UMB Financial First Quarter 2019 April 23, 2019 Exhibit 99.3

Cautionary Notice about Forward-Looking Statements This presentation of UMB Financial Corporation (the “company,” “our,” “us,” or “we”) contains, and our other communications may contain, forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These statements can be identified by the fact that they do not relate strictly to historical or current facts. Forward-looking statements often use words such as “believe,” “expect,” “anticipate,” “intend,” “estimate,” “project,” “outlook,” “forecast,” “target,” “trend,” “plan,” “goal,” or other words of comparable meaning or future-tense or conditional verbs such as “may,” “will,” “should,” “would,” or “could.” Forward-looking statements convey our expectations, intentions, or forecasts about future events, circumstances, results, or aspirations. All forward-looking statements are subject to assumptions, risks, and uncertainties, which may change over time and many of which are beyond our control. You should not rely on any forward-looking statement as a prediction or guarantee about the future. Our actual future objectives, strategies, plans, prospects, performance, condition, or results may differ materially from those set forth in any forward-looking statement. Some of the factors that may cause actual results or other future events, circumstances, or aspirations to differ from those in forward-looking statements are described in our Annual Report on Form 10-K, our Quarterly Reports on Form 10-Q or Current Reports on Form 8-K, or other applicable documents that are filed or furnished with the U.S. Securities and Exchange Commission (SEC). Any forward-looking statement made by us or on our behalf speaks only as of the date that it was made. We do not undertake to update any forward-looking statement to reflect the impact of events, circumstances, or results that arise after the date that the statement was made, except to the extent required by applicable securities laws. You, however, should consult disclosures (including disclosures of a forward-looking nature) that we may make in any subsequent Annual Report on Form 10-K, Quarterly Report on Form 10-Q, Current Report on Form 8-K, or other applicable document that is filed or furnished with the SEC.

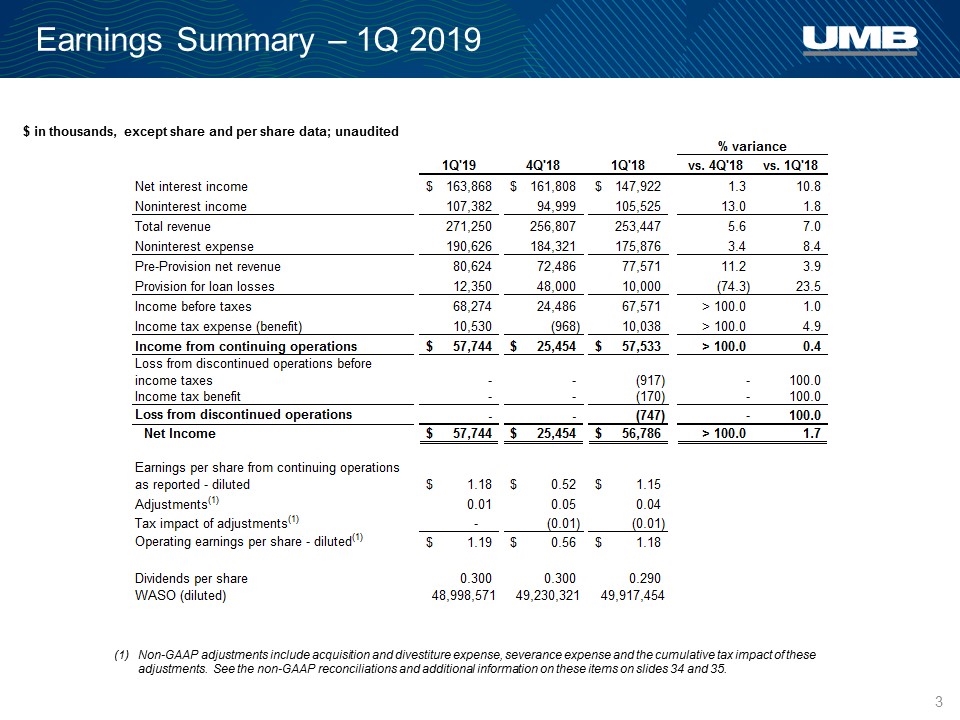

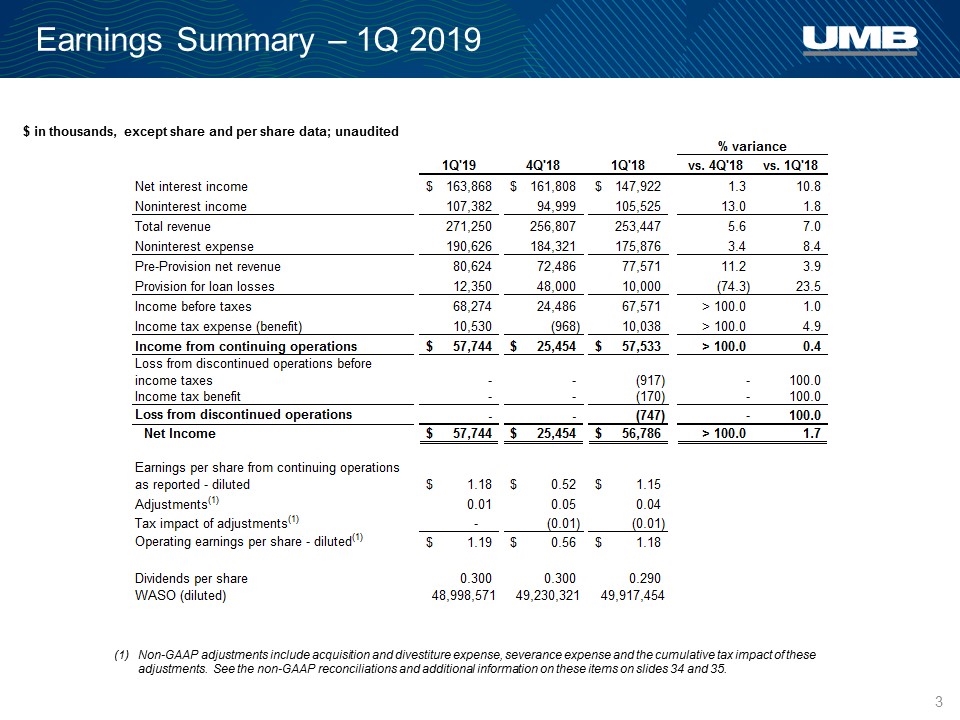

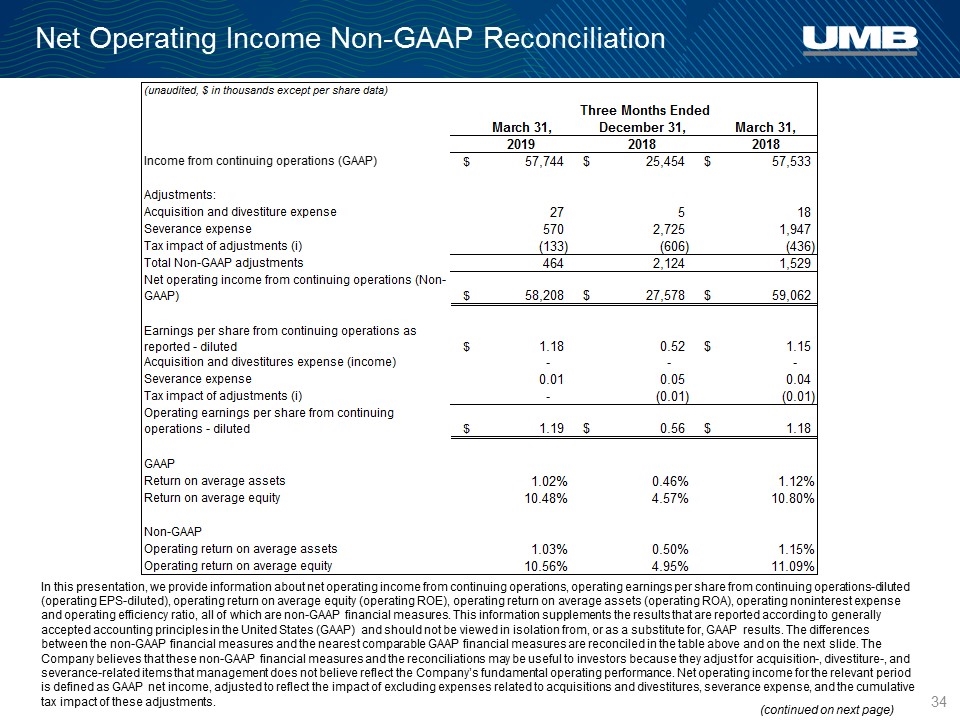

Earnings Summary – 1Q 2019 $ in thousands, except share and per share data; unaudited Non-GAAP adjustments include acquisition and divestiture expense, severance expense and the cumulative tax impact of these adjustments. See the non-GAAP reconciliations and additional information on these items on slides 34 and 35.

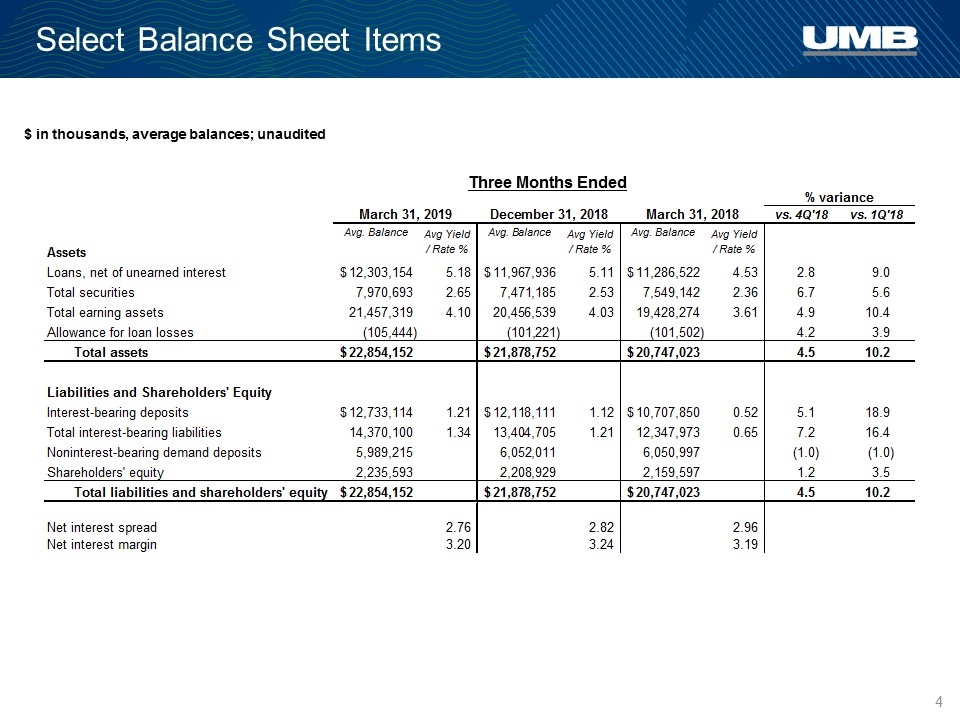

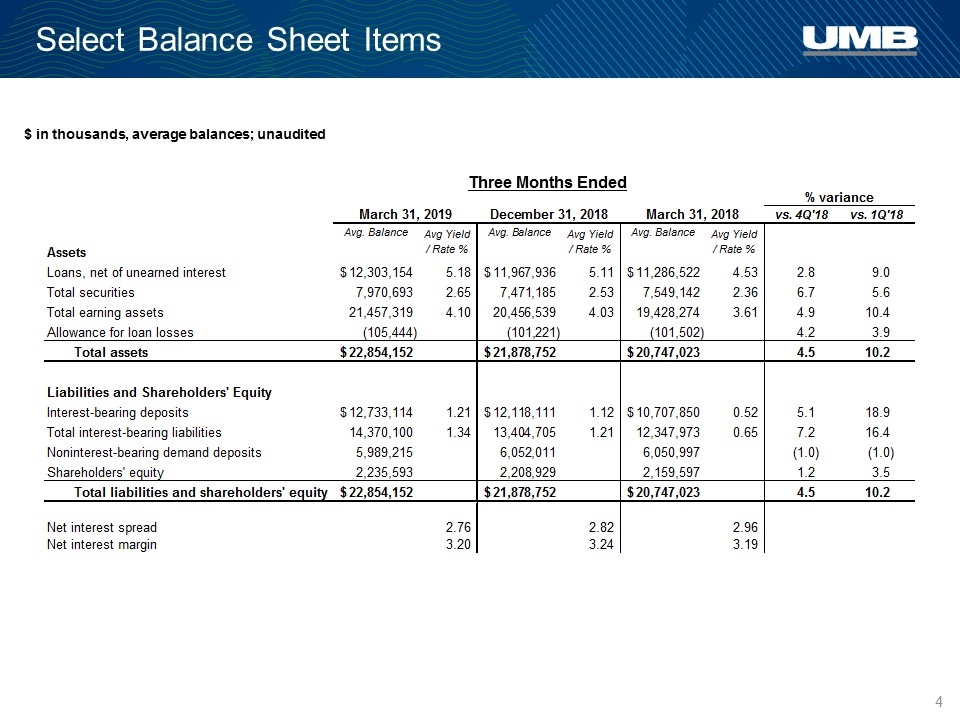

Select Balance Sheet Items $ in thousands, average balances; unaudited Three Months Ended

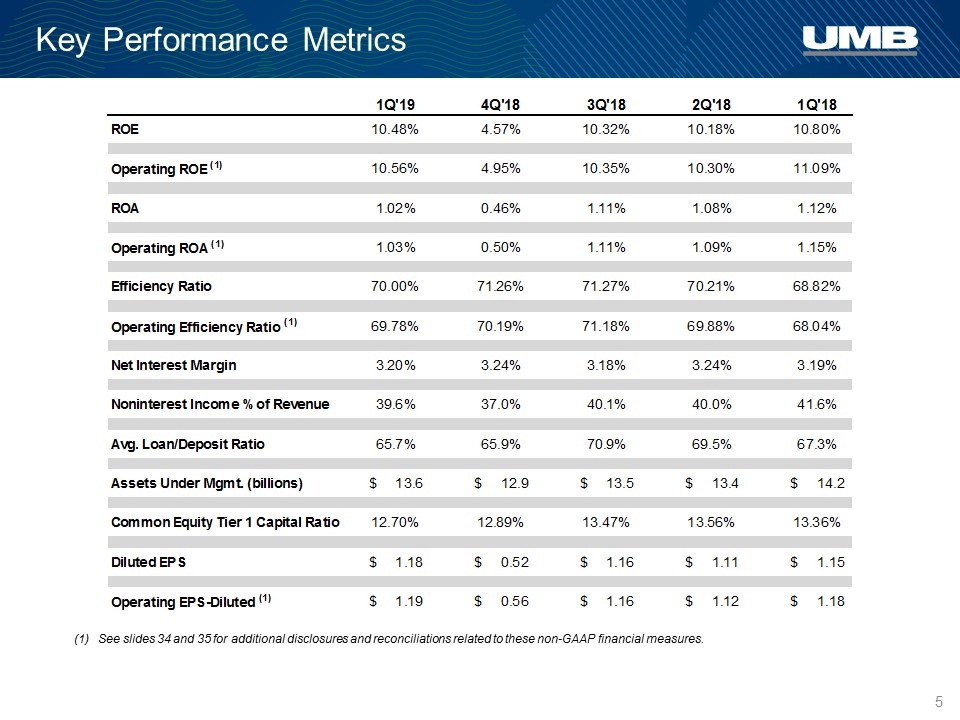

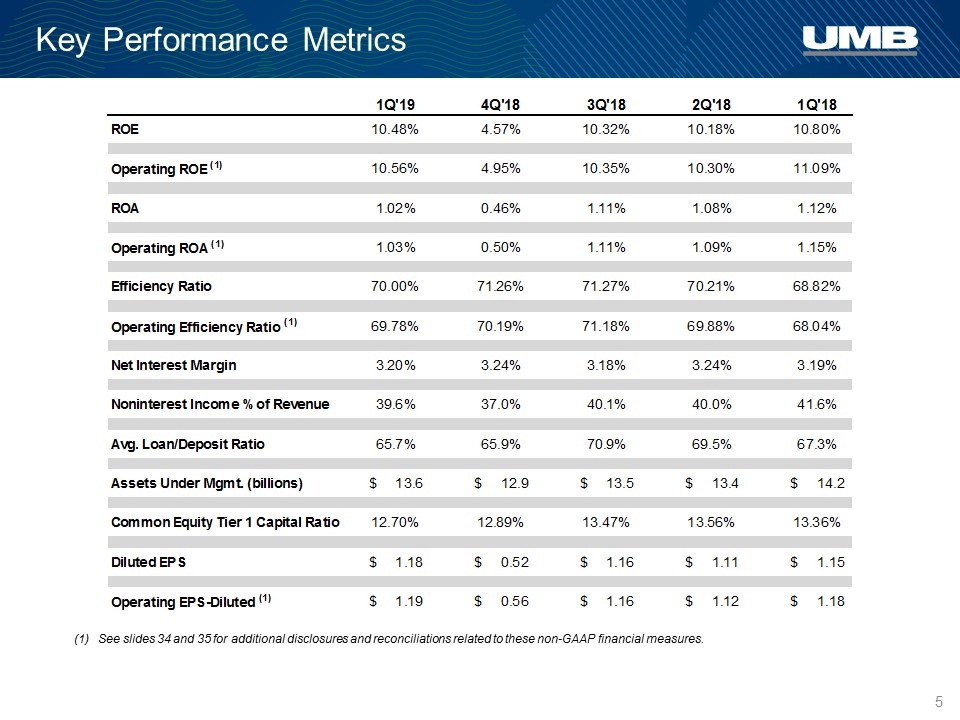

Key Performance Metrics See slides 34 and 35 for additional disclosures and reconciliations related to these non-GAAP financial measures.

Balance Sheet

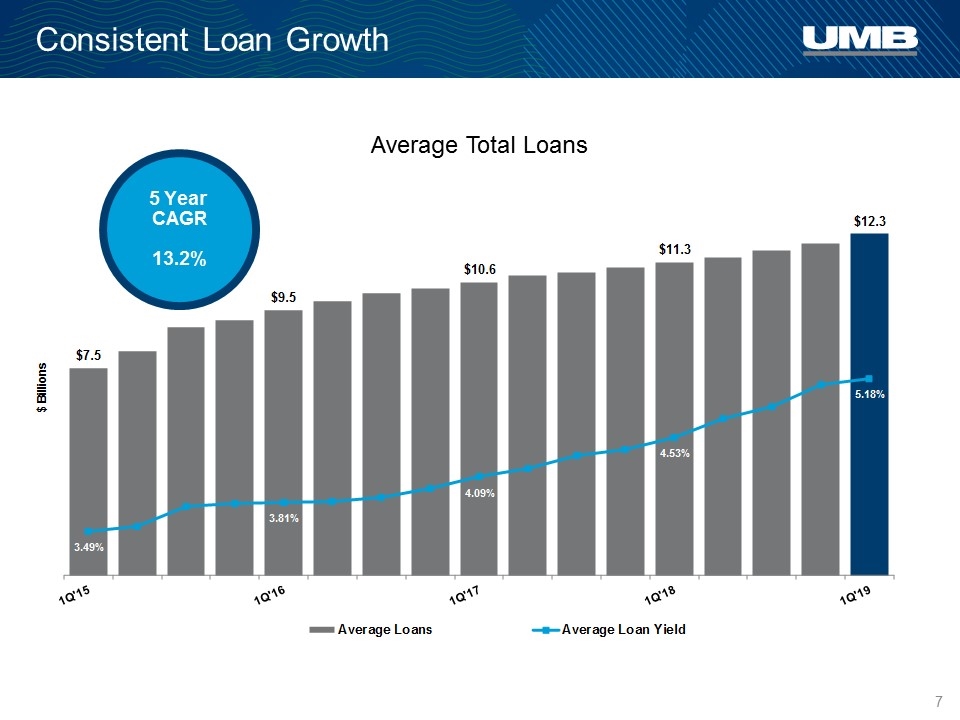

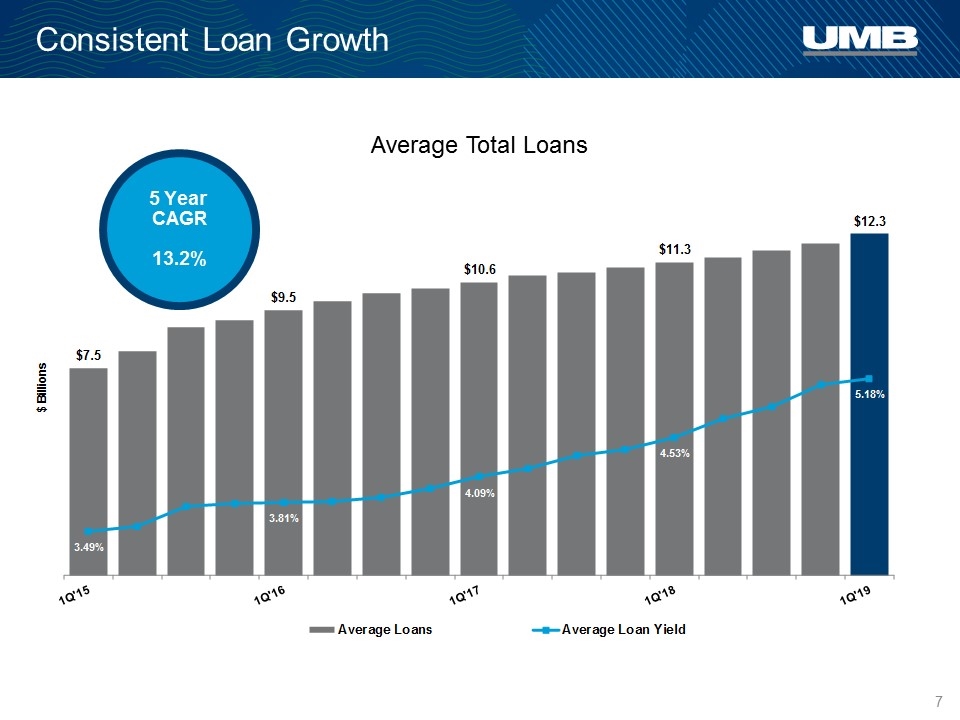

Consistent Loan Growth Average Total Loans 5 Year CAGR 13.2%

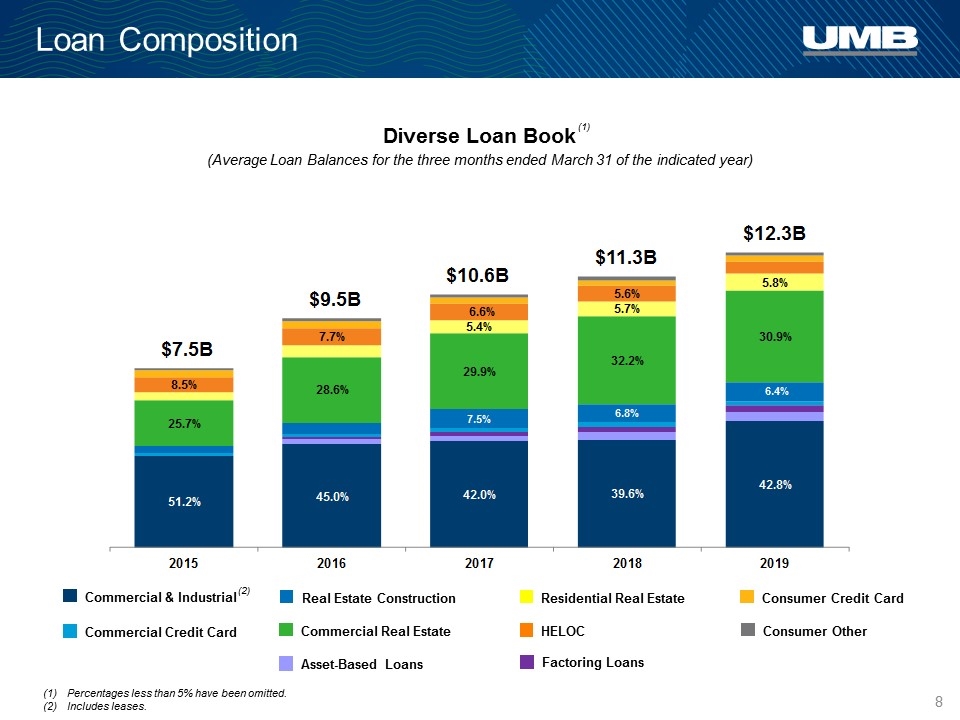

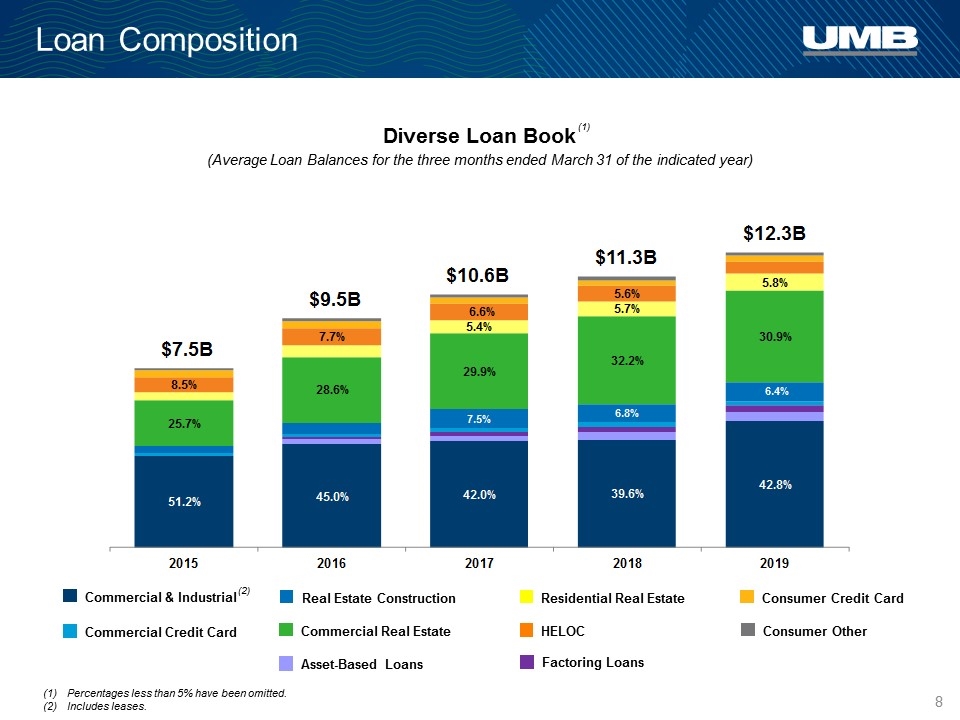

Loan Composition Diverse Loan Book (Average Loan Balances for the three months ended March 31 of the indicated year) Commercial Credit Card Commercial & Industrial HELOC Residential Real Estate Real Estate Construction Commercial Real Estate Consumer Credit Card Consumer Other Factoring Loans Asset-Based Loans Percentages less than 5% have been omitted. Includes leases. (1) (2)

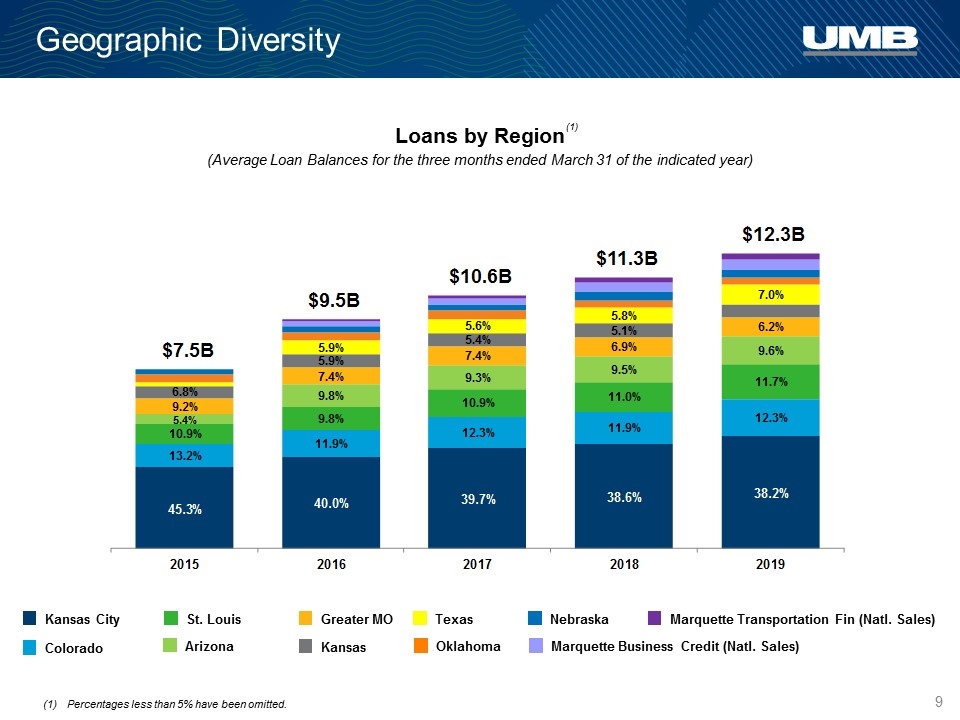

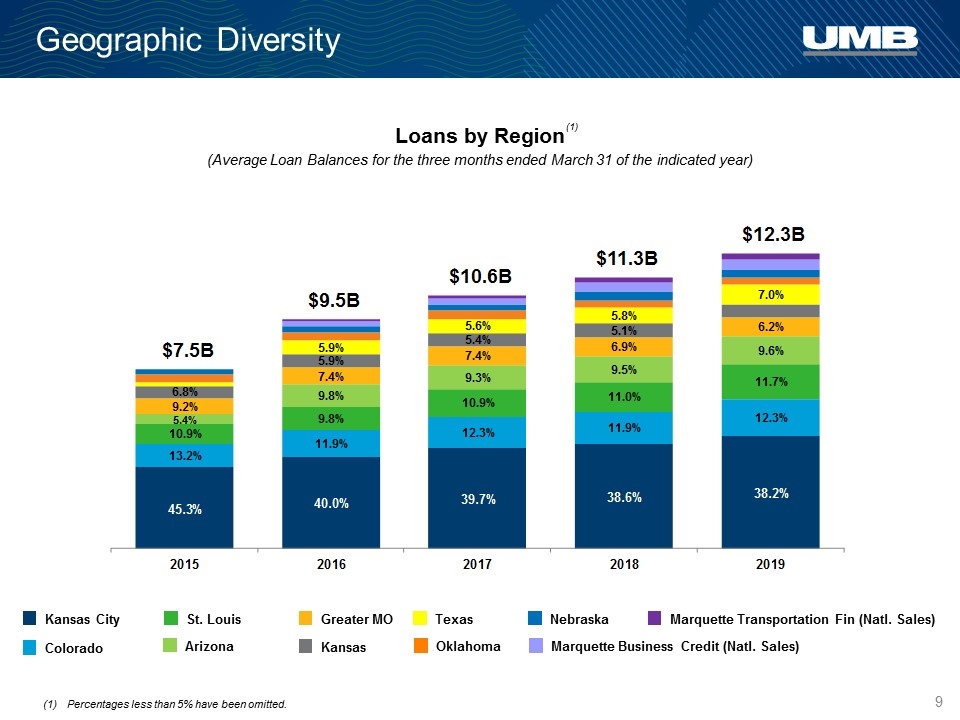

Colorado Kansas City Kansas Greater MO St. Louis Arizona Texas Oklahoma Marquette Transportation Fin (Natl. Sales) Nebraska Marquette Business Credit (Natl. Sales) Geographic Diversity Loans by Region (Average Loan Balances for the three months ended March 31 of the indicated year) Percentages less than 5% have been omitted. (1)

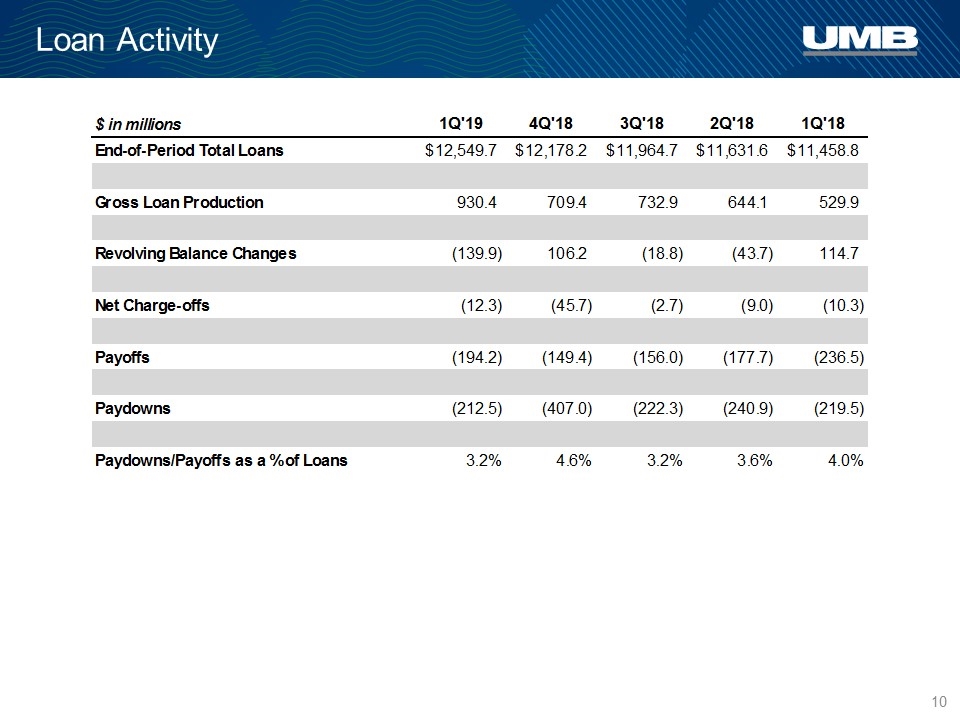

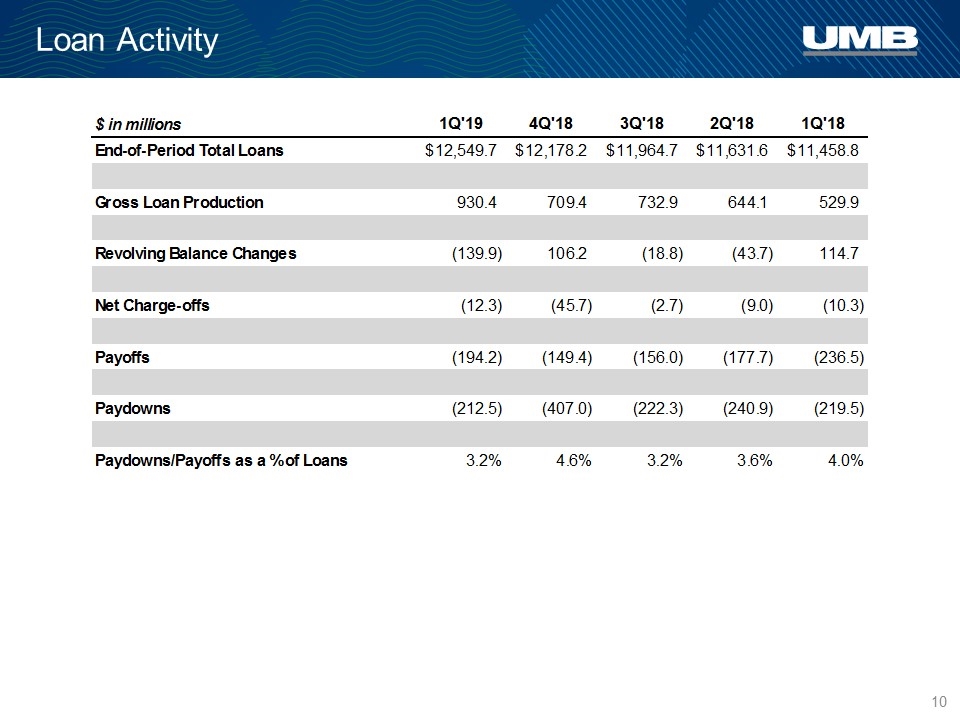

Loan Activity

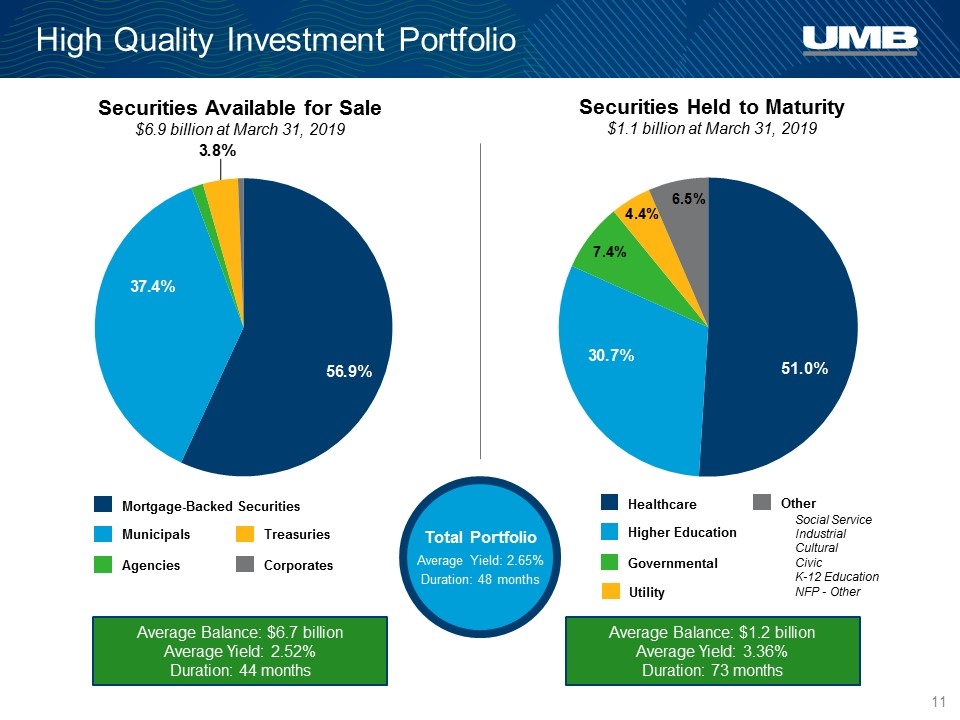

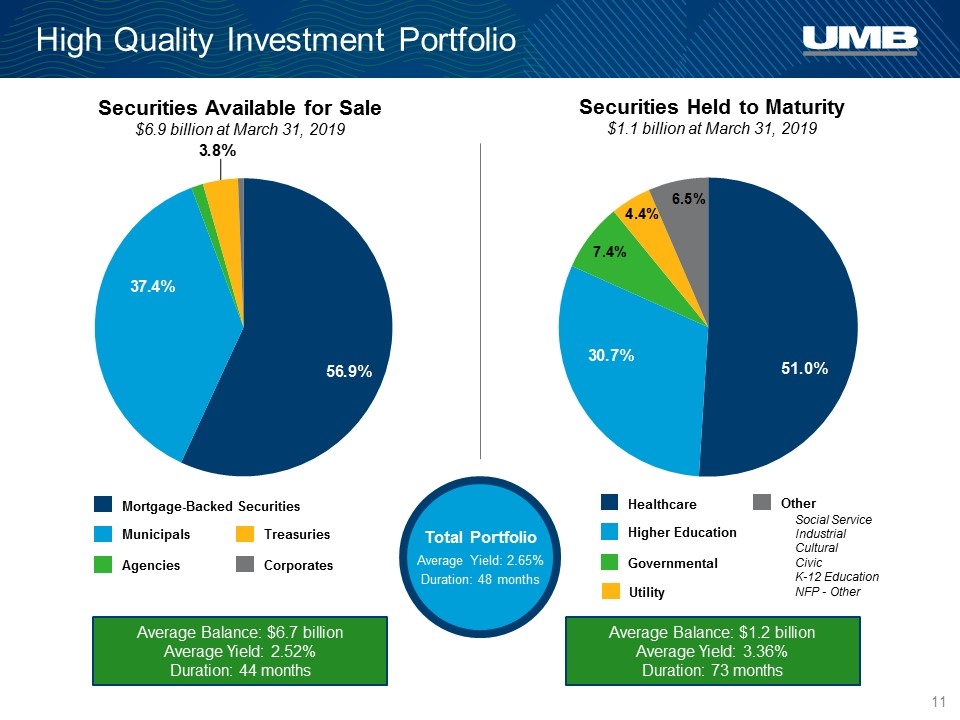

High Quality Investment Portfolio Securities Held to Maturity $1.1 billion at March 31, 2019 Securities Available for Sale $6.9 billion at March 31, 2019 Governmental Other Higher Education Healthcare Utility Social Service Industrial Cultural Civic K-12 Education NFP - Other Average Balance: $6.7 billion Average Yield: 2.52% Duration: 44 months Average Balance: $1.2 billion Average Yield: 3.36% Duration: 73 months Total Portfolio Average Yield: 2.65% Duration: 48 months Agencies Corporates Municipals Mortgage-Backed Securities Treasuries

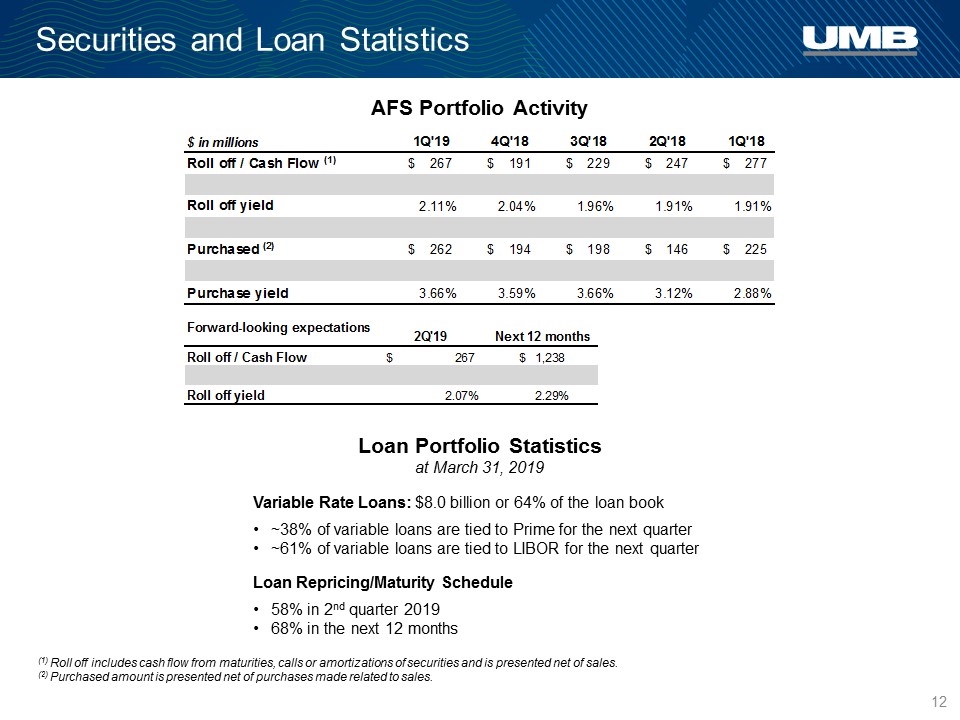

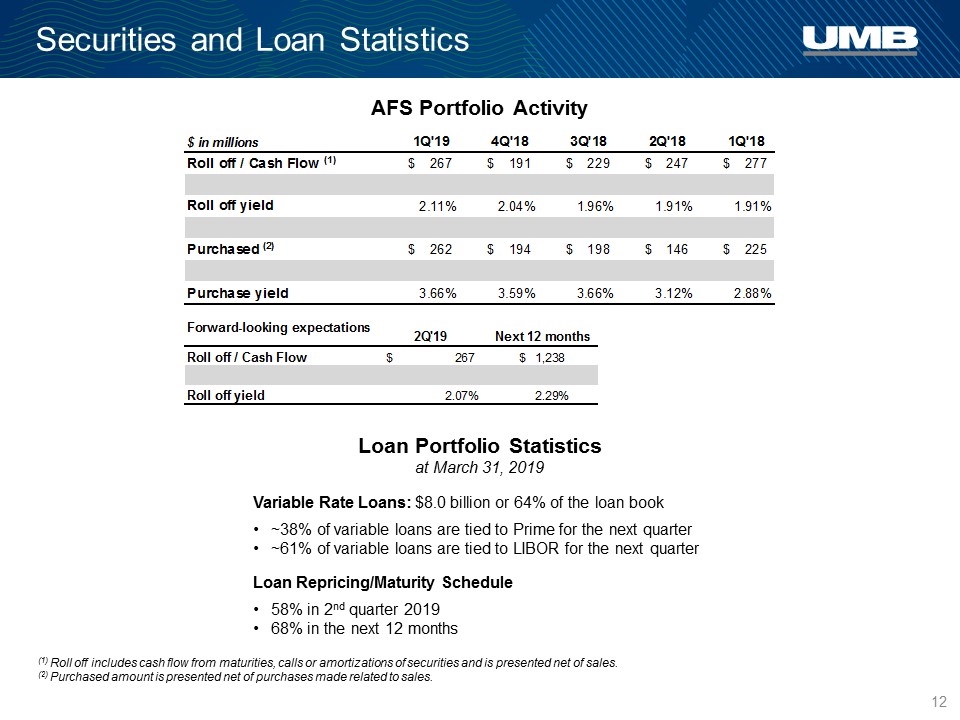

Securities and Loan Statistics (1) Roll off includes cash flow from maturities, calls or amortizations of securities and is presented net of sales. (2) Purchased amount is presented net of purchases made related to sales. Loan Portfolio Statistics at March 31, 2019 Variable Rate Loans: $8.0 billion or 64% of the loan book ~38% of variable loans are tied to Prime for the next quarter ~61% of variable loans are tied to LIBOR for the next quarter Loan Repricing/Maturity Schedule 58% in 2nd quarter 2019 68% in the next 12 months AFS Portfolio Activity

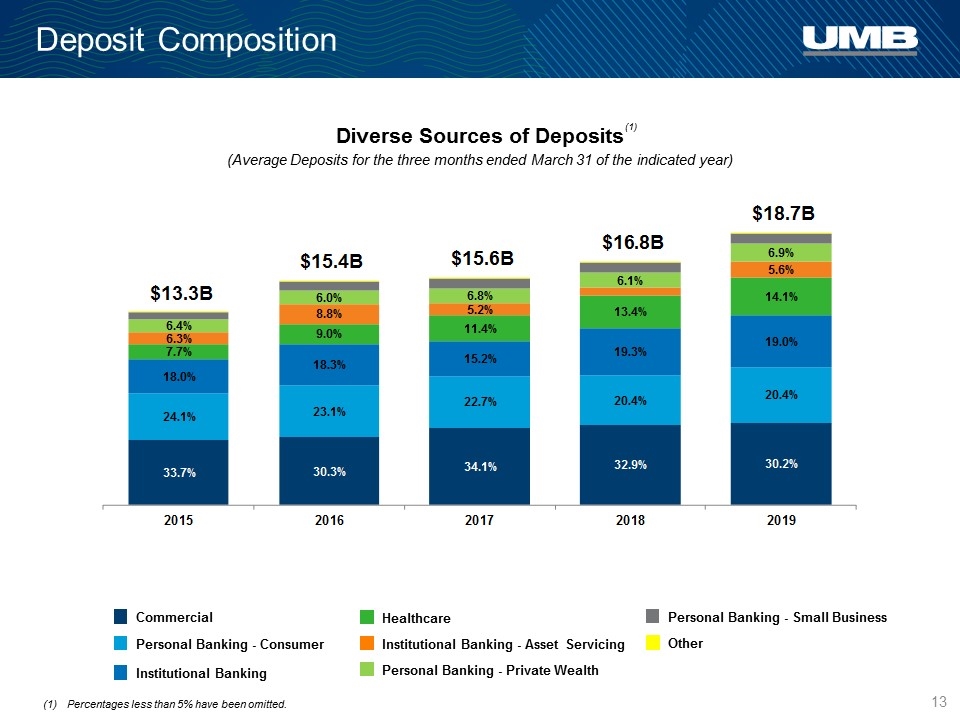

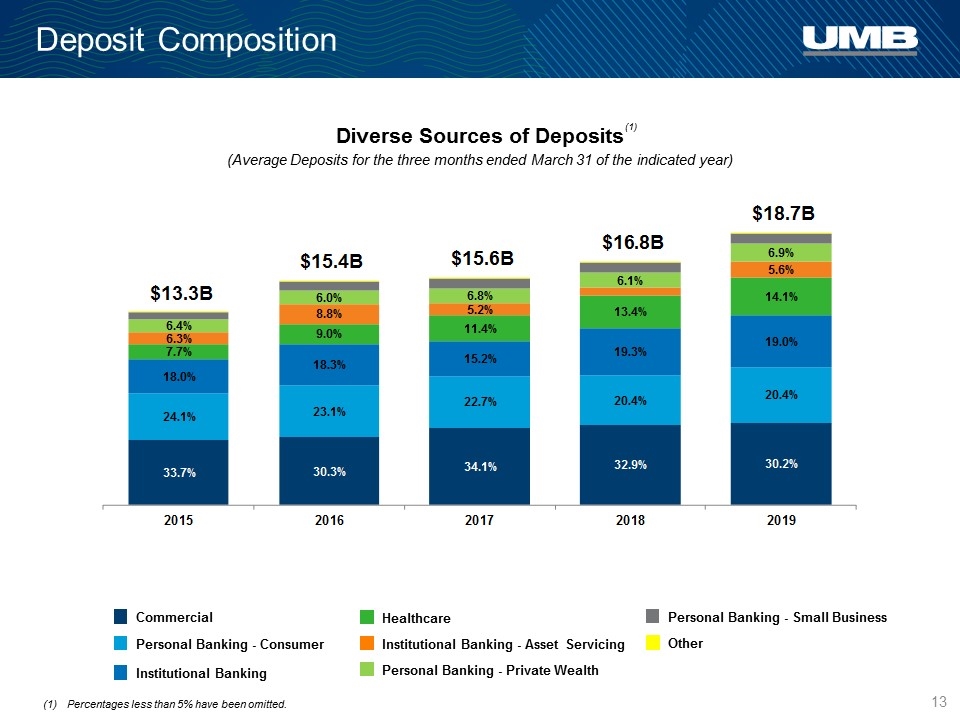

Diverse Sources of Deposits (Average Deposits for the three months ended March 31 of the indicated year) Deposit Composition Personal Banking - Consumer Commercial Institutional Banking Personal Banking - Private Wealth Institutional Banking - Asset Servicing Healthcare Personal Banking - Small Business Other Percentages less than 5% have been omitted. (1)

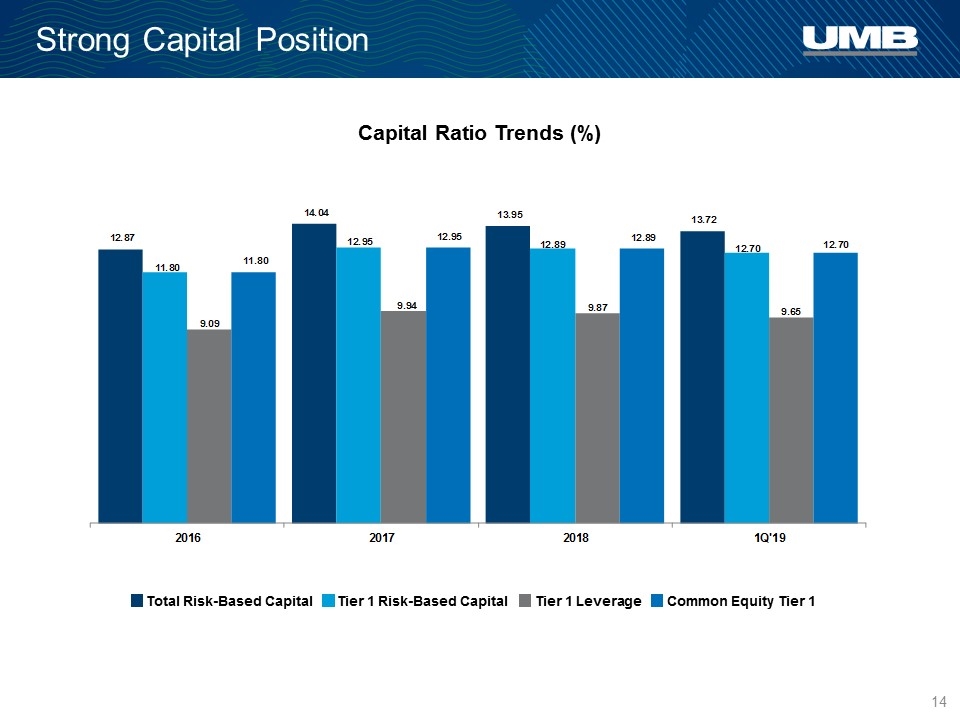

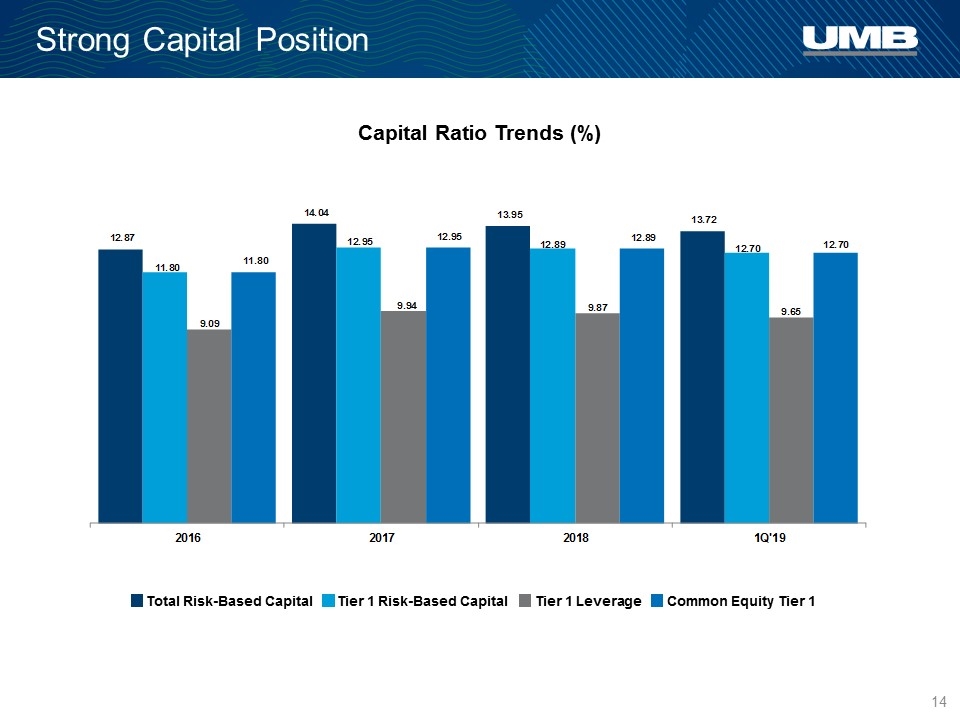

Strong Capital Position Capital Ratio Trends (%) Total Risk-Based Capital Tier 1 Risk-Based Capital Tier 1 Leverage Common Equity Tier 1

Asset Quality

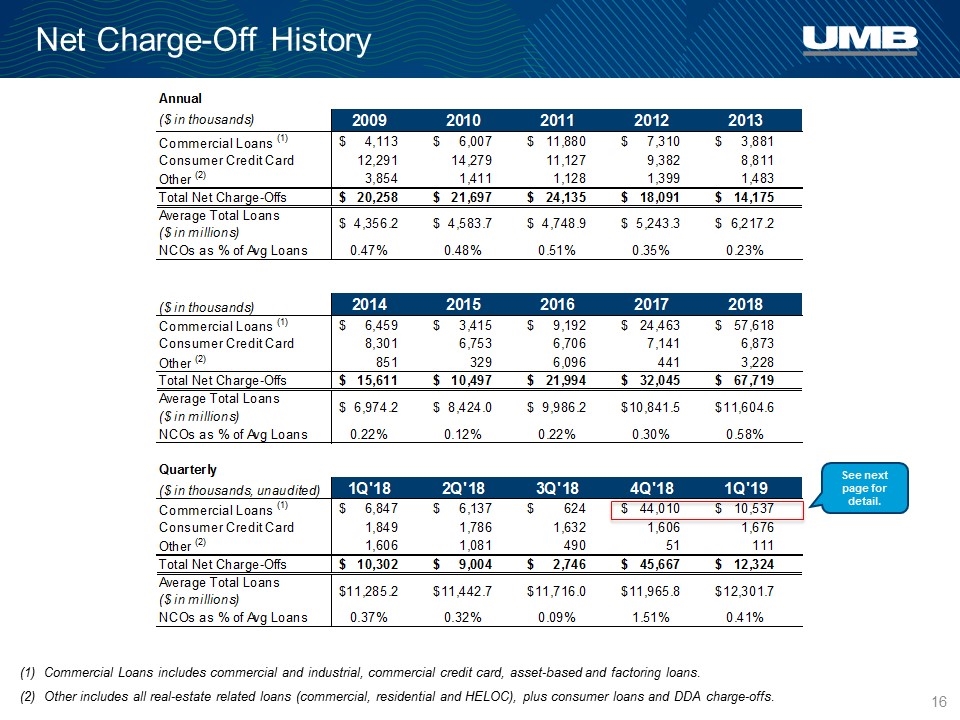

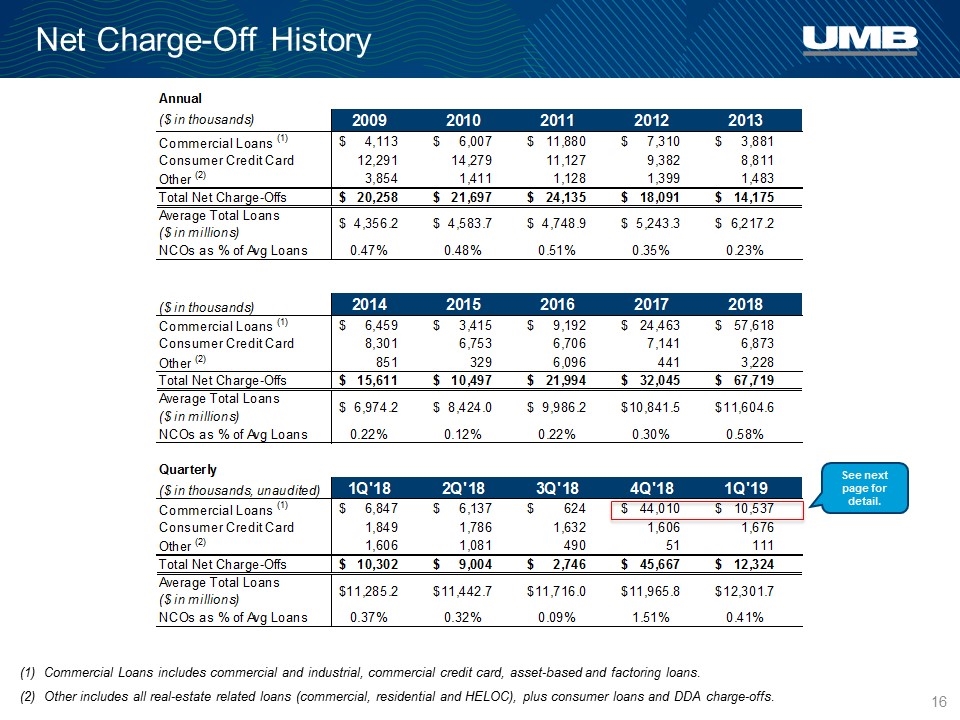

Net Charge-Off History (1) Commercial Loans includes commercial and industrial, commercial credit card, asset-based and factoring loans. (2) Other includes all real-estate related loans (commercial, residential and HELOC), plus consumer loans and DDA charge-offs. See next page for detail.

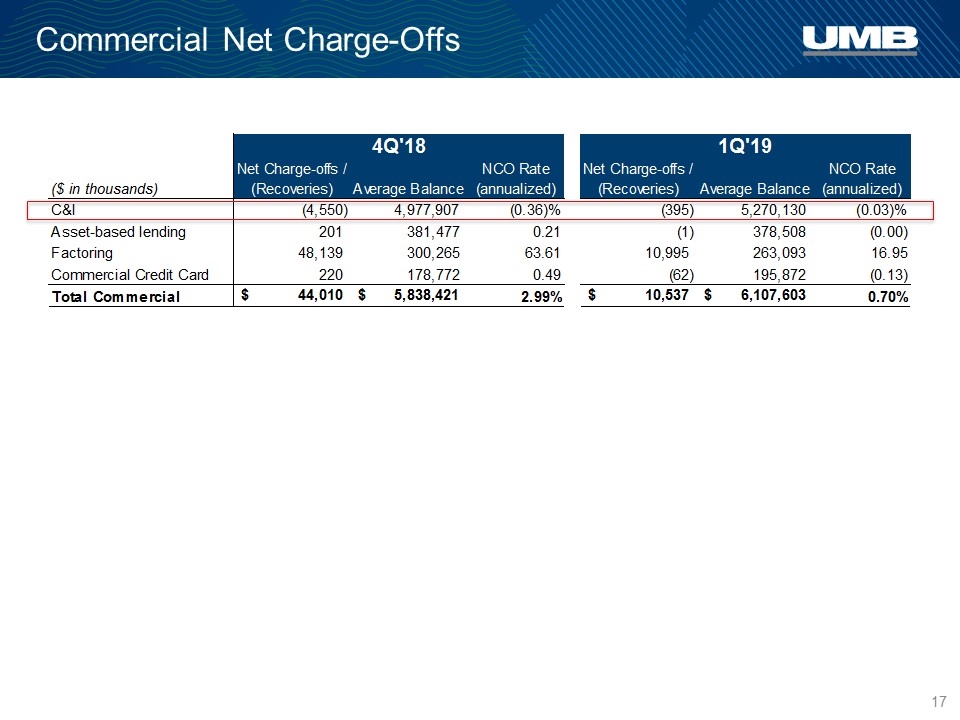

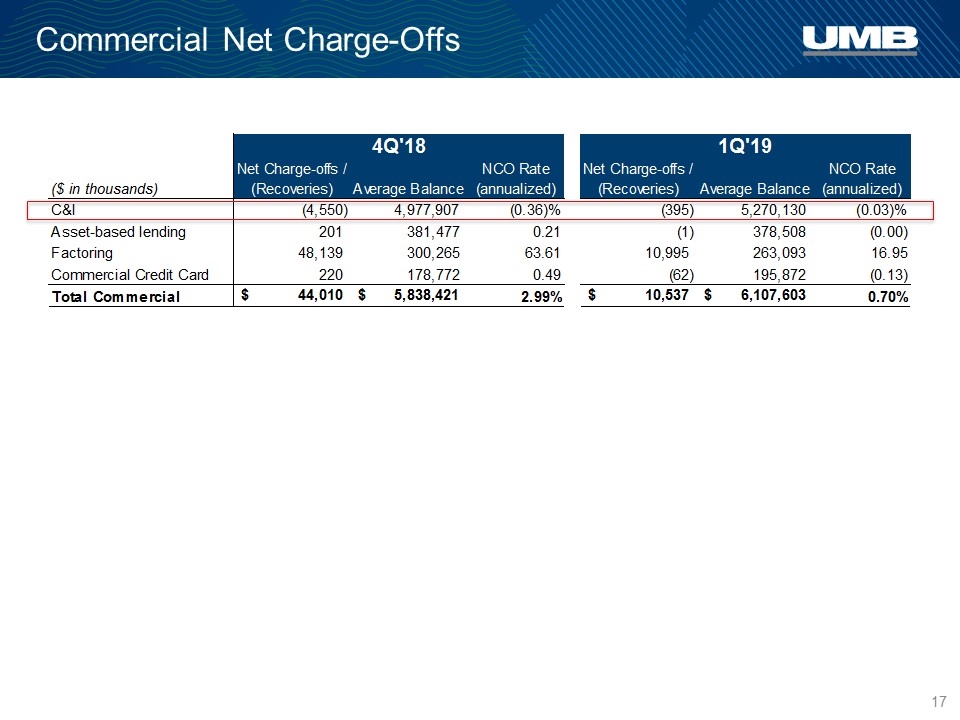

Commercial Net Charge-Offs

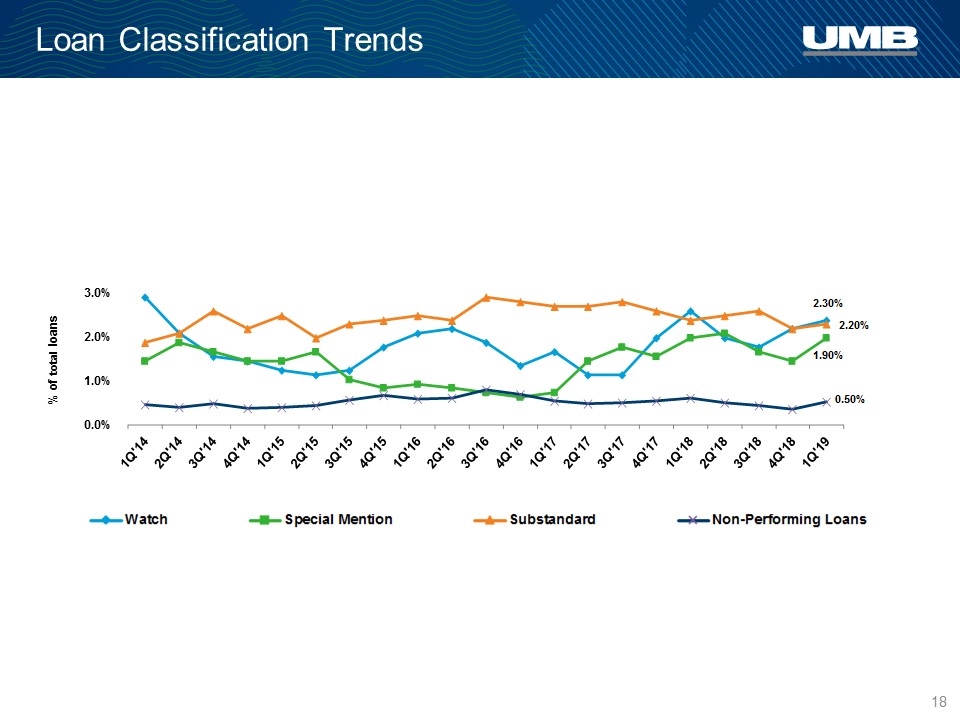

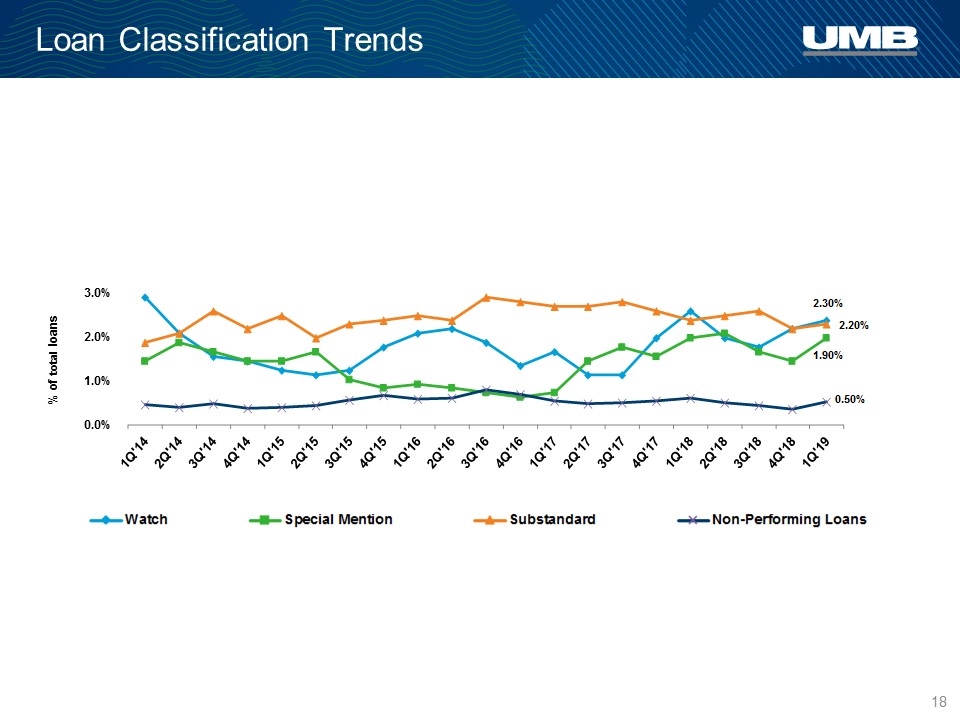

Loan Classification Trends % of total loans 0.0% 1.0% 2.0% 3.0%

Income Statement

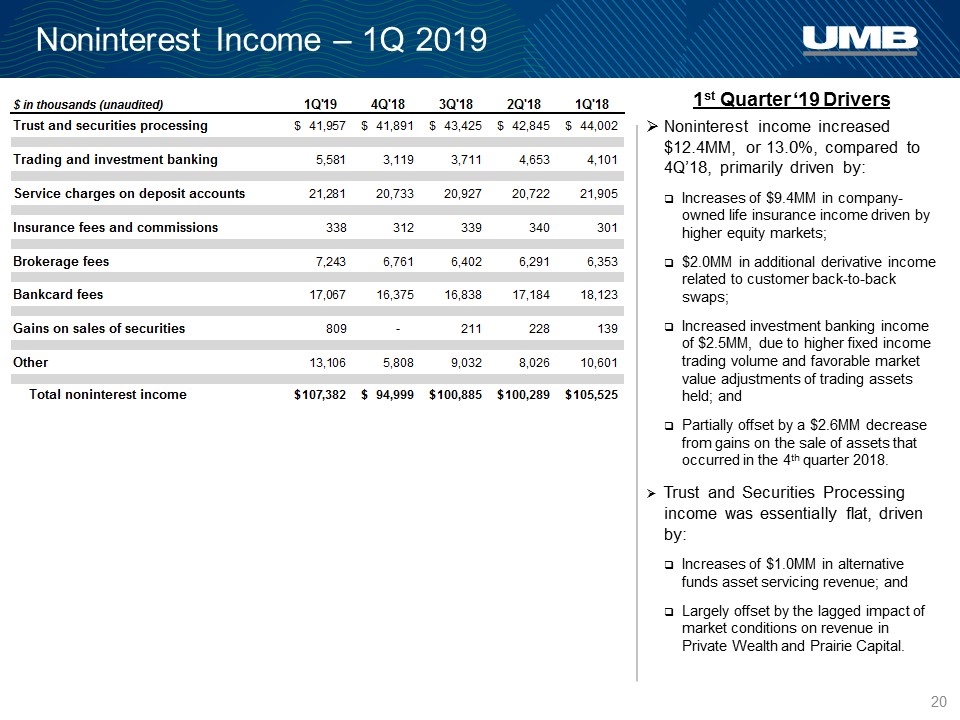

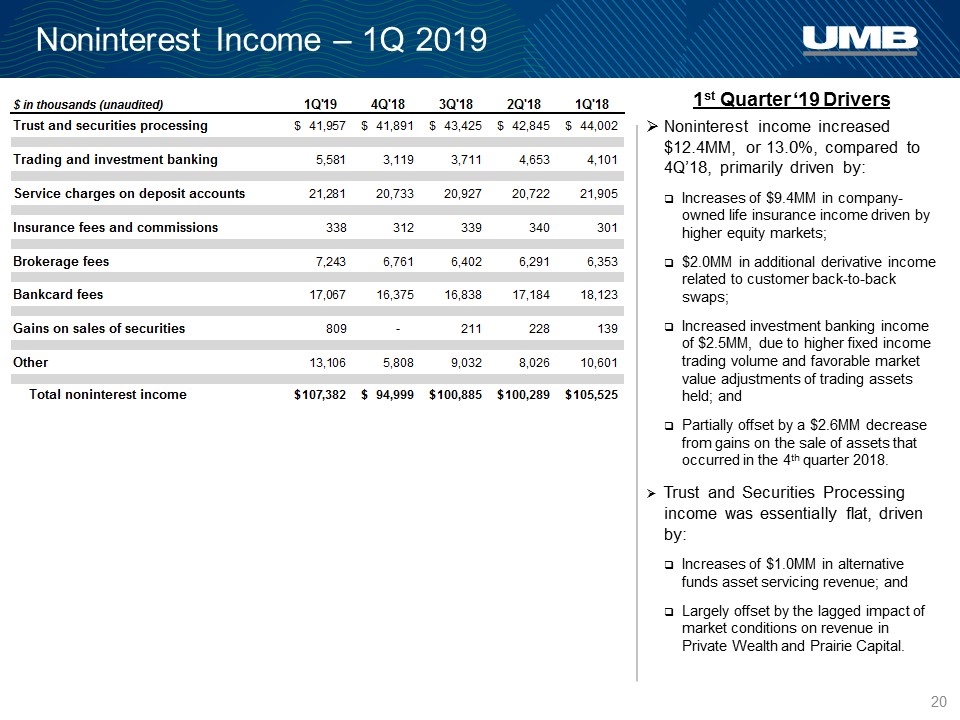

Noninterest Income – 1Q 2019 Noninterest income increased $12.4MM, or 13.0%, compared to 4Q’18, primarily driven by: Increases of $9.4MM in company-owned life insurance income driven by higher equity markets; $2.0MM in additional derivative income related to customer back-to-back swaps; Increased investment banking income of $2.5MM, due to higher fixed income trading volume and favorable market value adjustments of trading assets held; and Partially offset by a $2.6MM decrease from gains on the sale of assets that occurred in the 4th quarter 2018. Trust and Securities Processing income was essentially flat, driven by: Increases of $1.0MM in alternative funds asset servicing revenue; and Largely offset by the lagged impact of market conditions on revenue in Private Wealth and Prairie Capital. 1st Quarter ‘19 Drivers

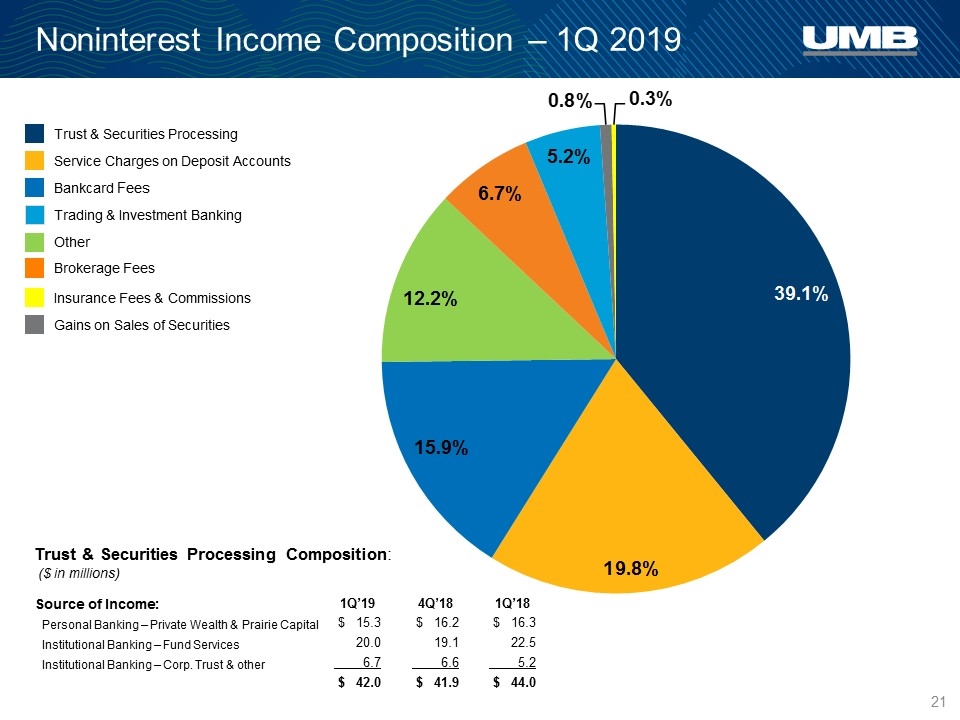

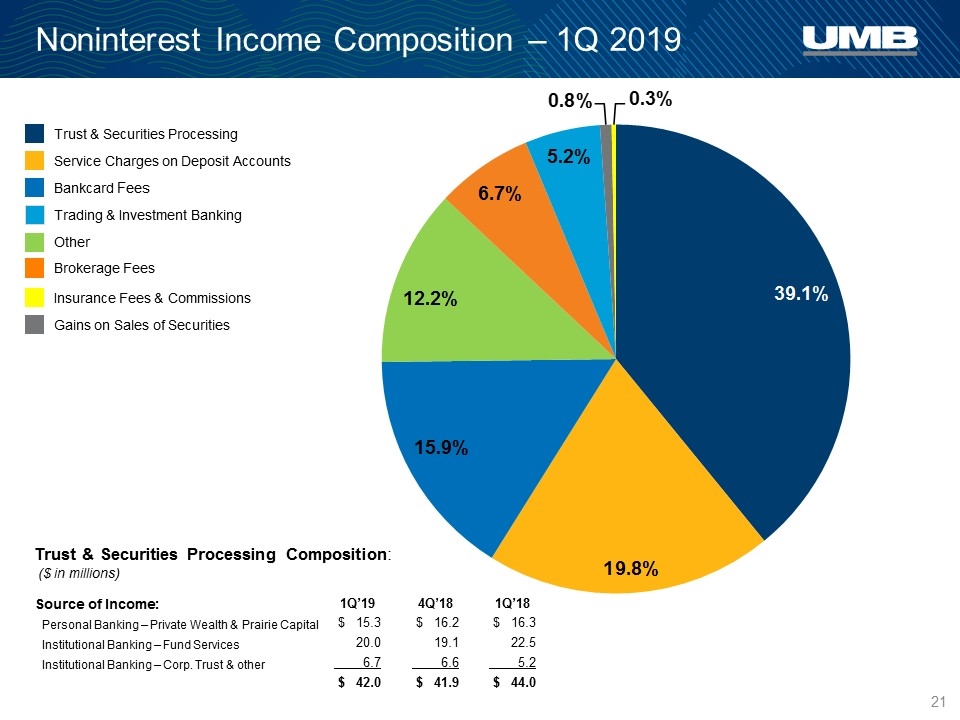

Bankcard Fees Noninterest Income Composition – 1Q 2019 Service Charges on Deposit Accounts Trust & Securities Processing Insurance Fees & Commissions Other Brokerage Fees Trading & Investment Banking Trust & Securities Processing Composition: ($ in millions) Gains on Sales of Securities Source of Income: 1Q’19 4Q’18 1Q’18 Personal Banking – Private Wealth & Prairie Capital $ 15.3 $ 16.2 $ 16.3 Institutional Banking – Fund Services 20.0 19.1 22.5 Institutional Banking – Corp. Trust & other 6.7 6.6 5.2 $ 42.0 $ 41.9 $ 44.0

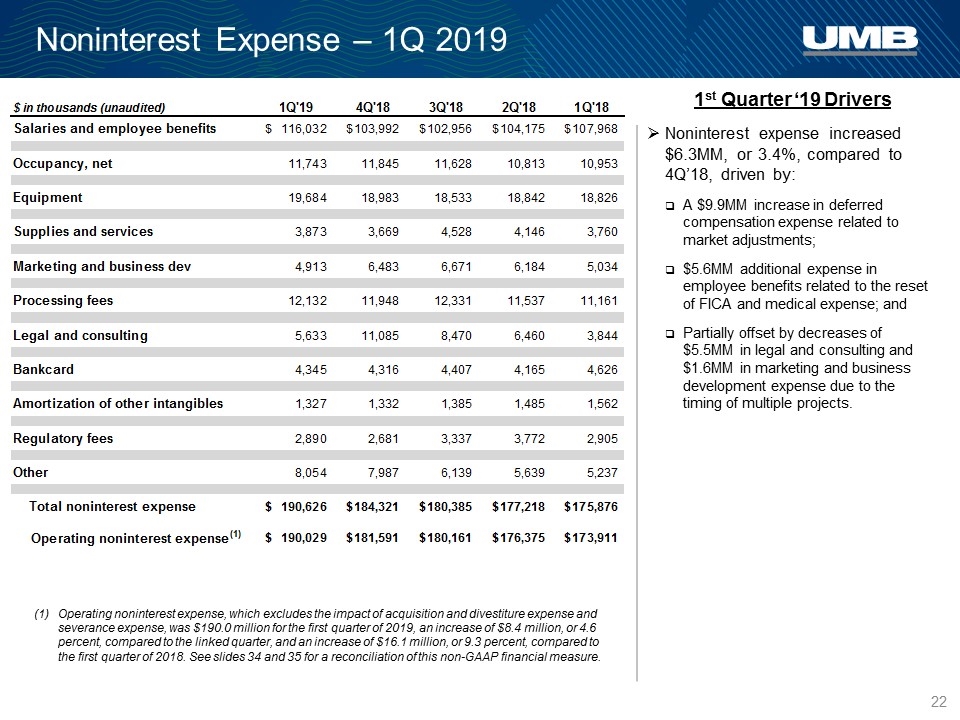

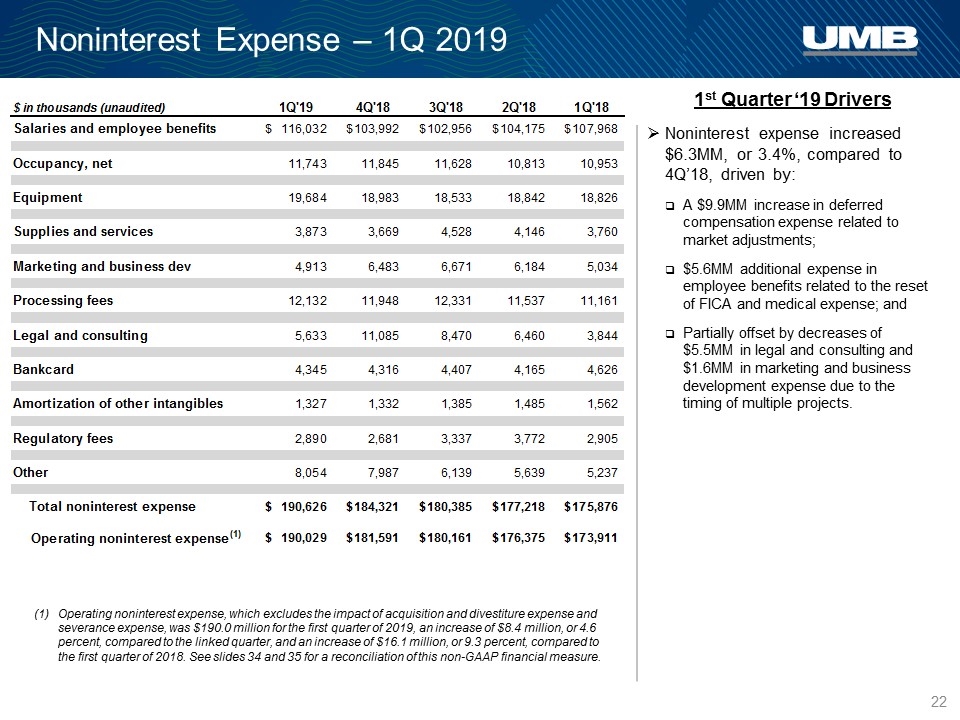

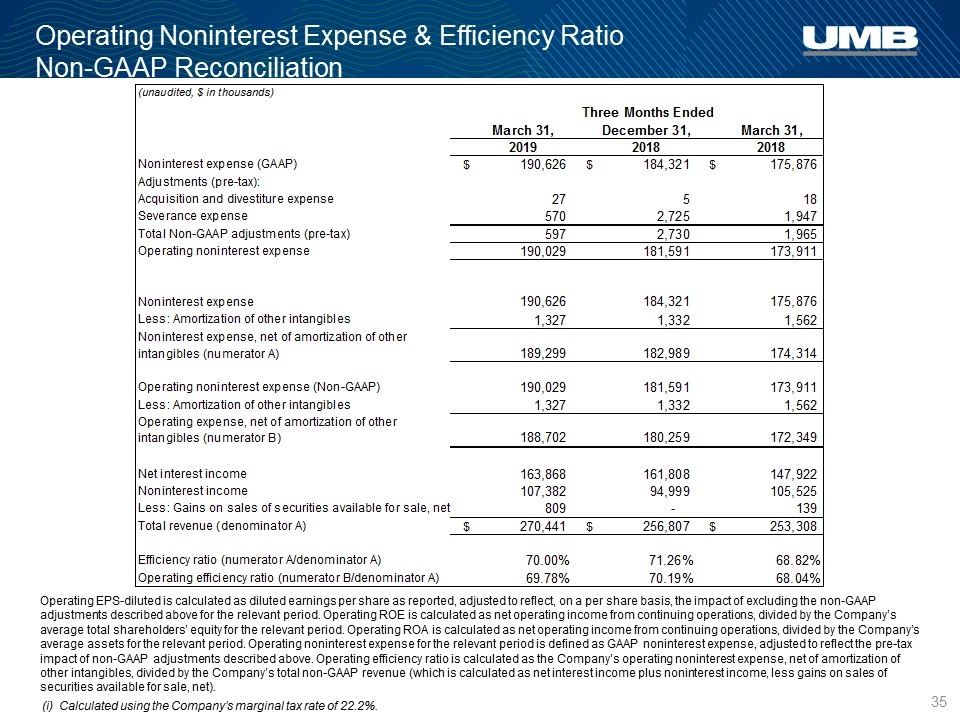

Noninterest Expense – 1Q 2019 Operating noninterest expense, which excludes the impact of acquisition and divestiture expense and severance expense, was $190.0 million for the first quarter of 2019, an increase of $8.4 million, or 4.6 percent, compared to the linked quarter, and an increase of $16.1 million, or 9.3 percent, compared to the first quarter of 2018. See slides 34 and 35 for a reconciliation of this non-GAAP financial measure. Noninterest expense increased $6.3MM, or 3.4%, compared to 4Q’18, driven by: A $9.9MM increase in deferred compensation expense related to market adjustments; $5.6MM additional expense in employee benefits related to the reset of FICA and medical expense; and Partially offset by decreases of $5.5MM in legal and consulting and $1.6MM in marketing and business development expense due to the timing of multiple projects. 1st Quarter ‘19 Drivers

Segment Updates

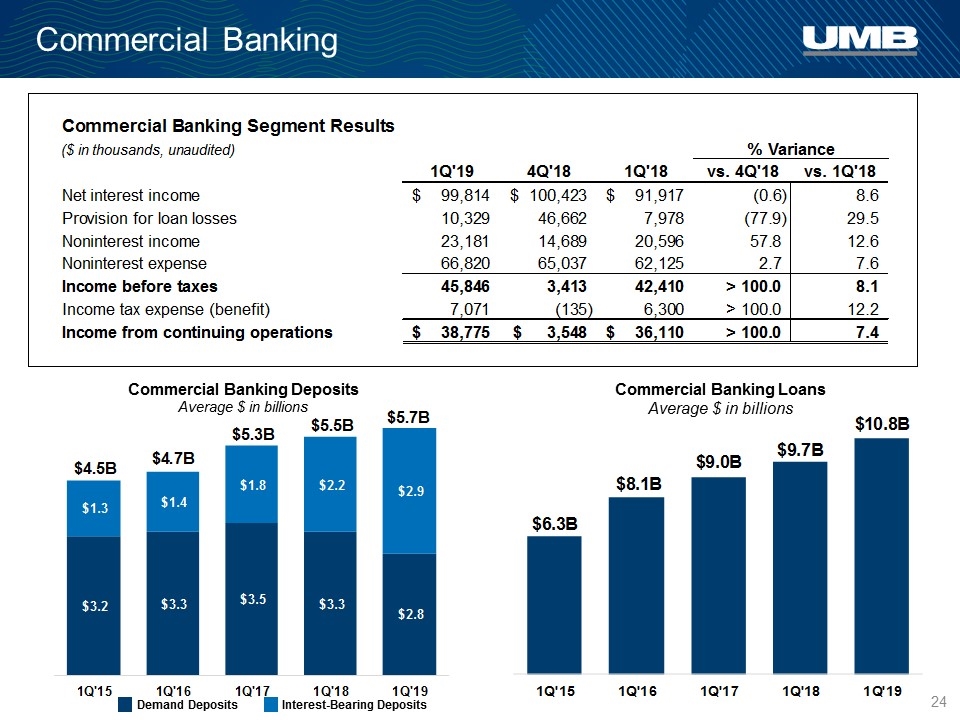

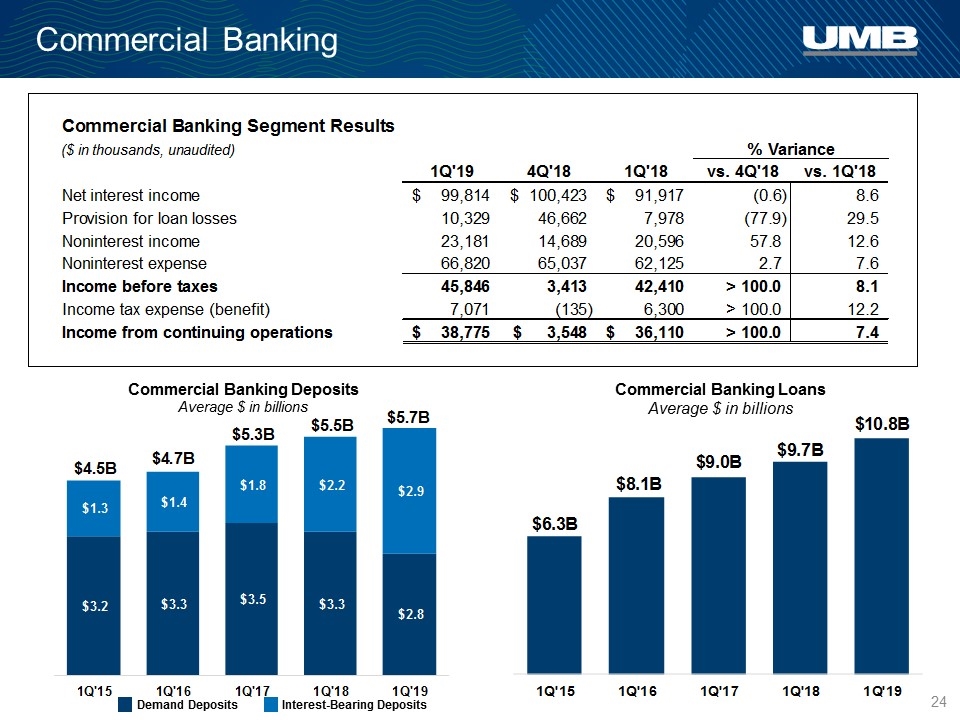

Commercial Banking Commercial Banking Loans Average $ in billions Commercial Banking Deposits Average $ in billions Demand Deposits Interest-Bearing Deposits

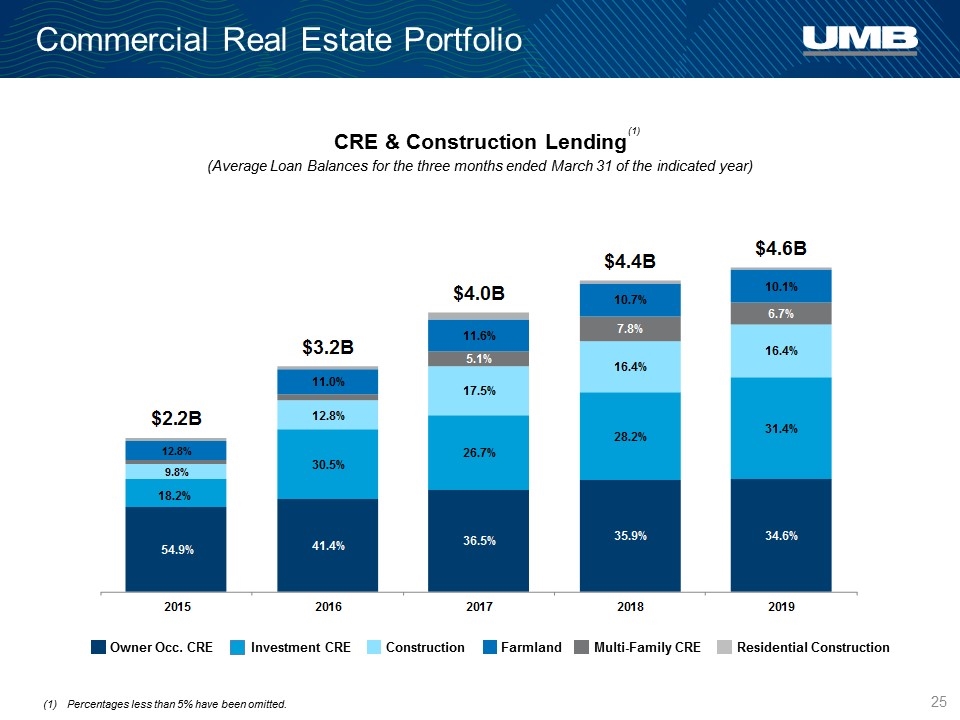

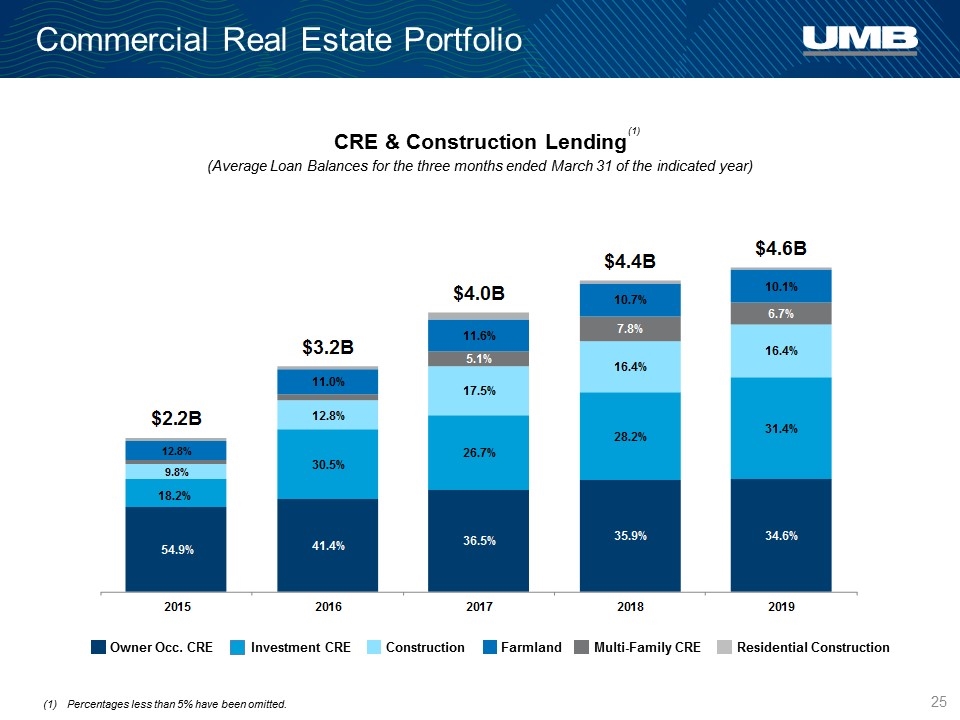

Commercial Real Estate Portfolio CRE & Construction Lending (Average Loan Balances for the three months ended March 31 of the indicated year) Investment CRE Owner Occ. CRE Construction Farmland Multi-Family CRE Residential Construction (1) Percentages less than 5% have been omitted.

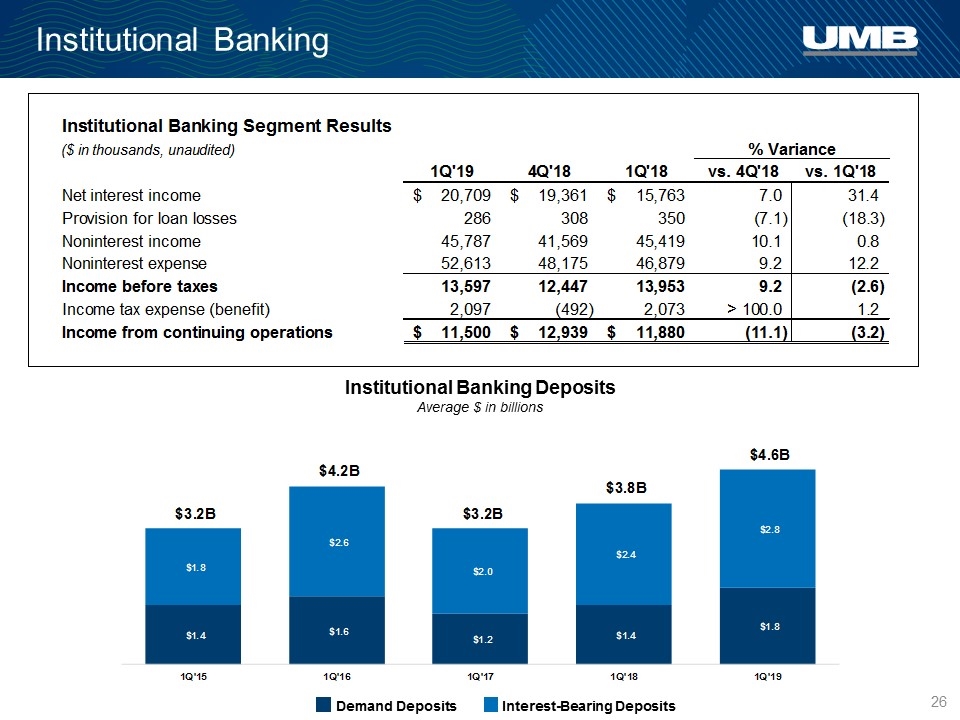

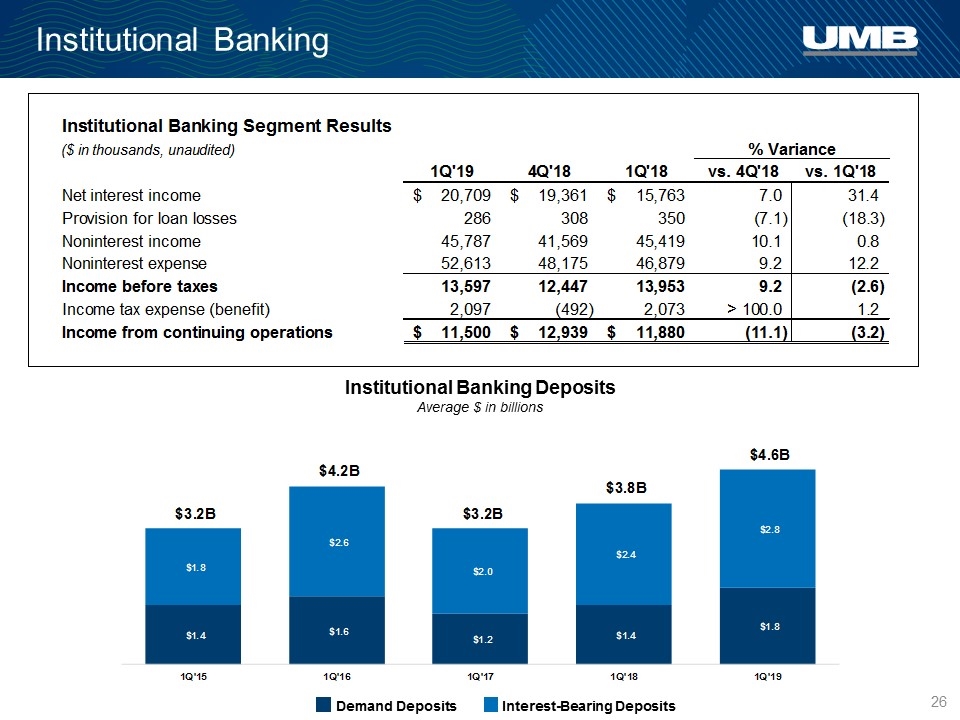

Institutional Banking Institutional Banking Deposits Average $ in billions Demand Deposits Interest-Bearing Deposits

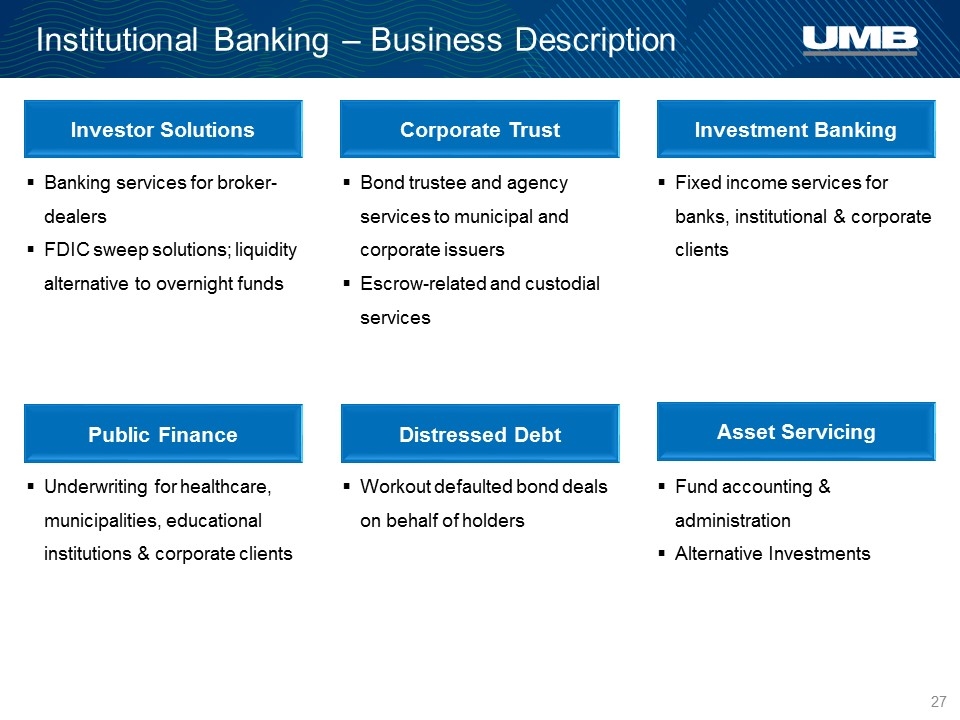

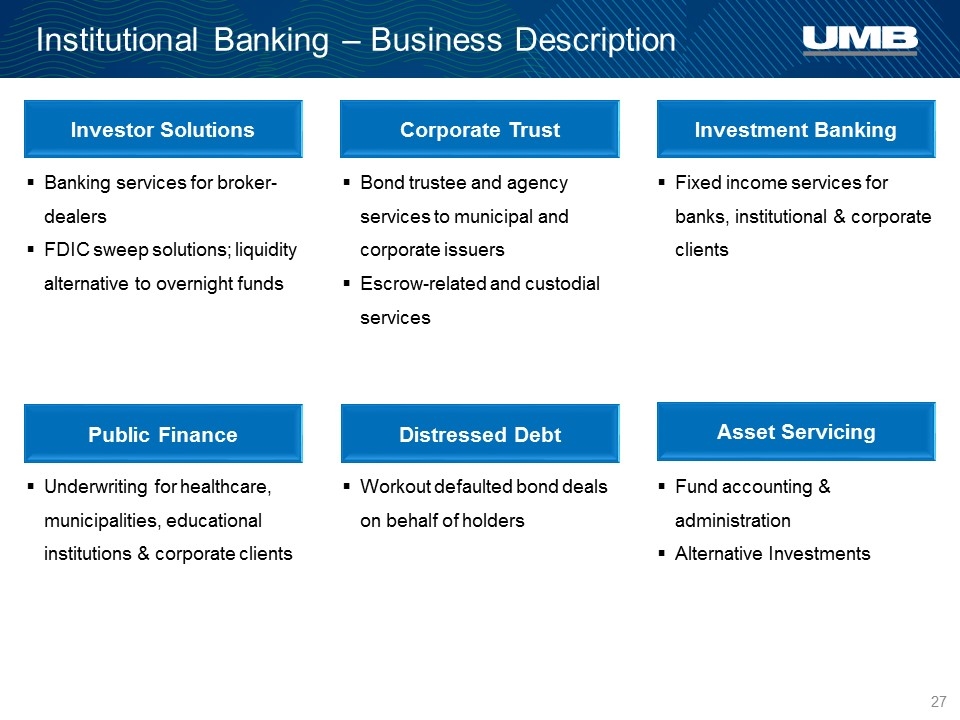

Institutional Banking – Business Description Banking services for broker-dealers FDIC sweep solutions; liquidity alternative to overnight funds Fixed income services for banks, institutional & corporate clients Underwriting for healthcare, municipalities, educational institutions & corporate clients Fund accounting & administration Alternative Investments Workout defaulted bond deals on behalf of holders Investor Solutions Corporate Trust Investment Banking Public Finance Distressed Debt Asset Servicing Bond trustee and agency services to municipal and corporate issuers Escrow-related and custodial services

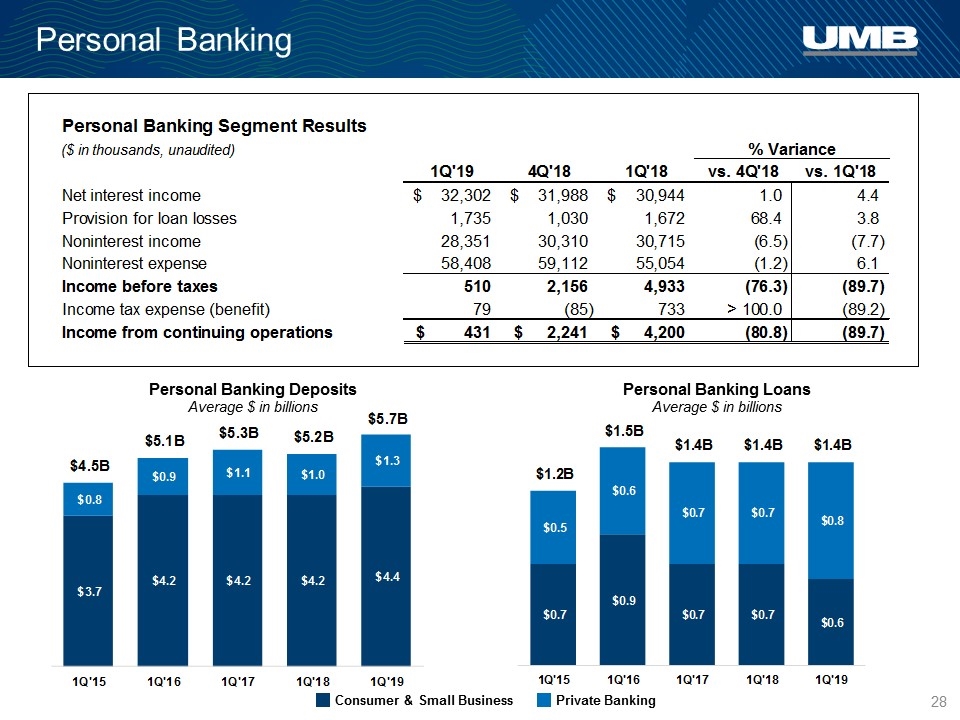

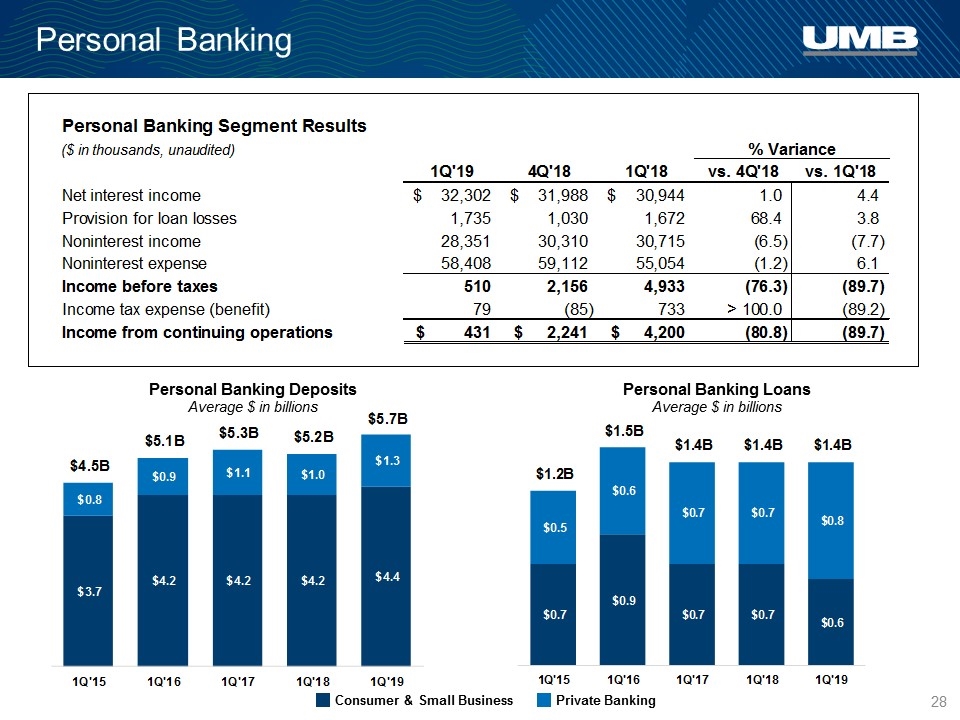

Personal Banking Personal Banking Deposits Average $ in billions Personal Banking Loans Average $ in billions Consumer & Small Business Private Banking

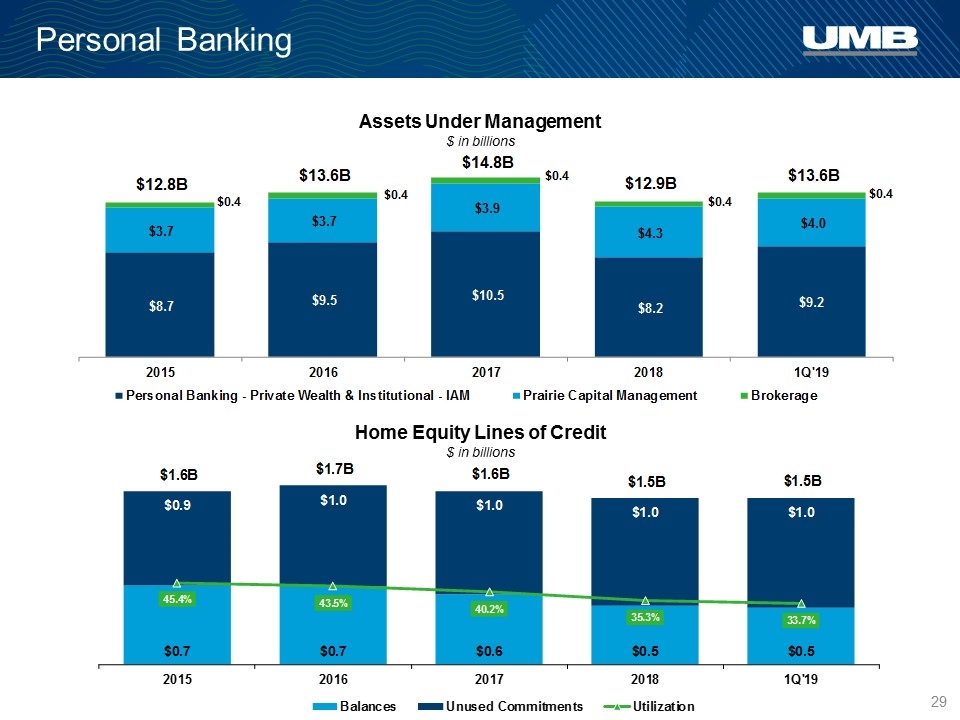

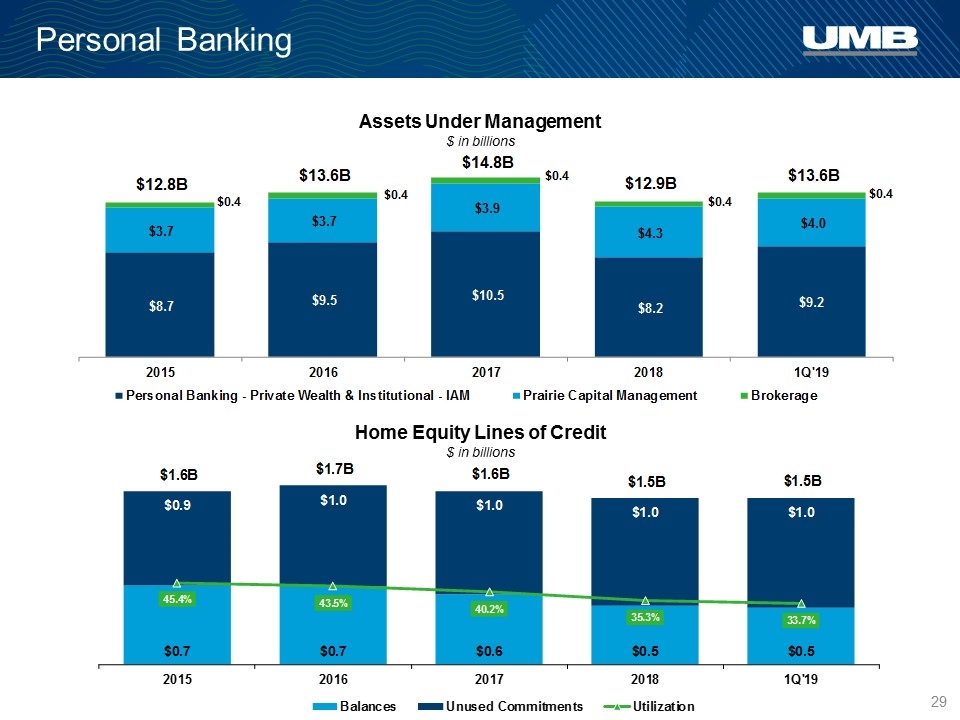

Home Equity Lines of Credit $ in billions Assets Under Management $ in billions Personal Banking UPDATE

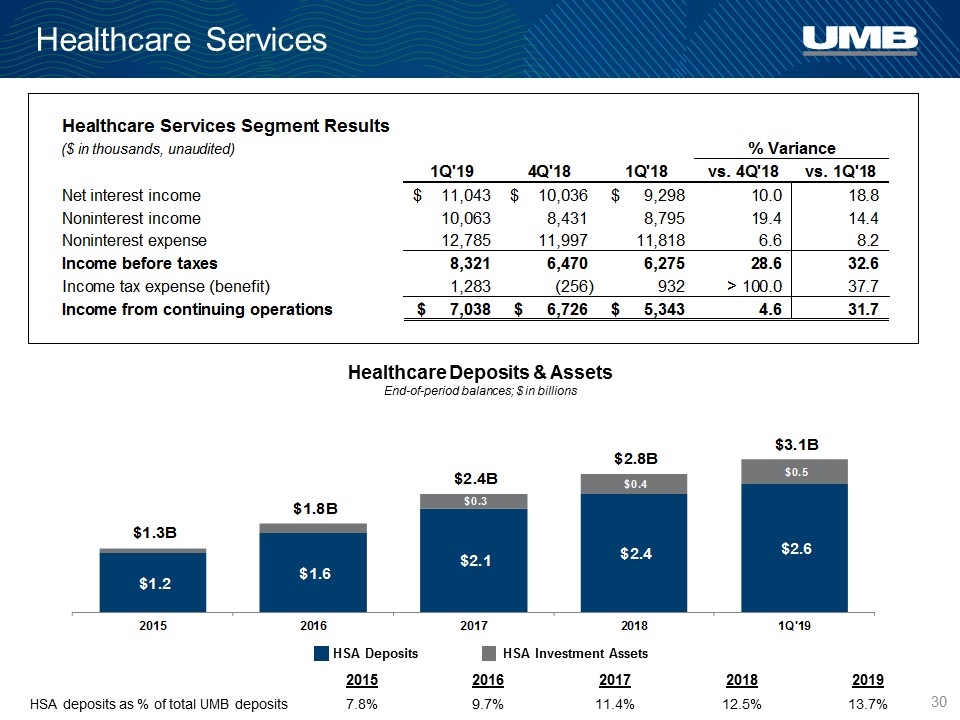

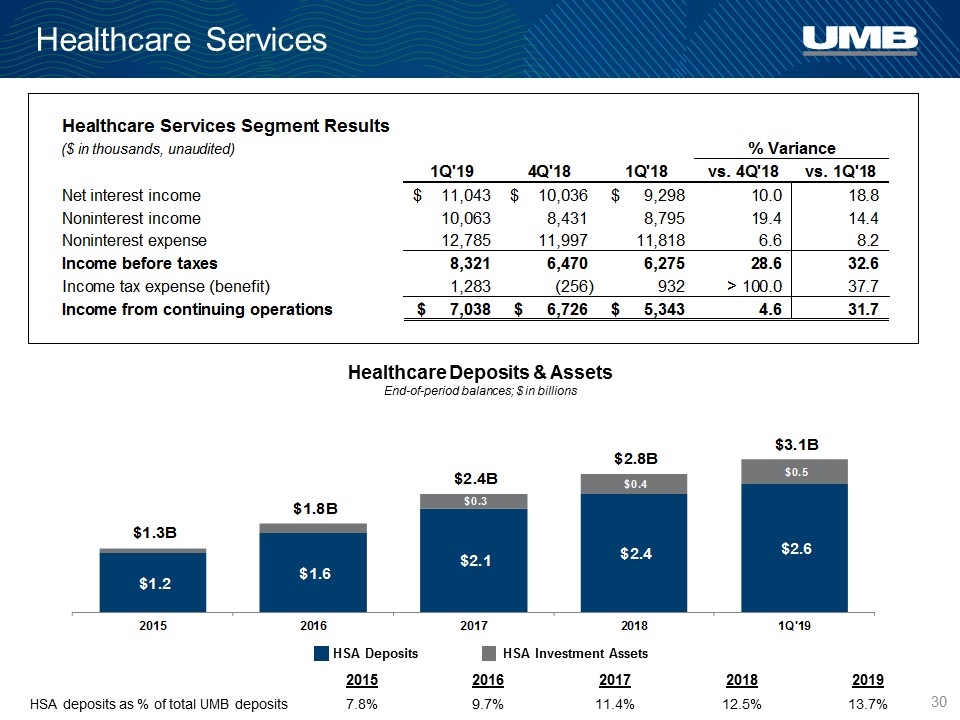

Healthcare Services Healthcare Deposits & Assets End-of-period balances; $ in billions 2015 2016 2017 2018 2019 HSA deposits as % of total UMB deposits 7.8% 9.7% 11.4% 12.5% 13.7% HSA Deposits HSA Investment Assets

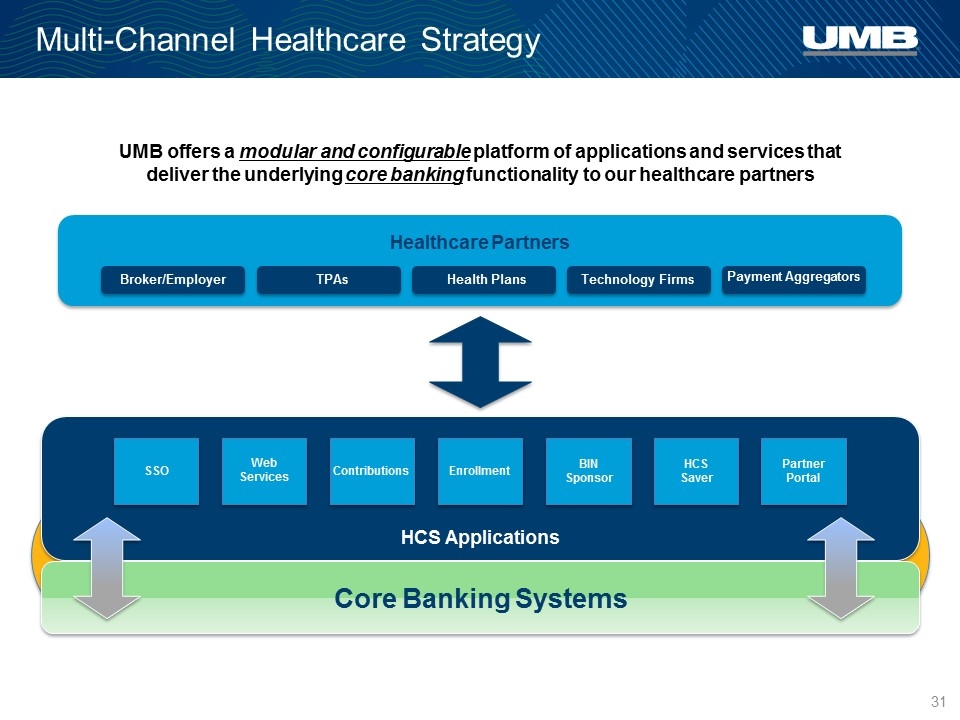

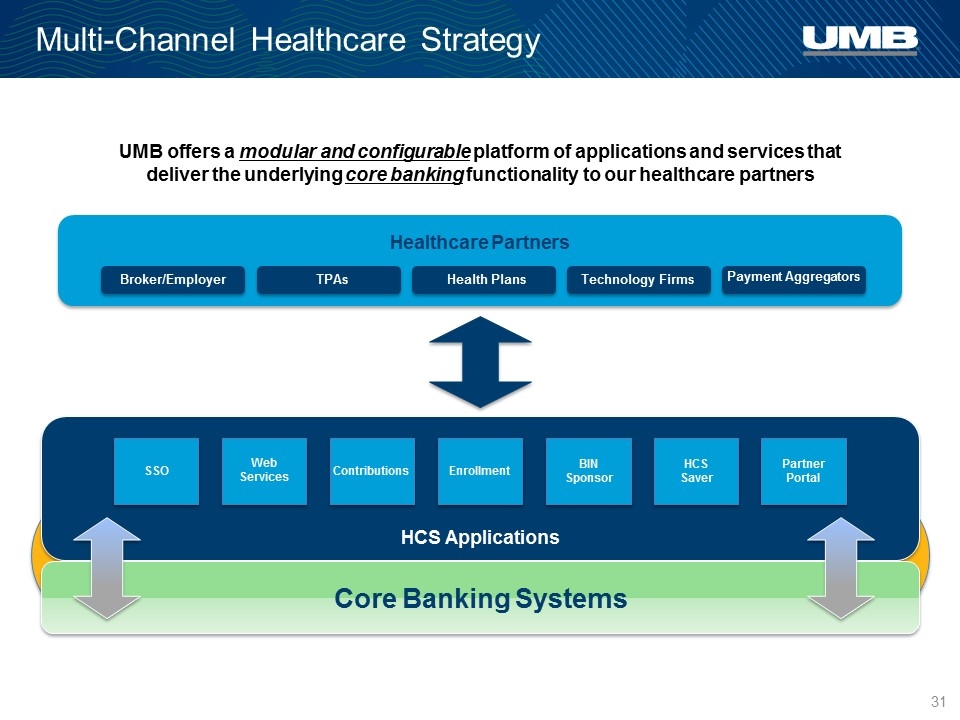

Multi-Channel Healthcare Strategy UMB offers a modular and configurable platform of applications and services that deliver the underlying core banking functionality to our healthcare partners Broker/Employer TPAs Health Plans Technology Firms Payment Aggregators Healthcare Partners HCS Applications SSO Web Services Contributions Enrollment BIN Sponsor HCS Saver Partner Portal Core Banking Systems

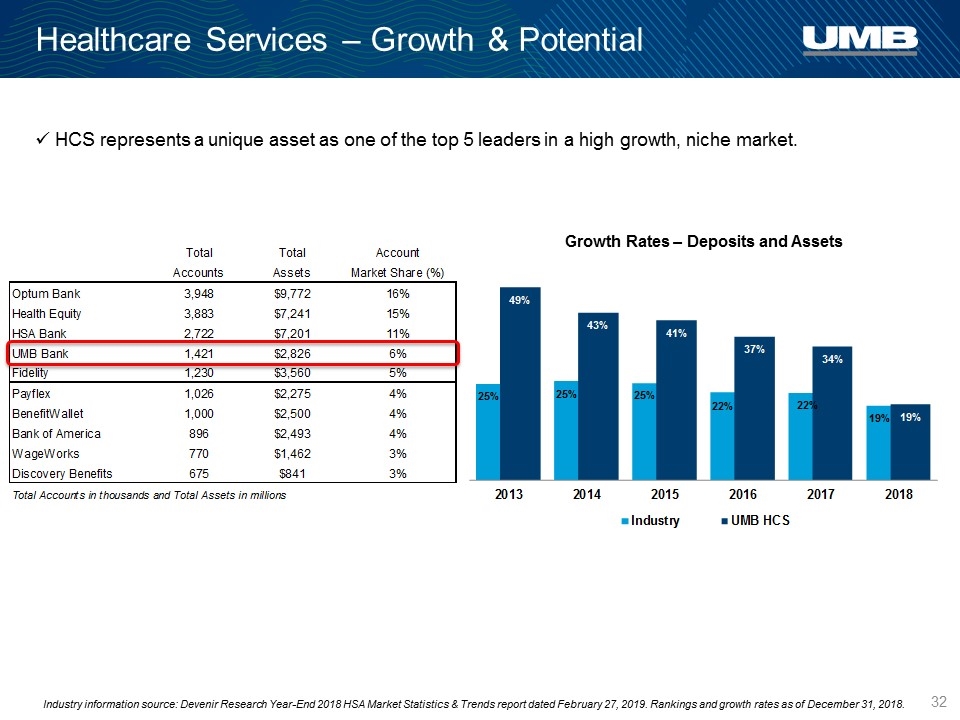

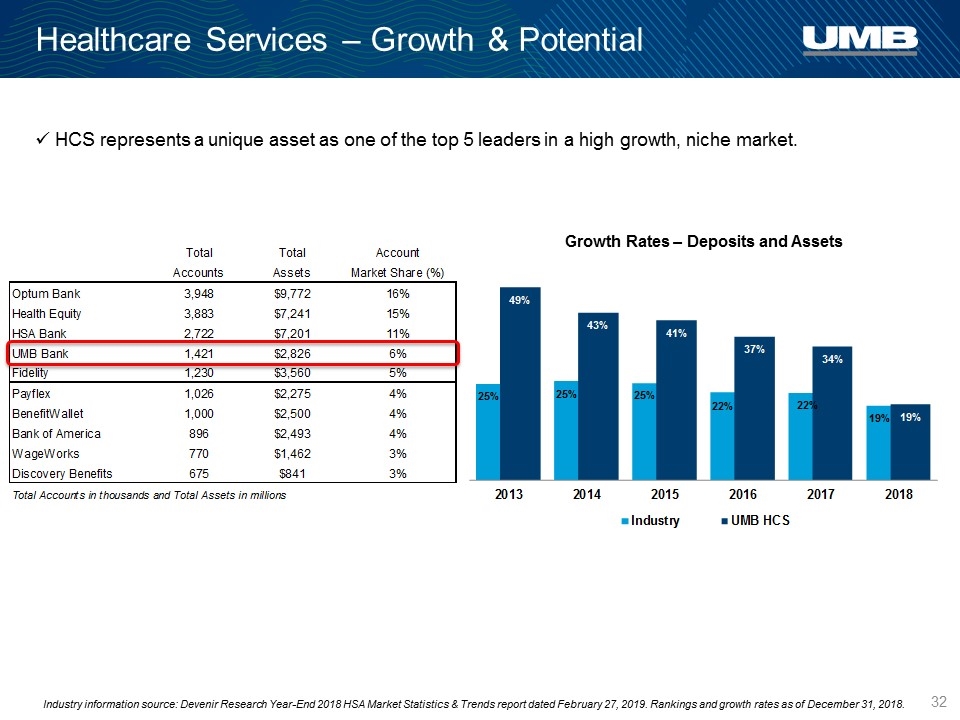

Healthcare Services – Growth & Potential Industry information source: Devenir Research Year-End 2018 HSA Market Statistics & Trends report dated February 27, 2019. Rankings and growth rates as of December 31, 2018. HCS represents a unique asset as one of the top 5 leaders in a high growth, niche market. Growth Rates – Deposits and Assets

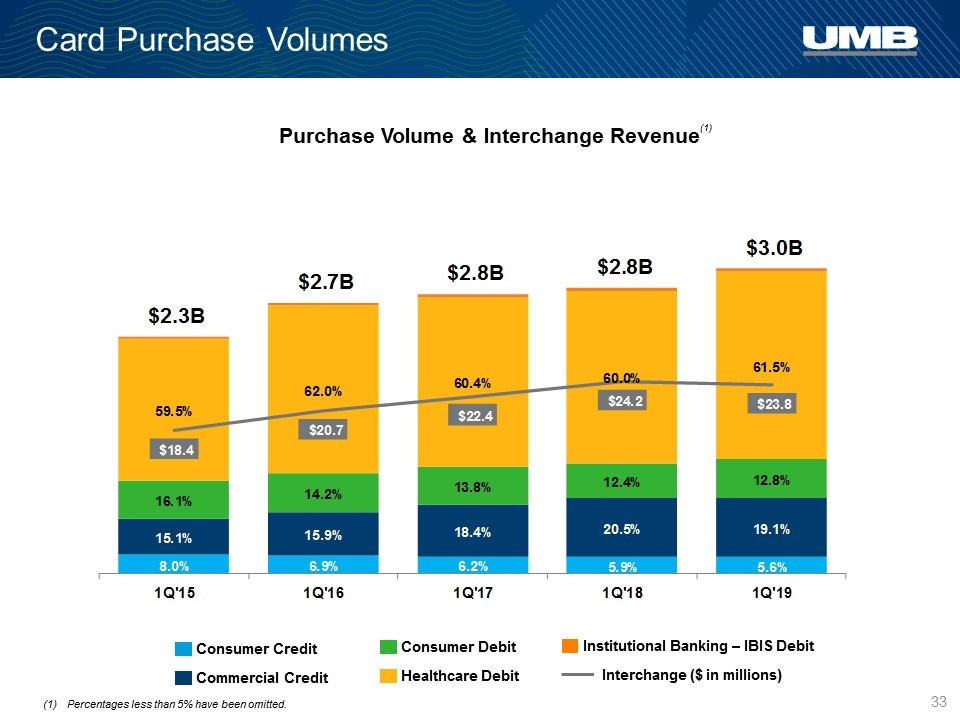

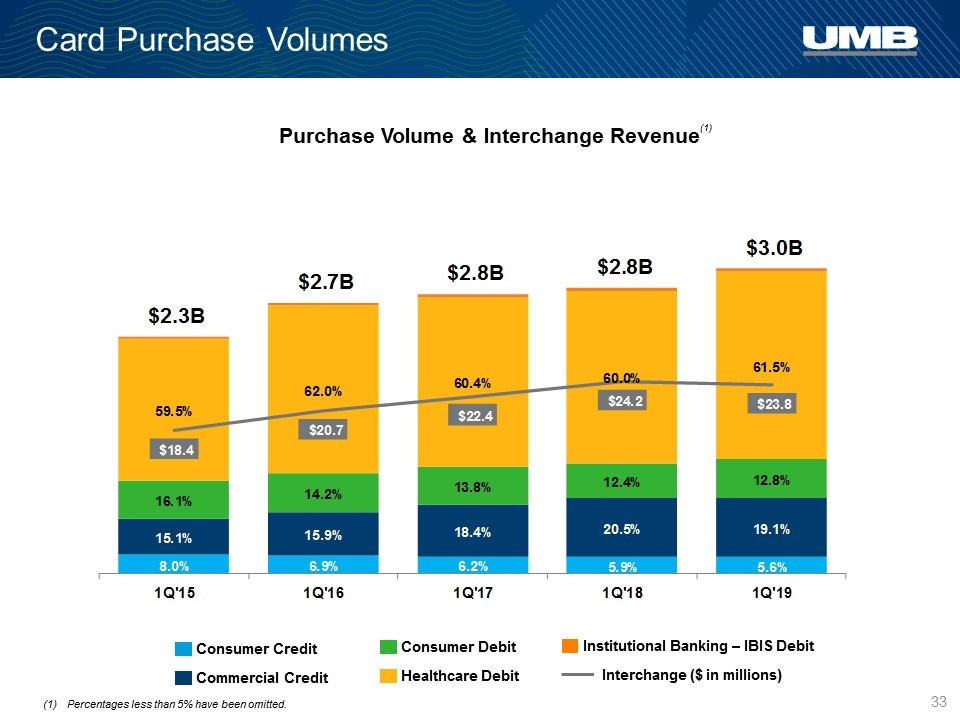

Card Purchase Volumes Purchase Volume & Interchange Revenue Commercial Credit Consumer Credit Consumer Debit Healthcare Debit Institutional Banking – IBIS Debit Interchange ($ in millions) Percentages less than 5% have been omitted. (1)

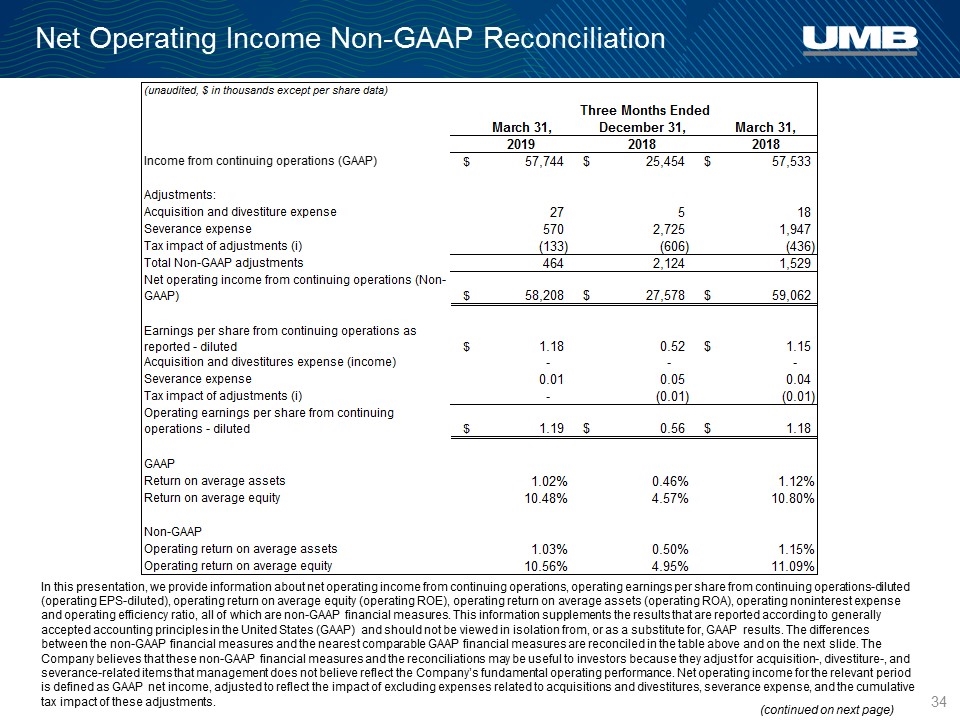

In this presentation, we provide information about net operating income from continuing operations, operating earnings per share from continuing operations-diluted (operating EPS-diluted), operating return on average equity (operating ROE), operating return on average assets (operating ROA), operating noninterest expense and operating efficiency ratio, all of which are non-GAAP financial measures. This information supplements the results that are reported according to generally accepted accounting principles in the United States (GAAP) and should not be viewed in isolation from, or as a substitute for, GAAP results. The differences between the non-GAAP financial measures and the nearest comparable GAAP financial measures are reconciled in the table above and on the next slide. The Company believes that these non-GAAP financial measures and the reconciliations may be useful to investors because they adjust for acquisition-, divestiture-, and severance-related items that management does not believe reflect the Company’s fundamental operating performance. Net operating income for the relevant period is defined as GAAP net income, adjusted to reflect the impact of excluding expenses related to acquisitions and divestitures, severance expense, and the cumulative tax impact of these adjustments. Net Operating Income Non-GAAP Reconciliation (continued on next page)

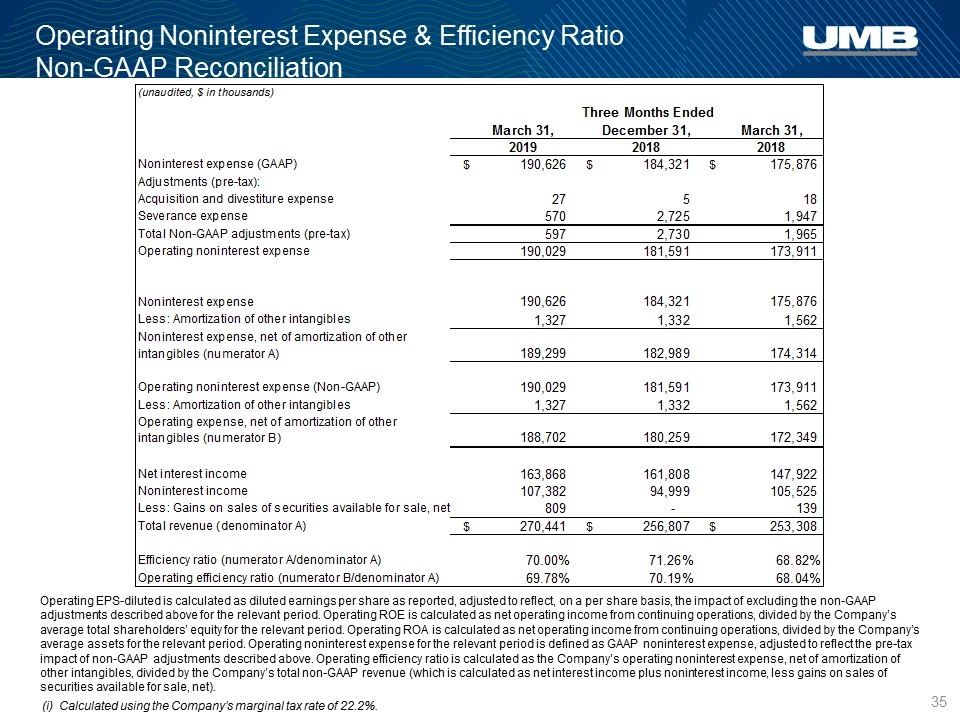

(i) Calculated using the Company's marginal tax rate of 22.2%. Operating Noninterest Expense & Efficiency Ratio Non-GAAP Reconciliation Operating EPS-diluted is calculated as diluted earnings per share as reported, adjusted to reflect, on a per share basis, the impact of excluding the non-GAAP adjustments described above for the relevant period. Operating ROE is calculated as net operating income from continuing operations, divided by the Company’s average total shareholders’ equity for the relevant period. Operating ROA is calculated as net operating income from continuing operations, divided by the Company’s average assets for the relevant period. Operating noninterest expense for the relevant period is defined as GAAP noninterest expense, adjusted to reflect the pre-tax impact of non-GAAP adjustments described above. Operating efficiency ratio is calculated as the Company’s operating noninterest expense, net of amortization of other intangibles, divided by the Company’s total non-GAAP revenue (which is calculated as net interest income plus noninterest income, less gains on sales of securities available for sale, net).