UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant x Filed by a Party other than the Registrant ¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ¨ | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| x | Soliciting Material under §240.14a-12

|

ENDOLOGIX, INC.

(Name of registrant as specified in its charter)

(Name of person(s) filing proxy statement, if other than the registrant)

Payment of Filing Fee (Check the appropriate box):

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11 |

| | (1) | Title of each class of securities to which the transaction applies:

|

| | (2) | Aggregate number of securities to which the transaction applies: |

| | (3) | Per unit price or other underlying value of the transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | Proposed maximum aggregate value of the transaction: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | Amount Previously Paid: |

| | (2) | Form, Schedule or Registration Statement No.: |

EXPLANATORY NOTE

Filed Documents

This filing consists of the following document relating to the proposed acquisition of Nellix, Inc. by Endologix, Inc.:

Exhibit A: PowerPoint slide presentation used at conferences held on November 16, 2010 and November 17, 2010.

Additional Information About the Proposed Transaction and Where to Find It

This presentation may be deemed soliciting material relating to the proposed transaction between Endologix, Inc. and Nellix, Inc. In connection with the proposed transaction, Endologix, Inc. filed a preliminary proxy statement with the Securities and Exchange Commission on November 9, 2010. When completed, a definitive proxy statement will be filed with the Securities and Exchange Commission and mailed to the stockholders of Endologix, Inc.INVESTORS AND SECURITY HOLDERS ARE ADVISED TO READ THE PRELIMINARY PROXY STATEMENT, THE DEFINITIVE PROXY STATEMENT (WHEN AVAILABLE) AND OTHER RELEVANT DOCUMENTS BECAUSE THEY CONTAIN OR WILL CONTAIN IMPORTANT INFORMATION ABOUT ENDOLOGIX, INC. AND THE PROPOSED TRANSACTION. Investors and security holders may obtain a free copy of the preliminary proxy statement, the definitive proxy statement (when available) and other relevant documents filed by Endologix, Inc. with the Securities and Exchange Commission at the Securities and Exchange Commission’s Web site at www.sec.gov.

The preliminary proxy statement, the definitive proxy statement (when available) and other relevant documents may also be obtained for free on Endologix, Inc.’s website at www.endologix.com under “Investor Relations/Financial Information/SEC Filings” or by directing such request to Investor Relations, Endologix, Inc., (949) 595-7283.

Endologix, Inc. and its directors and executive officers may be deemed to be participants in the solicitation of proxies from the stockholders of Endologix, Inc. in connection with the proposed transaction. Information concerning the interests of Endologix, Inc.’s participants in the solicitation is set forth in Endologix, Inc.’s proxy statements and Annual Reports on Form 10-K, previously filed with the Securities and Exchange Commission, in the preliminary proxy statement relating to the proposed transaction, and in the definitive proxy statement relating to the proposed transaction when it becomes available.

1

|

1 Investor Presentation November 2010 Nasdaq: ELGX www.endologix.com |

|

2 Safe Harbor This presentation contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, regarding, among other things, statements relating to the potential benefits of Endologix, Inc.’s proposed acquisition of Nellix, Inc., including expected operating synergies, the strength of Nellix, Inc.’s technology and the potential for long-term growth and expanded market share. Endologix, Inc. intends such forward-looking statements to be covered by the safe harbor provisions for forward-looking statements contained in Section 21E of the Exchange Act and the Private Securities Litigation Reform Act of 1995. These statements are based on the current estimates and assumptions of Endologix, Inc.’s management as of the date of this presentation and are subject to risks, uncertainties, changes in circumstances and other factors that may cause actual results to differ materially from the forward-looking statements made in this presentation. Important factors that could cause actual results to differ materially from forward-looking statements include, but are not limited to, risks relating to the ability to consummate the proposed acquisition, the ability to successfully integrate the Nellix technology with its current and future product offerings, the scope of potential use of the Nellix technology, the ability to obtain and maintain required U.S. Food and Drug Administration and other regulatory approvals of the Nellix technology, the scope and validity of intellectual property rights applicable to the Nellix technology, the ability to build a direct sales and marketing organization in Europe, competition from other companies, the ability to successfully market and sell its products, plans for developing new products and entering new markets and additional factors that may affect future results which are detailed in Endologix, Inc.'s Annual Report on Form 10-K filed with the SEC on March 3, 2010, and in Endologix, Inc.’s other periodic reports filed with the SEC. Endologix, Inc. undertakes no obligation to revise or update information herein to reflect events or circumstances in the future, even if new information becomes available. |

|

3 Executive Summary Strategically Positioned For Leadership of $1+ Billion Aortic Stent Graft Market Innovative Product Portfolio with Robust New Product Pipeline – Nellix Acquisition Announced October 27, 2010 Strong Financial Performance – 3Q 2010 Revenue Growth of 30% – 79% Gross Margin Significant Continued Growth Potential – Expanding Sales Force in US and Going Direct in Europe – Multiple New Product Launches Over Next 5 Years |

|

4 Endologix AAA Repair Minimally Invasive Endovascular Stent Graft 13th Leading Cause of Death in the U.S. Affects ~1.2 Million People in U.S. Age Related Disease (mostly men) 200,000 New Diagnoses Annually ~65,000 AAA Procedures Annually in U.S. – 60% EVAR – 40% Open Surgery Extremely Invasive High Mortality and Morbidity Long Operating Times Long Hospital Recovery Numerous Complications VS |

|

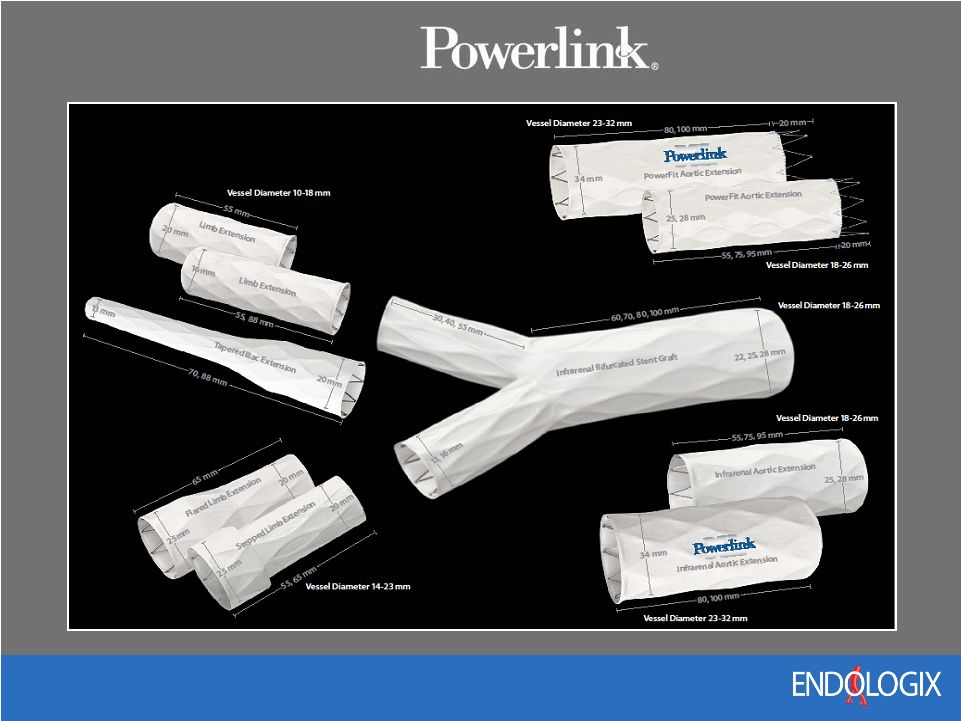

5 Competitive Landscape Powerlink - Endologix Talent – Medtronic Excluder – WL Gore Zenith – Cook Proximal Fixation Anatomical Fixation |

|

7 Low Profile AAA Delivery System Launched in 2009 Integrated Sheath and Hemostasis Valve to Simplify Procedure, Lower Blood Loss and Reduce OR time |

|

8 Clinical Results Combined Results of Three Prospective, Multicenter Clinical Trials (up to 5 yr follow-up) – 157 Patients at 28 U.S. Centers – 0% Aneurysm Ruptures – 0% Conversion to Open Repair – 0% Device Migration – 0% Stent Fractures – 0% Graft Fatigue – 0% Aneurysm-Related Mortality – Reduced or Stable Aneurysm Sacs in 93% of Patients at One Year J. ENDOVASC THER. 2010;17:153-152 |

|

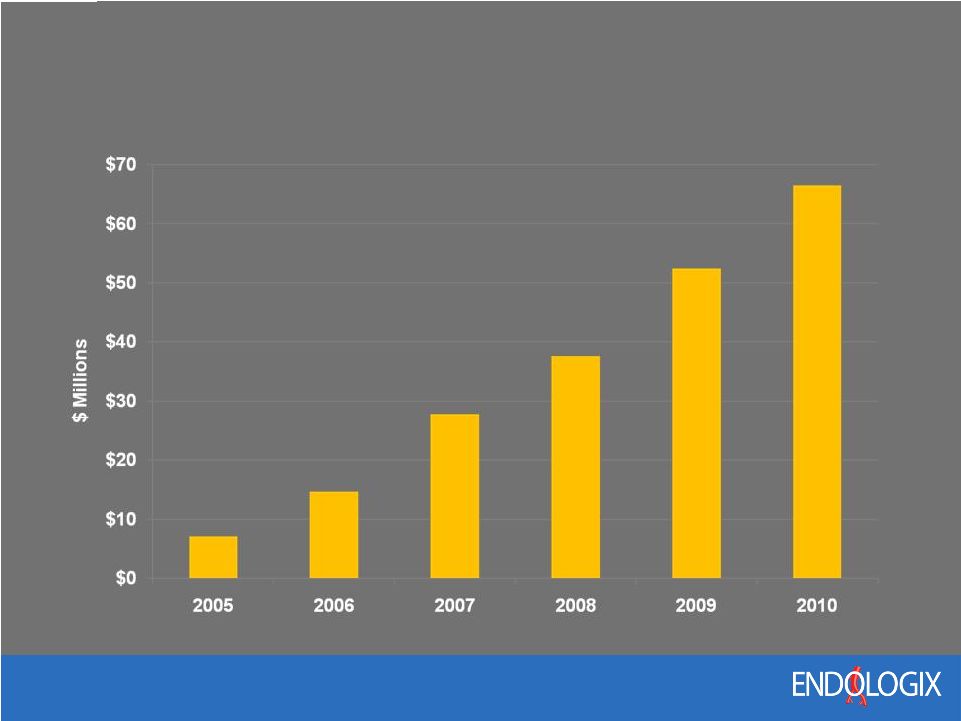

9 Historical Revenue Growth Annual CAGR = 57% *Mid-point of 2010 Guidance |

|

10 EVAR Unmet Needs Ability to Treat Short Aortic Necks and Juxtarenal AAAs Fully Percutaneous Secondary Interventions – 20% of EVAR patients – Endoleaks Lifetime Surveillance |

|

11 First ever Randomized Multi-Center Trial to Compare Percutaneous EVAR to Surgical Cut Down EVAR 20 sites Enrolling 210 Patients Collaboration with Abbott on Closure Devices Complete Enrollment 2011 – Approval Anticipated in 2012 |

|

12 New Low Profile EVAR Device Expected U.S. Approval in 2011 |

|

13 Device to Treat Short Necks and Juxtarenal Aneurysms – Represents ~20% of Diagnosed AAAs – Provides a Better Solution for Patients Currently Treated Off-Label – Adjustable Branches Accommodate a Variety of Renal Anatomies First Patients Treated in November 2010 with positive Results Ventana Stent Graft |

|

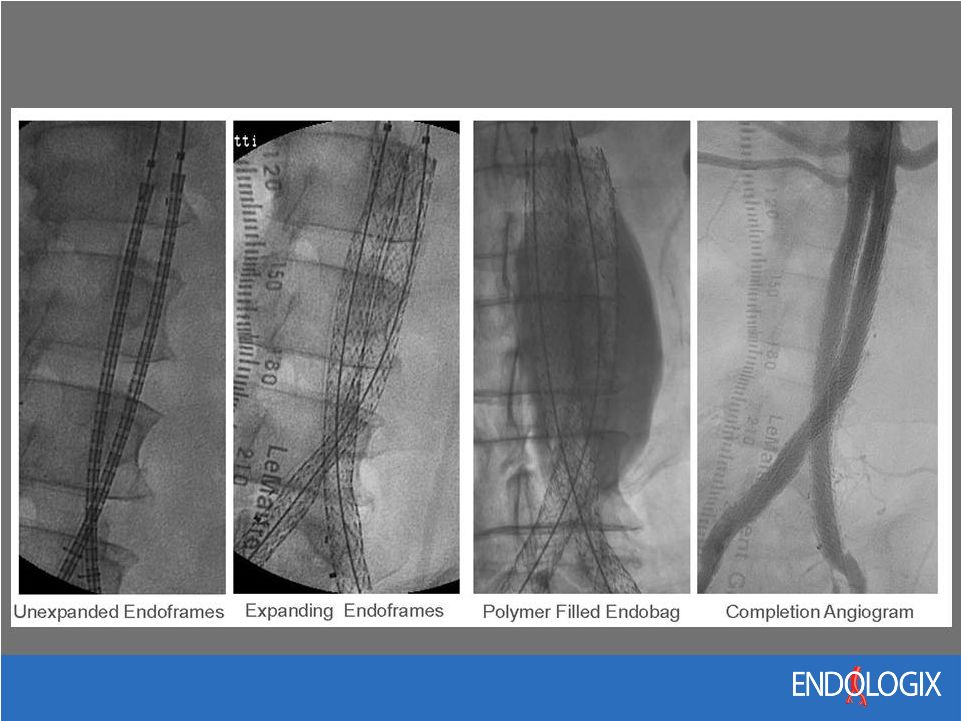

14 Nellix Technology Overview Disruptive New AAA Therapy – Endobags are filled with a biostable polymer to seal and stablize the AAA – Integrated Endoframes pave blood flow lumens to the legs Potential to Improve Outcomes and Expand the EVAR Market – Expected to reduce secondary interventions, long-term surveillance, radiation exposure and healthcare costs – Broadest expected indication of all EVAR devices |

|

15 Nellix Implant Procedure |

|

16 Nellix Exceptional Clinical Results 34 Patients (follow –up to 2 years) Over 50% of implants are outside the indications for other EVAR devices Minimal endoleaks and secondary interventions with 1 st generation device 100% freedom from AAA-related mortality No aneurysm ruptures No stent graft migration Strong physician feedback |

|

17 AAA Competitive Landscape Company Device Profile Neck Length Neck Diameter ELGX AFX 19F 15mm 32mm MDT Endurant 18F - 20F 10mm 32mm Cook Zenith LP 16F - 18F 15mm 32mm Gore Repositionable 18F - 20F 15mm 29mm Trivascular Ovation 14F - 15F 7mm 32mm Nellix Nellix* 18F - 19F 5mm 34mm JNJ Incraft 14F 15mm 32mm Terumo Anaconda 21F - 23F 15mm 32mm Nellix can treat more AAA anatomies than other EVAR devices and is the only device that completely seals the aneurysm sac *Expected profile and neck capabilities in IDE device |

|

18 Nellix Acquisition Agreement All stock transaction At closing Essex Woodlands will invest $15M – 2 ELGX board seats Estimated 11% dilution at initial deal closing Deal Structure Upfront Stock at Closing $15M 30% Milestones $10M OUS sales (TTM) $20M* 40% PMA Approval $15M 30% Total $50M 100% 70% of consideration based upon commercial and regulatory success * Ranges from $24M to $10M based on time to achieve |

|

19 Nellix Milestones 2011 2012 2013 2014 2015 Technology transfer to ELGX Build EU direct sales organization Nellix International launch U.S. IDE clinical trial PMA approval US launch Enrollment EU Launch Anticipated Timing: |

|

20 2011 2012 2013 2014 IntuiTrak New Sizes Europe Nellix Europe IntuiTrak New Sizes International AFX U.S. 2015 ELGX Planned New Product Pipeline PEVAR U.S. Ventana Europe IntuiTrak Japan Nellix International Xpand Europe Ventana International AFX2 U.S. Xpand International Aortic Stent International Xpand U.S. Nellix U.S. 17 new product launches planned over the next 4-5 years Aortic Stent Europe Ventana U.S. |

|

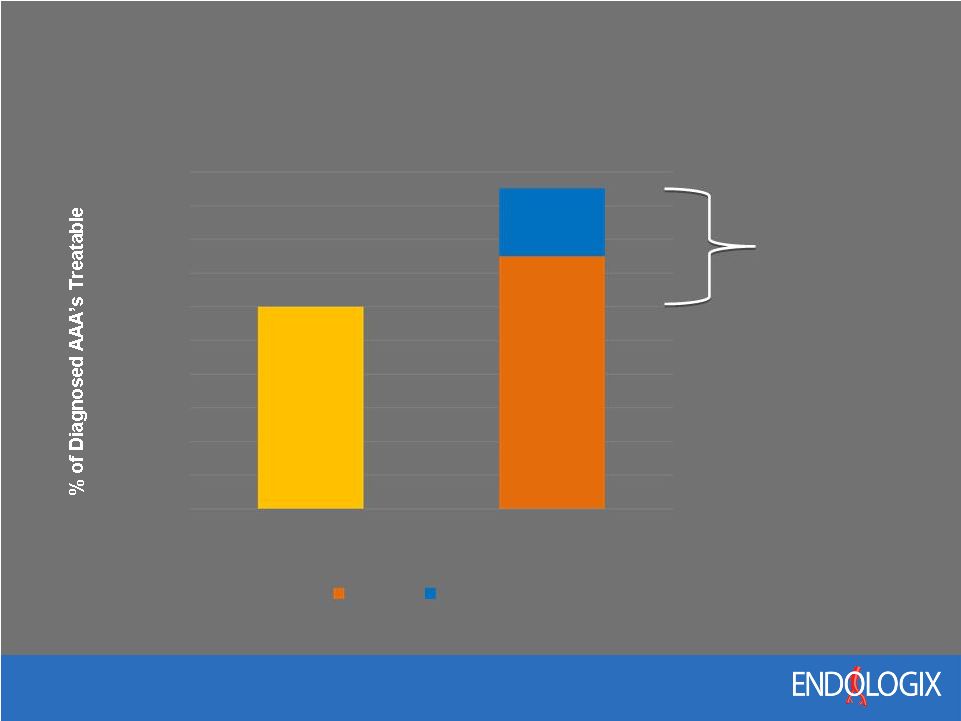

21 Potential EVAR Market Expansion ~60% Potential EVAR Market Increase 0% 10% 20% 30% 40% 50% 60% 70% 80% 90% 100% Current EVAR Future EVAR Nellix Ventana |

|

22 Global Sales Force U.S. Direct Sales Force – 61 Territories at the end of Q3 2010 – ~260 Years of EVAR Experience – 30% Expansion Planned For 2010 – Reps are Highly Trained Aortic Specialists • Profile = Top Performing Cardiovascular Reps • Extensive Training Program • Provide Direct Physician Support in 95% of Procedures International Direct & Distributor Sales Force – Transitioning to Direct Sales Force in Europe in 2011 – Currently 13 Distributors Covering 22 Countries • Includes Europe, Asia and South America |

|

23 ELGX Market Opportunities $1B $300M $400M Infrarenal Juxtarenal Thoracic 2015 Aortic Stent Ventana $1.7B AFX TAA Stent Graft Xpand PEVAR Nellix |

|

24 Financial Guidance 2010 Global Revenue of $66M - $67M – Increase over 2009 of 26% - 28% 2011 Global Revenue of $78M - $82M 2011 loss of $0.25 - $0.30 per share – Nellix R&D: ~$13.0M or ($0.23) – EU Sales Force: ~$5.7M or ($0.10) – Deal Amortization & Integration: ~$2.2M or ($0.04) Expect core business profitability in 2011 Expect total company profitability by Q4 2012 Operating margins of 25% - 30% by 2015 Forecasted Sales CAGR of 25%+ (2011-2015) |

|

25 ELGX Growth Drivers U.S. Sales Force Expansion Transition to Direct Sales Force in Europe New Product Pipeline – Expanded Size Range (2010) – AFX Endovascular System – PEVAR – Fenestrated Device (Ventana) – Nellix Endovascular System – BX Covered Stent (Xpand) – Aortic Stent – Thoracic Stent Graft |

|

26 Post Acquisition Balance Sheet ASSETS Cash $40M Total Current Assets $60M Net Fixed Assets $3M Goodwill & Intangibles $47M TOTAL ASSETS $110M LIABILITIES & EQUITY Total Current Liabilities $12M Long Term Liabilities $1M Total Liabilities $13M Total Equity $97M TOTAL LIABILITIES & EQUITY $110M Strong cash position to execute growth strategy |

|

27 Executive Summary Strong Core Business + Nellix Acquisition Creates a Company with Market Leadership Potential Multiple Growth Drivers in $1.7 Billion Market by 2015 – Robust New Product Pipeline – Potential to Expand the EVAR Market from 60% up to 95% of Diagnosed AAAs – EU Direct Sales Force Strong Financial Performance – 3Q 2010 Revenue Growth of 30% – 79% Gross Margin |