Exhibit 99.1

PRECISION DRILLING ANNUAL INFORMATION FORM

Throughout this Annual Information Form (AIF), the terms, we, us, our, Corporation, Company, Precision and Precision Drilling mean Precision Drilling Corporation and, where indicated, all our consolidated subsidiaries and any partnerships of which we and/or our Subsidiaries are a part.

Information in the AIF is as of December 31, 2022 unless specified otherwise. All amounts are in Canadian dollars unless specified otherwise.

| | | |

| | TABLE OF CONTENTS |

| 1 | About Precision |

| 1 | Corporate Governance |

| 2 | Corporate Structure |

| 3 | Recent Developments and Three-Year History |

| 3 | 2022 Accomplishments and Highlights |

| 5 | 2021 Accomplishments and Highlights |

| 7 | 2020 Accomplishments and Highlights |

| 9 | Our Business |

| 9 | Business Segments Overview |

| 10 | Contract Drilling Services |

| 13 | Completion and Production Services |

| 15 | Corporate Responsibility |

| 16 | Environmental |

| 16 | Social |

| 19 | Governance |

| 22 | Capital Structure |

| 22 | Common Shares |

| 25 | Preferred Shares |

| 26 | Material Debt |

| 31 | Risks in Our Business |

| 44 | Our Directors and Officers |

| 44 | Board of Directors |

| 46 | Our Board Committees |

| 48 | Our Executive Officers |

| 49 | Other Material Information |

| 49 | Interests of Experts |

| 49 | Materials Contracts |

| 49 | Legal Proceedings and Regulatory Actions |

| 49 | Management’s Discussion and Analysis |

| 49 | Transfer Agent and Registrar |

| 49 | Additional Information About Precision |

| 49 | About Registered Trademarks |

| 50 | Financial Measures and Ratios |

| 50 | Cautionary Statement About Forward-Looking Information and Statements |

| 52 | Appendix |

| 52 | Audit Committee Charter |

Precision is a leading provider of safe and environmentally responsible High Performance, High Value services to the energy industry, offering customers access to an extensive fleet of Super Series drilling rigs. Precision has commercialized an industry-leading digital technology portfolio known as AlphaTM technologies that utilizes advanced automation software and analytics to generate efficient, predictable, and repeatable results for energy customers. Additionally, Precision offers well service rigs, camps and rental equipment all backed by a comprehensive mix of technical support services and skilled, experienced personnel. Our drilling services are enhanced by our EverGreenTM suite of environmental solutions, which bolsters our commitment to reducing the environmental impact on our operations.

From our founding as a private drilling contractor in 1951, Precision has grown to become one of the most active drillers in North America. Our High Performance, High Value competitive advantage is underpinned by four distinguishing features:

| ▪ | a high-quality land drilling rig fleet, with AC Super Triple rigs enabled with our AlphaTM technologies and supported by our EverGreenTM suite of environmental solutions to deliver consistent, repeatable, high-quality wellbores while improving safety, performance, operational efficiency and reducing environmental impact |

| ▪ | size and scale of our vertically integrated operations that provide higher margins and better service capabilities |

| ▪ | a diverse culture focused on operational excellence, which includes corporate responsibility, safety and field performance, and |

| ▪ | a capital structure that provides long-term stability, flexibility and liquidity, allowing us to take advantage of business cycle opportunities. |

CORPORATE GOVERNANCE

Precision incorporates financial, environmental, and social responsibility into our operations, and is guided by our core values and corporate governance principles. With the support and oversight of our Board of Directors (Board), we are committed to maintaining high standards of ethics and integrity. We recognize that governance practices such as board independence, proactive shareholder engagement and risk management help us sustain the trust we have built with our stakeholders.

To deliver results, we focus on operational excellence, top-tier environmental, social and governance (ESG) performance and productive stakeholder engagement. We integrate our health, safety and environmental (HSE) commitment into our operations and incorporate ESG performance goals in our compensation program.

In July 2022, we published our third annual Corporate Responsibility Report that highlights the Company’s progress in ESG efforts, and provides an outline of Precision’s ESG strategies, focus areas, and performance. We expanded our reporting to include additional elements from the Sustainability Accounting Standards Board (SASB) and Task Force on Climate-Related Financial Disclosures (TCFD) guidelines. Our Corporate Responsibility Report also incorporated a significantly broader base of ESG related metrics – including emissions and energy use – where relevant and reliable information is available. We invite you to review Precision’s ESG matters beginning on page 15 or, for more specific information, you can read our Corporate Responsibility Report available at www.precisiondrilling.com/esg/.

This year, we honored our commitment to increase the diversity of our Board with the appointment of Lori Lancaster. Ms. Lancaster brings fresh business perspectives and extensive financial knowledge. In 2023, we remain committed to diversity and plan to add another diverse candidate to the Board. A search is already underway, and we are confident the new member will also complement the skills of and bring value to the Board. We have also amended our diversity policy to include our commitment to achieve and maintain at least 30% of female representation on our Board membership. To learn more about our diversity efforts, please read our Management Information Circular for our 2023 Annual Meeting of Shareholders when available or visit our website.

Our directors have a history of achievement and an effective mix of skills, knowledge and business experience. The directors continue to provide oversight in support of future operations and monitor regulatory developments and governance best practices in Canada, the United States (U.S.) and internationally. As part of their oversight, our Board has established three standing committees, comprised of independent directors, to help carry out its responsibilities effectively:

| ▪ | Corporate Governance, Nominating and Risk Committee (CGNRC), and |

| ▪ | Human Resources and Compensation Committee (HRCC). |

The Board may also create special ad hoc committees from time to time to deal with important matters that arise.

Management has also established internal committees, including the Enterprise Risk Management Committee, the Compliance Committee, the Disclosure Committee and the Health, Safety, Environment and Corporate Responsibility Council (HSE and Corporate Responsibility Council). Two of our directors, Mr. Culbert and Mr. Williams, are active members of the HSE and Corporate Responsibility Council and attend quarterly meetings.

Precision Drilling Corporation 2022 Annual Information Form | 1 |

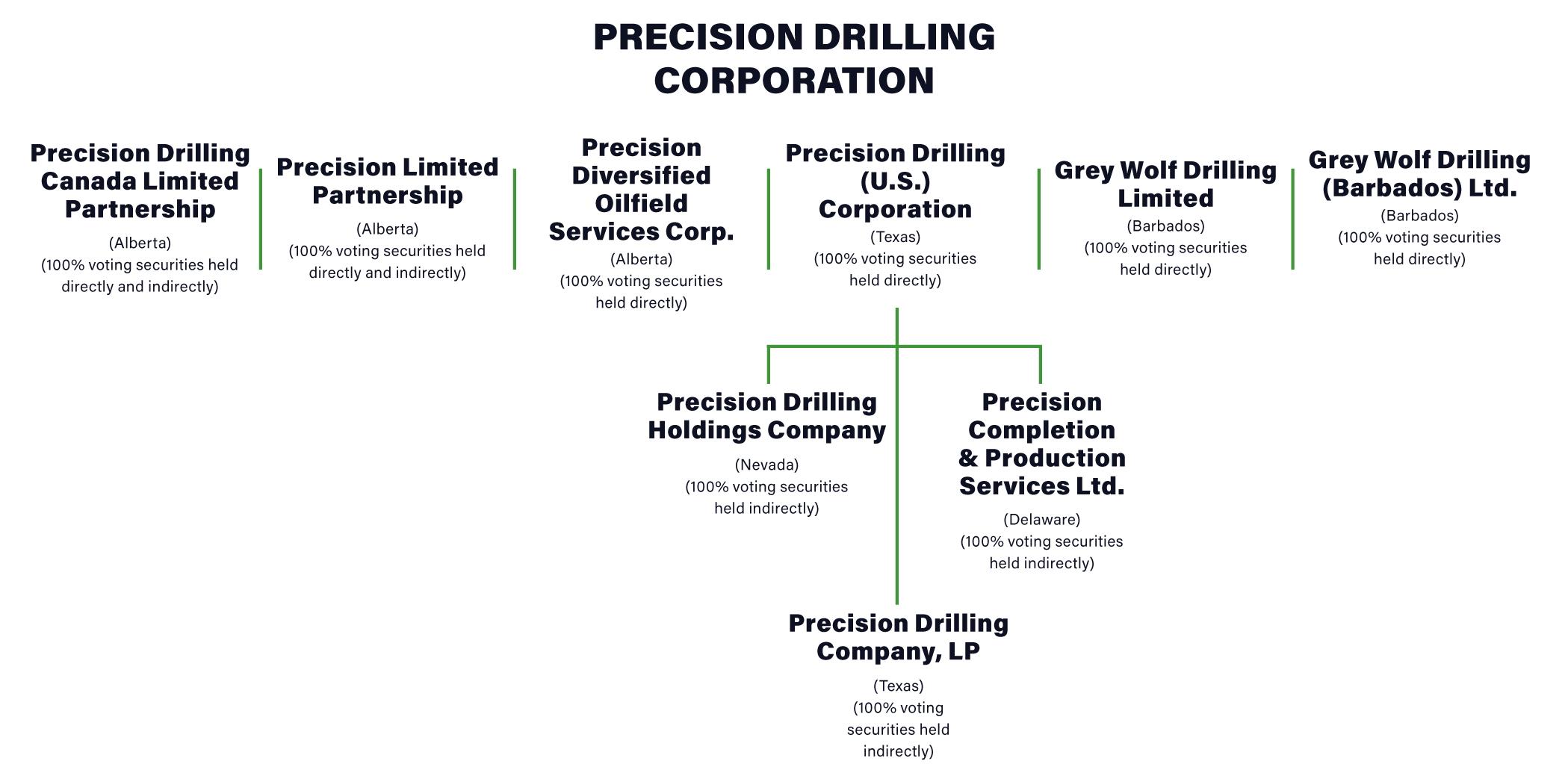

CORPORATE STRUCTURE

Precision was formed by amalgamation under the Business Corporations Act (Alberta). We previously operated as an income trust, known as Precision Drilling Trust, and converted to a corporate entity on June 1, 2010, under a statutory plan of arrangement.

On March 8, 2013, we repealed our old by-laws and adopted new by-laws to provide for, among other things, an advance notice requirement for Precision shareholders nominating directors for election to the Board and an increase in the quorum requirement for our shareholder meetings to 25% from 5%. The amendments were confirmed by our shareholders on May 8, 2013.

Our common shares trade on the Toronto Stock Exchange (TSX), under the symbol PD, and on the New York Stock Exchange (NYSE), under the symbol PDS.

Our principal corporate and registered office is at:

| | |

Suite 800, 525 – 8th Avenue SW Calgary, Alberta Canada T2P 1G1 | Phone: Fax: Email: Website: | 403.716.4500 403.264.0251 info@precisiondrilling.com www.precisiondrilling.com |

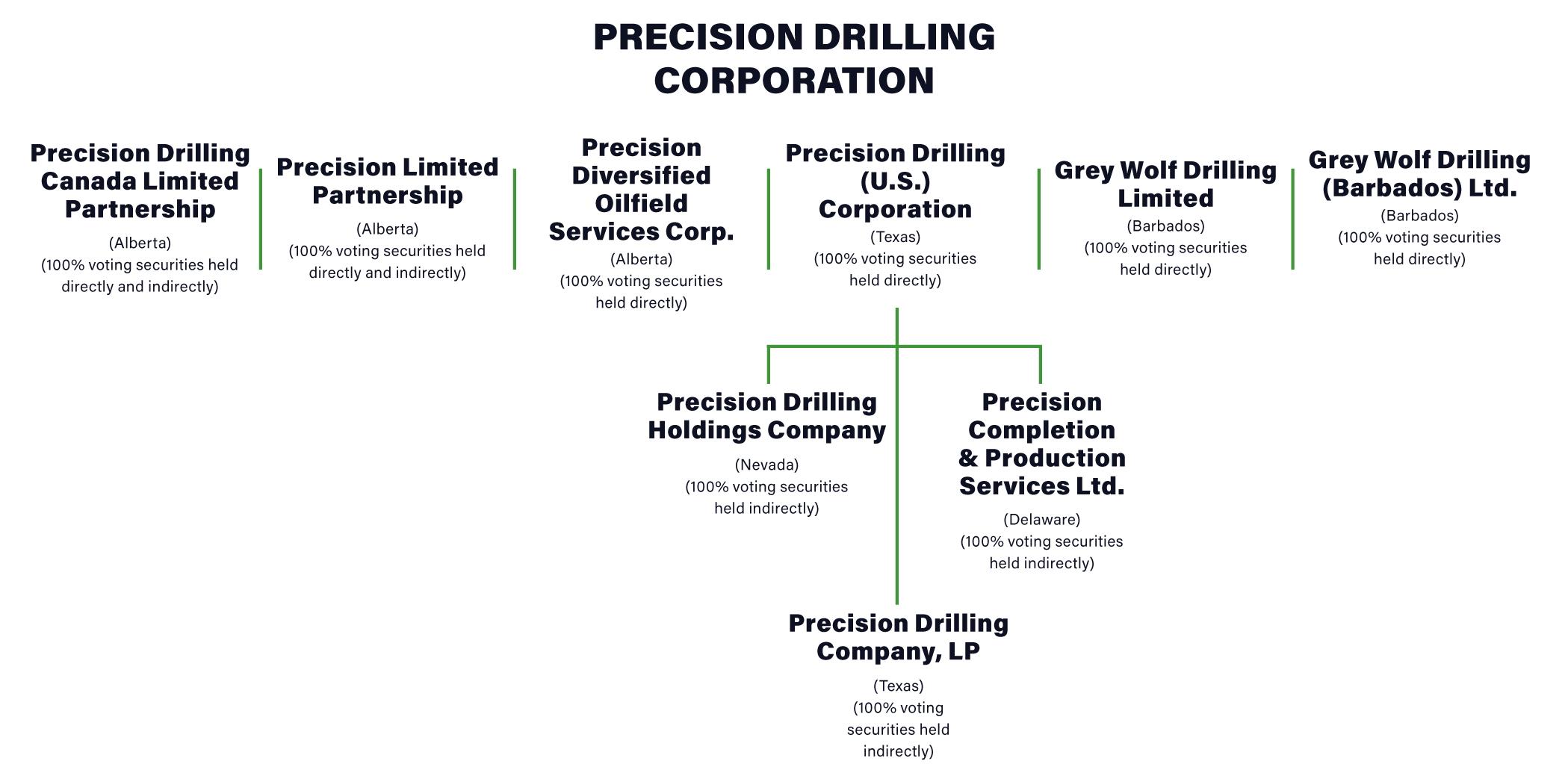

The chart below shows our organizational structure and material subsidiaries or partnerships, including the jurisdiction where each was incorporated, formed or continued and whether we hold the voting securities directly or indirectly. For simplification, non-material subsidiaries are excluded.

| |

2 | Precision Drilling Corporation 2022 Annual Information Form |

RECENT DEVELOPMENTS AND THREE-YEAR HISTORY In 2022, the global economy continued to recover from the COVID-19 pandemic and demand for global energy increased. High commodity prices and low inventory levels, following a multi-year period of upstream underinvestment, provided a strong backdrop for the oilfield services industry with land drilling activity increasing 52% in the U.S. and 33% in Canada over the prior year. Over the past several years, we have improved our financial position through debt reduction, refinancings, and share repurchases, while maintaining a strong liquidity position. Since the start of 2016, our financial discipline has allowed us to reduce our debt balance by US$781 million. We remain committed to improving our balance sheet and are well on track to meet our long-term and recently updated goal of repaying over $500 million in debt from the beginning of 2022 through to the end of 2025 and reaching our updated target sustained Net Debt to Adjusted EBITDA ratio (see Financial Measures and Ratios on page 50) of below 1.0 times by the end of 2025. In addition to debt reduction targets through 2025, we plan to allocate 10% to 20% of free cash flow before debt principal repayments toward the return of capital to shareholders. Accomplishments and Highlights Historically, Precision has set annual strategic priorities. Management reports progress quarterly and prepares a final report of the results at the end of each year. We have a multi-year track record (as detailed below) of delivering results to achieve our stated priorities. 2022 Accomplishments |

2022 Strategic Priorities | 2022 Results |

Grow revenue through scaling AlphaTM technologies and EverGreenTM suite of environmental solutions across Precision's Super Series rig fleet and further competitive differentiation through ESG initiatives | ▪Grew AlphaTM revenue by over 60% compared to 2021. ▪Increased total paid days for AlphaAutomationTM by over 50% from 2021. ▪Ended the year with 70 AlphaTM rigs, a 49% increase from the beginning of the year. ▪Expanded our commercial AlphaAppsTM to 21 versus 16 a year ago and increased AlphaAppsTM paid days by 15% from 2021. ▪Exited 2022 with seven field deployed EverGreenTM Battery Energy Storage Systems (BESS), 15 EverGreenTM Integrated Power and Emissions Monitoring Systems and 21 high mast LED lighting systems. |

Grow free cash flow by maximizing operating leverage as demand for our High Performance, High Value services continues to rebound | ▪Generated cash provided by operations of $237 million, representing a 70% increase over the prior year. ▪Grew our active rig count by 40% in the U.S. and 30% in Canada as compared with 2021. ▪Increased our daily operating margins 41% in the U.S. and 36% in Canada. ▪Acquired High Arctic’s well servicing business and associated rental assets and increased our Completion and Production Services’ Adjusted EBITDA1 to $38 million versus $6 million in 2021 ▪Awarded four five-year drilling contracts in Kuwait, increasing our International rig count to eight by mid-2023. Our eight long-term contracts will generate steady and reliable cash flow into 2028. |

Utilize free cash flow to continue strengthening our balance sheet while investing in our people, equipment, and returning capital to shareholders | ▪Reduced debt by $106 million, ending the year with approximately $600 million in available liquidity (which is cash plus unused credit facilities). ▪Returned $10 million of capital to shareholders through share repurchases. ▪Reinvested $184 million into our equipment and infrastructure and disposed of non-core and underutilized assets for proceeds of $37 million. ▪Hired and trained over 1,300 people new to the industry and increased our number of field coaches who conducted 155 site visits and provide over 10,000 hours of training. |

(1) Adjusted EBITDA is a non-GAAP measure – see Financial Measures and Ratios on page 50.

2022 Highlights

Industry Conditions With positive supply-demand fundamentals for energy, oil and natural gas commodity prices were strong in 2022 but dynamic as geopolitical issues, supply chain disruptions, inflation and climbing interest rates increased economic uncertainty. In the U.S., WTI averaged US$94.23 per barrel, an increase of 39% from the prior year, and Henry Hub natural gas prices increased 75% to average US$6.51 per MMBtu. |

Capital Expenditures Our capital spending for the year totaled $184 million and by spend category (see Financial Measures and Ratios on page 50) included $121 million for maintenance and infrastructure and $63 million for expansion and upgrades. |

Precision Drilling Corporation 2022 Annual Information Form | 3 |

High Arctic Energy Services, Inc. Acquisition On July 27, 2022, we acquired the well servicing business and associated rentals assets of High Arctic Energy Services, Inc. (High Arctic) for an aggregate purchase price of $38 million, payable in cash (the Transaction). The Transaction provided Precision with well servicing rigs, related rental assets, ancillary support equipment, inventories and spares, and six additional operating facilities in key basins, four of which are owned. |

International Drilling Contracts On October 19, 2022, we announced Precision was awarded four drilling contracts in Kuwait, each with a five-year term and an optional one-year renewal. The contract awards are for our AC Super Triple 3000 HP rigs and will increase our active rig count in Kuwait from three rigs to five rigs by the middle of 2023. During the year, Precision also signed three rig contracts in the Kingdom of Saudi Arabia to five-year contract extensions. With these three rig contract extensions and the Kuwait contract awards, Precision will have eight rigs under long-term contracts in the Middle East stretching into 2028. |

Technology Initiatives As of December 31, 2022, Precision had 70 AlphaTM rigs throughout North America, a 49% increase from the beginning of the year. Our AlphaTM rigs are fully digitally-enabled, pad-walking AC Super Triples equipped with AlphaAutomationTM and a platform to deploy AlphaAppsTM and AlphaAnalyticsTM. To date, Precision’s AlphaTM rigs have drilled over 2,600 wells in the U.S. and Canada and have been fully commercialized in numerous basins since November 2019. |

EverGreenTM Suite of Environmental Solutions Precision’s EverGreenTM suite of environmental solutions encompasses the development and implementation of multiple technologies aimed at quantifying and reducing greenhouse gas emissions at the wellsite. As of December 31, 2022, Precision had seven BESS, 15 Integrated Power and Emissions Monitoring Systems and 21 high mast LED lighting systems deployed throughout North America. As of December 31, 2022, Precision also had over 60 rigs equipped with dual-fuel engines, natural gas engines and/or grid tie-in technology. See Environmental - EverGreenTM Suite of Environmental Solutions on page 16. |

Debt Repayments In 2022, we repaid $106 million of debt, exceeding our debt reduction target of $75 million for the year. There were no changes to our Senior Credit Facility in 2022, with the Covenant Relief Period ceasing September 30, 2022. See Capital Structure – Material Debt on page 26. |

Normal Course Issuer Bid On August 29, 2022, we renewed our normal course issuer bid (NCIB) through the facilities of the TSX and NYSE. The NCIB allows us to buy back up to 1,148,771 Common Shares, or approximately 10% of the public float as of August 15, 2022 for cancellation. For the year ended December 31, 2022, we repurchased and cancelled 130,395 common shares for approximately $10 million. These repurchases were funded from cash flow and account for approximately 1.1% of our available public float. |

Board of Directors On October 4, 2022, Lori A. Lancaster was appointed to the Board of Directors. |

| |

4 | Precision Drilling Corporation 2022 Annual Information Form |

2021 Accomplishments

2021 Strategic Priorities | 2021 Results |

Grow revenue and market share through our digital leadership position | ▪Increased revenue by 6% as compared with 2020 as we achieved an average market share of 33% in Canada and 9% in the U.S. ▪Ended the year with 47 AlphaTM rigs, a 21% increase from the beginning of the year. ▪Increased our paid AlphaAutomationTM days by 123% versus the prior year. ▪Expanded our commercial AlphaAppsTM to 16 versus six in 2020 and increased AlphaAppsTM paid days by more than 600% year over year. ▪Negotiated a long-term supply agreement to outfit the balance of the Super Triple rig fleet with AlphaAutomationTM kits, mitigating inflationary pressures and supply chain risk. |

Demonstrate operational leverage to generate free cash flow and reduce debt | ▪Reduced debt by $115 million, exceeding the midpoint of our targeted range. ▪Ended the year with more than $530 million in available liquidity. ▪Returned $4 million of capital to shareholders through share repurchases. ▪Extended our debt maturities with our earliest maturity date now in 2025 as we: ▪issued US$400 million of unsecured senior notes due in 2029, ▪redeemed our 2023 and 2024 unsecured senior notes, and ▪extended the maturity of our Senior Credit Facility to June 18, 2025. ▪Disposed of non-core and underutilized assets for proceeds of $13 million, which included divesting the directional drilling assets for an ownership stake in Cathedral Energy Services Ltd. |

Deliver leading ESG performance to strengthen customer and stakeholder positioning | ▪Published our second annual Corporate Responsibility Report. ▪Formed our ‘E-Team’ and ‘S-Team’ to develop and implement certain ESG strategies and tactics. ▪Launched Precision’s EverGreenTM suite of environmental solutions during the year. ▪Secured customer commitments to deploy three BESS in the first quarter of 2022 and expect several additional commitments by mid-2022. ▪Expect to deploy eight Integrated Power & Emissions Fuel Monitoring Systems in early 2022. |

2021 Highlights

Industry Conditions In 2021, the return of global energy demand, sustained periods of strong commodity prices and the multi-year period of upstream underinvestment provided a positive backdrop for the oilfield services industry. In Canada, industry activity surpassed pre-pandemic levels as takeaway capacity continued to improve, price differentials shrank and the startup of liquified natural gas (LNG) exports progressed. In the U.S., the active rig count steadily rose throughout the year as producers looked to replenish declining drilled but uncompleted well inventories. |

Environmental, Social and Governance On July 14, 2021, we published our second annual Corporate Responsibility Report that documented our progress in ESG efforts and provided an outline of our ESG strategies, focus areas and performance. |

EverGreenTM Suite of Environmental Solutions On July 14, 2021, we announced the brand launch of our EverGreenTM suite of environmental solutions, bolstering our commitment to reduce the environmental impact of oilfield operations. See Environmental – EverGreenTM Suite of Environmental Solutions on page 16. |

Debt Repayment and U.S. Senior Note Offering Our 2021 targeted debt reduction range was $100 million to $125 million. We ended 2021 with a total of $115 million of debt reduction, exceeding the low end of our targeted range by $15 million. During 2021, we redeemed and retired the outstanding amounts of our 7.75% senior notes due 2023 (2023 Notes) and 5.25% senior notes due 2024 (2024 Notes) using net proceeds from our 2029 Notes (as defined below) that were issued in June 2021 along with drawings on our syndicated senior credit facility (Senior Credit Facility). In June 2021, we completed a US$400 million offering of 6.875% senior unsecured notes due in 2029 (2029 Notes) in a private placement. See Capital Structure – Material Debt on page 26. |

Technology Initiatives As of December 31, 2021, Precision had 47 AlphaTM rigs throughout North America, a 21% increase from the beginning of 2021. Our AlphaTM rigs are fully digitally-enabled, pad-walking AC Super Triples equipped with AlphaAutomationTM and a platform to deploy AlphaAppsTM and AlphaAnalyticsTM. |

Precision Drilling Corporation 2022 Annual Information Form | 5 |

Directional Drilling On July 23, 2021, we divested our directional drilling business to Cathedral Energy Services Ltd. (Cathedral) for $6 million. The transaction included the sale of operating assets and personnel from our directional drilling business, including our operations facility in Nisku, Alberta. |

Capital Expenditures Our capital spending for 2021 totaled $76 million. Our capital spending by spend category included $57 million for maintenance and infrastructure and $19 million for expansion and upgrades. |

Normal Course Issuer Bid On August 27, 2021, we renewed our NCIB through the facilities of the TSX and NYSE. For the year ended December 31, 2021, we repurchased and cancelled 155,168 common shares for $4 million. These repurchases were funded from cash flow and accounted for approximately 1.2% of our available public float. |

Canadian Emergency Wage Subsidy On April 1, 2020, the Government of Canada announced the Canadian Emergency Wage Subsidy (CEWS) program, which subsidized a portion of employee wages for Canadian employers whose businesses had been adversely affected by the COVID-19 pandemic. The CEWS program benefitted Precision and our employees throughout 2021 as it allowed us to retain a higher employment level for Canadian positions within our organization. In 2021, we recognized $24 million of CEWS program assistance that was presented as a reduction to operating and general and administrative expense of $21 million and $3 million, respectively. |

Extensions and Amendments to the Senior Credit Facility On June 18, 2021, we extended the maturity of our Senior Credit Facility’s to June 18, 2025; however, US$53 million will expire on November 21, 2023. We also extended and amended certain financial covenants during the Covenant Relief Period (as defined below). See Capital Structure – Material Debt – Senior Credit Facility on page 26. |

| |

6 | Precision Drilling Corporation 2022 Annual Information Form |

2020 Accomplishments

2020 Strategic Priorities | 2020 Results |

Generate strong free cash flow and reduce debt by $100 million to $150 million in 2020 and by $700 million between 2018 and 2022 | ▪Generated cash provided by operations of $226 million, compared with $288 million in 2019. ▪Deduced total debt by $171 million, exceeding our targeted range. ▪Increased our long-term debt reduction target from $700 to $800 million from 2018 through 2022. ▪At year-end, we reduced debt levels by approximately $550 million, just three years into our five-year debt reduction plan. ▪Ended the year with $661 million in available liquidity. ▪Returned $11 million of capital to shareholders through share repurchases. |

Demonstrate operational excellence in all aspects of our business including operational, financial and ESG metrics | ▪Achieved record market share levels in Canada throughout the year of over 30% and sustained strong market share of approximately 8% in the U.S. ▪Earned daily operating margins of US$11,518 in the U.S. and $8,065 in Canada during the year. International day rates remained stable at US$54,811. ▪Generated Adjusted EBITDA Non-GAAP of $263 million, down 33% from 2019 despite a 42% reduction in global drilling activity levels due to the COVID-19 pandemic. ▪Reported positive cash flow and Adjusted EBITDA of $11 million from our Completion & Production Services segment. ▪Published our first Corporate Responsibility Report, conducted a materiality assessment and established Scope 1 and 2 emission baselines. |

Leverage our AlphaTM suite of technologies platform as a competitive differentiator and source of financial returns for Precision | ▪Ended the year with 39 AlphaTM rigs in the North American market. ▪Drilled approximately 650 wells with AlphaAutomationTM in 2020. ▪Had 18 AlphaAppsTM available, six of which were commercial. ▪Drilled approximately 200 wells with AlphaAppsTM, resulting in over 2,300 app-days during the year. ▪Commercialized AlphaAnalyticsTM. |

2020 Highlights

Industry Conditions In 2020, the COVID-19 pandemic negatively impacted the energy industry resulting in significant global oil supply imbalances and near-term crude oil price volatility. Our customers responded by materially reducing capital spending leading to a rapid reduction in global oilfield service activity levels. In this reduced-activity environment, our customers remained focused on operational efficiencies. |

COVID-19 Pandemic Health and Safety Initiatives Precision responded to the COVID-19 pandemic by implementing comprehensive safety protocols to protect the health and welfare of our people and stakeholders from the risks of COVID-19. Precision did not suffer any shutdowns, interruption in services or capability reductions due to the pandemic. |

Canadian Emergency Wage Subsidy In 2020, we recognized $26 million of CEWS program assistance that was presented as a reduction to operating and general and administrative expense of $21 million and $5 million, respectively. Funds from the CEWS program were used to support employment tied to Precision’s Canadian operations, field support centers and corporate head office in Calgary, Alberta. |

Capital Expenditures Our capital spending for 2020 totaled $62 million. Our capital spending by spend category included $35 million for maintenance infrastructure and intangibles and $27 million for expansion and upgrades. |

Share Consolidation On November 12, 2020, we implemented a 20:1 share consolidation which resulted in 13,459,593 common shares outstanding as at December 31, 2020. |

Amendments to Senior Credit Facility On April 9, 2020, we amended our Senior Credit Facility to obtain certain covenant relief from our lenders through March 2022. See Capital Structure – Material Debt – Senior Credit Facility on page 26. |

Precision Drilling Corporation 2022 Annual Information Form | 7 |

Debt Repayment Our 2020 targeted debt reduction range was $100 million to $150 million. During 2020, we retired the remainder of our 2021 Notes with total redemptions of US$88 million. During the year, we also repurchased and cancelled US$3 million of the 2021 Notes, US$59 million of the 2023 Notes, US$44 million of the 2024 Notes, and US$22 million of the 2026 Notes (as defined below). We ended 2020 with a total of $171 million of debt reduction, exceeding the high end of our targeted range by $21 million. See Capital Structure – Material Debt on page 26. |

Technology Initiatives As at December 31, 2020, Precision had 39 AlphaTM rigs deployed throughout North America, which are fully digitally-enabled, pad-walking AC Super Triples equipped with AlphaAutomationTM and a platform to deploy AlphaAppsTM and AlphaAnalyticsTM. |

Normal Course Issuer Bid On August 27, 2020, we renewed our NCIB through the facilities of the TSX and NYSE. In 2020, we repurchased and cancelled 420,588 common shares (on a post-consolidation basis) for approximately $11 million. These repurchases were funded from cash flow and account for approximately 3.5% of our available public float. |

U.S. Directional Drilling In March 2020, we suspended our U.S. directional drilling operations. |

Board of Directors On May 14, 2020, Mr. Allen R. Hagerman retired from the Board. |

| |

8 | Precision Drilling Corporation 2022 Annual Information Form |

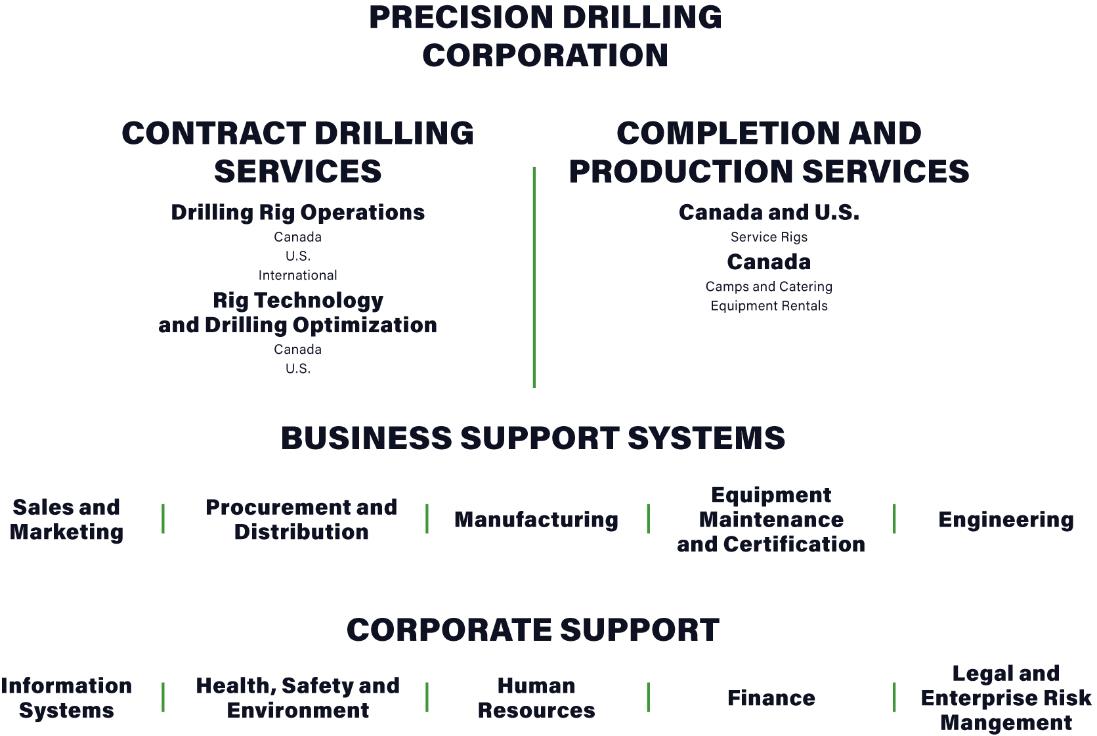

BUSINESS SEGMENTS OVERVIEW

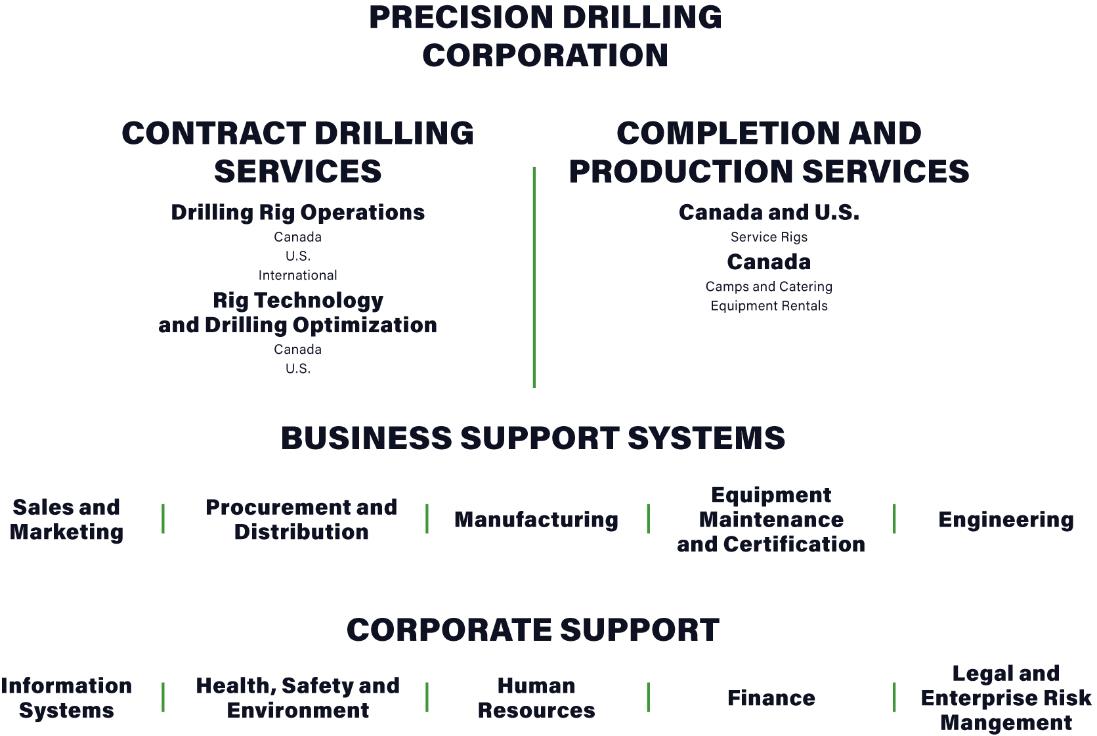

We have two business segments – Contract Drilling Services and Completion and Production Services, which share business support systems and corporate and administrative services.

The following tables summarize our two business segments and the scope of our services:

CONTRACT DRILLING SERVICES |

Operates our drilling rigs in Canada, the U.S. and internationally and provides onshore well drilling services to exploration and production companies in the oil, natural gas and geothermal industries. At December 31, 2022, the segment consisted of: ▪225 land drilling rigs, including: – 111 in Canada – 101 in the U.S. – 6 in Kuwait – 4 in Kingdom of Saudi Arabia – 2 in the Kurdistan region of Iraq – 1 in the country of Georgia ▪engineering, manufacturing and repair services, primarily for Precision’s operations ▪centralized procurement, inventory, and distribution of consumable supplies for our global operations ▪diverse offerings from our AlphaTM technologies including: – 70 AlphaTM rigs with commercial AlphaAutomationTM – 21 commercial AlphaAppsTM – deployed commercial AlphaAnalyticsTM offering ▪wide array of offerings from our EverGreenTM suite of environmental solutions: – Battery Energy Storage System (BESS) and real-time fuel/emissions monitoring capabilities currently offered across North America – 60 rigs equipped with dual-fuel engines, natural gas engines and/or power grid tie-in technology | Canada | ▪land drilling services ▪procurement and distribution of oilfield supplies ▪manufacture and refurbishment of drilling and service rig equipment |

U.S. | ▪land drilling services ▪turnkey drilling services ▪procurement and distribution of oilfield supplies ▪manufacture and refurbishment of drilling and service rig equipment |

International | ▪land drilling services |

Precision Drilling Corporation 2022 Annual Information Form | 9 |

COMPLETION AND PRODUCTION SERVICES | | |

Comprises a number of businesses providing completion and workover services and ancillary services to oil and natural gas exploration and production companies in Canada and the U.S. At December 31, 2022, the segment consisted of: ▪ 135 registered well completion and workover service rigs, including: – 125 in Canada – 10 in the U.S. ▪more than 1,900 oilfield rental items, including surface storage, power generation, and solids control equipment, primarily in Canada ▪103 wellsite accommodation units in Canada ▪782 drill camp beds, 654 base camp beds and three kitchen diners in Canada | Canada | ▪well completion and workover service rigs ▪camp and catering services ▪oilfield surface equipment rental ▪wellsite accommodations |

U.S. | ▪well completion and workover service rigs |

Revenue

Year ended December 31 (thousands of Canadian dollars) | | 2022 | | | 2021 | | |

Contract Drilling Services | | $ | 1,436,134 | | | $ | 877,943 | | |

Completion and Production Services | | | 187,171 | | | | 113,488 | | |

Inter-segment eliminations | | | (6,111) | | | | (4,584) | | |

Total revenue | | $ | 1,617,194 | | | $ | 986,847 | | |

CONTRACT DRILLING SERVICES

Precision Drilling

At the end of 2022, we had a large fleet of land drilling rigs deployed in Canada, the U.S. and internationally:

| ▪ | Canada – we operated the largest fleet of land drilling rigs in country. At year end, we were marketing 111 drilling rigs located throughout western Canada, accounting for approximately 25% of the industry’s estimated fleet of 440 land drilling rigs. |

| ▪ | United States – At year end, we were marketing 101 land drilling rigs, the fifth largest fleet, representing approximately 7% of the country’s estimated 1,542 total marketed land drilling rigs. |

| ▪ | Internationally – At year end, we were marketing six land drilling rigs in Kuwait, four in Kingdom of Saudi Arabia, two in the Kurdistan region of Iraq, and one in the country of Georgia. |

Drilling Contracts

Our contract terms are generally based on the complexity and risk of operations, on-site drilling conditions, the type of equipment used and anticipated duration of work to be performed.

Drilling contracts can be for single or multiple wells and can vary in length from a few days on shallow single-well applications to multiple-year, multiple-well drilling programs for more complex applications. Term drilling contracts typically have fixed utilization rates for a minimum of six months and usually include early termination penalties, escalating costs provisions and contract renewal options. Short-term contracts that provide drilling rigs on a well-to-well basis are typically subject to termination by the customer on short notice or with little or no penalty.

In 2022, we had an average of 47 drilling rigs (31 in the U.S., 10 in Canada and six internationally) working under term contracts. Utilization days from term contracts was approximately 37% of our total contract drilling utilization days for the year.

We market our drilling rigs mainly on a regional basis through sales and marketing personnel. We secure contracts to drill wells either through competitive bidding or as a result of business development efforts and negotiations with customers.

Our contracts have been carried out almost exclusively on a daywork basis. Under a daywork contract, we:

| ▪ | provide a drilling rig with required personnel, and the customer supervises the drilling of the well |

| ▪ | charge the customer a fixed rate per day regardless of the number of days needed to drill the well |

| ▪ | charge the customer a fixed rate per day or a lump sum amount to mobilize the rig to the well site location, rig-up, rig-down and demobilize the rig to a secure site, and |

| ▪ | generally, we do not bear any of the costs arising from downhole risks or loss of reserves. |

We also drilled a small number of wells near the U.S. Gulf Coast (approximately 1% of our U.S. rig utilization in 2022) on a turnkey basis. Under a turnkey contract, we agree to drill a well to a certain depth for a fixed price. We assume higher risk under those contracts and therefore generally have the potential for greater profit or loss.

| |

10 | Precision Drilling Corporation 2022 Annual Information Form |

Seasonality

Drilling and well servicing activity is affected by seasonal weather patterns and ground conditions. In Canada and the northern U.S., wet weather and the spring thaw make the ground unstable, resulting in road restrictions that may limit the movement of heavy oilfield equipment and reduce the level of drilling and well servicing activity primarily during the second quarter of the year.

In northern Canada, some drilling sites can only be accessed in the winter once the terrain is frozen, which usually begins late in the fourth quarter. Our business activity depends, in part, on the severity and duration of the winter drilling season. See Risks in our Business, starting on page 31.

Competition

The land drilling industry is highly competitive and fragmented with the top five providers in each of the U.S. and Canada owning approximately 50% of the industry rig fleet in the U.S. and approximately 78% of the industry rig fleet in Canada as of December 31, 2022.

Since 2014, the five largest U.S. drillers have increased market share of active rigs from approximately 42% to 60% today, as operators continue to pursue the highest performing rigs with digital offerings from contractors that have appropriate scale and technology.

Technology has increasingly differentiated the market, as customers continue to transition away from vertical wells to more complex directional and horizontal drilling programs that require higher capacity rigs. Consequently, the rig market has been shedding older, low technology rigs in favour of more powerful and efficient, high-specification rigs better suited for horizontal wells and resource development programs. Increasingly, digital technologies and rig-based software are becoming enablers of efficiency, and as a result, are in demand from our customers.

Competitive Strategy

Providing High Performance, High Value services to our customers represents the core of our competitive strategy. We deliver High Performance through passionate people supported by quality business systems, drilling technology, equipment and infrastructure designed to optimize results and reduce risks. We create High Value by operating safely and sustainably, lowering our customers’ risks and costs while improving efficiency, developing our people and striving to generate superior financial returns for our investors.

We keep customer well costs down by maximizing operating efficiency and minimizing environmental impact in several ways:

| ▪ | using innovative and advanced drilling technology that is efficient, reduces costs and minimizes impact on the environment |

| ▪ | having equipment that is geographically dispersed, reliable and well maintained |

| ▪ | monitoring our equipment to minimize mechanical downtime |

| ▪ | managing operations effectively to keep non-productive time to a minimum |

| ▪ | staffing well trained crews, with performance measured against defined competencies |

| ▪ | incentivizing our executives and eligible employees based on performance against safety, operational, employee retention, strategic, ESG and financial measures, and |

| ▪ | employing industry-leading alternative rig energy sources and fuel monitoring to reduce emissions and cost. |

There is a strong customer preference for Super Specification (Super-Spec) rigs not only due to the higher rig specifications that enable more technical drilling, but also due to the drilling efficiencies gained in utilizing these rigs. Super-Spec rigs typically include AC power, digital control systems, integrated top drives, pad walking systems, highly mechanized pipe handling, and high capacity mud pumps. With 95 rigs, representing 45% of our North America fleet, considered Super-Spec, we are well positioned to meet the needs of our customers. Furthermore, our customers prefer rigs that have recently drilled and have an experienced crew.

We have a footprint in all of the most active North American resource plays, including the Deep Basin, Bakken, Cardium, Duvernay, Montney, Viking, Clearwater, and other heavy oil formations in Canada and Cana Woodford, Eagle Ford, Granite Wash, Haynesville, Marcellus, Mid-Continent, Niobrara, Permian, Rocky Mountains, Utica and Williston in the U.S.

Drilling Fleet

We focus on providing efficient, cost-reducing drilling technologies that seek to minimize environmental impact. Design innovations and technology improvements, such as multi-well pad capability and rapid mobility between wells, capture incremental time savings during the drilling process. Precision has invested over $3 billion in its drilling rig fleet since 2010, adding over 125 Super Series drilling rigs during the period. With one of the newest and most technically capable fleets in North America and the Middle East, Precision’s Super Series rigs have been designed for industrial-style drilling: highly efficient, mobile, safe, controllable, upgradable; and able to act as a platform for digital and emission-reducing technology delivery to the well location. Precision has completed relatively low-dollar cost upgrades over the past several years, including additions of walking

Precision Drilling Corporation 2022 Annual Information Form | 11 |

systems, higher pressure and capacity mud pumps, increased setback capacity and AlphaAutomationTM and AlphaAppsTM technology. Precision’s Super Series drilling rig fleet meets the industrial-style drilling requirements of our customers in North America and deep, high-pressure/high-temperature drilling projects internationally. As of December 31, 2022, we had 225 Super Series rigs in our fleet.

AlphaTM Technologies

Precision is a leading provider of digital technologies that automate key processes of the drilling cycle and significantly improves the efficiency of the downhole function. We partner with various industry leaders to develop a widespread portfolio of technology offerings which include: AlphaAutomationTM, AlphaAppsTM and AlphaAnalyticsTM. To date, Precision has drilled over 2,600 wells with AlphaAutomationTM, which includes approximately 850 wells drilled in 2022, enhancing the performance and value of its Super Triple drilling rig fleet. As at December 31, 2022, the Company had 70 AlphaAutomationTM systems commercialized across various basins in the U.S. and Canada, which support an open platform to host multiple in-house, customer-developed or third-party applications. Precision currently has 21 commercial AlphaAppsTM and offers our AlphaAnalyticsTM data services to further enhance the value proposition of our digital offering.

EverGreenTM Suite of Environmental Solutions

In 2021, we launched our EverGreenTM suite of environmental solutions, bolstering our commitment to reduce the environmental impact of oilfield operations. Our EverGreenTM suite of environmental solutions is comprised of EverGreenMonitoringTM, EverGreenEnergyTM and EverGreenTM Fuel Cell. We aim to provide the cleanest, most efficient and most cost-effective rig power sources for our customers through our EverGreenEnergyTM offerings, and our EverGreenMonitoringTM systems which deliver the fuel and emissions data that allow our customers to monitor their gains in real time and track their emissions. We tested, field hardened, and implemented our BESS and fuel monitoring system in 2022, and we have multiple commercial agreements in place for each of these technologies for installation on customer locations in the first quarter of 2023.

International

Grey Wolf International (Grey Wolf) is our platform and market brand for our international oil and natural gas drilling market. Grey Wolf is currently active in Kuwait and the Kingdom of Saudi Arabia and continues to explore opportunities in various additional international markets. International oilfield service operations involve relatively long sales cycles with bidding periods, contract award periods and rig mobilization periods measured in months. Grey Wolf has a regional office in Dubai, United Arab Emirates.

Manufacturing

Based in Calgary, Alberta, Rostel Industries manufactures drilling rigs and equipment and refurbishes components for our drilling and service rigs as well as third-party equipment. Rostel Industries supports our vertical integration, and approximately 72% of its revenue in 2022 was related to Precision business. Having the in-house ability to repair and provide new components for our drilling and service rigs improves the efficiency and reliability of our fleets.

Oilfield Supply

Columbia Oilfield Supply in Canada and Precision Drilling Oilfield Supply in the U.S. utilize general oilfield supply warehouses that procure, package and distribute large volumes of consumable oilfield supplies for our rig sites. Our supply warehouses achieve economies of scale through bulk purchasing and standardized product selection and then coordinate distribution to Precision rig sites. Columbia Oilfield Supply and Precision Drilling Oilfield Supply play a key role in our supply chain management. In 2022, 99% of Columbia Oilfield Supply and 100% of Precision Drilling Oilfield Supply activities supported Precision operations. These operations leverage our procurement volumes to lower costs and reduce the administrative workload for field personnel, enhancing our competitiveness.

Employees

The market for experienced personnel in the oilfield services industry can be competitive due to the cyclical nature of the work, the uncertainty of continuing employment, and generally higher employment rates during periods of high oil and natural gas prices and drilling activities. We strive to position ourselves for increased activity while maintaining performance excellence through our safety performance and reputation. These factors help us attract and retain experienced, well-trained employees when the industry experiences crew shortages during peak operating periods.

Throughout the year, we continued to assess our workforce and focused on recruitment of personnel to fill technical roles that drive our drilling optimization and AlphaTM suite of technologies. In 2022, we had an average of 4,802 employees, with a high of 5,387.

| |

12 | Precision Drilling Corporation 2022 Annual Information Form |

Bench Strength and Recruiting

We utilize proven formal procedures to retain key drilling personnel (including drillers, rig managers, and field superintendents) during reduced drilling activity periods. Drillers are often temporarily repositioned to lower positions and return as a driller once drilling activity increases. This practice allows us to meet drilling demand and retain qualified employees. We also rely on our industry-leading recruiting programs to attract new drilling personnel. Our initial recruiting focus for entry-level positions is outreach to our extensive alumni network, supplemented by job postings and other recruiting efforts that attract industry personnel as well as new people to the oilfield services industry. New drilling personnel receive intensive onboarding and training.

Technical Support Centres

We operate two contract drilling technical centres, one in Nisku, Alberta and one in Houston, Texas, and one completion and production technical centre in Red Deer, Alberta. These centres accommodate our technical service and field training groups and consolidate field support and training for our operations. The Houston and Nisku facilities have fully-functioning training rigs with the latest drilling technologies. Also, our Houston facility accommodates our rig manufacturing group. In 2022, we trained more than 6,200 people at our technical centres.

Our Global Field Competency Program ensures that our field operations employees obtain competency levels for their current position and potential future positions. The program defines specific skills and learning pathways for certain jobs and identifies any skill gaps that an individual employee is required to remedy. The Global Field Competency Program supports our broader corporate vision and strategy by ensuring our drilling personnel provide High Performance, High Value services to our customers. In 2022, we completed 989 competency assessments throughout North America.

COMPLETION AND PRODUCTION SERVICES

Precision Completion and Production Services

Precision offers a versatile fleet of service rigs for well completion, workover, abandonment, maintenance and re-entry preparation services. The fleet is strategically positioned throughout western Canada and in the northern U.S.

Well Service Activities

Well servicing jobs are typically of short duration and generally conducted during daylight hours, so it is important for a service rig to be close to customer demand and be able to move quickly from one site to another. Well servicing requires a unique skill set as crews must deal with the potential dangers and safety concerns of working with pressurized wellbores. Completion and workover services can take a few days to several weeks to complete depending on the depth of the well and the complexity of the completion or workover.

On July 27, 2022, we acquired the well servicing business and associated rentals assets of High Arctic Energy Services, Inc. for an aggregate purchase price of $38 million. The transaction added a fleet of 80 service rigs (51 marketed and 29 inactive) to our Canadian well servicing operations, skilled and experienced field personnel, rental assets, ancillary support equipment, inventories and spares, and six additional operating facilities in key basins.

At the end of 2022, Precision Well Servicing had an industry leading market share in Canada, based on operating hours, of approximately 14% of total industry operating hours. The total Canadian industry well servicing fleet average is approximately 724 service rigs. Our fleet of 125 service rigs is the largest in western Canada.

Precision has an additional 143 well completion and workover service rigs in Canada that are not registered with the industry association.

In 2022, Precision Completion and Production Services operated 10 service rigs in the United States.

Service Rig Fleet

The table below shows the configuration of Precision’s marketed well servicing fleet as at December 31, 2022. The fleet’s operating features are detailed on our website.

Type of Service Rig | | | Size/Capability | | Total | |

Mobile Rigs | | | | | | | |

▪Highly mobile, efficient rig up and rig down, minimal surface disturbance, | | | Single | | | 62 | |

freestanding design eliminates anchoring | | | Double | | | 57 | |

| | | Slant | | | 6 | |

Total1 | | | | | | 125 | |

1 Does not include 143 additional service rigs in Canada that are not registered with the Canadian Association of Energy Contractors (CAOEC).

Precision Drilling Corporation 2022 Annual Information Form | 13 |

Service Rig Activities

Well servicing operations have two distinct functions – workovers and abandonments and completions. The demand for completion services is generally more volatile than for workover services.

Of our total oil and natural gas well service rig activity in Canada in 2022:

| ▪ | workovers and abandonments accounted for approximately 89%, and |

| ▪ | completions accounted for approximately 11%. |

Workovers and Abandonments – Workover services are generally provided according to customer preventive maintenance schedules or on a call-out basis when a well needs major repairs or modifications. Workover services generally involve remedial work such as repairing or replacing equipment in the well, enhancing production, re-completing a new producing zone, recovering lost equipment or abandoning the well.

Producing oil and natural gas wells generally require some type of workover or maintenance during their life cycle. The demand for production or workover services is based on the total number of existing active wells and their age and producing characteristics.

Completions – Customers often contract a specialized service rig to take over from a larger, more expensive drilling rig to prepare a newly drilled well for initial production. The service rig and crew work jointly with other services to open and stimulate the wellbore producing zones for initial production.

The demand for well completion services is generally related to the level of drilling activity in a region.

Precision Rentals

Precision Rentals provides more than 1,900 pieces of oilfield rental equipment for rental to customers from three operating centres and 12 stocking points throughout western Canada, supported by a technical service centre in central Alberta.

Precision Rentals has four distinct product categories:

| ▪ | surface equipment (including environmental invert drilling mud storage, hydraulic fracturing fluid storage, production tanks and other fluid handling equipment) |

| ▪ | wellsite accommodations (fully equipped units that provide on-site office and lodging for field personnel) |

| ▪ | power generation equipment, and |

| ▪ | solids control equipment. |

Precision Camp Services

Precision Camp Services provides food and accommodation to personnel working at remote locations in western Canada. At the end of 2022, Precision Camp Services had 34 drill camps and base camp dormitories along with kitchen or diners to accommodate 654 people in western Canada. Each drill camp includes six building units that typically accommodate 20 to 25 rig crew members and other personnel and, if required, individual dormitory units that accommodate up to 44 additional personnel can be added.

Precision Camp Services has also configured several camps and dormitories to provide housing and meals for base camps with up to 500 personnel on separate major projects in western Canada. As the oil and natural gas industry searches for new reserves in more remote locations, crews need to stay near the worksite, often in camps, throughout the duration of a drilling program. Precision Camp Services serves Precision and other companies in the upstream oil and natural gas sector and, from time to time, other industries operating in remote locations.

| |

14 | Precision Drilling Corporation 2022 Annual Information Form |

ESG in All We Do

In 2022, we maintained our focus on those ESG areas that we determined to be material to Precision in our 2020 materiality assessment. We continued our efforts to adopt proactive and sustainable means to ensure ESG is accounted for in all that we do. Our “E” (Environmental) and “S” (Social) teams, comprised of high-performing employees from throughout the organization worked collaboratively to drive environmental and social efforts. We also published our third annual Corporate Responsibility Report, which can be found on the Sustainability section of our website, in alignment with the Sustainability Accounting Standards Board (SASB) and Task Force on Climate Related Financial Disclosures (TCFD) frameworks. A major evolution of our disclosure included in this report included our 2021 greenhouse gas (GHG) emissions data associated with our direct operations and those we conduct on behalf of our customers, which we will continue to share on an annual basis.

The expansion of our short-term incentive plan (STIP) goals in 2021 to include ESG goals beyond health, safety, and environmental (HSE) targets, highlighted our focus on accelerating the evaluation, testing, implementation, and commercialization of several lower-carbon energy sources, monitoring systems, and energy efficient equipment substitutions and modifications. This success led us to expand further on those goals in 2022, creating an even stronger incentive for all our salaried, non-exempt employees that are eligible for the STIP to contribute toward these efforts. We met or exceeded all of these goals in 2022, resulting in even greater environmental and associated financial gains both internally and for our customers.

Our Board oversees the Corporation’s commitment, approach, planning, performance, monitoring and disclosure related to sustainability and ESG matters, including an annual review of Board and committee charters and receives quarterly reports on ESG mapping, materiality assessments and ESG-related risks.

In 2023, we are excited to transition the ESG highlights shared in our Corporate Responsibility Report onto our website, where the information will represent not just a single snapshot of the year, but will portray a frequently updated view of our ESG efforts. We have maintained our alignment with SASB and TCFD and will continue to publish ESG performance data for the preceding year. For more detailed information on our ESG efforts, please visit our website.

Our Commitment to Corporate Responsibility

In 2022, we continued to deliver on our multi-year corporate responsibility strategy by developing and completing the following initiatives:

| ▪ | disclosed GHG emissions data for the first time |

| ▪ | expanded the impact of our “E” and “S” teams to drive intentional environmental and social efforts across the organization and with our customers |

| ▪ | further expanded the ESG goals in our STIP scorecard to incentivize innovation within our own organization and with our customers |

| ▪ | increased investment in the EverGreenTM product line, growing and differentiating our products and technologies aimed at reducing environmental impact |

| ▪ | partnered with our customers to mobilize over 30 additional independent emissions monitoring or reduction systems |

| ▪ | recruited and added an additional female director and initiated efforts to add another female director by the end of 2023 |

| ▪ | continued our long-term strategic alliance with Shock Trauma Air Rescue Services (STARS) in Canada |

| ▪ | increased employee volunteer hours year over year |

| ▪ | continued an ongoing formal work from home program for our office-based employees |

| ▪ | conducted ransomware drills, identifying and mitigating potential challenges to our response processes, and |

| ▪ | continued our summer internship program, employing 47 interns from 24 universities. |

ESG Materiality

In 2022, we maintained our focus on the following areas:

Precision Drilling Corporation 2022 Annual Information Form | 15 |

ENVIRONMENTAL

Target Zero and Climate Change Stewardship

Our Health, Safety and Environmental strategy continues to guide us toward Target Zero – our commitment to minimize any negative impact on our employees, the environment, and the communities where we operate. We recognize climate change is an important global risk and we actively monitor developments that have the potential to impact our business, our customers, and the environment.

In 2022, we publicly disclosed, for the first time, emissions associated with our direct operations and those we conduct on behalf of our customers. This data is being used to identify opportunities to reduce emissions through efficiency gains, alternate forms of energy, and hydrocarbon fuel use reductions across all operations.

While many operational decisions are still within the control of our customers, we continue to commit a significant amount of our internal resources to develop technology that will ensure that the safest and most environmentally friendly drilling options will also be the best financial options for our customers. In 2022, this focus facilitated the continued increase in adoption of our AlphaTM technologies and our EverGreenTM suite of environmental solutions such as BESS and real-time fuel consumption and emissions monitoring equipment.

Environmental goals were expanded significantly for 2022, with challenging targets laid out for our operations, technical, and marketing teams. These included:

| |

STIP Target Area | Results |

Develop and implement GHG emission monitoring / quantification systems | 15 systems developed and deployed in the field, including real-time monitoring dashboards |

Implement lower carbon power systems or technologies | 22 lower carbon power systems and technologies developed and deployed in the field, with additional systems contracted for deployment in 2023 |

Initiate environmental initiatives targeting Company facilities, fleet, or controlled operations | Initiated LED lighting projects for three facilities to reduce energy consumption |

EverGreenTM Suite of Environmental Solutions

Precision’s EverGreenTM suite of environmental solutions was launched in 2021, differentiating new and existing products specifically aimed at quantifying and reducing the environmental impact of drilling operations at the wellsite.

As part of our EverGreenEnergyTM sub-product line, our BESS has now been field hardened and proven to provide significant reductions in hydrocarbon fuel use, and in turn a similar reduction in emissions and fuel cost. A successful launch of this technology in 2021 quickly expanded with the implementation of five additional units in 2022. Further systems are scheduled for customer implementation throughout 2023.

We also saw significant adoption of our Integrated Power & Emissions Fuel Monitoring System (System), a part of our EverGreenMonitoringTM sub-product line, which is capable of measuring and communicating real-time wellsite GHG emissions. 15 Systems were installed in 2022, with additional units scheduled to come online throughout 2023. These Systems provide Precision and our customers with real-time insight into the correlation between power demand, fuel consumption, and resulting GHG emissions throughout the well construction process, and allow capture and analysis of this data across different rigs, well profiles, engine types, and geographic areas. This knowledge source has become instantly meaningful to help improve both Precision’s and our customers’ understanding of the variability of land drilling GHG emissions and help operate power generating equipment with optimal fuel consumption and carbon footprint efficiency.

SOCIAL

Our Corporate Culture

Our commitment to creating a work environment where employees feel safe, respected, and appreciated is our highest priority. We understand the importance of building a culture that will provide Precision with a competitive advantage over not only our direct peers in the oilfield services industry but other employers in the areas where we operate. To foster our culture, we have developed the “S” Team which is comprised of our Passionate People who bring a wide range of ideas, perspectives, skills, and cultures to Precision.

Our Board champions a collaborative and transparent culture, where employees are free to speak their minds and management actively listens to feedback. We regularly conduct focus groups and launch Leadership and Culture surveys with our employees in the field and in our corporate offices. We use the information gathered in these surveys to receive feedback on our strengths and possible areas of improvement. We then summarize the information, formulate action plans and share the feedback with the Board.

| |

16 | Precision Drilling Corporation 2022 Annual Information Form |

Our Core Values and Key Beliefs

Our Core Values and Key Beliefs successfully promote a culture of integrity and accountability. Our Core Values drive our culture, as they are foundational to how we approach our business. From the top down, the commitment to these values helps ensure we are moving in the right direction with a ‘Down to Earth’ common sense purpose among our employees. Our Key Beliefs are fundamental to how we operate our business every day. They are how we want our employees to act, interact, and be perceived. By creating a feeling of personal ownership and a culture of hard work, innovation and productivity, our Core Values and Key Beliefs encourage an environment that brings out the best in everyone.

Employee Safety and Training

Employee safety is embedded in all that we do at Precision, from job planning and change management to the critical task assessments and safety observations our employees perform every day. We deliver High Performance, High Value service to our customers without compromising the health and safety of our employees or those in the communities where we work.

Precision’s commitment to providing industry-leading comprehensive training and development to our employees can be seen through the extensive instructor-led and virtual courses, as well as face-to-face coaching. In 2022, over 82,000 employee training hours were focused on Precision’s culture, rig roles and responsibilities, well control, tools, and equipment, HSE standards, leadership and communication at one of our world-class training facilities, located in Nisku, Alberta and Houston, Texas. Additionally, we increased our rig-site training in the second half of 2022 with over 10,000 employee training hours during 155 rig visits.

A specific focus on new employee development is driven through our Short-Service Employee (SSE) program, which is catered to rig-based employees with low levels of experience to ensure they are well-positioned for long-term success at Precision. During the first six months with Precision, these employees are paired with a mentor and put through various tasks under supervision to ensure they adapt to our culture, develop a safety-first mentality, and enable them to perform their duties to the best of their ability. In 2022, we dedicated over 25,000 SSE-specific training hours to approximately 1,350 employees who were new to the industry.

Employee Wellness

Employees are provided tools and support to care for their mental and physical health. Precision offers competitive benefit packages to all eligible employees throughout the organization, including health, vision, and dental plans. We also offer a multitude of formal programs to assist employees in achieving physical, mental, and financial well-being, including our Employee Assistance Program that provides confidential counseling for personal issues, financial planning resources, beneficiary financial counseling, will preparation, and legal assistance.

Diversity, Equity and Inclusion

Employee Diversity, Equity and Inclusion

Delivering strong operational and financial results in today’s environment requires the expertise and positive contributions of every Precision employee. We are committed to developing a diverse range of thoughts, experiences, and points of view to complement our strategy and decision-making processes. Precision is an inclusive workplace that strives to be free of discrimination, harassment, workplace violence, and retaliation. Our diversity, equity and inclusion policy (Diversity Policy) prohibits discrimination of any kind and promotes diversity and inclusivity among our employees, management, and the Board.

Each year our employees are required to participate in and complete our Diversity, Equity, and Inclusion, and Harassment Discrimination and Workplace Violence courses. In 2022, approximately 5,100 employees globally completed these courses.

Management Diversity

Increasing diversity at the management level is essential to maintaining our competitive advantage and is a factor in managing our talent pool and making strategic hires.

The executive leadership team reviews the talent pool regularly and considers the individual’s development, industry experience, background and race and gender representation, as well as other factors before recommending executive appointments to the Board for approval. The Board also considers the representation of women and other diversity factors, in executive positions when reviewing the management succession plan and approving executive appointments. We do not have specific gender targets for management as we believe the skills, qualifications and attributes of the candidate and the needs of the organization are paramount.

Currently, 20% (one out of five) of our executive officers are female and 60% (three out of five) of our executive team self-identify as an Other Diverse Person(1).

Precision Drilling Corporation 2022 Annual Information Form | 17 |

Board Diversity

When recruiting new directors, the CGNRC considers our vision and business strategy, the skills and competencies of the current directors, gaps in Board skills, and the attributes, knowledge and experience new directors should have to best enhance our business plan and strategies. The CGNRC also considers diversity as part of this process, including the level of female representation on the Board. When assessing Board composition or identifying suitable candidates for appointment to the Board, the CGNRC will include a slate of minority candidates for all open Board seats.

Currently, 22% (two out of nine) of our Board members are female and 44% (four out of nine) of our Board members self-identify as an Other Diverse Person(1).

Position Title | Total Number | Number of Women | % of Women | Number of Other Diverse Person(1) | % of Other Diverse Person |

Board of Directors(2) | 9 | 2 | 22% | 4 | 44% |

Executive Officers(3) | 5 | 1 | 20% | 3 | 60% |

| (1) | An Other Diverse Person includes directors or executives that have self-identified into one or more of the following categories: Racialized Person, LGBTQ2S+, disability and indigenous people (First Nations, Inuit, or Metis). Racialized is derived by the Ontario Human Rights Commission from the concept of “visible minority” defined as person other than Aboriginal Peoples, who are non-Caucasian in race or non-white in color. We have defined 'Disability’ as a person with a physical or mental condition that is permanent, ongoing, episodic or of some persistence, and is a substantial or significant limit on an individual's ability to carry out some of life’s important functions or activities, such as employment. | |

| (2) | Board of Directors includes eight independent Board members and the President and Chief Executive Officer. | |

| (3) | Executive Officers includes the Chief Financial Officer, President, North American Drilling, Chief Administrative Officer, Chief Legal and Compliance Officer, and Chief Technology Officer. | |

|

This year the Board has committed to recruit a third female director in 2023, to achieve our target of 30% female representation on the Board as set out in our Diversity Policy. We believe that this is an important step in increasing diversity on our Board. |

Reporting and Accountability

The Human Resources department reviews the structure, size, pay equity and composition of our workforce annually and prepares a report for the Chief Administrative Officer and the Chief Executive Officer. Similarly, the executive leadership team meets regularly to assess its optimum composition, and annually provides a report to the CGNRC.

Talent Management

As an industry leader, we are committed to recruiting and retaining high-performing, Passionate People at every level of our Company. Precision has developed a strong recruitment marketing strategy both in the field and for our corporate support roles. We ensure the value proposition we provide in the ways of pay and benefits remains competitive and engages our employees. We have implemented systems and processes that help us execute our talent management strategy to maintain a well-trained, highly competent, and capable talent pool, both in the field and corporate positions with a broad range of business experience throughout market cycles. Our Talent Management and Field Training & Development departments have been very successful with implementing new technology platforms and internal learning systems to find inventive ways to provide learning and development opportunities leveraging our in-house technical expertise, while still maintaining the necessary in-person interactions to develop appropriate levels of understanding, as well as strong professional networks.

University Internship Programs

During 2022, Precision initiated industry exposure efforts by broadening students’ technical education and familiarity with our industry through Career Days. In 2022, we hosted 47 interns from over 24 universities working in Canada and the U.S, with nationalities represented from North and South America, Western and Southern Africa, Southeast Asia, and Northern Europe. We believe our internship program provides an important talent pool for our future permanent hires and provides participants with practical experience that cannot be obtained in the classroom and is an excellent introduction to the industry we operate in.

Community and Industry Engagement

We are proud to invest in causes that are important to our employees, customers, and the communities where we operate. Throughout 2022, our “PD Cares” corporate giving program contributed to several exceptional health and human services organizations and youth programs.

For over 30 years, one of our proudest partnerships in Canada has been with the STARS Foundation which provides rapid and specialized emergency care and transportation for critically ill and injured patients. STARS operates 24/7 bases in Calgary, Edmonton, Grande Prairie, Regina, Saskatoon, and Winnipeg which are well aligned to provide critical support to remote field operations and employees both on and off the job residing across Western Canada.

In addition to these long-standing partnerships, in 2022 Precision employees donated their time and resources to many great organizations, including Camp Kindle, Habitat for Humanity, AutismSpeaks, Alberta Cancer Foundation, City of Houston Parks, Houston Livestock Show and Rodeo, National MS Society, Texas Children’s Hospital, Inn from the Cold, and EvenStart Calgary.

| |

18 | Precision Drilling Corporation 2022 Annual Information Form |

Our commitment to the energy industry is evidenced by our participation in several non-profit organizations, such as the Canadian Association of Energy Contractors (CAOEC), International Association of Drilling Contractors (IADC), Business Council of Alberta, the Modern Miracle Network and the Fraser Institute.

Indigenous Relationships

Precision recognizes the history and diversity of Indigenous peoples. Our relationships help create opportunities and deliver outcomes beneficial to our Indigenous partners, the communities in which we all live, and our customers. Precision strives to support local Indigenous communities through ongoing engagement, employment, and mutually beneficial business opportunities. Precision currently has several successful business relationships with Indigenous nations across Western Canada, including joint ventures, collaboration, and benefits agreements.

GOVERNANCE

Corporate Governance, Ethics & Compliance

As we strive for sustainable operations, we work to be financially, environmentally, and socially responsible. At all times we are guided by our Core Values, Key Beliefs, and strong corporate governance principles. We remain committed to ethical behavior through our Code of Business Conduct and Ethics (the Code), and our employment policies and practices. The Board and our external and internal auditors provide oversight and ensure compliance throughout our organization. To sustain the trust of our stakeholders, we promote Board independence, proactive shareholder engagement, risk management and ethics and integrity principles.

Governance Guidelines

Our Corporate Governance Guidelines outline the composition, structure, procedures, and policies that guide our Board. These guidelines are reviewed annually and serve as a guidepost for the Board. Topics pertaining to corporate citizenship, governance and sustainability are also routinely reviewed at meetings of the Board and its committees.

Our Code of Business Conduct and Ethics

We believe ethical behavior is fundamental to the way we do business. Our Code ensures every director, executive officer, manager, employee, and contractor is aware of Precision’s values. The full text of the Code is available on the Corporate Governance section of our website.

We have a robust, proven corporate governance system that is effective in ensuring a transparent culture. It allows for ethical issues to be reported, assessed, and resolved in a timely manner. This system employs a strong body of policies, enforcement mechanisms and a closed-loop resolution process of issues that are reported.

The Code addresses the following key areas, among others:

▪ financial reporting and accountability ▪ maintaining confidentiality ▪ avoiding conflicts of interest ▪ complying with laws ▪ safeguarding corporate assets ▪ reporting illegal or unethical behavior | | ▪ fair dealing ▪ disclosure ▪ anti-retaliation ▪ data and privacy security ▪ bribery and corruption, and ▪ harassment and discrimination |

Every director, executive officer, manager, and employee must annually acknowledge that they have read, understood, and will abide by the Code. Each member of the senior management team must also certify quarterly whether they are aware of any breaches of the Code. In-person and online training is provided annually to all permanent employees and covers an array of topics related to business conduct and ethics.

|

PD EthicsLine The PD EthicsLine is available for anyone within or outside of Precision to confidentially and anonymously report any suspected illegal or unethical conduct or breach of our policies. With the oversight of the Audit and HRCC Committees, there were no ethics incidents in 2022 that required disclosure and 100% of the issues reported through the PD EthicsLine were reviewed and resolved. An independent third party operates the PD EthicsLine and notifies the Chief Compliance Officer (CCO) immediately upon receiving a complaint. |

Precision Drilling Corporation 2022 Annual Information Form | 19 |

Internal Policies

We work proactively to ensure our workforce and the Board understand their obligations to uphold our standards and the law when it comes to ethics and compliance. We have developed internal corporate policies, in addition to our Code, to guide our directors, officers, and employees in meeting our standards and fulfilling our responsibilities to our shareholders, governmental, and regulatory authorities, business partners and each other. The following are some of our internal policies that we have put in place to ensure compliance and to reflect our current business practices:

▪ Human Rights ▪ Anti-Bribery and Anti-Corruption ▪ International Trade - Sanctions ▪ Insider Trading ▪ Privacy | ▪ Avoiding Conflicts of Interest ▪ Public Policy & Lobbying ▪ Diversity, Equity and Inclusion, and ▪ Harassment, Discrimination and Workplace Violence |

Clawbacks

Our senior leadership team is held accountable for their decisions. As such, we have designed our compensation plan so any consequences stemming from our policies, employment agreements and incentive plans align with Precision’s best interests.

Our Clawback Policy entitles us to recoup some, or all incentive compensation awarded or paid to our senior leadership team, including our Chief Executive Officer, both past and present, if:

| ▪ | there was a restatement of our financial statements for a fiscal year or fiscal quarter when they were with Precision, or |

| ▪ | there was an error in calculating executive compensation during their time with Precision, or | |

| ▪ | the member of the senior leadership team engaged in misconduct, including fraud, non-compliance with applicable laws and any act or omission that would entitle an employee to be terminated for cause. | |

The Policy applies to all forms of incentive awards including bonuses, restricted share units, performance share units and stock options.

Enterprise Risk Management and Sustainability