Exhibit 99.1

Message to the shareholders

HIGHLIGHTS

> | Net income of $2.27 per share (diluted) |

| | |

> | Further reductions in export differential |

| | |

> | Continued increases in the production of Vacuum Gasoil (“VGO”) |

| | |

> | Enhanced Oil Recovery project (“EOR”) approved |

| | |

> | New exploration successes at Aryskum and North Nurali |

| | |

> | Production guidance for 2005: 170,000 bopd |

| | |

> | 5,257,475 shares repurchased and cancelled |

| | |

> | Shares approved for listing on the Kazakhstan Stock Exchange |

FINANCIAL HIGHLIGHTS

| (IN MILLIONS OF US$ EXCEPT PER SHARE AMOUNTS) | | Nine Months ended Sept. 30 | | Three Months ended Sept. 30 | |

|

| | | | 2004 | | 2003 | | 2004 | | 2003 | |

|

| Gross Revenue | | $ | 1,237.3 | | $ | 806.7 | | $ | 518.6 | | $ | 303.2 | |

| Net income | | | 385.7 | | | 228.1 | | | 176.2 | | | 91.2 | |

| | Per share (basic) | | | 5.00 | | | 2.92 | | | 2.30 | | | 1.17 | |

| | Per share (diluted) | | | 4.89 | | | 2.81 | | | 2.27 | | | 1.12 | |

| Cash flow | | | 443.2 | | | 288.4 | | | 186.9 | | | 108.5 | |

| | Per share (basic) | | | 5.75 | | | 3.69 | | | 2.44 | | | 1.40 | |

| | Per share (diluted) | | | 5.62 | | | 3.55 | | | 2.41 | | | 1.34 | |

| Weighted Average Shares Outstanding | | | | | | | | | | | | | |

| | Basic | | | 77,118,191 | | | 78,258,611 | | | 76,652,399 | | | 77,707,623 | |

| | Diluted | | | 78,905,718 | | | 81,288,890 | | | 77,716,702 | | | 81,266,718 | |

| Shares Outstanding at End of Period | | | 76,023,141 | | | 77,771,788 | | | 76,023,141 | | | 77,771,788 | |

|

PetroKazakhstan is pleased to announce its financial results for the third quarter of 2004 with $176.2 million of net income, a 93.2% increase over the quarter ended September 30, 2003 and $186.9 million of cash flow, a 72.3% increase over the quarter ended September 30, 2003. This represents basic net income per share of $2.30 and basic cash flow per share of $2.44 for the quarter. The comparable figures for the quarter ended September 30, 2003 were $1.17 basic net income per share and $1.40 basic cash flow per share.

For the nine months ended September 30, 2004 net income was $385.7 million, a 69.1% increase over the same period of 2003, and cash flow of $443.2 million, a 53.7% increase over the same period of 2003. This represents basic net income per share of $5.00 and basic cash flow per share of $5.75. The comparable figures for the nine months ended September 30, 2003, were net income per share of $2.92 and basic cash flow per share of $3.69.

SHARE REPURCHASES

The Company’s substantial issuer bid share tender, which ended on July 19, 2004, has resulted in the repurchase and cancellation of 3,999,975 shares at C$40.00 per share.

The Company’s normal course issuer bid program was renewed on August 13, 2004 and will terminate on August 12, 2005. Under the terms of this share repurchase program, the Company repurchased and cancelled 1,257,500 shares at an average price of C$40.00 in the third quarter of 2004.

Due to the timing of the share cancellations, the full impact of these repurchases will be reflected in the fourth quarter.

At the end of the third quarter, the Company had 76,023,141 common shares outstanding and 1,688,545 options and convertible securities.

LISTING ON THE KAZAKHSTAN STOCK EXCHANGE On October 21, 2004 the Kazakhstan Stock Exchange announced that the common shares of PetroKazakhstan had been approved for listing on the Exchange. The Company believes that this will create an excellent opportunity for Kazakh investors to participate in the growth and success of a business operating in Kazakhstan. PetroKazakhstan is the first foreign company to be granted approval for listing. Trading in PetroKazakhstan shares on the Kazakhstan Stock Exchange is expected to commence in the fourth quarter of 2004. UPSTREAM OPERATIONS REVIEW PRODUCTION During the third quarter of 2004, PetroKazakhstan’s production volumes totaled 14.52 million barrels or an average of 157,786 barrels of oil per day (“bopd”) representing an increase of 2.0% over the third quarter 2003 average production of 154,712 bopd and a 4.4% increase over the second quarter of 2004 average production rate of 151,104 bopd. Development wells in Kyzylkiya, Aryskum, Kumkol North and Akshabulak fields have contributed to these increases. In spite of these increases, mechanical pump failures on some high rate wells as well as allocation of capacity at the Kumkol Central Processing Facility used by both PetroKazakhstan and the neighbouring field operator, Turgai Petroleum, has adversely affected overall production. While these limitations are being addressed and corrected, the Company is revising its expectation for the fourth quarter to about 158,000 bopd, bringing the anticipated 2004 annual average production down to 152,000 bopd (versus the prior estimate of 160,000 bopd). PetroKazakhstan’s budget for 2005 is based on an annual average net production of 170,000 bopd. FIELD DEVELOPMENTS The Aryskum development drilling campaign continued with eleven wells completed in the third quarter of 2004 bringing the total so far this year to fourteen. The Company plans to drill four more wells before the end of the year, one of which will be a horizontal well to improve production rates in the southern portion of the field. One production well has been drilled in the Kyzylkiya field and three in the neighbouring Kolzhan license to the north this quarter, bringing the total number of wells drilled in the area this year to thirteen. Work continues on the upgrade of the Akshabulak processing facilities that will enable production rates to increase to over 60,000 bopd (30,000 bopd net) by mid 2005. Two development and field delineation wells were drilled in the last quarter. | | Production from the East Kumkol field resumed in the third quarter following regulatory authority approvals. ENHANCED OIL RECOVERY PROJECT Following the completion of a feasibility study for miscible hydrocarbon injection for enhanced oil recovery in the Kumkol field, the Company is now proceeding with a project to commence injection of a Liquefied Petroleum Gas (“LPG”) blend by mid 2005. It is expected that the oil recovery factor can be significantly increased through this proven technique. EXPLORATION AND APPRAISAL Of major importance has been the discovery of a new productive reservoir within the Aryskum field area below the extensive field gas cap. Well AK 401 was drilled as a gas injector but was drilled slightly deeper to examine the potential presence of a deeper reservoir below the gas cap. A 15 meter net oil section was encountered and the well is currently under test, producing light, 43 degree API crude on a reduced choke at a rate of 1,400 bopd. This is a completely new reservoir that has not been accounted for in previous reserves evaluations. A full appraisal drilling program will now be undertaken with the first well to be drilled before the end of the year. Interpretation of the 3D seismic of the Northern Kyzylkiya area is now complete and a potentially significant further extension to the field has been identified. A well is planned to test this potential field extension during the fourth quarter of 2004. Following completion of the enhanced seismic interpretation of the North Nurali field, two appraisal well locations were selected. The first of these appraisal wells has recently been completed. Good oil shows were encountered within the main Doshan reservoir interval. A second additional basement reservoir interval with oil shows was also encountered. Testing of both intervals is about to commence. The second appraisal well is currently drilling. An 85 square kilometre (“km2”) 3D seismic survey was acquired to the north of the North Nurali field to evaluate potential satellite structures along this trend. PetroKazakhstan holds a 75% interest and operatorship of License 951-D which covers two blocks (the Doshan block and the Zhamansu block) in the South Turgai Basin over a total area of 4,290 km2. Following interpretation of 2D seismic data acquired earlier this year a series of prospects have been identified within the Zhamansu block. Four exploration wells will be drilled within this block by the end of 2004. The existing D-3 well within the Doshan block has been re-tested at low rates of around 100 bopd. This well is being considered for future fracture stimulation. In total, the Company drilled ten exploration wells in the first three quarters of 2004 with a success ratio of 80% and plans to drill seven additional exploration wells in the fourth quarter of 2004. |

EXPLOITATION OF GAS AND LPG RESERVES PetroKazakhstan, as a 50% partner in the Kazgermunai Joint Venture, is also participating in Kazgermunai’s LPG extraction plant for the Akshabulak field. The 30 million standard cubic feet per day (“mmscfd”) plant will provide 2,900 bopd of LPG and 600 bopd of condensate. Facilities have been designed, and equipment is being procured. Construction has started for completion by mid 2005. The dry gas will be provided to the city of Kyzylorda through a pipeline to be constructed by KazTransGaz. DOWNSTREAM MARKETING, TRANSPORTATION AND REFINING CRUDE OIL LOGISTICS The volume of crude oil shipped from the Company’s loading stations during the third quarter of 2004 was 7.83 mmbbls (1,012 thousand tonnes) which represents an increase of 10% compared to the second quarter of 2004 and the third quarter of 2003. The Company’s terminal at Dzhusaly handled approximately 69% of all crude oil shipments, slightly down on the previous quarter, as the performance of the state operated pipeline and terminal at Atasu improved substantially from the operational problems experienced during the second quarter. Shipments to the Tehran refinery were reduced to 41% of the previous quarter volumes as the Ministry of Energy and Mineral Resources (“MEMR”) restricted export quotas on that route. There is an on going dialogue between PetroKazakhstan and the MEMR. PetroKazakhstan’s contention is that these restrictions are not justified as all the logistics are provided and managed by PetroKazakhstan, that there is capacity and that this route is in the best interests of the Company, the Republic of Kazakhstan as well as Iran and the neighbouring transit countries. Management remains confident that ultimately a positive outcome to these discussions can be achieved. Caspian Pipeline Consortium (“CPC”) deliveries continued to grow towards their contractual maximum and were up 4% on the previous quarter. Current deliveries account for approximately 96% of the contractual maximum and the fourth quarter of 2004 should see the maximum achieved. CRUDE OIL PRICES AND TRANSPORTATION DIFFERENTIALS International crude oil prices continued their upward drive. The average of the daily mean of Platts quotations for Brent Dated was up $6.22 per barrel against the previous quarter and stood at $41.54 per barrel. The spread of Brent quotations during the third quarter also rose dramatically to $12.47 with a maximum quotation of $47.25. OPEC supplied increased quantities of heavy sour crude oil on the market and consequently there was a widening in the differential between the values of light sweet and heavy sour crude oil. Having started the year at $1.60 per barrel, the discount for Urals in the Mediterranean finished the third quarter at $7.00 per barrel. A similar effect was seen on the Oman/Dubai quotations versus Brent Dated. The premium of Kumkol priced Cost, Insurance and Freight (“CIF”) in the Mediterranean over Brent improved throughout the third quarter closing at 92.5 US cents per barrel. | | The combination of higher international market prices and reduced transportation costs saw a significant improvement in the net return per barrel measured at the production field gate compared to both the second quarter of 2004 and the third quarter of 2003. REFINING AND REFINED PRODUCT SALES Refinery throughput was slightly down at 7.18 mmbbls in the third quarter of 2004 compared to 7.7 mmbbls during the second quarter of 2004. Average weighted refined product prices rose as VGO sales accounted for a larger percentage of the sales mix. Production of VGO is planned to increase during the fourth quarter and further benefits will be seen from this during the coming months. Despite these improvements, domestic net returns continued to lag export net returns by a substantial margin. In accordance with the timetable agreed with the Ministry of Energy and Mineral Resources, the refinery has been making preparations for its annual maintenance shutdown scheduled from mid October to mid November. Closing inventories of refined products are broadly in line with those at the end of the same quarter in the preceding three years. Nevertheless, it is anticipated that some refined products will be either imported or purchased to ensure the Company can continue to supply its regular customers on the domestic and export markets. Additionally, the Company has in place a crude oil export program for October and November to ensure that the additional crude oil available for export during the refinery shutdown can be handled without any restriction to its crude oil production. During the refinery turnaround, equipment will be installed to extend the cycle of future planned refinery maintenance shutdowns to three to five years, instead of the current one year cycle. DIRECTORS AND OFFICERS Mr. Jean-Paul Bisnaire has elected to resign from the Board of Directors of the Company, effective October 31, 2004, following his recent appointment as Senior Executive Vice President of Manulife Financial. The Board of Directors is grateful to Mr. Bisnaire for his outstanding contribution to the Company both as a Legal Advisor and as a Director. The Company is pleased to announce, effective November 1, 2004, the appointment of Clayton J. Clift as Chief Financial Officer. Mr. Clift has held the position of Vice President, Finance of the Company’s upstream and downstream operating subsidiaries since December 2000. Respectfully submitted on behalf of the board of Directors, Bernard F. Isautier President and Chief Executive Officer October 28, 2004 |

MANAGEMENT’S DISCUSSION AND ANALYSIS

The following Management’s Discussion and Analysis (“MD&A”) of the financial condition and results of our operations should be read in conjunction with the unaudited consolidated financial statements of the Corporation included in this report and our MD&A and audited consolidated financial statements for the year ended December 31, 2003. Our financial statements have been prepared in accordance with Canadian GAAP. This discussion and analysis contains forward-looking statements, which involve risks and uncertainties. Our actual results could differ materially from those anticipated in the forward-looking statements.

In our MD&A we use certain terms including “netback” and “cash flow”. These are non-GAAP terms with cash flow defined as cash generated from operating activities before changes in non-cash working capital and netback is defined within our MD&A.

Except as otherwise required by the context, reference in this MD&A to “our”, “we” or “us” refer to the combined business of PetroKazakhstan Inc. and all of its subsidiaries and joint ventures.

All numbers are in U.S. Dollars unless otherwise indicated.

HIGHLIGHTS

|

| | | Three months ended September 30 | |

|

| | | 2004 | | 2003 | |

|

| Net income ($000’s) | | | 176,218 | | | 91,150 | |

Cash flow ($000’s)1 | | | 186,944 | | | 108,498 | |

| Basic net income per share | | | 2.30 | | | 1.17 | |

| Basic cash flow per share | | | 2.44 | | | 1.40 | |

| BOPD | | | 157,786 | | | 154,712 | |

| Capital expenditures | | | 32,284 | | | 37,079 | |

|

|

| | | Nine months ended September 30 | |

|

| | | 2004 | | 2003 | |

|

| Net income ($000’s) | | | 385,731 | | | 228,132 | |

Cash flow ($000’s)1 | | | 443,177 | | | 288,391 | |

| Basic net income per share | | | 5.00 | | | 2.92 | |

| Basic cash flow per share | | | 5.75 | | | 3.69 | |

| BOPD | | | 150,630 | | | 146,898 | |

| Capital expenditures | | | 98,700 | | | 124,094 | |

|

1 Cash flow: We evaluate our operations based upon our net income and cash flow. Cash flow is a non-GAAP measure that represents cash flow from operations before changes in working capital. We consider this to be a key measure as we use this measure to evaluate our ability to generate cash to fund our growth through capital expenditures and our ability to repay debt. The comparable GAAP measure is cash flow from operating activities. The following table reconciles our non-GAAP measure cash flow to the comparable GAAP measure “Cash flow from operating activities”.

|

| | Three months ended September 30 | |

|

| | | 2004 | | 2003 | |

| | | ($’000s) | | ($’000s) | |

|

| Cash flow | | | 186,944 | | | 108,498 | |

| Changes in non-cash operating working capital items | | | 5,479 | | | (3,094 | ) |

| Cash flow from operating activities | | | 192,423 | | | 105,404 | |

|

|

| | | Nine months ended September 30 | |

|

| | | 2004 | | 2003 | |

| | | ($’000s) | | ($’000s) | |

|

| Cash flow | | | 443,177 | | | 288,391 | |

| Changes in non-cash operating working capital items | | | 49,693 | | | (45,462 | ) |

| Cash flow from operating activities | | | 492,870 | | | 242,929 | |

|

NET RETURN PER BARREL

Set forth below are the details of the average net return achieved for crude oil export sales and sales derived from the refining of our own crude. These tables show averages across all types of sales contracts and illustrate the relationship between exports of crude oil versus refining our own crude oil and marketing refined crude oil products.

|

| | | Three months ended September 30, 2004 | |

|

| | | Crude Oil | | Own Crude Oil | |

| | | Exports | | Refined and Sold* | |

| | | ($/bbl) | | ($/bbl) | |

|

| Net sales price achieved | | | 35.75 | | | 28.15 | |

| Transportation costs | | | (6.18 | ) | | (3.13 | ) |

| Selling costs | | | (0.61 | ) | | (0.76 | ) |

| Crude utilized in refining | | | - | | | (1.75 | ) |

| Refining cost | | | - | | | (0.81 | ) |

| Royalties and taxes - downstream | | | - | | | (0.55 | ) |

| General and administrative costs - downstream | | | - | | | (0.56 | ) |

|

| Netback at Kumkol** | | | 28.96 | | | 20.59 | |

| Production cost | | | (1.61 | ) | | (1.61 | ) |

| Royalties and taxes - upstream | | | (3.34 | ) | | (3.34 | ) |

| General and administrative costs - upstream | | | (0.65 | ) | | (0.65 | ) |

|

| Net return per barrel | | | 23.36 | | | 14.99 | |

|

|

| | Three months ended September 30, 2003 | |

|

| | | Crude Oil | | Own Crude Oil | |

| | | Exports | | Refined and Sold* | |

| | | ($/bbl) | | ($/bbl) | |

|

| Net sales price achieved | | | 21.56 | | | 18.29 | |

| Transportation costs | | | (7.75 | ) | | (1.40 | ) |

| Selling costs | | | (0.47 | ) | | (0.70 | ) |

| Crude utilized in refining | | | - | | | (1.06 | ) |

| Refining cost | | | - | | | (0.49 | ) |

| Royalties and taxes - downstream | | | - | | | (0.02 | ) |

| General and administrative costs - downstream | | | - | | | (0.47 | ) |

|

| Netback at Kumkol** | | | 13.34 | | | 14.15 | |

| Production cost | | | (1.11 | ) | | (1.11 | ) |

| Royalties and taxes - upstream | | | (1.73 | ) | | (1.73 | ) |

| General and administrative costs - upstream | | | (0.59 | ) | | (0.59 | ) |

|

| Net return per barrel | | | 9.91 | | | 10.72 | |

|

| * | Net sales price achieved shown in these tables does not include the price received for purchased refined products resold. |

| | |

| ** | Average Platts Brent or a similar index for each respective period does not reflect our average realized Brent price because of the timing of recognition of sales for financial statement purposes and the terms of the sales. Financial statement sales revenue is the basis used to determine the net sales price achieved in these tables. Therefore, a comparison of average Platts Brent or similar index to our netback at Kumkol cannot be used to determine our differential. |

During the third quarter of 2004, the netback at Kumkol for crude oil exports increased by $15.62/bbl compared to the same quarter of 2003 due to a substantial increase in market prices (average Platts Brent was $41.54/bbl compared to $28.38/bbl in 2003). This was partly offset by foregone revenue due to our hedging program, which had a negative impact of $1.60 per barrel sold in the third quarter of 2004 compared to $0.04/bbl in the same quarter of 2003. Transportation costs decreased by $1.57/bbl due to the use of sales routes, different from those used in the previous year, and savings in pipeline costs. Royalties and taxes increased by $1.61/bbl due to the accrual of tax assessments relating to penalties and fines and royalties on gas (See Note 15 to the consolidated financial statements). The increase in royaltie s was also due to the increase in crude oil prices.

The netback at Kumkol for own crude oil refined and sold increased by $6.44/bbl compared to the third quarter of 2003 due to higher sales prices, offset in part by increases in our transportation costs, because we exported some refined products volumes on a non-FCA basis.

|

| | Nine months ended September 30, 2004 | |

|

| | | Crude Oil | | Own Crude Oil | |

| | | Exports | | Refined and Sold* | |

| | | ($/bbl) | | ($/bbl) | |

|

| Net sales price achieved | | | 29.48 | | | 23.01 | |

| Transportation costs | | | (6.47 | ) | | (1.99 | ) |

| Selling costs | | | (0.57 | ) | | (0.68 | ) |

| Crude utilized in refining | | | - | | | (1.45 | ) |

| Refining cost | | | - | | | (0.69 | ) |

| Royalties and taxes - downstream | | | - | | | (0.69 | ) |

| General and administrative costs - downstream | | | - | | | (0.49 | ) |

|

| Netback at Kumkol** | | | 22.44 | | | 17.02 | |

| Production cost | | | (1.71 | ) | | (1.71 | ) |

| Royalties and taxes - upstream | | | (1.99 | ) | | (1.99 | ) |

| General and administrative costs - upstream | | | (0.60 | ) | | (0.60 | ) |

|

| Net return per barrel | | | 18.14 | | | 12.72 | |

|

|

| | | Nine months ended September 30, 2003 | |

|

| | | Crude Oil | | Own Crude Oil | |

| | | Exports | | Refined and Sold* | |

| | | ($/bbl) | | ($/bbl) | |

|

| Net sales price achieved | | | 21.00 | | | 15.66 | |

| Transportation costs | | | (7.97 | ) | | (1.12 | ) |

| Selling costs | | | (0.38 | ) | | (0.68 | ) |

| Crude utilized in refining | | | - | | | (0.91 | ) |

| Refining cost | | | - | | | (0.54 | ) |

| Royalties and taxes - downstream | | | - | | | (0.14 | ) |

| General and administrative costs - downstream | | | - | | | (0.45 | ) |

|

| Netback at Kumkol** | | | 12.65 | | | 11.82 | |

| Production cost | | | (1.25 | ) | | (1.25 | ) |

| Royalties and taxes - upstream | | | (1.27 | ) | | (1.27 | ) |

| General and administrative costs - upstream | | | (0.59 | ) | | (0.59 | ) |

|

| Net return per barrel | | | 9.54 | | | 8.71 | |

|

| * | Net sales price achieved shown in these tables does not include the price received for purchased refined products resold. |

| | |

| ** | Average Platts Brent or a similar index for each respective period does not reflect our average realized Brent price because of the timing of recognition of sales for financial statement purposes and the terms of the sales. Financial statement sales revenue is the basis used to determine the net sales price achieved in these tables. Therefore, a comparison of average Platts Brent or similar index to our netback at Kumkol cannot be used to determine our differential. |

During the first nine months of 2004, the netback at Kumkol for crude oil exports increased by $9.79/bbl compared to the same period of 2003 due to a significant increase in market prices (average Platts Brent was $36.36/bbl compared to $28.63/bbl in 2003) and savings in transportation costs. This was partially offset by foregone revenue due to our hedging program, which had a negative impact of $1.09 per barrel sold in the first three quarters of 2004 compared to $0.20/bbl for the same period in 2003. Transportation costs decreased by $1.50/bbl due to the use of sales routes, different from those used in the previous year, and savings in pipeline costs. Royalties and taxes increased by $0.72/bbl due to the accrual of tax assessments relating to penalties and fines and royalties on gas (See Note 15 to the consolidated financial statements). The increase in royalties was also due to the increase in crude oil prices.

The netback at Kumkol for own crude oil refined and sold increased by $5.20/bbl compared to the third quarter of 2003 due to higher sales prices, offset in part by increases in our transportation and selling costs. Transportation costs increased because we exported some refined products volumes on a non-FCA basis.

KEY PERFORMANCE INDICATORS

We measure the performance of our Upstream and Downstream operations using the following key performance indicators.

|

| | | Three months ended September 30 | |

|

| | | 2004 | | 2003 | |

|

| BOPD | | | 157,786 | | | 154,712 | |

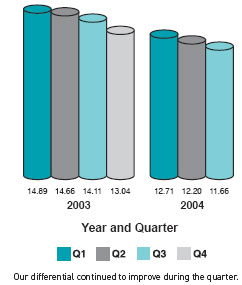

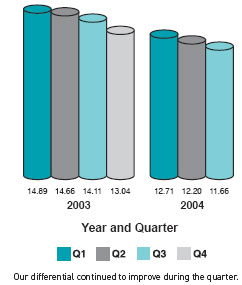

| Differential* ($/bbl) | | | 11.66 | | | 14.11 | |

| Average refined products price ($/bbl) | | | 28.15 | | | 18.29 | |

| Production expense ($/bbl) | | | 1.61 | | | 1.11 | |

| Refining cost ($/bbl) | | | 0.81 | | | 0.49 | |

| General and administrative ($/bbl) | | | 1.21 | | | 1.06 | |

| Effective income tax rate, % | | | 35.5 | % | | 30.9 | % |

|

|

| | | Nine months ended September 30 | |

|

| | | 2004 | | 2003 | |

|

| BOPD | | | 150,630 | | | 146,898 | |

| Differential* ($/bbl) | | | 12.12 | | | 14.53 | |

| Average refined products price ($/bbl) | | | 23.01 | | | 15.66 | |

| Production expense ($/bbl) | | | 1.71 | | | 1.25 | |

| Refining cost ($/bbl) | | | 0.69 | | | 0.54 | |

| General and administrative ($/bbl) | | | 1.09 | | | 1.04 | |

| Effective income tax rate, % | | | 36.4 | % | | 31.1 | % |

|

* | Our differential is calculated as the difference between the average Brent price received for finalized crude oil export sales made by PKKR and Turgai, and our netback at Kumkol. It is the sum of the costs and discounts incurred in order to transport and sell our crude oil to international markets. The sales revenue used in this measure differs from sales revenue in the statement of net income and the net return table for the following reasons: |

| | |

| | • | The differential does not include Kazgermunai sales over which we have limited control. Kazgermunai is excluded because the differential is used to measure the performance of our internal marketing and transportation group. |

| | | |

| | • | The differential is calculated using finalized sales transactions. Our financial statements include estimates on shipments in transit at the end of the quarter that may slightly differ from the final transactions. |

BOPD. See Production and Processing for a discussion of our production. Differentials. The graph to the right shows our differential over the last year and the first three quarters of 2004 ($/bbl) based on completed sales. Production expenses. Production expenses were higher in the third quarter and nine months of 2004 compared to 2003 because of a number of factors. We continue to use temporary power generators to operate single well batteries in the KAM fields pending construction of infrastructure. The water cut in a number of our fields including our JV Turgai continued to increase resulting in higher production expenses. The number of wells commissioned in 2004 is higher compared to 2003. Refining cost. Refining costs for the third quarter and the first nine months of 2004 are higher by $1.7 million and $2.3 million, respectively, when compared to the same periods of 2003. The main reasons for the increase are higher costs for repairs and purchased energy. Purchased energy costs were higher due to the continuous operation of the vacuum distillation unit during the third quarter of 2004. | |  |

General and administrative expenses. General and administrative expenses increased in the third quarter of 2004 due to $0.7 million ($2.8 million for nine months of 2004) of compensation cost being recognized for stock options granted pursuant to the new accounting standard, which we adopted at the beginning of 2004. The remaining increase is attributable to increased activity levels.

Effective income tax rate. The statutory tax rate in Kazakhstan, where all of our operations are located, is 30%. Our effective tax rate differs due to certain expenses, which cannot be deducted for statutory tax purposes. Our tax rate as a percentage of net income before tax in the third quarter of 2004 was 35.5% compared to 30.9% in the same quarter of 2003 (36.4% for the

nine months of 2004 compared to 31.1% for the same period of 2003). The effective income tax rates are higher in 2004 due to provisions for excess profit tax in our Turgai joint venture, whereas there was no provision in 2003. The effective rate also increased in the third quarter of 2004 due to the accrual of taxes under dispute (see Royalties and Taxes).

PRODUCTION AND PROCESSING

PRODUCTION

The following table sets forth our barrels of oil produced per day by field and on a consolidated basis.

|

| | | Three months ended September 30 | |

|

| Field | | 2004 | | 2003 | |

| | | (BOPD) | | (BOPD) | |

|

| Kumkol South | | | 48,126 | | | 57,137 | |

| Kumkol North | | | 36,703 | | | 31,169 | |

| South Kumkol | | | 22,400 | | | 29,551 | |

| Kyzylkiya | | | 11,727 | | | 8,681 | |

| Aryskum | | | 10,659 | | | 8,984 | |

| Maibulak | | | 1,951 | | | 1,174 | |

| North Nurali | | | 827 | | | - | |

| East Kumkol | | | 752 | | | - | |

| License #952 | | | 371 | | | - | |

| License #951 | | | 15 | | | - | |

| Kazgermunai Fields | | | 24,255 | | | 18,016 | |

|

| Total | | | 157,786 | | | 154,712 | |

|

|

| | | Nine months ended September 30 | |

|

| Field | | 2004 | | 2003 | |

| | | (BOPD) | | (BOPD) | |

|

| Kumkol South | | | 46,799 | | | 58,789 | |

| Kumkol North | | | 34,998 | | | 28,799 | |

| South Kumkol | | | 23,837 | | | 29,265 | |

| Kyzylkiya | | | 10,317 | | | 7,587 | |

| Aryskum | | | 9,166 | | | 6,431 | |

| Maibulak | | | 2,153 | | | 734 | |

| North Nurali | | | 504 | | | - | |

| East Kumkol | | | 252 | | | - | |

| License #952 | | | 272 | | | - | |

| License #951 | | | 9 | | | - | |

| Kazgermunai Fields | | | 22,323 | | | 15,293 | |

|

| Total | | | 150,630 | | | 146,898 | |

|

Kumkol South. The decrease in Kumkol South production in the third quarter and for the first nine months of 2004 was mainly due to 18 wells that border the Kumkol North field that were shut-in for the first four months of 2004 and are now on a reduced production scheme under a technical regime designed to equalize the reservoir pressure along the border between the fields. Additionally, during the third quarter of 2004 water injection capacity has been a limiting factor in optimizing our production due to increased water production from our Kumkol South, South Kumkol and Kumkol North fields.

Kumkol North. Increases in production from our Kumkol North field were due to an increase in the number of production wells and installation of artificial lift.

South Kumkol. South Kumkol production decreased due to declining reservoir pressure which necessitated conversion of three of our producing wells to water injection wells. We had 22 producing wells in the third quarter of 2003 as opposed to 18 producing wells in the same quarter of 2004.

KAM fields. The increase in production from our KAM fields (Kyzylkiya, Aryskum, Maibulak) was due to the increased number of wells put on production and implementation of our artificial lift program.

East Kumkol. East Kumkol is currently on an extended production test, pending completion of a hydrocarbon production contract and finalization of a joint operating agreement with our 40% partner Turgai.

Kazgermunai fields. Kazgermunai completed surface facility debottlenecking measures in late 2003, leading to the increase in 2004 production. The increase in production was also due to PetroKazakhstan accepting Kazgermunai trucked oil at Kumkol with a higher watercut than was acceptable at the truck off loading stations in Kyzylorda.

INVENTORY

The following table sets forth the movements in crude oil inventory for our Upstream operations for the three and nine months ended September 30, 2004 and 2003.

|

| | | Three months ended September 30 | |

|

| | | 2004 | | 2003 | |

| | | (MMbbls) | | (MMbbls) | |

|

| Opening inventory of crude oil | | | 2.61 | | | 2.12 | |

| Production | | | 14.52 | | | 14.23 | |

| Crude oil purchased from third parties | | | - | | | 0.02 | |

| Crude oil purchased from joint ventures (50%) | | | 0.07 | | | 0.13 | |

| Sales or transfers | | | (14.87 | ) | | (14.37 | ) |

| Field and transportation losses | | | (0.10 | ) | | (0.04 | ) |

|

| Closing inventory of crude oil | | | 2.23 | | | 2.09 | |

|

|

| | | Nine months ended September 30 | |

|

| | | 2004 | | 2003 | |

| | | (MMbbls) | | (MMbbls) | |

|

| Opening inventory of crude oil | | | 2.87 | | | 2.72 | |

| Production | | | 41.28 | | | 40.10 | |

| Crude oil purchased from third parties | | | 1.09 | | | 0.02 | |

| Crude oil purchased from joint ventures (50%) | | | 0.22 | | | 0.54 | |

| Sales or transfers | | | (43.04 | ) | | (40.51 | ) |

| Field and transportation losses | | | (0.19 | ) | | (0.13 | ) |

| Return of purchased crude | | | - | | | (0.65 | ) |

|

| Closing inventory of crude oil | | | 2.23 | | | 2.09 | |

|

SALES OF CRUDE OIL

The following table sets out our total crude oil sales and transfers from Upstream operations for the three and nine months ended September 30, 2004 and 2003.

|

| | | Three months ended September 30 | |

|

| | | 2004 | | 2004 | | 2003 | | 2003 | |

| | | MMbbls | | % | | MMbbls | | % | |

|

| Crude oil exports | | | 8.45 | | | 56.8 | % | | 7.22 | | | 50.2 | % |

| Crude oil transferred to downstream | | | 3.97 | | | 26.7 | % | | 4.62 | | | 32.2 | % |

| Crude oil transferred to downstream by joint ventures (50%) | | | 1.50 | | | 10.1 | % | | 1.72 | | | 12.0 | % |

| Royalty payments | | | 0.95 | | | 6.4 | % | | 0.81 | | | 5.6 | % |

|

| Total crude oil sales or transfers | | | 14.87 | | | 100.0 | % | | 14.37 | | | 100.0 | % |

|

|

| | | Nine months ended September 30 | |

|

| | | 2004 | | 2004 | | 2003 | | 2003 | |

| | | MMbbls | | % | | MMbbls | | % | |

|

| Crude oil exports | | | 23.29 | | | 54.1 | % | | 20.58 | | | 50.8 | % |

| Crude oil transferred to downstream | | | 12.22 | | | 28.4 | % | | 14.55 | | | 35.9 | % |

| Crude oil transferred to downstream by joint ventures (50%) | | | 4.70 | | | 10.9 | % | | 4.57 | | | 11.3 | % |

| Royalty payments | | | 2.83 | | | 6.6 | % | | 0.81 | | | 2.0 | % |

|

| Total crude oil sales or transfers | | | 43.04 | | | 100.0 | % | | 40.51 | | | 100.0 | % |

|

REFINING

Our total processed volumes were as follows:

|

| | | Three months ended September 30 | |

|

| | | 2004 | | 2003 | |

| | | (MMbbls) | | (MMbbls) | |

|

| Feedstock refined into product | | | 7.04 | | | 8.30 | |

| Tolled volumes | | | 0.14 | | | - | |

|

| Total processed volumes* | | | 7.18 | | | 8.30 | |

|

|

| | | Nine months ended September 30 | |

|

| | | 2004 | | 2003 | |

| | | (MMbbls) | | (MMbbls) | |

|

| Feedstock refined into product | | | 21.74 | | | 23.85 | |

| Tolled volumes | | | 0.27 | | | 0.23 | |

|

| Total processed volumes* | | | 22.01 | | | 24.08 | |

|

*The total processed volumes are used for our per barrel calculations.

Sources of feedstock supplies for our refinery were as follows:

| |

| | | Three months ended September 30 | |

| |

| | | 2004 | | 2003 | |

| | | (MMbbls) | | (MMbbls) | |

| |

| Acquired from PKKR | | | 3.97 | | | 4.62 | |

| Purchased from joint ventures (100%) | | | 3.00 | | | 3.44 | |

| Purchased from third parties | | | 0.01 | | | 0.07 | |

|

| Total feedstock acquired | | | 6.98 | | | 8.13 | |

|

|

| | | Nine months ended September 30 | |

|

| | | 2004 | | 2003 | |

| | | (MMbbls) | | (MMbbls) | |

|

| Acquired from PKKR | | | 12.22 | | | 14.55 | |

| Purchased from joint ventures (100%) | | | 9.40 | | | 9.14 | |

| Purchased from third parties | | | 0.01 | | | 0.07 | |

|

| Total feedstock acquired | | | 21.63 | | | 23.76 | |

|

The movements in our feedstock inventory at our refinery were as follows:

|

| | | Three months ended September 30 | |

|

| | | 2004 | | 2003 | |

| | | (MMbbls) | | (MMbbls) | |

|

| Opening inventory of crude oil feedstock | | | 0.05 | | | 0.23 | |

| Purchase and acquisition of feedstock | | | 6.98 | | | 8.13 | |

| Recoverable feedstock from traps | | | 0.03 | | | - | |

| Feedstock refined into product | | | (7.04 | ) | | (8.30 | ) |

|

| Closing inventory of feedstock | | | 0.02 | | | 0.06 | |

|

|

| | | Nine months ended September 30 | |

|

| | | 2004 | | 2003 | |

| | | (MMbbls) | | (MMbbls) | |

|

| Opening inventory of crude oil feedstock | | | 0.03 | | | 0.20 | |

| Purchase and acquisition of feedstock | | | 21.63 | | | 23.76 | |

| Recoverable feedstock from traps | | | 0.10 | | | (0.05 | ) |

| Feedstock refined into product | | | (21.74 | ) | | (23.85 | ) |

|

| Closing inventory of feedstock | | | 0.02 | | | 0.06 | |

|

The movement in inventory of refined products was as follows:

|

| | | Three months ended September 30 | |

|

| | | 2004 | | 2003 | |

| | | (MM Tonnes)* | | (MM Tonnes)* | |

|

| Opening inventory of refined product | | | 0.18 | | | 0.12 | |

| Refined product from feedstock | | | 0.85 | | | 1.01 | |

| Refined product purchased | | | 0.01 | | | - | |

| Refined product sold | | | (0.90 | ) | | (0.97 | ) |

| Refined product internal use | | | (0.01 | ) | | - | |

|

| Closing inventory of refined product | | | 0.13 | | | 0.16 | |

|

|

| | | Nine months ended September 30 | |

|

| | | 2004 | | 2003 | |

| | | (MM Tonnes)* | | (MM Tonnes)* | |

|

| Opening inventory of refined product | | | 0.26 | | | 0.22 | |

| Refined product from feedstock | | | 2.63 | | | 2.90 | |

| Refined product purchased | | | 0.05 | | | 0.01 | |

| Refined product sold | | | (2.78 | ) | | (2.97 | ) |

| Refined product internal use | | | (0.03 | ) | | - | |

|

| Closing inventory of refined product | | | 0.13 | | | 0.16 | |

|

| * | The inventory of products represents a mix of products for which no unique conversion from barrels to tonnes exists. The standard conversion used by us for crude oil is 7.746 barrels to the tonne. |

RESULTS OF OPERATIONS

REVENUE

As at June 30, 2004, approximately 1.3 mmbbls of non-FCA sales were in transit and hence, included in inventory. The net income realized on these sales in the third quarter of 2004 was $20.0 million, as compared to $18.1 million of net income estimated at June 30, 2004. As at September 30, 2004, approximately 0.8 mmbbls of non-FCA sales were in transit and included in inventory. We expect to realize these volumes in the fourth quarter of 2004 for net income of $16.0 million.

|

| | | Three months ended September 30 | | | | | |

|

| | | 2004 | | 2003 | | Change | | | |

| | | ($000’s) | | ($000’s) | | ($000’s) | | % | |

|

| Crude oil | | | 321,676 | | | 163,955 | | | 157,721 | | | 96.2 | |

| Refined products | | | 195,466 | | | 137,355 | | | 58,111 | | | 42.3 | |

| Service fees | | | 284 | | | 864 | | | (580 | ) | | (67.1 | ) |

| Interest income | | | 1,176 | | | 978 | | | 198 | | | 20.2 | |

|

| Total revenue | | | 518,602 | | | 303,152 | | | 215,450 | | | 71.1 | |

|

|

| | | Nine months ended September 30 | | | | | |

|

| | | 2004 | | 2003 | | Change | | | |

| | | ($000’s) | | ($000’s) | | ($000’s) | | % | |

|

| Crude oil | | | 735,240 | | | 440,372 | | | 294,868 | | | 67.0 | |

| Refined products | | | 495,474 | | | 359,769 | | | 135,705 | | | 37.7 | |

| Service fees | | | 4,166 | | | 4,191 | | | (25 | ) | | (0.6 | ) |

| Interest income | | | 2,416 | | | 2,344 | | | 72 | | | 3.1 | |

|

| Total revenue | | | 1,237,296 | | | 806,676 | | | 430,620 | | | 53.4 | |

|

CRUDE OIL

The table below sets out volumes sold, net realized prices and crude oil revenue:

THREE MONTHS ENDED SEPTEMBER 30, 2004

|

| | | Volumes Sold | | Net Realized Price | | Revenue | |

| | | (MMbbls) | | ($/bbl) | | ($000’s) | |

|

| Crude sales sold FCA | | | - | | | - | | | - | |

| Crude sales sold non-FCA | | | 6.72 | | | 38.10 | | | 256,020 | |

| Kazgermunai export sales | | | 1.73 | | | 26.60 | | | 46,017 | |

| Royalty payments* | | | 0.95 | | | 20.67 | | | 19,639 | |

|

| Total | | | 9.40 | | | 34.22 | | | 321,676 | |

|

THREE MONTHS ENDED SEPTEMBER 30, 2003

|

| | | Volumes Sold | | Net Realized Price | | Revenue | |

| | | (MMbbls) | | ($/bbl) | | ($000’s) | |

|

| Crude sales sold FCA | | | 0.38 | | | 14.44 | | | 5,489 | |

| Crude sales sold non-FCA | | | 5.34 | | | 22.75 | | | 121,495 | |

| Kazgermunai export sales | | | 1.50 | | | 19.15 | | | 28,727 | |

| Royalty payments* | | | 0.81 | | | 10.18 | | | 8,244 | |

|

| Total | | | 8.03 | | | 20.42 | | | 163,955 | |

|

NINE MONTHS ENDED SEPTEMBER 30, 2004

|

| | | Volumes Sold | | Net Realized Price | | Revenue | |

| | | (MMbbls) | | ($/bbl) | | ($000’s) | |

|

| Crude sales sold FCA | | | - | | | - | | | - | |

| Crude sales sold non-FCA | | | 18.21 | | | 31.01 | | | 564,636 | |

| Kazgermunai export sales | | | 5.08 | | | 24.05 | | | 122,172 | |

| Royalty payments* | | | 2.83 | | | 17.11 | | | 48,432 | |

|

| Total | | | 26.12 | | | 28.15 | | | 735,240 | |

|

NINE MONTHS ENDED SEPTEMBER 30, 2003

|

| | | Volumes Sold | | Net Realized Price | | Revenue | |

| | | (MMbbls) | | ($/bbl) | | ($000’s) | |

|

| Crude sales sold FCA | | | 2.89 | | | 15.49 | | | 44,781 | |

| Crude sales sold non-FCA | | | 13.58 | | | 23.32 | | | 316,665 | |

| Kazgermunai export sales | | | 4.11 | | | 17.20 | | | 70,682 | |

| Royalty payments* | | | 0.81 | | | 10.18 | | | 8,244 | |

|

| Total | | | 21.39 | | | 20.59 | | | 440,372 | |

|

| * | Royalty price is the average sales price at wellhead. |

Our increase in crude oil revenue for the third quarter and the first nine months of 2004 compared to the same periods in 2003 was due to the substantial increase in crude oil market prices and the absence of FCA sales.

Royalty payments represent deliveries for royalty in kind volumes. There were no royalty in kind volumes in the second quarter and first half of 2003, because we settled our royalty obligations in cash.

REFINED PRODUCT REVENUE

The tables below set forth the related tonnes of refined products sold, the average prices obtained and revenues received for the three and nine months ended September 30, 2004 and 2003.

|

| | | Three months ended September 30 | |

|

| | | Tonnes | | Average Price | | Revenue | |

| | | Sold | | ($/tonne) | | ($000’s) | |

|

2004 | | | 896,499 | | | 218.03 | | | 195,466 | |

| 2003 | | | 969,634 | | | 141.66 | | | 137,355 | |

|

|

| | | Nine months ended September 30 | |

|

| | | Tonnes | | Average Price | | Revenue | |

| | | Sold | | ($/tonne) | | ($000’s) | |

|

2004 | | | 2,780,389 | | | 178.20 | | | 495,474 | |

| 2003 | | | 2,965,755 | | | 121.31 | | | 359,769 | |

|

Third quarter 2004 revenues included the sale of 105,513 tonnes (131,011 tonnes for the first nine months of 2004) of our new product Vacuum Gasoil (“VGO”), a product not produced or sold in 2003. VGO generated revenues of $27.2 million in the third quarter of 2004 ($33.0 million in the first nine months).

PRODUCTION EXPENSES

Production expenses relate to the cost of producing crude oil in our Upstream operations. Based on the number of barrels of oil produced, these costs were as follows:

|

| | | Production | | Per barrel of oil | |

| | | Expenses | | Produced | |

| | | ($000’s) | | ($/bbl) | |

|

Three months ended September 30, 2004 | | | 23,392 | | | 1.61 | |

| Three months ended September 30, 2003 | | | 15,812 | | | 1.11 | |

Nine months ended September 30, 2004 | | | 70,508 | | | 1.71 | |

| Nine months ended September 30, 2003 | | | 49,961 | | | 1.25 | |

|

Production expenses increased by $7.6 million for the third quarter of 2004. The factors were as follows.

| | • | The increase in water cut at our Kumkol South, South Kumkol and Turgai fields and additional wells placed on artificial lift resulted in increased expenditures of $4.5 million. |

| | | |

| | • | Our production expenses increased by $1.7 million due to the release of inventoried production expenses, as sales volumes exceeded production volumes. This accounts for $0.12/bbl increase in our per unit costs. |

Production expenses increased by $20.5 million for the nine months ended September 30, 2004. The contributing factors were as follows.

| | • | The continued increase in water cut at our Kumkol South, South Kumkol and Turgai fields and additional wells placed on artificial lift resulted in the increased expenditures of $9.6 million. Additional capital will be invested during 2005 on EOR ("Enhanced Oil Recovery") and water handling facilities, that will reduce our production expenses. |

| | | |

| | • | In our KAM fields we are operating single well batteries pending completion of infrastructure. We also commissioned a number of new facilities, Aryskum CPF, Aryskum gas compressor for gas re-injection, Maibulak water injection, Aryskum pumping station on our KAM pipeline, and we commenced installation of artificial lift, all of which led to higher costs of approximately $5.5 million. |

| | | |

| | • | During 2005 we will be installing flowlines to tie in the single wells at KAM fields to our main facilities and we are also planning to increase capacities of the existing facilities to handle the increasing fluid production. |

| | | |

| | • | Our production expenses increased by $2.7 million due to the release of inventoried production expenses, as sales volumes exceeded production volumes. This accounts for $0.07/bbl increase in our per unit costs. |

Our upstream operations have embarked on a program focused on reducing our production expenses. A number of initiatives have been identified and we are in the process of implementation. The third quarter results demonstrate that this program is having an impact.

ROYALTIES AND TAXES

The following table sets forth the components of royalties and taxes.

|

| | | Three months ended September 30 | |

|

| | | 2004 | | 2003 | |

| | | ($000’s) | | ($000’s) | |

|

| Royalties and production bonus | | | 30,635 | | | 18,695 | |

| Tax assessments | | | 14,562 | | | - | |

| Other taxes | | | 7,209 | | | 6,034 | |

|

| Total | | | 52,406 | | | 24,729 | |

|

|

| | | Nine months ended September 30 | |

|

| | | 2004 | | 2003 | |

| | | ($000’s) | | ($000’s) | |

|

| Royalties and production bonus | | | 59,999 | | | 36,439 | |

| Tax assessments | | | 14,813 | | | 492 | |

| ARNM assessment | | | 3,600 | | | - | |

| Other taxes | | | 18,801 | | | 17,218 | |

|

| Total | | | 97,213 | | | 54,149 | |

|

Royalties and Production Bonus

Royalties and production bonus for the third quarter of 2004 were $30.6 million, which represented an effective overall royalty rate of 8.6% excluding production bonuses of $0.2 million. Royalties and production bonus for the third quarter of 2003 were $18.7 million, an overall royalty rate of 9.9%, after excluding the production bonuses of $0.3 million. The reasons for the lower overall royalty rate were that a higher proportion of production came from fields with lower royalty rates and the temporary reduction in production at Kumkol South. Despite the decrease in the average rate, royalties and taxes increased due to the increase in crude oil prices.

Royalties and production bonus for the nine months ended September 30, 2004 were $60.0 million, which represented an effective overall royalty rate of 7.1% excluding production bonuses of $0.5 million. Royalties and production bonus for the same period of 2003 were $36.4 million, which represented an effective overall royalty rate of 7.9% excluding production bonuses of $0.7 million. The decrease in the royalty rate was mainly due to the decreased production from Kumkol South, a field with higher royalty rates.

Tax Assessments

As described in Note 15 to our consolidated financial statements, tax assessments totalling $13.0 million were recorded in the third quarter of 2004. There were $8.0 million in fines and penalties relating to an assessment for road fund taxes and $5.0 million for royalties on associated gas. An additional provision of $1.6 million for penalties was recorded relating to interest charges on this tax assessment.

For the nine months of 2004 we received assessments amounting to $0.3 million for property taxes and social taxes. Tax assessments of $0.5 million in the first nine months of 2003 represent tax assessments received on excise and other taxes for 2000 and 2001.

ARNM Assessment

As described in Note 20 to our 2003 annual report, the Agency for Regulation of Natural Monopolies and Protection of Competition (“ARNM”) alleged that PetroKazakhstan Oil Products, our subsidiary operating our refinery, charged prices for refined oil products that in total were $6.3 million in excess of ARNM authorized maximum prices. In April 2004 following a Supreme Court decision, we paid $3.6 million to satisfy the assessment. See Note 15 to the interim consolidated financial statements.

Other Taxes

Other taxes of $7.2 million in the third quarter of 2004 include:

| | • | excise tax on refined products ($3.7 million in 2004 compared to $4.0 million in 2003); |

| | | |

| | • | value added tax on crude oil ($2.0 million in 2004 compared to $0.8 million in 2003); |

| | | |

| | • | various taxes, including property taxes, road fund and other ($1.5 million in 2004 compared to $1.2 million in 2003). |

Other taxes of $18.8 million in the first nine month periods ended September 30, 2004 include:

| | • | Excise tax on refined products ($10.8 million in 2004 compared to $8.6 million in 2003); |

| | | |

| | • | Excise tax on crude oil exports (nil in 2004 compared to $1.0 million in 2003); |

| | | |

| | • | Value added tax on crude oil ($3.4 million in 2004 compared to $4.2 million in 2003); |

| | | |

| | • | Various taxes, including property taxes, road fund and other ($4.6 million in 2004 compared to $3.4 million in 2003). |

TRANSPORTATION

The table below sets out the components of transportation costs.

|

| | | Three months ended September 30 | |

|

| | | 2004 | | 2003 | |

| | | ($000’s) | | ($000’s) | |

|

| Pipeline | | | 8,347 | | | 11,350 | |

| Kazgermunai transportation | | | 7,923 | | | 5,904 | |

| Railway - crude oil | | | 39,537 | | | 33,667 | |

| Railway - refined products | | | 13,576 | | | 2,011 | |

| Other | | | 3,179 | | | 3,387 | |

|

| Total | | | 72,562 | | | 56,319 | |

|

|

| | | Nine months ended September 30 | |

|

| | | 2004 | | 2003 | |

| | | ($000’s) | | ($000’s) | |

|

| Pipeline | | | 25,686 | | | 49,387 | |

| Kazgermunai transportation | | | 22,466 | | | 12,014 | |

| Railway - crude oil | | | 113,117 | | | 101,412 | |

| Railway - refined products | | | 19,628 | | | 2,011 | |

| Other | | | 6,974 | | | 6,767 | |

|

| Total | | | 187,871 | | | 171,591 | |

|

Pipeline

Pipeline costs decreased by $3.0 million in the third quarter of 2004 compared to 2003 primarily due to the following:

| | • | Decrease of $3.1 million, as a result of a decrease in volumes sold for export through the Kumkol - Shymkent pipeline (0.2 mmbbls in the third quarter of 2004 compared to 2.2 mmbbls in the third quarter of 2003), partially offset by higher tariffs for the Kumkol - Shymkent pipeline in 2004 ($1.65/bbl in 2004 compared to $1.54/bbl in 2003) due to the change in the exchange rate of Tenge to U.S. dollar; |

| | | |

| | • | Decrease of $0.6 million, as a result of a decrease of 1.0 mmbbls in crude oil volumes sent to the refinery through the Kumkol - Shymkent pipeline, partially offset by the increase in the pipeline rate ($0.89/bbl in 2004 compared to $0.84/bbl in 2003) due to the change in the exchange rate of Tenge to U.S. dollar; |

| | | |

| | • | Increase of $0.7 million due to volumes shipped through Atasu terminal to China (2.1 mmbbls in the third quarter of 2004 compared to 1.2 mmbbls in the third quarter of 2003). |

Pipeline costs decreased by $23.7 million during the nine months ended September 30, 2004 compared to the same period of 2003 primarily due to the following:

| | • | Decrease of $10.5 million in non-FCA pipeline costs (nil for the first nine months of 2004 compared to $10.5 million in the same period of 2003) because we did not use the Atyrau-Samara pipeline; |

| | | |

| | • | Decrease of $15.0 million, as a result of a decrease in volumes sold for export through the Kumkol - Shymkent pipeline (2.5 mmbbls in 2004 compared to 13.0 mmbbls in 2003), partially offset by higher tariffs for the Kumkol - Shymkent pipeline in 2004 ($1.65/bbl in 2004 compared to $1.51/bbl in 2003) due to the change in the exchange rate of Tenge to U.S. dollar; |

| | | |

| | • | Decrease of $2.1 million, as a result of a decrease of 2.6 mmbbls in crude oil volumes sent to the refinery through the Kumkol - Shymkent pipeline; |

| | | |

| | • | Increase of $3.9 million on volumes shipped through our KAM pipeline and through Atasu terminal to China. Our KAM pipeline became operational in the third quarter of 2003, hence our expenses related to the KAM pipeline are higher by $2.3 million for the first nine months of 2004 compared to the same period of 2003, as there were no expenses for the first half of 2003. Our transportation expenses through Atasu terminal were higher by $1.6 million as we shipped 3.4 mmbbls in the first nine months of 2004 compared to 1.5 mmbbls in the first nine months of 2003. |

Railway - Crude Oil

Railway transportation of crude oil increased by $5.9 million in the third quarter of 2004 due to our increased sales volumes. Railway costs are higher in the first nine months of 2004 by $11.7 million due to the increase in sales volumes.

Railway - Refined Products

Railway transportation of refined products increased by $11.6 million in the third quarter of 2004, as we exported 155,702 tonnes of various products on a non-FCA basis in the third quarter of 2004 compared to 22,000 tonnes sold for export on a non-FCA basis in the same quarter of 2003.

Other

Other transportation costs are mainly trucking costs incurred to transport crude oil from the KAM fields.

REFINING

Refining costs represent the direct costs related to processing crude oil sold as refined products during the period and the refining costs attached to volumes processed on behalf of tollers.

Refining costs for the third quarter of 2004 were $5.8 million ($0.81/bbl) compared to $4.1 million ($0.49/bbl) in the same quarter of 2003. Refining costs for the nine months ended September 30, 2004 were $15.2 million ($0.69/bbl) compared to $12.9 million ($0.54/bbl) in the same period of 2003.The main reasons for the $2.3 million increase in refining costs were higher repair costs and additional purchased steam and electric power related to the start-up and operation of the vacuum distillation unit during 2004. During the third quarter of 2004 the vacuum distillation unit operated continuously at an average rate of more than 43,500 tonnes per month, up significantly from 7,700 tonnes per month during the first half of the year.

CRUDE OIL AND REFINED PRODUCT PURCHASES

Crude oil and refined product purchases represent the expensed portion of crude oil purchased for the refinery from third parties, as well as refined products purchased for resale. Purchases and sales between our Upstream and Downstream business units are eliminated on consolidation.

Our purchases of crude oil and refined products were as follows:

|

| | | Three months ended September 30 | |

|

| | | 2004 | | 2003 | |

| | | ($000’s) | | ($000’s) | |

|

| Crude oil | | | 28,055 | | | 16,978 | |

| Refined products | | | - | | | - | |

|

| Total | | | 28,055 | | | 16,978 | |

|

|

| | | Nine months ended September 30 | |

|

| | �� | 2004 | | 2003 | |

| | | ($000’s) | | ($000’s) | |

|

| Crude oil | | | 86,261 | | | 42,394 | |

| Refined products | | | 6,186 | | | - | |

|

| Total | | | 92,447 | | | 42,394 | |

|

During the first quarter of 2004 we repurchased the royalty-in-kind volumes for $17.1 million and subsequently resold them. The remaining purchases of crude oil were made from our joint ventures. The volumes purchased from our joint ventures are approximately at the same level as in the third quarter and first nine months of 2003, however, the increase in crude oil prices led to higher costs.

SELLING

Selling expenses for crude oil are comprised of customs, quality inspection and costs related to the export of crude oil. Selling expenses for refined products are comprised of the costs of operating the regional distribution centres and other costs related to our Downstream operations.

|

| | | Three months ended September 30 | |

|

| | | 2004 | | 2003 | |

| | | ($000’s) | | ($000’s) | |

|

| Crude oil | | | 5,151 | | | 3,371 | |

| Refined products | | | 5,254 | | | 4,133 | |

|

| Total | | | 10,405 | | | 7,504 | |

|

|

| | | Nine months ended September 30 | |

|

| | | 2004 | | 2003 | |

| | | ($000’s) | | ($000’s) | |

|

| Crude oil | | | 13,385 | | | 7,878 | |

| Refined products | | | 14,683 | | | 12,455 | |

|

| Total | | | 28,068 | | | 20,333 | |

|

The increase in crude oil selling expenses during the third quarter and first nine months of 2004 compared to the same periods of 2003 was the direct result of increased export sales volumes related to non-FCA routes, for which all selling costs are absorbed by us, and the increase in Kazgermunai sales volumes.

Selling expenses related to refined products also increased during the third quarter and first nine months of 2004 compared to the same periods of 2003 due to increases in storage fees, transportation security fees and personnel costs.

GENERAL AND ADMINISTRATIVE

The table below analyzes total general and administrative costs for Upstream, Downstream and Corporate. In the case of Upstream and Downstream the general and administrative costs are also presented on a per barrel basis.

THREE MONTHS ENDED SEPTEMBER 30, 2004

|

| | | General and | | Per barrel of oil | |

| | | Administrative | | produced or processed* | |

| | | ($000’s) | | ($/bbl) | |

|

| Upstream | | | 9,418 | | | 0.65 | |

| Downstream | | | 4,038 | | | 0.56 | |

| Corporate | | | 2,130 | | | | |

|

| Total | | | 15,586 | | | | |

|

| * | Including tollers’ volumes |

THREE MONTHS ENDED SEPTEMBER 30, 2003

|

| | | General and | | Per barrel of oil | |

| | | Administrative | | produced or processed* | |

| | | ($000’s) | | ($/bbl) | |

|

| Upstream | | | 8,415 | | | 0.59 | |

| Downstream | | | 3,861 | | | 0.47 | |

| Corporate | | | 1,385 | | | | |

|

| Total | | | 13,661 | | | | |

|

| * | Including tollers’ volumes |

The increase in upstream general and administrative expenses was due to a $1.0 million charitable donation. The increase in corporate was due to $0.7 million of compensation cost being recognized for stock options granted pursuant to the new accounting standard.

NINE MONTHS ENDED SEPTEMBER 30, 2004

|

| | | General and | | Per barrel of oil | |

| | | Administrative | | produced or processed* | |

| | | ($000’s) | | ($/bbl) | |

|

| Upstream | | | 24,678 | | | 0.60 | |

| Downstream | | | 10,869 | | | 0.49 | |

| Corporate | | | 8,946 | | | | |

|

| Total | | | 44,493 | | | | |

|

| * | Including tollers’ volumes |

NINE MONTHS ENDED SEPTEMBER 30, 2003

|

| | | General and | | Per barrel of oil | |

| | | Administrative | | produced or processed* | |

| | | ($000’s) | | ($/bbl) | |

|

| Upstream | | | 23,536 | | | 0.59 | |

| Downstream | | | 10,750 | | | 0.45 | |

| Corporate | | | 2,908 | | | | |

|

| Total | | | 37,194 | | | | |

|

| * | Including tollers’ volumes |

The increase in upstream general and administrative expenses was due to a $1.0 million charitable donation. The increase in corporate expenses was mainly due to $2.8 million of compensation cost being recognized for stock options granted pursuant to the new accounting standard. The remaining increase is attributable to increased activity levels.

INTEREST AND FINANCING

The following table sets forth our interest and financing costs and any related amortization of debt issue costs or discounts upon issuance of the debt instrument.

|

| | | Three months ended September 30 | |

|

| | | 2004 | | 2003 | |

| | | ($000’s) | | ($000’s) | |

|

| 9.625% Notes | | | 3,504 | | | 3,845 | |

| Term facility | | | 3,278 | | | 2,428 | |

| Kazgermunai debt | | | 251 | | | 420 | |

| PKOP bonds | | | - | | | 699 | |

| Short-term debt | | | 334 | | | 243 | |

| Accretion expense | | | 608 | | | 513 | |

| Term loans | | | 129 | | | - | |

| Less portion capitalized | | | - | | | - | |

|

| Total | | | 8,104 | | | 8,148 | |

|

The interest on our term facility increased in the third quarter of 2004 due to $2.1 million of expensed deferred costs following the early repayment of the term facility. This was offset by a $1.3 million decrease in interest expense for the term facility compared to the same quarter of 2003 as the principal has been reduced through monthly principal repayments.

|

| | | Nine months ended September 30 | |

|

| | | 2004 | | 2003 | |

| | | ($000’s) | | ($000’s) | |

|

| 9.625% Notes | | | 11,035 | | �� | 8,697 | |

| Term facility | | | 6,082 | | | 7,790 | |

| Kazgermunai debt | | | 1,053 | | | 1,067 | |

| PKOP bonds | | | 469 | | | 1,881 | |

| Short-term debt | | | 760 | | | 608 | |

| 12% Notes | | | - | | | 8,718 | |

| Accretion expense | | | 1,824 | | | 1,539 | |

| Term loans | | | 379 | | | - | |

| Less portion capitalized | | | (13 | ) | | - | |

|

| Total | | | 21,589 | | | 30,300 | |

|

| | • | Our 9.625% Notes interest expense increased in the first nine months of 2004 by $2.3 million, as the Notes were issued in February 2003. |

| | | |

| | • | Our term facility interest expense decreased by $1.7 million in the first nine months of 2004 due to the full repayment of the facility, which was partially offset by $2.1 million of expensed deferred costs following early repayment. |

| | | |

| | • | PKOP bonds were fully redeemed on February 26, 2004. |

| | | |

| | • | Accretion expense represents the increase in the present value of our asset retirement obligations due to the passage of time. |

| | | |

| | • | Our 12% Notes interest expense in 2003 was $8.7 million including $6.6 million of issue costs that were expensed when we redeemed these notes on February 2, 2003. |

DEPRECIATION AND DEPLETION

THREE MONTHS ENDED SEPTEMBER 30, 2004

|

| | | Depreciation and | | Depreciation and | |

| | | Depletion ($000’s) | | Depletion ($/bbl*) | |

|

| Upstream | | | 24,419 | | | 1.68 | |

| Downstream | | | 5,170 | | | 0.72 | |

| Corporate | | | 319 | | | | |

|

| Total | | | 29,908 | | | | |

|

| * | Downstream includes tollers’ volumes |

THREE MONTHS ENDED SEPTEMBER 30, 2003

|

| | | Depreciation and | | Depreciation and | |

| | | Depletion ($000’s) | | Depletion ($/bbl*) | |

|

| Upstream | | | 16,355 | | | 1.15 | |

| Downstream | | | 4,784 | | | 0.58 | |

| Corporate | | | 24 | | | | |

|

| Total | | | 21,163 | | | | |

|

| * | Downstream includes tollers’ volumes |

The increase in upstream depreciation and depletion expense of $8.1 million includes $13.1 million of additional depletion due to the increase in the depletable assets and future development costs, partially offset by $5.2 million due to the decrease of the depletion rate. The depletion rate decreased from 6.5% in the third quarter of 2003 to 4.1% in 2004 due to the changes in the reserve base. Starting January 1, 2004 we use the proved reserves to calculate depletion, as opposed to proved developed reserves used in 2003, because this resulted in a more representative charge to earnings.

NINE MONTHS ENDED SEPTEMBER 30, 2004

|

| | | Depreciation and | | Depreciation and | |

| | | Depletion ($000’s) | | Depletion ($/bbl*) | |

|

| Upstream | | | 62,210 | | | 1.51 | |

| Downstream | | | 15,085 | | | 0.69 | |

| Corporate | | | 944 | | | | |

|

| Total | | | 78,239 | | | | |

|

| * | Downstream includes tollers’ volumes |

NINE MONTHS ENDED SEPTEMBER 30, 2003

|

| | | Depreciation and | | Depreciation and | |

| | | Depletion ($000’s) | | Depletion ($/bbl*) | |

|

| Upstream | | | 43,461 | | | 1.08 | |

| Downstream | | | 14,105 | | | 0.59 | |

| Corporate | | | 82 | | | | |

|

| Total | | | 57,648 | | | | |

|

| * | Downstream includes tollers’ volumes |

The increase in upstream depreciation and depletion expense of $18.7 million includes $33.1 of additional depletion due to the increase in depletable assets and future development costs, partially offset by $14.5 million due to the decrease of the depletion rate. The depletion rate decreased from 18.5% in the first nine months of 2003 to 11.8% in the same period of 2004 due to the changes in the reserve base as noted above.

INCOME TAXES

|

| | | Three months ended September 30 | |

|

| | | 2004 | | 2003 | |

| | | ($000’s) | | ($000’s) | |

|

| Upstream | | | 80,867 | | | 17,878 | |

| Downstream | | | 16,030 | | | 21,549 | |

| Corporate | | | (84 | ) | | 1,666 | |

|

| Total | | | 96,813 | | | 41,093 | |

|

|

| | | Nine months ended September 30 | |

|

| | | 2004 | | 2003 | |

| | | ($000’s) | | ($000’s) | |

|

| Upstream | | | 155,020 | | | 55,619 | |

| Downstream | | | 63,412 | | | 46,417 | |

| Corporate | | | 2,598 | | | 1,794 | |

|

| Total | | | 221,030 | | | 103,830 | |

|

Income taxes increased by $55.7 million in the third quarter of 2004 compared to the same quarter of 2003 mainly due to an increase in income before taxes. We also provided $15.2 million for excess profit tax in the third quarter of 2004 for our joint venture Turgai. $10.1 million of our tax assessments recorded in the third quarter of 2004 are not deductible for tax, which increases our taxes by $3.0 million. In Kazgermunai, our joint venture, we incurred an additional $4.3 million of income tax, as the marginal tax rate exceeded the statutory rate of 30% per the sliding scale prescribed by the hydrocarbon contract and, therefore, the effective tax rate became 40% in the third quarter of 2004.

Income taxes increased by $117.2 million in the first nine months of 2004 compared to the same period of 2003 mainly due to an increase in income before taxes. We also provided $25.1 million for excess profit tax in the first nine months of 2004 for our joint venture Turgai. $10.1 million of our tax assessments recorded in the third quarter of 2004 are not deductible for tax, which increases our taxes by $3.0 million. In Kazgermunai we incurred an additional $7.5 million of income tax because the marginal tax rate exceeded the statutory tax rate and, therefore, the effective tax rate became 38% for the first nine months of 2004.

Income taxes in our corporate segment are the withholding tax on the dividends paid from subsidiaries in Kazakhstan to Canada.

CAPITAL EXPENDITURES AND COMMITMENTS

The tables below set forth a breakdown of our capital expenditures.

|

| | | | Three months ended September 30 | |

|

| | | | 2004 | | 2003 | |

| | | | ($000’s) | | ($000’s) | |

|

| Upstream | | | | | | | |

| | Development wells | | | 11,647 | | | 12,718 | |

| | Facilities and equipment | | | 10,600 | | | 13,743 | |

| | Exploration | | | 7,474 | | | 7,885 | |

| Downstream | | | | | | | |

| | Refinery HS&E | | | 67 | | | 128 | |

| | Refinery sustaining | | | 688 | | | 569 | |

| | Refinery return projects | | | 500 | | | 1,606 | |

| | Marketing & other | | | 891 | | | 10 | |

| Corporate | | | 417 | | | 420 | |

|

| Total capital expenditure | | | 32,284 | | | 37,079 | |

|

| Less accrued amounts | | | (909 | ) | | (1,063 | ) |

|

| Total cash capital expenditure | | | 31,375 | | | 36,016 | |

|

|

| | | | Nine months ended September 30 | |

|

| | | | 2004 | | 2003 | |

| | | | ($000’s) | | ($000’s) | |

|

| Upstream | | | | | | | |

| | Development wells | | | 27,977 | | | 26,136 | |

| | Facilities and equipment | | | 42,665 | | | 69,290 | |

| | Exploration | | | 19,165 | | | 16,346 | |

| Downstream | | | | | | | |

| | Refinery HS&E | | | 1,959 | | | 468 | |

| | Refinery sustaining | | | 2,346 | | | 2,324 | |

| | Refinery return projects | | | 1,986 | | | 8,744 | |

| | Marketing & other | | | 1,541 | | | 25 | |

| Corporate | | | 1,061 | | | 761 | |

|

| Total capital expenditure | | | 98,700 | | | 124,094 | |

|

| Less accrued amounts | | | (4,271 | ) | | (2,614 | ) |

|

| Total cash capital expenditure | | | 94,429 | | | 121,480 | |

|

LIQUIDITY

The levels of cash, current assets and current liabilities as at September 30, 2004 and December 31, 2003 are set out below.

|

| | | As at | | As at | |

| | | September 30, 2004 | | December 31, 2003 | |

| | | ($000’s) | | ($000’s) | |

|

| Cash | | | 245,975 | | | 184,660 | |

| Cash flow (annualised) | | | 590,903 | | | 399,931 | |

| Working capital* | | | 116,678 | | | 151,737 | |

| Net debt** | | | (79,453 | ) | | 135,220 | |

|

| Ratio of cash flow to net debt*** | | | (7.4 | ) | | 3.0 | |

| Ratio of cash flow to fixed charges**** | | | 20.5 | | | 10.6 | |

| Ratio of earnings to fixed charges***** | | | 29.1 | | | 13.6 | |

|

* Working capital is net of cash and short-term debt

** Net debt includes short-term and long-term debt less cash

*** Quarterly cash flow is annualized

**** Fixed charges include interest expense and preferred dividends before tax

***** Earnings is income before income taxes plus fixed charges

Our net working capital has decreased mainly due to increases in our accounts payable, offset in part by increases in our accounts receivable. The main components of the increase in accounts payable are income and excess profit tax, accrued dividends payable and amounts owed for crude oil purchased from one of our joint ventures. Our accounts receivable increased due to the significant increase in crude oil prices.

Our restricted cash is $50.7 million as at September 30, 2004 ($35.5 million at December 31, 2003). Restricted cash includes $8.8 million of cash dedicated to a debt service reserve account for the Corporation’s Term Facility and $41.9 million of cash dedicated to a margin account for the Corporation’s hedging program. Though our term facility was fully repaid as at September 30, 2004, we still have a balance in our debt service reserve account because our hedging liability has not been discharged in full. The restricted cash balance related to the hedging program has increased by $16.9 million since December 31, 2003 due to the change in the mark-to-market valuation of our hedging contracts.

Our long-term debt substantially decreased from $246.7 million at December 31, 2003 to $150.7 million at September 30, 2004. As at September 30, 2004 we fully repaid our Term Facility. During the nine months ended September 30, 2004 Kazgermunai repaid $24.3 million of its long-term debt.

We have entered into a $100.0 million committed unsecured credit facility, $30.0 million of which is dedicated to margin calls related to our hedging program.

INTERIM CONSOLIDATED STATEMENTS OF INCOME AND RETAINED EARNINGS

(EXPRESSED IN THOUSANDS OF UNITED STATES DOLLARS, EXCEPT PER SHARE AMOUNTS)

Unaudited

|

| | | | Three Months Ended September 30 | | Nine Months Ended September 30 | |

| | | | 2004 | | 2003 | | 2004 | | 2003 | |

|

| REVENUE | | | | | | | | | | | | | |

| | Crude oil | | | 321,676 | | | 163,955 | | | 735,240 | | | 440,372 | |

| | Refined products | | | 195,466 | | | 137,355 | | | 495,474 | | | 359,769 | |

| | Service fees | | | 284 | | | 864 | | | 4,166 | | | 4,191 | |

| | Interest income | | | 1,176 | | | 978 | | | 2,416 | | | 2,344 | |

|

| | | | | 518,602 | | | 303,152 | | | 1,237,296 | | | 806,676 | |

|

| EXPENSES | | | | | | | | | | | | | |

| | Production | | | 23,392 | | | 15,812 | | | 70,508 | | | 49,961 | |

| | Royalties and taxes | | | 52,406 | | | 24,729 | | | 97,213 | | | 54,149 | |

| | Transportation | | | 72,562 | | | 56,319 | | | 187,871 | | | 171,591 | |

| | Refining | | | 5,815 | | | 4,094 | | | 15,217 | | | 12,898 | |

| | Crude oil and refined product purchases | | | 28,055 | | | 16,978 | | | 92,447 | | | 42,394 | |

| | Selling | | | 10,405 | | | 7,504 | | | 28,068 | | | 20,333 | |

| | General and administrative | | | 15,586 | | | 13,661 | | | 44,493 | | | 37,194 | |

| | Interest and financing costs | | | 8,104 | | | 8,148 | | | 21,589 | | | 30,300 | |

| | Depletion and depreciation | | | 29,908 | | | 21,163 | | | 78,239 | | | 57,648 | |

| | Foreign exchange (gain) / loss | | | (566 | ) | | 1,950 | | | (6,361 | ) | | (3,576 | ) |

|

| | | | | 245,667 | | | 170,358 | | | 629,284 | | | 472,892 | |

|

| INCOME BEFORE INCOME TAXES | | | 272,935 | | | 132,794 | | | 608,012 | | | 333,784 | |

|

| INCOME TAXES (Note 11) | | | | | | | | | | | | | |

| | Current provision | | | 119,401 | | | 45,891 | | | 254,403 | | | 109,143 | |

| | Future income tax | | | (22,588 | ) | | (4,798 | ) | | (33,373 | ) | | (5,313 | ) |

|

| | | | | 96,813 | | | 41,093 | | | 221,030 | | | 103,830 | |

|

| NET INCOME BEFORE NON-CONTROLLING INTEREST | | | 176,122 | | | 91,701 | | | 386,982 | | | 229,954 | |

| NON-CONTROLLING INTEREST | | | (96 | ) | | 551 | | | 1,251 | | | 1,822 | |

|

| NET INCOME | | | 176,218 | | | 91,150 | | | 385,731 | | | 228,132 | |

|

| RETAINED EARNINGS, BEGINNING OF PERIOD | | | 570,609 | | | 198,885 | | | 378,819 | | | 73,151 | |

| Substantial course issuer bid (Note 10) | | | (111,335 | ) | | - | | | (111,335 | ) | | - | |

| Normal course issuer bid (Note 10) | | | (35,528 | ) | | - | | | (35,528 | ) | | (11,232 | ) |

| Common share dividends | | | (8,669 | ) | | - | | | (26,375 | ) | | - | |

| Preferred share dividends | | | (9 | ) | | (8 | ) | | (26 | ) | | (24 | ) |

|

| RETAINED EARNINGS, END OF PERIOD | | | 591,286 | | | 290,027 | | | 591,286 | | | 290,027 | |

|

| BASIC NET INCOME PER SHARE (Note 12) | | | 2.30 | | | 1.17 | | | 5.00 | | | 2.92 | |

|

| DILUTED NET INCOME PER SHARE (Note 12) | | | 2.27 | | | 1.12 | | | 4.89 | | | 2.81 | |

|

See accompanying notes to the interim consolidated financial statements.

INTERIM CONSOLIDATED BALANCE SHEETS

(EXPRESSED IN THOUSANDS OF UNITED STATES DOLLARS)

UNAUDITED

|