UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number 811-07619

Nuveen Investment Trust

(Exact name of registrant as specified in charter)

Nuveen Investments

333 West Wacker Drive, Chicago, IL 60606

(Address of principal executive offices) (Zip code)

Kevin J. McCarthy

Nuveen Investments

333 West Wacker Drive

Chicago, IL 60606

(Name and address of agent for service)

Registrant’s telephone number, including area code: (312) 917-7700

Date of fiscal year end: June 30

Date of reporting period: June 30, 2014

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policy making roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. ss.3507.

ITEM 1. REPORTS TO STOCKHOLDERS.

| | |

| | |  |

| Mutual Funds | |

| | | | | | |

| | | | | | | Annual Report June 30, 2014 |

| | | | | | | | | | | | | | | | |

| | | | | | | Share Class / Ticker Symbol |

| | | Fund Name | | | | Class A | | Class C | | Class R3 | | Class R6 | | Class I | | |

|

| | Nuveen NWQ Global Equity Fund | | | | NGEAX | | NGECX | | — | | — | | NGEIX | | |

| | Nuveen NWQ Global Equity Income Fund

(formerly Nuveen NWQ Equity Income Fund) | | | | NQGAX | | NQGCX | | — | | — | | NQGIX | | |

| | Nuveen NWQ Multi-Cap Value Fund | | | | NQVAX | | NQVCX | | NMCTX | | — | | NQVRX | | |

| | Nuveen NWQ Large-Cap Value Fund | | | | NQCAX | | NQCCX | | NQCQX | | — | | NQCRX | | |

| | Nuveen NWQ Small/Mid-Cap Value Fund | | | | NSMAX | | NSMCX | | NWQRX | | — | | NSMRX | | |

| | Nuveen NWQ Small-Cap Value Fund | | | | NSCAX | | NSCCX | | NSCQX | | NSCFX | | NSCRX | | |

| | Nuveen Tradewinds Value Opportunities Fund | | | | NVOAX | | NVOCX | | NTVTX | | — | | NVORX | | |

| | | | | | | | | | | | |

| | | | | | |

| | | | |

| | | | | | | | |

| | |

| | | | |

| | NUVEEN INVESTMENTS TO BE ACQUIRED BY TIAA-CREF | | |

| | |

| | On April 14, 2014, TIAA-CREF announced that it had entered into an agreement to acquire Nuveen Investments, the parent company of your fund’s investment adviser, Nuveen Fund Advisors, LLC (“NFAL”) and the Nuveen affiliates that act as sub-advisers to the majority of the Nuveen Funds. TIAA-CREF is a national financial services organization with approximately $569 billion in assets under management (as of March 31, 2014) and is a leading provider of retirement services in the academic, research, medical and cultural fields. Nuveen anticipates that it will operate as a separate subsidiary within TIAA-CREF’s asset management business, and that its current leadership and key investment teams will stay in place. Your fund investment will not change as a result of Nuveen’s change of ownership. You will still own the same fund shares and the underlying value of those shares will not change as a result of the transaction. NFAL and your fund’s sub-adviser(s) will continue to manage your fund according to the same objectives and policies as before, and we do not anticipate any significant changes to your fund’s operations. Under the securities laws, the consummation of the transaction will result in the automatic termination of the investment management agreements between the funds and NFAL and the investment sub-advisory agreements between NFAL and each fund’s sub-adviser(s). The new agreements have been approved by shareholders of Nuveen NWQ Global Equity Fund, Nuveen NWQ Global Equity Income Fund and Nuveen NWQ Multi-Cap Value Fund. Shareholder meetings for Nuveen NWQ Large-Cap Value Fund, Nuveen NWQ Small/Mid-Cap Value Fund, Nuveen NWQ Small-Cap Value Fund and Nuveen Tradewinds Value Opportunities Fund have been adjourned until Friday, September 19, 2014, with respect to approval of the new investment management and investment sub-advisory agreements (as well as the approval of certain fundamental investment policy changes) to permit the continued solicitation of additional votes. The adjourned meetings for these funds will be held at 2:30 p.m., Central time, on Friday, September 19, 2014 at the offices of Nuveen Investments, 333 West Wacker Drive, Chicago, Illinois 60606. Nuveen’s transaction with TIAA-CREF is currently expected to close early in the fourth quarter of 2014, but remains subject to other customary closing conditions. | | |

| | | | |

| | | | | | Must be preceded by or accompanied by a prospectus. NOT FDIC INSURED MAY LOSE VALUE

NO BANK GUARANTEE | | |

| | | | | | | | | | |

| | | | | | | | | | | | | |

Table

of Contents

Chairman’s Letter

to Shareholders

Dear Shareholders,

After significant growth in 2013, domestic and international equity markets have been less com-pelling during the first part of 2014. Concerns about deflation, political uncertainty in many places and the potential for more fragile economies to impact other countries have produced uncertainty in the markets.

Europe is beginning to emerge slowly from the recession in mid-2013, with improved GDP and employment trends in some countries. However, Japan’s deflationary headwinds have resur-faced; and China shows signs of slowing from credit distress combined with declines in manufacturing and exports. Most recently, tensions between Russia and Ukraine may continue to hold back stocks and support government bonds in the near term.

Despite these headwinds, there are some encouraging signs of forward momentum in the mar-kets. In the U.S., the news is more positive with financial risks slowly receding, positive GDP trends, downward trending unemployment and stronger household finances and corporate spending.

It is in such changeable markets that professional investment management is most important. Investment teams who have experienced challenging markets in the past understand how their asset class can behave in rapidly changing times. Remaining committed to their investment disciplines during these times is a critical component to achieving long-term success. In fact, many strong investment track records are established during challenging periods because experienced investment teams understand that volatile markets place a premium on companies and investment ideas that can weather the short-term volatility. By maintaining appropriate time horizons, diversification and relying on practiced investment teams, we believe that investors can achieve their long-term investment objectives.

As always, I encourage you to communicate with your financial consultant if you have any ques-tions about your investment in a Nuveen Fund. On behalf of the other members of the Nuveen Fund Board, we look forward to continuing to earn your trust in the months and years ahead.

Sincerely,

William J. Schneider

Chairman of the Board

August 25, 2014

Portfolio Managers’

Comments

Nuveen NWQ Global Equity Fund

Nuveen NWQ Global Equity Income Fund

Nuveen NWQ Multi-Cap Value Fund

Nuveen NWQ Large-Cap Value Fund

Nuveen NWQ Small/Mid-Cap Value Fund

Nuveen NWQ Small-Cap Value Fund

Nuveen Tradewinds Value Opportunities Fund

The Nuveen NWQ Global Equity Fund, Nuveen NWQ Global Equity Income Fund, Nuveen NWQ Multi-Cap Value Fund, Nuveen NWQ Large-Cap Value Fund, Nuveen NWQ Small/Mid-Cap Value Fund and Nuveen NWQ Small-Cap Value Fund feature portfolio management by NWQ Investment Management Company, LLC (NWQ), an affiliate of Nuveen Investments, Inc. Jon Bosse is the Chief Investment Officer of NWQ and manages the Nuveen NWQ Multi-Cap Value and Large-Cap Value Funds. Phyllis Thomas, CFA, manages the Nuveen NWQ Small/Mid-Cap Value and Small-Cap Value Funds. Gregg Tenser, CFA, manages the Nuveen NWQ Global Equity Fund and James Stephenson, CFA, manages the Nuveen NWQ Global Equity Income Fund.

On December 13, 2013, the Fund’s name changed from Nuveen NWQ Equity Income Fund to Nuveen NWQ Global Equity Income Fund and James T. Stephenson, CFA, became the sole portfolio manager of the Fund. The Principal Investment Strategy was changed to state that the Fund may invest in securities of issuers located anywhere in the world. Under normal market conditions, the Fund will invest at least 40% of its net assets in non-U.S. securities and will invest in securities of at least three different countries (one of which may be the United States). The Fund may invest up to 20% of its net assets in securities of companies located in emerging markets.

The Nuveen Tradewinds Value Opportunities Fund features portfolio management by Tradewinds Global Investors, LLC (Tradewinds), an affiliate of Nuveen Investments, Inc. Joann Barry, CFA and F. Rowe Michels, CFA serve as portfolio managers of the Fund.

Here they discuss the U.S. economy and equity markets, their management strategies and the performance of the Funds for the twelve-month reporting period ended June 30, 2014.

What factors affected the U.S. economy and equity markets during the twelve-month reporting period ended June 30, 2014?

During this reporting period, the U.S. economy continued its bumpy advance toward recovery from recession. The Federal Reserve (Fed) maintained efforts to bolster growth and promote progress toward its mandates of maximum employment and price stability by holding the benchmark fed funds rate at the record low level of zero to 0.25% that it established in December 2008. Based on its view that the underlying strength in the broader economy was enough to support ongoing improvement in the labor market, the Fed began to reduce or taper, its monthly asset purchases in $10 billion increments over the course of five consecutive meetings (December 2013 through June 2014). As of July 2014, the Fed’s monthly purchases comprise $15 billion in mortgage-backed securities (versus the original $40 billion per month) and $20 billion in longer-term Treasury securities (versus $45 billion). Following its June 2014 meeting (subsequent to the close of this reporting period), the Fed reiterated that it would continue to look at a wide range of factors, including labor market conditions, indicators of inflationary pressures and readings on financial developments, in determining future actions, saying that it would likely maintain the current target range for the fed funds rate for a considerable time after the asset purchase program ends, especially if projected inflation continues to run below the Fed’s 2% longer-run goal.

Certain statements in this report are forward-looking statements. Discussions of specific investments are for illustration only and are not intended as recommendations of individual investments. The forward-looking statements and other views expressed herein are those of the portfolio managers as of the date of this report. Actual future results or occurrences may differ significantly from those anticipated in any forward-looking statements and the views expressed herein are subject to change at any time, due to numerous market and other factors. The Funds disclaim any obligation to update publicly or revise any forward-looking statements or views expressed herein.

Portfolio Managers’ Comments (continued)

In the second quarter of 2014, the U.S. economy, as measured by the U.S. gross domestic product (GDP), grew 4%. In the previous quarter, the GDP contracted at an annualized rate of 2.1%, the economy’s weakest quarter since the recession officially ended in June 2009. The decline during this period was attributed in part to the severe weather of the past winter, which deterred consumer spending and disrupted construction, production and shipping. The Consumer Price Index (CPI) rose 2.1% year-over-year as of June 2014, while the core CPI (which excludes food and energy) increased 1.9% during the same period, in line with the Fed’s unofficial longer-term objective of 2% for this inflation measure. As of June 2014, the national unemployment rate was 6.2%, down from the 7.3% reported in July 2013, but still higher than levels that would provide consistent support for optimal GDP growth. The 113,000 net new jobs added in May 2014 meant that the economy finally had regained all of the 8.7 million jobs lost during the recent recession. The housing market continued to post gains, as the average home price in the S&P/Case-Shiller Index of 20 major metropolitan areas rose 9.3% for the twelve months ended May 2014 (most recent data available at the time this report was prepared).

As this reporting period began, several events touched off increased volatility in the financial markets. First, in May 2013, then-Fed Chairman Ben Bernanke’s remarks about tapering the Fed’s asset purchase program triggered widespread uncertainty about the next step for the Fed’s quantitative easing program and its impact on the markets as well as the overall economy. This uncertainty was compounded by headline credit stories involving Detroit’s bankruptcy filing in July 2013, the largest municipal bankruptcy in history and the disappointing news that continued to come out of Puerto Rico, where a struggling economy and years of deficit spending and borrowing led to multiple downgrades on the commonwealth’s bonds. Meanwhile, political debate over federal spending continued, as Congress failed to reach an agreement on the federal budget for Fiscal 2014. On October 1, 2013, the start date for Fiscal 2014, the federal government shut down for 16 days until an interim appropriations bill was signed into law. (Consensus on a $1.1 trillion federal spending bill was ultimately reached in January 2014, and in February 2014, members of Congress agreed to suspend the $16.7 trillion debt ceiling until March 2015).

The U.S. equity markets reached new highs as investors rewarded decent corporate earnings against moderate economic growth, geopolitical concerns, including Russia’s recent annexation of Crimea and continued unrest in the Middle East. The prospect of acquisitions by companies holding a record amount of cash as well as private equity firms also supported stock prices. Part of this activity is being driven by the desire of U.S. companies to reincorporate overseas for tax reasons (corporate inversion) in order to avoid double taxation when repatriating foreign earnings. All sectors of the Russell 1000® Value Index posted double digit gains, led by technology, materials & processing, and producer durables. Emerging markets (EM) were also pressured by concerns of slower growth and capital flight brought on by the prospect for higher long term U.S. interest rates as the Federal Reserve reduces its asset purchases. The Fed ended its tapering speculation in January when it began reducing its pace of monthly purchases of Treasury and mortgage-backed securities (MBS) securities. From an investment standpoint, we continue to be encouraged by the increase in activism and return of capital that is helping to drive returns and create value.

How did the Funds perform during the twelve-month reporting period ended June 30, 2014?

The tables in the Fund Performance and Expense Ratios section of this report provide Class A Share total returns for the Funds for the one-year, five-year, ten-year and/or since inception periods ended June 30, 2014. Each Funds’ Class A Share total returns at net asset value (NAV) are compared with the performance of their corresponding market index and Lipper classification average. A more detailed account of each Fund’s performance is provided later in this report.

What strategies were used to manage the Funds during the twelve-month reporting period ended June 30, 2014 and how did these strategies influence performance?

Nuveen NWQ Global Equity Fund

The Nuveen Global Equity Fund’s Class A Shares at NAV underperformed the MSCI World Index and the comparative Lipper classification during the abbreviated reporting period since its inception on April 1, 2014 through June 30, 2014.

The second quarter 2014 was particularly trying, but not as a result of any one particular stock, rather, a more general malaise in our European holdings detracted from performance. As bottom-up investors, we do not view the world in terms of overweights and underweights, but it is nevertheless mathematically factual that we are overweight continental Europe. The European Central Bank

cut rates to try to stave off deflation, we saw general sluggishness in many of our European holdings. The conflict in the Ukraine also served as a headwind for some of our German companies, particularly those that had exposure in the area.

Several positions contributed to our positive absolute return during the abbreviated reporting period. Dublin-based Jazz Pharmaceuticals, Inc. was a new position in the quarter which we purchased after a rare earnings miss caused the stock to fall 30% below its first quarter 2014 highs. The company has a significant degree of pricing power with its leading product Xyrem (a drug for narcolepsy), sufficient patent protection to keep generics at bay and balance sheet flexibility to bring other drugs in house to further extend its pipeline. In addition to a top flight management team, given its tax-advantaged structure, Jazz has also become an enticing target for a larger U.S. drug company looking for an inversion opportunity.

Japan Tobacco Inc. (JT) appreciated given solid fundamentals, an attractive valuation and the potential for higher capital return to shareholders. Fundamentally, the company is benefiting from higher prices in Russia as that market shifts from low priced products to medium and premium priced brands, areas in which JT is well positioned. There is also the potential for more aggressive price hikes in Japan, as cigarette prices are low relative to other developed countries. More recently, the company acquired British e-cigarette maker, Zandera Ltd. This has lessened concerns of a future decline in JT’s growth given expansion of the electronic cigarette market.

Lastly, Canadian Natural Resources Limited, a name that has remained inexpensive for a number of years, finally showed some signs of closing the gap with our fair value estimate for the company. While the company has invested significant capital over the past few years to ramp up its Horizon oil sands project, we are finally seeing free cash flow projections rising and the company is enjoying a re-rating by the market as we get closer to the immense wave of free cash flow expected in the latter half of the decade as the Horizon expansion phase is completed. Further patience will be required, but trends are finally going in our favor.

Several holdings contributed to the Fund’s underperformance. Management software provider, CA Technologies, Inc., underperformed given concerns of a potential pause in the company’s earnings growth. Fiscal 2015 represents a transition year for the company and management is forecasting a slight decrease in revenues and flat operating margins.

Ericsson, a Swedish multi-national provider of communication technology, declined after the company reported mixed first quarter results that showed sales and earnings below consensus, but better margins as management begins to focus on improving profitability. The company shed 3,000 employees during the reporting period. We believe that 2014 will be a transition year as U.S. projects roll off and capex/infrastructure spending by the telecom companies in China and Europe begins to ramp up. We remain quite enthused, however, as a more stable pricing environment should help margins, while further growth in Europe and Asia will surely keep Ericsson’s top line growing.

Lastly, Swiss bank UBS AG weakened after the company reported weak operating trends relative to peers, and concerns regarding the potential cost of regulatory litigation (dark pools, Libor manipulation). We continue to favor UBS as the company offers leverage to potentially stronger markets through faster deleveraging, improved capital markets revenues, and higher private banking activity. We believe the company’s stronger capital leaves it with a sufficient buffer to meet stricter regulation and litigation constraints, and there is a potential for a greater capital return.

During this invest up period, Bio-Rad Laboratories, Inc., a leading producer of specialty chemicals and instruments for the life science research and clinical diagnostic markets, was added to the Fund. Several developments have caused the company’s profitability to contract meaningfully. We believe the company is working to address its margins with new products, acquired technology, and investments in ERP software. As the company improves its execution, we believe there is the potential for earnings power to exist over the next several quarters. Additionally, increases in academic/government spending should provide a tailwind for revenue growth in the second half of 2014 and into 2015.

INPEX Corporation is Japan’s largest oil and gas exploration & production company with midlevel global production and reserves. Most of the company’s current profits come from the Mahakam block in Indonesia, but the company is also developing a project in Australia called Ichthys for supply to Japan. Steady progress towards the completion of Ichthys should be a catalyst for an upward revaluation for the shares. Demand for liquid natural gas has increased in Japan following the Great Eastern Japan Earthquake in 2011 given the decrease in nuclear power generation. Our analysis suggests that Inpex’s reserves are very inexpensive both on an absolute basis, as well as compared to its peers.

Portfolio Managers’ Comments (continued)

Orkla ASA is a Norwegian consumer and industrial conglomerate that is divesting its non-core assets to focus on its branded packaged foods business. Post transformation, we believe that the remaining brand business could become an attractive takeover target. The company has been marred by setbacks with a key divestiture, difficulties closing a sizable merger with a competing Norwegian foods company, and soft performance across its core food portfolio. We believe these issues are transitory and that the stock represents a particularly compelling risk/reward at current levels.

We also sold several positions including Applied Materials, Inc., which was sold as the stock had rebounded up to our target valuation, and we feared results could be vulnerable to disappointing semiconductor capital equipment orders. Additionally, we sold out of Vodafone Group PLC as the last of our catalysts had played out.

Nuveen NWQ Global Equity Income Fund (formerly Nuveen NWQ Equity Income Fund)

The Nuveen Global Equity Income Fund’s Class A Shares at NAV outperformed its comparative Lipper Category but underperformed the MSCI World Index during the twelve-month ending June 30, 2014.

The Fund is designed to provide high current income and long-term capital appreciation. Under normal market conditions, the Fund invests at least 80% of the sum of its net assets and the amount of any borrowings for investment purposes in equity securities. The Fund may invest in securities of issuers located anywhere in the world. Under normal market conditions, the Fund invests at least 40% of its net assets in non-U.S. securities and invests in securities of companies representing at least three different countries (one of which may be the United States). The Fund may invest up to 20% of its net assets in securities of companies located in emerging markets. The Fund may invest in equity securities issued by companies of any market capitalization, including small- and mid-capitalization companies. The Fund may utilize derivatives, including currency options, currency futures and options on such futures, and currency forwards. The Fund may use these derivatives to manage market or business risk, enhance the Fund’s return, or hedge against adverse movements in currency exchange rates.

Our goals are to provide a high total return to our investors with a lower amount of risk. Managing an equity income based strategy can accomplish this through both capital appreciation and a higher than average proportion of return through dividends. Often these types of stocks have carried less risk, although history is fraught with episodes where this was not the case. That is why we feel it is more important than ever to approach this strategy as a value investor, which has been the core of NWQ’s philosophy since 1982.

With interest rates at low levels, investors continued to look towards many traditional and non-traditional means to achieve yield. Valuations in many industries traditionally favored by equity income investors, such as utilities, real estate investment trusts (REITs) and telecom services are at or near historic highs. We found better valuations globally in other industries such as financials, media, technology and automotive that have the capacity for increasing capital return to shareholders. This may not only lead to increasing returns in the form of dividends, but can also lead to a meaningful re-valuation of the company as investors gain confidence in their ability to allocate capital properly.

We found Europe to be an attractive market both in terms of yield and valuations. Europe and the U.K. have a broad set of industries where the companies exhibit an attractive dividend yield. The broader markets yield over 3% and exhibit high yields across many sectors. This contrasts to the U.S. and Japan where market yields are closer to 2% and the opportunity set for higher yielding companies is much narrower. Valuations and margins in Europe are also well below prior pre-crisis level as the recovery in Europe is behind other parts of the globe such as the U.S. This offers an additional opportunity to participate in a recovery that is still emerging and not priced into the market.

During the reporting period, we continued to find better values and more upside for capital return in the financial and technology spaces. Many financials’ balance sheets are over capitalized with room for share repurchases and dividend increases as the regulatory cloud surrounding them continues to lift. Technology companies with sub-optimal capital structures and too much cash will receive even more pressure over time to return that capital to shareholders. We think both sectors will increase their capital returns, which will in turn allow for a re-rating of the companies. This is where we saw the most opportunity during the reporting period.

Finally, we continued to employ a bottom up approach. We can find interesting names in a variety of industries. Rather than look for the highest dividend paying stocks, we look to invest in the best companies at an attractive valuation with a good risk/reward profile

and catalysts that can change the valuation of the company. Companies that are showing renewed capital discipline can often demonstrate this through a return of capital. Increased dividend payments, as well as share repurchases, become the catalyst for re-rating when it comes from companies that previously were misallocating capital. Often this comes from a management change, for example when the CFO becomes the CEO or perhaps when an outside force such as an activist investor applies the pressure needed to affect change. We are seeing an increasing amount of these types of opportunities across multiple industries.

The Fund’s performance reflects strong gains in several holdings for the year, although returns did underperform the MSCI World Index for the reporting period. The consumer discretionary, energy and utility sectors had the largest positive contribution on absolute and relative performance versus the benchmark as the catalyst for a number of our positions became more apparent. These gains were partially offset by relative underperformance in the financial, health care and technology sectors. Interpublic Group of Companies, Inc. and Vodafone Group PLC were among two of our top investments, while we experienced the largest losses in METRO AG and Royal Philips NV. Geographically, our top performing countries were Japan and Canada, while investments in the U.S., Netherlands and Germany lagged.

Several individual positions contributed positively to performance. AstraZeneca PLC appreciated as the company received a takeout offer from Pfizer, which was rejected based on valuation. Under U.K. takeover laws, Pfizer can submit another bid after six months. In addition to the financial engineering benefits (corporate tax rate inversion), AstraZeneca has a broad drug pipeline and several long term opportunities that Pfizer wants. Astra’s rejection appears to reflect management’s confidence in its own framework for growth for the company.

Daimler AG benefited from improving operational performance and a cycle recovery in many of its key end markets. The company is well positioned to benefit from a recovery in the global truck cycle, particularly in Europe and North America. The company maintains a consistent dividend policy, aiming to pay out on average 40% of its underlying earnings annually to shareholders.

Teva Pharmaceutical Industries has embarked on an aggressive $2 billion cost cutting plan that should help maintain strong profitability in the face of the upcoming patent expiration of its multiple sclerosis drug, Copaxone. Teva received FDA approval in late January for a 3 day/week dosing for Copaxone, and is actively working to shift its patients to the new formulation. We increased our position prior to the stock’s explosive rally, making it one of the larger investments in the Fund. We did modestly trim the position after its substantial gain.

Several positions detracted from performance. We purchased CenturyLink Inc. in August 2013 following a decline in the shares after the company lowered its earnings guidance. The shares declined further in January when management preemptively reduced its dividend to maintain financial flexibility when it becomes a full cash tax payer in 2015. CenturyLink’s business is steadily improving as the company slowly changes its business mix and proceeds with a substantial cost cutting program. We eliminated the position after the stock had rebounded from its lows for more compelling investment opportunities.

Copa Holdings, S.A. is a leading Latin American airline with a strong balance sheet and one of the most modern fleets in the industry. The company’s primary hub in Panama is ideally positioned between North and South America. The shares sold off on concerns that Venezuela, a strategically important market for Copa, would devalue its currency and place restrictions on the repatriation of cash out of the country. The company has $300 million in cash trapped on its balance sheet. Furthermore, Copa had to reduce service in the country and has placed limits on bolivar-denominated ticket sales. Although we believe that Copa’s robust growth and high profitability remain intact despite these headwinds, we eliminated the position due to risk/reward concerns.

Mosaic Company declined sharply last July on news that low cost producer, Uralkali, had splintered the Eastern European potash cartel, bringing instability to the potash market and uncertainty on where prices would ultimately bottom. Mosaic’s stock was able to work its way higher from its lows on anticipation that the Russians & Belarusians would be able to put the cartel back together. However, we felt that with capacity still coming on and little evidence of an increase in demand, higher potash prices would be tough to come by. Therefore, we used a brief rally in the stock that was driven by anticipation of a Chinese import contract being resolved to exit our position.

Portfolio Managers’ Comments (continued)

We added several new positions to the Fund during the reporting period. Agrium Inc. is a low cost producer that generates strong earnings even when nitrogen markets trade down to the low point on the cost curve. At the time of purchase, the company’s valuation reflected near term issues that we believed would be solved this year, providing limited downside on the stock price. Deutsche Borse Group is engaged in the operation of the German stock exchange. We purchased the stock as we believe there are opportunities to bring off-market derivative trading activity on to the exchanges, which could be a growth driver for the company. Deutsche Borse is also poised to benefit from a consolidation of global exchanges, as well as the potential European economic recovery. ProSiebenSat1 Media is a German TV broadcaster with one of the best strategies for structural growth in European media. The company is also poised to benefit from a recovery in the German economy, which would directly feed through to higher advertising rates. ProSieben’s revenue growth is being driven by higher distribution (carriage) fees as the penetration of high definition channels increases. Expansion of the video on demand (VOD) market where the company owns key properties such as Maxdome and myvideo.de is also a positive. ProSieben’s dividend yield is among the highest in the media sector, and the company could re-lever its balance sheet to return capital to shareholders.

Several holdings were eliminated or trimmed during the reporting period based on valuation, deteriorating fundamentals or to raise cash as we rotated into new investment opportunities. Applied Materials, Inc. was sold as the shares approached our target price following strong performance. We also feared the stock could be vulnerable to disappointing semiconductor capital equipment orders in the near term. We moved the proceeds into other semiconductor names including Analog Devices and Microchip Technology. Barrick Gold Corporation was sold on reports that management was in discussions for a merger with Newmont Mining. We viewed this action as contrary to the company’s strategy of shrinking to become more focused and profitable. Metro AG was eliminated due to our concerns surrounding the possible negative effects of the ongoing Ukraine unrest on the firm’s earnings, profitability and restructuring capability.

We also wrote covered call options on individual stocks, while investing in those same stocks, to enhance returns while foregoing some upside potential. This activity made a small positive contribution to the performance during the period.

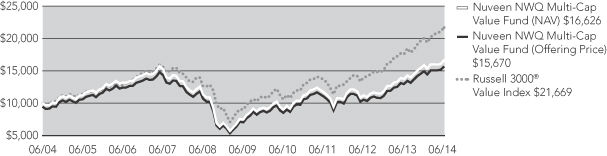

Nuveen NWQ Multi-Cap Value Fund

Class A Shares at NAV for the Nuveen NWQ Multi-Cap Value Fund underperformed the Russell 3000® Value Index and its Lipper classification average for the twelve-month reporting period ended June 30, 2014.

The Fund seeks long-term capital appreciation by investing in equity securities of companies with large, medium and small market capitalizations that are selected on an opportunistic basis. Generally, the Fund’s manager looks for undervalued companies where catalysts exist that may help unlock value or improve profitability. Such catalysts can be new management, improving fundamentals, renewed management focus, industry consolidation or company restructuring.

The Fund generated a strong gain during the reporting period, although behind the Russell 3000® Value Index. The Fund’s performance reflects gains across several holdings and sectors with the consumer discretionary, staples and utility sectors outperforming. Investments in the energy, health care, materials and technology sectors also generated gains, although lagged the benchmark.

Several positions contributed to performance. Canadian Natural Resources Limited appreciated given lower heavy oil differentials, the company’s accretive purchase of Canadian assets from Encana and the continued expansion of alternatives to transport crude from Canada. We trimmed our position in Canadian Natural in favor of adding to Occidental Petroleum Corporation were we believe the catalysts for value creation/recognition are more timely.

Shares of Harman International Industries significantly outperformed as the company has benefited from accelerating revenue growth and margin expansion in its infotainment business. The company’s new products offer better operating margins than prior generations because they are built on common platforms. The infotainment industry continues to benefit as car companies replace AM/FM/CD players with center-screen consoles, an area in which Harman is well positioned. We recently eliminated the position following a substantial increase in the share price.

Also positively contributing was LSI Corporation. The company received a takeover offer from Avago Technologies for $11.15 per share, which sent the shares meaningfully higher. We purchased the stock as we believed the company was poised to generate sig-

nificant growth from its flash memory products as its third generation flash processor was set to launch and expected to outperform competitor offerings.

Lastly, VeriFone Holdings, Inc. rose sharply as investors recognized new management’s efforts to improve execution of the company’s point of sale terminal business. False concern that VeriFone might have some responsibility in the Target Corporation security breach last December provided us an opportunity to increase our position in the stock. VeriFone’s services business is also growing rapidly, which currently represents roughly 40% of revenues and we believe could expand to 50% in the next few years.

Several positions detracted from performance. Avon Products, Inc. declined as the company’s turnaround is taking longer, costing more and facing far stronger headwinds than originally anticipated. The number of representatives that Avon has selling its product continues to fall and Eastern Europe has proven to be a much tougher challenge than we had envisioned, primarily due to a significant slowdown in Russia. On the positive side, the company appears to have finally settled with the SEC and Justice Department regarding its Foreign Corrupt Practices Act violations, while Brazil continues to show positive momentum. Avon signed a distribution deal in Brazil with cosmetics maker, Coty, Inc. The company has a great deal of heavy lifting yet to go, but we firmly believe the Avon brand continues to have a great deal of value.

Cisco Systems, Inc. declined on concerns that the company is facing several headwinds, including price-based competition from Huawei Technologies Co. Ltd. and Hewlett-Packard Company, technology-based competition from smaller point product vendors and ongoing weakness in the emerging markets. We eliminated the position in October in favor of increasing our position in Oracle Corporation, which we expect to benefit from an expanded and focused sales force, the launch of a new database offering, and growth in its engineered systems products.

In January, we initiated a new position in Express, Inc. following a sharp sell-off in the stock price after the company missed earnings expectations and lowered its earnings outlook. The shares continued to weaken after our purchase given a very difficult environment for apparel retailers. Fundamentals continue to look challenging in the near term, but management is taking efforts to improve profitability by restructuring its store base. Recently, Sycamore Partners, a private equity firm run by the former chairman of Express, disclosed that it had acquired a 9.9% stake and had an interest in acquiring the rest of the company.

Several new positions were added to the Fund during the reporting period. Among them was Impax Laboratories, a drug company that has not participated in the current bull market for pharmaceutical stocks because the company’s primary manufacturing facility has been under a FDA Warning Letter since 2011. This has kept Impax from capitalizing on numerous ‘first to file’ generic drug opportunities. The company also has a branded pipeline drug for Parkinson’s disease that cannot be approved and launched until its clears up its manufacturing problems. A new CEO has recently been appointed and we think it is reasonable to believe that the manufacturing issues are nearing an end. Impax boasts over $6 in cash per share on its balance sheet (more than 25% of its market capitalization); therefore M&A (and perhaps even a tax inversion) could be part of its plan. We anticipate the stock to respond positively once the company is able to capitalize on launching new products.

We also purchased International Game Technology (IGT) in early June 2014 on the belief that management was exploring strategic alternatives, including a possible sale of the company. The risk reward for owning the shares was very compelling, in our view. Shortly thereafter in mid-July (subsequent to the close of this reporting period), GTECH S.p.A., an Italian gaming equipment manufacturer, announced that an agreement had been reached to acquire IGT for $18.25 per share in cash and stock. Even without the merger, we felt that the downside in the shares was limited given the company’s dominant position in the gaming equipment sector as well as regional gaming trends that appear to be bottoming. While IGT has been losing market share in its gaming operations over the last two years, its strong free cash flow generation and the increasing value of DoubleDown Casino (its social gaming segment) would allow it to weather the tougher industry conditions and return capital to shareholders.

We also added Key Energy Services Inc., which provides onshore energy production services. The shares have underperformed its North American peers due to a significant decline in business activity in Mexico ahead of energy policy reform that is currently underway in that country (which is expected to improve foreign participation). A self-reported Foreign Corrupt Practices Act

Portfolio Managers’ Comments (continued)

investigation is also being conducted in Mexico, which has also been a headwind. While we believed these issues are transitory, the stock price seems to imply that they will persist indefinitely. Going forward, we expect Key Energy’s business will improve as it increases its North American activity, getting closer to its fleet’s revenue and margin potential. Furthermore, we anticipate Mexico’s energy policy reform will result in a meaningful uplift for Key Energy beyond 2015.

We eliminated several positions during the reporting period, including PennyMac Financial Services Inc. (PFSI), which was eliminated from the Fund based on valuation. We used the proceeds to purchase PennyMac Mortgage Investment Trust (PMT) where we believe the risk/reward more favorable. PMT is a specialty finance company that invests primarily in residential mortgage loans and mortgage related assets. Tyson Foods, Inc. had also reached our estimate of fair value. We felt the company’s risk profile had increased given headwinds brought on by pricing pressure in its chicken, beef, and pork businesses. We sold Vodafone Group following gains on the announcement that Verizon would purchase Vodafone’s 45% stake in Verizon Wireless, and speculation that AT&T would purchase the company.

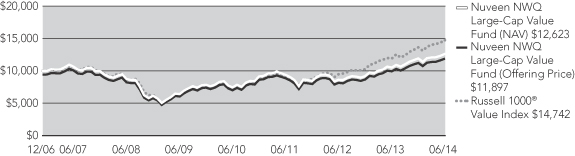

Nuveen NWQ Large-Cap Value Fund

The Fund’s Class A Shares at NAV underperformed both the Russell 1000® Value Index and the comparative Lipper classification average for the twelve-month reporting period ended June 30, 2014.

The Fund seeks long-term capital appreciation by investing in equity securities of companies with large market capitalizations that are selected on an opportunistic basis. Generally, the Fund’s manager looks for undervalued companies where catalysts exist that may help unlock value or improve profitability. Such catalysts can be new management, improving fundamentals, renewed management focus, industry consolidation or company restructuring.

The Fund generated a strong gain during the reporting period, although trailed the Russell 1000® Value Index. The Fund’s performance reflects gains across several holdings and sectors with the energy, consumer staples, finance, producer durables and utility sectors outperforming. Investments in the consumer discretionary, health care, materials and technology sectors also generated gains, although lagged the benchmark. Significant and unusual cash flow activity had a negative impact on performance as the Fund, at times, held higher levels of cash than normal.

Those holdings that contributed positively to the Fund’s performance include the insurance broker, Aon PLC, appreciated given strong results, efficiencies from its relocation to the United Kingdom, and excitement over the potential for its private healthcare exchange investments to drive profitability and growth.

Baker Hughes, the oilfield service provider, also positively contributed to performance, which benefited from favorable end market trends in the North American pressure pumping market and improved operational efficiency. For the last two years, the company’s North America margins had been negatively impacted by an oversupply of pressure pumping services and execution missteps. The stock outperformed as these margins appeared to have hit an inflection point due to new technology, better utilization and recent restructuring efforts.

Lastly, Teva Pharmaceutical Industries has embarked on an aggressive $2 billion cost cutting plan that should help maintain strong profitability in the face of the upcoming patent expiration of its multiple sclerosis drug, Copaxone. Teva received FDA approval in late January for a 3 day/week dosing for Copaxone, and is actively working to shift its patients to the new formulation. We increased our position prior to the stock’s explosive rally, making it one of the larger investments in the Fund. We did modestly trim the position after its substantial gain.

Several positions detracted from performance. Avon Products, Inc. declined as the company’s turnaround is taking longer, costing more, and facing far stronger headwinds than originally anticipated. The number of representatives that Avon has selling its product continues to fall, and Eastern Europe has proven to be a much tougher challenge than we had previously envisioned, primarily due to a significant slowdown in Russia. On the positive side, the company appears to have finally settled with the SEC and Justice Department regarding its Foreign Corrupt Practices Act violations, while Brazil continues to show positive momentum. Avon signed a

distribution deal in Brazil with cosmetics maker, Coty, Inc. The company has a great deal of heavy lifting yet to go, but we firmly believe the Avon brand continues to have a great deal of value.

Norwegian Cruise Line declined as additional capacity has entered the Caribbean cruise market, and the company issued conservative guidance. The Getaway, Norwegian’s new ship in that market, is generating double digit premiums. The overhang of an upcoming stock issuance from major holders continues to be a modest headwind, although we believe this will provide an opportunity for better liquidity and investment in an excellent operator with a compelling valuation and earnings ramp. We increased our position on Norwegian Cruise Lines in December in conjunction with a secondary public offering of the shares.

Lastly, Talisman Energy declined notwithstanding the sale of $2+ billion of assets and numerous additional catalysts that should unfold this year. Activist investor Carl Icahn holds 7% of the stock and has two representatives on the board of directors. We believe the continued cash flow burn and misperception over potential abandonment liabilities of the company’s North Sea assets have created an investor overhang on the stock. However, we believe Talisman will be able to successfully divest these assets, among other assets, in order to conserve cash flow and remove the negative sentiment towards the company. The board of directors appears to be aligned with value creation and doing all that is necessary to get the job done.

Several new positions were added to the Fund during the reporting period. Among them was Agrium Inc., a supplier of agricultural products generated strong earnings even when nitrogen markets trade down to the low point on the cost curve. At the time of purchase, the company’s valuation reflected near term issues that we believed would be solved this year, providing limited downside on the stock price.

Shares of Ford Motor Company were purchased after the company announced that it would have a down year in 2014 given a significant amount of investment spending. The company plans to launch twenty-three new products that we believe will drive an earnings recovery in 2015. Ford is also well positioned to benefit from a European economic recovery. The company has a strong balance sheet, generates solid cash flow, and recently increased its dividend by 25%.

Target Corporation was purchased after the stock had declined following a difficult holiday shopping season for retailers as a whole, the company’s disclosure that its internal payment system had been breached, and concerns regarding ongoing losses at the company’s Canadian operations. While the market’s negative sentiment reflected Target’s issues, we felt the stock price was overly discounted. We believe the company is positioned for earnings growth given the improving strength of its core customer and ultimately stabilization in store traffic.

We sold several positions during the reporting period. We exited Applied Materials, Inc. based on our concern that expectations for the company’s capital spending outlook had become too aggressive, as well as issues surrounding its pending acquisition of Tokyo Electron. While Applied Materials’ stock price had recently declined 9% from its high due to industry and company concerns, the stock had appreciated significantly from our original investment initiated in December 2012. Instead we favored a slightly larger position in Teradyne Inc. were we felt the outlook was better and the valuation more attractive. Teradyne is well-positioned to benefit from significant growth in its wireless and cellular testing business.

We also eliminated oil refiner Valero Energy Partners LP in favor of establishing a larger position in Tesoro Corporation, the parent company. Shares of Valero had risen sharply since our purchase and had become a higher expectation stock given the market’s view that the company was the absolute winner as increased crude oil production in the U.S. would create an oversupplied environment that would significantly widen refining margins, particularly in the Gulf Coast. We found it difficult to argue that we had a competitive advantage in our analysis of the company. We believed Tesoro, on the other hand, was extremely undervalued and loaded with catalysts over the coming year, not just in the near term.

We eliminated our position in pharmaceutical company AbbVie Company shortly after our purchase as the company changed course and unexpectedly announced a high premium, high multiple bid to acquire Shire PLC. While the Shire transaction would enable a corporate inversion thereby reducing taxes and avoiding cash repatriation penalties, we were concerned about the price of the acquisition and the potential risk related to AbbVie’s confidence in its promising Hepatitis C drug currently undergoing trials, as well as greater risk to its Humira (anti-inflammatory) franchise once its patent protection expires.

Portfolio Managers’ Comments (continued)

Lastly, Mosaic Company was sold after the stock had moved higher on anticipation that the Russians & Belarusians would put their potash cartel back together. We felt that with capacity still coming on and little evidence of increased demand, higher potash prices would be tough to come by. Shares of Mosaic had rallied prior to our sale on anticipation of a Chinese import contract being resolved. With the stock having reached our estimate of fair value, we no longer felt the risk/reward for continuing to hold the stock was as attractive

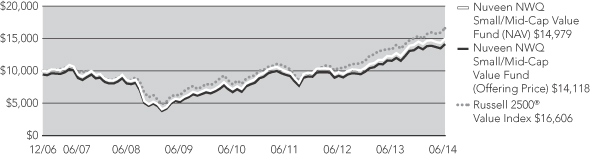

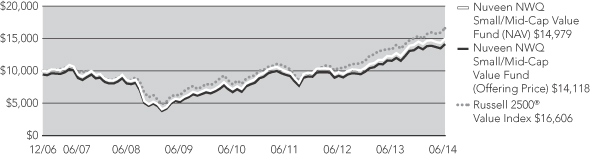

Nuveen NWQ Small/Mid-Cap Value Fund

The Fund’s Class A Shares at NAV underperformed both the Russell 2500® Value Index and the comparative Lipper classification average for the twelve-month reporting period ended June 30, 2014.

The Fund continued to follow its disciplined investment approach, which seeks long-term capital appreciation by investing in equity securities of companies with small- to mid-market capitalizations selected using an analyst-driven, value oriented process. The portfolio manager looks for undervalued companies where catalysts exist to unlock value or improve profitability. Such catalysts can be new management, improving fundamentals, renewed management focus, industry consolidation or company restructuring.

For the twelve-month reporting period, strong stock selection in the energy, health care and technology sectors contributed to the Fund’s positive returns. An underweight allocation in the financial services sector and poor stock selection in the consumer discretionary sector detracted from the Fund’s relative performance. In the broader market, value stocks performed better than growth stocks across all capitalizations.

Harman International Industries was a leading contributor to performance during the reporting period as the company’s shares nearly doubled. Harman continues to demonstrate solid operating performance in all its divisions with particular strength in Infotainment, where the company has seen increased adoption of its offerings among consumers and original equipment manufacturers (OEMs). While we modestly trimmed our position on the strength in the shares, our outlook for the company remains favorable.

Carrizo Oil & Gas, Inc. was also a significant contributor to the Fund’s performance as the company’s shares rose significantly. Energy stocks performed well as oil prices climbed as global growth improved and geopolitical risks grew. Carrizo continues to aggressively increase oil production and has made significant strides in reducing debt levels through the sale of non-core assets. We continue to find the shares attractive given the company’s proven ability to generate liquidity as it aggressively increases liquids/oil production

The Fund also benefited from increased mergers and acquisition activity during the reporting period as portfolio holdings Schawk, Inc. and LSI Logic Corporation were acquired by larger competitors. In the case of LSI, the stock price rose significantly after the company announced that it had agreed to be acquired by Avago Technologies for $11.15 per share. The deal represented a 39% premium to LSI’s closing price on the day prior to the announcement. The position was eliminated with the shares trading near the offer price.

Those holdings that detracted from the Fund’s performance include Elizabeth Arden Inc. Shares of the company declined in a volatile second quarter that saw its shares trade substantially higher amid takeover speculation only to close the reporting period lower after LG Household & Health confirmed it was not interested in acquiring the company. Disappointing fiscal third quarter results, released during LG’s evaluation period, did little to bolster Elizabeth Arden’s appeal as a takeover target. While we trimmed our position near the highs for the reporting period, we are nonetheless disappointed by the turn in the events. We believe the stock is near a bottom and are confident that recently announced restructuring and cost savings program can restore the company to profitability. While improvement may take time, we believe sales in the mass channel will recover and that a repositioned Elizabeth Arden fragrance and skincare line will drive performance over the long term. We believe the risk/reward is quite attractive at current levels.

Louisiana-Pacific Corporation also detracted from performance. The company is engaged in the manufacturing of engineered wood building materials, including Oriented Strand Board (OSB), structural framing products and exterior siding for use in residential, industrial and light commercial construction. Shares fell as earnings have missed expectations and have remained weak following the termination of the company’s agreement to acquire Ainsworth Lumber Co. Ltd. in May due to anti-trust hurdles. Despite the recent

results, we believe the company is well-positioned to benefit from multi-year growth in new home construction. We also believe that most of the recent shortfall was the result of cold weather rather than weakening end-demand for the company’s products. We believe this weakness is temporary and expect volumes and pricing to rebound as the weather improves and distributors and retailers rebuild inventories. Lastly, industrial engineering and manufacturer TriMas Corporation declined during the reporting period. We eliminated our positions as acquisition related costs continue to depress margins and earnings growth.

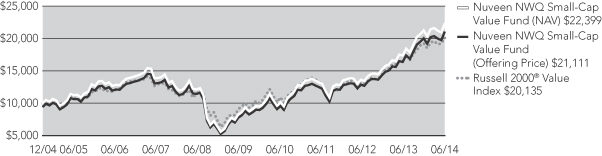

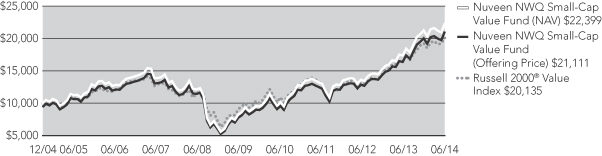

Nuveen NWQ Small-Cap Value Fund

The Fund’s Class A Shares at NAV outperformed the Russell 2000® Value Index and its Lipper classification average for the twelve-month reporting period ended June 30, 2014.

During the reporting period, the Fund continued to follow its disciplined investment approach. The Fund seeks long-term capital appreciation by investing in equity securities of companies with small market capitalizations selected using an analyst-driven, value oriented process. NWQ seeks to provide superior risk-adjusted returns through an analyst-driven, value-oriented process. The Fund’s manager looks for undervalued companies where catalysts exist to unlock value or improve profitability. Such catalysts can be new management, improving fundamentals, renewed management focus, industry consolidation or company restructuring.

For the twelve-month reporting period, positive stock selection in the technology and producer durables was offset by weakness in the financial services and stock selection in consumer discretionary sectors. In the broader market, value stocks performed better than growth stocks across all capitalizations.

Harman International Industries was a leading contributor to performance as the company’s shares nearly doubled over the previous twelve months. Harman continues to demonstrate solid operating performance in all its divisions with particular strength in Infotainment, where the company has seen increased adoption of its offerings among consumers and original equipment manufacturers. While we modestly trimmed our position on the strength in the shares, our outlook for the company remains favorable.

Carrizo Oil & Gas, Inc. was also a significant contributor to the Fund’s performance as the company’s shares rose significantly during the reporting period. Energy stocks performed well as oil prices climbed as global growth improved and geopolitical risks grew. Carrizo continues to aggressively increase oil production and has made significant strides in reducing debt levels through the sale of non-core assets. We continue to find the shares attractive given the company’s proven ability to generate liquidity as it aggressively increases liquids/oil production.

The Fund also benefited from increased mergers and acquisition activity during the reporting period as portfolio holdings Measurement Specialties, TMS International, and Maidenform Brands were all acquired by larger competitors. Also during the reporting period, portfolio holding Orbital Science Corporation announced that it would merge with the aerospace and defense segment of Alliant Techsystems (ATK). We trimmed our position on strength in the shares following the announcement. The transaction is not expected to close until the end of 2014 as the sporting segment of ATK must first be spun-off into a separate entity. While we believe the combined company will benefit from increased scale and significant cost synergies, it is unlikely these synergies will be realized until late 2015.

Those holdings that detracted from the Fund’s performance include Elizabeth Arden Inc. Shares of the company declined in a volatile second quarter that saw its shares trade substantially higher amid takeover speculation only to close lower after LG Household & Health confirmed it was not interested in acquiring the company. Disappointing fiscal third quarter results, released during LG’s evaluation period, did little to bolster Elizabeth Arden’s appeal as a takeover target. We believe the stock is near a bottom and are confident that recently announced restructuring and cost savings program can restore the company to profitability. While improvement may take time, we believe sales in the mass channel will recover and that a repositioned Elizabeth Arden fragrance and skincare line will drive performance over the long term. We believe the risk/reward is quite attractive at current levels.

Shares of Homestreet, Inc. also declined on concerns that rising interest rates would impact loan growth for the company as refinancing activity decreased. While we acknowledge origination volumes may slow, in our view, any declines are already fully discounted in

Portfolio Managers’ Comments (continued)

the company’s share price. Additionally, the company’s operations are highly scalable and we believe operating expenses could be reduced accordingly should a slower mortgage market take hold. While we continue to find the shares attractive, we did trim our position during the reporting period.

Last, industrial engineering and manufacturer TriMas Corporation declined during the reporting period. We eliminated our positions as acquisition related costs continue to depress margins and earnings growth.

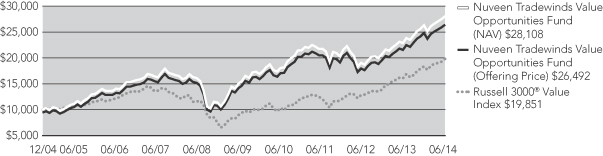

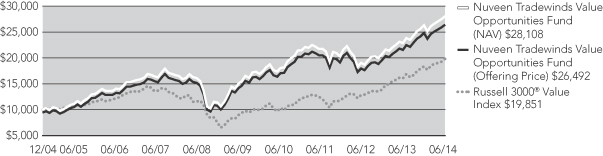

Nuveen Tradewinds Value Opportunities Fund

The Fund’s Class A Shares at NAV underperformed the Russell 3000® Value Index and outperformed the Lipper classification average for the twelve-month reporting period ended June 30, 2014.

The Fund seeks long-term capital appreciation by investing in equity securities of companies with varying market capitalizations selected using an eclectic, value-oriented process. Our team assesses each company held in the Fund individually to determine its future prospects and intrinsic value. Attractive valuation is our number one criterion and is a prerequisite for investing in any company. Some other criteria that we look for are sustainable business models, meaningful barriers to entry, and the ability to meet basic needs.

The Fund’s information technology sector was both the largest absolute and relative contributor to results, while the telecommunication services sector was the only negative performing sector of the portfolio and the largest detractor of relative results.

After trading mostly flat for the first half of the reporting period and despite a period of stock price pressure, information technology product distributor and services provider Ingram Micro Inc. resumed its strong stock price growth over latter part of the reporting period. Having modestly missed analyst expectations for the first quarter of 2014, the company has beaten revenue and earnings expectations on improving demand, and we believe management continues to effectively unlock efficiencies and better diversify the business.

Global pharmaceutical firm Merck & Co. Inc. gained during the reporting period partly on plans to sell or spin-off non-pharmaceutical divisions, possibly including the Coppertone and Dr. Scholl’s businesses. Investors appear to appreciate the company’s increased focus on profitable products with healthy growth prospects, which may assist in improving the company’s revenues.

Global advertising holding company The Interpublic Group of Companies Inc. was another contributor to portfolio performance. The company announced well-received results during the latter part of the reporting period. The results also showed operating and interest expenses declining meaningfully. Interpublic’s management has indicated that 2014 organic growth and operating margin targets will be met or exceeded.

Latin America focused telecom company, NII Holdings Inc., which was eliminated from the Fund during the reporting period and was the Fund’s largest individual detractor, enduring a number of challenges. The transition of the company from a 2G to a 3G network operator has proven more difficult than many investors expected. This has caused subscriber losses and profits to come in more negatively than previously forecasted by the company, thus feeding into already extremely pessimistic market sentiment. NII’s management hoped for a turnaround in the near future, with the company having achieved a better competitive position than it has had for years, in our view.

Added to the Fund during the reporting period, French oil/gas supplies firm Vallourec SA was also a detractor from portfolio performance. We believe recently lowered earnings guidance from the company was received poorly by investors. In our view, the factors driving the lowered guidance, namely reductions in planned orders by large Vallourec customers, are onetime issues. We continue to believe the company is well positioned to benefit from long term industry trends.

Canadian oil and gas company Talisman Energy Inc. reported financial results during the reporting period that came in at or below expectations. Overall earnings were impacted by notable one-time impairment charges. With the company focusing on a strategic realigning of its operations, including the potential sale of substantial non-strategic assets, we maintain confidence that Talisman has substantial upside at current prices.

Risk

Considerations

Risk Considerations

Nuveen NWQ Global Equity Fund

Mutual fund investing involves risk; principal loss is possible. There is no guarantee the Fund’s investment objectives will be achieved. Prices of equity securities may decline significantly over short or extended periods of time. Investments in smaller companies are subject to greater volatility than those of larger companies. Non-U.S. investments involve risks such as currency fluctuation, political and economic instability, lack of liquidity and differing legal and accounting standards. These risks are magnified in emerging markets. These and other risk considerations, such as currency and value stock risks, are described in detail in the Fund’s prospectus.

Nuveen NWQ Global Equity Income Fund

Mutual fund investing involves risk; principal loss is possible. There is no guarantee the Fund’s investment objectives will be achieved. Prices of equity securities may decline significantly over short or extended periods of time. Non-U.S. investments involve risks such as currency fluctuation, political and economic instability, lack of liquidity and differing legal and accounting standards. These risks are magnified in emerging markets. These and other risk considerations, such as credit, derivatives, high yield securities, and interest rate risks, are described in detail in the Fund’s prospectus.

Nuveen NWQ Multi-Cap Value Fund

Mutual fund investing involves risk; principal loss is possible. There is no guarantee the Fund’s investment objectives will be achieved. Prices of equity securities may decline significantly over short or extended periods of time. Investments in smaller companies are subject to greater volatility than those of larger companies. Non-U.S. investments involve risks such as currency fluctuation, political and economic instability, lack of liquidity and differing legal and accounting standards. These risks are magnified in emerging markets. These and other risk considerations, such as currency and value stock risks, are described in detail in the Fund’s prospectus.

Nuveen NWQ Large-Cap Value Fund

Mutual fund investing involves risk; principal loss is possible. There is no guarantee the Fund’s investment objectives will be achieved. Prices of equity securities may decline significantly over short or extended periods of time. Non-U.S. investments involve risks such as currency fluctuation, political and economic instability, lack of liquidity and differing legal and accounting standards. These risks are magnified in emerging markets. These and other risk considerations, such as currency, large cap stock, and value stock risks, are described in detail in the Fund’s prospectus.

Nuveen NWQ Small/Mid-Cap Value Fund

Mutual fund investing involves risk; principal loss is possible. There is no guarantee the Fund’s investment objectives will be achieved. Prices of equity securities may decline significantly over short or extended periods of time. Investments in smaller companies are subject to greater volatility than those of larger companies. Non-U.S. investments involve risks such as currency fluctuation, political and economic instability, lack of liquidity and differing legal and accounting standards. These risks are magnified in emerging markets. These and other risk considerations, such as currency and value stock risks, are described in detail in the Fund’s prospectus.

Nuveen NWQ Small-Cap Value Fund

Mutual fund investing involves risk; principal loss is possible. There is no guarantee the Fund’s investment objectives will be achieved. Prices of equity securities may decline significantly over short or extended periods of time. Investments in smaller companies are subject to greater volatility than those of larger companies. Non-U.S. investments involve risks such as currency fluctuation,

Risk Considerations (continued)

political and economic instability, lack of liquidity and differing legal and accounting standards. These risks are magnified in emerging markets. These and other risk considerations, such as currency and value stock risks, are described in detail in the Fund’s prospectus.

Nuveen Tradewinds Value Opportunities Fund

Mutual fund investing involves risk; principal loss is possible. There is no guarantee the Fund’s investment objectives will be achieved. Prices of equity securities may decline significantly over short or extended periods of time. Investments in smaller companies are subject to greater volatility than those of larger companies. Non-U.S. investments involve risks such as currency fluctuation, political and economic instability, lack of liquidity and differing legal and accounting standards. These risks are magnified in emerging markets. These and other risk considerations, such as currency and value stock risks, are described in detail in the Fund’s prospectus.

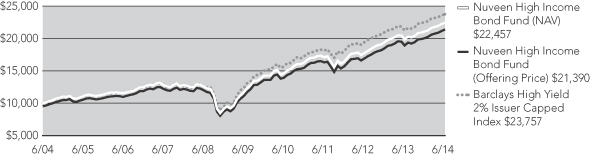

Fund Performance

and Expense Ratios

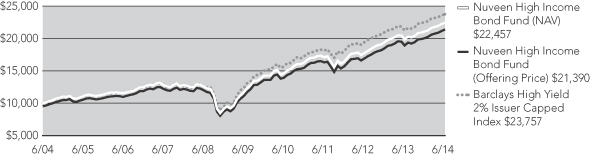

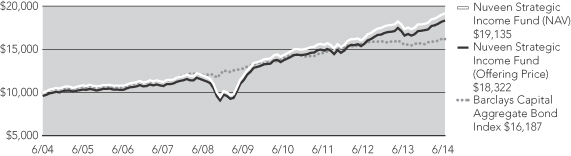

The Fund Performance and Expense Ratios for each Fund are shown within this section of the report.

Returns quoted represent past performance, which is no guarantee of future results. Current performance may be higher or lower than the performance shown. Investment returns and principal value will fluctuate so that when shares are redeemed, they may be worth more or less than their original cost. Returns without sales charges would be lower if the sales charge were included. Returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Returns may reflect a contractual agreement between certain Funds and the investment adviser to waive certain fees and expenses; see Notes to Financial Statements, Note 7 — Management Fees and Other Transactions with Affiliates for more information. In addition, returns may reflect a voluntary expense limitation by the Funds’ investment adviser that may be modified or discontinued at any time without notice. For the most recent month-end performance visit www.nuveen.com or call (800) 257-8787.

Returns reflect differences in sales charges and expenses, which are primarily differences in distribution and service fees. Fund returns assume reinvestment of dividends and capital gains.

Comparative index and Lipper return information is provided for the Funds’ Class A Shares at net asset value (NAV) only.

The expense ratios shown reflect the Funds’ total operating expenses (before fee waivers and/or expense reimbursements, if any) as shown in the Funds’ most recent prospectus. The expense ratios include management fees and other fees and expenses.

Fund Performance and Expense Ratios (continued)

Nuveen NWQ Global Equity Fund

Refer to the first page of this Fund Performance and Expense Ratios section for further explanation of the information included within this section. Refer to the Glossary of Terms Used in this Report for definitions of terms used within this section.

Fund Performance

Total Returns as of June 30, 2014

| | |

| | | Cumulative |

| | | Since

Inception* |

Class A Shares at NAV | | 3.35% |

Class A Shares at maximum Offering Price | | (2.59)% |

MSCI World Index | | 4.24% |

Lipper Global Multi-Cap Value Funds Classification Average | | 3.78% |

| |

Class C Shares | | 3.15% |

Class I Shares | | 3.40% |

Indexes and Lipper averages are not available for direct investment.

Class A Shares have a maximum 5.75% sales charge (Offering Price). Class A Share purchases of $1 million or more are sold at net asset value without an up-front sales charge but may be subject to a contingent deferred sales charge (CDSC), also known as a back-end sales charge, if redeemed within twelve months of purchase. Class C Shares have a 1% CDSC for redemptions within less than twelve months, which is not reflected in the one-year total return. Class I Shares have no sales charge and may be purchased under limited circumstances or by specified classes of investors.

Expense Ratios as of Most Recent Prospectus

| | | | | | | | | | | | |

| | | Share Class | |

| | | Class A | | | Class C | | | Class I | |

Gross Expense Ratios | | | 1.43% | | | | 2.18% | | | | 1.18% | |

Net Expense Ratios | | | 1.25% | | | | 2.00% | | | | 1.00% | |

The Fund’s investment adviser has agreed to waive fees and/or reimburse expenses through October 31, 2016 so that total annual Fund operating expenses (excluding 12b-1 distribution and/or service fees, interest expenses, taxes, acquired fund fees and expenses, fees incurred in acquiring and disposing of portfolio securities and extraordinary expenses) do not exceed 1.00% of the average daily net assets of any class of Fund shares. The expense limitation may be terminated or modified prior to that date only with the approval of the Board of Trustees of the Fund.

| * | Since inception returns are from 4/01/14. |

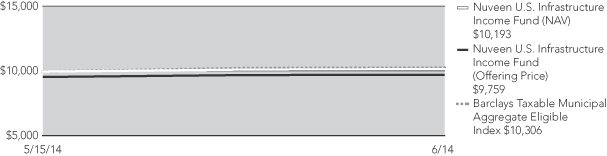

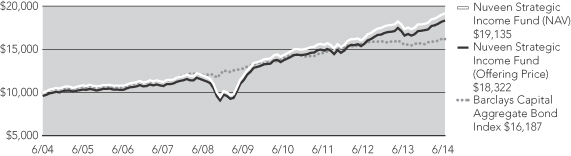

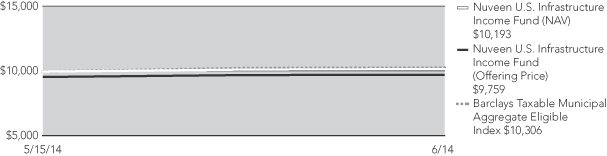

Growth of an Assumed $10,000 Investment as of June 30, 2014 – Class A Shares

The graphs do not reflect the deduction of taxes that a shareholder may pay on Fund distributions or the redemption of Fund shares.

Fund Performance and Expense Ratios (continued)

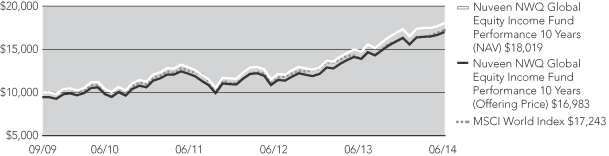

Nuveen NWQ Global Equity Income Fund

Refer to the first page of this Fund Performance and Expense Ratios section for further explanation of the information included within this section. Refer to the Glossary of Terms Used in this Report for definitions of terms used within this section.

Fund Performance

Average Annual Total Returns as of June 30, 2014

| | | | | | | | |

| | | Average Annual | |

| | | 1-Year | | | Since

Inception* | |

Class A Shares at NAV | | | 22.28% | | | | 13.08% | |

Class A Shares at maximum Offering Price | | | 15.25% | | | | 11.69% | |

MSCI World Index | | | 24.05% | | | | 12.05% | |

Russell 1000® Value Index | | | 23.81% | | | | 16.03% | |

Lipper Global Equity Income Funds Classification Average | | | 21.08% | | | | 11.39% | |

| | |

Class C Shares | | | 21.36% | | | | 12.23% | |

Class R3 Shares** | | | 21.99% | | | | 12.80% | |

Class I Shares | | | 22.63% | | | | 13.36% | |

Indexes and Lipper averages are not available for direct investment.

Performance prior to December 13, 2013, reflects the Fund’s performance using investment strategies that differed significantly from those currently in place.

Class A Shares have a maximum 5.75% sales charge (Offering Price). Class A Share purchases of $1 million or more are sold at net asset value without an up-front sales charge but may be subject to a contingent deferred sales charge (CDSC), also known as a back-end sales charge, if redeemed within twelve months of purchase. Class C Shares have a 1% CDSC for redemptions within less than twelve months, which is not reflected in the one-year total return. Class R3 Shares have no sales charge will only be available for purchase by eligible retirement plans. Class I Shares have no sales charge and may be purchased under limited circumstances or by specified classes of investors.

Expense Ratios as of Most Recent Prospectus

| | | | | | | | | | | | | | | | |

| | | Share Class | |

| | | Class A | | | Class C | | | Class R3** | | | Class I | |

Gross Expense Ratios | | | 5.32% | | | | 6.07% | | | | 5.57% | | | | 5.07% | |

Net Expense Ratios | | | 1.22% | | | | 1.97% | | | | 1.47% | | | | 0.97% | |

The Fund’s investment adviser has agreed to waive fees and/or reimburse expenses through October 31, 2016 so that total annual Fund operating expenses (excluding 12b-1 distribution and/or service fees, interest expenses, taxes, acquired fund fees and expenses, fees incurred in acquiring and disposing of portfolio securities and extraordinary expenses) do not exceed 1.00% of the average daily net assets of any class of Fund shares. The expense limitation may be terminated or modified prior to that date only with the approval of the Board of Trustees of the Fund.

| * | Since inception returns are from 9/15/09. |

| ** | Class R3 Shares are not available for public offering. |

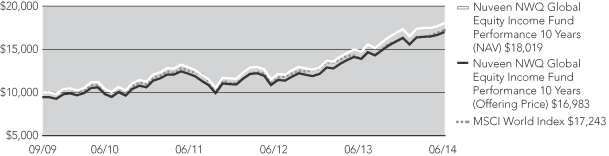

Growth of an Assumed $10,000 Investment as of June 30, 2014 – Class A Shares

The graphs do not reflect the deduction of taxes that a shareholder may pay on Fund distributions or the redemption of Fund shares.

Fund Performance and Expense Ratios (continued)