, national restaurant and retail companies, both privately held and publicly held, the Board believes Mr. Deitchle has the experience necessary to help guide the development of our strategic positioning and expansion plans. | |

Biography: Mr. Deitchle has been a member of our Board of Directors since November 2004, and has served as our Chairman of the Board since June 2008. Since February 2013, Mr. Deitchle has been managing member of Restaurant Advisory Services LLC, which specializes in advising both public and privately-held chain restaurant companies. Mr. Deitchle served as our Chief Executive Officer from February 2005 until his retirement in February 2013, and as our President from February 2005 until December 2012. From April 2004 to January 2005, Mr. Deitchle served as President, Chief Operating Officer and a director of Fired Up, Inc., which previously owned, operated and franchised the Johnny Carino’s Italian restaurant concept. From 1995 to 2004, he was a member of the executive management team at The Cheesecake Factory Incorporated (NASDAQ: CAKE), an operator of upscale casual dining restaurants, with his last position as corporate President. From 1984 to 1995, he was employed by the parent company of Long John Silver’s Restaurants, Inc., with his last position as Executive Vice President. Mr. Deitchle previously served on the Board of Directors of Fogo de Chao, Inc. (formerly NASDAQ: FOGO), an operator of Brazilian-style steakhouses that became a private company in 2018. | ||

| BJ’s Restaurants, Inc. | 8 |

Proposal 1: Election of Directors • Director Nominees

GREGORY (“GREG”) S. LEVIN

| ||

Age: 55 Director since 2021

Committees: • N/A | Director Qualifications: With experience as our President since January 2018 and as our Chief Financial Officer from September 2005 through August 2021, in addition to over 20 years of executive and financial management experience with large, national restaurant companies, both privately held and publicly held, the Board believes Mr. Levin has the necessary background and experience to lead the development and execution of our longer-term strategic positioning and expansion plans, as well as our shorter-term tactical plans. | |

Biography: Mr. Levin has served as our Chief Executive Officer, President and as a member of our Board of Directors since September 2021 and previously served as our President, Chief Financial Officer and Secretary from January 2018 through August 2021. He previously served as our Executive Vice President, Chief Financial Officer and Secretary from June 2008 to December 2017, as our Executive Vice President and Chief Financial Officer from October 2007 to May 2008, and as Chief Financial Officer from September 2005 to September 2007. From February 2004 to August 2005, Mr. Levin served as Chief Financial Officer and Secretary of SB Restaurant Company, a privately held company that operated the Elephant Bar Restaurants. From 1996 to 2004, Mr. Levin was employed by California Pizza Kitchen, Inc., operator and licensor of casual dining restaurants, with his last position as Vice President, Chief Financial Officer and Secretary. Earlier in his career, he served as an audit manager with Ernst & Young LLP. | ||

PETER (“PETE”) A. BASSI (Lead Independent Director)

| ||

Age: 73 Director since 2004

Committees: • Audit • Compensation • Governance and Nominating (Chair) | Director Qualifications: As a former senior executive officer of one of the largest publicly held restaurant companies in the United States with extensive public company directorship experience, as well as extensive marketing knowledge and expertise from his over 40 years in the food and beverage industry, Mr. Bassi brings uniquely suited management experience to the Board. Mr. Bassi’s significant financial experience also qualifies him as an audit committee financial expert under applicable rules of the SEC. | |

Biography: Mr. Bassi has been a member of our Board of Directors since September 2004, and currently serves as our Lead Independent Director. Mr. Bassi served as Chairman of Yum! Restaurants International (also known as “YRI”) from June 1997 until his retirement in 2005. YRI was the International Division of Yum! Brands, Inc. (“Yum!”), which operates and franchises Taco Bell, Pizza Hut, and KFC Restaurants and was created in 1997 in a spin-off from PepsiCo, Inc. Prior to leading YRI, he was in charge of YRI’s Asian business. Mr. Bassi joined PepsiCo in 1972 in the Pepsi-Cola Company division. During his long tenure at PepsiCo, Mr. Bassi served in various assignments at Pepsi-Cola International, Pizza Hut (U.S. and International), Frito-Lay, and Taco Bell. Mr. Bassi currently serves on the Board of Directors of Yum China (NASDAQ: YUMC). From 2009 to 2019, Mr. Bassi served on the Board of Directors of Potbelly Sandwich Works (NASDAQ: PBPB), and from 2015 to 2018, Mr. Bassi served on the Board of Directors of Mekong Capital, a Vietnamese private equity firm. | ||

| 9 | 2023 Proxy Statement |

Proposal 1: Election of Directors • Director Nominees

LARRY D. BOUTS

| ||

Age: 74 Director since 2004

Committees: • Audit (Chair) • Compensation

| Director Qualifications: Mr. Bouts has extensive management and financial experience as a former senior executive of large consumer-discretionary segment companies, including Six Flags Theme Parks and the International Division of Toys “R” Us. Mr. Bouts also has significant financial experience which qualifies him as an audit committee financial expert under applicable rules of the SEC. | |

Biography: Mr. Bouts has been a member of our Board of Directors since April 2004. Mr. Bouts currently serves as an investor and advisor to several early stage companies in various industry segments, including technology, energy and consumer-oriented businesses. Previously, Mr. Bouts served as Chairman and Chief Executive Officer of Six Flags Theme Parks while it was a private company. Prior to that, he led the launch of the Toys “R” Us international expansion throughout Canada, Australia, Europe, and Asia as President of the International Division, successfully developing a profitable multi-billion dollar offshore retail brand in over 25 countries. Mr. Bouts spent 13 years at PepsiCo, Inc. where he held various planning and finance positions, including Chief Financial Officer of two of PepsiCo’s operating divisions. | ||

BINA CHAURASIA

| ||

Age: 60 Director since 2020

Committees: • Compensation | Director Qualifications: Ms. Chaurasia has extensive human resource experience from her over 20 years in senior leadership and executive management positions. We believe her experience provides substantial insight to the Compensation Committee with respect to issues regarding our valuable human capital and the human resources elements of our business. | |

Biography: Ms. Chaurasia has been a member of our Board of Directors since November 2020. Since August 2017, Ms. Chaurasia has worked at Tanium, a privately held endpoint security and systems management company based in Emeryville, California. She currently serves as Chief Administrative and Operating Officer, where she is responsible for human resources, strategy, global enablement, procurement, information technology, legal and real estate. Prior to this role, Ms. Chaurasia served as Chief People Officer at Tanium. Ms. Chaurasia previously served as Chief Human Resources Officer at Ericsson from 2010 to 2016, Vice President of Global Talent for Hewlett-Packard from 2007 to 2010, and Vice President of Global Human Resources at Gap Inc. from 2003 to 2007. Ms. Chaurasia also previously held senior human resource leadership roles at PepsiCo-Yum! and at Sun Microsystems. | ||

| BJ’s Restaurants, Inc. | 10 |

Proposal 1: Election of Directors • Director Nominees

JAMES (“JIM”) A. DAL POZZO

| ||

Age: 64 Director since 2001

Committees: • Audit • Governance and Nominating

| Director Qualifications: Mr. Dal Pozzo’s experience as the Chairman of the Board and former Chief Executive Officer of a holding company with interests in foodservice distribution, restaurants and real estate development provides him with extensive knowledge of the food distribution, supply chain operations and restaurant industries. Mr. Dal Pozzo is a Certified Public Accountant, and his significant financial experience also qualifies him as an audit committee financial expert under applicable rules of the SEC. | |

Biography: Mr. Dal Pozzo has been a member of our Board of Directors since January 2001. Mr. Dal Pozzo served as Chairman of the Board of The Jacmar Companies, a food distribution company servicing restaurants in California and Nevada, from January 2013 to December 2019, as Chief Executive Officer from January 2013 to December 2017, as President from 1993 to January 2013, and as Chief Financial Officer and Treasurer from 1987 to 1992. Prior to working for The Jacmar Companies, Mr. Dal Pozzo served as Chief Financial Officer of the Ojai Ranch and Investment Company in 1992. Mr. Dal Pozzo is a Certified Public Accountant and was with Peat Marwick from 1981 to 1987, where he specialized in the restaurant, distribution, retail and manufacturing industries. | ||

NOAH A. ELBOGEN

| ||

Age: 40 Director since 2014

Committees: • Audit • Compensaton | Director Qualifications: Mr. Elbogen has significant investment, financial and operations experience from nearly 20 years as an institutional investor, equity research analyst, public company director, and senior executive focused primarily on the restaurant industry. Mr. Elbogen’s significant financial experience also qualifies him as an audit committee financial expert under applicable rules of the SEC. | |

Biography: Mr. Elbogen has been a member of our Board of Directors since June 2014. Mr. Elbogen currently serves as a Partner and Chief Financial Officer of Act III Holdings, LLC, which he joined in May 2019. From August 2016 to June 2019, Mr. Elbogen served as Managing Member and Chief Executive Officer of Misada Capital Group LLC. From July 2011 to July 2016, Mr. Elbogen served as an Investment Analyst at Luxor Capital Group, LP, where he focused primarily on the restaurant sector. Prior to joining Luxor Capital Group, Mr. Elbogen served as a Research Analyst covering the consumer sector at S.A.C. Capital Management, LLC from August 2009 to June 2011, at Highbridge Capital Management, LLC from January 2007 to January 2009, and at Scout Capital Management LLC from August 2005 to January 2007. Mr. Elbogen began his investment career as an Equity Research Associate at Bear Stearns where he covered the Specialty Retail and Hardlines sectors. Mr. Elbogen served as Director at Papa Murphy’s Holdings, Inc. (formerly NASDAQ: FRSH) from December 2017 to May 2019. | ||

| 11 | 2023 Proxy Statement |

Proposal 1: Election of Directors • Director Nominees

LEA ANNE S. OTTINGER

| ||

Age: 64 Director since 2010

Committees: • Compensation (Chair) • Governance and Nominating | Director Qualifications: Ms. Ottinger has significant investment and financial expertise from her many years as a principal in private equity and as a strategic business advisor specializing in mergers and acquisitions, which benefits the Board and Compensation Committee. She has been involved in the acquisition, sale, advisory role, or operations of over 20 companies, with an emphasis on growth-oriented businesses in the consumer/retail sector. She also has prior experience as a public company director with experience in governance, Board oversight, strategic planning, and audit functions. | |

Biography: Ms. Ottinger has been a member of our Board of Directors since August 2010. In 1998, Ms. Ottinger founded LMR Advisors, where she serves as a strategic business consultant supporting growth-oriented businesses primarily in the consumer/retail sector. Building upon her career in private equity as a Vice President of Berkshire Partners, and its predecessor, Thomas H. Lee Company from 1982 to 1989, her focus is on the resources and strategies required to maximize value creation, with expertise in mergers and acquisitions and monetization strategies that enhance business expansion and realization of stakeholder financial objectives. From 1990 to 1998, Ms. Ottinger was a franchise owner and operator of several The Body ShopTM skin and hair care stores and served as a national franchisee representative. From June 2004 until its acquisition in March 2010, she served on the Board of Directors of Bare Escentuals, Inc. (formerly NASDAQ: BARE), one of the leading cosmetic companies in the United States. | ||

JULIUS W. ROBINSON, JR.

| ||

Age: 50 Director since 2022

Committees: • Compensation | Director Qualifications: With almost 30 years of hospitality operations and executive experience with a publicly held multi-unit hospitality company, the Board believes Mr. Robinson is qualified to serve. | |

Biography: Mr. Robinson has been a member of our Board of Directors since January 2022. Mr. Robinson currently serves as the Chief Sales and Marketing Officer for the United States and Canada at Marriott International, Inc. (“Marriott”), which is based in Bethesda, Maryland, and encompasses a portfolio of nearly 8,000 properties under 30 leading brands spanning 139 countries and territories. Marriott operates and franchises hotels and licenses vacation ownership resorts all around the world. Mr. Robinson is responsible for top line sales and leads the disciplines of Sales, Distribution, Field Marketing, Loyalty, Revenue Strategy, and Public Relations and Crisis Communications for Marriott’s largest division. Mr. Robinson’s experience in the hospitality industry spans nearly three decades with Marriott. His senior leadership roles include Senior Vice President and Global Brand Leader for Marriott Hotels and Sheraton Hotels, and Global Brand Leader for Autograph Collection Hotels and Tribute Portfolio, which represent Marriott’s foray into independent and boutique hotels. Mr. Robinson also previously served as Vice President of Global Sales, Vice President of Brand Franchising, and Regional Vice President of Revenue Management for the Eastern United States. | ||

| BJ’s Restaurants, Inc. | 12 |

Proposal 1: Election of Directors • Director Nominees

JANET M. SHERLOCK

| ||

Age: 57 Director since 2019

Committees: • Audit • Governance and Nominating

| Director Qualifications: Ms. Sherlock has significant management and technology experience as an executive for some of the world’s best known consumer brands, including Ralph Lauren and Carter’s. Her experience developing breakthrough growth strategies for these brands, coupled with her extensive technology background and cybersecurity expertise, is of considerable value as we continue to invest in our digital platform and technology capabilities. | |

Biography: Ms. Sherlock has been a member of our Board of Directors since January 2019. Ms. Sherlock currently serves as Chief Digital and Technology Officer of Ralph Lauren Corporation, a global leader in the marketing, design, and distribution of apparel, fragrance, accessories, and home products. From January 2010 to July 2017, Ms. Sherlock was Chief Information Officer at Carter’s, Inc., a global manufacturer and retailer of baby and children’s apparel and accessories. Prior to that, Ms. Sherlock led the Digital and Omni-Channel practice at Gartner, a leading research and advisory firm, from October 2008 to December 2009. Ms. Sherlock also held various business and technology leadership roles at Calico Corners/Everfast, Inc., Guess?, Inc., BP and ExxonMobil from 1998 to 2008. | ||

GREGORY (“GREG”) A. TROJAN

| ||

Age: 63 Director since 2012

Committees: • N/A | Director Qualifications: As our retired Chief Executive Officer, and with extensive experience as an executive with large, national retail, consumer products and restaurant companies, the Board believes Mr. Trojan has the necessary background and experience to lead the development and execution of our strategic positioning and expansion plans. | |

Biography: Mr. Trojan has been a member of our Board of Directors since December 2012. He served as our Chief Executive Officer from February 2013 through August 2021, and previously served as our President from December 2012 until January 2018. Prior to joining us, Mr. Trojan served as President, Chief Executive Officer and Director of Guitar Center, Inc., a leading retailer of musical instrument products, from November 2010 to November 2012, and as President, Chief Operating Officer and Director from October 2007 to November 2010. From 1998 to 2006, Mr. Trojan served as Chief Executive Officer of House of Blues Entertainment, Inc., an operator of restaurant and music venues, concerts and media properties, and as President from 1996 to 1998. Prior to that, he held various positions with PepsiCo, Inc. from 1990 to 1996, including service as Chief Executive Officer of California Pizza Kitchen, Inc., when it was owned by PepsiCo. Earlier in his career, Mr. Trojan was a consultant at Bain & Company, the Wharton Small Business Development Center and Arthur Andersen & Company. Mr. Trojan joined the Board of Directors of Casey’s General Stores, Inc. (NASDAQ: CASY) in July 2021, and previously served on the Board of Directors of Oakley, Inc. from June 2005 to November 2007 and Domino’s Pizza, Inc. (NYSE: DPZ) from March 2010 to November 2017. | ||

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A VOTE “FOR” ALL OF THE NOMINEES ABOVE.

| 13 | 2022 Proxy Statement |

Corporate Governance • Determination of Director Independence

CORPORATE GOVERNANCE

We are committed to strong corporate governance that is designed to promote the long-term interests of our shareholders and other stakeholders, foster responsible decision making and accountability by management and team members, encourage and promote diversity and inclusion, and maintain appropriate internal checks and balances.

Determination of Director Independence

In March 2022, the Board undertook its annual review of director independence with respect to its incumbent directors. During this review, the Board considered transactions and relationships between us and our subsidiaries and affiliates and each of our incumbent directors or any members of their immediate families, including those reported under “Certain Relationships and Related Transactions.” The purpose of this review was to determine whether any such relationships or transactions were inconsistent with a determination that the director is independent under the applicable rules of the SEC and the NASDAQ as well as our Corporate Governance Guidelines.

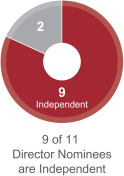

As a result of this review, the Board affirmatively determined that all of our directors serving during fiscal 2022, and all of those who are nominated for election at the Annual Meeting, are independent of us and our management under the applicable rules of the SEC and the NASDAQ, with the exception of Messrs. Levin and Trojan. Mr. Levin is not considered to be independent due to his current service as our Chief Executive Officer and President. Mr. Trojan is not considered to be independent due to his recent service as our Chief Executive Officer.

Majority Voting Policy

Our Board of Directors has adopted a majority voting policy which provides for majority voting for directors in uncontested elections. Under our majority voting policy, which is part of our Corporate Governance Guidelines, a director nominee must receive more “For” votes than “Withhold” votes. Abstentions or non-votes will have no effect on the director election since only “For” and “Withhold” votes with respect to a nominee will be counted. Any incumbent director nominee who receives a greater number of “Withhold” votes than “For” votes with respect to his or her election at the 2023 Annual Meeting shall tender his or her resignation within 15 days of the final vote. Our Board, within 90 days of receiving the certified voting results pertaining to the election, will decide whether to accept the resignation of any unsuccessful incumbent or take other action, through a process managed by the Governance and Nominating Committee. In reaching its decision, the Board may consider any factors it deems relevant, including the director’s qualifications, the director’s past and expected future contributions to us, the overall composition of the Board, and whether accepting the tendered resignation would cause us to fail to meet any applicable rule or regulation, including NASDAQ listing standards. The Board will promptly disclose the decision whether to accept the director’s resignation offer (and the reasons for rejecting the resignation, if applicable) in a document filed with the SEC.

Board Meetings and Board Committees

Each director is expected to dedicate sufficient time, energy and attention to ensure the diligent performance of their duties, including attendance at meetings of our shareholders, the Board and those Committees of which they are a member. The Board met six times during fiscal 2022. Each of our directors attended 75% or more of the aggregate total number of meetings of the Board and the total meetings of all Committees of the Board on which he or she served that were held during the last fiscal year while such person was a member of the Board. At the end of each regularly scheduled quarterly Board meeting, the non-employee directors met in executive session without members of management present. While we do not have a policy regarding Board member attendance at our Annual Meeting, typically all serving directors and all standing for election attend our annual shareholder meeting.

| BJ’s Restaurants, Inc. | 14 |

Corporate Governance • Board Meetings and Board Committees

The business of our Board of Directors is conducted through full meetings of the Board of Directors, as well as through meetings of its three standing committees: the Audit Committee, the Compensation Committee, and the Governance and Nominating Committee. The current composition of each Board committee is set forth below:

Director | Audit Committee | Compensation Committee | Governance and Nominating Committee | Board of Directors | ||||||||||||||||

Gerald W. Deitchle |

|

|

|

|

|

|

|

|

| Chair | ||||||||||

Gregory S. Levin |

|

|

|

|

|

|

|

|

| X | ||||||||||

Peter A. Bassi(1) | X | X | Chair | X | ||||||||||||||||

Larry D. Bouts | Chair | X |

|

|

| X | ||||||||||||||

Bina Chaurasia |

|

|

| X |

|

|

| X | ||||||||||||

James A. Dal Pozzo | X |

|

|

| X | X | ||||||||||||||

Noah A. Elbogen | X | X |

|

|

| X | ||||||||||||||

Lea Anne S. Ottinger |

|

|

| Chair | X | X | ||||||||||||||

Keith E. Pascal |

|

|

|

|

|

| X | X | ||||||||||||

Julius W. Robinson, Jr. |

|

|

| X |

|

|

| X | ||||||||||||

Janet M. Sherlock | X |

|

|

| X | X | ||||||||||||||

Gregory A. Trojan |

|

|

|

|

|

|

|

|

| X | ||||||||||

| (1) | Mr. Bassi serves as the Lead Independent Director. |

| (2) | Mr. Pascal will cease service as a member of the Board and any committees thereof upon completion of the Annual Meeting. |

Audit Committee

Our Board maintains an Audit Committee which reviews and reports to the Board on various auditing, internal control and accounting matters, including the quarterly reviews and annual audit report from our independent auditor, enterprise risk management and cybersecurity matters. The Audit Committee consists of Mr. Bassi, Mr. Bouts, Mr. Dal Pozzo, Mr. Elbogen and Ms. Sherlock. Mr. Dal Pozzo joined the Audit Committee in January 2022, and Mr. Elbogen served as a member of the Audit Committee from September 2020 through January 2022 and re-joined in January 2023. All of the members of the Audit Committee who currently serve or who served in fiscal 2022 were independent directors under applicable NASDAQ and SEC rules. In addition, the Board has determined that each of Messrs. Bouts, Bassi, Dal Pozzo, and Elbogen qualify as an audit committee financial expert under applicable SEC rules. Mr. Bouts served as the Chairman of the Audit Committee in 2022. The Audit Committee held eight meetings during the last fiscal year. See “Report of the Audit Committee” for a further description of the functions performed by the Audit Committee. The charter for the Audit Committee is available under “ Governance” in the “Investors” section of our website at http://www.bjsrestaurants.com.

Compensation Committee

The Compensation Committee determines executive compensation philosophy, programs and policies, administers executive compensation plans, and monitors the performance and compensation of certain officers and other team members. The Compensation Committee also approves annual cash incentive metrics and determines annual cash incentive bonuses to be paid under our short-term Performance Incentive Plan (“PIP”) as well as awards under our Equity Incentive Plan, as amended (the “Equity Incentive Plan”). The Compensation Committee currently consists of Mr. Bassi, Mr. Bouts, Ms. Chaurasia, Mr. Elbogen, Mr. Robinson and Ms. Ottinger. Mr. Robinson joined the Compensation Committee in January 2022, and Mr. Elbogen served as a

| 15 | 2022 Proxy Statement |

Corporate Governance • Compensation Committee

member of the Compensation Committee from March 2016 through January 2022, and rejoined in January 2023. Ms. Ottinger served as the Chair of the Compensation Committee during fiscal 2022. All of the members of the Compensation Committee who currently serve or who served in fiscal 2022 were independent directors. The Compensation Committee held seven meetings during the last fiscal year. See “Compensation Discussion and Analysis” for a further description of the functions performed by the Compensation Committee. The charter for the Compensation Committee is available under “Governance” in the “Investors” section of our website at http://www.bjsrestaurants.com.

Governance and Nominating Committee

Our Board also maintains a Governance and Nominating Committee that is responsible for developing, implementing and monitoring policies and practices relating to our corporate governance. The Governance and Nominating Committee, in conjunction with management, implements our Code of Integrity, Ethics and Conduct and Human and Labor Rights Policies, which cover all of our directors, officers and team members and are designed to promote the honest, ethical and fair conduct of our business. In addition, the Committee develops and implements our Corporate Governance Guidelines. The Committee also has oversight of our Human and Labor Rights Policies and our sustainability and Environmental, Social, and Governance (“ESG”) initiatives. The Committee also prepares and supervises the Board’s annual review of directors’ independence, the Board’s performance self-evaluation, peer feedback and Committee evaluations and oversees Director recruitment efforts.

The Governance and Nominating Committee currently consists of Mr. Bassi, Mr. Dal Pozzo, Ms. Ottinger, and Ms. Sherlock. Mr. Pascal served on the Governance and Nominating Committee from December 2020 through January 2022, and re-joined in January 2023. All of the members of the Governance and Nominating Committee who currently serve or who served in fiscal 2022 were independent directors. Mr. Bassi served as Chairman of the Governance and Nominating Committee during 2022. The Governance and Nominating Committee conducted its business within the context of regularly scheduled quarterly Board meetings and also held eight separate meetings during the last fiscal year. The charter for the Governance and Nominating Committee is available under “Governance” in the “Investors” section of our website at http://www.bjsrestaurants.com.

Corporate Governance Materials Available on Company Website

The following information relating to our corporate governance is available under “Governance” in the “Investors” section of our website at http://www.bjsrestaurants.com:

| • | Code of Integrity, Ethics and Conduct |

| • | Corporate Governance Guidelines |

| • | Audit Committee Charter |

| • | Compensation Committee Charter |

| • | Governance and Nominating Committee Charter |

You may obtain copies of these materials, free of charge, by sending a written request to our Executive Vice President and General Counsel, BJ’s Restaurants, Inc., 7755 Center Avenue, Suite 300, Huntington Beach, California 92647. Please specify which documents you would like to receive.

If we make any substantive amendments to the Code of Integrity, Ethics and Conduct or grant any waiver, including any implicit waiver, from a provision of the Code of Integrity, Ethics and Conduct to our Chief Executive Officer and President, Chief Financial Officer, or Chief Accounting Officer, we will disclose the nature of such amendment or waiver on our website or in a report on Form 8-K.

Shareholder Communications

Any shareholder who wishes to communicate directly with the Board of Directors, or one or more specific directors, may send a letter marked as “confidential” addressed to the Board of Directors, or to the specific director(s)

| BJ’s Restaurants, Inc. | 16 |

Corporate Governance • Shareholder Communications

intended to be addressed, to our Restaurant Support Center located at 7755 Center Avenue, Suite 300, Huntington Beach, California 92647. In turn, we will forward all such communications to the Board of Directors or to the specific director(s) identified by the shareholder. Our policy is to send every shareholder’s communication to the entire Board of Directors or to the identified director(s) if one or more specific director is identified.

Board Involvement in Risk Oversight

Our management is principally responsible for defining the various risks facing us, formulating risk management policies and procedures, and managing our risk exposures on a day to-day basis. The Board’s responsibility is to monitor our risk management processes by understanding our material risks and evaluating whether management has reasonable controls in place to address those risks. The involvement of the Board in reviewing our business strategy is an integral aspect of the Board’s assessment of management’s tolerance for risk and what constitutes an appropriate level of risk.

While the full Board has overall responsibility for risk oversight, the Board has delegated oversight responsibility related to certain risks to the Audit Committee. As such, the Audit Committee is responsible for reviewing our risk assessment and risk management policies. Accordingly, management regularly reported to the Audit Committee on risk management during fiscal 2022. The Audit Committee, in turn, reported on the matters discussed at the Committee level to the full Board. The Audit Committee and the full Board focus on the material risks facing us, including operational, technology and cybersecurity, reputational, market, credit, liquidity and legal risks, to assess whether management has reasonable controls in place to address these risks. We perform third-party cybersecurity audits no less than annually, following the standard set by the National Institute of Standards and Technology. We also conduct third-party security reviews and testing of our network, processes and systems on a regular basis. We use internally developed proprietary software, cloud-based software as a service (SaaS) as well as purchased software, with proven, non-proprietary hardware. As a result, we have not experienced an information systems data breach to date. While we believe that our internal policies, systems and procedures for cybersecurity are thorough, the risk of a cybersecurity event cannot be eliminated.

We maintain a robust system of data protection and cybersecurity resources, technology and processes. In addition to performing an annual risk assessment and developing a mitigation plan, along with a comprehensive review and update of our cybersecurity policies and procedures, we continuously evaluate new and emerging risks and ever-changing legal and compliance requirements. We also monitor risks relating to sensitive information at our business partners, where relevant, and reevaluate the risks at these partners periodically. We make strategic investments to address these risks and compliance requirements to keep Company, guest and team member data secure, including maintaining a network privacy and security insurance policy. Our comprehensive cybersecurity program includes agreements with third-party cybersecurity partners for continuous monitoring, alerting, and response.

We perform annual and ongoing cybersecurity awareness training for our management and Restaurant Support Center team members as well as specialized training for our users with privileged access. In addition, we provide annual credit card handling training following Payment Card Industry (PCI) guidelines to all team members that handle guest credit cards. We also provide data protection and cybersecurity reports quarterly to the Audit Committee and periodically to the full Board of Directors. Further, the Compensation Committee is charged with reviewing and discussing with management whether our compensation arrangements are consistent with effective controls and sound risk management. The Board believes this division of responsibilities provides an effective and efficient approach for addressing risk management.

Board Leadership Structure and Lead Independent Director

Our Board leadership structure includes active independent directors. The independent directors meet in executive session at each regularly scheduled quarterly Board meeting, and each standing Board Committee is comprised solely of and led by independent directors.

Our governance documents, including our Corporate Governance Guidelines, provide the Board with flexibility to select the appropriate leadership structure. In determining the leadership structure, the Board considers the best interests of the shareholders, our Company and specific business needs.

| 17 | 2022 Proxy Statement |

Corporate Governance • Board Leadership Structure and Lead Independent Director

Mr. Deitchle has served as Chairman of the Board since June 2008. The Board believes that Mr. Deitchle was and continues to be best situated to serve as Chairman in light of his many years of executive and financial management experience with high growth restaurant companies and his eight years of prior service to the Company as our Chief Executive Officer. We believe the oversight provided by the Board’s independent directors, the work of the Board’s Committees and the coordination between the Chief Executive Officer and the independent directors, as conducted by the Lead Independent Director, all provide effective oversight of our strategic plans and operations.

Mr. Bassi currently serves as our Lead Independent Director to chair the Board’s executive sessions of non-employee directors. As Lead Independent Director, he also reviews and approves the agenda for each full meeting of the Board and performs such other duties as the Board may, from time to time, assign to assist the Board and its various Committees in fulfilling their respective responsibilities. We believe that maintaining a Lead Independent Director that is separate from the Chairman is appropriate in light of Mr. Deitchle’s prior service as an officer of the Company.

In light of the demands of Mr. Levin’s oversight of the day-to-day operations, the Board believes that the separation of the role of Chief Executive Officer and Chairman is appropriate. In particular, it permits Mr. Levin to focus his full time and attention on the business, the supervision of which has become increasingly complex as we have grown. The Board may re-evaluate the effectiveness of this structure in the future.

Succession Planning

The Board is actively engaged and involved in senior level talent management. The Board reviews the Company’s people strategy in support of its business strategy at least annually. This includes a detailed discussion of the Company’s leadership bench and succession plans with a focus on key positions at the senior leadership level. Annually, the CEO provides the Board with an assessment of senior executives and persons considered successors to senior executives. The Nominating and Governance Committee also recommends policies regarding succession in the event of an emergency impacting the CEO or the planned retirement of the CEO. Strong potential leaders are given exposure and visibility to Board members through formal presentations and informal events. More broadly, the Board reviews and evaluates human capital metrics, strategic objectives and other initiatives with respect to the overall workforce, including diversity, recruiting and development programs.

Director Compensation

All directors who are elected to the Board and who are not employees of us or any of our subsidiaries receive compensation for their services. Directors who are also our employees do not receive any additional compensation for serving on the Board. Shares for equity awards to non-employee directors are issued from our Equity Incentive Plan, as amended, which was approved by our shareholders, pursuant to which we are authorized to grant shares of our Common Stock and share-based awards to directors. As discussed further under “Stock Ownership Guidelines” below, all non-employee directors are currently required to hold shares of our Common Stock with a value equal to at least $325,000. We reimburse directors for travel to board meetings and related expenses and for any costs incurred in connection with attending director continuing education programs.

The Compensation Committee periodically reviews non-employee director compensation and consults with its compensation consultant to make sure that the compensation levels are appropriate and consistent with the director compensation programs at comparable companies. In the fourth quarter of 2021, the Compensation Committee conducted its periodic review of non-employee director compensation and made the following changes, effective January 1, 2022. No other changes were made to director compensation during fiscal 2022. Such compensation is as follows:

| • | annual cash retainer of $65,000, payable in quarterly installments; |

| • | annual cash retainer of $10,000 for the non-chair members of the Audit Committee, $8,500 for the non-chair members of the Compensation Committee, and $6,500 for the non-chair members of the Governance and Nominating Committee, payable in quarterly installments; |

| BJ’s Restaurants, Inc. | 18 |

Corporate Governance • Director Compensation

| • | annual cash retainer of $20,000 for the chair of the Audit Committee, $14,000 for the chair of the Compensation Committee, and $12,000 for the chair of the Governance and Nominating Committee, payable in quarterly installments; |

| • | additional annual cash retainer to our Lead Independent Director of $25,000, payable in quarterly installments; |

| • | additional annual cash retainer to any non-employee Chairman of the Board of $75,000, payable in quarterly installments; |

| • | annual restricted stock unit award of $110,000, in fair market value on the date of grant, which vests one year from the date of grant; and |

| • | initial equity award to a non-employee director upon joining the Board is a prorated portion of the annual equity award (rather than a full $110,000 annual equity award). As a result, directors appointed during the first quarter of the calendar year are entitled to the full $110,000 annual RSU award, and directors appointed in subsequent quarters receive a pro rata portion of the annual grant based on the number of full quarters remaining in the fiscal year, including the quarter in which they were appointed (e.g., directors appointed in the fourth calendar quarter are entitled to 25% ($27,500) of the annual equity award). This initial equity award is granted as of the 15th day of the month occurring following the date of the recipient’s election to the Board. |

Delivery of equity compensation comprised of RSUs with a one-year vesting period is consistent with equity compensation practices of comparable public companies and is intended to effectively align non-employee directors’ interests with those of our shareholders. For both the initial and annual equity awards to non-employee directors, the underlying number of RSUs is determined based on the most recent closing market price of our Common Stock as of the date of grant. If a non-employee director dies or retires from the Board after at least six years of continuous service, any unvested RSUs, stock options or other awards held by the non-employee director shall become fully vested as of the date of death or retirement.

The following table sets forth information concerning the compensation of our non-employee directors during fiscal 2022:

Name(1) | Fees Earned or Paid in Cash ($) | Stock Awards ($)(2) | All Other Compensation | Total ($) | ||||||||||||||||

Peter A. Bassi | 120,500 | 110,008 | — | 230,508 | ||||||||||||||||

Larry D. Bouts | 93,500 | 110,008 | — | 203,508 | ||||||||||||||||

Bina Chaurasia | 73,500 | 110,008 | — | 183,508 | ||||||||||||||||

James A. Dal Pozzo | 81,500 | 110,008 | — | 191,508 | ||||||||||||||||

Gerald W. Deitchle | 140,000 | 110,008 | — | 250,008 | ||||||||||||||||

Noah A. Elbogen | 65,000 | 110,008 | — | 175,008 | ||||||||||||||||

Lea Anne S. Ottinger | 85,500 | 110,008 | — | 195,508 | ||||||||||||||||

Keith E. Pascal | 65,000 | 110,008 | — | 175,008 | ||||||||||||||||

Julius W. Robinson, Jr. | 73,500 | 110,020 | — | 183,520 | ||||||||||||||||

Janet Sherlock | 81,500 | 110,008 | — | 191,508 | ||||||||||||||||

Gregory A. Trojan | 65,000 | 110,008 | 12,000 | (3) | 187,008 | |||||||||||||||

Patrick D. Walsh(4) | 11,745 | — | — | 11,745 | ||||||||||||||||

| (1) | Mr. Levin is absent from this table because directors who are also our employees receive no additional compensation for serving on the Board of Directors. The compensation of Mr. Levin, as our Chief Executive Officer and President, is reflected in the Summary Compensation Table of this Proxy Statement. |

| 19 | 2022 Proxy Statement |

Corporate Governance • Director Compensation