with the Immigration and Naturalization Service of the U.S. Department of Justice (the Department of Homeland Security’s predecessor agency with respect to, among other matters, foreign students and exchange visitors) and state approving agencies for veterans benefits in Washington, D.C., Maryland and Virginia. All of the applicable agencies approved the transaction, which closed in May 2001.

In February 2004, New Mountain transferred 350,000 of its shares of the Company’s Series A Convertible Redeemable Preferred Stock (together with all associated accrued cash and stock dividends), representing approximately 2.6% of the outstanding common stock equivalents of Strayer, (the ‘‘Trust Shares’’) to the New Mountain Strayer Trust, an irrevocable trust. The beneficiaries of the trust are all of New Mountain’s partners, at the time of a distribution from the trust, who are U.S. citizens or residents for tax purposes. Before transferring the Trust Shares to the trust, New Mountain irrevocably deposited into escrow the Trust Shares and gave to the trustee an irrevocable proxy to vote the Trust Shares during the escrow period. In connection with the transfer to escrow and the associated reduction in New Mountain’s ownership and control below the Department of Education’s 25% regulatory threshold, Strayer University was required to make a number of submissions to educational regulatory bodies, including, among others, filing an application for approval to continue to participate in federal student financial aid programs with the Department of Education. All of the applicable regulatory agencies approved the transaction. As is customary for institutions undergoing a change of ownership resulting in a change of control, the Department of Education recertified the University on a provisional basis through December 2006. After the Department of Education and other relevant regulatory agencies approved the change in ownership and control resulting from the transfer of the Trust Shares into escrow, the escrow agent transferred the Trust Shares to the New Mountain Strayer Trust. The University’s education regulators, including the Department of Education, Middle States and relevant state education agencies, either did not require or provided approval in connection with the subsequent public offering in February 2004.

If Strayer University underwent a change of control that required approval by any state authority, Middle States or any federal agency, and any required regulatory approval were significantly delayed, limited or denied, there could be a material adverse effect on Strayer University’s ability to offer certain educational programs, award certain degrees, diplomas or certificates, operate one or more of its locations, admit certain students or participate in Title IV programs, which in turn would materially and adversely affect Strayer University’s operations. A change that required approval by a state regulatory authority, Middle States or a federal agency could also delay Strayer University’s ability to establish new campuses or educational programs and may have other adverse regulatory effects. Furthermore, the suspension from Title IV programs and the necessity of obtaining regulatory approvals in connection with a change of control may materially limit Strayer University’s flexibility in future financing or acquisition transactions.

We maintain a website at http://www.strayereducation.com. The information on our website is not incorporated by reference in this Annual Report on Form 10-K and our web address is included as an inactive textual reference only. We make available on our website our Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Exchange Act as soon as reasonably practicable after we electronically file such material with, or furnish it to, the SEC.

The Form 10-K and other reports filed with the SEC can be read or copied at the SEC’s Public Reference Room at 100 F Street, NE, Washington, D.C. 20549. Information on the operation of the Public Reference Room can be obtained by calling the SEC at 1-800-SEC-0330. The SEC maintains a website that contains reports, proxy and information statements, and other information regarding issuers that file electronically with the SEC; the website address is http://www.sec.gov.

Investing in our common stock involves a high degree of risk. You should carefully consider the following risk factors and all other information contained in this Annual Report on Form 10-K or in the

Table of Contentsdocuments incorporated by reference herein before deciding to purchase our common stock. The occurrence of any of the following risks could materially harm our business, and you could suffer a complete loss of your investment. See ‘‘Cautionary Notice Regarding Forward-Looking Statements.’’

Risks Related to Extensive Regulation of Our Business

If we fail to comply with the extensive regulatory requirements for our business, we could face significant monetary liabilities, fines and penalties, including loss of access to federal student loans and grants for our students.

As a provider of higher education, we are subject to extensive regulation on both the federal and state levels. In particular, the Higher Education Act of 1965, as amended (the ‘‘Higher Education Act’’), and related regulations subject Strayer University and all other higher education institutions that participate in the various federal student financial aid programs under Title IV of the Higher Education Act (‘‘Title IV programs’’) to significant regulatory scrutiny.

The Higher Education Act mandates specific regulatory responsibilities for each of the following components of the higher education regulatory triad: (1) the federal government through the U.S. Department of Education (the ‘‘Department of Education’’); (2) the accrediting agencies recognized by the U.S. Secretary of Education and (3) state education regulatory bodies.

The regulations, standards and policies of these regulatory agencies frequently change, and changes in, or new interpretations of, applicable laws, regulations or standards could have a material adverse effect on our accreditation, authorization to operate in various states, permissible activities, receipt of funds under Title IV programs or costs of doing business.

If we are found to be in noncompliance with any of these regulations, standards or policies, we could lose our access to Title IV program funds, which would have a material adverse effect on our business. In the 2006 fall term, approximately 57% of our students participated in one or more Title IV programs. Findings of noncompliance also could result in our being required to pay monetary damages, or being subjected to fines, penalties, injunctions, restrictions on our access to Title IV program funds or other censure that could have a material adverse effect on our business.

If we fail to maintain our institutional accreditation, we would lose our ability to participate in Title IV programs.

Strayer University is institutionally accredited by the Middle States Commission on Higher Education (‘‘Middle States’’), one of the six regional accrediting agencies recognized by the U.S. Secretary of Education as a reliable authority as to educational quality. Accreditation by an accrediting agency recognized by the Secretary of Education is required in order for an institution to become and remain eligible to participate in Title IV programs. The loss of accreditation would, among other things, render Strayer University ineligible to participate in Title IV programs and would have a material adverse effect on our business. In addition, an adverse action by Middle States other than loss of accreditation, such as issuance of a warning, could have a material adverse effect on our business or have an adverse effect on the market price of our common stock.

If we fail to maintain any of our state authorizations, we would lose our ability to operate in that state and to participate in Title IV programs there.

With respect to each campus, Strayer University is authorized to operate and to grant degrees, diplomas or certificates by the applicable education agency of the state where the campus is located. Such state authorization is required in order for students at the campus to be eligible to participate in Title IV programs. The loss of authorization in a state would, among other things, render Strayer University ineligible to participate in Title IV programs at least at those state campus locations and could have a material adverse effect on our business.

Student loan defaults could result in the loss of eligibility to participate in Title IV programs.

In general, under the Higher Education Act, an educational institution may lose its eligibility to participate in some or all Title IV programs if, for three consecutive federal fiscal years, 25% or more

25

Table of Contentsof its students who were required to begin repaying their student loans in the relevant federal fiscal year default on their payment by the end of the next federal fiscal year. In addition, an institution may lose its eligibility to participate in some or all Title IV programs if its default rate for a federal fiscal year was greater than 40%. If we lose eligibility to participate in Title IV programs because of high student loan default rates, it would have a material adverse effect on our business. Strayer University’s default rates calculated by the Department of Education on Federal Family Education Loan Program loans for the 2002, 2003 and 2004 federal fiscal years, the three most recent years for which this information is available, were 3.7%, 2.7% and 4.5%, respectively. The average cohort default rates for proprietary institutions nationally, as calculated by the Department of Education, were 8.7%, 7.3% and 8.6% in federal fiscal years 2002, 2003 and 2004, respectively.

A failure to demonstrate ‘‘administrative capability’’ or ‘‘financial responsibility’’ may result in the loss of eligibility to participate in Title IV programs.

If we fail to maintain ‘‘administrative capability’’ as defined by the Department of Education, we could lose our eligibility to participate in Title IV programs or have that eligibility adversely conditioned, which would have a material adverse effect on our business. Furthermore, if we fail to demonstrate ‘‘financial responsibility’’ under the Department of Education’s regulations, we could lose our eligibility to participate in Title IV programs or have that eligibility adversely conditioned, which would have a material adverse effect on our business.

We are subject to sanctions if we fail to calculate and make timely payment of refunds of Title IV program funds for students who withdraw before completing their educational program.

The Higher Education Act and Department of Education regulations require us to calculate refunds of unearned Title IV program funds disbursed to students who withdraw from their educational program before completing it. If refunds are not properly calculated or timely paid, we may be sanctioned or subject to other adverse actions by the Department of Education, which could have a material adverse effect on our business.

We are dependent on the renewal and maintenance of Title IV programs.

Congress reauthorizes the Higher Education Act, which is the law governing Title IV programs, approximately every five to six years. Congress is currently considering reauthorization of the Higher Education Act. Additionally, Congress determines the funding level for each Title IV program on an annual basis. Any action by Congress that significantly reduces funding for Title IV programs or the ability of our school or students to participate in these programs could materially harm our business. A reduction in government funding levels could lead to lower enrollments at our school and require us to arrange for alternative sources of financial aid for our students. Lower student enrollments or our inability to arrange such alternative sources of funding could adversely affect our business.

Our school would lose its eligibility to participate in federal student financial aid programs if the percentage of our revenues derived from those programs were too high.

A proprietary institution loses its eligibility to participate in the federal student financial aid programs if it derives more than 90% of its revenues, on a cash basis, from these programs in any fiscal year. Using the Department of Education’s formula, we derived approximately 71% of our cash-basis revenues from these programs in 2005.

Our failure to comply with the Department of Education’s incentive compensation rules could result in sanctions.

If we pay a bonus, commission or other incentive payment in violation of applicable requirements, we could be subject to sanctions, which could have a material adverse effect on our business.

Risks Related to Our Business

We may not be able to sustain our recent growth rate, and we may not be able to manage future growth effectively.

We have experienced a period of significant growth since the beginning of 2001. Over this period, we opened 33 new campuses and our revenue increased 22% between 2000 and 2006 on a compound

26

Table of Contentsannual basis. Our ability to sustain our current rate of growth depends on a number of factors, including our ability to obtain regulatory approvals, our ability to recruit and retain high quality academic and administrative personnel at new campuses and competitive factors. In addition, growth and expansion of our operations may place a significant strain on our resources and increased demands on our management information and reporting systems, financial management controls and personnel. Although we have made a substantial investment in augmenting our financial and management information systems and other resources to support future growth, we cannot assure you that we will be able to manage further expansion effectively. Failure to do so could adversely affect our business.

Our success depends in part on our ability to update and expand the content of existing programs and develop new programs in a cost-effective manner and on a timely basis.

Our success depends in part on our ability to update and expand the content of our programs, develop new programs in a cost-effective manner and meet students’ needs in a timely manner. Prospective employers of our graduates increasingly demand that their entry-level employees possess appropriate technological and other skills. The update and expansion of our existing programs and the development of new programs may not be accepted by students, prospective employers or the online education market. If we cannot respond to changes in industry requirements, our business may be adversely affected. Even if we are able to develop acceptable new programs, we may not be able to introduce these new programs as quickly as students require due to regulatory constraints or as quickly as our competitors introduce competing new programs.

Our strategy of opening new schools and adding new services is dependent on regulatory approvals and requires significant resources.

Establishing new schools and locations and adding new services require us to make investments in management and capital expenditures, incur marketing expenses and reallocate other resources. To open a new school or location, we are required to obtain appropriate federal, state, and accrediting agency approvals, which may be conditioned or delayed in a manner which could significantly affect our growth plans. In addition, to be eligible for federal student financial aid programs, the new school or location would have to be approved by the Department of Education. We cannot assure you that we will be able to open successfully new campus locations or add new services in the future. Our failure to manage effectively the operations of newly established schools and locations could adversely affect our business.

Our financial performance depends in part on our ability to continue to develop awareness of the programs we offer among working adult students.

The continued development of awareness of the programs we offer among working adult students is critical to the continued acceptance and growth of our programs. If we are unable to continue to develop awareness of the programs we offer, this could limit our enrollments and negatively impact our business. The following are some of the factors that could prevent us from successfully marketing our programs:

|  |  |

| • | the emergence of more successful competitors; |

|  |  |

| • | customer dissatisfaction with our services and programs; |

|  |  |

| • | performance problems with our online systems; and |

|  |  |

| • | our failure to maintain or expand our brand or other factors related to our marketing. |

We face strong competition in the post-secondary education market.

Post-secondary education in our market area is highly competitive. We compete with traditional public and private two-year and four-year colleges, other for-profit schools and alternatives to higher education, such as employment and military service. Public colleges may offer programs similar to those of Strayer University at a lower tuition level as a result of government subsidies, government

27

Table of Contentsand foundation grants, tax-deductible contributions and other financial sources not available to proprietary institutions. Some of our competitors in both the public and private sectors have substantially greater financial and other resources than we do. This strong competition could adversely affect our business.

Strayer University Online and Strayer University do not rely on exclusive proprietary rights and intellectual property, and competitors may attempt to duplicate Strayer programs and methods.

Third parties may attempt to develop competing programs or duplicate or copy aspects of Strayer University’s curriculum, online library, quality management and other proprietary content. Any such attempt, if successful, could adversely affect our business. In the ordinary course of its business, Strayer develops intellectual property of many kinds that is or will be the subject of copyright, trademark, service mark, patent, trade secret or other protections. Such intellectual property includes but is not limited to Strayer’s courseware materials for classes taught via the Internet or via other distance learning means and business know-how and internal processes and procedures developed to respond to the requirements of its various education regulatory agencies.

Our future success depends in part upon our ability to recruit and retain key personnel.

In connection with our May 2001 recapitalization, we hired a new management team, including Robert S. Silberman, our Chairman and Chief Executive Officer, to implement our new growth strategy. Our success to date has been, and our continuing success will be, substantially dependent upon our ability to attract and retain highly qualified executive officers, faculty and administrators and other key personnel. If we cease to employ any of these integral personnel or fail to manage a smooth transition to new personnel, our business could suffer.

Seasonal and other fluctuations in our operating results could adversely affect the trading price of our common stock.

Our business is subject to seasonal fluctuations, which cause our operating results to fluctuate from quarter to quarter. This fluctuation may result in volatility or have an adverse effect on the market price of our common stock. We experience, and expect to continue to experience, seasonal fluctuations in our revenue. Historically, our quarterly revenues and income have been lowest in the third quarter (July through September) because fewer students are enrolled during the summer months. We also incur significant expenses in preparing for our peak enrollment in the fourth quarter (October through December), including investing in online infrastructure necessary to support increased usage. These investments result in fluctuations in our operating results which could result in volatility or have an adverse effect on the market price of our common stock. In addition, because of the recent increase in the use of personal computers and access to the Internet, the online education market is a rapidly evolving market, and we may not be able to accurately forecast future enrollment growth and revenues.

Regulatory requirements may make it more difficult to acquire us.

A change in ownership resulting in a change of control of Strayer would trigger a requirement for recertification of Strayer University by the Department of Education for purposes of participation in federal student financial aid programs, a review of Strayer University’s accreditation by Middle States and reauthorization of Strayer University by certain state licensing and other regulatory agencies. If we underwent a change of control that required approval by any state authority, Middle States or any federal agency, and any required regulatory approval were significantly delayed, limited or denied, there could be a material adverse effect on our ability to offer certain educational programs, award certain degrees, diplomas or certificates, operate one or more of our locations, admit certain students or participate in Title IV programs, which in turn could have a material adverse effect on our business. These factors may discourage takeover attempts.

Capacity constraints or system disruptions to Strayer University Online’s computer networks could damage the reputation of Strayer University and limit our ability to attract and retain students.

The performance and reliability of Strayer University Online’s program infrastructure is critical to our reputation and ability to attract and retain students. Any system error or failure, or a sudden and

28

Table of Contentssignificant increase in traffic, could result in the unavailability of Strayer University Online’s computer networks. We cannot assure you that Strayer University Online will be able to expand its program infrastructure on a timely basis sufficient to meet demand for its programs. Strayer University Online’s computer systems and operations could be vulnerable to interruption or malfunction due to events beyond its control, including natural disasters and telecommunications failures. Any interruption to Strayer University Online’s computer systems or operations could have a material adverse effect on our ability to attract and retain students.

Strayer University Online’s computer networks may be vulnerable to security risks that could disrupt operations and require it to expend significant resources.

Strayer University Online’s computer networks may be vulnerable to unauthorized access, computer hackers, computer viruses and other security problems. A user who circumvents security measures could misappropriate proprietary information or cause interruptions or malfunctions in operations. As a result, Strayer University Online may be required to expend significant resources to protect against the threat of these security breaches or to alleviate problems caused by these breaches.

Strayer University Online operates in a highly competitive market with rapid technological changes and it may not compete successfully.

Online education is a highly fragmented and competitive market that is subject to rapid technological change. Competitors vary in size and organization from traditional colleges and universities, many of which have some form of online education programs, to for-profit schools, corporate universities and software companies providing online education and training software. We expect the online education and training market to be subject to rapid changes in technologies. Strayer University Online’s success will depend on its ability to adapt to these changing technologies.

Government regulations relating to the Internet could increase Strayer University Online’s cost of doing business, affect its ability to grow or otherwise have a material adverse effect on our business.

The increasing popularity and use of the Internet and other online services for the delivery of education has led and may lead to the adoption of new laws and regulatory practices in the United States or foreign countries or to the interpretation of the application of existing laws and regulations to such services. These new laws and interpretations may relate to issues such as online privacy, copyright, trademark and service mark, sales taxes, fair business practices and the requirement that online education institutions qualify to do business as a foreign corporation or be licensed as a school in one or more jurisdictions where they have no physical location. New laws, regulations or interpretations related to doing business over the Internet could increase Strayer University Online’s cost of doing business, affect its ability to increase enrollments and revenues or otherwise have a material adverse effect on our business.

In addition, as of July 1, 2006, if Strayer University fails to meet Middle States’ standards with respect to distance education, its otherwise eligible distance education programs could lose eligibility for federal student financial aid programs. Such an occurrence would have a material adverse effect on our business.

We may not be able to successfully complete or integrate future acquisitions.

As part of our growth strategy, we expect to consider selective acquisitions. We cannot assure you that we will be able to complete successfully any acquisitions on favorable terms, or that if we do, we will be able to successfully integrate the personnel, operations and technologies of any such acquisitions. Our failure to successfully complete or integrate future acquisitions could disrupt our business and materially and adversely affect our profitability and liquidity by distracting our management and employees and increasing our expenses. In addition, because an acquisition is considered a change in ownership and control of the acquired institution under applicable regulatory standards, we must seek approval from the Department of Education and most applicable state agencies and accrediting agencies and possibly other regulatory bodies when we acquire an institution. If we were unable to obtain such approvals of an institution we acquired, depending on the size of that acquisition, that failure could have a material adverse effect on our business.

29

Table of ContentsItem 1B. Unresolved Staff Comments

There are no SEC staff comments on the Company’s periodic SEC reports which are unresolved.

Item 2. Properties

We lease all of our campus and administrative facilities except for six campus facilities which we own. Our campuses are located in Pennsylvania, Delaware, Maryland, Washington, D.C., Virginia, North Carolina, South Carolina, Georgia, Tennessee, Florida, Alabama and Kentucky, and our corporate headquarters is located in Virginia. Our leases generally range from five to ten years with one to two renewal options for extended terms. As of December 31, 2006, we leased 46 campus and administrative facilities consisting of approximately 640,000 square feet. The facilities that we own consist of approximately 140,000 square feet.

We evaluate current utilization of our facilities and projected enrollment growth to determine facility needs. We anticipate that approximately an additional 130,000 square feet will be leased in 2007.

Item 3. Legal Proceedings

From time to time, the Company is involved in litigation and other legal proceedings arising out of the ordinary course of its business. There are no pending material legal proceedings to which the Company is subject or to which the Company’s property is subject.

Item 4. Submission of Matters to a Vote of Security Holders

No matters were voted upon by stockholders during the fourth quarter of 2006.

30

Table of ContentsPART II

Item 5. Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

Our common stock is traded on the Nasdaq National Market under the symbol ‘‘STRA.’’ The following table sets forth, for the periods indicated, the high, low, and closing sale prices of the Company’s common stock, as reported on the Nasdaq National Market.

|  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |

| |  |  | High |  |  | Low |  |  | Close |

| 2006 |  |  |  |  | | |  |  |  |  | | |  |  |  |  | | |

| First Quarter |  |  |  | $ | 104.49 | |  |  |  | $ | 87.07 | |  |  |  | $ | 102.26 | |

| Second Quarter |  |  |  | $ | 112.00 | |  |  |  | $ | 94.34 | |  |  |  | $ | 97.12 | |

| Third Quarter |  |  |  | $ | 111.49 | |  |  |  | $ | 92.59 | |  |  |  | $ | 108.21 | |

| Fourth Quarter |  |  |  | $ | 118.88 | |  |  |  | $ | 100.84 | |  |  |  | $ | 106.05 | |

| 2005 |  |  |  |  | | |  |  |  |  | | |  |  |  |  | | |

| First Quarter |  |  |  | $ | 115.96 | |  |  |  | $ | 102.18 | |  |  |  | $ | 113.32 | |

| Second Quarter |  |  |  | $ | 115.21 | |  |  |  | $ | 77.24 | |  |  |  | $ | 86.26 | |

| Third Quarter |  |  |  | $ | 103.27 | |  |  |  | $ | 78.27 | |  |  |  | $ | 94.52 | |

| Fourth Quarter |  |  |  | $ | 102.70 | |  |  |  | $ | 85.37 | |  |  |  | $ | 93.70 | |

|

Peer Group Performance Graph

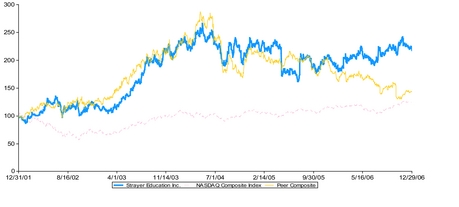

The following performance graph compares the Company’s cumulative stockholder return on its common stock since December 31, 2001 with The NASDAQ Stock Market (U.S.) Index and a self-determined peer group consisting of Apollo Group, Inc. (APOL), Career Education Corporation (CECO), Corinthian Colleges, Inc. (COCO), DeVry, Inc. (DV), and ITT Educational Services, Inc. (ESI). At present, there is no comparative index for the education industry. This graph is not deemed to be ‘‘soliciting material’’ or to be filed with the SEC or subject to the SEC’s proxy rules or to the liabilities of Section 18 of the Securities Exchange Act, and the graph shall not be deemed to be incorporated by reference into any prior or subsequent filing by the Company under the Securities Act or the Securities Exchange Act.

31

Table of ContentsComparison of 60 Month Cumulative Total Return*

Among Strayer Education, Inc.

The NASDAQ Stock Market (U.S.) Index and a Peer Group

|  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |

| Name |  |  | 12/31/01 |  |  | 12/31/02 |  |  | 12/31/03 |  |  | 12/31/04 |  |  | 12/30/05 |  |  | 12/29/06 |

| Strayer Education, Inc. |  |  |  |  | 100 | |  |  |  |  | 118 | |  |  |  |  | 223 | |  |  |  |  | 225 | |  |  |  |  | 192 | |  |  |  |  | 218 | |

| NASDAQ Stock Market (U.S.) |  |  |  |  | 100 | |  |  |  |  | 68 | |  |  |  |  | 103 | |  |  |  |  | 112 | |  |  |  |  | 113 | |  |  |  |  | 124 | |

| Peer Group |  |  |  |  | 100 | |  |  |  |  | 127 | |  |  |  |  | 207 | |  |  |  |  | 215 | |  |  |  |  | 177 | |  |  |  |  | 143 | |

|

|  |

| * | The comparison assumes $100 was invested on December 31, 2001 in the Company’s common stock, the NASDAQ Stock Market (U.S.) Index and the peer companies selected by the Company. |

NOTE: Peer group consists of Apollo Group, Inc., Career Education Corporation, Corinthian Colleges, Inc., DeVry, Inc. and ITT Educational Services, Inc.

As of January 31, 2007, there were 14,293,584 shares of common stock outstanding, and approximately 80 holders of record. In addition, there exist a number (approximately 17,000 as of December 2006) of institutional and other holders of common stock whose shares are held in nominee accounts by brokers.

As announced on November 3, 2003, the Company’s Board of Directors initially authorized the Company to repurchase up to an aggregate of $15 million in value of common stock through December 31, 2004 in open market purchases from time to time at the discretion of the Company’s management, depending on market conditions and other corporate considerations. The Company’s Board of Directors amended the program on various dates, increasing the repurchase amount authorized and extending the expiration date. Since inception, a total of $145 million has been authorized by the Company’s Board of Directors for share repurchases through December 31, 2007, of which $32 million was remaining at December 31, 2006. All of the Company’s share repurchases were effected in compliance with Rule 10b-18 under the Securities Exchange Act of 1934, as amended. This share repurchase plan may be modified, suspended or terminated at any time by the Company without notice.

32

Table of ContentsA summary of the Company’s share repurchases since the inception of the plan is as follows:

|  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |

| |  |  | Shares

repurchased |  |  | Average price

paid per share |  |  | Cost of share

repurchases |

| |  |  | (#) |  |  | ($) |  |  | ($ mil.) |

| 2003 |  |  |  |  | 32,350 | |  |  |  |  | 99.57 | |  |  |  |  | 3.2 | |

| 2004 |  |  |  |  | 346,444 | |  |  |  |  | 106.13 | |  |  |  |  | 36.8 | |

| 2005 |  |  |  |  | 410,071 | |  |  |  |  | 92.59 | |  |  |  |  | 38.0 | |

| 2006 |  |  |  |  | 349,066 | |  |  |  |  | 100.39 | |  |  |  |  | 35.0 | |

| Total |  |  |  |  | 1,137,931 | |  |  |  |  | 99.30 | |  |  |  |  | 113.0 | |

|

A summary of the Company’s share repurchases during the three months ended December 31, 2006 is as follows:

|  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |

| |  |  | Total number

of shares

repurchased1 |  |  | Average price

paid per share |  |  | Remaining

authorization

under the plan |

| |  |  | (#) |  |  | ($) |  |  | ($ mil.) |

| October |  |  |  |  | — | |  |  |  |  | — | |  |  |  |  | | |

| November |  |  |  |  | 12,800 | |  |  |  |  | 110.88 | |  |  |  |  | | |

| December |  |  |  |  | 59,500 | |  |  |  |  | 110.64 | |  |  |  |  | | |

| Total |  |  |  |  | 72,300 | |  |  |  |  | 110.69 | |  |  |  |  | 32.0 | |

|

|  |

| 1. | All shares repurchased were part of a publicly announced plan. |

We have established a policy of declaring quarterly cash dividends on our common stock. Consistent with this policy, we have paid common stock dividends on a quarterly basis for more than the past six years. The Company announced in October 2006 that, commencing with its fourth quarter dividend to be paid on December 11, 2006, it was increasing its annual common stock dividend by 25% to $1.25 per share from $1.00 per share. This increase in annual dividend will result in a quarterly dividend payment of $0.3125 per share. Whether to declare dividends and the amount of dividends to be paid in the future will be reviewed periodically by our Board of Directors in light of the Company’s earnings, cash flow, financial condition, capital needs, investment opportunities and regulatory considerations. There is no requirement or assurance that common dividends will continue to be paid.

In 2001, we issued to New Mountain Partners, LP and MidOcean Capital Investors, LP (formerly DB Capital Partners, Inc) our Series A Convertible Redeemable Preferred Stock, the terms of which are described in detail in Note 7 to the Consolidated Financial Statements below. In March 2004, 3.1 million outstanding and accrued shares of the Series A Convertible Redeemable Preferred Stock were converted into shares of common stock on a one for one basis and sold in a secondary public offering. The Company received no proceeds from such offering other than $4.2 million associated with certain management option exercises in connection with the exercise by the underwriters of the ‘‘green shoe’’ with respect to the secondary offering. In June 2004, the remaining 875,120 outstanding and accrued shares of Series A Convertible Redeemable Preferred Stock were called for redemption by the Company and in lieu of being redeemed for cash, were converted by the holders into 875,120 common shares in accordance with the terms of the Series A shares. As a result, the Company has no more preferred shares outstanding.

33

Table of ContentsSet forth in the table below is information pertaining to securities authorized for issuance under our equity compensation plans. There are options but no warrants or other rights existing under these plans.

Equity Compensation Plan Information

as of December 31, 2006

|  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |

| Plan Category |  |  | Number of securities to

be issued upon exercise

of outstanding options,

warrants and rights |  |  | Weighted average

exercise

price of outstanding

options, warrants

and rights |  |  | Number of

securities remaining

available for future

issuance under

equity compensation

plans (excluding

securities reflected

in column (a)) |

| |  |  | (a) |  |  | (b) |  |  | (c) |

| 1. |  |  | Equity compensation plans previously approved by security holders |  |  |  |  | | |  |  |  |  | | |  |  |  |  | | |

| |  |  | A. |  |  | 1996 Stock Option Plan as amended at the May 2001, the May 2005, and the May 2006 Annual Shareholders’ Meetings |  |  |  |  | 762,334 | |  |  |  | $ | 56.42 | |  |  |  |  | 485,088 | |

| 2. |  |  | Equity compensation plans not previously approved by security holders |  |  |  |  | — | |  |  |  |  | — | |  |  |  |  | — | |

| |  |  | Total |  |  |  |  | 762,334 | |  |  |  | $ | 56.42 | |  |  |  |  | 485,088 | |

|

Item 6. Selected Financial Data.

The following table sets forth, for the periods and at the dates indicated, selected consolidated financial and operating data. The financial information has been derived from our consolidated financial statements.

The information set forth below is qualified by reference to and should be read in conjunction with our consolidated financial statements and notes thereto and ‘‘Management’s Discussion and Analysis of Financial Condition and Results of Operations’’ and other information included elsewhere or incorporated by reference in this Annual Report on Form 10-K.

34

Table of Contents

|  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |

| |  |  | Year Ended December 31, |

| |  |  | 2002 |  |  | 2003 |  |  | 2004 |  |  | 2005 |  |  | 2006 |

| |  |  | (in thousands, except per share, enrollment and campus data) |

| Income Statement Data: |  |  |  |  | | |  |  |  |  | | |  |  |  |  | | |  |  |  |  | | |  |  |  |  | | |

| Revenues |  |  |  | $ | 116,710 | |  |  |  | $ | 147,025 | |  |  |  | $ | 183,194 | |  |  |  | $ | 220,507 | |  |  |  | $ | 263,648 | |

| Costs and expenses: |  |  |  |  | | |  |  |  |  | | |  |  |  |  | | |  |  |  |  | | |  |  |  |  | | |

| Instruction and educational support |  |  |  |  | 41,601 | |  |  |  |  | 53,116 | |  |  |  |  | 63,860 | |  |  |  |  | 76,977 | |  |  |  |  | 91,120 | |

| Selling and promotion |  |  |  |  | 16,773 | |  |  |  |  | 22,768 | |  |  |  |  | 29,435 | |  |  |  |  | 41,090 | |  |  |  |  | 52,269 | |

| General and administration |  |  |  |  | 17,107 | |  |  |  |  | 20,013 | |  |  |  |  | 24,416 | |  |  |  |  | 27,576 | |  |  |  |  | 40,723 | |

| Gain on sale of asset |  |  |  |  | — | |  |  |  |  | 1,772 | |  |  |  |  | — | |  |  |  |  | — | |  |  |  |  | — | |

| Income from operations |  |  |  |  | 41,229 | |  |  |  |  | 52,900 | |  |  |  |  | 65,483 | |  |  |  |  | 74,864 | |  |  |  |  | 79,536 | |

| Investment and other income |  |  |  |  | 1,775 | |  |  |  |  | 2,420 | |  |  |  |  | 1,595 | |  |  |  |  | 2,982 | |  |  |  |  | 4,542 | |

| Secondary offering expenses |  |  |  |  | 490 | |  |  |  |  | — | |  |  |  |  | — | |  |  |  |  | — | |  |  |  |  | — | |

| Income before income taxes |  |  |  |  | 42,514 | |  |  |  |  | 55,320 | |  |  |  |  | 67,078 | |  |  |  |  | 77,846 | |  |  |  |  | 84,078 | |

| Provision for income taxes |  |  |  |  | 16,730 | |  |  |  |  | 21,646 | |  |  |  |  | 25,838 | |  |  |  |  | 29,781 | |  |  |  |  | 31,771 | |

| Net income |  |  |  |  | 25,784 | |  |  |  |  | 33,674 | |  |  |  |  | 41,240 | |  |  |  |  | 48,065 | |  |  |  |  | 52,307 | |

| Preferred stock dividends and accretion |  |  |  |  | 7,344 | |  |  |  |  | 5,136 | |  |  |  |  | 1,389 | |  |  |  |  | — | |  |  |  |  | — | |

| Net income available to common stockholders |  |  |  | $ | 18,440 | |  |  |  | $ | 28,538 | |  |  |  | $ | 39,851 | |  |  |  | $ | 48,065 | |  |  |  | $ | 52,307 | |

| Net income per share: |  |  |  |  | | |  |  |  |  | | |  |  |  |  | | |  |  |  |  | | |  |  |  |  | | |

| Basic |  |  |  | $ | 2.14 | |  |  |  | $ | 2.67 | |  |  |  | $ | 2.91 | |  |  |  | $ | 3.32 | |  |  |  | $ | 3.69 | |

| Diluted |  |  |  | $ | 1.78 | |  |  |  | $ | 2.27 | |  |  |  | $ | 2.74 | |  |  |  | $ | 3.26 | |  |  |  | $ | 3.61 | |

| Weighted average shares outstanding: |  |  |  |  | | |  |  |  |  | | |  |  |  |  | | |  |  |  |  | | |  |  |  |  | | |

| Basic |  |  |  |  | 8,617 | |  |  |  |  | 10,694 | |  |  |  |  | 13,674 | |  |  |  |  | 14,472 | |  |  |  |  | 14,187 | |

| Diluted(a) |  |  |  |  | 14,516 | |  |  |  |  | 14,857 | |  |  |  |  | 15,057 | |  |  |  |  | 14,741 | |  |  |  |  | 14,492 | |

| Other Data: |  |  |  |  | | |  |  |  |  | | |  |  |  |  | | |  |  |  |  | | |  |  |  |  | | |

| Depreciation and amortization |  |  |  | $ | 3,642 | |  |  |  | $ | 4,367 | |  |  |  | $ | 5,375 | |  |  |  | $ | 6,619 | |  |  |  | $ | 7,059 | |

| Stock-based compensation expense(b) |  |  |  |  | — | |  |  |  |  | — | |  |  |  |  | — | |  |  |  | $ | 48 | |  |  |  | $ | 8,049 | |

| Capital expenditures |  |  |  | $ | 17,113 | |  |  |  | $ | 6,840 | |  |  |  | $ | 11,063 | |  |  |  | $ | 12,275 | |  |  |  | $ | 13,183 | |

| Cash dividends per common share |  |  |  | $ | 0.26 | |  |  |  | $ | 0.26 | |  |  |  | $ | 0.41 | |  |  |  | $ | 0.63 | |  |  |  | $ | 1.06 | |

| Enrollment(d) |  |  |  |  | 16,532 | |  |  |  |  | 20,138 | |  |  |  |  | 23,539 | |  |  |  |  | 27,305 | |  |  |  |  | 31,372 | |

| Campuses(e) |  |  |  |  | 20 | |  |  |  |  | 25 | |  |  |  |  | 30 | |  |  |  |  | 35 | |  |  |  |  | 43 | |

|

|  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |

| |  |  | At December 31, |

| |  |  | 2002 |  |  | 2003 |  |  | 2004 |  |  | 2005 |  |  | 2006 |

| |  |  | (in thousands) |

| Balance Sheet Data: |  |  |  |  | | |  |  |  |  | | |  |  |  |  | | |  |  |  |  | | |  |  |  |  | | |

| Cash, cash equivalents and marketable securities |  |  |  | $ | 67,256 | |  |  |  | $ | 108,040 | |  |  |  | $ | 122,757 | |  |  |  | $ | 119,806 | |  |  |  | $ | 128,426 | |

| Working capital(f) |  |  |  |  | 55,901 | |  |  |  |  | 94,760 | |  |  |  |  | 112,726 | |  |  |  |  | 110,886 | |  |  |  |  | 122,204 | |

| Total assets |  |  |  |  | 140,124 | |  |  |  |  | 182,556 | |  |  |  |  | 210,114 | |  |  |  |  | 225,845 | |  |  |  |  | 270,844 | |

| Long-term liabilities |  |  |  |  | 2,055 | |  |  |  |  | 2,894 | |  |  |  |  | 5,784 | |  |  |  |  | 6,569 | |  |  |  |  | 7,689 | |

| Total liabilities |  |  |  |  | 39,942 | |  |  |  |  | 53,892 | |  |  |  |  | 61,192 | |  |  |  |  | 74,005 | |  |  |  |  | 99,317 | |

Series A convertible redeemable

preferred stock |  |  |  |  | 93,807 | |  |  |  |  | 95,686 | |  |  |  |  | — | |  |  |  |  | — | |  |  |  |  | — | |

| Total stockholders’ equity |  |  |  |  | 6,375 | |  |  |  |  | 32,978 | |  |  |  |  | 148,922 | |  |  |  |  | 151,840 | |  |  |  |  | 171,527 | |

|

|  |

| (a) | Diluted weighted average shares outstanding include common shares issued and outstanding, the assumed conversion of Series A Preferred Stock issued in May 2001, accrued payment-in-kind dividends on and assumed conversion of the Series A Preferred Stock, the dilutive impact of restricted stock and outstanding stock options using the Treasury Stock Method. |

35

Table of Contents |  |

| (b) | In 2006, the Company adopted FAS 123(R), Share-based Payment, and began recording expense for all forms of stock-based compensation. Prior to 2006, only stock-based compensation expense for restricted stock grants was being recorded. |

|  |

| (c) | Reflects the purchase for $12 million of three previously leased campus facilities in January 2002. |

|  |

| (d) | Reflects student enrollment as of the beginning of the fall academic term for each year indicated. |

|  |

| (e) | Reflects number of campuses offering classes during the fourth quarter of each year indicated. |

|  |

| (f) | Working capital is calculated by subtracting current liabilities from current assets. |

Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations

You should read the following discussion in conjunction with ‘‘Selected Historical Financial and Other Information,’’ our consolidated financial statements and the notes thereto, the ‘‘Cautionary Notice Regarding Forward-Looking Statements,’’ Item 1A entitled ‘‘Risk Factors’’ and the other information appearing elsewhere, or incorporated by reference, in this Annual Report on Form 10-K.

Background and Overview

We are an education services holding company that owns Strayer University, Inc. and Education Loan Processing, Inc. (‘‘ELP’’). The University is an institution of higher education which offers undergraduate and graduate degree programs at 47 campuses (including two new campuses opened for the 2007 winter term enrollment and two new campuses opened for the 2007 spring term enrollment) in Pennsylvania, Delaware, Maryland, Washington, D.C., Virginia, North Carolina, South Carolina, Tennessee, Georgia, Florida, Alabama, Kentucky, and worldwide through Strayer University Online. The Company is planning to open a total of eight new campuses in 2007, including four that have already been opened.

ELP was created to administer the Company’s student loan portfolio. In 2003, the Company sold its loan portfolio to a financial institution. ELP continued to originate loans for immediate sale and administered them. Now, ELP only administers existing loans and helps students obtain new loans directly from third party lenders without the Company’s origination.

As set forth below, enrollment (measured by fall term to fall term), full-time tuition rates, revenues, income from operations and net income have all increased in each of the last three years.

|  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |

| |  |  | Year Ended December 31, |

| |  |  | 2004 |  |  | 2005 |  |  | 2006(a) |

| Fall term enrollment |  |  |  |  | 23,539 | |  |  |  |  | 27,305 | |  |  |  |  | 31,372 | |

| % Change from prior year |  |  |  |  | 17 | |  |  |  |  | 16 | |  |  |  |  | 15 | |

| Full-time tuition (per course) |  |  |  | $ | 1,096 | |  |  |  | $ | 1,152 | |  |  |  | $ | 1,215 | |

| % Change from prior year |  |  |  |  | 5 | |  |  |  |  | 5 | |  |  |  |  | 5 | |

| Revenues (in thousands) |  |  |  | $ | 183,194 | |  |  |  | $ | 220,507 | |  |  |  | $ | 263,648 | |

| % Change from prior year |  |  |  |  | 25 | |  |  |  |  | 20 | |  |  |  |  | 20 | |

| Income from operations (in thousands) |  |  |  | $ | 65,483 | |  |  |  | $ | 74,864 | |  |  |  | $ | 79,536 | |

| % Change from prior year |  |  |  |  | 24 | |  |  |  |  | 14 | |  |  |  |  | 6 | |

| Net income (in thousands) |  |  |  | $ | 41,240 | |  |  |  | $ | 48,065 | |  |  |  | $ | 52,307 | |

| % Change from prior year |  |  |  |  | 22 | |  |  |  |  | 17 | |  |  |  |  | 9 | |

| Diluted net income per share |  |  |  | $ | 2.74 | |  |  |  | $ | 3.26 | |  |  |  | $ | 3.61 | |

| % Change from prior year |  |  |  |  | 21 | |  |  |  |  | 19 | |  |  |  |  | 11 | |

|

|  |

| (a) | In 2006, the Company adopted FAS 123(R) related to stock-based compensation and began recording stock-based compensation expense for all forms of stock-based compensation. |

36

Table of ContentsStrayer University derives approximately 97% of its revenue from tuition collected from its students. The academic year of the University is divided into four quarters, which approximately coincide with the four quarters of the calendar year. Students make payment arrangements for the tuition for each course prior to the beginning of the quarter. When students register for courses, tuition is recorded as unearned tuition, and is recognized in the quarter of instruction. If a student withdraws from a course prior to completion, the University refunds a portion of the tuition depending on when the withdrawal occurs. Tuition revenue is shown net of any refunds, withdrawals, corporate discounts, employee tuition discounts and scholarships. The University also derives revenue from other sources such as textbook-related income, application fees, commencement fees, placement test fees, withdrawal fees, loan administration fees, and other income, which are all recognized when incurred.

At the time of registration, unearned tuition (a liability) is recorded for academic services to be provided and a tuition receivable is recorded for the portion of the tuition not paid upfront in cash. Because the University’s academic quarters coincide with the calendar quarters, tuition receivable at the end of any calendar quarter largely represents student tuition due for the following academic quarter. Based upon past experience and judgment, the University establishes an allowance for doubtful accounts with respect to accounts receivable not included in unearned tuition. Any uncollected account more than six months past due for students who have left the University is charged against the allowance. Our bad debt expense as a percentage of revenue for the years ended December 31, 2004, 2005 and 2006 was 2.3%, 2.5% and 2.9%, respectively.

Strayer University’s expenses consist of instruction and educational support expenses, selling and promotion expenses, and general and administration expenses. Instruction and educational support expenses generally contain items of expense directly attributable to the educational activity of the University. This expense category includes salaries and benefits of faculty and academic administrators and, beginning in 2006, stock-based compensation expense. Instruction and educational support expenses also include costs of educational supplies and facilities, including rent for campus facilities, certain costs of establishing and maintaining computer laboratories and all other physical plant and occupancy costs, with the exception of costs attributable to the corporate offices.

Selling and promotion expenses include salaries, benefits and, beginning in 2006, stock-based compensation expense of personnel engaged in recruitment, admissions, retention, promotion and development, as well as costs of advertising and production of marketing materials.

General and administration expenses include salaries, benefits and, beginning in 2006, stock-based compensation expense of management and employees engaged in student services, accounting, human resources, compliance and other corporate functions, along with the occupancy costs attributable to such functions. Bad debt expense is also included as a general and administration expense.

Investment and other income consists primarily of earnings and realized gains or losses on investments.

Critical Accounting Policies and Estimates

‘‘Management’s Discussion and Analysis of Financial Condition and Results of Operations’’ discusses our consolidated financial statements, which have been prepared in accordance with accounting principles generally accepted in the United States of America. The preparation of these consolidated financial statements requires management to make estimates and judgments that affect the reported amounts of assets, liabilities, revenues and expenses and the related disclosures of contingent assets and liabilities. On an ongoing basis, management evaluates its estimates and judgments related to its allowance for uncollectible accounts, income tax provisions, valuation of deferred tax assets, forfeiture rates for stock-based compensation plans and accrued expenses. Management bases its estimates and judgments on historical experience and various other factors and assumptions that are believed to be reasonable under the circumstances, the results of which form the basis for making judgments regarding the carrying values of assets and liabilities that are not readily apparent from other sources. Actual results may differ from these estimates under different assumptions or conditions.

37

Table of ContentsManagement believes that the following critical accounting policies are its more significant judgments and estimates used in the preparation of its consolidated financial statements. Tuition revenue is deferred at the time of registration and is recognized as income, net of any refunds or withdrawals, in the respective quarter of instruction. Advance registrations for the next quarter are recorded as unearned tuition. We record estimates for our allowance for uncollectible accounts for tuition receivable from students. If the financial condition of our students were to deteriorate, resulting in impairment of their ability to make required payments for tuition payable to us, additional allowances may be required. We record estimates for our accrued expenses and income tax liabilities. We periodically review our assumed forfeiture rates for stock-based awards and adjust them as necessary. Should actual results differ from our estimates, revisions to our accrued expenses, stock-based compensation expenses, and income tax liabilities may be required.

New Campuses

The Company’s goal is to serve the demand for post secondary adult education nationwide by opening new campuses every year. A new campus typically requires up to $1 million in upfront capital costs for leasehold improvements, furniture and fixtures, and computer equipment. In the first year of operation, assuming a midyear opening, the Company expects to incur operating losses of approximately $1 million including depreciation related to the upfront capital costs. A new campus is typically expected to begin generating operating income on a quarterly basis after four to six quarters of operation, which is generally upon reaching an enrollment level of about 300 students. The Company’s new campus notional model assumes an increase of average enrollment by 100-150 students per year until reaching a level of about 1,000 students. Given the potential internal rate of return achieved with each new campus (an estimated 70%), opening new campuses is an important part of the Company’s strategy. The Company believes it has sufficient capital resources from cash, cash equivalents, marketable securities and cash generated from operating activities to continue to open new campuses for at least the next 12 months.

The Company plans to open eight new campuses in 2007 including four already opened. In 2006, the Company opened eight new campuses. The Company opened five new campuses in each of the preceding three years. See ‘‘New Campuses Opened’’ table in Item 1 for information regarding the locations of these new campuses.

Results of Operations

In 2006, the Company generated $263.6 million in revenue, a 20% increase compared to 2005, primarily as a result of average enrollment growth of 15% and a 5% tuition increase which commenced in January 2006. Income from operations was $79.5 million for 2006, an increase of 6% compared to 2005. In 2006, the Company began recording stock-based compensation expense which amounted to $8.1 million before tax for the year ended December 31, 2006. Net income in 2006 was $52.3 million, an increase of 9% compared to 2005. Net income for the year ended December 31, 2006 includes the effect of a $5.1 million after tax expense related to stock-based compensation. Earnings per diluted share was $3.61 in 2006 compared to $3.26 in 2005, an increase of 11%. Diluted earnings per share for the year ended December 31, 2006 includes the effect of a $0.35 per share after tax expense related to stock-based compensation.

38

Table of ContentsThe following table sets forth certain income statement data as a percentage of revenues for the periods indicated:

|  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |

| |  |  | Year Ended December 31, |

| |  |  | 2004 |  |  | 2005 |  |  | 2006 |

| Revenues |  |  |  |  | 100.0 | |  |  |  |  | 100.0 | |  |  |  |  | 100.0 | |

| Costs and expenses: |  |  |  |  | | |  |  |  |  | | |  |  |  |  | | |

| Instruction and educational support |  |  |  |  | 34.9 | |  |  |  |  | 34.9 | |  |  |  |  | 34.6 | |

| Selling and promotion |  |  |  |  | 16.1 | |  |  |  |  | 18.6 | |  |  |  |  | 19.8 | |

| General and administration |  |  |  |  | 13.3 | |  |  |  |  | 12.5 | |  |  |  |  | 15.4 | |

| Income from operations |  |  |  |  | 35.7 | |  |  |  |  | 34.0 | |  |  |  |  | 30.2 | |

| Investment and other income |  |  |  |  | 0.9 | |  |  |  |  | 1.3 | |  |  |  |  | 1.7 | |

| Income before income taxes |  |  |  |  | 36.6 | |  |  |  |  | 35.3 | |  |  |  |  | 31.9 | |

| Provision for income taxes |  |  |  |  | 14.1 | |  |  |  |  | 13.5 | |  |  |  |  | 12.1 | |

| Net income |  |  |  |  | 22.5 | |  |  |  |  | 21.8 | |  |  |  |  | 19.8 | |

| Tax rate |  |  |  |  | 38.5 | |  |  |  |  | 38.3 | |  |  |  |  | 37.8 | |

|

Year Ended December 31, 2006 Compared To Year Ended December 31, 2005

Enrollment. Average enrollment increased 15% from 23,903 students for the year ended December 31, 2005 to 27,554 students for the same period in 2006. This growth is principally due to new campus openings, stable growth in our mature markets and the rapid growth in markets outside of commuting distance to a Strayer University physical campus served by Strayer University Online.

Revenues. Revenues increased 20% from $220.5 million in 2005 to $263.6 million in 2006 principally due to a 15% increase in the average enrollment and a 5% tuition increase which commenced in January 2006.

Instruction and educational support expenses. Instruction and educational support expenses increased $14.1 million, or 18%, from $77.0 million in 2005 to $91.1 million in 2006. This increase was principally due to direct costs necessary to support the increase in student enrollments including faculty compensation, related academic staff salaries, and campus facility costs which increased $4.7 million, $3.0 million, and $2.9 million, respectively. The increase is also partly attributable to $0.6 million in stock-based compensation expense which the Company began recording in 2006. These costs as a percentage of revenues decreased slightly to 34.6% in 2006 from 34.9% in 2005.

Selling and promotion expenses. Selling and promotion expenses increased $11.2 million, or 27%, from $41.1 million in 2005 to $52.3 million in 2006. This increase was principally due to the direct costs required to generate leads for enrollment growth, the addition of admissions personnel, particularly at new campuses and at Strayer University Online, the increase in the number of new campuses opened in 2006 compared to 2005 (eight, up from five in 2005) and stock-based compensation expense. These expenses as a percentage of revenues increased from 18.6% in 2005 to 19.8% in 2006 largely attributable to both marketing costs and staffing costs growing faster than tuition revenue, as the Company has increased the number of new campuses opened.

General and administration expenses. General and administration expenses increased $13.1 million, or 48%, from $27.6 million in 2005 to $40.7 million in 2006. The increase is largely attributable to $6.9 million of stock-based compensation expense which the Company began recording in 2006. This increase was also due to increased employee compensation and related expenses at both corporate and campus locations and higher bad debt expense, each increasing by $2.2 million. General and administration expenses as a percentage of revenues increased to 15.4% in 2006 from 12.5% in 2005 primarily due to the inclusion of stock-based compensation.

Income from operations. Income from operations increased $4.6 million, or 6%, from $74.9 million in 2005 to $79.5 million in 2006 due to the aforementioned factors.

Investment and other income. Investment and other income increased $1.5 million, or 52%, from $3.0 million in 2005 to $4.5 million in 2006. This increase was principally due to higher yields from the

39

Table of ContentsCompany’s investments in a short-term tax-exempt bond fund and tax-exempt money market funds. In addition, a higher average cash balance in 2006 partly contributed to this increase.

Provision for income taxes. Income tax expense increased $2.0 million, or 7%, from $29.8 million in 2005 to $31.8 million in 2006 primarily due to the increase in income before taxes attributable to the factors discussed above. This was partly offset by a lower effective tax rate of 37.8% in 2006, compared to 38.3% in 2005, resulting primarily from higher income from tax-exempt securities.

Net income. Net income increased $4.2 million, or 9%, from $48.1 million in 2005 to $52.3 million in 2006 because of the factors discussed above.

Year Ended December 31, 2005 Compared To Year Ended December 31, 2004

Enrollment. Average enrollment increased 18% from 20,340 students for the year ended December 31, 2004 to 23,903 students for the same period in 2005. This growth is principally due to new campus openings, stable growth in our mature markets and the rapid growth in markets outside of commuting distance to a Strayer University physical campus served by Strayer University Online.

Revenues. Revenues increased 20% from $183.2 million in 2004 to $220.5 million in 2005 principally due to a 18% increase in the average enrollment. Although tuition increased 5% in 2005, revenue per student increased only 2%, affected by a mix shift to graduate students who, on average, take fewer classes than undergraduate students.

Instruction and educational support expenses. Instruction and educational support expenses increased $13.1 million, or 21%, from $63.9 million in 2004 to $77.0 million in 2005. This increase was principally due to direct costs necessary to support the increase in student enrollments including faculty compensation, related academic staff salaries, and campus facility costs which increased $4.5 million, $3.1 million, and $3.0 million, respectively. These costs as a percentage of revenues were 34.9% in 2005 as well as in 2004.

Selling and promotion expenses. Selling and promotion expenses increased $11.7 million, or 40%, from $29.4 million in 2004 to $41.1 million in 2005. This increase was principally due to the direct costs required to generate leads for enrollment growth and the addition of admissions personnel, particularly at new campuses and at Strayer University Online. These expenses as a percentage of revenues increased from 16.1% in 2004 to 18.6% in 2005 largely attributable to both marketing costs and staffing costs growing faster than tuition revenue, as the Company prepared to open an increased number of new campuses in 2006.

General and administration expenses. General and administration expenses increased $3.2 million, or 13%, from $24.4 million in 2004 to $27.6 million in 2005. This increase was principally due to increased employee compensation and related expenses at both corporate and campus locations and higher bad debt expense, which increased $0.7 million and $1.3 million, respectively. General and administration expenses as a percentage of revenues decreased slightly to 12.5% in 2005 from 13.3% in 2004 primarily due to greater revenues being spread over the largely fixed costs of various centralized functions.

Income from operations. Income from operations increased $9.4 million, or 14%, from $65.5 million in 2004 to $74.9 million in 2005 due to the aforementioned factors.

Investment and other income. Investment and other income increased $1.4 million, or 87%, from $1.6 million in 2004 to $3.0 million in 2005. This increase was principally due to higher yields from the Company’s investments in a short-term tax-exempt bond fund and tax-exempt money market funds.

Provision for income taxes. Income tax expense increased $4.0 million, or 15%, from $25.8 million in 2004 to $29.8 million in 2005 primarily due to the increase in income before taxes attributable to the factors discussed above. This was partly offset by a lower effective tax rate of 38.3% in 2005, compared to 38.5% in 2004, resulting primarily from higher income from tax-exempt securities.

Net income. Net income increased $6.9 million, or 16.6%, from $41.2 million in 2004 to $48.1 million in 2005 because of the factors discussed above.

40

Table of ContentsSeasonality

Our quarterly results of operations tend to vary significantly within a year because of student enrollment patterns. Enrollment generally is highest in the fourth quarter, or fall term, and lowest in the third quarter, or summer term. In 2006, enrollments by term were as follows:

2006 Enrollment by Term

|  |  |  |  |  |  |

| Term |  |  | Enrollment |

| Winter |  |  |  |  | 27,621 | |

| Spring |  |  |  |  | 27,289 | |

| Summer |  |  |  |  | 23,932 | |

| Fall |  |  |  |  | 31,372 | |

| Average |  |  |  |  | 27,554 | |

|

The following table sets forth our revenues on a quarterly basis for the years ended December 31, 2004, 2005 and 2006:

Quarterly Revenues

(dollars in thousands)

|  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |

| |  |  | 2004 |  |  | 2005 |  |  | 2006 |

| Three Months Ended |  |  | Amount |  |  | Percent |  |  | Amount |  |  | Percent |  |  | Amount |  |  | Percent |

| March 31 |  |  |  | $ | 46,106 | |  |  |  |  | 25 | |  |  |  | $ | 56,153 | |  |  |  |  | 26 | |  |  |  | $ | 67,090 | |  |  |  |  | 25 | |

| June 30 |  |  |  |  | 46,811 | |  |  |  |  | 26 | |  |  |  |  | 55,249 | |  |  |  |  | 25 | |  |  |  |  | 65,558 | |  |  |  |  | 25 | |

| September 30 |  |  |  |  | 38,009 | |  |  |  |  | 21 | |  |  |  |  | 47,087 | |  |  |  |  | 21 | |  |  |  |  | 56,693 | |  |  |  |  | 22 | |

| December 31 |  |  |  |  | 52,268 | |  |  |  |  | 28 | |  |  |  |  | 62,018 | |  |  |  |  | 28 | |  |  |  |  | 74,307 | |  |  |  |  | 28 | |

| Total for Year |  |  |  | $ | 183,194 | |  |  |  |  | 100 | |  |  |  | $ | 220,507 | |  |  |  |  | 100 | |  |  |  | $ | 263,648 | |  |  |  |  | 100 | |

|

Costs generally are not affected by the seasonal factors as much as enrollment and revenue, and do not vary significantly on a quarterly basis.

Liquidity and Capital Resources

At December 31, 2006, the Company had cash, cash equivalents and marketable securities of $128.4 million compared to $119.8 million at December 31, 2005. Most of the Company’s excess cash is invested in tax-exempt money market funds and a diversified, short-term, investment grade, tax-exempt bond fund to minimize the Company’s principal risk and to benefit from the tax efficiency of the funds’ underlying securities. As of December 31, 2006, the Company had a total of $75.7 million invested in the short-term, tax-exempt bond fund, having added $30 million to it in the first quarter of 2006. At December 31, 2006, the 429 issues in this fund had an average credit rating of AA, an average maturity and an average duration of 1.2 years, as well as an average yield to maturity of 3.8%. We had no debt as of December 31, 2006 or December 31, 2005.

For the year ended December 31, 2006, the Company generated $61.8 million net cash from operating activities compared to $55.1 million for the same period in 2005. Capital expenditures were $13.2 million for the year ended December 31, 2006 compared to $12.3 million for the same period in 2005. Capital expenditures for the year ending December 31, 2007 are expected to be in the range of $15-18 million inclusive of the expected openings of eight new campuses. For the year ended December 31, 2006, we paid $15.3 million in cash dividends to our common stockholders and spent $35.0 million repurchasing our common shares in the open market.

In 2006, bad debt expense as a percentage of revenue was 2.9% compared to 2.5% for the same period in 2005. Days sales outstanding, adjusted to exclude tuition receivable related to future quarters, was 13 days at the end of the fourth quarter 2006 compared to 10 days in 2005. This increase was partly attributable to the growth of corporate sponsored students which tend to receive extended payment terms.

41

Table of ContentsCurrently, the Company invests its cash in bank overnight deposits, money market funds and a short-term tax-exempt bond fund. In addition, the Company has available two $10.0 million credit facilities from two banks. There have been no borrowings by the Company under these credit facilities. The Company believes that existing cash, cash equivalents, and marketable securities, cash generated from operating activities, and if necessary, cash borrowed under the credit facilities, will be sufficient to meet the Company’s requirements for at least the next 12 months.

The table below sets forth the Company’s cash and cash equivalents and marketable securities as of December 31, 2004, 2005 and 2006:

Cash and Marketable Securities

(in millions)

|  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |

| |  |  | At December 31, |

| |  |  | 2004 |  |  | 2005 |  |  | 2006 |

| Cash and cash equivalents |  |  |  | $ | 97.0 | |  |  |  | $ | 74.2 | |  |  |  | $ | 52.7 | |

| Marketable securities (short-term bond fund) |  |  |  |  | 25.8 | |  |  |  |  | 45.6 | |  |  |  |  | 75.7 | |

| Total |  |  |  | $ | 122.8 | |  |  |  | $ | 119.8 | |  |  |  | $ | 128.4 | |

|

|  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |

| |  |  | Year Ended December 31, |

| |  |  | 2004 |  |  | 2005 |  |  | 2006 |

| Investment and other income |  |  |  | $ | 1.6 | |  |  |  | $ | 3.0 | |  |  |  | $ | 4.5 | |

|

The table below sets forth our contractual commitments associated with operating leases as of December 31, 2006:

|  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |

| |  |  | Payments Due By Period (in thousands) |

| |  |  | Total |  |  | Less than 1

Year |  |  | 1-3 Years |  |  | 3-5 Years |  |  | More than 5

Years |

| Operating leases |  |  |  | $ | 109,227 | |  |  |  | $ | 13,941 | |  |  |  | $ | 29,384 | |  |  |  | $ | 26,604 | |  |  |  | $ | 39,298 | |

|

Impact of Inflation

Inflation has not had a significant impact on the Company’s historical operations.

Off-Balance Sheet Arrangements

As of December 31, 2006, the Company does not have any off-balance sheet arrangements as defined by Item 303(a)(4) of the Securities Exchange Commission Regulation S-K.

Item 7A. Quantitative and Qualitative Disclosures about Market Risk

The Company is subject to the impact of interest rate changes and may be subject to changes in the market values of its current and future investments. The Company invests its excess cash in bank overnight deposits, money market funds and a short-term tax-exempt bond fund. The Company has not used derivative financial instruments in its investment portfolio.

Earnings from investments in bank overnight deposits, money market mutual funds and short-term tax-exempt bond funds may be adversely affected in the future should interest rates change. The Company’s future investment income may fall short of expectations due to changes in interest rates or the Company may suffer losses in principal if forced to sell securities that have declined in market value due to changes in interest rates. As of December 31, 2006, a 10% increase or decline in interest rates will not have a material impact on the Company’s future earnings, fair values or cash flows related to investments in cash equivalents or interest earning marketable securities.

42

Table of ContentsItem 8. Financial Statements and Supplementary Data

INDEX TO CONSOLIDATED FINANCIAL STATEMENTS

|  |  |  |

| |  |  | Page |

| Strayer Education, Inc. |  |  | |

| Report of Independent Registered Public Accounting Firm |  |  | 44 |

| Consolidated Balance Sheets as of December 31, 2005 and 2006 |  |  | 46 |

| Consolidated Statements of Income for each of the three years in the period ended December 31, 2006 |  |  | 47 |

| Consolidated Statements of Comprehensive Income for each of the three years in the period ended December 31, 2006 |  |  | 47 |

| Consolidated Statements of Stockholders’ Equity for each of the three years in the period ended December 31, 2006 |  |  | 48 |

| Consolidated Statements of Cash Flows for each of the three years in the period ended December 31, 2006 |  |  | 49 |

| Notes to Consolidated Financial Statements |  |  | 50 |

| Schedule II-Valuation and Qualifying Accounts |  |  | 64 |

|

All other schedules are omitted because they are not applicable or the required information is included in the consolidated financial statements or notes thereto.

43

Table of ContentsReport of Independent Registered Public Accounting Firm

To Board of Directors and Stockholders

Strayer Education, Inc.

We have completed integrated audits of Strayer Education, Inc.’s consolidated financial statements and of its internal control over financial reporting as of December 31, 2006, in accordance with the standards of the Public Company Accounting Oversight Board (United States). Our opinions, based on our audits, are presented below.

Consolidated financial statements and financial statement schedule

In our opinion, the consolidated financial statements listed in the accompanying index present fairly, in all material respects, the financial position of Strayer Education, Inc. and its subsidiaries at December 31, 2006 and 2005, and the results of their operations and their cash flows for each of the three years in the period ended December 31, 2006 in conformity with accounting principles generally accepted in the United States of America. In addition, in our opinion, the financial statement schedule listed in the accompanying index presents fairly, in all material respects, the information set forth therein when read in conjunction with the related consolidated financial statements. These financial statements and financial statement schedule are the responsibility of the Company’s management. Our responsibility is to express an opinion on these financial statements and financial statement schedule based on our audits. We conducted our audits of these statements in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit of financial statements includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, and evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

As discussed in Note 2 to the consolidated financial statements, the Company changed the manner in which it accounts for share-based compensation in 2006.

Internal control over financial reporting

Also, in our opinion, management’s assessment, included in Management’s Report on Internal Control Over Financial Reporting appearing under Item 9A, that the Company maintained effective internal control over financial reporting as of December 31, 2006 based on criteria established in Internal Control – Integrated Framework issued by the Committee of Sponsoring Organizations of the Treadway Commission (COSO), is fairly stated, in all material respects, based on those criteria. Furthermore, in our opinion, the Company maintained, in all material respects, effective internal control over financial reporting as of December 31, 2006, based on criteria established in Internal Control – Integrated Framework issued by the COSO. The Company’s management is responsible for maintaining effective internal control over financial reporting and for its assessment of the effectiveness of internal control over financial reporting. Our responsibility is to express opinions on management’s assessment and on the effectiveness of the Company’s internal control over financial reporting based on our audit. We conducted our audit of internal control over financial reporting in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether effective internal control over financial reporting was maintained in all material respects. An audit of internal control over financial reporting includes obtaining an understanding of internal control over financial reporting, evaluating management’s assessment, testing and evaluating the design and operating effectiveness of internal control, and performing such other procedures as we consider necessary in the circumstances. We believe that our audit provides a reasonable basis for our opinions.

A company’s internal control over financial reporting is a process designed to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with generally accepted accounting principles. A company’s internal control over financial reporting includes those policies and procedures that (i) pertain to the maintenance of records that, in reasonable detail, accurately and fairly reflect the transactions and

44