| | | FREE WRITING PROSPECTUS |

| | | FILED PURSUANT TO RULE 433 |

| | | REGISTRATION FILE NO.: 333-226123-10 |

| | | |

| October [7], 2020 | Benchmark 2020-B20 |

| |

| |

| Collateral Term Sheet |

BENCHMARK 2020-B20 This material is for your information, and none of J.P. Morgan Securities LLC (“JPMS”), Deutsche Bank Securities Inc., Citigroup Global Markets Inc., Goldman Sachs & Co. LLC, Drexel Hamilton, LLC and Academy Securities, Inc., (each individually, an “Underwriter”, and together, the ‘‘Underwriters’’) are soliciting any action based upon it. This material is not to be construed as an offer to sell or the solicitation of any offer to buy any security in any jurisdiction where such an offer or solicitation would be illegal. The depositor has filed a registration statement (including a prospectus) with the SEC (SEC File No. 333-226123) for the offering to which this free writing prospectus relates. Before you invest, you should read the prospectus in the registration statement and other documents the depositor has filed with the SEC for more complete information about the depositor, the issuing entity and this offering. You may get these documents for free by visiting EDGAR on the SEC Web site at www.sec.gov. Alternatively, the depositor, any underwriter or any dealer participating in the offering will arrange to send you the prospectus if you request it by calling (800) 408-1016 or by emailing the ABS Syndicate Desk at abs_synd@jpmorgan.com. THE SECURITIES TO WHICH THIS INFORMATION RELATES WILL BE MORE FULLY DESCRIBED IN A PROSPECTUS (THE “PROSPECTUS”), WHICH IS NOT YET AVAILABLE. THE PROSPECTUS WILL CONTAIN MATERIAL INFORMATION THAT IS NOT CONTAINED IN THESE MATERIALS (INCLUDING WITHOUT LIMITATION A DETAILED DISCUSSION OF RISKS ASSOCIATED WITH AN INVESTMENT IN THE CERTIFICATES, UNDER THE HEADING “RISK FACTORS” IN THE PROSPECTUS). Neither this document nor anything contained in this document shall form the basis for any contract or commitment whatsoever. The information contained in this document is preliminary as of the date of this document, supersedes any previous such information delivered to you and will be superseded by any such information subsequently delivered prior to the time of sale. These materials are subject to change, completion or amendment from time to time. This information is based upon management forecasts and reflects prevailing conditions and management's views as of this date, all of which are subject to change. J.P. Morgan is the marketing name for the investment banking businesses of JPMorgan Chase & Co. and its subsidiaries worldwide. Securities, syndicated loan arranging, financial advisory and other investment banking activities are performed by JPMS and its securities affiliates, and lending, derivatives and other commercial banking activities are performed by JPMorgan Chase Bank, National Association and its banking affiliates. JPMS is a member of SIPC and the NYSE. THE CERTIFICATES REFERRED TO IN THESE MATERIALS ARE SUBJECT TO MODIFICATION OR REVISION (INCLUDING THE POSSIBILITY THAT ONE OR MORE CLASSES OF CERTIFICATES MAY BE SPLIT, COMBINED OR ELIMINATED AT ANY TIME PRIOR TO ISSUANCE OR AVAILABILITY OF A FINAL PROSPECTUS) AND ARE OFFERED ON A “WHEN, AS AND IF ISSUED” BASIS. THE UNDERWRITERS MAY FROM TIME TO TIME PERFORM INVESTMENT BANKING SERVICES FOR, OR SOLICIT INVESTMENT BANKING BUSINESS FROM, ANY COMPANY NAMED IN THESE MATERIALS. THE UNDERWRITERS AND/OR THEIR AFFILIATES OR RESPECTIVE EMPLOYEES MAY FROM TIME TO TIME HAVE A LONG OR SHORT POSITION IN ANY CERTIFICATE OR CONTRACT DISCUSSED IN THESE MATERIALS. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. |

| October [7], 2020 | Benchmark 2020-B20 |

THE REPUBLIC OF KOREA

THIS PROSPECTUS IS NOT, AND UNDER NO CIRCUMSTANCES IS THIS PROSPECTUS TO BE CONSTRUED AS, A PUBLIC OFFERING OF SECURITIES IN KOREA. NEITHER THE ISSUER NOR ANY OF ITS AGENTS MAKE ANY REPRESENTATION WITH RESPECT TO THE ELIGIBILITY OF ANY RECIPIENTS OF THIS PROSPECTUS TO ACQUIRE THE OFFERED CERTIFICATES UNDER THE LAWS OF KOREA, INCLUDING, BUT WITHOUT LIMITATION, THE FOREIGN EXCHANGE TRANSACTION LAW AND REGULATIONS THEREUNDER (THE “FETL”). THE OFFERED CERTIFICATES HAVE NOT BEEN REGISTERED WITH THE FINANCIAL SERVICES COMMISSION OF KOREA FOR PUBLIC OFFERING IN KOREA, AND NONE OF THE OFFERED CERTIFICATES MAY BE OFFERED, SOLD OR DELIVERED, DIRECTLY OR INDIRECTLY, OR OFFERED OR SOLD TO ANY PERSON FOR RE-OFFERING OR RESALE, DIRECTLY OR INDIRECTLY IN KOREA OR TO ANY RESIDENT OF KOREA EXCEPT PURSUANT TO THE FINANCIAL INVESTMENT SERVICES AND CAPITAL MARKETS ACT AND THE DECREES AND REGULATIONS THEREUNDER (THE “FSCMA”), THE FETL AND ANY OTHER APPLICABLE LAWS, REGULATIONS AND MINISTERIAL GUIDELINES IN KOREA. WITHOUT PREJUDICE TO THE FOREGOING, THE NUMBER OF OFFERED CERTIFICATES OFFERED IN KOREA OR TO A RESIDENT OF KOREA SHALL BE LESS THAN FIFTY AND FOR A PERIOD OF ONE YEAR FROM THE ISSUE DATE OF THE OFFERED CERTIFICATES, NONE OF THE OFFERED CERTIFICATES MAY BE DIVIDED RESULTING IN AN INCREASED NUMBER OF OFFERED CERTIFICATES. FURTHERMORE, THE OFFERED CERTIFICATES MAY NOT BE RESOLD TO KOREAN RESIDENTS UNLESS THE PURCHASER OF THE OFFERED CERTIFICATES COMPLIES WITH ALL APPLICABLE REGULATORY REQUIREMENTS (INCLUDING, BUT NOT LIMITED TO, GOVERNMENT REPORTING APPROVAL REQUIREMENTS UNDER THE FETL AND ITS SUBORDINATE DECREES AND REGULATIONS) IN CONNECTION WITH THE PURCHASE OF THE OFFERED CERTIFICATES.

JAPAN

THE OFFERED CERTIFICATES HAVE NOT BEEN AND WILL NOT BE REGISTERED UNDER THE FINANCIAL INSTRUMENTS AND EXCHANGE LAW OF JAPAN, AS AMENDED (THE “FIEL”), AND DISCLOSURE UNDER THE FIEL HAS NOT BEEN AND WILL NOT BE MADE WITH RESPECT TO THE OFFERED CERTIFICATES. ACCORDINGLY, EACH UNDERWRITER HAS REPRESENTED AND AGREED THAT IT HAS NOT, DIRECTLY OR INDIRECTLY, OFFERED OR SOLD AND WILL NOT, DIRECTLY OR INDIRECTLY, OFFER OR SELL ANY OFFERED CERTIFICATES IN JAPAN OR TO, OR FOR THE BENEFIT OF, ANY RESIDENT OF JAPAN (WHICH TERM AS USED IN THIS PROSPECTUS MEANS ANY PERSON RESIDENT IN JAPAN, INCLUDING ANY CORPORATION OR OTHER ENTITY ORGANIZED UNDER THE LAWS OF JAPAN) OR TO OTHERS FOR REOFFERING OR RE-SALE, DIRECTLY OR INDIRECTLY, IN JAPAN OR TO, OR FOR THE BENEFIT OF, ANY RESIDENT OF JAPAN EXCEPT PURSUANT TO AN EXEMPTION FROM THE REGISTRATION REQUIREMENTS OF, AND OTHERWISE IN COMPLIANCE WITH, THE FIEL AND OTHER RELEVANT LAWS, REGULATIONS AND MINISTERIAL GUIDELINES OF JAPAN. AS PART OF THIS OFFERING OF THE OFFERED CERTIFICATES, THE UNDERWRITERS MAY OFFER THE OFFERED CERTIFICATES IN JAPAN TO UP TO 49 OFFEREES IN ACCORDANCE WITH THE ABOVE PROVISIONS.

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

| Structural and Collateral Term Sheet | Benchmark 2020-B20 |

| Collateral Characteristics |

| Loan Pool | |

| Initial Pool Balance (“IPB”): | $903,488,876 |

| Number of Mortgage Loans: | 34 |

| Number of Mortgaged Properties: | 89 |

| Average Cut-off Date Balance per Mortgage Loan: | $26,573,202 |

| Weighted Average Current Mortgage Rate: | 3.56841% |

| 10 Largest Mortgage Loans as % of IPB: | 55.7% |

| Weighted Average Remaining Term to Maturity(1): | 109 months |

| Weighted Average Seasoning: | 2 months |

| Credit Statistics | |

| Weighted Average UW NCF DSCR(2)(3): | 2.71x |

| Weighted Average UW NOI DY(2)(3): | 10.9% |

| Weighted Average Cut-off Date Loan-to-Value Ratio (“LTV”)(2)(3)(4): | 56.0% |

| Weighted Average Maturity Date LTV(1)(2)(3)(4): | 53.5% |

| Other Statistics | |

| % of Mortgage Loans with Additional Debt: | 22.7% |

| % of Mortgaged Properties with Single Tenants: | 36.9% |

| Amortization | |

| Weighted Average Original Amortization Term(5): | 349 months |

| Weighted Average Remaining Amortization Term(5): | 349 months |

| % of Mortgage Loans with Interest-Only: | 65.4% |

| % of Mortgage Loans with Partial Interest-Only followed by Amortizing Balloon: | 12.1% |

| % of Mortgage Loans with Amortizing Balloon: | 12.0% |

| % of Mortgage Loans with ARD-Interest Only: | 10.5% |

| Lockbox / Cash Management(6) | |

| % of Mortgage Loans with In-Place, Hard Lockboxes: | 81.8% |

| % of Mortgage Loans with Springing Lockboxes: | 17.4% |

| % of Mortgage Loans with In-Place, Soft Lockboxes: | 0.8% |

| % of Mortgage Loans with Springing Cash Management: | 85.1% |

| % of Mortgage Loans with In-Place Cash Management: | 14.9% |

| Reserves | |

| % of Mortgage Loans Requiring Monthly Tax Reserves: | 70.2% |

| % of Mortgage Loans Requiring Monthly Insurance Reserves: | 31.9% |

| % of Mortgage Loans Requiring Monthly CapEx Reserves(7): | 50.3% |

| % of Mortgage Loans Requiring Monthly TI/LC Reserves(8): | 54.8% |

| (1) | In the case of Loan Nos. 3 and 16, with an anticipated repayment date, Remaining Term to Maturity and Maturity Date LTV are calculated as of the related anticipated repayment date. |

| (2) | In the case of Loan Nos. 1, 2, 3, 4, 6, 9, 11, 12, 16, 17, 18, 19 and 23, the UW NCF DSCR, UW NOI DY, Cut-off Date LTV and Maturity Date LTV Ratio calculations include the related Pari Passu Companion Loan(s). In the case of Loan Nos. 1, 3, 9, and 17, the UW NCF DSCR, UW NOI DY, Cut-off Date LTV and Maturity Date LTV calculations exclude the related Subordinate Companion Loan(s) and/or related mezzanine loan(s). |

| (3) | In the case of Loan No. 21, the UW NOI DY, Cut-Off Date LTV and Maturity Date LTV are calculated net of a holdback reserve. In the case of Loan No. 3, the UW NCF DSCR and UW NOI DY are calculated based on the master lease annual rent of $292,000,000. |

| (4) | In the case of Loan Nos. 1, 3, 6, 7, 16, 18, and 20, the Cut-off Date LTV and the Maturity Date LTV are calculated by using an appraised value based on certain hypothetical assumptions. Refer to “Description of the Mortgage Pool—Assessments of Property Value and Condition” and “—Appraised Value” in the Preliminary Prospectus for additional details. |

| (5) | Excludes 24 mortgage loans that are interest-only for the entire term. |

| (6) | For a more detailed description of Lockbox / Cash Management, refer to “Description of the Mortgage Pool—Certain Terms of the Mortgage Loans—Mortgaged Property Accounts” in the Preliminary Prospectus. |

| (7) | CapEx Reserves include FF&E reserves for hotel properties. |

| (8) | Calculated only with respect to the Cut-off Date Balance of mortgage loans secured or partially secured by retail, office, industrial and mixed use properties. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

| Structural and Collateral Term Sheet | Benchmark 2020-B20 |

| Collateral Characteristics |

Mortgage Loan Seller | Number of Mortgage Loans | Number of Mortgaged Properties | Aggregate Cut-off Date Balance | % of IPB |

| CREFI | 12 | 18 | $252,572,750 | 28.0% |

| GSMC(1)(2) | 10 | 11 | 195,080,000 | 21.6 |

| GACC(3)(4) | 7 | 9 | 193,336,126 | 21.4 |

| JPMCB | 3 | 48 | 122,500,000 | 13.6 |

| CREFI/GACC(3)(5) | 1 | 2 | 70,000,000 | 7.7 |

| JPMCB/CREFI(6) | 1 | 1 | 70,000,000 | 7.7 |

| Total | 34 | 89 | $903,488,876 | 100.0% |

| (1) | Eight of the mortgage loans (16.1%) being sold by Goldman Sachs Mortgage Company (“GSMC”) were originated or co-originated by an affiliate thereof, Goldman Sachs Bank USA, and will be transferred to GSMC on or prior to the Closing Date. |

| (2) | In the case of Loan No. 11, the whole loan was co-originated by Goldman Sachs Bank USA (“GSBI”), American General Life Insurance Company, The Variable Annuity Life Insurance Company, National Union Fire Insurance Company of Pittsburgh, PA. and American Home Assurance Company. In the case of Loan No. 23, the whole loan was co-originated by GSBI and Bank of America, N.A. |

| (3) | Each mortgage loan being sold by German American Capital Corporation (“GACC”) was originated or co-originated, either DBR Investments Co. Limited or Deutsche Bank AG, New York Branch, each an affiliate of GACC and will be transferred to GACC on or prior to the Closing Date. |

| (4) | In the case of Loan No. 1, the whole loan was co-originated by DBR Investments Co. Limited and JPMCB. |

| (5) | In the case of Loan No. 3, the whole loan was co-originated by CREFI, Barclays Capital Real Estate Inc., Deutsche Bank AG, New York Branch and Société Générale Financial Corporation. Loan No. 3 is evidenced by two promissory notes: (i) Note A-13-4, with a principal balance of $46,666,667 as of the Cut-off Date, as to which CREFI is acting as mortgage loan seller, and (ii) Note A-15-4, with a principal balance of $23,333,333 as of the Cut-off Date, as to which GACC is acting as mortgage loan seller. |

| (6) | In the case of Loan No. 2, the whole loan was co-originated by Wells Fargo Bank, National Association, JPMCB and CREFI. Loan No. 2 is evidenced by four promissory notes: (i) Note A-4 and Note A-5, with an aggregate principal balance of $35,000,000 as of the Cut-off Date, as to which JPMCB is acting as mortgage loan seller, and (ii) Note A-6 and Note A-7, with an aggregate principal balance of $35,000,000 as of the Cut-off Date, as to which CREFI is acting as mortgage loan seller. |

| Ten Largest Mortgage Loans |

| No. | Loan Name | Mortgage Loan Seller | No. of Prop. | Cut-off Date Balance | % of IPB | SF / Units | Property Type | UW NCF DSCR(1)(2) | UW NOI DY(1)(2) | Cut-off Date LTV(1)(3) | Maturity Date LTV(1)(3)(4) |

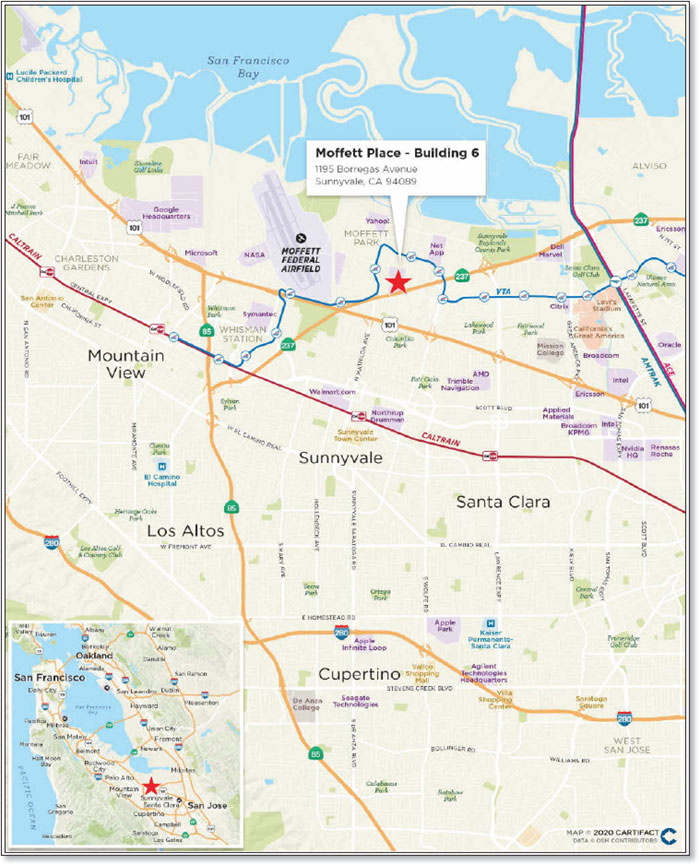

| 1 | Moffett Place - Building 6 | GACC | 1 | $74,850,000 | 8.3% | 314,352 | Office | 3.50x | 12.2% | 37.1% | 37.1% |

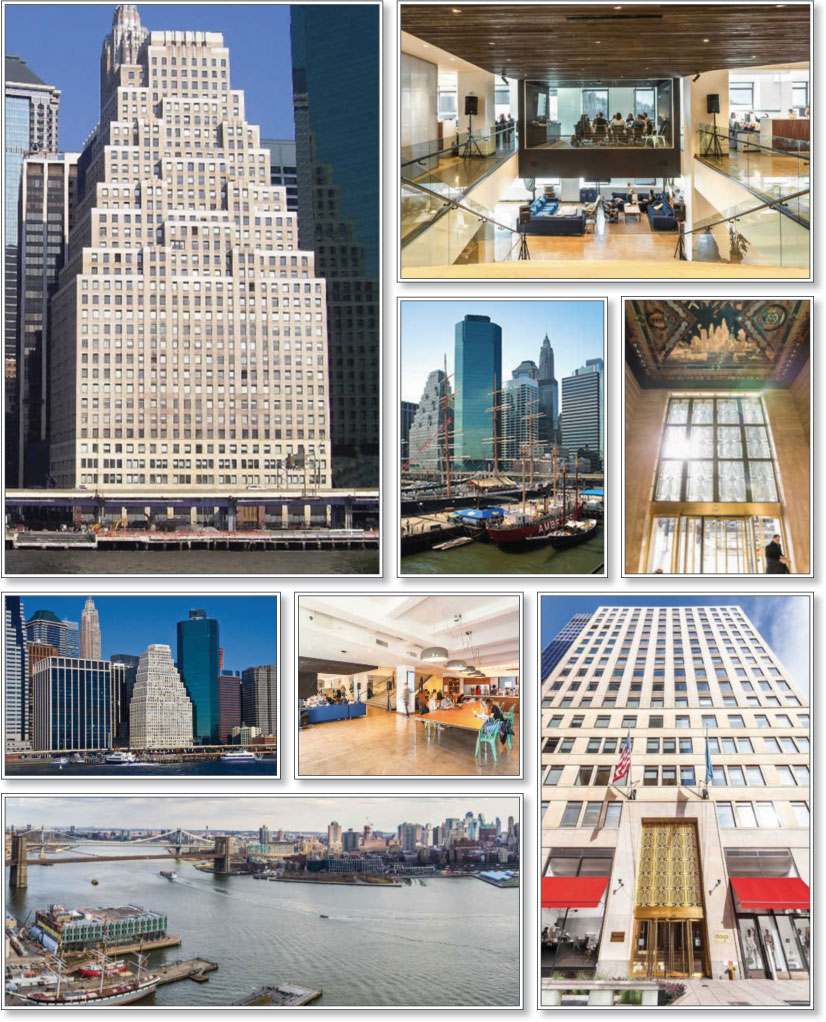

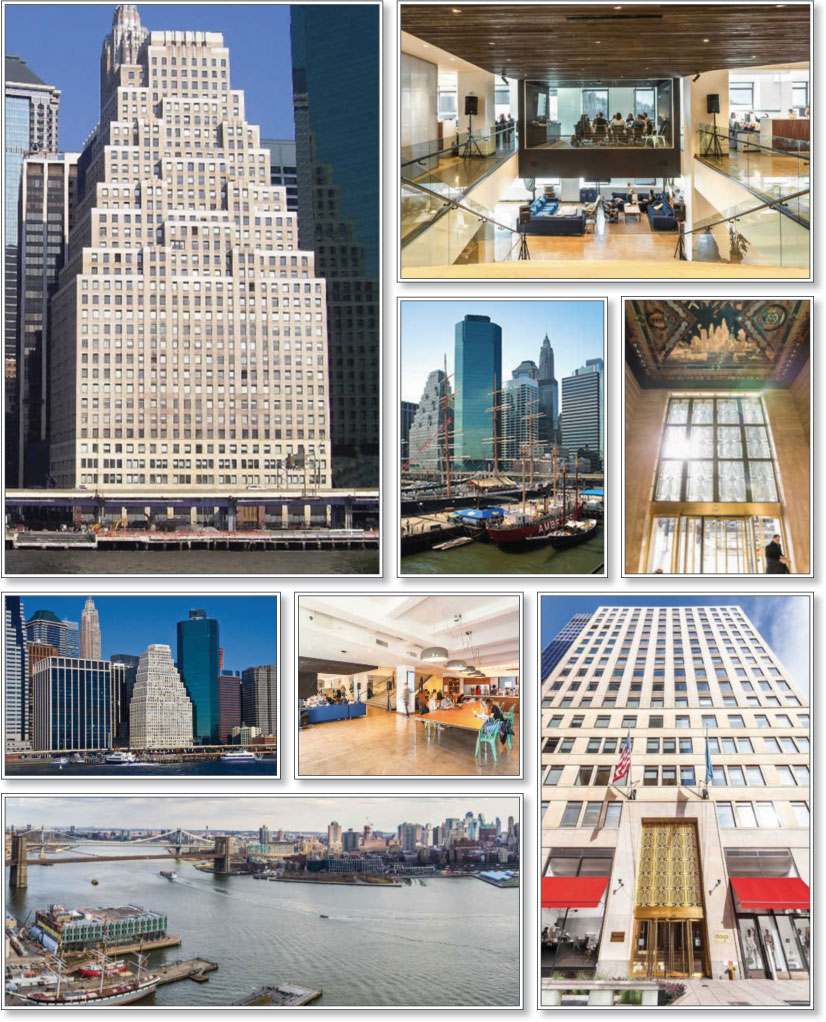

| 2 | 120 Wall Street | JPMCB/CREFI | 1 | $70,000,000 | 7.7% | 668,276 | Office | 2.74x | 9.3% | 57.9% | 57.9% |

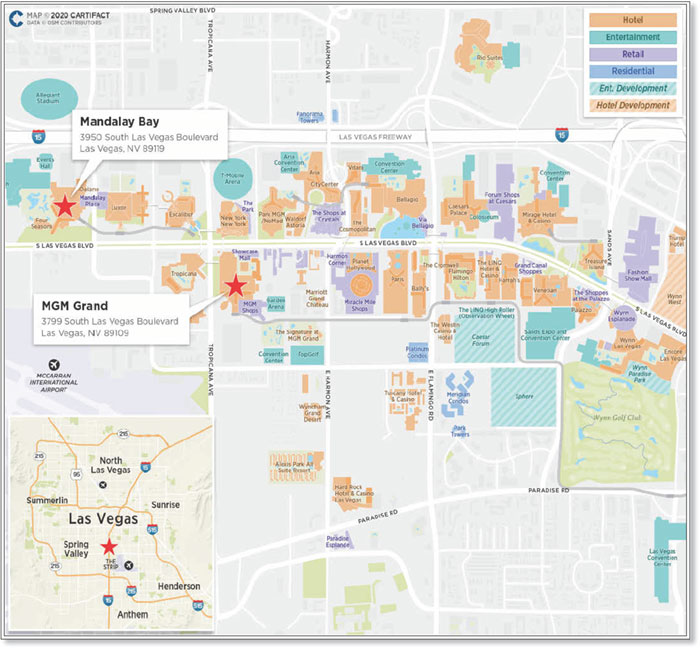

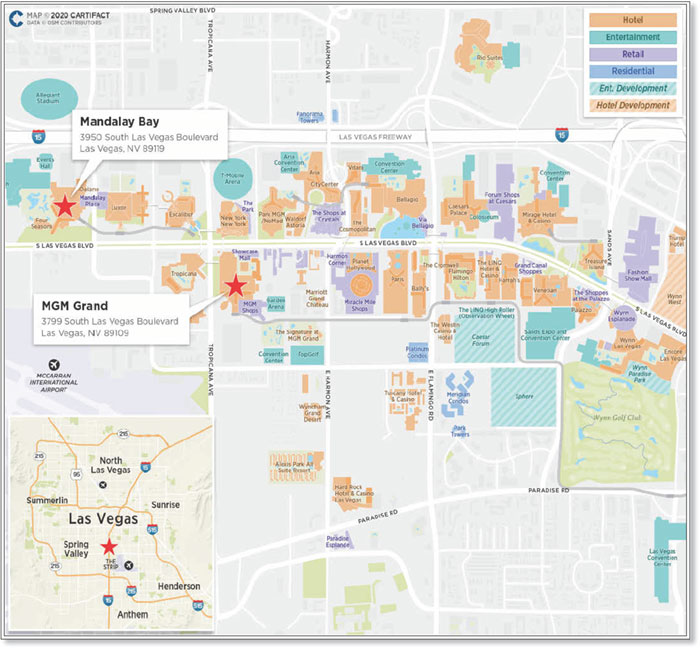

| 3 | MGM Grand & Mandalay Bay | CREFI/GACC | 2 | $70,000,000 | 7.7% | 9,748 | Hotel | 4.95x | 17.9% | 35.5% | 35.5% |

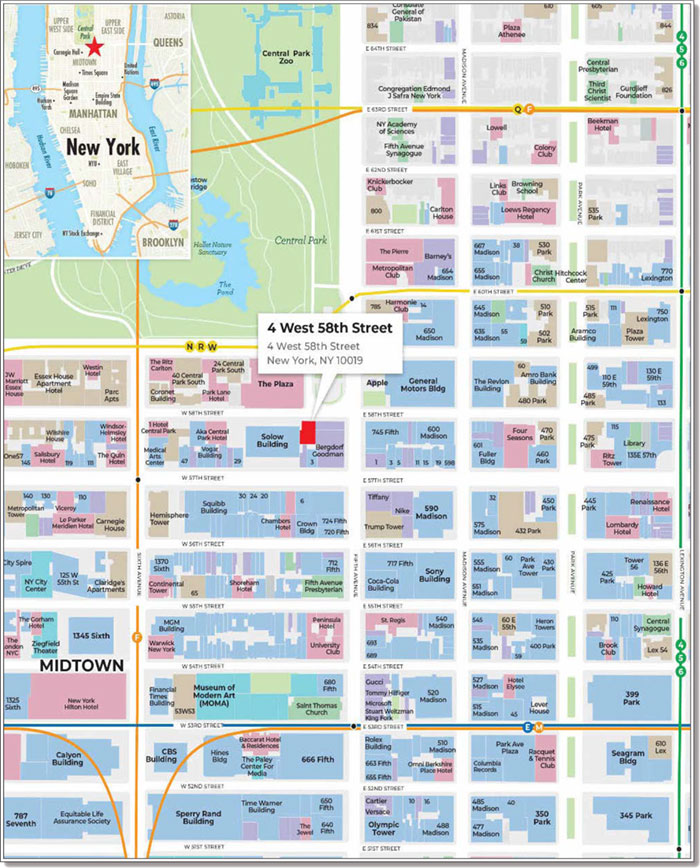

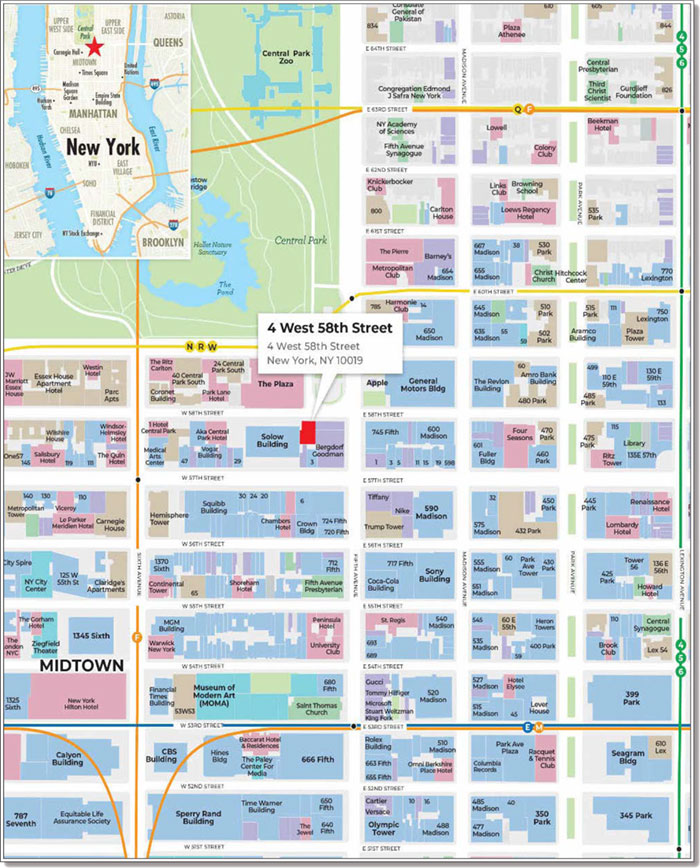

| 4 | 4 West 58th Street | JPMCB | 1 | $62,500,000 | 6.9% | 83,537 | Mixed Use | 1.94x | 7.4% | 69.4% | 69.4% |

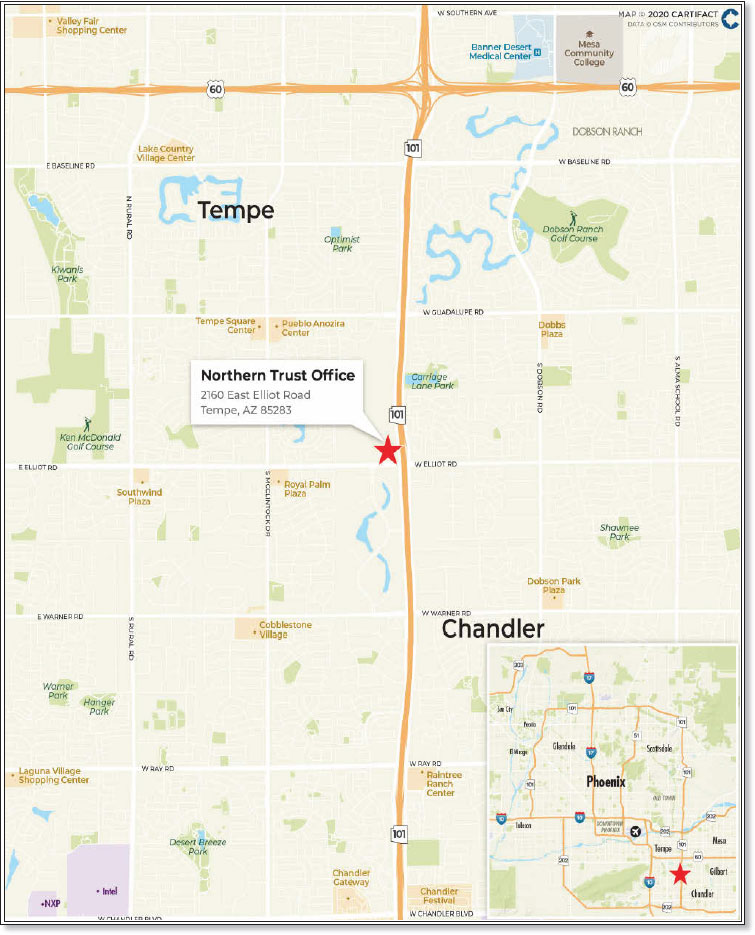

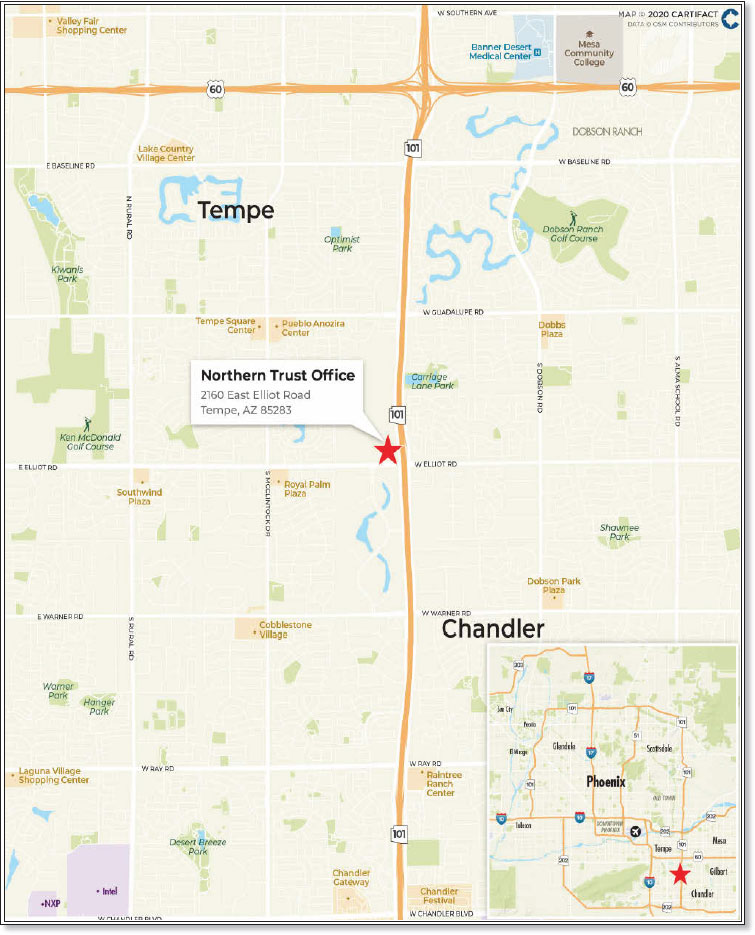

| 5 | Northern Trust Office | CREFI | 1 | $40,400,000 | 4.5% | 149,371 | Office | 2.58x | 9.4% | 62.6% | 62.6% |

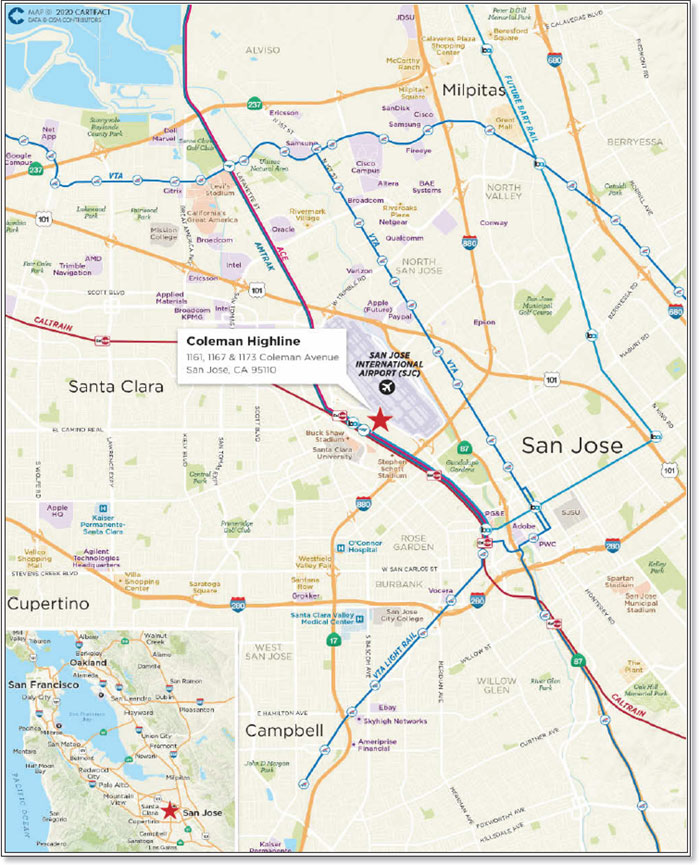

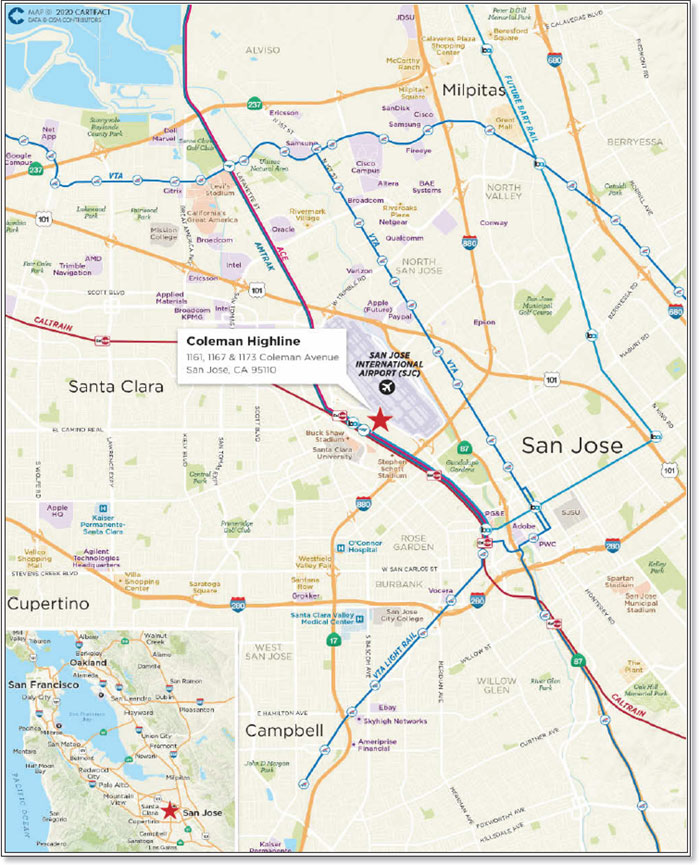

| 6 | Coleman Highline | GACC | 1 | $40,000,000 | 4.4% | 380,951 | Office | 3.64x | 10.3% | 50.8% | 50.8% |

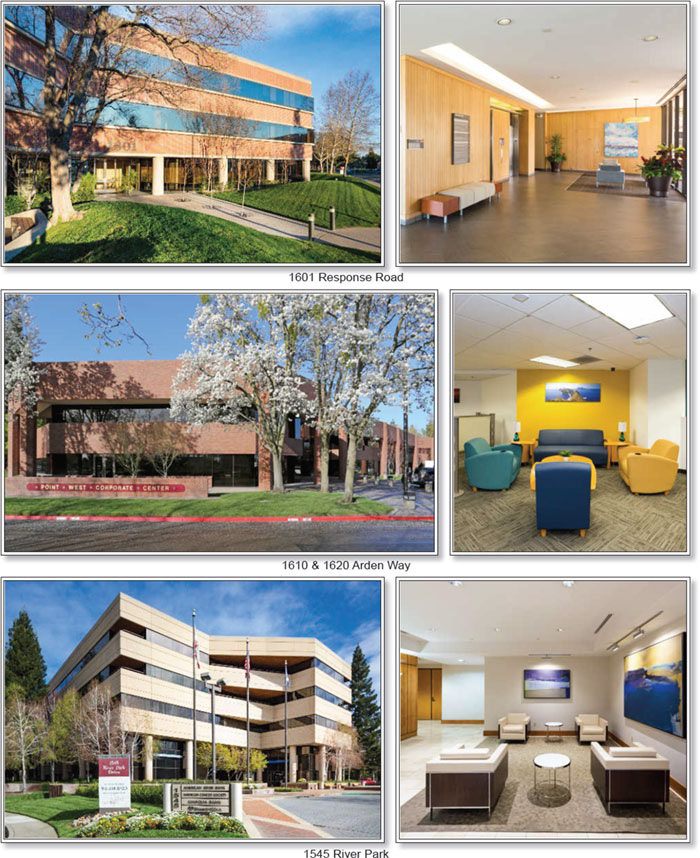

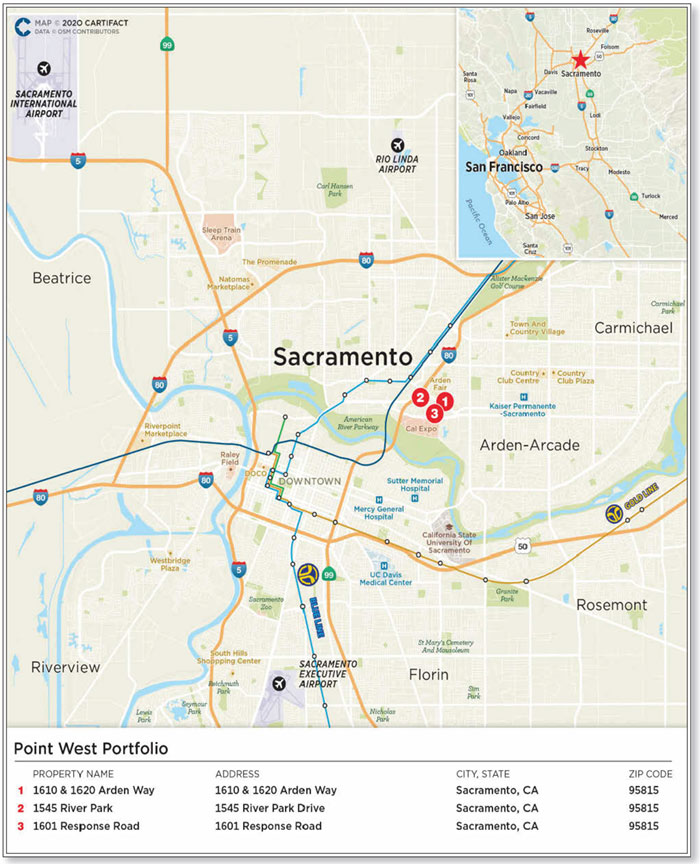

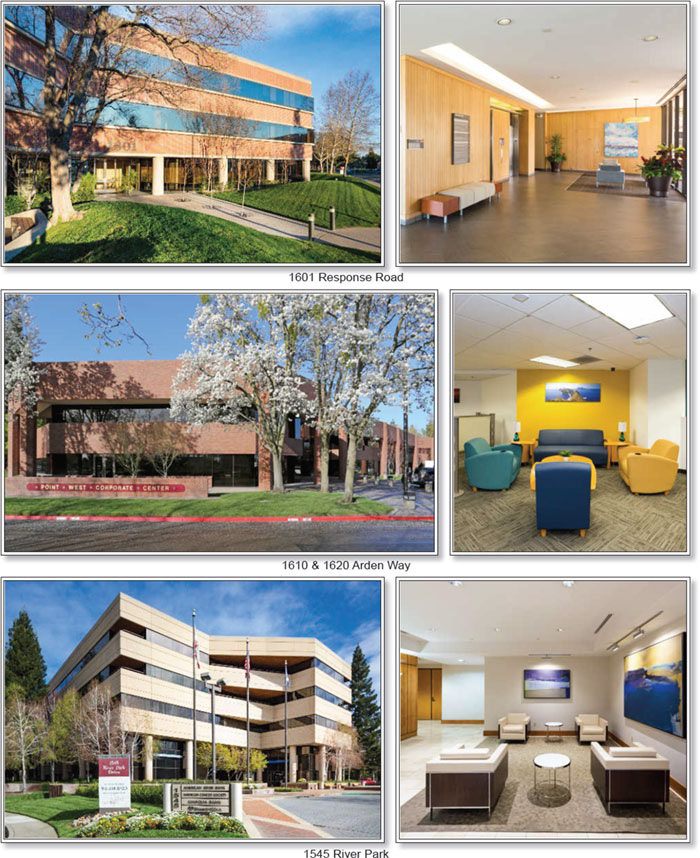

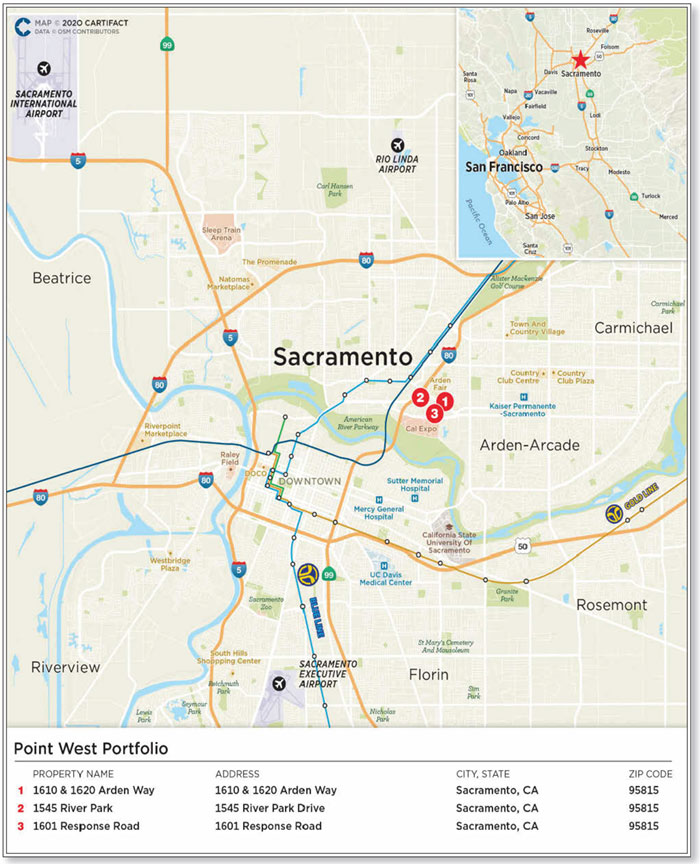

| 7 | Point West Portfolio | GACC | 3 | $39,500,000 | 4.4% | 346,227 | Office | 3.30x | 11.7% | 59.4% | 59.4% |

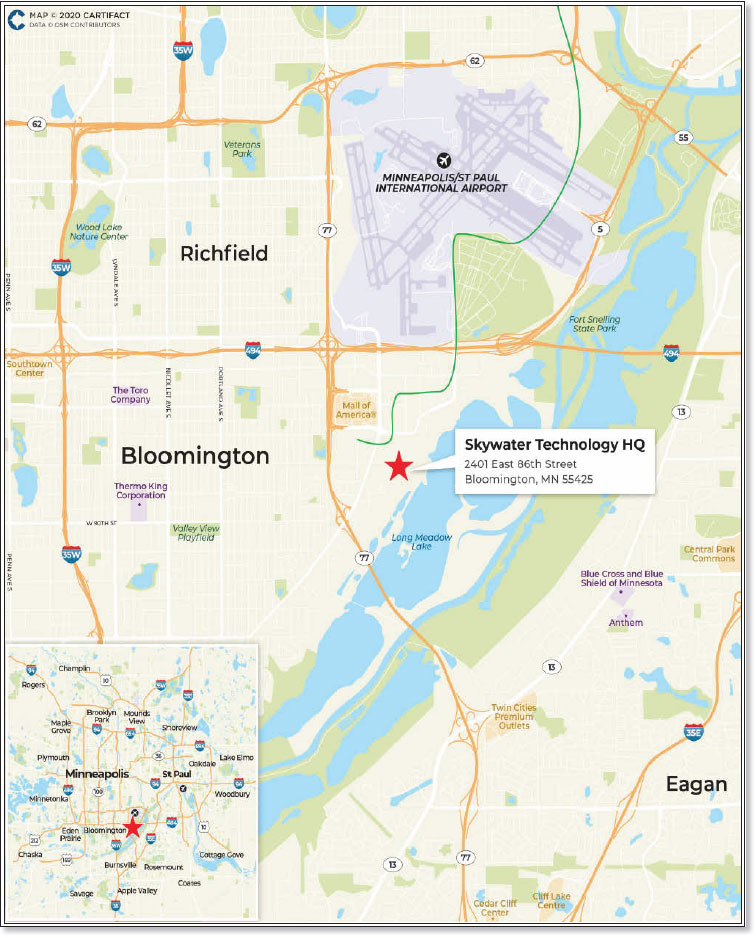

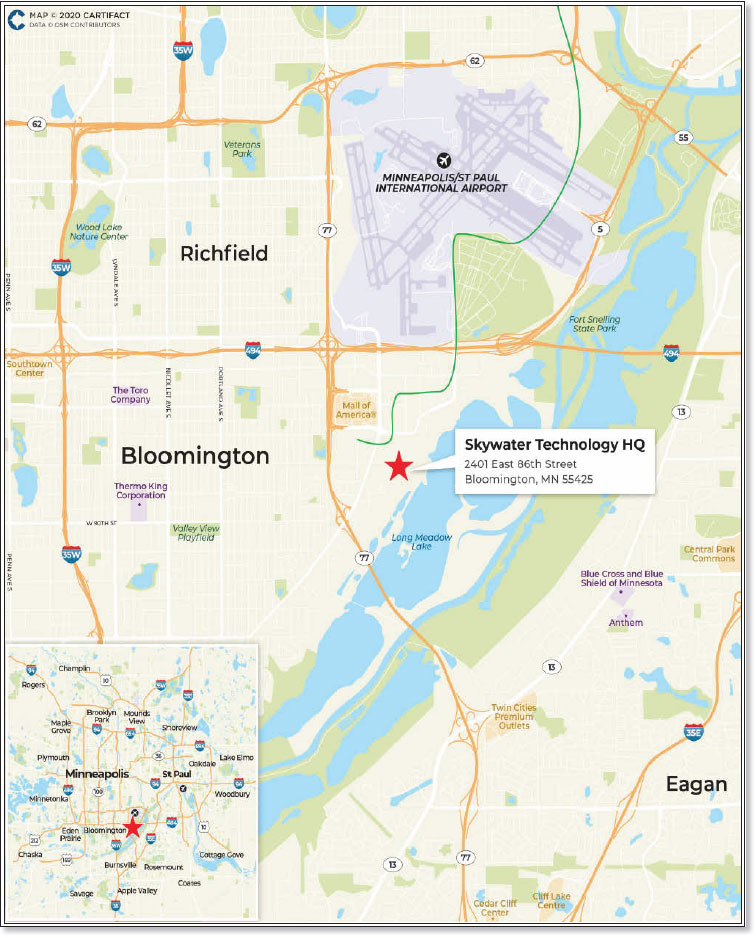

| 8 | Skywater Technology HQ | CREFI | 1 | $39,000,000 | 4.3% | 393,765 | Industrial | 1.80x | 11.5% | 49.5% | 34.8% |

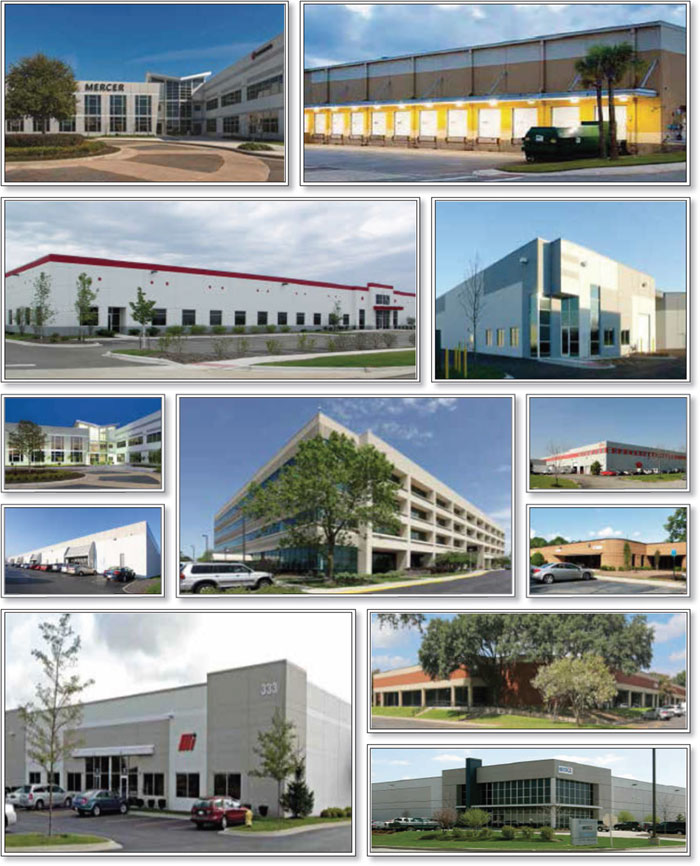

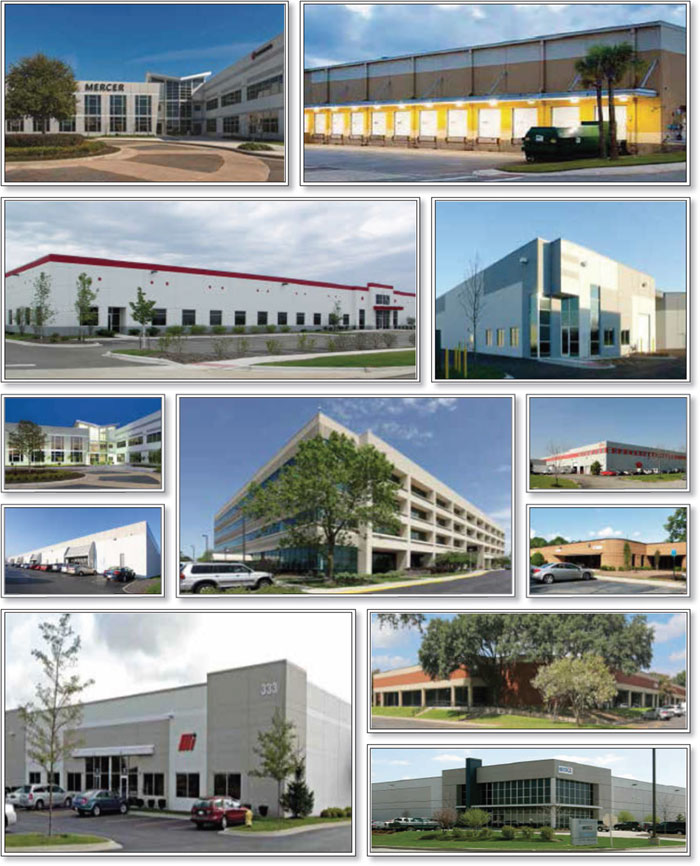

| 9 | Agellan Portfolio | JPMCB | 46 | $35,000,000 | 3.9% | 6,094,177 | Various | 3.03x | 15.7% | 41.9% | 41.9% |

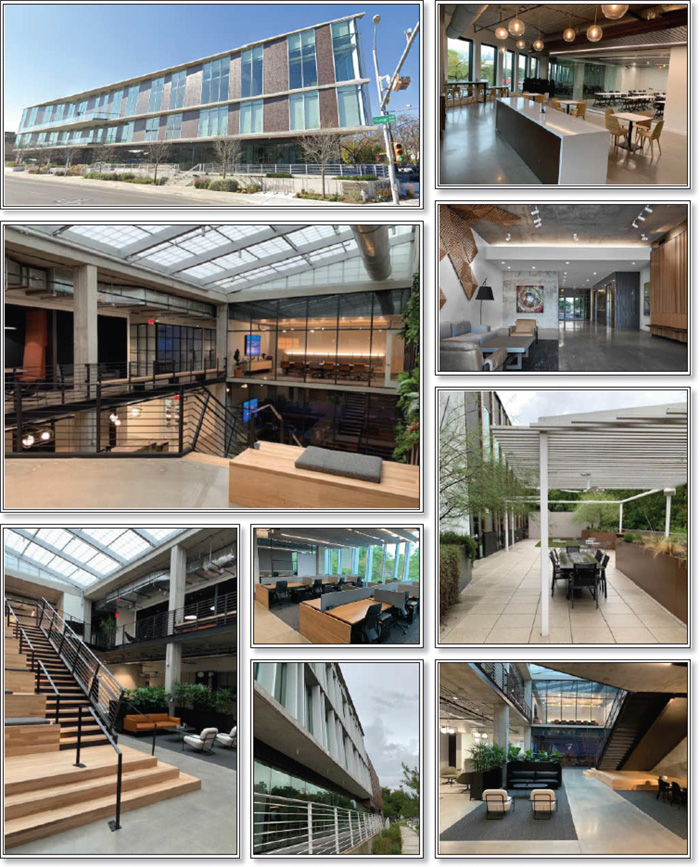

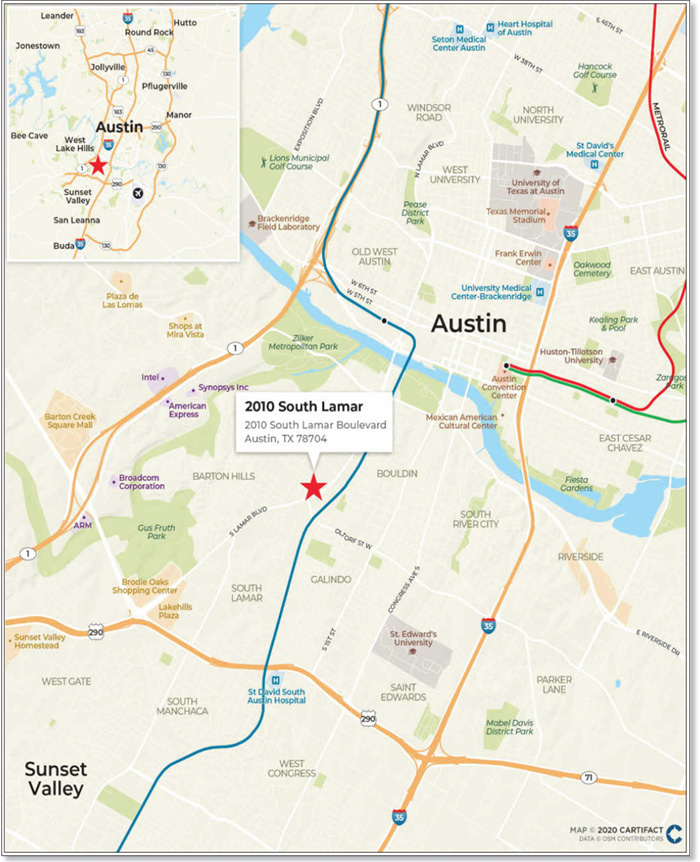

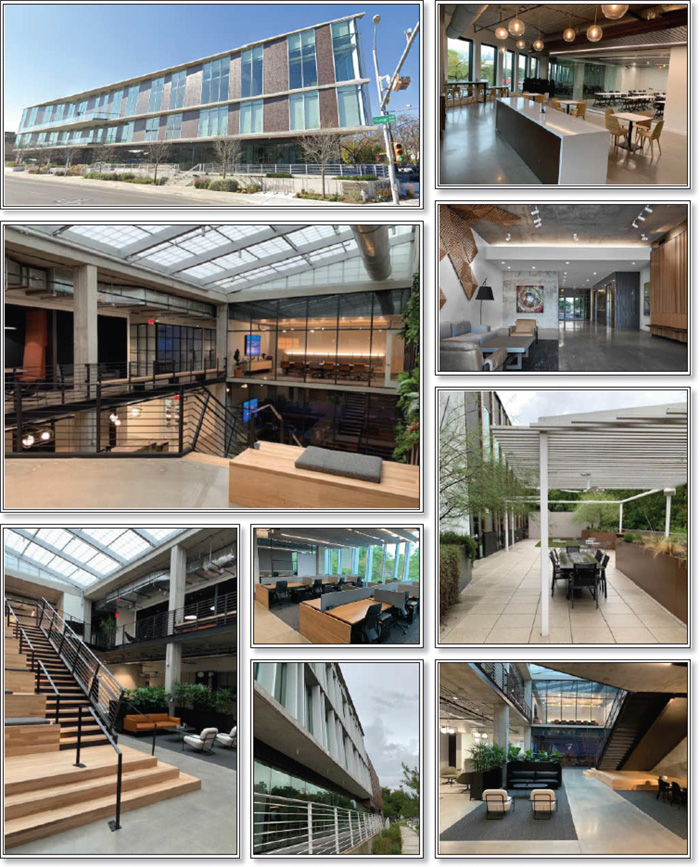

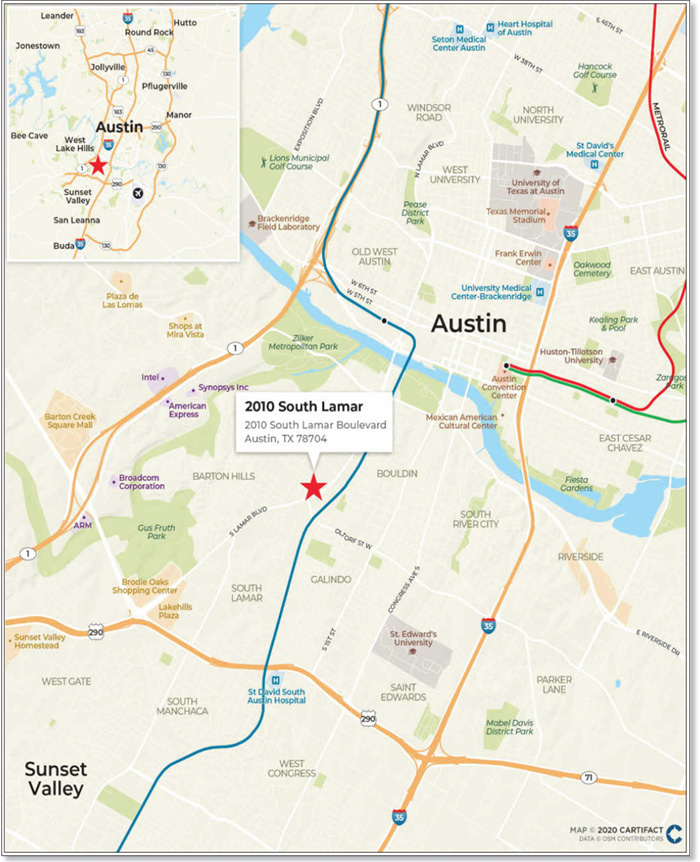

| 10 | 2010 South Lamar | CREFI | 1 | $32,100,000 | 3.6% | 80,067 | Office | 2.17x | 9.5% | 59.9% | 59.9% |

| Top 3 Total/Weighted Average | 4 | $214,850,000 | 23.8% | | | 3.72x | 13.1% | 43.4% | 43.4% |

| Top 5 Total/Weighted Average | 6 | $317,750,000 | 35.2% | | | 3.23x | 11.5% | 50.9% | 50.9% |

| Top 10 Total/Weighted Average | 58 | $503,350,000 | 55.7% | | | 3.07x | 11.6% | 51.4% | 50.3% |

| (1) | In the case of Loan Nos. 1, 2, 3, 4, 6 and 9 the UW NCF DSCR, UW NOI DY, Cut-off Date LTV and Maturity Date LTV Ratio calculations include the related Pari Passu Companion Loan(s). In the case of Loan Nos. 1, 3 and 9, the UW NCF DSCR, UW NOI DY, Cut-off Date LTV and Maturity Date LTV calculations exclude the related Subordinate Companion Loan(s) and/or related mezzanine loan(s). |

| (2) | In the case of Loan No. 3, the UW NCF DSCR and UW NOI DY are calculated based on the master lease annual rent of $292,000,000. |

| (3) | In the case of Loan Nos. 1, 3, 6 and 7, the Cut-off Date LTV and the Maturity Date LTV are calculated by using an appraised value based on certain hypothetical assumptions. Refer to “Description of the Mortgage Pool—Assessments of Property Value and Condition” and “—Appraised Value” in the Preliminary Prospectus for additional details. |

| (4) | In the case of Loan No. 3, with an anticipated repayment date, Maturity Date LTV is calculated as of the related anticipated repayment date. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

| Structural and Collateral Term Sheet | Benchmark 2020-B20 |

| Collateral Characteristics |

| |

| Companion Loan Summary |

| | | | | | | | Lead Servicer for | Master Servicer | Special Servicer |

| Loan | | | | Original | Cut-off Date | | Whole Loan | Under Lead | Under Lead |

| No. | Mortgage Loan | Note(s) | Balance ($) | Balance ($) | Holder of Note | (Y/N) | Securitization | Securitization |

| 1 | Moffett Place - | A-1-S, A-2-S | | $500,000 | $500,000 | MOFT 2020-B6 | No | | |

| | Building 6 | | | | | | | | |

| | | A-1-C1, A-1-C2, A-1-C3, A-1-C4, A-1- | | | | | | |

| | | C6 | $74,850,000 | $74,850,000 | BMARK 2020-B20 | No | | |

| | | | | | | | | | |

| | | A-1-C5-1, A-2-C | $57,750,000 | $57,750,000 | BMARK 2020-B19 | No | | |

| | | B-1, B-2(1) | | $66,900,000 | $66,900,000 | MOFT 2020-B6 | Yes(2) | KeyBank | KeyBank |

| | | Total | | $200,000,000 | $200,000,000 | | | | |

| 2 | 120 Wall Street | A-1, A-2, A-3 | | $95,000,000 | $95,000,000 | WFB | Yes | (3) | (3) |

| | | A-4, A-5, A-6, A-7 | $70,000,000 | $70,000,000 | BMARK 2020-B20 | No(3) | | |

| | | Total | | $165,000,000 | $165,000,000 | | | | |

| | MGM Grand & | | | | | | | | |

| 3 | Mandalay Bay | A-1, A-2, A-3, A-4 | $670,139 | $670,139 | BX 2020-VIVA | No | | |

| | | | | | | | | | |

| | | A-5, A-6, A-7, A-8 | $794,861 | $794,861 | BX 2020-VIV2 | No | | |

| | | A-9, A-10, A-11, A-12 | $1,000,000 | $1,000,000 | BX 2020-VIV3 | No | | |

| | | A-13-1, A-15-1 | $65,000,000 | $65,000,000 | BMARK 2020-B18 | No | | |

| | | A-14-1, A-16-1 | $69,500,000 | $69,500,000 | BBCMS 2020-C8 | No | | |

| | | A-13-2, A-15-3 | $80,000,000 | $80,000,000 | BMARK 2020-B19 | No | | |

| | | A-15-2 | | $50,000,000 | $50,000,000 | DBJPM 2020-C9 | No | | |

| | | A-16-2, A-16-3 | $301,347,000 | $301,347,000 | SocGen | No | | |

| | | A-13-4, A-15-4 | $70,000,000 | $70,000,000 | BMARK 2020-B20 | No | | |

| | | A-14-3, A-14-4 | $241,847,000 | $241,847,000 | Barclays | No | | |

| | | A-13-3, A-13-5 | $509,360,667 | $509,360,667 | CREFI | No | | |

| | | A-15-5, A-15-6 | $204,680,333 | $204,680,333 | DBRI | No | | |

| | | B-1-A, B-2-A, B-3-A, B-4-A, B-1-B, B-2-B, B-3-B, B-4-B(1) | $329,861 | $329,861 | BX 2020-VIVA | No | | |

| | | B-5-A, B-6-A, B-7-A, B-8-A, B-5-B, B-6-B, B-7-B, B-8-B(1) | $374,355,139 | $374,355,139 | BX 2020-VIV2 | No | | |

| | | B-9-A, B-10-A, B-11-A, B-12-A(1) | $429,715,000 | $429,715,000 | BX 2020-VIV3 | No | | |

| | | C-1, C-2, C-3, C-4(1) | $561,400,000 | $561,400,000 | BX 2020-VIVA | Yes(4) | KeyBank | Situs |

| | | Total | | $3,000,000,000 | $3,000,000,000 | | | | |

| 4 | 4 West 58th Street | A-1 | | $62,500,000 | $62,500,000 | BMARK 2020-B20 | Yes | Midland | Midland |

| | | A-2, A-3 | | $62,500,000 | $62,500,000 | JPMCB | No | | |

| | | Total | | $125,000,000 | $125,000,000 | | | | |

| 6 | Coleman Highline | A-1, A-3, A-5 | | $85,000,000 | $85,000,000 | BMARK 2020-B19 | Yes | Midland | Rialto |

| | | A-2 | | $30,000,000 | $30,000,000 | DBJPM 2020-C9 | No | | |

| | | A-4, A-6 | | $40,000,000 | $40,000,000 | BMARK 2020-B20 | No | | |

| | | Total | | $155,000,000 | $155,000,000 | | | | |

| (1) | Each note represents a subordinate companion loan. |

| (2) | In the case of Loan No. 1, the controlling note as of the date hereof is a related subordinate note. Upon the occurrence of certain trigger events specified in the related co-lender agreement, however, control will generally shift to a more senior note in the subject whole loan, which more senior note will thereafter be the controlling note. The more senior note may be included in another securitization trust, in which case the directing party for the related whole loan will be the party designated under the servicing agreement for such securitization trust. See “Description of the Mortgage Pool—The Whole Loans—The Non-Serviced AB Whole Loans—The Moffett Place – Building 6 Whole Loan” in the Preliminary Prospectus. |

| (3) | In the case of Loan No. 2, the whole loan is expected to be serviced under the Benchmark 2020-B20 pooling and servicing agreement until such time as the controlling note has been securitized, at which point the whole loan will be serviced under the pooling and servicing agreement related to such securitization. |

| (4) | In the case of Loan No. 3, the initial controlling note is Note C-1, so long as no related control appraisal period with respect to Note C-1 and the related pari passu C notes has occurred and is continuing. If and for so long as a control appraisal period has occurred and is continuing, then the controlling note will be as described under “Description of the Mortgage Pool—The Whole Loans—The Non-Serviced AB Whole Loans—The MGM Grand & Mandalay Bay Pari Passu-AB Whole Loan” in the Preliminary Prospectus. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

| Structural and Collateral Term Sheet | Benchmark 2020-B20 |

| Collateral Characteristics |

| | | | | | | Lead | Master | Special |

| | | | | | | Servicer for | Servicer | Servicer Under |

| Loan | | | Original | Cut-off Date | | Whole Loan | Under Lead | Lead |

| No. | Mortgage Loan | Note(s) | Balance ($) | Balance ($) | Holder of Note | (Y/N) | Securitization | Securitization |

| 9 | Agellan Portfolio | A-1 | $75,000,000 | $75,000,000 | BMARK 2020-B18 | No | | |

| | | A-2, A-6 | $61,000,000 | $61,000,000 | DBJPM 2020-C9 | No | | |

| | | A-3, A-4 | $60,000,000 | $60,000,000 | BMARK 2020-B19 | No | | |

| | | A-5, A-7 | $35,000,000 | $35,000,000 | BMARK 2020-B20 | No | | |

| | | B Note(1) | $172,000,000 | $172,000,000 | BMARK 2020-B18 | Yes(2) | Midland | Midland |

| | | Total | $403,000,000 | $403,000,000 | | | | |

| 11 | 333 South Wabash | A-1 (AGL, AGL-Fortitude) | $91,000,000 | $91,000,000 | AGL | | | |

| | | A-1 (VALIC) | $35,000,000 | $35,000,000 | VALIC | | | |

| | | A-2-A | $30,000,000 | $30,000,000 | BMARK 2020-B20 | | | |

| | | A-2-B | $50,000,000 | $50,000,000 | BMARK 2020-B19 | Yes(3) | Midland | Rialto |

| | | A-2-C | $20,000,000 | $20,000,000 | DBJPM 2020-C9 | | | |

| | | A-1 (AHAC, AHAC- | $11,200,000 | $11,200,000 | AHAC | | | |

| | | Fortitude) | | | | | | |

| | | A-1 (NUFI-Fortitude) | $2,800,000 | $2,800,000 | NUFI | | | |

| | | Total | $240,000,000 | $240,000,000 | | | | |

| | Redmond Town | | | | | | | |

| 12 | Center | A-1-1, A-2 | $30,000,000 | $30,000,000 | BMARK 2020-B19 | Yes | Midland | Rialto |

| | | A-1-2-A, A-1-2-B, A-3-2 | $41,500,000 | $41,500,000 | CREFI | No | | |

| | | A-3-1, A-4 | $30,000,000 | $30,000,000 | BMARK 2020-B20 | No | | |

| | | Total | $101,500,000 | $101,500,000 | | | | |

| 16 | USAA Plano | A-1 | $38,600,000 | $38,600,000 | BMARK 2020-B19 | Yes | Midland | Rialto |

| | | A-2 | $25,000,000 | $25,000,000 | BMARK 2020-B20 | No | | |

| | | Total | $63,600,000 | $63,600,000 | | | | |

| 17 | The Hub | A-1 | $25,000,000 | $25,000,000 | BMARK 2020-B20 | Yes | Midland | Midland |

| | | A-2 | 19,205,881 | 19,205,881 | GSBI | No | | |

| | | Total | $44,205,881 | $44,205,881 | | | | |

| 18 | Troy Technology Park | A-1 | $25,000,000 | $25,000,000 | BMARK 2020-B20 | Yes | Midland | Midland |

| | | A-2 | $20,000,000 | $20,000,000 | JPMCB | No | | |

| | | | $45,000,000 | $45,000,000 | | | | |

| | | Total | | | | | | |

| 19 | Amazon Industrial Portfolio | A-1 | $80,000,000 | $80,000,000 | BMARK 2020-B19 | Yes | Midland | Rialto |

| | | A-2 | $35,000,000 | $35,000,000 | DBJPM 2020-C9 | No | | |

| | | A-3 | $24,100,000 | $24,100,000 | BMARK 2020-B20 | No | | |

| | | Total | $139,100,000 | $139,100,000 | | | | |

| 23 | 711 Fifth Avenue | A-1-1, A-1-10 | $62,500,000 | $62,500,000 | GSMS 2020-GC47 | Yes | Wells Fargo | KeyBank |

| | | A-1-2, A-1-3, A-1-4, A-1-5- | $184,000,000 | $184,000,000 | GSBI | No | | |

| | | A, A-1-5-C, A-1-16, A-1-17 | | | | | | |

| | | A-1-5-B | $15,000,000 | $15,000,000 | BMARK 2020-B20 | No | | |

| | | A-1-6, A-1-7 | $40,000,000 | $40,000,000 | JPMDB 2020-COR7 | No | | |

| | | A-1-8, A-1-13, A-1-9 | $45,000,000 | $45,000,000 | BMARK 2020-B18 | No | | |

| | | A-1-11, A-1-12, A-1-14 | $25,000,000 | $25,000,000 | DBJPM 2020-C9 | No | | |

| | | A-1-15 | $10,000,000 | $10,000,000 | BMARK 2020-B19 | No | | |

| | | A-2-1 | $60,000,000 | $60,000,000 | BANK 2020-BNK28 | No | | |

| | | A-2-2 | $43,000,000 | $43,000,000 | BANK 2020-BNK27 | No | | |

| | | A-2-3, A-2-4 | $60,500,000 | $60,500,000 | BANA | No | | |

| | | Total | $545,000,000 | $545,000,000 | | | | |

| (1) | Each note represents a subordinate companion loan. |

| (2) | In the case of Loan No. 9, the initial controlling note is Note B, for so long as no control appraisal period with respect to Note B is continuing. See “Description of the Mortgage Pool—The Whole Loans The Non-Serviced AB Whole Loans—The Agellan Portfolio Whole Loan” in the Preliminary Prospectus. The Agellan Portfolio Whole Loan will be serviced under the pooling and servicing agreement for the Benchmark 2020-B18 transaction. |

| (3) | In the case of Loan No. 11, The controlling note is A-2-B; however, so long as AGL, VALIC, AHAC and NUFI (collectively, the “Life Company Lenders”) hold at least $75,000,000 in outstanding principal balance of the 333 South Wabash whole loan, Asset Management (U.S.), LLC (“AIG”) is irrevocably appointed as the controlling note holder representative with the ability to exercise all rights of the Controlling Note holder. Accordingly, for purposes of discussing the rights of the directing holder and related matters in this Term Sheet, the notes evidencing the portion of the 333 South Wabash whole loan held by the Life Company Lenders will be deemed to collectively constitute the related Controlling Note. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

| Structural and Collateral Term Sheet | Benchmark 2020-B20 |

| Collateral Characteristics |

| |

| Additional Debt Summary |

No. | Loan Name | Trust Cut-off Date Balance | Subordinate Debt Cut-off Date Balance(1) | Total Debt Cut-off Date Balance | Mortgage Loan UW NCF DSCR(2)(3) | Total Debt UW NCF DSCR(3) | Mortgage Loan Cut-off Date LTV(2)(4) | Total Debt Cut-off Date LTV(4) | Mortgage Loan UW NOI DY(2)(3) | Total Debt UW NOI DY(3) |

| 1 | Moffett Place - Building 6 | $74,850,000 | $115,900,000 | $249,000,000 | 3.50x | 1.59x | 37.1% | 69.3% | 12.2% | 6.5% |

| 3 | MGM Grand & Mandalay Bay | $70,000,000 | $1,365,800,000 | $3,000,000,000 | 4.95x | 2.70x | 35.5% | 65.2% | 17.9% | 9.7% |

| 9 | Agellan Portfolio | $35,000,000 | $203,000,000 | $434,000,000 | 3.03x | 1.54x | 41.9% | 78.8% | 15.7% | 8.3% |

| 17 | The Hub | $25,000,000 | $2,560,000 | $46,765,881 | 3.04x | 2.76x | 54.7% | 57.9% | 11.1% | 10.5% |

| (1) | In the case of Loan Nos. 3 and 17, Subordinate Debt Cut-off Date Balance represents one or more Subordinate Companion Loans. In the case of Loan Nos. 1 and 9, Subordinate Debt Cut-off Date Balance represents one or more Subordinate Companion Loans and one or more mezzanine loans. |

| (2) | In the case of Loan Nos. 1, 3, 9 and 17, the Mortgage Loan UW NCF DSCR, Mortgage Loan UW NOI DY and Mortgage Loan Cut-off Date LTV calculations include the related Pari Passu Companion Loan(s). In the case of Loan Nos. 1, 3, 9 and 17, the Mortgage Loan UW NCF DSCR, Mortgage Loan UW NOI DY and Mortgage Loan Cut-off Date LTV calculations exclude the related Subordinate Companion Loan(s) and/or related mezzanine loan(s). |

| (3) | In the case of Loan No. 3, the Mortgage Loan UW NCF DSCR, Total Debt UW NCF DSCR, Mortgage Loan UW NOI DY and Total Debt UW NOI DY are calculated based on the master lease annual rent of $292,000,000. |

| (4) | In the case of Loan Nos. 1 and 3, the Mortgage Loan Cut-off Date LTV and Total Debt Cut-Off Date LTV are calculated by using an appraised value based on certain hypothetical assumptions. Refer to “Description of the Mortgage Pool—Assessments of Property Value and Condition” and “—Appraised Value” in the Preliminary Prospectus for additional details. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

| Structural and Collateral Term Sheet | Benchmark 2020-B20 |

| Collateral Characteristics |

| |

| Mortgaged Properties by Type(1) |

| | | | | | Weighted Average |

| | | | Cut-off Date | | | UW | UW | Cut-off | Maturity |

| | | Number of | Principal | % of | | NCF | NOI | Date | Date LTV |

| Property Type | Property Subtype | Properties | Balance | IPB | Occupancy | DSCR(2)(3) | DY(2)(3) | LTV(2)(3)(4) | (2)(3)(4)(5) |

| Office | CBD | 9 | $279,342,804 | 30.9% | 95.7% | 2.86x | 10.4% | 53.8% | 53.8% |

| | Suburban | 9 | 173,980,645 | 19.3 | 95.6% | 2.78x | 11.0% | 57.9% | 54.1% |

| | Medical | 1 | 9,500,000 | 1.1 | 100.0% | 2.36x | 9.3% | 60.1% | 60.1% |

| | Subtotal: | 19 | $462,823,449 | 51.2% | 95.7% | 2.82x | 10.6% | 55.5% | 54.0% |

| | | | | | | | | | |

| Mixed Use | Office/Retail | 2 | $77,500,000 | 8.6% | 95.5% | 2.13x | 7.8% | 66.5% | 66.5% |

| | Retail/Office | 2 | 55,000,000 | 6.1 | 96.1% | 2.36x | 10.9% | 61.5% | 59.5% |

| | Industrial/Office | 1 | 25,000,000 | 2.8 | 85.8% | 1.66x | 9.2% | 72.9% | 60.9% |

| | Medical/Retail | 1 | 20,400,000 | 2.3 | 83.6% | 2.06x | 9.1% | 58.2% | 58.2% |

| | Multifamily/Retail | 1 | 5,700,000 | 0.6 | 100.0% | 2.08x | 8.6% | 48.7% | 48.7% |

| | Multifamily/Office | 1 | 2,300,000 | 0.3 | 100.0% | 1.90x | 8.0% | 50.0% | 50.0% |

| | Subtotal: | 8 | $185,900,000 | 20.6% | 93.2% | 2.12x | 9.1% | 64.2% | 62.0% |

| | | | | | | | | | |

| Industrial | Flex/R&D | 3 | $64,130,250 | 7.1% | 98.3% | 1.77x | 11.0% | 56.0% | 42.3% |

| | Warehouse/Distribution | 20 | 38,437,841 | 4.3 | 98.2% | 2.62x | 10.9% | 56.2% | 56.2% |

| | Flex | 23 | 13,120,223 | 1.5 | 89.9% | 3.03x | 15.7% | 41.9% | 41.9% |

| | Manufacturing | 1 | 6,186,126 | 0.7 | 100.0% | 2.11x | 11.3% | 59.5% | 48.9% |

| | Warehouse | 1 | 168,486 | 0.0 | 100.0% | 3.03x | 15.7% | 41.9% | 41.9% |

| | Subtotal: | 48 | $122,042,927 | 13.5% | 97.4% | 2.19x | 11.5% | 54.7% | 47.0% |

| | | | | | | | | | |

| Hotel | Full Service | 2 | $70,000,000 | 7.7% | 87.5% | 4.95x | 17.9% | 35.5% | 35.5% |

| | Subtotal: | 2 | $70,000,000 | 7.7% | 87.5% | 4.95x | 17.9% | 35.5% | 35.5% |

| | | | | | | | | | |

| Self Storage | Self Storage | 8 | $36,722,500 | 4.1% | 85.4% | 2.00x | 9.3% | 62.4% | 55.3% |

| | Subtotal: | 8 | $36,722,500 | 4.1% | 85.4% | 2.00x | 9.3% | 62.4% | 55.3% |

| | | | | | | | | | |

| Retail | Anchored | 1 | $7,800,000 | 0.9% | 98.9% | 1.81x | 11.5% | 65.0% | 59.0% |

| | Other | 1 | 7,250,000 | 0.8 | 100.0% | 2.97x | 10.7% | 54.1% | 54.1% |

| | Subtotal: | 2 | $15,050,000 | 1.7% | 99.4% | 2.37x | 11.1% | 59.7% | 56.6% |

| | | | | | | | | | |

| Multifamily | Mid-Rise | 1 | $5,800,000 | 0.6% | 100.0% | 1.85x | 7.5% | 63.7% | 63.7% |

| | Garden | 1 | 5,150,000 | 0.6 | 100.0% | 2.48x | 9.8% | 55.1% | 55.1% |

| | Subtotal: | 2 | $10,950,000 | 1.2% | 100.0% | 2.15x | 8.6% | 59.7% | 59.7% |

| | | | | | | | | | |

| | Total / Weighted Average: | 89 | $903,488,876 100.0% | 94.5% | 2.71x | 10.9% | 56.0% | 53.5% |

| (1) | Because this table presents information relating to the mortgaged properties and not mortgage loans, the information for mortgage loans secured by more than one mortgaged property is based on allocated loan amounts. |

| (2) | In the case of Loan Nos. 1, 2, 3, 4, 6, 9, 11, 12, 16, 17, 18, 19 and 23, the UW NCF DSCR, UW NOI DY, Cut-off Date LTV and Maturity Date LTV Ratio calculations include the related Pari Passu Companion Loan(s). In the case of Loan Nos. 1, 3, 9 and 17, the UW NCF DSCR, UW NOI DY, Cut-off Date LTV and Maturity Date LTV calculations exclude the related Subordinate Companion Loan(s) and/or related mezzanine loan(s). |

| (3) | In the case of Loan No. 21, the UW NOI DY, Cut-off Date LTV and Maturity Date LTV are calculated net of a holdback reserve. In the case of Loan No. 3, the UW NCF DSCR and UW NOI DY are calculated based on the master lease annual rent of $292,000,000. |

| (4) | In the case of Loan Nos. 1, 3, 6, 7, 16, 18, and 20, the Cut-off Date LTV and the Maturity Date LTV are calculated by using an appraised value based on certain hypothetical assumptions. Refer to “Description of the Mortgage Pool—Assessments of Property Value and Condition” and “—Appraised Value” in the Preliminary Prospectus for additional details. |

| (5) | In the case of Loan Nos. 3 and 16, with an anticipated repayment date, Maturity Date LTV is calculated as of the related anticipated repayment date. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

| Structural and Collateral Term Sheet | Benchmark 2020-B20 |

| Collateral Characteristics |

| |

| Mortgaged Properties by Location(1) |

State | Number of Properties | Cut-off Date

Principal

Balance | % of IPB | Weighted Average |

Occupancy | UW NCF DSCR(2)(3) | UW NOI DY(2)(3) | Cut-off Date

LTV(2)(3)(4) | Maturity Date

LTV (2)(3)(4)(5) |

| California | 10 | $241,580,250 | 26.7% | 94.0% | 3.00x | 10.9% | 51.7% | 50.0% |

| New York | 7 | 186,300,000 | 20.6 | 96.3% | 2.47x | 8.8% | 60.9% | 60.9% |

| Texas | 24 | 95,050,993 | 10.5 | 97.9% | 2.50x | 11.5% | 56.4% | 53.5% |

| Nevada | 2 | 70,000,000 | 7.7 | 87.5% | 4.95x | 17.9% | 35.5% | 35.5% |

| Michigan | 3 | 56,194,169 | 6.2 | 91.2% | 1.79x | 10.2% | 66.7% | 58.0% |

| Minnesota | 2 | 49,300,000 | 5.5 | 97.8% | 1.83x | 11.6% | 53.3% | 39.8% |

| Illinois | 11 | 43,553,474 | 4.8 | 92.2% | 2.83x | 11.0% | 58.3% | 58.3% |

| Arizona | 1 | 40,400,000 | 4.5 | 100.0% | 2.58x | 9.4% | 62.6% | 62.6% |

| Washington | 3 | 40,290,000 | 4.5 | 92.2% | 1.83x | 10.3% | 65.7% | 61.2% |

| Florida | 2 | 16,551,136 | 1.8 | 100.0% | 2.55x | 10.1% | 58.6% | 58.6% |

| Kansas | 1 | 11,959,907 | 1.3 | 100.0% | 2.38x | 8.0% | 64.7% | 64.7% |

| Idaho | 3 | 11,887,500 | 1.3 | 84.6% | 1.41x | 8.6% | 67.5% | 54.2% |

| Alabama | 1 | 7,800,000 | 0.9 | 98.9% | 1.81x | 11.5% | 65.0% | 59.0% |

| Louisiana | 1 | 7,080,000 | 0.8 | 91.7% | 2.87x | 10.2% | 58.8% | 58.8% |

| Wisconsin | 1 | 6,186,126 | 0.7 | 100.0% | 2.11x | 11.3% | 59.5% | 48.9% |

| New Jersey | 1 | 5,200,000 | 0.6 | 86.6% | 2.55x | 10.1% | 54.9% | 54.9% |

| Pennsylvania | 1 | 4,800,000 | 0.5 | 85.7% | 2.55x | 10.1% | 54.9% | 54.9% |

| Georgia | 9 | 3,944,665 | 0.4 | 95.2% | 3.03x | 15.7% | 41.9% | 41.9% |

| Oregon | 1 | 2,615,000 | 0.3 | 78.9% | 1.41x | 8.6% | 67.5% | 54.2% |

| Indiana | 1 | 1,534,615 | 0.2 | 100.0% | 3.03x | 15.7% | 41.9% | 41.9% |

| Ohio | 2 | 582,754 | 0.1 | 55.2% | 3.03x | 15.7% | 41.9% | 41.9% |

| Maryland | 1 | 464,640 | 0.1 | 92.2% | 3.03x | 15.7% | 41.9% | 41.9% |

| Kentucky | 1 | 213,648 | 0.0 | 100.0% | 3.03x | 15.7% | 41.9% | 41.9% |

| Total / Weighted Average: | 89 | $903,488,876 | 100.0% | 94.5% | 2.71x | 10.9% | 56.0% | 53.5% |

| (1) | Because this table presents information relating to the mortgaged properties and not mortgage loans, the information for mortgage loans secured by more than one mortgaged property is based on allocated loan amounts. |

| (2) | In the case of Loan Nos. 1, 2, 3, 4, 6, 9, 11, 12, 16, 17, 18, 19 and 23, the UW NCF DSCR, UW NOI DY, Cut-off Date LTV and Maturity Date LTV Ratio calculations include the related Pari Passu Companion Loan(s). In the case of Loan Nos. 1, 3, 9 and 17, the UW NCF DSCR, UW NOI DY, Cut-off Date LTV and Maturity Date LTV calculations exclude the related Subordinate Companion Loan(s) and/or related mezzanine loan(s). |

| (3) | In the case of Loan No. 21, the UW NOI DY, Cut-off Date LTV and Maturity Date LTV are calculated net of a holdback reserve. In the case of Loan No. 3, the UW NCF DSCR and UW NOI DY are calculated based on the master lease annual rent of $292,000,000. |

| (4) | In the case of Loan Nos. 1, 3, 6, 7, 16, 18, and 20, the Cut-off Date LTV and the Maturity Date LTV are calculated by using an appraised value based on certain hypothetical assumptions. Refer to “Description of the Mortgage Pool—Assessments of Property Value and Condition” and “—Appraised Value” in the Preliminary Prospectus for additional details. |

| (5) | In the case of Loan Nos. 3 and 16, with an anticipated repayment date, Maturity Date LTV is calculated as of the related anticipated repayment date. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

| Structural and Collateral Term Sheet | Benchmark 2020-B20 |

| Collateral Characteristics |

| |

| Cut-off Date Principal Balance |

Range of Cut-off Date Principal Balances | Number of

Loans | Cut-off Date

Principal

Balance | % of IPB | Weighted Average |

Mortgage

Rate | Remaining

Loan

Term(1) | UW

NCF DSCR(2)(3) | UW

NOI

DY(2)(3) | Cut-off

Date

LTV(2)(3)(4) | Maturity

Date

LTV(1)(2)(3)(4) |

| $2,300,000 - | $9,999,999 | 9 | $56,766,126 | 6.3% | 3.71571% | 110 | 2.31x | 9.8% | 58.1% | 56.2% |

| $10,000,000 - | $19,999,999 | 4 | 54,942,500 | 6.1 | 3.83999% | 118 | 2.12x | 9.7% | 61.7% | 55.2% |

| $20,000,000 - | $24,999,999 | 3 | 66,100,000 | 7.3 | 3.55261% | 111 | 2.22x | 9.7% | 63.2% | 59.0% |

| $25,000,000 - | $49,999,999 | 14 | 448,330,250 | 49.6 | 3.59549% | 103 | 2.52x | 10.8% | 58.2% | 54.7% |

| $50,000,000 - | $74,850,000 | 4 | 277,350,000 | 30.7 | 3.44446% | 116 | 3.32x | 11.8% | 49.2% | 49.2% |

| Total / Wtd. Avg: | 34 | $903,488,876 | 100.0% | 3.56841% | 109 | 2.71x | 10.9% | 56.0% | 53.5% |

Range of Mortgage Interest Rates | Number of Loans | Cut-off Date

Principal

Balance | % of IPB | Weighted Average |

Mortgage

Rate | Remaining

Loan

Term(1) | UW

NCF DSCR(2)(3) | UW

NOI

DY(2)(3) | Cut-off

Date

LTV(2)(3)(4) | Maturity

Date

LTV(1)(2)(3)(4) |

| 2.80000% - | 3.00000% | 1 | $40,000,000 | 4.4% | 2.80000% | 119 | 3.64x | 10.3% | 50.8% | 50.8% |

| 3.00001% - | 3.50000% | 10 | 307,966,126 | 34.1 | 3.29246% | 118 | 2.88x | 10.7% | 52.0% | 50.0% |

| 3.50001% - | 4.00000% | 17 | 450,480,250 | 49.9 | 3.65316% | 108 | 2.61x | 10.9% | 59.4% | 56.4% |

| 4.00001% - | 4.50000% | 5 | 70,042,500 | 7.8 | 4.14594% | 97 | 1.91x | 9.5% | 61.9% | 56.9% |

| 4.50001% - | 4.62820% | 1 | 35,000,000 | 3.9 | 4.62820% | 58 | 3.03x | 15.7% | 41.9% | 41.9% |

| Total / Wtd. Avg: | 34 | $903,488,876 | 100.0% | 3.56841% | 109 | 2.71x | 10.9% | 56.0% | 53.5% |

| Original Term to Maturity in Months |

Original Term to Maturity in Months | Number of Loans | Cut-off Date

Principal

Balance | % of IPB | Weighted Average |

Mortgage

Rate | Remaining

Loan

Term(1) | UW

NCF DSCR(2)(3) | UW

NOI

DY(2)(3) | Cut-off

Date

LTV(2)(3)(4) | Maturity

Date

LTV(1)(2)(3)(4) |

| 60 | 4 | $73,000,000 | 8.1% | 4.24284% | 56 | 2.41x | 12.8% | 53.1% | 51.6% |

| 84 | 2 | 72,500,000 | 8.0 | 3.81237% | 84 | 2.40x | 9.4% | 61.4% | 61.4% |

| 96 | 1 | 30,000,000 | 3.3 | 3.53000% | 95 | 2.75x | 10.1% | 62.8% | 62.8% |

| 107 | 1 | 24,100,000 | 2.7 | 3.25000% | 105 | 2.38x | 8.0% | 64.7% | 64.7% |

| 110 | 1 | 21,600,000 | 2.4 | 3.71800% | 110 | 2.19x | 12.3% | 66.3% | 53.5% |

| 120 | 25 | 682,288,876 | 75.5 | 3.47853% | 118 | 2.80x | 11.0% | 54.8% | 52.0% |

| Total / Wtd. Avg: | 34 | $903,488,876 | 100.0% | 3.56841% | 109 | 2.71x | 10.9% | 56.0% | 53.5% |

| Remaining Term to Maturity in Months(1) |

| | Weighted Average |

Range of Remaining Term to Maturity in Months | Number of

Loans | Cut-off Date

Principal

Balance | % of IPB | Mortgage Rate | Remaining

Loan

Term(1) | UW

NCF DSCR(2)(3) | UW

NOI

DY(2)(3) | Cut-off

Date

LTV(2)(3)(4) | Maturity

Date

LTV(1)(2)(3)(4) |

| 53 - | 60 | 4 | $73,000,000 | 8.1% | 4.24284% | 56 | 2.41x | 12.8% | 53.1% | 51.6% |

| 61 - | 84 | 2 | 72,500,000 | 8.0 | 3.81237% | 84 | 2.40x | 9.4% | 61.4% | 61.4% |

| 85 - | 119 | 10 | 370,850,000 | 41.0 | 3.44319% | 113 | 3.21x | 11.6% | 51.7% | 50.8% |

| 120 - | 120 | 18 | 387,138,876 | 42.8 | 3.51551% | 120 | 2.34x | 10.2% | 59.7% | 54.9% |

| Total / Wtd. Avg: | | 34 | $903,488,876 | 100.0% | 3.56841% | 109 | 2.71x | 10.9% | 56.0% | 53.5% |

| (1) | In the case of Loan Nos. 3 and 16, with an anticipated repayment date, Remaining Loan Term and Maturity Date LTV is calculated as of the related anticipated repayment date. |

| (2) | In the case of Loan Nos. 1, 2, 3, 4, 6, 9, 11, 12, 16, 17, 18, 19 and 23, the UW NCF DSCR, UW NOI DY, Cut-off Date LTV and Maturity Date LTV calculations include the related Pari Passu Companion Loan(s). In the case of Loan Nos. 1, 3, 9 and 17, the UW NCF DSCR, UW NOI DY, Cut-off Date LTV and Maturity Date LTV calculations exclude the related Subordinate Companion Loan(s) and/or related mezzanine loan(s). |

| (3) | In the case of Loan No. 21, the UW NOI DY, Cut-off Date LTV and Maturity Date LTV are calculated net of a holdback reserve. In the case of loan No. 3, the UW NCF DSCR, UW NOI DY are calculated based on the master lease annual rent of $292,000,000. |

| (4) | In the case of Loan Nos. 1, 3, 6, 7, 16, 18 and 20, the Cut-off Date LTV and the Maturity Date LTV are calculated by using an appraised value based on certain hypothetical assumptions. Refer to “Description of the Mortgage Pool—Assessments of Property Value and Condition” and “—Appraised Value” in the Preliminary Prospectus for additional details. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

| Structural and Collateral Term Sheet | Benchmark 2020-B20 |

| Collateral Characteristics |

| |

| Original Amortization Term in Months |

| | Weighted Average |

Original Amortization Term in Months | Number

of Loans | Cut-off Date

Principal

Balance | % of IPB | Mortgage

Rate | Remaining

Loan

Term(1) | UW NCF DSCR(2)(3) | UW

NOI

DY(2)(3) | Cut-off

Date

LTV(2)(3)(4) | Maturity

Date

LTV(1)(2)(3)(4) |

| Interest Only | 24 | $685,630,000 | 75.9% | 3.52361% | 109 | 3.00x | 11.0% | 53.7% | 53.7% |

| 300 | - | 300 | 1 | 39,000,000 | 4.3 | 3.44000% | 120 | 1.80x | 11.5% | 49.5% | 34.8% |

| 360 | - | 360 | 9 | 178,858,876 | 19.8 | 3.76816% | 107 | 1.77x | 10.3% | 66.4% | 56.7% |

| Total / Wtd. Avg: | | 34 | $903,488,876 | 100.0% | 3.56841% | 109 | 2.71x | 10.9% | 56.0% | 53.5% |

| Remaining Amortization Term in Months |

| | Weighted Average |

Range of Remaining Amortization Term in Months | Number

of Loans | Cut-off Date

Principal

Balance | % of IPB | Mortgage

Rate | Remaining

Loan

Term(1) | UW NCF DSCR(2)(3) | UW

NOI

DY(2)(3) | Cut-off

Date

LTV(2)(3)(4) | Maturity

Date

LTV(1)(2)(3)(4) |

| Interest Only | 24 | $685,630,000 | 75.9% | 3.52361% | 109 | 3.00x | 11.0% | 53.7% | 53.7% |

| 300 | - | 300 | 1 | 39,000,000 | 4.3 | 3.44000% | 120 | 1.80x | 11.5% | 49.5% | 34.8% |

| 360 | - | 360 | 9 | 178,858,876 | 19.8 | 3.76816% | 107 | 1.77x | 10.3% | 66.4% | 56.7% |

| Total / Wtd. Avg: | | 34 | $903,488,876 | 100.0% | 3.56841% | 109 | 2.71x | 10.9% | 56.0% | 53.5% |

Amortization Types | Number

of Loans | Cut-off Date

Principal

Balance | % of IPB | Weighted Average |

Mortgage

Rate | Remaining

Loan

Term(1) | UW

NCF DSCR(2)(3) | UW

NOI

DY(2)(3) | Cut-off

Date

LTV(2)(3)(4) | Maturity

Date

LTV(1)(2)(3)(4) |

| Interest Only | 22 | $590,630,000 | 65.4% | 3.51528% | 108 | 2.78x | 10.2% | 55.8% | 55.8% |

| IO-Balloon | 6 | 109,286,126 | 12.1 | 3.72708% | 101 | 1.81x | 10.6% | 66.6% | 59.3% |

| Balloon | 4 | 108,572,750 | 12.0 | 3.69163% | 118 | 1.75x | 10.5% | 60.1% | 46.2% |

| ARD-Interest Only | 2 | 95,000,000 | 10.5 | 3.57537% | 115 | 4.39x | 16.0% | 40.1% | 40.1% |

| Total / Wtd. Avg: | 34 | $903,488,876 | 100.0% | 3.56841% | 109 | 2.71x | 10.9% | 56.0% | 53.5% |

| Underwritten Net Cash Flow Debt Service Coverage Ratios(2)(3) |

| | Weighted Average |

Range of Underwritten Net Cash Flow Debt Service Coverage Ratios | Number of Loans | Cut-off Date

Principal

Balance | % of IPB | Mortgage

Rate | Remaining

Loan

Term(1) | UW

NCF DSCR(2)(3) | UW

NOI

DY(2)(3) | Cut-off

Date

LTV(2)(3)(4) | Maturity

Date

LTV(1)(2)(3)(4) |

| 1.41x - | 1.49x | 1 | $19,642,500 | 2.2% | 4.28000% | 120 | 1.41x | 8.6% | 67.5% | 54.2% |

| 1.50x - | 1.74x | 2 | 53,330,250 | 5.9 | 3.64750% | 120 | 1.61x | 9.1% | 68.7% | 55.6% |

| 1.75x - | 1.99x | 8 | 187,700,000 | 20.8 | 3.68445% | 106 | 1.86x | 9.8% | 63.1% | 57.7% |

| 2.00x - | 2.24x | 5 | 85,986,126 | 9.5 | 3.85904% | 100 | 2.14x | 10.2% | 60.3% | 56.4% |

| 2.25x - | 4.95x | 18 | 556,830,000 | 61.6 | 3.45174% | 110 | 3.23x | 11.7% | 51.3% | 51.3% |

| Total / Wtd. Avg: | | 34 | $903,488,876 | 100.0% | 3.56841% | 109 | 2.71x | 10.9% | 56.0% | 53.5% |

| (1) | In the case of Loan Nos. 3 and 16, with an anticipated repayment date, Remaining Loan Term and Maturity Date LTV is calculated as of the related anticipated repayment date. |

| (2) | In the case of Loan Nos. 1, 2, 3, 4, 6, 9, 11, 12, 16, 17, 18, 19 and 23, the UW NCF DSCR, UW NOI DY, Cut-off Date LTV and Maturity Date LTV calculations include the related Pari Passu Companion Loan(s). In the case of Loan Nos. 1, 3, 9 and 17, the UW NCF DSCR, UW NOI DY, Cut-off Date LTV and Maturity Date LTV calculations exclude the related Subordinate Companion Loan(s) and/or related mezzanine loan(s). |

| (3) | In the case of Loan No. 21, the UW NOI DY, Cut-off Date LTV and Maturity Date LTV are calculated net of a holdback reserve. In the case of loan No. 3, the UW NCF DSCR, UW NOI DY are calculated based on the master lease annual rent of $292,000,000. |

| (4) | In the case of Loan Nos. 1, 3, 6, 7, 16, 18 and 20, the Cut-off Date LTV and the Maturity Date LTV are calculated by using an appraised value based on certain hypothetical assumptions. Refer to “Description of the Mortgage Pool—Assessments of Property Value and Condition” and “—Appraised Value” in the Preliminary Prospectus for additional details. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

| Structural and Collateral Term Sheet | Benchmark 2020-B20 |

| Collateral Characteristics |

| |

| LTV Ratios as of the Cut-off Date(2)(3)(4) |

| | Weighted Average |

Range of Cut-off Date LTVs | Number of Loans | Cut-off Date

Principal Balance | % of IPB | Mortgage

Rate | Remaining

Loan

Term(1) | UW

NCF DSCR(2)(3) | UW

NOI

DY(2)(3) | Cut-off

Date

LTV(2)(3)(4) | Maturity

Date

LTV(1)(2)(3)(4) |

| 35.5% - | 39.9% | 2 | $144,850,000 | 16.0% | 3.46048% | 116 | 4.20x | 15.0% | 36.3% | 36.3% |

| 40.0% - | 49.9% | 3 | 79,700,000 | 8.8 | 4.00399% | 88 | 2.36x | 13.1% | 46.1% | 38.9% |

| 50.0% - | 59.9% | 15 | 333,966,126 | 37.0 | 3.39208% | 116 | 2.83x | 10.2% | 56.6% | 56.4% |

| 60.0% - | 69.9% | 13 | 319,972,750 | 35.4 | 3.68332% | 103 | 2.07x | 9.4% | 65.5% | 61.2% |

| 70.0% - | 72.9% | 1 | 25,000,000 | 2.8 | 3.69000% | 120 | 1.66x | 9.2% | 72.9% | 60.9% |

| Total / Wtd. Avg: | | 34 | $903,488,876 | 100.0% | 3.56841% | 109 | 2.71x | 10.9% | 56.0% | 53.5% |

| LTV Ratios as of the Maturity Date(1)(2)(3)(4) |

Range of Maturity Date LTVs | Number of Loans | Cut-off Date

Principal Balance | % of IPB | Weighted Average |

Mortgage

Rate | Remaining

Loan

Term(1) | UW

NCF DSCR(2)(3) | UW

NOI

DY(2)(3) | Cut-off

Date

LTV(2)(3)(4) | Maturity

Date

LTV(1)(2)(3)(4) |

| 34.8% - | 39.9% | 3 | $183,850,000 | 20.3% | 3.45614% | 117 | 3.69x | 14.2% | 39.1% | 36.0% |

| 40.0% - | 44.9% | 1 | 35,000,000 | 3.9 | 4.62820% | 58 | 3.03x | 15.7% | 41.9% | 41.9% |

| 45.0% - | 49.9% | 2 | 11,886,126 | 1.3 | 3.59647% | 91 | 2.10x | 10.0% | 54.3% | 48.8% |

| 50.0% - | 54.9% | 10 | 194,122,750 | 21.5 | 3.48373% | 117 | 2.61x | 10.2% | 57.7% | 52.9% |

| 55.0% - | 69.4% | 18 | 478,630,000 | 53.0 | 3.56769% | 107 | 2.36x | 9.6% | 62.9% | 61.4% |

| Total / Wtd. Avg: | | 34 | $903,488,876 | 100.0% | 3.56841% | 109 | 2.71x | 10.9% | 56.0% | 53.5% |

Prepayment Protection | Number of Loans | Cut-off Date

Principal Balance | % of IPB | Weighted Average |

Mortgage

Rate | Remaining

Loan

Term(1) | UW

NCF DSCR(2)(3) | UW

NOI

DY(2)(3) | Cut-off

Date

LTV(2)(3)(4) | Maturity

Date

LTV(1)(2)(3)(4) |

| Defeasance | 25 | $565,252,750 | 62.6% | 3.59919% | 106 | 2.38x | 10.2% | 60.1% | 56.6% |

| Defeasance or Yield Maintenance | 4 | 221,036,126 | 24.5 | 3.37093% | 117 | 3.68x | 13.1% | 43.8% | 43.5% |

| Yield Maintenance | 5 | 117,200,000 | 13.0 | 3.79242% | 108 | 2.47x | 10.5% | 59.6% | 57.2% |

| Total / Wtd. Avg: | 34 | $903,488,876 | 100.0% | 3.56841% | 109 | 2.71x | 10.9% | 56.0% | 53.5% |

Loan Purpose | Number of

Loans | Cut-off Date

Principal Balance | % of IPB | Weighted Average |

Mortgage

Rate | Remaining

Loan

Term(1) | UW

NCF DSCR(2)(3) | UW

NOI

DY(2)(3) | Cut-off

Date

LTV(2)(3)(4) | Maturity

Date

LTV(1)(2)(3)(4) |

| Refinance | 22 | $527,658,626 | 58.4% | 3.53664% | 109 | 2.78x | 10.7% | 54.5% | 53.4% |

| Acquisition | 8 | 222,730,250 | 24.7 | 3.58243% | 113 | 3.09x | 12.2% | 54.6% | 51.0% |

| Recapitalization | 4 | 153,100,000 | 16.9 | 3.65754% | 103 | 1.91x | 9.8% | 63.5% | 57.2% |

| Total / Wtd. Avg: | 34 | $903,488,876 | 100.0% | 3.56841% | 109 | 2.71x | 10.9% | 56.0% | 53.5% |

| (1) | In the case of Loan Nos. 3 and 16, with an anticipated repayment date, Remaining Loan Term and Maturity Date LTV is calculated as of the related anticipated repayment date. |

| (2) | In the case of Loan Nos. 1, 2, 3, 4, 6, 9, 11, 12, 16, 17, 18, 19 and 23, the UW NCF DSCR, UW NOI DY, Cut-off Date LTV and Maturity Date LTV calculations include the related Pari Passu Companion Loan(s). In the case of Loan Nos. 1, 3, 9 and 17, the UW NCF DSCR, UW NOI DY, Cut-off Date LTV and Maturity Date LTV calculations exclude the related Subordinate Companion Loan(s) and/or related mezzanine loan(s). |

| (3) | In the case of Loan No. 21, the UW NOI DY, Cut-off Date LTV and Maturity Date LTV are calculated net of a holdback reserve. In the case of loan No. 3, the UW NCF DSCR, UW NOI DY are calculated based on the master lease annual rent of $292,000,000. |

| (4) | In the case of Loan Nos. 1, 3, 6, 7, 16, 18 and 20, the Cut-off Date LTV and the Maturity Date LTV are calculated by using an appraised value based on certain hypothetical assumptions. Refer to “Description of the Mortgage Pool—Assessments of Property Value and Condition” and “—Appraised Value” in the Preliminary Prospectus for additional details. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

| Structural and Collateral Term Sheet | Benchmark 2020-B20 |

| Collateral Characteristics |

| Previous Securitization History(1) |

No. | Mortgaged Property | Cut-off Date Principal Balance | % of IPB | Location | Property Type | Previous Securitization |

| 2 | 120 Wall Street | $70,000,000 | 7.7% | New York, NY | Office | MSBAM 2014-C14 |

| 7 | Point West Portfolio | $39,500,000 | 4.4% | Sacramento, CA | Office | PFP 2017-4 |

| 9 | Agellan Portfolio | $35,000,000 | 3.9% | Various, Various | Various | MSC 2019-AGLN |

| 14 | 2665 North First | $29,000,000 | 3.2% | San Jose, CA | Office | PFP 2015-2 |

| 25.01 | Storage at Atlas(2) | $5,200,000 | 0.6% | Ocean Township, NJ | Self Storage | CGCMT 2016-P3 |

| 25.02 | Storage at Mont Mini(2) | $4,800,000 | 0.5% | Montgomeryville, PA | Self Storage | GSMS 2015-GC34 |

| 29 | Storage Post – Jefferson, LA | $7,080,000 | 0.8% | Jefferson, LA | Self Storage | UBSCM 2012-C1 |

| (1) | The table above represents the properties for which the previously existing debt was securitized, based on information provided by the related borrower or obtained through searches of a third-party database. |

| (2) | Cut-off Date Principal Balance represents the allocated loan amount for each respective mortgaged property. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

| Structural and Collateral Term Sheet | Benchmark 2020-B20 |

| | |

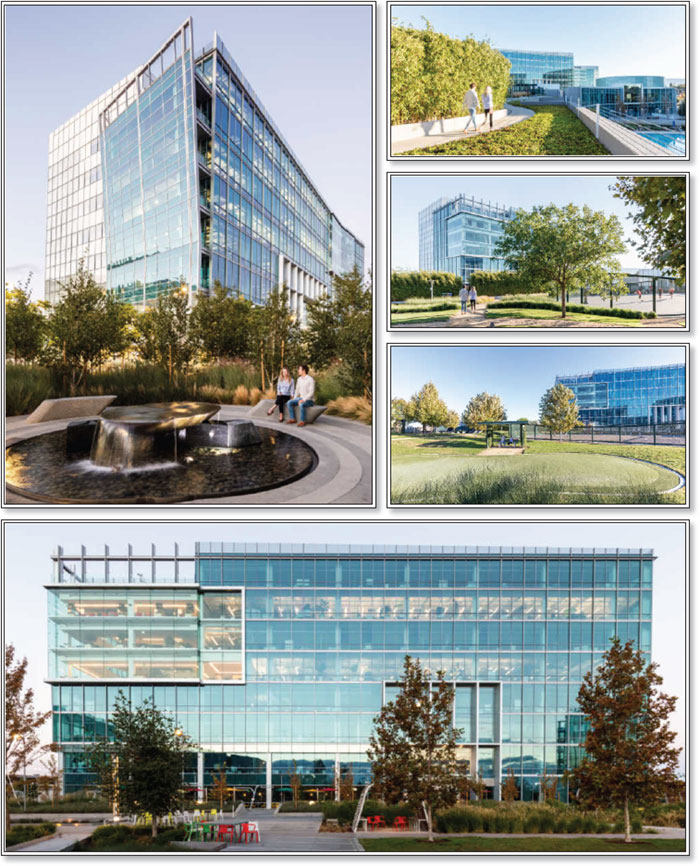

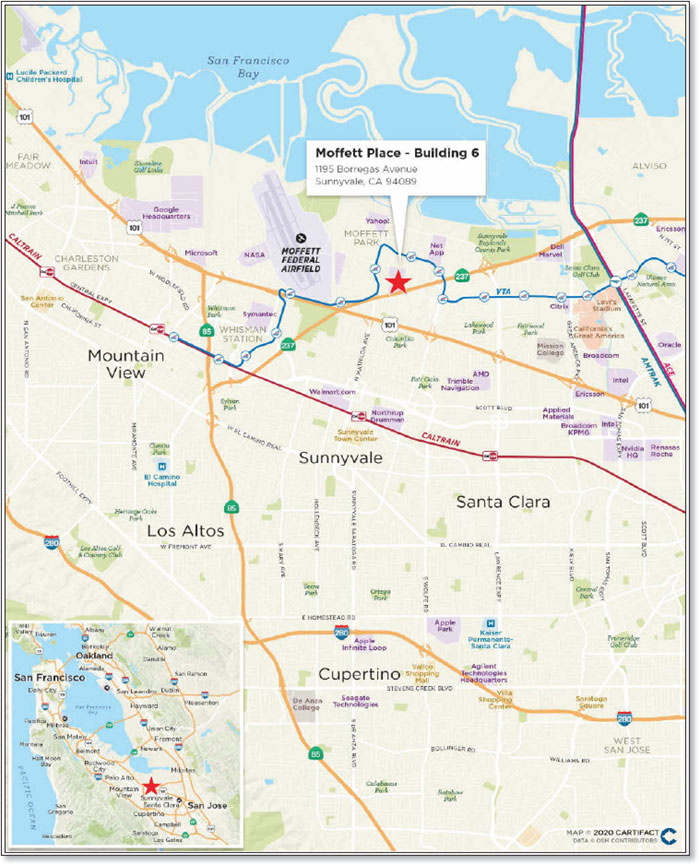

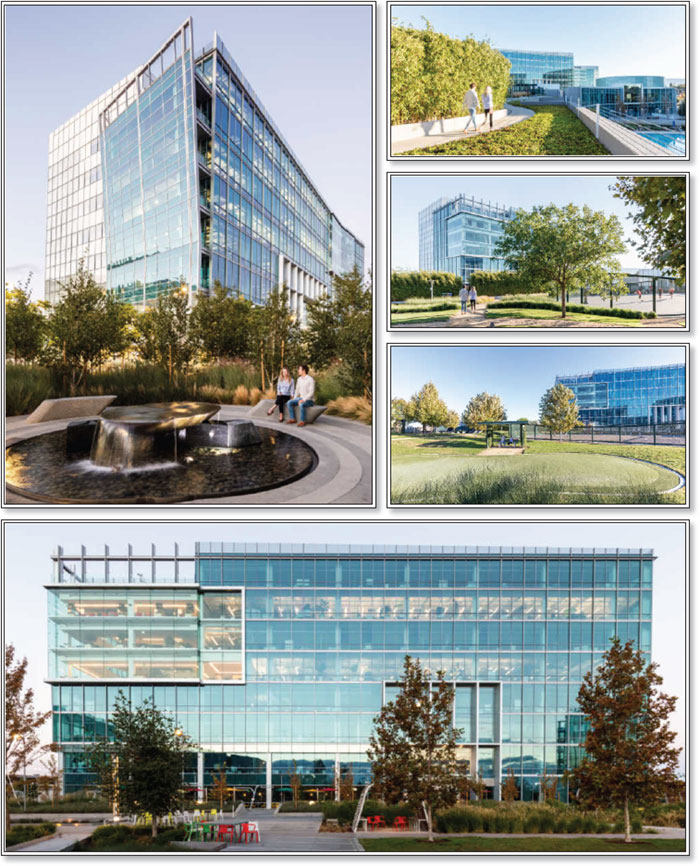

| Moffett Place - Building 6 |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

| Structural and Collateral Term Sheet | Benchmark 2020-B20 |

| | |

| Moffett Place - Building 6 |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

| Structural and Collateral Term Sheet | Benchmark 2020-B20 |

| | |

| Moffett Place - Building 6 |

| Mortgage Loan Information | | Property Information |

| Mortgage Loan Seller: | GACC | | Single Asset / Portfolio: | Single Asset |

| Original Principal Balance(1): | $74,850,000 | | Title: | Fee |

| Cut-off Date Principal Balance(1): | $74,850,000 | | Property Type - Subtype: | Office – CBD |

| % of Pool by IPB: | 8.3% | | Net Rentable Area (SF): | 314,352 |

| Loan Purpose: | Refinance | | Location: | Sunnyvale, CA |

| Borrower: | MP B6 LLC | | Year Built / Renovated: | 2020 / N/A |

| Loan Sponsor: | Jay Paul | | Occupancy: | 100.0% |

| Interest Rate: | 3.369279% | | Occupancy Date: | 10/6/2020 |

| Note Date: | 8/6/2020 | | Number of Tenants: | 1 |

| Maturity Date: | 8/6/2030 | | 2017 NOI: | N/A |

| Interest-only Period: | 120 months | | 2018 NOI: | N/A |

| Original Term: | 120 months | | 2019 NOI: | N/A |

| Original Amortization: | None | | TTM NOI: | N/A |

| Amortization Type: | Interest Only | | UW Economic Occupancy: | 95.0% |

| Call Protection: | L(24),Grtr1%orYM(2), | | UW Revenues: | $18,990,159 |

| | DeforGrtr1%orYM(87),O(7) | | UW Expenses: | $2,692,414 |

| Lockbox / Cash Management: | Hard / In Place | | UW NOI(5): | $16,297,746 |

| Additional Debt: | Yes | | UW NCF(5): | $15,910,023 |

| Additional Debt Balance: | $58,250,000 / $66,900,000 / | | Appraised Value / Per SF(2)(5): | $359,200,000 / $1,143 |

| | $49,000,000 | | Appraisal Date: | 5/1/2021 |

| Additional Debt Type: | Pari Passu / Subordinate / | | | |

| | Mezzanine | | | |

| | | | | |

| Escrows and Reserves(3) | | Financial Information(5) |

| Initial | Monthly | Initial Cap | | | Senior Notes | Whole Loan/Total Debt |

| Taxes: | $0 | $85,000 | N/A | | Cut-off Date Loan / SF: | $423 | $636 / $792 |

| Insurance: | $0 | Springing | N/A | | Maturity Date Loan / SF: | $423 | $636 / $792 |

| Replacement Reserves: | $0 | Springing | N/A | | Cut-off Date LTV(2): | 37.1% | 55.7% / 69.3% |

| TI/LC: | $2,728,059 | $0 | N/A | | Maturity Date LTV(2): | 37.1% | 55.7% / 69.3% |

| Other(4): | $14,559,592 | Springing | N/A | | UW NCF DSCR: | 3.50x | 2.33x / 1.59x |

| | | | | | UW NOI Debt Yield: | 12.2% | 8.1% / 6.5% |

| | | |

| Sources and Uses |

| Sources | Proceeds | % of Total | | Uses | Proceeds | % of Total |

| Senior Notes | $133,100,000 | 53.5% | | Payoff Existing Debt | $164,454,172 | 66.0% |

| Junior Notes | 66,900,000 | 26.9 | | Return of Equity | 57,161,746 | 23.0 |

| Mezzanine Loan | 49,000,000 | 19.7 | | Upfront Reserves | 17,287,652 | 6.9 |

| | | | | Closing Costs | 10,096,430 | 4.1 |

| Total Sources | $249,000,000 | 100.0% | | Total Uses | $249,000,000 | 100.0% |

| (1) | The Cut-off Date Balance of $74,850,000 represents the non-controlling Note A-1-C1, Note A-1-C2, Note A-1-C3, Note A-1-C4, and Note A-1-C6, and is part of the Moffett Place - Building 6 Whole Loan (as defined below), which is evidenced by nine pari passu senior notes and two junior notes, and has an aggregate outstanding principal balance as of the Cut-off Date of $200,000,000. For additional information, see “The Loan” herein. |

| (2) | The appraised value represents the “Prospective Market Value Upon Stabilization” as of May 1, 2021. The appraiser also concluded an “As-Is” appraised value of $333,000,000 as of August 1, 2020, which results in a Cut-off Date LTV and Maturity Date LTV of 40.0% for the Moffett Place - Building 6 Senior Notes (as defined below), 60.1% for the Moffett Place - Building 6 Whole Loan (as defined below) and 74.8% for the Moffett Place - Building 6 Total Debt (as defined below). |

| (3) | For a full description of Escrows and Reserves, please refer to “Escrows and Reserves” below. In addition, the appraisal concluded to a “Hypothetical As If Vacant” appraised value (“Go Dark” Value) equal to $289,100,000 as of August 1, 2020. Based on the “Hypothetical Go Dark” appraised value, the Cut-off Date LTV and Maturity Date LTV are 46.0 % for the Moffett Place - Building 6 Senior Notes, 69.2% for the Moffett Place - Building 6 Whole Loan and 86.1% for the Moffett Place - Building 6 Total Debt. |

| (4) | The Other reserve is comprised of a $2,496,716 debt service reserve, a $12,062,876 free rent reserve and a springing lease sweep reserve. The lease sweep reserve is subject to the Lease Sweep Reserve Cap (as defined below). |

| (5) | While the Moffett Place – Building 6 Whole Loan was originated after the emergence of the novel coronavirus pandemic and the economic disruption resulting from measures to combat the pandemic, the pandemic is an evolving situation and could impact the Moffett Place – Building 6 Whole Loan more severely than assumed in the |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

| Structural and Collateral Term Sheet | Benchmark 2020-B20 |

| | |

| Moffett Place - Building 6 |

underwriting of the Moffett Place – Building 6 Whole Loan and could adversely affect the NOI, NCF and occupancy information, as well as the appraised value and the DSCR, LTV and Debt Yield metrics presented above. See “Risk Factors— Risks Related to Market Conditions and Other External Factors—Coronavirus Pandemic Has Adversely Affected the Global Economy and Will Likely Adversely Affect the Performance of the Mortgage Loans” in the Preliminary Prospectus.

The Loan. The Moffett Place - Building 6 mortgage loan (the “Moffett Place - Building 6 Loan”) is part of a whole loan with an aggregate outstanding principal balance as of the Cut-off Date of $200.0 million (the “Moffett Place - Building 6 Whole Loan”), evidenced by nine pari passu senior notes with an aggregate initial principal balance of $133,100,000 (collectively the “Moffett Place - Building 6 Senior Notes”) and two junior notes with an aggregate initial principal balance of $66,900,000 (collectively the “Moffett Place - Building 6 Junior Notes”). The loan is secured by the borrower’s fee interest in a 314,352 square foot, newly constructed Class A office building located in Sunnyvale, California. The non-controlling Note A-1-C1, Note A-1-C2, Note A-1-C3, Note A-1-C4, and Note A-1-C6, with an outstanding principal balance as of the Cut-off Date of $74.85 million, will be included in the Benchmark 2020-B20 trust. The remaining notes have been contributed to one or more securitization trusts. The relationship between the holders of the Moffett Place - Building 6 Whole Loan is governed by a co-lender agreement as described under “Description of the Mortgage Pool—The Whole Loans—The Non-Serviced Pari Passu Whole Loans” in the Preliminary Prospectus. The Moffett Place – Building 6 Whole Loan will be serviced under the trust and servicing agreement for the MOFT 2020-B6 transaction. The Moffett Place - Building 6 Whole Loan has a 10-year term and will be interest-only for the term of the loan.

| Whole Loan Summary |

| Note | Original Balance | Cut-off Date Balance | Note Holder | Controlling Piece |

| A-1-S, A-2-S | $500,000 | $500,000 | MOFT 2020-B6 | No |

| A-1-C5, A-2-C | $57,750,000 | $57,750,000 | Benchmark 2020-B19 | No(1) |

| A-1-C1, A-1-C2, A-1-C3, A-1-C4, A-1-C6 | $74,850,000 | $74,850,000 | Benchmark 2020-B20 | No |

| B-1, B-2 | $66,900,000 | $66,900,000 | MOFT 2020-B6 | Yes(1) |

| Whole Loan | $200,000,000 | $200,000,000 | |

| (1) | The initial controlling notes are Note B-1 and Note B-2, so long as no Moffett Place - Building 6 control appraisal period has occurred and is continuing. If and for so long as a Moffett Place - Building 6 control appraisal period has occurred and is continuing, then the controlling note will be the Note A-1-C5. See “Description of the Mortgage Pool—The Whole Loans—The Moffett Place - Building 6 Pari Passu-AB Whole Loan” in the Preliminary Prospectus. The Moffett Place - Building 6 Whole Loan is being serviced pursuant to the MOFT 2020-B6 trust and servicing agreement. For so long as no Moffett Place - Building 6 control appraisal period has occurred and is continuing, the control rights of the Moffett Place - Building 6 Junior Notes will be exercisable by the controlling class under the MOFT 2020-B6 trust and servicing agreement. |

The Borrower. The borrower is MP B6 LLC. The borrower is structured to be a single purpose entity with two independent directors in its organizational structure.

The Loan Sponsor. The loan sponsor is Joseph K. Paul, also known as Jay Paul, and the non-recourse carveout guarantor is Paul Guarantor LLC. Jay Paul is the founder of Jay Paul Company, which is a privately-held real estate firm based in San Francisco, California that concentrates on the acquisition, development and management of commercial properties throughout California with a specific focus on creating projects for technology firms. Jay Paul Company has developed over 13.0 million square feet of institutional quality space including projects for Apple, Amazon, Facebook, Google, Microsoft, HP, Rambus, Nokia, Tencent and DreamWorks. Jay Paul Company owns over 25 office buildings in Moffett Park, totaling nearly 7.2 million square feet including Moffett Place, Moffett Gateway, Technology Corner, Moffett Towers, Moffett Towers II and Moffett Towers Buildings A, B & C.

The Property. The Moffett Place - Building 6 property is a newly-constructed eight-story, Class A LEED Gold Certified, office building totaling 314,352 square feet located in Sunnyvale, California. The Moffett Place - Building 6 property is part of a larger six building, 55 acre campus known as Moffett Place (the “Moffett Campus”), which in the aggregate (including the Moffett Place - Building 6 property) includes approximately 1.9 million square feet of Class A office space that is 100.0% leased to Google, an approximately 52,500 square feet amenities building including a conference center, a swimming pool, an outdoor common area space, a café and three separate parking structures and surface parking. The overall parking ratio is 3.3 spaces per 1,000 square feet of net rentable area. The rooftop level (level 3) on one of the parking structures is improved with the landlord's "High Garden" concept as a project amenity. The "High Garden" features walking and running trails, outdoor volleyball, bocce ball courts and other recreational features.

To govern access to the non-collateral common areas, conference facility and parking structures (the “Common Area Spaces”), the Moffett Place - Building 6 property is subject to a declaration of covenants, conditions and restrictions (the “Moffett Place CCR”) with Moffett Place LLC (an affiliate of the loan sponsor and an affiliate of the owner of the non-collateral buildings at the Moffett Campus). The Moffett Place CCR grants the borrower non-exclusive easement rights over the Common Area Spaces. Ownership of the Common Area Spaces governed by the Moffett Place CCR is held by Moffett Place Association LLC (the “Association”).

The Moffett Place - Building 6 property is 100.0% leased to Google (Google’s parent company, Alphabet Inc. (NASDAQ: GOOG) is rated Aa2/AA+ by Moody’s/S&P) pursuant to a new 8.7-year triple net lease through January 2029, with two, seven-year extension options and

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

| Structural and Collateral Term Sheet | Benchmark 2020-B20 |

| | |

| Moffett Place - Building 6 |

no early termination rights. Google has an in place base rent of $49.56 per square foot with approximately 2.2% annual rent escalations. The Google lease commenced on May 21, 2020 and Google has fully accepted its space with no outs or remaining landlord work. Google is in the process of building out its space with an expected occupancy date by September/October of 2021. Google was provided $55.10 per square foot in tenant improvements and approximately 12 months of free rent. At loan origination, approximately $2.7 million was reserved for the remaining outstanding tenant obligations and approximately $12.1 million for free rent.

Under the Google lease, so long as the landlord owns the Moffett Place - Building 6 property, Google has a right of first offer to purchase all or any portion of the six building Moffett Campus which the landlord has determined in its sole discretion to sell. Such right excludes an offer to sell one or more buildings in the Moffett Campus to an affiliate of the landlord or to an entity or person that becomes the owner of the Moffett Place - Building 6 property or the Moffett Campus through a foreclosure by trustee’s power of sale, judicially or otherwise, or as a purchaser at a foreclosure sale.

COVID-19 Update. On July 27, 2020, due to the COVID-19 pandemic, Google announced that it would extend its global voluntary work-from-home option through June of 2021 for roles of employees that are not needed in the office. Google had originally told employees to expect to return to the office in January of 2021. As of October 1, 2020, Google has not made any requests for rent relief. Google is in a free rent period through May 2021. As of October 1, 2020, the Moffett Place – Building 6 Whole Loan is not subject to any modification or forbearance requests related to the COVID-19 pandemic. The Moffett Place – Building 6 Whole Loan is current as of the September 2020 payment date. See “Risk Factors—Risks Related to Market Conditions and Other External Factors—Current Coronavirus Pandemic May Adversely Affect the Global Economy and the Performance of the Mortgage Loans” in the Preliminary Prospectus.

The Market. The Moffett Place - Building 6 property is located in Moffett Park, a submarket of Sunnyvale in Silicon Valley, California. Moffett Park comprises 519 acres which has undergone significant redevelopment over the past 15 years. The area has grown into one of the San Francisco Bay Area’s technology hubs, with firms such as Amazon, Google, Facebook, Comcast, and Verizon (Yahoo!) leasing significant space. Moffett Park is located adjacent to State Highway 237, Interstate 680, Interstate 280, and U.S. Highway 101 and has access from both the northern peninsula and areas in San Jose and the East Bay, making it a convenient location for corporate users.

Regional commuter service is indirectly provided for Moffett Park. Shuttles from Downtown Sunnyvale Caltrain station and the Altamont Commuter Express Great America station provide morning and evening services to the park. Future indirect regional access may be provided by the Bay Area Rapid Transit (“BART”) to San Jose extension. The BART extension would provide service potential from East Bay cities to downtown San Jose where additional shuttle or VTA light rail connections would be necessary to serve Moffett Park.

The VTA light rail Borregas Station is located within a half mile of the Moffett Place - Building 6 property along Java Drive, while the Java / Borregas bus stop is a five minute walk away. Access to major highways 101 and 237 is within a mile of the Moffett Place - Building 6 property and the downtown Sunnyvale Caltrain station is approximately three miles to the south. The San Jose International Airport is located about nine miles from the Moffett Place - Building 6 property.

According to the appraisal, the Moffett Park office submarket had a vacancy rate of 0.6% with an average asking rent of $69.60 per square foot. The following chart summarizes comparable office leases that range in base rent from $50.40 to $60.00 per square foot.

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

| Structural and Collateral Term Sheet | Benchmark 2020-B20 |

| | |

| Moffett Place - Building 6 |

| | Summary of Comparable Office Leases(1) | | | |

| Property | Tenant Name | Lease

Start Date | Term

(mos.) | Lease Type | Tenant

Size (SF) | Base

Rent PSF | Free Rent

(mos.) | TI PSF |

| Moffett Place -Building 6 | Google | May-20 | 105 | NNN | 314,352(2) | $49.56(2) | 12 | $55.10 |

| Moffett Towers II -Building III | Facebook | Jan-20 | 180 | NNN | 1,087,689 | $52.20 | 7 | $60.00 |

| 520 Almanor Avenue | Nokia, Inc | Apr-19 | 150 | NNN | 231,000 | $50.40 | 6 | $80.00 |

| Grove 221 | 23 and Me | May-19 | 144 | NNN | 154,987 | $60.00 | 9 | $83.71 |

| 1001 North Shoreline | Google | Apr-18 | 144 | NNN | 132,960 | $60.00 | 3 | $50.00 |

| Pathline Park | Synopsys | Nov-19 | 144 | NNN | 360,100 | $51.00 | 0 | $70.00 |

| 620 National View | Google | Dec-18 | 120 | NNN | 151,065 | $59.40 | 0 | $80.00 |

| Total / Wtd. Avg.(3) | | | 161 | | 2,117,801 | $53.37 | 5 | $66.42 |

| (2) | Based on the rent roll as of October 6, 2020. |

| (3) | Total / Wtd. Avg. excludes the Moffett Place - Building 6 property. |

| | | Summary of Comparable Office Sales(1) | | | | |

| Property | City, State | NRA | Year Built/Renovated | Occupancy | Transaction Date | Sales Price | Sales Price PSF | Cap Rate |

| Moffett Place - Building | Sunnyvale, CA | 314,352 | 2020 | 100.0% | NAP | NAP | NAP | NAP |

| 620 National View | Mountain View, CA | 151,065 | 2017 | 100.0% | Sep-19 | $190,000,000 | $1,258 | 4.8% |

| Grove 221 | Sunnyvale, CA | 154,987 | 2018 | 100.0% | Mar-19 | $183,000,000 | $1,181 | 5.1% |

| Shoreline Technology | Mountain View, CA | 795,663 | 1985 / 2000 | 92.0% | Nov-18 | $1,000,000,000 | $1,257 | 3.5% |

| 1001 North Shoreline | Mountain View, CA | 132,960 | 2017 | 100.0% | Mar-18 | $169,000,000 | $1,158 | 4.4% |

| Menlo Gateway | Menlo Park, CA | 772,983 | 2019 | 100.0% | Nov-17 | $850,000,000 | $1,100 | 5.0% |

| Total / Wtd. Avg.(2) | | 2,007,658 | | 96.8% | | $763,194,608 | $1,184 | 4.4% |

| (2) | Total / Wtd. Avg. excludes the Moffett Place - Building 6 property. |

| Historical and Current Occupancy(1) |

| 2017 | 2018 | 2019 | Current(2) |

| NAP | NAP | NAP | 100.0% |

| (1) | Historical information is not available due to the recent construction of the Moffett Place - Building 6 property. |

| (2) | Based on the rent roll as of October 6, 2020. |

| Tenant Summary(1) |

| Tenant | Ratings Moody’s/Fitch/S&P(2) | Net Rentable Area (SF) | % of

Total NRA | Base Rent

PSF | % of Total

Base Rent | Lease

Expiration Date |

| Google | Aa2 / NR / AA+ | 314,352 | 100.0% | $49.56 | 100.0% | 1/31/2029 |

| Total | | 314,352 | 100.0% | $49.56 | 100.0% | |

| Other Occupied | | 0 | 0.0 | $0.00 | 0.0 | |

| Total Occupied | | 314,352 | 100.0% | $49.56 | 100.0% | |

| Vacant | | 0 | 0.0 | | | |

| Total | | 314,352 | 100.0% | | | |

| (1) | Based on the rent roll as of October 6, 2020. |

| (2) | Credit Ratings are those of the parent company. The tenant is the sole obligor with respect to the lease obligation. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

| Structural and Collateral Term Sheet | Benchmark 2020-B20 |

| | |

| Moffett Place - Building 6 |

| Lease Rollover Schedule(1) |

| Year | Number of Leases Expiring | Net Rentable Area Expiring | % of NRA Expiring | Base Rent Expiring | % of Base Rent Expiring | Cumulative Net Rentable Area Expiring | Cumulative % of NRA Expiring | Cumulative Base Rent Expiring | Cumulative % of Base Rent Expiring |

| Vacant | NAP | 0 | 0.0% | NAP | NAP | 0 | 0.0% | NAP | NAP |

| MTM & 2020 | 0 | 0 | 0.0 | $0 | 0.0% | 0 | 0.0% | $0 | 0.0% |

| 2021 | 0 | 0 | 0.0 | 0 | 0.0 | 0 | 0.0% | $0 | 0.0% |

| 2022 | 0 | 0 | 0.0 | 0 | 0.0 | 0 | 0.0% | $0 | 0.0% |

| 2023 | 0 | 0 | 0.0 | 0 | 0.0 | 0 | 0.0% | $0 | 0.0% |

| 2024 | 0 | 0 | 0.0 | 0 | 0.0 | 0 | 0.0% | $0 | 0.0% |

| 2025 | 0 | 0 | 0.0 | 0 | 0.0 | 0 | 0.0% | $0 | 0.0% |

| 2026 | 0 | 0 | 0.0 | 0 | 0.0 | 0 | 0.0% | $0 | 0.0% |

| 2027 | 0 | 0 | 0.0 | 0 | 0.0 | 0 | 0.0% | $0 | 0.0% |

| 2028 | 0 | 0 | 0.0 | 0 | 0.0 | 0 | 0.0% | $0 | 0.0% |

| 2029 | 1 | 314,352 | 100.0 | 15,579,285 | 100.0 | 314,352 | 100.0% | $15,579,285 | 100.0% |

| 2030 | 0 | 0 | 0.0 | 0 | 0.0 | 314,352 | 100.0% | $15,579,285 | 100.0% |

| 2031 and Thereafter | 0 | 0 | 0.0 | 0 | 0.0 | 314,352 | 100.0% | $15,579,285 | 100.0% |

| Total | 1 | 314,352 | 100.0% | $15,579,285 | 100.0% | | | | |

| (1) | Based on the rent roll as of October 6, 2020. |

| Underwritten Net Cash Flow(1) |

| | Underwritten | Underwritten

$ Per Square Foot | %(2) |