| | | FREE WRITING PROSPECTUS |

| | | FILED PURSUANT TO RULE 433 |

| | | REGISTRATION FILE NO.: 333-258342-05 |

| | | |

BANK5 2024-5YR9

Free Writing Prospectus Collateral Term Sheet

J.P. Morgan Chase Commercial Mortgage Securities Corp.

as Depositor

JPMorgan Chase Bank, National Association

Morgan Stanley Mortgage Capital Holdings LLC

Wells Fargo Bank, National Association

as Sponsors and Mortgage Loan Sellers

Commercial Mortgage Pass-Through Certificates

Series 2024-5YR9

August 9, 2024

J.P. MORGAN

Co-Lead Bookrunner

Manager | MORGAN STANLEY

Co-Lead Bookrunner

Manager | WELLS FARGO

SECURITIES

Co-Lead Bookrunner

Manager |

Academy Securities Co-Manager | | Drexel Hamilton Co-Manager |

STATEMENT REGARDING THIS FREE WRITING PROSPECTUS

This material is for your information, and none of J.P. Morgan Securities LLC, Morgan Stanley & Co. LLC, Wells Fargo Securities, LLC, Drexel Hamilton, LLC and Academy Securities, Inc. (each individually, an “Underwriter”, and together, the ‘‘Underwriters’’) are soliciting any action based upon it. This material is not to be construed as an offer to sell or the solicitation of any offer to buy any security in any jurisdiction where such an offer or solicitation would be illegal.

| THE INFORMATION IN THIS COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. |

| | T-1 | |

The Depositor has filed a registration statement (including a prospectus) with the SEC (SEC File no. 333-258342) for the offering to which this free writing prospectus relates. Before you invest, you should read the prospectus in the registration statement and other documents the Depositor has filed with the SEC for more complete information about the Depositor, the issuing entity and this offering. You may get these documents for free by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, the Depositor or any Underwriter or any dealer participating in the offering will arrange to send you the prospectus if you request it by calling (800) 408-1016 or by emailing the ABS Syndicate Desk at abs_synd@jpmorgan.com.

THE SECURITIES TO WHICH THIS INFORMATION RELATES WILL BE MORE FULLY DESCRIBED IN A PROSPECTUS (THE “PROSPECTUS”), WHICH IS NOT YET AVAILABLE. THE PROSPECTUS WILL CONTAIN MATERIAL INFORMATION THAT IS NOT CONTAINED IN THESE MATERIALS (INCLUDING WITHOUT LIMITATION A DETAILED DISCUSSION OF RISKS ASSOCIATED WITH AN INVESTMENT IN THE CERTIFICATES, UNDER THE HEADING “RISK FACTORS” IN THE PROSPECTUS).

Neither this document nor anything contained in this document shall form the basis for any contract or commitment whatsoever. The information contained in this document is preliminary as of the date of this document, supersedes any previous such information delivered to you and will be superseded by any such information subsequently delivered prior to the time of sale. These materials are subject to change, completion or amendment from time to time.

This document has been prepared by the Underwriters for information purposes only and does not constitute, in whole or in part, a prospectus for the purposes of Regulation (EU) 2017/1129 (as amended), such Regulation as it forms part of the domestic law of the United Kingdom and/or Part VI of the Financial Services and Markets Act 2000 (as amended); and does not constitute an offering document for any other purpose.

The attached information contains certain tables and other statistical analyses (the “Computational Materials”) that have been prepared in reliance upon information furnished by the Mortgage Loan Sellers. Numerous assumptions were used in preparing the Computational Materials, which may or may not be reflected in this document. The Computational Materials should not be construed as either projections or predictions or as legal, tax, financial or accounting advice. You should consult your own counsel, accountant and other advisors as to the legal, tax, business, financial and related aspects of a purchase of these certificates. Any weighted average lives, yields and principal payment periods shown in the Computational Materials are based on prepayment and/or loss assumptions, and changes in such prepayment and/or loss assumptions may dramatically affect such weighted average lives, yields and principal payment periods. In addition, it is possible that prepayments or losses on the underlying assets will occur at rates higher or lower than the rates shown in the Computational Materials. The specific characteristics of the certificates may differ from those shown in the Computational Materials due to differences between the final underlying assets and the preliminary underlying assets used in preparing the Computational Materials. The principal amount and designation of any certificate described in the Computational Materials are subject to change prior to issuance. None of the Underwriters nor any of their respective affiliates make any representation or warranty as to the actual rate or timing of payments or losses on any of the underlying assets or the payments or yield on the certificates.

This information is based upon management forecasts and reflects prevailing conditions and management’s views as of this date, all of which are subject to change.

This document contains forward-looking statements. Those statements are subject to certain risks and uncertainties that could cause the success of collections and the actual cash flow generated to differ materially from the information set forth in this document. While such information reflects projections prepared in good faith based upon methods and data that are believed to be reasonable and accurate as of their dates, the Depositor undertakes no obligation to revise these forward-looking statements to reflect subsequent events or circumstances. Investors should not place undue reliance on forward-looking statements and are advised to make their own independent analysis and determination with respect to the forecasted periods, which reflect the Depositor’s view only as of the date of this document.

J.P. Morgan is the marketing name for the investment banking businesses of JPMorgan Chase & Co. and its subsidiaries worldwide. Securities, syndicated loan arranging, financial advisory and other investment banking activities are performed by JPMS and its securities affiliates, and lending, derivatives and other commercial banking activities are performed by JPMorgan Chase Bank, National Association and its banking affiliates. JPMS is a member of SIPC and the NYSE.

Wells Fargo Securities is the trade name for the capital markets and investment banking services of Wells Fargo & Company and its subsidiaries, including but not limited to Wells Fargo Securities, LLC, a member of the New York Stock Exchange, Financial Industry Regulatory Authority (“FINRA”), the National Futures Association (“NFA”) and the Securities Investor Protection Corporation (“SIPC”), Wells Fargo Prime Services, LLC, a member of FINRA, NFA and SIPC, and Wells Fargo Bank, National Association. Wells Fargo Securities, LLC and Wells Fargo Prime Services, LLC are distinct entities from affiliated banks and thrifts.

Capitalized terms used in this material but not defined herein shall have the meanings ascribed to them in the Prospectus.

THE UNDERWRITERS MAY FROM TIME TO TIME PERFORM INVESTMENT BANKING SERVICES FOR, OR SOLICIT INVESTMENT BANKING BUSINESS FROM, ANY COMPANY NAMED IN THESE MATERIALS. THE UNDERWRITERS AND/OR THEIR AFFILIATES OR RESPECTIVE EMPLOYEES MAY FROM TIME TO TIME HAVE A LONG OR SHORT POSITION IN ANY CERTIFICATE OR CONTRACT DISCUSSED IN THESE MATERIALS.

| THE INFORMATION IN THIS COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. |

| | T-2 | |

| BANK5 2024-5YR9 | Collateral Statistics |

| Mortgage Loan Sellers | No. of

Mortgage

Loans | No. of

Mortgaged

Properties | Aggregate

Cut-off Date

Balance | % of

Pool |

| Morgan Stanley Mortgage Capital Holdings LLC | 16 | 16 | $356,309,688 | 39.1% |

| Wells Fargo Bank, National Association | 10 | 14 | $243,515,526 | 26.8% |

| JPMorgan Chase Bank, National Association | 6 | 6 | $230,390,000 | 25.3% |

| JPMorgan Chase Bank, National Association / Wells Fargo Bank, National Association | 1 | 8 | $80,000,000 | 8.8% |

| Total: | 33 | 44 | $910,215,214 | 100.0% |

| Pool Statistics | |

| Aggregate Cut-off Date Balance: | $910,215,214 |

| Number of Mortgage Loans: | 33 |

| Average Cut-off Date Balance per Mortgage Loan: | $27,582,279 |

| Number of Mortgaged Properties: | 44 |

| Average Cut-off Date Balance per Mortgaged Property: | $20,686,709 |

| Weighted Average Mortgage Rate: | 6.5867% |

| % of Pool Secured by 5 Largest Mortgage Loans: | 44.0% |

| % of Pool Secured by 10 Largest Mortgage Loans: | 65.9% |

| % of Pool Secured by ARD Loans: | 0.0% |

| Weighted Average Original Term to Maturity (months): | 60 |

| Weighted Average Remaining Term to Maturity (months): | 60 |

| Weighted Average Seasoning (months): | 0 |

| % of Pool Secured by Single Tenant Mortgaged Properties: | 4.0% |

| % of Pool Secured by Refinance Loans: | 78.5% |

| % of Pool Secured by Acquisition Loans: | 20.4% |

| % of Pool Secured by Recapitalization Loans: | 1.1% |

| Additional Debt | |

| % of Pool with Pari Passu Mortgage Debt: | 50.1% |

| % of Pool with Mezzanine Mortgage Debt: | 16.3% |

| % of Pool with Subordinate Debt: | 14.3% |

| Credit Statistics | |

| Weighted Average UW NOI DSCR: | 1.73x |

| Weighted Average UW NOI Debt Yield: | 11.8% |

| Weighted Average UW NCF DSCR: | 1.65x |

| Weighted Average UW NCF Debt Yield: | 11.3% |

| Weighted Average Cut-off Date LTV Ratio: | 57.2% |

| Weighted Average Maturity Date LTV Ratio: | 56.7% |

| THE INFORMATION IN THIS COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. |

| | T-3 | |

| BANK5 2024-5YR9 | Collateral Statistics |

| Property Type Distribution(1) |

| Property Type | Number of

Mortgaged

Properties | Aggregate

Cut-off Date

Balance | % of

Pool | Wtd. Avg. Mortgage Rate | Wtd. Avg. UW NCF DSCR | Wtd. Avg.

UW NOI

Debt Yield | Wtd. Avg. Cut-off

Date LTV | Wtd. Avg. Maturity

Date LTV |

| Retail | 13 | $323,300,526 | 35.5% | 6.5897% | 1.65x | 11.8% | 58.2% | 57.4% |

| Anchored | 9 | $193,950,526 | 21.3% | 6.3876% | 1.65x | 11.1% | 59.8% | 59.8% |

| Super Regional Mall | 1 | $88,000,000 | 9.7% | 6.8160% | 1.72x | 13.7% | 56.0% | 53.0% |

| Unanchored | 2 | $29,000,000 | 3.2% | 7.1007% | 1.54x | 11.7% | 59.9% | 59.9% |

| Single Tenant | 1 | $12,350,000 | 1.4% | 6.9500% | 1.36x | 10.3% | 44.1% | 44.1% |

| Mixed Use | 13 | $195,134,161 | 21.4% | 6.0379% | 2.01x | 14.1% | 50.1% | 49.1% |

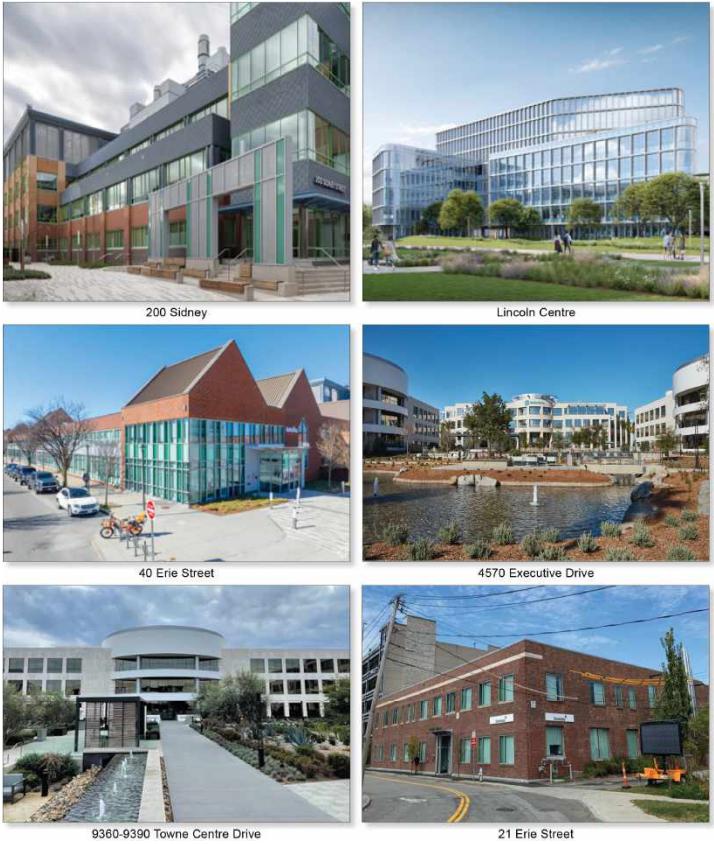

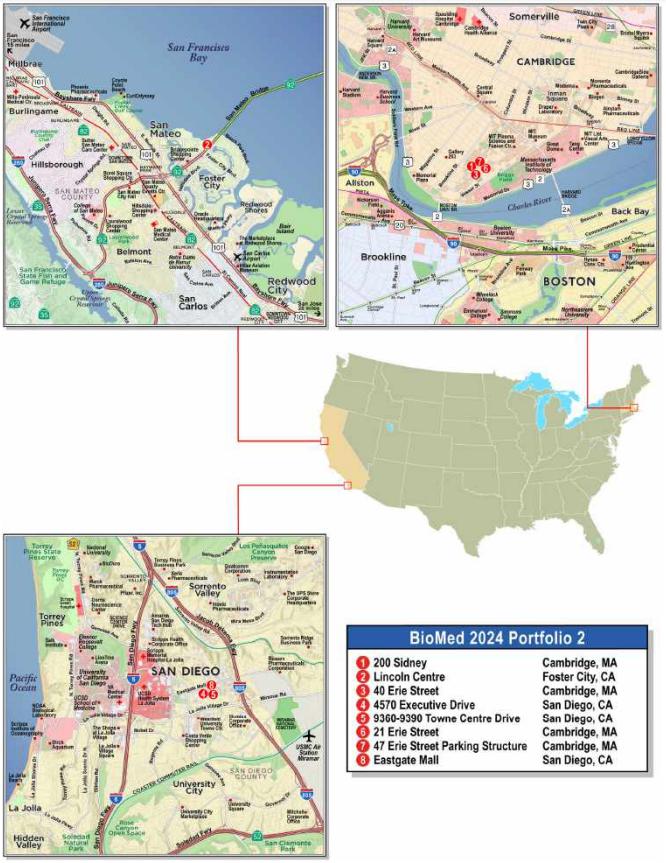

| Lab/Office | 7 | $77,789,474 | 8.5% | 5.4876% | 2.34x | 13.1% | 50.1% | 50.1% |

| Retail/Office | 2 | $61,494,688 | 6.8% | 6.1659% | 2.03x | 18.5% | 42.6% | 39.3% |

| Office/Retail | 1 | $33,750,000 | 3.7% | 6.6340% | 1.67x | 11.4% | 57.7% | 57.7% |

| Multifamily/Retail | 2 | $18,750,000 | 2.1% | 6.7100% | 1.25x | 8.9% | 59.5% | 59.5% |

| Multifamily/Retail/Office | 1 | $3,350,000 | 0.4% | 6.7000% | 1.54x | 10.7% | 60.9% | 60.9% |

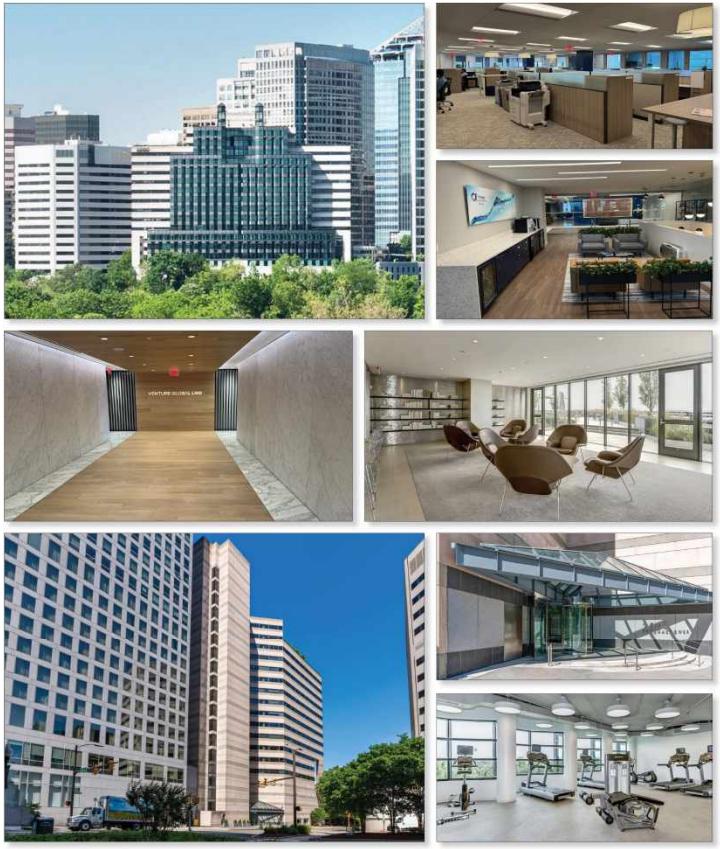

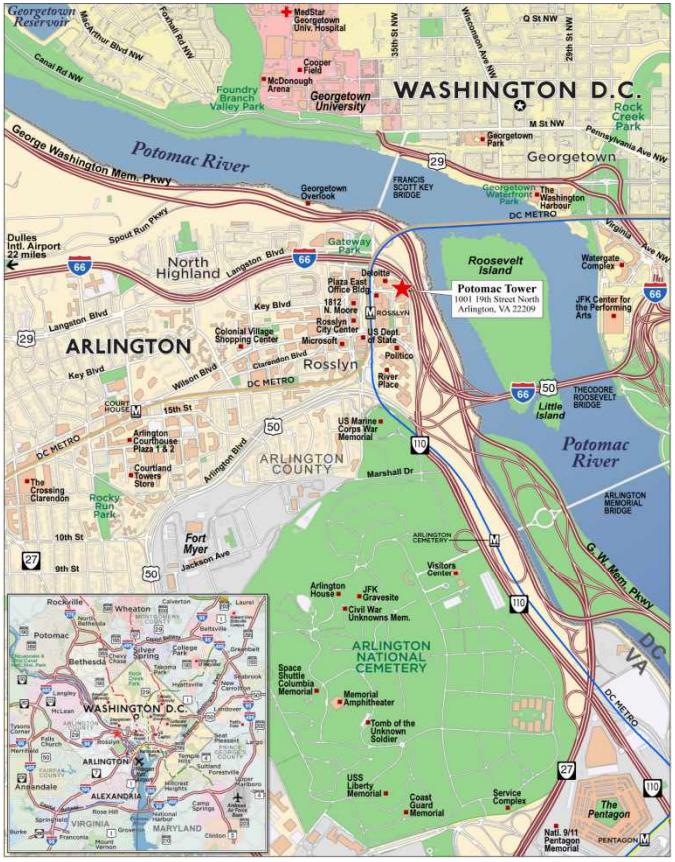

| Office | 3 | $160,000,000 | 17.6% | 7.4470% | 1.51x | 11.8% | 60.4% | 60.4% |

| CBD | 2 | $109,000,000 | 12.0% | 7.4979% | 1.46x | 11.5% | 59.7% | 59.7% |

| Suburban | 1 | $51,000,000 | 5.6% | 7.3380% | 1.62x | 12.4% | 61.7% | 61.7% |

| Multifamily | 5 | $139,900,000 | 15.4% | 6.1275% | 1.39x | 8.8% | 65.8% | 65.8% |

| Mid Rise | 1 | $90,000,000 | 9.9% | 5.9100% | 1.35x | 8.2% | 65.0% | 65.0% |

| High Rise | 1 | $31,500,000 | 3.5% | 6.1000% | 1.42x | 8.9% | 67.9% | 67.9% |

| Garden | 2 | $12,900,000 | 1.4% | 7.0840% | 1.51x | 11.2% | 64.7% | 64.7% |

| Student Housing | 1 | $5,500,000 | 0.6% | 7.6000% | 1.65x | 13.3% | 68.6% | 68.6% |

| Self Storage | 5 | $41,255,000 | 4.5% | 6.7617% | 1.66x | 11.6% | 48.2% | 48.2% |

| Self Storage | 5 | $41,255,000 | 4.5% | 6.7617% | 1.66x | 11.6% | 48.2% | 48.2% |

| Hospitality | 1 | $33,400,000 | 3.7% | 7.4700% | 1.46x | 13.1% | 46.1% | 46.1% |

| Full Service | 1 | $33,400,000 | 3.7% | 7.4700% | 1.46x | 13.1% | 46.1% | 46.1% |

| Manufactured Housing | 2 | $7,785,000 | 0.9% | 6.0454% | 1.43x | 8.8% | 65.9% | 65.9% |

| Manufactured Housing | 2 | $7,785,000 | 0.9% | 6.0454% | 1.43x | 8.8% | 65.9% | 65.9% |

| Industrial | 1 | $7,230,000 | 0.8% | 6.9520% | 1.44x | 10.9% | 59.8% | 59.8% |

| Manufacturing | 1 | $7,230,000 | 0.8% | 6.9520% | 1.44x | 10.9% | 59.8% | 59.8% |

| Other | 1 | $2,210,526 | 0.2% | 5.4876% | 2.34x | 13.1% | 50.1% | 50.1% |

| Parking Garage | 1 | $2,210,526 | 0.2% | 5.4876% | 2.34x | 13.1% | 50.1% | 50.1% |

| Total/Wtd. Avg. | 44 | $910,215,214 | 100.0% | 6.5867% | 1.65x | 11.8% | 57.2% | 56.7% |

| (1) | All numerical information concerning the mortgage loans is approximate and, in the case of mortgage loans secured by multiple properties, is based on allocated loan amounts with respect to such properties. All weighted average information regarding the mortgage loans reflects the weighting of the mortgage loans based on their outstanding principal balances as of the Cut-off Date or, in the case of mortgage loans secured by multiple properties, allocated loan amounts. The sum of numbers and percentages in columns may not match the “Total” due to rounding. With respect to any mortgage loan that is part of a whole loan, unless otherwise indicated, all LTV, DSCR and Debt Yield calculations include any related pari passu companion loans and exclude any related subordinate companion loans and/or mezzanine loans, as applicable. For mortgaged properties securing residential cooperative mortgage loans, the UW NCF DSCR and UW NOI Debt Yield for each such mortgaged property is calculated using underwritten net operating income or underwritten net cash flow, as applicable, for the related residential cooperative property which is the projected net operating income or net cash flow, as applicable, reflected in the most recent appraisal obtained by or otherwise in the possession of the related mortgage loan seller as of the Cut-off Date. LTV calculations are based upon the appraised value of the residential cooperative property determined as if such residential cooperative property is operated as a residential cooperative, inclusive of the amount of the underlying debt encumbering such residential cooperative property. The UW NCF DSCR, UW NOI Debt Yield and LTV calculations do not take into account any subordinate debt (whether or not secured by the related mortgaged property), that currently exists or is allowed under the terms of any mortgage |

| THE INFORMATION IN THIS COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. |

| | T-4 | |

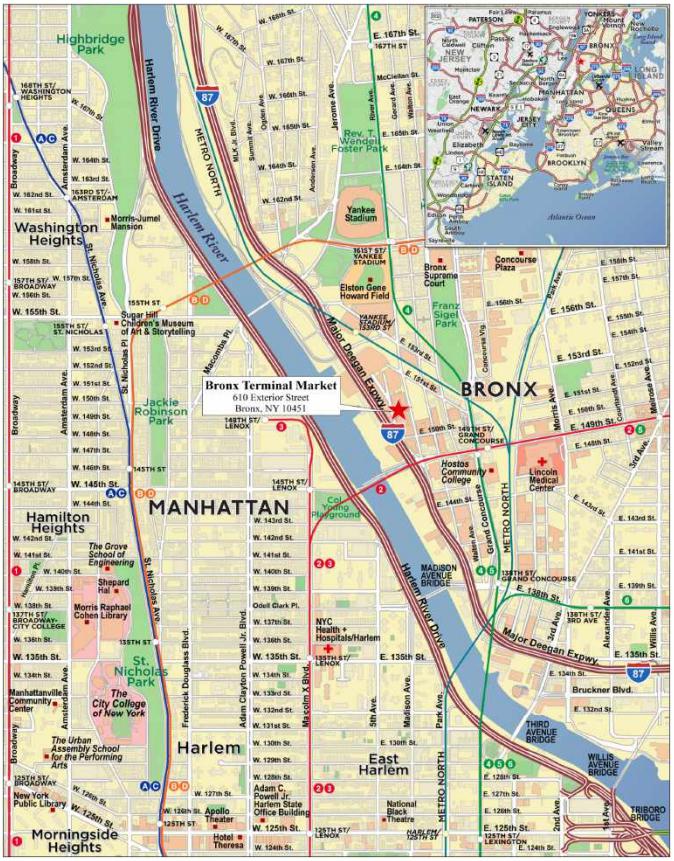

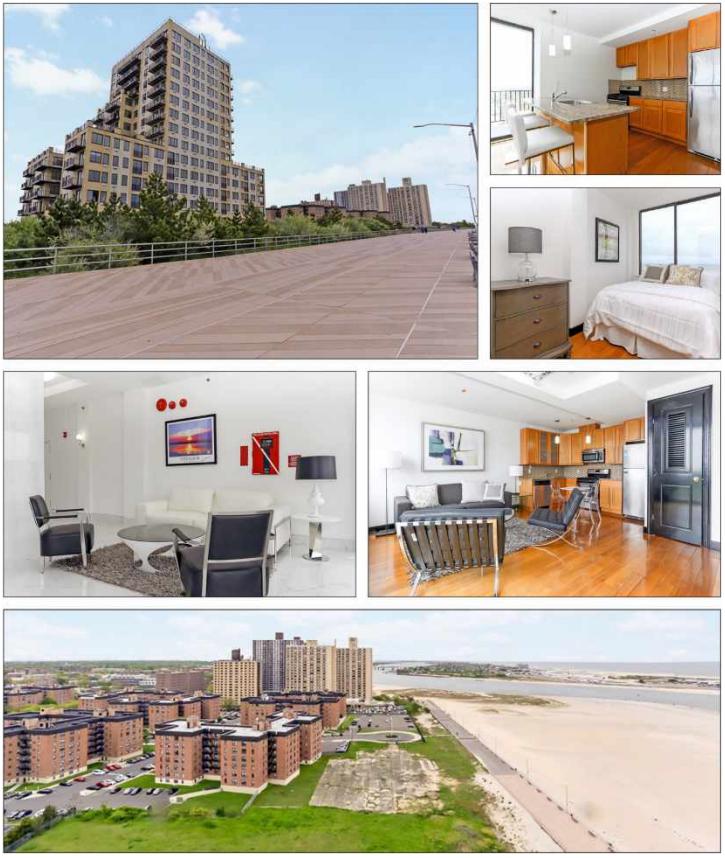

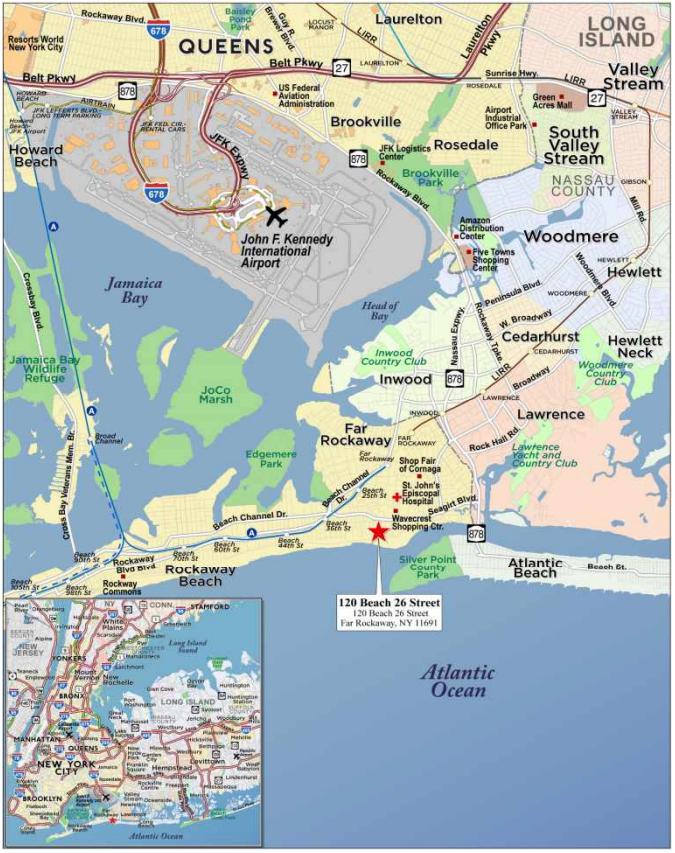

| Multifamily – Mid Rise | Loan #1 | Cut-off Date Balance: | | $90,000,000 |

| 1001-13 North 2nd Street, 1015 North | The Piazza | Cut-off Date LTV: | | 65.0% |

| 2nd Street, 1010 North Hancock | | UW NCF DSCR: | | 1.35x |

| Street, 1050 North Hancock Street | | UW NOI Debt Yield: | | 8.2% |

| and 145 West Wildey Street, Unit 1 | | | | |

| Philadelphia, PA 19123 | | | | |

| This is not a research report and was not prepared by any Underwriter’s research department. Please see additional important information and qualifications at the end of this Term Sheet. |

| | T-5 | |

| Multifamily – Mid Rise | Loan #1 | Cut-off Date Balance: | | $90,000,000 |

| 1001-13 North 2nd Street, 1015 North | The Piazza | Cut-off Date LTV: | | 65.0% |

| 2nd Street, 1010 North Hancock | | UW NCF DSCR: | | 1.35x |

| Street, 1050 North Hancock Street | | UW NOI Debt Yield: | | 8.2% |

| and 145 West Wildey Street, Unit 1 | | | | |

| Philadelphia, PA 19123 | | | | |

| This is not a research report and was not prepared by any Underwriter’s research department. Please see additional important information and qualifications at the end of this Term Sheet. |

| | T-6 | |

| Mortgage Loan No. 1 – The Piazza |

| Mortgage Loan Information | | Property Information |

| Mortgage Loan Seller: | JPMCB | | Single Asset/Portfolio: | Single Asset |

| Credit Assessment (Fitch/Moody’s/KBRA): | NR/NR/NR | | Location: | Philadelphia, PA 19123 |

| Original Balance(1): | $90,000,000 | | General Property Type(4): | Multifamily |

| Cut-off Date Balance(1): | $90,000,000 | | Detailed Property Type: | Mid Rise |

| % of Initial Pool Balance: | 9.9% | | Title Vesting: | Fee |

| Loan Purpose: | Refinance | | Year Built/Renovated: | 2006-2007/2019 |

| Borrower Sponsor: | Post Brothers | | Size(3)(4): | 332 Units |

| Guarantors: | Michael A. Pestronk and Matthew | | Cut-off Date Balance per Unit(1): | $326,958 |

| | I. Pestronk | | Maturity Balance per Unit(1): | $326,958 |

| Mortgage Rate: | 5.9100% | | Property Manager: | Post Commercial Real Estate, LLC |

| Note Date: | 8/5/2024 | | | |

| Maturity Date: | 8/5/2029 | | Underwriting and Financial Information |

| Term to Maturity: | 60 months | | UW NOI(5)(6): | $8,887,612 |

| Amortization Term: | 0 months | | UW NCF: | $8,800,305 |

| IO Period: | 60 months | | UW NOI Debt Yield(1): | 8.2% |

| Seasoning: | 0 months | | UW NCF Debt Yield(1): | 8.1% |

| Prepayment Provisions: | L(24),YM1(30),O(6) | | UW NOI Debt Yield at Maturity(1): | 8.2% |

| Lockbox/Cash Mgmt Status: | Soft/In Place | | UW NCF DSCR(1): | 1.35x |

| Additional Debt Type(1): | (Pari Passu/Mezzanine) | | Most Recent NOI(5): | $7,187,606 (4/30/2024 TTM) |

| Additional Debt Balance(1): | $18,550,000/$18,500,000 | | 2nd Most Recent NOI: | $7,112,438 (12/31/2023) |

| Future Debt Permitted (Type): | No (NAP) | | 3rd Most Recent NOI: | $6,157,265 (12/31/2022) |

| Reserves(2) | | Most Recent Occupancy(3)(6): | 97.6% (6/20/2024) |

| Type | Initial | Monthly | Cap | | 2nd Most Recent Occupancy: | 93.0% (4/30/2024 TTM) |

| RE Taxes: | $625,851 | $128,170 | NAP | | 3rd Most Recent Occupancy: | 93.6% (12/31/2023) |

| Insurance: | $0 | Springing | NAP | | Appraised Value (as of)(7): | $167,000,000 (5/22/2024) |

| Replacement Reserve: | $7,276 | $7,276 | NAP | | Appraised Value per Unit: | $503,012 |

| TI/LC Reserve: | $2,393 | $2,393 | $86,145 | | Cut-off Date LTV Ratio(1): | 65.0% |

| Unfunded Obligations Reserve: | $3,330,271 | $0 | NAP | | Maturity Date LTV Ratio(1): | 65.0% |

| Gap Rent Reserve: | $730,806 | $0 | NAP | | | |

| Coworking Space Conversion Reserve(3): | $2,400,000 | $0 | NAP | | | |

| | | | | | | | |

Sources and Uses |

| Sources | Proceeds | % of Total | | Uses | Proceeds | % of Total |

| Whole Loan Amount(1): | $108,550,000 | 72.6% | | Loan Payoff: | $134,615,404 | 90.0% |

| Borrower Equity: | $22,500,468 | 15.0% | | Closing Costs: | $7,838,467 | 5.2% |

| Mezzanine Loan Amount(8): | $18,500,000 | 12.4% | | Upfront Reserves: | $7,096,597 | 4.7% |

| Total Sources: | $149,550,468 | 100.0% | | Total Uses: | $149,550,468 | 100.0% |

| (1) | The Piazza Mortgage Loan (as defined below) is part of The Piazza Whole Loan (as defined below) with an original aggregate principal balance of $108,550,000. The Cut-off Date Balance per Unit, Maturity Balance per Unit, UW NOI Debt Yield, UW NCF Debt Yield, UW NOI Debt Yield at Maturity, UW NCF DSCR, Cut-off Date LTV Ratio and Maturity Date LTV Ratio presented above are based on The Piazza Whole Loan. |

| (2) | See “Escrows and Reserves” section below. |

| (3) | Size and Most Recent Occupancy are inclusive of the 16 residential units required to be delivered on or before March 5, 2025 and upon conversion of the recently vacated WeWork commercial space. In connection with the conversion, the borrower sponsor has received all necessary permits and approvals from the city. Although the units are yet to be completed, funds have been reserved for the related estimated cost of construction and an affiliate of the borrowers has executed a master lease for rents associated with the yet to be constructed units, to remain in place until such time each unit has been completed and leased to a third-party tenant. |

| (4) | The Piazza Property (as defined below) includes 28,715 SF of commercial retail space (exclusive of SF associated with the recently vacated WeWork commercial space), which is 100.0% leased as of the origination date of The Piazza Whole Loan. |

| (5) | The increase from Most Recent NOI to UW NOI is primarily attributable to (i) the construction of the 16 residential units required to be delivered on or before March 5, 2025 and upon conversion of the recently vacated WeWork commercial space and (ii) 100.0% leased commercial space. |

| (6) | UW NOI and Most Recent Occupancy is inclusive of certain executed residential leases commencing in August and September of 2024. |

| (7) | Appraised Value of $167,000,000 represents the “hypothetical as-if-stabilized” appraised value based on the hypothetical assumption that the three retail leases are signed and the conversion of the WeWork space is completed. The borrowers were required at loan origination to deposit (i) $3,330,271 into the Unfunded Obligations Reserve and $730,806 into the Gap Rent Reserve related to the three retail leases, and (ii) $2,400,000 into the Coworking Space Conversion Reserve related to the estimated cost of construction associated with conversion of the WeWork space. The appraisal also provides for an “as is” value of $155,800,000. The “as is” appraised value results in a Cut-off Date LTV Ratio and Maturity Date LTV Ratio of 69.7% for The Piazza Whole Loan. |

| (8) | Concurrently with the funding of The Piazza Whole Loan, RCG LV Debt VII REIT, LLC funded a mezzanine loan in the amount of $18,500,000 (“The Piazza Mezzanine Loan” and, together with The Piazza Whole Loan, “The Piazza Total Debt”). The Piazza Total Debt results in a Cut-off Date LTV Ratio and Maturity Date LTV Ratio of 76.1%, a UW NCF DSR of 1.05x and an UW NOI DY of 7.0%. See “Mezzanine Loan” below. |

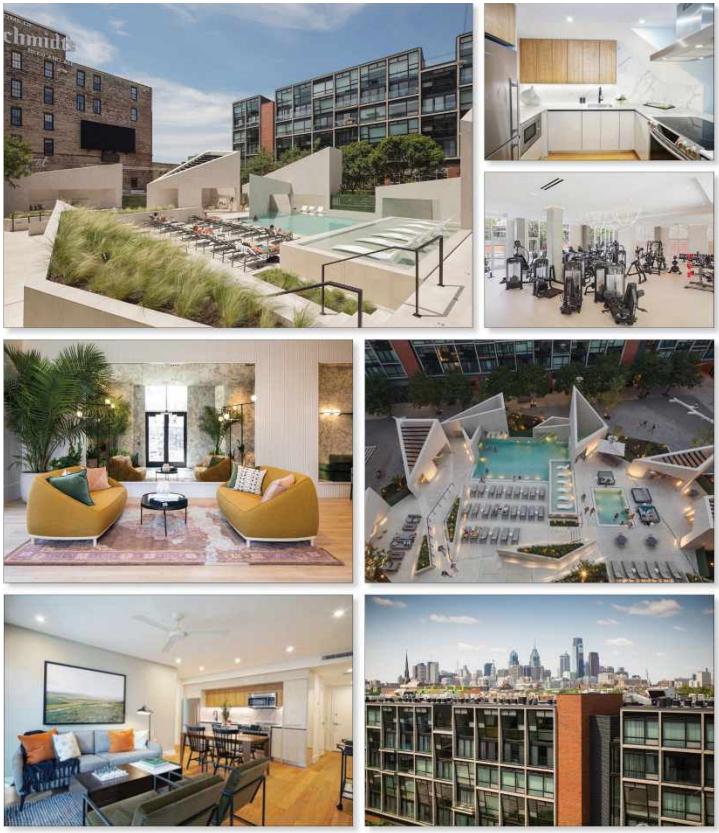

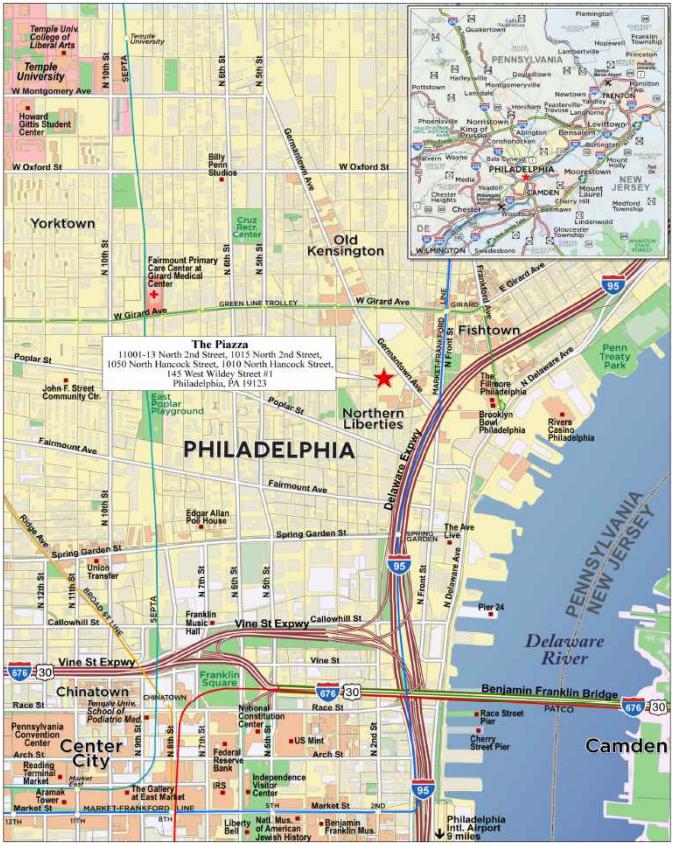

The Mortgage Loan. The largest mortgage loan (“The Piazza Mortgage Loan”) is part of a whole loan (“The Piazza Whole Loan”) evidenced by three pari passu promissory notes in the aggregate original principal amount of $108,550,000. The Piazza Whole Loan is secured by a first priority fee mortgage encumbering a 332-unit luxury multifamily apartment complex, inclusive of 28,715 SF of commercial retail space, located in Philadelphia, PA (“The Piazza Property”).

| This is not a research report and was not prepared by any Underwriter’s research department. Please see additional important information and qualifications at the end of this Term Sheet. |

| | T-7 | |

| Multifamily – Mid Rise | Loan #1 | Cut-off Date Balance: | | $90,000,000 |

| 1001-13 North 2nd Street, 1015 North | The Piazza | Cut-off Date LTV: | | 65.0% |

| 2nd Street, 1010 North Hancock | | UW NCF DSCR: | | 1.35x |

| Street, 1050 North Hancock Street | | UW NOI Debt Yield: | | 8.2% |

| and 145 West Wildey Street, Unit 1 | | | | |

| Philadelphia, PA 19123 | | | | |

The Piazza Mortgage Loan is evidenced by the controlling senior Note A-1 with an original principal amount of $75,000,000 and the non-controlling Note A-2-1 with an original principal amount of $15,000,000. The remaining promissory note comprising The Piazza Whole Loan is summarized in the below table. The Piazza Whole Loan will be serviced pursuant to the pooling and servicing agreement for the BANK5 2024-5YR9 securitization trust. See “Description of the Mortgage Pool—The Whole Loans—The Serviced Pari Passu Whole Loans” and “Pooling and Servicing Agreement” in the prospectus.

| The Piazza Whole Loan Summary |

Note | Original Balance | Cut-off Date Balance | Note Holder | Controlling

Piece |

| A-1 | $75,000,000 | $75,000,000 | BANK5 2024-5YR9 | Yes |

| A-2-1 | $15,000,000 | $15,000,000 | BANK5 2024-5YR9 | No |

| A-2-2(1) | $18,550,000 | $18,550,000 | JPMCB | No |

| Whole Loan | $108,550,000 | $108,550,000 | | |

| (1) | Expected to be contributed to one or more future securitization trusts. |

The Borrowers and the Borrower Sponsor. The borrowers are 1010 North Hancock Partners, LP, Piazza Partners I, LP, 1050 North Hancock Partners, LP and 145 W. Wildey Lot Associates, LP, each a Pennsylvania limited partnership, each structured to be a special purpose entity with two independent directors, and Piazza LLC, a Pennsylvania limited liability company, structured to be a special purpose entity with two independent directors. The borrower sponsor is Post Brothers which is jointly owned by the non-recourse carveout guarantors, Michael A. Pestronk and Matthew I. Pestronk.

Founded in 2006 by brothers Matthew and Michal Pestronk, Post Brothers was formed to exclusively focus on creating and operating infill, class-A, “best-in-class” Philadelphia apartment buildings. Since its founding, Post Brothers has developed more than 30 properties, 8,000 apartments and 700,000 SF of complimentary office and retail space. Consistent with its goals of offering upscale living at an accessible price point, Post Brothers constructed the first LEED-certified residential high-rise in Philadelphia, making Post Brothers the largest private buyer of wind-generated electricity in the Philadelphia region. Post Brothers employs over 200 vertically integrated employees, providing the company deep in-house expertise in design, construction, leasing and property management, allowing for the company to focus on product quality.

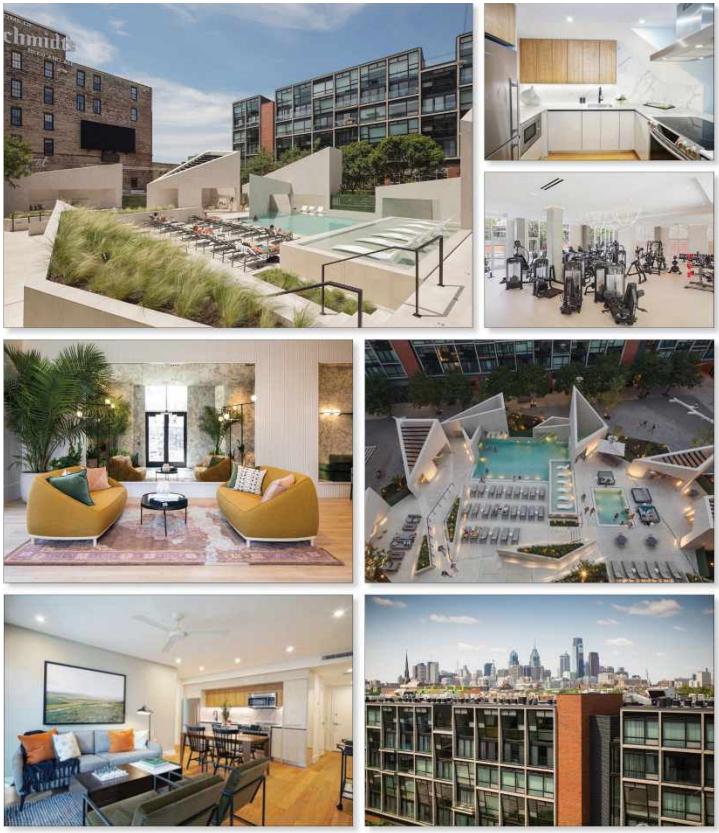

The Property. The Piazza Property is a mid-rise, luxury apartment complex comprised of three distinct buildings, as well as 28,715 SF of commercial space. Located in the Northern Liberties neighborhood, the appraisal notes that The Piazza Property was the premier property that began the Northern Liberties renaissance. Each of the three buildings that comprise The Piazza Property (Erbe, Navona and Montesino), features its own unique style and offerings. Full of amenities, The Piazza Property offers residents access to apartment features such as spas, expansive and fully equipped fitness facilities with tanning beds, steam rooms, hydro massage tables and a sauna, as well as two exclusive pool clubs. Other public and private amenities include an on-site dog park, access to a kid’s playground and concierge and valet services. Additionally, residents of The Piazza Property have access to the amenities available at the neighboring sponsor-owned Piazza Alta property, which features a 25,000 SF rooftop pool club with interconnected sets of large pools, a hot tub, splash pad, fire pits, kitchens and lounge space, as well as additional fitness centers and a terrace and sun deck with cabanas, outdoor lounges and a golf simulator. Located on the adjacent block, there is a 302-space parking garage that is part of The Piazza Property. As of June 25, 2024, the parking garage was 98.7% percent leased at an average rental rate of $298, representing an approximately $100 discount per space to the nearby Piazza Alta.

The borrower sponsor acquired The Piazza Property in 2018 for approximately $97.9 million and has since invested approximately $40.0 million in capital expenditures, including a full gut-renovation of 60 of the 316 units currently available, termed “Palazzo” units. Renovated Palazzo units incorporate upgraded Brazilian oak flooring throughout the units, brand new kitchen appliances and finishes as well as updated bathroom features. The remaining 256 units are labeled as “Authentic”. The Piazza Property’s current multifamily unit mix is comprised of 158 one-bed and 158 two-bed units. WeWork previously rented, and recently vacated, approximately 30,000 SF of commercial space at The Piazza Property. The borrower sponsor plans to transform 20,951 SF of the space into 16 new residential multifamily units, consisting of 13 one bedroom and three two-bedroom units. The new units, averaging 1,309 SF, are expected to be larger than the existing Palazzo units, averaging 885 SF, and are expected to command higher rental rates. In connection with the WeWork conversion, for which the borrower sponsor has already obtained all necessary permits and approvals from the City, $2,400,000 was reserved at loan origination for the estimated cost of construction. The 16 new residential units are required to be delivered on or before March 5, 2025 and upon conversion of the recently vacated WeWork commercial space and an affiliate of the borrowers has executed a master lease for the 16 anticipated units. The master lease has a term of 63 months and requires a total rent of $58,220 per month. The master lease will be backstopped by the guarantors and burn off as leases are converted and leased to third-party tenants.

| This is not a research report and was not prepared by any Underwriter’s research department. Please see additional important information and qualifications at the end of this Term Sheet. |

| | T-8 | |

| Multifamily – Mid Rise | Loan #1 | Cut-off Date Balance: | | $90,000,000 |

| 1001-13 North 2nd Street, 1015 North | The Piazza | Cut-off Date LTV: | | 65.0% |

| 2nd Street, 1010 North Hancock | | UW NCF DSCR: | | 1.35x |

| Street, 1050 North Hancock Street | | UW NOI Debt Yield: | | 8.2% |

| and 145 West Wildey Street, Unit 1 | | | | |

| Philadelphia, PA 19123 | | | | |

The following table presents certain information relating to the residential unit mix of The Piazza Property:

| Unit Mix(1) |

| Unit Type | Total No. of Units | Leased Units | % of Total Units | Occupancy | Average Unit Size (SF) | Average Underwritten Monthly Rent per Unit | Average Monthly Rent per Unit(2) |

| 1 Bedroom – Authentic | 129 | | 128 | | 38.9% | | 99.2% | 728 | $2,246 | $2,475 |

| 1 Bedroom – Palazzo | 29 | | 28 | | 8.7% | | 96.6% | 694 | $2,832 | $2,950 |

| 1 Bedroom – New Units(3) | 13 | | 13 | | 3.9% | | 100.0% | 1,068 | $3,310(4) | $3,300 |

| 2 Bedroom – Authentic | 127 | | 124 | | 38.3% | | 97.6% | 1,092 | $2,939 | $3,175 |

| 2 Bedroom – Palazzo | 31 | | 28 | | 9.3% | | 90.3% | 1,064 | $3,992 | $4,000 |

| 2 Bedroom – New Units(3) | 3 | | 3 | | 0.9% | | 100.0% | 2,354 | $5,062(4) | $5,000 |

| Total/Weighted Average | 332 | | 324 | | 100.0% | | 97.6% | 923 | $2,782 | $2,982 |

| (1) | Information based on the underwritten rent roll inclusive of (i) certain executed residential leases commencing in August and September of 2024 and (ii) the yet to be constructed WeWork units for which an affiliate of the borrowers has executed a master lease. |

| (2) | Information obtained from the appraisal. |

| (3) | Represents the 16 residential units required to be delivered on or before March 5, 2025 and upon conversion of the recently vacated WeWork commercial space. In connection with the conversion, the borrower sponsor has received all necessary permits and approvals from the city. Although the units are yet to be completed, funds have been reserved for the related estimated cost of construction and an affiliate of the borrowers has executed a master lease for rents associated with the yet to be constructed units, to remain in place until such time each unit has been completed and leased to a third-party tenant. |

| (4) | Average Underwritten Monthly Rent per Unit reflects rents to be collected per the terms of the master lease agreement. |

The following table presents certain information relating to the rent growth since acquisition of The Piazza Property:

| Rent Growth(1) |

| Date | 1 Bedroom – Authentic | 1 Bedroom - Palazzo | 2 Bedroom – Authentic | 2 Bedroom - Palazzo |

| Jun-2018 | $1,572 | NAP | $1,981 | NAP |

| Jun-2019 | $1,723 | NAP | $2,085 | NAP |

| Jun-2020 | $1,890 | $2,336 | $2,316 | $3,200 |

| Jun-2021 | $1,939 | $2,420 | $2,458 | $3,305 |

| Jun-2022 | $2,091 | $2,587 | $2,657 | $3,642 |

| Jun-2023 | $2,144 | $2,674 | $2,817 | $3,805 |

| Jun-2024 | $2,244 | $2,842 | $2,940 | $4,014 |

| Total / Average Annual Growth | 42.8% / 7.1% | 21.7% / 5.4% | 48.4% / 8.1% | 25.4% / 6.4% |

| (1) | Information obtained from the borrower sponsor. |

The commercial component at The Piazza Property is currently 100.0% leased to nine tenants, three of which were recently executed in July and August 2024. The three largest tenants by underwritten rent are Atrium, which is an affiliate of the borrowers, Dollar General and Urban Village Brewing Co. Atrium is a restaurant and coffee shop, Dollar General is a low-cost grocery store and Urban Village Brewing Co. is a bar serving craft beers and other artisan specialties. For the trailing twelve months as of November 2023, Urban Village Brewing Co. recorded approximately $650 in sales PSF. Other retail tenants include: Orangetheory Fitness, a commercial gym specializing in fitness classes; SweatHouz, an infrared sauna and cold plunge recovery studio; Anejo, an upscale Mexican restaurant and bar; Sugared + Bronzed, a skin care services provider focusing on tanning and hair removal; Hudson Table, a kitchen studio that hosts cooking demonstrations and classes and Bagels & Co, a family owned “roast to order” coffee shop.

On or prior to origination, an affiliate of the borrower, Place Hospitality LLC, entered into two separate leases at The Piazza Property. One of the borrower-affiliated leases is for space that is ultimately intended, but not contractually required, to be assigned to SweatHouz, on the same terms and conditions as the Place Hospitality LLC lease that is currently in-place. The Atrium lease was also executed by Place Hospitality LLC, an affiliate of the borrowers, who intends to operate the space under the name Atrium. The tenants’ obligations under the borrower-affiliated leases are guaranteed by the non-recourse carveout guarantors pursuant to the related guaranty agreement and are personally guaranteed by the borrowers. The guaranteed obligations with respect to the Atrium space will terminate upon the achievement of a debt service coverage ratio (accounting for both The Piazza Whole Loan and The Piazza Mezzanine Loan) of 1.10x or greater for two consecutive calendar quarters, excluding rent associated with the Atrium lease. The guaranteed obligations with respect to the SweatHouz space will terminate upon the earlier to occur of (i) an assignment of Place Hospitality LLC’s interest in its lease to a tenant that is not an affiliate of the borrowers in accordance with The Piazza Whole Loan documents, (ii) the occurrence of each of the following: (A) the commencement of such non-affiliated tenant’s lease term, (B) the tendering of possession of the leased space to the applicable non-affiliated tenant and (C) the commencement of such non-affiliated tenant paying full unabated rent under such lease (except for market-standard rent abatements or free rent periods, in which case, the borrowers will be required to deposit into a free rent reserve an amount equal to such rent abatement or free rent), in each case, in accordance with The Piazza Whole Loan documents and (iii) the date that is 63 months after origination.

| This is not a research report and was not prepared by any Underwriter’s research department. Please see additional important information and qualifications at the end of this Term Sheet. |

| | T-9 | |

| Multifamily – Mid Rise | Loan #1 | Cut-off Date Balance: | | $90,000,000 |

| 1001-13 North 2nd Street, 1015 North | The Piazza | Cut-off Date LTV: | | 65.0% |

| 2nd Street, 1010 North Hancock | | UW NCF DSCR: | | 1.35x |

| Street, 1050 North Hancock Street | | UW NOI Debt Yield: | | 8.2% |

| and 145 West Wildey Street, Unit 1 | | | | |

| Philadelphia, PA 19123 | | | | |

The following table presents certain information relating to the commercial tenancy at The Piazza Property:

| Tenant Summary(1) |

| Tenant Name | Credit Rating (Moody's/Fitch S&P)(2) | Tenant SF | % of Total SF | Annual UW Rent | % of Total Annual UW Rent | Annual UW Rent PSF(2) | Lease Expiration | Renewal Options | Term. Option (Y/N) |

| Atrium(3)(4) | NR/NR/NR | 5,640 | 19.6% | $451,200 | 32.2% | $80.00 | 7/4/2035 | 1 x 5 Yr | N |

| Dollar General | Baa2/NR/BBB | 5,692 | 19.8% | $219,142 | 15.6% | $38.50 | 2/28/2027 | 2 x 5 Yr | N |

| Urban Village Brewing Co. | NR/NR/NR | 4,825 | 16.8% | $197,190 | 14.1% | $40.87 | 11/30/2026 | 2 x 5 Yr | N |

| SweatHouz(3)(4) | NR/NR/NR | 2,395 | 8.3% | $131,725 | 9.4% | $55.00 | 7/4/2035 | 1 x 5 Yr | N |

| Anejo | NR/NR/NR | 2,800 | 9.8% | $112,000 | 8.0% | $40.00 | 12/31/2029 | 2 x 5 Yr | N |

| Subtotal/Wtd. Avg. | | 21,352 | 74.4% | $1,111,257 | 79.2% | $52.04 | | | |

| | | | | | | | | | |

| Other Tenants | | 7,363 | 25.6% | $291,075 | 20.8% | $39.53 | | | |

| Occupied Collateral Total(3) | | 28,715 | 100.0% | $1,402,332 | 100.0% | $48.84 | | | |

| Vacant Space | | 0 | 0.0% | | | | | | |

| Total/Wtd. Avg. | | 28,715 | 100.0% | | | | | | |

| (1) | Information based on the underwritten rent roll as of June 20, 2024. |

| (2) | Certain ratings are those of the parent company whether or not the parent guarantees the lease. |

| (3) | Leases have been executed but the tenant is not yet in occupancy or paying rent. |

| (4) | Prior to origination, an affiliate of the borrower, Place Hospitality LLC, entered into two separate leases at The Piazza Property. One of the borrower-affiliated leases is for space that is ultimately intended to be assigned to SweatHouz, on the same terms and conditions of the Place Hospitality LLC lease that is currently in-place. Atrium is an affiliate of the borrower, which lease was executed by Place Hospitality LLC and is intended to operate the space under the name Atrium. The tenants’ obligations under the borrower-affiliated leases are guaranteed by the non-recourse carveout guarantors pursuant to the related guaranty of recourse obligations and are personally guaranteed by the borrowers. |

The following table presents certain information relating to the commercial lease rollover schedule at The Piazza Property:

| Lease Rollover Schedule(1)(2) |

| Year | # of Leases Rolling | SF Rolling | Approx % of SF Rolling | Approx Cumulative % of SF Rolling | Total UW Rent Rolling | Approx % of Total UW Rent Rolling | Approx Cumulative % of Total UW Rent Rolling | UW Rent PSF Rolling |

| MTM/2024 | 0 | 0 | 0.0% | 0.0% | $0 | 0.0% | 0.0% | $0.00 |

| 2025 | 0 | 0 | 0.0% | 0.0% | $0 | 0.0% | 0.0% | $0.00 |

| 2026 | 1 | 4,825 | 16.8% | 16.8% | $197,190 | 14.1% | 14.1% | $40.87 |

| 2027 | 2 | 8,962 | 31.2% | 48.0% | $328,217 | 23.4% | 37.5% | $36.62 |

| 2028 | 0 | 0 | 0.0% | 48.0% | $0 | 0.0% | 37.5% | $0.00 |

| 2029 | 2 | 4,355 | 15.2% | 63.2% | $175,000 | 12.5% | 49.9% | $40.18 |

| 2030 | 1 | 1,138 | 4.0% | 67.1% | $42,000 | 3.0% | 52.9% | $36.91 |

| 2031 | 0 | 0 | 0.0% | 67.1% | $0 | 0.0% | 52.9% | $0.00 |

| 2032 | 0 | 0 | 0.0% | 67.1% | $0 | 0.0% | 52.9% | $0.00 |

| 2033 | 0 | 0 | 0.0% | 67.1% | $0 | 0.0% | 52.9% | $0.00 |

| 2034 | 0 | 0 | 0.0% | 67.1% | $0 | 0.0% | 52.9% | $0.00 |

| 2035 & Thereafter | 3 | 9,435 | 32.9% | 100.0% | $659,925 | 47.1% | 100.0% | $69.94 |

| Vacant | 0 | 0 | 0.0% | 100.0% | $0 | 0.0% | 100.0% | $0.00 |

| Total/Wtd. Avg. | 9 | 28,715 | 100.0% | | $1,402,332 | 100.0% | | $48.84 |

| (1) | Information is based on the underwritten rent roll as of June 20, 2024. |

| (2) | Certain tenants may have lease termination options that are exercisable prior to the originally stated expiration date of the related lease and are not considered in the rollover schedule. |

| This is not a research report and was not prepared by any Underwriter’s research department. Please see additional important information and qualifications at the end of this Term Sheet. |

| | T-10 | |

| Multifamily – Mid Rise | Loan #1 | Cut-off Date Balance: | | $90,000,000 |

| 1001-13 North 2nd Street, 1015 North | The Piazza | Cut-off Date LTV: | | 65.0% |

| 2nd Street, 1010 North Hancock | | UW NCF DSCR: | | 1.35x |

| Street, 1050 North Hancock Street | | UW NOI Debt Yield: | | 8.2% |

| and 145 West Wildey Street, Unit 1 | | | | |

| Philadelphia, PA 19123 | | | | |

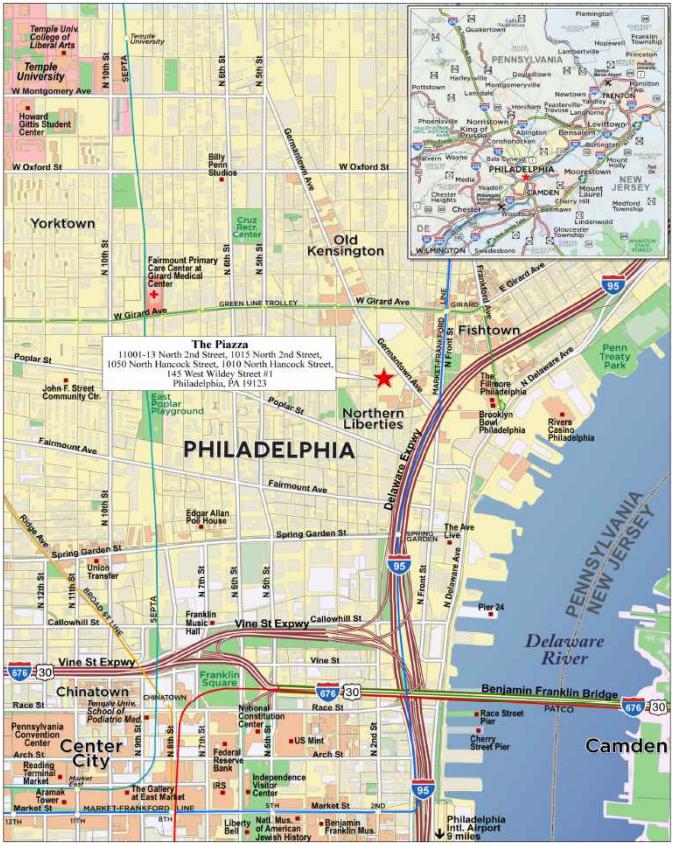

The Market. The Piazza Property is located in the Northern Liberties neighborhood of Philadelphia. Northern Liberties has experienced a significant amount of redevelopment over the past two decades. In recent years, the area has seen a steady influx of residents which helped propel additional demand and additional development of the area. Today, the submarket appeals to households of all types, with many seeking higher quality housing at more affordable prices than at the heart of Center City. Being less densely developed with high rise buildings also helps to provide a more neighborhood like atmosphere. The submarket benefits from accessible public transit as The Piazza Property is located within walking distance of two subway stops providing direct access to core locations within Center City. Moreover, the subway also provides access to the primary regional rail lines serving numerous Pennsylvania suburban communities. Popular demand generators for Northern Liberties include its artistic, culinary and entertainment activity. According to the appraisal, approximately 4.0% of submarket inventory and 4.9% of the market inventory represents newer construction. Furthermore, absorption for the last 12 months was positive for the overall market area and at the submarket level, with a healthy approximate 1:1 ratio.

Northern Liberties is part of the Philadelphia-Camden-Wilmington metropolitan statistical area (“MSA”), the eighth most populated MSA in the United States. The MSA is highlighted by a dynamic mix of key industries, including education and health services, finance, biotechnology, manufacturing and tourism. According to the appraisal, there are 13 Fortune 500 companies located in the MSA; the MSA is one of the top three bioscience regions in the northeast and seventh nationally. Additionally, according to the appraisal, approximately 40% of the United States population can be reached within a day’s drive and approximately 60% of the United States population is situated within a two-hour flight radius. As the seventh largest MSA in employment, the MSA maintains an unemployment rate of 3.3% as of the fourth quarter of 2023. The MSA features an expansive logistics ecosystem, which includes several major highways, railways, international airports and public transit systems. Additionally, local manufacturers have been a recent source of strength, with payrolls climbing in the MSA despite losing momentum nationally. Economic reliance on manufacturing, as well as food and pharmaceuticals has led to the MSA seeing more stable demand.

According to the appraisal, the zip code that The Piazza Property is located in has an average household income of $134,334 as of 2023, with almost 50% of households having income levels supporting the average market rent of The Piazza Property. Additionally, the zip code recorded a 2023 population of 21,206 individuals. The demographic profile of Northern Liberties has increased rapidly since 2010, with the zip code seeing an approximately 54.6% increase to its population between 2010 and 2023. Moreover, according to the appraisal, annual population growth in The Piazza Property’s zip code is projected to be 5.8% in the future.

According to the appraisal, the Northern Liberties submarket is considered a top tier market area, with an average rental rate well above that of the overall metro markets and city of Philadelphia overall. As of the first quarter of 2024, the submarket reported total inventory of 3,729 units with a 15.3% vacancy rate and average asking rents of $2,281 per month. The appraisal identified five directly competitive multifamily properties as detailed in the table below:

| Competitive Set |

| | The Piazza (Subject) | The Poplar | Piazza Alta | The Carson | The Battery | Corner 2nd |

| Year Built/Renovated | 2006-2007/2019 | 1929/2021 | 2022/NAP | 2023/NAP | 1920/2023 | 2023/NAP |

| Number of Units | 332(1)(2) | 285 | 695 | 373 | 235 | 71 |

| Average Monthly Rent (per unit) | | | | | | |

| 1 Bedroom | $2,425(1)(3) | $2,548 | $3,090 | $2,693 | $3,300 | $3,085 |

| 1 Bedroom PSF | $3.24(1)(3) | $2.94 | $4.12 | $3.42 | $4.50 | $3.93 |

| 2 Bedroom | $3,170(1)(3) | $4,565 | $4,695 | $4,060 | $4,367 | $4,395 |

| 2 Bedroom PSF | $2.85(1)(3) | $3.06 | $4.51 | $3.74 | $3.39 | $3.61 |

| Occupancy | 97.6%(1)(2) | 93.0% | 93.0% | 51.0%(4) | 63.0%(4) | 97.0% |

Source: Appraisal, unless otherwise indicated.

| (1) | Information based on the underwritten rent roll inclusive of (i) certain residential leases commencing in August and September of 2024 and (ii) the yet to be constructed WeWork units for which an affiliate of the borrowers has executed a master lease. |

| (2) | Number of Units is inclusive of the 16 residential units required to be delivered on or before March 5, 2025 and upon conversion of the recently vacated WeWork commercial space. In connection with the conversion, the borrower sponsor has received all necessary permits and approvals from the city. Although the units are yet to be completed, funds have been reserved for the related estimated cost of construction and an affiliate of the borrowers has executed a master lease for rents associated with the yet to be constructed units, to remain in place until such time each unit has been completed and leased to a third-party tenant. |

| (3) | Calculated as a weighted average between Authentic, Palazzo and new units. |

| (4) | The Carson and The Battery were recently delivered and are still in an initial lease-up period. |

Appraisal. The appraiser concluded to a “hypothetical as-if-stabilized” value for The Piazza Property of $167,000,000 as of May 22, 2024, based on the hypothetical assumption that the three retail leases are executed and the conversion of the WeWork space is completed. Prior to the origination date, three retail leases were executed resulting in 100.0% commercial occupancy. The borrowers were required at loan origination to deposit (i) $3,330,271 into the Unfunded Obligations Reserve and $730,806 into the Gap Rent Reserve, in order to fully capitalize outstanding obligations associated with the three retail leases, and (ii) $2,400,000 into the Coworking Space Conversion Reserve for estimated cost of construction associated with conversion of the WeWork units. Further, an affiliate of the borrowers executed a master lease for the 16 new anticipated units. The appraisal also provides for an “as is” appraised value of $155,800,000. The “as is” appraised value results in a Cut-off Date LTV Ratio and Maturity Date LTV Ratio of 69.7% for The Piazza Whole Loan.

Environmental Matters. According to the Phase I environmental site assessment dated June 6, 2024, there was no evidence of any recognized environmental l conditions at The Piazza Property.

| This is not a research report and was not prepared by any Underwriter’s research department. Please see additional important information and qualifications at the end of this Term Sheet. |

| | T-11 | |

| Multifamily – Mid Rise | Loan #1 | Cut-off Date Balance: | | $90,000,000 |

| 1001-13 North 2nd Street, 1015 North | The Piazza | Cut-off Date LTV: | | 65.0% |

| 2nd Street, 1010 North Hancock | | UW NCF DSCR: | | 1.35x |

| Street, 1050 North Hancock Street | | UW NOI Debt Yield: | | 8.2% |

| and 145 West Wildey Street, Unit 1 | | | | |

| Philadelphia, PA 19123 | | | | |

Operating History and Underwritten Net Cash Flow. The following table presents certain information relating to the historical operating performance and Underwritten Net Cash Flow at The Piazza Property:

| Cash Flow Analysis |

| | 2021 | 2022 | 2023 | TTM April 2024 | UW(1) | UW per Unit(1) |

| Base Rent | $8,838,021 | $9,495,375 | $9,919,605 | $10,050,456 | $10,116,694 | $30,472 |

| Vacant Income (New Units) | $0 | $0 | $0 | $0 | $698,640(2) | $2,104 |

| Vacant Income (Existing) | $0 | $0 | $0 | $0 | $339,060 | $1,021 |

| Commercial Rental Income | $1,177,984 | $1,197,815 | $1,065,414 | $924,142 | $1,402,332 | $4,224 |

| Commercial Other Income | $71,777 | $72,787 | $86,181 | $86,405 | $124,355 | $375 |

| Gross Potential Rent | $10,087,782 | $10,765,977 | $11,071,200 | $11,061,003 | $12,681,080 | $38,196 |

| (Vacancy / Concessions) | ($1,601,099) | ($1,514,318) | ($1,193,819) | ($1,182,922) | ($1,114,034)(3) | ($3,356) |

| Net Rentable Income | $8,486,683 | $9,251,659 | $9,877,381 | $9,878,081 | $11,567,046 | $34,840 |

| Other Income | $646,694 | $835,776 | $1,065,399 | $1,134,081 | $1,246,049 | $3,753 |

| Effective Gross Income | $9,133,377 | $10,087,435 | $10,942,780 | $11,012,162 | $12,813,095 | $38,594 |

| | | | | | | |

| Real Estate Taxes | $1,405,957 | $1,473,207 | $1,437,773 | $1,429,394 | $1,460,511 | $4,399 |

| Insurance | $218,280 | $254,640 | $252,855 | $256,539 | $275,665 | $830 |

| Other Operating Expenses | $2,032,283 | $2,202,324 | $2,139,713 | $2,138,623 | $2,189,307 | $6,594 |

| Total Operating Expenses | $3,656,520 | $3,930,171 | $3,830,341 | $3,824,557 | $3,925,483 | $11,824 |

| | | | | | | |

| Net Operating Income | $5,476,857 | $6,157,265 | $7,112,438 | $7,187,606 | $8,887,612 | $26,770 |

| Replacement Reserves | $0 | $0 | $0 | $0 | $87,307 | $263 |

| Net Cash Flow | $5,476,857 | $6,157,265 | $7,112,438 | $7,187,606 | $8,800,305 | $26,507 |

| | | | | | | |

| Occupancy (%) | 88.1% | 90.0% | 93.6% | 93.0% | 97.6%(4) | |

| NOI DSCR(5) | 0.84x | 0.95x | 1.09x | 1.11x | 1.37x | |

| NCF DSCR(5) | 0.84x | 0.95x | 1.09x | 1.11x | 1.35x | |

| NOI Debt Yield(5) | 5.0% | 5.7% | 6.6% | 6.6% | 8.2% | |

| NCF Debt Yield(5) | 5.0% | 5.7% | 6.6% | 6.6% | 8.1% | |

|

| (1) | Information based on the underwritten rent roll inclusive of (i) certain residential leases commencing in August and September of 2024 and (ii) the yet to be constructed WeWork units for which an affiliate of the borrowers has executed a master lease. |

| (2) | Inclusive of rent attributable to the 16 additional units required to be delivered on or before Mach 5, 2025 and upon conversion of the recently vacated WeWork commercial space. In connection with the conversion, the borrower sponsor has received all necessary permits and approvals from the city. Although the units are yet to be completed, funds have been reserved for the related estimated cost of construction and an affiliate of the borrowers has executed a master lease for rents associated with the yet to be constructed units, to remain in place until such time each unit has been completed and leased to a third-party tenant. |

| (3) | UW (Vacancy/Concessions) is inclusive of (i) in-place vacancy (as of June 20, 2024 including certain executed residential leases commencing in August and September of 2024) for the current residential unit inventory, (ii) all rents associated with the yet to be constructed WeWork units and (iii) 5.0% economic vacancy for the commercial rental space. |

| (4) | Represents residential occupancy inclusive of (i) 16 yet to be constructed residential units required to be delivered on or before March 5, 2025 and upon conversion of the WeWork space, for which an affiliate of the borrowers has executed a master lease and (ii) certain residential leases commencing in August and September of 2024. |

| (5) | Debt service coverage ratios and debt yields are based on The Piazza Whole Loan. |

Escrows and Reserves.

Real Estate Taxes – On the loan origination date, the borrowers were required to make an upfront deposit of $625,851 into a reserve for real estate taxes. In addition, the borrowers are required to deposit into a real estate tax reserve, on a monthly basis, an amount equal to 1/12 of the real estate taxes that the mortgage lender estimates will be payable during the next ensuing twelve months (initially estimated to be $128,170).

Insurance – The borrowers are required to deposit into an insurance reserve, on a monthly basis, an amount equal to 1/12 of the insurance premiums that the mortgage lender estimates will be payable for the renewal of the insurance coverage; provided, however, that such monthly reserves for insurance premiums have been conditionally suspended so long as (i) no event of default has occurred and is continuing and (ii) the insurance coverage for The Piazza Property is included in a blanket policy approved by the lender in its reasonable discretion.

Replacement Reserve – On the loan origination date, the borrowers were required to make an upfront deposit of $7,276 into a reserve for replacement reserves. In addition, the borrowers are required to deposit into a replacement reserve, on a monthly basis, $7,276.

TI/LC Reserve – On the loan origination date, the borrowers were required to make an upfront deposit of $2,393 into a reserve for TI/LC reserves. In addition, the borrowers are required to deposit into a TI/LC reserve, on a monthly basis, $2,393, along with any lease termination fees or other payments received by the borrowers in connection with the termination or modification of any non-residential lease at The Piazza Property. The TI/LC reserve is subject to a cap of $86,145.

Unfunded Obligations Reserve – On the loan origination date, the borrowers were required to make an upfront deposit of $3,330,271 into a reserve for unfunded obligations reserves associated with the TI/LC costs of three recently executed retail leases.

| This is not a research report and was not prepared by any Underwriter’s research department. Please see additional important information and qualifications at the end of this Term Sheet. |

| | T-12 | |

| Multifamily – Mid Rise | Loan #1 | Cut-off Date Balance: | | $90,000,000 |

| 1001-13 North 2nd Street, 1015 North | The Piazza | Cut-off Date LTV: | | 65.0% |

| 2nd Street, 1010 North Hancock | | UW NCF DSCR: | | 1.35x |

| Street, 1050 North Hancock Street | | UW NOI Debt Yield: | | 8.2% |

| and 145 West Wildey Street, Unit 1 | | | | |

| Philadelphia, PA 19123 | | | | |

Gap Rent Reserve – On the loan origination date, the borrowers were required to make an upfront deposit of $730,806 into a gap rent reserve associated with three recently executed retail leases.

Coworking Space Conversion Reserve – On the loan origination date, the borrowers were required to make an upfront deposit of $2,400,000 into a reserve for the estimated costs of construction associated with the conversion of the WeWork space to 16 new residential units.

Lockbox and Cash Management. The Piazza Whole Loan is structured with a soft lockbox and in place cash management. The borrowers and the property manager are required to direct the non-residential tenants to pay rent directly into the lockbox account, and to deposit any rents otherwise received into such account within two business days after receipt. All funds in the lockbox account are required to be swept once every business day to a lender-controlled cash management account. Funds in the cash management account are required to be applied to debt service and the reserves and escrows described above and applied to debt service under The Piazza Mezzanine Loan in accordance with The Piazza Whole Loan documents, with any excess funds (i) during the continuance of a Cash Sweep Event (as defined below)(other than a Cash Sweep Event that occurs solely as a result of a mezzanine event of default), to be deposited into an excess cash flow reserve account held by the lender as cash collateral for The Piazza Whole Loan, or (ii) if a Cash Sweep Event is in effect solely as a result of a mezzanine event of default, (x) first, to the mezzanine lender in an amount equal to any deferred interest that was not paid during such Cash Sweep Period and (y) second, into an excess cash flow reserve account held by the lender as cash collateral for The Piazza Whole Loan, or (iii) to the extent no Cash Sweep Event is in effect, disbursed to the borrower.

A “Cash Sweep Event” means the occurrence of (i) an event of default, (ii) any bankruptcy action of a borrower or the property manager, (iii) the debt service coverage ratio (x) with respect to The Piazza Whole Loan and The Piazza Mezzanine Loan, falling below 1.05x based on the trailing three-month period preceding the date of such determination, or (y) solely with respect to The Piazza Whole Loan, falling below 1.34x based on the trailing three-month period preceding the date of such determination (collectively, a “DSCR Trigger Event”) or (iv) any mezzanine event of default. As of the origination date, a Cash Sweep Event is in effect due to the occurrence of a DSCR Trigger Event.

A Cash Sweep Event will no longer be continuing (a) with respect to clause (iii) above, upon (1) the achievement of a debt service coverage ratio (accounting for both The Piazza Whole Loan and The Piazza Mezzanine Loan) of 1.10x or greater for two consecutive calendar quarters based upon the trailing three-month period immediately preceding the date of determination, and (2) the achievement of a debt service coverage ratio (accounting for The Piazza Whole Loan only) of 1.40x or greater for two consecutive calendar quarters based upon the trailing three-month period immediately preceding the date of determination, (b) with respect to clause (i) above, upon the acceptance by the lender of a cure of such event of default or an express waiver of such event of default in writing by the lender in its sole and absolute discretion, (c) with respect to clause (ii) above, solely with respect to the property manager, if, within 60 days of the occurrence thereof, the borrowers replace the applicable property manager with a qualified property manager under a replacement management agreement, or (d) with respect to clause (iv) above, such mezzanine event of default has been cured in accordance with the terms of the related The Piazza Mezzanine Loan documents; provided, however, (i) no event of default under The Piazza Whole Loan documents has occurred and be continuing, and (ii) the borrowers have paid all of the lender’s reasonable, out-of-pocket expenses incurred in connection with such cure including reasonable, out-of-pocket attorney’s fees and expenses. In no event may the borrowers be entitled to cure a Cash Sweep Event caused by a bankruptcy action of any of the borrowers.

Mezzanine Loan. Concurrently with the funding of The Piazza Whole Loan, RCG LV Debt VII REIT, LLC funded a mezzanine loan in the amount of $18,500,000 to be secured by the mezzanine borrowers’ interests in the borrowers as collateral for The Piazza Mezzanine Loan. The Piazza Mezzanine Loan is coterminous with The Piazza Whole Loan. The Piazza Mezzanine Loan accrues interest at an all-in rate of 12.5000% per annum, of which 10.000% is to be paid as part of each monthly debt service payment amount, and of which 2.5000% per annum is added to the debt to the extent not paid on each monthly payment date. The Piazza Mezzanine Loan is interest-only through the loan term. A mezzanine intercreditor agreement was executed at loan origination.

| | Mezzanine

Original Principal

Balance | Mezzanine Interest Rate | Loan Term

(Original) | Amortization

Term

(Original) | IO Period | Total Debt U/W

DSCR based on NOI/NCF(1) | Total Debt U/W

Debt Yield

based

on NOI/NCF | Total Debt

Cut-off Date

LTV Ratio | Total Debt LTV

Ratio at

Maturity |

Piazza Mezzanine

Loan | $18,500,000 | 12.50% | 60 | 0 | 60 | 1.06x / 1.05x | 7.0% / 6.9% | 76.1% | 76.1% |

| (1) | Total Debt U/W DSCR based on NOI/NCF is calculated exclusive of the 2.5000% per annum added to the debt to the extent not paid on each monthly payment date. |

Condominium: One parcel of The Piazza Property (the 145 W. Wildey Street parcel) is subject to a condominium structure comprised of (i) a garage unit (80% ownership of the condominium), and (ii) a roof unit (20% ownership of the condominium). The 145 W. Wildey Lot Associates, LP borrower owns the garage unit, which controls the condominium.

Terrorism Insurance. The borrowers are required to obtain and maintain property insurance for 100% of full replacement cost and business interruption insurance for 18 months plus a 12-month extended period of indemnity. Such insurance is required to cover perils of terrorism and acts of terrorism. See “Risk Factors—Risks Relating to the Mortgage Loans—Terrorism Insurance May Not Be Available for All Mortgaged Properties” in the prospectus.

| This is not a research report and was not prepared by any Underwriter’s research department. Please see additional important information and qualifications at the end of this Term Sheet. |

| | T-13 | |

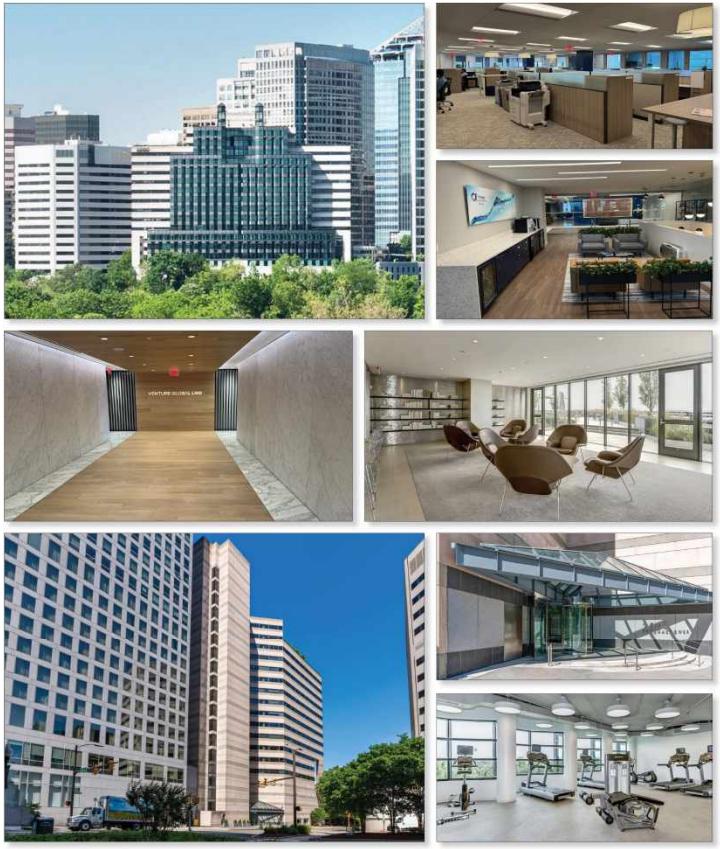

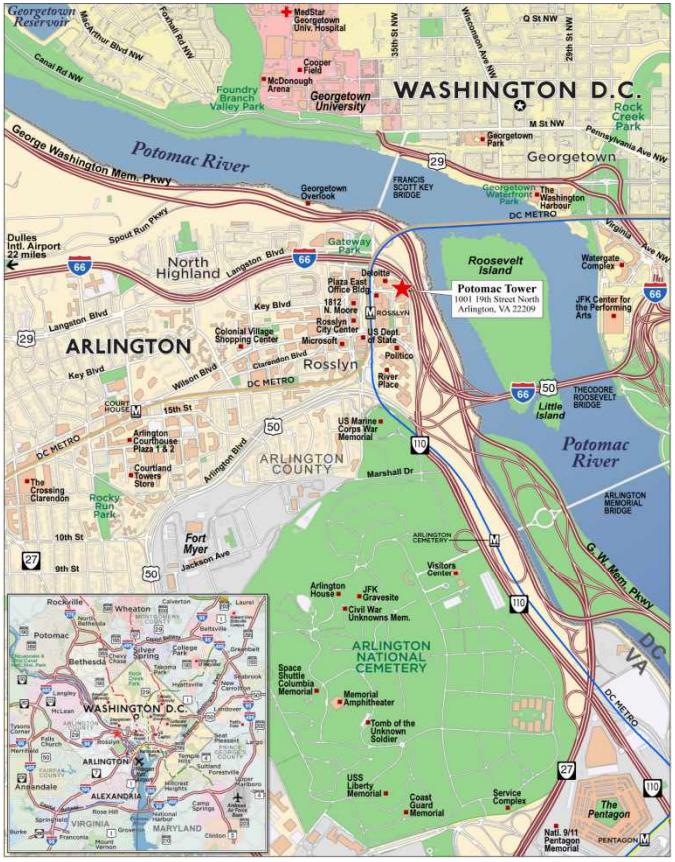

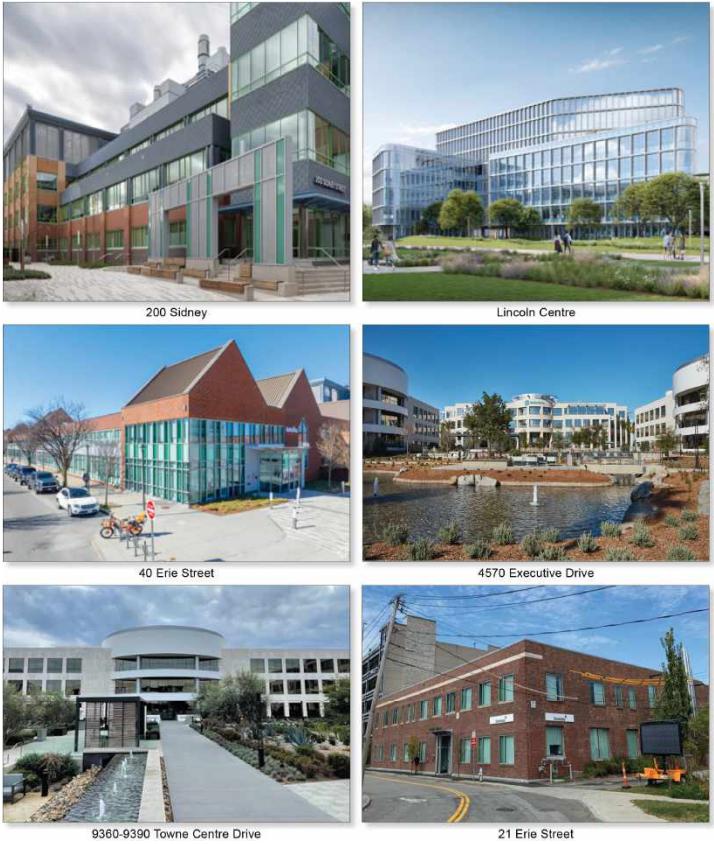

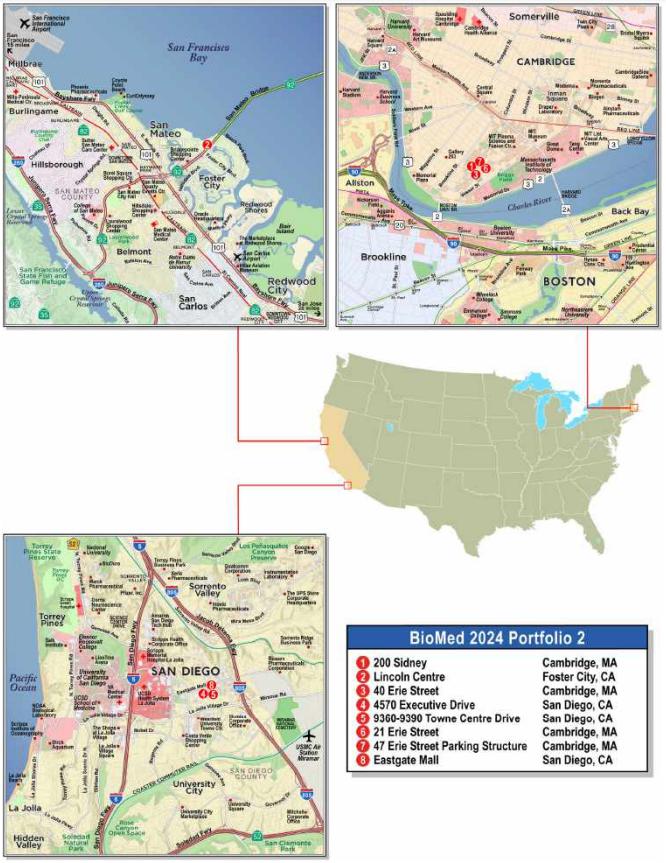

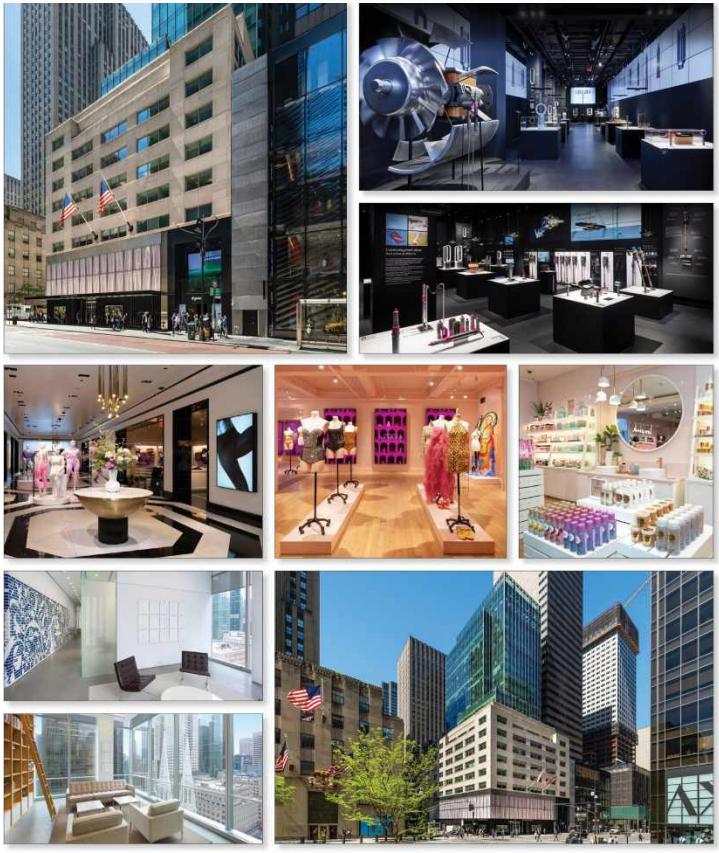

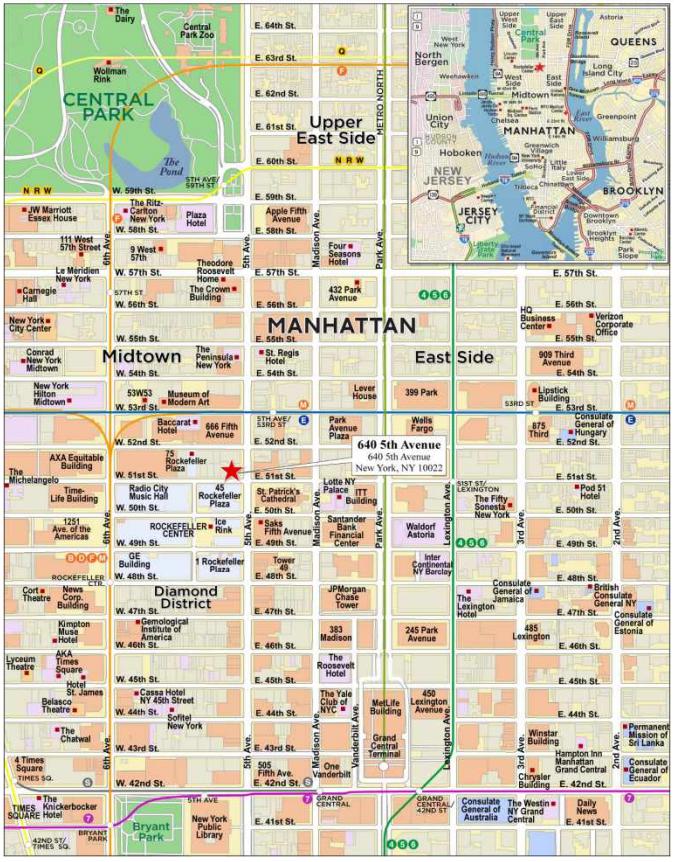

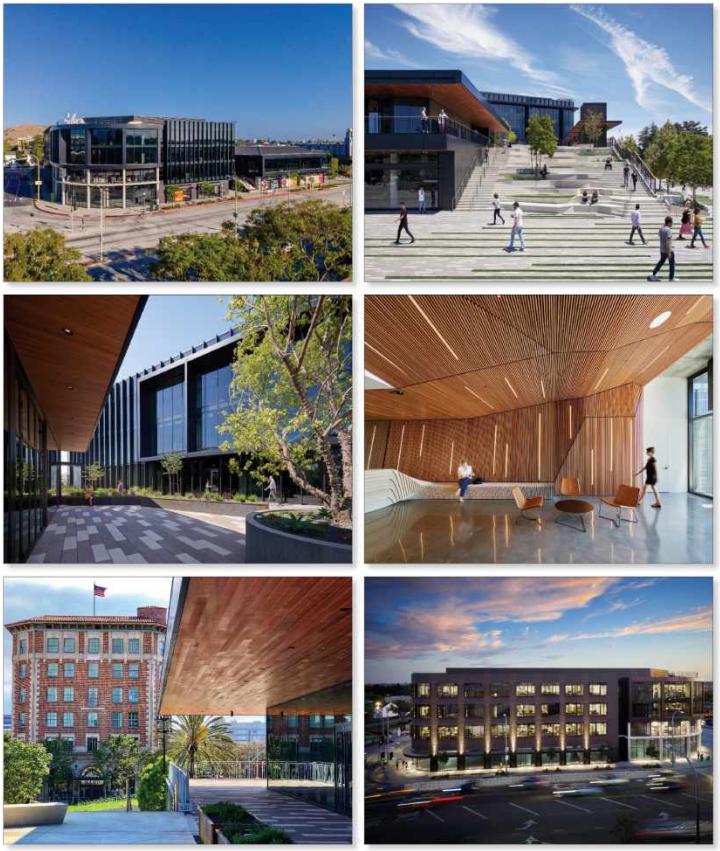

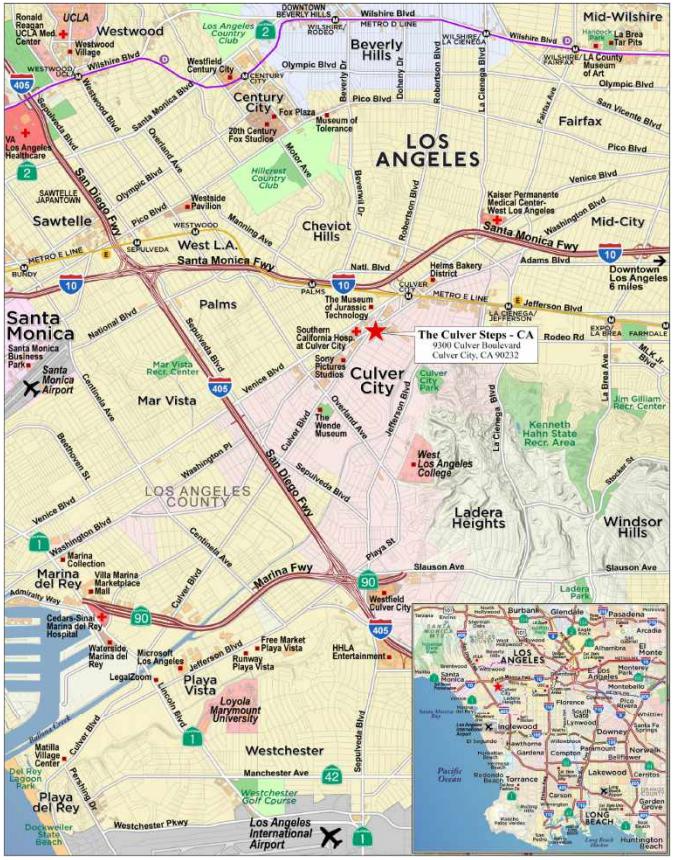

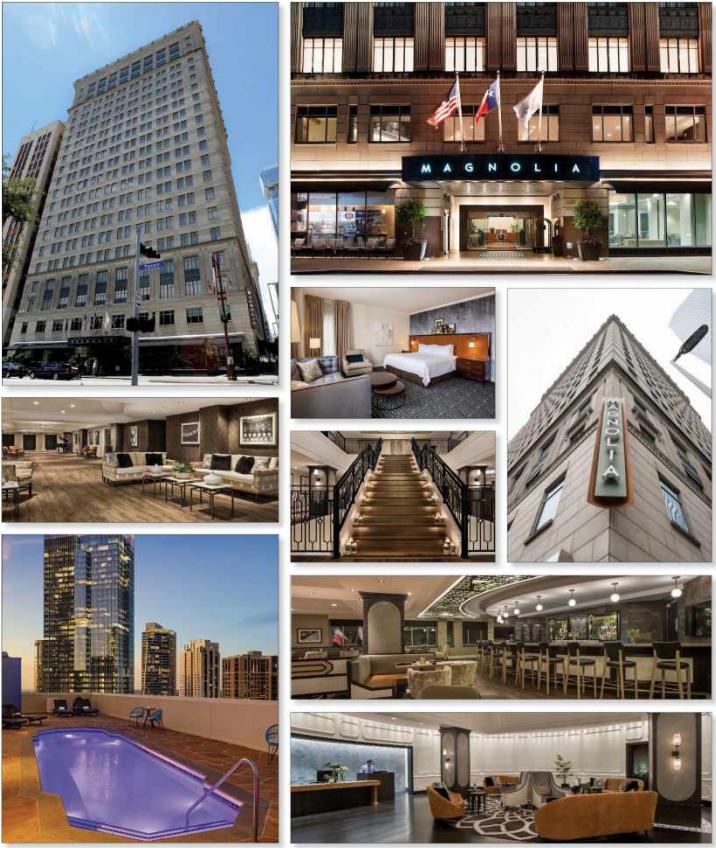

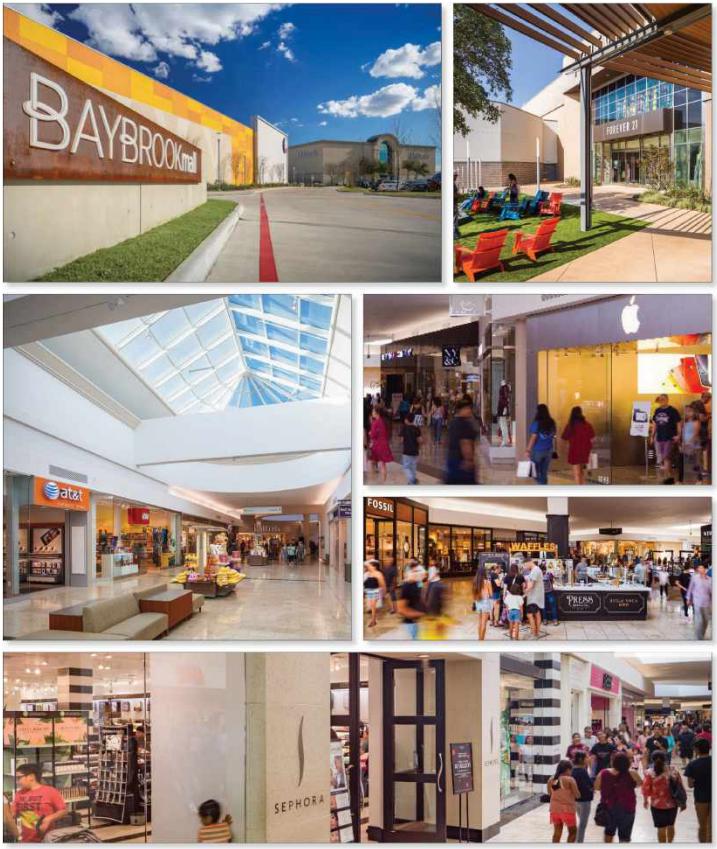

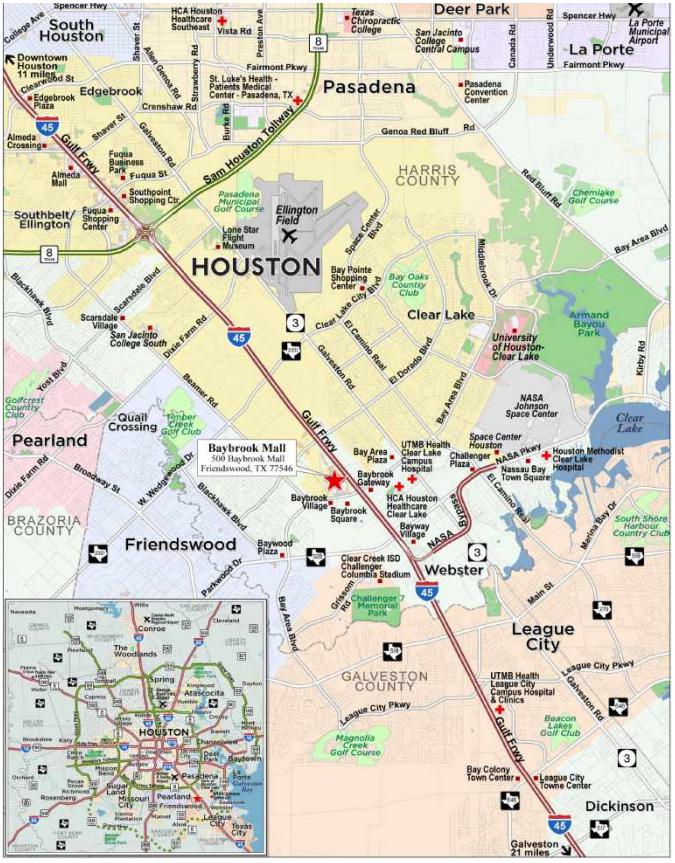

| Retail – Super Regional Mall | Loan #2 | Cut-off Date Balance: | | $88,000,000 |

| 500 Baybrook Mall | Baybrook Mall | Cut-off Date LTV: | | 56.0% |

| Friendswood, TX 77546 | | UW NCF DSCR: | | 1.72x |

| | | UW NOI Debt Yield: | | 13.7% |

| This is not a research report and was not prepared by any Underwriter’s research department. Please see additional important information and qualifications at the end of this Term Sheet. |

| | T-14 | |

| Retail – Super Regional Mall | Loan #2 | Cut-off Date Balance: | | $88,000,000 |

| 500 Baybrook Mall | Baybrook Mall | Cut-off Date LTV: | | 56.0% |

| Friendswood, TX 77546 | | UW NCF DSCR: | | 1.72x |

| | | UW NOI Debt Yield: | | 13.7% |

| This is not a research report and was not prepared by any Underwriter’s research department. Please see additional important information and qualifications at the end of this Term Sheet. |

| | T-15 | |

| Retail – Super Regional Mall | Loan #2 | Cut-off Date Balance: | | $88,000,000 |

| 500 Baybrook Mall | Baybrook Mall | Cut-off Date LTV: | | 56.0% |

| Friendswood, TX 77546 | | UW NCF DSCR: | | 1.72x |

| | | UW NOI Debt Yield: | | 13.7% |

| This is not a research report and was not prepared by any Underwriter’s research department. Please see additional important information and qualifications at the end of this Term Sheet. |

| | T-16 | |

| Retail – Super Regional Mall | Loan #2 | Cut-off Date Balance: | | $88,000,000 |

| 500 Baybrook Mall | Baybrook Mall | Cut-off Date LTV: | | 56.0% |

| Friendswood, TX 77546 | | UW NCF DSCR: | | 1.72x |

| | | UW NOI Debt Yield: | | 13.7% |

| This is not a research report and was not prepared by any Underwriter’s research department. Please see additional important information and qualifications at the end of this Term Sheet. |

| | T-17 | |

| Mortgage Loan No. 2 – Baybrook Mall |

| Mortgage Loan Information | | Property Information |

| Mortgage Loan Seller: | MSMCH | | Single Asset/Portfolio: | Single Asset |

| Credit Assessment (Fitch/Moody’s/KBRA): | NR/NR/NR | | Location: | Friendswood, TX 77546 |

| Original Balance(1): | $88,000,000 | | General Property Type: | Retail |

| Cut-off Date Balance(1): | $88,000,000 | | Detailed Property Type: | Super Regional Mall |

| % of Initial Pool Balance: | 9.7% | | Title Vesting: | Fee |

| Loan Purpose: | Refinance | | Year Built/Renovated: | 1978/2016 |

| Borrower Sponsors: | Brookfield Properties Retail Holding LLC | | Size(4): | 540,986 SF |

| | and SMRF Baybrook Investor Member | | Cut-off Date Balance Per SF(1): | $407 |

| | LLC | | Maturity Date Balance Per SF(1): | $385 |

| Guarantor: | BPR Nimbus LLC | | Property Manager: | Brookfield Properties Retail Inc. |

| Mortgage Rate: | 6.8160% | | | (borrower-related) |

| Note Date: | 7/19/2024 | | | |

| Maturity Date: | 8/1/2029 | | | |

| Term to Maturity: | 60 months | | Underwriting and Financial Information |

| Amortization Term: | 360 months | | UW NOI: | $30,209,945 |

| IO Period: | 0 months | | UW NCF: | $29,652,729 |

| Seasoning: | 0 months | | UW NOI Debt Yield(1): | 13.7% |

| Prepayment Provisions: | L(24),D(32),O(4) | | UW NCF Debt Yield(1): | 13.5% |

| Lockbox/Cash Mgmt Status: | Hard/Springing | | UW NOI Debt Yield at Maturity(1): | 14.5% |

| Additional Debt Type(1): | Pari Passu | | UW NCF DSCR(1): | 1.72x |

| Additional Debt Balance(1): | $132,000,000 | | Most Recent NOI: | $29,848,392 (5/31/2024 TTM) |

| Future Debt Permitted (Type): | No (NAP) | | 2nd Most Recent NOI: | $29,919,970 (12/31/2023) |

| Reserves(2) | | 3rd Most Recent NOI: | $28,591,885 (12/31/2022) |

| Type | Initial | Monthly | Cap | | Most Recent Occupancy: | 95.4% (6/30/2024) |

| RE Taxes: | $0 | Springing | NAP | | 2nd Most Recent Occupancy: | 99.3% (12/31/2023) |

| Insurance: | $0 | Springing | NAP | | 3rd Most Recent Occupancy: | 97.5% (12/31/2022) |

| Replacement Reserve: | $0 | Springing | $270,493 | | Appraised Value (as of)(5): | $392,659,260 (6/4/2024) |

| TI/LC Reserve: | (3) | Springing | $1,081,972 | | Appraised Value Per SF(5): | $726 |

| Anchor Tenant Reserve: | $0 | Springing | NAP | | Cut-off Date LTV Ratio(1)(5): | 56.0% |

| | | | | | Maturity Date LTV Ratio(1)(5): | 53.0% |

| | | | | | | | |

| Sources and Uses |

| Sources | Proceeds | % of Total | | Uses | Proceeds | % of Total |

| Whole Loan Amount(1): | $220,000,000 | 100.0% | | Loan Payoff: | $213,488,234 | 97.0% |

| | | | | Return of Equity: | $5,037,736 | 2.3% |

| | | | | Closing Costs: | $1,474,030 | 0.7% |

| Total Sources: | $220,000,000 | 100.0% | | Total Uses: | $220,000,000 | 100.0% |

| (1) | The Baybrook Mall Mortgage Loan (as defined below) is part of the Baybrook Mall Whole Loan (as defined below), with an aggregate original principal amount of $220,000,000. The Cut-off Date Balance Per SF, Maturity Date Balance Per SF, UW NOI Debt Yield, UW NCF Debt Yield, UW NOI Debt Yield at Maturity, UW NCF DSCR, Cut-off Date LTV Ratio and Maturity Date LTV Ratio numbers presented above are based on the Baybrook Mall Whole Loan. |

| (2) | See “Escrows and Reserves” below for further discussion of reserve requirements. |

| (3) | On the origination date, the borrower provided a Guaranty of Limited Payment (as described below) from the non-recourse carveout guarantor in lieu of depositing approximately $1,984,194 into a TI/LC reserve. See “Escrows and Reserves” below for further discussion of the Guaranty of Limited Payment. |

| (4) | Size does not include 720,931 SF of space associated with Dillard’s, Macy’s and Living Space, all non-collateral anchor tenants. |

| (5) | The Appraised Value is the Market Value “As Is” with Escrow Reserve, which assumes that $2,659,260.33 will be reserved for tenant improvements. The Market Value “As Is” Appraised Value without the reserve is $390,000,000, which results in a Cut-off Date LTV Ratio and Maturity Date LTV Ratio of 56.4% and 53.3% respectively, and an Appraised Value Per SF of $720.91. Since the date of the appraisal, some of the outstanding tenant improvements have been paid. At origination, the outstanding tenant improvements of approximately $1,984,194 were guaranteed by the guarantor under the Guaranty of Limited Payment in lieu of a reserve. |

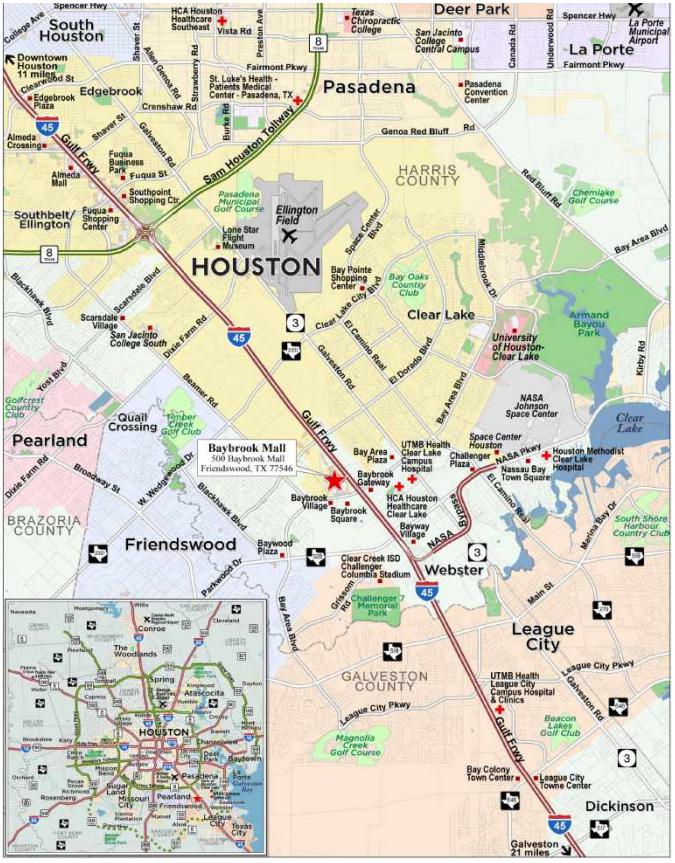

The Mortgage Loan. The second largest mortgage loan (the “Baybrook Mall Mortgage Loan”) is part of a whole loan (the “Baybrook Mall Whole Loan”) evidenced by eleven pari passu promissory notes with an aggregate original principal amount of $220,000,000. The Baybrook Mall Whole Loan is secured by a first priority fee mortgage encumbering a 540,986 SF retail property located in Friendswood, Texas (the “Baybrook Mall Property”). The Baybrook Mall Whole Loan was co-originated by Morgan Stanley Bank, N.A. (“MSBNA”), Societe Generale Financial Corporation (“SGFC”) and Barclays Capital Real Estate Inc. (“BCREI”) on July 19, 2024. The Baybrook Mall Mortgage Loan is evidenced by the controlling Note A-1 and the non-controlling Note A-2 with an aggregate original principal amount of $88,000,000. The Baybrook Mall Whole Loan will be serviced pursuant to the pooling and servicing agreement for the BANK5 2024-5YR9 securitization trust. See “Description of the Mortgage Pool-The Whole Loans-The Serviced Pari Passu Whole Loans”, and “Pooling and Servicing Agreement” in the prospectus.

| This is not a research report and was not prepared by any Underwriter’s research department. Please see additional important information and qualifications at the end of this Term Sheet. |

| | T-18 | |

| Retail – Super Regional Mall | Loan #2 | Cut-off Date Balance: | | $88,000,000 |

| 500 Baybrook Mall | Baybrook Mall | Cut-off Date LTV: | | 56.0% |

| Friendswood, TX 77546 | | UW NCF DSCR: | | 1.72x |

| | | UW NOI Debt Yield: | | 13.7% |

The table below summarizes the promissory notes that comprise the Baybrook Mall Whole Loan.

| Baybrook Mall Whole Loan Summary |

| Note | Original Balance | Cut-off Date Balance | Note Holder | Controlling Note |

| A-1 | $60,000,000 | $60,000,000 | BANK5 2024-5YR9 | Yes |

| A-2 | $28,000,000 | $28,000,000 | BANK5 2024-5YR9 | No |

| A-3(1) | $10,000,000 | $10,000,000 | MSMCH | No |

| A-4(1) | $10,000,000 | $10,000,000 | MSMCH | No |

| A-5(1) | $25,000,000 | $25,000,000 | BCREI | No |

| A-6(1) | $18,000,000 | $18,000,000 | BCREI | No |

| A-7(1) | $8,000,000 | $8,000,000 | BCREI | No |

| A-8(1) | $5,000,000 | $5,000,000 | BCREI | No |

| A-9(1) | $30,000,000 | $30,000,000 | SGFC | No |

| A-10(1) | $16,000,000 | $16,000,000 | SGFC | No |

| A-11(1) | $10,000,000 | $10,000,000 | SGFC | No |

| Total | $220,000,000 | $220,000,000 | | |

| (1) | Expected to be contributed to one or more future securitization transactions or may otherwise be transferred at any time. |

The Borrower and the Borrower Sponsors. The borrower is Baybrook Mall, LLC, a single-purpose, Delaware limited liability company with two independent directors in its organizational structure. Legal counsel to the borrower delivered a non-consolidation opinion in connection with the origination of the Baybrook Mall Whole Loan. The non-recourse carveout guarantor is BPR Nimbus LLC. The borrower sponsors are Brookfield Properties Retail Holding LLC and SMRF Baybrook Investor Member LLC, which is owned by Nuveen Asset Management, LLC (“Nuveen”). Brookfield Properties Retail Holding LLC is an affiliate of Brookfield Property Partners L.P., the public real estate vehicle for Brookfield Asset Management Inc. Brookfield Property Partners, L.P. is a large global real estate company, with more than 1,000 managed properties and 380 million SF of managed space worldwide. Brookfield Property Partners, L.P. owns and operates properties in the world’s major markets, with a global portfolio that includes office, retail, multifamily, logistics, hospitality, and development opportunities. The borrower is owned by a joint venture between Brookfield Properties Retail Holdings LLC (51%) and Nuveen (49%). Nuveen is an asset manager and wholly owned subsidiary of Teachers Insurance and Annuity Association.

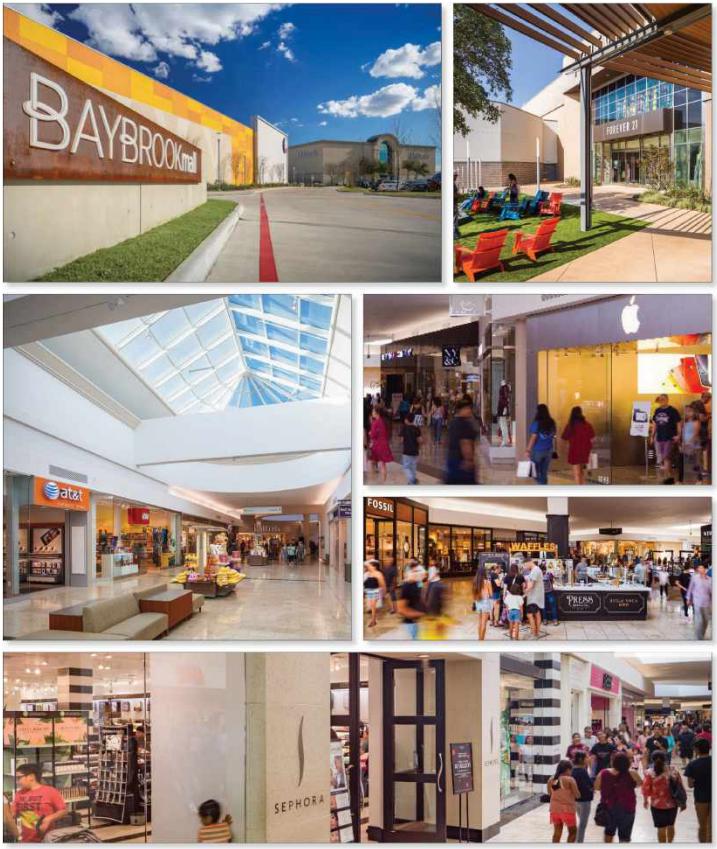

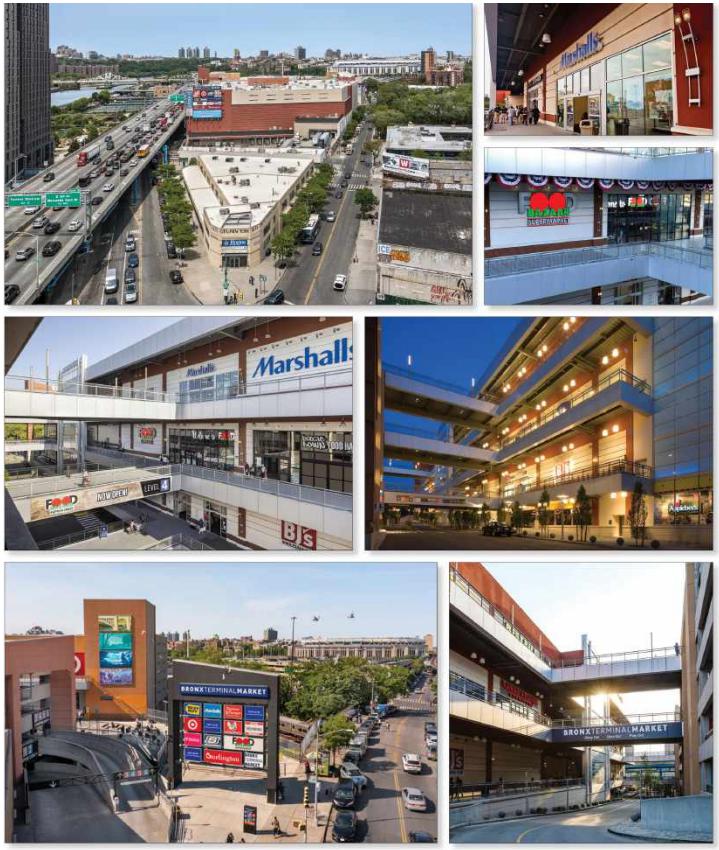

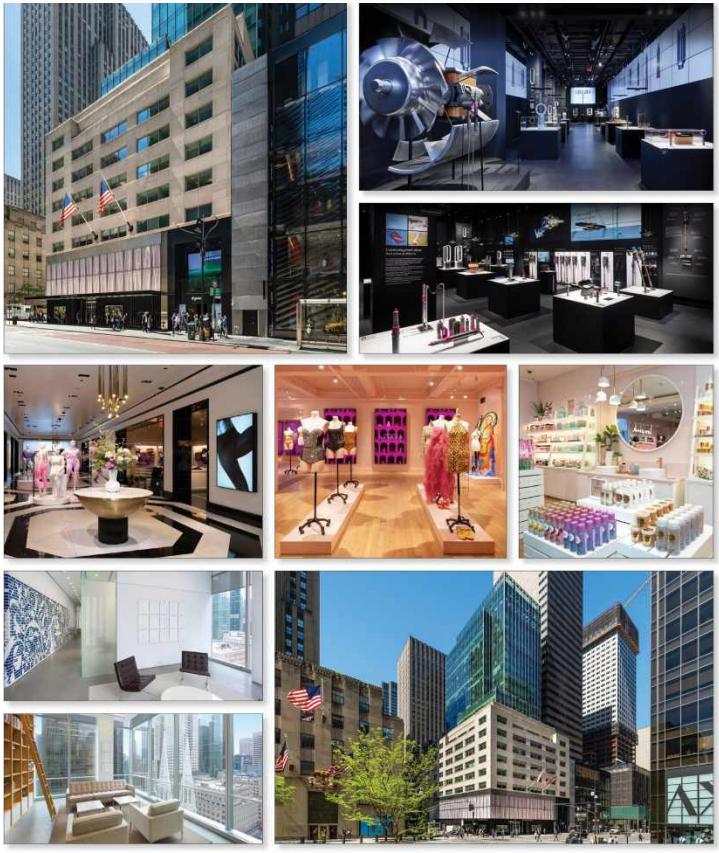

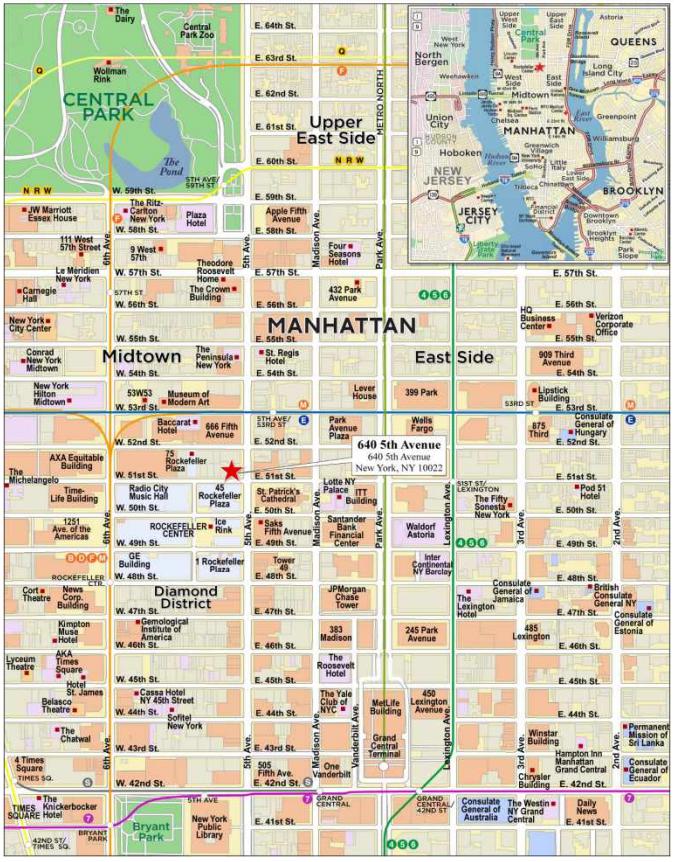

The Property. The Baybrook Mall Property is a 540,986 SF super regional shopping center, which is part of a larger 1,261,917 SF super regional shopping center (the “Baybrook Mall Regional Shopping Center”) located in Friendswood, Texas. As of June 30, 2024, the Baybrook Mall Property was 95.4% leased to a granular rent roll comprised of approximately 140 tenants. The five largest tenants by SF at the Baybrook Mall Property comprise approximately 13.8% of underwritten rent, and no single tenant makes up more than 5.7% of the underwritten rent. Additionally, the ten largest tenants by SF account for 23.7% of the aggregate underwritten rent. Notable national tenants at the Baybrook Mall Property include Apple, Sephora, Foot Locker, Buckle, Lego, Shoe Palace, Victoria’s Secret, and Finish Line. The Baybrook Mall Property is anchored by Dillard’s, Macy’s, Living Spaces and JCPenney. The Dillard’s, Macy’s and Living Spaces tenants are separately owned and are not part of the collateral. Additionally, the borrower sponsor owns the remainder of the Baybrook Mall Regional Shopping Center, which includes an adjacent outdoor lifestyle center as well as a power center anchored by Dick’s Sporting Goods, neither of which are part of the collateral. The Baybrook Mall Property includes three restaurant outparcels: Denny’s, The Cheesecake Factory and P.F. Changs. The Baybrook Mall Regional Shopping Center has seen completed expansion projects including an additional lifestyle expansion and power center, adding more than 30 retailers, 10 restaurants, and entertainment venues including The Lawn, a spacious grassy area providing a gathering spot for the community. Since 2019, the borrower sponsor invested approximately $16.8 million in capital expenditures at the Baybrook Mall Property, including property development and tenant improvements.

The following table presents inline sales history at the Baybrook Mall Property:

| Tenant Sales PSF(1) | |

| Tenant Type | 2021 Sales | 2021 Sales PSF | 2022 Sales | 2022 Sales PSF | 2023 Sales | 2023 Sales PSF | TTM 5/31/2024 Sales | TTM 5/31/2024 Sales PSF | TTM 5/31/2024 Occupancy Cost(2) |

| Inline (<10,000 SF) | $189,773,031 | $976 | $203,360,206 | $881 | $203,295,153 | $855 | $206,637,422 | $863 | 14.2% |

| Inline (<10,000 SF excl. Apple) | $148,088,487 | $782 | $156,222,056 | $692 | $164,350,170 | $706 | $168,012,667 | $717 | 17.2% |

| (1) | Information is based on sales information provided by the borrower sponsor. |

| (2) | Occupancy Cost is based on current underwritten total rent (the sum of underwritten base rent, percentage rent, overage rent and underwritten reimbursements). |

Major Tenants.

JCPenney (96,605 SF, 17.9% of NRA, 1.3% of underwritten base rent) Founded in 1902 and headquartered in Plano, Texas, JC Penney is a department store chain with approximately 50,000 employees. JC Penney serves customers at more than 650 stores across the United States and Puerto Rico. JC Penney is one of the nation’s largest retailers of apparel, home, jewelry, and beauty merchandise with a growing portfolio of private and national brands. JC Penney has anchored the Baybrook Mall Property since 2005, has a lease expiration date of January 31, 2026, and has six, five-year extension options remaining. JC Penney filed for bankruptcy in 2020 during the beginning of the COVID -19 pandemic and emerged from bankruptcy in December 2020.

| This is not a research report and was not prepared by any Underwriter’s research department. Please see additional important information and qualifications at the end of this Term Sheet. |

| | T-19 | |

| Retail – Super Regional Mall | Loan #2 | Cut-off Date Balance: | | $88,000,000 |

| 500 Baybrook Mall | Baybrook Mall | Cut-off Date LTV: | | 56.0% |

| Friendswood, TX 77546 | | UW NCF DSCR: | | 1.72x |

| | | UW NOI Debt Yield: | | 13.7% |

Forever 21 (81,772 SF, 15.1% of NRA, 0.0% of underwritten base rent) Founded in 1984 and headquartered in Los Angeles, California, Forever 21 sells men's and women's clothing and accessories. Forever 21 is located in more than 540 locations globally and online throughout the United States and in Canada, Europe, Japan, Korea, and the Philippines. Forever 21 has been a tenant at the Baybrook Mall Property since 2009, has a lease expiration date of December 31, 2026, and has no extension options remaining. Forever 21 pays percentage rent instead of base rent. Based on the May 2024 TTM period, Forever 21 percentage in lieu rent was $519,744. $519,744 of percentage rent was underwritten for Forever 21. Forever 21 filed for bankruptcy in 2019 and emerged from bankruptcy in 2020.

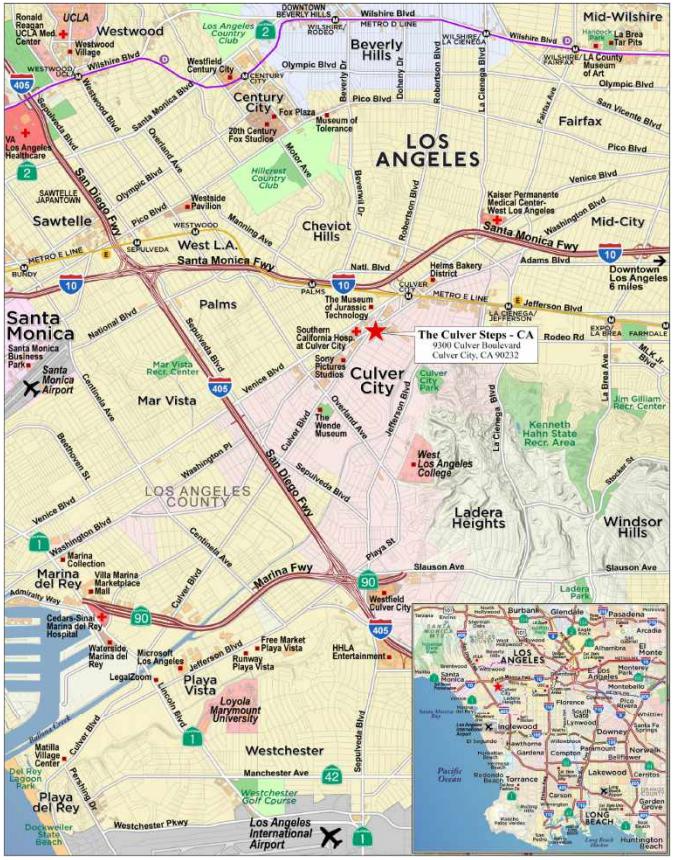

H&M (17,510 SF, 3.2% of NRA, 3.0% of underwritten base rent) H&M is a global retailer offering affordable apparel for men, women and children. H&M was incorporated in 1947 and remains under the control of the family of founder Erling Persson. H&M group’s brands are H&M, H&M Home, COS, Weekday, Monki, & Other Stories, ARKET, Afound and Singular Society. H&M operates approximately 4,338 stores across 77 markets with approximately 143,000 employees. H&M has been a tenant at the Baybrook Mall Property since 2022, has a lease expiration date of January 31, 2032, and has two, three-year extension options remaining. H&M has the right to terminate its lease upon 365 days‘ notice if the tenant’s net sales fail to exceed $5,440,386 between January 1, 2026 through December 31, 2026, or $5,984,425 between January 1, 2028 through December 31, 2028. H&M is required to pay a termination fee equal to 50% of the then unamortized portion of the construction allowance. H&M’s sales for the TTM May 2024 period were $4,596,073.