Different by Design. UMB Financial Corporation Annual Meeting of Shareholders April 24, 2018 Exhibit 99.2

Cautionary Notice about Forward-Looking Statements This presentation of UMB Financial Corporation (the “company,” “our,” “us,” or “we”) contains, and our other communications may contain, forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These statements can be identified by the fact that they do not relate strictly to historical or current facts. Forward-looking statements often use words such as “believe,” “expect,” “anticipate,” “intend,” “estimate,” “project,” “outlook,” “forecast,” “target,” “trend,” “plan,” “goal,” or other words of comparable meaning or future-tense or conditional verbs such as “may,” “will,” “should,” “would,” or “could.” Forward-looking statements convey our expectations, intentions, or forecasts about future events, circumstances, results, or aspirations. All forward-looking statements are subject to assumptions, risks, and uncertainties, which may change over time and many of which are beyond our control. You should not rely on any forward-looking statement as a prediction or guarantee about the future. Our actual future objectives, strategies, plans, prospects, performance, condition, or results may differ materially from those set forth in any forward-looking statement. Some of the factors that may cause actual results or other future events, circumstances, or aspirations to differ from those in forward-looking statements are described in our Annual Report on Form 10-K for the year ended December 31, 2017, our subsequent Quarterly Reports on Form 10-Q or Current Reports on Form 8-K, or other applicable documents that are filed or furnished with the U.S. Securities and Exchange Commission (SEC). Any forward-looking statement made by us or on our behalf speaks only as of the date that it was made. We do not undertake to update any forward-looking statement to reflect the impact of events, circumstances, or results that arise after the date that the statement was made, except to the extent required by applicable securities laws. You, however, should consult disclosures (including disclosures of a forward-looking nature) that we may make in any subsequent Annual Report on Form 10-K, Quarterly Report on Form 10-Q, Current Report on Form 8-K, or other applicable document that is filed or furnished with the SEC.

Agenda Different by Design 2017 Results & Highlights Questions & Answers First Quarter 2018 Focus

Different by Design

Different by Design

Different by Design - Risk-adjusted Returns - Diversity - Consistency

Agenda Different by Design 2017 Results & Highlights Questions & Answers First Quarter 2018 Focus

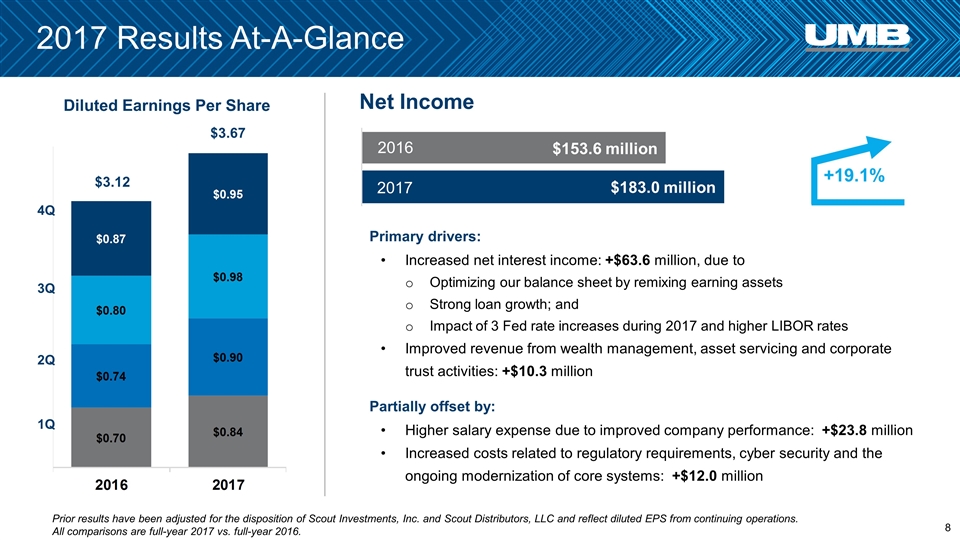

2017 Results At-A-Glance Diluted Earnings Per Share 4Q 3Q 2Q 1Q $3.12 $3.67 2016 $153.6 million 2017 $183.0 million +19.1% Primary drivers: Increased net interest income: +$63.6 million, due to Optimizing our balance sheet by remixing earning assets Strong loan growth; and Impact of 3 Fed rate increases during 2017 and higher LIBOR rates Improved revenue from wealth management, asset servicing and corporate trust activities: +$10.3 million Partially offset by: Higher salary expense due to improved company performance: +$23.8 million Increased costs related to regulatory requirements, cyber security and the ongoing modernization of core systems: +$12.0 million Net Income Prior results have been adjusted for the disposition of Scout Investments, Inc. and Scout Distributors, LLC and reflect diluted EPS from continuing operations. All comparisons are full-year 2017 vs. full-year 2016.

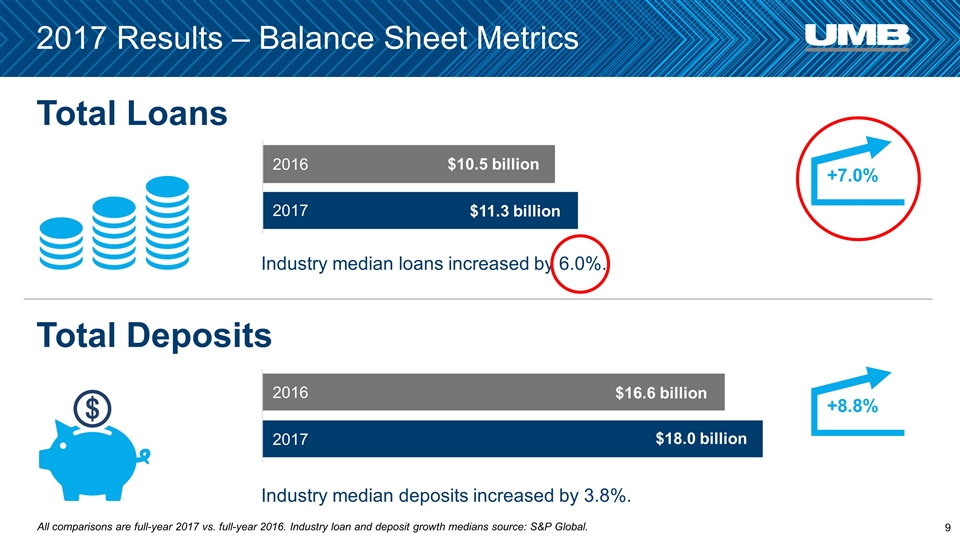

2017 Results – Balance Sheet Metrics Industry median loans increased by 6.0%. Industry median deposits increased by 3.8%. All comparisons are full-year 2017 vs. full-year 2016. Industry loan and deposit growth medians source: S&P Global. $10.5 billion $11.3 billion $16.6 billion $18.0 billion Total Loans Total Deposits 2016 2017 2016 2017 +7.0% +8.8%

Consistent Underwriting Standards History of Net Charge-Offs (1) Commercial Loans includes commercial & industrial, commercial credit card, asset-based and factoring loans. (2) Other includes all real-estate related loans (commercial, residential and HELOC) plus consumer loans and DDA charge-offs. (1) (2) (1) (2)

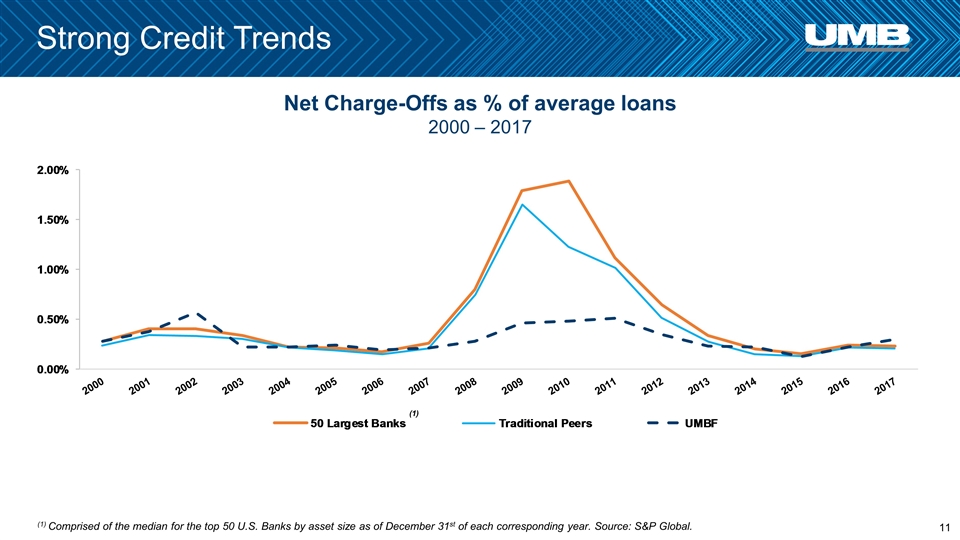

Strong Credit Trends Net Charge-Offs as % of average loans 2000 – 2017 (1) Comprised of the median for the top 50 U.S. Banks by asset size as of December 31st of each corresponding year. Source: S&P Global. (1)

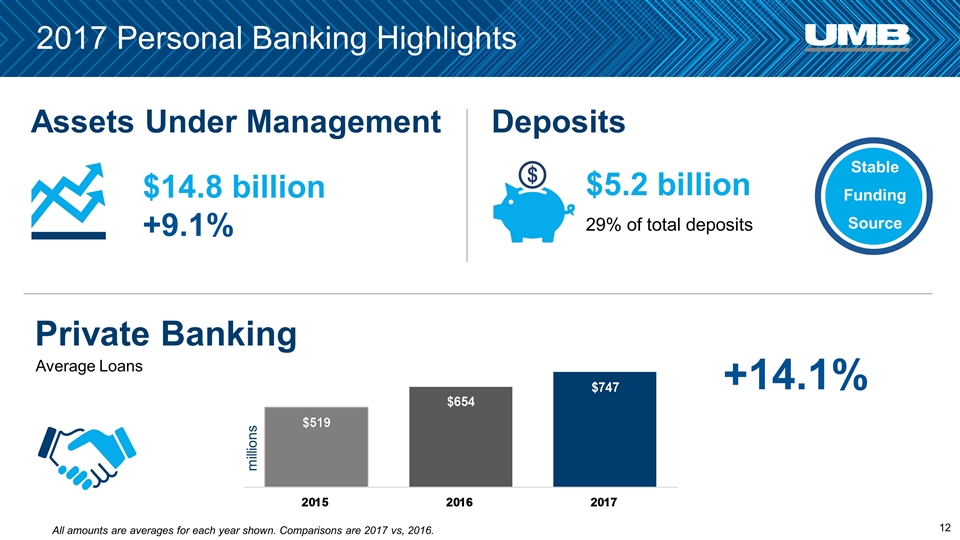

2017 Personal Banking Highlights millions Private Banking Average Loans $5.2 billion 29% of total deposits Deposits $14.8 billion +9.1% Assets Under Management Stable Funding Source All amounts are averages for each year shown. Comparisons are 2017 vs, 2016. +14.1%

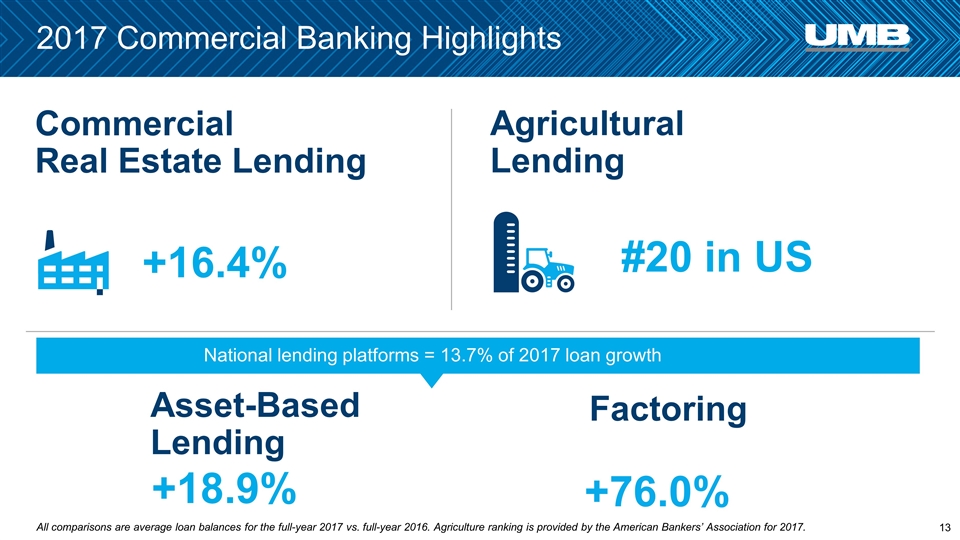

2017 Commercial Banking Highlights Asset-Based Lending +18.9% +76.0% Factoring +16.4% Commercial Real Estate Lending Agricultural Lending #20 in US National lending platforms = 13.7% of 2017 loan growth All comparisons are average loan balances for the full-year 2017 vs. full-year 2016. Agriculture ranking is provided by the American Bankers’ Association for 2017.

2017 Institutional Banking Highlights FDIC Sweep 2016 $9.6 million Municipal Trading Corporate Trust Assets under Administration Assets All comparisons are full-year 2017 vs. full-year 2016 and amounts are as of December 31st of each corresponding year. 2016 $51.9 billion 2017 $52.3 billion 2016 $12 billion 2017 $15.7 billion 2017 $11.3 million

$185.6 $188.7 $206.3 2015 2016 2017 2017 Fund Services Highlights $206.3 billion +9.3% Billions Assets under Administration 8 Years Running Named as a top workplace by the Milwaukee Journal Sentinel Outstanding Commitment For Client Service All comparisons are full-year 2017 vs. full-year 2016.

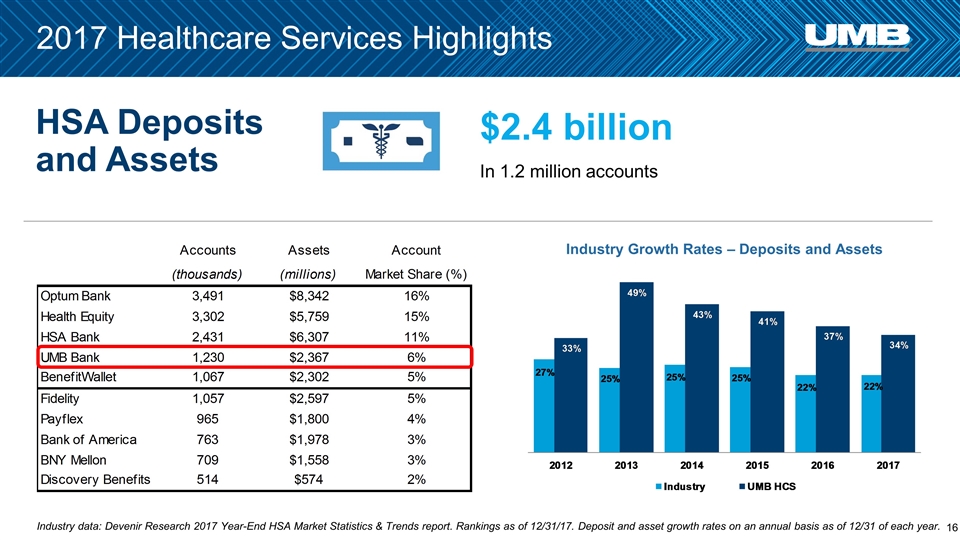

2017 Healthcare Services Highlights Industry Growth Rates – Deposits and Assets Industry data: Devenir Research 2017 Year-End HSA Market Statistics & Trends report. Rankings as of 12/31/17. Deposit and asset growth rates on an annual basis as of 12/31 of each year. HSA Deposits and Assets $2.4 billion In 1.2 million accounts

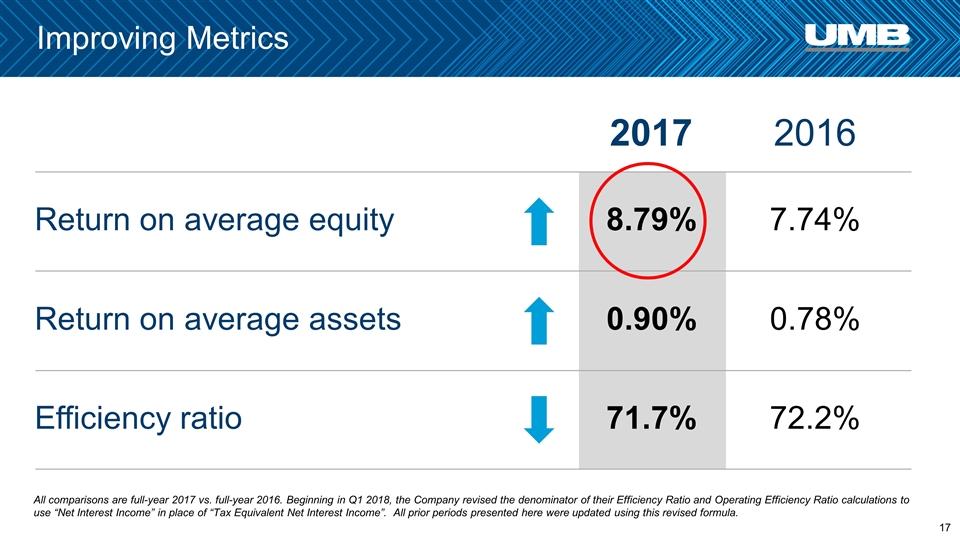

Improving Metrics 71.7% Return on average equity Return on average assets 8.79% 0.90% 2017 Efficiency ratio 7.74% 0.78% 72.2% 2016 All comparisons are full-year 2017 vs. full-year 2016. Beginning in Q1 2018, the Company revised the denominator of their Efficiency Ratio and Operating Efficiency Ratio calculations to use “Net Interest Income” in place of “Tax Equivalent Net Interest Income”. All prior periods presented here were updated using this revised formula.

Agenda Different by Design 2017 Results & Highlights Questions & Answers First Quarter 2018 Focus

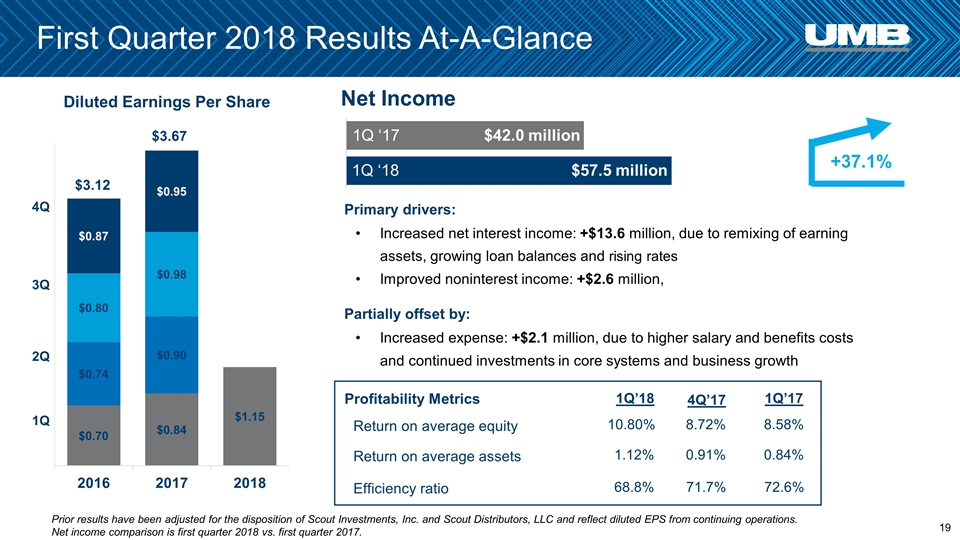

First Quarter 2018 Results At-A-Glance Return on average equity Return on average assets Efficiency ratio Profitability Metrics 10.80% 1.12% 1Q’18 8.72% 0.91% 4Q’17 8.58% 0.84% 1Q’17 68.8% 71.7% 72.6% Prior results have been adjusted for the disposition of Scout Investments, Inc. and Scout Distributors, LLC and reflect diluted EPS from continuing operations. Net income comparison is first quarter 2018 vs. first quarter 2017. 1Q ‘17 $42.0 million 1Q ‘18 $57.5 million +37.1% Primary drivers: Increased net interest income: +$13.6 million, due to remixing of earning assets, growing loan balances and rising rates Improved noninterest income: +$2.6 million, Partially offset by: Increased expense: +$2.1 million, due to higher salary and benefits costs and continued investments in core systems and business growth 4Q 3Q 2Q 1Q $3.67 Diluted Earnings Per Share $3.12 Net Income

Agenda Different by Design 2017 Results & Highlights Questions & Answers First Quarter 2018 Focus

Focus On… - Our People - Our Customers - Our Communities - Our Shareholders

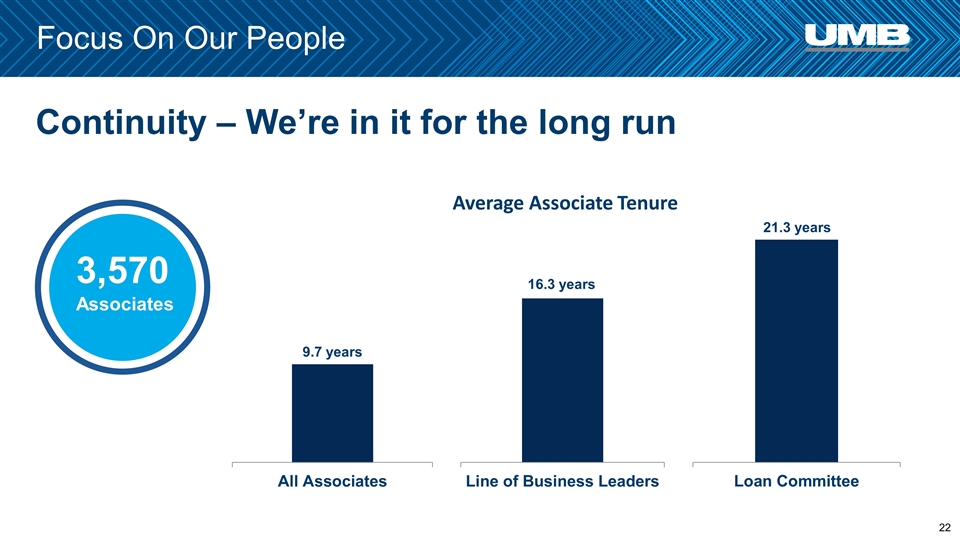

Focus On Our People 21.3 years 16.3 years 9.7 years Continuity – We’re in it for the long run Average Associate Tenure 3,570 Associates

Focus On Our Customers Industry 2016 Industry 2017 UMB 2016 UMB 2017 American Customer Satisfaction Index “Score” Source: Market Strategies International 100-Point Scale

Focus On Our Communities Volunteer Time Off (VTO) 1,293 Associates Used VTO Eligible associates receive 16 hours each year to spend volunteering with a qualifying 501(c)(3) of their choice. Community Involvement 23,995 Community Involvement Hours 10,574 Total VTO Hours 1,322 VTO Workdays $579,239 Value of Community Involvement Activities

Focus On Our Communities The Pack Shack Humanity vs. Hunger American Royal School Tours Rose Brooks Center for Domestic Violence Volunteers for Outdoor Colorado

Focus On Our Communities City Union Mission Heartland Tree Alliance American Royal Neighborhood Schools Program ReStart KC

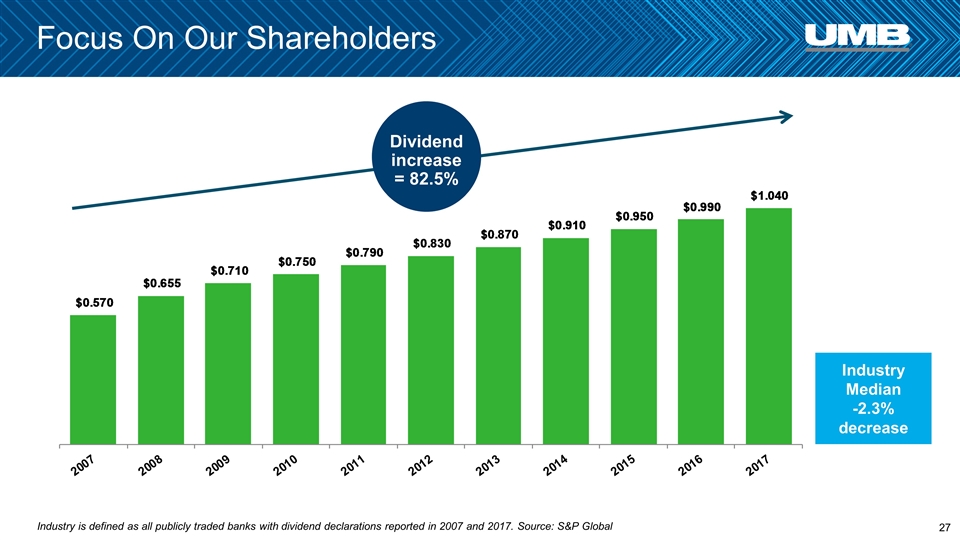

Focus On Our Shareholders Dividend increase = 82.5% Industry Median -2.3% decrease Industry is defined as all publicly traded banks with dividend declarations reported in 2007 and 2017. Source: S&P Global

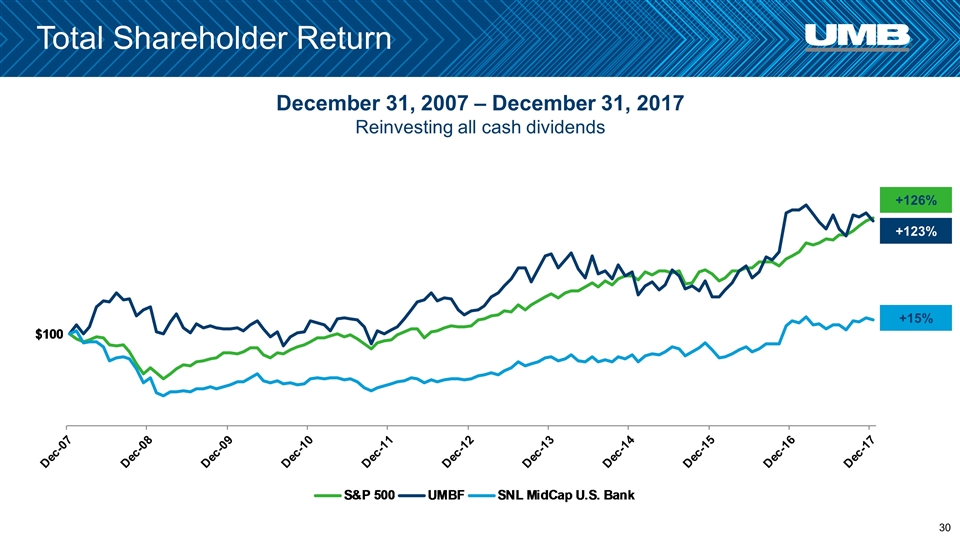

Total Shareholder Return December 31, 2007 – December 31, 2017 Reinvesting all cash dividends +123%

Total Shareholder Return December 31, 2007 – December 31, 2017 Reinvesting all cash dividends +126% +123%

Total Shareholder Return December 31, 2007 – December 31, 2017 Reinvesting all cash dividends +15% +126% +123%

Agenda Different by Design 2017 Results & Highlights Questions & Answers First Quarter 2018 Focus

Questions & Answers