| FREE WRITING PROSPECTUS | ||

| FILED PURSUANT TO RULE 433 | ||

| REGISTRATION FILE NO.: 333-190246-11 | ||

| Dated December 5, 2014 | JPMBB 2014-C26 |

Free Writing Prospectus Structural and Collateral Term Sheet | ||

JPMBB 2014-C26 | ||

$1,449,606,872 (Approximate Mortgage Pool Balance) | ||

$1,224,918,000 (Approximate Offered Certificates) | ||

J.P. Morgan Chase Commercial Mortgage Securities Corp. Depositor | ||

| | ||

COMMERCIAL MORTGAGE PASS-THROUGH CERTIFICATES SERIES 2014-C26 | ||

| | ||

JPMorgan Chase Bank, National Association Column Financial, Inc. Barclays Bank PLC Redwood Commercial Mortgage Corporation General Electric Capital Corporation RAIT Funding, LLC Mortgage Loan Sellers | ||

J.P. Morgan Co-Lead Manager and Joint Bookrunner | Barclays Co-Lead Manager and Joint Bookrunner | Credit Suisse Co-Lead Manager and Joint Bookrunner |

Drexel Hamilton Co-Manager | ||

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

| Dated December 5, 2014 | JPMBB 2014-C26 |

This material is for your information, and none of J.P. Morgan Securities LLC (“JPMS”), Barclays Capital Inc. (“Barclays”), Credit Suisse Securities (USA) LLC (“Credit Suisse”) and Drexel Hamilton, LLC (“Drexel”) (each individually, an “Underwriter”, and together, the ‘‘Underwriters’’) is soliciting any action based upon it. This material is not to be construed as an offer to sell or the solicitation of any offer to buy any security in any jurisdiction where such an offer or solicitation would be illegal.

The Depositor has filed a registration statement (including a prospectus) with the SEC (SEC File no. 333-190246) for the offering to which this free writing prospectus relates. Before you invest, you should read the prospectus in the registration statement and other documents the Depositor has filed with the SEC for more complete information about the Depositor, the issuing trust and this offering. You may get these documents for free by visiting EDGAR on the SEC Web site at www.sec.gov. Alternatively, the Depositor or any Underwriter or any dealer participating in the offering will arrange to send you the prospectus if you request it by calling 1 (866) 400-7834 or by emailing cmbs-prospectus@jpmorgan.com.

Neither this document nor anything contained in this document shall form the basis for any contract or commitment whatsoever. The information contained in this document is preliminary as of the date of this document, supersedes any previous such information delivered to you and will be superseded by any such information subsequently delivered prior to the time of sale. These materials are subject to change, completion or amendment from time to time.

The attached information contains certain tables and other statistical analyses (the “Computational Materials”) that have been prepared in reliance upon information furnished by the Mortgage Loan Sellers. Numerous assumptions were used in preparing the Computational Materials, which may or may not be reflected in this document. The Computational Materials should not be construed as either projections or predictions or as legal, tax, financial or accounting advice. You should consult your own counsel, accountant and other advisors as to the legal, tax, business, financial and related aspects of a purchase of these certificates. Any weighted average lives, yields and principal payment periods shown in the Computational Materials are based on prepayment and/or loss assumptions, and changes in such prepayment and/or loss assumptions may dramatically affect such weighted average lives, yields and principal payment periods. In addition, it is possible that prepayments or losses on the underlying assets will occur at rates higher or lower than the rates shown in the Computational Materials. The specific characteristics of the certificates may differ from those shown in the Computational Materials due to differences between the final underlying assets and the preliminary underlying assets used in preparing the Computational Materials. The principal amount and designation of any certificate described in the Computational Materials are subject to change prior to issuance. None of the Underwriters nor any of their respective affiliates make any representation or warranty as to the actual rate or timing of payments or losses on any of the underlying assets or the payments or yield on the certificates.

This information is based upon management forecasts and reflects prevailing conditions and management’s views as of this date, all of which are subject to change.

This document contains forward-looking statements. Those statements are subject to certain risks and uncertainties that could cause the success of collections and the actual cash flow generated to differ materially from the information set forth in this document. While such information reflects projections prepared in good faith based upon methods and data that are believed to be reasonable and accurate as of their dates, the issuer undertakes no obligation to revise these forward-looking statements to reflect subsequent events or circumstances. Investors should not place undue reliance on forward-looking statements and are advised to make their own independent analysis and determination with respect to the forecasted periods, which reflect the issuer’s view only as of the date of this document.

J.P. Morgan is the marketing name for the investment banking businesses of JPMorgan Chase & Co. and its subsidiaries worldwide. Securities, syndicated loan arranging, financial advisory and other investment banking activities are performed by JPMS and its securities affiliates, and lending, derivatives and other commercial banking activities are performed by JPMorgan Chase Bank, National Association and its banking affiliates. JPMS is a member of SIPC and the NYSE.

THE CERTIFICATES REFERRED TO IN THESE MATERIALS ARE SUBJECT TO MODIFICATION OR REVISION (INCLUDING THE POSSIBILITY THAT ONE OR MORE CLASSES OF CERTIFICATES MAY BE SPLIT, COMBINED OR ELIMINATED AT ANY TIME PRIOR TO ISSUANCE OR AVAILABILITY OF A FINAL PROSPECTUS) AND ARE OFFERED ON A “WHEN, AS AND IF ISSUED” BASIS. PROSPECTIVE INVESTORS SHOULD UNDERSTAND THAT, WHEN CONSIDERING THE PURCHASE OF THESE CERTIFICATES, A CONTRACT OF SALE WILL COME INTO BEING NO SOONER THAN THE DATE ON WHICH THE RELEVANT CLASS OF CERTIFICATES HAS BEEN PRICED AND THE UNDERWRITERS HAVE CONFIRMED THE ALLOCATION OF CERTIFICATES TO BE MADE TO INVESTORS; ANY “INDICATIONS OF INTEREST” EXPRESSED BY ANY PROSPECTIVE INVESTOR, AND ANY “SOFT CIRCLES” GENERATED BY THE UNDERWRITERS, WILL NOT CREATE BINDING CONTRACTUAL OBLIGATIONS FOR SUCH PROSPECTIVE INVESTORS, ON THE ONE HAND, OR THE UNDERWRITERS, THE DEPOSITOR OR ANY OF THEIR RESPECTIVE AGENTS OR AFFILIATES, ON THE OTHER HAND.

AS A RESULT OF THE FOREGOING, A PROSPECTIVE INVESTOR MAY COMMIT TO PURCHASE CERTIFICATES THAT HAVE CHARACTERISTICS THAT MAY CHANGE, AND EACH PROSPECTIVE INVESTOR IS ADVISED THAT ALL OR A PORTION OF THE CERTIFICATES REFERRED TO IN THESE MATERIALS MAY BE ISSUED WITHOUT ALL OR CERTAIN OF THE CHARACTERISTICS DESCRIBED IN THESE MATERIALS. EACH UNDERWRITER’S OBLIGATION TO SELL CERTIFICATES TO ANY PROSPECTIVE INVESTOR IS CONDITIONED ON THE CERTIFICATES AND THE TRANSACTION HAVING THE CHARACTERISTICS DESCRIBED IN THESE MATERIALS. IF THE UNDERWRITERS DETERMINE THAT A CONDITION IS NOT SATISFIED IN ANY MATERIAL RESPECT, SUCH PROSPECTIVE INVESTOR WILL BE NOTIFIED, AND NEITHER THE DEPOSITOR NOR THE UNDERWRITERS WILL HAVE ANY OBLIGATION TO SUCH PROSPECTIVE INVESTOR TO DELIVER ANY PORTION OF THE CERTIFICATES THAT SUCH PROSPECTIVE INVESTOR HAS COMMITTED TO PURCHASE, AND THERE WILL BE NO LIABILITY OR OBLIGATION BETWEEN THE UNDERWRITERS, THE DEPOSITOR OR ANY OF THEIR RESPECTIVE AGENTS OR AFFILIATES, ON THE ONE HAND, AND SUCH PROSPECTIVE INVESTOR, ON THE OTHER HAND, AS A CONSEQUENCE OF THE NON-DELIVERY.

THE UNDERWRITERS MAY FROM TIME TO TIME PERFORM INVESTMENT BANKING SERVICES FOR, OR SOLICIT INVESTMENT BANKING BUSINESS FROM, ANY COMPANY NAMED IN THESE MATERIALS. THE UNDERWRITERS AND/OR THEIR AFFILIATES OR RESPECTIVE EMPLOYEES MAY FROM TIME TO TIME HAVE A LONG OR SHORT POSITION IN ANY CERTIFICATE OR CONTRACT DISCUSSED IN THESE MATERIALS.

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

|  |  |

| 1 of 133 |

| Structural and Collateral Term Sheet | JPMBB 2014-C26 |

| Indicative Capital Structure |

Publicly Offered Certificates

| Class | Expected Ratings (Moody’s / DRBS / Kroll) | Approximate Initial Certificate Balance or Notional Amount(1) | Approximate Initial Credit Support(2) | Expected Weighted Avg. Life (years)(3) | Expected Principal Window(3) | Certificate Principal to Value Ratio(4) | Underwritten NOI Debt Yield(5) | |||||

| A-1 | Aaa(sf) / AAA(sf) / AAA(sf) | $59,050,000 | 30.000% | 3.02 | 1/15-10/19 | 47.0% | 14.7% | |||||

| A-2 | Aaa(sf) / AAA(sf) / AAA(sf) | $211,650,000 | 30.000% | 4.89 | 10/19-1/20 | 47.0% | 14.7% | |||||

| A-3 | Aaa(sf) / AAA(sf) / AAA(sf) | $300,000,000 | 30.000% | 9.77 | 7/24-11/24 | 47.0% | 14.7% | |||||

| A-4 | Aaa(sf) / AAA(sf) / AAA(sf) | $337,579,000 | 30.000% | 9.89 | 11/24-12/24 | 47.0% | 14.7% | |||||

| A-SB | Aaa(sf) / AAA(sf) / AAA(sf) | $106,446,000 | 30.000% | 7.30 | 10/19-7/24 | 47.0% | 14.7% | |||||

| X-A | Aa1(sf) / AAA(sf) / AAA(sf) | $1,108,949,000(6) | N/A | N/A | N/A | N/A | N/A | |||||

| X-B | Aa3(sf) / AAA(sf) / AAA(sf) | $67,045,000(6) | N/A | N/A | N/A | N/A | N/A | |||||

A-S(7)(8) | Aa1(sf) / AAA(sf) / AAA(sf) | $94,224,000 | 23.500% | 9.96 | 12/24-12/24 | 51.4% | 13.5% | |||||

B(7)(8) | Aa3(sf) / AA(sf) / AA(sf) | $67,045,000 | 18.875% | 9.96 | 12/24-12/24 | 54.5% | 12.7% | |||||

C(7)(8) | A3(sf) / A(high)(sf) / A(sf) | $48,924,000 | 15.500% | 9.96 | 12/24-12/24 | 56.8% | 12.2% | |||||

EC(7)(8)(9) | A1(sf) / A(high)(sf) / A(sf) | $210,193,000 | 15.500% | 9.96 | 12/24-12/24 | 56.8% | 12.2% | |||||

Privately Offered Certificates(10) |

| Class | Expected Ratings (Moody’s / DBRS / Kroll) | Approximate Initial Certificate Balance or Notional Amount(1) | Approximate Initial Credit Support(2) | Expected Weighted Avg. Life (years)(3) | Expected Principal Window(3) | Certificate Principal to Value Ratio(4) | Underwritten NOI Debt Yield(5) | |||||

| X-C | A3(sf) / AAA(sf) / AAA(sf) | $48,924,000(6) | N/A | N/A | N/A | N/A | N/A | |||||

| X-D | NR / AAA(sf) / BBB-(sf) | $106,908,000(6) | N/A | N/A | N/A | N/A | N/A | |||||

| X-E | NR / AAA(sf) / BB(sf) | $34,428,000(6) | N/A | N/A | N/A | N/A | N/A | |||||

| X-F | NR / AAA(sf) / B(sf) | $25,369,000(6) | N/A | N/A | N/A | N/A | N/A | |||||

| X-NR | NR / AAA(sf) / NR | $57,983,872(6) | N/A | N/A | N/A | N/A | N/A | |||||

| D | NR / BBB(low)(sf) / BBB-(sf) | $106,908,000 | 8.125% | 9.96 | 12/24-12/24 | 61.7% | 11.2% | |||||

| E | NR / BB(sf) / BB(sf) | $34,428,000 | 5.750% | 9.96 | 12/24-12/24 | 63.3% | 10.9% | |||||

| F | NR / B(sf) / B(sf) | $25,369,000 | 4.000% | 9.96 | 12/24-1/25 | 64.5% | 10.7% | |||||

| NR | NR / NR / NR | $57,983,872 | 0.000% | 10.04 | 1/25-1/25 | 67.2% | 10.3% | |||||

Privately Offered Loan-Specific Certificates

| Class | Expected Ratings (Moody’s / DBRS / Kroll) | Approximate Initial Certificate Balance(1) | Approximate Initial Credit Support(2) | Expected Weighted Avg. Life (years)(3) | Expected Principal Window(3) | Certificate Principal to Value Ratio(4) | Underwritten NOI Debt Yield(5) | |||||

HOW(11) | NR / NR / NR | $10,000,000 | 0.000% | 9.71 | 9/24-9/24 | N/A | N/A | |||||

| (1) | In the case of each such Class, subject to a permitted variance of plus or minus 5%. |

| (2) | The credit support percentages set forth for Class A-1, Class A-2, Class A-3, Class A-4, and Class A-SB Certificates represent the approximate initial credit support for the Class A-1, Class A-2, Class A-3, Class A-4 and Class A-SB Certificates in the aggregate. The credit support percentage for each of the Publicly Offered Certificates and the Privately Offered Certificates does not include the HOW Trust Subordinate Companion Loan. |

| (3) | Assumes 0% CPR / 0% CDR and a December 29, 2014 closing date. Based on modeling assumptions as described in the Free Writing Prospectus dated December 5, 2014 (the “Free Writing Prospectus”). |

| (4) | The “Certificate Principal to Value Ratio” for any Class (other than the Class A-1, Class A-2, Class A-3, Class A-4 and Class A-SB Certificates) is calculated as the product of (a) the weighted average Cut-off Date LTV Ratio for the mortgage loans, multiplied by (b) a fraction, the numerator of which is the total initial Certificate Balance of such Class of Certificates and all Classes of Principal Balance Certificates senior to such Class of Certificates and the denominator of which is the total initial Certificate Balance of all of the Principal Balance Certificates. The Class A-1, Class A-2, Class A-3, Class A-4 and Class A-SB Certificate Principal to Value Ratios are calculated in the aggregate for those Classes as if they were a single Class. Investors should note, however, that excess mortgaged property value associated with a mortgage loan will not be available to offset losses on any other mortgage loan. |

| (5) | The “Underwritten NOI Debt Yield” for any Class (other than the Class A-1, Class A-2, Class A-3, Class A-4 and Class A-SB Certificates) is calculated as the product of (a) the weighted average UW NOI Debt Yield for the mortgage loans and (b) the total initial Certificate Balance of all of the Classes of Principal Balance Certificates divided by the total initial Certificate Balance for such Class and all Classes of Principal Balance Certificates senior to such Class of Certificates. The Underwritten NOI Debt Yield for each of the Class A-1, Class A-2, Class A-3, Class A-4 and Class A-SB Certificates is calculated in the aggregate for those Classes as if they were a single Class. Investors should note, however, that net operating income from any mortgaged property supports only the related mortgage loan and will not be available to support any other mortgage loan. |

| (6) | The Class X-A, Class X-B, Class X-C, Class X-D, Class X-E, Class X-F and Class X-NR Notional Amounts are defined in the Free Writing Prospectus. |

| (7) | A holder of Class A-S, Class B and Class C Certificates (the “Exchangeable Certificates”) may exchange such Classes of Certificates (on an aggregate basis) for a related amount of Class EC Certificates, and Class EC Certificates may be exchanged for a ratable portion of each class of Exchangeable Certificates. |

| (8) | The initial Certificate Balance of a Class of Exchangeable Certificates represents the principal balance of such Class without giving effect to any exchange. The initial Certificate Balance of the Class EC Certificates is equal to the aggregate of the initial Certificate Balances of the Exchangeable Certificates and represents the maximum principal balance of such Class that could be issued in an exchange. See “Exchangeable Certificates and the Class EC Certificates” below. |

| (9) | Although the Class EC Certificates are listed below the Class C Certificates in the chart, the Class EC Certificates’ payment entitlements and subordination priority will be a result of the payment entitlements and subordination priority at each level of the related component classes of Class A-S, Class B and Class C Certificates. For purposes of determining the Approximate Initial Credit Support, Certificate Principal to Value Ratio and Underwritten NOI Debt Yield for Class EC Certificates, the calculation is based on the aggregate initial Certificate Balance of Class A-S, Class B and Class C Certificates as if they were a single class. |

| (10) | The Class R Certificates are not shown above. |

| (11) | The 543 Howard mortgage loan, which equals approximately $30.8 million (the “543 Howard Mortgage Loan”), is secured by the same mortgage instrument on the same related mortgaged property as the HOW Trust Subordinate Companion Loan with a principal balance of $10.0 million (the “HOW Trust Subordinate Companion Loan”, together with the 543 Howard Mortgage Loan, the “543 Howard Whole Loan”). The Class HOW certificates will only receive distributions from, and will only incur losses with respect to, the HOW Trust Subordinate Companion Loan. Such class will share in losses and shortfalls on the 543 Howard Whole Loan only. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

|  |  |

| 2 of 133 |

| Structural and Collateral Term Sheet | JPMBB 2014-C26 |

| Summary of Transaction Terms |

| Securities Offered: | $1,224,918,000 monthly pay, multi-class, commercial mortgage REMIC Pass-Through Certificates. |

Co-Lead Managers and Joint Bookrunners: | J.P. Morgan Securities LLC, Barclays Capital Inc. and Credit Suisse Securities (USA) LLC. |

| Co-Manager: | Drexel Hamilton, LLC |

| Mortgage Loan Sellers: | JPMorgan Chase Bank, National Association (“JPMCB”) (36.9%), Column Financial, Inc. (“CFI”) (21.0%), Barclays Bank PLC (“Barclays”) (18.9%), Redwood Commercial Mortgage Corporation (“Redwood”) (10.9%), General Electric Capital Corporation (“GECC”) (7.1%), and RAIT Funding, LLC (“RAIT”) (5.1%). |

| Master Servicer: | Midland Loan Services, a Division of PNC Bank, National Association (“Midland”). |

| Special Servicer: | Midland Loan Services, a Division of PNC Bank, National Association. |

| Directing Certificateholder: | Blackrock Realty Advisors, Inc. on behalf of one or more managed funds or accounts. |

| Trustee: | Wells Fargo Bank, National Association. |

| Certificate Administrator: | Wells Fargo Bank, National Association. |

| Senior Trust Advisor: | Pentalpha Surveillance LLC. |

| Rating Agencies: | Moody’s Investors Service, Inc. (“Moody’s”), DBRS, Inc. (“DBRS”) and Kroll Bond Rating Agency, Inc. (“KBRA”). |

| Pricing Date: | On or about December 17, 2014. |

| Closing Date: | On or about December 29, 2014. |

| Cut-off Date: | With respect to each mortgage loan, the related due date in December 2014, or with respect to any mortgage loan that has its first due date in January 2015 or February 2015, the date that would otherwise have been the related due date in December 2014. |

| Distribution Date: | The 4th business day after the Determination Date in each month, commencing in January 2015. |

| Determination Date: | 11th day of each month, or if the 11th day is not a business day, the next succeeding business day, commencing in January 2015. |

| Assumed Final Distribution Date: | The Distribution Date in January 2025, which is the latest anticipated repayment date of the Certificates. |

| Rated Final Distribution Date: | The Distribution Date in January 2048. |

| Tax Treatment: | The Publicly Offered Certificates are expected to be treated as REMIC regular interests for U.S. federal income tax purposes. |

| Form of Offering: | The Class A-1, Class A-2, Class A-3, Class A-4, Class A-SB, Class X-A, Class X-B, Class A-S, Class B, Class C and Class EC Certificates will be offered publicly (the “Publicly Offered Certificates”). The Class X-C, Class X-D, Class X-E, Class X-F, Class X-NR, Class D, Class E, Class F, Class NR, Class HOW and Class R Certificates (the “Privately Offered Certificates”) will be offered domestically to Qualified Institutional Buyers and (other than with respect to the Class HOW Certificates) to Institutional Accredited Investors and to institutions that are not U.S. Persons pursuant to Regulation S. |

| SMMEA Status: | The Certificates will not constitute “mortgage related securities” for purposes of SMMEA. |

| ERISA: | The Publicly Offered Certificates are expected to be ERISA eligible. |

| Optional Termination: | 1.0% clean-up call. |

| Minimum Denominations: | The Publicly Offered Certificates (other than the Class X-A and Class X-B Certificates) will be issued in minimum denominations of $10,000 and integral multiples of $1 in excess of $10,000. The Class X-A and Class X-B Certificates will be issued in minimum denominations of $1,000,000 and in integral multiples of $1 in excess of $1,000,000. |

| Settlement Terms: | DTC, Euroclear and Clearstream Banking. |

| Analytics: | The transaction is expected to be modeled by Intex Solutions, Inc. and Trepp, LLC and is expected to be available on Bloomberg L.P., Blackrock Financial Management Inc., Interactive Data Corporation and Markit. |

| Risk Factors: | THE CERTIFICATES INVOLVE CERTAIN RISKS AND MAY NOT BE SUITABLE FOR ALL INVESTORS. SEE THE “RISK FACTORS” SECTION OF THE FREE WRITING PROSPECTUS. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

|  |  |

| 3 of 133 |

| Structural and Collateral Term Sheet | JPMBB 2014-C26 |

Collateral Characteristics |

| Loan Pool | ||

Initial Pool Balance (“IPB”): | $1,449,606,872 | |

| Number of Mortgage Loans: | 69 | |

| Number of Mortgaged Properties: | 93 | |

| Average Cut-off Date Balance per Mortgage Loan: | $21,008,795 | |

| Weighted Average Current Mortgage Rate: | 4.44151% | |

| 10 Largest Mortgage Loans as % of IPB: | 37.6% | |

Weighted Average Remaining Term to Maturity(1)(2): | 110 months | |

| Weighted Average Seasoning: | 1 month | |

| Credit Statistics | ||

Weighted Average UW NCF DSCR(3)(4): | 1.69x | |

Weighted Average UW NOI Debt Yield(3): | 10.3% | |

Weighted Average Cut-off Date Loan-to-Value Ratio (“LTV”)(3)(5): | 67.2% | |

Weighted Average Maturity Date LTV(1)(3)(5): | 58.9% | |

| Other Statistics | ||

| % of Mortgage Loans with Additional Debt: | 24.9% | |

| % of Mortgaged Properties with Single Tenants: | 6.6% | |

| Amortization | ||

Weighted Average Original Amortization Term(6): | 354 months | |

Weighted Average Remaining Amortization Term(6): | 354 months | |

| % of Mortgage Loans with Partial Interest-Only followed by Amortizing Balloon: | 63.4% | |

| % of Mortgage Loans with Amortizing Balloon: | 20.9% | |

| % of Mortgage Loans with Interest-Only: | 11.2% | |

| % of Mortgage Loans with Partial Interest-Only followed by Amortizing Balloon followed by ARD-Structure: | 2.6% | |

| % of Mortgage Loans with Interest-Only followed by ARD-Structure: | 1.3% | |

| % of Mortgage Loans with Amortizing Balloon followed by ARD-Structure | 0.6% | |

Cash Management(7) | ||

| % of Mortgage Loans with In-Place, CMA Lockboxes: | 45.1% | |

| % of Mortgage Loans with In-Place, Hard Lockboxes: | 31.5% | |

| % of Mortgage Loans with Springing Lockboxes: | 18.5% | |

| % of Mortgage Loans with No Lockbox: | 3.0% | |

| % of Mortgage Loans with In-Place, Soft Lockboxes: | 1.8% | |

| Reserves | ||

| % of Mortgage Loans Requiring Monthly Tax Reserves: | 78.5% | |

| % of Mortgage Loans Requiring Monthly Insurance Reserves: | 38.4% | |

% of Mortgage Loans Requiring Monthly CapEx Reserves(8): | 62.7% | |

% of Mortgage Loans Requiring Monthly TI/LC Reserves(9): | 60.5% | |

| (1) | In the case of Loan Nos. 11, 29 and 46 each with an anticipated repayment date, as of the related anticipated repayment date. |

| (2) | In the case of Loan Nos. 2 and 29, the first payment dates for the loans are February 1, 2015. On the Closing Date, JPMCB will deposit sufficient funds to pay the interest associated with the interest due for the January 2015 payment for the related loans. Information presented in this term sheet reflects the loans’ contractual loan terms. |

| (3) | In the case of Loan Nos. 1, 6, 8 and 26, the UW NCF DSCR, UW NOI Debt Yield, Cut-off Date LTV and Maturity Date LTV calculations include the related Pari Passu Companion Loan. In the case of Loan No. 20, the UW NCF DSCR, UW NOI Debt Yield, Cut-off Date LTV and Maturity Date LTV calculations exclude the HOW Trust Subordinate Companion Loan. |

| (4) | In the case of Loan No. 20, the UW NCF DSCR is calculated using the average of principal and interest payments over the first 12 months following the cut-off date based on the principal payment schedule provided on Annex F of the Free Writing Prospectus. In the case of Loan No. 45, the UW NCF DSCR is calculated using the average of principal and interest payments over the first 12 months following the initial interest only period based on the principal payment schedule provided on Annex G of the Free Writing Prospectus. |

| (5) | In the case of Loan Nos. 14, 28, 52 and 65 the Cut-off Date LTV and the Maturity Date LTV are calculated based upon a hypothetical ”as-stabilized,” “as-renovated” or “as-complete” appraised value based on certain assumptions. Refer to “Description of the Mortgage Pool – Assessments of Property Value and Condition” in the Free Writing Prospectus for additional details. |

| (6) | Excludes six mortgage loans that are interest-only for the entire term or until the anticipated repayment date, as applicable. |

| (7) | For a detailed description of Cash Management, refer to “Description of the Mortgage Pool – Lockbox Accounts” in the Free Writing Prospectus. |

| (8) | CapEx Reserves include FF&E reserves for hotel properties. |

| (9) | Calculated only with respect to Cut-off Date Balance of mortgage loans secured by retail, industrial, office and mixed use properties. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

|  |  |

| 4 of 133 |

| Structural and Collateral Term Sheet | JPMBB 2014-C26 |

Collateral Characteristics |

Mortgage Loan Seller | Number of Mortgage Loans | Number of Mortgaged Properties | Aggregate Cut-off Date Balance | % of IPB | |

| JPMCB | 19 | 37 | $535,590,750 | 36.9 | % |

| Column | 12 | 18 | 304,654,404 | 21.0 | |

| Barclays | 12 | 12 | 273,628,152 | 18.9 | |

| RCMC | 10 | 10 | 158,546,099 | 10.9 | |

| GECC | 8 | 8 | 103,096,851 | 7.1 | |

| RAIT | 8 | 8 | 74,090,617 | 5.1 | |

| Total: | 69 | 93 | $1,449,606,872 | 100.0 | % |

| Ten Largest Mortgage Loans |

| No. | Loan Name | Mortgage Loan Seller | No. of Prop. | Cut-off Date Balance | % of IPB | SF/ Rooms | Property Type | UW NCF DSCR(1) | UW NOI Debt Yield(1) | Cut-off Date LTV(1) | Maturity Date LTV(1) | |

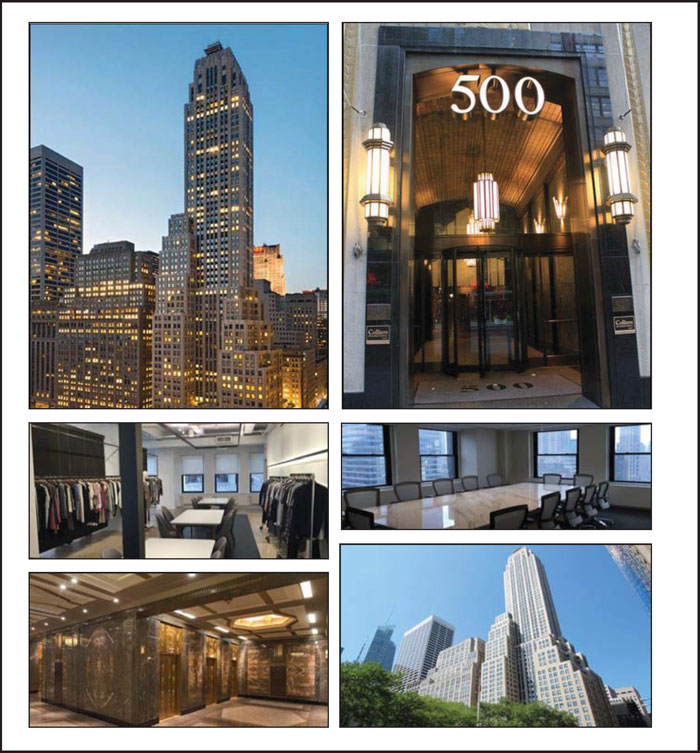

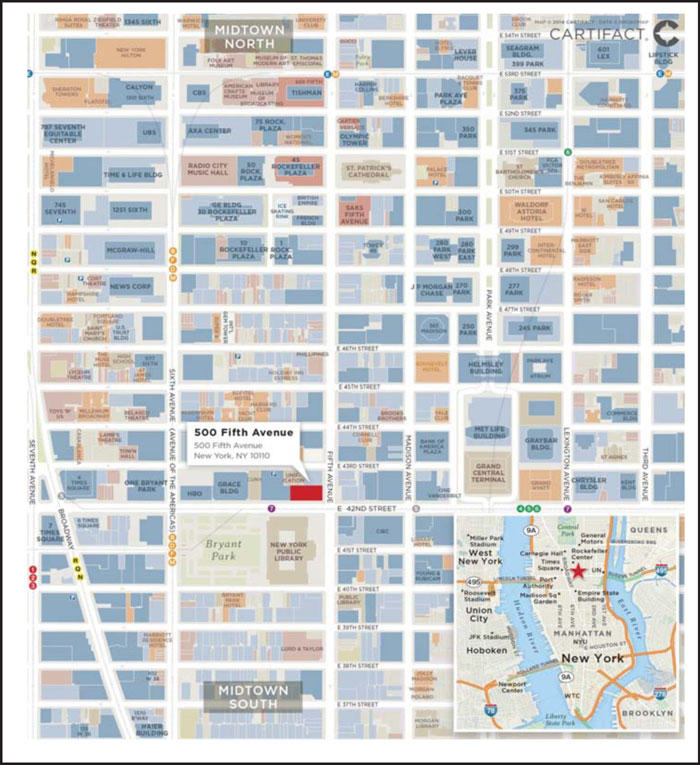

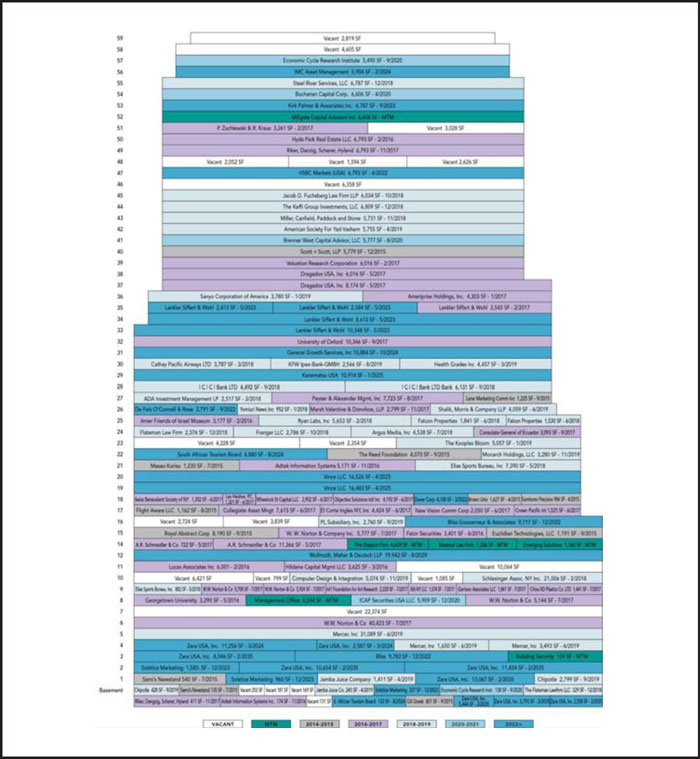

| 1 | 500 Fifth Avenue | Column | 1 | $100,000,000 | 6.9% | 712,791 | Office | 3.37x | 13.7% | 33.3% | 33.3% | |

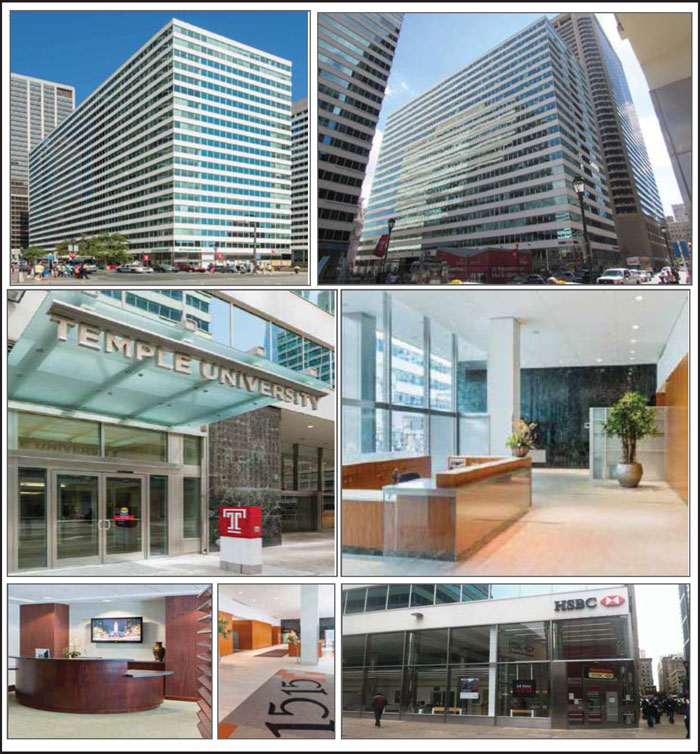

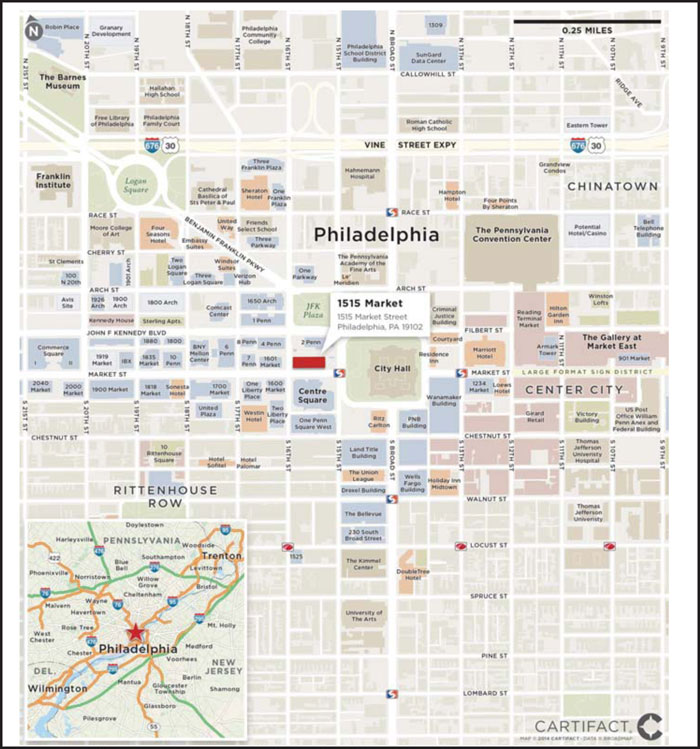

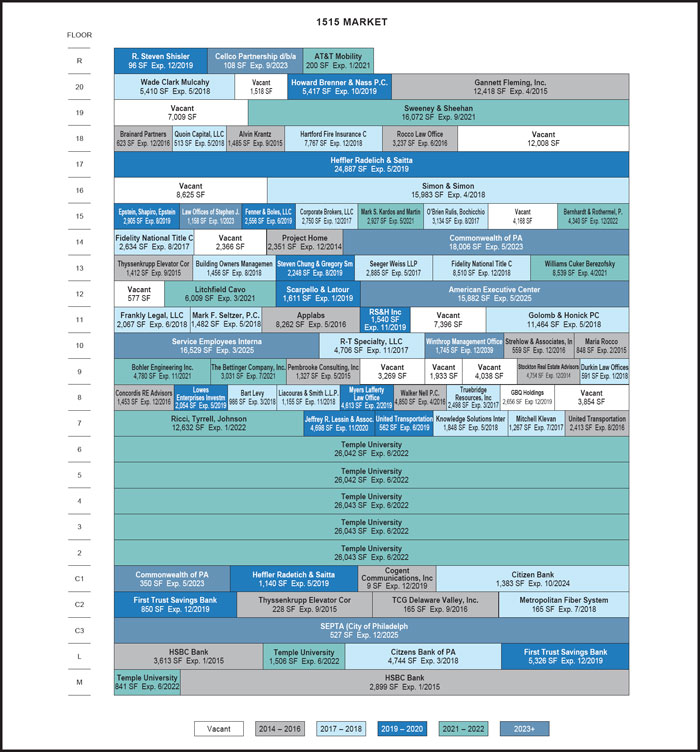

| 2 | 1515 Market | JPMCB | 1 | $63,750,000 | 4.4% | 502,213 | Office | 1.50x | 10.3% | 73.3% | 66.8% | |

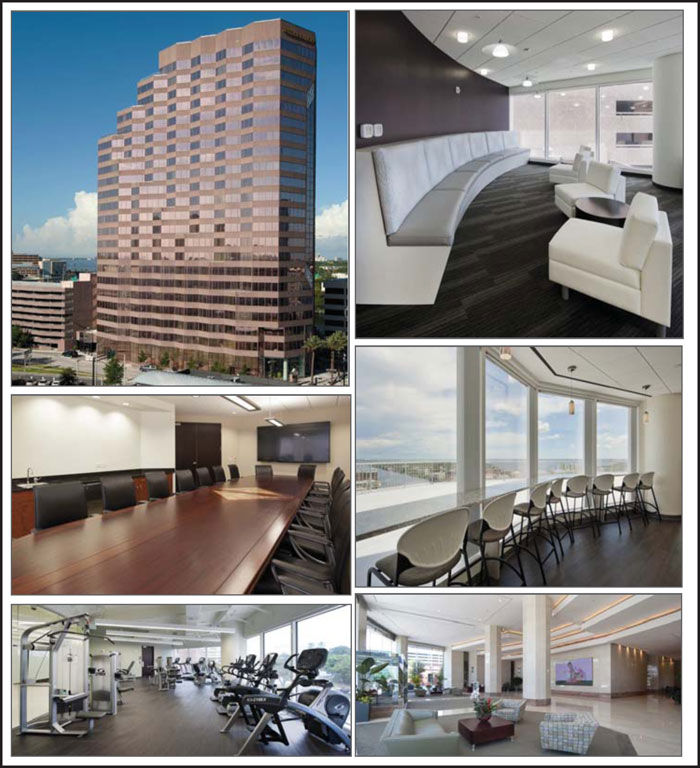

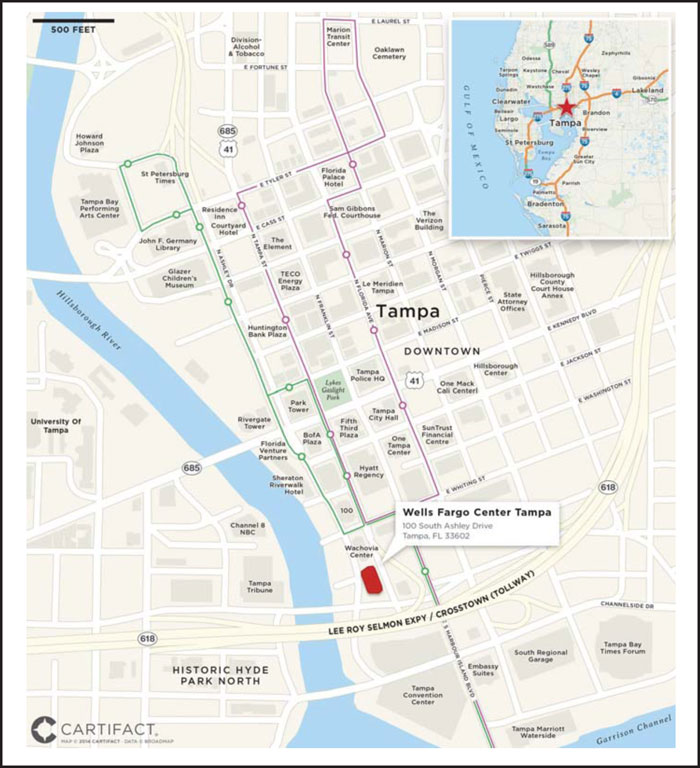

| 3 | Wells Fargo Center Tampa | JPMCB | 1 | $59,800,000 | 4.1% | 389,524 | Office | 1.33x | 9.0% | 76.7% | 70.4% | |

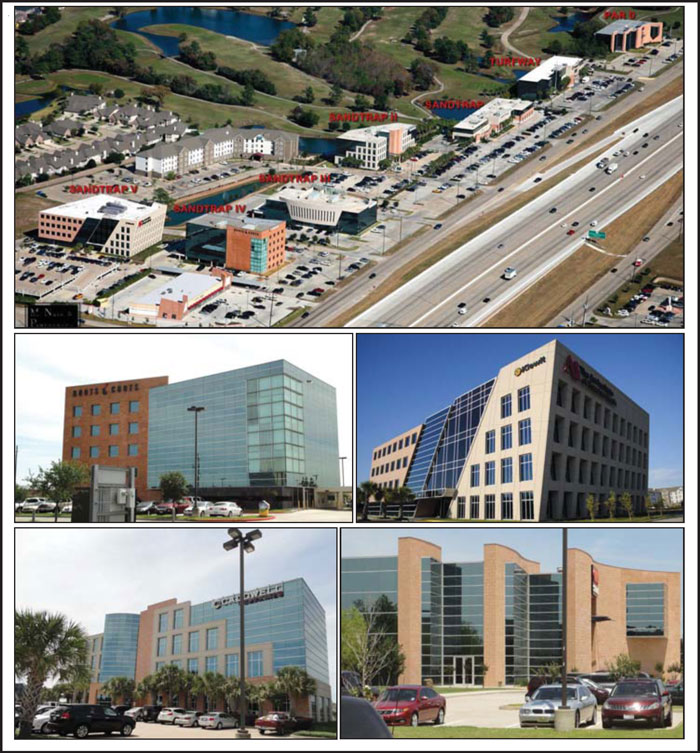

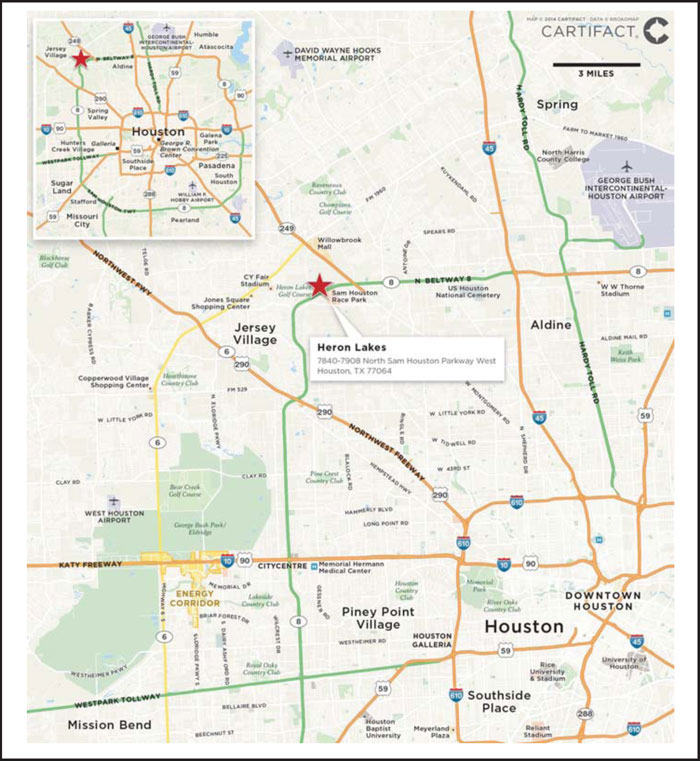

| 4 | Heron Lakes | JPMCB | 1 | $52,000,000 | 3.6% | 314,504 | Office | 1.36x | 9.3% | 73.2% | 62.5% | |

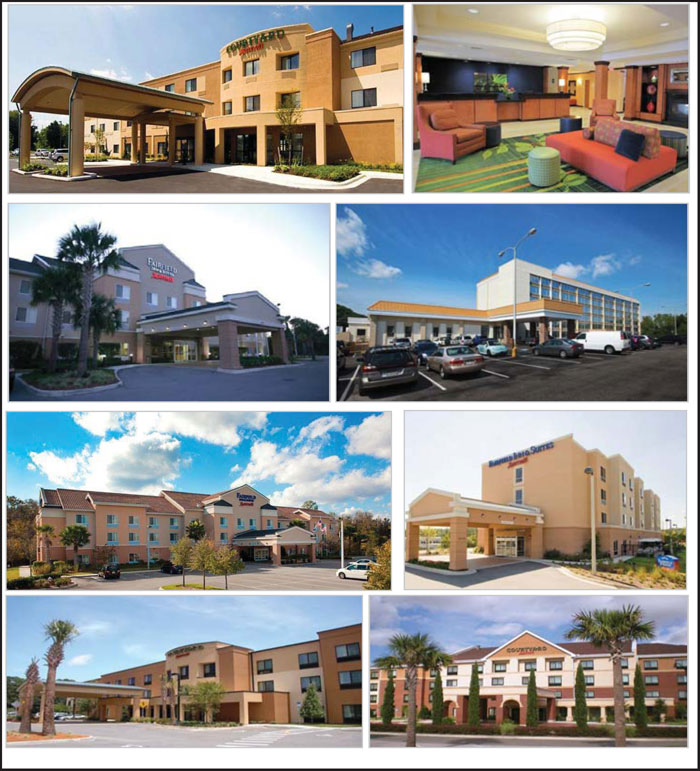

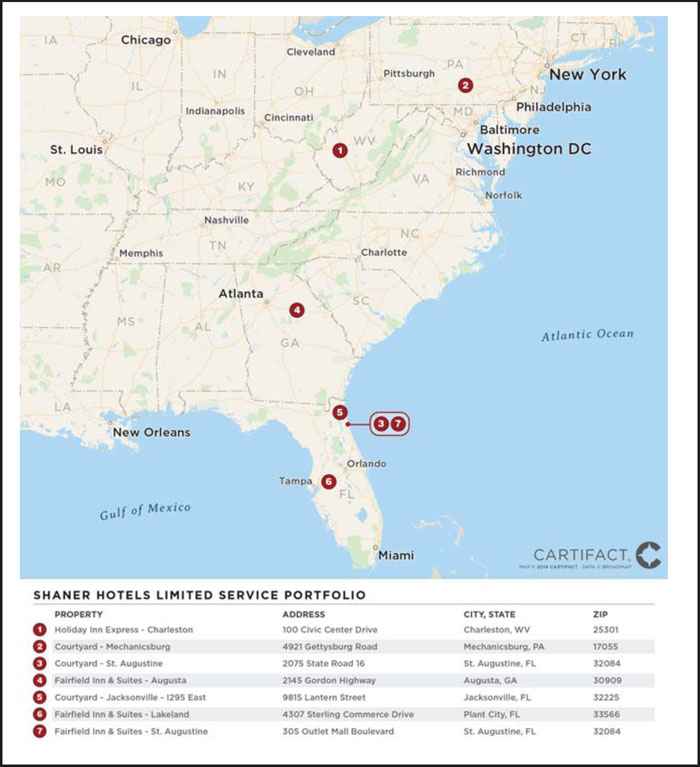

| 5 | Shaner Hotels Limited Service Portfolio | JPMCB | 7 | $49,750,000 | 3.4% | 732 | Hotel | 1.75x | 10.7% | 68.9% | 58.8% | |

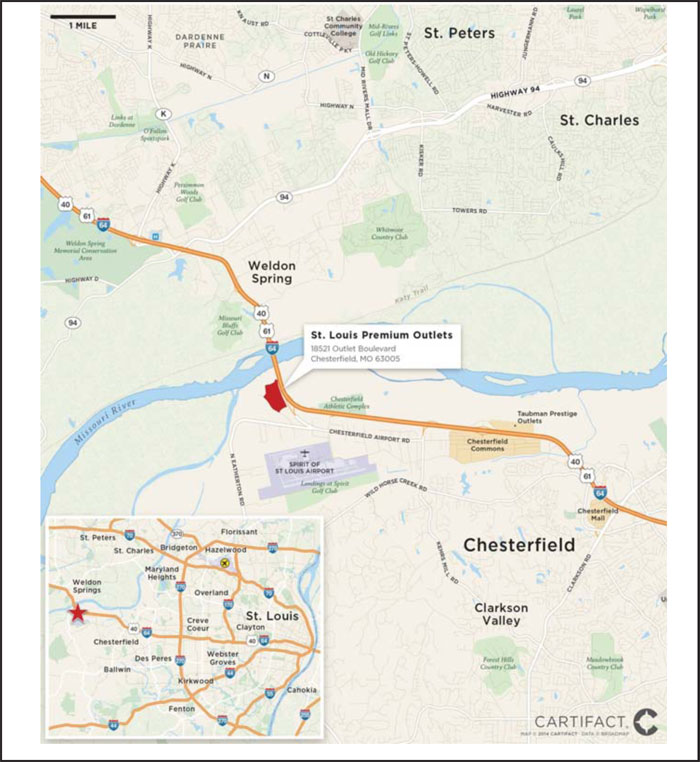

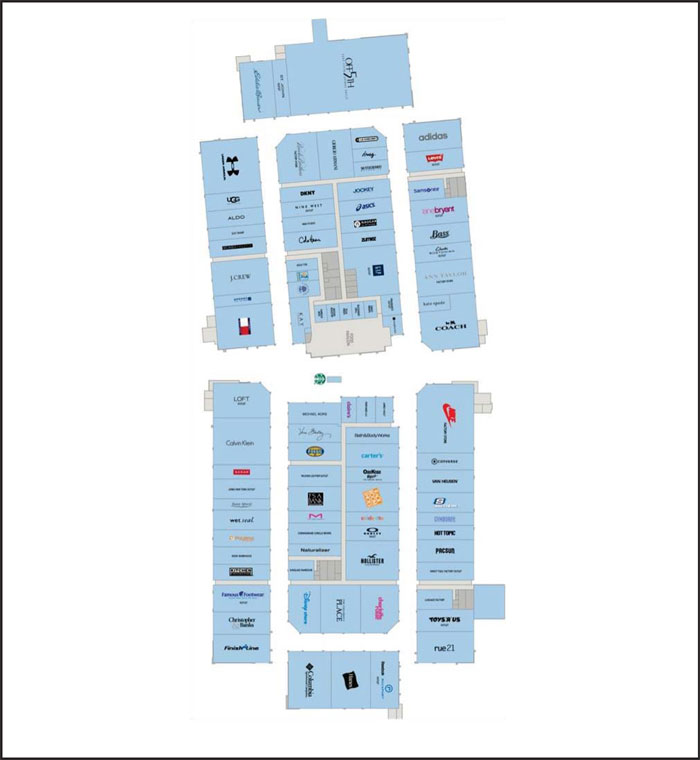

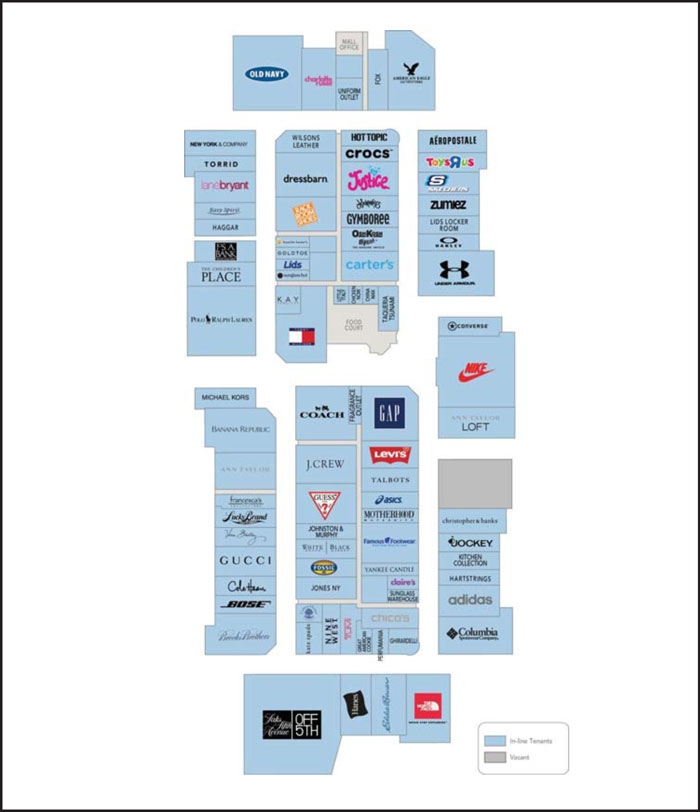

| 6 | St. Louis Premium Outlets | Column | 1 | $47,500,000 | 3.3% | 351,462 | Retail | 1.41x | 8.6% | 71.6% | 65.1% | |

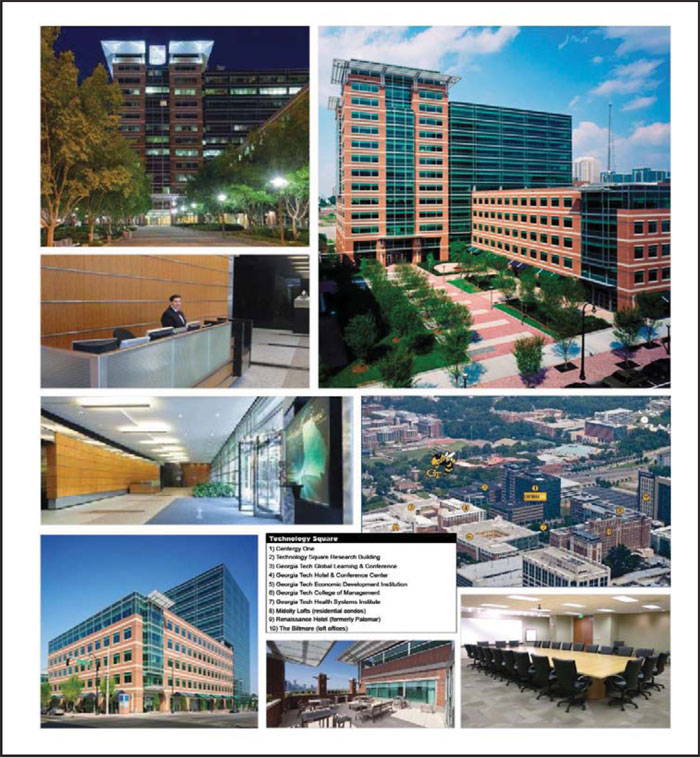

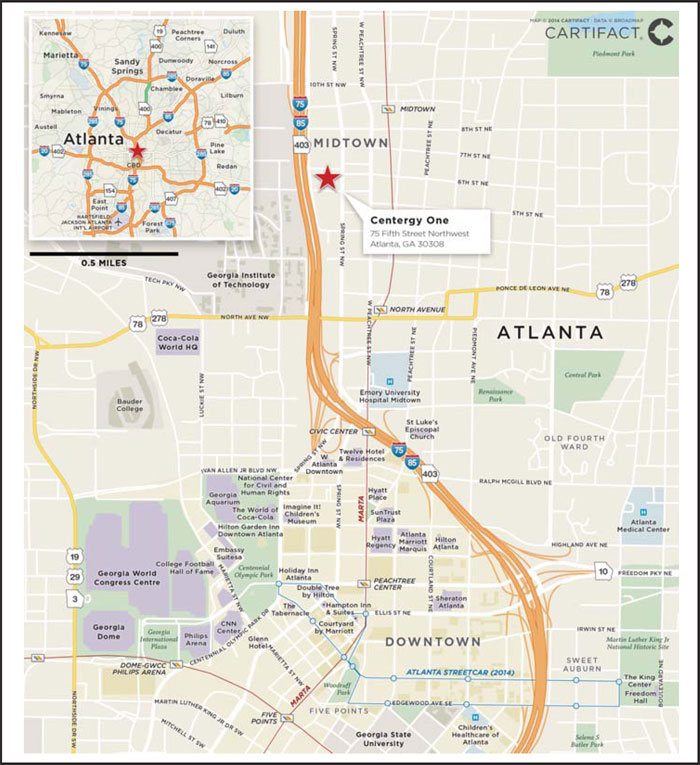

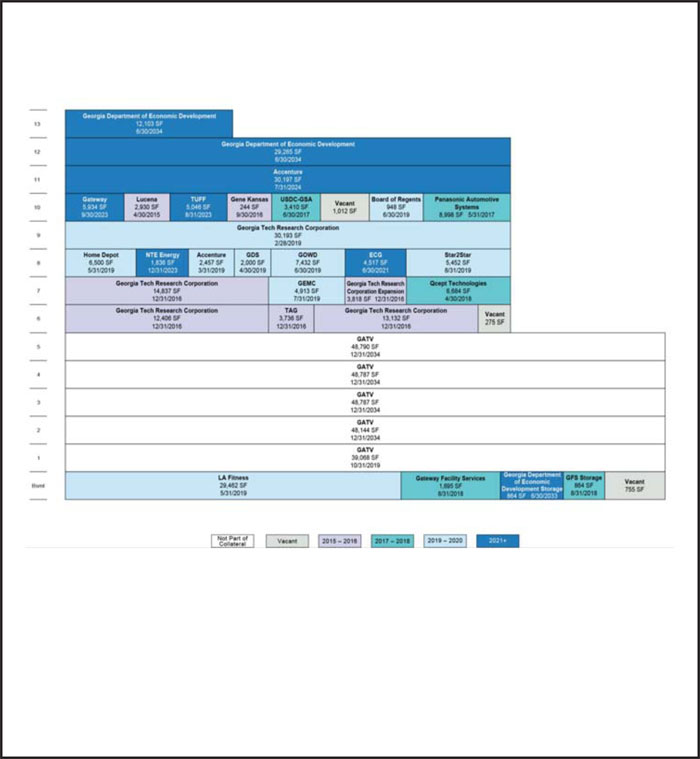

| 7 | Centergy One | GECC | 1 | $45,750,000 | 3.2% | 253,435 | Office | 1.29x | 8.9% | 75.0% | 64.2% | |

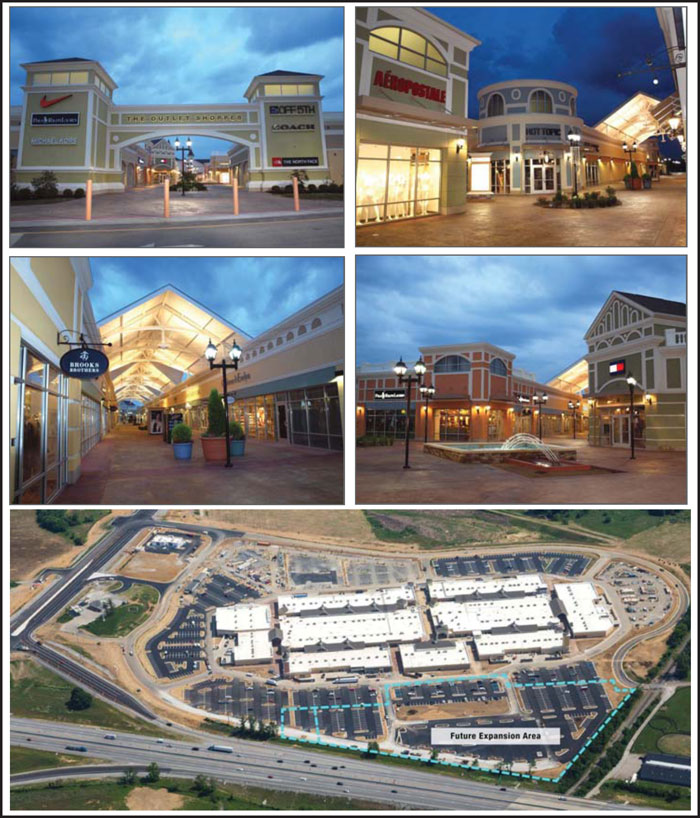

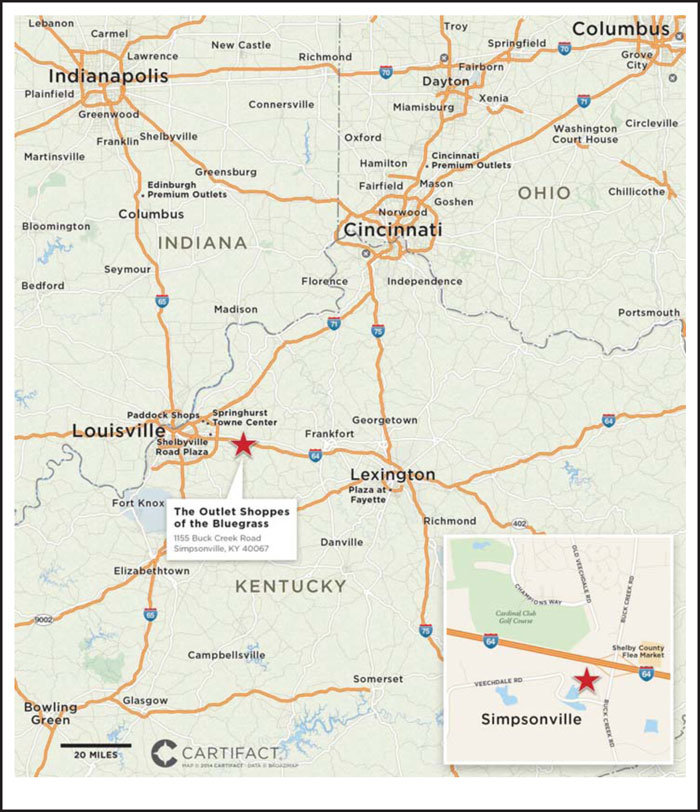

| 8 | The Outlet Shoppes of the Bluegrass | JPMCB | 1 | $45,000,000 | 3.1% | 374,683 | Retail | 1.83x | 11.3% | 63.0% | 49.7% | |

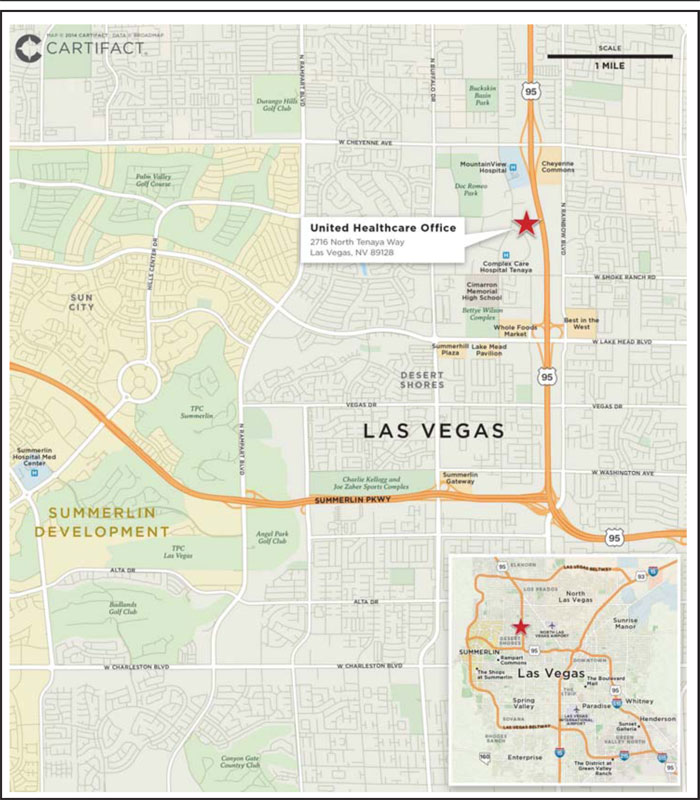

| 9 | United Healthcare Office | Barclays | 1 | $42,000,000 | 2.9% | 204,123 | Office | 2.02x | 9.8% | 70.0% | 70.0% | |

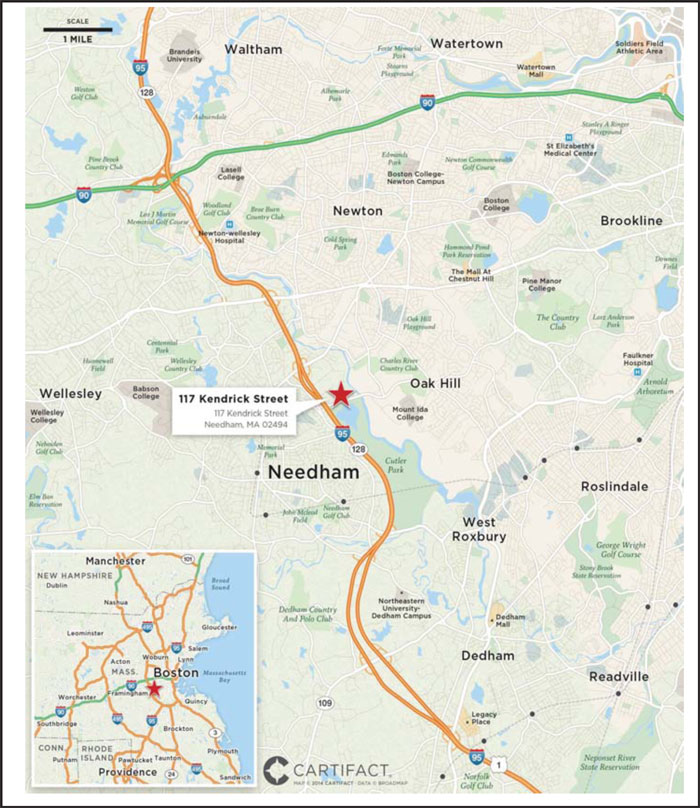

| 10 | 117 Kendrick Street | JPMCB | 1 | $39,560,000 | 2.7% | 212,846 | Office | 1.33x | 8.7% | 74.6% | 68.1% | |

| Top 3 Total/Weighted Average | 3 | $223,550,000 | 15.4% | 2.29x | 11.5% | 56.3% | 52.8% | |||||

| Top 5 Total/Weighted Average | 11 | $325,300,000 | 22.4% | 2.06x | 11.0% | 60.9% | 55.3% | |||||

| Top 10 Total/Weighted Average | 16 | $545,110,000 | 37.6% | 1.86x | 10.4% | 64.9% | 58.5% | |||||

| (1) | In the case of Loan Nos. 1, 6 and 8, the UW NCF DSCR, UW NOI Debt Yield, Cut-off Date LTV and Maturity Date LTV calculations include the related Pari Passu Companion Loan. |

| Pari Passu Note Loan Summary | ||||||||||||||

No. | Loan Name | Trust Cut- off Date Balance | Pari Passu Loan Cut- off Date Balance | Total Mortgage Loan Cut- off Date Balance | Controlling Pooling & Servicing Agreement | Master Servicer | Special Servicer | Voting Rights | ||||||

| 1 | 500 Fifth Avenue | $100,000,000 | $100,000,000 | $200,000,000 | JPMBB 2014-C26 | Midland | Midland | JPMBB 2014-C26 | ||||||

| 6 | St. Louis Premium Outlets | $47,500,000 | $47,500,000 | $95,000,000 | JPMBB 2014-C26 | Midland | Midland | JPMBB 2014-C26 | ||||||

| 8 | The Outlet Shoppes of the Bluegrass | $45,000,000 | $32,500,000 | $77,500,000 | JPMBB 2014-C26 | Midland | Midland | JPMBB 2014-C26 | ||||||

| 26 | Florida Multifamily Portfolio | $22,300,000 | $35,000,000 | $57,300,000 | JPMBB 2014-C25 | Wells Fargo | Rialto | JPMBB 2014-C25 | ||||||

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

|  |  |

| 5 of 133 |

| Structural and Collateral Term Sheet | JPMBB 2014-C26 |

Collateral Characteristics |

Additional Debt Summary(1) |

No. | Loan Name | Trust Cut-off Date Balance | Subordinate Debt Cut-off Date Balance | Total Debt Cut-off Date Balance | Mortgage Loan UW NCF DSCR | Total Debt UW NCF DSCR | Mortgage Loan Cut-off Date LTV | Total Debt Cut-off Date LTV | Mortgage Loan UW NOI Debt Yield | Total Debt UW NOI Debt Yield | ||||||||||||

| 2 | 1515 Market | $63,750,000 | $8,500,000 | $72,250,000 | 1.50x | 1.22x | 73.3% | 83.0% | 10.3% | 9.1% | ||||||||||||

| 4 | Heron Lakes | $52,000,000 | $7,000,000 | $59,000,000 | 1.36x | 1.11x | 73.2% | 83.1% | 9.3% | 8.2% | ||||||||||||

| 5 | Shaner Hotels Limited Service Portfolio | $49,750,000 | $8,050,000 | $57,800,000 | 1.75x | 1.38x | 68.9% | 80.0% | 10.7% | 9.2% | ||||||||||||

| 9 | United Healthcare Office | $42,000,000 | $9,000,000 | $51,000,000 | 2.02x | 1.37x | 70.0% | 85.0% | 9.8% | 8.1% | ||||||||||||

| 20 | 543 Howard(2) | $30,798,301 | $10,000,000 | $40,798,301 | 1.44x | 1.19x | 56.2% | 74.4% | 11.4% | 8.6% | ||||||||||||

| 22 | Marriott Fort Lauderdale | $25,950,000 | $4,000,000 | $29,950,000 | 1.64x | 1.31x | 63.0% | 72.7% | 10.1% | 8.8% | ||||||||||||

| 24 | Eagle View Apartments | $24,000,000 | $3,200,000 | $27,200,000 | 1.50x | 1.22x | 72.7% | 82.4% | 9.3% | 8.2% | ||||||||||||

| 26 | Florida Multifamily Portfolio(3) | $22,300,000 | $12,000,000 | $34,300,000 | 1.84x | 1.34x | 66.1% | 80.0% | 12.8% | 10.6% | ||||||||||||

| 31 | Renaissance Boca Raton | $18,450,000 | $4,000,000 | $22,450,000 | 1.72x | 1.27x | 59.3% | 72.2% | 10.6% | 8.7% | ||||||||||||

| 39 | Eastwood Village Shopping Center | $12,900,000 | $1,600,000 | $14,500,000 | 1.72x | 1.41x | 74.8% | 84.1% | 11.4% | 10.1% | ||||||||||||

| 42 | 10 New Road | $9,750,000 | $1,370,000 | $11,120,000 | 1.76x | 1.41x | 72.2% | 82.4% | 11.6% | 10.2% | ||||||||||||

| 45 | Hampshire Park Apartments(4) | $9,000,000 | $900,000 | $9,900,000 | 1.52x | 1.27x | 76.8% | 84.4% | 9.6% | 8.8% | ||||||||||||

| (1) | In the case of Loan Nos. 2, 4, 5, 9, 22, 24, 26, 31, 39, 42 and 45, subordinate debt represents mezzanine loans. In the case of Loan No. 20, subordinate debt represents a B-Note. |

| (2) | In the case of Loan No. 20, the Mortgage Loan UW NCF DSCR and Total Debt UW NCF DSCR are calculated using the average of principal and interest payments over the first 12 months following the cut-off date based on the principal payment schedule provided on Annex F of the Free Writing Prospectus. |

| (3) | In the case of Loan No. 26, Mortgage Loan UW NCF DSCR, Mortgage Loan UW NOI Debt Yield and Mortgage Loan Cut-off Date LTV calculations include the related Pari Passu Companion Loan. |

| (4) | In the case of Loan No. 45, the Mortgage Loan UW NCF DSCR and Total Debt UW NCF DSCR are calculated using the average of principal and interest payments over the first 12 months following the initial interest only period based on the principal payment schedule provided on Annex G of the Free Writing Prospectus. |

| HOW Trust Subordinate Companion Loan Summary |

| HOW Subordinate | Mortgage | Mortgage | Whole | Mortgage | |||||||

| Mortgage | Companion | Whole | Loan | Whole | Loan | Loan | Loan | Whole | |||

| Loan | Loan | Loan | UW | Loan | Cut-off | Cut-off | UW NOI | Loan | |||

| Cut-off Date | Cut-off Date | Cut-off Date | NCF | UW NCF | Date | Date | Debt | UW NOI | |||

| No. | Loan Name | Balance | Balance | Balance | DSCR | DSCR | LTV | LTV | Yield | Debt Yield | |

| 20 | 543 Howard (1)(2) | $30,798,301 | $10,000,000 | $40,798,301 | 1.44x | 1.19x | 56.2% | 74.4% | 11.4% | 8.6% |

| (1) | The Class HOW Certificates, which are backed by the HOW Trust Subordinate Companion Loan, are expected to be sold to Redwood Commercial Mortgage Corporation or its affiliates. |

| (2) | In the case of Loan No. 20, the Mortgage Loan UW NCF DSCR and Whole Loan UW NCF DSCR are calculated using the average of principal and interest payments over the first 12 months following the cut-off date based on the principal payment schedule provided on Annex F of the Free Writing Prospectus. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

|  |  |

| 6 of 133 |

| Structural and Collateral Term Sheet | JPMBB 2014-C26 | |

| Collateral Characteristics | ||

Mortgaged Properties by Type(1) |

| Weighted Average | ||||||||||||||||

| Property Type | Property Subtype | Number of Properties | Cut-off Date Principal Balance | % of IPB | Occupancy | UW NCF DSCR(2)(3) | UW NOI DY(2) | Cut-off Date LTV(2)(4) | Maturity Date LTV(2)(4)(5) | |||||||

| Office | CBD | 9 | $368,413,301 | 25.4% | 93.7% | 2.08x | 11.2% | 59.4% | 53.1% | |||||||

| Suburban | 10 | 253,917,871 | 17.5 | 97.2% | 1.52x | 9.8% | 71.9% | 64.8% | ||||||||

| Medical | 1 | 8,720,789 | 0.6 | 100.0% | 1.50x | 10.5% | 69.8% | 51.9% | ||||||||

| Subtotal: | 20 | $631,051,961 | 43.5% | 95.2% | 1.85x | 10.6% | 64.6% | 57.8% | ||||||||

| Multifamily | Garden | 27 | $175,358,986 | 12.1% | 94.7% | 1.40x | 9.2% | 75.2% | 65.7% | |||||||

| High Rise | 2 | 57,453,152 | 4.0 | 94.1% | 1.58x | 10.2% | 60.2% | 52.9% | ||||||||

| Student | 2 | 10,650,000 | 0.7 | 98.9% | 1.34x | 8.4% | 72.5% | 62.1% | ||||||||

| Subtotal: | 31 | $243,462,138 | 16.8% | 94.8% | 1.44x | 9.4% | 71.6% | 62.5% | ||||||||

| Hotel | Full Service | 4 | $114,400,000 | 7.9% | 76.2% | 1.71x | 10.6% | 66.7% | 57.8% | |||||||

| Limited Service | 10 | 89,455,000 | 6.2 | 73.2% | 1.66x | 10.5% | 69.4% | 57.0% | ||||||||

| Extended Stay | 3 | 31,970,000 | 2.2 | 81.3% | 1.77x | 10.9% | 68.7% | 60.7% | ||||||||

| Subtotal: | 17 | $235,825,000 | 16.3% | 75.8% | 1.70x | 10.6% | 68.0% | 57.9% | ||||||||

| Retail | Anchored | 6 | $98,238,691 | 6.8% | 94.4% | 1.41x | 9.3% | 69.6% | 60.6% | |||||||

| Outlet Center | 2 | 92,500,000 | 6.4 | 98.8% | 1.61x | 9.9% | 67.4% | 57.1% | ||||||||

| Shadow Anchored | 2 | 21,627,000 | 1.5 | 92.8% | 1.85x | 11.9% | 70.4% | 60.7% | ||||||||

| Unanchored | 2 | 10,590,108 | 0.7 | 90.6% | 1.49x | 9.8% | 68.1% | 58.0% | ||||||||

| Single Tenant | 1 | 3,096,114 | 0.2 | 100.0% | 1.40x | 8.9% | 64.5% | 52.7% | ||||||||

| Subtotal: | 13 | $226,051,914 | 15.6% | 96.0% | 1.54x | 9.8% | 68.6% | 59.2% | ||||||||

| Industrial | Flex | 3 | $33,590,738 | 2.3% | 84.9% | 1.53x | 10.5% | 69.7% | 62.5% | |||||||

| Warehouse | 2 | 15,978,750 | 1.1 | 96.8% | 1.99x | 11.4% | 66.2% | 59.6% | ||||||||

| Subtotal: | 5 | $49,569,488 | 3.4% | 88.7% | 1.68x | 10.8% | 68.6% | 61.6% | ||||||||

| Manufactured Housing | Manufactured Housing | 5 | $35,446,371 | 2.4% | 87.4% | 1.65x | 10.4% | 70.5% | 57.6% | |||||||

| Mixed Use | Industrial/Office | 1 | $20,000,000 | 1.4% | 100.0% | 1.73x | 10.7% | 61.0% | 54.3% | |||||||

| Self Storage | Self Storage | 1 | $8,200,000 | 0.6% | 84.2% | 1.57x | 9.4% | 63.6% | 52.6% | |||||||

| Total / Weighted Average: | 93 | $1,449,606,872 | 100.0% | 91.7% | 1.69x | 10.3% | 67.2% | 58.9% | ||||||||

| (1) | Because this table presents information relating to the mortgaged properties and not mortgage loans, the information for mortgage loans secured by more than one mortgaged property is based on allocated loan amounts. |

| (2) | In the case of Loan Nos. 1, 6, 8 and 26, the UW NCF DSCR, UW NOI Debt Yield, Cut-off Date LTV and Maturity Date LTV calculations include the related Pari Passu Companion Loan. In the case of Loan No. 20, the UW NCF DSCR, UW NOI Debt Yield, Cut-off Date LTV and Maturity Date LTV calculations exclude the HOW Trust Subordinate Companion Loan. |

| (3) | In the case of Loan No. 20, the UW NCF DSCR is calculated using the average of principal and interest payments over the first 12 months following the cut-off date based on the principal payment schedule provided on Annex F of the Free Writing Prospectus. In the case of Loan No. 45, the UW NCF DSCR is calculated using the average of principal and interest payments over the first 12 months following the initial interest only period based on the principal payment schedule provided on Annex G of the Free Writing Prospectus. |

| (4) | In the case of Loan Nos. 14, 28, 52 and 65 the Cut-off Date LTV and the Maturity Date LTV are calculated based upon a hypothetical “as-stabilized,” “as-renovated” or “as-complete” appraised value based on certain assumptions. Refer to “Description of the Mortgage Pool – Assessments of Property Value and Condition” in the Free Writing Prospectus for additional details. |

| (5) | In the case of Loan Nos. 11, 29 and 46, each of which has an anticipated repayment date, Maturity Date LTV is as of the related anticipated repayment date. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

|  |  |

| 7 of 133 |

| Structural and Collateral Term Sheet | JPMBB 2014-C26 | |

| Collateral Characteristics | ||

Mortgaged Properties by Location(1) | |||||||||||||||

Weighted Average | |||||||||||||||

State | Number of Properties | Cut-off Date Principal Balance | % of IPB | Occupancy | UW NCF DSCR(2)(3) | UW NOI DY(2) | Cut-off Date LTV(2)(4) | Maturity Date LTV(2)(4)(5) | |||||||

| Florida | 25 | $228,362,793 | 15.8% | 85.3% | 1.60x | 10.2% | 69.1% | 60.4% | |||||||

| New York | 4 | 166,825,000 | 11.5 | 92.6% | 2.61x | 12.2% | 47.5% | 44.2% | |||||||

| Texas | 7 | 131,495,310 | 9.1 | 91.5% | 1.36x | 9.1% | 72.2% | 63.9% | |||||||

| Massachusetts | 4 | 91,060,000 | 6.3 | 92.2% | 1.40x | 9.9% | 72.9% | 67.4% | |||||||

| Georgia | 5 | 88,376,381 | 6.1 | 92.0% | 1.48x | 9.7% | 71.2% | 61.5% | |||||||

| California | 6 | 83,438,409 | 5.8 | 98.8% | 2.01x | 11.5% | 55.7% | 45.6% | |||||||

| Kentucky | 2 | 79,000,000 | 5.4 | 84.0% | 1.71x | 10.9% | 69.9% | 57.9% | |||||||

| Pennsylvania | 3 | 75,206,888 | 5.2 | 86.7% | 1.52x | 10.3% | 72.7% | 65.5% | |||||||

| Illinois | 5 | 70,838,601 | 4.9 | 94.4% | 1.59x | 10.9% | 70.2% | 58.5% | |||||||

| North Carolina | 6 | 56,438,986 | 3.9 | 94.4% | 1.19x | 8.0% | 79.6% | 68.4% | |||||||

| Missouri | 1 | 47,500,000 | 3.3 | 100.0% | 1.41x | 8.6% | 71.6% | 65.1% | |||||||

| Maryland | 2 | 45,938,078 | 3.2 | 93.9% | 1.74x | 10.9% | 55.2% | 44.5% | |||||||

| Nevada | 2 | 44,070,000 | 3.0 | 99.9% | 1.99x | 9.8% | 69.8% | 69.4% | |||||||

| Wisconsin | 1 | 38,100,000 | 2.6 | 95.9% | 1.33x | 8.9% | 72.2% | 61.9% | |||||||

| West Virginia | 2 | 33,640,000 | 2.3 | 91.0% | 1.57x | 9.7% | 71.6% | 59.9% | |||||||

| Colorado | 2 | 24,838,691 | 1.7 | 94.8% | 1.38x | 8.9% | 68.2% | 60.8% | |||||||

| Connecticut | 1 | 24,000,000 | 1.7 | 100.0% | 1.28x | 8.6% | 74.3% | 63.9% | |||||||

| Indiana | 3 | 22,598,750 | 1.6 | 92.6% | 1.73x | 9.9% | 70.1% | 63.3% | |||||||

| South Carolina | 2 | 22,400,000 | 1.5 | 96.2% | 1.57x | 9.0% | 76.4% | 69.1% | |||||||

| New Jersey | 2 | 18,782,871 | 1.3 | 82.5% | 1.57x | 10.6% | 67.6% | 49.9% | |||||||

| Alabama | 1 | 12,900,000 | 0.9 | 97.9% | 1.72x | 11.4% | 74.8% | 63.5% | |||||||

| Delaware | 1 | 9,750,000 | 0.7 | 81.3% | 2.37x | 14.4% | 75.0% | 60.6% | |||||||

| Rhode Island | 1 | 9,750,000 | 0.7 | 94.7% | 1.76x | 11.6% | 72.2% | 61.3% | |||||||

| Michigan | 1 | 8,350,000 | 0.6 | 96.0% | 1.84x | 13.3% | 57.6% | 48.2% | |||||||

| Arizona | 2 | 6,896,114 | 0.5 | 95.9% | 1.43x | 9.3% | 71.3% | 59.9% | |||||||

| Louisiana | 1 | 5,700,000 | 0.4 | 87.2% | 3.06x | 15.4% | 55.9% | 55.9% | |||||||

| Mississippi | 1 | 3,350,000 | 0.2 | 98.6% | 1.48x | 9.6% | 71.3% | 58.3% | |||||||

| Total / Weighted Average: | 93 | $1,449,606,872 | 100.0% | 91.7% | 1.69x | 10.3% | 67.2% | 58.9% | |||||||

| (1) | Because this table presents information relating to the mortgaged properties and not mortgage loans, the information for mortgage loans secured by more than one mortgaged property is based on allocated loan amounts. |

| (2) | In the case of Loan Nos. 1, 6, 8 and 26, the UW NCF DSCR, UW NOI Debt Yield, Cut-off Date LTV and Maturity Date LTV calculations include the related Pari Passu Companion Loan. In the case of Loan No. 20, the UW NCF DSCR, UW NOI Debt Yield, Cut-off Date LTV and Maturity Date LTV calculations exclude the HOW Trust Subordinate Companion Loan. |

| (3) | In the case of Loan No. 20, the UW NCF DSCR is calculated using the average of principal and interest payments over the first 12 months following the cut-off date based on the principal payment schedule provided on Annex F of the Free Writing Prospectus. In the case of Loan No. 45, the UW NCF DSCR is calculated using the average of principal and interest payments over the first 12 months following the initial interest only period based on the principal payment schedule provided on Annex G of the Free Writing Prospectus. |

| (4) | In the case of Loan Nos. 14, 28, 52 and 65 the Cut-off Date LTV and the Maturity Date LTV are calculated based upon a hypothetical ”as-stabilized,” “as-renovated” or “as-complete” appraised value based on certain assumptions. Refer to “Description of the Mortgage Pool – Assessments of Property Value and Condition” in the Free Writing Prospectus for additional details. |

| (5) | In the case of Loan Nos. 11, 29 and 46, each of which has an anticipated repayment date, Maturity Date LTV is as of the related anticipated repayment date. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

|  |  |

| 8 of 133 |

| Structural and Collateral Term Sheet | JPMBB 2014-C26 | |

| Collateral Characteristics | ||

| Cut-off Date Principal Balance |

Weighted Average | |||||||||||||||||||||

| Range of Principal Balances | Number of Loans | Cut-off Date Principal Balance | % of IPB | Mortgage Rate | Remaining Loan Term(1)(5) | UW NCF DSCR(2)(3) | UW NOI DY(2) | Cut-off Date LTV(2)(4) | Maturity Date LTV(1)(2)(4) | ||||||||||||

| $2,070,000 | - | $9,999,999 | 28 | $169,031,642 | 11.7% | 4.52795% | 115 | 1.68x | 10.6% | 68.8% | 59.1% | ||||||||||

| $10,000,000 | - | $19,999,999 | 14 | 213,169,792 | 14.7 | 4.44804% | 99 | 1.76x | 10.6% | 66.6% | 57.5% | ||||||||||

| $20,000,000 | - | $24,999,999 | 5 | 114,300,000 | 7.9 | 4.52902% | 119 | 1.55x | 10.4% | 69.7% | 60.9% | ||||||||||

| $25,000,000 | - | $49,999,999 | 18 | 677,555,439 | 46.7 | 4.51513% | 112 | 1.53x | 9.8% | 69.6% | 60.6% | ||||||||||

| $50,000,000 | - | $100,000,000 | 4 | 275,550,000 | 19.0 | 4.16613% | 106 | 2.12x | 11.1% | 59.5% | 54.6% | ||||||||||

| Total / Weighted Average: | 69 | $1,449,606,872 | 100.0% | 4.44151% | 110 | 1.69x | 10.3% | 67.2% | 58.9% | ||||||||||||

| Mortgage Interest Rates |

Weighted Average | |||||||||||||||||||||

Range of Mortgage Interest Rates | Number of Loans | Cut-off Date Principal Balance | % of IPB | Mortgage Rate | Remaining Loan Term(1)(5) | UW NCF DSCR(2)(3) | UW NOI DY(2) | Cut-off Date LTV(2)(4) | Maturity Date LTV(1)(2)(4) | ||||||||||||

| 3.55000% | - | 4.40000% | 19 | $527,863,469 | 36.4% | 4.08270% | 116 | 2.03x | 11.1% | 61.1% | 54.6% | ||||||||||

| 4.40001% | - | 4.60000% | 23 | 472,673,628 | 32.6 | 4.48442% | 116 | 1.51x | 9.8% | 70.5% | 60.8% | ||||||||||

| 4.60001% | - | 4.80000% | 17 | 309,463,775 | 21.3 | 4.69883% | 93 | 1.53x | 9.7% | 70.3% | 62.3% | ||||||||||

| 4.80001% | - | 5.00000% | 8 | 67,356,001 | 4.6 | 4.94082% | 118 | 1.42x | 10.4% | 66.0% | 50.5% | ||||||||||

| 5.00001% | - | 5.22000% | 2 | 72,250,000 | 5.0 | 5.21471% | 87 | 1.40x | 9.5% | 76.9% | 70.4% | ||||||||||

| Total / Weighted Average: | 69 | $1,449,606,872 | 100.0% | 4.44151% | 110 | 1.69x | 10.3% | 67.2% | 58.9% | ||||||||||||

Original Term to Maturity/ARD in Months(1)(5) |

Weighted Average | ||||||||||||||||||

Original Term to Maturity/ARD in Months(5) | Number of Loans | Cut-off Date Principal Balance | % of IPB | Mortgage Rate | Remaining Loan Term(1)(5) | UW NCF DSCR(2)(3) | UW NOI DY(2) | Cut-off Date LTV(2)(4) | Maturity Date LTV(1)(2)(4) | |||||||||

| 60 | 9 | $221,338,691 | 15.3% | 4.65049% | 59 | 1.72x | 9.9% | 69.3% | 66.1% | |||||||||

| 120 | 60 | 1,228,268,181 | 84.7 | 4.40385% | 119 | 1.69x | 10.3% | 66.8% | 57.6% | |||||||||

| Total / Weighted Average: | 69 | $1,449,606,872 | 100.0% | 4.44151% | 110 | 1.69x | 10.3% | 67.2% | 58.9% | |||||||||

Remaining Term to Maturity/ARD in Months(1)(5) |

Weighted Average | ||||||||||||||||||||

Remaining Term to Maturity/ARD in Months(5) | Number of Loans | Cut-off Date Principal Balance | % of IPB | Mortgage Rate | Remaining Loan Term(1)(5) | UW NCF DSCR(2)(3) | UW NOI DY(2) | Cut-off Date LTV(2)(4) | Maturity Date LTV(1)(2)(4) | |||||||||||

| 58 | - | 60 | 9 | $221,338,691 | 15.3% | 4.65049% | 59 | 1.72x | 9.9% | 69.3% | 66.1% | |||||||||

| 61 | - | 120 | 60 | 1,228,268,181 | 84.7 | 4.40385% | 119 | 1.69x | 10.3% | 66.8% | 57.6% | |||||||||

| Total / Weighted Average: | 69 | $1,449,606,872 | 100.0% | 4.44151% | 110 | 1.69x | 10.3% | 67.2% | 58.9% | |||||||||||

| (1) | In the case of Loan Nos. 11, 29 and 46, each of which has an anticipated repayment date, Remaining Loan Term, Original Term To Maturity/ARD, Remaining Term to Maturity/ARD and Maturity Date LTV are as of the related anticipated repayment date. |

| (2) | In the case of Loan Nos. 1, 6, 8 and 26, the UW NCF DSCR, UW NOI Debt Yield, Cut-off Date LTV and Maturity Date LTV calculations include the related Pari Passu Companion Loan. In the case of Loan No. 20, the UW NCF DSCR, UW NOI Debt Yield, Cut-off Date LTV and Maturity Date LTV calculations exclude the HOW Trust Subordinate Companion Loan. |

| (3) | In the case of Loan No. 20, the UW NCF DSCR is calculated using the average of principal and interest payments over the first 12 months following the cut-off date based on the principal payment schedule provided on Annex F of the Free Writing Prospectus. In the case of Loan No. 45, the UW NCF DSCR is calculated using the average of principal and interest payments over the first 12 months following the initial interest only period based on the principal payment schedule provided on Annex G of the Free Writing Prospectus. |

| (4) | In the case of Loan Nos. 14, 28, 52 and 65 the Cut-off Date LTV and the Maturity Date LTV are calculated based upon a hypothetical “as-stabilized,” “as-renovated” or “as-complete” appraised value based on certain assumptions. Refer to “Description of the Mortgage Pool – Assessments of Property Value and Condition” in the Free Writing Prospectus for additional details. |

| (5) | In the case of Loan Nos. 2 and 29, the the first payment dates for the loans are February 1, 2015. On the Closing Date, JPMCB will deposit sufficient funds to pay the interest due for the January 2015 payment for the related loans. Information presented in this term sheet reflects the loans’ contractual loan terms. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

|  |  |

| 9 of 133 |

| Structural and Collateral Term Sheet | JPMBB 2014-C26 | |

| Collateral Characteristics | ||

| Original Amortization Term in Months |

Weighted Average | ||||||||||||||||||

Original Amortization Term in Months | Number of Loans | Cut-off Date Principal Balance | % of IPB | Mortgage Rate | Remaining Loan Term(1)(5) | UW NCF DSCR(2)(3) | UW NOI DY(2) | Cut-off Date LTV(2)(4) | Maturity Date LTV(1)(2)(4) | |||||||||

| Interest Only | 6 | $180,988,750 | 12.5% | 3.91119% | 96 | 2.99x | 12.7% | 45.6% | 45.6% | |||||||||

| 300 | 6 | 77,906,961 | 5.4 | 4.84410% | 118 | 1.47x | 10.7% | 65.1% | 47.6% | |||||||||

| 324 | 2 | 71,078,986 | 4.9 | 4.41100% | 119 | 1.19x | 8.0% | 79.7% | 68.5% | |||||||||

| 360 | 55 | 1,119,632,176 | 77.2 | 4.50116% | 111 | 1.53x | 10.0% | 70.0% | 61.2% | |||||||||

| Total / Weighted Average: | 69 | $1,449,606,872 | 100.0% | 4.44151% | 110 | 1.69x | 10.3% | 67.2% | 58.9% | |||||||||

| Remaining Amortization Term in Months |

Weighted Average | ||||||||||||||||||||

Remaining Amortization Term in Months | Number of Loans | Cut-off Date Principal Balance | % of IPB | Mortgage Rate | Remaining Loan Term(1)(5) | UW NCF DSCR(2)(3) | UW NOI DY(2) | Cut-off Date LTV(2)(4) | Maturity Date LTV(1)(2)(4) | |||||||||||

| Interest Only | 6 | $180,988,750 | 12.5% | 3.91119% | 96 | 2.99x | 12.7% | 45.6% | 45.6% | |||||||||||

| 297 | - | 299 | 3 | 44,501,961 | 3.1 | 4.91742% | 117 | 1.49x | 11.3% | 59.7% | 41.6% | |||||||||

| 300 | - | 360 | 60 | 1,224,116,162 | 84.4 | 4.50262% | 112 | 1.51x | 9.9% | 70.6% | 61.4% | |||||||||

| Total / Weighted Average: | 69 | $1,449,606,872 | 100.0% | 4.44151% | 110 | 1.69x | 10.3% | 67.2% | 58.9% | |||||||||||

| Amortization Types |

Weighted Average | ||||||||||||||||||

| Amortization Types | Number of Loans | Cut-off Date Principal Balance | % of IPB | Mortgage Rate | Remaining Loan Term(1)(5) | UW NCF DSCR(2)(3) | UW NOI DY(2) | Cut-off Date LTV(2)(4) | Maturity Date LTV(1)(2)(4) | |||||||||

| IO-Balloon | 40 | $918,625,986 | 63.4% | 4.47758% | 117 | 1.49x | 9.8% | 71.4% | 62.4% | |||||||||

| Balloon | 21 | 303,021,347 | 20.9 | 4.54189% | 103 | 1.59x | 10.5% | 66.3% | 54.5% | |||||||||

| Interest Only | 5 | 161,688,750 | 11.2 | 3.95430% | 100 | 2.92x | 12.5% | 46.3% | 46.3% | |||||||||

| ARD-IO-Balloon | 1 | 38,250,000 | 2.6 | 5.21000% | 58 | 1.25x | 8.7% | 75.0% | 71.8% | |||||||||

| ARD-Interest Only | 1 | 19,300,000 | 1.3 | 3.55000% | 60 | 3.61x | 13.9% | 40.0% | 40.0% | |||||||||

| ARD-Balloon | 1 | 8,720,789 | 0.6 | 4.79000% | 118 | 1.50x | 10.5% | 69.8% | 51.9% | |||||||||

| Total / Weighted Average: | 69 | $1,449,606,872 | 100.0% | 4.44151% | 110 | 1.69x | 10.3% | 67.2% | 58.9% | |||||||||

Underwritten Net Cash Flow Debt Service Coverage Ratios(2)(3) |

Weighted Average | ||||||||||||||||||||

| Underwritten Net Cash Flow Debt Service Coverage Ratios | Number of Loans | Cut-off Date Principal Balance | % of IPB | Mortgage Rate | Remaining Loan Term(1)(5) | UW NCF DSCR(2)(3) | UW NOI DY(2) | Cut-off Date LTV(2)(4) | Maturity Date LTV(1)(2)(4) | |||||||||||

| 1.19x | - | 1.36x | 13 | $365,334,565 | 25.2% | 4.64287% | 100 | 1.28x | 8.6% | 75.5% | 67.0% | |||||||||

| 1.36x | - | 1.44x | 12 | 240,044,415 | 16.6 | 4.49510% | 117 | 1.41x | 9.7% | 69.7% | 59.7% | |||||||||

| 1.46x | - | 1.54x | 17 | 255,531,709 | 17.6 | 4.43171% | 112 | 1.51x | 10.2% | 70.9% | 62.0% | |||||||||

| 1.56x | - | 1.64x | 6 | 95,708,029 | 6.6 | 4.73208% | 119 | 1.59x | 10.1% | 71.0% | 60.0% | |||||||||

| 1.66x | - | 1.79x | 8 | 162,286,023 | 11.2 | 4.43931% | 119 | 1.75x | 10.9% | 62.8% | 52.9% | |||||||||

| 1.81x | - | 2.00x | 6 | 139,963,381 | 9.7 | 4.32749% | 119 | 1.87x | 11.9% | 64.1% | 53.8% | |||||||||

| 2.01x | - | 3.61x | 7 | 190,738,750 | 13.2 | 3.94129% | 97 | 2.96x | 12.8% | 47.1% | 46.4% | |||||||||

| Total / Weighted Average: | 69 | $1,449,606,872 | 100.0% | 4.44151% | 110 | 1.69x | 10.3% | 67.2% | 58.9% | |||||||||||

| (1) | In the case of Loan Nos. 11, 29 and 46, each of which has an anticipated repayment date, Remaining Loan Term, Original Term To Maturity/ARD, Remaining Term to Maturity/ARD and Maturity Date LTV are as of the related anticipated repayment date. |

| (2) | In the case of Loan Nos. 1, 6, 8 and 26, the UW NCF DSCR, UW NOI Debt Yield, Cut-off Date LTV and Maturity Date LTV calculations include the related Pari Passu Companion Loan. In the case of Loan No. 20, the UW NCF DSCR, UW NOI Debt Yield, Cut-off Date LTV and Maturity Date LTV calculations exclude the HOW Trust Subordinate Companion Loan. |

| (3) | In the case of Loan No. 20, the UW NCF DSCR is calculated using the average of principal and interest payments over the first 12 months following the cut-off date based on the principal payment schedule provided on Annex F of the Free Writing Prospectus. In the case of Loan No. 45, the UW NCF DSCR is calculated using the average of principal and interest payments over the first 12 months following the initial interest only period based on the principal payment schedule provided on Annex G of the Free Writing Prospectus. |

| (4) | In the case of Loan Nos. 14, 28, 52 and 65 the Cut-off Date LTV and the Maturity Date LTV are calculated based upon a hypothetical “as-stabilized,” “as-renovated” or “as-complete” appraised value based on certain assumptions. Refer to “Description of the Mortgage Pool – Assessments of Property Value and Condition” in the Free Writing Prospectus for additional details. |

| (5) | In the case of Loan Nos. 2 and 29, the the first payment dates for the loans are February 1, 2015. On the Closing Date, JPMCB will deposit sufficient funds to pay the interest due for the January 2015 payment for the related loans. Information presented in this term sheet reflects the loans’ contractual loan terms. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

|  |  |

| 10 of 133 |

| Structural and Collateral Term Sheet | JPMBB 2014-C26 | |

| Collateral Characteristics | ||

LTV Ratios as of the Cut-off Date(2)(4) |

Weighted Average | ||||||||||||||||||||

| Range of Cut-off Date LTVs | Number of Loans | Cut-off Date Principal Balance | % of IPB | Mortgage Rate | Remaining Loan Term(1)(5) | UW NCF DSCR(2)(3) | UW NOI DY(2) | Cut-off Date LTV(2)(4) | Maturity Date LTV(1)(2)(4) | |||||||||||

| 33.3% | - | 59.9% | 9 | $235,280,203 | 16.2% | 4.07079% | 112 | 2.61x | 12.6% | 44.8% | 39.3% | |||||||||

| 60.0% | - | 64.9% | 10 | 170,778,985 | 11.8 | 4.35687% | 115 | 1.73x | 10.7% | 62.4% | 52.9% | |||||||||

| 65.0% | - | 69.9% | 13 | 185,719,979 | 12.8 | 4.55479% | 113 | 1.65x | 10.6% | 68.3% | 58.7% | |||||||||

| 70.0% | - | 75.0% | 26 | 552,393,720 | 38.1 | 4.42132% | 112 | 1.50x | 9.7% | 72.3% | 64.1% | |||||||||

| 75.0% | - | 80.0% | 11 | 305,433,986 | 21.1 | 4.74205% | 100 | 1.35x | 9.0% | 77.1% | 67.9% | |||||||||

| Total / Weighted Average: | 69 | $1,449,606,872 | 100.0% | 4.44151% | 110 | 1.69x | 10.3% | 67.2% | 58.9% | |||||||||||

LTV Ratios as of the Maturity Date(1)(2)(4) |

Weighted Average | ||||||||||||||||||||

Range of Maturity Date/ARD LTVs | Number of Loans | Cut-off Date Principal Balance | % of IPB | Mortgage Rate | Remaining Loan Term(1)(5) | UW NCF DSCR(2)(3) | UW NOI DY(2) | Cut-off Date LTV(2)(4) | Maturity Date LTV(1)(2)(4) | |||||||||||

| 33.3% | - | 44.9% | 4 | $185,051,453 | 12.8% | 3.96998% | 112 | 2.78x | 12.8% | 41.1% | 36.1% | |||||||||

| 45.0% | - | 49.9% | 5 | 75,032,871 | 5.2 | 4.25810% | 120 | 1.80x | 11.4% | 61.9% | 48.9% | |||||||||

| 50.0% | - | 54.9% | 8 | 134,216,903 | 9.3 | 4.49533% | 120 | 1.70x | 10.6% | 62.9% | 52.9% | |||||||||

| 55.0% | - | 59.9% | 19 | 245,440,968 | 16.9 | 4.45672% | 114 | 1.65x | 10.5% | 67.6% | 58.2% | |||||||||

| 60.0% | - | 65.0% | 16 | 305,940,691 | 21.1 | 4.56796% | 116 | 1.44x | 9.5% | 73.5% | 62.8% | |||||||||

| 65.0% | - | 71.8% | 17 | 503,923,986 | 34.8 | 4.54347% | 100 | 1.45x | 9.4% | 74.6% | 68.2% | |||||||||

| Total / Weighted Average: | 69 | $1,449,606,872 | 100.0% | 4.44151% | 110 | 1.69x | 10.3% | 67.2% | 58.9% | |||||||||||

| Prepayment Protection |

Weighted Average | ||||||||||||||||||

Prepayment Protection | Number of Loans | Cut-off Date Principal Balance | % of IPB | Mortgage Rate | Remaining Loan Term(1)(5) | UW NCF DSCR(2)(3) | UW NOI DY(2) | Cut-off Date LTV(2)(4) | Maturity Date LTV(1)(2)(4) | |||||||||

Defeasance | 48 | $965,936,122 | 66.6% | 4.44050% | 111 | 1.72x | 10.3% | 65.9% | 57.4% | |||||||||

Yield Maintenance | 21 | 483,670,750 | 33.4 | 4.44354% | 107 | 1.64x | 10.3% | 69.8% | 61.8% | |||||||||

Total / Weighted Average: | 69 | $1,449,606,872 | 100.0% | 4.44151% | 110 | 1.69x | 10.3% | 67.2% | 58.9% | |||||||||

| Loan Purpose |

Weighted Average | ||||||||||||||||||

| Loan Purpose | Number of Loans | Cut-off Date Principal Balance | % of IPB | Mortgage Rate | Remaining Loan Term(1)(5) | UW NCF DSCR(2)(3) | UW NOI DY(2) | Cut-off Date LTV(2)(4) | Maturity Date LTV(1)(2)(4) | |||||||||

| Refinance | 45 | $963,702,008 | 66.5% | 4.41378% | 111 | 1.74x | 10.3% | 65.5% | 56.7% | |||||||||

| Acquisition | 24 | 485,904,864 | 33.5 | 4.49653% | 107 | 1.61x | 10.2% | 70.6% | 63.1% | |||||||||

| Total / Weighted Average: | 69 | $1,449,606,872 | 100.0% | 4.44151% | 110 | 1.69x | 10.3% | 67.2% | 58.9% | |||||||||

| (1) | In the case of Loan Nos. 11, 29 and 46, each of which has an anticipated repayment date, Remaining Loan Term, Original Term To Maturity/ARD, Remaining Term to Maturity/ARD and Maturity Date LTV are as of the related anticipated repayment date. |

| (2) | In the case of Loan Nos. 1, 6, 8 and 26, the UW NCF DSCR, UW NOI Debt Yield, Cut-off Date LTV and Maturity Date LTV calculations include the related Pari Passu Companion Loan. In the case of Loan No. 20, the UW NCF DSCR, UW NOI Debt Yield, Cut-off Date LTV and Maturity Date LTV calculations exclude the HOW Trust Subordinate Companion Loan. |

| (3) In the case of Loan No. 20, the UW NCF DSCR is calculated using the average of principal and interest payments over the first 12 months following the cut-off date based on the principal payment schedule provided on Annex F of the Free Writing Prospectus. In the case of Loan No. 45, the UW NCF DSCR is calculated using the average of principal and interest payments over the first 12 months following the initial interest only period based on the principal payment schedule provided on Annex G of the Free Writing Prospectus. |

| (4) | In the case of Loan Nos. 14, 28, 52 and 65 the Cut-off Date LTV and the Maturity Date LTV are calculated based upon a hypothetical “as-stabilized,” “as-renovated” or “as-complete” appraised value based on certain assumptions. Refer to “Description of the Mortgage Pool – Assessments of Property Value and Condition” in the Free Writing Prospectus for additional details. |

| (5) | In the case of Loan Nos. 2 and 29, the the first payment dates for the loans are February 1, 2015. On the Closing Date, JPMCB will deposit sufficient funds to pay the interest due for the January 2015 payment for the related loans. Information presented in this term sheet reflects the loans’ contractual loan terms. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

|  |  |

| 11 of 133 |

| Structural and Collateral Term Sheet | JPMBB 2014-C26 | |

| Collateral Characteristics | ||

Previous Securitization History(1) |

| No. | Loan Name | Location | Property Type | Previous Securitization |

| 2 | 1515 Market | Philadelphia, PA | Office | JPMCC 2007-LDPX |

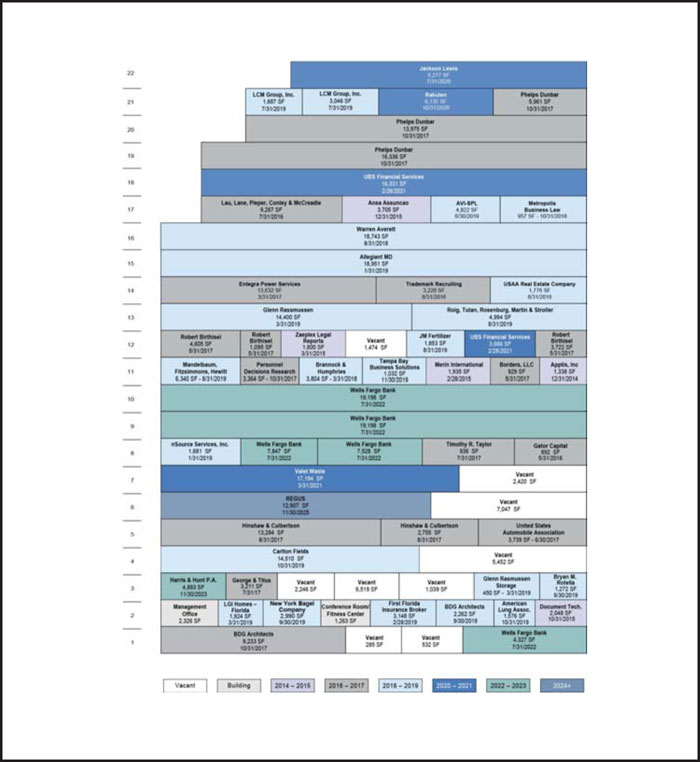

| 4 | Heron Lakes | Houston, TX | Office | JPMCC 2013-FL3 |

| 5.01 | Holiday Inn Express - Charleston | Charleston, WV | Hotel | GSMS 2006-GG6 |

| 7 | Centergy One | Atlanta, GA | Office | CSFB 2005-C5 |

| 9 | United Healthcare Office | Las Vegas, NV | Office | WBCMT 2006-C27 |

| 13.01 | Gable Oaks | Rockhill, SC | Multifamily | CSMC 2007-C5 |

| 13.02 | Sharon Pointe | Charlotte, NC | Multifamily | CSMC 2008-C1 |

| 13.03 | Woodbrook | Monroe, NC | Multifamily | CSMC 2007-C5 |

| 18.01 | Huntersville Apartments | Huntersville, NC | Multifamily | CSMC 2007-C5 |

| 18.02 | Wexford Apartments | Charlotte, NC | Multifamily | CSMC 2008-C1 |

| 18.03 | Davidson Apartments | Concord, NC | Multifamily | CSMC 2007-C5 |

| 18.04 | Marion Ridge Apartments | Shelby, NC | Multifamily | CSMC 2008-C1 |

| 22 | Marriott Fort Lauderdale | Fort Lauderdale, FL | Hotel | CSFB 2005-C5 |

| 25 | Newington Commons | Newington, CT | Retail | MSC 2005-HQ6 |

| 28 | Westview Apartments | Lewisville, TX | Multifamily | FREMF 2013-KF02 |

| 31 | Renaissance Boca Raton | Boca Raton, FL | Hotel | CSFB 2005-C5 |

| 32 | Broadway Marketplace - Parcel 2,3,4 | Denver, CO | Retail | JPMCC 2004-C3 |

| 35 | Hilton Garden Inn Tampa Riverview | Riverview, FL | Hotel | S2H 2012-LV1 |

| 46 | 100 Provena Way | Bourbonnais, IL | Office | WBCMT 2006-C24 |

| 47 | Forest Cove | Ann Arbor, MI | Office | GCCFC 2004-GG1 |

| 49 | Summer Chase | Little River, SC | Multifamily | GECMC 2005-C1 |

| 50 | Walden Park Shopping Center | Austin, TX | Retail | GCCFC 2005-GG3 |

| 53 | Mill Creek Crossing | Buford, GA | Retail | FDIC 2012-C1 |

| 54 | Cypress Pointe | Redding, CA | Retail | BSCMS 2005-T18 |

| 58 | 3445 North Causeway | Metairie, LA | Office | BACM 2006-4 |

| 60 | 701 Martinsville | Liberty Corner, NJ | Office | MSC 2005-HQ5 |

| 67 | Mobile Gardens MHC | Mission, TX | Manufactured Housing | WBCMT 2007-C31 |

| (1) | The table above represents the properties for which the previously existing debt was most recently securitized, based on information provided by the related borrower or obtained through searches of a third-party database. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

|  |  |

| 12 of 133 |

| Structural and Collateral Term Sheet | JPMBB 2014-C26 |

Class A-2(1) |

No. | Loan Name | Location | Cut-off Date Balance | % of IPB | Maturity/ARD Balance | % of Certificate Class(2) | Original Loan Term | Remaining Loan Term | UW NCF DSCR | UW NOI Debt Yield | Cut-off Date LTV Ratio | Maturity Date/ARD LTV Ratio | |||||||||

| 3 | Wells Fargo Center Tampa | Tampa, FL | $59,800,000 | 4.1% | $54,914,163 | 25.9% | 60 | 60 | 1.33x | 9.0% | 76.7% | 70.4% | |||||||||

| 9 | United Healthcare Office | Las Vegas, NV | 42,000,000 | 2.9 | 42,000,000 | 19.8 | 60 | 58 | 2.02x | 9.8% | 70.0% | 70.0% | |||||||||

| 11 | The View & Legends | Dallas, TX | 38,250,000 | 2.6 | 36,619,487 | 17.3 | 60 | 58 | 1.25x | 8.7% | 75.0% | 71.8% | |||||||||

| 29 | 1019 Market Street | San Francisco, CA | 19,300,000 | 1.3 | 19,300,000 | 9.1 | 60 | 60 | 3.61x | 13.9% | 40.0% | 40.0% | |||||||||

| 30 | Fordham Road Business Park | Wilmington, MA | 18,500,000 | 1.3 | 17,911,899 | 8.5 | 60 | 59 | 1.51x | 10.7% | 69.8% | 67.6% | |||||||||

| 32 | Broadway Marketplace - Parcel 2,3,4 | Denver, CO | 16,638,691 | 1.1 | 15,283,737 | 7.2 | 60 | 59 | 1.29x | 8.6% | 70.5% | 64.8% | |||||||||

| 33 | Staybridge Suites Savannah Historic District | Savannah, GA | 14,850,000 | 1.0 | 14,152,798 | 6.7 | 60 | 59 | 1.53x | 9.5% | 62.4% | 59.5% | |||||||||

| 55 | American Water Works | Pensacola, FL | 6,300,000 | 0.4 | 5,769,609 | 2.7 | 60 | 60 | 1.41x | 9.8% | 74.6% | 68.4% | |||||||||

| 58 | 3445 North Causeway | Metairie, LA | 5,700,000 | 0.4 | 5,700,000 | 2.7 | 60 | 60 | 3.06x | 15.4% | 55.9% | 55.9% | |||||||||

| Total / Weighted Average: | $221,338,691 | 15.3% | $211,651,694 | 100.0% | 60 | 59 | 1.72x | 9.9% | 69.3% | 66.1% | |||||||||||

| (1) | The table above presents the mortgage loans whose balloon payments would be applied to pay down the principal balance of the Class A-2 Certificates, assuming a 0% CPR and applying the “Modeling Assumptions” described in the Free Writing Prospectus, including the assumptions that (i) none of the mortgage loans in the pool experience prepayments, defaults or losses; (ii) there are no extensions of maturity dates of any mortgage loans in the pool; and (iii) each mortgage loan in the pool is paid in full on its stated maturity date or anticipated repayment date, as applicable. Each class of Certificates, including the Class A-2 Certificates, evidences undivided ownership interests in the entire pool of mortgage loans. Debt service coverage ratio, debt yield and loan-to-value ratio information does not take into account subordinate debt (whether or not secured by the mortgaged property), if any, that is allowed under the terms of any mortgage loan. See Annex A-1 to the Free Writing Prospectus. |

| (2) | Reflects the percentage equal to the Maturity/ARD Balance divided by the initial Class A-2 Certificate Balance. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

|  |  |

| 13 of 133 |

| Structural and Collateral Term Sheet | JPMBB 2014-C26 |

| Structural Overview |

| ■ | Accrual: | Each Class of Certificates (other than the Class HOW and Class R Certificates) will accrue interest on a 30/360 basis. Interest on the Class HOW Certificates will be calculated on an Actual/360 Basis. The Class R Certificates will not accrue interest. On each Distribution Date, any excess interest collected in respect of any mortgage loan in the trust with an anticipated repayment date during the related due period will be distributed to the holders of the Class NR Certificates. | |

| ■ | Distribution of Interest: | On each Distribution Date, accrued interest for each Class of Certificates (other than the Class HOW and Class R Certificates) at the applicable pass-through rate will be distributed in the following order of priority to the extent of available funds: first, to the Class A-1, Class A-2, Class A-3, Class A-4, Class A-SB, Class X-A, Class X-B, Class X-C, Class X-D, Class X-E, Class X-F and Class X-NR Certificates, on a pro rata basis, based on the interest entitlement for each such Class on such date, and then to the Class A-S, Class B, Class C, Class D, Class E, Class F and Class NR Certificates, in that order, in each case until the interest entitlement for such date payable to each such Class is paid in full. | |

| Payments of interest collected on the 543 Howard Whole Loan will be allocated first to the 543 Howard Mortgage Loan and then to the HOW Trust Subordinate Companion Loan (as defined below). Interest allocated to the HOW Trust Subordinate Companion Loan will only be available to make distributions and pay other amounts in respect of the Class HOW Certificates, as applicable. | |||

The pass-through rate applicable to the Class A-1, Class A-2, Class A-3, Class A-4, Class A-SB, Class A-S, Class B, Class C, Class D, Class E, Class F and Class NR certificates on each Distribution Date will be a per annum rate equal to one of (i) a fixed rate, (ii) the weighted average of the net mortgage rates on the mortgage loans (in each case adjusted, if necessary, to accrue on the basis of a 360-day year consisting of twelve 30-day months), (iii) the lesser of a specified fixed pass-through rate and the rate described in clause (ii) above or (iv) the rate described in clause (ii) above less a specified percentage. | |||

| The pass-through rate for the Class X-A Certificates for any Distribution Date will equal the excess, if any, of (a) the weighted average of the net mortgage rates on the mortgage loans (in each case adjusted, if necessary, to accrue on the basis of a 360-day year consisting of twelve 30-day months), over (b) the weighted average of the pass-through rates on the Class A-1, Class A-2, Class A-3, Class A-4, Class A-SB and Class A-S Certificates, weighted on the basis of their respective Certificate Balances immediately prior to that Distribution Date and calculated without giving effect to any exchange and conversion of any Class A-S Certificates for Class EC Certificates. | |||

| The pass-through rate for the Class X-B Certificates for any Distribution Date will equal the excess, if any, of (a) the weighted average of the net mortgage rates on the mortgage loans (in each case adjusted, if necessary, to accrue on the basis of a 360-day year consisting of twelve 30-day months), over (b) the pass-through rate of the Class B Certificates for that Distribution Date. | |||

| The pass-through rate for the Class X-C certificates for any distribution date will equal the excess, if any, of (a) the weighted average of the net mortgage rates on the mortgage loans (in each case adjusted, if necessary, to accrue on the basis of a 360-day year consisting of twelve 30-day months), over (b) the pass-through rate of the Class C certificates for that distribution date. | |||

| The pass-through rate for the Class X-D Certificates for any Distribution Date will equal the excess, if any, of (a) the weighted average of the net mortgage rates on the mortgage loans (in each case adjusted, if necessary, to accrue on the basis of a 360-day year consisting of twelve 30-day months), over (b) the pass-through rate of the Class D Certificates for that Distribution Date. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

|  |  |

| 14 of 133 |

| Structural and Collateral Term Sheet | JPMBB 2014-C26 |

| Structural Overview |

| The pass-through rate for the Class X-E Certificates for any Distribution Date will equal the excess, if any, of (a) the weighted average of the net mortgage rates on the mortgage loans (in each case adjusted, if necessary, to accrue on the basis of a 360-day year consisting of twelve 30-day months), over (b) the pass-through rate of the Class E Certificates for that Distribution Date. | |||

| The pass-through rate for the Class X-F Certificates for any Distribution Date will equal the excess, if any, of (a) the weighted average of the net mortgage rates on the mortgage loans (in each case adjusted, if necessary, to accrue on the basis of a 360-day year consisting of twelve 30-day months), over (b) the pass-through rate of the Class F Certificates for that Distribution Date. | |||

| The pass-through rate for the Class X-NR certificates for any distribution date will equal the excess, if any, of (a) the weighted average of the net mortgage rates on the mortgage loans (in each case adjusted, if necessary, to accrue on the basis of a 360-day year consisting of twelve 30-day months), over (b) the pass-through rate of the Class NR certificates for that distribution date. | |||

| The Class EC Certificates will not have a pass-through rate, but will be entitled to receive the sum of the interest otherwise distributable on the portion of Exchangeable Certificates that have been converted in an exchange for such Class EC Certificates. | |||

| On each Distribution Date, any excess interest collected in respect of any mortgage loan in the trust with an anticipated repayment date during the related due period will be distributed to the holders of the Class NR Certificates. | |||

See “Description of the Certificates—Distributions” in the Free Writing Prospectus. | |||

| ■ | Distribution of Principal: | On any Distribution Date prior to the Cross-Over Date, payments in respect of principal of the Certificates will be distributed first, to the Class A-SB Certificates until the Certificate Balance of the Class A-SB Certificates is reduced to the planned principal balance for the related Distribution Date set forth in Annex E to the Free Writing Prospectus, second, to the Class A-1 Certificates, until the Certificate Balance of such Class is reduced to zero, third, to the Class A-2 Certificates, until the Certificate Balance of such Class is reduced to zero, fourth, to the Class A-3 Certificates, until the Certificate Balance of such Class is reduced to zero, fifth, to the Class A-4 Certificates, until the Certificate Balance of such Class is reduced to zero, sixth, to the Class A-SB Certificates, until the Certificate Balance of such Class is reduced to zero and then to the Class A-S, Class B, Class C, Class D, Class E, Class F and Class NR Certificates, in that order, until the Certificate Balance of each such Class is reduced to zero. | |

On any Distribution Date on or after the Cross-Over Date, payments in respect of principal of the Certificates will be distributed first, to the Class A-1, Class A-2, Class A-3, Class A-4 and Class A-SB Certificates, on a pro rata basis, based on the Certificate Balance of each such Class until the Certificate Balance of each such Class is reduced to zero and then, to the Class A-S, Class B, Class C, Class D, Class E, Class F and Class NR Certificates, in that order, until the Certificate Balance of each such Class is reduced to zero. | |||

The “Cross-Over Date” means the Distribution Date on which the aggregate Certificate Balances of the Class A-S, Class B, Class C, Class D, Class E, Class F and Class NR Certificates (without giving effect to any exchange of the Exchangeable Certificates for Class EC Certificates) have been reduced to zero (after taking into account any allocation of realized losses on the mortgage loans (exclusive of any related companion loan and with respect to the 543 Howard Whole Loan, exclusive of the HOW Trust Subordinate Companion Loan) to such Classes on or prior to such date). If Exchangeable Certificates are converted in an exchange for Class EC Certificates, all principal that would otherwise be distributable to such converted Exchangeable Certificates will be distributed to such Class EC Certificates. | |||

The Class X-A, Class X-B, Class X-C, Class X-D, Class X-E, Class X-F and Class X-NR Certificates (the “Class X Certificates”) will not be entitled to receive distributions of |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

|  |  |

| 15 of 133 |

| Structural and Collateral Term Sheet | JPMBB 2014-C26 |

| Structural Overview |