| | | FREE WRITING PROSPECTUS |

| | | FILED PURSUANT TO RULE 433 |

| | | REGISTRATION FILE NO.: 333-226123-02 |

| | | |

| February [7], 2019 | JPMCC 2019-COR4 |

| | | |

Free Writing Prospectus

Structural and Collateral Term Sheet |

| |

| | JPMCC 2019-COR4 | |

| | | |

This material is for your information, and none of J.P. Morgan Securities LLC (“JPMS”), Deutsche Bank Securities Inc., Citigroup Global Markets Inc., Goldman Sachs & Co.LLC, Drexel Hamilton, LLC and Academy Securities, Inc., (each individually, an “Underwriter”, and together, the ‘‘Underwriters’’) are soliciting any action based upon it. This material is not to be construed as an offer to sell or the solicitation of any offer to buy any security in any jurisdiction where such an offer or solicitation would be illegal. The depositor has filed a registration statement (including a prospectus) with the SEC (SEC File No. 333-206361) for the offering to which this free writing prospectus relates. Before you invest, you should read the prospectus in the registration statement and other documents the depositor has filed with the SEC for more complete information about the depositor, the issuing entity and this offering. You may get these documents for free by visiting EDGAR on the SEC Web site at www.sec.gov. Alternatively, the depositor, any underwriter or any dealer participating in the offering will arrange to send you the prospectus if you request it by calling (800) 408-1016 or by emailing the ABS Syndicate Desk atabs_synd@jpmorgan.com. THE SECURITIES TO WHICH THIS INFORMATION RELATES WILL BE MORE FULLY DESCRIBED IN A PROSPECTUS (THE “PROSPECTUS”), WHICH IS NOT YET AVAILABLE. THE PROSPECTUS WILL CONTAIN MATERIAL INFORMATION THAT IS NOT CONTAINED IN THESE MATERIALS (INCLUDING WITHOUT LIMITATION A DETAILED DISCUSSION OF RISKS ASSOCIATED WITH AN INVESTMENT IN THE CERTIFICATES, UNDER THE HEADING“RISK FACTORS”IN THE PROSPECTUS). Neither this document nor anything contained in this document shall form the basis for any contract or commitment whatsoever. The information contained in this document is preliminary as of the date of this document, supersedes any previous such information delivered to you and will be superseded by any such information subsequently delivered prior to the time of sale. These materials are subject to change, completion or amendment from time to time. This information is based upon management forecasts and reflects prevailing conditions and management’s views as of this date, all of which are subject to change. J.P. Morgan is the marketing name for the investment banking businesses of JPMorgan Chase & Co. and its subsidiaries worldwide. Securities, syndicated loan arranging, financial advisory and other investment banking activities are performed by JPMS and its securities affiliates, and lending, derivatives and other commercial banking activities are performed by JPMorgan Chase Bank, National Association and its banking affiliates. JPMS is a member of SIPC and the NYSE. THE UNDERWRITERS MAY FROM TIME TO TIME PERFORM INVESTMENT BANKING SERVICES FOR, OR SOLICIT INVESTMENT BANKING BUSINESS FROM, ANY COMPANY NAMED IN THESE MATERIALS. THE UNDERWRITERS AND/OR THEIR AFFILIATES OR RESPECTIVE EMPLOYEES MAY FROM TIME TO TIME HAVE A LONG OR SHORT POSITION IN ANY CERTIFICATE OR CONTRACT DISCUSSED IN THESE MATERIALS. |

| | |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. |

| | | |

| 1 of 106 |  |

| February [7], 2019 | JPMCC 2019-COR4 |

THE REPUBLIC OF KOREA

THIS PROSPECTUS IS NOT, AND UNDER NO CIRCUMSTANCES IS THIS PROSPECTUS TO BE CONSTRUED AS, A PUBLIC OFFERING OF SECURITIES IN KOREA. NEITHER THE ISSUER NOR ANY OF ITS AGENTS MAKE ANY REPRESENTATION WITH RESPECT TO THE ELIGIBILITY OF ANY RECIPIENTS OF THIS PROSPECTUS TO ACQUIRE THE OFFERED CERTIFICATES UNDER THE LAWS OF KOREA, INCLUDING, BUT WITHOUT LIMITATION, THE FOREIGN EXCHANGE TRANSACTION LAW AND REGULATIONS THEREUNDER (THE “FETL”). THE OFFERED CERTIFICATES HAVE NOT BEEN REGISTERED WITH THE FINANCIAL SERVICES COMMISSION OF KOREA FOR PUBLIC OFFERING IN KOREA, AND NONE OF THE OFFERED CERTIFICATES MAY BE OFFERED, SOLD OR DELIVERED, DIRECTLY OR INDIRECTLY, OR OFFERED OR SOLD TO ANY PERSON FOR RE-OFFERING OR RESALE, DIRECTLY OR INDIRECTLY IN KOREA OR TO ANY RESIDENT OF KOREA EXCEPT PURSUANT TO THE FINANCIAL INVESTMENT SERVICES AND CAPITAL MARKETS ACT AND THE DECREES AND REGULATIONS THEREUNDER (THE “FSCMA”), THE FETL AND ANY OTHER APPLICABLE LAWS, REGULATIONS AND MINISTERIAL GUIDELINES IN KOREA. WITHOUT PREJUDICE TO THE FOREGOING, THE NUMBER OF OFFERED CERTIFICATES OFFERED IN KOREA OR TO A RESIDENT OF KOREA SHALL BE LESS THAN FIFTY AND FOR A PERIOD OF ONE YEAR FROM THE ISSUE DATE OF THE OFFERED CERTIFICATES, NONE OF THE OFFERED CERTIFICATES MAY BE DIVIDED RESULTING IN AN INCREASED NUMBER OF OFFERED CERTIFICATES. FURTHERMORE, THE OFFERED CERTIFICATES MAY NOT BE RESOLD TO KOREAN RESIDENTS UNLESS THE PURCHASER OF THE OFFERED CERTIFICATES COMPLIES WITH ALL APPLICABLE REGULATORY REQUIREMENTS (INCLUDING, BUT NOT LIMITED TO, GOVERNMENT REPORTING APPROVAL REQUIREMENTS UNDER THE FETL AND ITS SUBORDINATE DECREES AND REGULATIONS) IN CONNECTION WITH THE PURCHASE OF THE OFFERED CERTIFICATES.

JAPAN

THE OFFERED CERTIFICATES HAVE NOT BEEN AND WILL NOT BE REGISTERED UNDER THE FINANCIAL INSTRUMENTS AND EXCHANGE LAW OF JAPAN, AS AMENDED (THE “FIEL”), AND DISCLOSURE UNDER THE FIEL HAS NOT BEEN AND WILL NOT BE MADE WITH RESPECT TO THE OFFERED CERTIFICATES. ACCORDINGLY, EACH UNDERWRITER HAS REPRESENTED AND AGREED THAT IT HAS NOT, DIRECTLY OR INDIRECTLY, OFFERED OR SOLD AND WILL NOT, DIRECTLY OR INDIRECTLY, OFFER OR SELL ANY OFFERED CERTIFICATES IN JAPAN OR TO, OR FOR THE BENEFIT OF, ANY RESIDENT OF JAPAN (WHICH TERM AS USED IN THIS PROSPECTUS MEANS ANY PERSON RESIDENT IN JAPAN, INCLUDING ANY CORPORATION OR OTHER ENTITY ORGANIZED UNDER THE LAWS OF JAPAN) OR TO OTHERS FOR REOFFERING OR RE-SALE, DIRECTLY OR INDIRECTLY, IN JAPAN OR TO, OR FOR THE BENEFIT OF, ANY RESIDENT OF JAPAN EXCEPT PURSUANT TO AN EXEMPTION FROM THE REGISTRATION REQUIREMENTS OF, AND OTHERWISE IN COMPLIANCE WITH, THE FIEL AND OTHER RELEVANT LAWS, REGULATIONS AND MINISTERIAL GUIDELINES OF JAPAN. AS PART OF THIS OFFERING OF THE OFFERED CERTIFICATES, THE UNDERWRITERS MAY OFFER THE OFFERED CERTIFICATES IN JAPAN TO UP TO 49 OFFEREES IN ACCORDANCE WITH THE ABOVE PROVISIONS.

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. |

| | | |

| 2 of 106 |  |

| Structural and Collateral Term Sheet | | JPMCC 2019-COR4 |

| |

| Collateral Characteristics |

| Loan Pool | |

| | Initial Pool Balance (“IPB”): | $774,087,963 |

| | Number of Mortgage Loans: | 38 |

| | Number of Mortgaged Properties: | 56 |

| | Average Cut-off Date Balance per Mortgage Loan: | $20,370,736 |

| | Weighted Average Current Mortgage Rate: | 5.03331% |

| | 10 Largest Mortgage Loans as % of IPB: | 57.7% |

| | Weighted Average Remaining Term to Maturity: | 114 months |

| | Weighted Average Seasoning: | 6 months |

| | | |

| Credit Statistics | |

| | Weighted Average UW NCF DSCR(1)(2): | 1.66x |

| | Weighted Average UW NOI Debt Yield(1): | 10.2% |

| | Weighted Average Cut-off Date Loan-to-Value Ratio (“LTV”)(1)(3): | 59.2% |

| | Weighted Average Maturity Date LTV(1)(3): | 55.5% |

| | | |

| Other Statistics | |

| | % of Mortgage Loans with Additional Debt: | 18.0% |

| | % of Mortgaged Properties with Single Tenants: | 20.5% |

| | | |

| Amortization | |

| | Weighted Average Original Amortization Term(4): | 360 months |

| | Weighted Average Remaining Amortization Term(4): | 359 months |

| | % of Mortgage Loans with Interest-Only: | 49.3% |

| | % of Mortgage Loans with Partial Interest-Only followed by Amortizing Balloon: | 40.7% |

| | % of Mortgage Loans with Amortizing Balloon: | 10.0% |

| | | |

| Lockbox / Cash Management(5) | |

| | % of Mortgage Loans with In-Place, Hard Lockboxes: | 75.2% |

| | % of Mortgage Loans with Springing Lockboxes: | 8.3% |

| | % of Mortgage Loans with In-Place, Soft Lockboxes: | 16.5% |

| | % of Mortgage Loans with Springing Cash Management: | 95.8% |

| | % of Mortgage Loans with In-Place Cash Management: | 4.2% |

| | | |

| Reserves | |

| | % of Mortgage Loans Requiring Monthly Tax Reserves: | 66.0% |

| | % of Mortgage Loans Requiring Monthly Insurance Reserves: | 41.8% |

| | % of Mortgage Loans Requiring Monthly CapEx Reserves(6): | 57.7% |

| | % of Mortgage Loans Requiring Monthly TI/LC Reserves(7): | 37.8% |

| | | |

| (1) | In the case of Loan Nos. 1, 3, 5, 6, 10 and 18, the UW NCF DSCR, UW NOI Debt Yield, Cut-off Date LTV and Maturity Date LTV calculations include the related Pari Passu Companion Loan(s). In the case of Loan Nos. 4, 5, 8 and 11, the UW NCF DSCR, UW NOI Debt Yield, Cut-off Date LTV and Maturity Date LTV calculations exclude the related mezzanine loan(s). |

| (2) | With respect to Loan No. 5, the UW NCF DSCR is calculated using the sum of the first 12 whole loan principal and interest payments after the expiration of the whole loan interest only period based on the assumed principal and interest payment schedule set forth in Annex G of the Preliminary Prospectus. With respect to Loan No. 8, the UW NCF DSCR is calculated using the sum of the first 12 principal and interest payments after the expiration of the interest only period based on the assumed principal and interest payment schedule set forth in Annex H of the Preliminary Prospectus. With respect to Loan No. 11, the UW NCF DSCR is calculated using the sum of the first 12 principal and interest payments after the expiration of the interest only period based on the assumed principal and interest payment schedule set forth in Annex I of the Preliminary Prospectus. |

| (3) | In the case of Loan Nos. 22 and 38, the Cut-off Date LTV and the Maturity Date LTV are calculated by using an appraised value based on certain hypothetical assumptions. Refer to “Description of the Mortgage Pool—Assessments of Property Value and Condition” and “—Appraised Value” in the Preliminary Prospectus for additional details. |

| (4) | Excludes 15 mortgage loans that are interest-only for the entire term. |

| (5) | For a more detailed description of Lockbox / Cash Management, refer to “Description of the Mortgage Pool—Certain Terms of the Mortgage Loans—Mortgaged Property Accounts” in the Preliminary Prospectus. |

| (6) | CapEx Reserves include FF&E reserves for hotel properties. |

| (7) | Calculated only with respect to the Cut-off Date Balance of mortgage loans secured or partially secured by retail, office, industrial and mixed use properties. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. |

| | | |

| 3 of 106 |  |

| Structural and Collateral Term Sheet | | JPMCC 2019-COR4 |

| |

| Collateral Characteristics |

Mortgage Loan Seller | Number of

Mortgage Loans | Number of

Mortgaged

Properties | Aggregate

Cut-off Date

Balance | % of IPB |

| LCM(1) | 30 | 46 | $648,493,903 | 83.8% |

| JPMCB | 8 | 10 | 125,594,061 | 16.2 |

| Total: | 38 | 56 | $774,087,963 | 100.0% |

| (1) | Five of the mortgage loans being sold by LCM were originated by Deutsche Bank AG, acting through its New York Branch (“DBNY”), or German American Capital Corporation or an affiliate thereof, and have been or will be purchased by LCM or an affiliate. One of the mortgage loans being sold by LCM, the Saint Louis Galleria mortgage loan, is part of a whole loan that was co-originated by Société Générale Financial Corporation and DBNY. Such mortgage loan has been or will be purchased by LCM or an affiliate. |

| Ten Largest Mortgage Loans |

| |

| No. | Loan Name | Mortgage

Loan Seller | No.

of Prop. | Cut-off Date Balance | % of IPB | SF / Rooms | Property Type | UW

NCF DSCR(1)(2) | UW NOI Debt

Yield(1) | Cut-off

Date

LTV(1) | Maturity

Date LTV(1) |

| 1 | Renaissance Seattle | LCM | 1 | $77,000,000 | 9.9% | 557 | Hotel | 2.22x | 12.6% | 55.3% | 55.3% |

| 2 | 400 South El Camino | LCM | 1 | $75,000,000 | 9.7% | 145,179 | Office | 1.57x | 10.3% | 58.6% | 50.3% |

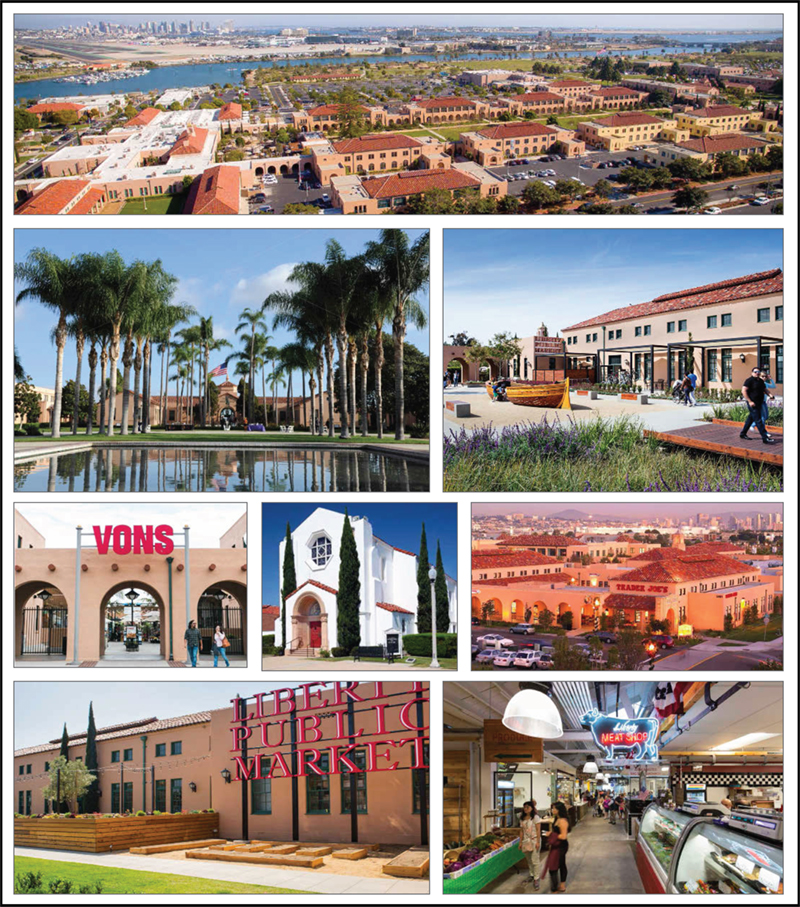

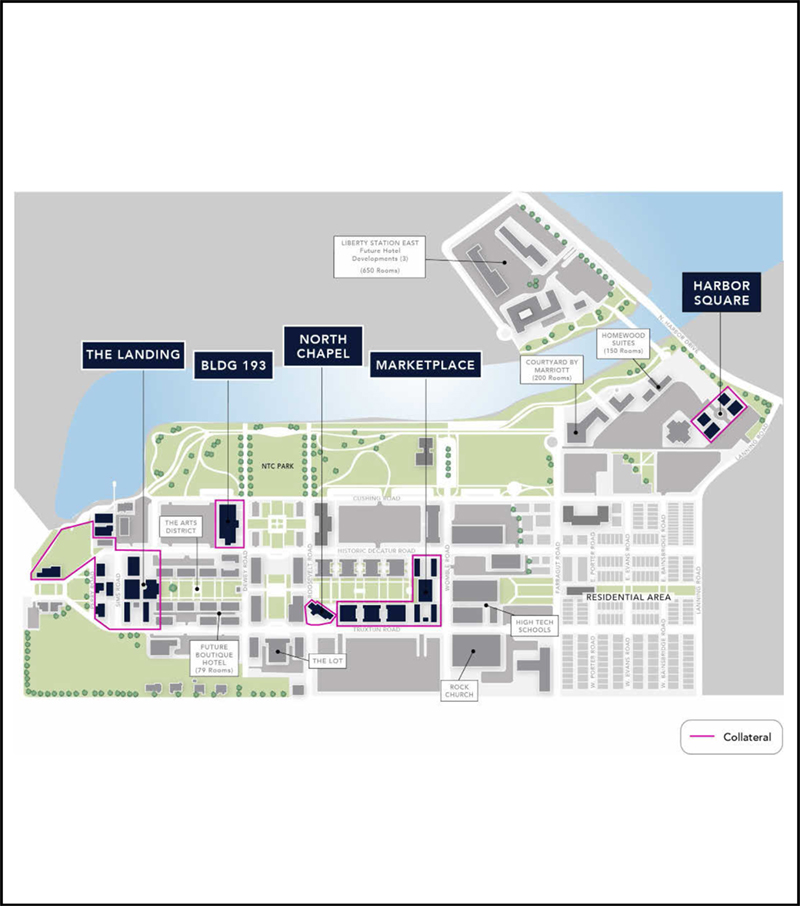

| 3 | Liberty Station Retail | JPMCB | 1 | $67,000,000 | 8.7% | 327,704 | Retail | 1.45x | 8.0% | 68.8% | 68.8% |

| 4 | Bedford Square | LCM | 1 | $48,000,000 | 6.2% | 107,943 | Mixed Use | 1.59x | 9.0% | 45.7% | 45.7% |

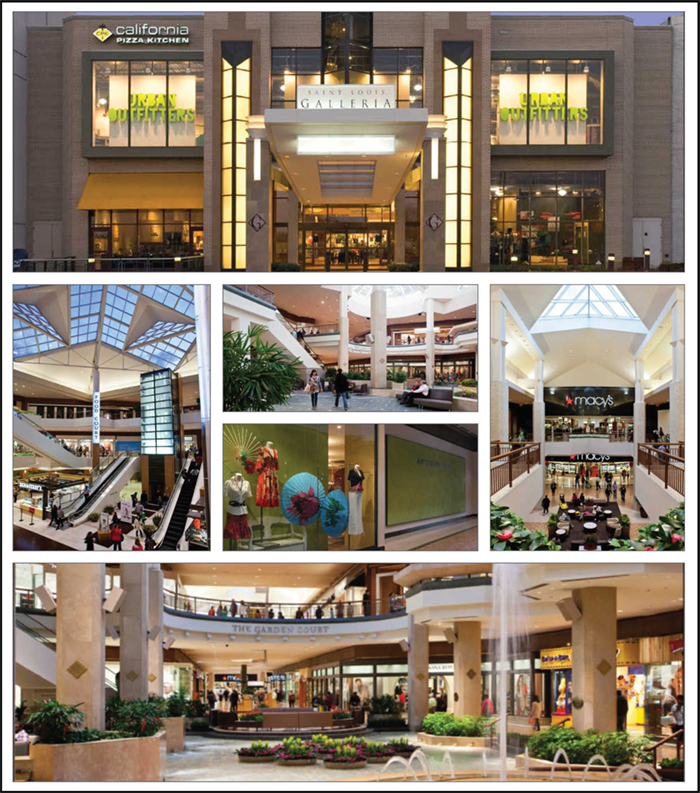

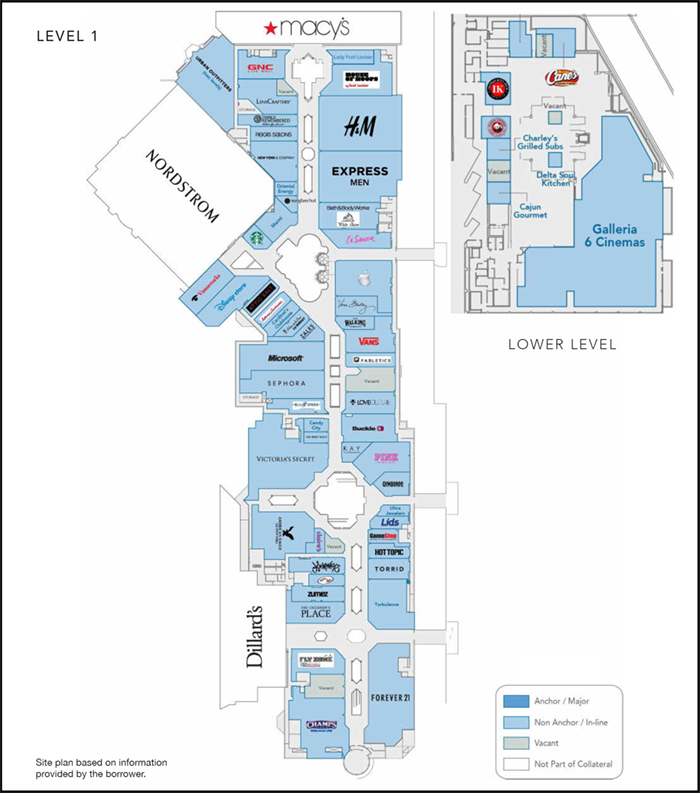

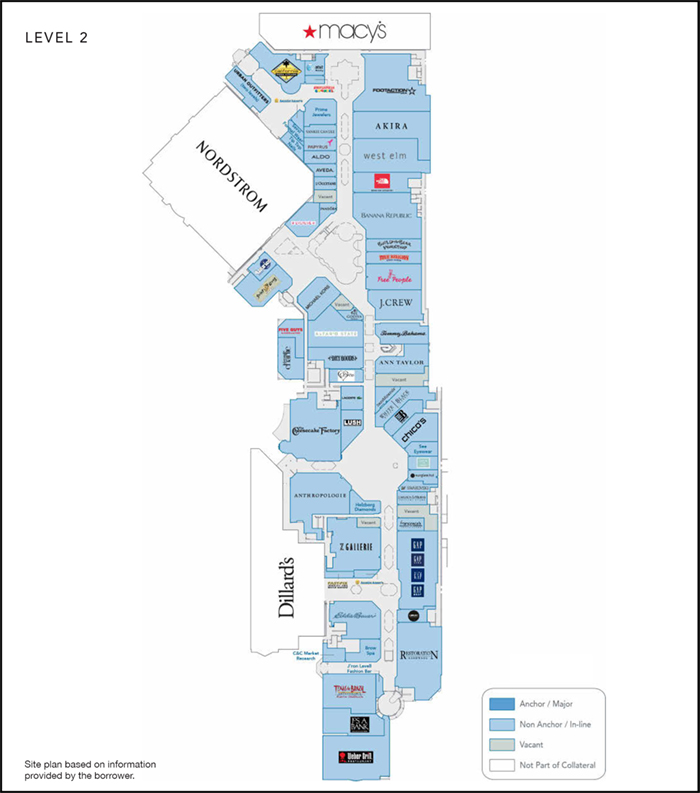

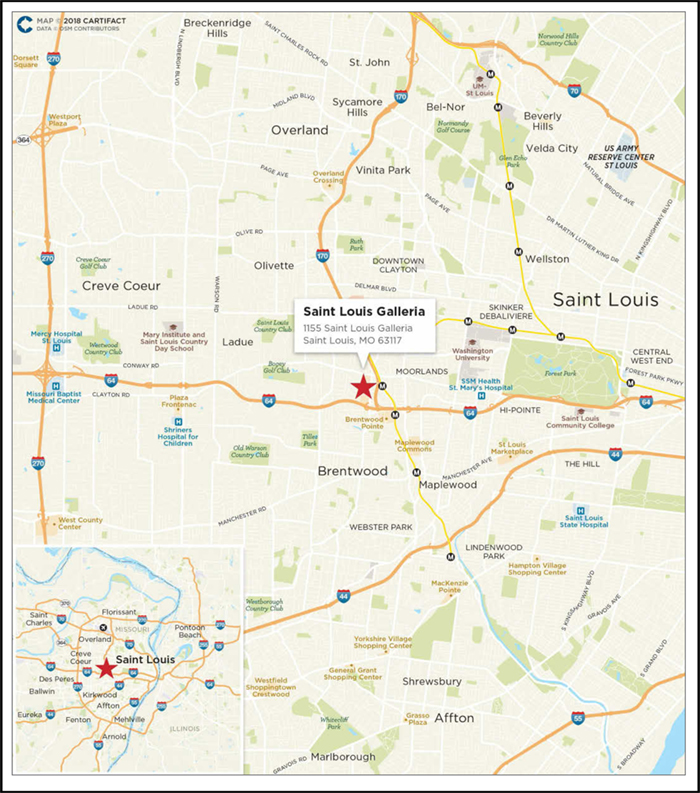

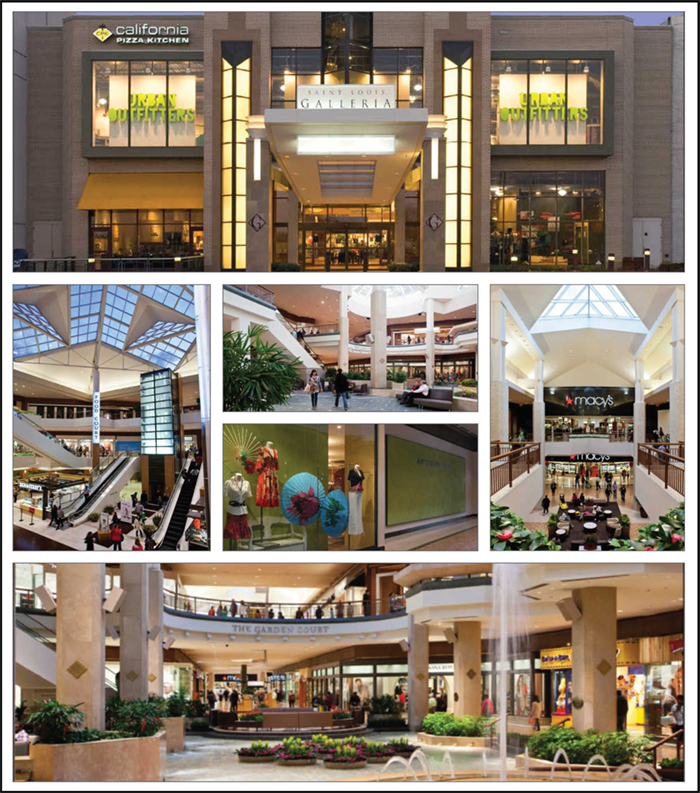

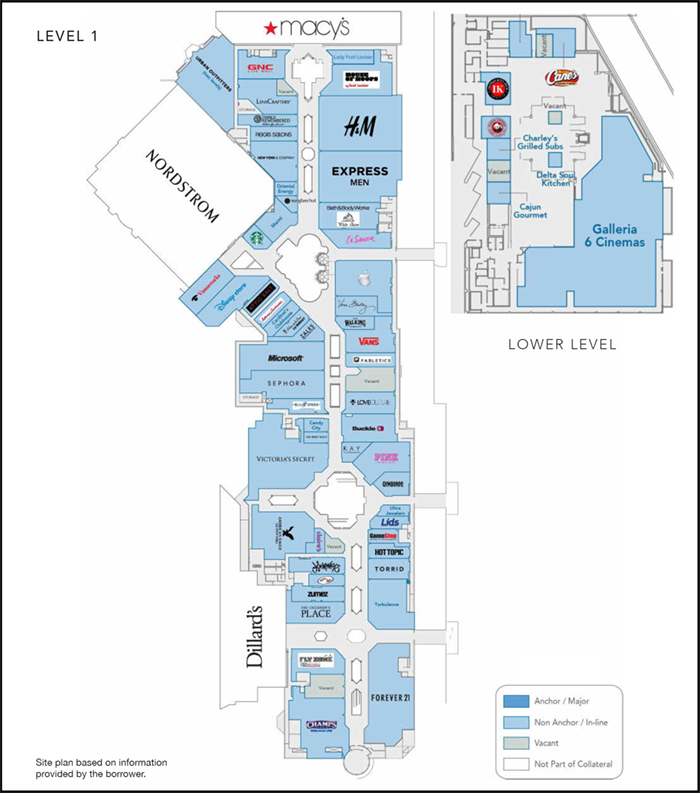

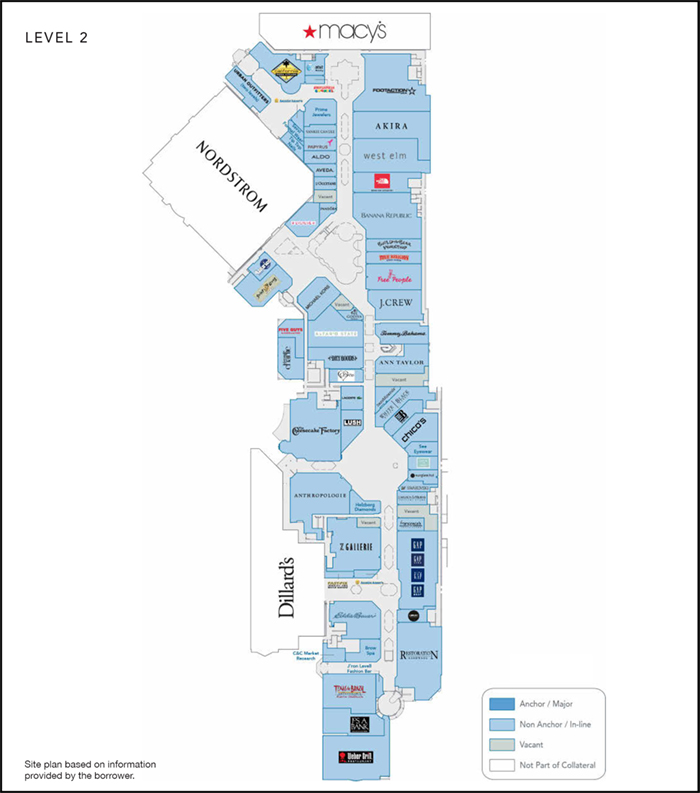

| 5 | Saint Louis Galleria | LCM | 1 | $46,479,245 | 6.0% | 465,695 | Retail | 1.67x | 11.3% | 51.5% | 47.0% |

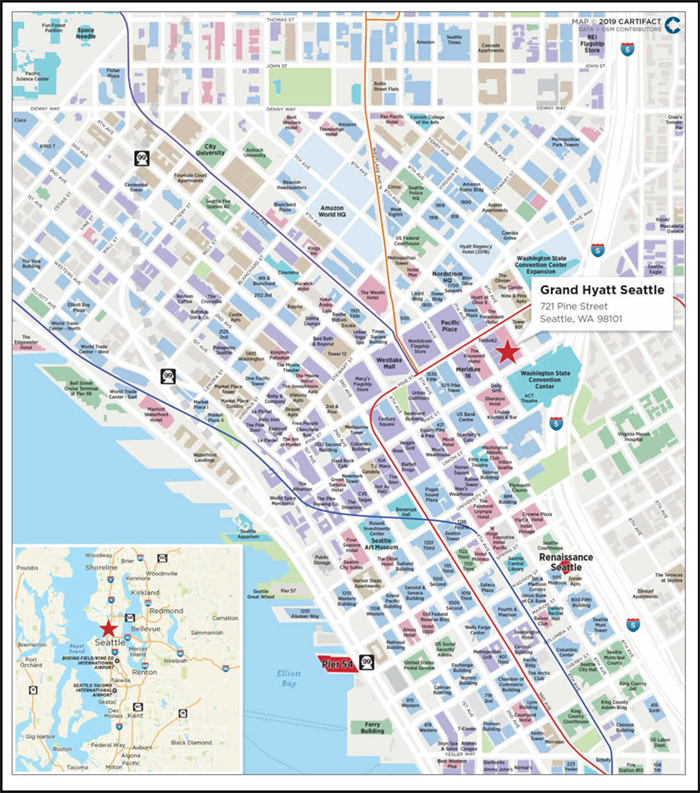

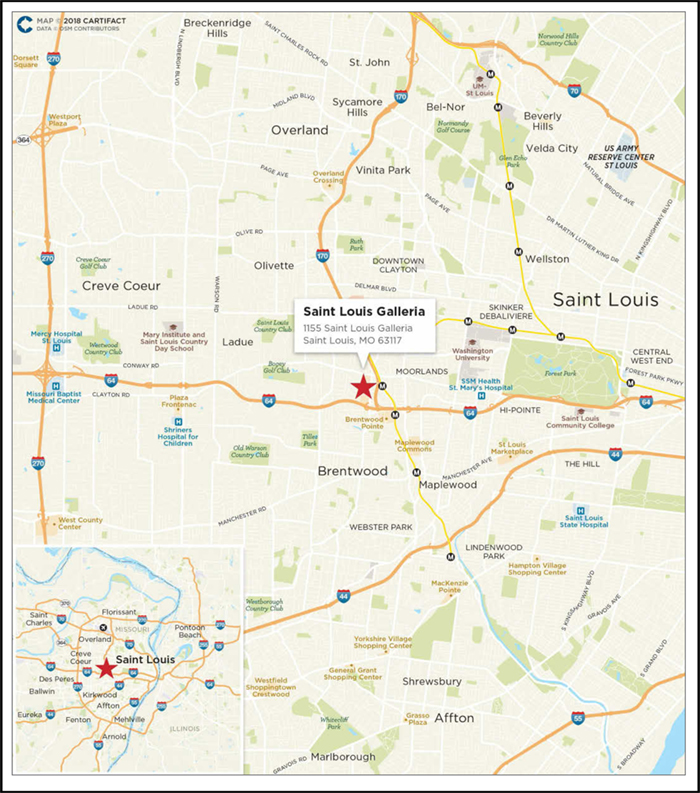

| 6 | Grand Hyatt Seattle | LCM | 1 | $33,000,000 | 4.3% | 457 | Hotel | 2.21x | 12.3% | 54.9% | 54.9% |

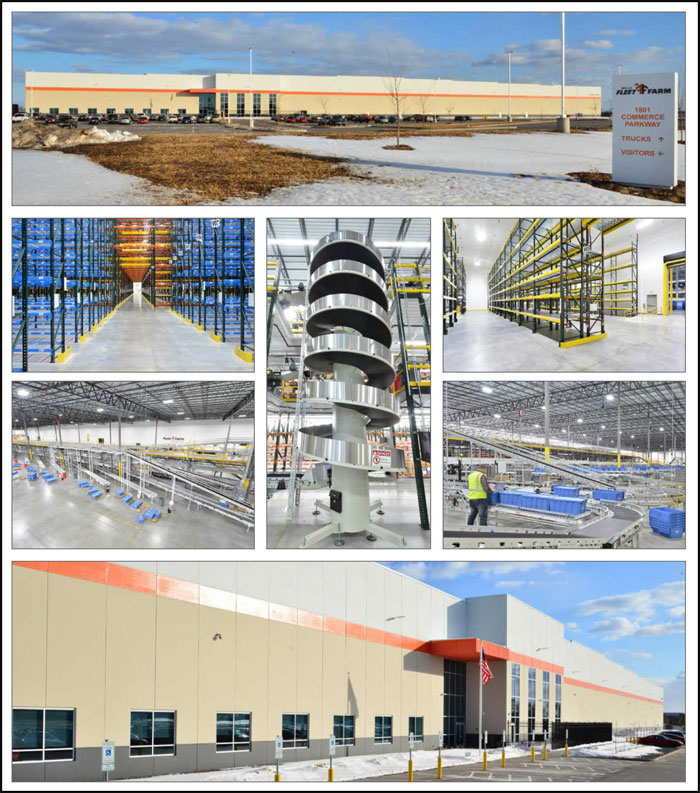

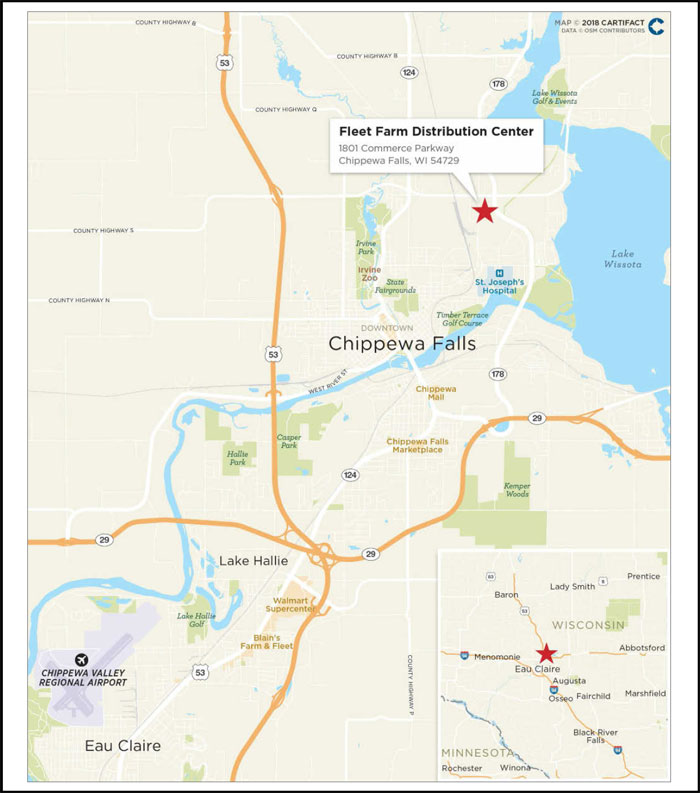

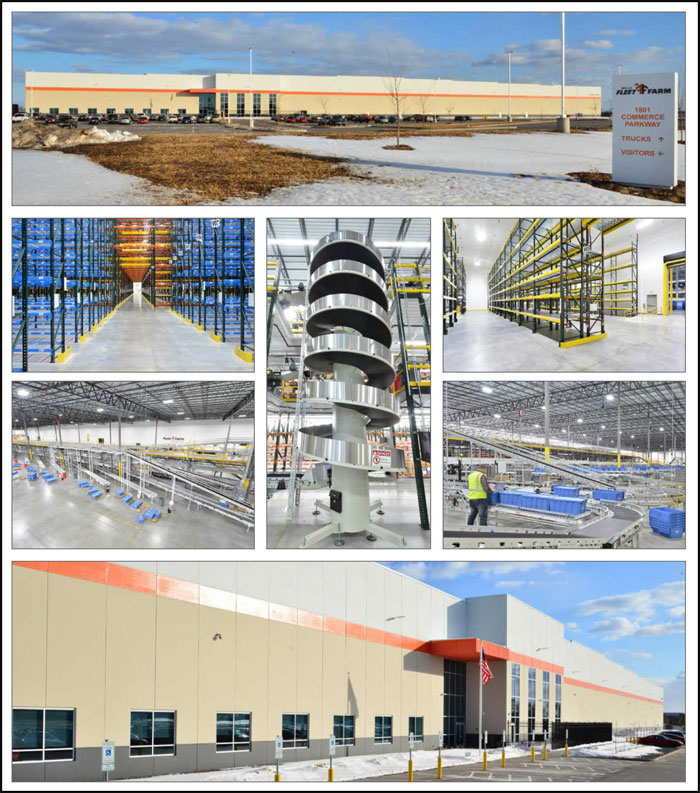

| 7 | Fleet Farm Distribution Center | LCM | 1 | $32,303,006 | 4.2% | 1,126,368 | Industrial | 1.33x | 9.5% | 64.0% | 52.7% |

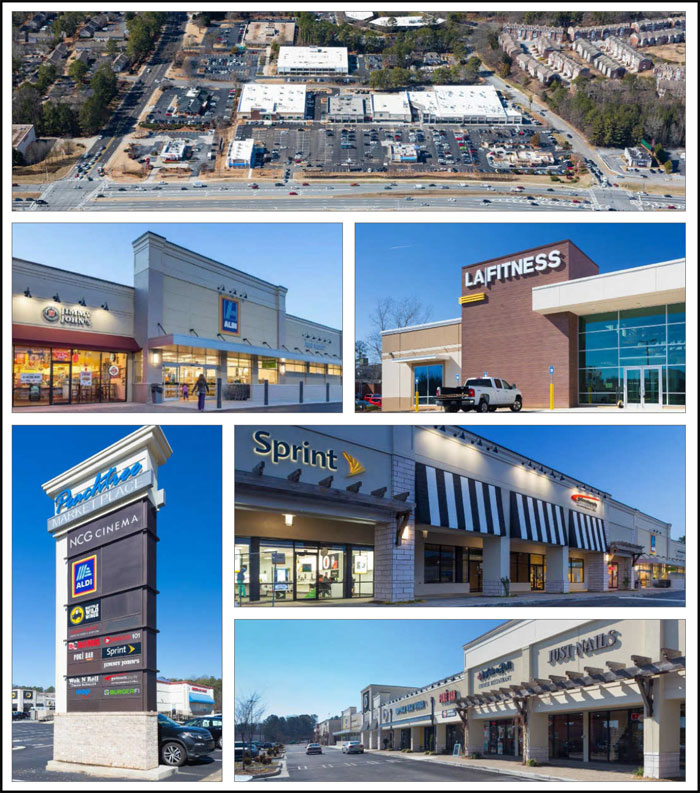

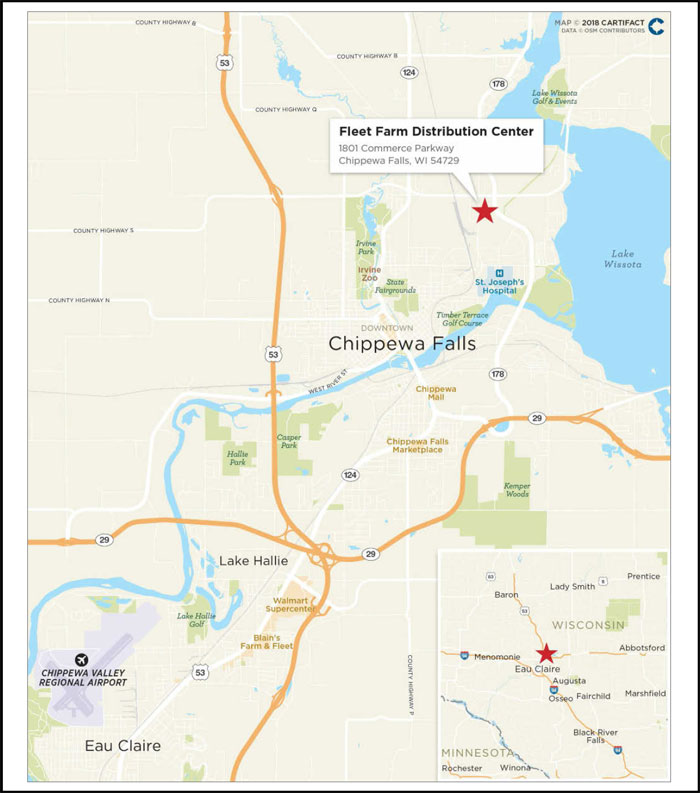

| 8 | Peachtree Corners Marketplace | LCM | 1 | $24,600,000 | 3.2% | 121,379 | Retail | 1.39x | 9.5% | 61.5% | 55.0% |

| 9 | Pier 54 Seattle | LCM | 1 | $23,000,000 | 3.0% | 65,749 | Mixed Use | 1.56x | 8.0% | 56.1% | 56.1% |

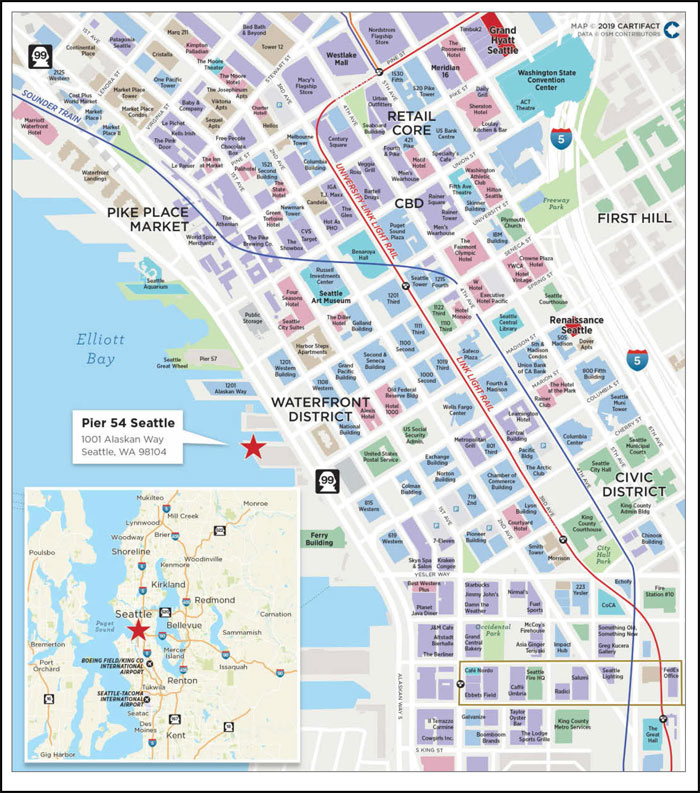

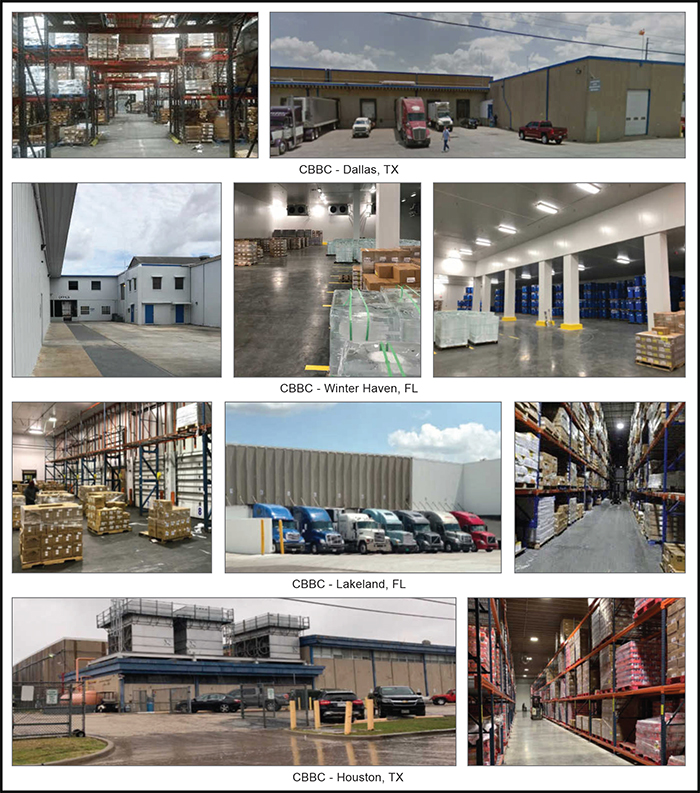

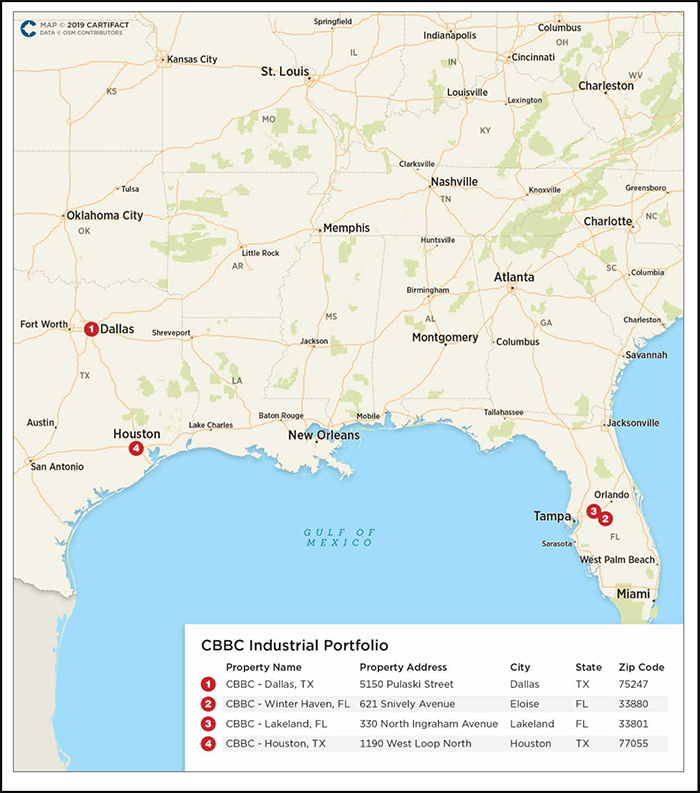

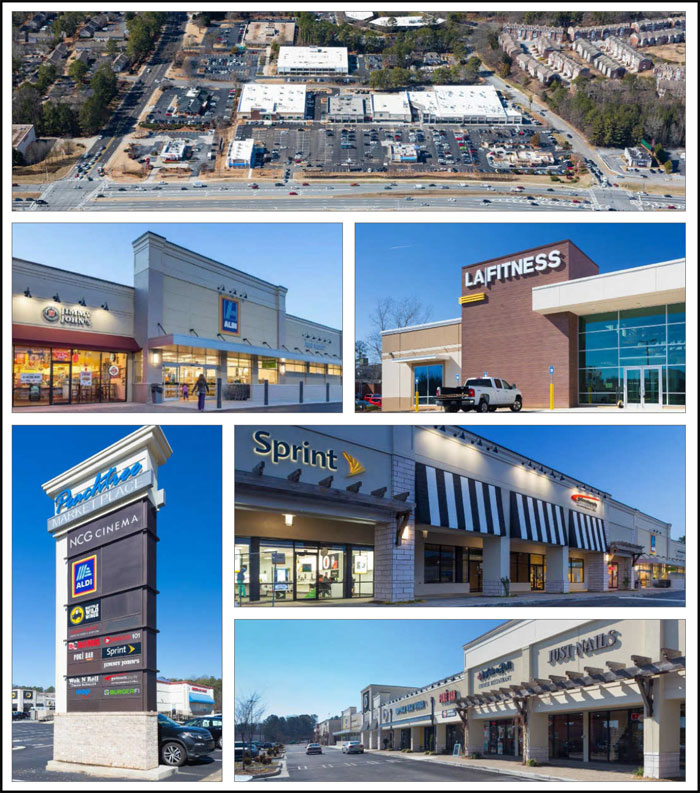

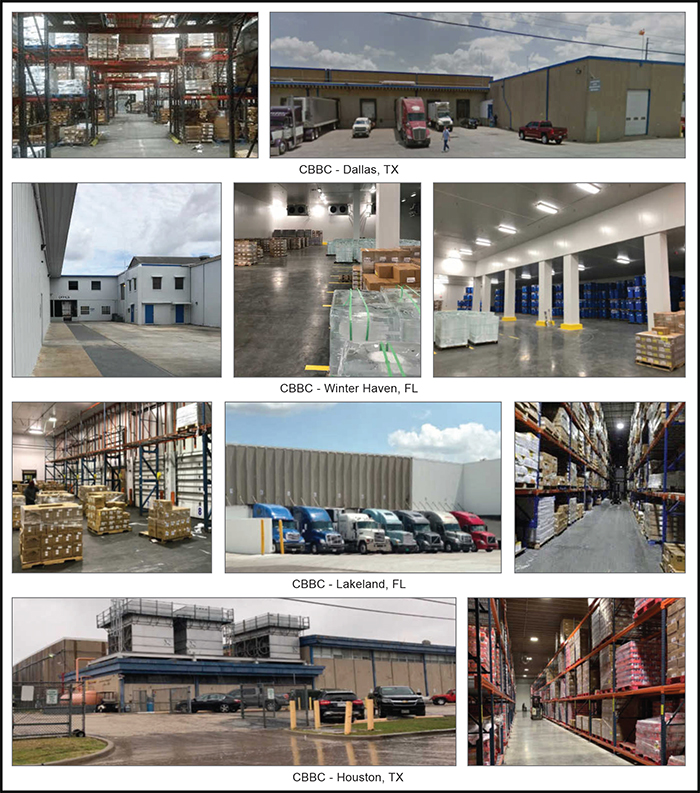

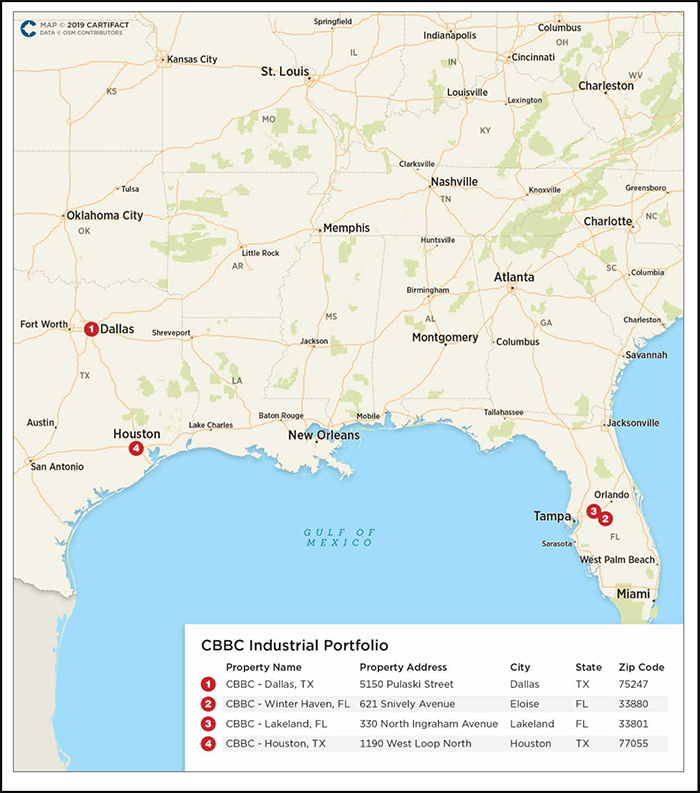

| 10 | CBBC Industrial Portfolio | LCM | 4 | $20,000,000 | 2.6% | 951,651 | Industrial | 1.77x | 10.4% | 61.7% | 61.7% |

| | | | | | | | | | | | |

| | Top 3 Total/Weighted Average | 3 | $219,000,000 | 28.3% | | | 1.76x | 10.4% | 60.6% | 57.7% |

| | Top 5 Total/Weighted Average | 5 | $313,479,245 | 40.5% | | | 1.72x | 10.3% | 56.9% | 54.3% |

| | Top 10 Total/Weighted Average | 13 | $446,382,251 | 57.7% | | | 1.71x | 10.2% | 57.7% | 54.7% |

| | | | | | | | | | | | | |

| (1) | In the case of Loan Nos. 1, 3, 5, 6 and 10, the UW NCF DSCR, UW NOI Debt Yield, Cut-off Date LTV and Maturity Date LTV calculations include the related Pari Passu Companion Loan(s). In the case of Loan Nos. 4, 5 and 8, the UW NCF DSCR, UW NOI Debt Yield, Cut-off Date LTV and Maturity Date LTV calculations exclude the related mezzanine loan(s). |

| (2) | With respect to Loan No. 5, the UW NCF DSCR is calculated using the sum of the first 12 whole loan principal and interest payments after the expiration of the whole loan interest only period based on the assumed principal and interest payment schedule set forth in Annex G of the Preliminary Prospectus. With respect to Loan No. 8, the UW NCF DSCR is calculated using the sum of the first 12 principal and interest payments after the expiration of the interest only period based on the assumed principal and interest payment schedule set forth in Annex H of the Preliminary Prospectus. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. |

| | | |

| 4 of 106 |  |

| Structural and Collateral Term Sheet | | JPMCC 2019-COR4 |

| |

| Collateral Characteristics |

| Pari Passu Companion Loan Summary |

| Loan No. | Mortgage

Loan | Note(s) | Original

Balance ($) | Cut-off Date Balance ($) | Holder of Note | Lead Servicer for

Whole Loan

(Y/N) | Master Servicer Under Lead Securitization | Special

Servicer Under Lead Securitization |

| 1 | Renaissance Seattle | Note A-1 | $50,000,000 | $50,000,000 | COMM 2017-COR2 | Y | Midland | Midland |

| | | Note A-2, A-3 | $77,000,000 | $77,000,000 | JPMCC 2019-COR4 | N | | |

| | | Total | $127,000,000 | $127,000,000 | | | | |

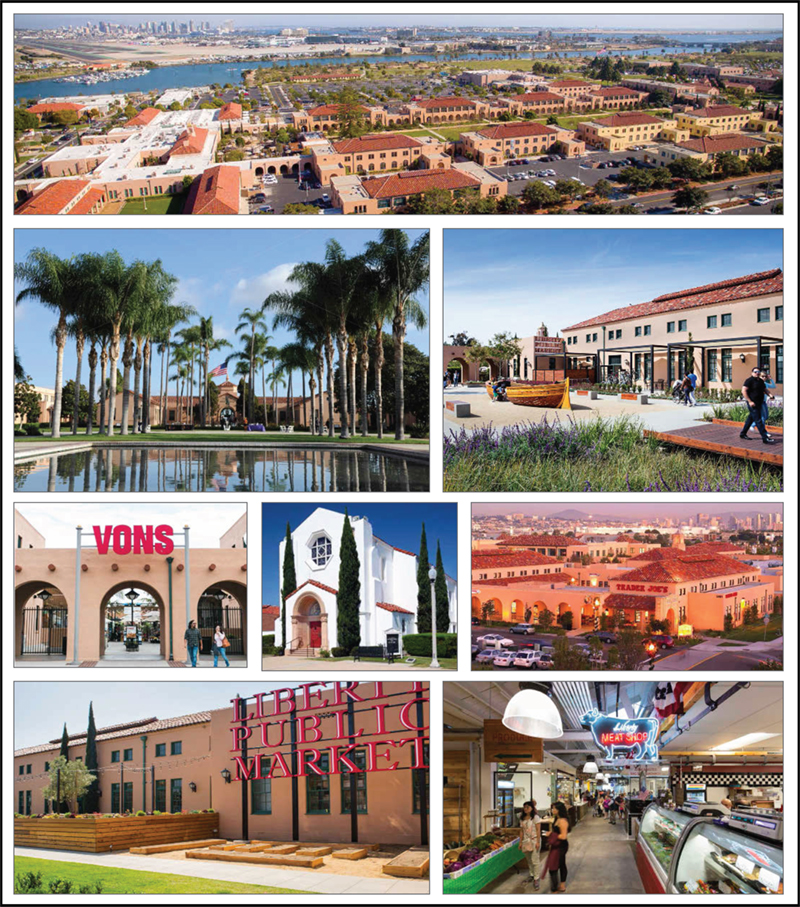

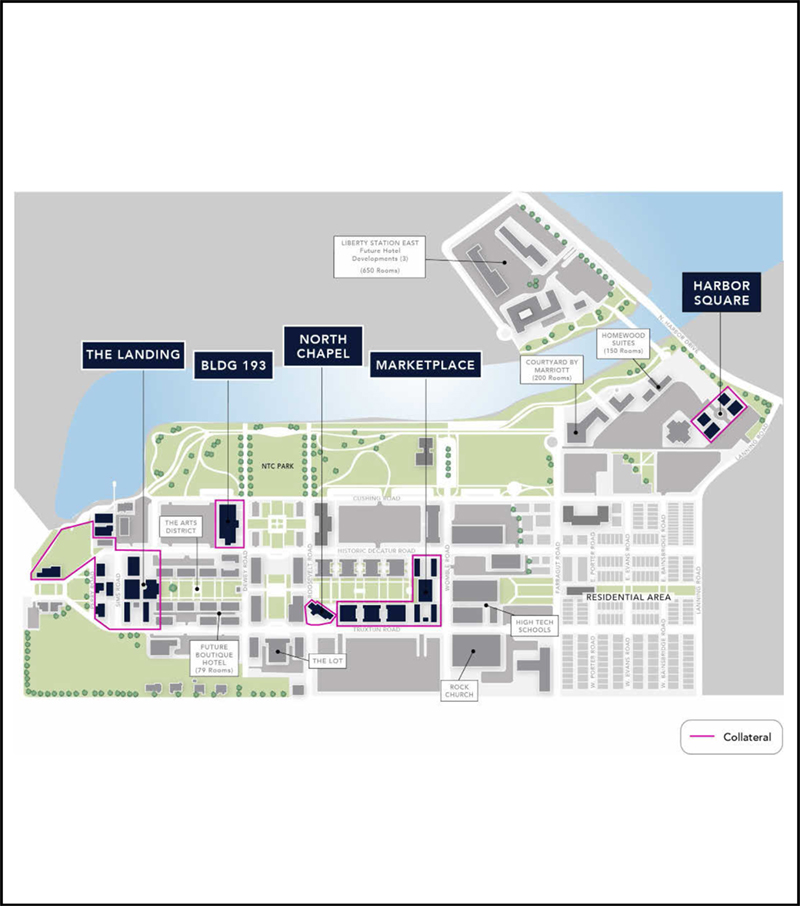

3 | Liberty Station Retail | Note A-1 | $67,000,000 | $67,000,000 | JPMCC 2019-COR4 | Y | Midland | Midland |

| | | Note A-2 | $20,000,000 | $20,000,000 | JPMCB | N | | |

| | | Note A-3 | $30,000,000 | $30,000,000 | Benchmark 2019-B9(1) | N | | |

| | | Total | $117,000,000 | $117,000,000 | | | | |

| 5 | Saint Louis Galleria | Note A-1-A1 | $60,000,000 | $60,000,000 | DBNY | Y | TBD | TBD |

| | | Note A-1-A2 | $55,000,000 | $55,000,000 | Benchmark 2018-B8 | N | | |

| | | Note A-1-A3, A-1-A4, A-1-A5 | $46,479,245 | $46,479,245 | JPMCC 2019-COR4 | N | | |

| | | Note A-2-A1, A-2-A3 | $45,000,000 | $45,000,000 | UBS 2018-C15 | N | | |

| | | Note A-2-A2, A-2-A4, A-2-A5 | $33,520,755 | $33,520,755 | Société Générale | N | | |

| | | Total | $240,000,000 | $240,000,000 | | | | |

6 | Grand Hyatt Seattle | Note A-1 | $50,000,000 | $50,000,000 | COMM 2017-COR2 | Y | Midland | Midland |

| | | Note A-2 | $50,000,000 | $50,000,000 | COMM 2018-COR3 | N | | |

| | | Note A-3 | $33,000,000 | $33,000,000 | JPMCC 2019-COR4 | N | | |

| | | Total | $133,000,000 | $133,000,000 | | | | |

10 | CBBC Industrial Portfolio | Note A-1 | $33,030,000 | $33,030,000 | UBS 2018-C15 | Y | Midland | Midland |

| | | Note A-2 | $20,000,000 | $20,000,000 | JPMCC 2019-COR4 | N | | |

| | | Total | $53,030,000 | $53,030,000 | | | | |

18 | Sheraton Music City | Note A-1 | $40,000,000 | $39,633,229 | Benchmark 2018-B4 | Y | Wells Fargo | CWCapital |

| | | Note A-2-A | $15,000,000 | $14,862,461 | Benchmark 2018-B8 | N | | |

| | | Note A-2-B | $15,000,000 | $14,862,461 | JPMCC 2019-COR4 | N | | |

| | | Total | $70,000,000 | $69,358,151 | | | | |

| (1) | The Benchmark 2019-B9 transaction is expected to close on February 14, 2019. |

| (2) | In the case of Loan No. 4, the whole loan is expected to be serviced under the Benchmark 2018-B8 pooling and servicing agreement until such time the controlling note has been securitized, at which point such whole loan will be serviced under the pooling and servicing agreement related to such securitization. DBNY holds the related controllingpari passucompanion loan and is entitled to exercise control rights until the securitization of such controllingpari passucompanion loan. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. |

| | | |

| 5 of 106 |  |

| Structural and Collateral Term Sheet | | JPMCC 2019-COR4 |

| |

| Collateral Characteristics |

No. | Loan Name | Trust

Cut-off

Date

Balance | Subordinate

Debt Cut-off

Date

Balance(1) | Total Debt

Cut-off

Date

Balance | Mortgage

Loan UW

NCF

DSCR(2)(3) | Total Debt

UW NCF

DSCR(3) | Mortgage

Loan

Cut-off

Date

LTV(2) | Total

Debt

Cut-off

Date

LTV | Mortgage

Loan UW

NOI Debt

Yield(2) | Total

Debt

UW NOI Debt

Yield |

| 4 | Bedford Square | $48,000,000 | $20,000,000 | $68,000,000 | 1.59x | 1.01x | 45.7% | 64.8% | 9.0% | 6.4% |

| 5 | Saint Louis Galleria | $46,479,245 | $24,136,252 | $264,136,252 | 1.67x | 1.55x | 51.5% | 56.7% | 11.3% | 10.3% |

| 8 | Peachtree Corners Marketplace | $24,600,000 | $2,900,000 | $27,500,000 | 1.39x | 1.20x | 61.5% | 68.8% | 9.5% | 8.5% |

| 11 | Arbors at the Park Ole Miss | $19,950,000 | $4,050,000 | $24,000,000 | 1.43x | 1.12x | 55.9% | 67.2% | 9.5% | 7.9% |

| | | | | | | | | | | |

| (1) | In the case of Loan Nos. 4, 5, 8 and 11, Subordinate Debt Cut-off Date Balance represents one or more mezzanine loans. |

| (2) | In the case of Loan Nos. 4, 5, 8 and 11, the Mortgage Loan UW NCF DSCR, Mortgage Loan UW NOI Debt Yield and Mortgage Loan Cut-off Date LTV calculations exclude the related mezzanine loan(s). In the case of Loan No. 5, the Mortgage Loan UW NCF DSCR, Mortgage Loan UW NOI Debt Yield and Mortgage Loan Cut-off Date LTV calculations include the related Pari Passu Companion Loan(s). |

| (3) | With respect to Loan No. 5, the Mortgage Loan UW NCF DSCR is calculated using the sum of the first 12 whole loan principal and interest payments after the expiration of the whole loan interest only period based on the assumed principal and interest payment schedule set forth in Annex G of the Preliminary Prospectus. With respect to Loan No. 8, the Mortgage Loan UW NCF DSCR is calculated using the sum of the first 12 principal and interest payments after the expiration of the interest only period based on the assumed principal and interest payment schedule set forth in Annex H of the Preliminary Prospectus. With respect to Loan No. 11, the Mortgage Loan UW NCF DSCR is calculated using the sum of the first 12 principal and interest payments after the expiration of the interest only period based on the assumed principal and interest payment schedule set forth in Annex I of the Preliminary Prospectus. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. |

| | | |

| 6 of 106 |  |

| Structural and Collateral Term Sheet | | JPMCC 2019-COR4 |

| |

| Collateral Characteristics |

| Mortgaged Properties by Type(1) |

| | | | | | Weighted Average |

| Property Type | Property Subtype | Number

of

Properties | Cut-off Date Principal

Balance | % of IPB | Occupancy | UW

NCF

DSCR(2)(3) | UW

NOI Debt Yield(2) | Cut-off

Date

LTV(2)(4) | Maturity

Date

LTV(2)(4) |

| Retail | Anchored | 4 | $106,087,500 | 13.7% | 93.6% | 1.46x | 8.9% | 67.1% | 64.5% |

| | Super Regional Mall | 1 | 46,479,245 | 6.0 | 96.9% | 1.67x | 11.3% | 51.5% | 47.0% |

| | Freestanding | 6 | 37,834,687 | 4.9 | 100.0% | 1.66x | 9.2% | 55.9% | 54.9% |

| | Unanchored | 3 | 6,591,652 | 0.9 | 100.0% | 1.37x | 9.4% | 66.6% | 56.5% |

| | Shadow Anchored | 1 | 4,046,001 | 0.5 | 100.0% | 1.46x | 10.2% | 71.4% | 59.3% |

| | Subtotal: | 15 | $201,039,085 | 26.0% | 95.9% | 1.55x | 9.5% | 61.4% | 58.3% |

| | | | | | | | | | |

| Office | Suburban | 8 | $87,700,000 | 11.3% | 94.5% | 1.71x | 10.8% | 59.9% | 57.3% |

| | CBD | 2 | 86,000,000 | 11.1 | 96.5% | 1.56x | 10.1% | 58.4% | 51.2% |

| | Medical | 10 | 26,030,000 | 3.4 | 100.0% | 1.55x | 9.8% | 60.1% | 54.9% |

| | Subtotal: | 20 | $199,730,000 | 25.8% | 96.1% | 1.63x | 10.3% | 59.3% | 54.3% |

| | | | | | | | | | |

| Hotel | Full Service | 3 | $124,862,461 | 16.1% | 82.3% | 2.17x | 12.4% | 55.8% | 54.6% |

| | Limited Service | 2 | 19,975,000 | 2.6 | 78.7% | 1.80x | 12.4% | 65.5% | 54.9% |

| | Subtotal: | 5 | $144,837,461 | 18.7% | 81.8% | 2.12x | 12.4% | 57.1% | 54.6% |

| | | | | | | | | | |

| Mixed Use | Retail/Multifamily | 1 | $48,000,000 | 6.2% | 83.9% | 1.59x | 9.0% | 45.7% | 45.7% |

| | Retail/Office | 1 | 23,000,000 | 3.0 | 66.6% | 1.56x | 8.0% | 56.1% | 56.1% |

| | Office/Retail | 2 | 12,350,000 | 1.6 | 88.6% | 1.31x | 9.2% | 60.2% | 53.5% |

| | Subtotal: | 4 | $83,350,000 | 10.8% | 79.8% | 1.54x | 8.8% | 50.7% | 49.7% |

| | | | | | | | | | |

| Industrial | Warehouse/Distribution | 6 | $71,553,006 | 9.2% | 100.0% | 1.46x | 9.9% | 64.6% | 58.2% |

| | Warehouse | 1 | 9,178,412 | 1.2 | 100.0% | 1.75x | 12.0% | 67.0% | 55.7% |

| | Subtotal: | 7 | $80,731,418 | 10.4% | 100.0% | 1.49x | 10.1% | 64.9% | 57.9% |

| | | | | | | | | | |

| Multifamily | Student | 1 | $19,950,000 | 2.6% | 97.1% | 1.43x | 9.5% | 55.9% | 47.5% |

| | Mid-Rise | 1 | 18,200,000 | 2.4 | 97.4% | 1.44x | 7.8% | 59.3% | 59.3% |

| | Garden | 2 | 15,500,000 | 2.0 | 94.9% | 1.46x | 8.2% | 71.9% | 71.9% |

| | Subtotal: | 4 | $53,650,000 | 6.9% | 96.6% | 1.44x | 8.5% | 61.7% | 58.5% |

| | | | | | | | | | |

| Manufactured Housing | Manufactured Housing | 1 | $10,750,000 | 1.4% | 97.1% | 1.32x | 8.9% | 55.2% | 49.2% |

| | Subtotal: | 1 | $10,750,000 | 1.4% | 97.1% | 1.32x | 8.9% | 55.2% | 49.2% |

| | Total / Weighted Average: | 56 | $774,087,963 | 100.0% | 92.1% | 1.66x | 10.2% | 59.2% | 55.5% |

| (1) | Because this table represents information relating to the mortgaged properties and not mortgage loans, the information for the mortgage loans secured by more than one mortgaged property is based on allocated loan amounts. |

| (2) | In the case of Loan Nos. 1, 3, 5, 6, 10 and 18, the UW NCF DSCR, UW NOI Debt Yield, Cut-off Date LTV and Maturity Date LTV calculations include the related Pari Passu Companion Loan(s). In the case of Loan Nos. 4, 5, 8 and 11, the UW NCF DSCR, UW NOI Debt Yield, Cut-off Date LTV and Maturity Date LTV calculations exclude the related mezzanine loan(s). |

| (3) | With respect to Loan No. 5, the UW NCF DSCR is calculated using the sum of the first 12 whole loan principal and interest payments after the expiration of the whole loan interest only period based on the assumed principal and interest payment schedule set forth in Annex G of the Preliminary Prospectus. With respect to Loan No. 8, the UW NCF DSCR is calculated using the sum of the first 12 principal and interest payments after the expiration of the interest only period based on the assumed principal and interest payment schedule set forth in Annex H of the Preliminary Prospectus. With respect to Loan No. 11, the UW NCF DSCR is calculated using the sum of the first 12 principal and interest payments after the expiration of the interest only period based on the assumed principal and interest payment schedule set forth in Annex I of the Preliminary Prospectus. |

| (4) | In the case of Loan Nos. 22 and 38, the Cut-off Date LTV and the Maturity Date LTV are calculated by using an appraised value based on certain hypothetical assumptions. Refer to “Description of the Mortgage Pool—Assessments of Property Value and Condition” and “—Appraised Value” in the Preliminary Prospectus for additional details. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. |

| | | |

| 7 of 106 |  |

| Structural and Collateral Term Sheet | | JPMCC 2019-COR4 |

|

| |

| Collateral Characteristics |

| Mortgaged Properties by Location(1) |

| |

| | | | | Weighted Average |

State | Number of Properties | Cut-off Date

Principal

Balance | % of

IPB | Occupancy | UW

NCF DSCR(2)(3) | UW

NOI Debt

Yield(2) | Cut-off Date

LTV(2)(4) | Maturity Date

LTV(2)(4) |

| California | 13 | $268,750,000 | 34.7% | 95.1% | 1.58x | 9.5% | 61.0% | 57.8% |

| Washington | 4 | 151,200,000 | 19.5 | 82.3% | 2.02x | 11.3% | 55.8% | 55.8% |

| Missouri | 5 | 62,522,746 | 8.1 | 97.2% | 1.66x | 11.2% | 55.0% | 49.6% |

| Connecticut | 1 | 48,000,000 | 6.2 | 83.9% | 1.59x | 9.0% | 45.7% | 45.7% |

| Georgia | 5 | 47,521,865 | 6.1 | 88.8% | 1.58x | 10.8% | 62.5% | 54.5% |

| Wisconsin | 2 | 34,383,006 | 4.4 | 100.0% | 1.35x | 9.5% | 63.6% | 52.7% |

| Tennessee | 3 | 27,287,461 | 3.5 | 84.4% | 1.65x | 10.3% | 65.3% | 59.3% |

| Mississippi | 1 | 19,950,000 | 2.6 | 97.1% | 1.43x | 9.5% | 55.9% | 47.5% |

| Indiana | 1 | 19,250,000 | 2.5 | 100.0% | 1.34x | 10.0% | 68.8% | 63.9% |

| Texas | 4 | 19,114,690 | 2.5 | 98.3% | 1.70x | 10.8% | 65.4% | 61.8% |

| Illinois | 5 | 16,897,822 | 2.2 | 91.7% | 1.36x | 9.4% | 59.1% | 52.8% |

| Florida | 3 | 14,185,310 | 1.8 | 100.0% | 1.70x | 9.7% | 63.9% | 63.9% |

| Ohio | 2 | 13,270,064 | 1.7 | 100.0% | 1.64x | 11.3% | 68.1% | 56.5% |

| New Mexico | 1 | 11,700,000 | 1.5 | 100.0% | 1.70x | 12.3% | 60.9% | 56.4% |

| Arizona | 1 | 8,600,000 | 1.1 | 100.0% | 1.36x | 9.2% | 63.7% | 57.7% |

| Pennsylvania | 1 | 3,840,000 | 0.5 | 100.0% | 1.65x | 10.3% | 57.4% | 52.7% |

| South Carolina | 2 | 3,555,000 | 0.5 | 100.0% | 1.65x | 10.3% | 57.4% | 52.7% |

| Colorado | 1 | 2,360,000 | 0.3 | 100.0% | 1.63x | 9.8% | 59.4% | 54.3% |

| Kentucky | 1 | 1,700,000 | 0.2 | 100.0% | 1.65x | 10.3% | 57.4% | 52.7% |

| Total / Weighted Average | 56 | $774,087,963 | 100.0% | 92.1% | 1.66x | 10.2% | 59.2% | 55.5% |

| (1) | Because this table represents information relating to the mortgaged properties and not mortgage loans, the information for the mortgage loans secured by more than one mortgaged property is based on allocated loan amounts. |

| (2) | In the case of Loan Nos. 1, 3, 5, 6, 10 and 18, the UW NCF DSCR, UW NOI Debt Yield, Cut-off Date LTV and Maturity Date LTV calculations include the related Pari Passu Companion Loan(s). In the case of Loan Nos. 4, 5, 8 and 11, the UW NCF DSCR, UW NOI Debt Yield, Cut-off Date LTV and Maturity Date LTV calculations exclude the related mezzanine loan(s). |

| (3) | With respect to Loan No. 5, the UW NCF DSCR is calculated using the sum of the first 12 whole loan principal and interest payments after the expiration of the whole loan interest only period based on the assumed principal and interest payment schedule set forth in Annex G of the Preliminary Prospectus. With respect to Loan No. 8, the UW NCF DSCR is calculated using the sum of the first 12 principal and interest payments after the expiration of the interest only period based on the assumed principal and interest payment schedule set forth in Annex H of the Preliminary Prospectus. With respect to Loan No. 11, the UW NCF DSCR is calculated using the sum of the first 12 principal and interest payments after the expiration of the interest only period based on the assumed principal and interest payment schedule set forth in Annex I of the Preliminary Prospectus. |

| (4) | In the case of Loan Nos. 22 and 38, the Cut-off Date LTV and the Maturity Date LTV are calculated by using an appraised value based on certain hypothetical assumptions. Refer to “Description of the Mortgage Pool—Assessments of Property Value and Condition” and “—Appraised Value” in the Preliminary Prospectus for additional details. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. |

| | | |

| 8 of 106 |  |

| Structural and Collateral Term Sheet | | JPMCC 2019-COR4 |

| |

| Collateral Characteristics |

| Cut-off Date Principal Balance |

| |

| | | | | Weighted Average |

Range of Cut-off Date

Principal Balances | Number of

Loans | Cut-off Date

Principal

Balance | % of

IPB | Mortgage

Rate | Remaining

Loan Term | UW

NCF

DSCR(1)(2) | UW NOI

Debt

Yield(1) | Cut-off

Date

LTV(1)(3) | Maturity

Date

LTV(1)(3) |

| $4,046,001 | - | $9,999,999 | 11 | $75,793,252 | 9.8% | 5.03399% | 114 | 1.68x | 10.7% | 65.2% | 58.2% |

| $10,000,000 | - | $19,999,999 | 17 | 251,912,461 | 32.5 | 5.14050% | 117 | 1.56x | 9.9% | 60.1% | 56.2% |

| $20,000,000 | - | $24,999,999 | 3 | 67,600,000 | 8.7 | 5.09771% | 116 | 1.56x | 9.3% | 59.7% | 57.4% |

| $25,000,000 | - | $49,999,999 | 4 | 159,782,251 | 20.6 | 5.01974% | 112 | 1.69x | 10.5% | 53.0% | 49.4% |

| $50,000,000 | - | $77,000,000 | 3 | 219,000,000 | 28.3 | 4.89979% | 112 | 1.76x | 10.4% | 60.6% | 57.7% |

| Total / Weighted Average: | 38 | $774,087,963 | 100.0% | 5.03331% | 114 | 1.66x | 10.2% | 59.2% | 55.5% |

| | | | | | | | | | | | |

| | | | | Weighted Average |

Range of

Mortgage Interest Rates | Number of

Loans | Cut-off Date

Principal

Balance | % of IPB | Mortgage Rate | Remaining

Loan Term | UW

NCF

DSCR(1)(2) | UW NOI

Debt

Yield(1) | Cut-off

Date LTV(1)(3) | Maturity

Date

LTV(1)(3) |

| 4.39200% | - | 4.89200% | 8 | $267,473,006 | 34.6% | 4.73327% | 109 | 1.84x | 11.2% | 58.2% | 53.8% |

| 4.89201% | - | 5.39200% | 26 | 422,564,958 | 54.6 | 5.13863% | 116 | 1.57x | 9.7% | 60.4% | 56.8% |

| 5.39201% | - | 5.48600% | 4 | 84,050,000 | 10.9 | 5.45860% | 117 | 1.51x | 9.3% | 56.6% | 54.8% |

| Total / Weighted Average: | 38 | $774,087,963 | 100.0% | 5.03331% | 114 | 1.66x | 10.2% | 59.2% | 55.5% |

| | | | | | | | | | | | |

| Original Term to Maturity in Months |

| | | | | Weighted Average |

Original Term to

Maturity in Months | Number of

Loans | Cut-off Date

Principal

Balance | % of IPB | Mortgage Rate | Remaining

Loan Term | UW

NCF

DSCR(1)(2) | UW NOI

Debt

Yield(1) | Cut-off

Date LTV(1)(3) | Maturity

Date

LTV(1)(3) |

| 60 | 1 | $4,994,687 | 0.6% | 5.00000% | 59 | 1.72x | 11.2% | 51.3% | 47.4% |

| 120 | 35 | 659,093,277 | 85.1 | 5.07434% | 117 | 1.56x | 9.8% | 60.0% | 55.6% |

| 121 | 2 | 110,000,000 | 14.2 | 4.78900% | 100 | 2.22x | 12.5% | 55.2% | 55.2% |

| Total / Weighted Average: | 38 | $774,087,963 | 100.0% | 5.03331% | 114 | 1.66x | 10.2% | 59.2% | 55.5% |

| | | | | | | | | | | |

| Remaining Term to Maturity in Months |

| | | | | Weighted Average |

Range of Remaining Term to

Maturity in Months | Number of

Loans | Cut-off Date

Principal

Balance | % of IPB | Mortgage Rate | Remaining

Loan Term | UW

NCF

DSCR(1)(2) | UW NOI

Debt

Yield(1) | Cut-off

Date LTV(1)(3) | Maturity

Date

LTV(1)(3) |

| 59 | - | 84 | 1 | $4,994,687 | 0.6% | 5.00000% | 59 | 1.72x | 11.2% | 51.3% | 47.4% |

| 85 | - | 119 | 33 | 725,380,777 | 93.7 | 5.03262% | 114 | 1.65x | 10.2% | 59.1% | 55.3% |

| 120 | - | 120 | 4 | 43,712,500 | 5.6 | 5.04851% | 120 | 1.71x | 9.9% | 62.7% | 59.2% |

| Total / Weighted Average: | 38 | $774,087,963 | 100.0% | 5.03331% | 114 | 1.66x | 10.2% | 59.2% | 55.5% |

| (1) | In the case of Loan Nos. 1, 3, 5, 6, 10 and 18, the UW NCF DSCR, UW NOI Debt Yield, Cut-off Date LTV and Maturity Date LTV calculations include the related Pari Passu Companion Loan(s). In the case of Loan Nos. 4, 5, 8 and 11, the UW NCF DSCR, UW NOI Debt Yield, Cut-off Date LTV and Maturity Date LTV calculations exclude the related mezzanine loan(s). |

| (2) | With respect to Loan No. 5, the UW NCF DSCR is calculated using the sum of the first 12 whole loan principal and interest payments after the expiration of the whole loan interest only period based on the assumed principal and interest payment schedule set forth in Annex G of the Preliminary Prospectus. With respect to Loan No. 8, the UW NCF DSCR is calculated using the sum of the first 12 principal and interest payments after the expiration of the interest only period based on the assumed principal and interest payment schedule set forth in Annex H of the Preliminary Prospectus. With respect to Loan No. 11, the UW NCF DSCR is calculated using the sum of the first 12 principal and interest payments after the expiration of the interest only period based on the assumed principal and interest payment schedule set forth in Annex I of the Preliminary Prospectus. |

| (3) | In the case of Loan Nos. 22 and 38, the Cut-off Date LTV and the Maturity Date LTV are calculated by using an appraised value based on certain hypothetical assumptions. Refer to “Description of the Mortgage Pool—Assessments of Property Value and Condition” and “—Appraised Value” in the Preliminary Prospectus for additional details.

|

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. |

| | | |

| 9 of 106 |  |

| Structural and Collateral Term Sheet | | JPMCC 2019-COR4 |

| |

| Collateral Characteristics |

| Original Amortization Term in Months |

| | | | | Weighted Average |

Original

Amortization

Term in Months | Number of

Loans | Cut-off Date

Principal

Balance | % of IPB | Mortgage Rate | Remaining Loan Term | UW

NCF

DSCR(1)(2) | UW NOI

Debt

Yield(1) | Cut-off

Date LTV(1)(3) | Maturity

Date

LTV(1)(3) |

| Interest Only | 15 | $381,300,000 | 49.3% | 5.09018% | 112 | 1.77x | 9.8% | 58.2% | 58.2% |

| 360 | 23 | 392,787,963 | 50.7 | 4.97810% | 116 | 1.55x | 10.6% | 60.2% | 52.9% |

| Total / Weighted Average: | 38 | $774,087,963 | 100.0% | 5.03331% | 114 | 1.66x | 10.2% | 59.2% | 55.5% |

| Remaining Amortization Term in Months |

| | | | | Weighted Average |

Range of Remaining

Amortization Term in Months | Number of

Loans | Cut-off Date

Principal

Balance | % of IPB | Mortgage Rate | Remaining Loan Term | UW

NCF

DSCR(1)(2) | UW NOI

Debt

Yield(1) | Cut-off

Date LTV(1)(3) | Maturity

Date

LTV(1)(3) |

| Interest Only | 15 | $381,300,000 | 49.3% | 5.09018% | 112 | 1.77x | 9.8% | 58.2% | 58.2% |

| 350 | - | 359 | 6 | 69,476,218 | 9.0 | 4.91499% | 109 | 1.53x | 10.5% | 63.5% | 52.9% |

| 360 | - | 360 | 17 | 323,311,745 | 41.8 | 4.99166% | 117 | 1.56x | 10.6% | 59.5% | 52.9% |

| Total / Weighted Average: | 38 | $774,087,963 | 100.0% | 5.03331% | 114 | 1.66x | 10.2% | 59.2% | 55.5% |

| | | | | | | | | | | | | |

| | | | | Weighted Average |

| Amortization Types | Number of

Loans | Cut-off Date

Principal

Balance | % of IPB | Mortgage

Rate | Remaining

Loan Term | UW

NCF

DSCR(1)(2) | UW NOI

Debt

Yield(1) | Cut-off

Date LTV(1)(3) | Maturity

Date

LTV(1)(3) |

| Interest Only | 15 | $381,300,000 | 49.3% | 5.09018% | 112 | 1.77x | 9.8% | 58.2% | 58.2% |

| IO-Balloon | 16 | 315,186,745 | 40.7 | 4.98629% | 117 | 1.55x | 10.6% | 59.4% | 52.9% |

| Balloon | 7 | 77,601,218 | 10.0 | 4.94483% | 110 | 1.54x | 10.5% | 63.7% | 53.0% |

| Total / Weighted Average: | 38 | $774,087,963 | 100.0% | 5.03331% | 114 | 1.66x | 10.2% | 59.2% | 55.5% |

| Underwritten Net Cash Flow Debt Service Coverage Ratios(1)(2) |

| | | | | Weighted Average |

Range of Underwritten Net

Cash Flow Debt Service

Coverage Ratios | Number of

Loans | Cut-off Date

Principal

Balance | % of IPB | Mortgage

Rate | Remaining

Loan Term | UW

NCF

DSCR(1)(2) | UW NOI

Debt

Yield(1) | Cut-off

Date LTV(1)(3) | Maturity

Date

LTV(1)(3) |

| 1.31x | - | 1.49x | 12 | $234,240,659 | 30.3% | 5.18508% | 116 | 1.39x | 8.9% | 64.5% | 59.8% |

| 1.50x | - | 1.75x | 20 | 374,034,844 | 48.3 | 5.01858% | 116 | 1.62x | 10.1% | 56.6% | 52.6% |

| 1.76x | - | 2.00x | 3 | 46,712,461 | 6.0 | 5.03038% | 116 | 1.82x | 11.6% | 62.2% | 56.4% |

| 2.01x | - | 2.25x | 2 | 110,000,000 | 14.2 | 4.78900% | 100 | 2.22x | 12.5% | 55.2% | 55.2% |

| 2.26x | - | 2.30x | 1 | 9,100,000 | 1.2 | 4.70000% | 120 | 2.30x | 11.3% | 65.0% | 65.0% |

| Total / Weighted Average: | 38 | $774,087,963 | 100.0% | 5.03331% | 114 | 1.66x | 10.2% | 59.2% | 55.5% |

| (1) | In the case of Loan Nos. 1, 3, 5, 6, 10 and 18, the UW NCF DSCR, UW NOI Debt Yield, Cut-off Date LTV and Maturity Date LTV calculations include the related Pari Passu Companion Loan(s). In the case of Loan Nos. 4, 5, 8 and 11, the UW NCF DSCR, UW NOI Debt Yield, Cut-off Date LTV and Maturity Date LTV calculations exclude the related mezzanine loan(s). |

| (2) | With respect to Loan No. 5, the UW NCF DSCR is calculated using the sum of the first 12 whole loan principal and interest payments after the expiration of the whole loan interest only period based on the assumed principal and interest payment schedule set forth in Annex G of the Preliminary Prospectus. With respect to Loan No. 8, the UW NCF DSCR is calculated using the sum of the first 12 principal and interest payments after the expiration of the interest only period based on the assumed principal and interest payment schedule set forth in Annex H of the Preliminary Prospectus. With respect to Loan No. 11, the UW NCF DSCR is calculated using the sum of the first 12 principal and interest payments after the expiration of the interest only period based on the assumed principal and interest payment schedule set forth in Annex I of the Preliminary Prospectus. |

| (3) | In the case of Loan Nos. 22 and 38, the Cut-off Date LTV and the Maturity Date LTV are calculated by using an appraised value based on certain hypothetical assumptions. Refer to “Description of the Mortgage Pool—Assessments of Property Value and Condition” and “—Appraised Value” in the Preliminary Prospectus for additional details.

|

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. |

| | | |

| 10 of 106 |  |

| Structural and Collateral Term Sheet | | JPMCC 2019-COR4 |

| |

| Collateral Characteristics |

| LTV Ratios as of the Cut-off Date(1)(3) |

| | | | | Weighted Average |

Range of

Cut-off Date LTVs | Number of

Loans | Cut-off Date

Principal

Balance | % of IPB | Mortgage

Rate | Remaining

Loan Term | UW

NCF

DSCR(1)(2) | UW NOI

Debt

Yield(1) | Cut-off

Date LTV(1)(3) | Maturity

Date

LTV(1)(3) |

| 45.7% | - | 55.7% | 8 | $248,223,932 | 32.1% | 5.03306% | 109 | 1.88x | 11.1% | 52.2% | 51.0% |

| 55.8% | - | 65.7% | 22 | 400,597,967 | 51.8 | 4.94936% | 116 | 1.58x | 10.0% | 60.4% | 54.8% |

| 65.8% | - | 69.9% | 4 | 100,328,412 | 13.0 | 5.28235% | 118 | 1.46x | 8.8% | 68.6% | 66.6% |

| 70.0% | - | 73.8% | 4 | 24,937,653 | 3.2 | 5.38245% | 114 | 1.46x | 9.6% | 72.8% | 66.5% |

| Total / Weighted Average: | 38 | $774,087,963 | 100.0% | 5.03331% | 114 | 1.66x | 10.2% | 59.2% | 55.5% |

| LTV Ratios as of the Maturity Date(1)(3) |

| | | | | Weighted Average |

Range of

Maturity Date LTVs | Number of

Loans | Cut-off Date

Principal

Balance | % of IPB | Mortgage

Rate | Remaining

Loan Term | UW

NCF

DSCR(1)(2) | UW NOI

Debt

Yield(1) | Cut-off

Date LTV(1)(3) | Maturity

Date

LTV(1)(3) |

| 45.7% | - | 49.9% | 5 | $130,173,932 | 16.8% | 5.23868% | 115 | 1.58x | 10.0% | 50.3% | 46.8% |

| 50.0% | - | 54.9% | 10 | 227,410,467 | 29.4 | 4.82096% | 113 | 1.65x | 10.4% | 58.4% | 52.1% |

| 55.0% | - | 59.9% | 15 | 265,953,565 | 34.4 | 5.00944% | 112 | 1.76x | 10.8% | 59.4% | 56.3% |

| 60.0% | - | 73.6% | 8 | 150,550,000 | 19.4 | 5.21867% | 117 | 1.55x | 9.1% | 67.7% | 66.7% |

| Total / Weighted Average: | 38 | $774,087,963 | 100.0% | 5.03331% | 114 | 1.66x | 10.2% | 59.2% | 55.5% |

| | | | | Weighted Average |

| Prepayment Protection | Number of

Loans | Cut-off Date

Principal

Balance | % of IPB | Mortgage

Rate | Remaining

Loan Term | UW

NCF

DSCR(1)(2) | UW NOI

Debt

Yield(1) | Cut-off

Date LTV(1)(3) | Maturity

Date

LTV(1)(3) |

| Defeasance | 29 | $562,672,315 | 72.7% | 5.05806% | 113 | 1.67x | 10.3% | 57.8% | 54.4% |

| Yield Maintenance | 6 | 115,315,648 | 14.9 | 4.81647% | 115 | 1.62x | 10.7% | 59.9% | 51.2% |

| Defeasance or Yield Maintenance | 3 | 96,100,000 | 12.4 | 5.14860% | 118 | 1.60x | 8.8% | 67.0% | 67.0% |

| Total / Weighted Average: | 38 | $774,087,963 | 100.0% | 5.03331% | 114 | 1.66x | 10.2% | 59.2% | 55.5% |

| | | | | Weighted Average |

| Loan Purpose | Number of

Loans | Cut-off Date

Principal

Balance | % of IPB | Mortgage

Rate | Remaining

Loan Term | UW

NCF

DSCR(1)(2) | UW NOI

Debt

Yield(1) | Cut-off

Date LTV(1)(3) | Maturity

Date

LTV(1)(3) |

| Refinance | 18 | $451,498,893 | 58.3% | 5.00752% | 113 | 1.72x | 10.5% | 56.2% | 52.5% |

| Acquisition | 17 | 263,194,413 | 34.0 | 5.12018% | 117 | 1.60x | 10.0% | 64.0% | 60.9% |

| Recapitalization | 3 | 59,394,658 | 7.7 | 4.84442% | 111 | 1.42x | 8.9% | 61.4% | 54.4% |

| Total / Weighted Average: | 38 | $774,087,963 | 100.0% | 5.03331% | 114 | 1.66x | 10.2% | 59.2% | 55.5% |

| (1) | In the case of Loan Nos. 1, 3, 5, 6, 10 and 18, the UW NCF DSCR, UW NOI Debt Yield, Cut-off Date LTV and Maturity Date LTV calculations include the related Pari Passu Companion Loan(s). In the case of Loan Nos. 4, 5, 8 and 11, the UW NCF DSCR, UW NOI Debt Yield, Cut-off Date LTV and Maturity Date LTV calculations exclude the related mezzanine loan(s). |

| (2) | With respect to Loan No. 5, the UW NCF DSCR is calculated using the sum of the first 12 whole loan principal and interest payments after the expiration of the whole loan interest only period based on the assumed principal and interest payment schedule set forth in Annex G of the Preliminary Prospectus. With respect to Loan No. 8, the UW NCF DSCR is calculated using the sum of the first 12 principal and interest payments after the expiration of the interest only period based on the assumed principal and interest payment schedule set forth in Annex H of the Preliminary Prospectus. With respect to Loan No. 11, the UW NCF DSCR is calculated using the sum of the first 12 principal and interest payments after the expiration of the interest only period based on the assumed principal and interest payment schedule set forth in Annex I of the Preliminary Prospectus. |

| (3) | In the case of Loan Nos. 22 and 38, the Cut-off Date LTV and the Maturity Date LTV are calculated by using an appraised value based on certain hypothetical assumptions. Refer to “Description of the Mortgage Pool—Assessments of Property Value and Condition” and “—Appraised Value” in the Preliminary Prospectus for additional details. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. |

| | | |

| 11 of 106 |  |

| Structural and Collateral Term Sheet | | JPMCC 2019-COR4 |

| |

| Collateral Characteristics |

| Previous Securitization History(1) |

| No. | Loan Name | Cut-off Date

Principal Balance | % of IPB | Location | Property

Type | Previous

Securitization |

| 2 | 400 South El Camino | $75,000,000 | 9.7% | San Mateo, CA | Office | COMM 2007-FL14 |

| 5 | Saint Louis Galleria | $46,479,245 | 6.0 | Saint Louis, MO | Retail | COMM 2014-CCRE14 |

| 19.01 | RDM Chicago Portfolio – 1200 North Ashland Avenue | $9,500,000 | 1.2 | Chicago, IL | Mixed Use | MSBAM 2014-C14 |

| 19.04 | RDM Chicago Portfolio – 230 West Division Street | $1,190,000 | 0.2 | Chicago, IL | Retail | MSBAM 2014-C14 |

| 27 | Hickory View Apartments | $10,600,000 | 1.4 | Nashville, TN | Multifamily | FNA 2015-M10 |

| Total | | $142,769,245 | 18.4% | | | |

| (1) | The table above represents the properties for which the previously existing debt was securitized, based on information provided by the related borrower or obtained through searches of a third-party database. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. |

| | | |

| 12 of 106 |  |

| Structural and Collateral Term Sheet | | JPMCC 2019-COR4 |

| |

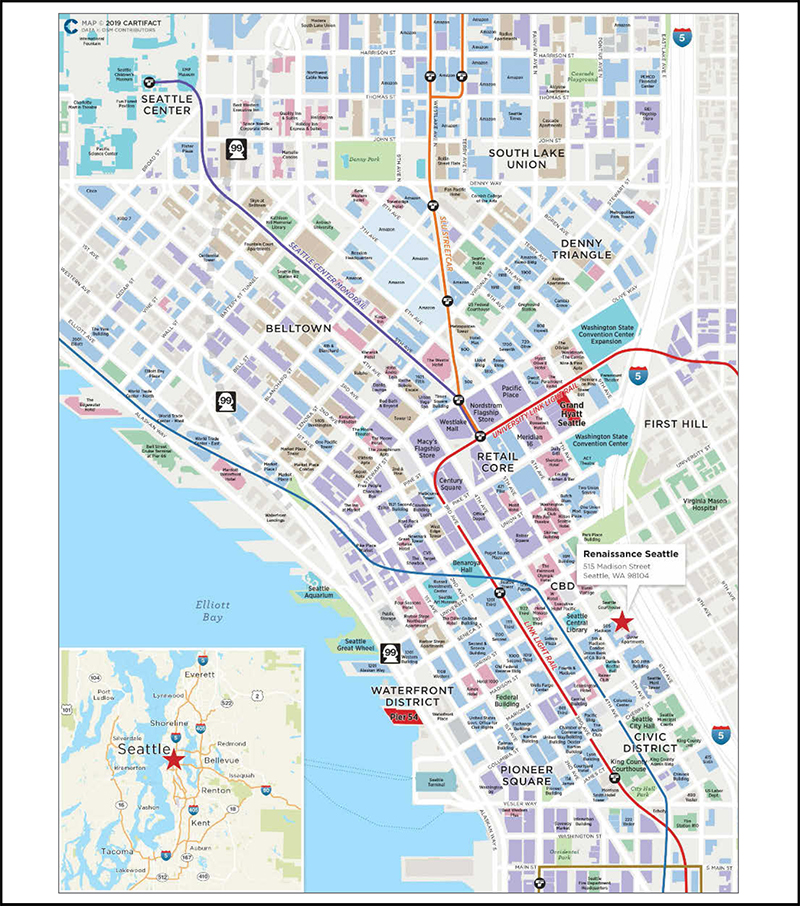

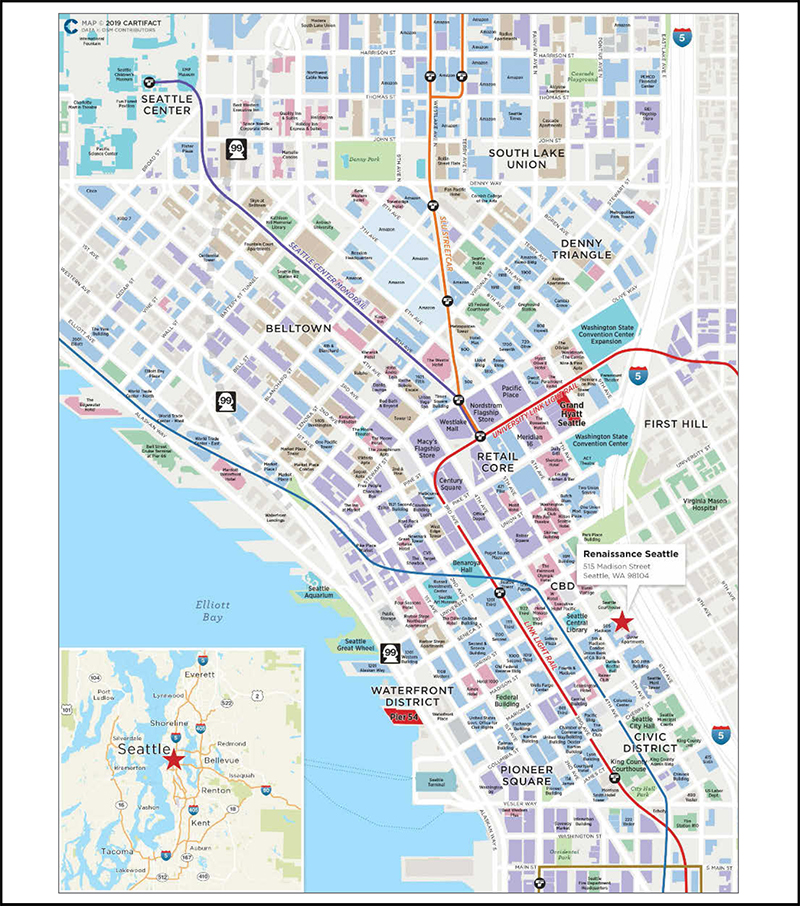

| Renaissance Seattle |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. |

| | | |

| 13 of 106 |  |

| Structural and Collateral Term Sheet | | JPMCC 2019-COR4 |

| |

| Renaissance Seattle |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. |

| | | |

| 14 of 106 |  |

| Structural and Collateral Term Sheet | | JPMCC 2019-COR4 |

| |

| Renaissance Seattle |

| Mortgage Loan Information | | Property Information |

| Mortgage Loan Seller: | LCM | | Single Asset / Portfolio: | Single Asset |

| Original Principal Balance(1): | $77,000,000 | | Title: | Fee |

| Cut-off Date Principal Balance(1): | $77,000,000 | | Property Type - Subtype: | Hotel – Full Service |

| % of Pool by IPB: | 9.9% | | Net Rentable Area (Rooms): | 557 |

| Loan Purpose: | Refinance | | Location: | Seattle, WA |

| Borrower: | Madison Hotel LLC | | Year Built / Renovated: | 1978 / 2014-2017 |

| Sponsor(2): | Hedreen Holdings LLC | | Occupancy / ADR / RevPAR | 81.6% / $208.70 / $170.36 |

| Interest Rate: | 4.81000% | | Occupancy / ADR / RevPAR Date: | 9/30/2018 |

| Note Date: | 5/2/2017 | | Number of Tenants: | N/A |

| Maturity Date: | 6/6/2027 | | 2015 NOI: | $15,824,756 |

| Interest-only Period: | 121 months | | 2016 NOI: | $16,093,069 |

| Original Term: | 121 months | | 2017 NOI: | $16,282,562 |

| Original Amortization: | None | | TTM NOI (as of 9/2018): | $16,263,877 |

| Amortization Type: | Interest Only | | UW Occupancy / ADR / RevPAR: | 81.6% / $208.70 / $170.36 |

| Call Protection: | L(45),Def(72),O(4) | | UW Revenues: | $44,885,370 |

| Lockbox / Cash Management: | Hard / Springing | | UW Expenses: | $28,882,387 |

| Additional Debt: | Yes | | UW NOI: | $16,002,982 |

| Additional Debt Balance(1): | $50,000,000 | | UW NCF: | $13,758,714 |

| Additional Debt Type(1): | Pari Passu | | Appraised Value / Per Room: | $229,700,000 / $412,388 |

| | | | Appraisal Date: | 3/8/2017 |

| | | | | |

| Escrows and Reserves(3) | | Financial Information(1) |

| | Initial | Monthly | Initial Cap | | Cut-off Date Loan / Room: | | $228,007 |

| Taxes: | $95,000 | $116,000 | N/A | | Maturity Date Loan / Room: | | $228,007 |

| Insurance: | $280,000 | $28,000 | N/A | | Cut-off Date LTV: | | 55.3% |

| FF&E Reserves: | $0 | 5% of Gross | N/A | | Maturity Date LTV: | | 55.3% |

| | | Income | | | UW NCF DSCR: | | 2.22x |

| TI/LC: | $0 | $0 | N/A | | UW NOI Debt Yield: | | 12.6% |

| Other: | $2,866,271 | $0 | N/A | | | | |

| | | | | | | | |

| | | | | | | | | |

|

| Sources and Uses |

| Sources | Proceeds | % of Total | | Uses | Proceeds | % of Total |

| Whole Loan | $127,000,000 | 100.0% | | Payoff Existing Debt | $92,423,041 | 72.8% |

| | | | | Upfront Reserves | 3,241,271 | 2.6% |

| | | % | | Closing Costs | 385,422 | 0.3% |

| | | % | | Return of Equity | 30,950,266 | 24.4% |

| Total Sources | $127,000,000 | 100.0% | | Total Uses | $127,000,000 | 100.0% |

| (1) | The Renaissance Seattle Mortgage Loan (as defined below) is part of a whole loan evidenced by threepari passu notes, with an aggregate outstanding principal balance as of the Cut-off Date of $127.0 million. The Financial Information presented in the chart above reflects the Cut-off Date balance of the $127.0 million Renaissance Seattle Whole Loan, (as defined below). |

| (2) | The sponsor is also the sponsor of the mortgage loan identified on Annex A-1 to the Preliminary Prospectus as Grand Hyatt Seattle, which has a Cut-off Date Principal Balance of $33.0 million. |

| (3) | For a full description of Escrows and Reserves, please refer to “Escrows and Reserves” below. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. |

| | | |

| 15 of 106 |  |

| Structural and Collateral Term Sheet | | JPMCC 2019-COR4 |

| |

| Renaissance Seattle |

The Loan.The Renaissance Seattle loan (the “Renaissance Seattle Mortgage Loan”) is secured by a first mortgage lien on the borrower’s fee interest in a 557-room full-service hotel located at 515 Madison Street in downtown Seattle, Washington (the “Renaissance Seattle Property”). The Renaissance Seattle Mortgage Loan is part of a whole loan that has an aggregate original principal balance of $127.0 million (the “Renaissance Seattle Whole Loan”) and is comprised of threepari passu notes, each described below. The controlling Note A-1 was contributed to the COMM 2017-COR2 trust as described in the “Whole Loan Summary” chart below. The non-controlling Notes A-2 and A-3, with an aggregate outstanding principal balance as of the Cut-off Date of $77.0 million, are being contributed to the JPMCC 2019-COR4 Trust. The relationship between the holders of the Renaissance Seattle Whole Loan will be governed by a co-lender agreement as described under “Description of the Mortgage Pool—The Whole Loans—The Non-Serviced Pari Passu Whole Loans” in the Preliminary Prospectus. The Renaissance Seattle Whole Loan has an approximately 10-year term and requires interest only payments for the term of the loan. The most recent prior financing of the Renaissance Seattle Property was not included in a securitization.

| Whole Loan Summary |

| Notes | Original Balance | Cut-off Date Balance | Note Holder | Controlling Piece |

| A-1 | $50,000,000 | $50,000,000 | COMM 2017-COR2 | Yes |

| A-2 | 50,000,000 | 50,000,000 | JPMCC 2019-COR4 | No |

| A-3 | 27,000,000 | 27,000,000 | JPMCC 2019-COR4 | No |

| Total | $127,000,000 | $127,000,000 | | |

The Borrower. The borrower, Madison Hotel LLC, is a single purpose Delaware limited liability company structured to be bankruptcy-remote, with two independent directors in its organizational structure.

The Loan Sponsor. The Renaissance Seattle Whole Loan’s sponsor and the nonrecourse carve-out guarantor is Hedreen Holdings LLC. Richard Hedreen, the CEO of R.C. Hedreen Co., the parent company of Hedreen Holdings LLC, has over 50 years of experience in real estate development, acquisition, and management. Mr. Hedreen’s current real estate portfolio includes the Renaissance Seattle Property, the Grand Hyatt Seattle (also an asset in the JPMCC 2019-COR4 Trust), the Hyatt @ Olive 8 and the 7th & Pine retail and parking property which is located directly below the Grand Hyatt Seattle hotel (but is not collateral for the Grand Hyatt Seattle Loan). All the properties in Mr. Hedreen’s current portfolio are located in downtown Seattle and all were originally developed by Mr. Hedreen.

Other notable developments by Mr. Hedreen include the Hilton Seattle, the Crowne Plaza Seattle Downtown hotel and the Olive 8 Condominiums which is comprised of 229 individually owned residential condominium units located above the Hyatt @ Olive 8 hotel. The 40-story Hyatt @ Olive 8 tower has one of the largest green roofs in downtown Seattle (8,355 square feet) and is LEED silver certified.

The Property. The Renaissance Seattle Property is a 557-room, 28-story, AAA Four-Diamond rated, full-service hotel located at 515 Madison Street in downtown Seattle, Washington, within the Seattle central business district. The borrower completed the construction of the Renaissance Seattle Property in 1978. Beginning in 2014, following the extension of the original Marriott franchise agreement through August 2028, the borrower commenced an approximately $24.7 million ($44,343 per room), chain-mandated PIP encompassing guestroom renovations, elevator upgrades, noise mitigation for windows, ballroom HVAC and lighting upgrades, renovations to the public space, fitness center, 28th floor meeting room and public restroom renovations and life safety upgrades which was completed in December 2017.

The Renaissance Seattle Property features 557 newly renovated guestrooms and suites, a Maxwell’s Restaurant and Lounge, the 515 Coffee Bar & Lounge, The Fig & The Judge Restaurant which also serves as the Renaissance Seattle Property’s concierge lounge, approximately 28,000 square feet of flexible meeting space, a newly renovated fitness center, a business center and a five-level subterranean parking garage containing 193 parking spaces. The Renaissance Seattle Property offers four guestroom configurations and suites. The configurations include 274 king guestrooms (350 square feet), 207 double/double guestrooms (350 square feet), 71 corner king guestrooms (350 square feet) and five luxury suites (750 square feet). Each guestroom at the Renaissance Seattle Property includes either a king or two double beds, at least one TV, a mini-fridge, a coffeemaker, work area with desk, dual line phones with voicemail, iron and ironing board, bathrobes, in-room safe, alarm clock radio and Wi-Fi throughout. Suites include a separate sitting area.

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. |

| | | |

| 16 of 106 |  |

| Structural and Collateral Term Sheet | | JPMCC 2019-COR4 |

| |

| Renaissance Seattle |

The Renaissance Seattle Property is located in the area known as the retail core neighborhood in downtown Seattle, a restaurant and shopping district just south of the Denny Triangle, situated near South Lake Union. According to the appraisal, the Renaissance Seattle Property is located near the area’s primary generators of lodging demand including dozens of upscale retailers and restaurants, major department stores, shopping centers, hotels, office buildings and the Washington State Convention Center (“WSCC”). Because of its central location, the retail core has a substantial daytime population throughout the week. According to the appraisal, the nearby neighborhoods Denny Triangle and South Lake Union represent two of the city’s fastest growing neighborhoods. Amazon’s corporate headquarters was relocated to South Lake Union in 2015.

According to the Downtown Seattle Association, Amazon’s footprint totals 7.6 million square feet with another 3.1 million square feet under development. Amazon reportedly will occupy a total of 12.0 million square feet by 2022, or equal to about a fifth of the inventory of downtown’s best-in-class office space.

In 2015, Expedia announced plans to relocate its headquarters from Bellevue to Downtown Seattle. The development plans will allow Expedia to transition its 3,500 employees to the Seattle campus, with full occupancy expected in 2019. Additionally, several Silicon Valley high-tech companies, such as Google and Facebook, also have a presence in Seattle. In 2016, Google announced plans to relocate its Fremont campus to South Lake Union in 2019. Google’s new campus, which began construction in the second quarter of 2017, will occupy 607,000 square feet of office space and will be able to accommodate 3,000 to 4,000 employees.

The loan sponsor also developed Seattle’s largest hotel, the Hyatt Regency located at 8th & Howell. The 1,260 room Hyatt Regency hotel broke ground in 2016, on a site previously owned by an affiliate of the loan sponsor and opened for business in December 2018. The Hyatt Regency is adjacent to the Washington State Convention Center Addition (“WSCC Addition”), which is scheduled to open in 2021. The preliminary cost of the WSCC Addition project is estimated at over $1.5 billion, and the expansion is expected to more than double the size of the existing WSCC, with an additional 440,000 square feet of meeting space planned for the project. The WSCC Addition project is expected to provide several economic benefits, including as much as $240.0 million annually in visitor spending, as many as 3,900 direct and indirect jobs, and some 6,000 jobs during construction.

The demand segmentation for the Renaissance Seattle Property consists of 50% commercial demand, 20% meeting and group demand, 15% leisure demand and 15% contract demand. The Renaissance Seattle Property’s top corporate accounts include Boeing, Pricewaterhouse, Accenture, Deloitte and Ernst & Young.

| Historical Occupancy, ADR, RevPAR(1)(2) |

| | Competitive Set | Renaissance Seattle(3) | Penetration Factor |

| Year | Occupancy | ADR | RevPAR | Occupancy | ADR | RevPAR | Occupancy | ADR | RevPAR |

| 2015 | 84.3% | $225.52 | $190.05 | 82.2% | $190.32 | $156.52 | 97.5% | 84.4% | 82.4% |

| 2016 | 82.2% | $232.80 | $191.47 | 84.0% | $195.78 | $164.42 | 102.1% | 84.1% | 85.9% |

| 2017 | 86.5% | $244.44 | $211.35 | 84.0% | $203.92 | $171.25 | 97.2% | 83.4% | 81.0% |

| TTM(4) | 84.0% | $230.91 | $193.87 | 81.6% | $208.70 | $170.36 | 97.2% | 90.4% | 87.9% |

| (1) | The minor variances between the underwriting, appraisal and above table with respect to Occupancy, ADR and RevPAR at the Renaissance Seattle Property are attributable to variances in reporting methodologies and/or timing differences. |

| (2) | Data provided by a third party travel research report. |

| (3) | Based on operating statements provided by the borrower. |

| (4) | TTM represents the trailing 12-month period ending on September 30, 2018. |

The Renaissance Seattle Property’s immediate marketplace includes eight competitive properties. The eight primary competitors range in size from 237 to 891 rooms. Overall, when taking into account the Renaissance Seattle Property, the competitive set collectively contains an aggregate of 4,137 rooms.

In total, the loan sponsor has developed approximately 55.6% of the appraisal’s competitive set by number of hotels (five of nine) and 48.6% by number of rooms (2,012 of 4,137), and currently owns 33.3% of the appraisal’s competitive set by number of hotels (three of nine) and 32.9% by number of rooms (1,360 of 4,137).

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. |

| | | |

| 17 of 106 |  |

| Structural and Collateral Term Sheet | | JPMCC 2019-COR4 |

| |

| Renaissance Seattle |

| Competitive Hotels Profile(1) |

| | | | | 2016 Estimated Operating Statistics |

| Property | Rooms | Year Opened | Meeting Space (SF) | Occupancy | ADR | RevPAR |

| Renaissance Seattle(2)(3) | 557 | 1978 | 28,000 | 84.0% | $195.78 | $164.42.x |

| Grand Hyatt Seattle(2) | 457 | 2001 | 22,000 | 80-85% | $230-240 | $200-210x |

| Hilton Seattle(4) | 237 | 1970 | 6,000 | 90-95% | $210-220 | $200-210x |

| Fairmont Olympic Hotel Seattle | 450 | 1924 | 17,500 | 65-70% | $250-260 | $180-190x |

| Westin Seattle | 891 | 1929 | 48,000 | 80-85% | $210-220 | $170-180x |

| Marriott Seattle Waterfront Hotel | 358 | 2003 | 11,000 | 80-85% | $260-270 | $210-220x |

| Hyatt @ Olive 8(2) | 346 | 2009 | 10,500 | 80-85% | $220-230 | $190-200x |

| Crowne Plaza Seattle Downtown(4) | 415 | 1983 | 8,500 | 80-85% | $170-180 | $140-150x |

| W Hotel Seattle | 426 | 1999 | 10,000 | 70-75% | $230-240 | $170-180x |

| Total | 4,137 | | | | | |

| (1) | Based on the appraisal. |

| (2) | Originally developed and currently owned by the loan sponsor. |

| (3) | The Renaissance Seattle 2016 Occupancy, ADR and RevPAR are based on operating statement provided by the borrower. |

| (4) | Originally developed by the loan sponsor and subsequently sold to a third party. |

| Operating History and Underwritten Net Cash Flow |

| | 2015 | 2016 | 2017 | TTM(1) | Underwritten | Per Room(2) | % of Total

Revenue(3) |

| Occupancy | 82.2% | 84.0% | 84.0% | 81.6% | 81.6% | | |

| ADR | $190.32 | $195.78 | $203.92 | $208.70 | $208.70 | | |

| RevPAR | $156.52 | $164.42 | $171.25 | $170.36 | $170.36 | | |

| | | | | | | | |

| Room Revenue | $31,735,225 | $33,509,972 | $34,816,678 | $34,635,950 | $34,635,950 | $62,183 | 77.2%% |

| Food & Beverage Revenue | 7,434,644 | 6,886,049 | 7,564,440 | 8,638,781 | 8,638,781 | 15,509 | 19.2%% |

| Other Departmental Revenue | 1,738,457 | 1,754,032 | 1,683,406 | 1,610,639 | 1,610,639 | 2,892 | 3.6%% |

| Total Revenue | $40,908,326 | $42,150,053 | $44,064,524 | $44,885,370 | $44,885,370 | $80,584 | 100.0%% |

| | | | | | | | |

| Room Expense | $7,679,367 | $7,868,949 | $8,350,870 | $8,293,845 | $8,293,845 | $14,890 | 23.9%% |

| Food & Beverage Expense | 5,876,452 | 6,133,686 | 6,238,916 | 6,284,901 | 6,284,901 | 11,283 | 72.8%% |

| Other Departmental Expense | 462,850 | 475,932 | 574,497 | 565,787 | 565,787 | 1,016 | 35.1%% |

| Departmental Expenses | $14,018,669 | $14,478,567 | $15,164,283 | $15,144,532 | $15,144,532 | $27,189 | 33.7%% |

| | | | | | | | % |

| Gross Operating Profit | $26,889,657 | $27,671,486 | $28,900,241 | $29,740,838 | $29,740,838 | $53,395 | 66.3%% |

| | | | | | | | |

| Admin & General | $2,639,121 | $2,720,847 | $2,991,161 | $3,077,181 | $3,077,181 | $5,525 | 6.9%% |

| Maintenance & Repairs | 1,547,679 | 1,563,521 | 1,597,454 | 1,610,200 | 1,610,200 | 2,891 | 3.6%% |

| Utility Costs | 1,046,315 | 1,067,538 | 1,112,436 | 1,124,860 | 1,124,860 | 2,019 | 2.5%% |

| Marketing | 2,493,020 | 2,594,580 | 2,664,136 | 2,690,699 | 2,690,699 | 4,831 | 6.0%% |

| Franchise Fee | 1,272,210 | 1,343,966 | 1,518,186 | 1,735,838 | 1,731,798 | 3,109 | 3.9%% |

| Management Fee | 609,244 | 579,003 | 714,455 | 1,080,876 | 1,346,561 | 2,418 | 3.0%% |

| Property Tax | 887,547 | 1,086,366 | 1,347,156 | 1,498,746 | 1,518,173 | 2,726 | 3.4%% |

| Insurance | 337,275 | 349,370 | 357,959 | 341,773 | 321,596 | 577 | 0.7%% |

| Other Expenses | 232,490 | 273,227 | 314,736 | 316,788 | 316,788 | 569 | 0.7%% |

| Total General/Unallocated Expenses | $11,064,901 | $11,578,417 | $12,617,678 | $13,476,960 | $13,737,855 | $24,664 | 30.6%% |

| Net Operating Income | $15,824,756 | $16,093,069 | $16,282,562 | $16,263,877 | $16,002,982 | $28,731 | 35.7%% |

| FF&E | 2,107,503 | 2,107,503 | 2,203,226 | 2,244,268 | 2,244,268 | 4,029 | 5.0%% |

| Net Cash Flow | $13,717,253 | $13,985,567 | $14,079,336 | $14,019,609 | $13,758,714 | $24,701 | 30.7%% |

| (1) | TTM column represents the trailing 12-month period ending on September 30, 2018. |

| (2) | Per Room values are based on 557 guest rooms. |

| (3) | % of Total Revenue for Room Expense, Food & Beverage Expense, and Other Departmental Expense are based on their corresponding revenue line items. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. |

| | | |

| 18 of 106 |  |

| Structural and Collateral Term Sheet | | JPMCC 2019-COR4 |

| |

| Renaissance Seattle |

Property Management. The Renaissance Seattle Property is managed by the R.C. Hedreen Co., which is an affiliate of the borrower.

Franchise Agreement. The Renaissance Seattle Property is subject to a franchise agreement with Marriott International, Inc. The franchise agreement commenced on March 1, 1998 and currently runs through August 14, 2028.

Escrows and Reserves. At origination, the borrower deposited (i) $2,866,271 for a PIP reserve, (ii) $280,000 for insurance premiums and (iii) $95,000 for real estate taxes.

Tax Escrows– On a monthly basis, the borrower is required to escrow 1/12 of annual estimated tax payments, which currently equates to $116,000.

Insurance Escrows– On a monthly basis, the borrower is required to escrow 1/12 of annual estimated insurance premiums, which currently equates to $28,000.

FF&E Reserves –On a monthly basis, the borrower is required to escrow 5.0% of the gross operating income for the preceding month.

Lockbox / Cash Management.The Renaissance Seattle Whole Loan is structured with a hard lockbox and springing cash management. All credit card receipts are required to be deposited by credit card processing companies directly into a lockbox account, and all non-credit card receipts are required to be deposited into the lockbox account within one business day of receipt by borrower or property manager. Amounts on deposit in the lockbox account will be transferred daily to an account controlled by the borrower unless a Cash Management Period (as defined below) is continuing. During a Cash Management Period, all funds in the lockbox account are required to be deposited into a lender-controlled cash management account and will be applied to pay monthly amounts due as required under the Renaissance Seattle Whole Loan, and any excess amounts will be retained by the lender as additional collateral for the Renaissance Seattle Whole Loan.

A “Cash Management Period” will occur (i) during the continuation of an event of default or (ii) if the debt yield is less than 7.5% for any quarter (until such time that the debt yield is at least 7.5% for two consecutive quarters).

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. |

| | | |

| 19 of 106 |  |

| Structural and Collateral Term Sheet | | JPMCC 2019-COR4 |

| |

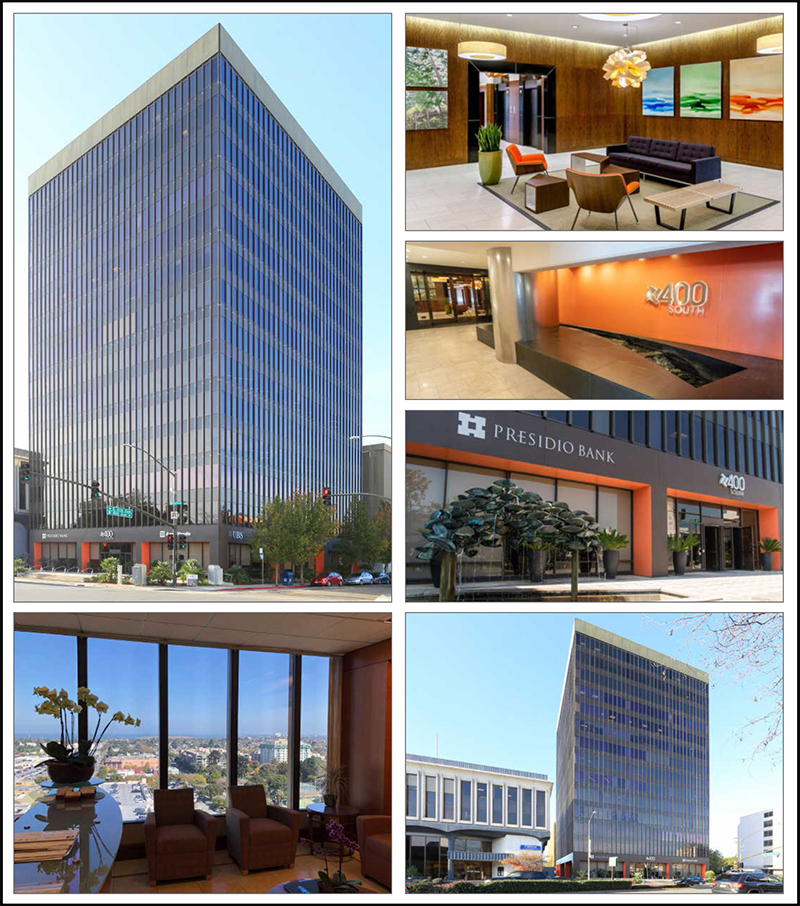

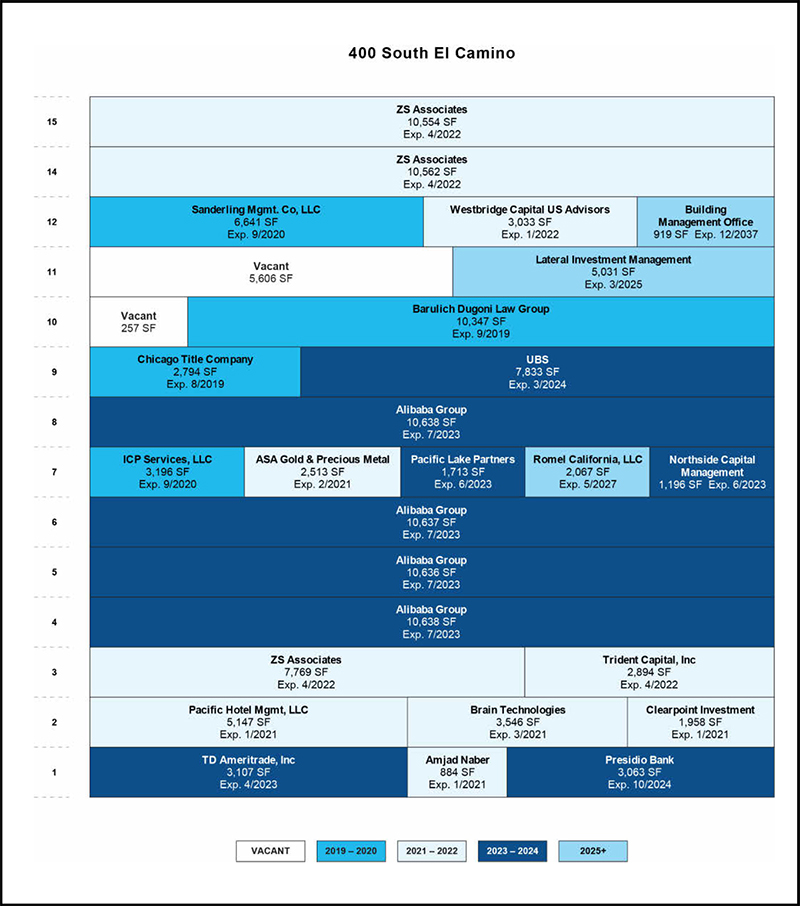

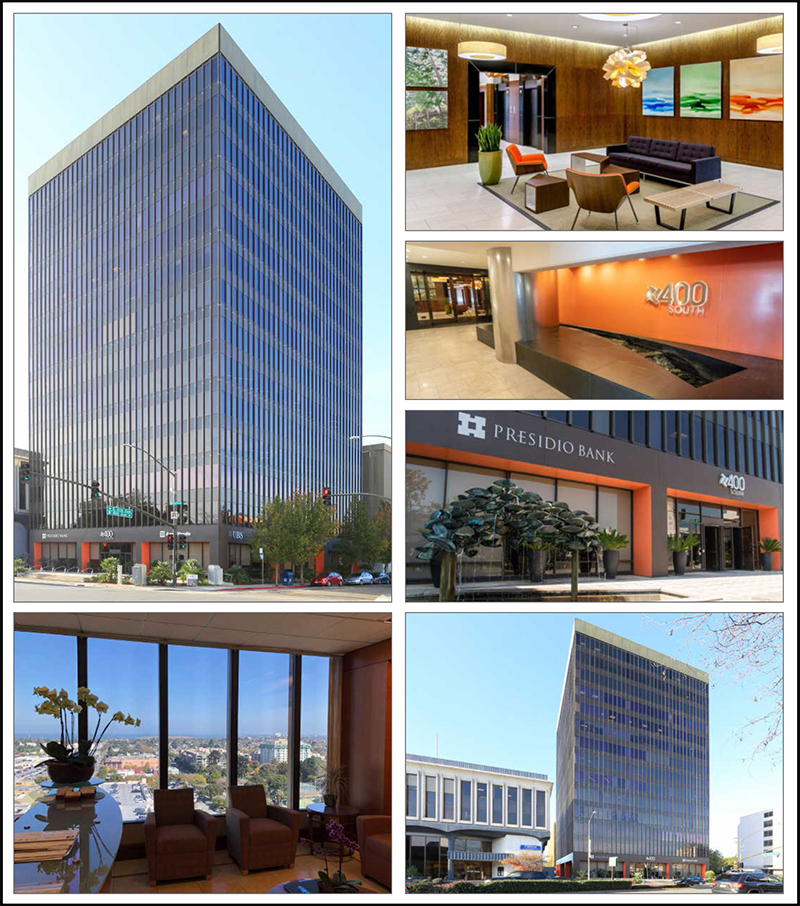

| 400 South El Camino |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. |

| | | |

| 20 of 106 |  |

| Structural and Collateral Term Sheet | | JPMCC 2019-COR4 |

| |

| 400 South El Camino |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. |

| | | |

| 21 of 106 |  |

| Structural and Collateral Term Sheet | | JPMCC 2019-COR4 |

| |

| 400 South El Camino |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. |

| | | |

| 22 of 106 |  |

| Structural and Collateral Term Sheet | | JPMCC 2019-COR4 |

| |

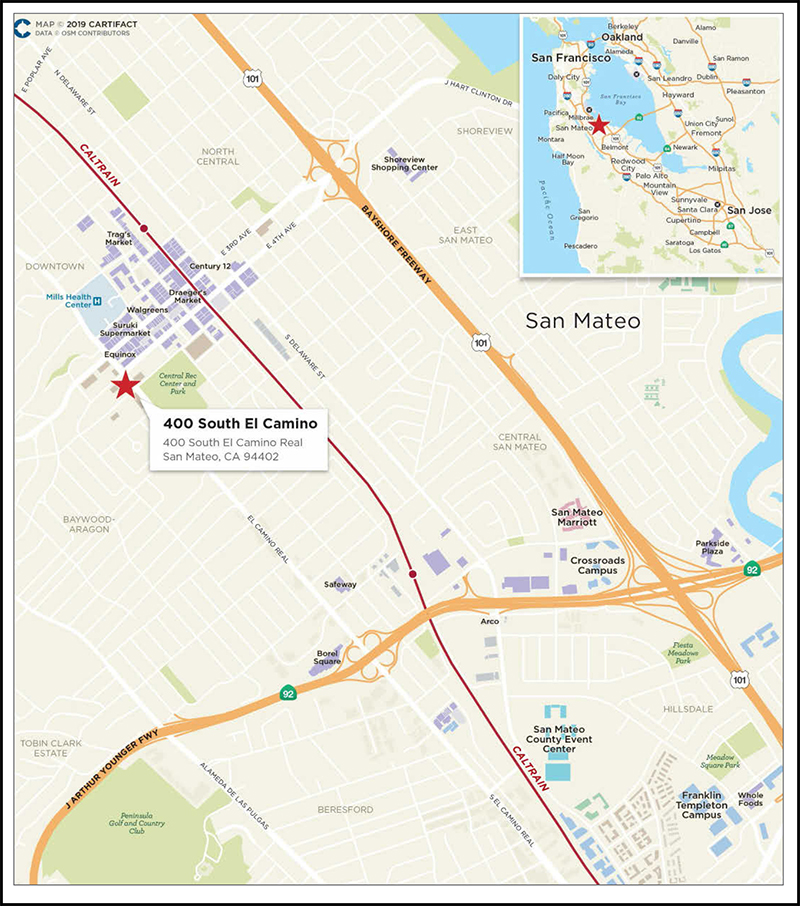

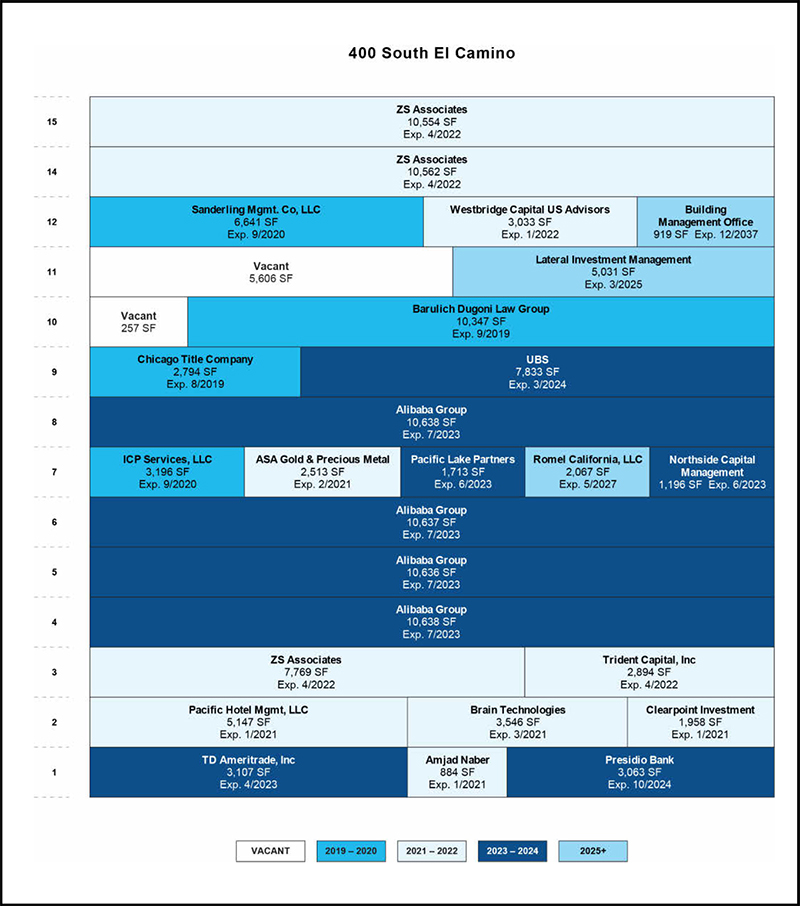

| 400 South El Camino |

| Mortgage Loan Information | | Property Information |

| Mortgage Loan Seller: | LCM | | Single Asset / Portfolio: | Single Asset |

| Original Principal Balance: | $75,000,000 | | Title: | Fee |

| Cut-off Date Principal Balance: | $75,000,000 | | Property Type - Subtype: | Office – CBD |

| % of Pool by IPB: | 9.7% | | Net Rentable Area (SF): | 145,179 |

| Loan Purpose: | Refinance | | Location: | San Mateo, CA |

| Borrower: | Romel 400, LLC | | Year Built / Renovated: | 1973 / 2015 |

| Loan Sponsor: | A.J. Batt | | Occupancy: | 96.0% |

| Interest Rate: | 4.69700% | | Occupancy Date: | 11/1/2018 |

| Note Date: | 11/28/2018 | | Number of Tenants: | 21 |

| Maturity Date: | 12/6/2028 | | 2015 NOI: | $5,305,486 |

| Interest-only Period: | 24 months | | 2016 NOI: | $5,706,746 |

| Original Term: | 120 months | | 2017 NOI: | $6,009,997 |

| Original Amortization: | 360 months | | TTM NOI (as of 9/2018): | $7,377,820 |

| Amortization Type: | IO–Balloon | | UW Economic Occupancy: | 95.0% |

| Call Protection: | Grtr1%orYM(116),O(4) | | UW Revenues: | $10,328,734 |

| Lockbox / Cash Management: | Soft / Springing | | UW Expenses: | $2,583,895 |

| Additional Debt: | N/A | | UW NOI: | $7,744,839 |

| Additional Debt Balance: | N/A | | UW NCF: | $7,319,465 |

| Additional Debt Type: | N/A | | Appraised Value / Per SF: | $128,000,000 / $882 |

| | | | Appraisal Date: | 10/9/2018 |

| | | | | |

| Escrows and Reserves(1) | | Financial Information |

| | Initial | Monthly | Initial Cap | | Cut-off Date Loan / SF: | $517 | |

| Taxes: | $0 | Springing | N/A | | Maturity Date Loan / SF: | $444 | |

| Insurance: | $0 | Springing | N/A | | Cut-off Date LTV: | | 58.6% | |

| Replacement Reserves: | $0 | Springing | N/A | | Maturity Date LTV: | | 50.3% | |

| TI/LC: | $0 | Springing | N/A | | UW NCF DSCR: | | 1.57x | |

| Other | $0 | $0 | N/A | | UW NOI Debt Yield: | | 10.3% | |

| | | | | | | | |

|

| |

| Sources and Uses |

| Sources | Proceeds | % of Total | | Uses | Proceeds | % of Total |

| Mortgage Loan | $75,000,000 | 100.0% | | Payoff Existing Debt | $55,419,285 | 73.9% |

| | | | | Closing Costs | 492,155 | 0.7% |

| | | | | Return of Equity | 19,088,559 | 25.5% |

| Total Sources | $75,000,000 | 100.0% | | Total Uses | $75,000,000 | 100.0% |

| | | | | | | | | | | | | | | | |

| (1) | For a full description of Escrows and Reserves, please refer to“Escrows and Reserves”below. |

The Loan. The 400 South El Camino loan (the “400 South El Camino Mortgage Loan”) has an outstanding principal balance as of the Cut-off Date of $75.0 million and is secured by a first mortgage lien on the borrower’s fee interest in a 14-story, 145,179 square foot Class A office building located in the central business district (“CBD”) of downtown San Mateo, California (the “400 South El Camino Property”). The 400 South El Camino Mortgage Loan has a 10-year term and, following a two-year interest-only period, will amortize on a 30-year schedule.

The Borrower.The borrowing entity for the 400 South El Camino Mortgage Loan is Romel 400, LLC, a Delaware limited liability company structured to be bankruptcy remote with one independent director.

The Loan Sponsor.The loan sponsor and nonrecourse carve-out guarantor is A.J. Batt. Mr. Batt founded ATEL Financial Services in 1977. During his tenure as founder and CEO, ATEL was one of the world’s largest equipment leasing companies, reportedly with a portfolio of equipment leases in excess of $1.5 billion. Mr. Batt sold ATEL in 2001 and has since been investing in real estate through his primary investment vehicles. Mr. Batt owns interests in over 20 commercial real estate properties located mainly in and around San Francisco.

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. |

| | | |

| 23 of 106 |  |

| Structural and Collateral Term Sheet | | JPMCC 2019-COR4 |

| |

| 400 South El Camino |

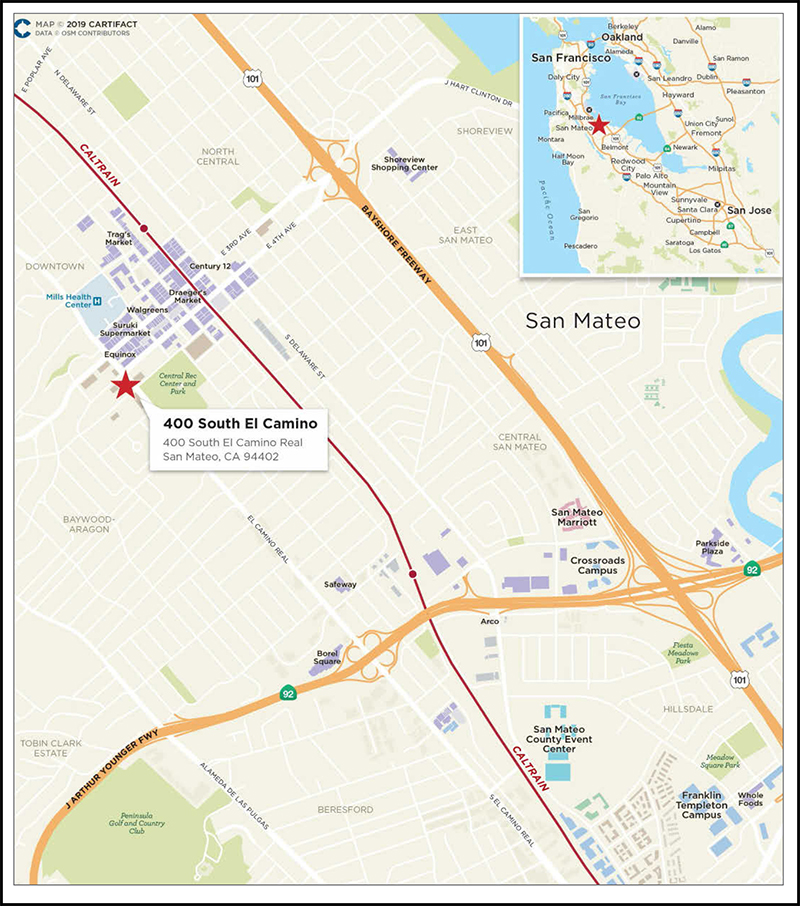

The Property. The 400 South El Camino Property is a 14-story, 145,179 square foot Class A office building located on South El Camino Real in San Mateo, California within the main business district and retail core and walking distance from the San Mateo Caltrain Station, which provides rail service through the West Bay cities of San Francisco, Burlingame, Palo Alto, and down to Sunnyvale and Santa Clara. The 400 South El Camino Property is the one of the tallest buildings in San Mateo, features floor-to-ceiling windows providing expansive views of the San Francisco Bay, includes 10,400 square foot floorplates and an adjoining six-story, 254-space parking garage providing a parking ratio of 1.75 spaces per 1,000 square feet of net rentable area (“NRA”). In addition to its proximity to the amenities and entertainment located in downtown San Mateo, the 400 South El Camino Property offers office tenants a location that is approximately equidistant to the major population and commercial centers of San Francisco, Silicon Valley and the East Bay.