UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N‑CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

| | |

| Investment Company Act file number | | 811-07619 |

Nuveen Investment Trust

(Exact name of registrant as specified in charter)

Nuveen Investments

333 West Wacker Drive

Chicago, Illinois 60606

(Address of principal executive offices) (Zip code)

Mark J. Czarniecki

Vice President and Secretary

901 Marquette Avenue

Minneapolis, Minnesota 55402

(Name and address of agent for service)

Registrant’s telephone number, including area code: (312) 917‑7700

Date of fiscal year end: June 30

Date of reporting period: December 31, 2024

| Item 1. | Reports to Stockholders. |

| | |

| |

Semi-Annual Shareholder Report

December 31, 2024 |

Nuveen Global Equity Income Fund

Class A Shares/NQGAX

Semi-Annual Shareholder Report

This semi-annual shareholder report contains important information about the Class A Shares of the Nuveen Global Equity Income Fund for the period of July 1, 2024 to December 31, 2024. You can find additional information at https://www.nuveen.com/en‑us/mutual‑funds/prospectuses. You can also request this information by contacting us at (800) 257‑8787.

What were the Fund costs for the last six months? (based on a hypothetical $10,000 investment)

| | | | |

| | |

| | | Cost of a $10,000 investment | | Costs paid as a percentage of

$10,000 investment* |

| | | |

| Class A Shares | | $57 | | 1.11% |

* Annualized for period less than one year.

Fund Statistics (as of December 31, 2024)

| | | | |

| |

| Fund net assets | | | $131,135,832 | |

| |

| Total number of portfolio holdings | | | 59 | |

| |

| Portfolio turnover (%) | | | 15% | |

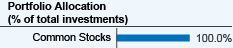

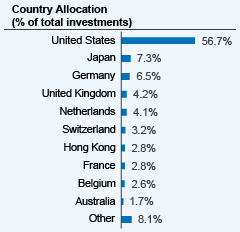

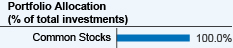

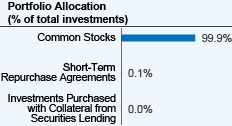

What did the Fund invest in? (as of December 31, 2024)

Availability of additional information about the Fund

You can find additional information about the Fund at https://www.nuveen.com/en‑us/mutual‑funds/prospectuses, including its:

| | • | | prospectus • financial statements and other information • fund holdings • proxy voting information |

You can also request this information at (800) 257‑8787.

| | |

67064Y321_SAR_1224 4148377-0226 | |  |

| | |

| |

Semi-Annual Shareholder Report

December 31, 2024 |

Nuveen Global Equity Income Fund

Class C Shares/NQGCX

Semi-Annual Shareholder Report

This semi-annual shareholder report contains important information about the Class C Shares of the Nuveen Global Equity Income Fund for the period of July 1, 2024 to December 31, 2024. You can find additional information at https://www.nuveen.com/en‑us/mutual‑funds/prospectuses. You can also request this information by contacting us at (800) 257‑8787.

What were the Fund costs for the last six months? (based on a hypothetical $10,000 investment)

| | | | |

| | |

| | | Cost of a $10,000 investment | | Costs paid as a percentage of

$10,000 investment* |

| | | |

| Class C Shares | | $95 | | 1.86% |

* Annualized for period less than one year.

Fund Statistics (as of December 31, 2024)

| | | | |

| |

| Fund net assets | | | $131,135,832 | |

| |

| Total number of portfolio holdings | | | 59 | |

| |

| Portfolio turnover (%) | | | 15% | |

What did the Fund invest in? (as of December 31, 2024)

Availability of additional information about the Fund

You can find additional information about the Fund at https://www.nuveen.com/en‑us/mutual‑funds/prospectuses, including its:

| | • | | prospectus • financial statements and other information • fund holdings • proxy voting information |

You can also request this information at (800) 257‑8787.

| | |

67064Y313_SAR_1224 4148377-0226 | |  |

| | |

| |

Semi-Annual Shareholder Report

December 31, 2024 |

Nuveen Global Equity Income Fund

Class I Shares/NQGIX

Semi-Annual Shareholder Report

This semi-annual shareholder report contains important information about the Class I Shares of the Nuveen Global Equity Income Fund for the period of July 1, 2024 to December 31, 2024. You can find additional information at https://www.nuveen.com/en‑us/mutual‑funds/prospectuses. You can also request this information by contacting us at (800) 257‑8787.

What were the Fund costs for the last six months? (based on a hypothetical $10,000 investment)

| | | | |

| | |

| | | Cost of a $10,000 investment | | Costs paid as a percentage of

$10,000 investment* |

| | | |

| Class I Shares | | $44 | | 0.86% |

* Annualized for period less than one year.

Fund Statistics (as of December 31, 2024)

| | | | |

| |

| Fund net assets | | | $131,135,832 | |

| |

| Total number of portfolio holdings | | | 59 | |

| |

| Portfolio turnover (%) | | | 15% | |

What did the Fund invest in? (as of December 31, 2024)

Availability of additional information about the Fund

You can find additional information about the Fund at https://www.nuveen.com/en‑us/mutual‑funds/prospectuses, including its:

| | • | | prospectus • financial statements and other information • fund holdings • proxy voting information |

You can also request this information at (800) 257‑8787.

| | |

67064Y297_SAR_1224 4148377-0226 | |  |

| | |

| |

Semi-Annual Shareholder Report

December 31, 2024 |

Nuveen Large Cap Value Opportunities Fund

Class A Shares/NQCAX

Semi-Annual Shareholder Report

This semi-annual shareholder report contains important information about the Class A Shares of the Nuveen Large Cap Value Opportunities Fund for the period of July 1, 2024 to December 31, 2024. You can find additional information at https://www.nuveen.com/en‑us/mutual‑funds/prospectuses. You can also request this information by contacting us at (800) 257‑8787.

What were the Fund costs for the last six months? (based on a hypothetical $10,000 investment)

| | | | |

| | |

| | | Cost of a $10,000 investment | | Costs paid as a percentage of

$10,000 investment* |

| | | |

| Class A Shares | | $51 | | 0.99% |

* Annualized for period less than one year.

Fund Statistics (as of December 31, 2024)

| | | | |

| |

| Fund net assets | | | $22,060,585 | |

| |

| Total number of portfolio holdings | | | 58 | |

| |

| Portfolio turnover (%) | | | 14% | |

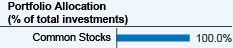

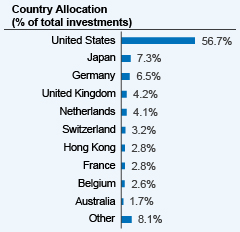

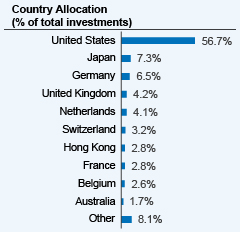

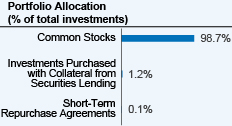

What did the Fund invest in? (as of December 31, 2024)

Availability of additional information about the Fund

You can find additional information about the Fund at https://www.nuveen.com/en‑us/mutual‑funds/prospectuses, including its:

| | • | | prospectus • financial statements and other information • fund holdings • proxy voting information |

You can also request this information at (800) 257‑8787.

| | |

67064Y628_SAR_1224 4148409-0226 | |  |

| | |

| |

Semi-Annual Shareholder Report

December 31, 2024 |

Nuveen Large Cap Value Opportunities Fund

Class C Shares/NQCCX

Semi-Annual Shareholder Report

This semi-annual shareholder report contains important information about the Class C Shares of the Nuveen Large Cap Value Opportunities Fund for the period of July 1, 2024 to December 31, 2024. You can find additional information at https://www.nuveen.com/en‑us/mutual‑funds/prospectuses. You can also request this information by contacting us at (800) 257‑8787.

What were the Fund costs for the last six months? (based on a hypothetical $10,000 investment)

| | | | |

| | |

| | | Cost of a $10,000 investment | | Costs paid as a percentage of

$10,000 investment* |

| | | |

| Class C Shares | | $90 | | 1.74% |

* Annualized for period less than one year.

Fund Statistics (as of December 31, 2024)

| | | | |

| |

| Fund net assets | | | $22,060,585 | |

| |

| Total number of portfolio holdings | | | 58 | |

| |

| Portfolio turnover (%) | | | 14% | |

What did the Fund invest in? (as of December 31, 2024)

Availability of additional information about the Fund

You can find additional information about the Fund at https://www.nuveen.com/en‑us/mutual‑funds/prospectuses, including its:

| | • | | prospectus • financial statements and other information • fund holdings • proxy voting information |

You can also request this information at (800) 257‑8787.

| | |

67064Y594_SAR_1224 4148409-0226 | |  |

| | |

| |

Semi-Annual Shareholder Report

December 31, 2024 |

Nuveen Large Cap Value Opportunities Fund

Class I Shares/NQCRX

Semi-Annual Shareholder Report

This semi-annual shareholder report contains important information about the Class I Shares of the Nuveen Large Cap Value Opportunities Fund for the period of July 1, 2024 to December 31, 2024. You can find additional information at https://www.nuveen.com/en‑us/mutual‑funds/prospectuses. You can also request this information by contacting us at (800) 257‑8787.

What were the Fund costs for the last six months? (based on a hypothetical $10,000 investment)

| | | | |

| | |

| | | Cost of a $10,000 investment | | Costs paid as a percentage of

$10,000 investment* |

| | | |

| Class I Shares | | $38 | | 0.74% |

* Annualized for period less than one year.

Fund Statistics (as of December 31, 2024)

| | | | |

| |

| Fund net assets | | | $22,060,585 | |

| |

| Total number of portfolio holdings | | | 58 | |

| |

| Portfolio turnover (%) | | | 14% | |

What did the Fund invest in? (as of December 31, 2024)

Availability of additional information about the Fund

You can find additional information about the Fund at https://www.nuveen.com/en‑us/mutual‑funds/prospectuses, including its:

| | • | | prospectus • financial statements and other information • fund holdings • proxy voting information |

You can also request this information at (800) 257‑8787.

| | |

67064Y586_SAR_1224 4148409-0226 | |  |

| | |

| |

Semi-Annual Shareholder Report

December 31, 2024 |

Nuveen Multi Cap Value Fund

Class A Shares/NQVAX

Semi-Annual Shareholder Report

This semi-annual shareholder report contains important information about the Class A Shares of the Nuveen Multi Cap Value Fund for the period of July 1, 2024 to December 31, 2024. You can find additional information at https://www.nuveen.com/en‑us/mutual‑funds/prospectuses. You can also request this information by contacting us at (800) 257‑8787.

What were the Fund costs for the last six months? (based on a hypothetical $10,000 investment)

| | | | |

| | |

| | | Cost of a $10,000 investment | | Costs paid as a percentage of

$10,000 investment* |

| | | |

| Class A Shares | | $60 | | 1.15% |

* Annualized for period less than one year.

Fund Statistics (as of December 31, 2024)

| | | | |

| |

| Fund net assets | | $ | 498,311,060 | |

| |

| Total number of portfolio holdings | | | 60 | |

| |

| Portfolio turnover (%) | | | 19% | |

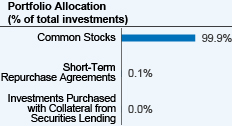

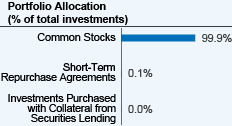

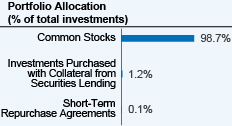

What did the Fund invest in? (as of December 31, 2024)

Availability of additional information about the Fund

You can find additional information about the Fund at https://www.nuveen.com/en‑us/mutual‑funds/prospectuses, including its:

| | • | | prospectus • financial statements and other information • fund holdings • proxy voting information |

You can also request this information at (800) 257‑8787.

| | |

67064Y792_SAR_1224 4148396-0226 | |  |

| | |

| |

Semi-Annual Shareholder Report

December 31, 2024 |

Nuveen Multi Cap Value Fund

Class C Shares/NQVCX

Semi-Annual Shareholder Report

This semi-annual shareholder report contains important information about the Class C Shares of the Nuveen Multi Cap Value Fund for the period of July 1, 2024 to December 31, 2024. You can find additional information at https://www.nuveen.com/en‑us/mutual‑funds/prospectuses. You can also request this information by contacting us at (800) 257‑8787.

What were the Fund costs for the last six months? (based on a hypothetical $10,000 investment)

| | | | |

| | |

| | | Cost of a $10,000 investment | | Costs paid as a percentage of

$10,000 investment* |

| | | |

| Class C Shares | | $99 | | 1.90% |

* Annualized for period less than one year.

Fund Statistics (as of December 31, 2024)

| | | | |

| |

| Fund net assets | | $ | 498,311,060 | |

| |

| Total number of portfolio holdings | | | 60 | |

| |

| Portfolio turnover (%) | | | 19% | |

What did the Fund invest in? (as of December 31, 2024)

Availability of additional information about the Fund

You can find additional information about the Fund at https://www.nuveen.com/en‑us/mutual‑funds/prospectuses, including its:

| | • | | prospectus • financial statements and other information • fund holdings • proxy voting information |

You can also request this information at (800) 257‑8787.

| | |

67064Y776_SAR_1224 4148396-0226 | |  |

| | |

| |

Semi-Annual Shareholder Report

December 31, 2024 |

Nuveen Multi Cap Value Fund

Class I Shares/NQVRX

Semi-Annual Shareholder Report

This semi-annual shareholder report contains important information about the Class I Shares of the Nuveen Multi Cap Value Fund for the period of July 1, 2024 to December 31, 2024. You can find additional information at https://www.nuveen.com/en‑us/mutual‑funds/prospectuses. You can also request this information by contacting us at (800) 257‑8787.

What were the Fund costs for the last six months? (based on a hypothetical $10,000 investment)

| | | | |

| | |

| | | Cost of a $10,000 investment | | Costs paid as a percentage of

$10,000 investment* |

| | | |

| Class I Shares | | $47 | | 0.90% |

* Annualized for period less than one year.

Fund Statistics (as of December 31, 2024)

| | | | |

| |

| Fund net assets | | | $498,311,060 | |

| |

| Total number of portfolio holdings | | | 60 | |

| |

| Portfolio turnover (%) | | | 19% | |

What did the Fund invest in? (as of December 31, 2024)

Availability of additional information about the Fund

You can find additional information about the Fund at https://www.nuveen.com/en‑us/mutual‑funds/prospectuses, including its:

| | • | | prospectus • financial statements and other information • fund holdings • proxy voting information |

You can also request this information at (800) 257‑8787.

| | |

67064Y768_SAR_1224 4148396-0226 | |  |

| | |

| |

Semi-Annual Shareholder Report

December 31, 2024 |

Nuveen Small Cap Value Opportunities Fund

Class A Shares/NSCAX

Semi-Annual Shareholder Report

This semi-annual shareholder report contains important information about the Class A Shares of the Nuveen Small Cap Value Opportunities Fund for the period of July 1, 2024 to December 31, 2024. You can find additional information at https://www.nuveen.com/en‑us/mutual‑funds/prospectuses. You can also request this information by contacting us at (800) 257‑8787.

What were the Fund costs for the last six months? (based on a hypothetical $10,000 investment)

| | | | |

| | |

| | | Cost of a $10,000 investment | | Costs paid as a percentage of

$10,000 investment* |

| | | |

| Class A Shares | | $64 | | 1.20% |

* Annualized for period less than one year.

Fund Statistics (as of December 31, 2024)

| | | | |

| |

| Fund net assets | | | $217,028,185 | |

| |

| Total number of portfolio holdings | | | 66 | |

| |

| Portfolio turnover (%) | | | 42% | |

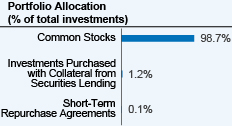

What did the Fund invest in? (as of December 31, 2024)

Availability of additional information about the Fund

You can find additional information about the Fund at https://www.nuveen.com/en‑us/mutual‑funds/prospectuses, including its:

| | • | | prospectus • financial statements and other information • fund holdings • proxy voting information |

You can also request this information at (800) 257‑8787.

| | |

67064Y750_SAR_1224 4148428-0226 | |  |

| | |

| |

Semi-Annual Shareholder Report

December 31, 2024 |

Nuveen Small Cap Value Opportunities Fund

Class C Shares/NSCCX

Semi-Annual Shareholder Report

This semi-annual shareholder report contains important information about the Class C Shares of the Nuveen Small Cap Value Opportunities Fund for the period of July 1, 2024 to December 31, 2024. You can find additional information at https://www.nuveen.com/en‑us/mutual‑funds/prospectuses. You can also request this information by contacting us at (800) 257‑8787.

What were the Fund costs for the last six months? (based on a hypothetical $10,000 investment)

| | | | |

| | |

| | | Cost of a $10,000 investment | | Costs paid as a percentage of

$10,000 investment* |

| | | |

| Class C Shares | | $104 | | 1.95% |

* Annualized for period less than one year.

Fund Statistics (as of December 31, 2024)

| | | | |

| |

| Fund net assets | | | $217,028,185 | |

| |

| Total number of portfolio holdings | | | 66 | |

| |

| Portfolio turnover (%) | | | 42% | |

What did the Fund invest in? (as of December 31, 2024)

Availability of additional information about the Fund

You can find additional information about the Fund at https://www.nuveen.com/en‑us/mutual‑funds/prospectuses, including its:

| | • | | prospectus • financial statements and other information • fund holdings • proxy voting information |

You can also request this information at (800) 257‑8787.

| | |

67064Y735_SAR_1224 4148428-0226 | |  |

| | |

| |

Semi-Annual Shareholder Report

December 31, 2024 |

Nuveen Small Cap Value Opportunities Fund

Class R6 Shares/NSCFX

Semi-Annual Shareholder Report

This semi-annual shareholder report contains important information about the Class R6 Shares of the Nuveen Small Cap Value Opportunities Fund for the period of July 1, 2024 to December 31, 2024. You can find additional information at https://www.nuveen.com/en‑us/mutual‑funds/prospectuses. You can also request this information by contacting us at (800) 257‑8787.

What were the Fund costs for the last six months? (based on a hypothetical $10,000 investment)

| | | | |

| | |

| | | Cost of a $10,000 investment | | Costs paid as a percentage of

$10,000 investment* |

| | | |

| Class R6 Shares | | $44 | | 0.83% |

* Annualized for period less than one year.

Fund Statistics (as of December 31, 2024)

| | | | |

| |

| Fund net assets | | | $217,028,185 | |

| |

| Total number of portfolio holdings | | | 66 | |

| |

| Portfolio turnover (%) | | | 42% | |

What did the Fund invest in? (as of December 31, 2024)

Availability of additional information about the Fund

You can find additional information about the Fund at https://www.nuveen.com/en‑us/mutual‑funds/prospectuses, including its:

| | • | | prospectus • financial statements and other information • fund holdings • proxy voting information |

You can also request this information at (800) 257‑8787.

| | |

670729847_SAR_1224 4148428-0226 | |  |

| | |

| |

Semi-Annual Shareholder Report

December 31, 2024 |

Nuveen Small Cap Value Opportunities Fund

Class I Shares/NSCRX

Semi-Annual Shareholder Report

This semi-annual shareholder report contains important information about the Class I Shares of the Nuveen Small Cap Value Opportunities Fund for the period of July 1, 2024 to December 31, 2024. You can find additional information at https://www.nuveen.com/en‑us/mutual‑funds/prospectuses. You can also request this information by contacting us at (800) 257‑8787.

What were the Fund costs for the last six months? (based on a hypothetical $10,000 investment)

| | | | |

| | |

| | | Cost of a $10,000 investment | | Costs paid as a percentage of

$10,000 investment* |

| | | |

| Class I Shares | | $51 | | 0.95% |

* Annualized for period less than one year.

Fund Statistics (as of December 31, 2024)

| | | | |

| |

| Fund net assets | | | $217,028,185 | |

| |

| Total number of portfolio holdings | | | 66 | |

| |

| Portfolio turnover (%) | | | 42% | |

What did the Fund invest in? (as of December 31, 2024)

Availability of additional information about the Fund

You can find additional information about the Fund at https://www.nuveen.com/en‑us/mutual‑funds/prospectuses, including its:

| | • | | prospectus • financial statements and other information • fund holdings • proxy voting information |

You can also request this information at (800) 257‑8787.

| | |

67064Y727_SAR_1224 4148428-0226 | |  |

| | |

| |

Semi-Annual Shareholder Report

December 31, 2024 |

Nuveen Small/Mid Cap Value Fund

Class A Shares/NSMAX

Semi-Annual Shareholder Report

This semi-annual shareholder report contains important information about the Class A Shares of the Nuveen Small/Mid Cap Value Fund for the period of July 1, 2024 to December 31, 2024. You can find additional information at https://www.nuveen.com/en‑us/mutual‑funds/prospectuses. You can also request this information by contacting us at (800) 257‑8787.

What were the Fund costs for the last six months? (based on a hypothetical $10,000 investment)

| | | | |

| | |

| | | Cost of a $10,000 investment | | Costs paid as a percentage of

$10,000 investment* |

| | | |

| Class A Shares | | $69 | | 1.31% |

* Annualized for period less than one year.

Fund Statistics (as of December 31, 2024)

| | | | |

| |

| Fund net assets | | | $109,493,923 | |

| |

| Total number of portfolio holdings | | | 66 | |

| |

| Portfolio turnover (%) | | | 31% | |

What did the Fund invest in? (as of December 31, 2024)

Availability of additional information about the Fund

You can find additional information about the Fund at https://www.nuveen.com/en‑us/mutual‑funds/prospectuses, including its:

| | • | | prospectus • financial statements and other information • fund holdings • proxy voting information |

You can also request this information at (800) 257‑8787.

| | |

67064Y578_SAR_1224 4148421-0226 | |  |

| | |

| |

Semi-Annual Shareholder Report

December 31, 2024 |

Nuveen Small/Mid Cap Value Fund

Class C Shares/NSMCX

Semi-Annual Shareholder Report

This semi-annual shareholder report contains important information about the Class C Shares of the Nuveen Small/Mid Cap Value Fund for the period of July 1, 2024 to December 31, 2024. You can find additional information at https://www.nuveen.com/en‑us/mutual‑funds/prospectuses. You can also request this information by contacting us at (800) 257‑8787.

What were the Fund costs for the last six months? (based on a hypothetical $10,000 investment)

| | | | |

| | |

| | | Cost of a $10,000 investment | | Costs paid as a percentage of

$10,000 investment* |

| | | |

| Class C Shares | | $108 | | 2.06% |

* Annualized for period less than one year.

Fund Statistics (as of December 31, 2024)

| | | | |

| |

| Fund net assets | | $ | 109,493,923 | |

| |

| Total number of portfolio holdings | | | 66 | |

| |

| Portfolio turnover (%) | | | 31% | |

What did the Fund invest in? (as of December 31, 2024)

Availability of additional information about the Fund

You can find additional information about the Fund at https://www.nuveen.com/en‑us/mutual‑funds/prospectuses, including its:

| | • | | prospectus • financial statements and other information • fund holdings • proxy voting information |

You can also request this information at (800) 257‑8787.

| | |

67064Y552_SAR_1224 4148421-0226 | |  |

| | |

| |

Semi-Annual Shareholder Report

December 31, 2024 |

Nuveen Small/Mid Cap Value Fund

Class R6 Shares/NWQFX

Semi-Annual Shareholder Report

This semi-annual shareholder report contains important information about the Class R6 Shares of the Nuveen Small/Mid Cap Value Fund for the period of July 1, 2024 to December 31, 2024. You can find additional information at https://www.nuveen.com/en‑us/mutual‑funds/prospectuses. You can also request this information by contacting us at (800) 257‑8787.

What were the Fund costs for the last six months? (based on a hypothetical $10,000 investment)

| | | | |

| | |

| | | Cost of a $10,000 investment | | Costs paid as a percentage of

$10,000 investment* |

| | | |

| Class R6 Shares | | $47 | | 0.89% |

* Annualized for period less than one year.

Fund Statistics (as of December 31, 2024)

| | | | |

| |

| Fund net assets | | $ | 109,493,923 | |

| |

| Total number of portfolio holdings | | | 66 | |

| |

| Portfolio turnover (%) | | | 31% | |

What did the Fund invest in? (as of December 31, 2024)

Availability of additional information about the Fund

You can find additional information about the Fund at https://www.nuveen.com/en‑us/mutual‑funds/prospectuses, including its:

| | • | | prospectus • financial statements and other information • fund holdings • proxy voting information |

You can also request this information at (800) 257‑8787.

| | |

670729466_SAR_1224 4148421-0226 | |  |

| | |

| |

Semi-Annual Shareholder Report

December 31, 2024 |

Nuveen Small/Mid Cap Value Fund

Class I Shares/NSMRX

Semi-Annual Shareholder Report

This semi-annual shareholder report contains important information about the Class I Shares of the Nuveen Small/Mid Cap Value Fund for the period of July 1, 2024 to December 31, 2024. You can find additional information at https://www.nuveen.com/en‑us/mutual‑funds/prospectuses. You can also request this information by contacting us at (800) 257‑8787.

What were the Fund costs for the last six months? (based on a hypothetical $10,000 investment)

| | | | |

| | |

| | | Cost of a $10,000 investment | | Costs paid as a percentage of

$10,000 investment* |

| | | |

| Class I Shares | | $56 | | 1.06% |

* Annualized for period less than one year.

Fund Statistics (as of December 31, 2024)

| | | | |

| |

| Fund net assets | | $ | 109,493,923 | |

| |

| Total number of portfolio holdings | | | 66 | |

| |

| Portfolio turnover (%) | | | 31% | |

What did the Fund invest in? (as of December 31, 2024)

Availability of additional information about the Fund

You can find additional information about the Fund at https://www.nuveen.com/en‑us/mutual‑funds/prospectuses, including its:

| | • | | prospectus • financial statements and other information • fund holdings • proxy voting information |

You can also request this information at (800) 257‑8787.

| | |

67064Y545_SAR_1224 4148421-0226 | |  |

Not applicable to this filing.

| Item 3. | Audit Committee Financial Expert. |

Not applicable to this filing.

| Item 4. | Principal Accountant Fees and Services. |

Not applicable to this filing.

| Item 5. | Audit Committee of Listed Registrants. |

Not applicable to this registrant.

| (a) | Schedule of Investments is included as part of the financial statements filed under Item 7 of this Form N-CSR. |

| Item 7. | Financial Statements and Financial Highlights for Open-End Management Investment Companies. |

Item

7.

Financial

Statements

and

Financial

Highlights

for

Open-End

Management

Investment

Companies

Portfolio

of

Investments

December

31,

2024

Global

Equity

Income

See

Notes

to

Financial

Statements

(Unaudited)

SHARES

DESCRIPTION

VALUE

LONG-TERM

INVESTMENTS

-

99.3%

130207386

COMMON

STOCKS

-

99.3%

AUSTRALIA

-

1.7%

92,413

BHP

Group

Ltd

$

2,254,392

TOTAL

AUSTRALIA

2,254,392

BELGIUM

-

2.5%

16,619

UCB

SA

3,308,239

TOTAL

BELGIUM

3,308,239

CANADA

-

1.1%

31,394

Nutrien

Ltd

1,404,753

TOTAL

CANADA

1,404,753

FINLAND

-

1.4%

164,692

Nordea

Bank

Abp

1,796,913

TOTAL

FINLAND

1,796,913

FRANCE

-

2.8%

10,530

Airbus

SE

1,686,177

18,135

Publicis

Groupe

SA

1,930,645

TOTAL

FRANCE

3,616,822

GERMANY

-

6.5%

6,264

Allianz

SE

1,925,321

9,218

Deutsche

Boerse

AG

2,123,423

68,961

Deutsche

Post

AG

2,434,486

10,304

Siemens

AG

2,009,225

TOTAL

GERMANY

8,492,455

HONG

KONG

-

2.8%

1,084,000

Hang

Lung

Properties

Ltd

864,201

355,492

Prudential

PLC

2,821,191

TOTAL

HONG

KONG

3,685,392

ITALY

-

1.4%

262,243

Enel

SpA

1,871,411

TOTAL

ITALY

1,871,411

JAPAN

-

7.2%

43,340

Kao

Corp

1,753,603

102,850

Mitsubishi

Electric

Corp

1,736,698

93,760

Mitsui

&

Co

Ltd

1,944,499

176,000

Sumitomo

Mitsui

Trust

Group

Inc

4,111,276

TOTAL

JAPAN

9,546,076

NETHERLANDS

-

4.1%

22,056

Heineken

NV

1,571,912

112,217

ING

Groep

NV

1,758,617

44,965

NN

Group

NV

1,960,857

TOTAL

NETHERLANDS

5,291,386

NORWAY

-

1.5%

175,623

Telenor

ASA

1,959,455

TOTAL

NORWAY

1,959,455

SINGAPORE

-

1.7%

184,520

Oversea-Chinese

Banking

Corp

Ltd

2,253,556

TOTAL

SINGAPORE

2,253,556

SOUTH

KOREA

-

0.9%

42,268

Samsung

Electronics

Co

Ltd

1,255,442

TOTAL

SOUTH

KOREA

1,255,442

SWITZERLAND

-

3.2%

20,012

DSM-Firmenich

AG

2,022,892

3,650

Zurich

Insurance

Group

AG

2,170,895

TOTAL

SWITZERLAND

4,193,787

UNITED

KINGDOM

-

4.2%

43,479

AstraZeneca

PLC,

Sponsored

ADR

2,848,744

216,511

National

Grid

PLC

2,572,205

TOTAL

UNITED

KINGDOM

5,420,949

See

Notes

to

Financial

Statements

Investments

in

Derivatives

SHARES

DESCRIPTION

VALUE

UNITED

STATES

-

56.3%

14,771

AbbVie

Inc

$

2,624,807

33,263

Alliant

Energy

Corp

1,967,174

175,411

AT&T

Inc

3,994,108

13,000

(a)

Boeing

Co/The

2,301,000

22,334

(b)

Broadcom

Inc

5,177,915

13,461

Chevron

Corp

1,949,691

36,860

Cisco

Systems

Inc

2,182,112

24,189

Coca-Cola

Co/The

1,506,007

39,411

Delta

Air

Lines

Inc

2,384,366

5,772

Eaton

Corp

PLC

1,915,554

5,355

Elevance

Health

Inc

1,975,460

78,974

Enterprise

Products

Partners

LP

2,476,625

4,903

Everest

Group

Ltd

1,777,141

29,379

Eversource

Energy

1,687,236

50,461

(b)

Fifth

Third

Bancorp

2,133,491

6,770

General

Dynamics

Corp

1,783,827

53,426

(b)

General

Motors

Co

2,846,003

416,756

Haleon

PLC

1,965,067

5,906

(b)

Home

Depot

Inc/The

2,297,375

4,884

Honeywell

International

Inc

1,103,247

42,038

Intel

Corp

842,862

13,417

JPMorgan

Chase

&

Co

3,216,189

38,082

Las

Vegas

Sands

Corp

1,955,892

19,241

Oracle

Corp

3,206,320

28,471

Sanofi

SA

2,767,687

110,368

Shell

PLC

3,440,280

44,916

Smurfit

WestRock

PLC

2,419,176

2,756

UnitedHealth

Group

Inc

1,394,150

39,987

Walmart

Inc

3,612,825

14,788

Walt

Disney

Co/The

1,646,644

47,069

Wells

Fargo

&

Co

3,306,127

TOTAL

UNITED

STATES

73,856,358

TOTAL

COMMON

STOCKS

(Cost

$95,167,219)

130,207,386

TOTAL

LONG-TERM

INVESTMENTS

(Cost

$95,167,219)

130,207,386

OTHER

ASSETS

&

LIABILITIES,

NET

- 0.7%

928,446

NET

ASSETS

-

100%

$

131,135,832

ADR

American

Depositary

Receipt

(a)

Non-income

producing;

issuer

has

not

declared

an

ex-dividend

date

within

the

past

twelve

months.

(b)

Investment,

or

portion

of

investment,

has

been

pledged

to

collateralize

the

net

payment

obligations

for

investments

in

derivatives.

Options

Written

Type

Description

(a)

Number

of

Contracts

Notional

Amount

(b)

Exercise

Price

Expiration

Date

Value

Call

Boeing

Co/The

(130)

$

(

2,210,000

)

$

170

4/17/25

$

(

244,400

)

Total

Options

Written

(premiums

received

$141,452)

(130)

$(2,210,000)

$(244,400)

(a)

Exchange-traded,

unless

otherwise

noted.

(b)

For

disclosure

purposes,

Notional

Amount

is

calculated

by

multiplying

the

Number

of

Contracts

by

the

Exercise

Price

by

100.

Portfolio

of

Investments

December

31,

2024

International

Value

See

Notes

to

Financial

Statements

(Unaudited)

SHARES

DESCRIPTION

VALUE

LONG-TERM

INVESTMENTS

-

99.4%

103680213

COMMON

STOCKS

-

99.4%

AUSTRALIA

-

1.1%

48,837

BHP

Group

Ltd

$

1,191,367

TOTAL

AUSTRALIA

1,191,367

BELGIUM

-

1.1%

16,282

Groupe

Bruxelles

Lambert

NV

1,113,295

TOTAL

BELGIUM

1,113,295

CANADA

-

3.4%

26,652

Agnico

Eagle

Mines

Ltd

2,084,453

32,996

Nutrien

Ltd

1,476,436

TOTAL

CANADA

3,560,889

CHINA

-

0.8%

9,799

(a)

Baidu

Inc,

Sponsored

ADR

826,154

TOTAL

CHINA

826,154

FINLAND

-

1.0%

93,800

Nordea

Bank

Abp

1,023,428

TOTAL

FINLAND

1,023,428

FRANCE

-

12.1%

35,002

Accor

SA

1,702,413

147,043

Alstom

SA

3,280,979

25,521

Publicis

Groupe

SA

2,716,956

37,814

Societe

Generale

SA

1,061,268

80,919

Technip

Energies

NV

2,161,468

12,006

Thales

SA

1,724,005

TOTAL

FRANCE

12,647,089

GERMANY

-

11.3%

44,499

AIXTRON

SE

699,227

6,037

Allianz

SE

1,855,549

56,296

Deutsche

Post

AG

1,987,382

34,535

Fresenius

Medical

Care

AG

1,572,406

9,683

SAP

SE

2,381,767

16,689

Siemens

AG

3,254,265

TOTAL

GERMANY

11,750,596

HONG

KONG

-

2.3%

916,000

Hang

Lung

Properties

Ltd

730,266

214,698

Prudential

PLC

1,703,848

TOTAL

HONG

KONG

2,434,114

JAPAN

-

21.8%

60,100

FUJIFILM

Holdings

Corp

1,243,446

99,600

Japan

Airlines

Co

Ltd

1,570,135

56,585

Komatsu

Ltd

1,541,508

95,462

Mabuchi

Motor

Co

Ltd

1,349,644

121,600

Mitsubishi

Electric

Corp

2,053,306

59,807

(b)

Nippon

Telegraph

&

Telephone

Corp,

ADR

1,503,165

90,000

Rohm

Co

Ltd

836,245

87,464

Sekisui

House

Ltd

2,085,501

102,600

Seven

&

i

Holdings

Co

Ltd

1,608,524

82,000

Sompo

Holdings

Inc

2,124,642

139,500

Sumitomo

Mitsui

Trust

Group

Inc

3,258,653

12,561

(b)

Toyota

Motor

Corp,

Sponsored

ADR

2,444,496

151,100

Yamaha

Corp

1,074,789

TOTAL

JAPAN

22,694,054

MACAU

-

1.8%

717,091

(a)

Sands

China

Ltd

1,909,327

TOTAL

MACAU

1,909,327

NETHERLANDS

-

8.2%

21,049

Heineken

NV

1,500,144

234,768

ING

Groep

NV

3,679,184

27,975

NN

Group

NV

1,219,949

See

Notes

to

Financial

Statements

SHARES

DESCRIPTION

VALUE

NETHERLANDS

(continued)

12,680

Wolters

Kluwer

NV

$

2,106,710

TOTAL

NETHERLANDS

8,505,987

SINGAPORE

-

1.7%

143,232

Oversea-Chinese

Banking

Corp

Ltd

1,749,303

TOTAL

SINGAPORE

1,749,303

SOUTH

AFRICA

-

1.4%

49,978

Anglo

American

PLC

1,477,707

TOTAL

SOUTH

AFRICA

1,477,707

SOUTH

KOREA

-

1.3%

13,324

Hyundai

Motor

Co

1,367,477

TOTAL

SOUTH

KOREA

1,367,477

SWITZERLAND

-

5.7%

28,156

Adecco

Group

AG

695,530

707

Barry

Callebaut

AG

941,343

11,964

DSM-Firmenich

AG

1,209,368

103,718

UBS

Group

AG

3,144,731

TOTAL

SWITZERLAND

5,990,972

TAIWAN

-

1.6%

50,000

Taiwan

Semiconductor

Manufacturing

Co

Ltd

1,625,001

TOTAL

TAIWAN

1,625,001

UNITED

KINGDOM

-

10.8%

721,930

Barclays

PLC

2,414,996

824,951

Dowlais

Group

PLC

693,033

299,714

Melrose

Industries

PLC

2,071,137

180,846

National

Grid

PLC

2,148,496

1,014,006

Taylor

Wimpey

PLC

1,543,321

532,571

Tesco

PLC

2,449,479

TOTAL

UNITED

KINGDOM

11,320,462

UNITED

STATES

-

12.0%

33,986

Axis

Capital

Holdings

Ltd

3,011,839

87,182

GSK

PLC

1,470,522

7,039

Roche

Holding

AG

1,968,151

25,261

Sanofi

SA

2,455,641

57,252

Shell

PLC,

ADR

3,586,838

TOTAL

UNITED

STATES

12,492,991

TOTAL

COMMON

STOCKS

(Cost

$71,810,161)

103,680,213

TOTAL

LONG-TERM

INVESTMENTS

(Cost

$71,810,161)

103,680,213

SHARES

DESCRIPTION

Coupon

VALUE

INVESTMENTS

PURCHASED

WITH

COLLATERAL

FROM

SECURITIES

LENDING

-

2.0%

2,112,112

(c)

State

Street

Navigator

Securities

Lending

Government

Money

Market

Portfolio

4

.460

%

(d)

2,112,112

TOTAL

INVESTMENTS

PURCHASED

WITH

COLLATERAL

FROM

SECURITIES

LENDING

(Cost

$2,112,112)

2,112,112

PRINCIPAL

DESCRIPTION

RATE

MATURITY

VALUE

SHORT-TERM

INVESTMENTS

-

0.1%

75,000

REPURCHASE

AGREEMENTS

-

0.1%

$

75,000

(e)

Fixed

Income

Clearing

Corporation

4

.430

01/02/25

75,000

TOTAL

REPURCHASE

AGREEMENTS

(Cost

$75,000)

75,000

TOTAL

SHORT-TERM

INVESTMENTS

(Cost

$75,000)

75,000

TOTAL

INVESTMENTS

(Cost

$

73,997,273

)

-

101

.5

%

105,867,325

OTHER

ASSETS

&

LIABILITIES,

NET

- (1.5)%

(

1,527,220

)

NET

ASSETS

-

100%

$

104,340,105

Portfolio

of

Investments

December

31,

2024

(continued)

International

Value

See

Notes

to

Financial

Statements

ADR

American

Depositary

Receipt

(a)

Non-income

producing;

issuer

has

not

declared

an

ex-dividend

date

within

the

past

twelve

months.

(b)

Investment,

or

a

portion

of

investment,

is

out

on

loan

for

securities

lending.

The

total

value

of

the

securities

out

on

loan

as

of

the

end

of

the

reporting

period

was

$2,045,141.

(c)

Investments

made

with

cash

collateral

received

from

securities

on

loan.

(d)

The

rate

shown

is

the

one-day

yield

as

of

the

end

of

the

reporting

period.

(e)

Agreement

with

Fixed

Income

Clearing

Corporation,

4.430%

dated

12/31/24

to

be

repurchased

at

$75,018

on

1/2/25,

collateralized

by

Government

Agency

Securities,

with

coupon

rate

3.250%

and

maturity

date

5/15/42,

valued

at

$76,616.

Portfolio

of

Investments

December

31,

2024

Large

Cap

Value

Opportunities

See

Notes

to

Financial

Statements

(Unaudited)

SHARES

DESCRIPTION

VALUE

LONG-TERM

INVESTMENTS

-

99.8%

21999113

COMMON

STOCKS

-

99

.8

%

21999113

AUTOMOBILES

&

COMPONENTS

-

4.3%

28,105

Ford

Motor

Co

$

278,240

12,541

General

Motors

Co

668,058

TOTAL

AUTOMOBILES

&

COMPONENTS

946,298

BANKS

-

9.1%

7,795

Citigroup

Inc

548,690

2,869

JPMorgan

Chase

&

Co

687,728

10,783

Wells

Fargo

&

Co

757,398

TOTAL

BANKS

1,993,816

CAPITAL

GOODS

-

14.2%

3,262

(a)

Boeing

Co/The

577,374

10,556

Flowserve

Corp

607,181

2,124

General

Dynamics

Corp

559,653

725

Hubbell

Inc

303,695

6,282

nVent

Electric

PLC

428,182

2,203

Regal

Rexnord

Corp

341,751

2,732

RTX

Corp

316,147

TOTAL

CAPITAL

GOODS

3,133,983

CONSUMER

DURABLES

&

APPAREL

-

0.6%

1,145

PulteGroup

Inc

124,691

TOTAL

CONSUMER

DURABLES

&

APPAREL

124,691

CONSUMER

STAPLES

DISTRIBUTION

&

RETAIL

-

3.0%

7,488

Walmart

Inc

676,541

TOTAL

CONSUMER

STAPLES

DISTRIBUTION

&

RETAIL

676,541

ENERGY

-

9.5%

8,462

Baker

Hughes

Co

347,111

1,302

Cheniere

Energy

Inc

279,761

2,833

Hess

Corp

376,817

24,182

Permian

Resources

Corp

347,737

11,866

Shell

PLC,

ADR

743,405

TOTAL

ENERGY

2,094,831

EQUITY

REAL

ESTATE

INVESTMENT

TRUSTS

(REITS)

-

2.6%

2,861

Alexandria

Real

Estate

Equities

Inc

279,091

2,582

Camden

Property

Trust

299,615

TOTAL

EQUITY

REAL

ESTATE

INVESTMENT

TRUSTS

(REITS)

578,706

FINANCIAL

SERVICES

-

10.7%

3,496

Discover

Financial

Services

605,612

2,809

(a)

Fiserv

Inc

577,025

3,276

KKR

&

Co

Inc

484,553

2,853

Morgan

Stanley

358,679

3,240

State

Street

Corp

318,006

TOTAL

FINANCIAL

SERVICES

2,343,875

FOOD,

BEVERAGE

&

TOBACCO

-

1.2%

2,204

Philip

Morris

International

Inc

265,251

TOTAL

FOOD,

BEVERAGE

&

TOBACCO

265,251

HEALTH

CARE

EQUIPMENT

&

SERVICES

-

3.9%

2,308

Quest

Diagnostics

Inc

348,185

1,015

UnitedHealth

Group

Inc

513,448

TOTAL

HEALTH

CARE

EQUIPMENT

&

SERVICES

861,633

HOUSEHOLD

&

PERSONAL

PRODUCTS

-

2.2%

50,425

(b)

Haleon

PLC,

ADR

481,055

TOTAL

HOUSEHOLD

&

PERSONAL

PRODUCTS

481,055

INSURANCE

-

4.2%

4,770

American

International

Group

Inc

347,256

740

Aon

PLC,

Class

A

265,778

1,300

RenaissanceRe

Holdings

Ltd

323,453

TOTAL

INSURANCE

936,487

Portfolio

of

Investments

December

31,

2024

(continued)

Large

Cap

Value

Opportunities

See

Notes

to

Financial

Statements

SHARES

DESCRIPTION

VALUE

MATERIALS

-

5.9%

3,908

BHP

Group

Ltd,

Sponsored

ADR

$

190,828

6,093

Corteva

Inc

347,057

6,088

DuPont

de

Nemours

Inc

464,210

5,418

Smurfit

WestRock

PLC

291,813

TOTAL

MATERIALS

1,293,908

MEDIA

&

ENTERTAINMENT

-

4.4%

2,483

Alphabet

Inc,

Class

A

470,032

6,003

(a)

TripAdvisor

Inc

88,664

2,913

Walt

Disney

Co/The

324,363

8,986

(a)

Warner

Bros

Discovery

Inc

94,982

TOTAL

MEDIA

&

ENTERTAINMENT

978,041

PHARMACEUTICALS,

BIOTECHNOLOGY

&

LIFE

SCIENCES

-

8.8%

5,506

AstraZeneca

PLC,

Sponsored

ADR

360,753

5,841

Gilead

Sciences

Inc

539,533

2,683

Merck

&

Co

Inc

266,905

12,023

Pfizer

Inc

318,970

9,317

Sanofi

SA,

ADR

449,359

TOTAL

PHARMACEUTICALS,

BIOTECHNOLOGY

&

LIFE

SCIENCES

1,935,520

SEMICONDUCTORS

&

SEMICONDUCTOR

EQUIPMENT

-

0.9%

10,440

Intel

Corp

209,322

TOTAL

SEMICONDUCTORS

&

SEMICONDUCTOR

EQUIPMENT

209,322

SOFTWARE

&

SERVICES

-

4.4%

15,494

Gen

Digital

Inc

424,226

3,158

Oracle

Corp

526,249

TOTAL

SOFTWARE

&

SERVICES

950,475

TECHNOLOGY

HARDWARE

&

EQUIPMENT

-

1.7%

3,504

Seagate

Technology

Holdings

PLC

302,430

9,009

(a)

Viasat

Inc

76,667

TOTAL

TECHNOLOGY

HARDWARE

&

EQUIPMENT

379,097

TELECOMMUNICATION

SERVICES

-

2.9%

27,954

AT&T

Inc

636,512

TOTAL

TELECOMMUNICATION

SERVICES

636,512

UTILITIES

-

5.3%

4,465

Alliant

Energy

Corp

264,060

2,286

Duke

Energy

Corp

246,294

5,610

FirstEnergy

Corp

223,166

5,256

Pinnacle

West

Capital

Corp

445,551

TOTAL

UTILITIES

1,179,071

TOTAL

COMMON

STOCKS

(Cost

$13,665,347)

21,999,113

TOTAL

LONG-TERM

INVESTMENTS

(Cost

$13,665,347)

21,999,113

SHARES

DESCRIPTION

RATE

VALUE

INVESTMENTS

PURCHASED

WITH

COLLATERAL

FROM

SECURITIES

LENDING

-

0.0%

4,999

(c)

State

Street

Navigator

Securities

Lending

Government

Money

Market

Portfolio

4

.460

%

(d)

4,999

TOTAL

INVESTMENTS

PURCHASED

WITH

COLLATERAL

FROM

SECURITIES

LENDING

(Cost

$4,999)

4,999

See

Notes

to

Financial

Statements

PRINCIPAL

DESCRIPTION

RATE

MATURITY

VALUE

SHORT-TERM

INVESTMENTS

-

0.1%

25,000

REPURCHASE

AGREEMENTS

-

0

.1

%

25,000

$

25,000

(e)

Fixed

Income

Clearing

Corporation

4

.430

%

01/02/25

$

25,000

TOTAL

REPURCHASE

AGREEMENTS

(Cost

$25,000)

25,000

TOTAL

SHORT-TERM

INVESTMENTS

(Cost

$25,000)

25,000

TOTAL

INVESTMENTS

-

99

.9

%

(Cost

$

13,695,346

)

22,029,112

OTHER

ASSETS

&

LIABILITIES,

NET

- 0.1%

31,473

NET

ASSETS

-

100%

$

22,060,585

ADR

American

Depositary

Receipt

(a)

Non-income

producing;

issuer

has

not

declared

an

ex-dividend

date

within

the

past

twelve

months.

(b)

Investment,

or

a

portion

of

investment,

is

out

on

loan

for

securities

lending.

The

total

value

of

the

securities

out

on

loan

as

of

the

end

of

the

reporting

period

was

$3,711.

(c)

Investments

made

with

cash

collateral

received

from

securities

on

loan.

(d)

The

rate

shown

is

the

one-day

yield

as

of

the

end

of

the

reporting

period.

(e)

Agreement

with

Fixed

Income

Clearing

Corporation,

4.430%

dated

12/31/24

to

be

repurchased

at

$25,006

on

1/2/25,

collateralized

by

Government

Agency

Securities,

with

coupon

rate

3.250%

and

maturity

date

5/15/42,

valued

at

$25,648.

Portfolio

of

Investments

December

31,

2024

Multi

Cap

Value

See

Notes

to

Financial

Statements

(Unaudited)

SHARES

DESCRIPTION

VALUE

LONG-TERM

INVESTMENTS

-

99.9%

497738966

COMMON

STOCKS

-

99

.9

%

497738966

AUTOMOBILES

&

COMPONENTS

-

4.3%

650,353

Ford

Motor

Co

$

6,438,495

281,112

General

Motors

Co

14,974,836

TOTAL

AUTOMOBILES

&

COMPONENTS

21,413,331

BANKS

-

12.0%

253,620

Bank

of

NT

Butterfield

&

Son

Ltd/The

9,269,811

172,766

Citigroup

Inc

12,160,999

63,230

JPMorgan

Chase

&

Co

15,156,863

235,903

Wells

Fargo

&

Co

16,569,826

80,448

Western

Alliance

Bancorp

6,720,626

TOTAL

BANKS

59,878,125

CAPITAL

GOODS

-

14.6%

72,529

(a)

Boeing

Co/The

12,837,633

19,978

Curtiss-Wright

Corp

7,089,593

282,720

Flowserve

Corp

16,262,054

44,709

General

Dynamics

Corp

11,780,374

16,119

Hubbell

Inc

6,752,088

150,401

nVent

Electric

PLC

10,251,332

49,555

Regal

Rexnord

Corp

7,687,467

TOTAL

CAPITAL

GOODS

72,660,541

CONSUMER

DURABLES

&

APPAREL

-

0.6%

26,219

PulteGroup

Inc

2,855,249

TOTAL

CONSUMER

DURABLES

&

APPAREL

2,855,249

CONSUMER

STAPLES

DISTRIBUTION

&

RETAIL

-

3.0%

165,234

Walmart

Inc

14,928,892

TOTAL

CONSUMER

STAPLES

DISTRIBUTION

&

RETAIL

14,928,892

ENERGY

-

10.3%

249,487

(b)

Atlas

Energy

Solutions

Inc

5,533,622

184,058

Baker

Hughes

Co

7,550,059

25,486

Cheniere

Energy

Inc

5,476,177

56,457

Hess

Corp

7,509,346

594,670

Permian

Resources

Corp

8,551,355

269,129

Shell

PLC,

ADR

16,860,932

TOTAL

ENERGY

51,481,491

EQUITY

REAL

ESTATE

INVESTMENT

TRUSTS

(REITS)

-

3.7%

63,271

Alexandria

Real

Estate

Equities

Inc

6,172,086

55,541

Camden

Property

Trust

6,444,978

168,816

STAG

Industrial

Inc

5,709,357

TOTAL

EQUITY

REAL

ESTATE

INVESTMENT

TRUSTS

(REITS)

18,326,421

FINANCIAL

SERVICES

-

8.1%

79,564

Discover

Financial

Services

13,782,872

58,975

(a)

Fiserv

Inc

12,114,645

61,094

Morgan

Stanley

7,680,738

68,303

State

Street

Corp

6,703,939

TOTAL

FINANCIAL

SERVICES

40,282,194

HEALTH

CARE

EQUIPMENT

&

SERVICES

-

2.3%

22,900

UnitedHealth

Group

Inc

11,584,194

TOTAL

HEALTH

CARE

EQUIPMENT

&

SERVICES

11,584,194

HOUSEHOLD

&

PERSONAL

PRODUCTS

-

2.2%

1,142,813

(b)

Haleon

PLC,

ADR

10,902,436

TOTAL

HOUSEHOLD

&

PERSONAL

PRODUCTS

10,902,436

INSURANCE

-

3.7%

14,655

Aon

PLC,

Class

A

5,263,490

16,113

Everest

Group

Ltd

5,840,318

29,226

RenaissanceRe

Holdings

Ltd

7,271,720

TOTAL

INSURANCE

18,375,528

See

Notes

to

Financial

Statements

SHARES

DESCRIPTION

VALUE

MATERIALS

-

4.9%

142,153

DuPont

de

Nemours

Inc

$

10,839,166

63,817

Innospec

Inc

7,023,699

125,081

Smurfit

WestRock

PLC

6,736,863

TOTAL

MATERIALS

24,599,728

MEDIA

&

ENTERTAINMENT

-

4.8%

48,733

Alphabet

Inc,

Class

A

9,225,157

374,471

(a)

TripAdvisor

Inc

5,530,937

61,738

Walt

Disney

Co/The

6,874,526

220,143

(a)

Warner

Bros

Discovery

Inc

2,326,912

TOTAL

MEDIA

&

ENTERTAINMENT

23,957,532

PHARMACEUTICALS,

BIOTECHNOLOGY

&

LIFE

SCIENCES

-

9.9%

446,050

(a)

ADMA

Biologics

Inc

7,649,758

102,749

AstraZeneca

PLC,

Sponsored

ADR

6,732,114

130,222

Gilead

Sciences

Inc

12,028,606

58,055

Merck

&

Co

Inc

5,775,311

243,502

Pfizer

Inc

6,460,108

216,055

Sanofi

SA,

ADR

10,420,333

TOTAL

PHARMACEUTICALS,

BIOTECHNOLOGY

&

LIFE

SCIENCES

49,066,230

SEMICONDUCTORS

&

SEMICONDUCTOR

EQUIPMENT

-

1.3%

95,311

Intel

Corp

1,910,986

86,260

(a)

Rambus

Inc

4,559,703

TOTAL

SEMICONDUCTORS

&

SEMICONDUCTOR

EQUIPMENT

6,470,689

SOFTWARE

&

SERVICES

-

5.8%

360,686

Gen

Digital

Inc

9,875,583

71,781

Oracle

Corp

11,961,586

221,469

(a)

Teradata

Corp

6,898,759

TOTAL

SOFTWARE

&

SERVICES

28,735,928

TECHNOLOGY

HARDWARE

&

EQUIPMENT

-

0.3%

202,661

(a)

Viasat

Inc

1,724,645

TOTAL

TECHNOLOGY

HARDWARE

&

EQUIPMENT

1,724,645

TELECOMMUNICATION

SERVICES

-

2.9%

640,534

AT&T

Inc

14,584,959

TOTAL

TELECOMMUNICATION

SERVICES

14,584,959

UTILITIES

-

5.2%

99,558

Alliant

Energy

Corp

5,887,860

51,456

Duke

Energy

Corp

5,543,869

113,429

FirstEnergy

Corp

4,512,206

117,576

Pinnacle

West

Capital

Corp

9,966,918

TOTAL

UTILITIES

25,910,853

TOTAL

COMMON

STOCKS

(Cost

$397,318,603)

497,738,966

TOTAL

LONG-TERM

INVESTMENTS

(Cost

$397,318,603)

497,738,966

SHARES

DESCRIPTION

RATE

VALUE

INVESTMENTS

PURCHASED

WITH

COLLATERAL

FROM

SECURITIES

LENDING

-

1.2%

6,176,318

(c)

State

Street

Navigator

Securities

Lending

Government

Money

Market

Portfolio

4

.460

%

(d)

6,176,318

TOTAL

INVESTMENTS

PURCHASED

WITH

COLLATERAL

FROM

SECURITIES

LENDING

(Cost

$6,176,318)

6,176,318

Portfolio

of

Investments

December

31,

2024

(continued)

Multi

Cap

Value

See

Notes

to

Financial

Statements

PRINCIPAL

DESCRIPTION

RATE

MATURITY

VALUE

SHORT-TERM

INVESTMENTS

-

0.1%

325,000

REPURCHASE

AGREEMENTS

-

0

.1

%

325,000

$

325,000

(e)

Fixed

Income

Clearing

Corporation

4

.430

%

01/02/25

$

325,000

TOTAL

REPURCHASE

AGREEMENTS

(Cost

$325,000)

325,000

TOTAL

SHORT-TERM

INVESTMENTS

(Cost

$325,000)

325,000

TOTAL

INVESTMENTS

-

101

.2

%

(Cost

$

403,819,921

)

504,240,284

OTHER

ASSETS

&

LIABILITIES,

NET

- (1.2)%

(

5,929,224

)

NET

ASSETS

-

100%

$

498,311,060

ADR

American

Depositary

Receipt

(a)

Non-income

producing;

issuer

has

not

declared

an

ex-dividend

date

within

the

past

twelve

months.

(b)

Investment,

or

a

portion

of

investment,

is

out

on

loan

for

securities

lending.

The

total

value

of

the

securities

out

on

loan

as

of

the

end

of

the

reporting

period

was

$5,908,775.

(c)

Investments

made

with

cash

collateral

received

from

securities

on

loan.

(d)

The

rate

shown

is

the

one-day

yield

as

of

the

end

of

the

reporting

period.

(e)

Agreement

with

Fixed

Income

Clearing

Corporation,

4.430%

dated

12/31/24

to

be

repurchased

at

$325,080

on

1/2/25,

collateralized

by

Government

Agency

Securities,

with

coupon

rate

3.250%

and

maturity

date

5/15/42,

valued

at

$331,618.

Portfolio

of

Investments

December

31,

2024

Small

Cap

Value

Opportunities

See

Notes

to

Financial

Statements

(Unaudited)

SHARES

DESCRIPTION

VALUE

LONG-TERM

INVESTMENTS

-

95.0%

206228680

COMMON

STOCKS

-

95

.0

%

206228680

BANKS

-

16.1%

106,725

(a)

Chain

Bridge

Bancorp

Inc

$

2,675,596

47,284

Enterprise

Financial

Services

Corp

2,666,818

171,693

Home

BancShares

Inc/AR

4,858,912

90,358

Independent

Bank

Corp/MI

3,147,169

133,079

Pacific

Premier

Bancorp

Inc

3,316,329

173,713

Seacoast

Banking

Corp

of

Florida

4,782,318

57,397

SouthState

Corp

5,709,853

59,795

(a)

Texas

Capital

Bancshares

Inc

4,675,969

37,678

Western

Alliance

Bancorp

3,147,620

TOTAL

BANKS

34,980,584

CAPITAL

GOODS

-

12.0%

28,809

Atkore

Inc

2,404,111

112,641

Columbus

McKinnon

Corp/NY

4,194,751

34,839

EnerSys

3,220,169

19,837

ESCO

Technologies

Inc

2,642,487

86,266

Flowserve

Corp

4,962,020

137,902

Mueller

Water

Products

Inc,

Class

A

3,102,795

17,378

(a)

MYR

Group

Inc

2,585,325

60,837

(a)

Vicor

Corp

2,939,644

TOTAL

CAPITAL

GOODS

26,051,302

COMMERCIAL

&

PROFESSIONAL

SERVICES

-

3.8%

480,995

Alight

Inc,

Class

A

3,328,485

54,992

Barrett

Business

Services

Inc

2,388,852

303,484

(a)

TrueBlue

Inc

2,549,266

TOTAL

COMMERCIAL

&

PROFESSIONAL

SERVICES

8,266,603

CONSUMER

DISCRETIONARY

DISTRIBUTION

&

RETAIL

-

1.6%

61,367

Academy

Sports

&

Outdoors

Inc

3,530,443

TOTAL

CONSUMER

DISCRETIONARY

DISTRIBUTION

&

RETAIL

3,530,443

CONSUMER

DURABLES

&

APPAREL

-

1.2%

358,863

(a)

Under

Armour

Inc,

Class

C

2,677,118

TOTAL

CONSUMER

DURABLES

&

APPAREL

2,677,118

CONSUMER

SERVICES

-

4.5%

209,004

(a)

El

Pollo

Loco

Holdings

Inc

2,411,906

172,064

Perdoceo

Education

Corp

4,554,534

26,828

(a)

Stride

Inc

2,788,234

TOTAL

CONSUMER

SERVICES

9,754,674

CONSUMER

STAPLES

DISTRIBUTION

&

RETAIL

-

1.2%

168,073

(a)

Grocery

Outlet

Holding

Corp

2,623,620

TOTAL

CONSUMER

STAPLES

DISTRIBUTION

&

RETAIL

2,623,620

ENERGY

-

4.9%

207,593

Antero

Midstream

Corp

3,132,578

101,460

(b)

Atlas

Energy

Solutions

Inc

2,250,383

64,293

California

Resources

Corp

3,336,164

84,201

Magnolia

Oil

&

Gas

Corp,

Class

A

1,968,619

TOTAL

ENERGY

10,687,744

EQUITY

REAL

ESTATE

INVESTMENT

TRUSTS

(REITS)

-

8.0%

115,187

CareTrust

REIT

Inc

3,115,808

135,468

Independence

Realty

Trust

Inc

2,687,685

69,932

PotlatchDeltic

Corp

2,744,831

70,668

SL

Green

Realty

Corp

4,799,771

119,707

STAG

Industrial

Inc

4,048,491

TOTAL

EQUITY

REAL

ESTATE

INVESTMENT

TRUSTS

(REITS)

17,396,586

FINANCIAL

SERVICES

-

7.2%

691,532

BGC

Group

Inc,

Class

A

6,265,280

249,222

DigitalBridge

Group

Inc

2,811,224

120,165

Marex

Group

PLC

3,745,543

Portfolio

of

Investments

December

31,

2024

(continued)

Small

Cap

Value

Opportunities

See

Notes

to

Financial

Statements

SHARES

DESCRIPTION

VALUE

FINANCIAL

SERVICES

(continued)

28,985

(a)

Mr

Cooper

Group

Inc

$

2,782,850

TOTAL

FINANCIAL

SERVICES

15,604,897

FOOD,

BEVERAGE

&

TOBACCO

-

1.6%

89,657

(a)

Simply

Good

Foods

Co/The

3,494,830

TOTAL

FOOD,

BEVERAGE

&

TOBACCO

3,494,830

HEALTH

CARE

EQUIPMENT

&

SERVICES

-

3.4%

78,522

(a)

Castle

Biosciences

Inc

2,092,611

172,103

(a)

Pediatrix

Medical

Group

Inc

2,257,992

174,902

(a)

Tactile

Systems

Technology

Inc

2,996,071

TOTAL

HEALTH

CARE

EQUIPMENT

&

SERVICES

7,346,674

INSURANCE

-

4.6%

61,523

Axis

Capital

Holdings

Ltd

5,452,168

90,824

(a)

Skyward

Specialty

Insurance

Group

Inc

4,590,245

TOTAL

INSURANCE

10,042,413

MATERIALS

-

2.4%

28,467

Materion

Corp

2,814,817

78,510

Worthington

Steel

Inc

2,498,188

TOTAL

MATERIALS

5,313,005

MEDIA

&

ENTERTAINMENT

-

2.2%

68,187

John

Wiley

&

Sons

Inc,

Class

A

2,980,454

267,542

(a)

Vimeo

Inc

1,712,269

TOTAL

MEDIA

&

ENTERTAINMENT

4,692,723

PHARMACEUTICALS,

BIOTECHNOLOGY

&

LIFE

SCIENCES

-

5.7%

242,746

(a)

ADMA

Biologics

Inc

4,163,094

110,863

(a)

Alkermes

PLC

3,188,420

54,345

(a)

Biohaven

Ltd

2,029,786

17,689

(a)

Cytokinetics

Inc

832,090

43,327

(a)

Halozyme

Therapeutics

Inc

2,071,464

TOTAL

PHARMACEUTICALS,

BIOTECHNOLOGY

&

LIFE

SCIENCES

12,284,854

SEMICONDUCTORS

&

SEMICONDUCTOR

EQUIPMENT

-

2.2%

64,128

(a)

Ambarella

Inc

4,664,671

TOTAL

SEMICONDUCTORS

&

SEMICONDUCTOR

EQUIPMENT

4,664,671

SOFTWARE

&

SERVICES

-

2.0%

310,147

Adeia

Inc

4,335,855

TOTAL

SOFTWARE

&

SERVICES

4,335,855

TECHNOLOGY

HARDWARE

&

EQUIPMENT

-

5.8%

207,867

(a)

Arlo

Technologies

Inc

2,326,032

290,235

(a)

Harmonic

Inc

3,839,809

33,441

(a)

Lumentum

Holdings

Inc

2,807,372

544,356

(a)

Powerfleet

Inc

NJ

3,625,411

TOTAL

TECHNOLOGY

HARDWARE

&

EQUIPMENT

12,598,624

UTILITIES

-

4.6%

33,140

IDACORP

Inc

3,621,539

32,265

MGE

Energy

Inc

3,031,620

47,594

Spire

Inc

3,228,301

TOTAL

UTILITIES

9,881,460

TOTAL

COMMON

STOCKS

(Cost

$172,400,748)

206,228,680

TOTAL

LONG-TERM

INVESTMENTS

(Cost

$172,400,748)

206,228,680

SHARES

DESCRIPTION

RATE

VALUE

INVESTMENTS

PURCHASED

WITH

COLLATERAL

FROM

SECURITIES

LENDING

-

1.1%

2,319,649

(c)

State

Street

Navigator

Securities

Lending

Government

Money

Market

Portfolio

4

.460

%

(d)

2,319,649

TOTAL

INVESTMENTS

PURCHASED

WITH

COLLATERAL

FROM

SECURITIES

LENDING

(Cost

$2,319,649)

2,319,649

See

Notes

to

Financial

Statements

PRINCIPAL

DESCRIPTION

RATE

MATURITY

VALUE

SHORT-TERM

INVESTMENTS

-

5.0%

10784827

REPURCHASE

AGREEMENTS

-

5

.0

%

10784827

$

10,450,000

(e)

Fixed

Income

Clearing

Corporation

4

.430

%

01/02/25

$

10,450,000

334,827

(f)

Fixed

Income

Clearing

Corporation

1

.360

01/02/25

334,827

TOTAL

REPURCHASE

AGREEMENTS

(Cost

$10,784,827)

10,784,827

TOTAL

SHORT-TERM

INVESTMENTS

(Cost

$10,784,827)

10,784,827

TOTAL

INVESTMENTS

-

101

.1

%

(Cost

$

185,505,224

)

219,333,156

OTHER

ASSETS

&

LIABILITIES,

NET

- (1.1)%

(

2,304,971

)

NET

ASSETS

-

100%

$

217,028,185

REIT

Real

Estate

Investment

Trust

(a)

Non-income

producing;

issuer

has

not

declared

an

ex-dividend

date

within

the

past

twelve

months.

(b)

Investment,

or

a

portion

of

investment,

is

out

on

loan

for

securities

lending.

The

total

value

of

the

securities

out

on

loan

as

of

the

end

of

the

reporting

period

was

$2,227,870.

(c)

Investments

made

with

cash

collateral

received

from

securities

on

loan.

(d)

The

rate

shown

is

the

one-day

yield

as

of

the

end

of

the

reporting

period.

(e)

Agreement

with

Fixed

Income

Clearing

Corporation,

4.430%

dated

12/31/24

to

be

repurchased

at

$10,452,572

on

1/2/25,

collateralized

by

Government

Agency

Securities,

with

coupon

rate

3.250%

and

maturity

date

5/15/42,

valued

at

$10,659,152.

(f)

Agreement

with

Fixed

Income

Clearing

Corporation,

1.360%

dated

12/31/24

to

be

repurchased

at

$334,852

on

1/2/25,