February 24, 2020 Debt Restructuring Supplemental Presentation 8 46 97 232 75 55 201 222 251 Exhibit 99.2

SAFE HARBOR About this Presentation This presentation (together with any accompanying oral or written communications, this “Presentation”) is being provided in connection with the debt restructuring (the “debt restructuring”) of Endologix, Inc. (“Endologix”). This Presentation is for informational purposes only and does not constitute an offer to sell or the solicitation of an offer to purchase any securities Endologix or any other person. The information contained herein does not purport to be all-inclusive. No representation is made as to the reasonableness of the assumptions made within or the accuracy or completeness of any projections, modeling or any other information contained herein. Any data on past performance, modeling contained herein is not an indication as to future performance. Endologix assumes no obligation to update the information in this Presentation. Nothing herein shall be deemed to constitute investment, legal, tax, financial, accounting or other advice. This Presentation contains financial forecasts. Endologix’s independent registered public accounting firm has not audited, reviewed, compiled, or performed any procedures with respect to the projections for the purpose of their inclusion in this Presentation, and accordingly, it has not expressed an opinion or provided any other form of assurance with respect thereto for the purpose of this Presentation. These projections should not be relied upon as being necessarily indicative of future results. In this Presentation, certain of the above-mentioned estimated information has been repeated (subject to the qualifications presented herein), for purposes of providing comparisons with historical data. The assumptions and estimates underlying the prospective financial information are inherently uncertain and are subject to a wide variety of significant business, economic and competitive risks and uncertainties that could cause actual results to differ materially from those contained in the prospective financial information. Accordingly, there can be no assurance that the prospective results are indicative of the future performance of Endologix or that actual results will not differ materially from those presented in the prospective financial information. Inclusion of the prospective financial information in this Presentation should not be regarded as a representation by any person that the results contained in the prospective financial information will be achieved. Forward-Looking Statements This Presentation includes “forward-looking statements” within the meaning of the “safe harbor” provisions of the United States Private Securities Litigation Reform Act of 1995. Forward-looking statements such as projected financial information may be identified by the use of words such as “forecast,” “intend,” “seek,” “target,” “anticipate,” “believe,” “will,” “expect,” “estimate,” “plan,” “outlook,” and “project” and other similar expressions that predict or indicate future events or trends or that are not statements of historical matters. Such forward-looking statements include statements about our beliefs and expectations and the estimated financial information and other projections contained herein. Such forward-looking statements with respect to financial performance, strategies, prospects and other aspects of the businesses of Endologix after completion of the debt restructuring are based on current expectations that are subject to risks and uncertainties. A number of factors could cause actual results or outcomes to differ materially from those expressed or implied by such forward-looking statements. These factors include, but are not limited to: (1) the ability to comply with NASDAQ listing standards following the consummation of the debt restructuring; (2) the risk that the debt restructuring disrupts current plans and operations of Endologix as a result of the announcement and consummation of the debt restructuring; (3) the ability to recognize the anticipated benefits of the debt restructuring; (4) costs related to the debt restructuring; (5) the possibility that Endologix may be adversely affected by other economic, business, and/or competitive factors; (6) the inability to achieve estimates of expenses and profitability; and (7) other risks and uncertainties indicated from time to time in Endologix’s annual and periodic reports, including those under “Risk Factors” therein, and other documents filed (or furnished) or to be filed (or furnished) with the Securities and Exchange Commission by Endologix. You are cautioned not to place undue reliance upon any forward-looking statements, which speak only as of the dates made. Endologix undertakes no commitment to update or revise the forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law.

DISCLOSURES Endologix products and associated components are not available in all countries or regions. Please contact your Endologix representative for details regarding product availability. Prior to use, refer to the “Instructions for Use” for complete and specific indications, contraindications, all warnings and precautions. Rx only. CAUTION: The Nellix® EndoVascular Aneurysm Sealing System is an investigational device in the USA. Limited by federal (or United States) law to investigational use only. It is not currently commercially available in any market. CAUTION: The Ovation Alto™ Abdominal Stent Graft System is an investigational device. Limited by federal (or United States) law to investigational use only. CAUTION: Next Gen EVAS and Nellix® ChEVAS are pipeline technologies and are not currently approved for commercial purposes in any market. © 2020 Endologix, Inc. All Rights Reserved.

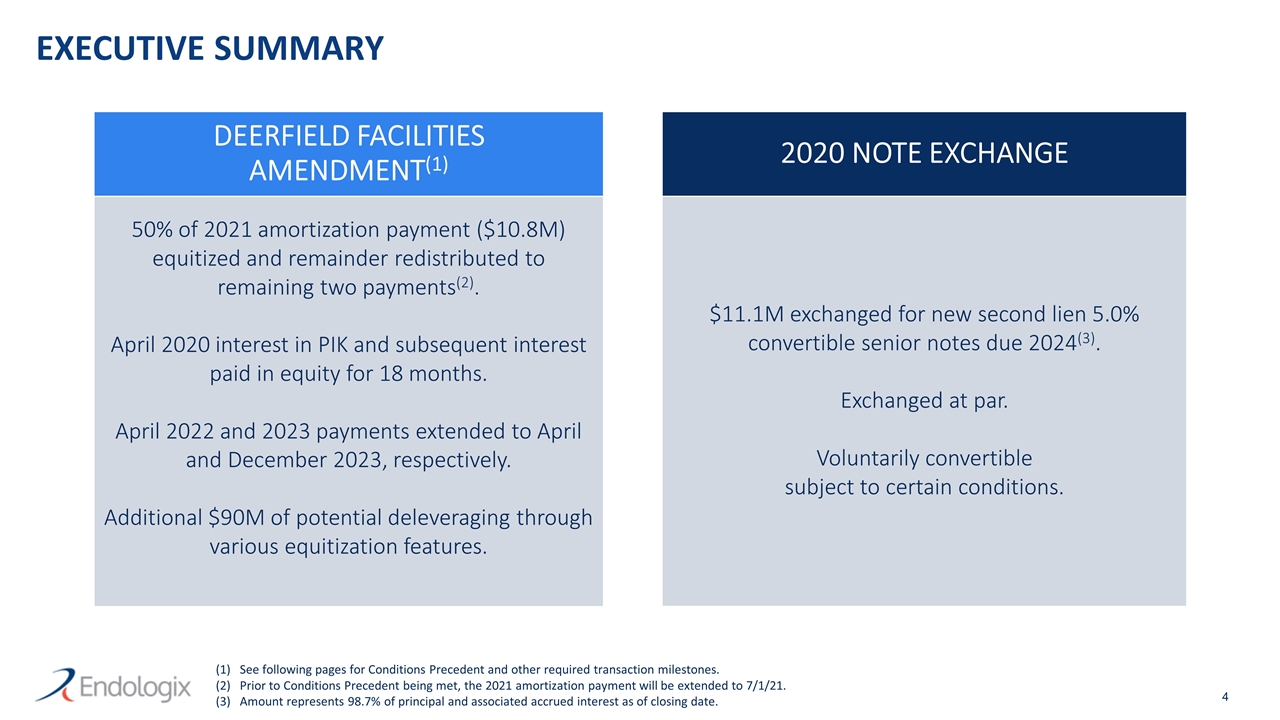

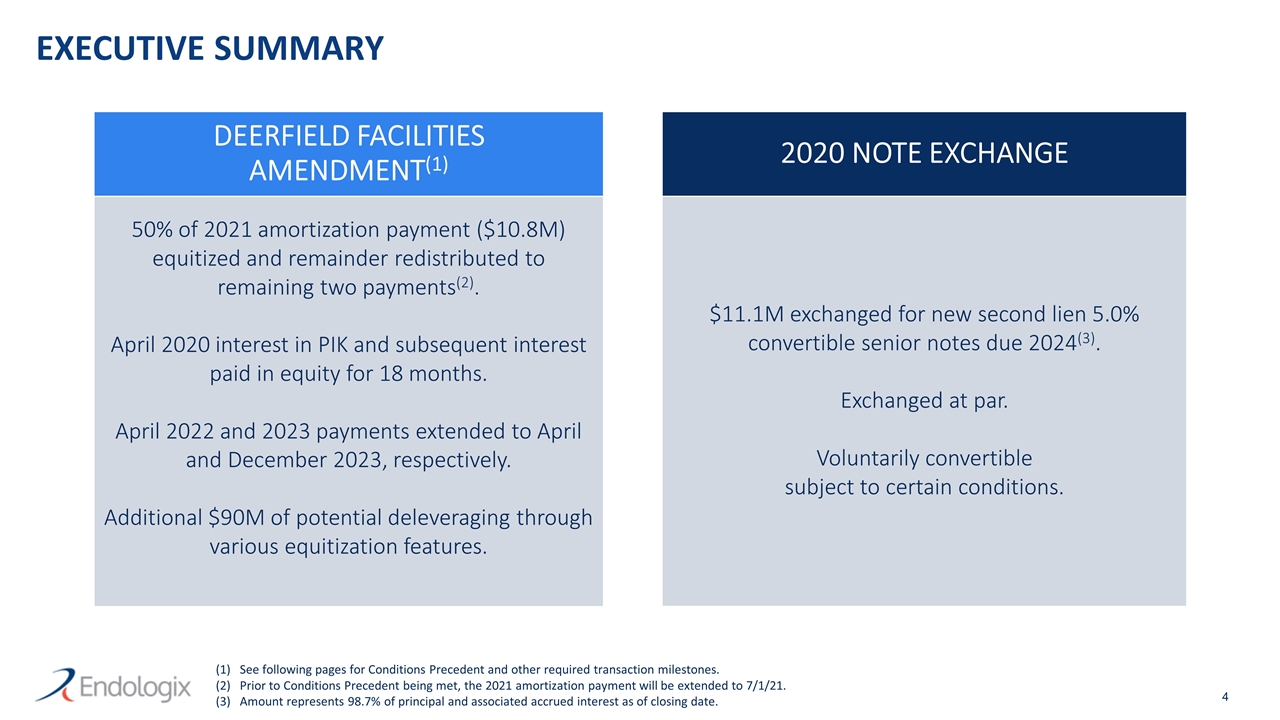

EXECUTIVE SUMMARY 50% of 2021 amortization payment ($10.8M) equitized and remainder redistributed to remaining two payments(2). April 2020 interest in PIK and subsequent interest paid in equity for 18 months. April 2022 and 2023 payments extended to April and December 2023, respectively. Additional $90M of potential deleveraging through various equitization features. DEERFIELD FACILITIES AMENDMENT(1) $11.1M exchanged for new second lien 5.0% convertible senior notes due 2024(3). Exchanged at par. Voluntarily convertible subject to certain conditions. 2020 NOTE EXCHANGE See following pages for Conditions Precedent and other required transaction milestones. Prior to Conditions Precedent being met, the 2021 amortization payment will be extended to 7/1/21. Amount represents 98.7% of principal and associated accrued interest as of closing date.

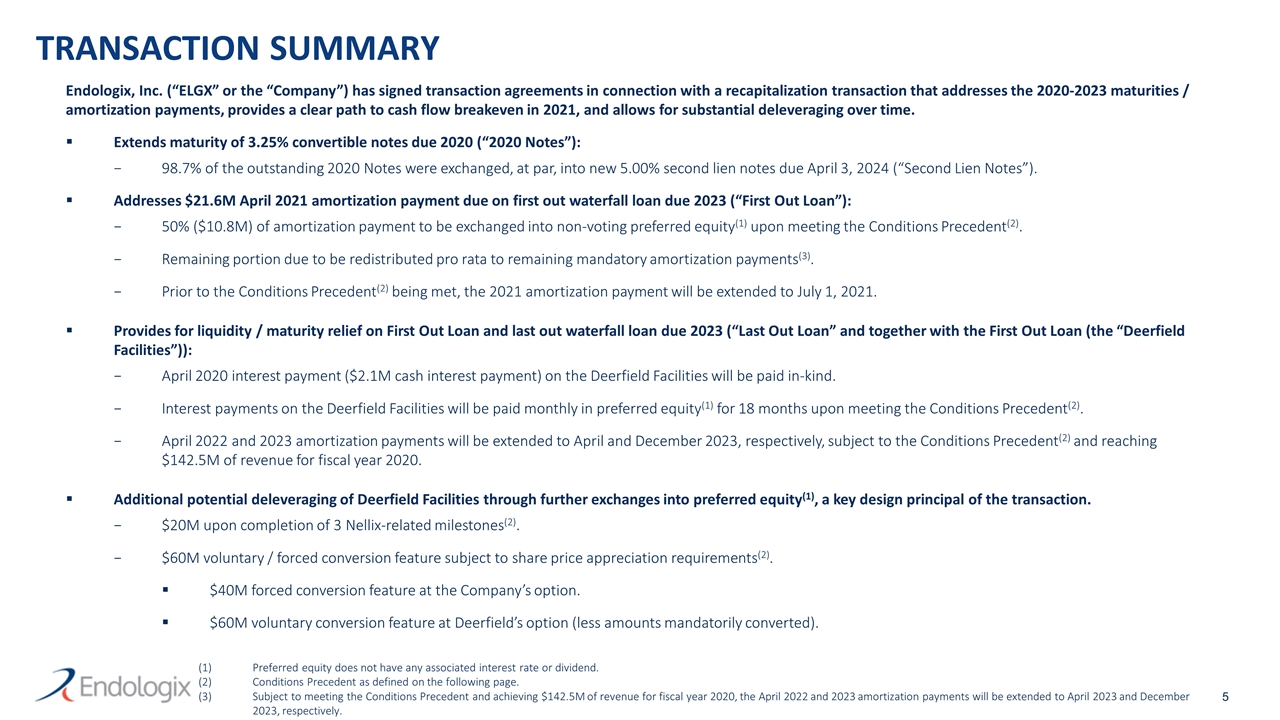

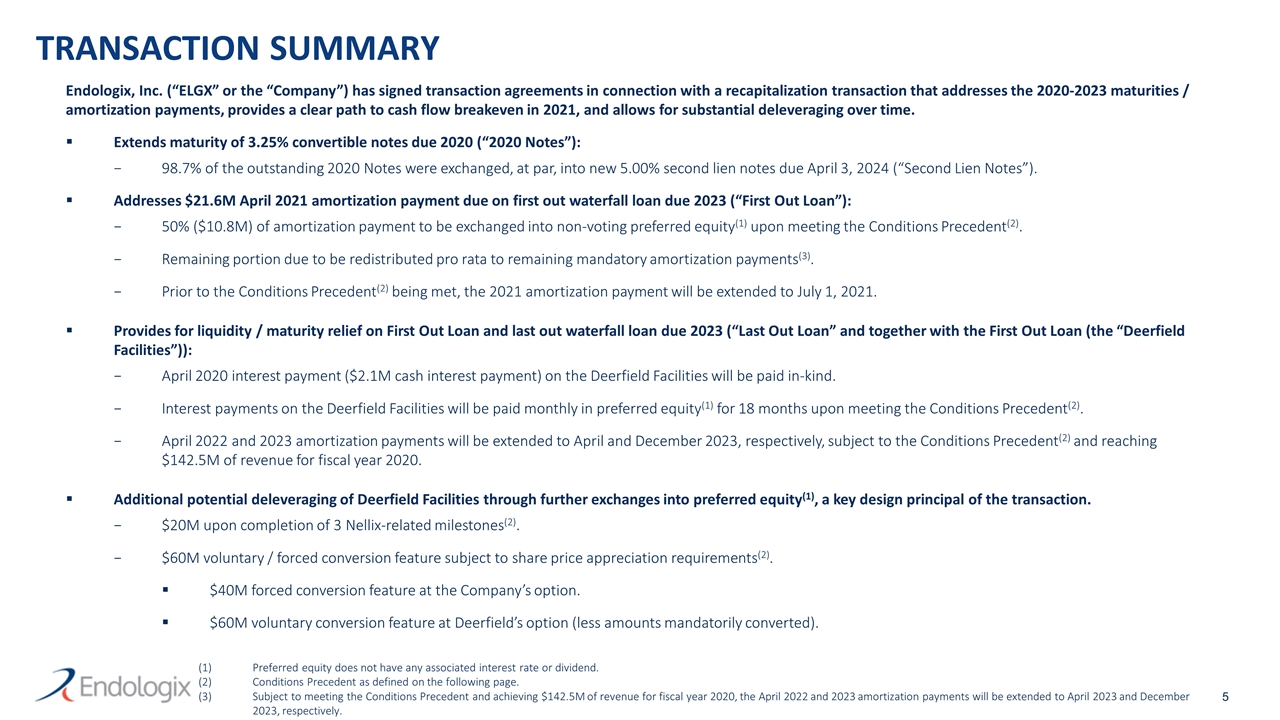

TRANSACTION SUMMARY Endologix, Inc. (“ELGX” or the “Company”) has signed transaction agreements in connection with a recapitalization transaction that addresses the 2020-2023 maturities / amortization payments, provides a clear path to cash flow breakeven in 2021, and allows for substantial deleveraging over time. Extends maturity of 3.25% convertible notes due 2020 (“2020 Notes”): 98.7% of the outstanding 2020 Notes were exchanged, at par, into new 5.00% second lien notes due April 3, 2024 (“Second Lien Notes”). Addresses $21.6M April 2021 amortization payment due on first out waterfall loan due 2023 (“First Out Loan”): 50% ($10.8M) of amortization payment to be exchanged into non-voting preferred equity(1) upon meeting the Conditions Precedent(2). Remaining portion due to be redistributed pro rata to remaining mandatory amortization payments(3). Prior to the Conditions Precedent(2) being met, the 2021 amortization payment will be extended to July 1, 2021. Provides for liquidity / maturity relief on First Out Loan and last out waterfall loan due 2023 (“Last Out Loan” and together with the First Out Loan (the “Deerfield Facilities”)): April 2020 interest payment ($2.1M cash interest payment) on the Deerfield Facilities will be paid in-kind. Interest payments on the Deerfield Facilities will be paid monthly in preferred equity(1) for 18 months upon meeting the Conditions Precedent(2). April 2022 and 2023 amortization payments will be extended to April and December 2023, respectively, subject to the Conditions Precedent(2) and reaching $142.5M of revenue for fiscal year 2020. Additional potential deleveraging of Deerfield Facilities through further exchanges into preferred equity(1), a key design principal of the transaction. $20M upon completion of 3 Nellix-related milestones(2). $60M voluntary / forced conversion feature subject to share price appreciation requirements(2). $40M forced conversion feature at the Company’s option. $60M voluntary conversion feature at Deerfield’s option (less amounts mandatorily converted). Preferred equity does not have any associated interest rate or dividend. Conditions Precedent as defined on the following page. Subject to meeting the Conditions Precedent and achieving $142.5M of revenue for fiscal year 2020, the April 2022 and 2023 amortization payments will be extended to April 2023 and December 2023, respectively.

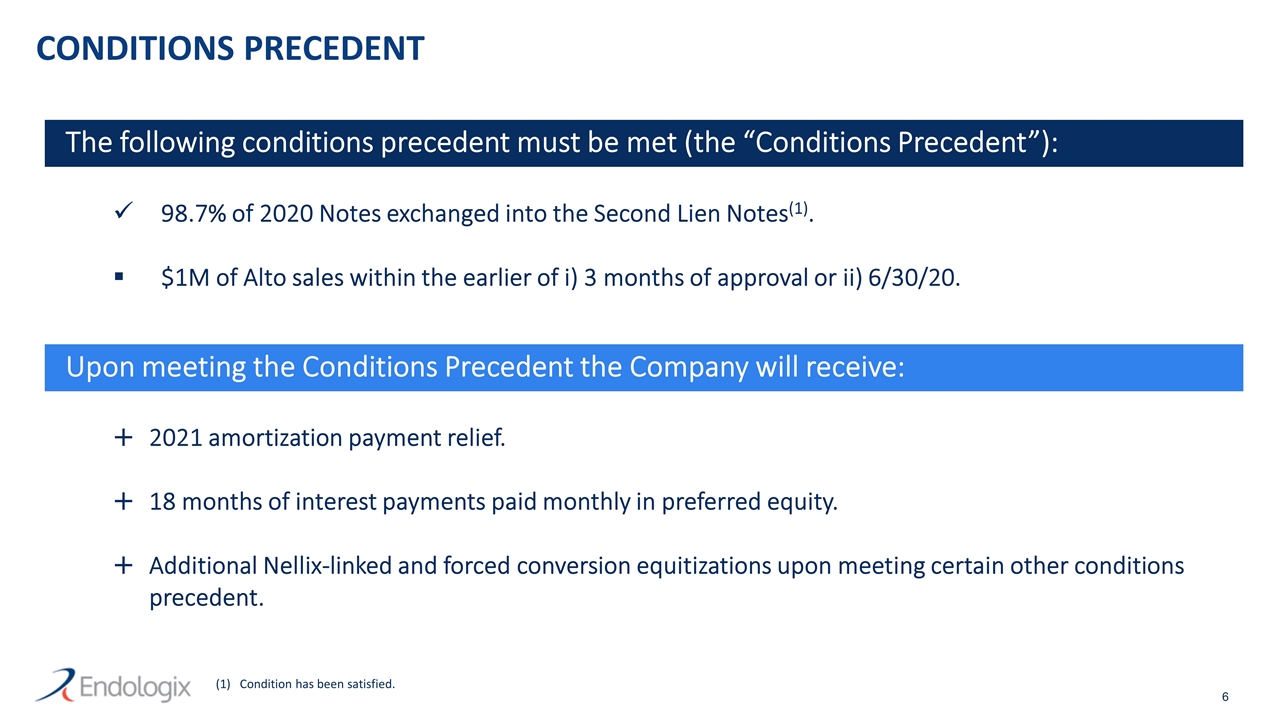

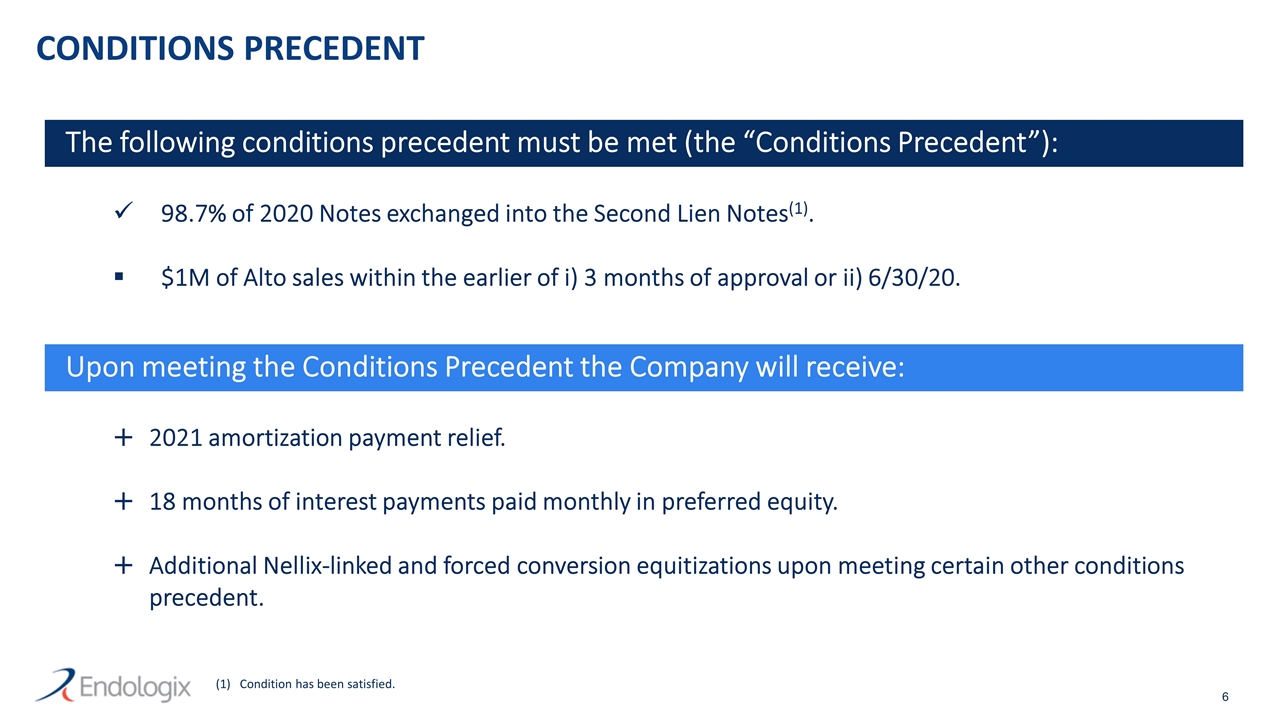

CONDITIONS PRECEDENT The following conditions precedent must be met (the “Conditions Precedent”): 98.7% of 2020 Notes exchanged into the Second Lien Notes(1). $1M of Alto sales within the earlier of i) 3 months of approval or ii) 6/30/20. Upon meeting the Conditions Precedent the Company will receive: 2021 amortization payment relief. 18 months of interest payments paid monthly in preferred equity. Additional Nellix-linked and forced conversion equitizations upon meeting certain other conditions precedent. The following conditions precedent must be met (the “Conditions Precedent”): Upon meeting the Conditions Precedent the Company will receive: Condition has been satisfied.

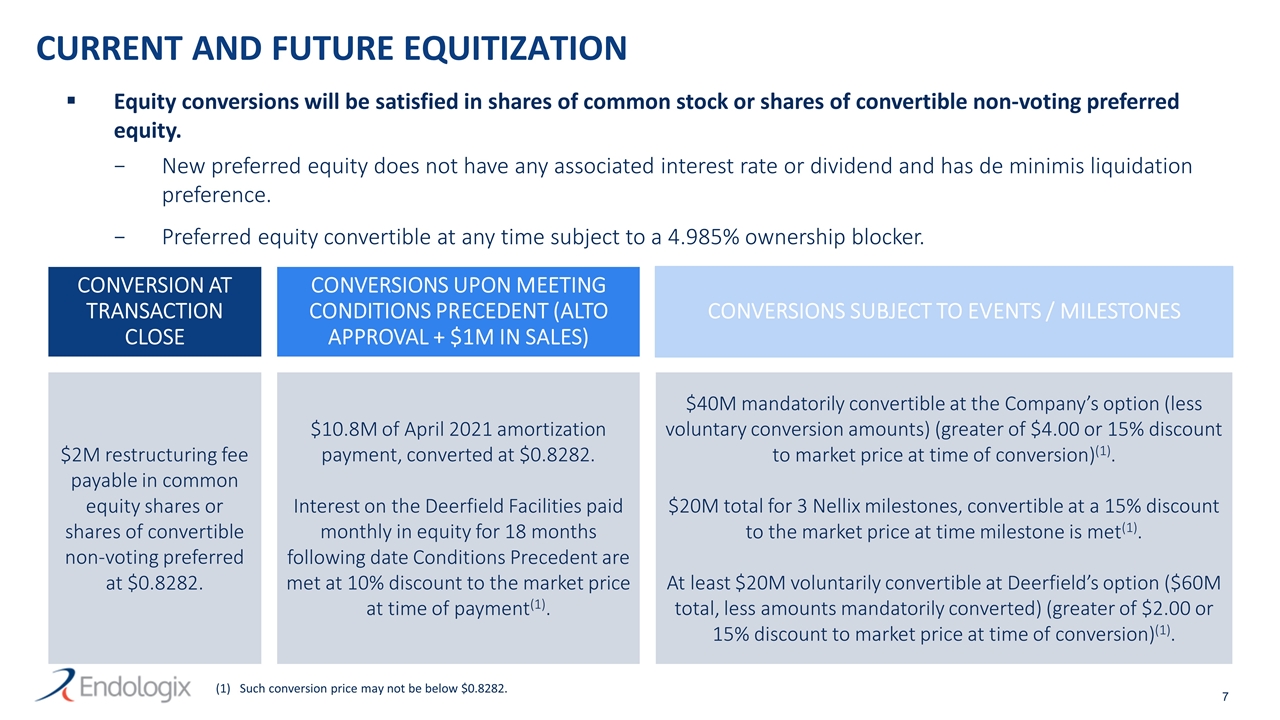

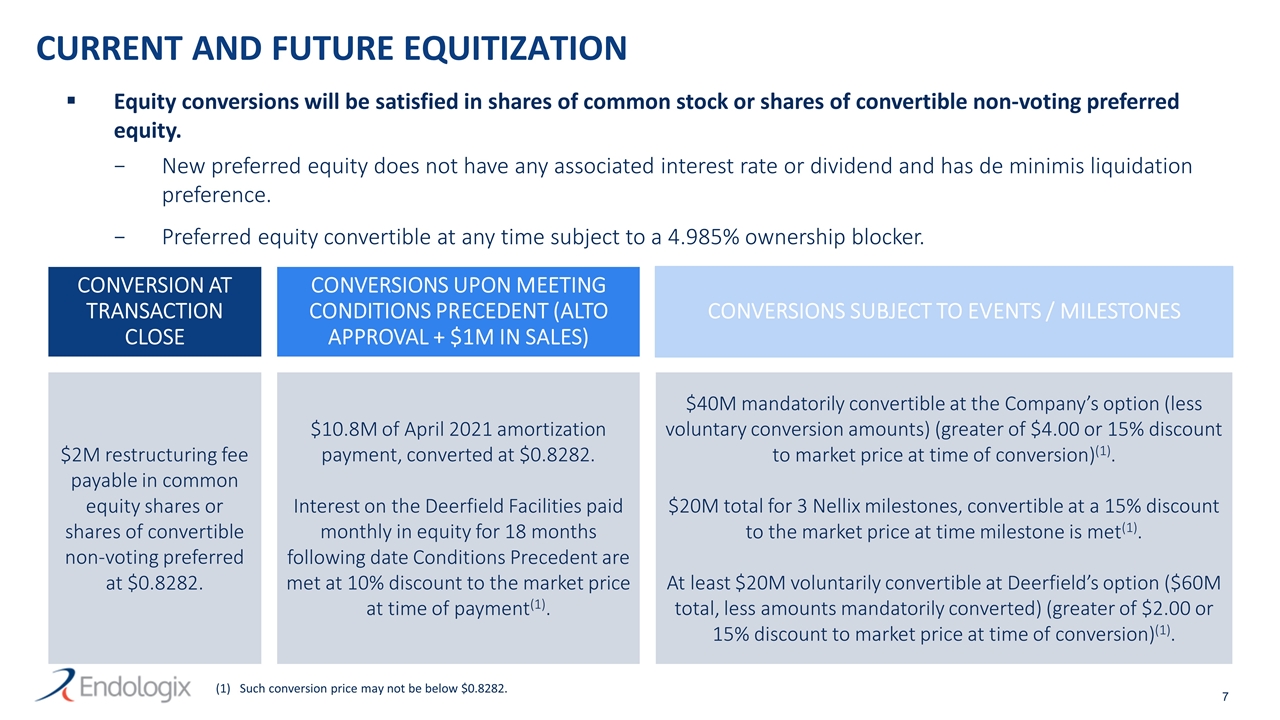

CURRENT AND FUTURE EQUITIZATION Equity conversions will be satisfied in shares of common stock or shares of convertible non-voting preferred equity. New preferred equity does not have any associated interest rate or dividend and has de minimis liquidation preference. Preferred equity convertible at any time subject to a 4.985% ownership blocker. $2M restructuring fee payable in common equity shares or shares of convertible non-voting preferred at $0.8282. CONVERSION AT TRANSACTION CLOSE CONVERSIONS UPON MEETING CONDITIONS PRECEDENT (ALTO APPROVAL + $1M IN SALES) CONVERSIONS SUBJECT TO EVENTS / MILESTONES $10.8M of April 2021 amortization payment, converted at $0.8282. Interest on the Deerfield Facilities paid monthly in equity for 18 months following date Conditions Precedent are met at 10% discount to the market price at time of payment(1). $40M mandatorily convertible at the Company’s option (less voluntary conversion amounts) (greater of $4.00 or 15% discount to market price at time of conversion)(1). $20M total for 3 Nellix milestones, convertible at a 15% discount to the market price at time milestone is met(1). At least $20M voluntarily convertible at Deerfield’s option ($60M total, less amounts mandatorily converted) (greater of $2.00 or 15% discount to market price at time of conversion)(1). Such conversion price may not be below $0.8282.

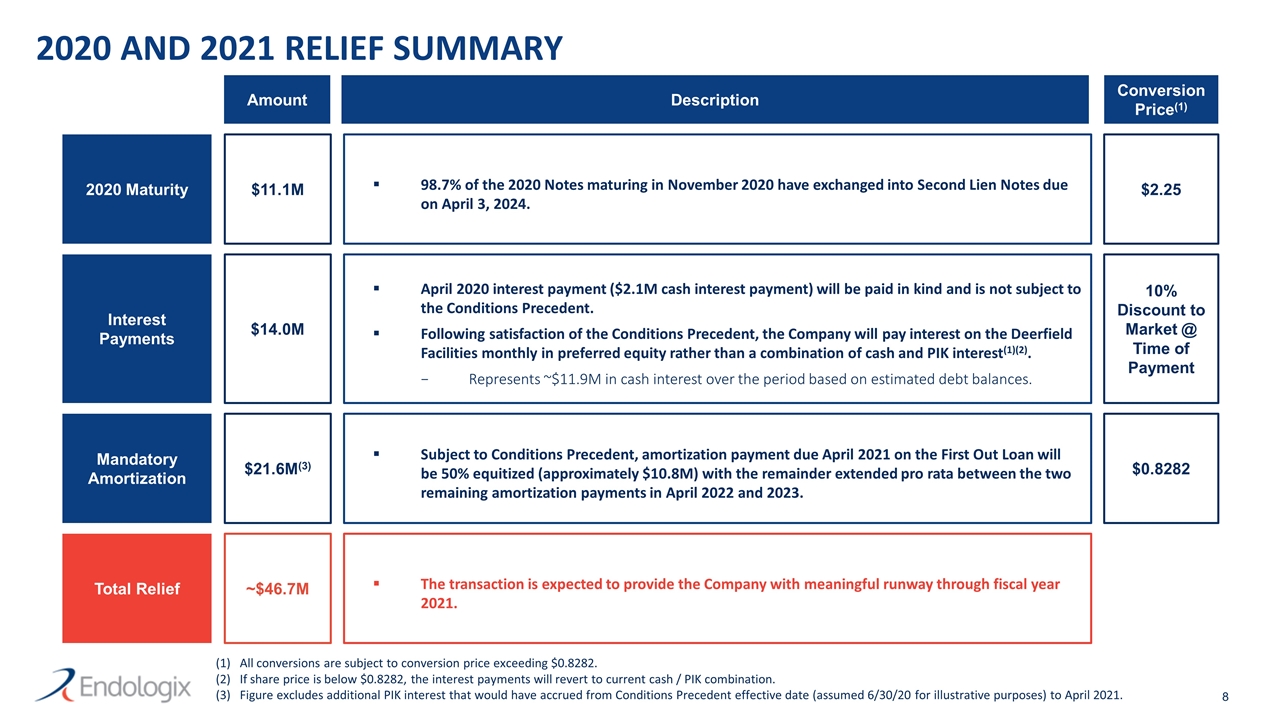

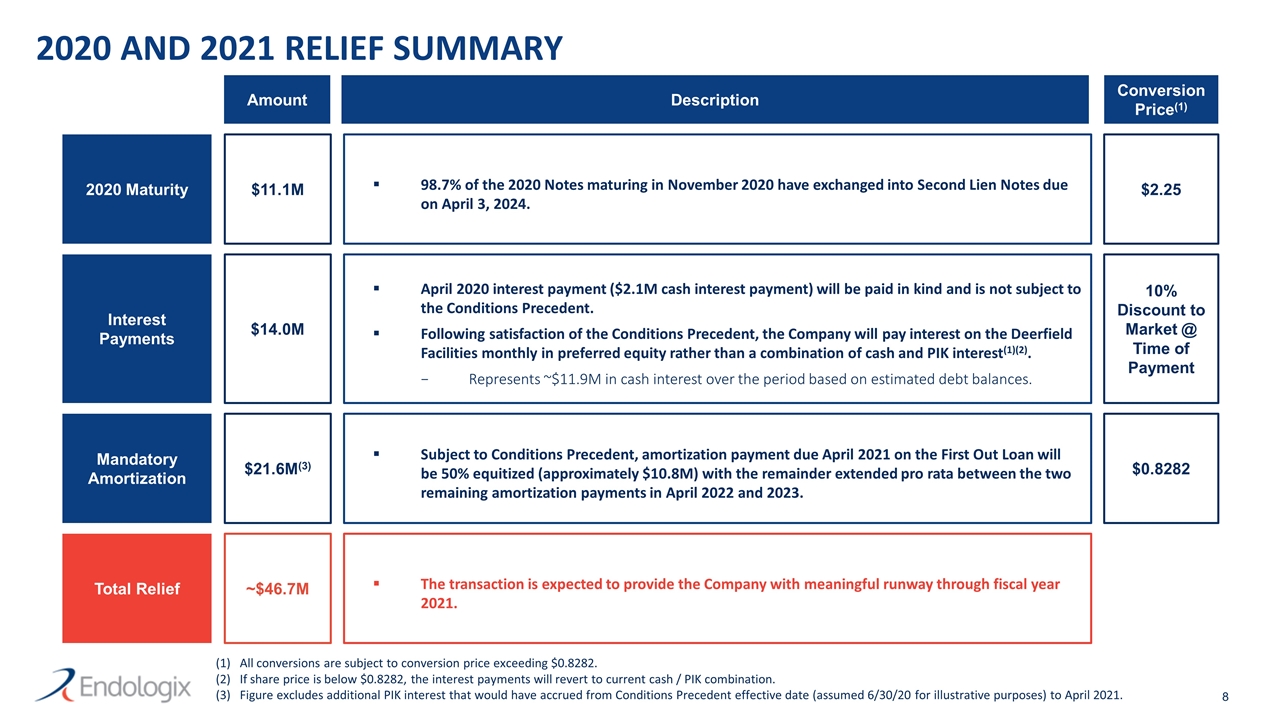

2020 AND 2021 RELIEF SUMMARY All conversions are subject to conversion price exceeding $0.8282. If share price is below $0.8282, the interest payments will revert to current cash / PIK combination. Figure excludes additional PIK interest that would have accrued from Conditions Precedent effective date (assumed 6/30/20 for illustrative purposes) to April 2021. $11.1M 98.7% of the 2020 Notes maturing in November 2020 have exchanged into Second Lien Notes due on April 3, 2024. $14.0M April 2020 interest payment ($2.1M cash interest payment) will be paid in kind and is not subject to the Conditions Precedent. Following satisfaction of the Conditions Precedent, the Company will pay interest on the Deerfield Facilities monthly in preferred equity rather than a combination of cash and PIK interest(1)(2). Represents ~$11.9M in cash interest over the period based on estimated debt balances. $21.6M(3) Subject to Conditions Precedent, amortization payment due April 2021 on the First Out Loan will be 50% equitized (approximately $10.8M) with the remainder extended pro rata between the two remaining amortization payments in April 2022 and 2023. ~$46.7M The transaction is expected to provide the Company with meaningful runway through fiscal year 2021. 2020 Maturity Interest Payments Mandatory Amortization Total Relief $2.25 10% Discount to Market @ Time of Payment $0.8282 Amount Description Conversion Price(1)

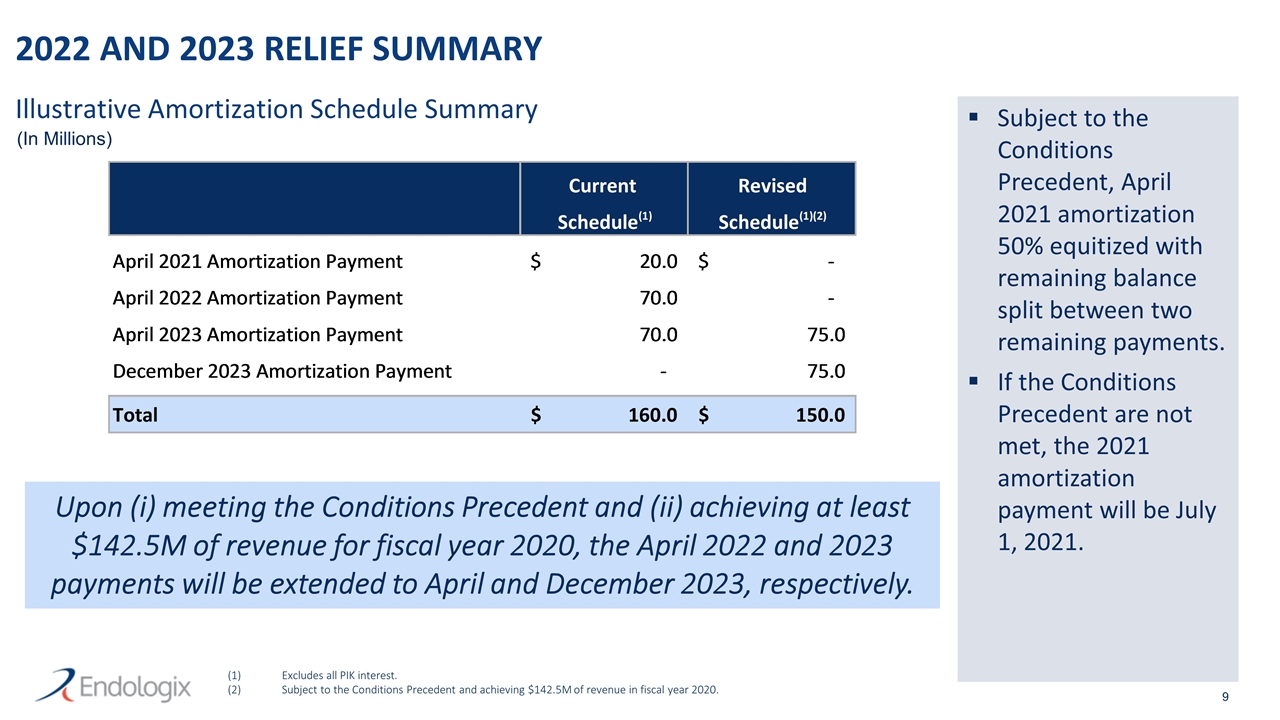

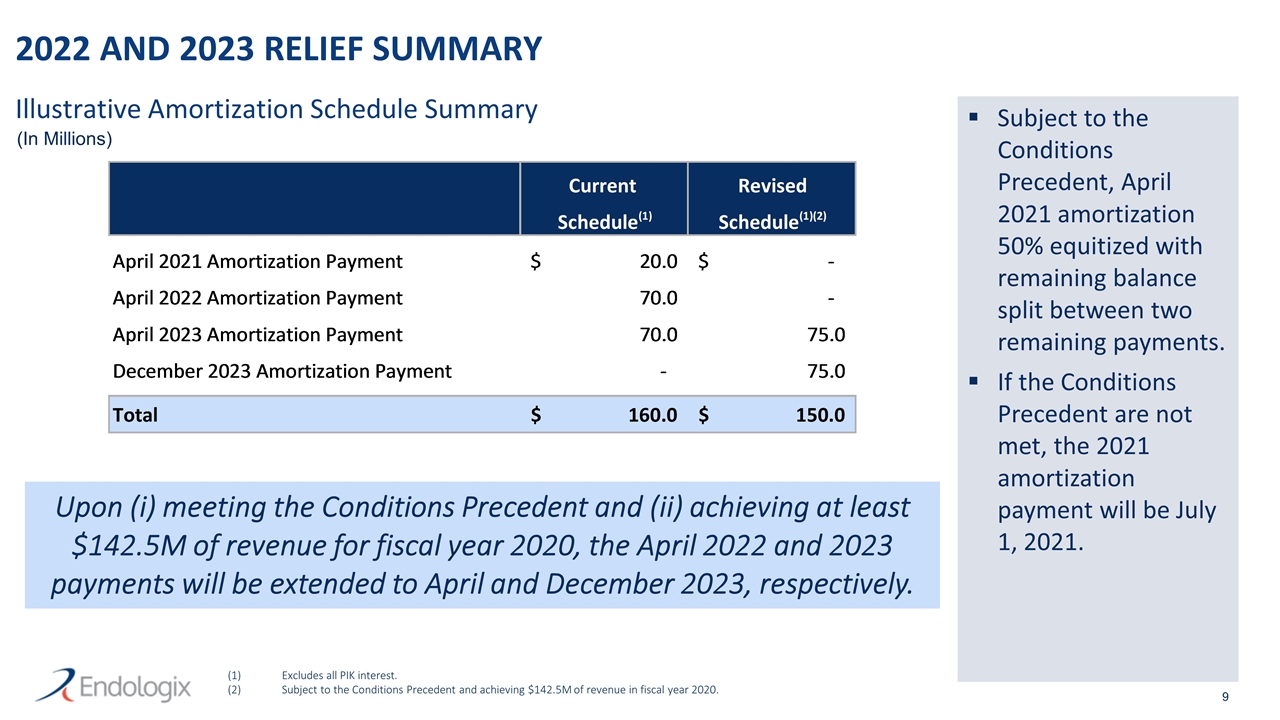

2022 AND 2023 RELIEF SUMMARY Subject to the Conditions Precedent, April 2021 amortization 50% equitized with remaining balance split between two remaining payments. If the Conditions Precedent are not met, the 2021 amortization payment will be July 1, 2021. Illustrative Amortization Schedule Summary Excludes all PIK interest. Subject to the Conditions Precedent and achieving $142.5M of revenue in fiscal year 2020. Upon (i) meeting the Conditions Precedent and (ii) achieving at least $142.5M of revenue for fiscal year 2020, the April 2022 and 2023 payments will be extended to April and December 2023, respectively. (In Millions)

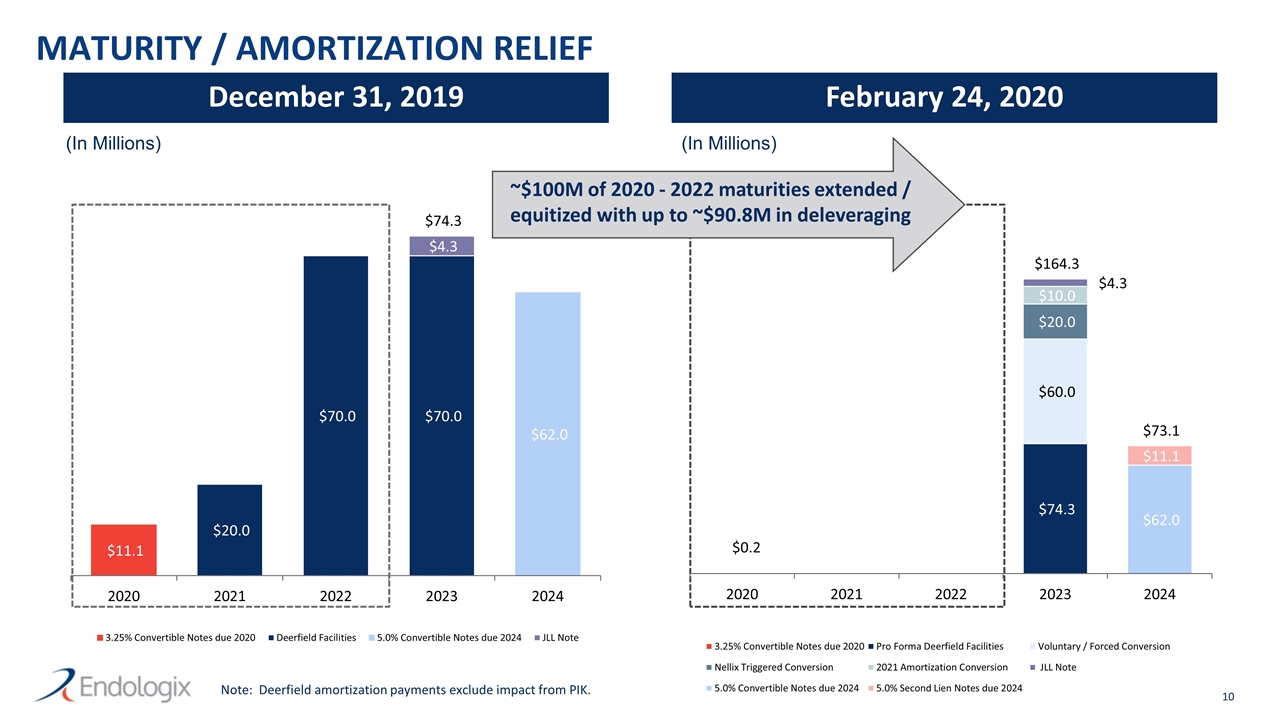

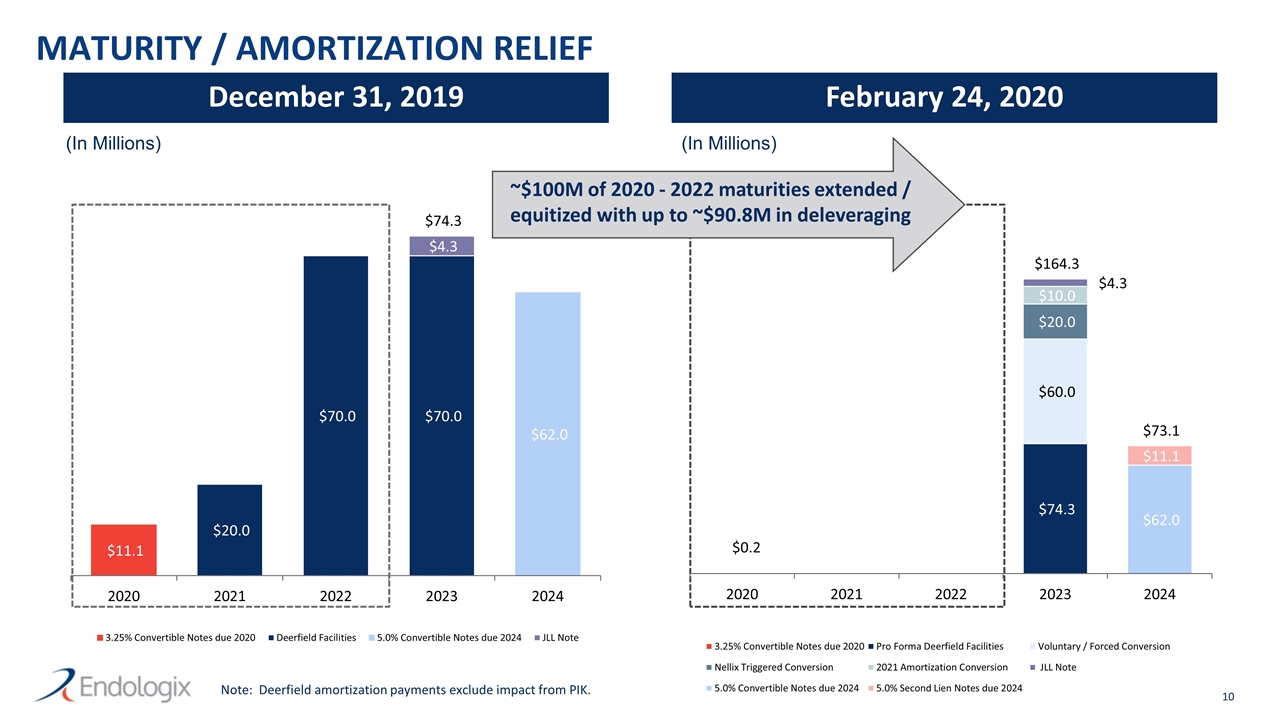

MATURITY / AMORTIZATION RELIEF Note: Deerfield amortization payments exclude impact from PIK. December 31, 2019 February 24, 2020 ~$100M of 2020 - 2022 maturities extended / equitized with up to ~$90.8M in deleveraging (In Millions) (In Millions)

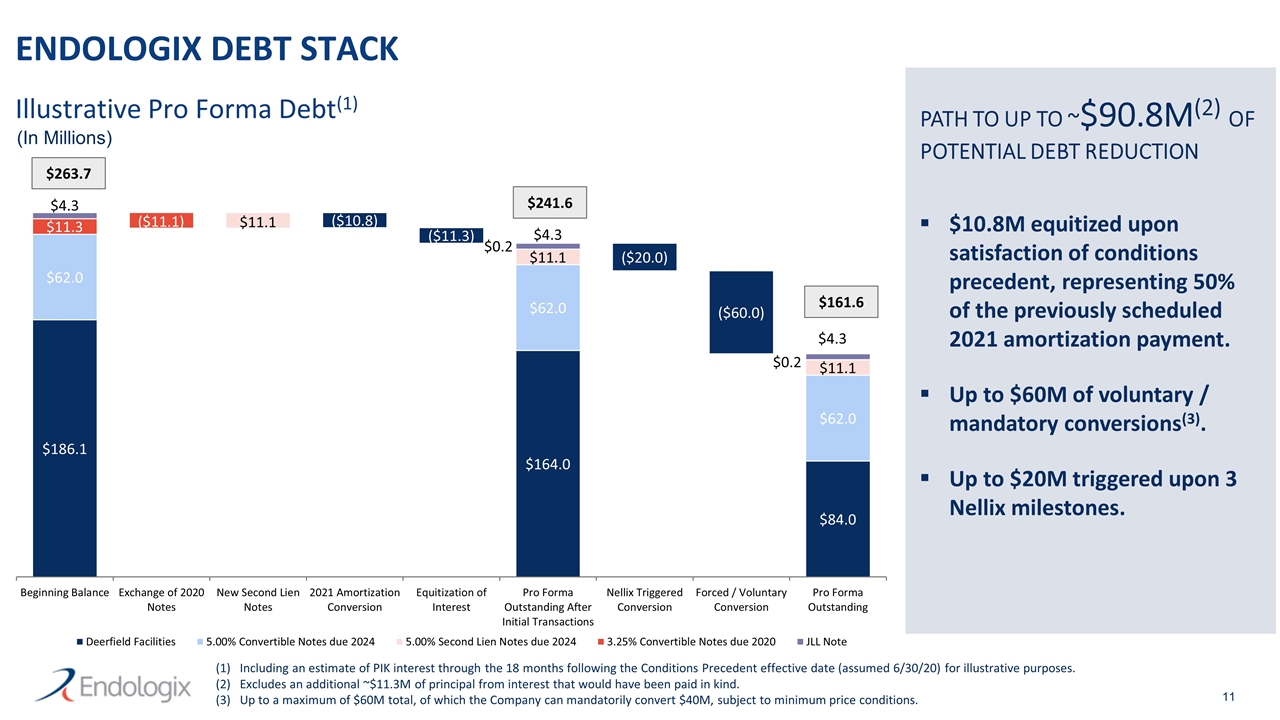

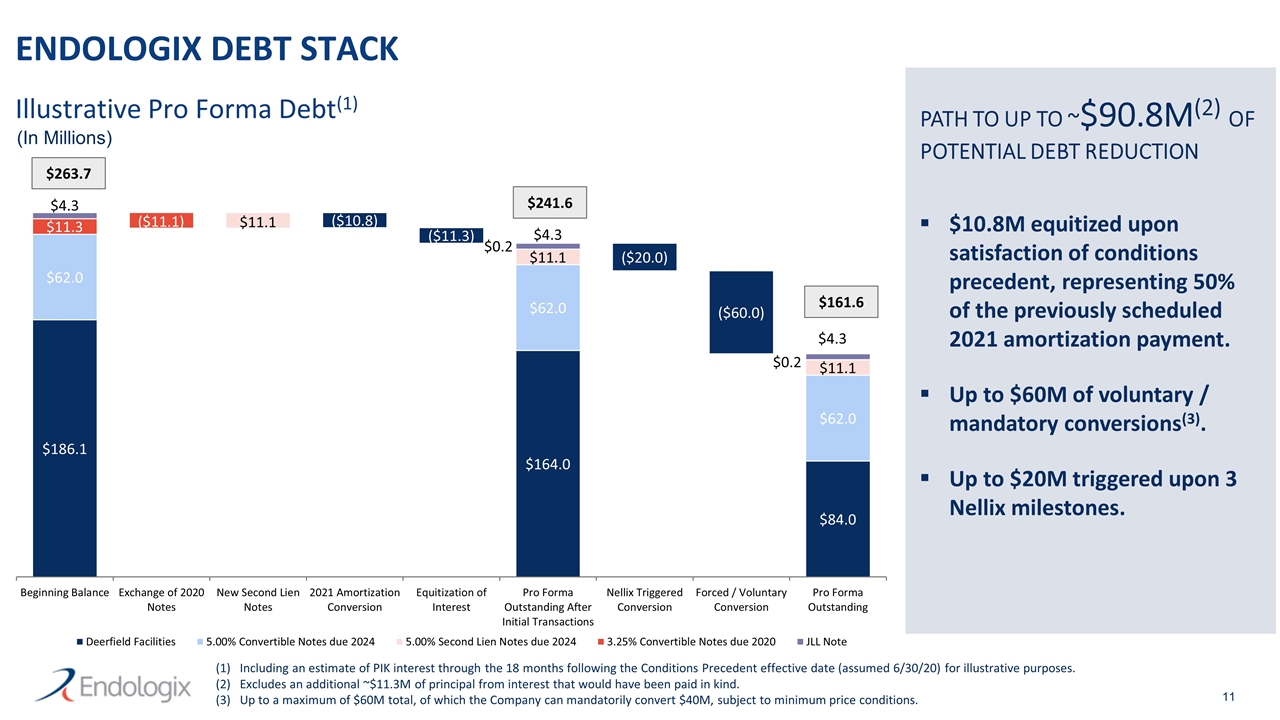

ENDOLOGIX DEBT STACK PATH TO UP TO ~$90.8M(2) OF POTENTIAL DEBT REDUCTION Illustrative Pro Forma Debt(1) $10.8M equitized upon satisfaction of conditions precedent, representing 50% of the previously scheduled 2021 amortization payment. Up to $60M of voluntary / mandatory conversions(3). Up to $20M triggered upon 3 Nellix milestones. Including an estimate of PIK interest through the 18 months following the Conditions Precedent effective date (assumed 6/30/20) for illustrative purposes. Excludes an additional ~$11.3M of principal from interest that would have been paid in kind. Up to a maximum of $60M total, of which the Company can mandatorily convert $40M, subject to minimum price conditions. $241.6 $161.6 $263.7 (In Millions)

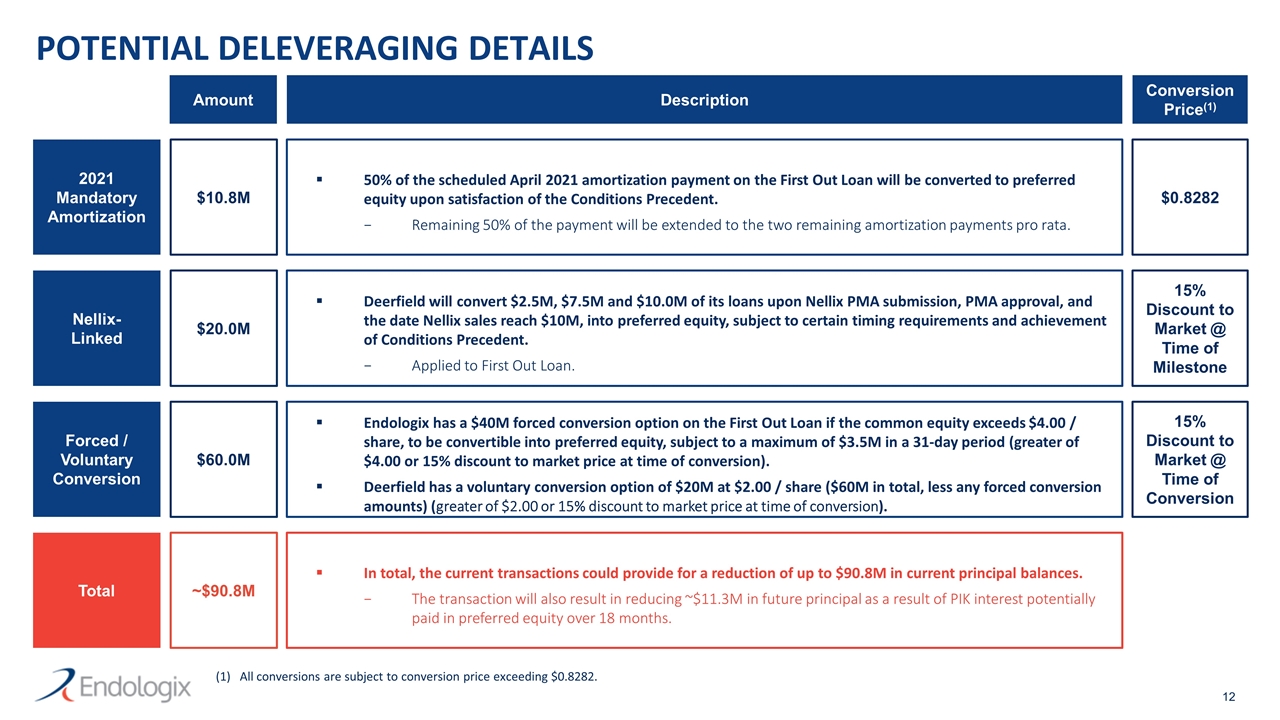

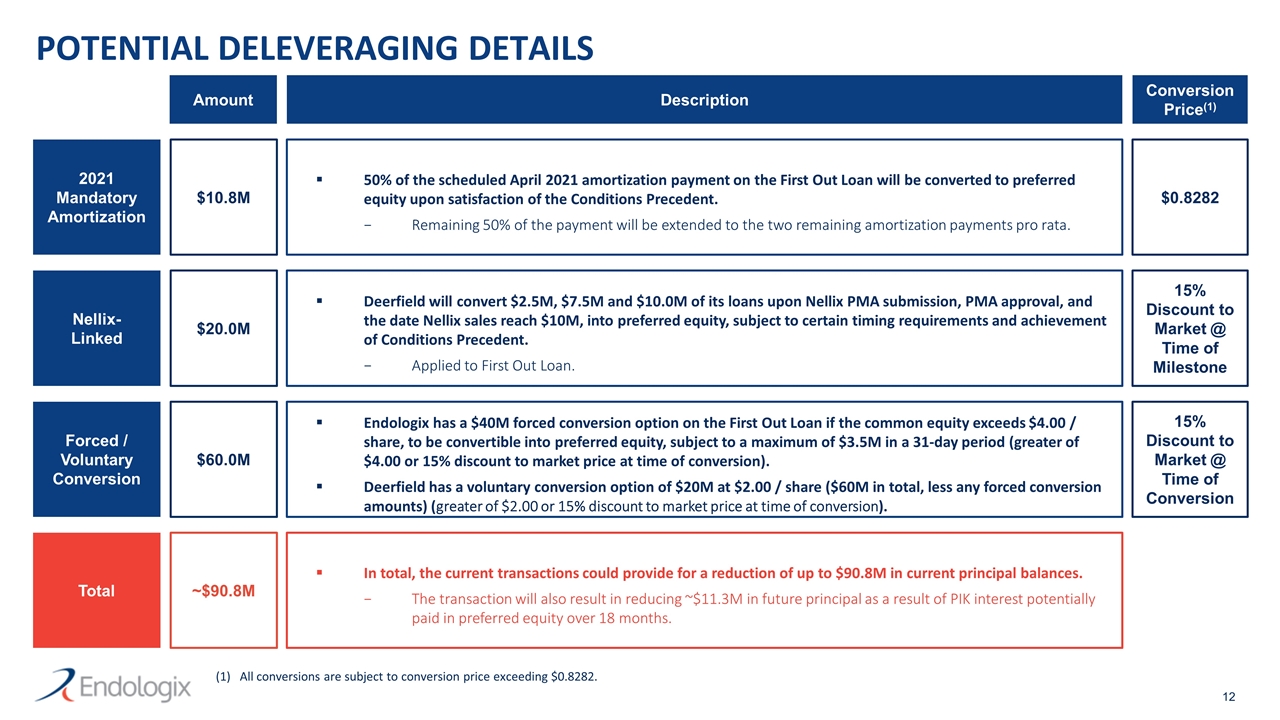

POTENTIAL DELEVERAGING DETAILS 2021 Mandatory Amortization Nellix- Linked Forced / Voluntary Conversion 50% of the scheduled April 2021 amortization payment on the First Out Loan will be converted to preferred equity upon satisfaction of the Conditions Precedent. Remaining 50% of the payment will be extended to the two remaining amortization payments pro rata. Deerfield will convert $2.5M, $7.5M and $10.0M of its loans upon Nellix PMA submission, PMA approval, and the date Nellix sales reach $10M, into preferred equity, subject to certain timing requirements and achievement of Conditions Precedent. Applied to First Out Loan. Endologix has a $40M forced conversion option on the First Out Loan if the common equity exceeds $4.00 / share, to be convertible into preferred equity, subject to a maximum of $3.5M in a 31-day period (greater of $4.00 or 15% discount to market price at time of conversion). Deerfield has a voluntary conversion option of $20M at $2.00 / share ($60M in total, less any forced conversion amounts) (greater of $2.00 or 15% discount to market price at time of conversion). Total In total, the current transactions could provide for a reduction of up to $90.8M in current principal balances. The transaction will also result in reducing ~$11.3M in future principal as a result of PIK interest potentially paid in preferred equity over 18 months. $10.8M $20.0M $60.0M ~$90.8M $0.8282 15% Discount to Market @ Time of Milestone 15% Discount to Market @ Time of Conversion Amount Description Conversion Price(1) All conversions are subject to conversion price exceeding $0.8282.

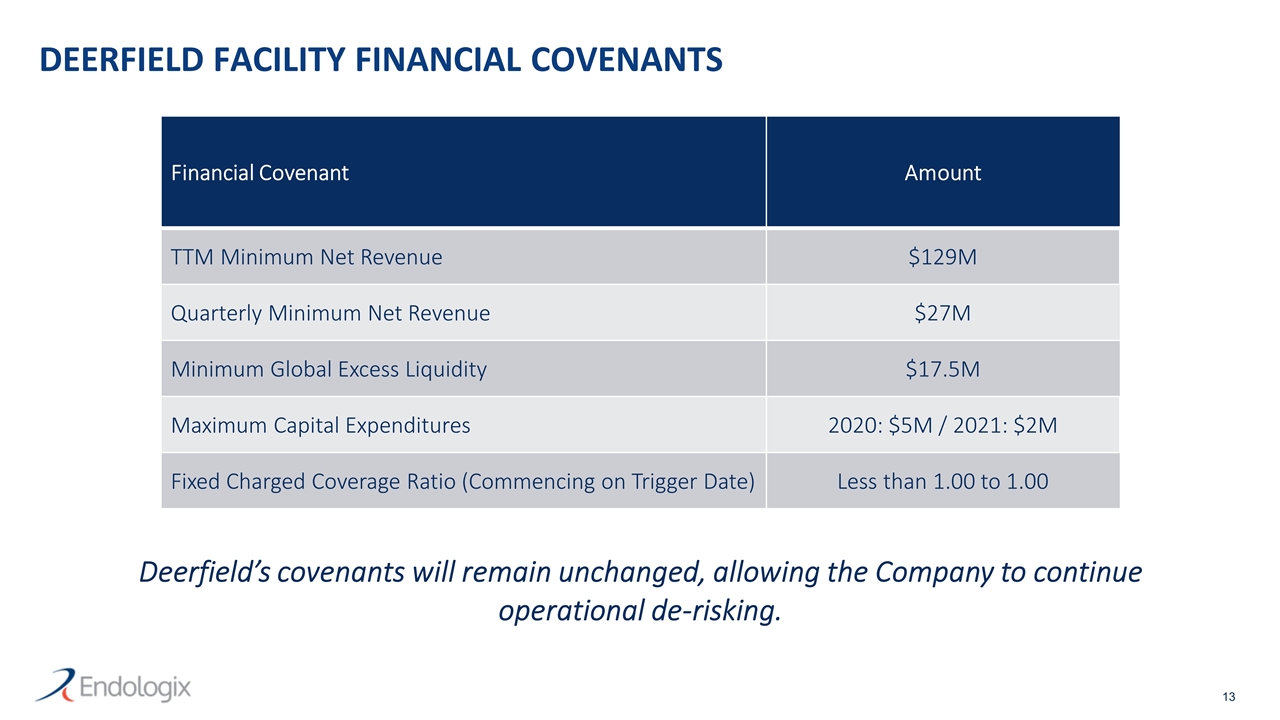

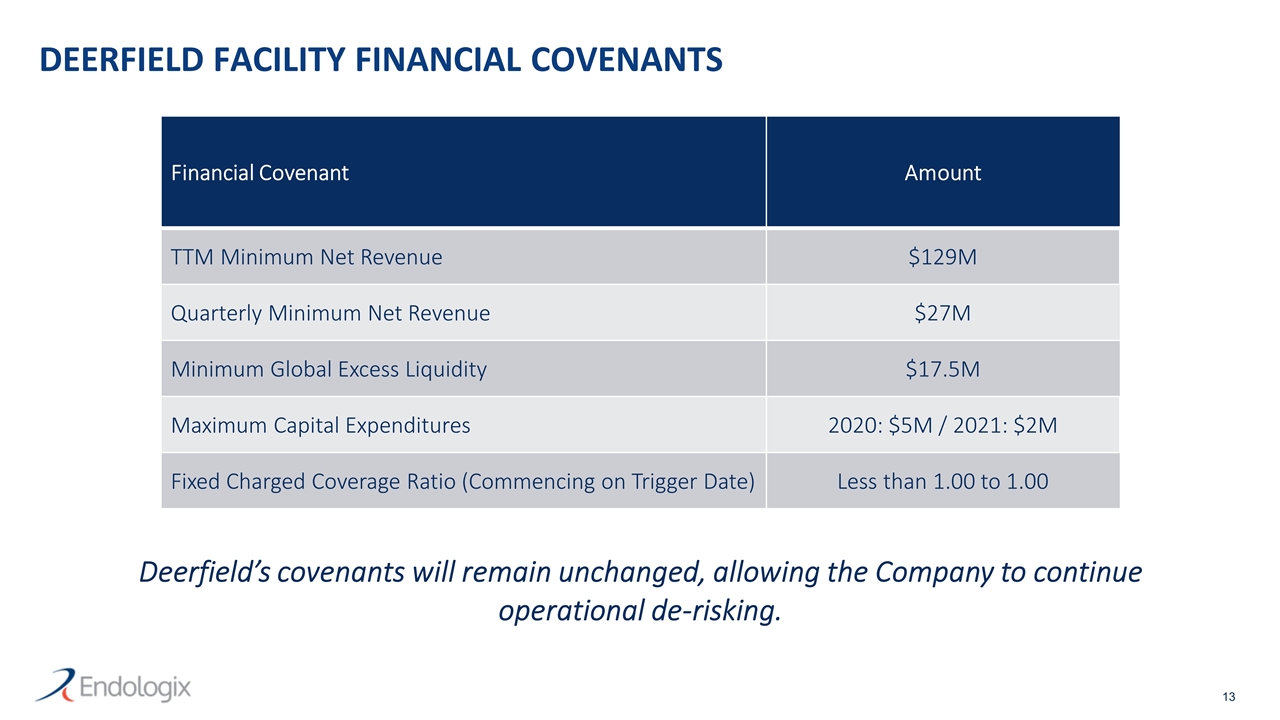

DEERFIELD FACILITY FINANCIAL COVENANTS Financial Covenant Amount TTM Minimum Net Revenue $129M Quarterly Minimum Net Revenue $27M Minimum Global Excess Liquidity $17.5M Maximum Capital Expenditures 2020: $5M / 2021: $2M Fixed Charged Coverage Ratio (Commencing on Trigger Date) Less than 1.00 to 1.00 Deerfield’s covenants will remain unchanged, allowing the Company to continue operational de-risking.