| | | FREE WRITING PROSPECTUS |

| | | FILED PURSUANT TO RULE 433 |

| | | REGISTRATION FILE NO.: 333-206361-15 |

| | | |

| July [20], 2018 | Benchmark 2018-B5 |

Free Writing Prospectus Structural and Collateral Term Sheet |

BENCHMARK 2018-B5 |

This material is for your information, and none of J.P. Morgan Securities LLC (“JPMS”), Deutsche Bank Securities Inc., Citigroup Global Markets Inc., Drexel Hamilton, LLC and Academy Securities, Inc., (each individually, an “Underwriter”, and together, the ‘‘Underwriters’’) are soliciting any action based upon it. This material is not to be construed as an offer to sell or the solicitation of any offer to buy any security in any jurisdiction where such an offer or solicitation would be illegal. The depositor has filed a registration statement (including a prospectus) with the SEC (SEC File No. 333-206361) for the offering to which this free writing prospectus relates. Before you invest, you should read the prospectus in the registration statement and other documents the depositor has filed with the SEC for more complete information about the depositor, the issuing entity and this offering. You may get these documents for free by visiting EDGAR on the SEC Web site at www.sec.gov. Alternatively, the depositor, any underwriter or any dealer participating in the offering will arrange to send you the prospectus if you request it by calling (800) 408-1016 or by emailing the ABS Syndicate Desk atabs_synd@jpmorgan.com. THE SECURITIES TO WHICH THIS INFORMATION RELATES WILL BE MORE FULLY DESCRIBED IN A PROSPECTUS (THE “PROSPECTUS”), WHICH IS NOT YET AVAILABLE. THE PROSPECTUS WILL CONTAIN MATERIAL INFORMATION THAT IS NOT CONTAINED IN THESE MATERIALS (INCLUDING WITHOUT LIMITATION A DETAILED DISCUSSION OF RISKS ASSOCIATED WITH AN INVESTMENT IN THE CERTIFICATES, UNDER THE HEADING“RISK FACTORS”IN THE PROSPECTUS). Neither this document nor anything contained in this document shall form the basis for any contract or commitment whatsoever. The information contained in this document is preliminary as of the date of this document, supersedes any previous such information delivered to you and will be superseded by any such information subsequently delivered prior to the time of sale. These materials are subject to change, completion or amendment from time to time. This information is based upon management forecasts and reflects prevailing conditions and management’s views as of this date, all of which are subject to change. J.P. Morgan is the marketing name for the investment banking businesses of JPMorgan Chase & Co. and its subsidiaries worldwide. Securities, syndicated loan arranging, financial advisory and other investment banking activities are performed by JPMS and its securities affiliates, and lending, derivatives and other commercial banking activities are performed by JPMorgan Chase Bank, National Association and its banking affiliates. JPMS is a member of SIPC and the NYSE. THE UNDERWRITERS MAY FROM TIME TO TIME PERFORM INVESTMENT BANKING SERVICES FOR, OR SOLICIT INVESTMENT BANKING BUSINESS FROM, ANY COMPANY NAMED IN THESE MATERIALS. THE UNDERWRITERS AND/OR THEIR AFFILIATES OR RESPECTIVE EMPLOYEES MAY FROM TIME TO TIME HAVE A LONG OR SHORT POSITION IN ANY CERTIFICATE OR CONTRACT DISCUSSED IN THESE MATERIALS. |

| |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

| July [20], 2018 | Benchmark 2018-B5 |

THE REPUBLIC OF KOREA

THIS PROSPECTUS IS NOT, AND UNDER NO CIRCUMSTANCES IS THIS PROSPECTUS TO BE CONSTRUED AS, A PUBLIC OFFERING OF SECURITIES IN KOREA. NEITHER THE ISSUER NOR ANY OF ITS AGENTS MAKE ANY REPRESENTATION WITH RESPECT TO THE ELIGIBILITY OF ANY RECIPIENTS OF THIS PROSPECTUS TO ACQUIRE THE OFFERED CERTIFICATES UNDER THE LAWS OF KOREA, INCLUDING, BUT WITHOUT LIMITATION, THE FOREIGN EXCHANGE TRANSACTION LAW AND REGULATIONS THEREUNDER (THE “FETL”). THE OFFERED CERTIFICATES HAVE NOT BEEN REGISTERED WITH THE FINANCIAL SERVICES COMMISSION OF KOREA FOR PUBLIC OFFERING IN KOREA, AND NONE OF THE OFFERED CERTIFICATES MAY BE OFFERED, SOLD OR DELIVERED, DIRECTLY OR INDIRECTLY, OR OFFERED OR SOLD TO ANY PERSON FOR RE-OFFERING OR RESALE, DIRECTLY OR INDIRECTLY IN KOREA OR TO ANY RESIDENT OF KOREA EXCEPT PURSUANT TO THE FINANCIAL INVESTMENT SERVICES AND CAPITAL MARKETS ACT AND THE DECREES AND REGULATIONS THEREUNDER (THE “FSCMA”), THE FETL AND ANY OTHER APPLICABLE LAWS, REGULATIONS AND MINISTERIAL GUIDELINES IN KOREA. WITHOUT PREJUDICE TO THE FOREGOING, THE NUMBER OF OFFERED CERTIFICATES OFFERED IN KOREA OR TO A RESIDENT OF KOREA SHALL BE LESS THAN FIFTY AND FOR A PERIOD OF ONE YEAR FROM THE ISSUE DATE OF THE OFFERED CERTIFICATES, NONE OF THE OFFERED CERTIFICATES MAY BE DIVIDED RESULTING IN AN INCREASED NUMBER OF OFFERED CERTIFICATES. FURTHERMORE, THE OFFERED CERTIFICATES MAY NOT BE RESOLD TO KOREAN RESIDENTS UNLESS THE PURCHASER OF THE OFFERED CERTIFICATES COMPLIES WITH ALL APPLICABLE REGULATORY REQUIREMENTS (INCLUDING, BUT NOT LIMITED TO, GOVERNMENT REPORTING APPROVAL REQUIREMENTS UNDER THE FETL AND ITS SUBORDINATE DECREES AND REGULATIONS) IN CONNECTION WITH THE PURCHASE OF THE OFFERED CERTIFICATES.

JAPAN

THE OFFERED CERTIFICATES HAVE NOT BEEN AND WILL NOT BE REGISTERED UNDER THE FINANCIAL INSTRUMENTS AND EXCHANGE LAW OF JAPAN, AS AMENDED (THE “FIEL”), AND DISCLOSURE UNDER THE FIEL HAS NOT BEEN AND WILL NOT BE MADE WITH RESPECT TO THE OFFERED CERTIFICATES. ACCORDINGLY, EACH UNDERWRITER HAS REPRESENTED AND AGREED THAT IT HAS NOT, DIRECTLY OR INDIRECTLY, OFFERED OR SOLD AND WILL NOT, DIRECTLY OR INDIRECTLY, OFFER OR SELL ANY OFFERED CERTIFICATES IN JAPAN OR TO, OR FOR THE BENEFIT OF, ANY RESIDENT OF JAPAN (WHICH TERM AS USED IN THIS PROSPECTUS MEANS ANY PERSON RESIDENT IN JAPAN, INCLUDING ANY CORPORATION OR OTHER ENTITY ORGANIZED UNDER THE LAWS OF JAPAN) OR TO OTHERS FOR REOFFERING OR RE-SALE, DIRECTLY OR INDIRECTLY, IN JAPAN OR TO, OR FOR THE BENEFIT OF, ANY RESIDENT OF JAPAN EXCEPT PURSUANT TO AN EXEMPTION FROM THE REGISTRATION REQUIREMENTS OF, AND OTHERWISE IN COMPLIANCE WITH, THE FIEL AND OTHER RELEVANT LAWS, REGULATIONS AND MINISTERIAL GUIDELINES OF JAPAN. AS PART OF THIS OFFERING OF THE OFFERED CERTIFICATES, THE UNDERWRITERS MAY OFFER THE OFFERED CERTIFICATES IN JAPAN TO UP TO 49 OFFEREES IN ACCORDANCE WITH THE ABOVE PROVISIONS.

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

2 of 130

| Structural and Collateral Term Sheet | | Benchmark 2018-B5 |

| |

| Collateral Characteristics |

| Loan Pool | |

| | Initial Pool Balance (“IPB”): | $1,039,132,161 |

| | Number of Mortgage Loans: | 55 |

| | Number of Mortgaged Properties: | 219 |

| | Average Cut-off Date Balance per Mortgage Loan: | $18,893,312 |

| | Weighted Average Current Mortgage Rate: | 4.63043% |

| | 10 Largest Mortgage Loans as % of IPB: | 48.5% |

| | Weighted Average Remaining Term to Maturity(1): | 107 months |

| | Weighted Average Seasoning: | 1 months |

| | | |

| Credit Statistics | |

| | Weighted Average UW NCF DSCR(2): | 2.18x |

| | Weighted Average UW NOI Debt Yield(2): | 11.3% |

| | Weighted Average Cut-off Date Loan-to-Value Ratio (“LTV”)(2)(3): | 56.7% |

| | Weighted Average Maturity Date LTV(1)(2)(3): | 52.7% |

| | | |

| Other Statistics | |

| | % of Mortgage Loans with Additional Debt: | 30.7% |

| | % of Mortgaged Properties with Single Tenants: | 16.6% |

| | | |

| Amortization | |

| | Weighted Average Original Amortization Term(4): | 343 months |

| | Weighted Average Remaining Amortization Term(4): | 343 months |

| | % of Mortgage Loans with Interest-Only: | 59.0% |

| | % of Mortgage Loans with Partial Interest-Only followed by Amortizing Balloon: | 19.9% |

| | % of Mortgage Loans with Amortizing Balloon: | 17.2% |

| | % of Mortgage Loans with Interest-Only followed by ARD structure: | 3.8% |

| | | |

| Lockbox / Cash Management(5) | |

| | % of Mortgage Loans with In-Place, Hard Lockboxes: | 47.4% |

| | % of Mortgage Loans with Springing Lockboxes: | 35.6% |

| | % of Mortgage Loans with Hard; Master Lease Rents (Soft Springing): | 9.9% |

| | % of Mortgage Loans with In-Place, Soft Lockboxes: | 6.2% |

| | % of Mortgage Loans with Soft Springing Lockboxes: | 0.9% |

| | % of Mortgage Loans with Springing Cash Management: | 81.0% |

| | % of Mortgage Loans with In-Place Cash Management: | 19.0% |

| | | |

| Reserves | |

| | % of Mortgage Loans Requiring Monthly Tax Reserves: | 77.2% |

| | % of Mortgage Loans Requiring Monthly Insurance Reserves: | 26.9% |

| | % of Mortgage Loans Requiring Monthly CapEx Reserves(6): | 68.4% |

| | % of Mortgage Loans Requiring Monthly TI/LC Reserves(7): | 34.6% |

| (1) | In the case of Loan No. 8, with an anticipated repayment date, Remaining Term to Maturity and Maturity Date LTV are calculated as of the related anticipated repayment date. |

| (2) | In the case of Loan Nos. 1, 4, 7, 8, 14, 18 and 19, the UW NCF DSCR, UW NOI Debt Yield, Cut-off Date LTV and Maturity Date LTV calculations include the related Pari Passu Companion Loan(s). In the case of Loan Nos. 1, 3, 4, 7, 8 and 10, the UW NCF DSCR, UW NOI Debt Yield, Cut-off Date LTV and Maturity Date LTV calculations exclude the related Subordinate Companion Loan(s) and/or related mezzanine loan(s). In the case of (i) Loan Nos. 23 and 24 and (ii) Loan Nos. 26 and 27, the loans in each such group are cross-collateralized and cross-defaulted with each other. As such, the calculations are based on the aggregate Cut-off Date Principal Balances, Maturity Date Principal Balances, UW NOI, UW NCF and Debt Service of the related group of those mortgage loans. |

| (3) | In the case of Loan Nos. 3, 7, 8, 10, 11, 14, 28, 37, 38, 40 and 43 the Cut-off Date LTV and the Maturity Date LTV are calculated by using an appraised value based on certain hypothetical assumptions. Refer to “Description of the Mortgage Pool—Assessments of Property Value and Condition” and “—Appraised Value” in the Preliminary Prospectus for additional details. |

| (4) | Excludes 24 mortgage loans that are interest-only for the entire term or until the related anticipated repayment date. |

| (5) | For a more detailed description of Lockbox / Cash Management, refer to “Description of the Mortgage Pool—Certain Terms of the Mortgage Loans—Mortgaged Property Accounts” in the Preliminary Prospectus. |

| (6) | CapEx Reserves include FF&E reserves for hotel properties. |

| (7) | Calculated only with respect to the Cut-off Date Balance of mortgage loans secured or partially secured by office, retail, flex and industrial properties. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

3 of 130

| Structural and Collateral Term Sheet | | Benchmark 2018-B5 |

| |

| Collateral Characteristics |

Mortgage Loan Seller | Number of

Mortgage Loans | Number of

Mortgaged

Properties | Aggregate

Cut-off Date

Balance | |

| JPMCB | 15 | 161 | $327,038,577 | 31.5% |

| CREFI | 23 | 38 | 347,680,896 | 33.5 |

| GACC(1) | 16 | 19 | 261,412,687 | 25.2 |

| JPMCB/GACC(2) | 1 | 1 | 103,000,000 | 9.9 |

| Total: | 55 | 219 | $1,039,132,161 | 100.0% |

| (1) | All of the loans for which GACC is the Mortgage Loan Seller were originated by Deutsche Bank, AG, New York Branch (“DBNY”) (an affiliate of GACC). In the case of Loan No. 8, the whole loan was co-originated by Barclays and DBNY. |

| (2) | In the case of Loan No. 1, the whole loan was co-originated by Wells Fargo Bank, National Association, Morgan Stanley Bank, National Association, JPMCB and DBNY. JPMCB will contribute the promissory note A-2-A-1 with a Cut-off Date Balance of $65,000,000 and DBNY will contribute the promissory note A-2-B-2-A with a Cut-off Date Balance of $38,000,000 to this securitization. |

| Ten Largest Mortgage Loans |

| |

| No. | Loan Name | Mortgage

Loan Seller | No.

of Prop. | Cut-off Date

Balance | % of

IPB | SF /

Rooms | Property Type | UW

NCF DSCR(1) | UW NOI Debt Yield(1) | Cut-off Date LTV(1)(2) | Maturity Date LTV(1)(2)(3) |

| 1 | Aventura Mall | JPMCB/GACC | 1 | $103,000,000 | 9.9% | 1,217,508 | Retail | 2.58x | 11.0% | 40.8% | 40.8% |

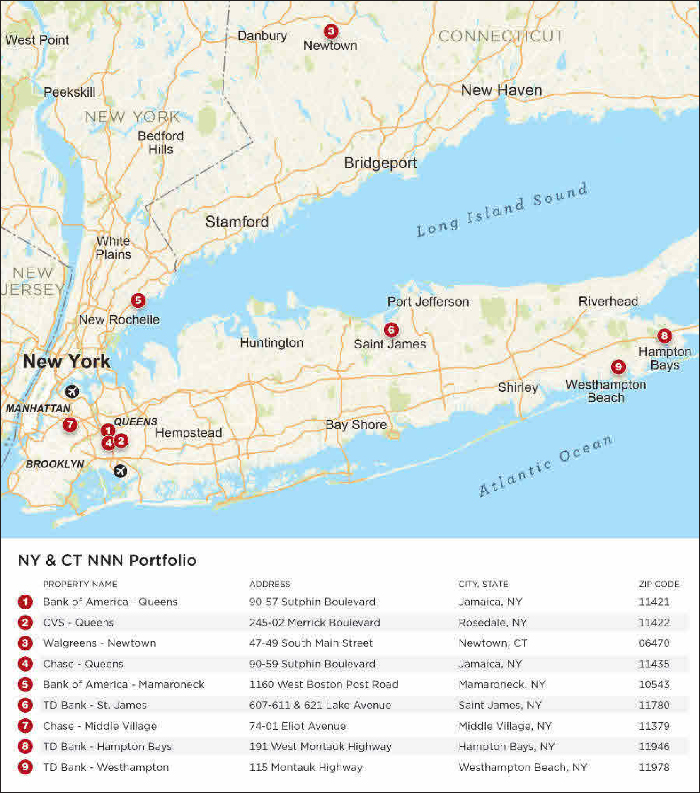

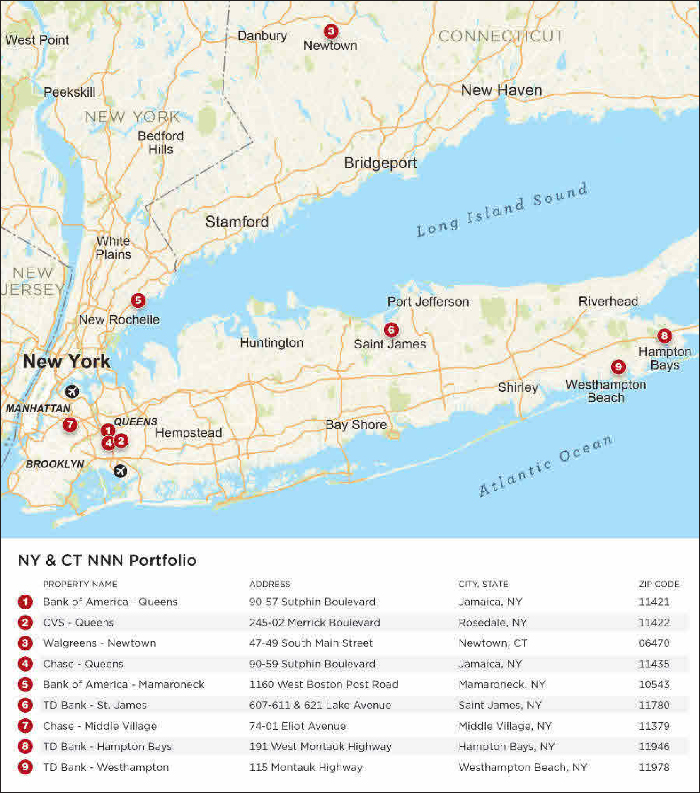

| 2 | NY & CT NNN Portfolio | CREFI | 9 | $57,375,000 | 5.5% | 70,333 | Retail | 1.61x | 8.3% | 61.2% | 61.2% |

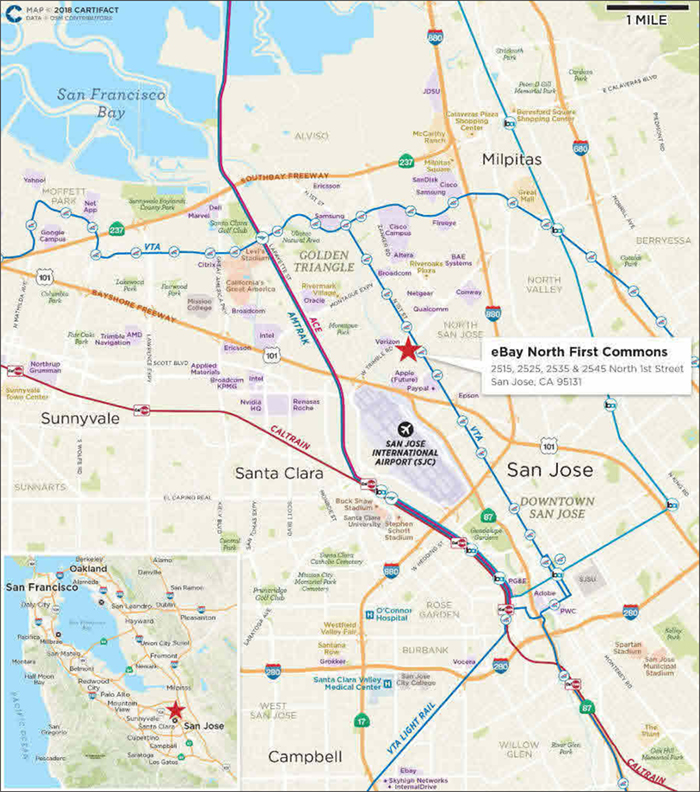

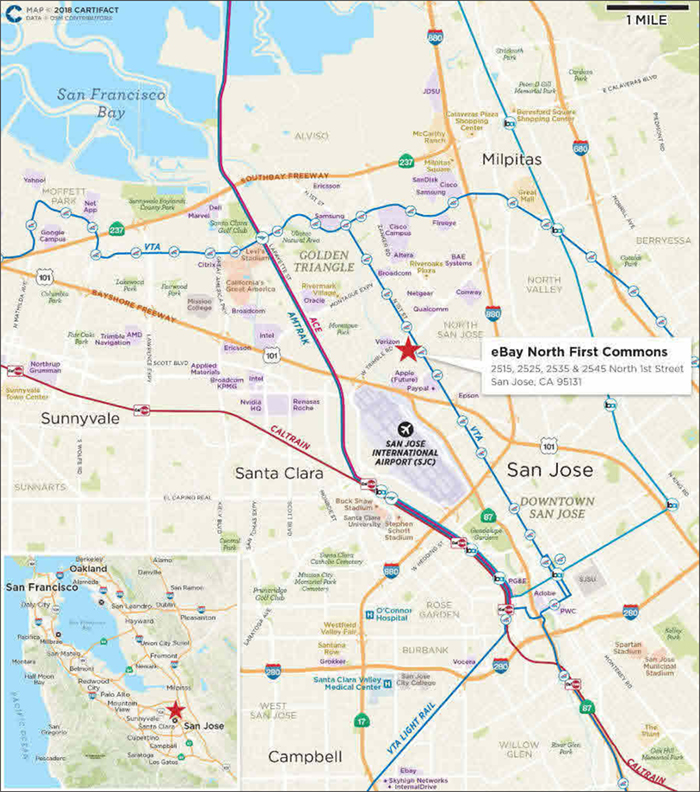

| 3 | eBay North First Commons | GACC | 1 | $51,000,000 | 4.9% | 250,056 | Office | 5.13x | 13.8% | 38.1% | 38.1% |

| 4 | Workspace | JPMCB | 147 | $50,000,000 | 4.8% | 9,884,763 | Various | 3.60x | 21.6% | 35.4% | 35.4% |

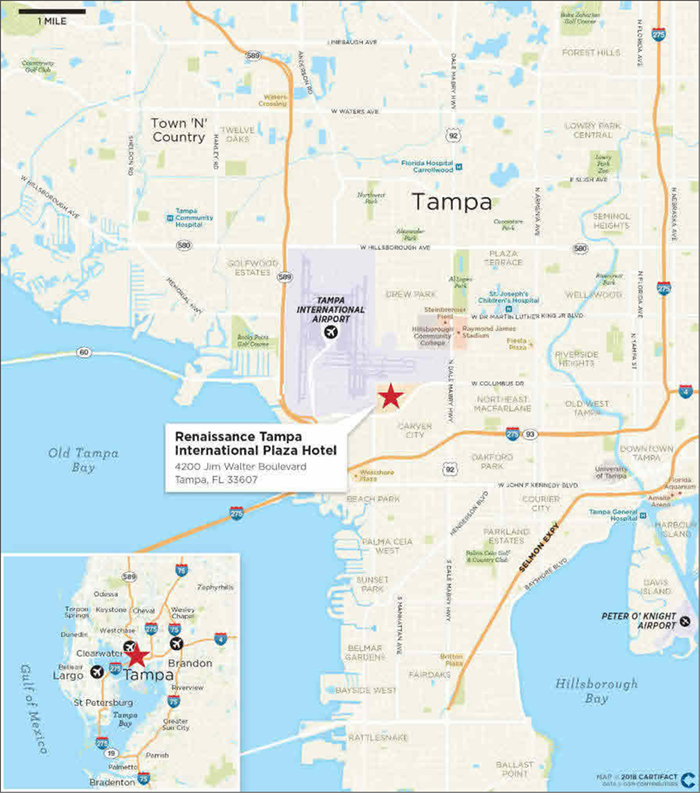

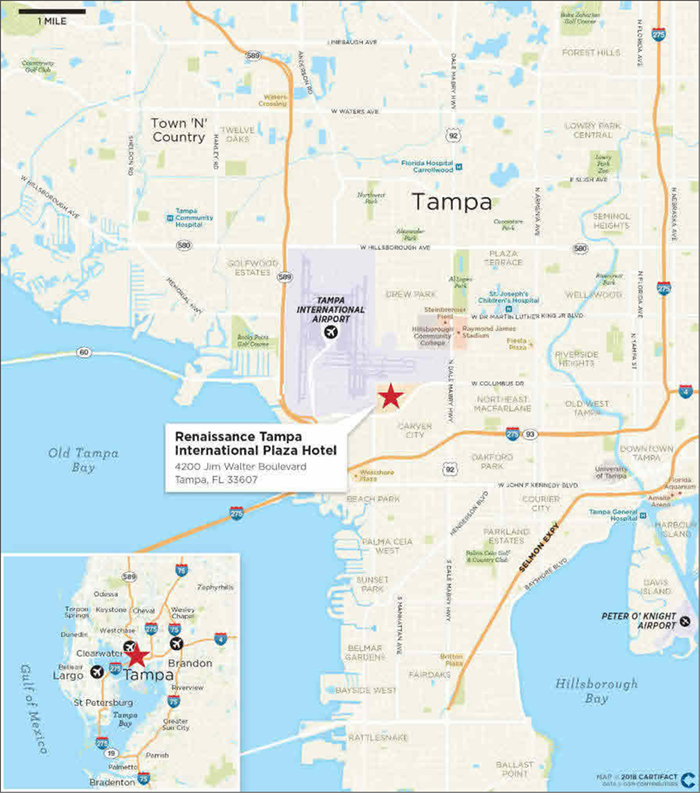

| 5 | Renaissance Tampa International Plaza Hotel | JPMCB | 1 | $44,200,000 | 4.3% | 293 | Hotel | 3.00x | 13.9% | 63.9% | 63.9% |

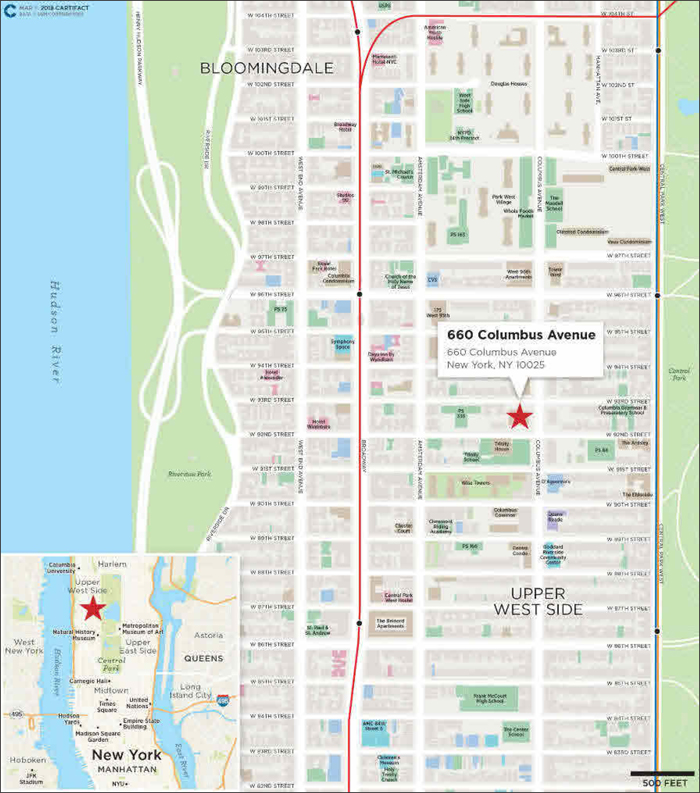

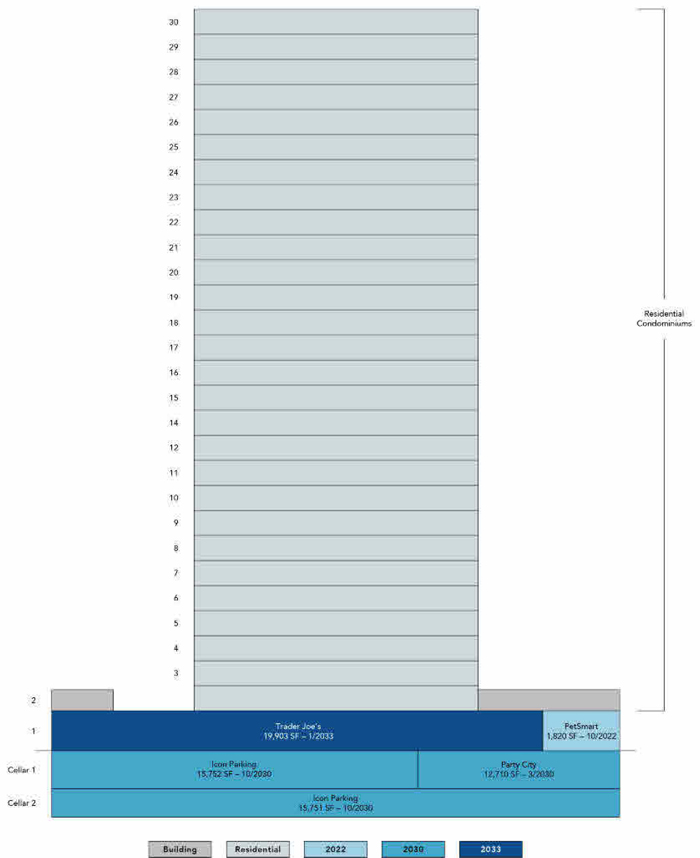

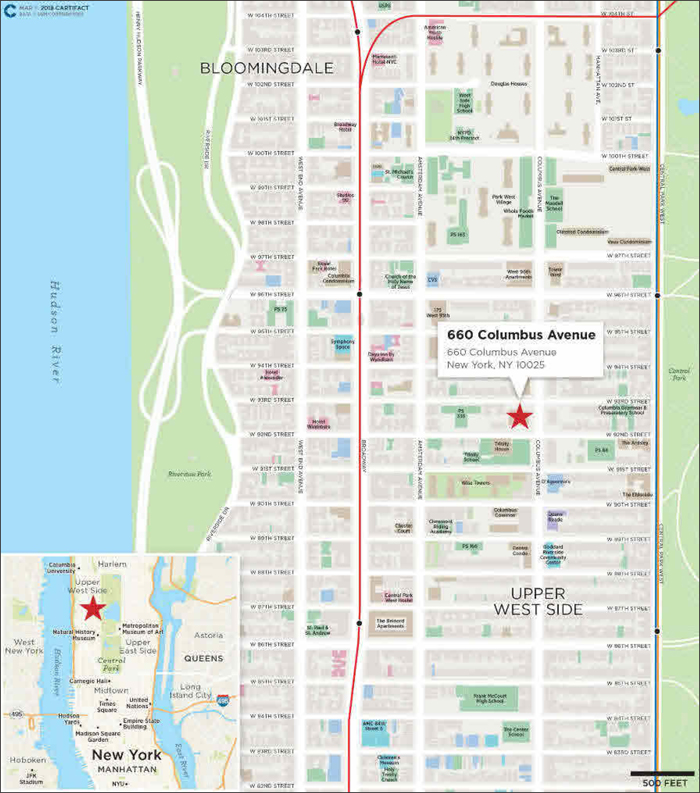

| 6 | 660 Columbus Avenue | JPMCB | 1 | $43,500,000 | 4.2% | 65,936 | Retail | 1.36x | 6.7% | 62.7% | 62.7% |

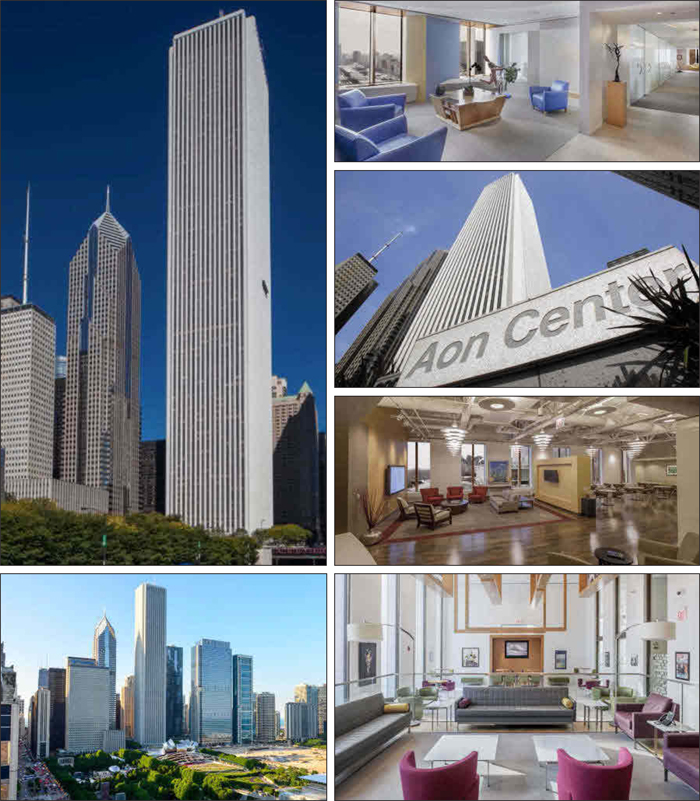

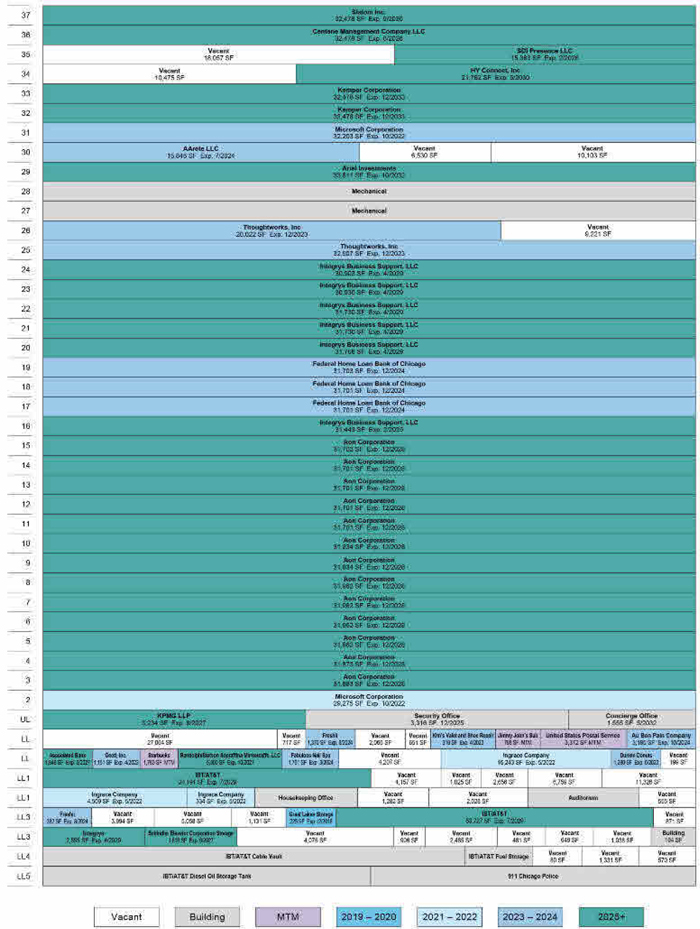

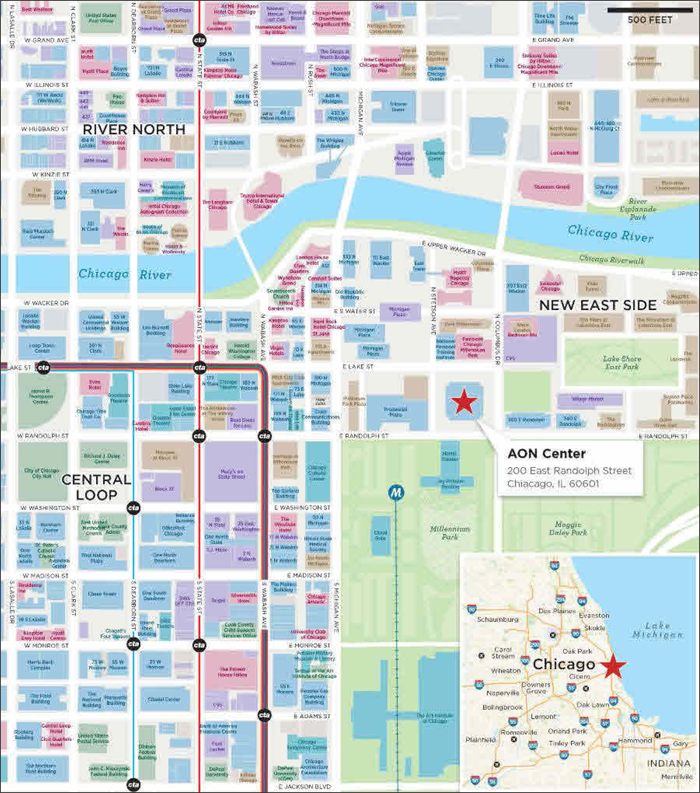

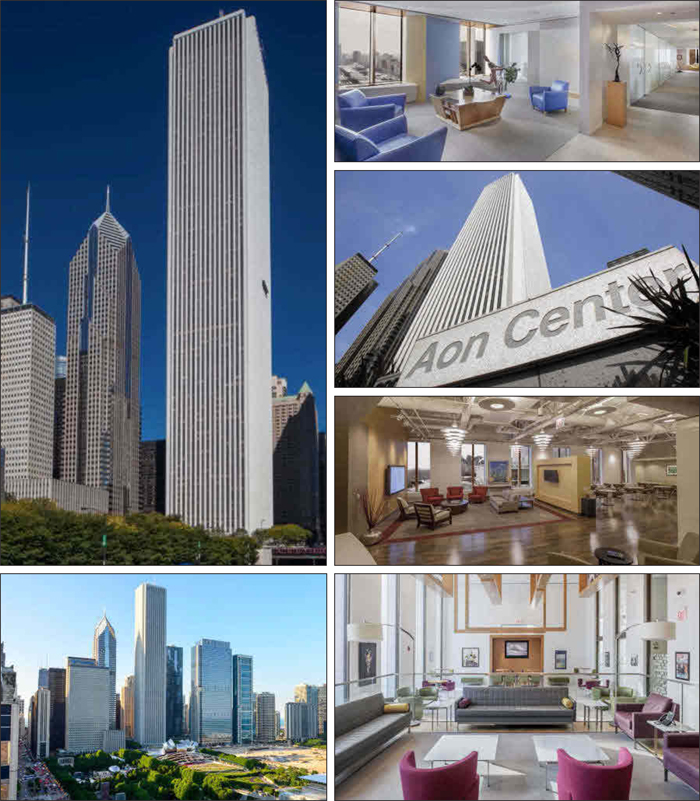

| 7 | Aon Center | JPMCB | 1 | $43,000,000 | 4.1% | 2,777,240 | Office | 3.03x | 15.5% | 40.3% | 40.3% |

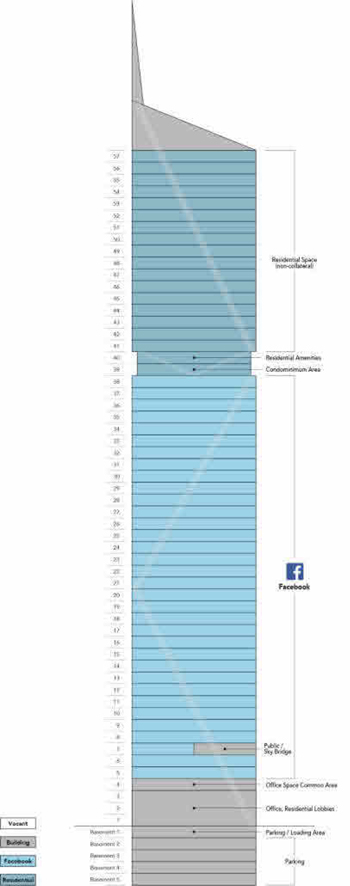

| 8 | 181 Fremont Street | GACC | 1 | $40,000,000 | 3.8% | 436,332 | Office | 3.14x | 11.8% | 39.6% | 39.6% |

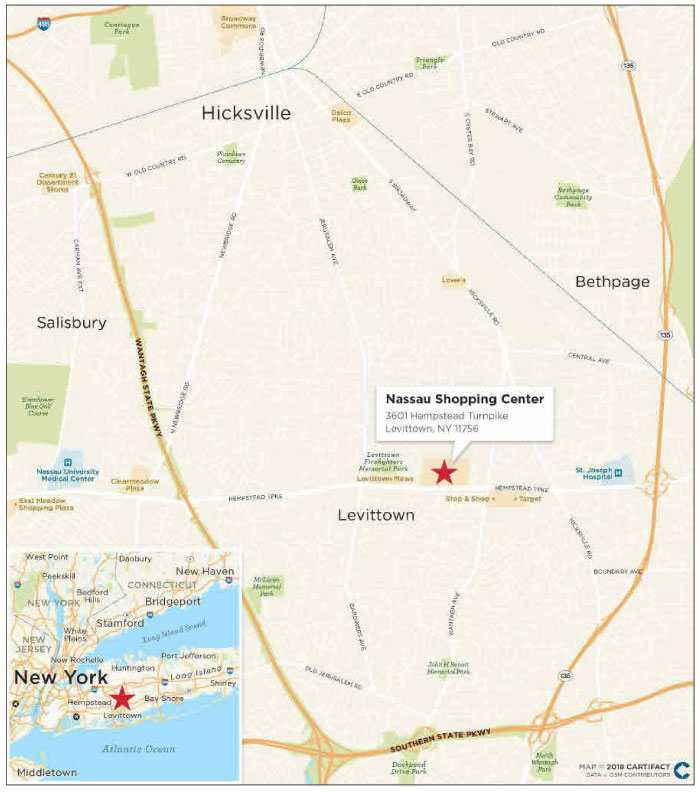

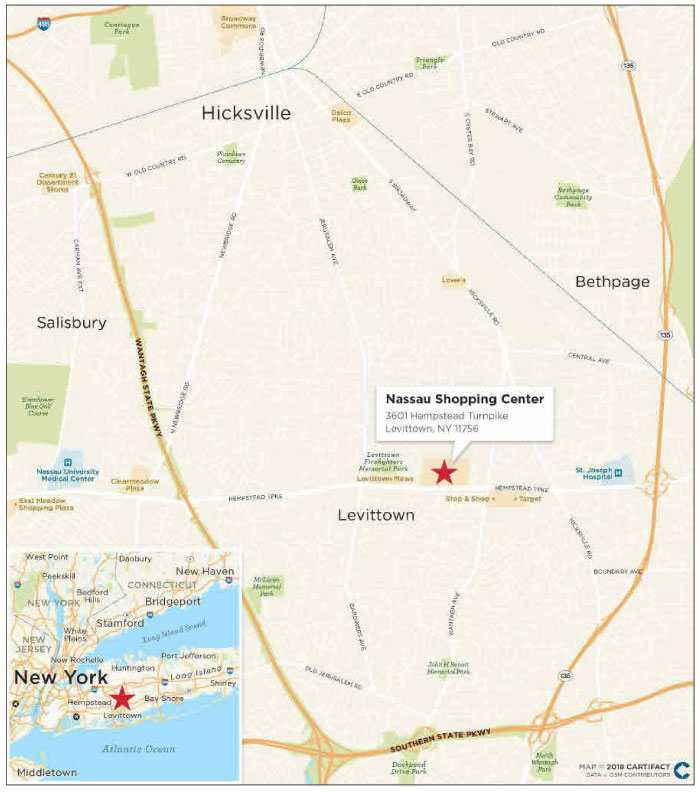

| 9 | Nassau Shopping Center | CREFI | 1 | $40,000,000 | 3.8% | 291,146 | Retail | 2.24x | 10.9% | 54.8% | 54.8% |

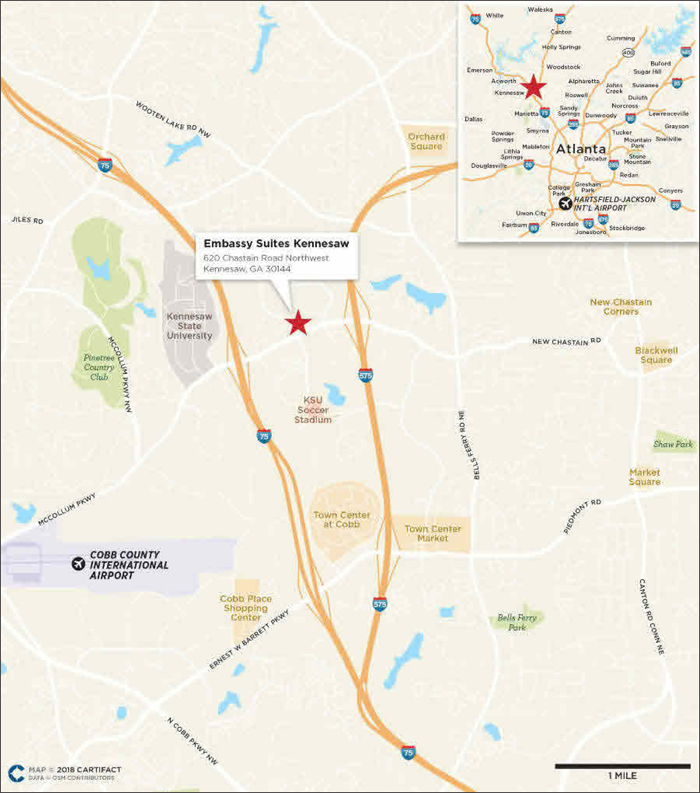

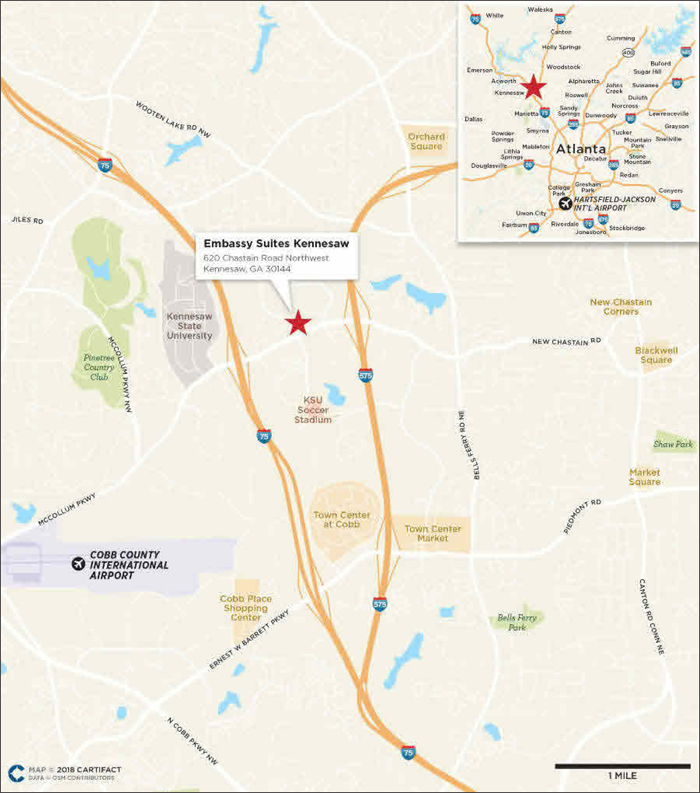

| 10 | Embassy Suites Kennesaw | JPMCB | 1 | $31,968,577 | 3.1% | 192 | Hotel | 1.81x | 12.1% | 64.6% | 53.7% |

| | | | | | | | | | | | |

| | Top 3 Total/Weighted Average | 11 | $211,375,000 | 20.3% | | | 2.93x | 10.9% | 45.7% | 45.7% |

| | Top 5 Total/Weighted Average | 159 | $305,575,000 | 29.4% | | | 3.05x | 13.1% | 46.6% | 46.6% |

| | Top 10 Total/Weighted Average | 164 | $504,043,577 | 48.5% | | | 2.77x | 12.4% | 48.7% | 48.0% |

| | | | | | | | | | | | | |

| (1) | In the case of Loan Nos. 1, 4, 7 and 8, the UW NCF DSCR, UW NOI Debt Yield, Cut-off Date LTV and Maturity Date LTV calculations include the related Pari Passu Companion Loan(s). In the case of Loan Nos. 1, 3, 4, 7, 8 and 10, the UW NCF DSCR, UW NOI Debt Yield, Cut-off Date LTV and Maturity Date LTV calculations exclude the related Subordinate Companion Loan(s) and/or related mezzanine loan(s). |

| (2) | In the case of Loan Nos. 3, 7, 8 and 10 the Cut-off Date LTV and the Maturity Date LTV are calculated by using an appraised value based on certain hypothetical assumptions. Refer to “Description of the Mortgage Pool—Assessments of Property Value and Condition” and “—Appraised Value” in the Preliminary Prospectus for additional details. |

| (3) | In the case of Loan No. 8, with an anticipated repayment date, Maturity Date LTV is calculated as of the related anticipated repayment date. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

4 of 130

| Structural and Collateral Term Sheet | | Benchmark 2018-B5 |

| |

| Collateral Characteristics |

| Pari Passu Companion Loan Summary |

| |

| Loan No. | Mortgage Loan | Note(s) | Original Balance ($) | Cut-off Date Balance ($) | Holder of Note | Lead Servicer for Whole Loan (Y/N) | Master Servicer Under Lead Securitization | Special Servicer Under Lead Securitization |

| 1 | Aventura Mall | A-1-A, A-1-B, A-1-C, A-1-D | $406,700,000 | $406,700,000 | Aventura Mall Trust 2018-AVM | Yes | Wells Fargo | CWCapital |

| | | A-2-A-1, A-2-B-3 | $115,000,000 | $115,000,000 | Benchmark 2018-B4 | No | | |

| | | A-2-A-2, A-2-B-2-A | $103,000,000 | $103,000,000 | Benchmark 2018-B5 | No | | |

| | | A-2-A-3, A-2-A-4, A-2-A-5 | $205,000,000 | $205,000,000 | JPMCB | No | | |

| | | A-2-B-1, A-2-B-2-B, A-2-B-2-C, A-2-B-4, A-2-B-5 | $142,000,000 | $142,000,000 | DBNY | No | | |

| | | A-2-C-1, A-2-C-2, A-2-C-3, A-2-C-4, A-2-C-5 | $220,000,000 | $220,000,000 | Morgan Stanley Mortgage Capital holdings, Inc. | No | | |

| | | A-2-D-1, A-2-D-2, A-2-D-3, A-2-D-4, A-2-D-5 | $220,000,000 | $220,000,000 | Wells Fargo Bank, National Association | No | | |

| | | B-1, B-2, B-3, B-4(1) | $343,300,000 | $343,300,000 | Aventura Mall Trust 2018-AVM | Yes | | |

| | | Total | $1,750,000,000 | $1,750,000,000 | | | | |

| 4 | Workspace | A-1, A-2, A-3, A-4 | $548,200,000 | $548,200,000 | JPMCB 2018-WPT(2) | Yes | Wells Fargo | CWCapital |

| | A-5, A-6 | $50,000,000 | $50,000,000 | Benchmark 2018-B5 | No | | |

| | | A-7, A-8, A-9, A-10 | $120,000,000 | $120,000,000 | JPMCB | No | | |

| | | B-1, B-2(1) | $556,800,000 | $556,800,000 | JPMCB 2018-WPT(2) | No | | |

| | | Total | $1,275,000,000 | 1,275,000,000 | | | | |

| 7 | Aon Center | A-1 | $50,000,000 | $50,000,000 | Benchmark 2018-B4 | No | Wells Fargo | CWCapital |

| | A-2 | $43,000,000 | $43,000,000 | Benchmark 2018-B5 | No | | |

| | | A-3 | $43,000,000 | $43,000,000 | JPMCB | No | | |

| | | A-4 | $214,000,000 | $214,000,000 | JPMCC 2018-AON | Yes | | |

| | | B(1) | $186,000,000 | $186,000,000 | JPMCC 2018-AON | No | | |

| | | Total | $536,000,000 | $536,000,000 | | | | |

| 8 | 181 Fremont Street | A-1, A-4 | $80,000,000 | $80,000,000 | Benchmark 2018-B4 | Yes | Wells Fargo | CWCapital |

| | A-2 | $58,000,000 | $58,000,000 | BANK 2018-BNK12 | No | | |

| | | A-3 | $22,000,000 | $22,000,000 | Wells Fargo, National Association | No | | |

| | | A-5 | $40,000,000 | $40,000,000 | Benchmark 2018-B5 | No | | |

| | | A-6-1 | $30,000,000 | $30,000,000 | WFCM 2018-C44 | No | | |

| | | A-6-2 | $20,000,000 | $20,000,000 | WFCM 2018-C45 | No | | |

| | | Total | $250,000,000 | $250,000,000 | | | | |

| 14 | Overland Park XChange | A-1 | $25,000,000 | $25,000,000 | Benchmark 2018-B5 | (3) | Wells Fargo | Midland Loan Services |

| | A-2 | $53,000,000 | $53,000,000 | JPMCB | (3) | | |

| | | Total | $78,000,000 | $78,000,000 | | | | |

18 | Radisson Blu Aqua Hotel | A-1 | $44,000,000 | $44,000,000 | Benchmark 2018-B1 | Yes | Wells Fargo | Park Birdge Lender Services |

| | A-2 | $20,000,000 | $20,000,000 | Benchmark 2018-B5 | No | | |

| | | Total | $64,000,000 | $64,000,000 | | | | |

| 19 | Westbrook Corporate Center | A-1 | $40,000,000 | $39,906,555 | Benchmark 2018-B4 | Yes | Wells Fargo | CWCapital |

| | A-2 | $40,000,000 | $39,906,555 | MSC 2018-H3 | No | | |

| | | A-3 | $19,000,000 | $18,955,614 | Benchmark 2018-B5 | No | | |

| | | Total | $99,000,000 | $98,768,724 | | No | | |

| (1) | Each note represents a subordinate companion loan. |

| (2) | The JPMCC 2018-WPT transaction is expected to close on July 31, 2018. |

| (3) | The Overland Park XChange Whole Loan will be serviced under the pooling and servicing agreement for the Benchmark 2018-B5 transaction until such time as Note A-2 has been securitized, at which point such Whole Loan will be serviced under the pooling and servicing agreement related to such securitization |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

5 of 130

| Structural and Collateral Term Sheet | | Benchmark 2018-B5 |

| |

| Collateral Characteristics |

No. | Loan Name | Trust

Cut-off Date Balance | Subordinate Debt Cut-off Date Balance(1) | Total Debt Cut-off Date Balance | Mortgage Loan UW NCF DSCR(2) | Total Debt UW NCF DSCR | Mortgage Loan

Cut-off Date LTV(2)(3) | Total Debt Cut-off Date LTV(3) | Mortgage Loan UW NOI Debt Yield(2) | Total Debt UW NOI Debt Yield |

| 1 | Aventura Mall | $103,000,000 | $343,300,000 | $1,750,000,000 | 2.58x | 2.07x | 40.8% | 50.7% | 11.0% | 8.8% |

| 3 | eBay North First Commons | $51,000,000 | $37,125,000 | $88,125,000 | 5.13x | 2.13x | 38.1% | 65.9% | 13.8% | 8.0% |

| 4 | Workspace | $50,000,000 | $696,000,000 | $1,275,000,000 | 3.60x | 1.63x | 35.4% | 78.0% | 21.6% | 9.8% |

| 7 | Aon Center | $43,000,000 | $327,500,000 | $677,500,000 | 3.03x | 1.42x | 40.3% | 80.0% | 15.5% | 7.8% |

| 8 | 181 Fremont Street | $40,000,000 | $225,000,000 | $475,000,000 | 3.14x | 1.38x | 39.6% | 75.2% | 11.8% | 6.2% |

| 10 | Embassy Suites Kennesaw | $31,968,577 | $4,000,000 | $35,968,577 | 1.81x | 1.51x | 64.6% | 72.7% | 12.1% | 10.8% |

| | | | | | | | | | | |

| (1) | In the case of Loan Nos. 1, 3 and 4 Subordinate Debt Cut-off Date Balance represents one or more Subordinate Companion Loans. In the case of Loan Nos. 7, Subordinate Debt Cut-off Date Balance represents one or more Subordinate Companion Loans and one or more mezzanine loans. In the case of Loan Nos. 8 and 10, Subordinate Debt Cut-off Date Balance represents one or more mezzanine loans. |

| (2) | In the case of Loan Nos. 1, 4, 7 and 8 the UW NCF DSCR, UW NOI Debt Yield, Cut-off Date LTV and Maturity Date LTV calculations include the related Pari Passu Companion Loan(s). In the case of Loan Nos. 1, 3, 4, 7, 8 and 10, the UW NCF DSCR, UW NOI Debt Yield, Cut-off Date LTV and Maturity Date LTV calculations exclude the related Subordinate Companion Loan(s) and/or related mezzanine loan(s). |

| (3) | In the case of Loan Nos. 3, 7, 8 and 10 the Cut-off Date LTV and the Maturity Date LTV are calculated by using an appraised value based on certain hypothetical assumptions. Refer to “Description of the Mortgage Pool—Assessments of Property Value and Condition” and “—Appraised Value” in the Preliminary Prospectus for additional details. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

6 of 130

| Structural and Collateral Term Sheet | | Benchmark 2018-B5 |

| |

| Collateral Characteristics |

| Mortgaged Properties by Type(1) |

| |

| | | | | | Weighted Average |

| Property Type | Property Subtype | Number of Properties | Cut-off Date Principal Balance | % of IPB | Occupancy | UW

NCF DSCR(2) | UW

NOI Debt Yield(2) | Cut-off Date LTV(2)(3) | Maturity Date LTV(2)(3)(4) |

| Retail | Anchored | 6 | $128,344,000 | 12.4% | 98.4% | 1.85x | 9.5% | 61.1% | 60.1% |

| | Super Regional Mall | 1 | 103,000,000 | 9.9 | 92.8% | 2.58x | 11.0% | 40.8% | 40.8% |

| | Unanchored | 10 | 52,881,679 | 5.1 | 99.0% | 1.60x | 9.1% | 63.4% | 59.8% |

| | Freestanding | 9 | 50,543,672 | 4.9 | 100.0% | 1.53x | 8.4% | 61.4% | 59.5% |

| | Shadow Anchored | 1 | 14,200,000 | 1.4 | 100.0% | 1.33x | 9.3% | 74.7% | 63.1% |

| | Subtotal: | 27 | $348,969,351 | 33.6% | 97.1% | 1.96x | 9.7% | 56.1% | 54.4% |

| | | | | | | | | | |

| Office | Suburban | 92 | $154,310,729 | 14.8% | 94.0% | 3.34x | 14.4% | 50.4% | 48.4% |

| | CBD | 4 | 138,952,526 | 13.4 | 87.9% | 2.62x | 13.1% | 44.8% | 41.0% |

| | Medical | 3 | 13,278,863 | 1.3 | 92.4% | 1.34x | 9.2% | 69.5% | 62.6% |

| | Subtotal: | 99 | $306,542,118 | 29.5% | 91.2% | 2.93x | 13.6% | 48.7% | 45.7% |

| | | | | | | | | | |

| Hotel | Full Service | 3 | $96,168,577 | 9.3% | 81.0% | 2.38x | 12.3% | 62.2% | 58.6% |

| | Limited Service | 4 | 37,156,213 | 3.6 | 72.3% | 1.60x | 12.6% | 64.4% | 47.1% |

| | Select Service | 2 | 26,197,520 | 2.5 | 88.4% | 1.86x | 14.8% | 57.3% | 38.9% |

| | Extended Stay | 1 | 13,500,000 | 1.3 | 80.3% | 1.89x | 12.1% | 67.5% | 57.0% |

| | Subtotal: | 10 | $173,022,309 | 16.7% | 80.2% | 2.10x | 12.7% | 62.3% | 53.0% |

| | | | | | | | | | |

| Multifamily | Garden | 6 | $91,199,630 | 8.8% | 95.7% | 1.32x | 8.8% | 69.1% | 63.0% |

| | Mid-rise | 5 | 41,500,000 | 4.0 | 96.2% | 1.53x | 7.8% | 59.2% | 59.2% |

| | Subtotal: | 11 | $132,699,630 | 12.8% | 95.9% | 1.39x | 8.4% | 66.0% | 61.8% |

| | | | | | | | | | |

| Self Storage | Self Storage | 10 | $48,190,250 | 4.6% | 84.8% | 1.39x | 8.8% | 67.8% | 61.6% |

| | Subtotal: | 10 | $48,190,250 | 4.6% | 84.8% | 1.39x | 8.8% | 67.8% | 61.6% |

| | | | | | | | | | |

| Industrial | Flex | 1 | $7,387,385 | 0.7% | 100.0% | 1.45x | 10.0% | 73.1% | 59.8% |

| | Warehouse | 1 | 5,997,679 | 0.6 | 100.0% | 1.45x | 10.0% | 73.1% | 59.8% |

| | Warehouse/Distribution | 1 | 2,700,000 | 0.3 | 100.0% | 1.84x | 9.2% | 63.1% | 63.1% |

| | Subtotal: | 3 | $16,085,064 | 1.5% | 100.0% | 1.52x | 9.9% | 71.4% | 60.4% |

| | | | | | | | | | |

| Flex | Office/Industrial | 58 | $13,385,156 | 1.3% | 93.3% | 3.60x | 21.6% | 35.4% | 35.4% |

| | Industrial | 1 | 238,281 | 0.0 | 72.7% | 3.60x | 21.6% | 35.4% | 35.4% |

| | Subtotal: | 59 | $13,623,438 | 1.3% | 92.9% | 3.60x | 21.6% | 35.4% | 35.4% |

| | | | | | | | | | |

| | Total / Weighted Average: | 219 | $1,039,132,161 | 100.0% | 91.8% | 2.18x | 11.3% | 56.7% | 52.7% |

| (1) | Because this table presents information relating to the mortgaged properties and not mortgage loans, the information for mortgage loans secured by more than one mortgaged property is based on allocated loan amounts. |

| (2) | In the case of Loan Nos. 1, 4, 7, 8, 14, 18 and 19, the UW NCF DSCR, UW NOI Debt Yield, Cut-off Date LTV and Maturity Date LTV calculations include the related Pari Passu Companion Loan(s). In the case of Loan Nos. 1, 3, 4, 7, 8 and 10, the UW NCF DSCR, UW NOI Debt Yield, Cut-off Date LTV and Maturity Date LTV calculations exclude the related Subordinate Companion Loan(s) and/or related mezzanine loan(s). In the case of (i) Loan Nos. 23 and 24 and (ii) Loan Nos. 26 and 27, the loans in each such group are cross-collateralized and cross-defaulted with each other. As such, the calculations are based on the aggregate Cut-off Date Principal Balances, Maturity Date Principal Balances, UW NOI, UW NCF and Debt Service of the related group of those mortgage loans. |

| (3) | In the case of Loan Nos. 3, 7, 8, 10, 11, 14, 28, 37, 38, 40 and 43 the Cut-off Date LTV and the Maturity Date LTV are calculated by using an appraised value based on certain hypothetical assumptions. Refer to “Description of the Mortgage Pool—Assessments of Property Value and Condition” and “—Appraised Value” in the Preliminary Prospectus for additional details. |

| (4) | In the case of Loan No. 8, with an anticipated repayment date, Maturity Date LTV is calculated as of the related anticipated repayment date. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

7 of 130

| Structural and Collateral Term Sheet | | Benchmark 2018-B5 |

| |

| Collateral Characteristics |

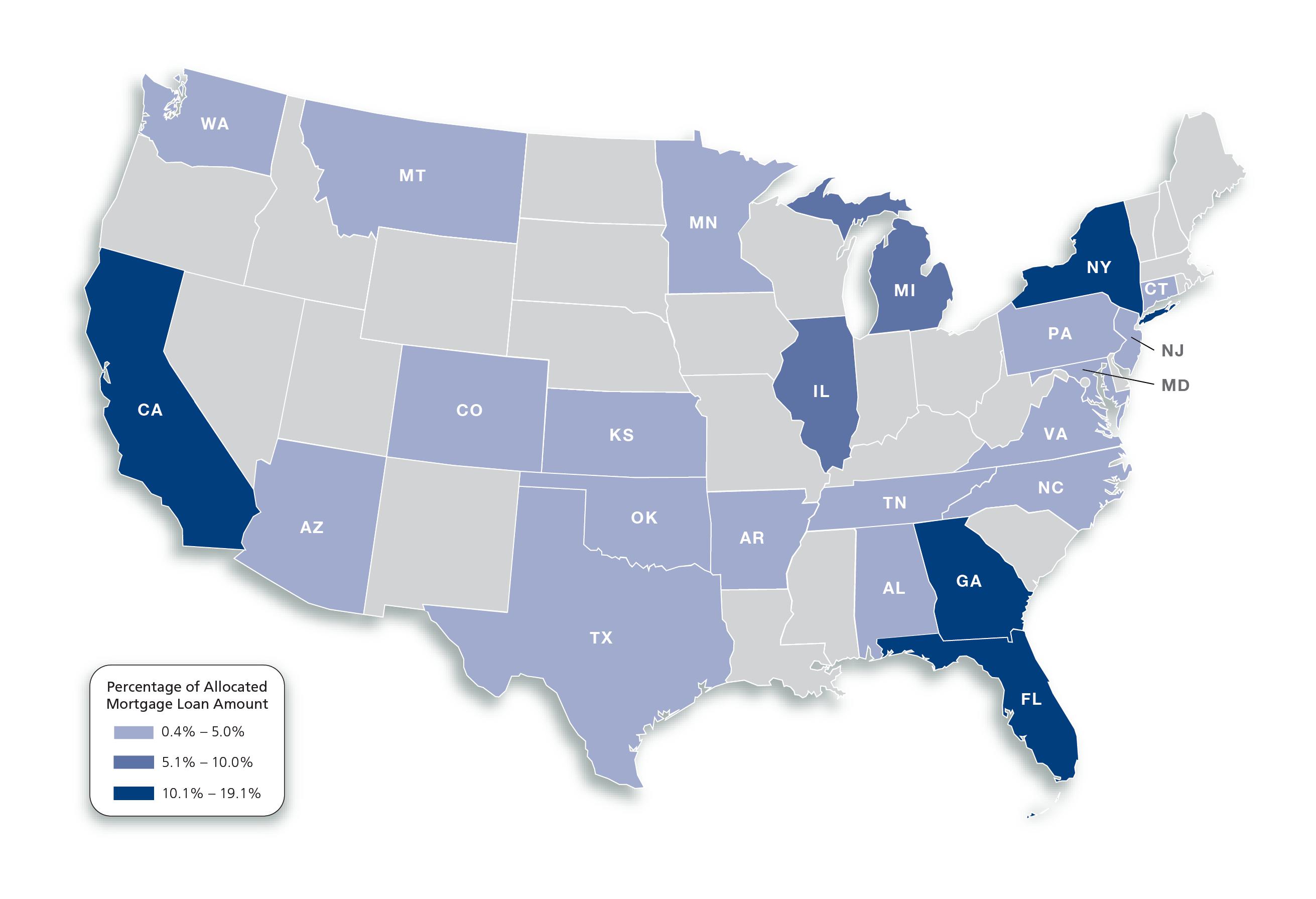

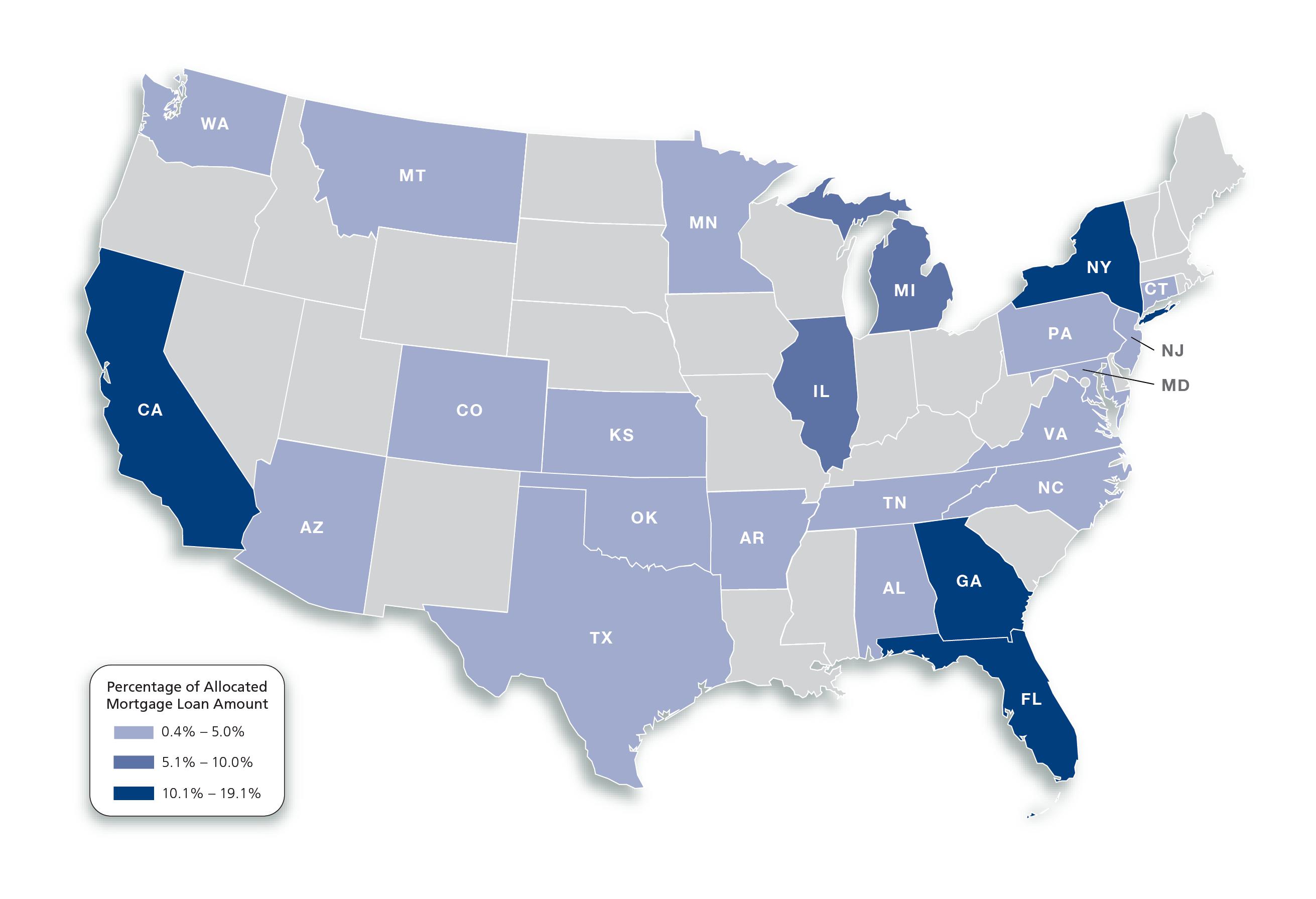

| Mortgaged Properties by Location(1) |

| |

| | | | | Weighted Average |

State | Number of Properties | Cut-off Date Principal Balance | % of IPB | Occupancy | UW

NCF DSCR(2) | UW

NOI Debt Yield(2) | Cut-off Date LTV(2)(3) | Maturity Date LTV(2)(3)(4) |

| New York | 16 | $198,475,000 | 19.1% | 96.8% | 1.80x | 8.9% | 55.8% | 55.8% |

| Florida | 50 | 194,001,766 | 18.7 | 90.0% | 2.66x | 12.6% | 49.6% | 49.3% |

| California | 6 | 133,326,269 | 12.8 | 99.4% | 3.43x | 12.4% | 46.4% | 43.1% |

| Georgia | 12 | 105,101,892 | 10.1 | 84.1% | 1.60x | 11.4% | 65.2% | 52.1% |

| Illinois | 6 | 97,918,476 | 9.4 | 86.5% | 2.25x | 12.4% | 53.6% | 49.9% |

| Michigan | 5 | 62,319,072 | 6.0 | 93.3% | 1.36x | 9.0% | 69.8% | 63.9% |

| Washington | 2 | 32,476,000 | 3.1 | 92.5% | 1.34x | 7.9% | 63.4% | 59.7% |

| Oklahoma | 1 | 29,952,526 | 2.9 | 80.1% | 1.35x | 11.8% | 70.1% | 52.3% |

| Kansas | 1 | 25,000,000 | 2.4 | 90.1% | 2.10x | 10.9% | 65.2% | 66.3% |

| Connecticut | 2 | 22,400,000 | 2.2 | 100.0% | 1.68x | 8.5% | 63.8% | 63.8% |

| Pennsylvania | 69 | 20,126,563 | 1.9 | 88.0% | 3.60x | 21.6% | 35.4% | 35.4% |

| Tennessee | 3 | 17,035,064 | 1.6 | 100.0% | 1.41x | 9.6% | 71.9% | 60.3% |

| Texas | 3 | 15,660,928 | 1.5 | 93.0% | 1.46x | 9.7% | 67.9% | 58.8% |

| North Carolina | 1 | 13,500,000 | 1.3 | 80.3% | 1.89x | 12.1% | 67.5% | 57.0% |

| Maryland | 1 | 10,610,000 | 1.0 | 97.5% | 2.41x | 11.9% | 62.8% | 62.8% |

| Alabama | 2 | 10,283,725 | 1.0 | 99.6% | 1.52x | 10.6% | 71.8% | 60.3% |

| Virginia | 2 | 10,146,208 | 1.0 | 76.7% | 1.55x | 11.5% | 66.5% | 55.4% |

| Colorado | 1 | 9,660,000 | 0.9 | 73.7% | 1.80x | 11.6% | 67.1% | 56.6% |

| Montana | 1 | 7,200,000 | 0.7 | 98.3% | 1.25x | 8.3% | 71.8% | 63.7% |

| Arkansas | 1 | 6,925,000 | 0.7 | 85.3% | 1.32x | 8.7% | 71.0% | 63.0% |

| Minnesota | 19 | 6,489,844 | 0.6 | 88.9% | 3.60x | 21.6% | 35.4% | 35.4% |

| Arizona | 14 | 6,473,828 | 0.6 | 94.8% | 3.60x | 21.6% | 35.4% | 35.4% |

| New Jersey | 1 | 4,050,000 | 0.4 | 100.0% | 1.51x | 8.1% | 67.5% | 67.5% |

| Total / Weighted Average: | 219 | $1,039,132,161 | 100.0% | 91.8% | 2.18x | 11.3% | 56.7% | 52.7% |

| (1) | Because this table presents information relating to the mortgaged properties and not mortgage loans, the information for mortgage loans secured by more than one mortgaged property is based on allocated loan amounts. |

| (2) | In the case of Loan Nos. 1, 4, 7, 8, 14, 18 and 19, the UW NCF DSCR, UW NOI Debt Yield, Cut-off Date LTV and Maturity Date LTV calculations include the related Pari Passu Companion Loan(s). In the case of Loan Nos. 1, 3, 4, 7, 8 and 10, the UW NCF DSCR, UW NOI Debt Yield, Cut-off Date LTV and Maturity Date LTV calculations exclude the related Subordinate Companion Loan(s) and/or related mezzanine loan(s). In the case of (i) Loan Nos. 23 and 24 and (ii) Loan Nos. 26 and 27, the loans in each such group are cross-collateralized and cross-defaulted with each other. As such, the calculations are based on the aggregate Cut-off Date Principal Balances, Maturity Date Principal Balances, UW NOI, UW NCF and Debt Service of the related group of those mortgage loans. |

| (3) | In the case of Loan Nos. 3, 7, 8, 10, 11, 14, 28, 37, 38, 40 and 43 the Cut-off Date LTV and the Maturity Date LTV are calculated by using an appraised value based on certain hypothetical assumptions. Refer to “Description of the Mortgage Pool—Assessments of Property Value and Condition” and “—Appraised Value” in the Preliminary Prospectus for additional details. |

| (4) | In the case of Loan No. 8, with an anticipated repayment date, Maturity Date LTV is calculated as of the related anticipated repayment date. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

8 of 130

| Structural and Collateral Term Sheet | | Benchmark 2018-B5 |

| |

| Collateral Characteristics |

| Cut-off Date Principal Balance |

| | | | | Weighted Average |

| Range of Cut-off Date Principal Balances | Number of Loans | Cut-off Date

Principal

Balance | % of

IPB | Mortgage Rate | Remaining Loan Term(1) | UW

NCF DSCR(2)(3) | UW

NOI

DY(2) | Cut-off

Date LTV(2)(4) | Maturity Date LTV(1)(2)(3) |

| $2,607,349 | - | $9,999,999 | 25 | $165,754,209 | 16.0% | 5.00424% | 117 | 1.50x | 9.2% | 65.6% | 59.6% |

| $10,000,000 | - | $19,999,999 | 12 | 168,556,947 | 16.2 | 4.89324% | 119 | 1.72x | 10.8% | 66.6% | 59.6% |

| $20,000,000 | - | $24,999,999 | 4 | 87,900,000 | 8.5 | 4.77866% | 116 | 1.44x | 8.6% | 65.2% | 61.0% |

| $25,000,000 | - | $49,999,999 | 10 | 355,546,005 | 34.2 | 4.56758% | 104 | 2.26x | 11.9% | 55.3% | 50.8% |

| $50,000,000 | - | $103,000,000 | 4 | 261,375,000 | 25.2 | 4.25954% | 96 | 3.06x | 13.0% | 43.7% | 43.7% |

| Total / Weighted Average: | 55 | $1,039,132,161 | 100.0% | 4.63043% | 107 | 2.18x | 11.3% | 56.7% | 52.7% |

| | | | | | | | | | | | |

| | | | | Weighted Average |

Range of

Mortgage Interest Rates | Number of Loans | Cut-off Date Principal Balance | % of IPB | Mortgage Rate | Remaining Loan Term(1) | UW

NCF DSCR(2) | UW

NOI

DY(2) | Cut-off

Date LTV(2)(3) | Maturity Date LTV(1)(2)(3) |

| 2.63768% | - | 3.99999% | 2 | $91,000,000 | 8.8% | 3.10842% | 83 | 4.26x | 12.9% | 38.8% | 38.8% |

| 4.00000% | - | 4.49999% | 4 | 182,976,269 | 17.6 | 4.22362% | 119 | 2.48x | 11.6% | 43.4% | 42.4% |

| 4.50000% | - | 4.99999% | 33 | 576,406,024 | 55.5 | 4.79108% | 110 | 1.81x | 10.4% | 63.0% | 58.0% |

| 5.00000% | - | 5.45000% | 16 | 188,749,868 | 18.2 | 5.26799% | 101 | 2.04x | 12.9% | 59.1% | 53.3% |

| Total / Weighted Average: | 55 | $1,039,132,161 | 100.0% | 4.63043% | 107 | 2.18x | 11.3% | 56.7% | 52.7% |

| Original Term to Maturity in Months |

| | | | | Weighted Average |

Original Term to

Maturity in Months | Number of Loans | Cut-off Date Principal Balance | % of IPB | Mortgage Rate | Remaining Loan Term(1) | UW

NCF DSCR(2) | UW

NOI

DY(2) | Cut-off

Date LTV(2)(3) | Maturity Date LTV(1)(2)(3) |

| 60 | 4 | $145,500,000 | 14.0% | 3.94715% | 58 | 3.67x | 14.1% | 48.3% | 48.1% |

| 61 | 1 | 50,000,000 | 4.8 | 5.37200% | 59 | 3.60x | 21.6% | 35.4% | 35.4% |

| 120 | 50 | 843,632,161 | 81.2 | 4.70433% | 119 | 1.84x | 10.2% | 59.4% | 54.5% |

| Total / Weighted Average: | 55 | $1,039,132,161 | 100.0% | 4.63043% | 107 | 2.18x | 11.3% | 56.7% | 52.7% |

| | | | | | | | | | |

| Remaining Term to Maturity in Months |

| | | | | Weighted Average |

| Range of Remaining Term to Maturity in Months | Number of Loans | Cut-off Date Principal Balance | % of IPB | Mortgage Rate | Remaining Loan Term(1) | UW

NCF DSCR(2) | UW

NOI

DY(2) | Cut-off

Date LTV(2)(3) | Maturity Date LTV(1)(2)(3) |

| 58 | - | 84 | 5 | $195,500,000 | 18.8% | 4.31156% | 59 | 3.65x | 16.0% | 45.0% | 44.9% |

| 85 | - | 119 | 39 | 683,132,161 | 65.7 | 4.66938% | 118 | 1.92x | 10.8% | 58.8% | 52.9% |

| 120 | - | 120 | 11 | 160,500,000 | 15.4 | 4.85308% | 120 | 1.50x | 7.8% | 62.1% | 61.3% |

| Total / Weighted Average: | 55 | $1,039,132,161 | 100.0% | 4.63043% | 107 | 2.18x | 11.3% | 56.7% | 52.7% |

| | | | | | | | | | | | |

| (1) | In the case of Loan No. 8, with an anticipated repayment date, Remaining Term to Maturity and Maturity Date LTV are calculated as of the related anticipated repayment date. |

| (2) | In the case of Loan Nos. 1, 4, 7, 8, 14, 18 and 19, the UW NCF DSCR, UW NOI Debt Yield, Cut-off Date LTV and Maturity Date LTV calculations include the related Pari Passu Companion Loan(s). In the case of Loan Nos. 1, 3, 4, 7, 8 and 10, the UW NCF DSCR, UW NOI Debt Yield, Cut-off Date LTV and Maturity Date LTV calculations exclude the related Subordinate Companion Loan(s) and/or related mezzanine loan(s). In the case of (i) Loan Nos. 23 and 24 and (ii) Loan Nos. 26 and 27, the loans in each such group are cross-collateralized and cross-defaulted with each other. As such, the calculations are based on the aggregate Cut-off Date Principal Balances, Maturity Date Principal Balances, UW NOI, UW NCF and Debt Service of the related group of those mortgage loans. |

| (3) | In the case of Loan Nos. 3, 7, 8, 10, 11, 14, 28, 37, 38, 40 and 43 the Cut-off Date LTV and the Maturity Date LTV are calculated by using an appraised value based on certain hypothetical assumptions. Refer to “Description of the Mortgage Pool—Assessments of Property Value and Condition” and “—Appraised Value” in the Preliminary Prospectus for additional details. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

9 of 130

| Structural and Collateral Term Sheet | | Benchmark 2018-B5 |

| |

| Collateral Characteristics |

| Original Amortization Term in Months |

| | | | | Weighted Average |

Original

Amortization

Term in Months | Number of Loans | Cut-off Date Principal Balance | % of IPB | Mortgage Rate | Remaining Loan Term(1) | UW

NCF DSCR(2) | UW

NOI

DY(2) | Cut-off

Date LTV(2)(3) | Maturity Date LTV(1)(2)(3) |

| Interest Only | 24 | $653,461,000 | 62.9% | 4.43151% | 101 | 2.59x | 11.7% | 50.2% | 50.3% |

| 240 | 1 | 31,924,901 | 3.1 | 4.83000% | 119 | 1.50x | 13.2% | 62.5% | 39.2% |

| 300 | 2 | 43,928,795 | 4.2 | 4.72592% | 119 | 1.61x | 13.2% | 64.6% | 48.0% |

| 360 | 28 | 309,817,464 | 29.8 | 5.01589% | 117 | 1.47x | 9.9% | 68.6% | 59.9% |

| Total / Weighted Average: | 55 | $1,039,132,161 | 100.0% | 4.63043% | 107 | 2.18x | 11.3% | 56.7% | 52.7% |

| Remaining Amortization Term in Months |

| | | | | Weighted Average |

| Range of Remaining Amortization Term in Months | Number of Loans | Cut-off Date Principal Balance | % of IPB | Mortgage Rate | Remaining Loan Term(1) | UW

NCF DSCR(2) | UW

NOI

DY(2) | Cut-off

Date LTV(2)(3) | Maturity Date LTV(1)(2)(3) |

| Interest Only | 24 | $653,461,000 | 62.9% | 4.43151% | 101 | 2.59x | 11.7% | 50.2% | 50.3% |

| 239 | - | 299 | 3 | 75,853,696 | 7.3% | 4.76972% | 119 | 1.56x | 13.2% | 63.7% | 44.3% |

| 300 | - | 360 | 28 | 309,817,464 | 29.8% | 5.01589% | 117 | 1.47x | 9.9% | 68.6% | 59.9% |

| Total / Weighted Average: | 55 | $1,039,132,161 | 100.0% | 4.63043% | 107 | 2.18x | 11.3% | 56.7% | 52.7% |

| | | | | | | | | | | | |

| | | | | Weighted Average |

| Amortization Types | Number of Loans | Cut-off Date Principal Balance | % of IPB | Mortgage Rate | Remaining Loan Term(1) | UW

NCF DSCR(2) | UW

NOI

DY(2) | Cut-off

Date LTV(2)(3) | Maturity Date LTV(1)(2)(3) |

| Interest Only | 23 | $613,461,000 | 59.0% | 4.47865% | 100 | 2.56x | 11.7% | 50.9% | 51.0% |

| IO-Balloon | 18 | 207,038,250 | 19.9 | 4.98102% | 116 | 1.38x | 9.2% | 68.7% | 61.5% |

| Balloon | 13 | 178,632,911 | 17.2 | 4.95177% | 119 | 1.61x | 12.2% | 66.5% | 51.4% |

| ARD-Interest Only | 1 | 40,000,000 | 3.8 | 3.70860% | 116 | 3.14x | 11.8% | 39.6% | 39.6% |

| Total / Weighted Average: | 55 | $1,039,132,161 | 100.0% | 4.63043% | 107 | 2.18x | 11.3% | 56.7% | 52.7% |

| Underwritten Net Cash Flow Debt Service Coverage Ratios(2) |

| | | | | Weighted Average |

| Range of Underwritten Net Cash Flow Debt Service Coverage Ratios | Number of Loans | Cut-off Date Principal Balance | % of IPB | Mortgage Rate | Remaining Loan Term(1) | UW

NCF DSCR(2) | UW

NOI

DY(2) | Cut-off

Date LTV(2)(3) | Maturity Date LTV(1)(2)(3) |

| 1.21x | - | 1.49x | 23 | $293,726,689 | 28.3% | 4.90611% | 117 | 1.34x | 8.8% | 67.9% | 60.8% |

| 1.50x | - | 1.74x | 14 | 199,795,932 | 19.2 | 4.95317% | 119 | 1.59x | 9.8% | 63.4% | 57.0% |

| 1.75x | - | 1.99x | 5 | 77,828,577 | 7.5 | 5.01999% | 117 | 1.85x | 11.1% | 62.8% | 55.2% |

| 2.00x | - | 2.24x | 4 | 83,670,962 | 8.1 | 4.49717% | 119 | 2.18x | 12.0% | 58.1% | 55.4% |

| 2.25x | - | 5.13x | 9 | 384,110,000 | 37.0 | 4.20185% | 89 | 3.20x | 13.9% | 43.2% | 43.2% |

| Total / Weighted Average: | 55 | $1,039,132,161 | 100.0% | 4.63043% | 107 | 2.18x | 11.3% | 56.7% | 52.7% |

| (1) | In the case of Loan No. 8, with an anticipated repayment date, Remaining Term to Maturity and Maturity Date LTV are calculated as of the related anticipated repayment date. |

| (2) | In the case of Loan Nos. 1, 4, 7, 8, 14, 18 and 19, the UW NCF DSCR, UW NOI Debt Yield, Cut-off Date LTV and Maturity Date LTV calculations include the related Pari Passu Companion Loan(s). In the case of Loan Nos. 1, 3, 4, 7, 8 and 10, the UW NCF DSCR, UW NOI Debt Yield, Cut-off Date LTV and Maturity Date LTV calculations exclude the related Subordinate Companion Loan(s) and/or related mezzanine loan(s). In the case of (i) Loan Nos. 23 and 24 and (ii) Loan Nos. 26 and 27, the loans in each such group are cross-collateralized and cross-defaulted with each other. As such, the calculations are based on the aggregate Cut-off Date Principal Balances, Maturity Date Principal Balances, UW NOI, UW NCF and Debt Service of the related group of those mortgage loans. |

| (3) | In the case of Loan Nos. 3, 7, 8, 10, 11, 14, 28, 37, 38, 40 and 43 the Cut-off Date LTV and the Maturity Date LTV are calculated by using an appraised value based on certain hypothetical assumptions. Refer to “Description of the Mortgage Pool—Assessments of Property Value and Condition” and “—Appraised Value” in the Preliminary Prospectus for additional details. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

10 of 130

| Structural and Collateral Term Sheet | | Benchmark 2018-B5 |

| |

| Collateral Characteristics |

| LTV Ratios as of the Cut-off Date(2)(3) |

| | | | | Weighted Average |

Range of

Cut-off Date LTVs | Number of Loans | Cut-off Date Principal Balance | % of IPB | Mortgage Rate | Remaining Loan Term(1) | UW

NCF DSCR(2) | UW

NOI

DY(2) | Cut-off

Date LTV(2)(3) | Maturity Date LTV(1)(2)(3) |

| 31.3% | - | 39.9% | 4 | $167,000,000 | 16.1% | 3.97165% | 82 | 3.80x | 15.5% | 36.6% | 36.6% |

| 40.0% | - | 49.9% | 2 | 146,000,000 | 14.1 | 4.27032% | 101 | 2.71x | 12.3% | 40.7% | 40.7% |

| 50.0% | - | 59.9% | 6 | 97,862,269 | 9.4 | 4.53412% | 117 | 2.01x | 10.5% | 54.6% | 52.6% |

| 60.0% | - | 65.9% | 19 | 370,297,172 | 35.6 | 4.85435% | 112 | 1.81x | 10.1% | 63.2% | 59.4% |

| 66.0% | - | 74.7% | 24 | 257,972,720 | 24.8 | 4.97582% | 117 | 1.44x | 10.1% | 70.3% | 60.4% |

| Total / Weighted Average: | 55 | $1,039,132,161 | 100.0% | 4.63043% | 107 | 2.18x | 11.3% | 56.7% | 52.7% |

| LTV Ratios as of the Maturity Date(1)(2)(3) |

| | | | | Weighted Average |

Range of

Maturity Date LTVs | Number of Loans | Cut-off Date Principal Balance | % of IPB | Mortgage Rate | Remaining Loan Term(1) | UW

NCF DSCR(2) | UW

NOI

DY(2) | Cut-off

Date LTV(2)(3) | Maturity Date LTV(1)(2)(3) |

| 31.3% | - | 39.9% | 6 | $212,901,170 | 20.5% | 4.13242% | 90 | 3.35x | 15.2% | 41.5% | 37.1% |

| 40.0% | - | 49.9% | 2 | 146,000,000 | 14.1 | 4.27032% | 101 | 2.71x | 12.3% | 40.7% | 40.7% |

| 50.0% | - | 54.9% | 9 | 157,225,797 | 15.1 | 4.79067% | 118 | 1.80x | 10.7% | 60.5% | 53.7% |

| 55.0% | - | 59.9% | 11 | 103,666,314 | 10.0 | 4.97974% | 119 | 1.59x | 10.7% | 68.2% | 58.0% |

| 60.0% | - | 68.6% | 27 | 419,338,880 | 40.4 | 4.86222% | 112 | 1.70x | 9.3% | 65.8% | 63.1% |

| Total / Weighted Average: | 55 | $1,039,132,161 | 100.0% | 4.63043% | 107 | 2.18x | 11.3% | 56.7% | 52.7% |

| | | | | Weighted Average |

| Prepayment Protection | Number of Loans | Cut-off Date Principal Balance | % of IPB | Mortgage Rate | Remaining Loan Term(1) | UW

NCF DSCR(2) | UW

NOI

DY(2) | Cut-off

Date LTV(2)(3) | Maturity Date LTV(1)(2)(3) |

| Defeasance(4) | 42 | $714,113,584 | 68.7% | 4.59807% | 110 | 2.07x | 10.7% | 58.2% | 53.1% |

| Yield Maintenance | 11 | 240,818,577 | 23.2 | 4.89281% | 106 | 2.22x | 12.4% | 53.8% | 51.5% |

| Defeasance or Yield Maintenance | 2 | 84,200,000 | 8.1 | 4.15448% | 86 | 3.07x | 12.9% | 52.4% | 52.4% |

| Total / Weighted Average: | 55 | $1,039,132,161 | 100.0% | 4.63043% | 107 | 2.18x | 11.3% | 56.7% | 52.7% |

| | | | | Weighted Average |

| Loan Purpose | Number of Loans | Cut-off Date Principal Balance | % of IPB | Mortgage Rate | Remaining Loan Term(1) | UW

NCF DSCR(2) | UW

NOI

DY(2) | Cut-off

Date LTV(2)(3) | Maturity Date LTV(1)(2)(3) |

| Refinance | 34 | $751,269,349 | 72.3% | 4.71494% | 111 | 2.03x | 11.0% | 56.3% | 52.4% |

| Acquisition | 19 | 245,462,812 | 23.6 | 4.36406% | 93 | 2.67x | 12.1% | 59.7% | 55.3% |

| Recapitalization | 1 | 26,000,000 | 2.5 | 4.30000% | 119 | 2.61x | 12.5% | 31.3% | 31.3% |

| Acquisition/Refinance | 1 | 16,400,000 | 1.6 | 5.27000% | 119 | 1.30x | 8.9% | 69.9% | 62.2% |

| Total / Weighted Average: | 55 | $1,039,132,161 | 100.0% | 4.63043% | 107 | 2.18x | 11.3% | 56.7% | 52.7% |

| (1) | In the case of Loan No. 8, with an anticipated repayment date, Remaining Term to Maturity and Maturity Date LTV are calculated as of the related anticipated repayment date. |

| (2) | In the case of Loan Nos. 1, 4, 7, 8, 14, 18 and 19, the UW NCF DSCR, UW NOI Debt Yield, Cut-off Date LTV and Maturity Date LTV calculations include the related Pari Passu Companion Loan(s). In the case of Loan Nos. 1, 3, 4, 7, 8 and 10, the UW NCF DSCR, UW NOI Debt Yield, Cut-off Date LTV and Maturity Date LTV calculations exclude the related Subordinate Companion Loan(s) and/or related mezzanine loan(s). In the case of (i) Loan Nos. 23 and 24 and (ii) Loan Nos. 26 and 27, the loans in each such group are cross-collateralized and cross-defaulted with each other. As such, the calculations are based on the aggregate Cut-off Date Principal Balances, Maturity Date Principal Balances, UW NOI, UW NCF and Debt Service of the related group of those mortgage loans. |

| (3) | In the case of Loan Nos. 3, 7, 8, 10, 11, 14, 28, 37, 38, 40 and 43 the Cut-off Date LTV and the Maturity Date LTV are calculated by using an appraised value based on certain hypothetical assumptions. Refer to “Description of the Mortgage Pool—Assessments of Property Value and Condition” and “—Appraised Value” in the Preliminary Prospectus for additional details. |

| (4) | In the case of Loan Nos. 5 and 8 the loan documents permit the borrowers to prepay the related loan with yield maintenance premium in the event the defeasance lockout period has not expired after certain dates. See the “Description of the Mortgage Pool—Certain Terms of the Mortgage Loans—Defeasance; Collateral Substitution” in the Preliminary Prospectus. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

11 of 130

| Structural and Collateral Term Sheet | | Benchmark 2018-B5 |

| |

| Collateral Characteristics |

| Previous Securitization History(1) |

| No. | Loan Name | Cut-off Date

Principal Balance | % of IPB | Location | Property Type | Previous Securitization |

| 3 | eBay North First Commons | $51,000,000 | 4.9% | San Jose, CA | Office | COMM 2013-CCRE7 |

| 10 | Embassy Suites Kennesaw | 31,968,577 | 3.1% | Kennesaw, GA | Hotel | JPMBB 2014-C24 |

| 15 | Woodland Gardens Apartments | 23,870,000 | 2.3% | Royal Oak, MI | Multifamily | FREMF 2016-KF25 |

| 17 | Kingsley Apartments | 21,280,000 | 2.0% | Sterling Heights, MI | Multifamily | FREMF 2016-KF22 |

| 20.03 | Amsdell Lawrenceville | 4,256,000 | 0.4% | Lawrenceville, GA | Self Storage | CGCMT 2016-GC36 |

| 33 | Deerfield Woods Apartments | 10,780,000 | 1.0% | Livonia, MI | Multifamily | FREMF 2016-KF25 |

| 46 | SSCP Little Rock | 6,925,000 | 0.7% | Little Rock, AR | Self Storage | GSMS 2012-GC6 |

| Total | | $150,079,577 | 14.4% | | | |

| (1) | The table above represents the properties for which the previously existing debt was securitized, based on information provided by the related borrower or obtained through searches of a third-party database. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

12 of 130

| Structural and Collateral Term Sheet | | Benchmark 2018-B5 |

[THIS PAGE INTENTIONALLY LEFT BLANK]

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

13 of 130

| Structural and Collateral Term Sheet | | Benchmark 2018-B5 |

| |

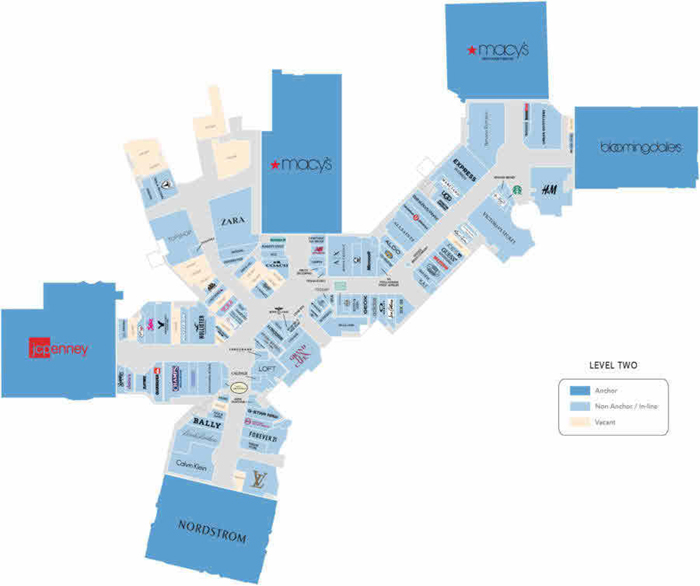

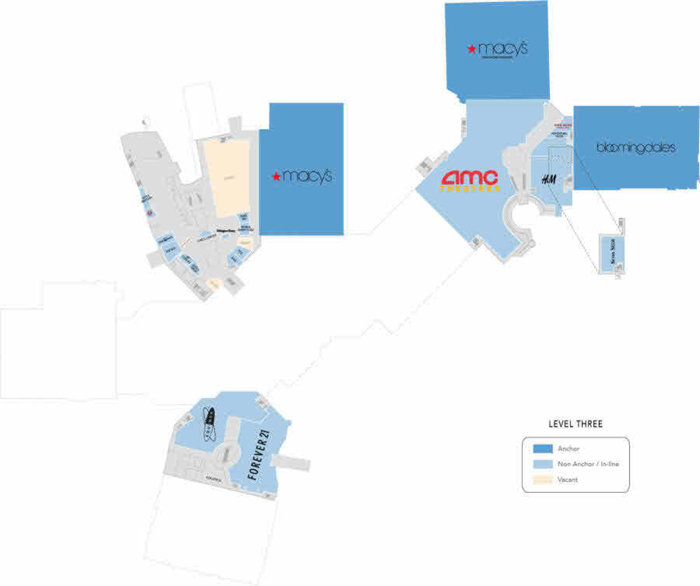

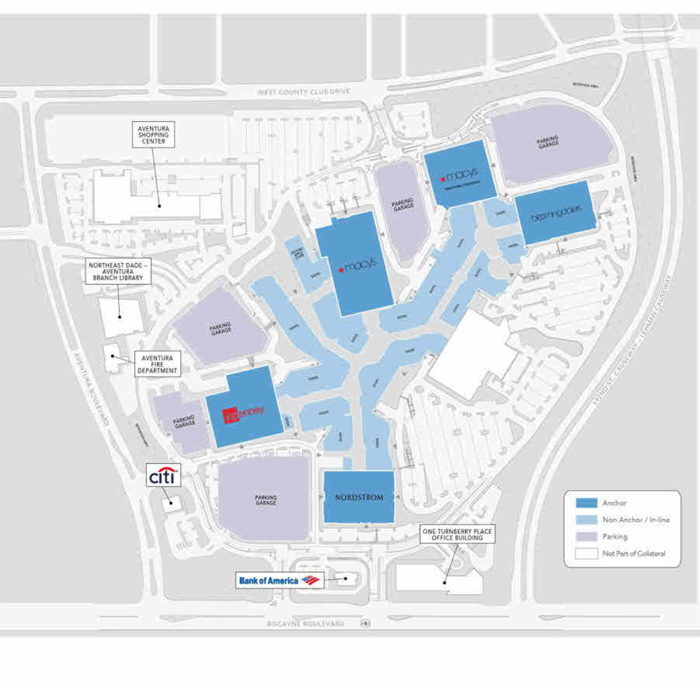

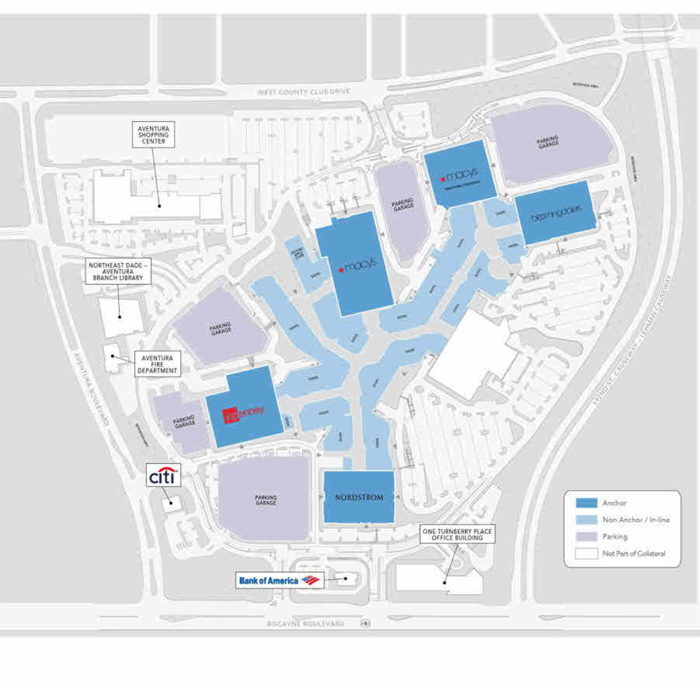

| Aventura Mall |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

14 of 130

| Structural and Collateral Term Sheet | | Benchmark 2018-B5 |

| |

| Aventura Mall |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

15 of 130

| Structural and Collateral Term Sheet | | Benchmark 2018-B5 |

| |

| Aventura Mall |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

16 of 130

| Structural and Collateral Term Sheet | | Benchmark 2018-B5 |

| |

| Aventura Mall |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

17 of 130

| Structural and Collateral Term Sheet | | Benchmark 2018-B5 |

| |

| Aventura Mall |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

18 of 130

| Structural and Collateral Term Sheet | | Benchmark 2018-B5 |

| |

| Aventura Mall |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

19 of 130

| Structural and Collateral Term Sheet | | Benchmark 2018-B5 |

| |

| Aventura Mall |

| Mortgage Loan Information | | Property Information |

| Mortgage Loan Seller(1): | JPMCB/GACC | | Single Asset / Portfolio: | Single Asset |

| Credit Assessment | | | Title: | Fee |

| (DBRS/Fitch/S&P)(2): | BBB(high)/Asf/A | | Property Type - Subtype: | Retail – Super Regional Mall |

| Original Principal Balance(3): | $103,000,000 | | Net Rentable Area (SF): | 1,217,508 |

| Cut-off Date Principal Balance(3): | $103,000,000 | | Location: | Aventura, FL |

| % of Pool by IPB: | 9.9% | | Year Built / Renovated: | 1983 / 2017 |

| Loan Purpose: | Refinance | | Occupancy(5): | 92.8% |

| Borrower: | Aventura Mall Venture | | Occupancy Date: | 2/14/2018 |

| Sponsors: | Simon Property Group, L.P., | | Number of Tenants: | 288 |

| | Jacquelyn Soffer, Jeffrey Soffer | | 2015 NOI: | $109,025,339 |

| Interest Rate: | 4.12125% | | 2016 NOI: | $110,653,403 |

| Note Date: | 6/7/2018 | 2017 NOI: | $115,240,562 |

| Maturity Date: | 7/1/2028 | TTM NOI (as of 3/31/2018): | $118,291,397 |

| Interest-only Period: | 120 months | | UW Economic Occupancy(5): | 92.9% |

| Original Term: | 120 months | | UW Revenues: | $185,479,647 |

| Original Amortization: | None | | UW Expenses: | $30,620,668 |

| Amortization Type: | Interest Only | | UW NOI(6): | $154,858,979 |

| Call Protection(4): | L(25),Def(88),O(7) | | UW NCF(6): | $151,571,708 |

| Lockbox / Cash Management: | Hard; Master Lease Rents (Soft | | Appraised Value / Per SF: | $3,450,000,000 / $2,834 |

| | Springing) / Springing | | | |

| Additional Debt: | Yes | | | |

| Additional Debt Balance: | $1,303,700,000 / $343,300,000 | | | |

| Additional Debt Type: | Pari Passu / Subordinate Debt | | | |

| | | | | |

| Escrows and Reserves(7) | | Financial Information(3) |

| | Initial | Monthly | Initial Cap | | | Senior Notes | Whole Loan |

| Taxes: | $0 | Springing | N/A | | Cut-off Date Loan / SF: | $1,155 | $1,437 |

| Insurance: | $0 | Springing | N/A | | Maturity Date Loan / SF: | $1,155 | $1,437 |

| Replacement Reserves: | $0 | Springing | $487,003 | | Cut-off Date LTV: | 40.8% | 50.7% |

| TI/LC: | $0 | Springing | $6,087,540 | | Maturity Date LTV: | 40.8% | 50.7% |

| Other(7): | $26,168,910 | $0 | N/A | | UW NCF DSCR: | 2.58x | 2.07x |

| | | | | | UW NOI Debt Yield: | 11.0% | 8.8% |

| | | | | | | | |

| Sources and Uses |

| Sources | Proceeds | % of Total | | Uses | Proceeds | % of Total |

| Whole Loan | $1,750,000,000 | 100.0% | | Existing CMBS Mortgage Loan Payoff | $1,230,695,723 | 70.3% |

| | | % | | Construction Debt Payoff (Expansion) | 200,853,019 | 11.5% |

| | | | | Upfront Reserves | 26,168,910 | 1.5% |

| | | | | Closing Costs | 13,967,630 | 0.8% |

| | | | | Return of Equity | 278,314,718 | 15.9% |

| Total Sources | $1,750,000,000 | 100.0% | | Total Uses | $1,750,000,000 | 100.0% |

| (1) | The Aventura Mall Whole Loan was co-originated by JPMCB, Wells Fargo Bank, N.A., DBNY and Morgan Stanley Bank, N.A. |

| (2) | DBRS/Fitch/S&P provided the ratings above for the Aventura Mall Loan in the context of its inclusion in the mortgage pool. |

| (3) | The Aventura Mall Loan is part of a whole loan comprised of (i) 24 senior pari passu notes, with an aggregate outstanding principal balance as of the Cut-off Date of $1.41 billion and (ii) four subordinate notes, with an aggregate outstanding principal balance as of the Cut-off Date of $343.3 million. The Senior Notes Financial Information presented in the chart above reflects the Cut-off Date balance of the senior notes, but excludes the related subordinate notes. The Whole Loan Financial Information presented in the chart above reflects the Cut-off Date Balance of the senior notes and subordinate notes evidencing the Aventura Mall Whole Loan. |

| (4) | The lockout period will be at least 25 payment dates beginning with and including the first payment date of August 1, 2018. Defeasance of the full $1.75 billion Aventura Mall Whole Loan is permitted after the date that is the earlier to occur of (i) August 1, 2021 or (ii) the date that is two years from the closing date of the securitization that includes the last note to be securitized (the “REMIC Prohibition Period”). If the REMIC Prohibition Period has not occurred by August 1, 2021, the borrower is permitted to prepay the Aventura Mall with a yield maintenance premium, except that the borrower is required to defease any portion of the Aventura Mall Whole Loan that is more than two years from its securitization date. The assumed lockout period of 25 payments is based on the expected Benchmark 2018-B5 securitization closing date in August 2018. The actual lockout period may be longer. |

| (5) | Occupancy and UW Economic Occupancy includes square footage to be leased by 12 tenants (33,813 square feet) with leases out for signature that are covered under a master lease as described under “Master Lease” herein. |

| (6) | UW NOI and UW NCF are based on the February 14, 2018 rent roll, executed leases and lender adjustments. See “Cash Flow Analysis” herein. |

| (7) | For a full description of Escrows and Reserves, please refer to “Escrows and Reserves” below. Other Initial Escrows and Reserves refers to two deposits made at closing by the Aventura Mall Borrower comprised of (i) $6,776,765 for certain free rent credits remaining in connection with certain leases at the Aventura Mall Property and (ii) $19,392,145 for certain outstanding tenant improvement allowances and/or leasing commissions due in connection with certain leases at the Aventura Mall Property. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

20 of 130

| Structural and Collateral Term Sheet | | Benchmark 2018-B5 |

| |

| Aventura Mall |

The Loan. The Aventura Mall loan (the “Aventura Mall Loan”) is part of a whole loan that has an outstanding principal balance as of the Cut-off Date of $1.75 billion (the “Aventura Mall Whole Loan”), which whole loan is secured by a first mortgage lien on the borrower’s fee interest in an approximately 1.2 million square feet super regional mall in Aventura, Florida. The Aventura Mall Whole Loan is comprised of (i) a senior loan, comprised of 24pari passu notes with an aggregate principal balance as of the Cut-off Date of $1,406.7 million, two of which, Note A-2-A-2 (JPMCB) and Note A-2-B-4 (GACC), with an outstanding principal balance as of the Cut-off Date of $65.0 million and $38.0 million, respectively, are being contributed to the Benchmark 2018-B5 Trust and constitute the Aventura Mall Loan, and the remaining notes have been or are expected to be contributed to other securitization trusts and (ii) a subordinate companion loan, comprised of fourpari passu notes, with an aggregate outstanding principal balance as of the Cut-off Date of $343.3 million (collectively, the “Aventura Mall Subordinate Companion Loan”), each as described below. The relationship between the holders of the Aventura Mall Whole Loan will be governed by a co-lender agreement as described under the “Description of the Mortgage Pool—The Whole Loans—The Non-Serviced AB Whole Loans—The Aventura Mall Whole Loan” in the Preliminary Prospectus. The Aventura Mall Whole Loan has a 10-year term and will be interest-only for the term of the loan. The most recent prior financing of the Aventura Mall property was included in the AVMT 2013-AVM securitization.

B4 Notes

(Benchmark 2018-B4)

$115,000,000

Notes A-2-A-1, A-2-B-3 | Companion A Notes (JPMCB)

$200,000,000

Notes A-2-A-3, A-2-A-4, A-2-A-5 | Companion A Notes

(Aventura Mall Trust 2018-AVM)

$406,700,000

Notes A-1-A, A-1-B, A-1-C, A-1-D | Companion A Notes

(GACC)

$142,000,000

Notes A-2-B-1, A-2-B-2, A-2-B-5 | Companion A Notes

(MSMCH)

$220,000,000

Notes A-2-C-1, A-2-C-2, A-2-C-3, A-2-C-4, A-2-C-5 | Companion A Notes

(WFB)

$220,000,000

Notes A-2-D-1, A-2-D-2, A-2-D-3, A-2-D-4, A-2-D-5 | B5 Notes

(Benchmark 2018-B5)

$103,000,000

Notes A-2-A-2, A-2-B-4 |

B Notes

(Aventura Mall Trust 2018-AVM)

$343,300,000

Notes B-1, B-2, B-3, B-4 |

| (1) | The Aventura Mall Whole Loan will be serviced pursuant to the trust and servicing agreement for the Aventura Mall Trust 2018-AVM securitization. |

The Borrower.The borrower is Aventura Mall Venture, a Florida general partnership structured to be a bankruptcy remote entity with two independent directors in its organizational structure (the “Aventura Mall Borrower”).

The Loan Sponsors. The loan sponsors and nonrecourse carveout guarantors are Jacquelyn Soffer and Jeffrey Soffer (the “Turnberry Guarantors”) and Simon Property Group, L.P. (the “Simon Guarantor”, and together with the Turnberry Guarantors, the “Guarantors”). The liability of the Guarantors for breaches or violations of the non-recourse carveout provisions in the loan documents is capped at $350.0 million plus all reasonable, out-of-pocket costs and expenses (including, but not limited to, court costs and fees and reasonable attorney’s fees) incurred by the lender in connection with the enforcement of, or preservation of the lender’s rights under, the guaranty. The liability as between the Turnberry Guarantors and the Simon Guarantor will be several but not joint.

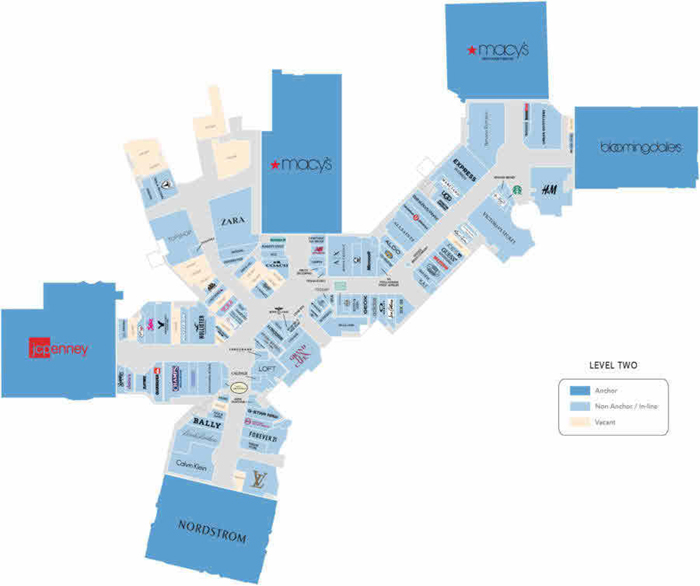

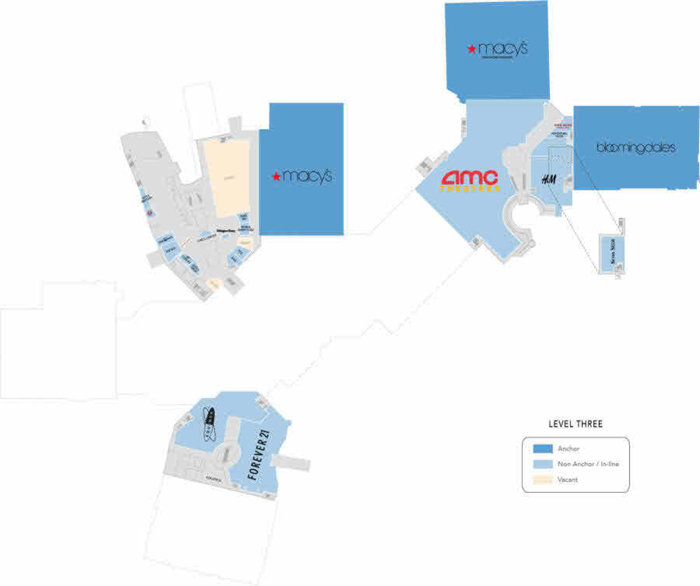

The Property. Aventura Mall is an approximately 2.2 million square foot, super regional mall that was developed by Turnberry in 1983 and subsequently expanded and renovated in 1997, 1998, 2006-2008 and 2017. Of the 2.2 million square feet, 1,217,508 square feet serves as collateral for the Aventura Mall Whole Loan (the “Aventura Mall Property”) which collateral also includes four anchor pad sites ground leased from the Aventura Mall Borrower. The collateral does not include 942,842 square feet of tenant-owned anchor improvements on those sites.

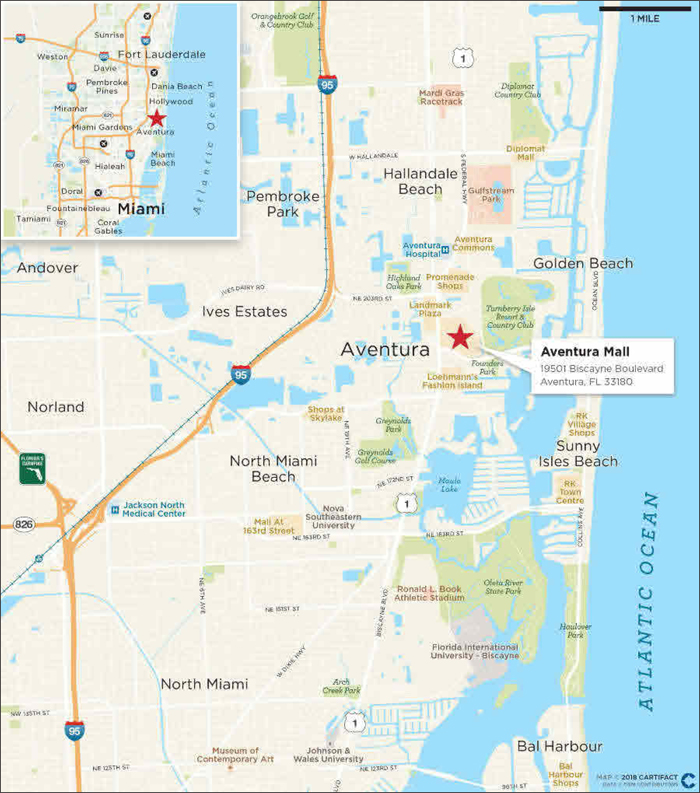

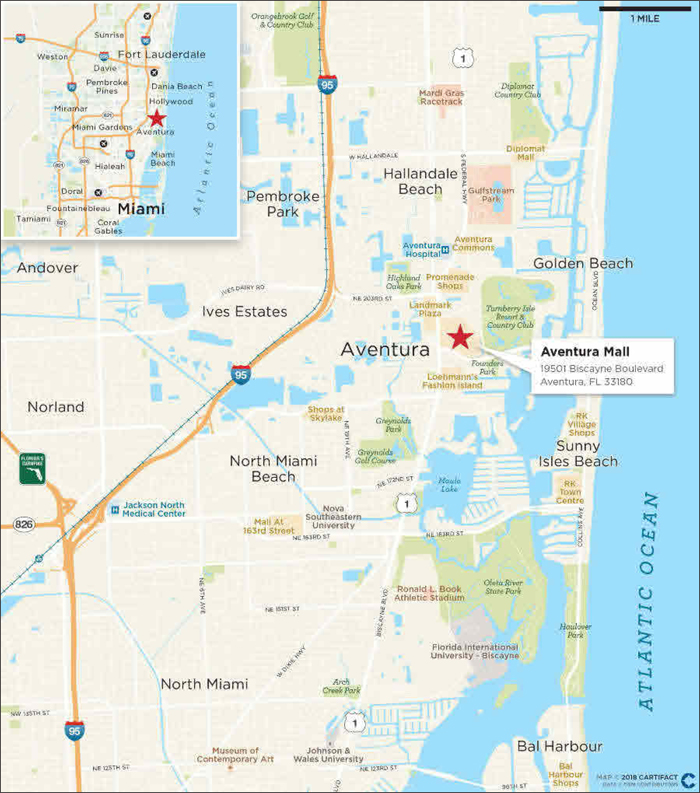

The Aventura Mall Property is located approximately 17 miles from downtown Miami and is surrounded by master-planned residential areas including Turnberry Isle, Porto Vita and the Waterways of Biscayne Bay. The Aventura Mall Property is the largest mall in Florida and the third largest mall in the United States. According to the appraisal, the Aventura Mall Property is the second most-visited shopping center in the United States with more than 28 million annual visitors. The Aventura Mall Property is anchored by a number of traditional mall anchors, including Macy’s, Bloomingdale’s, Macy’s Men’s & Home, Nordstrom and J.C. Penney Co., as well as a number of non-traditional mall anchors. The Aventura Mall has a mix of luxury, bridge to luxury and mass market tenants that appeal to a variety of shoppers.

The Aventura Mall Property is currently 92.8% leased as of February 14, 2018. The Aventura Mall Property is one of the top-performing malls in the U.S., with comparable in-line sales of $1,681 per square foot and total gross reported sales of approximately $1.2 billion as of the trailing 12 months ending February 2018.

In November 2017, the owners of the Aventura Mall Borrower opened a new 225,641 square foot expansion (the “Expansion Parcel”) at a cost of a $230.0 million, which is included in the collateral for the Aventura Mall Whole Loan. The Expansion Parcel features an approximately 20,000 square feet, two-level Apple store along with Tesla, Topshop, Zara, Serafina and Shake Shack. The Expansion Parcel is 72.2% leased as of February 14, 2018.

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

21 of 130

| Structural and Collateral Term Sheet | | Benchmark 2018-B5 |

| |

| Aventura Mall |

The Market. Regional access to the Aventura Mall is provided by I-95 and Biscayne Boulevard (U.S. Highway 1). The William Lehman Causeway, which connects the beach areas with U.S. Highway 1, also provides access to the Aventura Mall. The Aventura Mall is located approximately 17 miles from downtown Miami and is surrounded by Turnberry Isle, Porto Vita and the Waterways of Biscayne Bay. According to the appraisal, as of year-end 2017, Aventura Mall’s local trade area within a 15 mile radius is home to over 2.3 million people with an average income of $66,306.

As a destination retail mall north of Miami, Aventura Mall also appeals to a large international customer base, primarily from South America, Mexico and Europe.

| Population | Trade Area | Florida | USA |

| 2017 Population | 6,064,172 | 20,484,696 | 325,227,741 |

| Households | Trade Area | Florida | USA |

| 2017 Estimated # of Households | 2,270,759 | 8,032,734 | 122,737,174 |

| 2017 Average Household Income | $76,440 | $71,422 | $81,217 |

The appraiser considered six retail centers in the Miami MSA as the competitive set for the Aventura Mall Property. Three of the properties, Bal Harbour Shops, Sawgrass Mills and Dadeland Mall, are considered primary competition. The primary competition ranges from 460,000 square feet to approximately 2.4 million square feet and is located between 4.7 and 22.0 miles from the Aventura Mall Property. Pembroke Lakes Mall, Galleria Mall and Dolphin Mall are considered secondary competition. The secondary competition ranges from 955,000 square feet to approximately 1.4 million square feet and is located between 11.0 and 16.0 miles from the Aventura Mall Property.

| Competitive Set Summary(1) |

| Property | Location | Proximity (Miles) | Year Built / Renovated | Total GLA |

| Aventura Mall | Aventura, Florida | NAP | 1983 / 2017 | 2,156,203 |

| Bal Harbour Shops | Bal Harbour, Florida | 4.7 | 1965 / 2008 | 460,000 |

| Sawgrass Mills | Sunrise, Florida | 19.0 | 1990 / 2006 | 2,384,000 |

| Dadeland Mall | Kendall, Florida | 22.0 | 1962 / 2013 | 1,488,000 |

| Pembroke Lakes Mall | Pembroke Pines, Florida | 11.0 | 1992 / 1998 | 1,136,000 |

| Galleria Mall | Fort Lauderdale, Florida | 13.0 | 1980 / 2005 | 955,000 |

| Dolphin Mall | Miami, Florida | 16.0 | 2001 / 2010 | 1,403,000 |

| (1) | Based on the appraisal. |

| Non-Owned Anchors |

| Tenant | Ratings

Fitch/Moody’s/S&P(1) | Net Rentable Area (SF) | TTM February Sales | TTM February Sales Per Square Foot |

| Macy’s (GL) | BBB / Baa3 / BBB- | 299,011 | $81,164,209 | $271 |

| Bloomingdales (GL) | BBB / Baa3 / BBB- | 251,831 | $105,328,660 | $418 |

| Macy’s (Men’s & Home) (GL) | BBB / Baa3 / BBB- | 225,000 | $41,967,714 | $187 |

| Nordstrom (GL) | BBB+ / Baa1 / BBB+ | 167,000 | $53,536,758 | $321 |

| (1) | Certain ratings are those of the parent company whether or not the parent guarantees the lease. |

| Historical and Current Occupancy(1) |

| | 2008(2) | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | Current |

| Occupancy – Excluding Anchors | 84.1% | 94.9% | 95.2% | 96.6% | 94.9% | 98.9% | 97.8% | 97.8% | 97.3% | 97.7% | 91.4% |

| Occupancy – Including Anchors | 93.3% | 98.1% | 98.2% | 98.8% | 98.2% | 99.6% | 99.2% | 99.2% | 99.1% | 99.1% | 92.8% |

| (1) | Historical and Current Occupancy is based on the average of each respective year. Current occupancy is based on the February 14, 2018 rent roll, including recently executed leases and master leased tenants. |

| (2) | In 2008, occupancy declined due to a challenging corporate environment for several tenants including Stride Rite, Kay Bee Toys, The Sharper Image, Walden Books and Sigrid Olsen. 2008 occupancy as of December 31 was 87.9% and 96.1% for Occupancy – Excluding Anchors and Occupancy – Including Anchors, respectively. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

22 of 130

| Structural and Collateral Term Sheet | | Benchmark 2018-B5 |

| |

| Aventura Mall |

| Historical In-line Sales and Occupancy Costs(1) (2) |

| | 2015 | 2016 | 2017 | TTM February 2018 Sales Per Square Foot | TTM February 2018 Occupancy Cost |

| Comparable Sales Per Square Foot w/ Apple | $1,626 | $1,544 | $1,630 | $1,681 | 13.0% |

| Comparable Sales Per Square Foot w/o Apple | $1,229 | $1,114 | $1,147 | $1,162 | 18.9% |

| (1) | Not all tenants at the Aventura Mall Property are required to report sales. |

| (2) | Apple’s sales are based on the tenant’s 6,303 square feet of space in the existing mall. |

| Collateral Tenant Summary |

| Tenant | Ratings

Moody’s/S&P/ Fitch(1) | Net Rentable Area (SF) | % of

Total NRA | Base Rent Per Square Foot(2) | Lease Expiration(3) | % of Total

Base Rent | Most Recent Sales Per Square Foot | Occupancy Cost |

| Zara(4)(5) | NR / NR / NR | 34,454 | 2.8% | $119.58 | 10/31/2029 | 2.9% | $971 | 16.3% |

| Apple (2 Levels)(4)(6) | NR / Aa1 / AA+ | 20,218 | 1.7 | 173.11 | 1/31/2030 | 2.5 | $31,124 | 0.5% |

| H & M | NR / NR / NR | 28,830 | 2.4 | 117.09 | 1/31/2027 | 2.4 | $666 | 18.4% |

| Abercrombie & Fitch | NR / NR / BB- | 11,246 | 0.9 | 281.38 | 1/31/2020 | 2.2 | $1,555 | 20.9% |

| Victoria’s Secret | BB+ / Ba1 / BB+ | 18,387 | 1.5 | 165.00 | 7/31/2026 | 2.1 | $1,041 | 12.7% |

| Banana Republic | BB+ / Baa2 / BB+ | 16,857 | 1.4 | 175.05 | 2/29/2020 | 2.1 | $580 | 37.8% |

| Topshop(4) | NR / NR / NR | 23,296 | 1.9 | 122.00 | 10/31/2029 | 2.0 | NAV | NAV |

| XXI Forever | NR / NR / NR | 32,504 | 2.7 | 75.82 | MTM | 1.7 | $381 | 22.6% |

| Restoration Hardware | NR / NR / NR | 11,988 | 1.0 | 200.17 | 2/28/2019 | 1.7 | $2,150 | 11.4% |

| Champs Sports | NR / Ba1 / BB+ | 7,331 | 0.6 | 323.94 | 5/31/2023 | 1.7 | $1,555 | 22.8% |

| Louis Vuitton | WD / NR / A+ | 18,180 | 1.5 | 110.00 | 11/30/2022 | 1.4 | $1,989 | 7.8% |

| AMC Theatres(7) | B / B2 / B+ | 78,738 | 6.5 | 23.50 | 8/31/2023 | 1.3 | $703,921 | 10.6% |

| The Gap | BB+ / Baa2 / BB+ | 11,065 | 0.9 | 165.00 | 7/31/2024 | 1.3 | NAV | NAV |

| Gucci(8) | NR / NR / BBB+ | 8,383 | 0.7 | 201.57 | 12/31/2026 | 1.2 | $2,257 | 10.9% |

| Express | BB+ / Ba1 / BB+ | 11,320 | 0.9 | 145.75 | 1/31/2022 | 1.2 | $641 | 28.7% |

| Footlocker | NR / Ba1 / BB+ | 5,024 | 0.4 | 319.30 | 2/28/2025 | 1.1 | $1,238 | 29.3% |

| Mayor’s Jewelers | NR / NR / NR | 3,447 | 0.3 | 443.46 | 1/31/2024 | 1.1 | $6,052 | 7.9% |

| J. Crew | NR / Caa2 / CCC+ | 7,750 | 0.6 | 191.28 | 6/30/2020 | 1.0 | $806 | 28.6% |

| Armani Exchange | NR / NR / NR | 8,675 | 0.7 | 168.16 | 1/31/2021 | 1.0 | $924 | 23.0% |

| Michael Kors | BBB- / NR / BBB- | 3,678 | 0.3 | 393.93 | 9/30/2021 | 1.0 | $1,013 | 46.7% |

| Subtotal / Weighted Average | 361,371 | 29.7% | $129.41 | | 33.0% | | |

| Remaining Tenants | 767,910 | 63.1% | $123.55 | | 67.0% | | |

| Vacant | | 88,227 | 7.2% | NAP | | NAP | | |

| Total / Weighted Average | 1,217,508 | 100.0% | $125.42 | | 100.0% | | |

| | | | | | | | | | |

| (1) | Certain ratings are those of the parent company whether or not the parent guarantees the lease. |

| (2) | Base Rent Per Square Foot reflects the following: (a) in-place leases based on the February 14, 2018 rent roll, (b) contractual rent steps through June 2019 totaling $6.5 million including the $1.4 million contractual rent step that is scheduled to occur in August 2019 for the executed renewal of Victoria’s Secret (included in the Bridge Rent and Reimbursement Reserve) and (c) ground rent in an amount of approximately $1.3 million for tenants that own their improvements (Macy’s, Bloomingdale’s, Macy’s Men’s & Home and Nordstrom). |

| (3) | Certain tenants may have termination or contraction options due to co-tenancy provisions in the related leases (which may become exercisable prior to the originally stated expiration date of the tenant lease). |

| (4) | A full year of sales and occupancy costs are not available for Expansion Parcel tenants. |

| (5) | Zara was originally a tenant in the non-expansion portion of Aventura Mall, occupying approximately 19,000 square feet, before departing for Bal Harbour Shops in 2012. Zara has since returned to the Aventura Mall Property and opened in the Expansion Parcel in November 2017. The Most Recent Sales Per Square Foot are based on the tenant’s annualized sales from November 2017 through April 2018. |

| (6) | Most Recent Sales Per Square Foot for Apple are based on the tenant’s 6,303 square feet space in the pre-existing portion of the Aventura Mall Property. Apple recently executed a lease for approximately 20,000 square feet at the Expansion Parcel. |

| (7) | AMC Theatres Most Recent Sales Per Square Foot number reflects sales per screen (24 screens). |

| (8) | Gucci’s Most Recent Sales Per Square Foot are based on only accessories and children’s inventory. There are no clothing sales at the subject store. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

23 of 130

| Structural and Collateral Term Sheet | | Benchmark 2018-B5 |

| |

| Aventura Mall |

| Lease Rollover Schedule |

| Year | Number of Leases Expiring(1) | Net Rentable Area Expiring | % of NRA Expiring | Base Rent Expiring(2) | % of Base Rent Expiring | Cumulative Net Rentable Area Expiring | Cumulative % of NRA Expiring | Cumulative Base Rent Expiring | Cumulative % of Base Rent Expiring |

| 2018 & MTM(3) | 49 | 94,330 | 7.7% | $10,950,745 | 7.7% | 94,330 | 7.7% | $10,950,745 | 7.7% |

| 2019 | 31 | 91,803 | 7.5% | 12,376,749 | 8.7% | 186,133 | 15.3% | $23,327,493 | 16.5% |

| 2020 | 36 | 96,193 | 7.9% | 18,375,213 | 13.0% | 282,326 | 23.2% | $41,702,706 | 29.4% |

| 2021 | 24 | 54,397 | 4.5% | 13,685,691 | 9.7% | 336,723 | 27.7% | $55,388,398 | 39.1% |

| 2022 | 24 | 76,594 | 6.3% | 12,967,832 | 9.2% | 413,317 | 33.9% | $68,356,230 | 48.3% |

| 2023 | 29 | 352,941 | 29.0% | 16,933,820 | 12.0% | 766,258 | 62.9% | $85,290,050 | 60.2% |

| 2024 | 27 | 79,905 | 6.6% | 13,311,865 | 9.4% | 846,163 | 69.5% | $98,601,915 | 69.6% |

| 2025 | 13 | 19,020 | 1.6% | 5,163,035 | 3.6% | 865,183 | 71.1% | $103,764,950 | 73.3% |

| 2026 | 9 | 46,368 | 3.8% | 7,858,163 | 5.5% | 911,551 | 74.9% | $111,623,113 | 78.8% |

| 2027 | 20 | 78,035 | 6.4% | 10,641,238 | 7.5% | 989,586 | 81.3% | $122,264,351 | 86.3% |

| 2028 | 13 | 41,146 | 3.4% | 6,126,042 | 4.3% | 1,030,732 | 84.7% | $128,390,392 | 90.6% |

| 2029 & Beyond(4) | 13 | 98,549 | 8.1% | 13,247,802 | 9.4% | 1,129,281 | 92.8% | $141,638,194 | 100.0% |

| Vacant | NAP | 88,227 | 7.2% | NAP | NAP | 1,217,508 | 100.0% | NAP | NAP |

| Total / Wtd. Avg. | 288 | 1,217,508 | 100.0% | $141,638,194 | 100.0% | | | | |

| (1) | Number of leases expiring excludes approximately 30 temporary/kiosk tenants who operate under short term leases. |

| (2) | Base Rent Expiring reflects the following: (a) in-place leases based on the February 14, 2018 rent roll, (b) contractual rent steps through June 2019 totaling approximately $6.5 million including the $1.4 million contractual rent step that is scheduled to occur in August 2019 for the executed renewal of Victoria’s Secret (included in the Bridge Rent and Reimbursements Reserve), and (c) ground rent in an amount of approximately $1.3 million for tenants that own their improvements (Macy’s, Bloomingdale’s, Macy’s Men’s & Home and Nordstrom). |

| (3) | 2018 & MTM includes temporary tenants. |

| (4) | 2029 & Beyond includes the recently executed Apple lease square feet and lease expiration for the Expansion Parcel. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

24 of 130

| Structural and Collateral Term Sheet | | Benchmark 2018-B5 |

| |

| Aventura Mall |

| Operating History and Underwritten Net Cash Flow |

| | 2015 | 2016 | 2017 | TTM(1) | Underwritten | Per Square Foot | %(2) |

| Rents in Place(3) | $99,418,818 | $103,197,968 | $106,500,453 | $109,896,747 | $141,638,194 | $116.33 | 71.1% |

| Vacant Income | 0 | 0 | 0 | 0 | 13,640,745 | 11.20 | 6.9% |

| Gross Potential Rent | $99,418,818 | $103,197,968 | $106,500,453 | $109,896,747 | $155,278,939 | $127.54 | 78.0% |

| Percentage Rent | 5,466,448 | 4,115,391 | 3,447,721 | 3,326,930 | 3,627,027 | 2.98 | 1.8% |

| Total Reimbursements | 26,727,546 | 26,287,600 | 27,329,454 | 28,195,516 | 32,253,113 | 26.49 | 16.2% |

| Specialty Leasing Income | 3,536,265 | 3,076,589 | 4,453,595 | 4,900,785 | 3,805,199 | 3.13 | 1.9% |

| Other Income(4) | 3,628,986 | 3,701,438 | 3,994,113 | 4,090,769 | 4,156,114 | 3.41 | 2.1% |

| Net Rental Income | $138,778,063 | $140,378,986 | $145,725,336 | $150,410,748 | $199,120,392 | $163.55 | 100.0% |

| (Vacancy/Credit Loss) | (272,229) | (422,401) | (438,454) | (634,418) | (13,640,745) | (11.20) | (6.9)% |

| Effective Gross Income | $138,505,834 | $139,956,585 | $145,286,882 | $149,776,330 | $185,479,647 | $152.34 | 93.1% |

| | | | | | | | |

| Total Expenses | $29,480,495 | $29,303,182 | $30,046,320 | $31,484,933 | $30,620,668 | $25.15 | 16.5% |

| | | | | | | | |