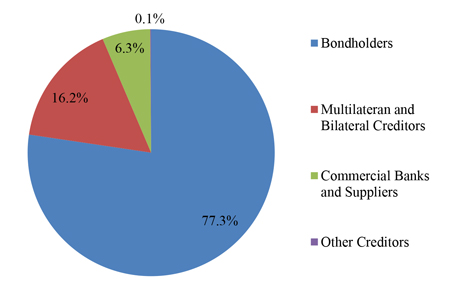

In 2021, 2022, and 2023, CFE issued a number of bonds in local and international markets. In July 2021, it issued a bond in the international market, the proceeds of which were used to refinance CFE’s previous obligations. In December 2021, CFE conducted its first tender offer in the local financial market for a repurchase of Cebures for a total of Ps. 7.8 billion and carried out an issuance of Cebures for Ps. 10.5 billion. On July 3, 2023 and December 5, 2023, CFE conducted its second and third ESG issuance of Cebures in the Mexican Stock Exchange for Ps. 10.5, respectively.

In 2022, CFE issued its first sustainable bonds, carried out its first liability management transaction in the international market and carried out its first green and social issuance of Certificados Bursátiles, the proceeds of which were used to promote investment in renewable energy, energy efficiency, electro-mobility and green building projects, as well as to provide basic electricity and internet services to remote and rural communities. On September 26, 2023, CFE completed its second liability management transaction in the international financial markets for U.S.$877.5 million, which resulted in the repurchasing of all bonds below par and a capital savings of U.S.$20.5 million.

On July 1, 2022, CFE entered into participation agreements with TC Energía and NewFortress Energy Corporation, with the goal of strengthening Mexico’s energy security and improving Mexico’s commercial relationship with the North American private energy sector. The agreement with TC Energía will improve and expand infrastructure for the transportation of natural gas to central and southeast Mexico. The agreement with NewFortress Energy will allow CFE to partner in natural gas liquefaction projects and use infrastructure to export natural gas to international markets for a period of 12 months. On March 23, 2023, CFEnergía S.A. de C.V., a subsidiary of CFE, and NFE Altamira Fast LNG Sociedad de R. L. de C.V. entered into a contract for the supply of natural gas off the coast of Altamira, Tamaulipas. The contract grants the entities the power to build liquefaction plants, marine gas platforms and a floating natural gas liquefaction plant in Altamira.

On January 11, 2023, CFE renewed a syndicated revolving credit facility for U.S.$1.5 billion for a term of three years, which may optionally be extended for two more years, for a total term of five years. In 2023, seven withdrawals were made under the facility for a total of U.S.$1.2 billion. During the first half of 2023, CFE issued Ps.10,000 million through its “sustainability-linked” funding scheme due to CFE satisfying certain environment and social performance indicators. In December 2023, CFE made a new issuance for a total amount of Ps. 10,000 million.

In September 2023, CFE carried out a liability management operation in the international capital markets for a target amount of U.S.$800 million and a maximum amount of up to U.S.$1,000 million. The results of the operation generated capital savings of U.S.$20.5 million. In December 2023, CFE repurchased the total outstanding amount of U.S.$387 million of its “4.875% Notes due 2024” bonds, which were set to expire in January 2024. This transaction allowed CFE to lower external debt payment pressures for the year 2024.

The operating license for Unit 2 of the Central Nucleoeléctrica Laguna Verde (Laguna Verde Nuclear Power Plant) was renewed on August 25, 2022, and is expected to be valid from April 11, 2025 to April 10, 2055.

The first phase of the Puerto Peñasco Photovoltaic Power Plant was inaugurated on February 17, 2023, which, when finalized, is expected to produce 1,000 megawatts (MW) of clean and efficient energy and 192 MW in batteries. On June 28, 2023, CFE and Agence Française de Développement (AFD) announced a 20-year, U.S.$98.7 million credit agreement for the financing of renewable energy investment projects, which will be used in the first phase of the Puerto Peñasco Photovoltaic Power Plant.

On June 12, 2023, the Government executed an agreement for the purchase from Iberdrola, a multinational energy sector company, of thirteen power plants (including renewable energy plants), located across seven Mexican states, for approximately U.S.$6 billion. This transaction was entered into by a national investment vehicle with majority participation of FONADIN, and covers 8,500 MW of energy generation, increasing the State’s participation in the electricity market from 39.6% to 55.5%.

The Government continues to promote private sector participation in the electric power sector and in electricity production. As of December 31, 2023, electricity generation capacity by fossil fuels represented 75.7% of the country’s total electricity generation capacity, as compared to 68.8% as of December 31, 2022, while electricity generation capacity from clean sources was 24.3%, as compared to 31.2% as of December 31, 2022.

D-79