United Mexican States

Ministry of Finance and Public Credit, p. 2

In addition, we have examined and relied on the originals or copies certified or otherwise identified to our satisfaction of all such other documents and certificates of public officials of Mexico, and we have made such investigations of law, as we have deemed appropriate as a basis for the opinion expressed below.

In rendering the opinion expressed below, we have assumed the authenticity of all documents submitted to us as originals and the conformity to the originals of all documents submitted to us as copies. In addition, we have assumed and have not verified (i) the accuracy as to factual matters of each document we have reviewed and (ii) that the Notes have been duly authenticated in accordance with the terms of the Indenture.

Based on the foregoing and subject to the further assumptions and qualifications set forth below, it is our opinion that the Notes are valid, binding and enforceable obligations of Mexico.

In giving the foregoing opinion, (a) we have assumed that each of Mexico and the Trustee has satisfied those legal requirements that are applicable to it to the extent necessary to make the Indenture and the Notes enforceable against the parties thereto (except that no such assumption is made as to Mexico regarding matters of the federal law of the United States of America or the law of the State of New York that in our experience normally would be applicable with respect to the Indenture or the Notes), (b) such opinion is subject to applicable bankruptcy, insolvency and similar laws affecting creditors’ rights generally and to general principles of equity and (c) such opinion is subject to the effect of judicial application of foreign laws or foreign governmental actions affecting creditors’ rights. In addition, we note that the enforceability in the United States of the waiver by Mexico of its immunities, as set forth in the Indenture and the Notes, is subject to the limitations imposed by the United States Foreign Sovereign Immunities Act of 1976. We express no opinion as to the enforceability of any such waiver of immunity to the extent that it purports to apply to any immunity to which Mexico may become entitled after the date hereof.

We also note that the designations in Section 9.7 of the Indenture of the U.S. federal courts sitting in The City of New York as a venue for actions or proceedings relating to the Indenture and the Notes is (notwithstanding the waiver in or pursuant to Section 9.7 of the Indenture) subject to the power of such courts to transfer actions pursuant to 28 U.S.C. § 1404(a) or to dismiss such actions or proceedings on the grounds that such federal court is an inconvenient forum for such action or proceeding.

We express no opinion as to the enforceability of paragraph 19 of the Terms and Conditions of the Notes relating to currency indemnity.

The foregoing opinion is limited to the federal law of the United States of America and the law of the State of New York.

We hereby consent to the filing of this opinion as an exhibit to Amendment No. 1 to Mexico’s Annual Report on Form 18-K for its Fiscal Year ended December 31, 2020 and to the references to us under the heading “Validity of the Securities” in the Base Prospectus. In giving such consent, we do not thereby admit that we are experts with respect to any part of the Registration Statement, including this exhibit, within the meaning of the term “expert” as used in the Securities Act, or the rules and regulations of the Commission issued thereunder. We assume no obligation to advise you, or to make any investigations, as to any legal developments or factual matters arising subsequent to the date hereof that might affect the opinion expressed herein.

| | |

| Very truly yours, |

|

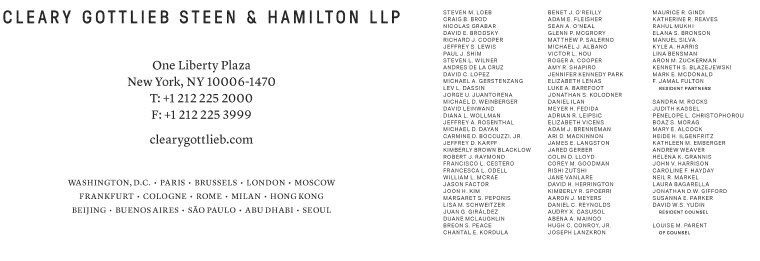

| CLEARY GOTTLIEB STEEN & HAMILTON LLP |

| |

| By | | /S/ NICOLAS GRABAR |

| | Nicolas Grabar, a Partner |