UMB Financial Annual Meeting of Shareholders April 25, 2017 Exhibit 99.2

Cautionary Notice about Forward-Looking Statements This presentation contains, and our other communications may contain, forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These statements can be identified by the fact that they do not relate strictly to historical or current facts—such as our statements about expected cost savings and other results of efficiency initiatives and our statements about reduced regulation, tax reform and our ability to capitalize on changes. Forward-looking statements often use words such as “believe,” “expect,” “anticipate,” “intend,” “estimate,” “project,” “outlook,” “forecast,” “target,” “trend,” “plan,” “goal,” or other words of comparable meaning or future-tense or conditional verbs such as “may,” “will,” “should,” “would,” or “could.” Forward-looking statements convey our expectations, intentions, or forecasts about future events, circumstances, results, or aspirations. All forward-looking statements are subject to assumptions, risks, and uncertainties, which may change over time and many of which are beyond our control. You should not rely on any forward-looking statement as a prediction or guarantee about the future. Our actual future objectives, strategies, plans, prospects, performance, condition, or results may differ materially from those set forth in any forward-looking statement. Some of the factors that may cause actual results or other future events, circumstances, or aspirations to differ from those in forward-looking statements are described in our Annual Report on Form 10-K for the year ended December 31, 2016, our subsequent Quarterly Reports on Form 10-Q or Current Reports on Form 8-K, or other applicable documents that are filed or furnished with the Securities and Exchange Commission (SEC). Any forward-looking statement made by us or on our behalf speaks only as of the date that it was made. We do not undertake to update any forward-looking statement to reflect the impact of events, circumstances, or results that arise after the date that the statement was made, except to the extent required by applicable securities laws. You, however, should consult further disclosures (including disclosures of a forward-looking nature) that we may make in any subsequent Annual Report on Form 10-K, Quarterly Report on Form 10-Q, Current Report on Form 8-K, or other applicable document that is filed or furnished with the SEC.

Agenda Evolution 2016 Highlights Questions & Answers 2017 and Beyond Focus

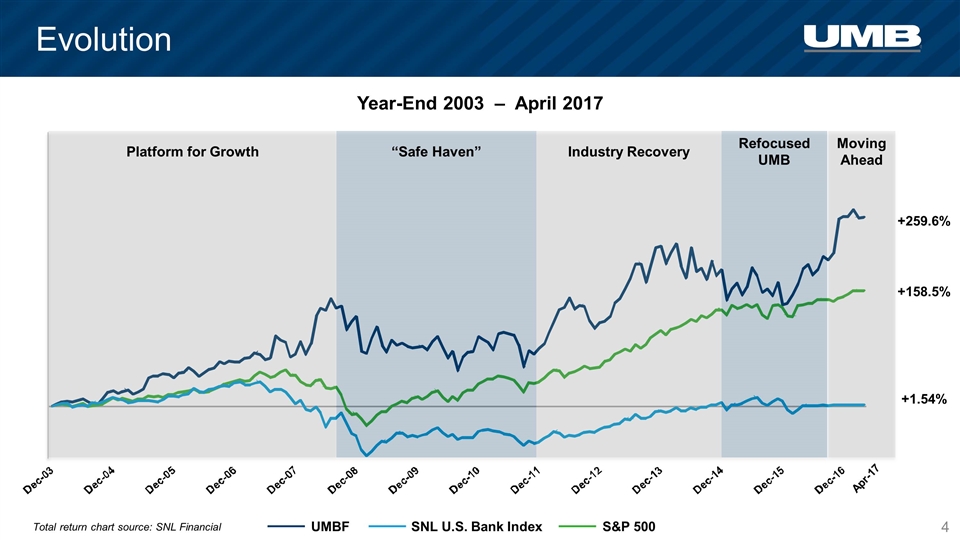

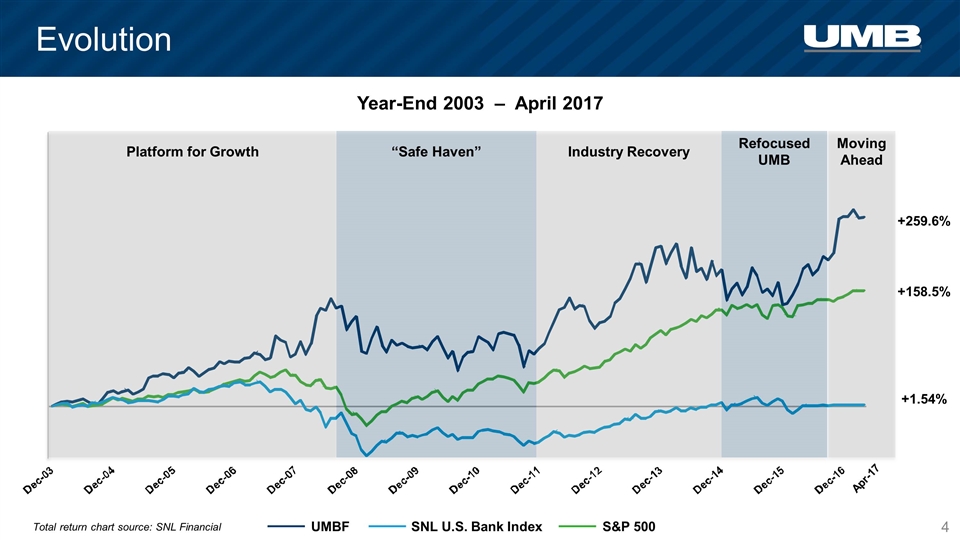

Evolution +259.6% +158.5% +1.54% UMBF S&P 500 SNL U.S. Bank Index Year-End 2003 – April 2017 Platform for Growth “Safe Haven” Industry Recovery Refocused UMB Apr-17 Total return chart source: SNL Financial Moving Ahead

Moving Ahead – Back to Basics 2017 Our Shared Vision To be recognized for the unparalleled customer experience. Our Shared Mission With our position of trust and our tradition of integrity, our shared mission is to know our customers and anticipate their needs; advocate and advise; innovate and surprise.

Runway – Our Investment Thesis Opportunity. Balance sheet remix Performance culture Market share opportunities Unique loan verticals Deposit generating capabilities Low cost of funds Diversity of noninterest income

Agenda Evolution 2016 Highlights Questions & Answers 2017 and Beyond Focus

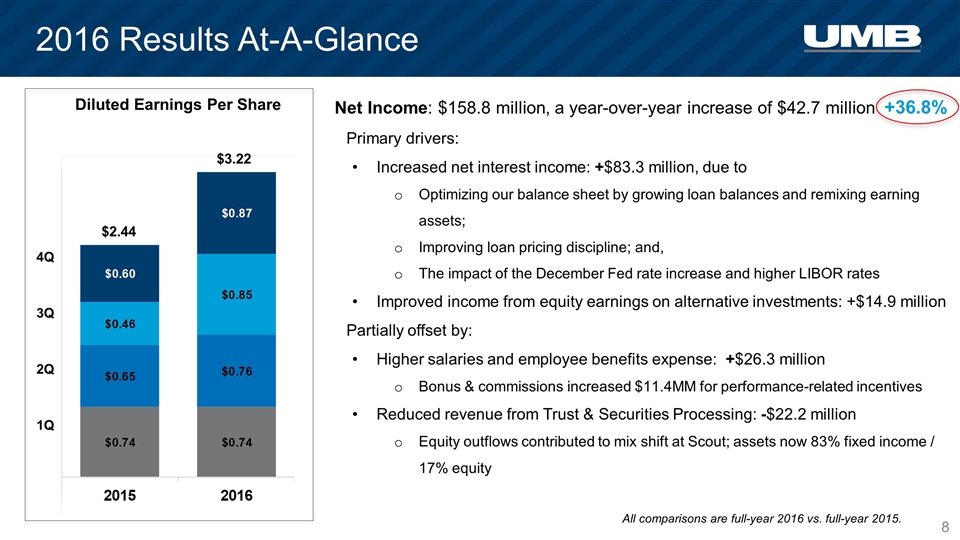

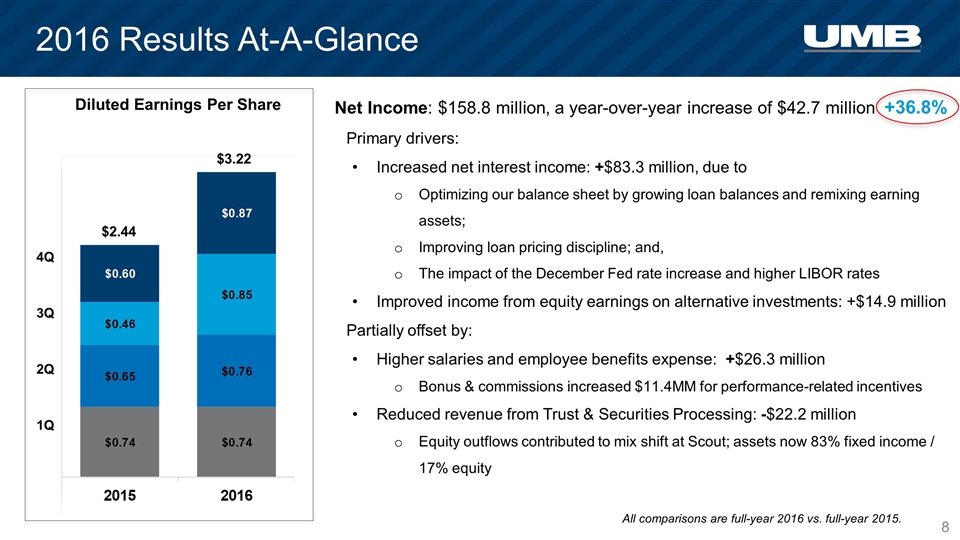

2016 Results At-A-Glance All comparisons are full-year 2016 vs. full-year 2015. Diluted Earnings Per Share $2.44 4Q 3Q 2Q 1Q Net Income: $158.8 million, a year-over-year increase of $42.7 million +36.8% Primary drivers: Increased net interest income: +$83.3 million, due to Optimizing our balance sheet by growing loan balances and remixing earning assets; Improving loan pricing discipline; and, The impact of the December Fed rate increase and higher LIBOR rates Improved income from equity earnings on alternative investments: +$14.9 million Partially offset by: Higher salaries and employee benefits expense: +$26.3 million Bonus & commissions increased $11.4MM for performance-related incentives Reduced revenue from Trust & Securities Processing: -$22.2 million Equity outflows contributed to mix shift at Scout; assets now 83% fixed income / 17% equity $3.22

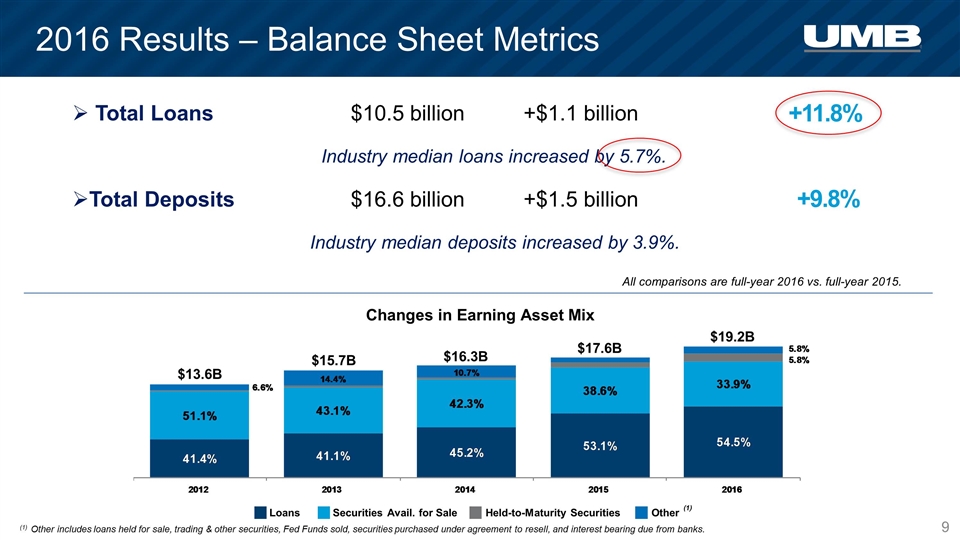

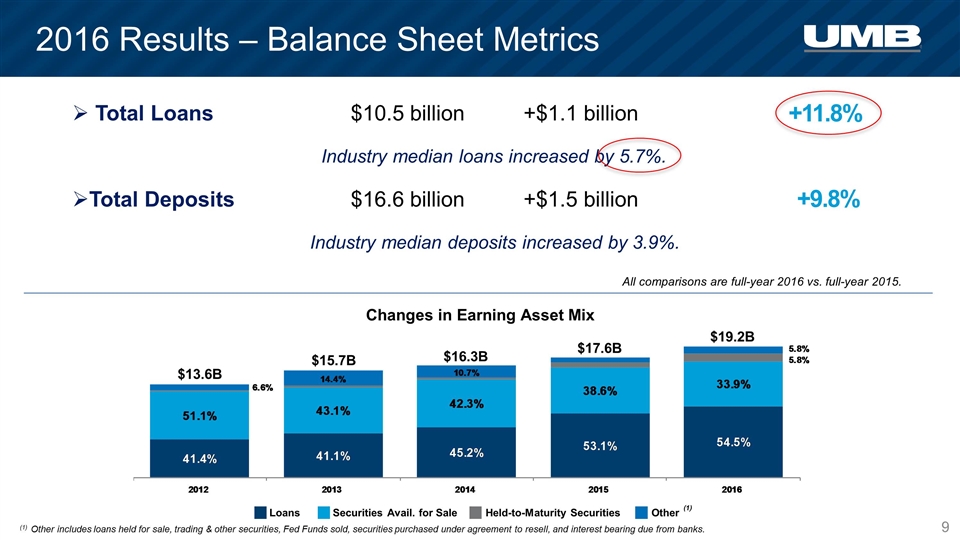

2016 Results – Balance Sheet Metrics (1) Other includes loans held for sale, trading & other securities, Fed Funds sold, securities purchased under agreement to resell, and interest bearing due from banks. (1) Loans Securities Avail. for Sale Held-to-Maturity Securities Other Changes in Earning Asset Mix Total Loans $10.5 billion +$1.1 billion +11.8% Industry median deposits increased by 3.9%. Total Deposits $16.6 billion +$1.5 billion +9.8% Industry median loans increased by 5.7%. $13.6B $15.7B $16.3B $17.6B $19.2B All comparisons are full-year 2016 vs. full-year 2015.

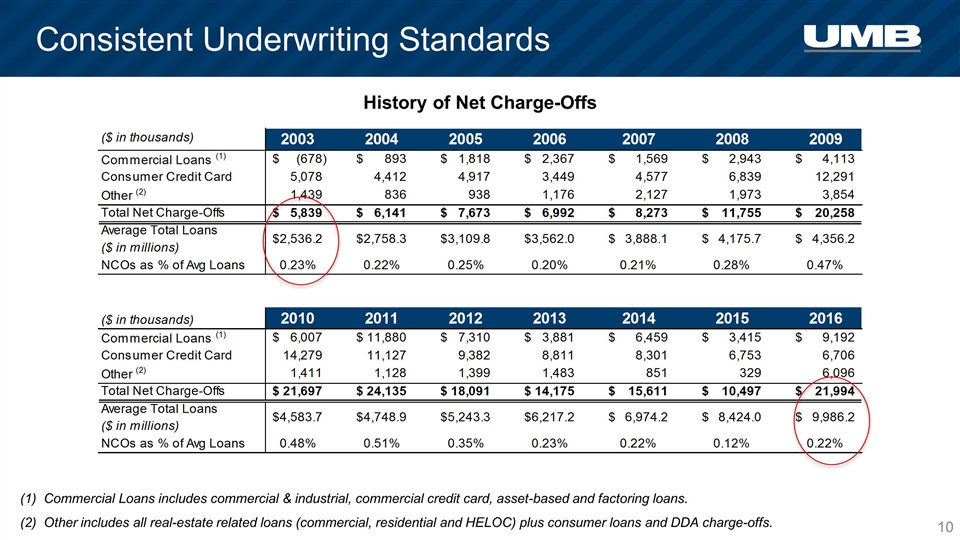

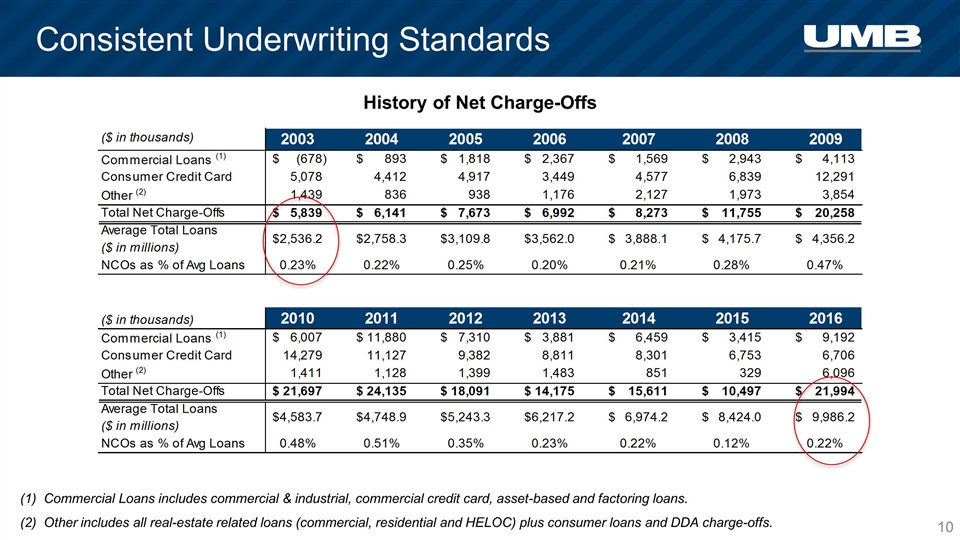

Consistent Underwriting Standards History of Net Charge-Offs (1) Commercial Loans includes commercial & industrial, commercial credit card, asset-based and factoring loans. (2) Other includes all real-estate related loans (commercial, residential and HELOC) plus consumer loans and DDA charge-offs.

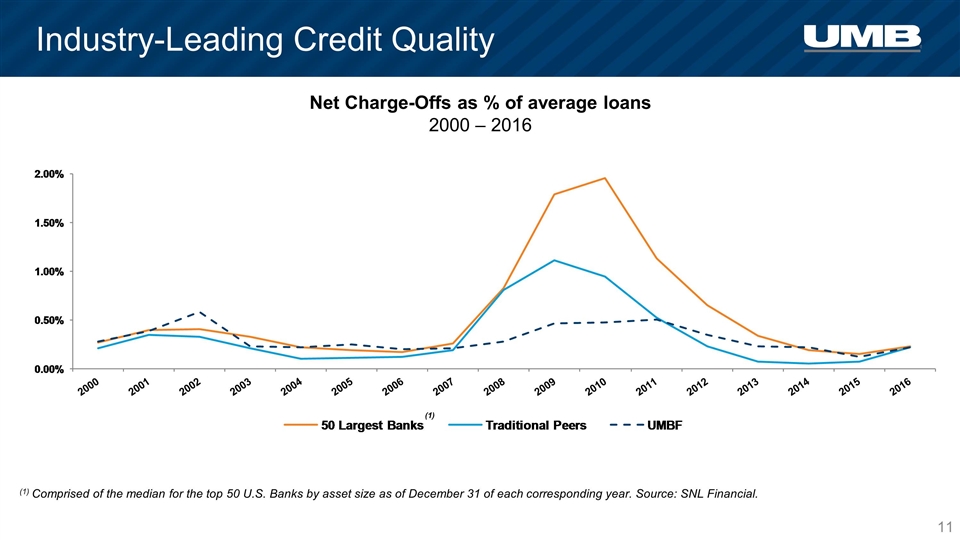

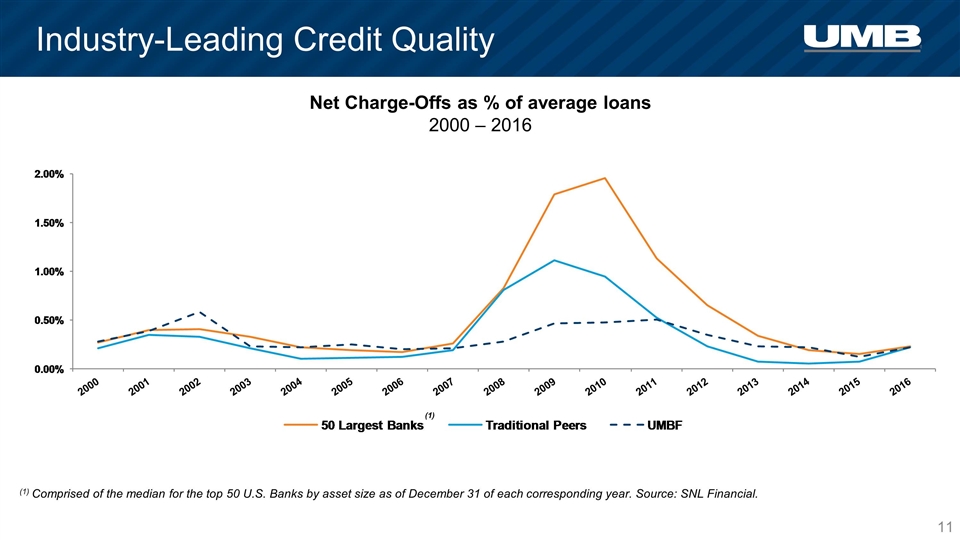

Industry-Leading Credit Quality (1) Comprised of the median for the top 50 U.S. Banks by asset size as of December 31 of each corresponding year. Source: SNL Financial. (1) Net Charge-Offs as % of average loans 2000 – 2016

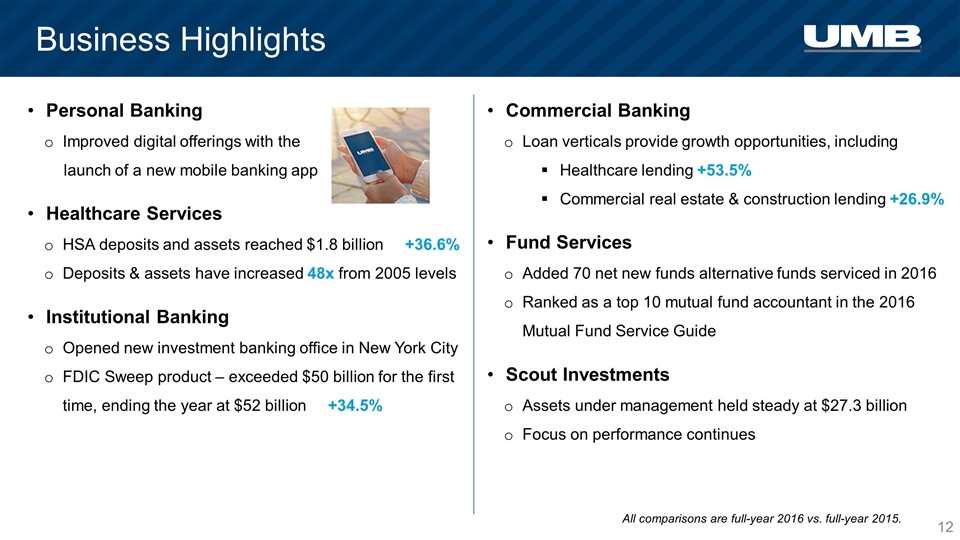

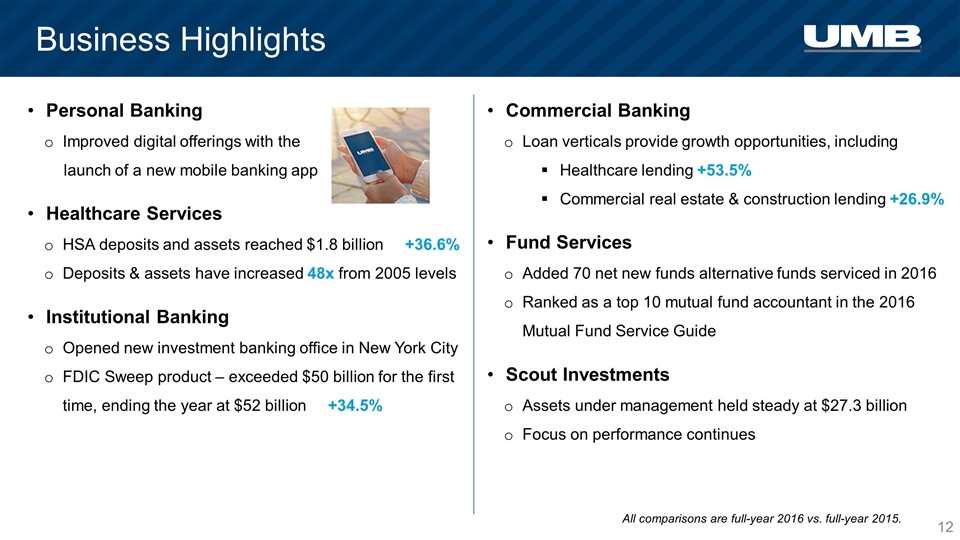

Business Highlights Personal Banking Improved digital offerings with the launch of a new mobile banking app Healthcare Services HSA deposits and assets reached $1.8 billion +36.6% Deposits & assets have increased 48x from 2005 levels Institutional Banking Opened new investment banking office in New York City FDIC Sweep product – exceeded $50 billion for the first time, ending the year at $52 billion +34.5% Commercial Banking Loan verticals provide growth opportunities, including Healthcare lending +53.5% Commercial real estate & construction lending +26.9% Fund Services Added 70 net new funds alternative funds serviced in 2016 Ranked as a top 10 mutual fund accountant in the 2016 Mutual Fund Service Guide Scout Investments Assets under management held steady at $27.3 billion Focus on performance continues All comparisons are full-year 2016 vs. full-year 2015.

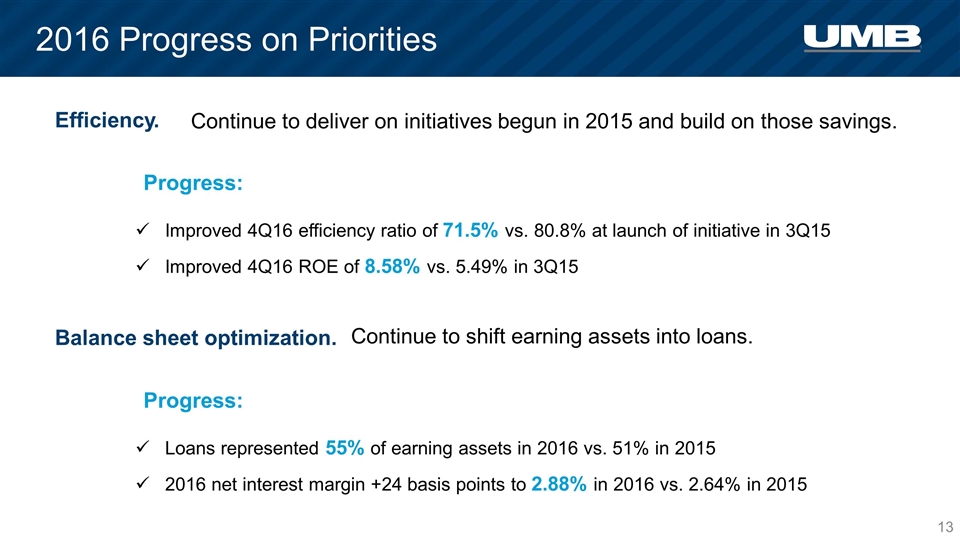

2016 Progress on Priorities Continue to deliver on initiatives begun in 2015 and build on those savings. Efficiency. Improved 4Q16 efficiency ratio of 71.5% vs. 80.8% at launch of initiative in 3Q15 Improved 4Q16 ROE of 8.58% vs. 5.49% in 3Q15 Progress: Continue to shift earning assets into loans. Balance sheet optimization. Loans represented 55% of earning assets in 2016 vs. 51% in 2015 2016 net interest margin +24 basis points to 2.88% in 2016 vs. 2.64% in 2015 Progress:

Agenda Evolution 2016 Highlights Questions & Answers 2017 and Beyond Focus

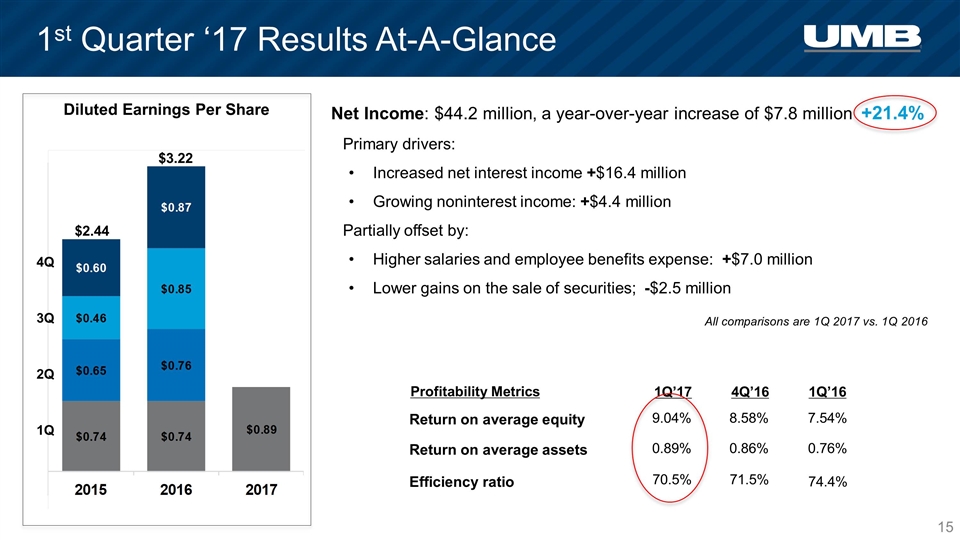

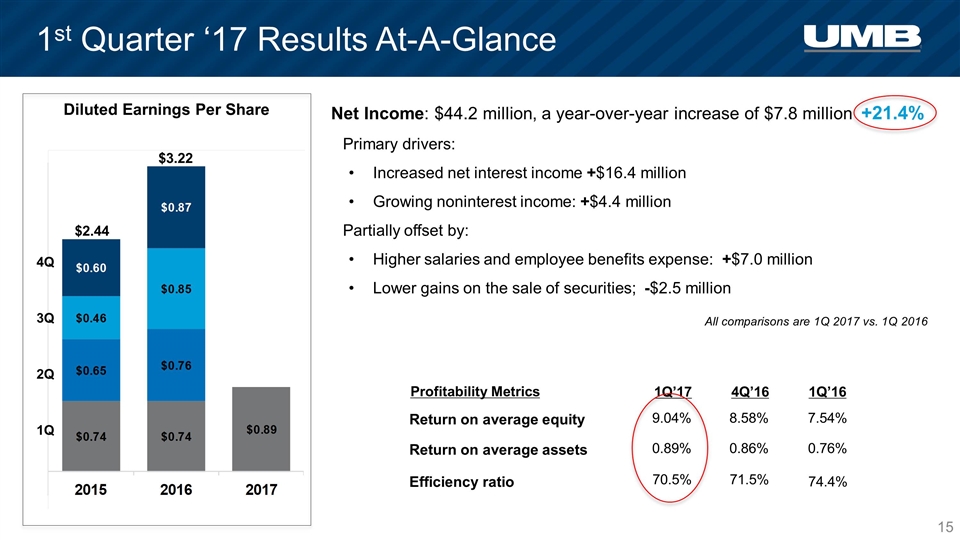

1st Quarter ‘17 Results At-A-Glance Return on average equity Return on average assets All comparisons are 1Q 2017 vs. 1Q 2016 Diluted Earnings Per Share $2.44 4Q 3Q 2Q 1Q $3.22 Net Income: $44.2 million, a year-over-year increase of $7.8 million +21.4% Primary drivers: Increased net interest income +$16.4 million Growing noninterest income: +$4.4 million Partially offset by: Higher salaries and employee benefits expense: +$7.0 million Lower gains on the sale of securities; -$2.5 million 9.04% 0.89% 1Q’17 8.58% 0.86% 4Q’16 7.54% 0.76% 1Q’16 Efficiency ratio 70.5% 71.5% 74.4% Profitability Metrics

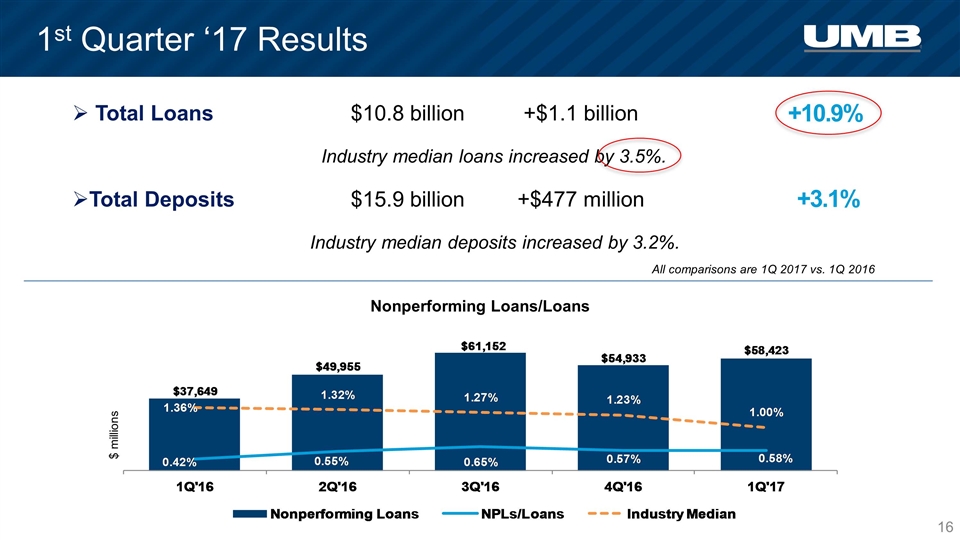

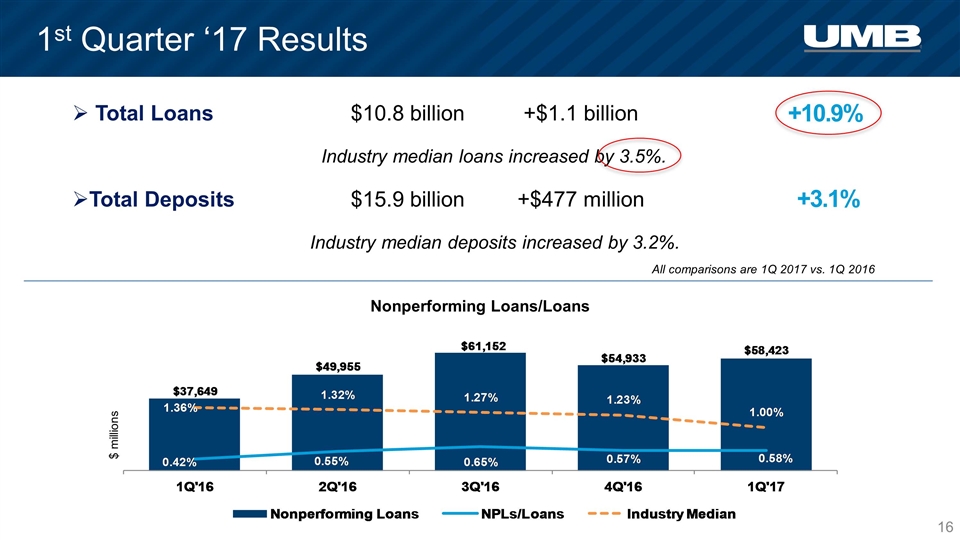

1st Quarter ‘17 Results Total Loans $10.8 billion +$1.1 billion +10.9% Industry median deposits increased by 3.2%. Total Deposits $15.9 billion +$477 million +3.1% All comparisons are 1Q 2017 vs. 1Q 2016 Nonperforming Loans/Loans $ millions Industry median loans increased by 3.5%.

April 20, 2017 Announcement UMB Announces Agreement to Sell Scout Investments to Carillon Tower Advisers Allows us to fully allocate our time, energy and capital to our core banking and asset servicing operations. Provides an opportunity for greater emphasis on driving results and organic growth in our relationship-based businesses, Scout has generated shareholder value over the years, we believe they will benefit from an environment that can bring enhanced distribution capabilities, scale, and dedicated resources. Strategic Rationale Transaction Summary Acquirer: Carillon Tower Advisers, a subsidiary of Raymond James Financial Consideration: $172.5 million in cash, subject to purchase price adjustments Anticipated Closing: By year-end 2017

Agenda Evolution 2016 Highlights Questions & Answers 2017 and Beyond Focus

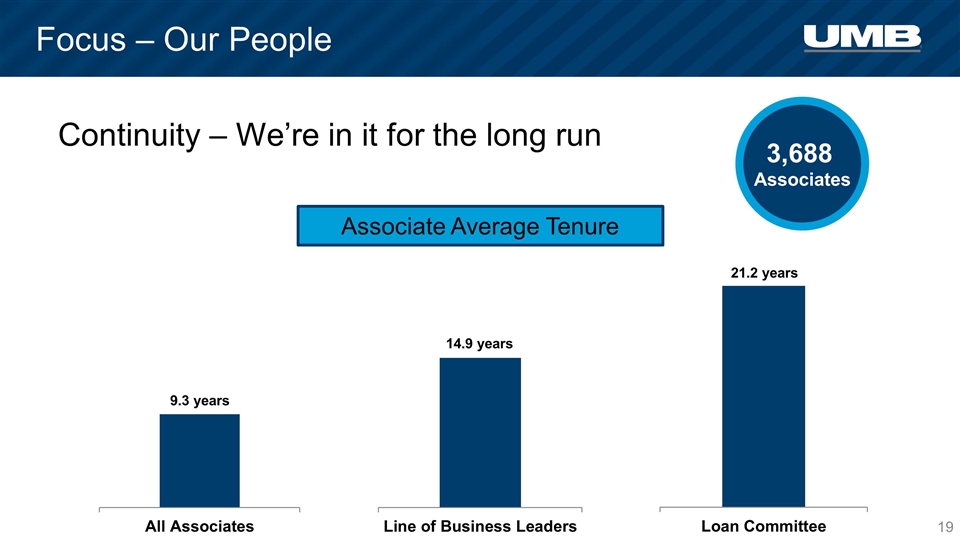

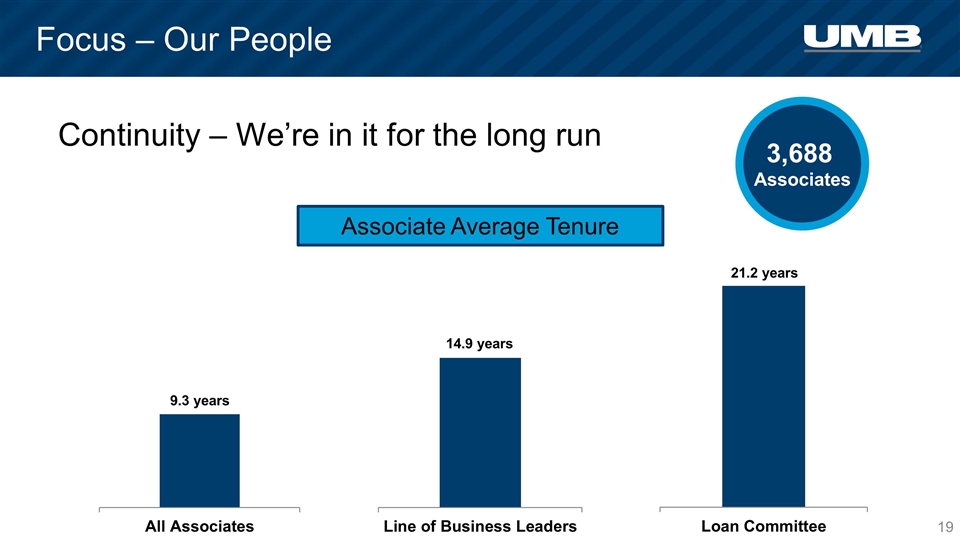

Focus – Our People Continuity – We’re in it for the long run 3,688 Associates Associate Average Tenure 21.2 years 14.9 years 9.3 years

Focus – Our Customers ACSI 2015 ACSI 2016 UMB 2015 UMB 2016 American Customer Satisfaction Index “Score” 100-Point Scale

Focus – Our Communities Volunteer time off (“VTO”): 9,809 hours

Focus – Our Shareholders Dividend increase = 92.2% Industry Median +3.3% increase Industry is defined as all publicly traded banks with dividends reported in 2006. Source: SNL Financial

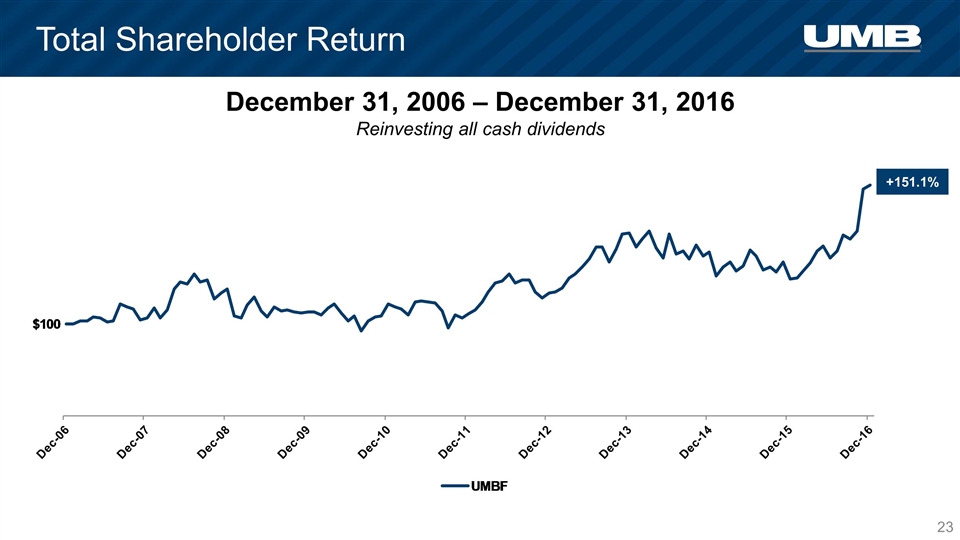

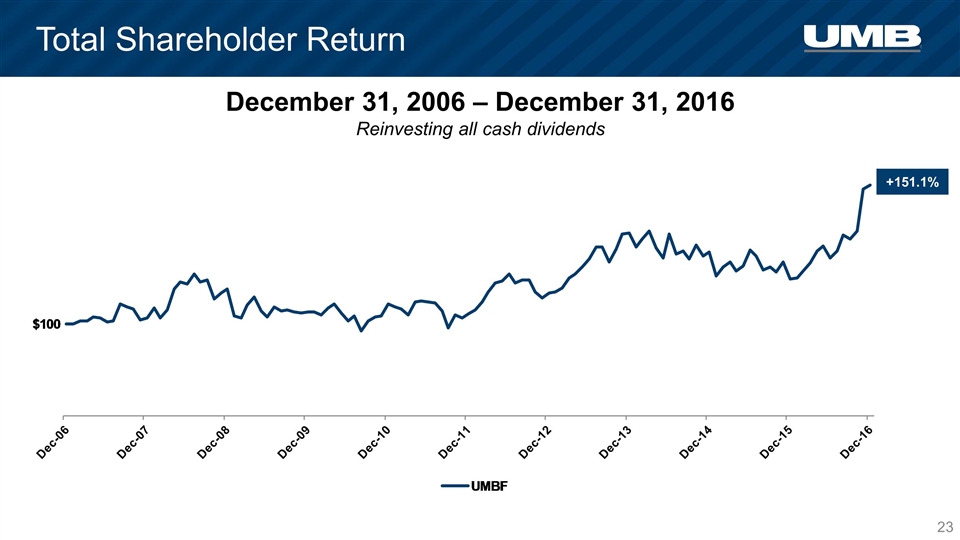

+151.1% December 31, 2006 – December 31, 2016 Reinvesting all cash dividends Total Shareholder Return

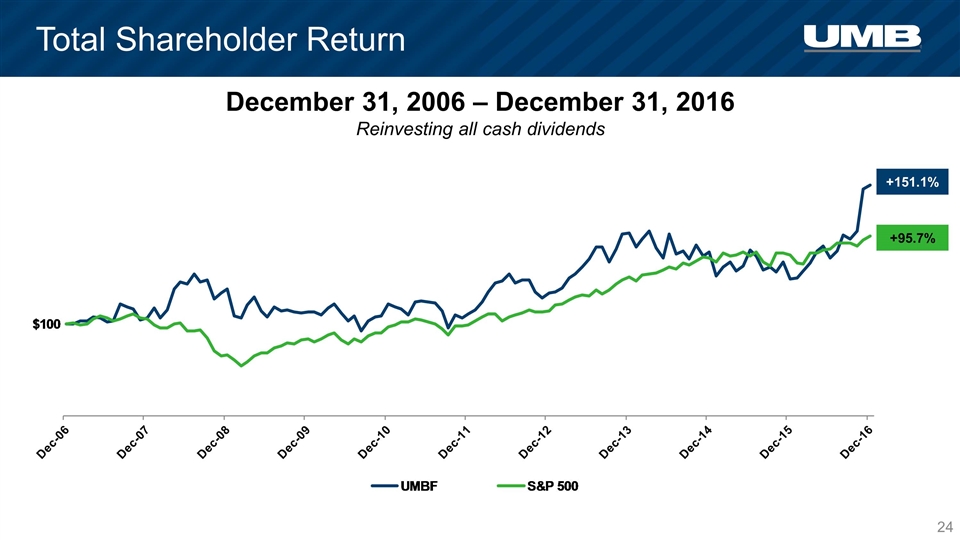

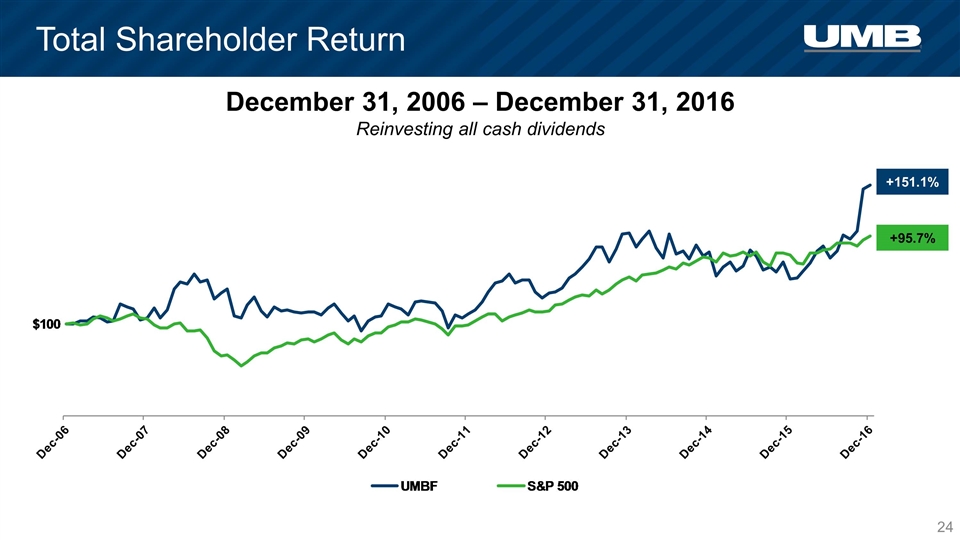

+95.7% December 31, 2006 – December 31, 2016 Reinvesting all cash dividends +151.1% Total Shareholder Return

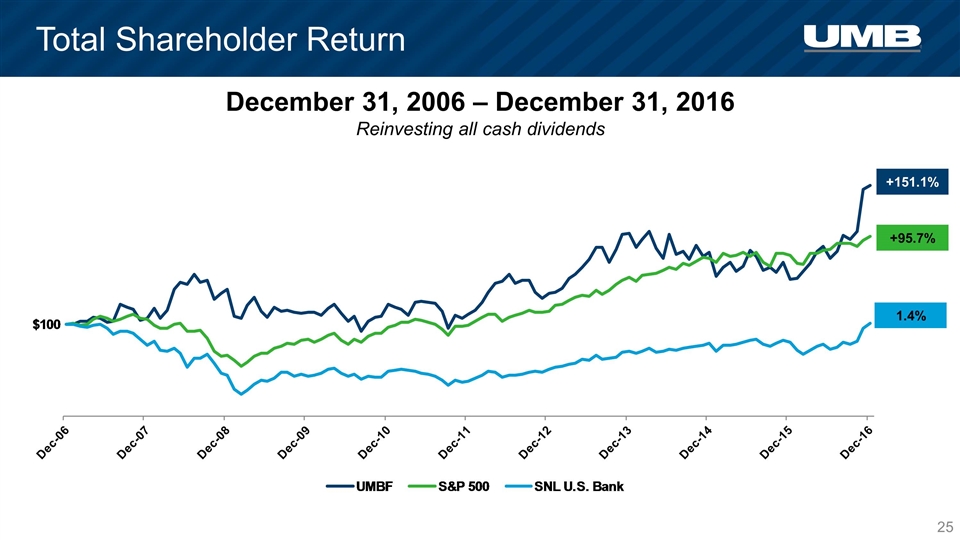

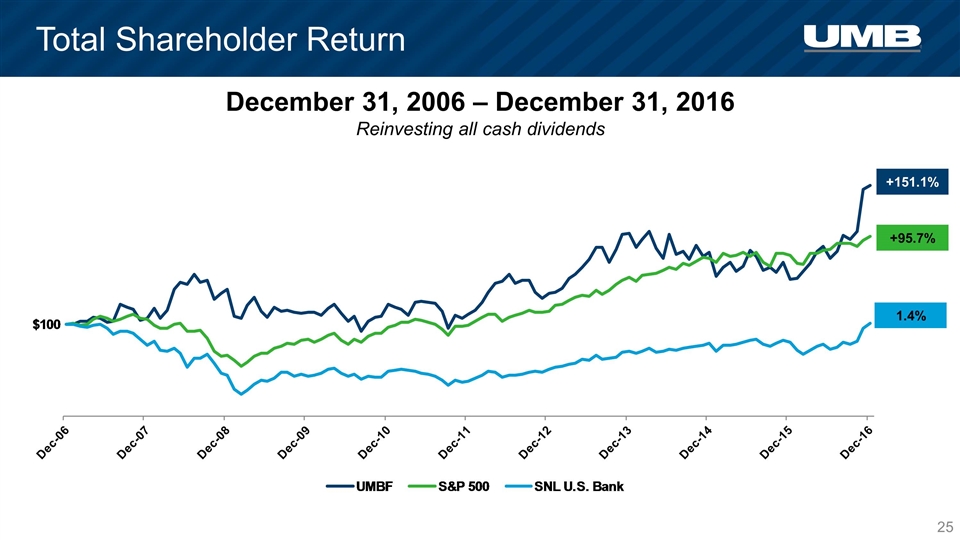

December 31, 2006 – December 31, 2016 Reinvesting all cash dividends 1.4% +95.7% +151.1% Total Shareholder Return

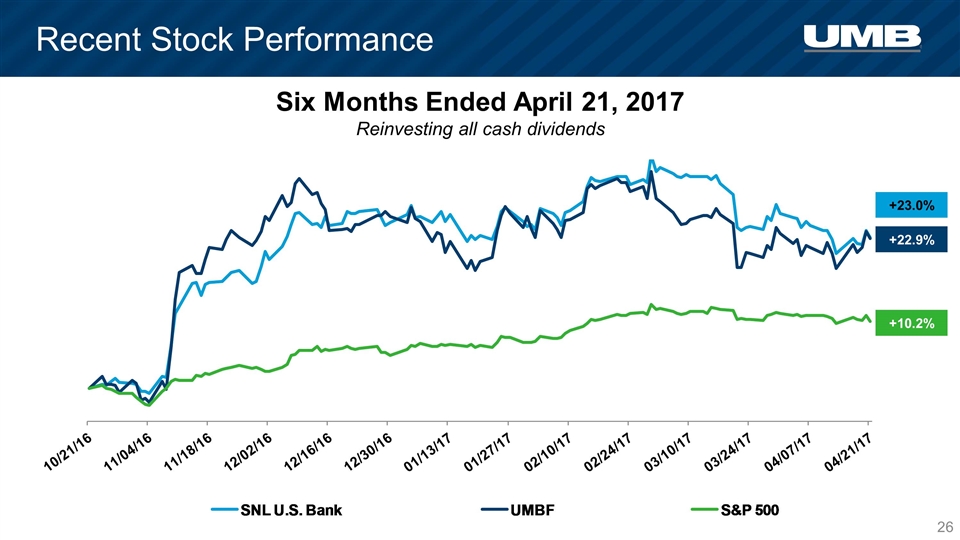

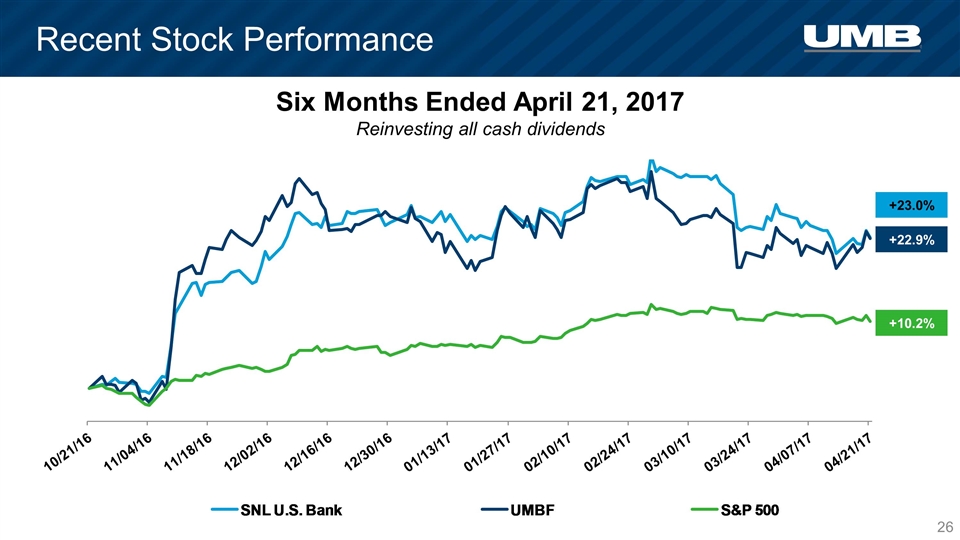

Six Months Ended April 21, 2017 Reinvesting all cash dividends Recent Stock Performance +10.2% +22.9% +23.0%

Agenda Evolution 2016 Highlights Questions & Answers 2017 and Beyond Focus

Questions & Answers