EXHIBIT 99.1

The information provided in this Exhibit is presented only in connection with the reporting changes described in the accompanying Form 8-K. This information does not reflect events occurring after February 28, 2012, the date we filed our 2011 Form 10-K, and does not modify or update the disclosures therein in any way, other than as required to reflect the change in reportable segments and the adoption of a new accounting standard, as described in the Form 8-K and set forth in Exhibits 99.1 through 99.5 attached thereto. You should therefore read this information in conjunction with the 2011 Form 10-K and any subsequent amendments on Form 10-K/A and with our reports filed with the Securities and Exchange Commission after February 28, 2012.

Part I, Item 1 — Business

General

NRG Energy, Inc., or NRG or the Company, is an integrated wholesale power generation and retail electricity company that aspires to be a leader in the way the industry and consumers think about, use, produce and deliver energy and energy services in major competitive power markets in the United States. First, NRG is a wholesale power generator engaged in the ownership and operation of power generation facilities; the trading of energy, capacity and related products; and the transacting in and trading of fuel and transportation services. Second, NRG is a retail electricity company engaged in the supply of electricity, energy services, and cleaner energy products to retail electricity customers in deregulated markets through Reliant Energy, Green Mountain Energy, and Energy Plus (collectively, the Retail Businesses). Finally, NRG is focused on the deployment and commercialization of potential disruptive technologies, like electric vehicles, Distributed Solar and smart meter technology, which have the potential to change the nature of the power supply industry.

Wholesale Power Generation

NRG's generation facilities consist of intermittent, baseload, intermediate and peaking power generation facilities in the United States and two international locations. The sale of capacity and power from baseload generation facilities accounts for a majority of the Company's generation revenues. In addition, NRG's generation portfolio provides the Company with opportunities to capture additional revenues by selling power during periods of peak demand, offering capacity or similar products, and providing ancillary services to support system reliability.

Retail

NRG's Retail Businesses arrange for the transmission and delivery of energy-related products to customers, bill customers, collect payments for products sold, and maintain call centers to provide customer service. The Retail Businesses sell products that range from system power to bundled products, which combine system power with protection products, energy efficiency and renewable energy solutions, or other value added products and services, including customer rewards offered through exclusive loyalty and affinity program partnerships. Based on metered locations, as of December 31, 2011, NRG's Retail Businesses combined to serve approximately 2.1 million residential, small business, commercial and industrial customers.

Alternative Energy

NRG's investment in and development of new technologies is focused where the Company believes the benefits of such investments represent significant commercial opportunities and create a comparative advantage for the Company. The development and investment initiatives are primarily focused in the areas of Distributed Solar, solar thermal and solar photovoltaic, and also include other low or no Greenhouse Gases, or GHG, emitting energy generating sources, such as the fueling infrastructure for electric vehicle, or EV, ecosystems.

NRG's Business Strategy

The Company believes that the American energy industry is going to be increasingly impacted by the long-term societal trend towards sustainability which is both generational and irreversible. Moreover, the information technology-driven revolution which has enabled greater and easier personal choice in other sectors of the consumer economy will do the same in the American energy sector over the years to come. As a result, energy consumers will have increasing personal control over whom they buy their energy from, how that energy is generated and used and what environmental impact these individual choices will have. The Company's initiatives in this area of future growth are focused on: (i) renewables, with a concentration in solar development; (ii) electric vehicle ecosystems; (iii) customer-facing energy products and services including smart grid services, nationwide retail green electricity, unique retail sales channels involving loyalty and affinity programs and custom design; and (iv) construction of

other forms of on-site clean power generation. The Company's advances in each of these areas are driven by select acquisitions, joint ventures, and investments that are more fully described in Item 1, Business - New and On-going Company Initiatives and Development Projects.

The Company's core business is focused on: (i) excellence in safety and operating performance of its existing assets; (ii) serving the energy needs of end-use residential, commercial and industrial customers in the Company's core markets with a retail energy product that is differentiated either by premium service (Reliant), sustainability (Green Mountain Energy) or loyalty/affinity programs (Energy Plus); (iii) optimal hedging of baseload generation and retail load operations, while retaining optionality on the Company's peaking facilities; (iv) repowering of power generation assets at premium sites; (v) investment in, and deployment of, alternative energy technologies both in its wholesale and, particularly, in and around its retail businesses and their customers; (vi) pursuing selective acquisitions, joint ventures, divestitures and investments; and (vii) engaging in a proactive capital allocation plan focused on achieving the regular return of and on stockholder capital within the dictates of prudent balance sheet management.

In summary, NRG's business strategy is intended to maximize stockholder value through the production and sale of safe, reliable and affordable power to its customers in the markets served by the Company, while aggressively positioning the Company to meet the market's increasing demand for sustainable and low carbon energy solutions. This strategy is designed to enhance the Company's core business of competitive power generation and mitigate the risk of declining power prices. The Company expects to become a leading provider of sustainable energy solutions that promotes national energy security, while utilizing the Company's retail business to complement and advance both initiatives.

Competition

NRG competes in wholesale power generation, deregulated retail energy services and in the development of renewable and conventional energy resources.

Wholesale Power Generation

Wholesale power generation is a capital-intensive, commodity-driven business with numerous industry participants. NRG competes on the basis of the location of its plants and ownership of portfolios of plants in various regions, which increases the stability and reliability of its energy supply. Wholesale power generation is a regional business that is currently highly fragmented and diverse in terms of industry structure. As such, there is a wide variation in terms of the capabilities, resources, nature and identity of the companies NRG competes with depending on the market. Competitors include regulated utilities, other independent power producers, and power marketers or trading companies, including those owned by financial institutions, municipalities and cooperatives.

Retail

The restructured electricity markets across the nation provide an intensely competitive landscape for energy providers to sell products and services to all customer segments (residential, small and mid-market businesses, governments and other public institutions). The markets in which we compete include, but are not limited to: Connecticut, Delaware, the District of Columbia, Illinois, Maryland, Massachusetts, New Jersey, New York, Pennsylvania, Ohio and Texas. The Electric Reliability Council of Texas, or ERCOT, is our primary market and constitutes both the highest number of customers and a substantial concentration of NRG's gross profits.

Retail customers make purchase decisions based on a variety of factors, including price, customer service, brand image, product choices, bundles or value-added features. Customers purchase products through a variety of sales channels including direct sales force, call centers, websites, brokers and brick-and-mortar stores. The Retail Businesses compete with national and international companies that operate in multiple geographic areas, as well as numerous companies that are regional or local in nature. Significant competitors in the markets in which we compete include Constellation, Direct Energy, GDF Suez and Energy Future Holdings (d/b/a TXU Energy), and other competitors, typically incumbent retail electric providers, which have the advantage of long-standing relationships with customers.

Development

NRG may submit bids to develop generation resources, predominantly in response to requests for proposals, or RFPs, for new conventional or renewable generation and/or generating capacity. Bids are solicited by regulated utilities or electric system operators, often to comply with mandated renewable portfolio standards or to achieve an improved reserve margin, which is a measure of a utility's available electric power capacity over and above the electric power capacity needed to meet normal peak demand levels. NRG competes against other power plant developers and manufacturers of solar panel assemblies. The number

and type of competitors vary based on the location, generation type, project size and counterparty specified in the RFP. Bids are awarded based on price, location of existing generation, prior experience developing generation resources similar to that specified in the RFP, and creditworthiness.

Competitive Strengths

Conventional Wholesale Power Generation

NRG has one of the largest and most diversified power generation portfolios in the United States, with approximately 23,585 MW of fossil fuel and nuclear generation capacity in 189 active generating units at 45 plants as of December 31, 2011. In addition, the Company has a 550 MW combined cycle gas plant under construction. The Company's power generation assets are diversified by fuel-type, dispatch level and region, which helps mitigate the risks associated with fuel price volatility and market demand cycles.

NRG's U.S. baseload and intermediate facilities provide the Company with a significant source of cash flow, while its peaking facilities provide NRG with opportunities to capture upside potential that can arise from time to time during periods of high demand.

Many of NRG's generation assets are located within densely populated areas that tend to have more robust wholesale pricing as a result of relatively favorable local supply-demand balance. NRG has generation assets located within Houston, New York City, southwestern Connecticut, and the Los Angeles and San Diego load basins. These facilities are often ideally situated for repowering or the addition of new capacity, because their location and existing infrastructure give them significant advantages over undeveloped sites.

Retail

Through its Retail Businesses, NRG served 2.1 million customers in 2011, delivering over 57 TWhs, making it one of the largest retail energy providers in the United States. NRG's Retail Businesses offer a broad range of services and value propositions that enable it to attract, retain, and increase the value of our residential, small business and commercial customer relationships. With the largest market share in ERCOT based on volume sales, Reliant Energy is recognized by its exemplary customer service (ranked the highest in customer satisfaction by the Public Utility Commission of Texas, or PUCT, in 2011) as well as its innovative technology product offerings and home energy services. As one of the nation's leading retail providers of clean energy, Green Mountain Energy is widely recognized as a pioneer in the competitive retail energy market and provides customers an environmentally friendly alternative to their energy supply requirements. Acquired in 2011, Energy Plus primarily enrolls and retains electricity and natural gas customers through exclusive marketing arrangements with leading loyalty program providers and affinity group associations. Through these Retail Businesses, NRG is able to provide its customers a broad range of energy services and products, including system power, distributed generation, solar and wind products, carbon management and specialty services, and smart grid services. The breadth and scope of these Retail Businesses also create opportunities for delivering value enhancing energy solutions to customers on a national level.

Solar and Other Alternative Energy Technologies

NRG is one of the largest solar power developers in the U.S., having demonstrated the ability to develop, construct and finance a full range of solar energy solutions for utilities, schools, municipalities, commercial and residential market segments. The Company has 545 MW of renewable generation capacity which consists of ownership interests in four wind farms, three Utility Scale Solar facilities, and approximately 30 MW of Distributed Solar as of December 31, 2011. In addition, the Company has 860 MW of solar capacity under construction: 855 MW at six Utility Scale Solar facilities and 5 MW of Distributed Solar. Through its relationships with solar equipment providers, NRG is able to deploy diverse solar technologies in both the utility and distributed generating scale projects that creates value for the Company while meeting the clean renewable energy requirements of its customers NRG is responding to the growing consumer demand for cleaner transportation solutions by building the first privately funded EV charging infrastructure network in select major metropolitan areas.

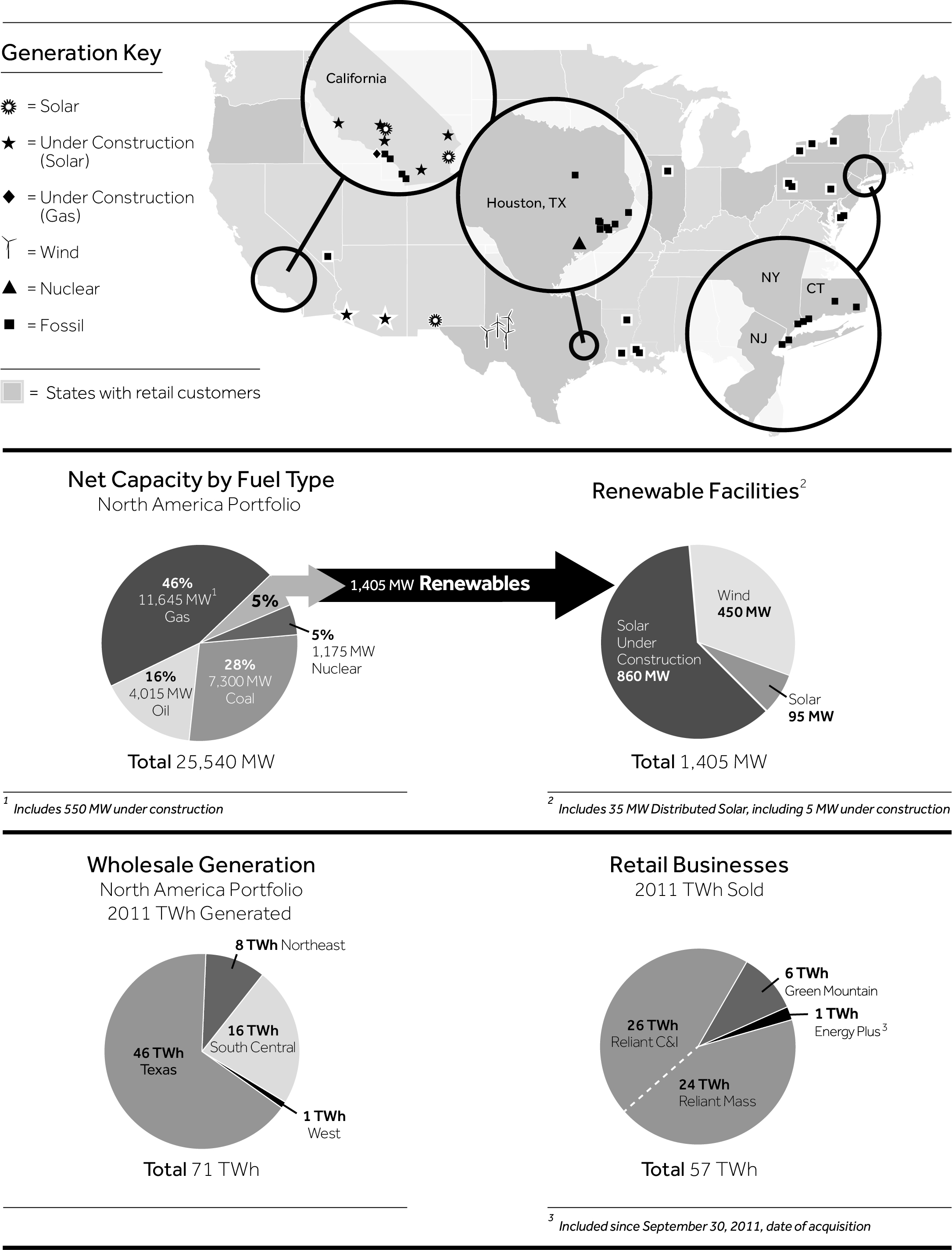

The map below shows the locations of NRG's U.S. power generation facilities as of December 31, 2011, (excluding Distributed Solar), both operating and under construction, as well as the states where NRG operates its Retail Businesses:

The following table summarizes NRG's global generation portfolio as of December 31, 2011, by operating segment, which includes 47 fossil fuel plants, three Utility Scale Solar facilities and four wind farms, as well as Distributed Solar facilities. Also included are one natural gas plant, six Utility Scale Solar facilities and additional Distributed Solar facilities currently under construction. All Utility Scale Solar and Distributed Solar facilities are described in megawatts on an alternating current, or AC, basis:

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Fossil Fuel, Nuclear, and Renewable |

| | | (In MW) |

| Generation Type | | Texas | | Northeast | | South Central | | West | | Other (Thermal) | | Alter-native Energy | | Total Domestic | | Other (Inter-national) | | Total Global |

| Natural gas | | 4,930 |

| | 1,300 |

| | 2,630 |

| | 2,130 |

| | 105 |

| | — |

| | 11,095 |

| | — |

| | 11,095 |

|

| Coal | | 4,190 |

| | 1,600 |

| | 1,495 |

| | — |

| | 15 |

| | — |

| | 7,300 |

| | 1,005 |

| | 8,305 |

|

| Oil | | — |

| | 4,015 |

| | — |

| | — |

| | — |

| | — |

| | 4,015 |

| | | | 4,015 |

|

| Nuclear | | 1,175 |

| | — |

| | — |

| | — |

| | — |

| | — |

| | 1,175 |

| | — |

| | 1,175 |

|

| Wind | | — |

| | — |

| | — |

| | — |

| | — |

| | 450 |

| | 450 |

| | — |

| | 450 |

|

| Utility Scale Solar | | — |

| | — |

| | — |

| | — |

| | — |

| | 65 |

| | 65 |

| | — |

| | 65 |

|

| Distributed Solar | | — |

| | — |

| | — |

| | — |

| | — |

| | 30 |

| | 30 |

| | — |

| | 30 |

|

| Total generation capacity | | 10,295 |

| | 6,915 |

| | 4,125 |

| | 2,130 |

| | 120 |

| | 545 |

| | 24,130 |

| | 1,005 |

| | 25,135 |

|

| | | | | | | | | | | | | | | | | | | |

| Under Construction | | | | | | | | | | | | | | | | | | |

| Natural gas | | — |

| | — |

| | — |

| | 550 |

| | — |

| | — |

| | 550 |

| | — |

| | 550 |

|

Utility Scale Solar (a) | | — |

| | — |

| | — |

| | — |

| | — |

| | 855 |

| | 855 |

| | — |

| | 855 |

|

| Distributed Solar | | — |

| | — |

| | — |

| | — |

| | — |

| | 5 |

| | 5 |

| | — |

| | 5 |

|

| Total under construction | | — |

| | — |

| | — |

| | 550 |

| | — |

| | 860 |

| | 1,410 |

| | — |

| | 1,410 |

|

(a) Includes 142 MWs, representing 49% of Agua Caliente's capacity, which was sold to a partner on January 18, 2012

In addition, the Company's thermal assets provide steam and chilled water capacity of approximately 1,170 megawatts thermal equivalent, or MWt, through its district energy business.

Reliability of future cash flows and portfolio diversification

NRG has hedged a portion of its expected baseload generation capacity with decreasing hedge levels through 2016. NRG also has cooperative load contract obligations in the South Central region expiring over various dates through 2025, which largely hedge the Company's generation in this region. In addition, as of December 31, 2011, the Company had purchased fuel forward under fixed price contracts, with contractually-specified price escalators, for approximately 42% of its expected baseload coal requirement from 2012 to 2016, excluding inventory. The Company has the capacity and intent to enter into additional hedges when market conditions are favorable.

The Company also has the advantage of being able to supply its Retail Businesses with its own generation, which can reduce the need to sell and buy power from other financial institutions and intermediaries, resulting in lower transaction costs and credit exposures. This combination of generation and retail allows for a reduction in actual and contingent collateral, through offsetting transactions and by reducing the need to hedge the retail power supply through third parties.

The generation and retail combination also provides stability in cash flows, as changes in commodity prices generally have offsetting impacts between the two businesses. The offsetting nature of generation and retail in relation to changes in market prices, is an integral part of NRG's goal of providing a reliable source of future cash flow for the Company.

When developing renewable and new, conventional power generation facilities, NRG typically secures long-term Power Purchase Agreements, or PPAs, which insulate the Company from commodity market volatility and provide future cash flow stability. These PPAs are typically contracted with high credit quality local utilities and have durations up to 25 years. Such projects include all of the Company's major Utility Scale Solar projects, in operation and under construction, as well as the 550 MW El Segundo Energy Center, or ESEC, project that is under construction.

Commercial Operations Overview

NRG seeks to maximize profitability and manage cash flow volatility through the marketing, trading and sale of energy, capacity and ancillary services into spot, intermediate and long-term markets and through the active management and trading of emissions allowances, fuel supplies and transportation-related services. The Company's principal objectives are the realization of the full market value of its asset base, including the capture of its extrinsic value, the management and mitigation of commodity market risk and the reduction of cash flow volatility over time.

NRG enters into power sales and hedging arrangements via a wide range of products and contracts, including power purchase agreements, or PPAs, fuel supply contracts, capacity auctions, natural gas derivative instruments and other financial instruments. The PPAs that NRG enters into require the Company to deliver MWh of power to its counterparties. In addition, because changes in power prices in the markets where NRG operates are generally correlated to changes in natural gas prices, NRG uses hedging strategies which may include power and natural gas forward sales contracts to manage the commodity price risk primarily associated with the Company's baseload generation assets. The objective of these hedging strategies is to stabilize the cash flow generated by NRG's portfolio of assets.

Baseload Operations

The following table summarizes NRG's U.S. Baseload capacity and the corresponding revenues and average natural gas prices and positions resulting from Baseload hedge agreements extending beyond February 14, 2012, and through 2016:

|

| | | | | | | | | | | | | | | | | | | | | | |

| | 2012 (a) | | 2013 | | 2014 | | 2015 | | 2016 | | Annual Average for 2012-2016 |

| | (Dollars in millions unless otherwise stated) |

Net Baseload Capacity (MW) (b) | 8,466 |

| | 8,466 |

| | 8,311 |

| | 8,311 |

| | 8,311 |

| | 8,373 |

|

Forecasted Baseload Capacity (MW) (c) | 5,823 |

| | 5,797 |

| | 5,453 |

| | 5,818 |

| | 6,013 |

| | 5,781 |

|

Total Baseload Sales (MW) (d) | 5,761 |

| | 4,756 |

| | 3,098 |

| | 1,407 |

| | 1,399 |

| | 3,284 |

|

Percentage Baseload Capacity Sold Forward (e) | 99 | % | | 82 | % | | 57 | % | | 24 | % | | 23 | % | | 57 | % |

Total Forward Hedged Revenues (f)(g) | $ | 2,236 |

| | $ | 1,909 |

| | $ | 1,103 |

| | NM (h) |

| | NM (h) |

| | |

Weighted Average Hedged Price ($ per MWh) (f) | $ | 52.86 |

| | $ | 45.83 |

| | $ | 40.64 |

| | NM (h) |

| | NM (h) |

| | |

| Average Equivalent Natural Gas Price ($ per MMBtu) | $ | 5.38 |

| | $ | 5.29 |

| | $ | 4.80 |

| | NM (h) |

| | NM (h) |

| | |

| Baseload Gas $1/MMBtu Up Sensitivity | $ | 50 |

| | $ | 145 |

| | $ | 259 |

| | $ | 368 |

| | $ | 387 |

| | |

| Baseload Gas $1/MMBtu Down Sensitivity | $ | — |

| | $ | (46 | ) | | $ | (180 | ) | | $ | (329 | ) | | $ | (350 | ) | | |

| Baseload Heat Rate 1 MMBtu/MWh Up Sensitivity | $ | 16 |

| | $ | 70 |

| | $ | 146 |

| | $ | 171 |

| | $ | 209 |

| | |

| Baseload Heat Rate 1 MMBtu/MWh Down Sensitivity | $ | (1 | ) | | $ | (47 | ) | | $ | (119 | ) | | $ | (157 | ) | | $ | (191 | ) | | |

| |

| (a) | 2012 represents the period March through December. |

| |

| (b) | Nameplate capacity net of station services reflecting unit retirement schedule. |

| |

| (c) | Forecasted generation dispatch output (MWh) based on forward price curve as of February 14, 2012, which is then divided by number of hours in a given year to arrive at MW capacity. The dispatch takes into account planned and unplanned outage assumptions. |

| |

| (d) | Includes amounts under power sales contracts and natural gas hedges. The forward natural gas quantities are reflected in equivalent MWh based on forward market implied heat rate as of February 14, 2012, and then combined with power sales to arrive at equivalent MWh hedged which is then divided by number of hours in given year to arrive at MW hedged. The Baseload Sales include swaps and delta of options sold which is subject to change. For detailed information on the Company's hedging methodology through use of derivative instruments, see discussion in Item 15 - Note 6, Accounting for Derivative Instruments and Hedging Activities, to the Consolidated Financial Statements. Includes inter-segment sales from the Company's Texas wholesale power generation business to the Retail Businesses. |

| |

| (e) | Percentage hedged is based on total baseload sales as described in (d) above divided by the forecasted baseload capacity. |

| |

| (f) | Represents all North American baseload sales, including energy revenue and demand charges. |

| |

| (g) | The South Central region's weighted average hedged prices ranges from $40/MWh-$50/MWh. These prices include demand charges and an estimated energy charge. |

| |

| (h) | NM — Not meaningful, as South Central hedges, which are subject to renegotiation of the transportation component of coal costs, represent a substantial portion of total hedges. |

Retail Operations

NRG's retail operations sell electricity on fixed price or indexed products, and these contracts have terms typically ranging from one month to five years. In 2011, the Company's Retail Businesses sold approximately 57 TWh of load. In any given year, TWh sold can be affected by weather, economic conditions and competition. The wholesale supply is typically purchased as the load is contracted in order to secure profit margin. The wholesale supply is purchased from a combination of NRG's wholesale portfolio and other third parties, depending on the existing hedge position for the NRG wholesale portfolio at the time.

Capacity and Other Contracted Revenue Sources

NRG revenues and cash flows benefit from capacity/demand payments and other contracted revenue sources, originating from either market clearing capacity prices, Resource Adequacy, or RA, contracts, tolling arrangements, PPAs and other long-term contractual arrangements:

| |

| • | Northeast — The Company's largest sources for capacity revenues are derived from market capacity auctions in ISO New England Inc., or ISO-NE, New York Independent System Operator, or NYISO, and PJM Interconnection LLC, or PJM. The region's share of the GenConn plants in Connecticut earns fixed payments for their output under long-term financial contracts with a utility counterparty. |

| |

| • | South Central — NRG earns demand payments from its long-term full-requirements load contracts with ten Louisiana distribution cooperatives. Of the ten contracts, seven expire in 2025 and account for 57% of the cooperative customer contract load, with the remaining three contracts currently set to expire in 2014. The Company has executed agreements to extend the contracts of two of these three cooperatives representing 19% of the cooperative load through 2025, subject to regulatory approval. The remaining counterparty, with a 550 MW load service contract, accounting for 24% of the cooperative total, has elected not to extend their contract when it expires in 2014. Demand payments from the current long term contracts are tied to summer peak demand and provide a mechanism for recovering a portion of costs associated with new or changed environmental laws or regulations. |

| |

| • | West — Many of the region's sites, including gas projects currently under construction, are under tolling agreements. The remaining sites have short-term RA contracts. |

| |

| • | Thermal — Output from the Company's thermal assets is generally sold under long-term contracts or through regulated public utility tariffs. The contracts or tariffs contain capacity or demand elements, mechanisms for fuel recovery and/or the recovery of operating expenses. Thermal output from the Thermal region's Northwind business is sold under long-term agreements with customers in Phoenix, while the PJM assets participate in the PJM capacity markets. |

| |

| • | Texas — The region's sources of capacity and contracted revenues are through capacity option premium agreements and black start agreements with ERCOT. |

| |

| • | International — Generation output from the Company's share of the Schkopau facility in Germany and the Gladstone facility in Australia is sold under long-term contracts, which include capacity payments as well as the reimbursement of certain fixed and variable costs. |

| |

| • | Alternative Energy — Output from alternative energy assets is generally sold through long-term PPAs and renewable incentive agreements. |

Fuel Supply and Transportation

NRG's fuel requirements consist of nuclear fuel and various forms of fossil fuel including coal, natural gas and oil. The prices of fossil fuels are highly volatile. The Company obtains its fossil fuels from multiple suppliers and transportation sources. Although availability is generally not an issue, localized shortages, transportation availability and supplier financial stability issues can and do occur. The preceding factors related to the sources and availability of raw materials are fairly uniform across the Company's business segments.

Coal — The Company is completely hedged for its domestic coal consumption for 2012; less so for subsequent years. Coal hedging is dynamic and is based on forecasted generation and market volatility. As of December 31, 2011, NRG had purchased forward contracts to provide fuel for approximately 42% of the Company's expected requirements from 2012 through 2016, excluding inventory. NRG arranges for the purchase, transportation and delivery of coal for the Company's baseload coal plants via a variety of coal purchase agreements, rail/barge transportation agreements, and rail car lease arrangements. The Company purchased approximately 27 million tons of coal in 2011, of which 98% was Powder River Basin coal and lignite.

The following table shows the percentage of the Company's coal requirements from 2012 through 2016 that have been purchased forward as of December 31, 2011:

|

| | |

| | Percentage of Company's Requirement (a)(b) |

| 2012 | 100 | % |

| 2013 | 52 | % |

| 2014 | 21 | % |

| 2015 | 20 | % |

| 2016 | 17 | % |

| |

| (a) | The hedge percentages reflect the current plan for the Jewett mine, which supplies lignite for NRG's Limestone facility. NRG has the contractual ability to change volumes and may do so in the future. |

| |

| (b) | Does not include coal inventory. |

As of December 31, 2011, NRG had approximately 5,900 privately leased or owned rail cars in the Company's transportation fleet. NRG has entered into rail transportation agreements with varying tenures that provide for substantially all of the Company's rail transportation requirements for the next three years.

Natural Gas — NRG operates a fleet of natural gas plants across all its U.S. wholesale regions, which are primarily comprised of peaking assets that run in times of high power demand. Due to the uncertainty of their dispatch, the fuel needs are managed on a spot basis as the Company does not believe it is prudent to forward purchase natural gas for units, the dispatch of which is highly unpredictable. The Company contracts for natural gas storage services as well as natural gas transportation services to ensure delivery of natural gas when needed.

Nuclear Fuel — South Texas Project's, or STP's, owners satisfy STP's fuel supply requirements by: (i) acquiring uranium concentrates and contracting for conversion of the uranium concentrates into uranium hexafluoride; (ii) contracting for enrichment of uranium hexafluoride; and (iii) contracting for fabrication of nuclear fuel assemblies. Through its proportionate participation in South Texas Project Nuclear Operating Company, or STPNOC, which is the U.S. Nuclear Regulatory Commission, or NRC, -licensed operator of STP and responsible for all aspects of fuel procurement, NRG is party to a number of long-term forward purchase contracts with many of the world's largest suppliers covering STP requirements for uranium and conversion services for the next five years, and with substantial portions of STP's requirements procured thereafter. Similarly, NRG is party to long-term contracts to procure STP's requirements for enrichment services and fuel fabrication for the life of the operating license.

Seasonality and Price Volatility

Annual and quarterly operating results of the Company's wholesale power generation segments can be significantly affected by weather and energy commodity price volatility. Significant other events, such as the demand for natural gas, interruptions in fuel supply infrastructure and relative levels of hydroelectric capacity can increase seasonal fuel and power price volatility. NRG derives a majority of its annual revenues in the months of May through October, when demand for electricity is generally at its highest in the Company's core domestic markets. Further, power price volatility is generally higher in the summer months, traditionally NRG's most important season. The Company's second most important season is the winter months of December through March when volatility and price spikes in underlying delivered fuel prices have tended to drive seasonal electricity prices. The preceding factors related to seasonality and price volatility are fairly uniform across the Company's wholesale generation business segments.

The sale of electric power to retail customers is also a seasonal business with the demand for power generally peaking during the summer months. As a result, net working capital requirements for the Company's retail operations generally increase during summer months along with the higher revenues, and then decline during off-peak months. Weather may impact operating results and extreme weather conditions could materially affect results of operations. The rates charged to retail customers may be impacted by fluctuations in the price of natural gas, transmission constraints, competition, and changes in market heat rates.

Regional Segment Review

Revenues

The following table contains a summary of NRG's operating revenues by segment for the years ended December 31, 2011, 2010, and 2009, as discussed in Item 15 — Note 18, Segment Reporting, to the Consolidated Financial Statements. Refer to that footnote for additional financial information about NRG's business segments and geographic areas, including a profit measure and total assets. In addition, refer to Item 2 — Properties, for information about facilities in each of NRG's business segments.

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Year Ended December 31, 2011 |

| | Energy Revenues | | Capacity Revenues | | Retail Revenues(a) | | Mark-to- Market Activities | | Contract Amor-tization | | Other Revenues(b) | | Total Operating Revenues |

| | (In millions) |

| Retail | $ | — |

| | $ | — |

| | $ | 5,812 |

| | $ | 8 |

| | $ | (178 | ) | | $ | — |

| | $ | 5,642 |

|

| Texas | 2,545 |

| | 28 |

| | — |

| | 173 |

| | — |

| | 86 |

| | 2,832 |

|

| Northeast | 579 |

| | 291 |

| | — |

| | 28 |

| | — |

| | 26 |

| | 924 |

|

| South Central | 548 |

| | 243 |

| | — |

| | (12 | ) | | 20 |

| | 18 |

| | 817 |

|

| West | 31 |

| | 118 |

| | — |

| | (4 | ) | | — |

| | 4 |

| | 149 |

|

| Other Conventional Generation | 58 |

| | 70 |

| | — |

| | — |

| | (1 | ) | | 196 |

| | 323 |

|

| Alternative Energy | 43 |

| | — |

| | — |

| | — |

| | — |

| | 1 |

| | 44 |

|

Corporate and Eliminations (c) | (1,735 | ) | | (14 | ) | | (5 | ) | | 132 |

| | — |

| | (30 | ) | | (1,652 | ) |

| Total | $ | 2,069 |

| | $ | 736 |

| | $ | 5,807 |

| | $ | 325 |

| | $ | (159 | ) | | $ | 301 |

| | $ | 9,079 |

|

| |

| (a) | Retail revenues include Energy Plus revenues of $63 million for the period October 1, 2011, to December 31, 2011. |

| |

| (b) | Primarily consists of revenues generated by the Thermal business, O&M revenues and unrealized trading activities. |

| |

| (c) | Energy revenues include inter-segment sales primarily between Texas and Northeast, and the Retail Businesses. |

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Year Ended December 31, 2010 |

| | Energy Revenues | | Capacity Revenues | | Retail Revenues(d) | | Mark-to- Market Activities | | Contract Amor-tization | | Other Revenues(e) | | Total Operating Revenues |

| | (In millions) |

| Retail | $ | — |

| | $ | — |

| | $ | 5,279 |

| | $ | (1 | ) | | $ | (223 | ) | | $ | — |

| | $ | 5,055 |

|

| Texas | 2,840 |

| | 25 |

| | — |

| | 57 |

| | 7 |

| | 111 |

| | 3,040 |

|

| Northeast | 726 |

| | 396 |

| | — |

| | (144 | ) | | — |

| | 47 |

| | 1,025 |

|

| South Central | 387 |

| | 235 |

| | — |

| | (45 | ) | | 21 |

| | 10 |

| | 608 |

|

| West | 25 |

| | 113 |

| | — |

| | (4 | ) | | — |

| | 4 |

| | 138 |

|

| Other Conventional Generation | 46 |

| | 71 |

| | — |

| | (2 | ) | | — |

| | 186 |

| | 301 |

|

| Alternative Energy | 39 |

| | — |

| | — |

| | — |

| | — |

| | 2 |

| | 41 |

|

Corporate and Eliminations (f) | (1,209 | ) | | (16 | ) | | (2 | ) | | (60 | ) | | — |

| | (72 | ) | | (1,359 | ) |

| Total | $ | 2,854 |

| | $ | 824 |

| | $ | 5,277 |

| | $ | (199 | ) | | $ | (195 | ) | | $ | 288 |

| | $ | 8,849 |

|

| |

| (d) | Retail revenues include Green Mountain Energy revenues of $69 million for the period November 5, 2010, to December 31, 2010. |

| |

| (e) | Primarily consists of revenues generated by the Thermal business, O&M revenues and unrealized trading activities. |

| |

| (f) | Energy revenues include inter-segment sales primarily between Texas and both Reliant Energy and Green Mountain Energy. |

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Year Ended December 31, 2009 |

| | Energy Revenues | | Capacity Revenues | | Retail Revenues(g) | | Mark-to- Market Activities | | Contract Amor-tization | | Other Revenues(h) | | Total Operating Revenues |

| | (In millions) |

| Retail | $ | — |

| | $ | — |

| | $ | 4,440 |

| | $ | — |

| | $ | (258 | ) | | $ | — |

| | $ | 4,182 |

|

| Texas | 2,762 |

| | 193 |

| | — |

| | (17 | ) | | 57 |

| | (57 | ) | | 2,938 |

|

| Northeast | 873 |

| | 407 |

| | — |

| | (70 | ) | | — |

| | (9 | ) | | 1,201 |

|

| South Central | 367 |

| | 269 |

| | — |

| | (17 | ) | | 22 |

| | (60 | ) | | 581 |

|

| West | 26 |

| | 122 |

| | — |

| | — |

| | — |

| | 2 |

| | 150 |

|

| Other Conventional Generation | 52 |

| | 79 |

| | — |

| | (2 | ) | | — |

| | 157 |

| | 286 |

|

| Alternative Energy | 8 |

| | — |

| | — |

| | — |

| | — |

| | — |

| | 8 |

|

Corporate and Eliminations (i) | (362 | ) | | (47 | ) | | — |

| | (1 | ) | | — |

| | 16 |

| | (394 | ) |

| Total | $ | 3,726 |

| | $ | 1,023 |

| | $ | 4,440 |

| | $ | (107 | ) | | $ | (179 | ) | | $ | 49 |

| | $ | 8,952 |

|

| |

| (g) | Retail revenues reflect Reliant Energy revenues for the period May 1, 2009, to December 31, 2009. |

| |

| (h) | Primarily consists of revenues generated by the Thermal business, O&M revenues and unrealized trading activities. |

| |

| (i) | Energy revenues include inter-segment sales between Texas and Reliant Energy. |

Operational Statistics

The following are industry statistics for the Company's fossil and nuclear plants, as defined by the North American Electric Reliability Council, or NERC, and are more fully described below:

Annual Equivalent Availability Factor, or EAF — Measures the percentage of maximum generation available over time as the fraction of net maximum generation that could be provided over a defined period of time after all types of outages and deratings, including seasonal deratings, are taken into account.

Net heat rate — The net heat rate represents the total amount of fuel in British Thermal Unit, or BTU, required to generate one net kWh provided.

Net Capacity Factor — The net amount of electricity that a generating unit produces over a period of time divided by the net amount of electricity it could have produced if it had run at full power over that time period. The net amount of electricity produced is the total amount of electricity generated minus the amount of electricity used during generation.

The tables below present these performance metrics for the Company's U.S. power generation portfolio, including those accounted for through equity method investments, for the years ended December 31, 2011, and 2010:

|

| | | | | | | | | | | | | | |

| | Year Ended December 31, 2011 |

| | | | | | Fossil and Nuclear Plants |

| | Net Owned Capacity (MW) | | Net Generation (MWh) | | Annual Equivalent Availability Factor | | Average Net Heat Rate BTU/kWh | | Net Capacity Factor |

| | (In thousands of MWh) |

Texas | 10,295 |

| | 45,165 |

| | 88.2 | % | | 10,300 |

| | 46.7 | % |

Northeast (a) | 6,915 |

| | 7,376 |

| | 87.2 |

| | 11,100 |

| | 11.1 |

|

| South Central | 4,125 |

| | 16,000 |

| | 89.9 |

| | 9,700 |

| | 43.9 |

|

| West | 2,130 |

| | 1,052 |

| | 88.5 |

| | 12,400 |

| | 5.6 |

|

| Alternative Energy | 545 |

| | 1,262 |

| | | | | | |

|

| | | | | | | | | | | | | | |

| | Year Ended December 31, 2010 |

| | | | | | Fossil and Nuclear Plants |

| | Net Owned Capacity (MW) | | Net Generation (MWh) | | Annual Equivalent Availability Factor | | Average Net Heat Rate BTU/kWh | | Net Capacity Factor |

| | (In thousands of MWh) |

| Texas | 10,295 |

| | 43,722 |

| | 89.6 | % | | 10,300 |

| | 48.1 | % |

Northeast (a) | 6,900 |

| | 9,366 |

| | 88.3 |

| | 11,000 |

| | 14.1 |

|

South Central (b) | 4,125 |

| | 11,168 |

| | 91.3 |

| | 10,500 |

| | 41.9 |

|

| West | 2,130 |

| | 869 |

| | 89.7 |

| | 11,800 |

| | 4.8 |

|

| Alternative Energy | 470 |

| | 1,030 |

| | | | | | |

| |

| (a) | Factor data and heat rate do not include the Keystone and Conemaugh facilities. |

| |

| (b) | Includes Cottonwood for the period November 15, 2010 (acquisition date), to December 31, 2010. |

The generation performance by region for the three years ended December 31, 2011, 2010, and 2009, is shown below:

|

| | | | | | | | |

| | Net Generation |

| | 2011 | | 2010 | | 2009 |

| | (In thousands of MWh) |

| Texas | | | | | |

| Coal | 30,256 |

| | 29,633 |

| | 30,023 |

|

Gas (a) | 5,949 |

| | 4,794 |

| | 5,224 |

|

Nuclear (b) | 8,960 |

| | 9,295 |

| | 9,396 |

|

| Total Texas | 45,165 |

| | 43,722 |

| | 44,643 |

|

| Northeast | | | | | |

| Coal | 5,551 |

| | 7,905 |

| | 7,945 |

|

| Oil | 83 |

| | 114 |

| | 134 |

|

| Gas | 1,742 |

| | 1,347 |

| | 1,141 |

|

| Total Northeast | 7,376 |

| | 9,366 |

| | 9,220 |

|

| South Central | | | | | |

| Coal | 10,865 |

| | 10,778 |

| | 10,235 |

|

Gas (c) | 5,135 |

| | 390 |

| | 163 |

|

| Total South Central | 16,000 |

| | 11,168 |

| | 10,398 |

|

| West | | | | | |

| Gas | 1,052 |

| | 869 |

| | 639 |

|

| Total West | 1,052 |

| | 869 |

| | 639 |

|

| Alternative Energy | | | | | |

| Solar | 79 |

| | 52 |

| | 1 |

|

| Wind | 1,183 |

| | 978 |

| | 350 |

|

| Total Alternative Energy | 1,262 |

| | 1,030 |

| | 351 |

|

| |

| (a) | MWh information reflects the undivided interest in total MWh generated by Cedar Bayou 4 beginning June 2009. |

| |

| (b) | MWh information reflects the Company's undivided interest in total MWh generated by STP. |

| |

| (c) | Includes Cottonwood since November 15, 2010 (acquisition date). |

Market Framework

Texas

NRG's largest wholesale power generation business segment is located in Texas in the physical control areas of the ERCOT market. In addition, Reliant Energy, Green Mountain Energy and Energy Plus activities in Texas are subject to standards and regulations adopted by the PUCT and ERCOT. In the ERCOT market, NRG's Retail Businesses are certified by the PUCT as Retail Electric Providers, or REPs, to contract with end-users to sell electricity and provide other value-enhancing services. In addition, NRG's Retail Businesses contract with transmission and distribution service providers, or TDSPs, to arrange for transportation to the customer.

The ERCOT market is one of the nation's largest and historically fastest growing power markets. For 2011, hourly demand ranged from a low of approximately 22,000 MW to a high of over 68,000 MW with installed generation capacity of approximately 81,000 MW (24,000 MW from coal, lignite and nuclear plants, 48,000 MW from gas, and 9,000 MW from wind). The ERCOT market has limited interconnections compared to other markets in the United States.

In November 2010, the ERCOT board of directors approved a new target equilibrium reserve margin level of 13.75%. The summer reserve margin for 2011 was forecast to be 18.4% in ERCOT's May 2011 Capacity, Demand and Reserve Report, or CDR. The latest CDR, initially published in December 2011, but updated in January 2012, forecasts a reserve margin level of 13.86% for Summer 2012. There are currently plans being implemented by the PUCT to build a significant amount of transmission from west Texas, the Texas panhandle, and continuing across the state to enable wind generation to reach load. The ultimate impact on wholesale dynamics from these plans are unknown. Currently, due to its intermittency and Texas' typically lower wind speeds during the summer months, ERCOT utilizes a capacity factor of 8.7% for the installed wind units when calculating the summer reserve margins.

On December 1, 2010, in compliance with a rule adopted by the PUCT, ERCOT replaced the zonal wholesale market design with a nodal market design that is based on Location Marginal Prices, or LMPs. The new nodal market, operational for all of 2011, includes, among other design changes, a financially binding day-ahead energy and ancillary services market administered by ERCOT. The nodal market design has resulted in improved dispatch of generation resources, more efficient management of transmission congestion, and an improved ability to integrate increased quantities of intermittent resources, such as wind and solar generating resources. Transmission congestion costs in the nodal market are directly assigned to the parties causing the congestion.

In response to projected shortfalls in planning reserves, and real time supply constraints in August 2011, at the direction of the PUCT, the ERCOT Independent System Operator, or ISO, is developing and implementing a number of market rule changes designed to achieve real-time energy pricing more reflective of higher energy value when ISO operating reserves are scarce or constrained - and thus improve forward market pricing signals and provide incentives for resource investment. Energy offer floors for certain ancillary service deployments have been implemented; other proposals under review include administrative pricing adjustments during operational shortages, higher energy pricing for ISO unit commitments for capacity, mitigation of price dampening from minimum energy from on-line resources, and formalizing emergency supply procurement by the ISO in a manner that would not suppress competitive pricing.

Northeast

NRG's second largest asset base is located in the Northeast region of the United States with generation assets within the control areas of the NYISO, ISO-NE, and PJM. Although each of the three NYISOs, also referred to as Regional Transmission Organizations, or RTOs, and their respective energy markets are functionally, administratively and operationally independent, they all follow, to a certain extent, similar market designs. Each ISO optimizes the scheduling and dispatch of power plant capabilities and price offers to meet system energy and reliability needs, and settles financial and physical energy deliveries at LMPs. LMPs reflect the value of energy at the specific location and time it is delivered. The LMP is determined by dispatching generators with the least cost energy supply offers to create the most reliable and economic solution where the energy is needed, subject to reliability and operational constraints on the system or individual generators. The ISO-sponsored LMP energy markets consist of two separate and characteristically distinct settlement time-frames. The first time-frame is a financially firm, day-ahead unit commitment market. The second time-frame is a financially settled, real-time dispatch and balancing market that fluctuates over a 24 hour period. All of these LMP energy markets are subject to stringent market mitigation measures, which can result in lower prices associated with certain generating units that are mitigated because they are deemed to have locational market power. In addition to the energy markets, each of the Northeast ISOs operates a capacity market that provides an additional opportunity for generating and demand response resources to earn revenues to offset their fixed costs that are not recovered in the energy markets, and reserve markets.

NRG's Retail Businesses are active in a number of areas in the Northeast region that have introduced retail competition, which allows our businesses to competitively provide retail power, natural gas and other value-enhancing services to customers. Each retail choice state is responsible for its own retail competition laws and regulations, and the specific operational, licensing, and compliance requirements vary on a state-by-state basis. In general, our Retail Businesses purchase energy from the wholesale market and utilize the existing transmission and distribution system to provide that power to end-use customers. Primary factors in the success of retail competition include how the state provides and prices default service. Incumbent utilities currently provide default service and as a result typically serve a majority of residential customers. However, as customers become more informed about the many benefits of retail choice and states continue to implement retail policies to further improve market dynamics, retail choice is expected to grow. The Company's Retail Businesses are currently licensed in many of the states allowing for retail choice in either the Commercial, industrial and governmental/institutional, or C&I, or Residential markets. Our Retail Businesses are expanding into a number of competitive choice states and offering a plethora of value propositions to customers to meet individual consumer preferences.

South Central

NRG's South Central region operates primarily in the Southeastern Electric Reliability Council/Entergy, or SERC-Entergy, region, which is a bilateral market without an RTO. In the South Central region, all power sales and purchases are consummated bilaterally between individual counterparties. Transacting counterparties are required to procure transmission service from the relevant transmission owners at their Federal Energy Regulatory Commission, or FERC, -approved tariff rates. In this market structure, NRG is able to provide balancing authority services in addition to wholesale power that allows NRG to provide full requirement services to load-serving entities, thus making NRG a competitive alternative to the integrated utilities operating in the region. NRG operates four Balancing Authorities, including the LAGEN Balancing Authority, which encompasses the generating facilities, the Company's cooperative load, and certain municipal entities purchasing long-term firm power from NRG.

West & Solar

The Company operates a fast-growing fleet of Utility Scale Solar and Distributed Solar generating assets within the balancing authority of the California Independent System Operator, or CAISO, as well as neighboring systems, and operates a fleet of natural gas fired facilities located entirely within the CAISO footprint. The CAISO operates day-ahead and real-time locational markets for energy and ancillary services, while managing congestion through nodal price fluctuations. The CAISO system facilitates NRG's sale of power and capacity products at market-based rates, or bilaterally pursuant to tolling arrangements with California's load serving entities, or LSEs. The CAISO, in conjunction with the California Public Utilities Commission, or CPUC, also determines specific capacity requirements for specified local areas. Both CAISO and CPUC rules require LSEs to contract with sufficient generation resources in order to maintain minimum levels of generation within defined local reliability areas.

California's resource mix is being significantly shaped by California's renewable portfolio standard and its greenhouse gas reduction rules. In particular, the state's renewable portfolio standard is 33% by 2020. In part driven by the renewable portfolio standard, several LSEs have entered into long-term PPAs with the Company's California and Arizona-based Utility Scale Solar generating facilities. The Company currently has PPAs for over 890 MW of solar generation assets both within the CAISO balancing authority, and selected markets outside of California, including Arizona. These contracts were approved by the CPUC.

The renewable portfolio standard is also expected to drive the need for generation resources with increased operating flexibility. The need is expected to be particularly acute in constrained areas of the transmission system, such as the San Diego and Los Angeles local reliability areas in which the Company currently operates natural gas-fired generation. The projected retirement of older flexible gas-fired coastal generating units that utilize once-through cooling is also a significant driver of long-term prices in California. Implementing market mechanisms to procure the needed flexibility, and allocating the costs associated with this flexibility, are key CAISO 2012 initiatives. NRG's CAISO natural gas-fired assets are in the Los Angeles or San Diego local reliability areas, and may benefit from local capacity requirements. The Company's El Segundo Energy Center development, which is currently under construction and the subject of a long-term tolling agreement, is an example of the type of flexible natural gas-fired generation resource that the CAISO has suggested will be necessary to maintain system reliability. Longer term, NRG's California portfolio's locational advantage may be impacted by new transmission, which may affect load pocket procurement requirements, and by the state's goal for additional distributed generation, which may also be located within these constrained local areas.

New and On-going Company Initiatives and Development Projects

NRG has a comprehensive set of initiatives and development projects that supports its strategy focused on: (i) excellence in safety and enhanced operating performance; (ii) earning a margin by selling electricity to end-use customers; (iii) development of new renewable and conventional power generation projects and repowering of power generation assets at existing sites; (iv) empowering retail customers with distinctive products and services; (v) engaging in a proactive capital allocation plan; and (vi) pursuing selective acquisitions, joint ventures, divestitures and investment in new energy-related businesses and new technologies in order to enhance the Company's asset mix and combat climate change.

Renewable Development and Acquisitions

As part of its core strategy, NRG has started and intends to continue to invest significantly in the development and acquisition of renewable energy projects, primarily solar. NRG's renewable strategy is intended to capitalize on first mover advantage in a high growth segment of NRG's business, the Company's existing presence in regions with attractive renewable resources and the prevalence, in the Company's core markets, of state-mandated renewable portfolio standards. A brief description of the Company's development efforts with respect to each renewable technology follows.

Solar

NRG has acquired and is developing a number of solar projects utilizing photovoltaic, or PV, as well as solar thermal technologies. The following table is a brief summary of the Company's major Utility Scale Solar projects as of December 31, 2011, that are under construction.

|

| | | | | | |

| NRG Owned Projects | Location | PPA | MW (a) | Expected COD | Status |

| Ivanpah | Ivanpah, CA | 20 - 25 year | 392 |

| 2013 | Under Construction |

Agua Caliente (b) | Yuma County, AZ | 25 year | 290 |

| 2012 - 2014 | Under Construction |

| CVSR | San Luis Obispo, CA | 25 year | 250 |

| 2012 - 2013 | Under Construction |

| Alpine | Lancaster, CA | 20 year | 66 |

| 2012 | Under Construction |

| Borrego | Borrego Springs, CA | 25 year | 26 |

| 2012 | Under Construction |

| Avra Valley | Pima County, AZ | 25 year | 25 |

| 2012 | Under Construction |

(a) Represents total project size.

(b) Includes a 30 MW block, which reached commercial operations on January 18, 2012.

Below is a summary of recent developments related to solar projects:

Ivanpah — On April 5, 2011, NRG acquired a 50.1% stake in the 392 MW Ivanpah Solar Electric Generation System, or Ivanpah, from BrightSource Energy, Inc., or BSE. BSE maintained a 21.8% interest in Ivanpah and the remaining 28.1% was acquired by a wholly-owned subsidiary of Google. Ivanpah is composed of three separate facilities - Ivanpah 1 (126 MW), Ivanpah 2 (133 MW), and Ivanpah 3 (133 MW). Operations for the first phase are scheduled to commence in the first quarter of 2013, with the second and third phases expected to reach commercial operations in the second and third quarters of 2013, respectively. Power generated from Ivanpah will be sold to Southern California Edison and Pacific Gas and Electric, under multiple 20 to 25 year PPAs. Ivanpah has entered into the Ivanpah Credit Agreement with the Federal Financing Bank, or FFB, which is guaranteed by the United States Department of Energy, or U.S. DOE, to borrow up to $1.6 billion to fund the construction of this solar facility. On June 10, 2011, the U.S. Fish and Wildlife Service, or FWS, issued a revised biological opinion allowing the Bureau of Land Management to lift its temporary suspension of activities order with respect to the Ivanpah Project, thus allowing those aspects of the project which were delayed to proceed.

Western Watershed Project filed a motion seeking a temporary restraining order against the Ivanpah Project on June 27, 2011, to shut the project down in order to protect the desert tortoise as well as other animals. It was denied as was plaintiff's request for a preliminary injunction. The plaintiffs appealed this decision on August 20, 2011 to the U.S. Court of Appeals for the Ninth Circuit. On January 27, 2012, the district court heard arguments on the parties' cross motions for summary judgment. The Company awaits the court's rulings.

Agua Caliente — On August 5, 2011, NRG acquired 100% of the 290 MW Agua Caliente solar project, or Agua Caliente, in Yuma, AZ. Operations are scheduled to commence in phases, with the first 30 MW block achieving commercial operations on January 19, 2012, and the final block scheduled to come on line in the first quarter of 2014. Power generated from Agua Caliente will be sold to Pacific Gas and Electric under a 25 year PPA. In connection with the acquisition, Agua Caliente Solar, LLC, a wholly-owned subsidiary of NRG, entered into the Agua Caliente Financing Agreement with the FFB, which is guaranteed by the U.S. DOE, to borrow up to $967 million to fund the construction of this solar facility.

On January 18, 2012, the Company completed the sale of a 49% interest in NRG Solar AC Holdings LLC, the indirect owner of the Agua Caliente project entity, to MidAmerican Energy Holdings Company, or MidAmerican. A portion of the cash consideration received at closing represented 49% of construction costs funded by NRG's equity contributions. MidAmerican will fund its proportionate share of future equity contributions and other credit support for the project.

CVSR — On September 30, 2011, NRG acquired 100% of the 250 MW California Valley Solar Ranch project, or CVSR, in eastern San Luis Obispo County, California. Power generated from CVSR will be sold to Pacific Gas and Electric under a 25 year PPA. In connection with the acquisition, High Plains Ranch II, LLC, a wholly-owned subsidiary of NRG, entered into the CVSR Financing Agreement with the FFB, which is guaranteed by the U.S. DOE, to borrow up to $1.2 billion to fund the construction of this solar facility. The Company continues to work with its partners and the U.S. DOE to satisfy all of the U.S. DOE loan disbursement requirements and funding is anticipated by the end of the first quarter of 2012. Operations are expected to commence in phases beginning in the third quarter of 2012 through the fourth quarter of 2013.

Utility Scale Solar Development Pipeline

NRG has a pipeline of solar development projects that currently total approximately 967 MW in generation capacity as of December 31, 2011. The projects in the pipeline, which were either acquired or internally developed, range in size from 20 MW to 238 MW, and have the potential to become operational between 2012 and 2018.

Distributed Solar

On September 28, 2011, the Company entered into an agreement with Prologis, Inc. to invest in a distributed generation project of up to 733 MW led by Prologis, which includes a U.S. DOE loan guarantee commitment of up to $1.4 billion.

On November 8, 2011, the Company acquired Solar Power Partners, or SPP, a leading developer of commercial and industrial Distributed Solar projects with 21 MW of Distributed Solar projects in operation or under construction. The acquisition combines the financial resources of NRG with the development and deal structuring capability of SPP to facilitate the build out of SPP's development pipeline of more than 300 MW of projects in early to late stage development in California, Hawaii, Arizona, Connecticut, New Mexico, Massachusetts, New Jersey, Ontario and Puerto Rico.

In furtherance of its Distributed Solar strategy, in December 2011, NRG announced that it will install solar power generating systems at MetLife Stadium, home of the New York Football Giants and New York Jets, as well as Gillette Stadium, home of the New England Patriots. In addition, it will install a solar power generating system at Patriot Place, a shopping, dining, and entertainment venue in Foxborough, Massachusetts. All of the Company's Distributed Solar projects are supported by long-term PPAs.

In support of the Company's solar generation strategy, in the fourth quarter of 2011, NRG Solar purchased solar panels in the aggregate amount of approximately $130 million from various equipment vendors, including SunPower Systems SARL, GCL Solar Energy, Inc., Solar Frontier Americas Inc. and Hanwha SolarOne (Qidong) Co., Ltd.. These transactions will provide economic benefits for designated Utility Scale Solar and Distributed Solar projects in the development pipeline as they are constructed and achieve commercial operation.

Retail Acquisition

On September 30, 2011, NRG acquired Energy Plus, a Philadelphia-based retail electricity and natural gas provider with a customer base principally in New York, Connecticut, Pennsylvania, New Jersey, Maryland, and Illinois. Energy Plus also sells electricity to retail customers in Texas and natural gas in Ohio, New York and New Jersey. As of December 31, 2011, Energy Plus had 188,000 customers from its retail and natural gas businesses combined. Through its rewards program offered through the company's exclusive marketing partnerships with leading loyalty program providers, Energy Plus provides NRG with an additional retail platform to expand its customer services and products in multiple retail markets.

Retail Growth Initiatives

Reliant Energy continues to expand its Reliant eSenseTM product offerings. eSense is a suite of technology solutions that use the advanced meter system network (smart meters) that is being rolled out to customers in ERCOT. Through December 31, 2011, Reliant has 525,000 customers using one of these products that provide customers insights, choices and convenience solutions. Reliant's eSense development was accelerated by the U.S. DOE grant received during 2010.

Reliant also continues to expand its Home SolutionsSM business with almost 220,000 customers utilizing home services products including protection products such as surge protection, in home power line protection, HVAC maintenance and energy efficiency products like air filter delivery and solar panel leasing.

Reliant Energy now offers commercial service in Delaware, Illinois, Maryland, New Jersey, Pennsylvania, and Washington, DC.

Electric Vehicle Infrastructure Development

NRG, through its subsidiary eVgo, continues its build out of the Houston and Dallas/Fort Worth Metroplex EV ecosystems, and the Company is on track to be the first company to equip an entire major market with the privately funded infrastructure needed for successful EV adoption and integration. As of December 2011, Houston had the largest single metropolitan-area network of DC fast chargers in the nation. eVgo offers consumers a subscription-based plan that locks in all charging requirements for EVs at a competitive monthly fee. Based upon the successful launch of its subscription-based business model in Texas, eVgo is evaluating a number of other geographical areas for expansion.

In September 2011, NRG, through its subsidiary, eV2g LLC, agreed to partner with the University of Delaware to develop vehicle-to-grid, or V2G, aggregation technology, a new EV infrastructure technology that manages the interaction of plugged-in electric vehicles with the electric grid to provide electricity supply and ancillary services including frequency regulation, demand response and other grid functions.

Post-combustion Carbon Capture Project

On March 9, 2010, NRG was selected by the U.S. DOE to receive up to $167 million, including funding from the American Recovery and Reinvestment Act, to build a 60 MW-equivalent post-combustion carbon capture demonstration unit at NRG's WA Parish plant southwest of Houston, with the intent of using the captured CO2 in enhanced oil recovery operations in oil fields on the Texas Gulf Coast. In the first half of 2011, an application was submitted to and approved by the U.S. DOE to conduct a front-end engineering and design, or FEED, study for an up-to 250 MW sized project, which would allow for larger volumes of CO2 production, leading to increased oil production through enhanced recovery efforts. The FEED study has been completed, and 50% of the costs of this phase were reimbursed by the U.S. DOE. To further the project's enhanced oil recovery operations, on October 3, 2011, Petra Nova LLC, a wholly-owned subsidiary of NRG, acquired a 50% interest in Texas Coastal Ventures, LLC, which owns a 100% working interest in the West Ranch oil field in Jackson County, Texas.

Energy Technology Ventures

On January 27, 2011, NRG entered into a joint venture with GE and ConocoPhillips to invest in venture-stage and growth-stage next generation energy technology companies. The joint venture, Energy Technology Ventures, will invest in and offer commercial collaboration opportunities to emerging energy technology companies in various sectors, including renewable power generation, smart grid, energy efficiency, emission controls, oil, natural gas, coal and biofuels. As of December 31, 2011, NRG has invested $14 million in several growth companies through Energy Technology Ventures as part of its plan to invest up to $100 million in this joint venture over four years.

Conventional Power Development

Projects Under Construction

The Company's El Segundo Energy Center LLC, or ESEC, commenced construction at its El Segundo Power Generating Station in El Segundo, California. Full notice to proceed with construction of the 550 MW fast start, gas turbine combined cycle generating facility was provided to the construction vendor on June 6, 2011. On August 23, 2011, the Company through its wholly owned subsidiary, NRG West Holdings LLC, entered into a credit agreement that established a loan facility with respect to ESEC consisting of a $540 million construction loan, $138 million in letter of credit facilities, and a revolving loan facility which permits working capital loans or letters of credit of up to $10 million. At the end of construction, the loan will convert to a term facility with semi annual amortization of principal and interest and a maturity date of August 31, 2023. The Company expects a commercial operation date of August 1, 2013.

Regulatory Matters

As operators of power plants and participants in wholesale and retail energy markets, certain NRG entities are subject to regulation by various federal and state government agencies. These include the Commodities Futures Trading Commission, or CFTC, FERC, NRC, and PUCT, as well as other public utility commissions in certain states where NRG's generating, thermal, or distributed generation assets are located. In addition, NRG is subject to the market rules, procedures and protocols of the various ISO markets in which it participates. Likewise, certain NRG entities participating in the retail markets are subject to rules and regulations established by the states in which NRG entities are licensed to sell at retail. NRG must also comply with the mandatory reliability requirements imposed by NERC and the regional reliability entities in the regions where the Company operates.

NRG's operations within the ERCOT footprint are not subject to rate regulation by the FERC, as they are deemed to operate solely within the ERCOT market and not in interstate commerce. As discussed below, these operations are subject to regulation by PUCT, as well as to regulation by the NRC with respect to the Company's ownership interest in STP.

CFTC

The CFTC, among other things, has regulatory oversight authority over the trading of electricity and gas commodities, including financial products and derivatives, under the Commodity Exchange Act, or CEA. On July 21, 2010, President Obama signed the Dodd-Frank Wall Street Reform and Consumer Protection Act, or the Dodd-Frank Act, which, among other things, aims to improve transparency and accountability in derivative markets. The Dodd-Frank Act increases the CFTC's regulatory authority on matters related to over-the-counter derivatives, market clearing, position reporting, and capital requirements. The Company expects that in 2012 the CFTC will clarify the scope of the Dodd-Frank Act and issue final rules concerning a central clearing and execution exemption for derivative end-users, margin requirements for transactions, the definition of a “swap” and other issues that will affect the Company's over-the-counter derivatives trading. Because there are many details that remain to be addressed in CFTC rulemaking proceedings, at this time we cannot measure the impact to the Company on its current operations or collateral requirements.

FERC

The FERC, among other things, regulates the transmission and the wholesale sale of electricity in interstate commerce under the authority of the Federal Power Act, or FPA. The transmission of electric energy occurring wholly within ERCOT is not subject to the FERC's jurisdiction under Sections 203 or 205 of the Federal Power Act. Under existing regulations, the FERC determines whether an entity owning a generation facility is an Exempt Wholesale Generator, or EWG, as defined in the Public Utility Holding Company Act of 2005, or PUHCA of 2005. The FERC also determines whether a generation facility meets the ownership and technical criteria of a Qualifying Facility, or QF, under Public Utility Regulatory Policies Act of 1978, or PURPA. Each of NRG's non-ERCOT U.S. generating facilities qualifies as a QF, or the subsidiary owning the facility qualifies as an EWG.

Federal Power Act — The FPA gives the FERC exclusive rate-making jurisdiction over the wholesale sale of electricity and transmission of electricity in interstate commerce. Under the FPA, the FERC, with certain exceptions, regulates the owners of facilities used for the wholesale sale of electricity or transmission in interstate commerce as public utilities, and establishes market rules that are just and reasonable.

Public utilities are required to obtain the FERC's acceptance, pursuant to Section 205 of the FPA, of their rate schedules for the wholesale sale of electricity. All of NRG's non-QF generating and power marketing entities located outside of ERCOT make sales of electricity pursuant to market-based rates, as opposed to traditional cost-of-service regulated rates. Every three years FERC conducts a review of the Company's market based rates and potential market power on a regional basis. In 2011, FERC approved NRG's market power update filing for its Northeast assets.

The FPA also gives the FERC jurisdiction to review certain transactions and numerous other activities of public utilities. Section 203 of the FPA requires the FERC's prior approval for the transfer of control of assets subject to the FERC's jurisdiction. Section 204 of the FPA gives the FERC jurisdiction over a public utility's issuance of securities or assumption of liabilities. However, the FERC typically grants blanket approval for future securities issuances and the assumption of liabilities to entities with market-based rate authority.

In accordance with the Energy Policy Act of 2005, or EPAct of 2005, the FERC has approved the NERC as the national Energy Reliability Organization, or ERO. As the ERO, NERC is responsible for the development and enforcement of mandatory reliability standards for the wholesale electric power system. In addition to complying with NERC requirements, each NRG entity must comply with the requirements of the regional reliability entity for the region in which it is located.

Public Utility Holding Company Act of 2005 — PUHCA of 2005 provides the FERC with certain authority over and access to books and records of public utility holding companies not otherwise exempt by virtue of their ownership of EWGs, QFs, and Foreign Utility Companies, or FUCOs. NRG is a public utility holding company, but because all of the Company's generating facilities have QF status or are owned through EWGs, it is exempt from the accounting, record retention, and reporting requirements of the PUHCA of 2005.

Public Utility Regulatory Policies Act — PURPA was passed in 1978 in large part to promote increased energy efficiency and development of independent power producers. PURPA created QFs to further both goals, and the FERC is primarily charged with administering PURPA as it applies to QFs. Certain QFs are exempt from regulation, either in whole or in part, under the FPA as public utilities.

NRC

The NRC is authorized under the Atomic Energy Act of 1954, as amended, or the AEA, among other things, to grant licenses for, and regulate the operation of, commercial nuclear power reactors. As a holder of an ownership interest in STP, NRG is an NRC licensee and is subject to NRC regulation. The NRC license gives the Company the right to only possess an interest in STP but not to operate it. Operating authority under the NRC operating license for STP is held by STPNOC. NRC regulation involves licensing, inspection, enforcement, testing, evaluation, and modification of all aspects of plant design and operation including the right to order a plant shutdown, technical and financial qualifications, and decommissioning funding assurance in light of NRC safety and environmental requirements. In addition, NRC's written approval is required prior to a licensee transferring an interest in its license, either directly or indirectly. As a possession-only licensee, i.e., non-operating co-owner, the NRC's regulation of NRG is primarily focused on the Company's ability to meet its financial and decommissioning funding assurance obligations. In connection with the NRC license, the Company and its subsidiaries have a support agreement to provide up to $120 million to support operations at STP.

Decommissioning Trusts — Upon expiration of the operation licenses for the two generating units at STP, currently scheduled for 2027 and 2028, the co-owners of STP are required under federal law to decontaminate and decommission the STP facility. Under NRC regulations, a power reactor licensee generally must pre-fund the full amount of its estimated NRC decommissioning obligations unless it is a rate-regulated utility, or a state or municipal entity that sets its own rates, or has the benefit of a state-mandated non-bypassable charge available to periodically fund the decommissioning trust such that the trust, plus allowable earnings, will equal the estimated decommissioning obligations by the time the decommissioning is expected to begin.